Supply Chain Pricing Models Considering Risk Attitudes under Free-Riding Behavior

Abstract

:1. Introduction

- (1)

- At what value are the free-riding coefficient, the pricing, and profit of the supply chain with a promotion strategy optimal;

- (2)

- How does the supply chain with a promotion strategy deal with the risks brought by free-riding behavior between supply chains;

- (3)

- When all supply chains implement promotion strategies at the same time, how to analyze the impact of the bidirectional free-riding behavior between supply chains on the pricing and profit of each supply chain?

2. Literature Review

2.1. Positive Impact of Free-Riding Behavior

2.2. Negative Impact of Free-Riding Behavior

2.3. The Double-Sided Nature of Free-Riding Behavior

2.4. Risk Attitudes

3. The Model

3.1. Model Description

3.2. Notation Definition and Model Assumptions

- (1)

- The potential market demand is large, and when consumers have the same preference for the two products, the demand meets ;

- (2)

- The implementation of a promotion strategy in the supply chain can expand its market demand and increase potential customers. At the same time, it will produce free-riding behavior between supply chains [50]. The increased income of free-riding companies is not necessarily less than that of companies implementing promotion strategies;

- (3)

- Consumers choose to buy merchants mainly based on their own needs and time cost, which is less affected by the cross-price elasticity coefficient between supply chains, i.e., [51];

- (4)

- It is assumed that the wholesale price of products provided by manufacturers to retailers in the two supply chains is equal and unchanged; the unit production cost of the two manufacturers is the same, which is , and the unit sales cost and each sunk cost of the retailer are not considered;

- (5)

- According to the mean-variance theory, the total expected utility of the supply chain is composed of its expected profit and standard deviation, that is: [15,52], where indicates that the supply chain is completely risks neutral, indicates that the supply chain is completely risk-averse and the greater the is, the more risk-averse the supply chain is [16].

