Have Sanctions Modified Iran’s Trade Policy? An Evidence of Asianization and De-Europeanization through the Gravity Model

Abstract

:1. Introduction

- (i)

- There is a negative relationship between the sanctions against Iran and Iran–EU members trade.

- (ii)

- There is a positive relationship between the sanctions against Iran and Iran–Asian countries trade.

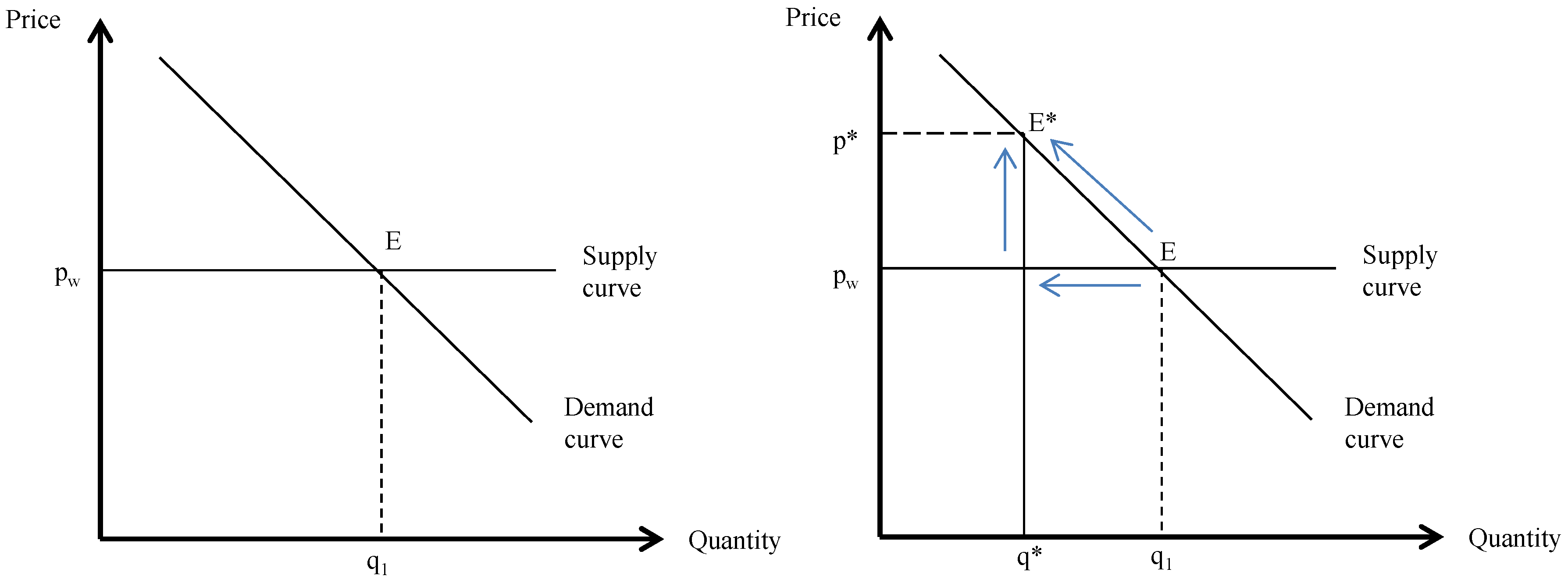

2. Theoretical Framework

3. Literature Review

4. Data and Methodology

4.1. Dataset Description

4.2. Model Specification

- Model I:

- Model II:

5. Results and Discussion

5.1. Panel Cross-Section Dependence Test

5.2. Panel Unit Root Tests

5.3. Pedroni Panel Cointegration Test

5.4. Gravity Model Estimation

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- H. Askari, J. Forrer, H. Teegen, and J. Yang. Economic Sanctions: Examining Their Philosophy and Efficacy. Westport, CT, USA: Praeger Publishers, 2003. [Google Scholar]

