Entropy and Semi-Entropies of LR Fuzzy Numbers’ Linear Function with Applications to Fuzzy Programming

Abstract

:1. Introduction

2. Preliminaries

- (1)

- (2)

- (3)

- (4)

3. The Entropy of a Linear Function with LR Fuzzy Numbers

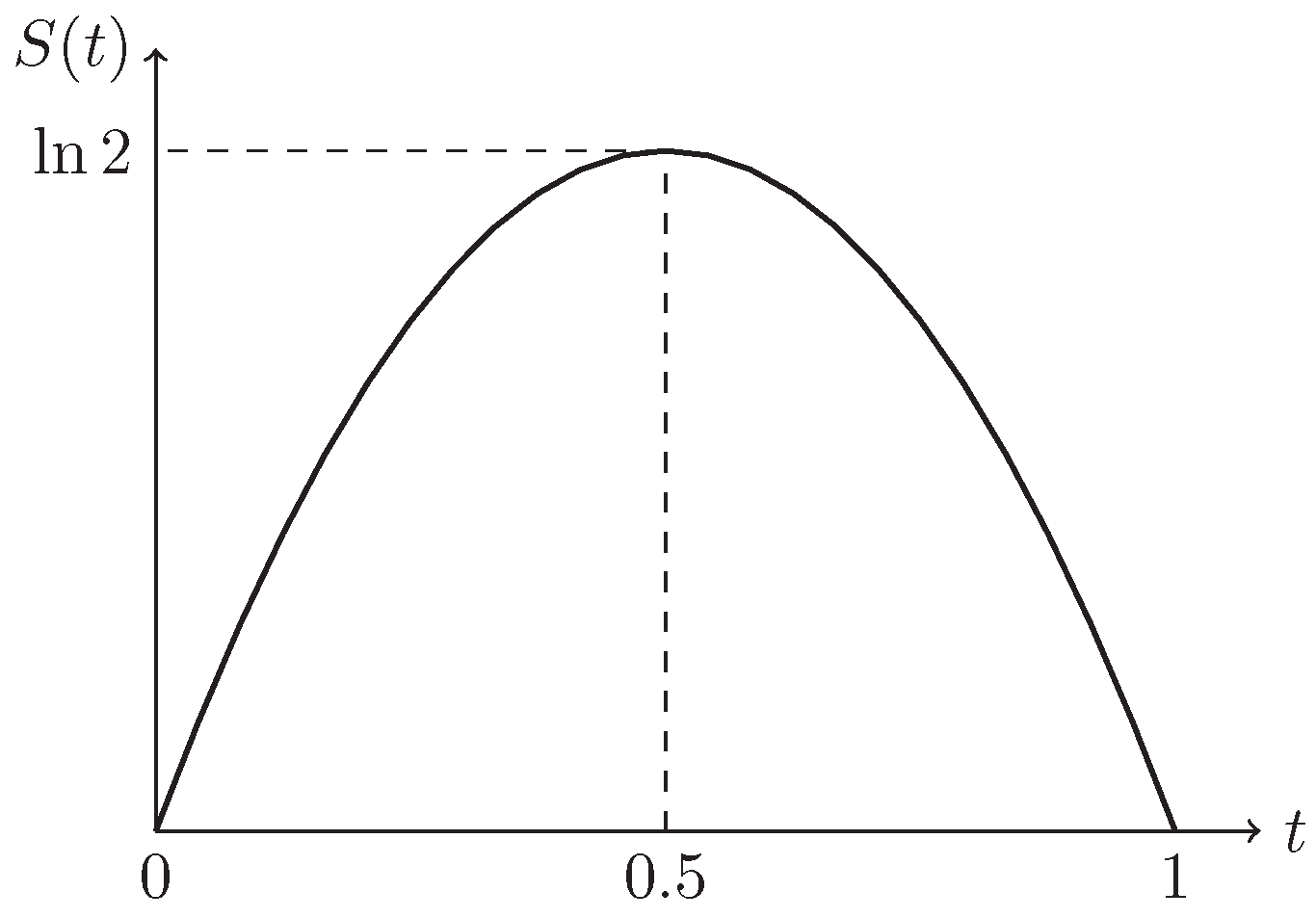

3.1. The Definition of Entropy

3.2. The Entropy of a Regular LR Fuzzy Number

3.3. The Entropy of a Linear Function

4. The Semi-Entropies of a Linear Function with LR Fuzzy Numbers

4.1. The Definitions of Semi-Entropies

4.2. The Semi-Entropy of a Regular LR Fuzzy Number

4.3. The Semi-Entropies of a Linear Function

5. Entropy Optimization Models

5.1. Mean-Entropy and Mean-Semi-Entropy Optimization Models in Return-Oriented Problems

