Human Services or Non-Human Services? How Online Retailers Make Service Decisions

Abstract

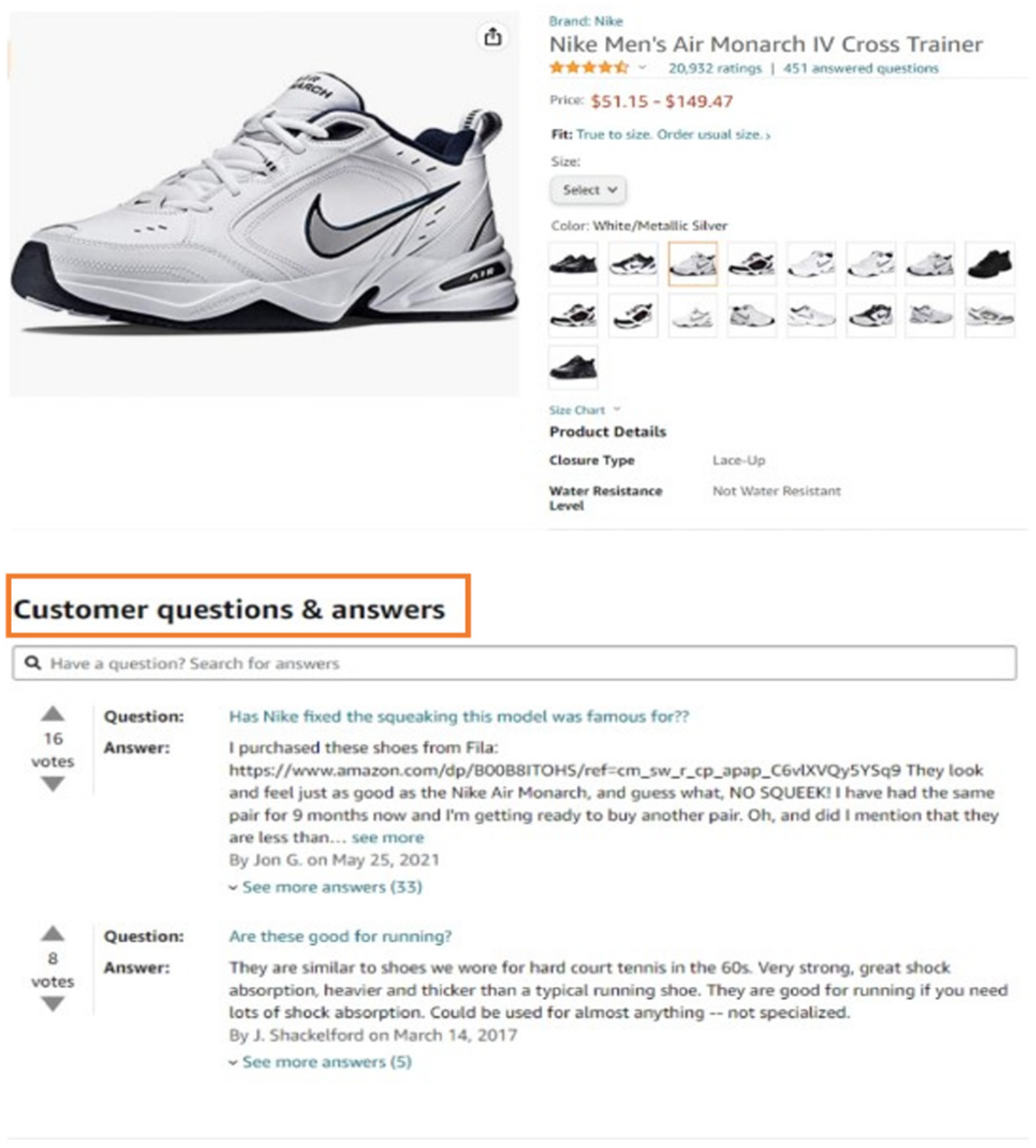

:1. Introduction

2. Literature Review

2.1. Duopoly Competition

2.2. Online Retailer

2.3. Human Services

3. The Model

3.1. Model Setups

3.2. Notations Description

4. Discussion

4.1. Mode NN: Online Retailers and Are Both Non-Human Services

4.2. Mode NH: Online Retailer Is a Non-Human Service, Online Retailer Is a Human Service

4.3. Equilibrium Results

5. Analysis of Service Strategy Selection

5.1. Comparative Analysis of Two Online Retailers in Mode NN

5.2. Comparative Analysis of Two Online Retailers in Mode NH

| Relationship between | Relationship between | ||

|---|---|---|---|

5.3. Sensitivity Analysis of the Service Level of Human Service

5.4. Comparative Analysis of Profit in Mode NH for Two Online Retailers

5.5. Optimal Service Strategy for Online Retailer

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Zheng, H.Y.; Ma, W.L. Click it and buy happiness: Does online shopping improve subjective well-being of rural residents in China? Appl. Econ. 2021, 53, 4192–4206. [Google Scholar] [CrossRef]

