Computer Vision Algorithms, Remote Sensing Data Fusion Techniques, and Mapping and Navigation Tools in the Industry 4.0-Based Slovak Automotive Sector

Abstract

:1. Introduction

- 1.

- Innovations in technology, the growth of information systems, and advancements in manufacturing processes make up the first dimension. The physical foundations and tools of globalization are developed in this way.

- 2.

- A broad range of social and economic structures enable the configuration of globalization processes [4].

2. Literature Review

3. Materials and Methods

- 3.

- Secondary source research to chart the expansion of Slovakia’s automotive industry and the performance of exports from national economies (Sario, economy.gov.sk, datacube, Statistical Office of Slovakia).

- 4.

- The main conclusions of the survey, which was collaboratively developed by employees working in Industry 4.0 and digitizing the company’s production, were acknowledged. The primary goal was to discover how familiar the chosen company employees were with the concept of Industry 4.0. The second goal was to determine how well-prepared the selected organizations were for the transition to a digital society as a way to increase added value via delivering technical innovations in the form of new products and processes [67]. Building unique methodologies based on the transformation (upgrade) of GVC at the level of process improvements and/or products for the increase of added value was the aim of this research, which was conducted from 1 January to 30 April 2022.

- 5.

- Researching and analyzing current automotive industry developments and the impact of Industry 4.0 on the Slovak automotive industry.

4. Results and Discussion

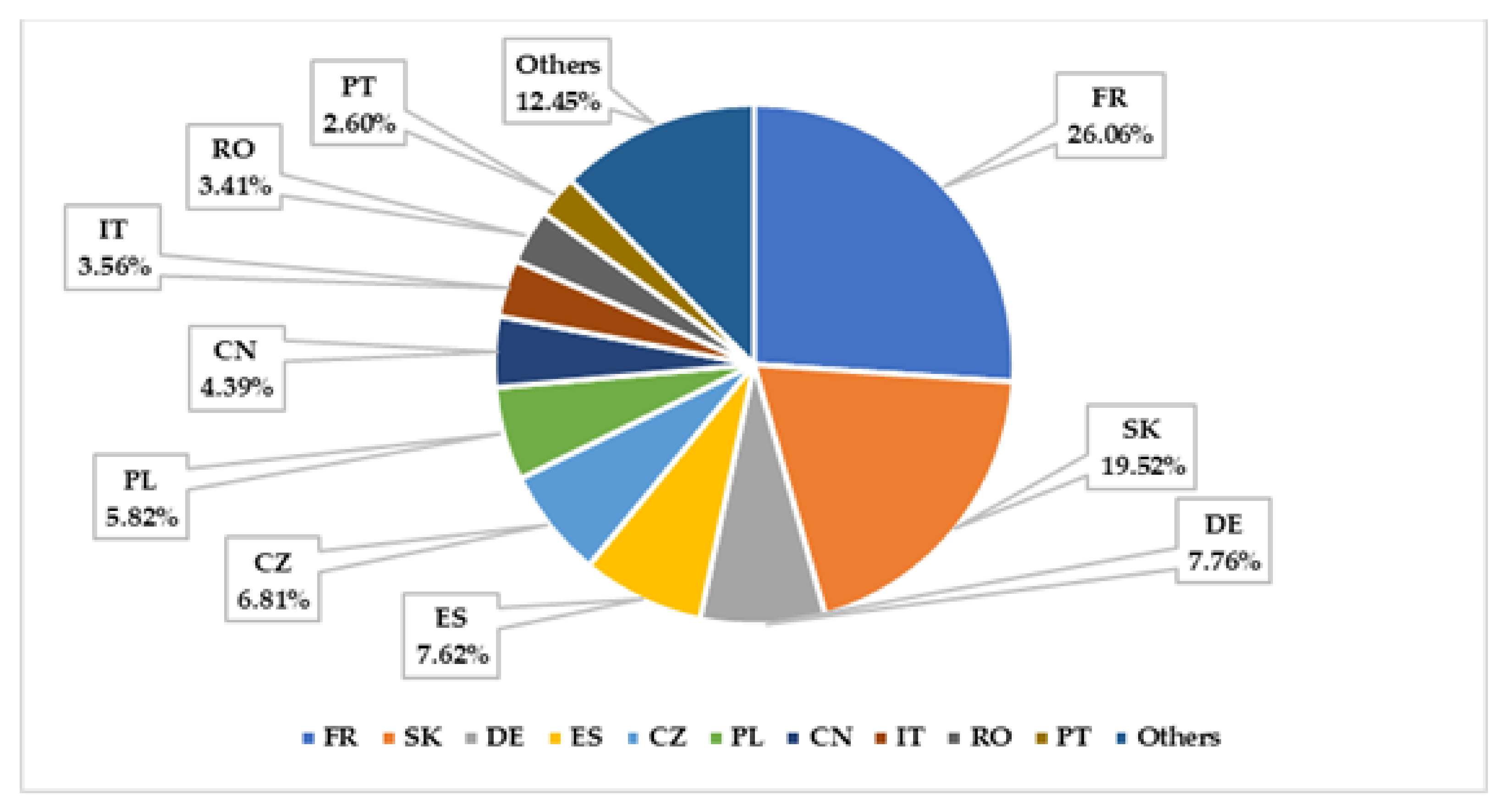

4.1. PSA Company’s Supplier Structure (Analysis of Added Value)

4.2. Implementing Industry 4.0 in PSA Group SVK

- 1.