- E. Rasoulinezhad. “Investigation of Sanctions and Oil Price Effects on the Iran-Russia Trade by Using the Gravity Model.” Vestnik St. Petersb. Univ. Ser. 5 Econ. 2 (2016): 68–84. [Google Scholar] [CrossRef]

- S.M. Fahimifard. “Studying Iranian Economic Integration with OIC members using gravity model.” J. Money Econ. 8 (2013): 169–181. [Google Scholar]

- F. Suvankulov, and Y. Guc. “Who is Trading Well in Central Asia? A Gravity Analysis of Exports from the Regional Powers to the Region.” Eur. J. Bus. Econ. 5 (2012): 21–43. [Google Scholar]

- A.R. Soori, and A. Tashkini. “Gravity model: An application to trade between Iran and regional blocs.” Iran. Econ. Rev. 16 (2012): 1–12. [Google Scholar]

- M. Taghavi, and N. Hosein Tash. “Testing the gravity model in Iran and some oil exporting countries.” Econ. Res. Rev. 11 (2011): 187–212. [Google Scholar]

- A. Esmaeili, and F. Pourebrahim. “Assessing Trade Potential in Agricultural Sector of Iran: Application of Gravity Model.” J. Food Prod. Mark. 17 (2011): 459–469. [Google Scholar] [CrossRef]

- H. Kalbasi. “The gravity model and Iran’s trade flows.” Asian Econ. Rev. 44 (2002): 225–243. [Google Scholar]

- R. Caruso. “The Impact of International Economic Sanctions on Trade Empirical Evidence over the Period 1960–2000.” Riv. Int. Sci. Soc. 113 (2005): 41–66. [Google Scholar]

- W.H. Kaempfer, and A.D. Lowenberg. International Economic Sanctions: A Public Choice Perspective. Boulder, CO, USA: Westview Press, 1992. [Google Scholar]

- W.H. Kaempfer, and A.D. Lowenberg. “Unilateral versus multilateral international sanctions: A public choice perspective.” Int. Stud. Q. 43 (1999): 37–58. [Google Scholar] [CrossRef]

- P.A.G. Van Bergeijk. “The Impact of Economic Sanctions in the 1990’s.” World Econ. 18 (1995): 443–455. [Google Scholar] [CrossRef]

- J. Yang, H. Askari, J. Forrer, and H. Teegen. “How Do US Economic Sanctions Affect EU’s Trade with Target Countries.” World Econ. 32 (2009): 1223–1244. [Google Scholar] [CrossRef]

- B.E. Dollery. “A Conceptual Note on Financial and Trade Sanctions Against South Africa.” Econ. Anal. Policy 23 (1993): 179–188. [Google Scholar] [CrossRef]

- S.J. Evenett. “The Impact of Economic Sanctions on South African Exports.” Scott. J. Political Econ. 49 (2002): 557–573. [Google Scholar] [CrossRef]

- S. Jafarey, and S. Lahiri. “Will trade sanctions reduce child labour? The role of credit markets.” J. Dev. Econ. 68 (2002): 137–156. [Google Scholar] [CrossRef]

- O. Lamotte. “Disentangling the Impact of Wars and Sanctions on International Trade: Evidence from Former Yugoslavia.” Comp. Econ. Stud. 54 (2012): 553–579. [Google Scholar] [CrossRef]

- M. Neuenkirch, and F. Neumeier. “The impact of UN and US economic sanctions on GDP growth.” Eur. J. Political Econ. 40 (2015): 110–125. [Google Scholar] [CrossRef]

- M. Karimi, and S. Haghpanah. “The effects of economic sanctions on disease specific clinical outcomes of patients with thalassemia and hemophilia in Iran.” Health Policy 119 (2015): 239–243. [Google Scholar] [CrossRef] [PubMed]

- M. Neuenkirch, and F. Neumeier. “The impact of US sanctions on poverty.” J. Dev. Econ. 121 (2016): 110–119. [Google Scholar] [CrossRef]

