Catastrophe Bond Diversification Strategy Using Probabilistic–Possibilistic Bijective Transformation and Credibility Measures in Fuzzy Environment

Abstract

:1. Introduction

2. The Literature Review

3. Catastrophe Bond Diversification Strategy Model Framework

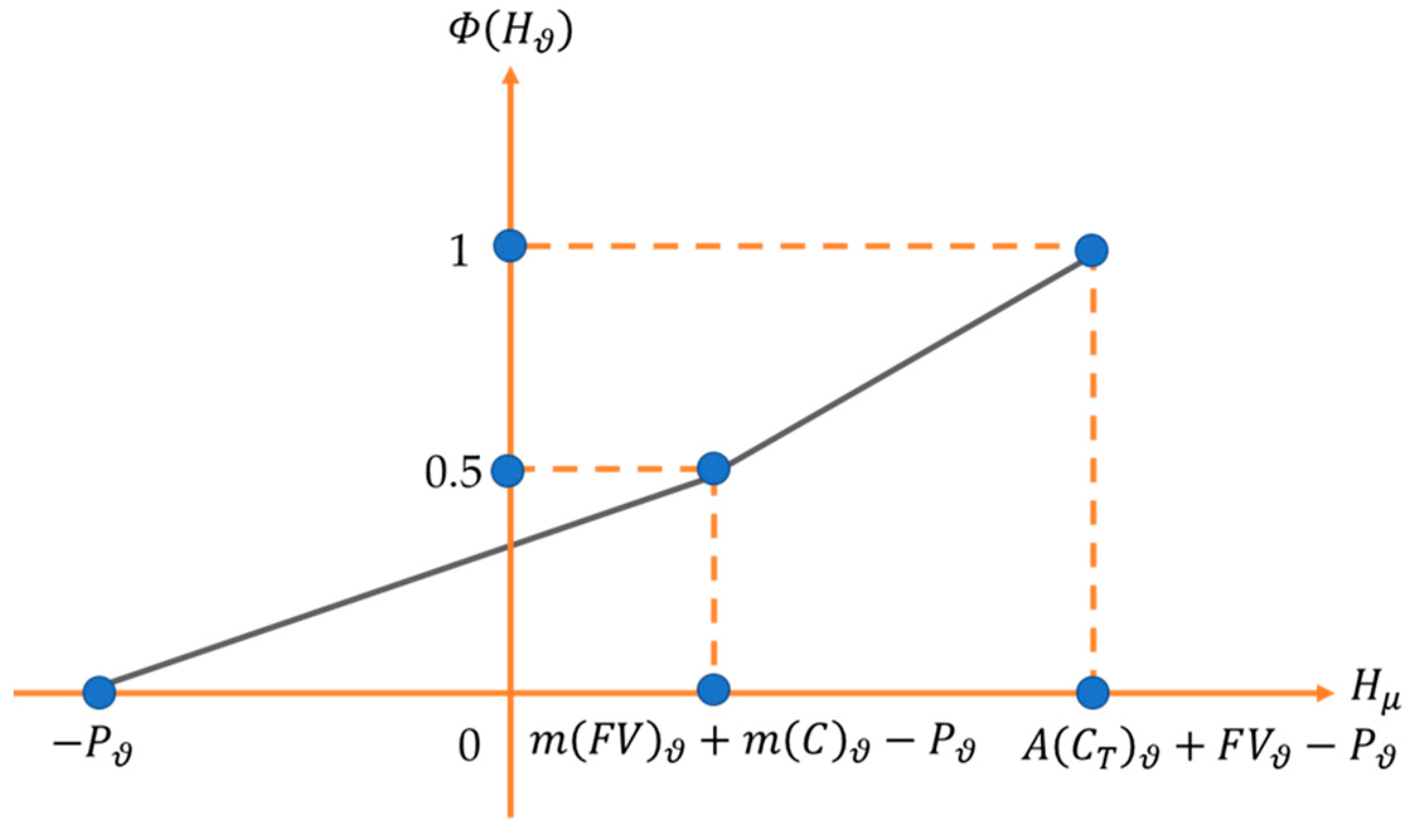

3.1. Identifying the Trigger Distributions of the Face Value and Coupon Payoff Functions