3.3. Model Construction

3.3.1. Neither Supply Chain Implements a Promotion Strategy

3.3.2. SC2 Promotes Promotion Strategy and SC1 One-Way Free Riding

3.3.3. SC1 Promotes Promotion Strategy and SC2 One-Way Free Riding

3.3.4. Both Supply Chains Carry out Promotion Strategies, Resulting in Bidirectional Free-Riding Behavior

4. Numerical Experiments

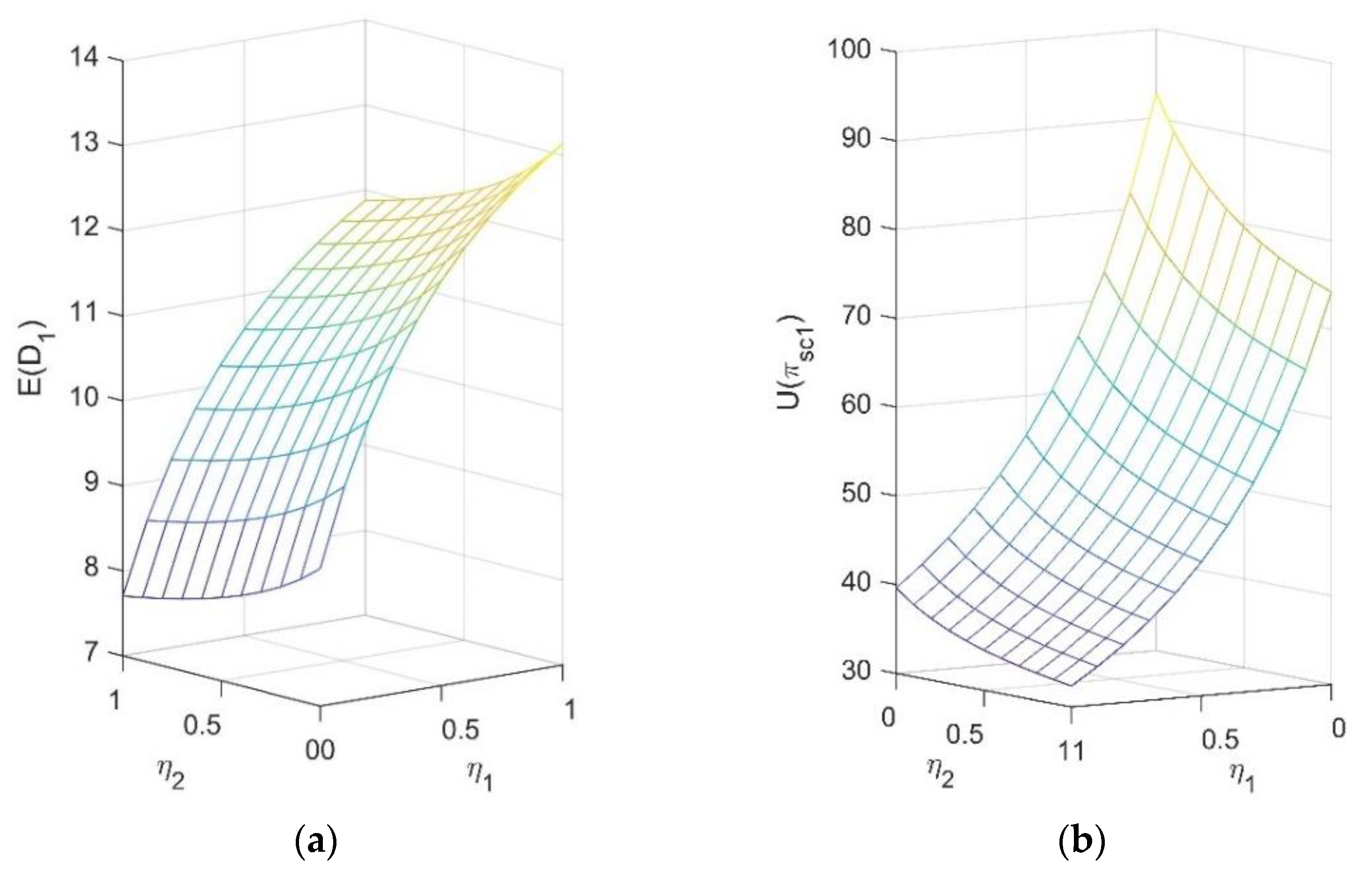

4.1. Influence of the Degree of Risk Aversion on Expected Demand and Total Expected Utility of Supply Chains under No Free-Riding Behavior

- (1)

- Both supply chain risk aversion coefficients have an impact on SC1 expected demand and total expected utility, but the impact of is more significant, indicating that the supply chain is more sensitive to the change in its risk aversion degree;

- (2)

- The expected demand of SC1 changes positively with and negatively with , because as the degree of SC1 risk aversion increases, gradually decreases according to proposition 1, and price reduction is beneficial to expand the market demand of SC1 under the condition of homogeneity of products and the same market. Similarly, keeping the unchanged, with the increase in , the market demand for SC2 increases, and the market demand for SC1 decreases accordingly;

- (3)

- The total expected utility of supply chain 1 and the risk aversion coefficient of the two supply chains change in the opposite direction. Although the market demand for SC1 changes positively with , , that is, the impact of price reduction is greater than that of demand increase. Lower risk tolerance leads to a smaller total expected utility, and when , the total expected utility of SC1 is the largest, which also reflects the principle of high risk and high return. Similarly, we can see from the fact that SC2 pricing decreases with the increase in its degree of risk aversion, SC2 market demand increases accordingly, and SC1 will tend to adopt a price reduction strategy with higher risk aversion to maintain the same competitiveness, so gradually decreases. The changes in total expected utility and expected demand of supply chain SC2 are similar to this section and will not be discussed here.

4.2. Influence of the Degree of Risk Aversion on Each Variable

- (1)

- As for the degree of risk aversion of a single supply chain, in any case, the pricing, effort level, and total expected utility of the supply chain are inversely proportional to the degree of risk aversion of itself and the other supply chain. This shows that when the degree of risk aversion of either supply chain increases, both supply chains in the market tend to adopt a conservative strategy, that is, reducing the price. However, it is known from 4.1. that the impact of price reduction is greater than that of demand increase, so the effort level and total expected utility of the supply chain are reduced accordingly;

- (2)

- When the degree of risk aversion of the two supply chains is the same, the pricing, effort level, and total expected utility of the supply chain are the largest when both supply chains implement the promotion strategy, the second when a single supply chain implements the promotion strategy, and the smallest when neither supply chain implements the promotion strategy. When the two supply chains adopt the same strategy, they have the same pricing, the same effort level, and the same total expected utility of the supply chain. When the two supply chains adopt different strategies, the supply chain pricing, effort level, and total expected utility of the promotion strategy are higher. This shows that under the same degree of risk aversion of the two supply chains and the small and equal free-riding coefficient between the supply chains, the promotion strategy of any supply chain can increase potential customers, expand the market demand of both sides, and further promote the supply chain to improve the effort level, pricing, and total expected utility. When both sides choose to implement the promotion strategy, each variable reaches the best result;

- (3)

- When the degree of risk aversion of the two supply chains is different, no matter what strategies they adopt, the pricing and total expected utility of the supply chain with a higher degree of risk aversion are lower, and the pricing and total expected utility of the supply chain with a lower degree of risk aversion are higher, which also reflects the principle of high risk and high return, and has nothing to do with whether the supply chain implements the promotion a strategy or not and the free-riding coefficient.

- (4)

- According to Table 1, Table 2 and Table 4, on the premise of an equal free-riding coefficient and the same degree of risk aversion in the supply chain, if the one-way free-riding coefficient between the supply chains is small, the supply chain pricing and total expected utility of the promotion strategy are higher than that of the other party. Otherwise, it is beneficial to the supply chain without a promotion strategy and has nothing to do with the risk aversion degree of the supply chain. This shows that only when the free-riding coefficient is small the promotion strategy is beneficial to itself, which further verifies the corollary 1 conclusion. At the same time, it shows that there is a critical value of a one-way free-riding coefficient between 0.2 and 0.5, which makes the total expected utility of the two supply chains equal. The analysis processes of SC1 implement promotion strategy and SC2 one-way free riding, two supply chains implement promotion strategy at the same time, and common free-riding are similar to the second case and will not be discussed here.