- In order to draw in international investment, the Slovak government must provide favorable circumstances for enterprises to go green.

- 2.

- Slovakian business must exert pressure on the government to establish the necessary legal framework for environmental protection.

- 3.

- The vehicle manufacturers’ headquarters must collaborate with their Slovakian suppliers to assist them in retraining workers to take advantage of new technology and production methods [82].

- 4.

- New training programs and cross-sectoral collaboration between the public and private sectors as well as academia are required for retraining and enhancing the quality of personnel to fulfil the work requirements of the rising e-mobility sub-sectors [83].

5. Conclusions

6. Specific Contributions to the Literature

7. Limitations and Further Directions of Research

8. Practical Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Hatzigeorgiou, A.; Lodefalk, M. A literature review of the nexus between migration and internationalization. J. Int. Trade Econ. Dev. 2021, 30, 319–340. [Google Scholar] [CrossRef]

- Nikulin, D.; Wolszczak-Derlacz, J.; Parteka, A. GVC and wage dispersion. Firm level evidence from employee-employer database. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 357–375. [Google Scholar] [CrossRef]

- Kordalska, A.; Olczyk, M. New patterns in the position of CEE countries in global value chains: Functional specialisation approach. Oeconomia Copernic. 2021, 12, 35–52. [Google Scholar] [CrossRef]

- Minarik, M.; Zabojnik, S.; Pasztorova, J. Sources of Value-Added in V4 automotive GVCs: The Case of Transport and Storage Services and Firm Level Technology Absorption. Cent. Eur. Bus. Rev. 2022, 11, 12–14. [Google Scholar] [CrossRef]

- Schoeneman, J.; Zhou, B.L.; Desmarais, B.A. Complex dependence in foreign direct investment: Network theory and empirical analysis. Political Sci. Res. Methods 2022, 12, 243–259. [Google Scholar] [CrossRef]

- Kumar, S.; Raut, R.D.; Narwane, V.S.; Narkhede, B.E. Applications of industry 4.0 to overcome the COVID-19 operational challenges. Diabetes Metab. Syndr. Clin. Res. Rev. 2020, 14, 1283–1289. [Google Scholar] [CrossRef]

- Said, M.; Shaheen, A.M.; Ginidi, A.R.; El-Sehiemy, R.A.; Mahmoud, K.; Lehtonen, M.; Darwish, M.M.F. Estimating Parameters of Photovoltaic Models Using Accurate Turbulent Flow of Water Optimizer. Processes 2021, 9, 627. [Google Scholar] [CrossRef]

- Martinez-Noya, A.; Garcia-Canal, E. International evidence on R&D services outsourcing practices by technological firms. Multinatl. Bus. Rev. 2014, 22, 372–393. [Google Scholar]

- Bonab, A.-F. The Development of Competitive Advantages of Brand in the Automotive Industry (Case Study: Pars Khodro Co). J. Internet Bank. Commer. 2017, 22, S8. [Google Scholar]

- Pavlinek, P.; Zenka, J. Value creation and value capture in the automotive industry: Empirical evidence from Czechia. Environ. Plan. 2016, 48, 937–959. [Google Scholar] [CrossRef]

- Modibbo, U.M.; Gupta, N.; Chatterjee, P.; Ali, I. A Systematic Review on the Emergence and Applications of Industry 4.0. In Computational Modelling in Industry 4.0.; Springer: Singapore, 2022. [Google Scholar] [CrossRef]

- Stock, T.; Obenaus, M.; Kunz, S.; Kohl, H. Industry 4.0 as enabler for a sustainable development: A qualitative assessment of its ecological and social potential. Process Saf. Environ. Prot. 2018, 118, 254–267. [Google Scholar] [CrossRef]

- Kotlebova, J.; Arendas, P.; Chovancova, B. Government expenditures in the support of technological innovations and impact on stock market and real economy: The empirical evidence from the US and Germany. Equilib. Q. J. Econ. Econ. Policy 2020, 15, 717–734. [Google Scholar] [CrossRef]

- Cerna, I.; Elteto, A.; Folfas, P.; Kuznar, A.; Krenkova, E.; Minarik, M.; Przezdziecka, E.; Szalavetz, A.; Tury, G.; Zabojnik, S. GVCs in Central Europe—A Perspective of the Automotive Sector after COVID-19; Ekonom: Bratislava, Slovakia, 2022; Available online: https://gvcsv4.euba.sk/images/PDF/monograph.pdf (accessed on 4 June 2022).