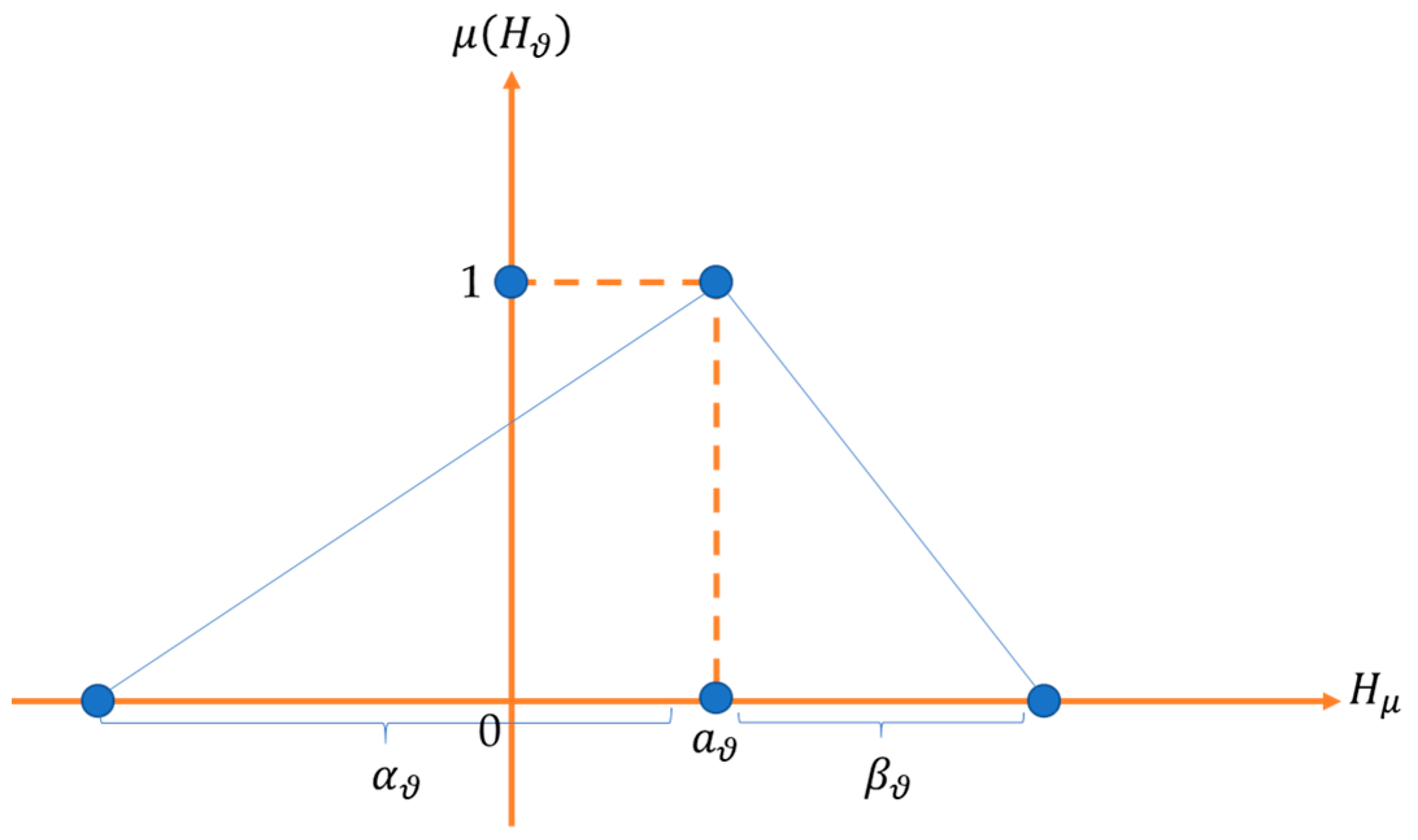

3.2. Determining the Degree of Membership of the Set of the Face Value and Coupons Based on the Payoff Function

3.3. Calculation of the Average of the Face Value and Coupons Using the Fuzzy Quantification Theory

3.4. Defining Triangular Fuzzy Variables for the Yield of Catastrophe Bond Investing

3.5. Formulating the Triangular Fuzzy Function for the Yield of Catastrophe Bond Investing