5.2. Mean-Entropy and Mean-Semi-Entropy Optimization Models in Cost-Oriented Problems

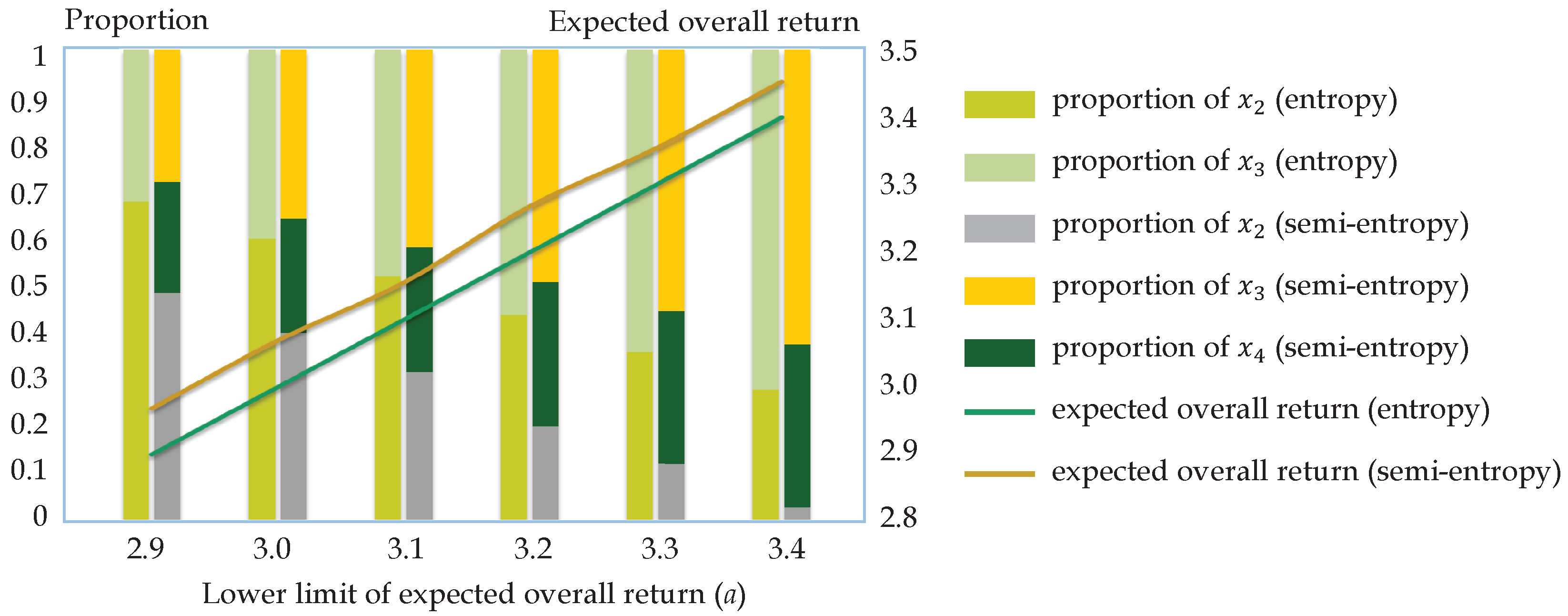

5.3. Numerical Examples

5.4. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| CD | credibility distribution |

| CF | credibility function |

| FP | fuzzy programming |

| ICD | inverse credibility distribution |

| MF | membership function |

References

- Ehsani, E.; Kazemi, N.; Olugu, E.U.; Eric, H.; Grosse, E.H.; Schwindl, K. Applying fuzzy multi-objective linear programming to a project management decision with nonlinear fuzzy membership functions. Neural Comput. Appl. 2017, 28, 2193–2206. [Google Scholar] [CrossRef]