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Political Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Pugliese, E.; Napolitano, L.; Zaccaria, A.; Pietronero, L. Coherent diversification in corporate technological portfolios. PLoS ONE 2019, 14, e0223403. [Google Scholar] [CrossRef]

- Mondejar, M.A.; Avtar, R.; Diaz, H.L.; Dubey, R.K.; Esteban, J.; Gomez-Morales, A.; Hallam, B.; Mbungu, N.T.; Okolo, C.C.; Prasad, K.A.; et al. Digitalization to achieve sustainable development goals: Steps towards a Smart Green Planet. Sci. Total Environ. 2021, 794, 148539. [Google Scholar] [CrossRef]

- Mugge, D. International economic statistics: Biased arbiters in global affairs? Fudan J. Humanit. Soc. Sci. 2020, 13, 93–112. [Google Scholar] [CrossRef]

- Ye, C.S.; Ye, Q.; Shi, X.P.; Sun, Y.P. Technology gap, global value chain and carbon intensity: Evidence from global manufacturing industries. Energy Policy 2020, 137, 111094. [Google Scholar] [CrossRef]

- Brioschi, M.; Bonardi, M.; Fabrizio, N.; Fuggetta, A.; Vrga, E.S.; Zuccala, M. Enabling and Promoting Sustainability through Digital API Ecosystems: An example of successful implementation in the smart city domain. Technol. Innov. Manag. Rev. 2021, 11, 4–10. [Google Scholar] [CrossRef]

- Kubickova, L.; Kormanakova, M.; Vesela, L.; Jelinkova, Z. The Implementation of Industry 4.0 Elements as a Tool Stimulating the Competitiveness of Engineering Enterprises. J. Compet. 2021, 13, 76–94. [Google Scholar] [CrossRef]

- Tao, F.; Qi, Q.; Wan, L.; Nee, A.Y.C. Digital Twins and Cyber-Physical Systems toward Smart Manufacturing and Industry 4.0: Correlation and Comparison. Engineering 2019, 5, 653–661. [Google Scholar] [CrossRef]

- Sjodin, D.R.; Parida, V.; Leksell, M.; Petrovic, A. Smart Factory Implementation and Process Innovation. Res. Technol. Manag. 2018, 61, 22–31. [Google Scholar] [CrossRef] [Green Version]

- Gray, M.; Kovacova, M. Internet of Things Sensors and Digital Urban Governance in Data-driven Smart Sustainable Cities. Geopolit. Hist. Int. Relat. 2021, 13, 107–120. [Google Scholar]

- Kliestik, T.; Zvarikova, K.; Lazaroiu, G. Data-driven Machine Learning and Neural Network Algorithms in the Retailing Environment: Consumer Engagement, Experience, and Purchase Behaviors. Econ. Manag. Financ. Mark. 2022, 17, 57–69. [Google Scholar] [CrossRef]

- Andronie, M.; Lazaroiu, G.; Iatagan, M.; Uța, C.; Ștefanescu, R.; Cocoșatu, M. Artificial Intelligence-Based Decision-Making Algorithms, Internet of Things Sensing Networks, and Deep Learning-Assisted Smart Process Management in Cyber-Physical Production Systems. Electronics 2021, 10, 2497. [Google Scholar] [CrossRef]

- Skare, M.; Gil-Alana, L.A.; Claudio-Quiroga, G.; Prziklas Druzeta, R. Income inequality in China 1952-2017: Persistence and main determinants. Oeconomia Copernic. 2021, 12, 863–888. [Google Scholar] [CrossRef]

- Popescu, G.H.; Valaskova, K.; Horak, J. Augmented Reality Shopping Experiences, Retail Business Analytics, and Machine Vision Algorithms in the Virtual Economy of the Metaverse. J. Self Gov. Manag. Econ. 2022, 10, 67–81. [Google Scholar] [CrossRef]

- Zabojnik, S. Selected Problems of International Trade and International Business; Econom: Bratislava, Slovakia, 2015; pp. 28–61. [Google Scholar]

- Krykavskyy, A.; Pokhylchenko, O.; Hayvanovych, N. Supply chain development drivers in industry 4.0 in Ukrainian enterprises. Oeconomia Copernic. 2019, 10, 273–290. [Google Scholar] [CrossRef]

- Clayton, E.; Kral, P. Autonomous Driving Algorithms and Behaviors, Sensing and Computing Technologies, and Connected Vehicle Data in Smart Transportation Networks. Contemp. Read. Law Soc. Justice 2021, 13, 9–22. [Google Scholar]

- Yang, F.; Gu, S. Industry 4.0, a revolution that requires technology and national strategies. Complex Intell. Syst. 2021, 7, 1311–1325. [Google Scholar] [CrossRef]

- Hermann, M.; Pentek, T.; Otto, B. Design Principles for Industry 4.0 Scenarios: A Literature Review. Technische Universitat Dortmund. 2016. Available online: http://www.snom.mb.tu-dortmund.de/cms/de/forschung/Arbeitsberichte/Design-Principles-for-Industrie-4_0-Scenarios.pdf (accessed on 2 May 2022).