3.6. Formulating the Credibility Distribution for a Triangular Fuzzy Variable of the Yield

3.7. Formulating the Diversification Strategy Model on Catastrophe Bond Assets

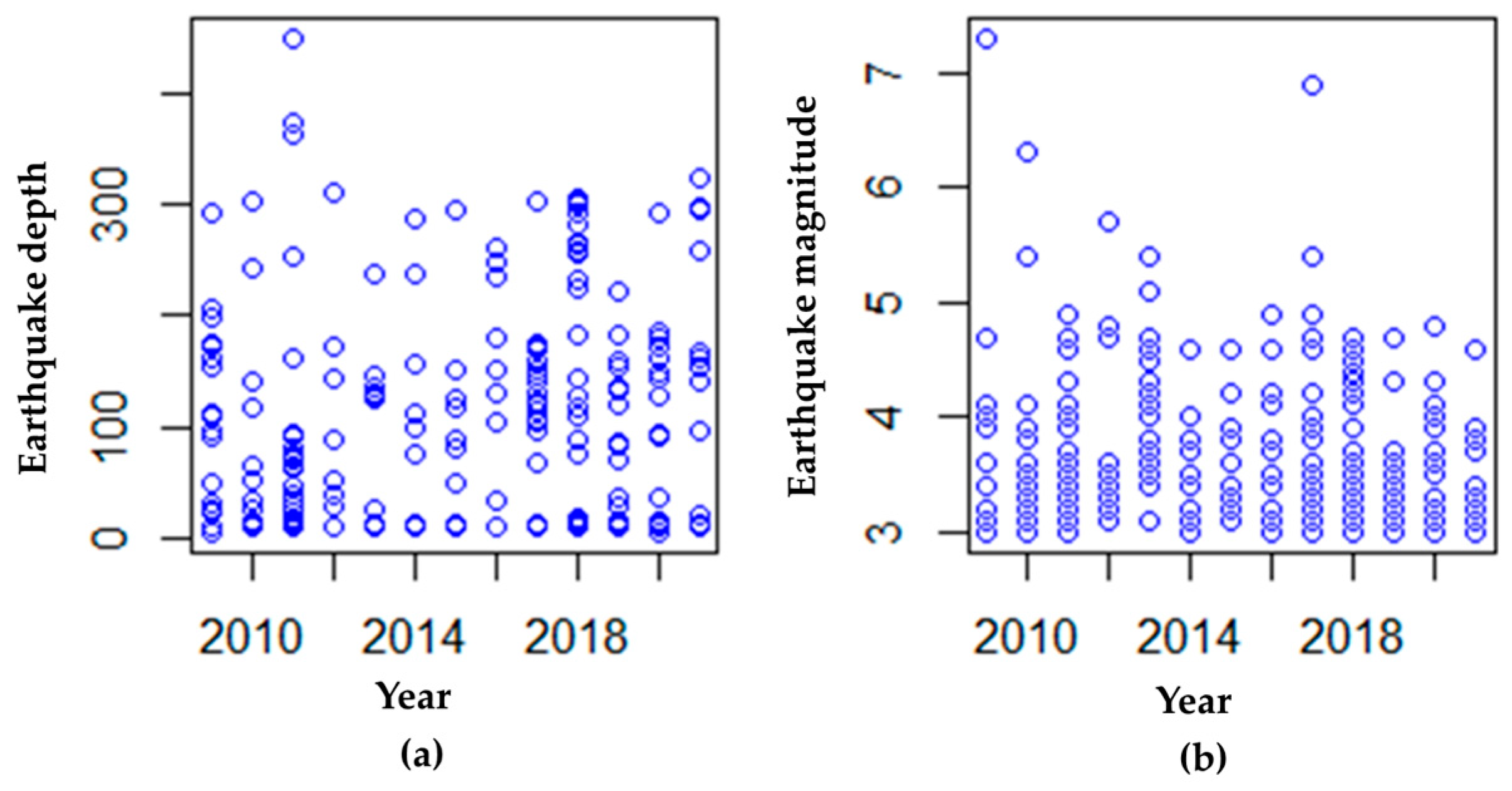

3.8. Numerical Simulation

3.9. Finding the Solutions to the Catastrophe Bond Diversification Strategy Model

- (1)

- Sequential Quadratic Programming

- (2)