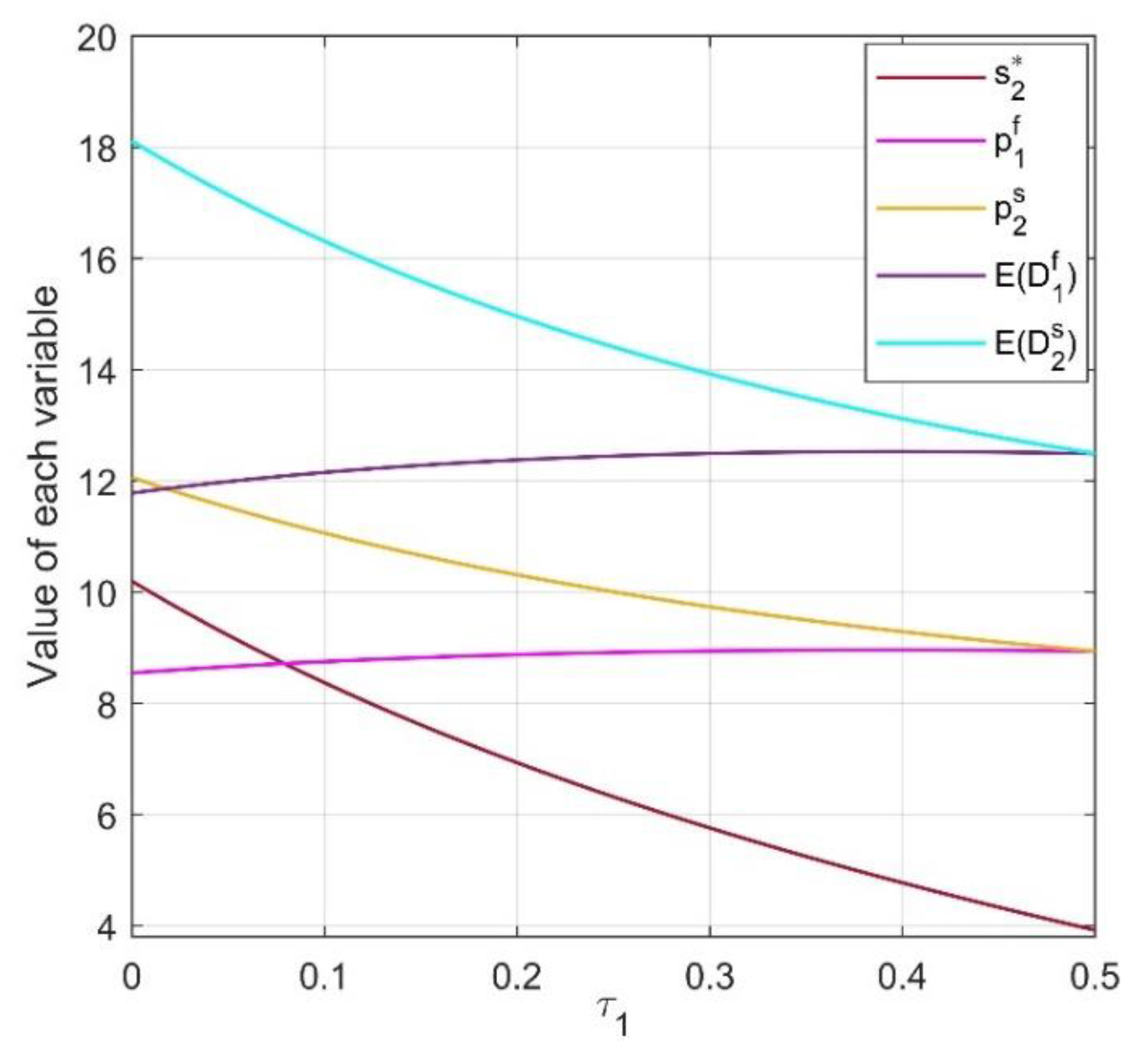

4.3. Impact of Variation of the One-Way Free-Riding Coefficient on Various Variables

- (1)

- The optimal effort level of SC2 changes inversely with the one-way free-riding coefficient between the supply chains, which means that the greater the free-riding coefficient, the less inclined SC2 is to make efforts to implement the promotion strategy. This reduces the enthusiasm of the supply chain to implement the promotion strategy and is not conducive to expanding the market demand of both sides;

- (2)

- When , the market demand and retail price of SC2 are always greater than that of SC1, and only when , the market demand and optimal pricing of the two supply chains are equal, which also indicates that when the free-riding coefficient between supply chains is small, rational SC2 will make efforts to implement promotion strategy; otherwise it will not adopt promotion strategy;

- (3)

- The total expected utility of SC1 increases with the increase in the free-riding coefficient, and the total expected utility of SC2 decreases with the increase in the free-riding coefficient. Only when , they are equal. This is because, although and , the increase in the free-riding coefficient between supply chains gradually makes the total expected utility of the two consistent, and when , , which further shows that when , SC2 makes efforts to promote the promotion strategy beneficial to it. The conclusion of the third case is similar to this and will not be discussed here.