- Klingenberg, C.O.; Borges, M.A.V.; Antunes, J., Jr. Industry 4.0 as a data-driven paradigm: A systematic literature review on technologies. J. Manuf. Technol. Manag. 2019, 32, 570–592. [Google Scholar] [CrossRef]

- Rogers, S.; Zvarikova, K. Big Data-driven Algorithmic Governance in Sustainable Smart Manufacturing: Robotic Process and Cognitive Automation Technologies. Anal. Metaphys. 2021, 20, 130–144. [Google Scholar]

- Ruttimann, B.G.; Stockli, M.T. Lean and Industry 4.0—Twins, Partners, or Contenders? A Due Clarification Regarding the Supposed Clash of Two Production Systems. J. Sci. Serv. Manag. 2016, 9, 485–500. [Google Scholar] [CrossRef]

- Krulicky, T.; Horak, J. Business performance and financial health assessment through artificial intelligence. Ekon. Manaz. Spektrum 2021, 15, 38–51. [Google Scholar] [CrossRef]

- Kovacova, M.; Lewis, E. Smart Factory Performance, Cognitive Automation, and Industrial Big Data Analytics in Sustainable Manufacturing Internet of Things. J. Self Gov. Manag. Econ. 2021, 9, 9–21. [Google Scholar]

- Mehmann, J.; Teuteberg, F. The fourth-party logistics service provider approach to support sustainable development goals in transportation—A case study of the German agricultural bulk logistics sector. J. Clean. Prod. 2016, 126, 382–393. [Google Scholar] [CrossRef]

- Galbraith, A.; Podhorska, I. Artificial Intelligence Data-driven Internet of Things Systems, Robotic Wireless Sensor Networks, and Sustainable Organizational Performance in Cyber-Physical Smart Manufacturing. Econ. Manag. Financ. Mark. 2021, 16, 56–69. [Google Scholar]

- Sony, M. Pros and cons of implementing Industry 4.0 for the organizations: A review and synthesis of evidence. Prod. Manuf. Res. 2020, 8, 244–272. [Google Scholar] [CrossRef]

- Dalenogare, L.; Benitez, N.; Ayala, N.F.; Frank, A.G. The expected contribution of Industry 4.0 technologies for industrial performance. Int. J. Prod. Econ. 2018, 204, 383–394. [Google Scholar] [CrossRef]

- Hinds, P.S.; Vogel, R.J.; Clarke-Steffen, L. The possibilities and pitfalls of doing a secondary analysis of a qualitative data set. Qual. Health Res. 1997, 7, 408–424. [Google Scholar] [CrossRef]

- Svabova, L.; Tesarova, E.N.; Durica, M.; Strakova, L. Evaluation of the impacts of the COVID-19 pandemic on the development of the unemployment rate in Slovakia: Counterfactual before-after comparison. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 261–284. [Google Scholar] [CrossRef]

- Verhof, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Lawrence, J.; Durana, P. Artificial Intelligence-driven Big Data Analytics, Predictive Maintenance Systems, and Internet of Things-Based Real-Time Production Logistics in Sustainable Industry 4.0 Wireless Networks. J. Self Gov. Manag. Econ. 2021, 9, 62–75. [Google Scholar]

- Zavadska, Z.; Zavadsky, J. Industry 4.0 and Intelligent Technologies in the Development of the Corporate Operation Management; Belianum: Banska Bystrica, Slovakia, 2020; pp. 130–155. [Google Scholar]

- Schot, J.; Steinmueller, W.E. Three frames for innovation policy: R&D, systems of innovation and transformative change. Res. Policy 2018, 47, 1554–1567. [Google Scholar]

- Lazaroiu, G.; Harrison, A. Internet of Things Sensing Infrastructures and Data-driven Planning Technologies in Smart Sustainable City Governance and Management. Geopolit. Hist. Int. Relat. 2021, 13, 23–36. [Google Scholar]

- Vinerean, S.; Budac, C.; Baltador, L.A.; Dabija, D.-C. Assessing the Effects of the COVID-19 Pandemic on M-Commerce Adoption: An Adapted UTAUT2 Approach. Electronics 2022, 11, 1269. [Google Scholar] [CrossRef]

- Zhong, R.; Xu, X.; Klotz, E.; Newman, S.T. Intelligent Manufacturing in the Context of Industry 4.0: A Review. Engineering 2021, 3, 616–630. [Google Scholar] [CrossRef]

- Belhadi, A.; Kamble, S.; Jabbour, C.J.C.; Gunasekaran, A.; Ndubisi, N.O.; Venkatesh, M. Manufacturing and service supply chain resilience to the COVID-19 outbreak: Lessons learned from the automobile and airline industries. Technol. Forecast. Soc. Change 2021, 163, 120–447. [Google Scholar] [CrossRef]

- Hoffmann, M. Smart Agents for the Industry 4.0; Springer: Berlin, Germany, 2019; pp. 226–297. [Google Scholar]

- State of FDI in Slovakia. 2022. Available online: https://www.sario.sk/sk/investicie/pzi-pribehy-uspesnych/pzi-prilev-odlev (accessed on 28 May 2022).