- Transformation and Linearization Technique

4. Yield Credibility Distribution

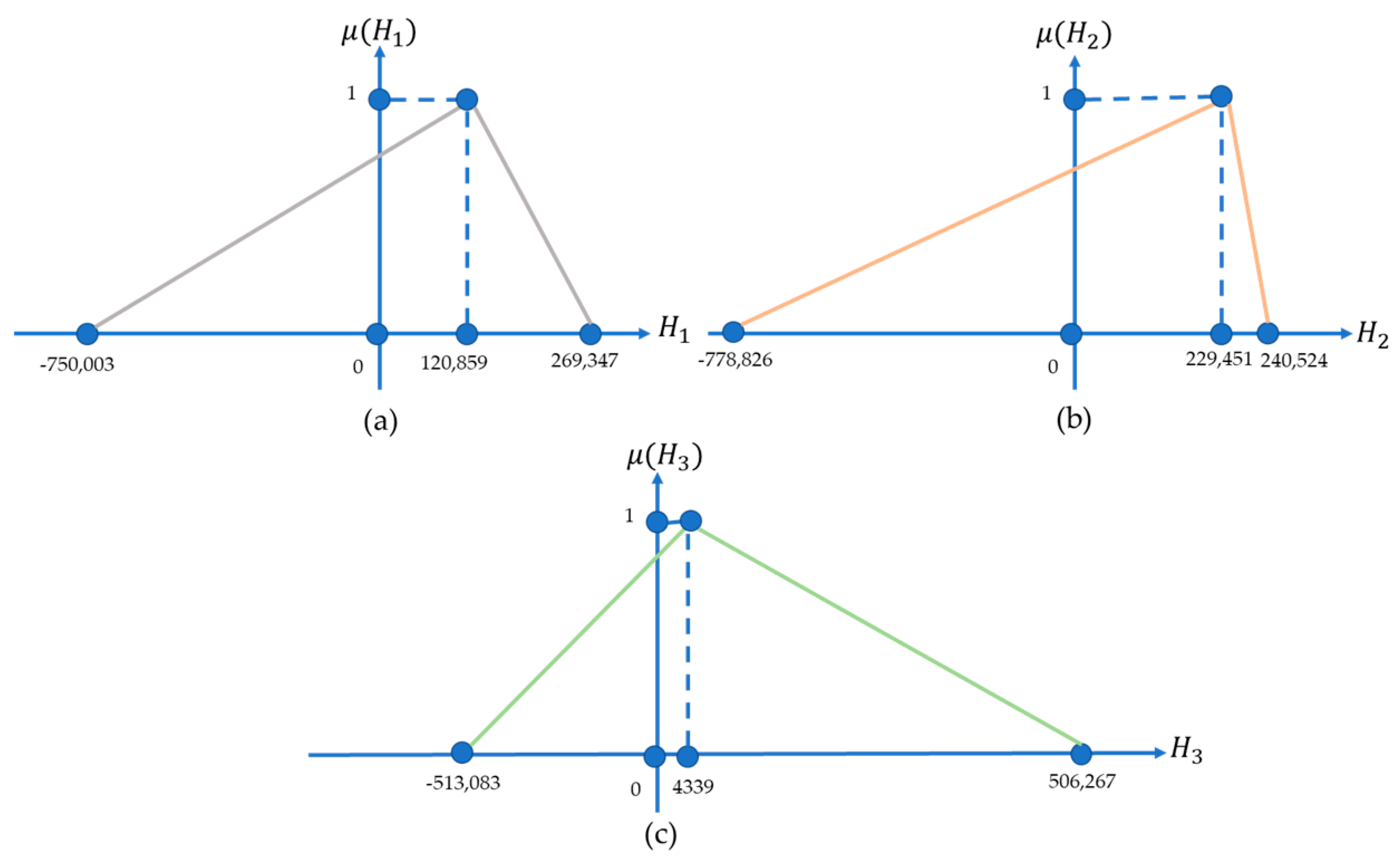

4.1. Modeling the Distribution of the Yield Credibility on the First catastrophe Bonds

4.2. Modeling the Distribution of the Yield Credibility on the Second Catastrophe Bonds

4.3. Modeling the Distribution of the Yield Credibility on the Third Catastrophe Bonds

5. Numerical Simulation of the Catastrophe Bond Diversification Strategy Model

- (1)

- Catastrophe Bond Pricing

- (a)

- Catastrophe Bond Pricing for Equation (16)

- (b)

- Catastrophe Bond Pricing for Equation (17)

- (c)

- Catastrophe Bond Pricing for Equation (18)

- (2)

- Calculating the Average Face Value and Coupons

- (a)

- The Average Face Value and Coupon in Equation (16)

- (b)

- The Average Face Value and Coupon in Equation (17)

- (c)

- The Average Face Value and Coupon in Equation (18)

- (3)

- Defining a Fuzzy Triangular Membership Function for the Yield.

- (4)

- Defining a Credibility Distribution of the Triangular Fuzzy Membership Function for the Yield

- (5)

- Simulation of Catastrophe Bond Strategy Diversification Model

- (6)

- Determine the solution of Equation (88)

- (7)

- Solution to Equation (87) Using Transformation and Linearization Techniques

6. Limitation of the Proposed Catastrophe Bond Diversification Model

- The calculation of the expected face value and coupon using PPTB and the quantification fuzzy theory can affect the calculation of the yields because the possibilistic measure of the fuzzy variable does not have self-duality.

- Models for calculating the expectations and variances of the yield using credibility measures have been good at overcoming the self-duality characteristic of the possibilistic measures. However, the definition of fuzzy variables in this study only uses triangular fuzzy variables, so it does not include other possibilities of obtaining the face value and coupon as a whole. The yield triangular fuzzy variable is defined as , where , and , so we cannot describe the possible yield for other triggering events in the piecewise linear payout function. One example is that, if you pay attention to Equations (16), (41), and (44), the possibility of a yield that can be obtained by investors that is equal to has not been described in the triangular fuzzy variable yield.

