Application of Various Price-Discount Policy for Deteriorated Products and Delay-in-Payments in an Advanced Inventory Model

Abstract

:1. Introduction

Contribution of this Research

2. Literature Review

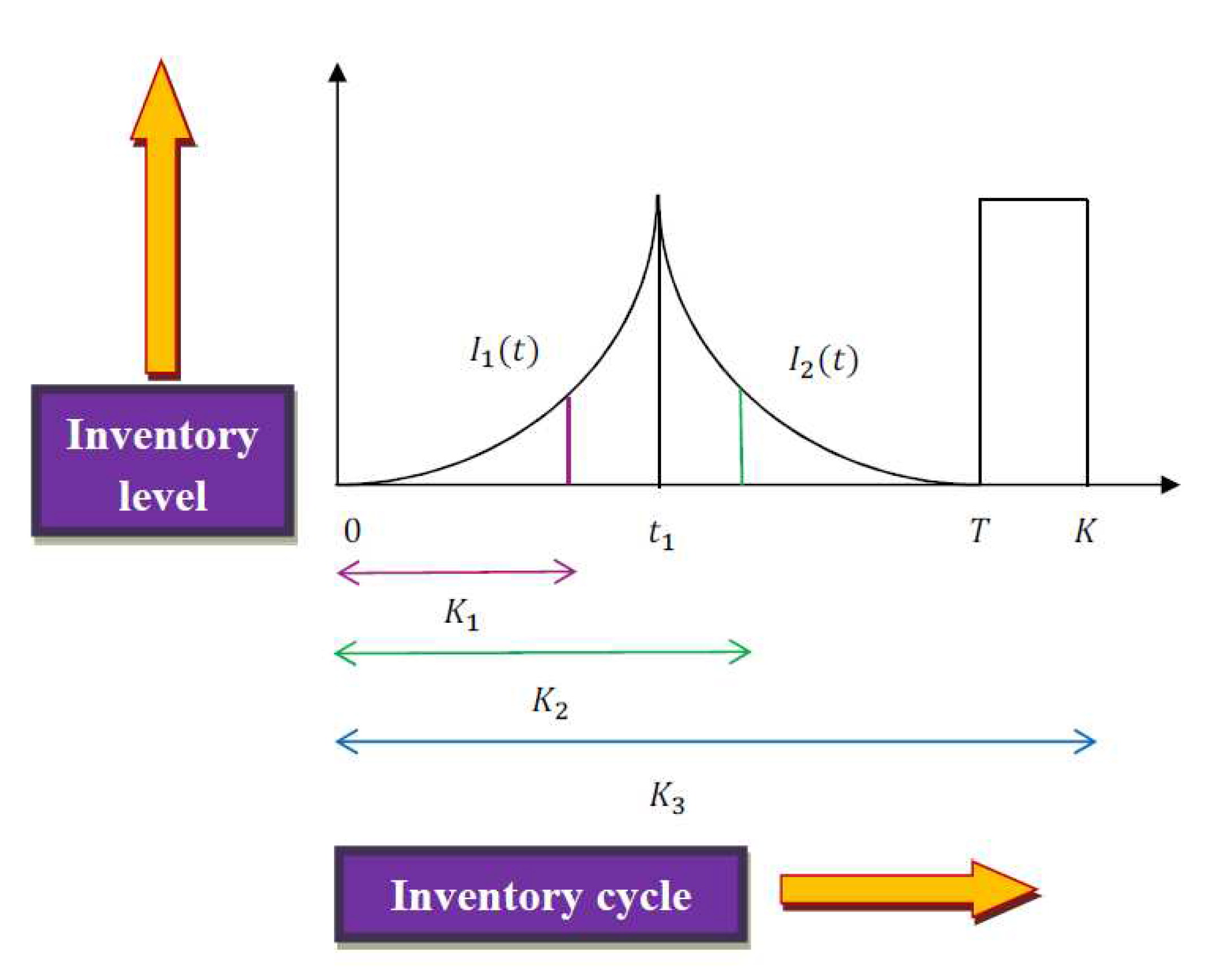

3. Mathematical Model

- In this study, the demand rate is variable. This model depicts that the demand rate of any product is affected by several parameters, for instance, time and selling price. The demand rate of products may change regarding time (Hsu and Li [5], Sarkar et al. [45]). In addition, the product’s demand rate generally enhances if the selling price of that product diminishes (Krugon and Nagaraju [9], Khanna et al. [36], Sarkar et al. [52]). For this reason, the demand of products is measured as time and price dependent. This model considers that demand increases quadratically with time and decreases linearly with selling-price.

- Delay-in-payments is highlighted in this model. Instead of allowing a single credit period, supplier permits different credit periods to the retailer for adjusting due payment (Mishra et al. [42]).

- Several price discount policies on purchasing cost are assumed in this model. As the supplier provides three credit periods to the retailer, the supplier offers a distinct price discount to the retailer in each credit period. In the first credit period, the supplier offers the biggest price discount on the purchasing cost. After that, in the second credit period the supplier offers a lesser price discount to the retailer. In the third and final credit period, no price discount is allotted for the retailer. The supplier generally utilizes this price discount technique to attract more retailers to earn maximum profit (Xu et al. [37], Sheehan et al. [38], Sana and Chaudhuri [48]).

- The production rate is finite with an infinite time horizon. Shortage and backlogging are not permitted. This model considers no lead time.