- Hopkins, E.; Siekelova, A. Internet of Things Sensing Networks, Smart Manufacturing Big Data, and Digitized Mass Production in Sustainable Industry 4.0. Econ. Manag. Financ. Mark. 2021, 16, 28–41. [Google Scholar]

- Pisar, P.; Bilkova, D. Controlling as a tool for SME management with an emphasis on innovations in the context of Industry 4.0. Equilib. Q. J. Econ. Econ. Policy 2019, 14, 763–785. [Google Scholar] [CrossRef]

- Johnson, E.; Nica, E. Connected Vehicle Technologies, Autonomous Driving Perception Algorithms, and Smart Sustainable Urban Mobility Behaviors in Networked Transport Systems. Contemp. Read. Law Soc. Justice 2021, 13, 37–50. [Google Scholar] [CrossRef]

- Vuong, T.K.; Mansori, S. An Analysis of the Effects of the Fourth Industrial Revolution on Vietnamese Enterprises. Manag. Dyn. Knowl. Econ. 2021, 9, 447–459. [Google Scholar]

- Chang, B.G.; Wu, K.S. The nonlinear relationship between financial flexibility and enter-prise risk-taking during the COVID-19 pandemic in Taiwan’s semiconductor industry. Oeconomia Copernic. 2021, 12, 307–333. [Google Scholar] [CrossRef]

- Lazaroiu, G.; Kliestik, T.; Novak, A. Internet of Things Smart Devices, Industrial Artificial Intelligence, and Real-Time Sensor Networks in Sustainable Cyber-Physical Production Systems. J. Self Gov. Manag. Econ. 2021, 9, 20–30. [Google Scholar] [CrossRef]

- Sierra-Perez, J.; Teixeira, J.G.; Romero-Piqueras, C.; Patricio, L. Designing sustainable services with the ECO-Service design method: Bridging user experience with environmental performance. J. Clean. Prod. 2021, 305, 127228. [Google Scholar] [CrossRef]

- European Commision, European Competitiveness Report 2014–2021. 2022. Available online: http://ec.europa.eu/enterprise/policies/industrial-competitiveness/competitiveness-analysis/european-competitiveness-report/index_en.htm (accessed on 29 April 2022).

- Hamilton, S. Deep Learning Computer Vision Algorithms, Customer Engagement Tools, and Virtual Marketplace Dynamics Data in the Metaverse Economy. J. Self Gov. Manag. Econ. 2022, 10, 37–51. [Google Scholar] [CrossRef]

- Konecny, V.; Barnett, C.; Poliak, M. Sensing and Computing Technologies, Intelligent Vehicular Networks, and Big Data-Driven Algorithmic Decision-Making in Smart Sustainable Urbanism. Contemp. Read. Law Soc. Justice 2021, 13, 30–39. [Google Scholar] [CrossRef]

- Lyons, N. Deep Learning-based Computer Vision Algorithms, Immersive Analytics and Simulation Software, and Virtual Reality Modeling Tools in Digital Twin-Driven Smart Manufacturing. Econ. Manag. Financ. Mark. 2022, 17, 67–81. [Google Scholar] [CrossRef]

- Glogovețan, A.I.; Dabija, D.-C.; Fiore, M.; Pocol, C.B. Consumer Perception and Understanding of European Union Quality Schemes: A Systematic Literature Review. Sustainability 2022, 14, 1667. [Google Scholar] [CrossRef]

- PSA Slovakia. 2022. Available online: http://www.psa-slovakia.sk/o-nas.html?page_id=172 (accessed on 15 March 2022).

- Nica, E. Urban Big Data Analytics and Sustainable Governance Networks in Integrated Smart City Planning and Management. Geopolit. Hist. Int. Relat. 2021, 13, 93–106. [Google Scholar] [CrossRef]

- Poliak, M.; Poliakova, A.; Svabova, L.; Zhuravleva, A.N.; Nica, E. Competitiveness of Price in International Road Freight Transport. J. Compet. 2021, 13, 83–98. [Google Scholar] [CrossRef]

- Kovacova, M.; Lazaroiu, G. Sustainable Organizational Performance, Cyber-Physical Production Networks, and Deep Learning-assisted Smart Process Planning in Industry 4.0-based Manufacturing Systems. Econ. Manag. Financ. Mark. 2021, 16, 41–54. [Google Scholar] [CrossRef]

- Kovacova, M.; Machova, V.; Bennett, D. Immersive Extended Reality Technologies, Data Visualization Tools, and Customer Behavior Analytics in the Metaverse Commerce. J. Self Gov. Manag. Econ. 2022, 10, 7–21. [Google Scholar] [CrossRef]

- Popescu, G.H.; Poliak, M.; Manole, C.; Dumitrescu, C.-O. Decentralized Finance, Blockchain Technology, and Digital Assets in Non-Fungible Token (NFT) Markets. Smart Gov. 2022, 1, 64–78. [Google Scholar] [CrossRef]

- Wallace, S.; Lazaroiu, G. Predictive Control Algorithms, Real-World Connected Vehicle Data, and Smart Mobility Technologies in Intelligent Transportation Planning and Engineering. Contemp. Read. Law Soc. Justice 2021, 13, 79–92. [Google Scholar] [CrossRef]

- Poliak, M.; Poliakova, A.; Zhuravleva, N.A.; Nica, E. Identifying the Impact of Parking Policy on Road Transport Economics. Mob. Netw. Appl. 2021. early access. [Google Scholar] [CrossRef]

- Kliestik, T.; Valaskova, K.; Nica, E.; Kovacova, M.; Lazaroiu, G. Advanced Methods of Earnings Management: Monotonic Trends and Change-Points under Spotlight in the Visegrad Countries. Oeconomia Copernic. 2020, 11, 371–400. [Google Scholar] [CrossRef]

- Cooper, H.; Poliak, M.; Konecny, V. Computationally Networked Urbanism and Data-driven Planning Technologies in Smart and Environmentally Sustainable Cities. Geopolit. Hist. Int. Relat. 2021, 13, 20–30. [Google Scholar] [CrossRef]