- The simulation only uses the example of the catastrophe bond determination model written in Equations (16) and (18) based on the trigger type of earthquake parameters and does not discuss other disasters, for example, droughts, floods, tornadoes, and terrorists. In addition, catastrophe bonds that are circulated in the market use indemnity, the loss index, and the modeled loss trigger types. However, the developed model can be adopted for other types of triggers and other disasters.

- We have not used real data on the catastrophe bonds circulating in the US market.

- The return and risk are the main indicators in the formation of a portfolio; if the objective function only involves the expected returns and the variance of the returns, then, in practice, it will fail if the returns on assets and the risk levels are identical.

- The method used to solve the catastrophe bond diversification strategy model results in the same investment proportion for each possible weight of different investor preferences.

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Cummins, J.D. CAT Bonds and Other Risk-Linked Securities: State of the Market and Recent Developments. Risk Manag. Insur. Rev. 2008, 11, 23–47. [Google Scholar] [CrossRef]

- Haffar, A.; Le Fur, É. Dependence Structure of CAT Bonds and Portfolio Diversification: A copula-GARCH approach. J. Asset Manag. 2022, 23, 297–309. [Google Scholar] [CrossRef]

- Mariani, M.; Amoruso, P. The Effectiveness of Catastrophe Bonds in Portfolio Diversification. Int. J. Econ. Financ. Issues. 2016, 6, 1760–1767. [Google Scholar]

- Carayannopoulos, P.; Perez, M.F. Diversification through Catastrophe Bonds: Lessons from the subprime financial crisis. Geneva Pap. Risk Insur. Issues Pract. 2015, 40, 1–28. [Google Scholar] [CrossRef] [Green Version]

- Kisha, R.J. Financial Services Review Catastrophe (CAT) Bonds: Risk Offsets with Diversification and High Returns. Financ. Serv. Rev. 2016, 25, 303–329. [Google Scholar]

- Yang, C.C.; Wang, M.; Chen, X. Catastrophe Effects on Stock Markets and Catastrophe Risk Securitization. J. Risk Financ. 2008, 9, 232–243. [Google Scholar] [CrossRef]

- Demers-Bélanger, K.; Lai, V.S. Diversification Benefits of CAT Bonds: An In-Depth Examination. Financ. Mark. Inst. Instrum. 2020, 29, 165–228. [Google Scholar] [CrossRef]

- Drobetz, W.; Schröder, H.; Tegtmeier, L. The Role of Catastrophe Bonds in an International Multi-Asset Portfolio: Diversifier, hedge, or safe haven? Financ. Res. Lett. 2020, 33, 1–7. [Google Scholar] [CrossRef]

- Sukono; Ibrahim, R.A.; Saputra, M.P.A.; Hidayat, Y.; Juahir, H.; Prihanto, I.G.; Halim, N.B.A. Modeling Multiple-Event Catastrophe Bond Prices Involving the Trigger Event Correlation, Interest, and Inflation Rates. Mathematics 2020, 10, 4685. [Google Scholar] [CrossRef]

- Sukono; Juahir, H.; Ibrahim, R.A.; Saputra, M.P.A.; Hidayat, Y.; Prihanto, I.G. Application of Compound Poisson Process in Pricing Catastrophe Bonds: A Systematic Literature Review. Mathematics 2022, 10, 2668. [Google Scholar] [CrossRef]

- Ibrahim, R.A.; Sukono; Napitupulu, H. Multiple-Trigger Catastrophe Bond Pricing Model and Its Simulation Using Numerical Methods. Mathematics 2022, 10, 1363. [Google Scholar] [CrossRef]

- Anggraeni, W.; Supian, S.; Sukono; Halim, N.B.A. Earthquake Catastrophe Bond Pricing Using Extreme Value Theory: A Mini-Review Approach. Mathematics 2022, 10, 4196. [Google Scholar] [CrossRef]

- Anggraeni, W.; Supian, S.; Halim, N.A. Single Earthquake Bond Pricing Framework with Double Trigger Parameters Based on Multi Regional Seismic Information. Mathematics 2023, 11, 689. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy Sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef] [Green Version]

- Deng, X.; Chen, C.; Wan, Y. A Novel Tolerantly Complete Layering Method for Fuzzy Mean-Variance-Skewness Portfolio Model within Transaction Costs. IAENG Int. J. Appl. Math. 2021, 51, 1–8. [Google Scholar]

- Huang, X. Mean-Entropy Models for Fuzzy Portfolio Selection. IEEE Trans. Fuzzy Syst. 2008, 16, 1096–1101. [Google Scholar] [CrossRef]