4. Solution Methodology

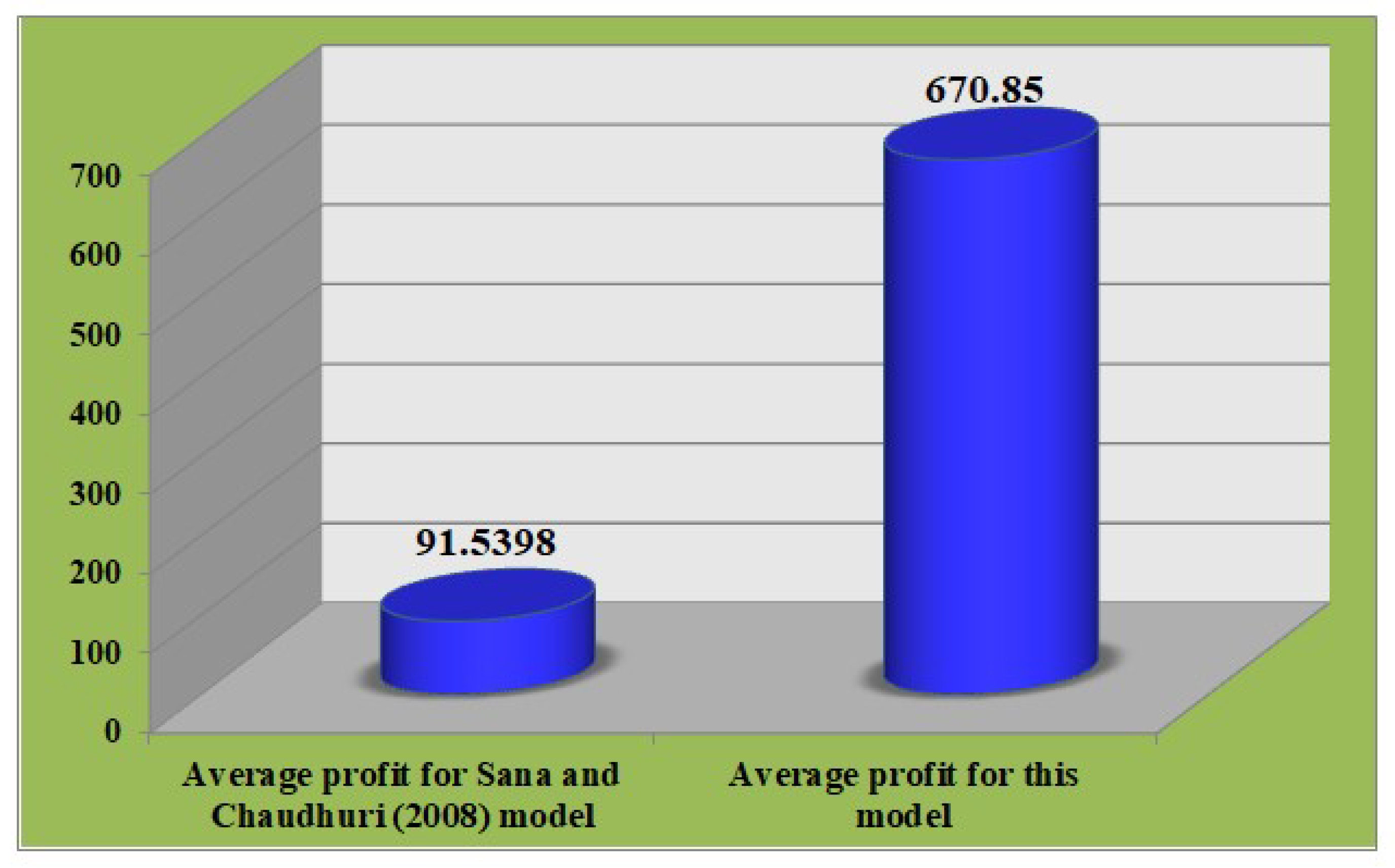

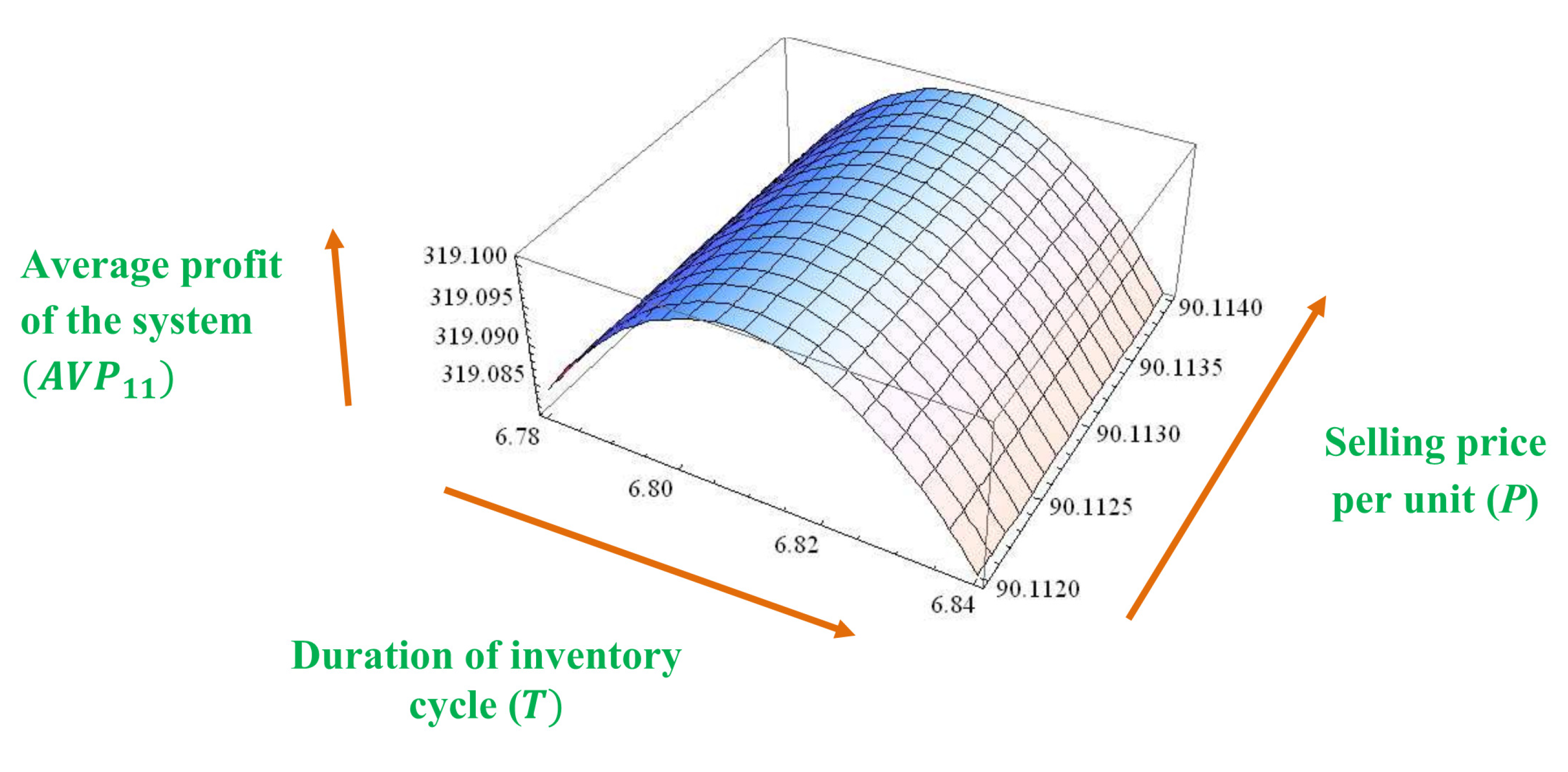

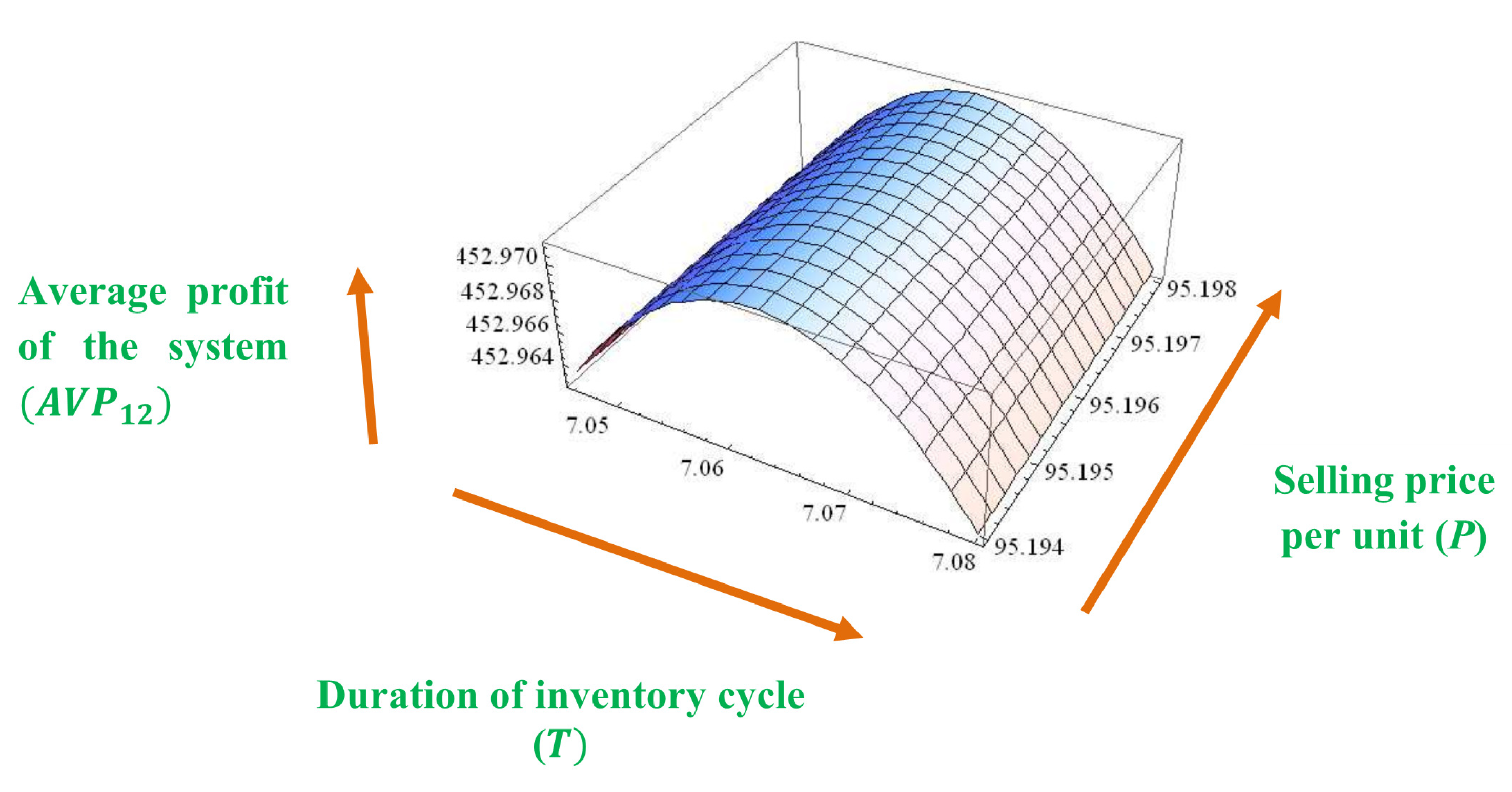

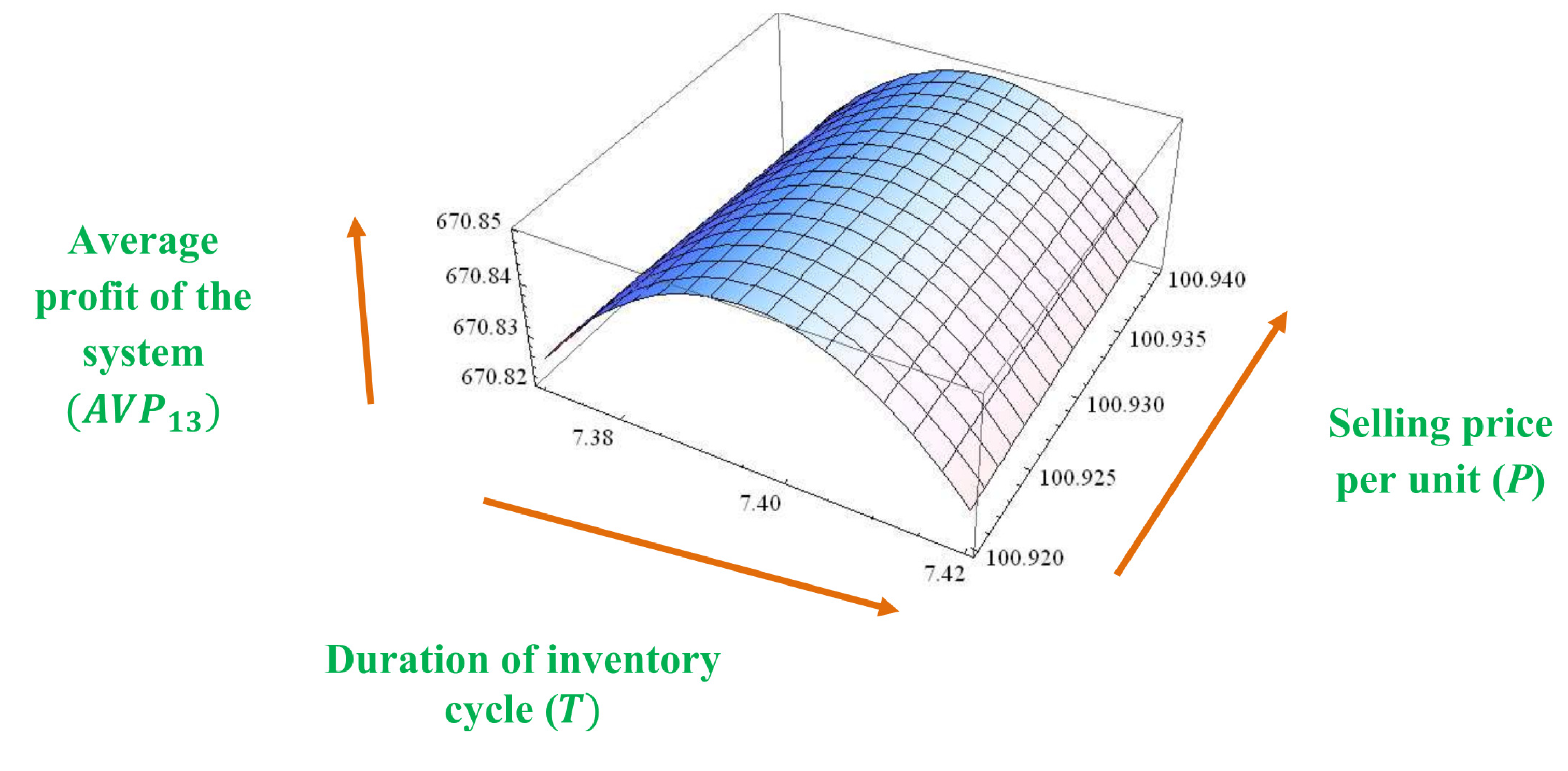

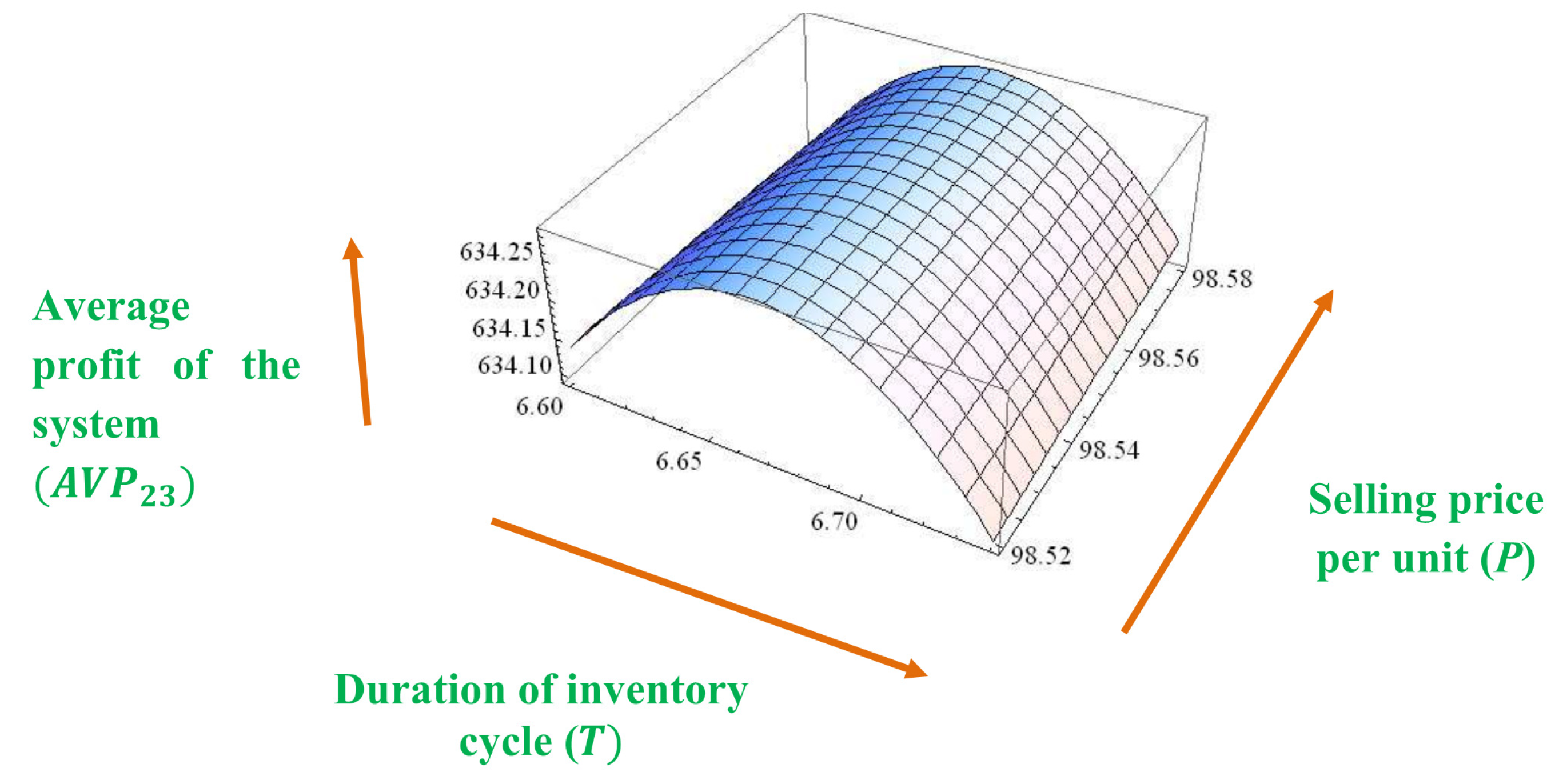

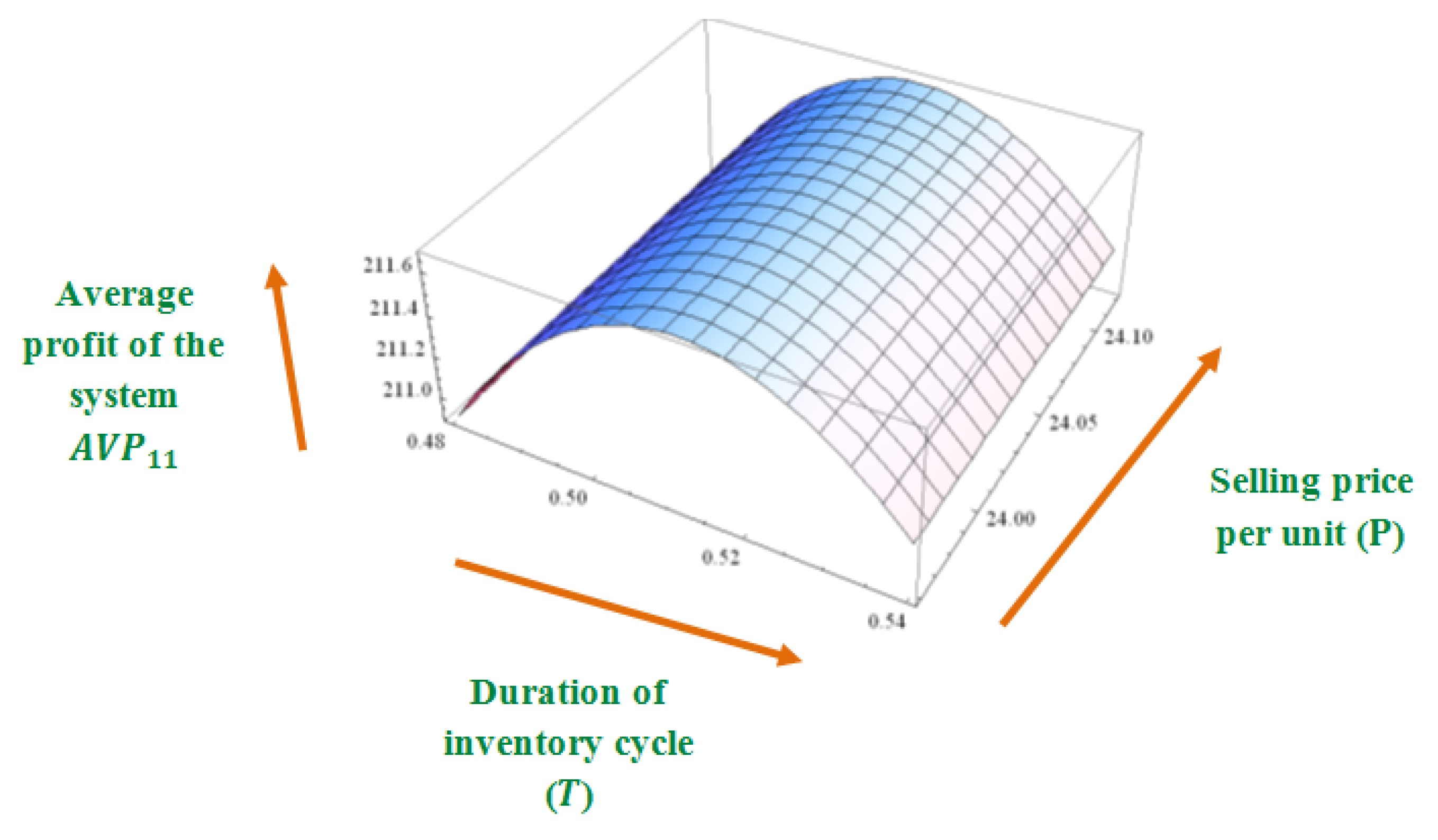

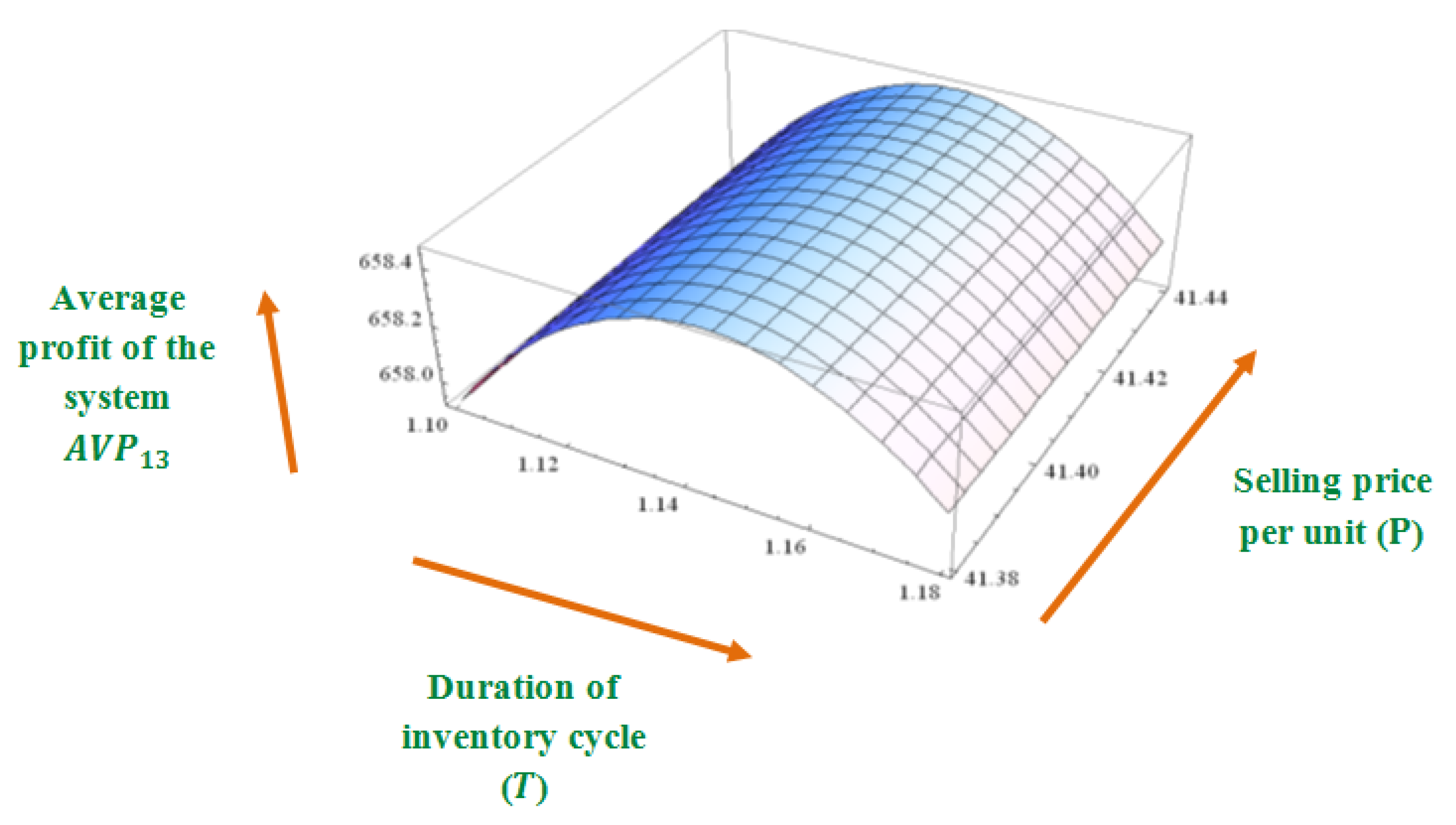

5. Numerical Example

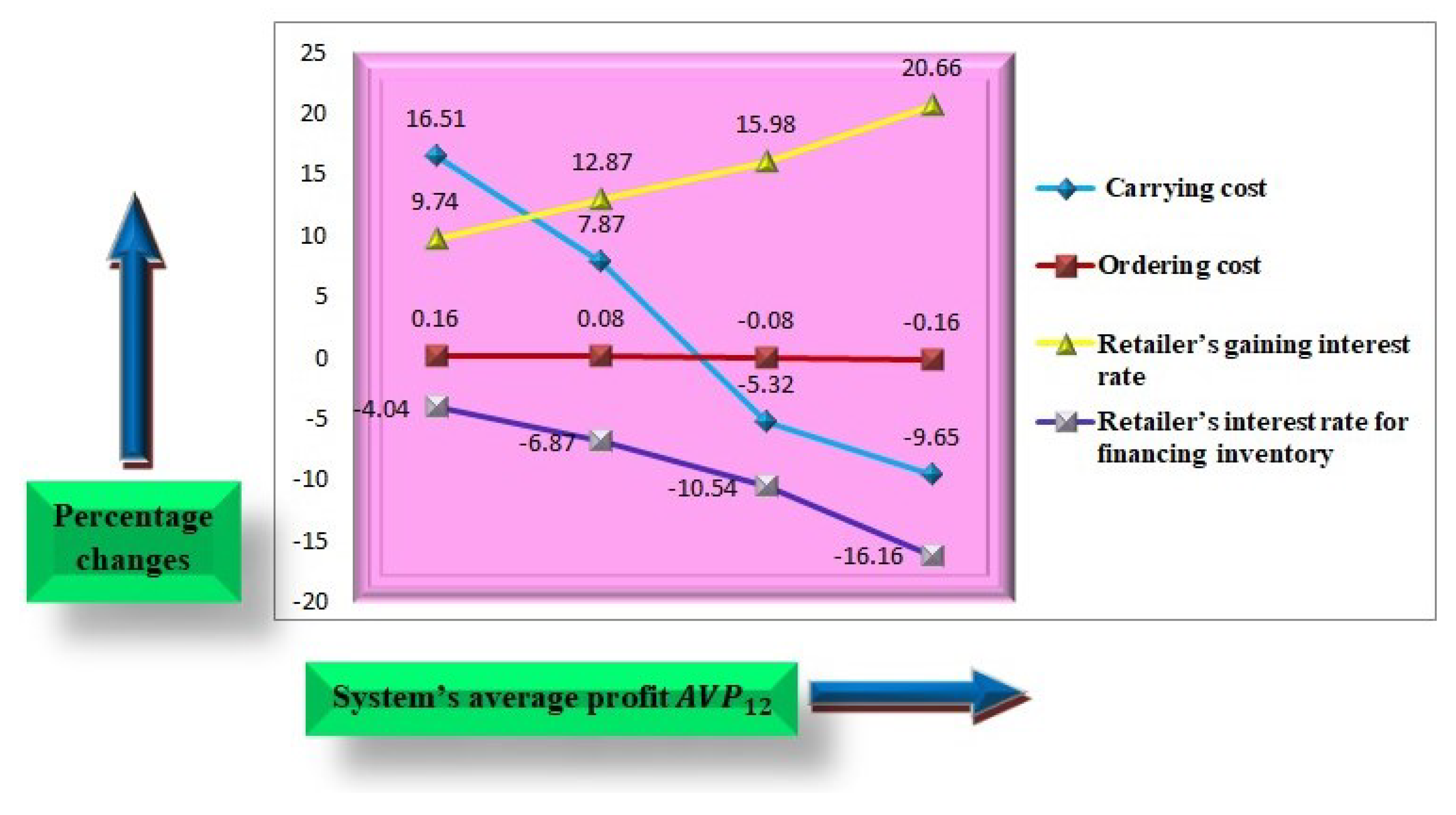

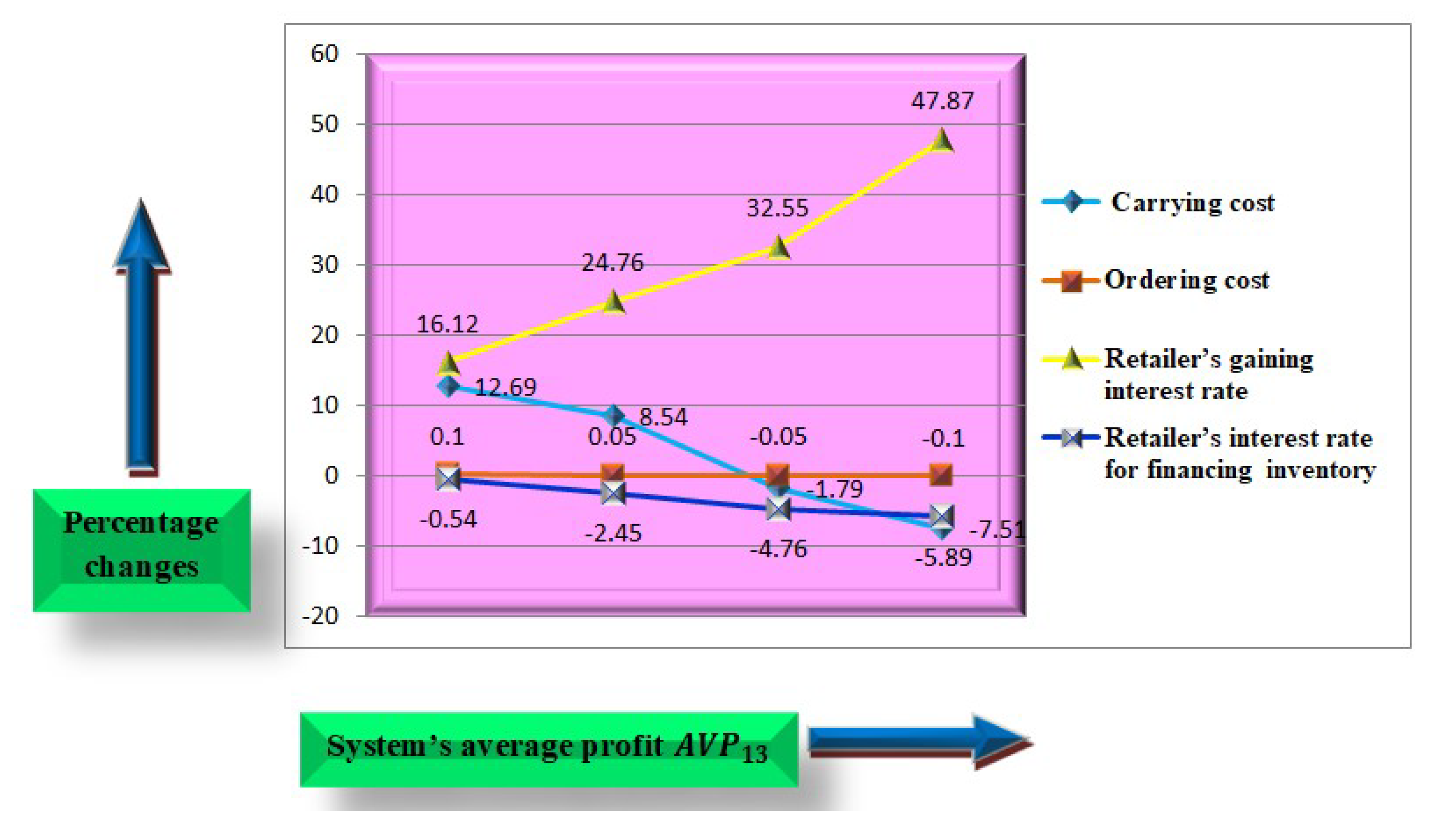

6. Sensitivity Analysis

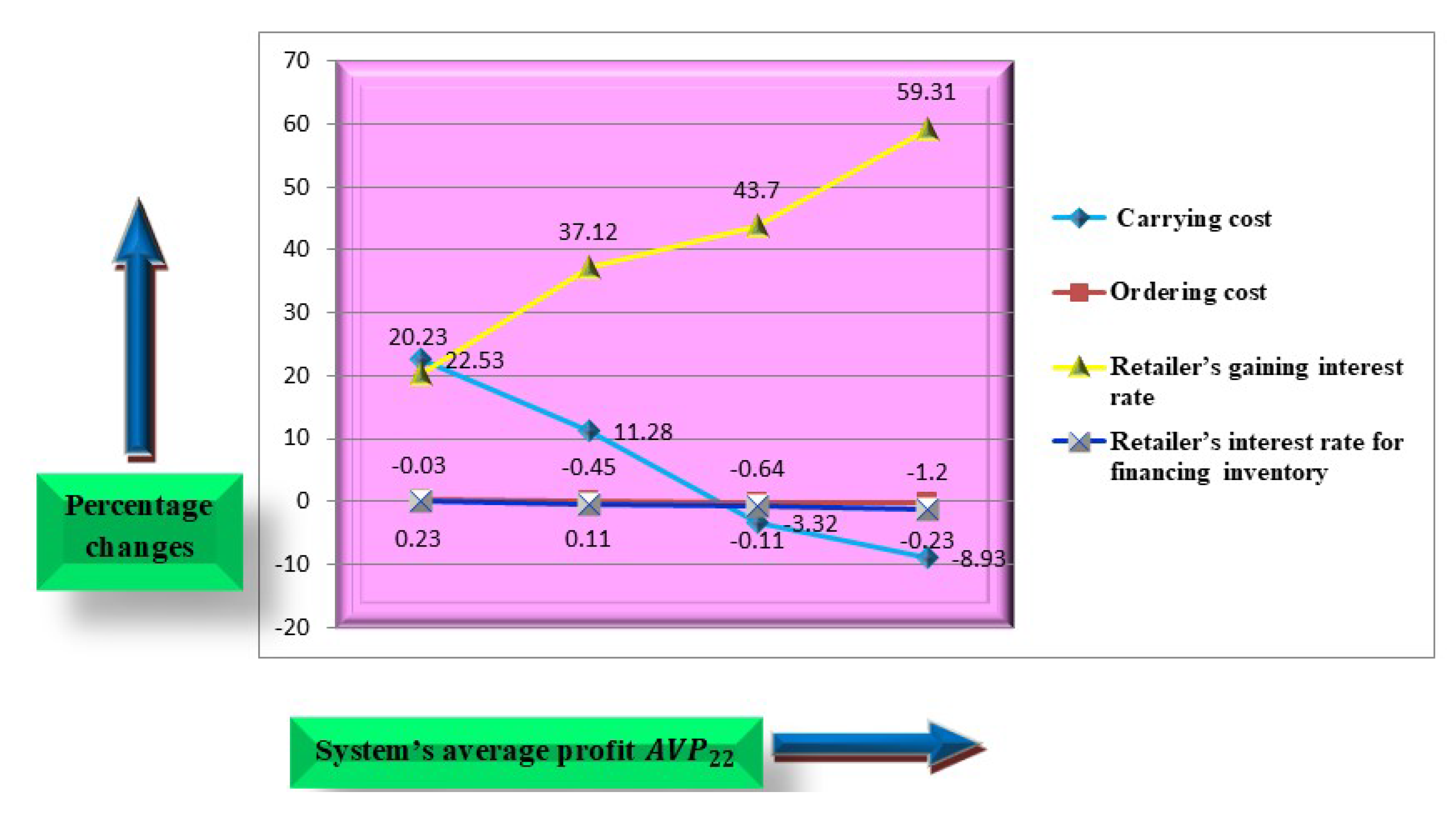

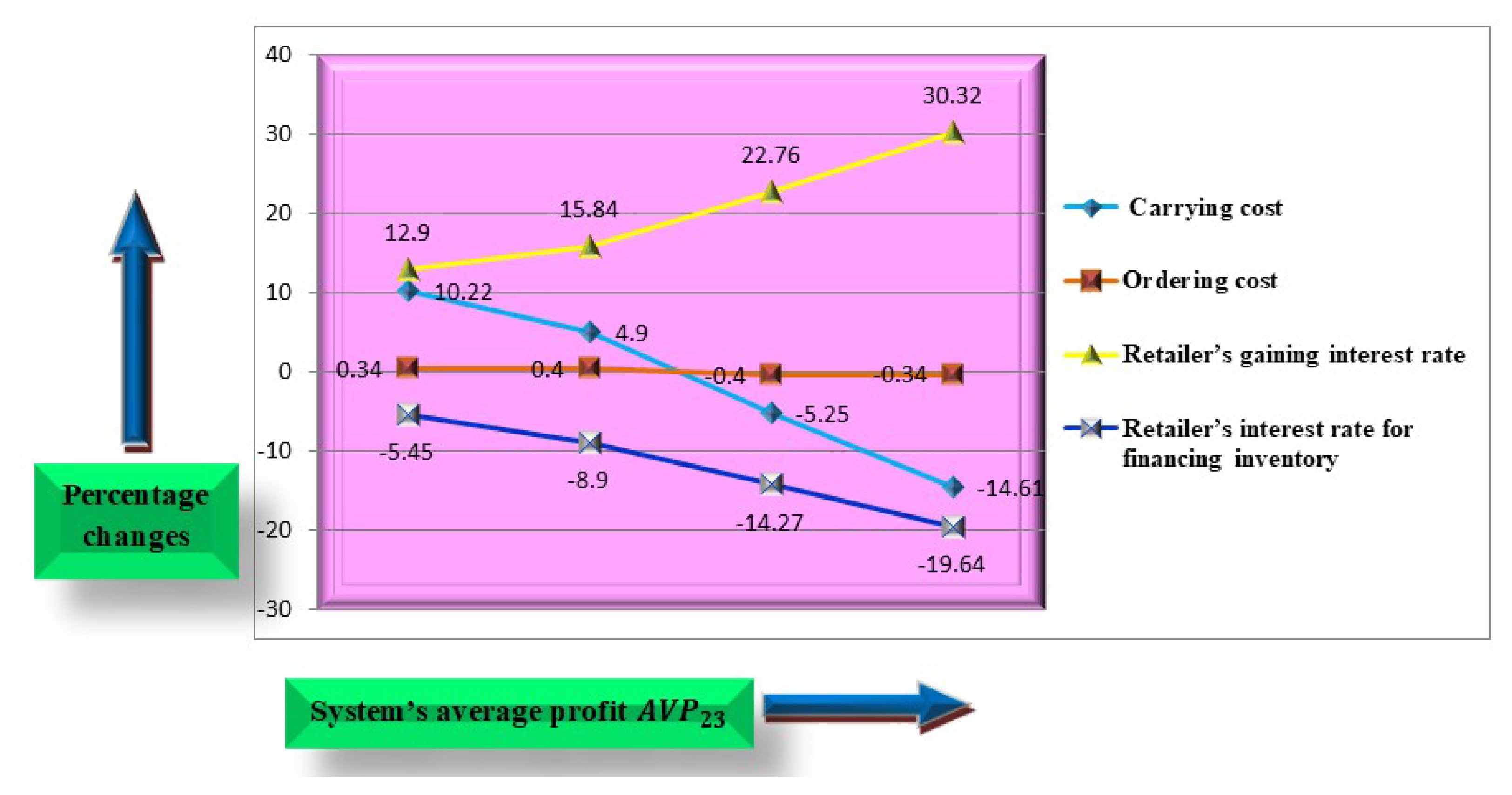