- Zhang, Q.; Zhou, J.; Wang, K.; Pantelous, A.A. An effective solution approach to fuzzy programming with application to project scheduling. Int. J. Fuzzy Syst. 2018, 20, 2383–2398. [Google Scholar] [CrossRef]

- Su, T. A fuzzy multi-objective linear programming model for solving remanufacturing planning problems with multiple products and joint components. Comput. Ind. Eng. 2017, 110, 242–254. [Google Scholar] [CrossRef]

- Su, T.; Wu, C.; Yang, H. An analysis of energy consumption and cost-effectiveness for overhead crane drive systems by using fuzzy multi-objective linear programming. J. Intell. Fuzzy Syst. 2018, 35, 6241–6253. [Google Scholar] [CrossRef]

- Yin, D. Application of interval valued fuzzy linear programming for stock portfolio optimization. Appl. Math. 2018, 9, 101–113. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef] [Green Version]

- Zadeh, L.A. Probability measures of fuzzy events. J. Math. Anal. Appl. 1968, 23, 421–427. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- De Luca, A.; Termini, S. A definition of nonprobabilistic entropy in the setting of fuzzy sets theory. Inf. Control 1972, 20, 301–312. [Google Scholar] [CrossRef]

- Trillas, E.; Riera, T. Entropies in finite fuzzy sets. Inf. Sci. 1978, 15, 159–168. [Google Scholar] [CrossRef]

- Kosko, B. Fuzzy entropy and conditioning. Inf. Sci. 1986, 40, 165–174. [Google Scholar] [CrossRef]

- Pal, N.R.; Pal, S.K. Object-background segmentation using new definitions of entropy. IEE Proc. E (Comput. Digit. Tech.) 1989, 136, 284–295. [Google Scholar] [CrossRef] [Green Version]

- Pal, N.R.; Pal, S.K. Higher order fuzzy entropy and hybrid entropy of a set. Inf. Sci. 1992, 61, 211–231. [Google Scholar] [CrossRef] [Green Version]

- Zhou, R.; Cai, R.; Tong, G. Applications of entropy in finance: A review. Entropy 2013, 15, 4909–4931. [Google Scholar] [CrossRef]

- Gao, J.; Liu, H. A risk-free protection index model for portfolio selection with entropy constraint under an uncertainty framework. Entropy 2017, 19, 80. [Google Scholar] [CrossRef]

- Zhou, R.; Liu, X.; Yu, M.; Huang, K. Properties of risk measures of generalized entropy in portfolio selection. Entropy 2017, 19, 657. [Google Scholar] [CrossRef]

- Gao, R.; Ralescu, D.A. Elliptic entropy of uncertain set and its applications. Int. J. Intell. Syst. 2018, 33, 836–857. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst. 1978, 1, 3–28. [Google Scholar] [CrossRef]

- Zadeh, L.A. A theory of approximate reasoning. Mach. Intell. 1979, 9, 149–194. [Google Scholar]

- Chen, X.; Dai, W. Maximum entropy principle for uncertain variables. Int. J. Fuzzy Syst. 2011, 13, 232–236. [Google Scholar]

- Li, P.; Liu, B. Entropy of credibility distributions for fuzzy variables. IEEE Trans. Fuzzy Syst. 2008, 16, 123–129. [Google Scholar]

- Liu, B.; Liu, Y. Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans. Fuzzy Syst. 2002, 10, 445–450. [Google Scholar]

- Gao, X.; You, C. Maximum entropy membership functions for discrete fuzzy variables. Inf. Sci. 2009, 179, 2353–2361. [Google Scholar] [CrossRef]