- Liu, B.; Liu, Y.K. Expected Value of Fuzzy Variable and Fuzzy Expected Value Models. IEEE Trans. Fuzzy Syst. 2002, 10, 445–450. [Google Scholar] [CrossRef]

- Liu, B. Uncertainty Theory, 2nd ed.; Springer: Berlin/Heidelberg, Germany; New York, NY, USA, 2007; pp. 97–125. [Google Scholar]

- Li, X.; Liu, B. A Sufficient and Necessary Condition for Credibility Measures. Int. J. Uncertain. Fuzzines Knowl. Based Syst. 2006, 14, 527–535. [Google Scholar] [CrossRef]

- Baltussen, G.; Post, G.T. Irrational Diversification: An Examination of Individual Portfolio Choice. J. Financ. Quant. Anal. 2011, 46, 1463–1491. [Google Scholar] [CrossRef] [Green Version]

- Li, X.; Shou, B.; Qin, Z. An Expected Regret Minimization Portfolio Selection Model. Eur. J. Oper. Res. 2018, 218, 484–492. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Caldeira, J.F.; Moura, G.V.; Santos, A.A.P. Bond Portfolio Optimization using Dynamic Factor Models. J. Empir. Financ. 2016, 37, 128–158. [Google Scholar] [CrossRef]

- Ortobelli, S.; Vitali, S.; Cassader, M.; Tichý, T. Portfolio Selection Strategy for Fixed Income Markets with Immunization on Average. Ann. Oper. Res. 2018, 260, 395–415. [Google Scholar] [CrossRef]

- Li, T.; Zhang, W.; Xu, W. Fuzzy Possibilistic Portfolio Selection Model with VaR Constraint and Risk-Free Investment. Econ. Model. 2013, 31, 12–17. [Google Scholar] [CrossRef]

- Michalopoulos, M.; Thomaidis, N.S.; Dounias, G.D.; Zopounidis, C. Using a Fuzzy Sets Approach to Select a Portfolio of Greek Government Bonds. Fuzzy Econ. Rev. 2004, 9, 27–48. [Google Scholar] [CrossRef]

- Rodríguez, Y.E.; Gómez, J.M.; Contreras, J. Diversified Behavioral Portfolio as an Alternative to Modern Portfolio Theory. North Am. J. Econ. Financ. 2021, 58, 101508. [Google Scholar] [CrossRef]

- Calvo, C.; Ivorra, C.; Liern, V. Fuzzy Portfolio Selection Including Cardinality Constraints and Integer Conditions. J. Optim. Theory Appl. 2016, 170, 343–355. [Google Scholar] [CrossRef]

- Calvo, C.; Ivorra, C.; Liern, V. On the Computation of the Efficient Frontier of the Portfolio Selection Problem. J. Appl. Math. 2012, 2012, 105616. [Google Scholar] [CrossRef] [Green Version]

- Zhang, W.G.; Liu, Y.J.; Xu, W.J. A Possibilistic Mean-Semivariance-Entropy Model for Multi-Period Portfolio Selection with Transaction Costs. Eur. J. Oper. Res. 2012, 222, 341–349. [Google Scholar] [CrossRef]

- Saborido, R.; Ruiz, A.B.; Bermúdez, J.D.; Vercher, E.; Luque, M. Evolutionary Multi-Objective Optimization Algorithms for Fuzzy Portfolio Selection. Appl. Soft Comput. J. 2016, 39, 48–63. [Google Scholar] [CrossRef]

- Vercher, E.; Bermúdez, J.D. Portfolio Optimization using a Credibility Mean-Absolute Semi-Deviation Model. Expert Syst. Appl. 2015, 42, 7121–7131. [Google Scholar] [CrossRef]

- Liagkouras, K.; Metaxiotis, K. Multi-Period Mean–Variance Fuzzy Portfolio Optimization Model with Transaction Costs. Eng. Appl. Artif. Intell. 2017, 67, 260–269. [Google Scholar] [CrossRef]

- Vercher, E.; Bermúdez, J.D.; Segura, J.V. Fuzzy Portfolio Optimization under Downside Risk Measures. Fuzzy Sets Syst. 2007, 158, 769–782. [Google Scholar] [CrossRef]

- Li, X.; Qin, Z.; Kar, S. Mean-Variance-Skewness Model for Portfolio Selection with Fuzzy Returns. Eur. J. Oper. Res. 2010, 202, 239–247. [Google Scholar] [CrossRef]

- Jalota, H.; Thakur, M.; Mittal, G. Modelling and Constructing Membership Function for Uncertain Portfolio Parameters: A Credibilistic Framework. Expert Syst. Appl. 2017, 71, 40–56. [Google Scholar] [CrossRef]