- C. Dreger, K.A. Kholodilin, D. Ulbricht, and J. Fidrmuc. “Between the hammer and the anvil: The impact of economic sanctions and oil prices on Russia’s ruble.” J. Comp. Econ. 44 (2016): 295–308. [Google Scholar] [CrossRef]

- S.K. Afesorgbor, and R. Mahadevan. “The Impact of Economic Sanctions on Income Inequality of Target States.” World Dev. 83 (2016): 1–11. [Google Scholar] [CrossRef]

- G.C. Hufbauer, K.A. Elliot, T. Cyrus, and E. Winston. US Economic Sanctions: Their Impact on Trade, Jobs, and Wages. Washington, DC, USA: Peterson Institute for International Economics, 1997. [Google Scholar]

- J. Yang, H. Askari, J. Forrer, and H.U.S. Teegen. “Economic Sanctions: An Empirical study.” Int. Trade J. 18 (2004): 23–62. [Google Scholar] [CrossRef]

- Z. Mehchy, R. Nasser, and M. Schiffbauer. “Trade determinants and potential of Syria: Using a gravity model “with an estimation of the Syrian crisis” impact on exports’.” Middle East Dev. J. 7 (2015): 226–251. [Google Scholar] [CrossRef]

- M. Aghazadeh. “International sanctions and their impacts on Iran’s economy.” Int. J. Econ. Financ. Stud. 6 (2014): 25–41. [Google Scholar]

- S. Bazoobandi. “Sanctions and Isolation, the Driving Force of Sino-Iranian Relations.” East Asia 32 (2015): 257–271. [Google Scholar] [CrossRef]

- O. Borszik. “International sanctions against Iran and Tehran’s responses: Political effects on the targeted regime.” Contemp. Political 22 (2015): 20–39. [Google Scholar] [CrossRef]

- J.I. Haidar. Sanctions and Export Deflection: Evidence from Iran. Amsterdam, The Netherlands: The de Nederlandsche Bank, 2016, Available online: http://www.economic-policy.org/wp-content/uploads/2016/04/Sanctions-and-Export-Deflection-Evidence-from-Iran.pdf (accessed on 24 December 2015).

- J.E. Anderson. “Trade, Size, and Frictions: The Gravity Model.” Available online: https://www2.bc.edu/~anderson/GravityNotes.pdf (accessed on 27 October 2016).

- “IRICA.” 2015. Available online: http://www.irica.gov.ir (accessed on 8 November 2015).

- World Bank. “World Development Indicators.” 2015. Available online: http://data.worldbank.org (accessed on 17 July 2015).

- IMF. “The World Economic Outlook Database.” 2015. Available online: http://www.imf.org/en/Data (accessed on 13 December 2015).

- CEPII. “GeoDist Database.” 2015. Available online: http://www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=6 (accessed on 2 October 2015).

- J.M. Wooldridge. Introductory Econometrics: A modern Approach, 5th ed. Belmont, CA, USA: Cengage Learning Publication, 2013. [Google Scholar]

- T. Tinbergen. Shaping the World Economy: Suggestions for an International Economic Policy. New York, NY, USA: The Twentieth Century Fund, 1962. [Google Scholar]

- H. Linnemann. An Econometric Study of International Trade Flows. Amsterdam, The Netherlands: North-Holland Pubulishing Co., 1966. [Google Scholar]

- J.A. Frankel. Is Japan Creating a Yen Bloc in East Asia and the Pacific? Cambridge, MA, USA: National Bureau of Economic Research, 1992. [Google Scholar]

- M. Pfaffermayr. “Foreign Direct Investment and Exports: A Time Series Approach.” Appl. Econ. 26 (1994): 337–351. [Google Scholar] [CrossRef]

- I.-H. Cheng, and H.J. Wall. Controlling for Heterogeneity in Gravity Models of Trade and Integration. Ann Arbor, MI, USA: Inter-University Consortium for Political and Social Research (ICPSR), 2005. [Google Scholar]

