1. Introduction

Geometric Brownian motion (GBM) frequently features in mathematical modelling. The advantage of modelling through this process lies in its universality, as it represents an attractor of more complex models that exhibit non-ergodic dynamics [

1,

2,

3]. As such, GBM has been used to underlie the dynamics of a diverse set of natural phenomena, including the distribution of incomes, body weights, rainfall, fragment sizes in rock crushing processes, etc. [

4,

5]. Nevertheless, perhaps the best-known application of GBM is in finance, and, in particular, in terms of the Black–Scholes (BS) model (or Black–Scholes–Merton model) [

6,

7,

8] for the pricing of European options.

By construction, GBM is a simple continuous-time stochastic process in which the logarithm of the randomly varying quantity of interest follows a Brownian motion with drift. Its non-ergodicity is manifested in the difference between the growth rate that was observed in an individual trajectory and the ensemble average growth [

9]. The time-averaged growth rate is dependent on both the drift and randomness in the system, whereas the ensemble growth rate is solely dependent on the drift. If only a single system is to be modelled, in the long run only the time-averaged growth rate is observed. This is naturally the case in financial market dynamics, for which only single time series exist, and where individual realisations would be expected to be distinctly disparate [

10].

Moreover, GBM is closely related to the problem of heterogeneous diffusion and turbulent diffusion, which are represented by the inhomogeneous advection–diffusion equation with position-dependent diffusion coefficient

and velocity field

. It is well known that, at a turbulent diffusion, the contaminant spreads very fast. For the case of Richardson diffusion, the position-dependent diffusion coefficient behaves as

and the relative mean squared displacement (MSD) scales as

[

11]. However, the fast spread of contaminants can be essentially increased due to multiplicative noise, such that the MSD grows exponentially with time [

12,

13].

Notably, in a variety of cases, GBM has failed to reproduce the properties of real asset prices. For instance, by definition, GBM is not able to adequately reproduce fat-tailed distributions of various characteristics observed in reality [

14]. As a solution, several alternating theories have been proposed, among which are: stochastic volatility [

15,

16,

17]; local volatility [

18,

19]; time-varying volatility [

20,

21], models utilising stochastic processes in which the noise follows a fat-tailed distribution [

22,

23,

24,

25,

26,

27]; and, generalisations of GBM based on subdiffusion [

28,

29,

30]. In the first approach, the volatility is a stochastic process itself. In local volatility models, asset prices follow a stochastic differential equation whose diffusion coefficient is a function of the price. The time-varying volatility models assume that the latent volatility is predictable with respect to the information set. In contrast to stochastic volatility, in these models the conditional variance is a deterministic function of the model parameters and past data. Utilising stochastic processes in which the noise follows a fat-tailed distribution intuitively leads to the desired result. However, it has been acknowledged that several models that are described as a fat-tailed process can, in truth, be derived from stochastic and local volatility models [

31,

32,

33,

34]. The last, i.e., the subdiffusive approach, differently from the other views, assumes anomalous price dynamics. Concretely, the observation that the distribution of log returns is fat-tailed can be attributed to prolonged periods, in which the price of the asset exhibits approximately constant extreme values. These constant periods can be considered to be trapping of particles, as is done in physical systems that manifest anomalous diffusion (subdiffusion) [

35,

36]. While the resulting subdiffusive GBM (sGBM) is able to easily reproduce real-life properties, the literature lacks an extensive study in which the exact empirical characteristics of the subdiffusive model are presented.

The purpose of this paper is to propose a unifying framework for the application of subdiffusive GBM models in option pricing. We do this by providing a thorough investigation on the properties of the so-called generalised GBM (gGBM) [

37]. gGBM is a stochastic process whose behaviour is critically determined by a memory kernel. By choosing the appropriate kernel, we recover the standard GBM and the typically used subdiffusive GBM models [

28,

29,

30]. In order to understand the behaviour of gGBM under various kernels, we perform a detailed analysis of the moments, log-moments, and the expectation of the periodic log returns, and obtain the corresponding probability density functions by using the subordination approach. We show that the dynamics of the model can be easily adjusted in order to mimic periods of constant prices and/or fat-tailed observations of returns, thus corresponding to realistic scenarios. More importantly, it is known that gGBM leads to risk-neutral asset price dynamics, and, thus, it is adequate for their modelling [