- Burnecki, K.; Kukla, G. Pricing of Zero-Coupon and Coupon Cat Bonds. Appl. Math. 2003, 30, 315–324. [Google Scholar] [CrossRef]

- Ma, Z.G.; Ma, C.Q. Pricing Catastrophe Risk Bonds: A Mixed Approximation Method. Insur. Math. Econ. 2013, 52, 243–254. [Google Scholar] [CrossRef]

- Ma, Z.; Ma, C.; Xiao, S. Pricing Zero-Coupon Catastrophe Bonds Using EVT with Doubly Stochastic Poisson Arrivals. Discret. Dyn. Nat. Soc. 2017, 2017, 3279647. [Google Scholar] [CrossRef] [Green Version]

- Liu, J.; Xiao, J.; Yan, L.; Wen, F. Valuing Catastrophe Bonds Involving Credit Risks. Math. Probl. Eng. 2014, 2014, 563086. [Google Scholar] [CrossRef] [Green Version]

- Härdle, W.K.; Cabrera, B.L. Calibrating CAT Bonds for Mexican earthquakes. J. Risk Insur. 2010, 77, 625–650. [Google Scholar] [CrossRef] [Green Version]

- Ibrahim, R.A.; Sukono; Napitupulu, H.; Ibrahim, R.I.; Deni, M.J.; Saputra, J. Estimating Flood Catastrophe Bond Prices Using Approximation Method of the Loss Agregate Distribution: Eidence from Indonesia. Decis. Sci. Lett. 2023, 12, 179–190. [Google Scholar] [CrossRef]

- Chao, W.; Katina, P. Valuing Multirisk Catastrophe Reinsurance Based on the Cox-Ingersoll-Ross (CIR) Model. Discret. Dyn. Nat. Soc. 2021, 2021, 8818486. [Google Scholar] [CrossRef]

- Chao, W.; Zou, H. Multiple-Event Catastrophe Bond Pricing Based on CIR-Copula-POT Model. Discret. Dyn. Nat. Soc. 2018, 2018, 5068480. [Google Scholar] [CrossRef]

- Zimbidis, A.; Frangos, N.E.; Pantelous, A.A. Modeling Earthquake Risk via Extreme Value Theory and Pricing the Respective Catastrophe Bonds. ASTIN Bull. 2007, 37, 163–183. [Google Scholar] [CrossRef] [Green Version]

- Tang, Q.; Yuan, Z. Cat Bond Pricing Under a Product Probability Measure with POT Risk Characterization. ASTIN Bull. 2019, 49, 457–490. [Google Scholar] [CrossRef] [Green Version]

- Wei, L.; Liu, L.; Hou, J. Pricing Hybrid-Triggered Catastrophe Bonds Based on Copula-EVT Model. Quant. Financ. Econ. 2022, 6, 223–243. [Google Scholar] [CrossRef]

- Shao, J.; Pantelous, A.; Papaioannou, A.D. Catastrophe Risk Bonds with Applications to Earthquakes. Eur. Actuar. J. 2015, 5, 113–138. [Google Scholar] [CrossRef]

- Nakajima, J.; Kunihama, T.; Omori, Y. Bayesian Modeling of Dynamic Extreme Values: Extension of generalized extreme value distributions with latent stochastic processes. J. Appl. Stat. 2017, 44, 1248–1268. [Google Scholar] [CrossRef] [Green Version]

- de Zea Bermudez, P.; Kotz, S. Parameter Estimation of the Generalized Pareto Distribution-Part I. J. Stat. Plan. Inference 2010, 140, 1353–1373. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, P.; Wang, D.; Zhang, Y.; Ji, R.; Cai, F. Identification and Risk Characteristics of Agricultural Drought Disaster Events Based on the Copula Function in Northeast China. Atmosphere 2022, 13, 2022. [Google Scholar] [CrossRef]

- Doğan, M.; Karakaş, A.M. Archimedean Copula Parameter Estimation with Kendall Distribution Function. J. Inst. Sci. Technol. 2017, 7, 187–198. [Google Scholar] [CrossRef]

- Jin, L.S.; Kalina, M.; Mesiar, R.; Borkotokey, S. Characterizations of the Possibility-Probability Transformations and Some Applications. Inf. Sci. 2019, 477, 281–290. [Google Scholar] [CrossRef]

- Diago, L.A.; Kitaoka, T.; Hagiwara, I. Analyzing KANSEI from Facial Expressions with Fuzzy Quantification Theory II. In Proceedings of the 2009 IEEE International Conference on Fuzzy Systems, Jeju, Republic of Korea, 20–24 August 2009; pp. 1591–1596. [Google Scholar] [CrossRef]