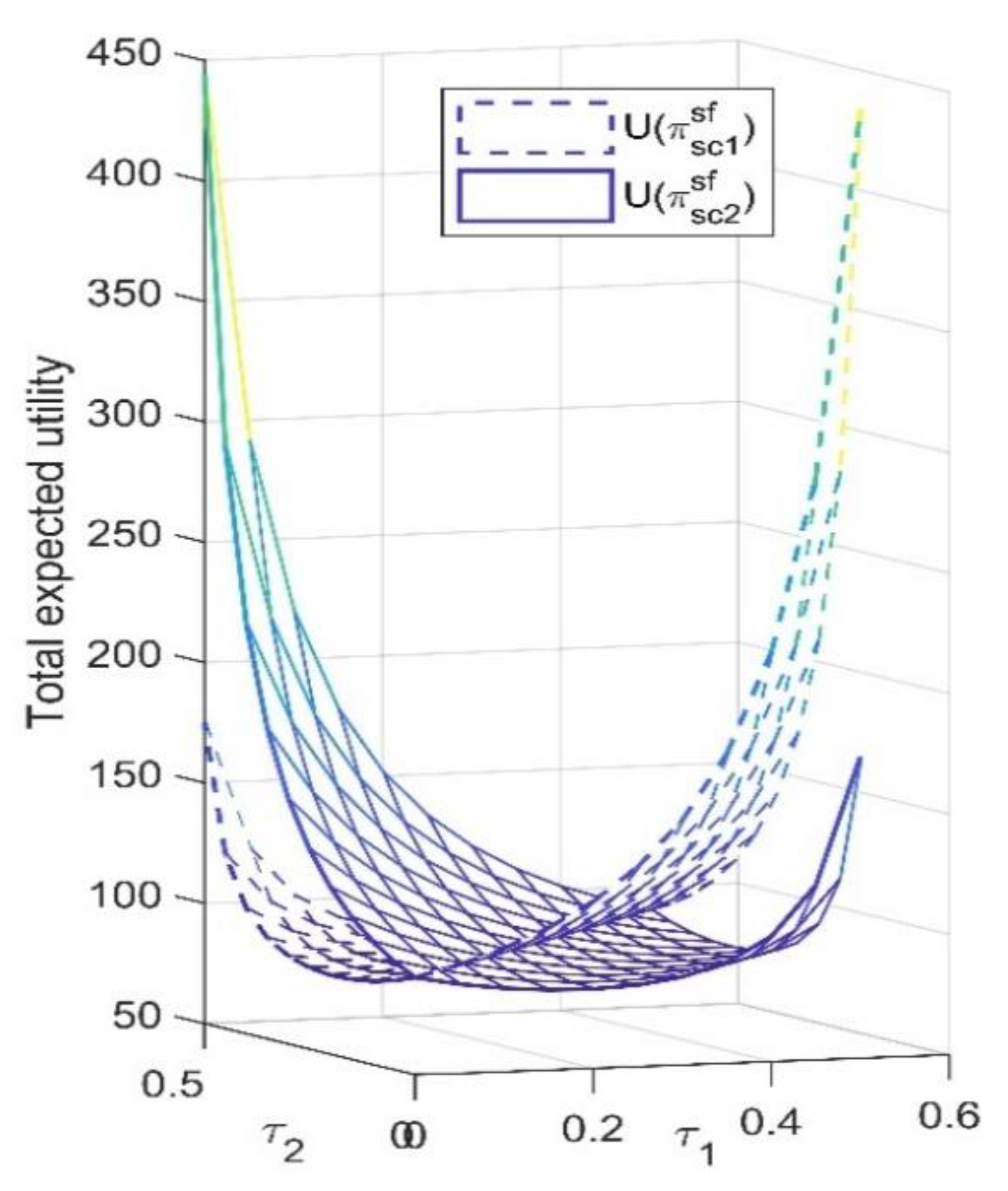

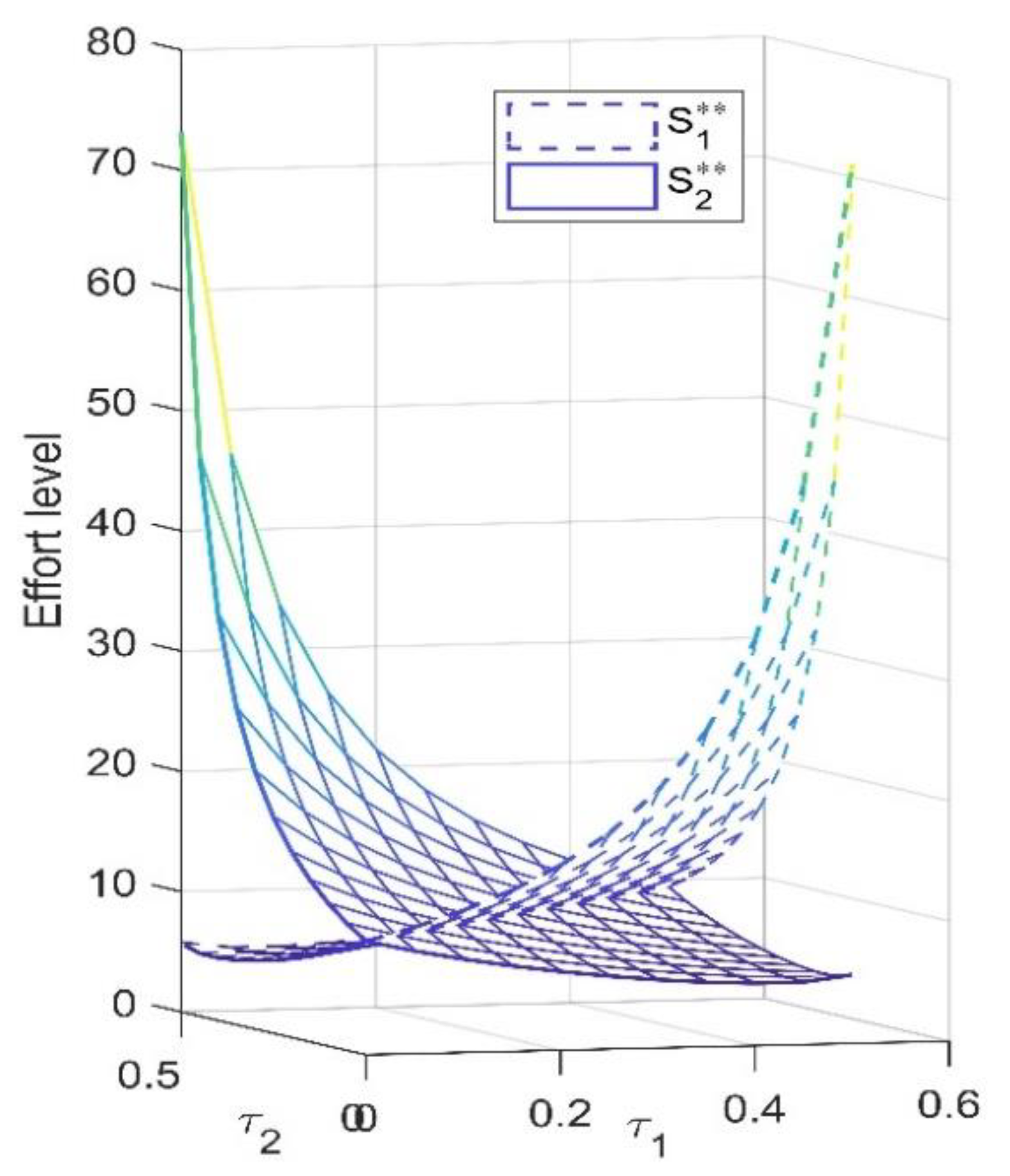

4.4. Impact of Variation of the Bidirectional Free-Riding Coefficient on Various Variables

- (1)

- When the two supply chain hitchhiking coefficients are not equivalent, the pricing, effort level, and total expected utility of the supply chain with a large coefficient are greater than those with a small coefficient. When the bidirectional free-riding coefficient takes or , the value of each variable reaches the maximum. This shows that when the free-riding coefficients of the two supply chains are different, the supply chain with a larger coefficient has an advantage in the market, and the supply chain with a competitive disadvantage may choose not to implement a promotion strategy. The competition gradually turns into the second or third case, which is not conducive to improving the enthusiasm of each supply chain to implement a promotion strategy;

- (2)

- When the free-riding coefficients of both sides are equal, the price, effort level, and total expected utility of the supply chains are always at the same level, respectively, and the two supply chains will adopt the same strategy: they implement the promotion strategy or not at the same time, but the values of each variable remain unchanged. This shows that when the bidirectional free-riding coefficient between supply chains is the same, whether they choose to implement or not implement the promotion strategy has little difference for themselves, and the results of the two supply chains implementing the promotion strategy at the same time are better than that of the other three cases.

5. Conclusions

5.1. Summary

- (1)

- Supply chain pricing, effort level, and total expected utility decrease with the increase in risk aversion of itself and the other party. When the degree of risk aversion of the two supply chains is different, no matter what strategies the two supply chains adopt, the party with the greater degree of risk aversion has lower pricing and lower total expected utility, and the party with the lesser degree of risk aversion has higher pricing and higher total expected utility. This has nothing to do with the value of the free-riding coefficient between the supply chains and also reflects the principle of high risk and high return;

- (2)

- When any supply chain implements the promotion strategy, its pricing changes inversely with the free-riding coefficient between the supply chains, and the free-riding supply chain pricing increases with the increase in the free-riding coefficient. Under the condition that the two supply chains have the same degree of risk aversion and consumers have the same preference for the products of the two supply chains, and only when the one-way free-riding coefficient is small, the implementation of promotion strategy in a single supply chain is beneficial to both; that is, the market demand of the two supply chains is higher than that without promotion strategy. At this time, the pricing and total expected utility of the supply chain with a promotion strategy are both higher than those of the other side; otherwise, it is beneficial to the supply chain without the promotion strategy and has nothing to do with the risk attitudes of the supply chain;