37]. We utilise this property of the model to investigate its capability to predict empirical option values. We find that the performance of a kernel ultimately depends on the parameters of the option, such as its maturity and moneyness. The first property describes the time that is left for the option to be exercised, whereas the second characteristic depicts the relative position of the current price with respect to the strike price of the option. At first sight, this conclusion appears intuitive—obviously the known information for the properties of the asset greatly impacts its price. However, the observation that a slight change in the known information may drastically change the dynamics suggests that there is a need in the option pricing literature for models that easily allow for such structural changes. We believe that the resolution to this issue lies in applying the concepts of time-averaging and ergodicity breaking to modelling financial time-series, and the gGBM framework offers a computationally inexpensive and efficiently tractable solution.

The paper is organised as follows. In

Section 2, we provide an overview of GBM in the BS model and its use in option pricing. We also give detailed results for the so-called sGBM in terms of the fractional Fokker–Planck equation and its corresponding continuous time random walk (CTRW) model. In

Section 3, we present gGBM and describe its properties using the subordination approach. In particular, we derive the corresponding Fokker–Planck equation with a memory kernel and obtain the respective moments and log-moments. The general function that is used in the Lévy exponent occurs as a memory kernel in the Fokker–Planck equation, which allows for us to recover the previously known results for GBM and sGBM. We consider generalisations of GBM and sGBM by introducing tempered sGBM, a mix of GBM and sGBM, as well as a mix of sGBMs. A numerical investigation of the properties of the model is given in

Section 4 and an empirical example of application of the gGBM in option pricing is presented in

Section 5.

Section 6 summarises our findings. In the Appendices, we give detailed calculations as well as derivation of the Fokker–Planck equation for the gGBM within the CTRW theory.

3. Generalised GBM

In this section, we consider a generalisation of GBM, under which the standard and subdiffusive GBM arise as special cases, by using the subordination approach. Here, we present analytical expressions for the first four moments and log-moments of the process for a variety of special cases. They are thoroughly analysed in the numerical experiments section.

The continuous time random walk approach to the corresponding Fokker–Planck equation is given in

Appendix B in detail. The same Fokker–Planck equation can be obtained using the coupled Langevin equations approach [

47], as given in Equations (

29) and (

30), where the waiting times are given by

, with

.

3.1. Subordination Approach

The generalisation of GBM that we consider is the model introduced by Magdziarz and Gajda [

37] in the form of a stochastic process

where

is the

generalised GBM (gGBM),

is the operational time, and

is an infinite divisible process, i.e., a strictly increasing Lévy motion with [

37]

and

is the Lévy exponent [

28,

37,

39]. Here we consider

. The current process should not be confused with the generalised grey Brownian motion, see Ref. [

54,

55,

56].

Next we find the PDF of gGBM which subordinates the processes from the time scale

t (physical time) to the GBM on a time scale

u (operational time). Specifically, the PDF

of a given random process

can be represented as [

28,

46,

57,

58,

59]

where

satisfies the Fokker–Planck Equation (

3) for the standard GBM. The function

is the PDF subordinating the random process

to the standard GBM. In Laplace space, Equation (

46) reads

where

. By considering

we then have

By Laplace transform of the Fokker–Planck Equation (

3) for the GBM, and using relation (

49), one finds that the PDF

satisfies

After applying an inverse Laplace transform, we arrive at the generalised Fokker–Planck equation (see Refs. [