- B.X. Nguyen. “The determinants of Vietnamese export flows: Static and dynamic panel gravity approach.” Int. J. Econ. Financ. 2 (2010): 122–129. [Google Scholar] [CrossRef]

- J.E. Anderson, and E.V. Wincoop. “Gravity with gravitas: A solution to the border puzzle.” Am. Econ. Rev. 93 (2003): 170–192. [Google Scholar] [CrossRef]

- S. Guttmann, and A. Richards. “Trade openness: An Australian Perspective.” Aust. Econ. Pap. 45 (2006): 188–203. [Google Scholar] [CrossRef]

- J. Squalli, and K. Wilson. A New Approach to Measuring Trade Openness. Report No. 06-07; Dubai, UAE: Economic Policy Research Unit, 2006, Available online: http://www.zu.ac.ae/research/images/06-07-web.pdf (accessed on 12 September 2015).

- S.S. Elmorsy. “Determinants of trade intensity of Egypt with COMESA countries.” J. Glob. South 2 (2015): 1–25. [Google Scholar] [CrossRef]

- C. Zhang, Y. Zhu, and Z. Lu. “Trade openness, financial openness and financial development in China.” J. Int. Money Financ. 59 (2015): 287–309. [Google Scholar] [CrossRef]

- K. Menyah, S. Nazlioglu, and Y. Wolde-Rufael. “Financial development, trade openness and economic growth in African countries: New insights from a panel causality approach.” Econ. Model. 37 (2014): 386–394. [Google Scholar] [CrossRef]

- S.L. Baier, and J.H. Bergstrand. “Do free trade agreements actually increase members’ international trade? ” J. Int. Econ. 71 (2007): 72–95. [Google Scholar] [CrossRef]

- S. Narayan, and T.T. Nguyen. “Does the trade gravity model depend on trading partners? Some evidence from Vietnam and her 54 trading partners.” Int. Rev. Econ. Financ. 41 (2016): 220–237. [Google Scholar] [CrossRef]

- E. Rasoulinezhad, and G.S. Kang. “A Panel Data Analysis of South Korea’s Trade with OPEC Member Countries: The Gravity Model Approach.” Iran. Econ. Rev. 20 (2016): 203–224. [Google Scholar]

- T.S. Breusch, and A.R. Pagan. “The Lagrange Multiplier Test and Its Applications to Model Specification in Econometrics.” Rev. Econ. Stud. 47 (1980): 239–253. [Google Scholar] [CrossRef]

- M.H. Pesaran. General Diagnostic Tests for Cross Section Dependence in Panels. Report No. 435; Bonn, Germany: IZA (Institute for the Study of Labor), 2004. [Google Scholar]

- M.H. Pesaran. “A simple panel unit root test in the presence of cross-section dependence.” J. Appl. Econ. 22 (2007): 265–312. [Google Scholar] [CrossRef]

- F. Taghizadeh Hesary, E. Rasoulinezhad, and Y. Kobayashi. Oil Price Fluctuations and Oil Consuming Sectors: An Empirical Analysis of Japan. Report No. 539; Tokyo, Japan: Asian Development Bank, 2015. [Google Scholar]

- M. Nasre Esfahani, and E. Rasoulinezhad. “Will Be There New CO2 Emitters in the Future? Evidence of Long-Run Panel Co-Integration for N-11 Countries.” Int. J. Energy Econ. Policy 6 (2016): 463–470. [Google Scholar]

- P. Pedroni. Fully Modified OLS for Heterogeneous Cointegrated Panels and the Case of Purchasing Power Parity. Report No. 96-020; Indiana, USA: Indiana University, 1996. [Google Scholar]

- P. Pedroni. “Purchasing power parity tests in cointegrated panels.” Rev. Econ. Stat. 83 (2001): 727–731. [Google Scholar] [CrossRef]