- (3)

- Through numerical examples, we further give the optimal one-way free-riding coefficient between the two supply chains with the same degree of risk aversion; when both supply chains make efforts to implement the promotion strategy, there will be bidirectional free-riding behavior between supply chains. At this time, the competition between supply chains gradually tends to the situation where a single supply chain implements the promotion strategy, or two supply chains adopt the same strategy. The result is optimal when both supply chains simultaneously implement the promotion strategy.

5.2. Limitations and Directions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviation

| Variable | Definition |

| Supply chain retailers | |

| Supply chain manufacturers | |

| Unit selling price in the supply chain under different circumstances | |

| The wholesale price of manufacturers within the supply chain | |

| The unit production cost of the manufacturer | |

| Consumer preference for retailer 1’s products | |

| Total potential market demand | |

| Price sensitivity coefficient of customer demand | |

| Cross price elasticity coefficient between supply chains | |

| The degree of risk aversion of supply chains | |

| Market demand fluctuation random variable | |

| Coefficient of supply chain promotion strategy effort level | |

| The effort level of supply chain promotion strategy | |

| The proportion of manufacturers sharing supply chain promotion cost | |

| Free-riding coefficient between supply chains | |

| Market demand of supply chain under different circumstances | |

| Expected market demand of supply chain under different circumstances | |

| Profit of retailer under different circumstances | |

| The total expected utility of the supply chain under different conditions |

Appendix A

References

- Giri, B.C.; Sharma, S. Manufacturer’s pricing strategy in a two-level supply chain with competing retailers and advertising cost dependent demand. Econ. Model. 2014, 38, 102–111. [Google Scholar] [CrossRef]

- Dogu, E.; Albayrak, Y.E. Criteria evaluation for pricing decisions in strategic marketing management using an intuitionistic cognitive map approach. Soft. Comput. 2018, 22, 4989–5005. [Google Scholar] [CrossRef]

- Sodhi, M.M.S.; Tang, C.S. Supply chain management for extreme conditions: Research opportunities. J. Supply. Chain Manag. 2021, 57, 7–16. [Google Scholar] [CrossRef]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar] [CrossRef]