37,

48], where one-sided

-stable waiting times are considered in detail)

where

is a so-called memory kernel. One observes that, for

, we arrive at the Fokker–Planck Equation (

3) for the GBM, and for

at the time fractional Fokker–Planck Equation (

26) for the sGBM. From Equations (

47) and (

48), we find for the PDF in the Laplace domain, see also Ref. [

48],

Remark 1. Here, we note that there are restrictions on the choice of the memory kernel since the PDF (46) should be non-negative. From the subordination integral it follows that the subordination function should be non-negative, which, according to the Bernstein theorem, means that its Laplace transform (48) should be a completely monotone function [60]. Therefore, the PDF (46) will be non-negative if is a completely monotone function, and is a Bernstein function, see Refs. [61,62]. Remark 2. We note that Equation (50) can be written in an equivalent form aswhere the memory kernel is connected to in Laplace space as , see Ref. [61]. From this relation, we find that for GBM (, i.e., ) the memory kernel is given by . For sGBM (, i.e., ) the memory kernel becomes , and, thus, Equation (53) readswhereis the Caputo fractional derivative of order [45]. The Laplace transform of the Caputo derivative of a given function reads . We note that, with the appropriate restrictions for and , both formulations are equivalent. Remark 3. For , , gGBM corresponds to sGBM. Using the subordination approach one finds [28]where is the Fox H-function, see Appendix D. By inverse Laplace transform (A42), one obtains [28]where we applied property (A43). The solution in Laplace space then becomeswhich is obtained in Ref. [48] in a similar way. From here, we can plot the PDF using numerical inverse Laplace transform techniques. 3.2. Generalised BS Formula

If we consider that the asset price follows a gGBM, then the generalised BS (gBS) formula for the option price is [

37]

where

is taken from the BS Formula (

25), and

is the subordination function defined by Equation (

48) in the Laplace domain. By Laplace transform one finds

Therefore, from Equation (

22), the corresponding equation for the option price becomes [

48]

3.3. Calculation of Moments

The

nth moment

can be calculated by multiplying both sides of Equation (

51) by

and integration over

x, see

Appendix C. In the Laplace domain, this results in

From this result, we reproduce the normalisation condition

. The general results for the first four moments in terms of the memory kernel become

The log-moments

, can also be calculated exactly through the memory kernel, see

Appendix C. The normalisation condition is satisfied, i.e.,

, while the log-mean reads

From here, we find, for the expectation of the periodic log return with period

where

, i.e.,

. Therefore, the expectation of the periodic log returns behaves as the rate of the first log-moment,

which is proportional to the memory kernel

. Moreover, for the second log-moment, we find

from where the log-variance becomes

The general results for third and fourth moments are given in

Appendix C.

From all of these general formulas, one can easily recover the previous results for the standard GBM (, i.e., ) and sGBM (, i.e., , ).

3.4. Exponentially Truncated Subdiffusive GBM

As an example for another memory kernel in gGBM, we consider a power-law memory kernel with exponential truncation,

where

is a characteristic crossover time scale,

. Such forms are important in many real-world applications, in which the scale-free nature of the waiting time dynamics is broken at macroscopic times

[

61]. Therefore,

where we use the shift rule of the Laplace transform,

, for

.

The mean value reads,

and the MSD is

The third and fourth moments become

respectively.

From the general result for the log-mean, we find that

where (

;

). Here,

is the incomplete gamma function, and

is the two parameter ML function [

45]. Note that, the Laplace transform of the two parameter ML function reads

. The asymptotic expansion formula for the two parameter ML function is

,

[

45,

52], while the asymptotic behaviour for negative arguments is given by power-law decay,

,

[

45,

52].

For the expectation of the periodic log return with period

, we find

This leads to a long run log return of 0, whereas on the short time scale the same observable behaves in the same way as sGBM. As such, the model can be used in order to model early herd behaviour, where the price of an asset grows simply as a consequence of investors following trends (short run behaviour), which last until the trade of the asset becomes congested (long run behaviour). The second log-moment is

from where the log-variance becomes

Here, we note that, for

, the obtained results correspond to those that were obtained for sGBM, as it should be since the exponential truncation has no influence on the process. We observe that on the long run the log-variance becomes constant, i.e., it is equal to

. In a similar way, for the third and fourth log-moments, we find

The subordination function, in this case, is given by

from where one can analyse the PDF

.

3.5. Combined Standard and Subdiffusive GBM

As another application, let us consider the combination of GBM and sGBM, represented by the memory kernel

where

,

, and

This case combines both motions governed by Equations (

3) and (

26). In this case, in a jump picture, normal GBM steps occur with weight

, while power-law waiting time steps are realised with weight

.