- P. Soren, B. Behnhard, and T. Glauben. Gravity Model Estimation: Fixed Effects vs. Random Intercept Poisson Pseudo Maximum Likelihood. Report No. 148; Halle, Germany: Leibniz Institute of Agricultural Development in Central and Eastern Europe (IAMO), 2014. [Google Scholar]

- J. Fidrmuc. “Gravity models in integrated panels.” Empir. Econ. 37 (2009): 435–446. [Google Scholar] [CrossRef]

- S.B. Linder. An Essay on Trade and Transformation. New York, NY, USA: John Wiley and Son, 1961. [Google Scholar]

- E.E. Leamer. “A FlatWorld, a Level Playing Field, a Small World After All, or None of the Above? A Review of Thomas L Friedman’s The World is Flat.” J. Econ. Lit. 45 (2007): 83–126. [Google Scholar] [CrossRef]

- A. Disdier, and K. Head. “The puzzling persistence of the distance effect on bilateral trade.” Rev. Econ. Stat. 90 (2008): 37–48. [Google Scholar] [CrossRef]

- 1The Islamic Republic of Iran Customs Administration.

- 2The study covers the period up to the voting by the Great Britain to withdraw from the EU.

- 3Anderson (2016) [30] expresses that “Gravity fits well with either aggregate or disaggregated trade flow data”.

- 4Website link: http://web.pdx.edu/~ito/Chinn-Ito_website.htm.

- 5It is calculated as the average of 44%, 44.2% and 48.5%.

- 6It is calculated as the average of 77.7%, 75% and 103%.

- 7It is calculated as the average of 1.08 and 1.37.

- 8It is calculated as the average of 2.90 and 1.78.

| Variables | Definition | Unit |

|---|---|---|

| Trade | Aggregated trade volume between Iran and trade partners | Thousand US $ |

| Y | GDP in Iran and trade partners | Thousand US $ |

| YP | GDP per capita in Iran and trade partners | Thousand US $ |

| DIS | Distance between capitals of Iran and trade partners | Kilometers |

| REMO | Multilateral Resistance Term (MRT) | - |

| CTI | The CTI in Iran/the CTI in trade partner | % |

| KAOPEN | The KAOPEN in Iran/the KAOPEN in trade partner | % |

| Sanctions | Dummy variable taking a value of one if there are sanctions against Iran | Dummy (0/1) |