- Chen, X.; Dai, W. Entropy of function of uncertain variables. Math. Comput. Model. 2012, 55, 754–760. [Google Scholar]

- Huang, X. Mean-entropy models for fuzzy portfolio selection. IEEE Trans. Fuzzy Syst. 2008, 16, 1096–1101. [Google Scholar] [CrossRef]

- Huang, X. A review of credibilistic portfolio selection. Fuzzy Optim. Decis. Mak. 2009, 8, 263–281. [Google Scholar] [CrossRef]

- Yang, L.; Li, K.; Gao, Z. Train timetable problem on a single-line railway with fuzzy passenger demand. IEEE Trans. Fuzzy Syst. 2009, 17, 617–629. [Google Scholar] [CrossRef]

- Lau, H.C.W.; Jiang, Z.; Ip, W.H.; Wang, D.W. A credibility-based fuzzy location model with Hurwicz criteria for the design of distribution systems in B2C e-commerce. Comput. Ind. Eng. 2010, 59, 873–886. [Google Scholar] [CrossRef]

- Li, X.; Qin, Z.; Ralescu, D.A. Credibilistic parameter estimation and its application in fuzzy portfolio selection. Iran. J. Fuzzy Syst. 2011, 8, 57–65. [Google Scholar]

- Ning, Y.; Ke, H.; Fu, Z. Triangular entropy of uncertain variables with application to portfolio selection. Methodol. Appl. 2015, 19, 2203–2209. [Google Scholar] [CrossRef]

- Zhou, J.; Li, X.; Kar, S.; Zhang, G.; Yu, H. Time consistent fuzzy multi-period rolling portfolio optimization with adaptive risk aversion factor. J. Amb. Intel. Hum. Comp. 2017, 8, 651–666. [Google Scholar] [CrossRef]

- Zhou, J.; Yang, F.; Wang, K. Fuzzy arithmetic on LR fuzzy numbers with applications to fuzzy programming. J. Intell. Fuzzy Syst. 2016, 30, 71–87. [Google Scholar] [CrossRef]

- Dubois, D.; Prade, H. Operations on fuzzy numbers. Int. J. Syst. Sci. 1978, 9, 613–626. [Google Scholar] [CrossRef]

- Liu, B. Membership functions and operational law of uncertain sets. Fuzzy Optim. Decis. Mak. 2012, 11, 387–410. [Google Scholar] [CrossRef]

- Yao, K.; Ke, H. Entropy operator for membership function of uncertain set. Appl. Math. Comput. 2014, 242, 898–906. [Google Scholar] [CrossRef]

- Dubois, D.; Prade, P. Possibility Theory; Springer: Boston, MA, USA, 1988. [Google Scholar]

- Li, X. Credibilistic Programming; Springer: Berlin, Germany, 2013. [Google Scholar]

- Liu, Y.; Liu, B. Expected value operator of random fuzzy variable and random fuzzy expected value models. Int. J. Uncertain Fuzz. 2003, 11, 195–215. [Google Scholar] [CrossRef]

- Zhou, J.; Li, X.; Pedrycz, W. Mean-semi-entropy models of fuzzy portfolio selection. IEEE Trans. Fuzzy Syst. 2016, 24, 1627–1636. [Google Scholar] [CrossRef]

| No. | Fuzzy Number | Range | Expected Value | Entropy |

|---|---|---|---|---|

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 |

| a | Mean-Entropy Model | Mean-Semi-Entropy Model | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Entropy | Mean | Lower Semi-Entropy | |||||||||

| 2.90 | 0 | 0.68 | 0.32 | 0 | 2.90 | 2.48 | 0 | 0.48 | 0.28 | 0.24 | 2.97 | 1.54 |

| 3.00 | 0 | 0.60 | 0.40 | 0 | 3.00 | 2.60 | 0 | 0.40 | 0.36 | 0.24 | 3.07 | 1.61 |

| 3.10 | 0 | 0.52 | 0.48 | 0 | 3.10 | 2.72 | 0 | 0.32 | 0.42 | 0.26 | 3.15 | 1.69 |