The mean value for this case is given by

where

is the Kummer confluent hypergeometric function,

is the three parameter ML function [

63], and

is the Pochhammer symbol. The Laplace transform of the three parameter ML function reads

. From here, we see that, for

and

, only the term for

in Equation (

88) survives, which yields the result for standard GBM as it should be. The opposite case, with

and

, yields

as it should be for the sGBM. For the second, third, and fourth moments, we find

Following the same procedure as previously, for the log-mean we find

and for the expectation of the periodic log return with period

,

This model introduces subdiffusive and trapping asset dynamics on short time scales (i.e., then the part multiplied with

is much bigger), whereas, on the long run, we recover the standard GBM dynamics. The second log-moment yields

from where the log-variance becomes

Similarly to the behaviour of the first log moment, in the log variance, for short time scales, the sGBM dynamics dominates. However, we observe that, on the long run, the dynamics is a combination of the two kernels, since the dominant term is

. Moreover, the third and fourth log-moments read

The subordination function for this case is given by

where the Lévy exponent is

.

3.6. Mix of Subdiffusive GBMs

We may further analyse the case of a mix of two sGBM with different power-law memory functions,

where

,

, and

This situation corresponds to the case of two different groups of periods of constant prices. For physical systems, this situation means that the process is a sum of two random processes with different waiting times [

64], as represented by the memory kernel (

101).

Therefore, for the mean, we find

while, for the second, third, and fourth moments, respectively, we obtain

Similarly, the log-mean yields

The expectation of the log return with period

, then becomes

Because

, on short times, the part of first sGBM dominates, whereas, on long times, it is the characteristic of the second sGBM that determines the dynamics. The second log-moment becomes

and for the log-variance we find

In this case, for short times, the kernel with the smaller exponent dominates the variance. Interestingly, for long times, this observable is determined by the magnitude of the larger exponent, which is opposite from the previous kernel examples. Moreover, the third and fourth log-moments read

For the mix of subdiffusive GBMs, the subordination function becomes

where the Lévy exponent is

, see Refs. [

64,

65].