| Variable | Type | Expected sign |

|---|---|---|

| Trade | Time-variant | Positive |

| YitYjt | Time-variant | Positive |

| YPitYPjt | Time-variant | Positive |

| REM | Time-variant | Positive |

| CTI | Time-variant | Positive |

| KAOPEN | Time-variant | Positive |

| Dis | Time-invariant | Negative |

| Sanctions | Time-invariant, Dummy | Positive (trade with Asia) |

| Sanctions | Time-invariant, Dummy | Negative (trade with Europe) |

| Case | Variables | Pesaran’s CD Test | Probability |

|---|---|---|---|

| Iran–EU Trade | LTRADE | 14.43 | 0.00 |

| LYY | 34.09 | 0.00 | |

| LYPYP | 29.89 | 0.00 | |

| LCTI | 36.02 | 0.00 | |

| LKAOPEN | 27.11 | 0.00 | |

| LREM | 25.73 | 0.0 | |

| Iran–Asian Countries Trade | LTRADE | 18.28 | 0.00 |

| LYY | 43.30 | 0.00 | |

| LYPYP | 31.59 | 0.00 | |

| LCTI | 37.25 | 0.00 | |

| LKAOPEN | 30.42 | 0.00 | |

| LREM | 28.12 | 0.00 |

| Case | Variable | Pesaran’s CADF | H0 | Stationary |

|---|---|---|---|---|

| Iran–EU Trade | LTrade | 19.55 (0.81) | Accept | No |

| D (LTrade) | 325.49 (0.00) | Reject | Yes | |

| LYY | 23.02 (0.63) | Accept | No | |

| D (LYY) | 200.83 (0.00) | Reject | Yes | |

| LYPYP | 2.94 (1.00) | Accept | No | |

| D (LYPYP) | 232.52 (0.00) | Reject | Yes | |

| LCTI | 25.74 (0.69) | Accept | No | |

| D (LCTI) | 264.85 (0.00) | Reject | Yes | |

| LKAOPEN | 20.02 (0.86) | Accept | No | |

| D (LKAOPEN) | 249.13 (0.00) | Reject | Yes | |

| LREM | 18.66 (0.52) | Accept | No | |

| D (LREM) | 198.11 (0.00) | Reject | Yes | |

| Iran–Asian Countries Trade | LTrade | 24.12 (0.50) | Accept | No |

| D (LTrade) | 193.28 (0.00) | Reject | Yes | |

| LYY | 9.83 (0.93) | Accept | No | |

| D (LYY) | 259.01 (0.00) | Reject | Yes | |

| LYPYP | 14.24 (0.53) | Accept | No | |

| D (LYPYP) | 301.62 (0.00) | Reject | Yes | |

| LCTI | 23.09 (0.59) | Accept | No | |

| D (LCTI) | 277.10 (0.00) | Reject | Yes | |

| LKAOPEN | 24.69 (0.62) | Accept | No | |

| D (LKAOPEN) | 213.84 (0.00) | Reject | Yes | |

| LREM | 20.02 (0.83) | Accept | No | |

| D (LREM) | 186.19 (0.00) | Reject | Yes |

| Case | Model | Statistic | Probability | Weighted Statistic | Probability | |

|---|---|---|---|---|---|---|

| Iran–EU Trade | Model I | Panel v-statistic | −0.13 | 0.55 | −3.34 | 0.99 |

| Panel rho-statistic | 3.97 | 1.00 | −2.45 * | 0.00 | ||

| Panel PP-statistic | −0.49 | 0.30 | −3.97 * | 0.00 | ||

| Panel ADF-statistic | −4.49 * | 0.00 | −4.27 * | 0.00 | ||

| Group rho-statistic | 5.46 | 1.00 | - | - | ||

| Group PP-statistic | −3.81 * | 0.00 | - | - | ||

| Group ADF-statistic | −4.47 * | 0.00 | - | - | ||

| Model II | Panel v-statistic | 1.53 ** | 0.06 | 0.79 | 0.21 | |

| Panel rho-statistic | −4.36 * | 0.00 | −2.81 * | 0.00 | ||

| Panel PP-statistic | −5.81 * | 0.00 | −4.74 * | 0.00 | ||

| Panel ADF-statistic | −5.13 * | 0.00 | −4.55 * | 0.00 | ||

| Group rho-statistic | −2.20 * | 0.01 | - | - | ||

| Group PP-statistic | −5.56 * | 0.00 | - | - | ||

| Group ADF-statistic | −5.31 * | 0.00 | - | - | ||

| Iran–Asian Countries Trade | Model I | Panel v-statistic | 2.05 * | 0.02 | −0.78 | 0.78 |