- For , which is the retailer’s carrying cost, it can be seen that whenever the parameter enhances, under various circumstances the system’s average profit functions are and , where decreases.

- If the unit ordering cost increased, then the system’s average profit, that is, and , diminish rapidly. With this observation, it can be found that the variation in both positive percentage changes along with negative percentage changes are quite equal for system’s average profit, that is, and , .

- As the retailer’s interest rate gaining for credit-balances which is increases, the system’s average profit which are and where raises automatically. That means the retailers may increase their benefit level as much as they can to gain more interest. is the key parameter to increase the system’s profitability.

- The parameter which is defined as the retailer’s interest rate for financing inventory which means that the retailer has to pay that much interest to the supplier. For this parameter , it is clearly observed from the sensitivity table that system’s average profit, that is, and , when always decreases whenever the parameter changes from a negative percentage to a positive percentage.

7. Managerial Insights

8. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix B

Decision Variables

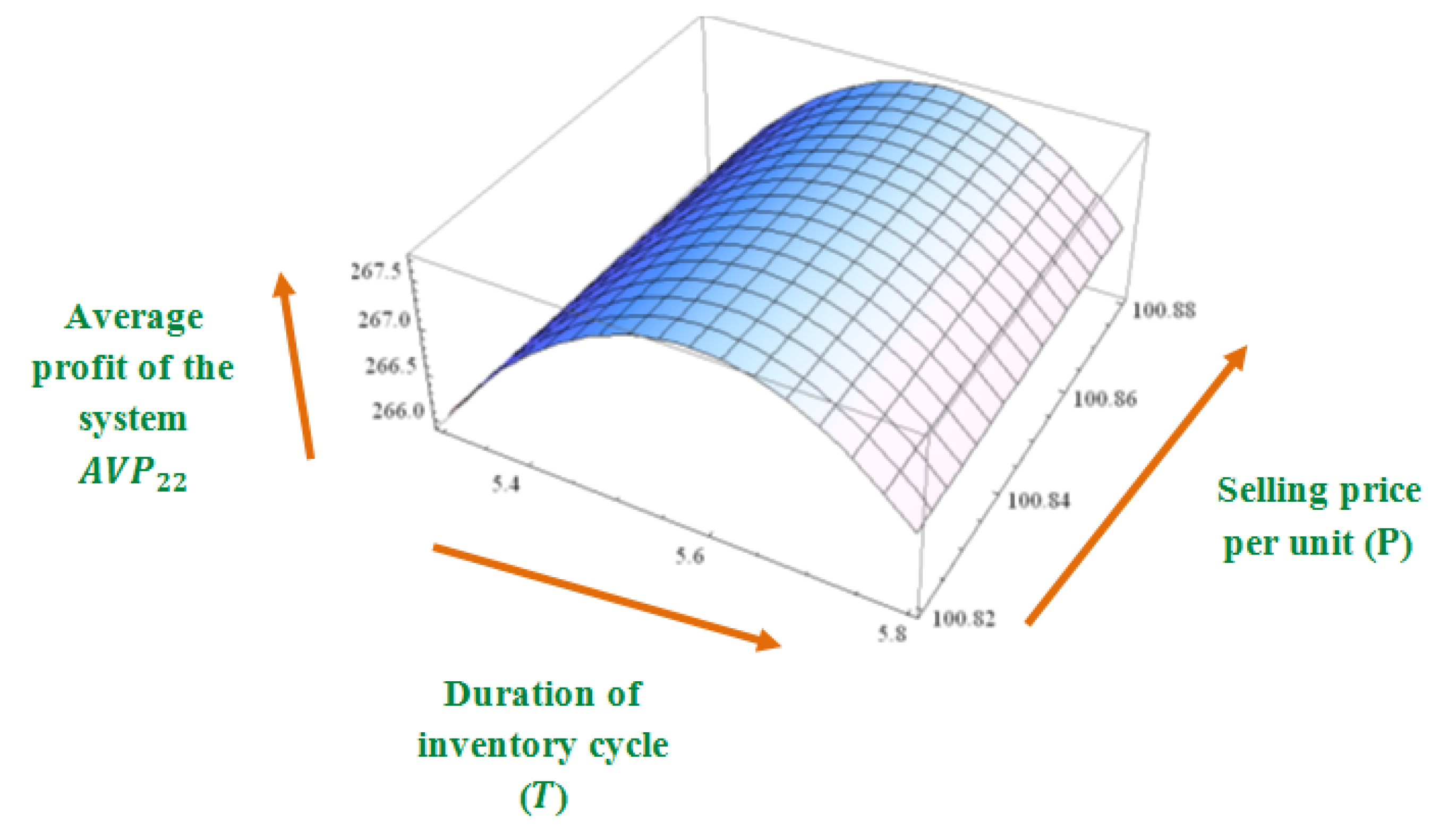

| P | selling-price ($/unit) |

| T | inventory cycle’s length (months) |

Parameters

| inventory’s level throughout the time interval (units) | |

| inventory’s level throughout (units) | |

| production rate (unit/unit time) | |

| K | delay-period (unit time) |

| allowable delay-duration (unit time) | |

| demand is related to both price, time, , , and all are scaling parameters. | |

| decaying rate, | |

| rate of discount on MRP at the ith allowable delay-period (%) | |

| cost of purchasing ($/unit) | |

| maximum retail price (MRP) ($/unit) | |

| carrying cost ($/unit) | |

| ordering cost ($/order) | |

| interest rate gaining for credit-balance (/$/unit time) | |

| interest rate for financing inventory (/$/unit time) | |

| production time | |

| optimal inventory cycle’s length (months) | |

| optimal selling-price ($/unit) | |

| average profit function when ($) | |

| system’s average profit during ($) |

References

- Dave, U.; Pandya, B. Inventory returns and special sales in a lot-size system with constant rate of deterioration. Eur. J. Oper. Res. 1985, 19, 305–312. [Google Scholar] [CrossRef]