- Xu, G.; Dan, B.; Zhang, X.; Liu, C. Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. Int. J. Prod. Econ. 2014, 147, 171–179. [Google Scholar] [CrossRef]

- Mehra, A.; Kumar, S.; Raju, J.S. Competitive strategies for brick-and-mortar stores to counter “showrooming”. Manag. Sci. 2018, 64, 3076–3090. [Google Scholar] [CrossRef] [Green Version]

- Wang, Z.; Ran, L.; Yang, D. Interplay between quality disclosure and cross-channel free riding. Electron. Commer. Res. Appl. 2021, 45, 101024. [Google Scholar] [CrossRef]

- Deloitte. Available online: https://www2.deloitte.com/content/dam/Deloitte/dk/Documents/strategy/e-commerce-covid-19-onepage.pdf (accessed on 25 December 2021).

- Kilgore, T. MarketWatch. Available online: https://www.marketwatch.com/story/covid-19-turned-the-hotel-industry-upside-down-but-it-wont-change-what-people-want-2020-08-23 (accessed on 15 February 2022).

- Wilcox, K.; Kim, H.M.; Sen, S. Why do consumers buy counterfeit luxury brands? J. Mark. Res. 2009, 46, 247–259. [Google Scholar] [CrossRef]

- Telser, L.G. Why should manufacturers want fair trade? J. Law. Econ. 1960, 3, 86–105. [Google Scholar] [CrossRef]

- Fraser, K. Fashionunited. Available online: https://fashionunited.com/news/business/88-percent–of–us–consumers-research-products-onlineto-buy-in-store/2018010919074 (accessed on 22 February 2022).

- Wang, C.; Chen, J.; Chen, X. The impact of customer returns and bidirectional option contract on refund price and order decisions. Eur. J. Oper. Res. 2019, 274, 267–279. [Google Scholar] [CrossRef]

- Sawik, B. Multiobjective newsvendor models with CVaR for flower industry. In Applications of Management Science; Emerald Publishing Limited: Bradford, UK, 2020; pp. 3–30. [Google Scholar]

- Zhao, S.; Zhu, Q. A risk-averse marketing strategy and its effect on coordination activities in a re-manufacturing supply chain under market fluctuation. J. Clean. Prod. 2018, 171, 1290–1299. [Google Scholar] [CrossRef]

- Sun, L.; Ma, J. Study and simulation on dynamics of a risk-averse supply chain pricing model with dual-channel and incomplete information. Int. J. Bifurcat. Chaos 2016, 26, 1650146. [Google Scholar] [CrossRef]

- Zhu, B.; Wen, B.; Ji, S.; Qiu, R. Coordinating a dual-channel supply chain with conditional value-at-risk under uncertainties of yield and demand. Comput. Ind. Eng. 2020, 139, 1352–1378. [Google Scholar] [CrossRef]

- Li, B.; Hou, P.W.; Chen, P.; Li, Q.H. Pricing strategy and coordination in a dual channel supply chain with a risk-averse retailer. Int. J. Prod. Econ. 2016, 178, 154–168. [Google Scholar] [CrossRef]

- Jiang, Y.; Li, B.; Song, D. Analysing consumer RP in a dual-channel supply chain with a risk-averse retailer. Eur. J. Ind. Eng. 2017, 11, 271–302. [Google Scholar] [CrossRef]

- Shin, J. How does free riding on customer service affect competition? Market. Sci. 2007, 26, 488–503. [Google Scholar] [CrossRef] [Green Version]

- Liang, Y.; Sun, X. Product green degree, service free-riding, strategic price difference in a dual-channel supply chain based on dynamic game. Optimization 2022, 71, 633–674. [Google Scholar] [CrossRef]

- Wang, D.; Liu, W.; Liang, Y.; Wei, S. Decision optimization in service supply chain: The impact of demand and supply-driven data value and altruistic behavior. Ann. Oper. Res. 2021, 56, 1–22. [Google Scholar] [CrossRef]

- Zhang, F.; Zhang, Z.; Xue, Y.; Zhang, J.; Che, Y. Dynamic green innovation decision of the supply chain with innovating and free-riding manufacturers: Cooperation and spillover. Complexity 2020, 2020, 8937847. [Google Scholar] [CrossRef]

- Zhou, Y.W.; Guo, J.S.; Zhou, W.H. Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- He, R.; Xiong, Y.; Lin, Z. Carbon emissions in a dual channel closed loop supply chain: The impact of consumer free riding behavior. J. Clean. Prod. 2016, 134, 384–394. [Google Scholar] [CrossRef] [Green Version]

- Jing, B. Showrooming and webrooming: Information externalities between online and offline sellers. Market. Sci. 2018, 37, 469–483. [Google Scholar] [CrossRef]

- Liu, Z.; Lu, L.; Qi, X. The showrooming effect on integrated dual channels. J. Oper. Res. Soc. 2020, 71, 1347–1356. [Google Scholar] [CrossRef]

- Yan, N.; Zhang, Y.; Xu, X.; Gao, Y. Online finance with dual channels and bidirectional free-riding effect. Int. J. Prod. Econ. 2021, 231, 107834. [Google Scholar] [CrossRef]

- Mittelstaedt, R.A. Sasquatch, the abominable snowman, free riders and other elusive beings. J. Macromark. 1986, 6, 25–35. [Google Scholar] [CrossRef]