- Asghari, M.; Fathollahi-Fard, A.M.; Mirzapour Al-E-Hashem, S.M.J.; Dulebenets, M.A. Transformation and Linearization Techniques in Optimization: A State-of-the-Art Survey. Mathematics 2022, 10, 283. [Google Scholar] [CrossRef]

- Zhou, J.; Yang, F.; Wang, K. Fuzzy Arithmetic on LR Fuzzy Numbers with Applications to Fuzzy Programming. J. Intell. Fuzzy Syst. 2016, 30, 71–87. [Google Scholar] [CrossRef]

- Yi, X.; Miao, Y.; Zhou, J.; Wang, Y. Some Novel Inequalities for Fuzzy Variables on the Variance and Its Rational Upper Bound. J. Inequalities Appl. 2016, 2016, 41. [Google Scholar] [CrossRef] [Green Version]

- Taha, H.A. Operation Research an Introduction, 10th ed.; Pearson Education: London, UK, 2017; pp. 343–344. [Google Scholar]

- Griva, I.; Nash, S.G.; Sofer, A. Linear and Nonlinear Optimization, 2nd ed.; SIAMS: Philadelpia, PA, USA, 2007; pp. 573–574. [Google Scholar]

- Pauer, G.; Török, Á. Binary Integer Modeling of the Traffic Flow Optimization Problem, in the Case of an Autonomous Transportation System. Oper. Res. Lett. 2021, 49, 136–143. [Google Scholar] [CrossRef]

- Ibrahim, R.A.; Sukono; Napitupulu, H.; Ibrahim, R.I. How to Price Catastrophe Bonds for Sustainable Earthquake Funding? A Systematic Review of the Pricing Framework. Sustainability 2023, 15, 7705. [Google Scholar] [CrossRef]

| Copula Class | Description | |||

|---|---|---|---|---|

| Clayton | ||||

| Frank | ||||

| Gumbel |

| 1 | −59,735 | 97,460,872,622 |

| 2 | −19,850 | 107,306,531,409 |

| 3 | −1488 | 86,590,764,648 |

| 0.1 | 0.9 | 0 | 0.3 | 0.7 | 8,209,606,308 |

| 0.2 | 0.8 | 0 | 0.3 | 0.7 | 16,419,205,620 |

| 0.3 | 0.7 | 0 | 0.3 | 0.7 | 24,628,804,930 |

| 0.4 | 0.6 | 0 | 0.3 | 0.7 | 32,838,404,240 |

| 0.5 | 0.5 | 0 | 0.3 | 0.7 | 41,048,003,560 |

| 0.6 | 0.4 | 0 | 0.3 | 0.7 | 49,257,602,870 |

| 0.7 | 0.3 | 0 | 0.3 | 0.7 | 57,467,202,180 |

| 0.8 | 0.2 | 0 | 0.3 | 0.7 | 65,676,801,490 |

| 0.9 | 0.1 | 0 | 0.3 | 0.7 | 73,886,400,800 |

| 0.1 | 0.9 | 0 | 1 | 0 | 139,575,994 |

| 0.2 | 0.8 | 0 | 1 | 0 | 279,132,137 |

| 0.3 | 0.7 | 0 | 1 | 0 | 418,688,282 |

| 0.4 | 0.6 | 0 | 1 | 0 | 558,244,259 |

| 0.5 | 0.5 | 0 | 1 | 0 | 697,800,570 |

| 0.6 | 0.4 | 0 | 1 | 0 | 837,356,714 |

| 0.7 | 0.3 | 0 | 1 | 0 | 976,912,857 |

| 0.8 | 0.2 | 0 | 1 | 0 | 111,646,900 |

| 0.9 | 0.1 | 0 | 1 | 0 | 125,602,514 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Anggraeni, W.; Supian, S.; Sukono; Halim, N.A. Catastrophe Bond Diversification Strategy Using Probabilistic–Possibilistic Bijective Transformation and Credibility Measures in Fuzzy Environment. Mathematics 2023, 11, 3513. https://doi.org/10.3390/math11163513

Anggraeni W, Supian S, Sukono, Halim NA. Catastrophe Bond Diversification Strategy Using Probabilistic–Possibilistic Bijective Transformation and Credibility Measures in Fuzzy Environment. Mathematics. 2023; 11(16):3513. https://doi.org/10.3390/math11163513

Chicago/Turabian StyleAnggraeni, Wulan, Sudradjat Supian, Sukono, and Nurfadhlina Abdul Halim. 2023. "Catastrophe Bond Diversification Strategy Using Probabilistic–Possibilistic Bijective Transformation and Credibility Measures in Fuzzy Environment" Mathematics 11, no. 16: 3513. https://doi.org/10.3390/math11163513