- Kliestik, T.; Novak, A.; Lazaroiu, G. Live Shopping in the Metaverse: Visual and Spatial Analytics, Cognitive Artificial Intelligence Techniques and Algorithms, and Immersive Digital Simulations. Linguist. Philos. Investig. 2022, 21, 187–202. [Google Scholar] [CrossRef]

- Woodward, B.; Kliestik, T. Intelligent Transportation Applications, Autonomous Vehicle Perception Sensor Data, and Decision-Making Self-Driving Car Control Algorithms in Smart Sustainable Urban Mobility Systems. Contemp. Read. Law Soc. Justice 2021, 13, 51–64. [Google Scholar] [CrossRef]

- Higgins, M.; Horak, J. Cyber-Physical Process Monitoring Systems, Artificial Intelligence-based Decision-Making Algorithms, and Sustainable Industrial Big Data in Smart Networked Factories. Econ. Manag. Financ. Mark. 2021, 16, 42–55. [Google Scholar] [CrossRef]

- Franklin, K.; Potcovaru, A.M. Autonomous Vehicle Perception Sensor Data in Sustainable and Smart Urban Transport Systems. Contemp. Read. Law Soc. Justice 2021, 13, 101–110. [Google Scholar] [CrossRef]

- Markauskas, M.; Baliute, A. Technological progress spillover effect in Lithuanian manufacturing industry. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 783–806. [Google Scholar] [CrossRef]

- Strakova, J.; Simberova, I.; Partlova, P.; Vachal, J.; Zich, R. The Value Chain as the Basis of Business Model Design. J. Compet. 2021, 13, 135–151. [Google Scholar] [CrossRef]

- Gajdosikova, D.; Valaskova, K.; Kliestik, T.; Machova, V. COVID-19 Pandemic and Its Impact on Challenges in the Construction Sector: A Case Study of Slovak Enterprises. Mathematics 2022, 10, 3130. [Google Scholar] [CrossRef]

- Valaskova, K.; Nagy, M.; Zabojnik, S.; Lazaroiu, G. Industry 4.0 Wireless Networks and Cyber-Physical Smart Manufacturing Systems as Accelerators of Value-Added Growth in Slovak Exports. Mathematics 2022, 10, 2452. [Google Scholar] [CrossRef]

- Vatamanescu, E.-M.; Bratianu, C.; Dabija, D.-C.; Popa, S. Capitalizing Online Knowledge Networks: From Individual Knowledge Acquisition towards Organizational Achievements. J. Knowl. Manag. 2022. [Google Scholar] [CrossRef]

- Zvarikova, K.; Cug, J.; Hamilton, S. Virtual Human Resource Management in the Metaverse: Immersive Work Environments, Data Visualization Tools and Algorithms, and Behavioral Analytics. Psychosociological Issues Hum. Resour. Manag. 2022, 10, 7–20. [Google Scholar] [CrossRef]

- Ionescu, L. Leveraging Green Finance for Low-Carbon Energy, Sustainable Economic Development, and Climate Change Mitigation during the COVID-19 Pandemic. Rev. Contemp. Philos. 2021, 20, 175–186. [Google Scholar] [CrossRef]

- Watson, R. Tradeable Digital Assets, Immersive Extended Reality Technologies, and Blockchain-based Virtual Worlds in the Metaverse Economy. Smart Gov. 2022, 1, 7–20. [Google Scholar] [CrossRef]

- Nica, E.; Poliak, M.; Popescu, G.H.; Parvu, I.-A. Decision Intelligence and Modeling, Multisensory Customer Experiences, and Socially Interconnected Virtual Services across the Metaverse Ecosystem. Linguist. Philos. Investig. 2022, 21, 137–153. [Google Scholar] [CrossRef]

- Durana, P.; Perkins, N.; Valaskova, K. Artificial Intelligence Data-driven Internet of Things Systems, Real-Time Advanced Analytics, and Cyber-Physical Production Networks in Sustainable Smart Manufacturing. Econ. Manag. Financ. Mark. 2021, 16, 20–30. [Google Scholar]

- Małkowska, A.; Urbaniec, M.; Kosała, M. The impact of digital transformation on European countries: Insights from a comparative analysis. Equilib. Q. J. Econ. Econ. Policy 2021, 16, 325–355. [Google Scholar] [CrossRef]

- Lazaroiu, G.; Andronie, M.; Iatagan, M.; Geamanu, M.; Ștefanescu, R.; Dijmarescu, I. Deep Learning-Assisted Smart Process Planning, Robotic Wireless Sensor Networks, and Geospatial Big Data Management Algorithms in the Internet of Manufacturing Things. ISPRS Int. J. Geo Inf. 2022, 11, 277. [Google Scholar] [CrossRef]

- Pelau, C.; Dabija, D.-C.; Ene, I. What Makes an AI Device Human-Like? The Role of Interaction Quality, Empathy and Perceived Psychological Anthropomorphic Characteristics in the Acceptance of Artificial Intelligence in the Service Industry. Comput. Hum. Behav. 2021, 122, 106855. [Google Scholar] [CrossRef]