- Chiou, J.S.; Wu, L.Y.; Chou, S.Y. You do the service but they take the order. J. Bus. Res. 2012, 65, 883–889. [Google Scholar] [CrossRef]

- Zheng, Z.L.; Bao, X. The investment strategy and capacity portfolio optimization in the supply chain with spillover effect based on artificial fish swarm algorithm. Adv. Prod. Eng. Manag. 2019, 14, 239–250. [Google Scholar] [CrossRef]

- Ke, H.; Jiang, Y. Equilibrium analysis of marketing strategies in supply chain with marketing efforts induced demand considering free riding. Soft. Comput. 2021, 25, 2103–2114. [Google Scholar] [CrossRef]

- Balakrishnan, A.; Sundaresan, S.; Zhang, B. Browse-and-switch: Retail-online competition under value uncertainty. Prod. Oper. Manag. 2014, 23, 1129–1145. [Google Scholar] [CrossRef]

- Liu, G.; Cao, H.; Zhu, G. Competitive pricing and innovation investment strategies of green products considering firms’ farsightedness and myopia. Int. Trans. Oper. Res. 2021, 28, 839–871. [Google Scholar] [CrossRef]

- Wang, J.; Yan, Y.; Du, H.; Zhao, R. The optimal sales format for green products considering downstream investment. Int. J. Prod. Res. 2020, 58, 1107–1126. [Google Scholar] [CrossRef]

- Xing, D.; Liu, T. Sales effort free riding and coordination with price match and channel rebate. Eur. J. Oper. Res. 2012, 219, 264–271. [Google Scholar] [CrossRef]

- Pu, X.; Gong, L.; Han, X. Consumer free riding: Coordinating sales effort in a dual-channel supply chain. Electron. Commer. Res. Appl. 2017, 22, 1–12. [Google Scholar] [CrossRef]

- Sun, H.; Wan, Y.; Zhang, L.; Zhou, Z. Evolutionary game of the green investment in a two-echelon supply chain under a government subsidy mechanism. J. Clean. Prod. 2019, 235, 1315–1326. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C. Contracting pricing and emission reduction for supply chain considering vertical technological spillovers. Int. J. Adv. Manuf. Tech. 2017, 93, 481–492. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C.; Li, H. Decision and coordination of low-carbon supply chain considering technological spillover and environmental awareness. Sci. Rep. 2017, 7, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Liu, C.; Dan, Y.; Dan, B.; Xu, G. Cooperative strategy for a dual-channel supply chain with the influence of free-riding customers. Electron. Commer. Res. Appl. 2020, 43, 101001. [Google Scholar] [CrossRef]

- Mobbs, D.; Trimmer, P.C.; Blumstein, D.T.; Dayan, P. Foraging for foundations in decision neuroscience: Insights from ethology. Nat. Rev. Neurosci. 2018, 19, 419–427. [Google Scholar] [CrossRef] [Green Version]

- Kim, H.; Toyokawa, W.; Kameda, T. How do we decide when (not) to free-ride? Risk tolerance predicts behavioral plasticity in cooperation. Evol. Hum. Behav. 2019, 40, 55–64. [Google Scholar] [CrossRef]

- Ma, L.; Liu, F.; Li, S.; Yan, H. Channel bargaining with risk-averse retailer. Int. J. Prod. Econ. 2012, 139, 155–167. [Google Scholar] [CrossRef]

- Li, B.; Chen, P.; Li, Q.; Wang, W. Dual-channel supply chain pricing decisions with a risk-averse retailer. Int. J. Prod. Res. 2014, 52, 7132–7147. [Google Scholar] [CrossRef]

- Xu, S.; Tang, H.; Lin, Z. Inventory and ordering decisions in dual-channel supply chains involving free riding and consumer switching behavior with supply chain financing. Complexity 2021, 2021, 5530124. [Google Scholar] [CrossRef]

- Ma, J.; Hong, Y. Dynamic game analysis on pricing and service strategy in a retailer-led supply chain with risk attitudes and free-ride effect. Kybernetes 2021, 51, 1156–1174. [Google Scholar] [CrossRef]

- Wang, F.; Yang, X.; Zhuo, X.; Xiong, M. Joint logistics and financial services by a 3PL firm: Effects of risk preference and demand volatility. Transport. Res. Part E-Log. 2019, 130, 312–328. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel conflict and coordination in the e-commerce age. Prod. Oper. Manag. 2004, 13, 93–110. [Google Scholar] [CrossRef] [Green Version]

- Krishnan, H.; Kapuscinski, R.; Butz, D.A. Coordinating contracts for decentralized supply chains with retailer promotional effort. Manag. Sci. 2004, 50, 48–63. [Google Scholar] [CrossRef]

- Huang, W.; Swaminathan, J.M. Introduction of a second channel: Implications for pricing and profits. Eur. J. Oper. Res. 2009, 194, 258–279. [Google Scholar] [CrossRef]

- Lau, H.S.; Lau, A.H.L. Manufacturer’s pricing strategy and return policy for a single-period commodity. Eur. J. Oper. Res. 1999, 116, 291–304. [Google Scholar] [CrossRef]

- Zhang, C.T.; Wang, Z. Production mode and pricing coordination strategy of sustainable products considering consumers’ preference. J. Clean. Prod. 2021, 296, 126476. [Google Scholar] [CrossRef]