4. Numerical Experiments

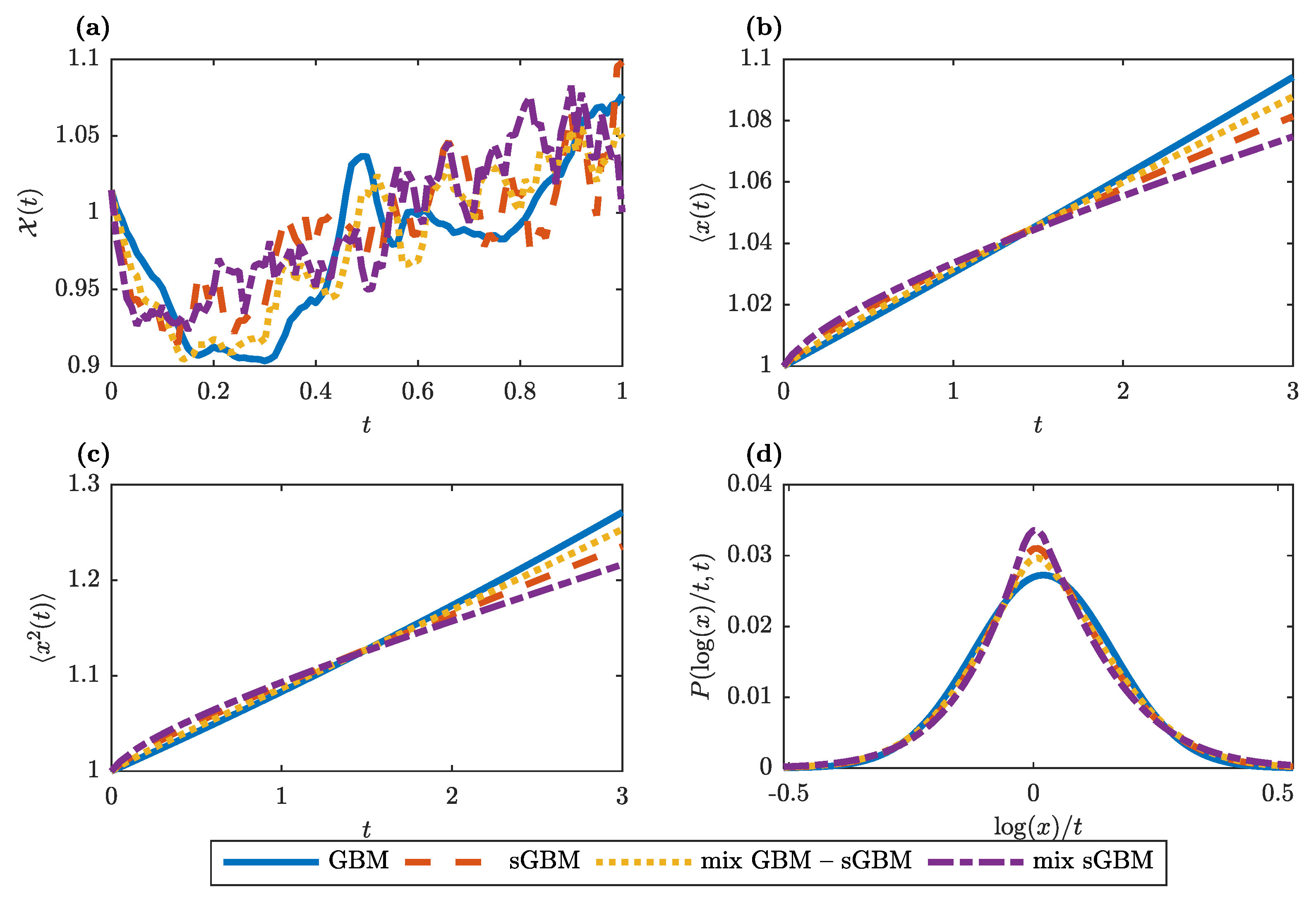

Figure 1a provides an intuitive illustration of the gGBM dynamics under various choices for the kernel. As argued, for standard GBM we observe smooth dynamics without periods of constant prices, whereas there is more turbulence in the asset price dynamics in the gGBM case. The periods of constant prices that are reproduced by gGBM depend, in general, on the time scale and, hence, the measuring units of the drift and volatility, with longer time scales also corresponding to longer periods of constant prices. In

Figure 1b,c we plot, respectively, the numerical approximations for the first moment and the MSD for GBM, sGBM, a mix of GBM and sGBM, and a mix of sGBMs. One can easily notice the nonlinear behaviour in the generalisations of GBM. For long times, all gGBMs give an exponential dependence of the first moment and the MSD on time but with smaller slope than the one of GBM. Finally,

Figure 1d shows the empirical PDF for the logarithmic return at

year. For each of the studied generalisations of GBM, the PDF is characterised with fatter tails (which should increase as the

parameters decrease), which means that it is more prone to producing values that fall far from the average.

The fat-tailed property can be observed in greater detail in

Figure 2, where we plot the skewness

g and excess kurtosis

in gGBM as a function of

(for sGBM and the mix of GBM-sGBM) or

(for the mix of sGBM) for the logarithmic return at

year. As is the case with general fat-tailed distributions, all of the generalisations exhibit positive skewness and excess kurtosis. This is exactly what makes the gGBM framework useful in understanding the statistical behaviour of the asset price dynamics. Moreover, the figure indicates that there is an inverse relationship between these two statistics and

(

), i.e., as

(

) increases,

g and

decrease. For small

(

), sGBM is the model with the largest skewness and excess kurtosis, followed by the mix of sGBM and the mix of GBM-sGBM. For large

(

), the mix of GBM-sGBM remains the model with the lowest

g and

, but, now, the mix of sGBM becomes the model with the largest values of the two statistics. The rationale for this observation is that the GBM-sGBM model already includes a GBM term, which greatly induces the fat tails, whereas the operational time in the mix of sGBM becomes dominated by the value of the second sGBM, which has a fixed value for

, thereby resulting in larger skewness and excess kurtosis.