- Frajtova Michalikova, K.; Suler, P.; Robinson, R. Virtual Hiring and Training Processes in the Metaverse: Remote Work Apps, Sensory Algorithmic Devices, and Decision Intelligence and Modeling. Psychosociological Issues Hum. Resour. Manag. 2022, 10, 50–63. [Google Scholar] [CrossRef]

- Cazazian, R. Blockchain Technology Adoption in Artificial Intelligence-based Digital Financial Services, Accounting Information Systems, and Audit Quality Control. Rev. Contemp. Philos. 2022, 21, 55–71. [Google Scholar] [CrossRef]

- Nica, E.; Kliestik, T.; Valaskova, K.; Sabie, O.-M. The Economics of the Metaverse: Immersive Virtual Technologies, Consumer Digital Engagement, and Augmented Reality Shopping Experience. Smart Gov. 2022, 1, 21–34. [Google Scholar] [CrossRef]

- Valaskova, K.; Machova, V.; Lewis, E. Virtual Marketplace Dynamics Data, Spatial Analytics, and Customer Engagement Tools in a Real-Time Interoperable Decentralized Metaverse. Linguist. Philos. Investig. 2022, 21, 105–120. [Google Scholar] [CrossRef]

- Pocol, C.B.; Stanca, L.; Dabija, D.-C.; Pop, I.D.; Mișcoiu, S. Knowledge Co-creation and Sustainable Education in the Labor Market-Driven University–Business Environment. Front. Environ. Sci. 2022, 10, 781075. [Google Scholar] [CrossRef]

- Kral, P.; Janoskova, K.; Dawson, A. Virtual Skill Acquisition, Remote Working Tools, and Employee Engagement and Retention on Blockchain-based Metaverse Platforms. Psychosociological Issues Hum. Resour. Manag. 2022, 10, 92–105. [Google Scholar] [CrossRef]

- Andronie, M.; Lazaroiu, G.; Ștefanescu, R.; Uța, C.; Dijmarescu, I. Sustainable, Smart, and Sensing Technologies for Cyber-Physical Manufacturing Systems: A Systematic Literature Review. Sustainability 2021, 13, 5495. [Google Scholar] [CrossRef]

- Peters, M.A. Poststructuralism and the Post-Marxist Critique of Knowledge Capitalism: A Personal Account. Rev. Contemp. Philos. 2022, 21, 21–37. [Google Scholar] [CrossRef]

- Vatamanescu, E.-M.; Alexandru, V.-A.; Mitan, A.; Dabija, D.-C. From the Deliberate Managerial Strategy towards International Business Performance: A Psychic Distance vs. Global Mindset Approach. Syst. Res. Behav. Sci. 2020, 37, 374–387. [Google Scholar] [CrossRef]

- Durana, P.; Krulicky, T.; Taylor, E. Working in the Metaverse: Virtual Recruitment, Cognitive Analytics Management, and Immersive Visualization Systems. Psychosociological Issues Hum. Resour. Manag. 2022, 10, 135–148. [Google Scholar] [CrossRef]

- Poliak, M.; Jurecki, R.; Buckner, K. Autonomous Vehicle Routing and Navigation, Mobility Simulation and Traffic Flow Prediction Tools, and Deep Learning Object Detection Technology in Smart Sustainable Urban Transport Systems. Contemp. Read. Law Soc. Justice 2022, 14, 25–40. [Google Scholar] [CrossRef]

- Kovacova, M.; Novak, A.; Machova, V.; Carey, B. 3D Virtual Simulation Technology, Digital Twin Modeling, and Geospatial Data Mining in Smart Sustainable City Governance and Management. Geopolit. Hist. Int. Relat. 2022, 14, 43–58. [Google Scholar] [CrossRef]

- Blake, R.; Frajtova Michalikova, K. Deep Learning-based Sensing Technologies, Artificial Intelligence-based Decision-Making Algorithms, and Big Geospatial Data Analytics in Cognitive Internet of Things. Anal. Metaphys. 2021, 20, 159–173. [Google Scholar] [CrossRef]

- Kliestik, T.; Musa, H.; Machova, V.; Rice, L. Remote Sensing Data Fusion Techniques, Autonomous Vehicle Driving Perception Algorithms, and Mobility Simulation Tools in Smart Transportation Systems. Contemp. Read. Law Soc. Justice 2022, 14, 137–152. [Google Scholar] [CrossRef]

- Zvarikova, K.; Horak, J.; Downs, S. Digital Twin Algorithms, Smart City Technologies, and 3D Spatio-Temporal Simulations in Virtual Urban Environments. Geopolit. Hist. Int. Relat. 2022, 14, 139–154. [Google Scholar] [CrossRef]

- Lăzăroiu, G.; Ionescu, L.; Andronie, M.; Dijmărescu, I. Sustainability Management and Performance in the Urban Corporate Economy: A Systematic Literature Review. Sustainability 2020, 12, 7705. [Google Scholar] [CrossRef]

- Carey, B. Geospatial Data Mining, Computer Vision-based Lane Detection and Object Localization Algorithms, and Mapping and Navigation Tools in Smart Urban Mobility Systems. Contemp. Read. Law Soc. Justice 2022, 14, 121–136. [Google Scholar] [CrossRef]