- Wu, S.; Li, Q. Emergency quantity discount contract with suppliers risk aversion under stochastic price. Mathematics 2021, 9, 1791. [Google Scholar] [CrossRef]

| 0.2 | 0.2 | 10.24 | 10.24 | 12.03 | 14.88 | 14.88 | 12.03 | 22.08 | 22.08 |

| 0.5 | 9.95 | 8.30 | 11.04 | 10.68 | 14.24 | 9.59 | 19.39 | 13.65 | |

| 0.8 | 9.77 | 7.10 | 10.53 | 8.56 | 13.85 | 8.10 | 18.28 | 10.18 | |

| 0.5 | 0.2 | 8.30 | 9.95 | 9.59 | 14.24 | 10.68 | 11.04 | 13.65 | 19.39 |

| 0.5 | 8.09 | 8.09 | 8.88 | 10.31 | 10.31 | 8.88 | 12.28 | 12.28 | |

| 0.8 | 7.95 | 6.93 | 8.51 | 8.30 | 10.08 | 7.55 | 11.69 | 9.26 | |

| 0.8 | 0.2 | 7.10 | 9.27 | 8.10 | 13.85 | 8.56 | 10.53 | 10.18 | 18.28 |

| 0.5 | 6.93 | 7.95 | 7.55 | 10.08 | 8.30 | 8.51 | 9.26 | 11.69 | |

| 0.8 | 6.83 | 6.83 | 7.27 | 8.14 | 8.14 | 7.27 | 8.87 | 8.87 |

| 0.2 | 0.2 | 67.82 | 67.82 | 100.50 | 106.00 | 106.00 | 100.50 | 200.50 | 200.50 |

| 0.5 | 63.13 | 51.62 | 81.65 | 71.14 | 97.23 | 74.79 | 153.00 | 115.10 | |

| 0.8 | 60.30 | 41.67 | 72.85 | 53.52 | 92.04 | 59.56 | 135.30 | 80.46 | |

| 0.5 | 0.2 | 51.62 | 63.13 | 74.79 | 97.23 | 71.14 | 81.65 | 115.10 | 153.00 |

| 0.5 | 48.17 | 48.17 | 61.48 | 65.77 | 65.77 | 61.48 | 90.86 | 90.86 | |

| 0.8 | 46.08 | 38.94 | 55.16 | 49.69 | 62.57 | 49.30 | 81.43 | 64.34 | |

| 0.8 | 0.2 | 41.67 | 60.30 | 59.56 | 92.04 | 53.52 | 72.85 | 80.46 | 135.30 |

| 0.5 | 38.94 | 46.08 | 49.30 | 62.57 | 49.69 | 55.16 | 64.34 | 81.43 | |

| 0.8 | 37.29 | 37.29 | 44.39 | 47.39 | 47.39 | 44.39 | 57.97 | 57.97 |

| 0.2 | 0.2 | 10.93 | 10.93 | 20.13 | 20.13 |

| 0.5 | 7.34 | 10.25 | 17.29 | 11.07 | |

| 0.8 | 5.52 | 9.84 | 16.11 | 7.28 | |

| 0.5 | 0.2 | 10.25 | 7.34 | 11.07 | 17.29 |

| 0.5 | 6.93 | 6.93 | 9.64 | 9.64 | |

| 0.8 | 5.24 | 6.69 | 9.02 | 6.33 | |

| 0.8 | 0.2 | 9.84 | 5.52 | 7.28 | 16.11 |

| 0.5 | 6.69 | 5.24 | 6.33 | 9.02 | |

| 0.8 | 5.07 | 5.07 | 5.92 | 5.92 |

| 0.2 | 0.2 | 11.96 | 11.96 | 90.40 | 73.24 | 11.44 | 10.70 | 89.20 | 71.66 |

| 0.5 | 11.15 | 9.26 | 75.60 | 42.93 | 10.84 | 8.57 | 78.16 | 53.81 | |

| 0.8 | 10.69 | 7.71 | 67.75 | 25.15 | 10.48 | 7.28 | 71.85 | 43.08 | |

| 0.5 | 0.2 | 9.51 | 11.47 | 56.32 | 66.87 | 9.11 | 10.31 | 65.62 | 66.05 |

| 0.5 | 8.94 | 8.94 | 46.73 | 39.03 | 8.69 | 8.30 | 58.11 | 49.85 | |

| 0.8 | 8.61 | 7.48 | 41.59 | 22.51 | 8.43 | 7.07 | 53.76 | 40.03 | |

| 0.8 | 0.2 | 8.03 | 11.18 | 35.69 | 63.12 | 7.70 | 10.08 | 51.91 | 62.74 |

| 0.5 | 7.59 | 8.75 | 28.91 | 36.73 | 7.38 | 8.14 | 46.26 | 47.49 | |

| 0.8 | 7.34 | 7.34 | 25.27 | 20.94 | 7.18 | 6.95 | 42.96 | 38.21 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, T.; Wang, K.; Mei, Y.; He, S.; Wang, Y. Supply Chain Pricing Models Considering Risk Attitudes under Free-Riding Behavior. Mathematics 2022, 10, 1723. https://doi.org/10.3390/math10101723

Gao T, Wang K, Mei Y, He S, Wang Y. Supply Chain Pricing Models Considering Risk Attitudes under Free-Riding Behavior. Mathematics. 2022; 10(10):1723. https://doi.org/10.3390/math10101723

Chicago/Turabian StyleGao, Taiguang, Kui Wang, Yali Mei, Shan He, and Yanfang Wang. 2022. "Supply Chain Pricing Models Considering Risk Attitudes under Free-Riding Behavior" Mathematics 10, no. 10: 1723. https://doi.org/10.3390/math10101723