Finally, we investigate the dependence of two standard quantities that are relevant in an option pricing scheme: (i) at-the-money (ATM) implied volatility and (ii) ATM volatility skew with respect to the gGBM parameters. Both of the quantities are a part of the moneyness property of the option. Moneyness describes the relative position of the current price of the asset () with respect to the strike price of the option (K). An option whose strike price is equal to the current price of the asset is said to be at-the-money; if the strike price is larger than the current price, the option is “out of the money”; and, if the strike price is smaller than the current price, the option is described to be “in the money”.

Moneyness is usually examined by plotting the implied volatility of an option for an underlying asset as a function of its strike price. This plot is formally known as the volatility smile. Its name is derived from the usual pattern, which suggests that the implied volatility is the lowest for options that are ATM, i.e., the plot looks like a parabola (smile). The ATM volatility skew is the first derivative of the volatility smile at the ATM point [

66]. A larger volatility skew implies that the implied volatility increases faster for options that are near the money (options whose strike price is near the current asset price), and vice versa.

Figure 3 displays the functional relationship between the two studied quantities and the parameter

(for sGBM and the mix of GBM-sGBM) or

(for the mix of sGBMs). For each gGBM model, we get that lower ATM implied volatilities can be attributed to lower diffusion rates, thereby suggesting that the gGBM framework can be used to describe the empirical at-the-money observations. Identically, there is a direct relationship between ATM volatility skews and

(

). In other words, in the gGBM framework, the slope of the volatility smile for at-the-money options behaves in the same manner as the magnitude of the implied volatility. This leads to lower near-the-money implied volatilities.

5. Empirical Example

In order to illustrate the power of the gGBM framework in the evaluation of options, we utilise empirical data of American options for two companies: Tesla (TSLA) and Apple (AAPL). By definition, the dynamics of American options differ from European, as they allow for exercising of the option at any time before the option expires. Nevertheless, as given in Ref. [

67], one can rely on the fact that American options on non-dividend-paying stocks have the same value as their European counterpart. This relation has allowed for the empirical examination of a pricing scheme of European options to be widely done via data for American ones.

For our analysis, we use freely available data from the Nasdaq’s Options Trading Centre. This dataset offers daily data for options of all companies quoted on the NASDAQ stock market. However, the options for most companies have small sample size. Therefore, we restricted the empirical analysis to Tesla and Apple, whose options are more frequently traded. In our estimations, the risk-free rate of return r is taken simply as the three-Month Treasury Bill Secondary Market Rate at the date of observation. The volatility parameter , on the other hand, was inferred from the values of the options on the market as the value that produces the minimum root mean squared pricing error (RMSE) in their fit.

For both assets, we evaluate the predictive performance of the same sGBM, a mix of GBM-sGBM, and a mix of sGBM models that were used in the numerical analysis of the previous section. The predicted option prices by the model were inferred via a Monte Carlo estimation of (

59) (see Refs [

28,

48]).