- Bhunia, A.K.; Jaggi, C.K.; Sharma, A.; Sharma, R. A two-warehouse inventory model for deteriorating items under permissible delay in payment with partial backlogging. Appl. Math. Comput. 2014, 232, 1125–1137. [Google Scholar] [CrossRef]

- Yang, Y.; Chi, H.; Zhou, W.; Fan, T.; Piramuthu, S. Deterioration control decision support for perishable inventory management. Decis. Support Syst. 2020, 134, 113308. [Google Scholar] [CrossRef]

- Khakzad, A.; Gholamian, M.R. The effect of inspection on deterioration rate: An inventory model for deteriorating items with advanced payment. J. Clean. Prod. 2020, 254, 120117. [Google Scholar] [CrossRef]

- Hsu, C.I.; Li, H.C. Optimal delivery service strategy for internet shopping with time-dependent consumer demand. Trans. Res. Part E Logis. Trans. Rev. 2006, 42, 473–497. [Google Scholar] [CrossRef]

- Khanra, S.; Mandal, B.; Sarkar, B. An inventory model with time dependent demand and shortages under trade credit policy. Econ. Model. 2013, 35, 349–355. [Google Scholar] [CrossRef]

- Wang, Y.; Li, D.; Cao, Z. Integrated timetable synchronization optimization with capacity constraint under time-dependent demand for a rail transit. Comput. Ind. Eng. 2020, 142, 106374. [Google Scholar] [CrossRef]

- Chen, L.; Chen, X.; Keblis, M.F.; Li, G. Optimal pricing and replenishment policy for deteriorating inventory under stock-level-dependent, time-varying and price-dependent demand. Comput. Ind. Eng. 2019, 135, 1294–1299. [Google Scholar] [CrossRef]

- Krugon, S.; Nagaraju, D. Optimality of cycle time and inventory decisions in a two echelon inventory system with non linear price dependent demand under credit period. Mater. Today Proc. 2018, 5, 12499–12508. [Google Scholar] [CrossRef]

- Dey, B.K.; Sarkar, B.; Sarkar, M.; Pareek, S. An integrated inventory model involving discrete setup cost reduction, variable safety factor, selling-price dependent demand, and investment. RAIRO Oper. Res. 2019, 53, 39–57. [Google Scholar] [CrossRef] [Green Version]

- Modak, N.M.; Kelle, P. Managing a dual-channel supply chain under price and delivery-time dependent stochastic demand. Eur. J. Oper. Res. 2019, 272, 147–161. [Google Scholar] [CrossRef]

- Gholami, R.A.; Sandal, L.K.; Ubøe, J. A solution algorithm for multi-period bi-level channel optimization with dynamic price-dependent stochastic demand. Omega 2020. [Google Scholar] [CrossRef]

- Torkaman, S.; Jokar, M.R.A.; Mutlu, N.; Woensel, T.V. Solving a production-routing problem with price-dependent demand using an outer approximation method. Comput. Ind. Eng. 2020, 123, 105019. [Google Scholar] [CrossRef]

- Alfares, H.K.; Ghaithan, A.M. Inventory and pricing model with price-dependent demand, time-varying holding cost, and quantity discounts. J. Comput. Ind. Eng. 2016, 94, 170–177. [Google Scholar] [CrossRef]

- Buratto, A.; Cesaretto, R.; Giovanni, P.D. Consignment contracts with cooperative programs and price discount mechanisms in a dynamic supply chain. Int. J. Prod. Econ. 2019, 218, 72–82. [Google Scholar] [CrossRef]

- Jadidi, O.; Jaber, M.Y.; Zolfaghari, S. Joint pricing and inventory problem with price dependent stochastic demand and price discounts. Comput. Ind. Eng. 2017, 114, 45–53. [Google Scholar] [CrossRef]

- Li, C.; Chu, M.; Zhou, C.; Zhao, L. Two-period discount pricing strategies for an e-commerce platform with strategic consumers. Comput. Indu. Eng. 2020, 147, 106640. [Google Scholar] [CrossRef]

- Qiu, X.; Lee, C.Y. Quantity discount pricing for rail transport in a dry port system. Trans. Res. Part E Logis. Trans. Rev. 2019, 122, 563–580. [Google Scholar] [CrossRef]

- Li, J.; Feng, H.; Zeng, Y. Inventory games with permissible delay in payments. Eur. J. Oper. Res. 2015, 234, 694–700. [Google Scholar] [CrossRef]

- Zou, X.; Tian, B. Retailer’s optimal ordering and payment strategy under two-level and flexible two-part trade credit policy. Comput. Ind. Eng. 2020, 142, 106317. [Google Scholar] [CrossRef]

- Aljazzar, S.M.; Gurtu, A.; Jaber, M.Y. Delay-in-payments—A strategy to reduce carbon emissions from supply chains. J. Clean. Prod. 2018, 170, 636–644. [Google Scholar] [CrossRef]

- Jory, S.R.; Khieu, H.D.; Ngo, T.N.; Phan, H.V. The influence of economic policy uncertainty on corporate trade credit and firm value. J. Corps Financ. 2020, 64, 101671. [Google Scholar] [CrossRef]

- Heng, K.J.; Labban, J.; Linn, R.J. An order-level lot-size inventory model for deteriorating items with finite replenishment rate. Comput. Ind. Eng. 1991, 20, 187–197. [Google Scholar] [CrossRef]

- Skouri, K.; Papachristos, S. A continuous review inventory model, with deteriorating items, time-varying demand, linear replenishment cost, partially time-varying backlogging. Appl. Math. Model. 2002, 26, 603–617. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S.; Cárdenas-Barrón, L.E. An inventory model with trade-credit policy and variable deterioration for fixed lifetime products. Ann. Oper. Res. 2015, 229, 677–702. [Google Scholar] [CrossRef]

- Sarkar, B.; Majumder, A.; Sarkar, M.; Dey, B.K.; Roy, G. Two-echelon supply chain model with manufacturing quality improvement and setup cost. J. Ind. Manag. Opt. 2017, 13, 1085–1104. [Google Scholar] [CrossRef] [Green Version]

- Iqbal, M.W.; Sarkar, B. Application of preservation technology for lifetime dependent products in an integrated production system. J. Ind. Manag. Opt. 2020, 16, 141–167. [Google Scholar]

- Goswami, A.; Chaudhuri, K.S. An EOQ model for deteriorating items with shortages and a linear trend in demand. J. Oper. Res. Soc. 1991, 42, 1105–1110. [Google Scholar] [CrossRef]

- Hariga, M. Optimal inventory policies for perishable items with time-dependent demand. Int. J. Prod. Econ. 1997, 50, 35–41. [Google Scholar] [CrossRef]

- Li, H.C. Optimal delivery strategies considering carbon emissions, time-dependent demands and demand-supply interactions. Eur. J. Oper. Res. 2015, 241, 739–748. [Google Scholar] [CrossRef]

- Zhao, S.T.; Wu, K.; Yuan, X.M. Optimal integer-ratio inventory coordination policy for an integrated multi-stage supply chain. Appl. Math. Model. 2016, 40, 3876–3894. [Google Scholar] [CrossRef]

- Avinadav, T.; Herbo, A.; Spiegel, U. Optimal inventory policy for a perishable item with demand function sensitive to price and time. Int. J. Prod. Econ. 2013, 144, 497–506. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S. Ordering and transfer policy and variable deterioration for a warehouse model. Hacet. J. Math. Stat. 2017, 46, 985–1014. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; Hur, S.; Mandal, B.; Dhaka, V. Optimal replenishment decision for retailers with variable demand for deteriorating products under a trade-credit policy. RAIRO Oper. Res. 2020. [Google Scholar] [CrossRef]

- Dey, B.K.; Pareek, S.; Tayyab, M.; Sarkar, B. Autonomation policy to control work-in-process inventory in a smart production system. Int. J. Prod. Res. 2020. [Google Scholar] [CrossRef]

- Khanna, A.; Kishore, A.; Sarkar, B.; Jaggi, C.K. Inventory and pricing decisions for imperfect quality items with inspection errors, sales returns, and partial backorders under inflation. Mathematics 2020, 54, 287–306. [Google Scholar] [CrossRef] [Green Version]

- Xu, X.; Chen, R.; Zhang, J. Effectiveness of trade-ins and price discounts: A moderating role of substitutability. J. Econ. Psychol. 2019, 70, 80–89. [Google Scholar] [CrossRef]

- Sheehan, D.; Hardesty, D.M.; Ziegler, A.H.; Chen, H. Consumer reactions to price discounts across online shopping experiences. J. Retail. Consum. Ser. 2019, 51, 129–138. [Google Scholar] [CrossRef]