| 3.20 | 0 | 0.44 | 0.56 | 0 | 3.20 | 2.84 | 0 | 0.20 | 0.49 | 0.31 | 3.27 | 1.83 |

| 3.30 | 0 | 0.36 | 0.64 | 0 | 3.30 | 2.96 | 0 | 0.12 | 0.55 | 0.32 | 3.35 | 1.91 |

| 3.40 | 0 | 0.28 | 0.72 | 0 | 3.40 | 3.08 | 0 | 0.03 | 0.62 | 0.34 | 3.45 | 2.01 |

| No. | Fuzzy Number | Range | Expected Value | Entropy |

|---|---|---|---|---|

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 |

| b | Mean-Entropy Model | Mean-Semi-Entropy Model | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Entropy | Mean | Upper Semi-Entropy | |||||||||

| 7.90 | 0.48 | 0.52 | 0 | 0 | 7.90 | 2.72 | 0.50 | 0.46 | 0 | 0.04 | 7.84 | 1.26 |

| 8.00 | 0.40 | 0.60 | 0 | 0 | 8.00 | 2.60 | 0.47 | 0.48 | 0 | 0.05 | 7.87 | 1.25 |

| 8.10 | 0.32 | 0.68 | 0 | 0 | 8.10 | 2.48 | 0.42 | 0.52 | 0 | 0.06 | 7.93 | 1.24 |

| 8.20 | 0.24 | 0.76 | 0 | 0 | 8.20 | 2.36 | 0.28 | 0.66 | 0 | 0.06 | 8.11 | 1.14 |

| 8.30 | 0.16 | 0.84 | 0 | 0 | 8.30 | 2.24 | 0.17 | 0.77 | 0 | 0.06 | 8.24 | 1.08 |

| 8.40 | 0.08 | 0.92 | 0 | 0 | 8.40 | 2.12 | 0.08 | 0.85 | 0 | 0.07 | 8.34 | 1.03 |

| Means | Object | Methodology | Mechanism | Characteristic |

|---|---|---|---|---|

| Calculation formulas | Cr-based entropy | Equation (15) | Credibility function | Complex operation |

| Equations (19) and (21) | Inverse credibility distribution | Simplified operation and favorable property of linear functions | ||

| Semi-entropies | Equation (22) | Credibility function | Lower semi-entropy targeting to downside risks (complex operation) | |

| Equations (25), (31) and (32) | Inverse credibility distribution | Initializing concept of upper semi-entropy (simplified operation) | ||

| Fuzzy programming models | Return-oriented | Model (36) | Equation (15) | Model with uncertain measures (solved only by custom algorithms) |

| Models (37)–(39) | Equations (19), (21), (31) | Mean-semi-entropy model and crisp equivalent forms (easily solved) | ||

| Cost-oriented | Models (40)–(43) | Equations (19), (21), (32) | Novel perspective and equivalent models with simple solving process |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, J.; Huang, C.; Zhao, M.; Li, H. Entropy and Semi-Entropies of LR Fuzzy Numbers’ Linear Function with Applications to Fuzzy Programming. Entropy 2019, 21, 697. https://doi.org/10.3390/e21070697

Zhou J, Huang C, Zhao M, Li H. Entropy and Semi-Entropies of LR Fuzzy Numbers’ Linear Function with Applications to Fuzzy Programming. Entropy. 2019; 21(7):697. https://doi.org/10.3390/e21070697

Chicago/Turabian StyleZhou, Jian, Chuan Huang, Mingxuan Zhao, and Hui Li. 2019. "Entropy and Semi-Entropies of LR Fuzzy Numbers’ Linear Function with Applications to Fuzzy Programming" Entropy 21, no. 7: 697. https://doi.org/10.3390/e21070697

APA StyleZhou, J., Huang, C., Zhao, M., & Li, H. (2019). Entropy and Semi-Entropies of LR Fuzzy Numbers’ Linear Function with Applications to Fuzzy Programming. Entropy, 21(7), 697. https://doi.org/10.3390/e21070697