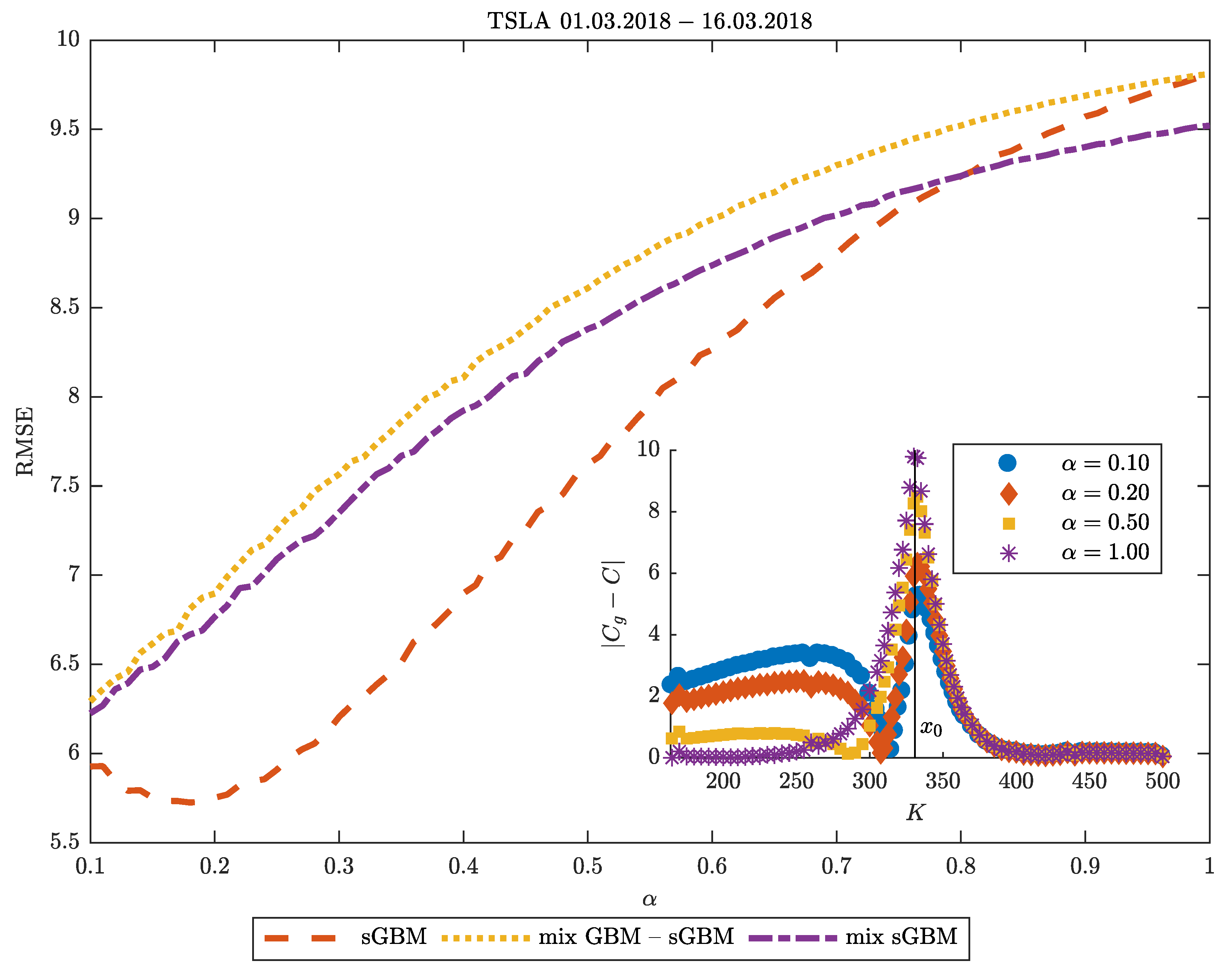

Moneyness in TSLA: Let us now turn our attention to

Figure 4, where we use TSLA data gathered on 1st March 2018 on options which expire on 16th March 2018 to examine the dependence of the sGBM, the mix of GBM-sGBM and the mix of sGBM models on

in predicting the option price. We discover that, in general, the TSLA asset price dynamics are best described as a sGBM, and the minimal error occurs around

. For large

, the mix of sGBM becomes the best performer, because it inherently includes a process with a lower subdiffusion and, thus, it has a close resemblance to the sGBM process with low

than the other models. For every

, the mix of GBM-sGBM has the worst performance since it includes a term with a normal diffusion.

In the inset plot of

Figure 4, we provide a more detailed information on the predictive properties of sGBM by examining its relation with the moneyness of the option. In it, we vary the diffusion parameter

, and plot the absolute difference in the estimated option price

and the observed option price as a function of the strike price. We find that, for in-the-money-options, the best prediction is with

, which corresponds to the BS model. However, as the strike price of the option nears the TSLA price, a transition occurs and

becomes the worst predictor of the option price, whereas the lower the subdiffusion parameter, the better prediction we obtain. For options that are out of the money, it appears that the performance of the prediction for the option price does not depend on

. These findings are in agreement with the discussion presented in the previous section regarding the ATM implied volatility and ATM volatility skew.