- Ba, S.L.; He, S.; Lee, S.Y. Mobile app adoption and its differential impact on consumer shopping behavior. Prod. Oper. Manag. 2021, 31, 764–780. [Google Scholar] [CrossRef]

- Craig, N.; DeHoratius, N.; Raman, A. The impact of supplier inventory service level on retailer demand. Manuf. Serv. Oper. Manag. 2017, 18, 461–474. [Google Scholar] [CrossRef] [Green Version]

- Devaraj, S.; Fan, M.; Kohli, R. Antecedents of B2C channel satisfaction and preference: Validating e-commerce metrics. Inf. Syst. Res. 2002, 13, 316–333. [Google Scholar] [CrossRef]

- Rohm, A.J.; Swaminathan, V. A typology of online shoppers based on shopping motivations. J. Busin. Res. 2004, 57, 748–757. [Google Scholar] [CrossRef]

- Desai, P.S.; Krishnamoorthy, A.; Sainam, P. “Call for Prices”: Strategic Implications of Raising Consumers’ Costs. Mark. Sci. 2010, 29, 158–174. [Google Scholar] [CrossRef] [Green Version]

- Shulman, J.D.; Cunha, M.; Saint Clair, J.K. Consumer uncertainty and purchase decision reversals: Theory and evidence. Mark. Sci. 2015, 34, 590–605. [Google Scholar] [CrossRef] [Green Version]

- Sun, H.Y.; Chen, J.Q.; Fan, M. Effect of live chat on traffic-to-sales conversion: Evidence from an online marketplace. Prod. Oper. Manag. 2020, 30, 1201–1219. [Google Scholar] [CrossRef]

- Hotelling, H. Stability in competition. Econ. J. 1929, 39, 41–57. [Google Scholar] [CrossRef]

- Moorthy, K.S. Product and price competition in a duopoly. Mark. Sci. 1988, 7, 141–168. [Google Scholar] [CrossRef]

- Singh, S.S.; Jain, D.C.; Krishnan, T.V. Customer loyalty programs: Are they profitable? Manag. Sci. 2008, 54, 1205–1211. [Google Scholar] [CrossRef]

- Lin, X.D.; Huang, X.L.; Liu, S.L.; Li, Y.L.; Luo, H.Y.; Yu, S.M. Competitive price-quality strategy of platforms under user privacy concerns. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 571–589. [Google Scholar] [CrossRef]

- Narayanan, V.G.; Raman, A.; Singh, J. Agency costs in a supply chain with demand uncertainty and price competition. Manag. Sci. 2005, 51, 120–132. [Google Scholar] [CrossRef] [Green Version]

- Armstrong, M. Competition in two-sided markets. RAND J. Econ. 2005, 37, 668–691. [Google Scholar] [CrossRef] [Green Version]

- Banerjee, B.; Bandyopadhyay, S. Advertising competition under consumer inertia. Mark. Sci. 2003, 22, 131–144. [Google Scholar] [CrossRef] [Green Version]

- Wan, Q.; Yang, S.L.; Shi, V.; Qiu, M. Optimal strategies of mobile targeting promotion under competition. Int. J. Prod. Econ. 2021, 237, 108143. [Google Scholar] [CrossRef]

- Elmachtoub, A.N.; Hamilton, M.L. The power of opaque products in pricing. Manag. Sci. 2021, 67, 4686–4702. [Google Scholar] [CrossRef]

- Jiang, Y.B.; Guo, H. Design of consumer review systems and product pricing. Inf. Syst. Res. 2015, 26, 714–730. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J.L.; Zhao, S.T.; Cheng, T.C.E.; Hua, G.W. Optimisation of online retailer pricing and carrier capacity expansion during low-price promotions with coordination of a decentralised supply chain. Int. J. Prod. Res. 2019, 57, 2809–2827. [Google Scholar] [CrossRef]

- Zhang, D.J.; Dai, H.C.; Dong, L.X.; Qi, F.F.; Zhang, N.N.; Liu, X.F.; Liu, Z.Y.; Yang, J. The long-term and spillover effects of price promotions on retailing platforms: Evidence from a large randomized experiment on alibaba. Manag. Sci. 2020, 66, 2589–2609. [Google Scholar] [CrossRef]

- Chen, K.Y.; Kaya, M.; Ozer, O. Dual sales channel management with service competition. Manuf. Serv. Oper. Manag. 2008, 10, 654–675. [Google Scholar] [CrossRef] [Green Version]

- Luo, J.F.; Ba, S.L.; Zhang, H. The effectiveness of online shopping characteristics and well-designed websites on satisfaction. Mis Q. 2012, 36, 1131–1144. [Google Scholar] [CrossRef] [Green Version]