- Kliestik, T.; Poliak, M.; Popescu, G.H. Digital Twin Simulation and Modeling Tools, Computer Vision Algorithms, and Urban Sensing Technologies in Immersive 3D Environments. Geopolit. Hist. Int. Relat. 2022, 14, 9–25. [Google Scholar] [CrossRef]

- Andronie, M.; Lăzăroiu, G.; Iatagan, M.; Hurloiu, I.; Dijmărescu, I. Sustainable Cyber-Physical Production Systems in Big Data-Driven Smart Urban Economy: A Systematic Literature Review. Sustainability 2021, 13, 751. [Google Scholar] [CrossRef]

- Konecny, V.; Jaśkiewicz, M.; Downs, S. Motion Planning and Object Recognition Algorithms, Vehicle Navigation and Collision Avoidance Technologies, and Geospatial Data Visualization in Network Connectivity Systems. Contemp. Read. Law Soc. Justice 2022, 14, 89–104. [Google Scholar] [CrossRef]

- Durana, P.; Krastev, V.; Buckner, K. Digital Twin Modeling, Multi-Sensor Fusion Technology, and Data Mining Algorithms in Cloud and Edge Computing-based Smart City Environments. Geopolit. Hist. Int. Relat. 2022, 14, 91–106. [Google Scholar] [CrossRef]

- Lăzăroiu, G.; Pera, A.; Ștefănescu-Mihăilă, R.O.; Mircică, N.; Neguriță, O. Can Neuroscience Assist Us in Constructing Better Patterns of Economic Decision-Making? Front. Behav. Neurosci. 2017, 11, 188. [Google Scholar] [CrossRef]

| Imports Based on Volume | Imports Based on Types of Parts | ||

|---|---|---|---|

| Country (Number of Suppliers) | Volume (pcs) | Country (Number of Suppliers) | Types of Parts (pcs) |

| FR (15) | 5,805,554 | FR (10) | 2668 |

| CZ (3) | 364,377 | CZ (6) | 905 |

| DE (1) | 203,952 | DE (1) | 80 |

| ES (1) | 64,990 | ES (1) | 194 |

| HU (1) | 20,441 | GB (1) | 319 |

| IT (1) | 29,363 | IT (1) | 98 |

| PL (3) | 191,273 | PL (3) | 325 |

| SK (5) | 201,026 | SK (7) | 902 |

| Order | Seller | Town | Products | Parts (pcs) |

|---|---|---|---|---|

| 1. | Faurecia Automotive SVK s.r.o. | Trnava | Car seats | 279 |

| 2. | Adhex Technologies | Senec | Foam parts | 158 |

| 3. | Lear Corporation Seating SVK | Presov | Seating systems | 119 |

| 4. | Eurostyle Systems s.r.o. | Banovce nad Bebravou | Plastic parts | 95 |

| 5. | SMRC Automotive Solutions | Nitra | Modules, cockpits | 92 |

| Areas | Recommendations |

|---|---|

| Increasing understanding and cooperating | 1. Campaign for information as regards cyber-physical production systems |

| 2. Encouragement of Internet of Things-based real-time production logistics research | |

| 3. Industry 4.0-based manufacturing systems implementation guidebook | |

| 4. Increased promotion of sustainable Internet of Manufacturing Things | |

| Industry 4.0 Research | 1. Assistance with applied research |

| 2. Research agenda for Industry 4.0 | |

| 3. Sector-oriented consortia | |

| 4. Attempts to cut back on R&D expenses | |

| The Smart Factory | 1. Support for the use of innovative materials and technologies |

| 2. Standardization (reference architecture) | |

| 3. Introduction of new models into supply chains | |

| 4. Use of industrial big data analytics | |

| Financing | 1. Better funding mechanisms |

| 2. Address the needs of the research agenda | |

| 3. Innovative public procurement | |

| 4. Implementation of pilot projects | |

| Employment and education | 1. A breakdown of the current situation’s primary needs |

| 2. Creating predictive curricula | |

| 3. Providing more specialized skills | |

| 4. Following the European agenda as regards new skills | |

| E-government and legislation | 1. Talent development that is ongoing in the public sector |

| 2. Commercial big data usage (Big Data) | |

| 3. Government’s active involvement in promoting the implementation of Industry 4.0 | |

| 4. A suggestion for a clear vs. digitization strategy |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nagy, M.; Lăzăroiu, G. Computer Vision Algorithms, Remote Sensing Data Fusion Techniques, and Mapping and Navigation Tools in the Industry 4.0-Based Slovak Automotive Sector. Mathematics 2022, 10, 3543. https://doi.org/10.3390/math10193543

Nagy M, Lăzăroiu G. Computer Vision Algorithms, Remote Sensing Data Fusion Techniques, and Mapping and Navigation Tools in the Industry 4.0-Based Slovak Automotive Sector. Mathematics. 2022; 10(19):3543. https://doi.org/10.3390/math10193543

Chicago/Turabian StyleNagy, Marek, and George Lăzăroiu. 2022. "Computer Vision Algorithms, Remote Sensing Data Fusion Techniques, and Mapping and Navigation Tools in the Industry 4.0-Based Slovak Automotive Sector" Mathematics 10, no. 19: 3543. https://doi.org/10.3390/math10193543