Maturity in Apple (AAPL): Next, we use AAPL data that were gathered for at-the-money options on 28th February 2018 and examine how the maturity T affects the performance of the same models in predicting the option price. We focus solely on data for at-the-money options in order to remove the potential bias in the prediction error that arises from the potential moneyness effect, which as we saw in the above paragraph might arise (i.e., we discovered that the error rate with respect to () depends on the moneyness of the option).

For this purpose, in

Table 1, we show the minimum RMSE and the corresponding optimal

(

) of the AAPL option price prediction for seven different maturity periods. We observe that for the shortest-term maturity (

years, or two days), a subdiffusive model (in particular sGBM or a mix of GBM-sGBM) is the model that best describes the option price. As the maturity increases, the optimal

(

) also increases, reaching a maximal value of 1 for options maturing at

years (one month) and

years (35 working days). However, for the options with the longest maturity, again a model with a very low subdiffusion rate is an optimal fit. Hence, the RMSE of the prediction depends on both the maturity of the options and choice of

(

).

To provide a better depiction on the role of

(

), in the predictive performance of sGBM, a mix of GBM-sGBM and a mix of sGBM, in

Figure 5 we depict the RMSE of the option price prediction as a function of the parameter

(

). We observe that, in general, only for the options with the longest maturity, one can observe a clear extremum, whereas, for every other maturity, it appears that every

(

) represents an adequate fit. Increasing this parameter will only lead to marginal and insignificant improvements in the error rate. As a consequence, one might even argue that different gGBM kernels can lead to similar outcomes in the pricing of options, an interesting finding as such.

Evidently, the performance of a kernel ultimately depends on the physical properties of the option. On the first sight, this conclusion appears intuitive—obviously the known information for the properties of the asset greatly impacts its price, the observation that a slight change in the known information may drastically change the dynamics suggests that there is a need in the option pricing literature for models that easily allow for such structural changes. In this aspect, we believe that the generalised GBM approach offers a computationally inexpensive and efficiently tractable solution to this issue. Consequently, we stress that a significant improvement of the description of the data in the gGBM framework can be achieved with comparatively few additional parameters.

6. Conclusions

We investigated the potential of GBM extensions that are based on subdiffusion to model and predict the price of options. By assuming that the price of the asset underlying the option undergoes a subdiffusive process, we introduced the gGBM framework as a potential model for its value.

Similar to previous works on subdiffusive GBM models, the dynamics of a particular gGBM instance is critically determined by a memory kernel. The advantage of gGBM comes in the flavour of allowing various forms for the functional form of the kernel. Depending on its choice, we may end up with asset price dynamics whose behaviour significantly varies on the short time in comparison to its long run characteristics. This, in turn, may induce observations of the properties of the asset price that more closely mimic realistic behaviour than standard GBM.

We explored the ability of gGBM to fit and predict real option values. Our empirical analysis confirmed the characteristics of gGBM, as we discovered that the performance of a certain choice of memory kernel is uniquely determined by the parameters of the option, such as its maturity and its moneyness. Because each kernel produces, in general, different long run and short run dynamics, this suggests that time-averages play an important role in efficient pricing of options. Formally, time-averaging is essential in the analysis of a single time-series (or a set of few), which is characterised with non-ergodic dynamics. The non-ergodicity creates non-equilibrium dynamics which, consequently, makes studies of the ensemble behaviour irrelevant. This leads to the introduction of novel strategies for analysing financial data [

9,

68].

In line with our conclusions, we believe that the next step in uncovering the properties of gGBM is demonstrating the ergodicity breaking of the process. Because multiplicative processes are frequently present in nature, this will not only extend the framework of gGBM in analysing financial data, but will also provide an avenue for applying the model in other scientific domains. Another fruitful research direction would be to incorporate the properties of gGBM in a wider framework for financial modelling, which includes the concept of “rough volatility”, where the instantaneous volatility is driven by a (rough) fractional Brownian motion [

69]. Building an explanatory model for the volatility in terms of gGBM would bring novel insights regarding the theoretical and empirical characteristics of the asset prices. We also leave for future analysis the problem of gGBM with stochastic volatility, which can be treated in the framework of the Fokker–Planck equation for gGBM with time varying volatility

, in analogy of the diffusing-diffusivity models for heterogeneous media [

56,

70,

71,

72,

73].