- Hu, M.Y.; Huang, F.; Hou, H.P.; Chen, Y.; Bulysheva, L. Customized logistics service and online shoppers’ satisfaction: An empirical study. Int. Res. 2016, 26, 484–497. [Google Scholar]

- Taylor, T.A. On-demand service platforms. Manuf. Serv. Oper. Manag. 2018, 20, 704–720. [Google Scholar] [CrossRef] [Green Version]

- Mudambi, S.M.; Schuff, D. What makes a helpful online review? A study of customer reviews on amazon.com. Mis Q. 2010, 34, 185–200. [Google Scholar] [CrossRef] [Green Version]

- Yang, L.; Dong, S.Z. Rebate strategy to stimulate online customer reviews. Int. J. Prod. Econ. 2018, 204, 99–107. [Google Scholar] [CrossRef]

- Lei, Z.F.; Yin, D.Z.; Mitra, S.; Zhang, H. Swayed by the reviews: Disentangling the effects of average ratings and individual reviews in online word-of-mouth. Prod. Oper. Manag. 2022, 31, 2393–2411. [Google Scholar] [CrossRef]

- Liu, Y.; Gan, W.X.; Zhang, Q. Decision-making mechanism of online retailer based on additional online comments of consumers. J. Retail. Consum. Serv. 2021, 59, 102389. [Google Scholar] [CrossRef]

- Fan, W.J.; Zhou, Q.Q.; Qiu, L.F.; Kumar, S. Should doctors open online consultation services? An empirical investigation of their impact on offline appointments. Inf. Syst. Res. 2022; ahead of print. [Google Scholar] [CrossRef]

- Shunko, M.; Niederhoff, J.; Rosokha, Y. Humans are not machines: The behavioral impact of queueing design on service time. Manag. Sci. 2018, 64, 453–473. [Google Scholar] [CrossRef] [Green Version]

- Huang, K.M.; Yao, J.H.; Zhang, J.; Feng, Z.Y. When human service meets crowdsourcing: Emerging in human service collaboration. IEEE Trans. Serv. Comput. 2019, 12, 460–473. [Google Scholar] [CrossRef]

- Tran, A.D.; Pallant, J.I.; Johnson, L.W. Exploring the impact of chatbots on consumer sentiment and expectations in retail. J. Retail. Consum. Serv. 2021, 63, 102718. [Google Scholar] [CrossRef]

- McLean, G.; Osei-Frimpong, K.; Wilson, A.; Pitardi, V. How live chat assistants drive travel consumers’ attitudes, trust and purchase intentions The role of human touch. Int. J. Contem. Hosp. Manag. 2020, 32, 1795–1812. [Google Scholar] [CrossRef]

- Tan, X.; Wang, Y.W.; Tan, Y. Impact of live chat on purchase in electronic markets: The moderating role of information cues. Inf. Syst. Res. 2019, 30, 1248–1271. [Google Scholar] [CrossRef]

| Notations | Definition |

|---|---|

| Initial utility of consumers | |

| , | Consumers’ utility obtained from purchasing products at online retailers and |

| , | Product price of online retailers and |

| Demand of online retailers and | |

| Unit time cost | |

| , | Consumers’ utility obtained from the non-human services provided by online retailers and |

| Service level of online retailer ’s human online shopping consultation service | |

| Consumer waiting cost in human service of online retailer | |

| Consumers’ sensitivity to human service level of online retailer | |

| Human service cost coefficient of online retailer | |

| NN, NH | Superscript, respectively, online retailer and are both non-human services and the online retailer is non-human services and online retailer is human services |

| , | Profit of online retailers and |

| Online Retailer | Equilibrium Results | Mode NN | Mode NH |

|---|---|---|---|

| — | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, L.; Wu, W.; Jiang, M. Human Services or Non-Human Services? How Online Retailers Make Service Decisions. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1791-1811. https://doi.org/10.3390/jtaer17040090

Zhao L, Wu W, Jiang M. Human Services or Non-Human Services? How Online Retailers Make Service Decisions. Journal of Theoretical and Applied Electronic Commerce Research. 2022; 17(4):1791-1811. https://doi.org/10.3390/jtaer17040090

Chicago/Turabian StyleZhao, Leilei, Weiwei Wu, and Minghui Jiang. 2022. "Human Services or Non-Human Services? How Online Retailers Make Service Decisions" Journal of Theoretical and Applied Electronic Commerce Research 17, no. 4: 1791-1811. https://doi.org/10.3390/jtaer17040090

APA StyleZhao, L., Wu, W., & Jiang, M. (2022). Human Services or Non-Human Services? How Online Retailers Make Service Decisions. Journal of Theoretical and Applied Electronic Commerce Research, 17(4), 1791-1811. https://doi.org/10.3390/jtaer17040090