| Panel rho-statistic | −1.73 * | 0.04 | −0.34 | 0.36 | ||

| Panel PP-statistic | −6.76 | 0.00 | −4.20 * | 0.00 | ||

| Panel ADF-statistic | −7.38 * | 0.00 | −4.81 * | 0.00 | ||

| Group rho-statistic | 0.69 | 0.75 | - | - | ||

| Group PP-statistic | −6.23 * | 0.00 | - | - | ||

| Group ADF-statistic | −5.98 * | 0.00 | - | - | ||

| Model II | Panel v-statistic | 1.05 | 0.14 | 0.51 | 0.30 | |

| Panel rho-statistic | −2.89 * | 0.00 | −2.02 | 0.02 | ||

| Panel PP-statistic | −4.36 * | 0.00 | −3.97 * | 0.00 | ||

| Panel ADF-statistic | −3.94 * | 0.00 | −4.27 * | 0.00 | ||

| Group rho-statistic | −1.64 * | 0.05 | - | - | ||

| Group PP-statistic | −4.49 * | 0.00 | - | - | ||

| Group ADF-statistic | −4.91 * | 0.00 | - | - |

| Case | Model | Variables | FE | RF | FMOLS |

|---|---|---|---|---|---|

| Iran–EU Trade | Model I | LYY | 0.26 (0.08) | 0.17 (0.01) | 0.38 (0.00) |

| LCTI | 0.43 (0.00) | 0.38 (0.00) | 0.48 (0.01) | ||

| LKAOPEN | 0.32 (0.04) | 0.31 (0.00) | 0.41 (0.00) | ||

| LREM | 0.25 (0.00) | 0.23 (0.02) | 0.31 (0.01) | ||

| LDIS | - | −1.08 (0.05) | - | ||

| SANC | −0.56 (0.00) | −0.48 (0.00) | −0.57 (0.00) | ||

| Model II | LYPYP | 0.29 (0.03) | 0.14 (0.05) | 0.50 (0.09) | |

| LCTI | 0.39 (0.02) | 0.40 (0.00) | 0.43 (0.00) | ||

| LKAOPEN | 0.36 (0.00) | 0.32 (0.03) | 0.39 (0.00) | ||

| LREM | 0.09 (0.01) | 0.08 (0.00) | 0.12 (0.01) | ||

| LDIS | - | −1.37 (0.00) | - | ||

| SANC | −0.75 (0.00) | −0.69 (0.00) | −0.76 (0.00) | ||

| Iran–Asian Countries Trade | Model I | LDYP | 0.50 (0.00) | 0.50 (0.00) | 0.49 (0.00) |

| LCTI | 0.53 (0.01) | 0.49 (0.04) | 0.58 (0.00) | ||

| LKAOPEN | 0.42 (0.00) | 0.40 (0.00) | 0.48 (0.01) | ||

| LREM | 0.17 (0.00) | 0.15 (0.00) | 0.23 (0.00) | ||

| LDIS | - | −2.90 (0.00) | - | ||

| SANC | 0.31 (0.00) | 0.29 (0.00) | 0.46 (0.00) | ||

| Model II | LYPYP | 0.14 (0.02) | 0.12 (0.04) | 0.19 (0.00) | |

| LCTI | 0.47 (0.03) | 0.46 (0.02) | 0.51 (0.02) | ||

| LKAOPEN | 0.45 (0.00) | 0.44 (0.00) | 0.48 (0.00) | ||

| LREM | 0.11 (0.04) | 0.09 (0.04) | 0.15 (0.00) | ||

| LDIS | - | −1.78 (0.03) | - | ||

| SANC | 0.84 (0.00) | 0.83 (0.00) | 0.96 (0.00) |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Popova, L.; Rasoulinezhad, E. Have Sanctions Modified Iran’s Trade Policy? An Evidence of Asianization and De-Europeanization through the Gravity Model. Economies 2016, 4, 24. https://doi.org/10.3390/economies4040024

Popova L, Rasoulinezhad E. Have Sanctions Modified Iran’s Trade Policy? An Evidence of Asianization and De-Europeanization through the Gravity Model. Economies. 2016; 4(4):24. https://doi.org/10.3390/economies4040024

Chicago/Turabian StylePopova, Liudmila, and Ehsan Rasoulinezhad. 2016. "Have Sanctions Modified Iran’s Trade Policy? An Evidence of Asianization and De-Europeanization through the Gravity Model" Economies 4, no. 4: 24. https://doi.org/10.3390/economies4040024

APA StylePopova, L., & Rasoulinezhad, E. (2016). Have Sanctions Modified Iran’s Trade Policy? An Evidence of Asianization and De-Europeanization through the Gravity Model. Economies, 4(4), 24. https://doi.org/10.3390/economies4040024