- Hota, S.K.; Sarkar, B.; Ghosh, S.K. Effects of unequal lot size and variable transportation in unreliable supply chain management. Mathematics 2020, 8, 357. [Google Scholar] [CrossRef] [Green Version]

- Jaggi, C.K.; Goyal, S.K.; Goel, S.K. Retailers optimal replenishment decisions with credit-linked demand under permissible delay in payments. Euro. J. Oper. Res. 2008, 190, 130–135. [Google Scholar] [CrossRef]

- Sarkar, B.; Gupta, H.; Chaudhuri, K.S.; Goyal, S.K. An integrated inventory model with variable lead time, defective units and delay in payments. App. Math. Comput. 2014, 237, 650–658. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Tseng, M.L. Effects of a hybrid-price-stock dependent demand on the optimal solutions of a deteriorating inventory system and trade-credit policy on re-manufactured product. J. Clean. Prod. 2019, 241, 118282. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Sarkar, B.; Hasani, M. Delayed payment policy in multi-product single-machine economic production quality model with repair failure and partial backordering. J. Ind. Manag. Opt. 2020, 16, 1273–1296. [Google Scholar]

- Sarkar, B.; Sana, S.S.; Chaudhuri, K.S. An imperfect production process for time varying demand with inflation and time value of money An EMQ model. Exp. Sys. Appl. 2011, 38, 13543–13548. [Google Scholar] [CrossRef]

- Sarkar, B.; Sarkar, S. Variable deterioration and demand-an inventory model. Econ. Model. 2013, 31, 548–556. [Google Scholar] [CrossRef]

- Teng, J.T.; Chang, C.T. Economic production quantity models for deteriorating items with price- and stock-dependent demand. Comput. Oper. Res. 2005, 32, 297–308. [Google Scholar] [CrossRef]

- Wu, J.; Skouri, K.; Teng, J.T.; Hu, Y. Two inventory systems with trapezoidal-type demand rate and time-dependent deterioration and backlogging. Exp. Syst. Appl. 2016, 46, 367–379. [Google Scholar] [CrossRef]

- Sana, S.; Chaudhuri, K.S. A deterministic EOQ model with delays in payments and price discounts offers. Eur. J. Oper. Res. 2008, 184, 509–533. [Google Scholar] [CrossRef]

- Shaw, B.K.; Sangal, I.; Sarkar, B. Joint effects of carbon emission, deterioration, and multi-stage inspection policy in an integrated inventory model. Opt. Inventory Manag. 2020, 195–208. [Google Scholar]

- Daryanto, Y.; Wee, H.M.; Widyadana, G.A. Low carbon supply chain coordination for imperfect quality deteriorating items. Mathematics 2019, 7, 234. [Google Scholar] [CrossRef] [Green Version]

- Mahapatra, A.S.; Sarkar, B.; Mahapatra, M.S.; Soni, H.N.; Mazumder, S.K. Development of a fuzzy economic order quantity model of deteriorating items with promotional effort and learning in fuzziness with a finite time horizon. Inventions 2019, 4, 36. [Google Scholar] [CrossRef] [Green Version]

- Sarkar, B.; Omair, M.; Kim, N. A cooperative advertising collaboration policy in supply chain management under uncertain conditions. Appl. Syst. Comput. 2020, 8, 105948. [Google Scholar] [CrossRef]

- Tamjidzad, S.; Mirmohammadi, S.H. A two-stage heuristic approach for a multi-item inventory system with limited budgetary resource and all-units discount. Comput. Ind. Eng. 2018, 124, 293–303. [Google Scholar] [CrossRef]

- Tayyab, M.; Jemai, J.; Lim, H.; Sarkar, B. A sustainable development framework for a cleaner multi-item multi-stage textile production system with a process improvement initiative. J. Clean. Prod. 2020, 246, 119055. [Google Scholar] [CrossRef]

- Khosravikia, F.; Clayton, P. Updated evaluation metrics for optimal intensity measure selection in probabilistic seismic demand models. Eng. Struct. 2020, 2021, 109899. [Google Scholar] [CrossRef]

- Guo, J.; Alam, M.S.; Wang, J.; Li, S.; Yuan, W. Optimal intensity measures for probabilistic seismic demand models of a cable-stayed bridge based on generalized linear regression models. Soil Dyn. Earthq. Eng. 2020, 131, 106024. [Google Scholar] [CrossRef]

- Peymankar, M.; Dehghanian, F.; Ghiami, Y.; Abolbashari, M.H. The effects of contractual agreements on the economic production quantity model with machine breakdown. Int. J. Prod. Econ. 2018, 201, 203–215. [Google Scholar] [CrossRef]

- Chiu, Y.S.P.; Li, Y.Y.; Chiu, T.; Chiu, S.W. Determining optimal uptime considering an unreliable machine, a maximum permitted backorder level, a multi-delivery plan, and disposal/rework of imperfect items. J. King Saud Univ. Eng. Sci. 2020, 32, 69–77. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S. Product inspection policy for an imperfect production system with inspection errors and warranty cost. Eur. J. Oper. Res. 2016, 248, 263–271. [Google Scholar] [CrossRef]

- Sarkar, M.; Pan, L.; Dey, B.K.; Sarkar, B. Does the autonomation policy really help in a smart production system for controlling defective production? Mathematics 2020, 8, 1142. [Google Scholar] [CrossRef]

- Vahdani, B.; Niaki, S.T.A.; Aslanzade, S. Production-inventory-routing coordination with capacity and time window constraints for perishable products: Heuristic and meta-heuristic algorithms. J. Clean. Prod. 2017, 161, 598–618. [Google Scholar] [CrossRef]

| Author(s) | Demand (Price and Time Related) | Discount Policy | Trade-Credit Policy | Deterioration |

|---|---|---|---|---|

| Dey et al. [10] | Price related | - | - | - |

| Alfares and Ghaithan [14] | Price related | Quantity discount | - | - |

| Li et al. [19] | - | - | One level | - |

| Avinadav et al. [32] | Price and time related | - | - | Constant |

| Xu et al. [37] | - | Discount in price | - | - |

| Jaggi et al. [40] | - | - | Two level | - |

| Sarkar et al. [44] | Time related | - | - | - |

| Sarkar and Sarkar [45] | - | - | - | Variable |

| Teng and Chang [46] | Price related | - | - | Constant |

| Wu et al. [47] | - | - | - | Variable |

| This model | Price and time related | Discount in price | One level | Constant |

| Parameters | Changes (in %) | ||||||

|---|---|---|---|---|---|---|---|

| −50% | 20.4 | 16.51 | 12.69 | 25.2 | 22.53 | 10.22 | |

| −25% | 10.28 | 7.87 | 8.54 | 12.53 | 11.28 | 4.9 | |

| +25% | −2.54 | −5.32 | −1.79 | −4.1 | −3.32 | −5.25 | |

| +50% | −7.76 | −9.65 | −7.51 | −11.74 | −8.93 | −14.61 | |

| −50% | 0.23 | 0.16 | 0.1 | 0.56 | 0.23 | 0.34 | |

| −25% | 0.11 | 0.08 | 0.05 | 0.28 | 0.11 | 0.4 | |

| +25% | −0.11 | −0.08 | −0.05 | −0.28 | −0.11 | −0.4 | |

| +50% | −0.23 | −0.16 | −0.1 | −0.56 | −0.23 | −0.34 | |

| −50% | 3.17 | 9.74 | 16.12 | 24.57 | 20.23 | 12.9 | |

| −25% | 4.53 | 12.87 | 24.76 | 30.77 | 37.12 | 15.84 | |

| +25% | 7.21 | 15.98 | 32.55 | 45.21 | 43.7 | 22.76 | |

| +50% | 9.56 | 20.66 | 47.87 | 58.1 | 59.31 | 30.32 | |

| −50% | −14.19 | −4.04 | −0.54 | −0.41 | −0.03 | −5.45 | |

| −25% | −20.3 | −6.87 | −2.45 | −1.43 | −0.45 | −8.9 | |

| +25% | −25.7 | −10.54 | −4.76 | −3.48 | −0.64 | −14.27 | |

| +50% | −31.45 | −16.16 | −5.89 | −5.71 | −1.2 | −19.64 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saren, S.; Sarkar, B.; Bachar, R.K. Application of Various Price-Discount Policy for Deteriorated Products and Delay-in-Payments in an Advanced Inventory Model. Inventions 2020, 5, 50. https://doi.org/10.3390/inventions5030050

Saren S, Sarkar B, Bachar RK. Application of Various Price-Discount Policy for Deteriorated Products and Delay-in-Payments in an Advanced Inventory Model. Inventions. 2020; 5(3):50. https://doi.org/10.3390/inventions5030050

Chicago/Turabian StyleSaren, Sharmila, Biswajit Sarkar, and Raj Kumar Bachar. 2020. "Application of Various Price-Discount Policy for Deteriorated Products and Delay-in-Payments in an Advanced Inventory Model" Inventions 5, no. 3: 50. https://doi.org/10.3390/inventions5030050