Predicting Fraud Victimization Using Classical Machine Learning

Abstract

:1. Introduction

- How do demographics affect the probability of fraud victimization?

- Which variables are the strongest predictors of fraud victimization?

Contribution

- From a risk mitigation perspective, knowing the predictive accuracy of the probability of financial exploitation will be valuable for identifying the key factors that determine the likelihood of financial exploitation and for protecting those people from unscrupulous investment advisors.

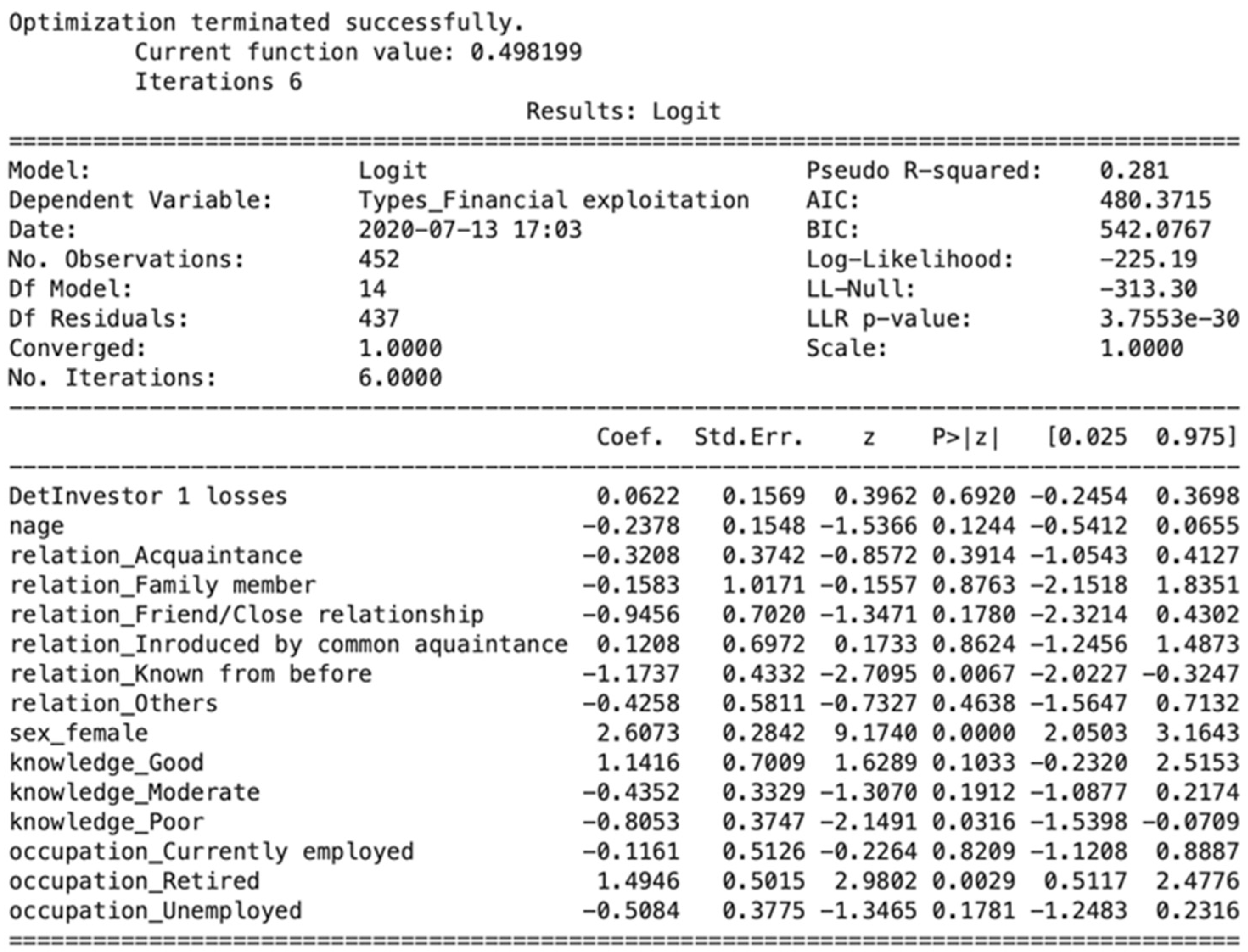

- From a practical perspective, the predictive model shows the probability of the investors more susceptible to fall victims of financial fraud—female investors, investors with poor financial knowledge, retirees, and those investors who know their advisors from previous relationships.

- From a policy making perspective, it is hard not to see the results of this finding being used by both the national and provincial securities regulators to inform Canada’s securities regulatory framework. Canada does not have a national securities regulator and relies on the self-regulation to protect investors and sanction bad actors. It is in this regard that the proposed study is contextualized to show why a wider audience might be interested in a paper on the effectiveness of self-regulation in Canada’s securities industry and highlights the need for self-regulatory reforms and a national securities regulator in Canada.

2. Self-Regulation: The Victim’s Perspective

“Merely merging the two SROs using the current self-regulatory model would not be adequate given the shortcomings of the current SRO system. The important question is would a consolidation be in the best interests of the investing public and in the public interest? We urge the CSA to consider a new self-regulator model and SRO organization.”

3. Theory and Literature Review

3.1. Lifestyle Exposure Theory

3.2. Fraud Victimization

3.3. The Present Study

4. Research Design

4.1. Financial Victimization Detection Model

4.2. Data Collection

4.3. Data Coding

4.4. Description of Variables

4.4.1. Predictors Considered

4.4.2. Target Suitability

- Gender

- Age

- Occupation

- Investment knowledge

- Financial loss

- Offender–victim relationship

4.4.3. Target Variable

4.4.4. Model Strategy

4.4.5. Preprocessing

4.4.6. Class Imbalance with SMOTE

4.4.7. Parameter Optimization

4.5. Machine Learning Algorithms Considered

4.5.1. Logistic Regression Algorithm

4.5.2. Naïve Bayes Classifier

- P(y|x) is the posterior probability of class (Y, target) given the predictor variables (x)

- P(x) is the prior probability of class x

- P(y|x) is the likelihood given the predictor x of a given class

- P(x) is the prior probability of predictor x

4.5.3. Support Vector Machines (SVM)

5. Findings and Analysis

5.1. The Vulnerable Fraud Victim

“[The offender] took over operation of both EM and PM’s RRSP accounts in early 2003 as the primary advisor. At this point, the [r]espondent had never met EM nor had he ever spoken to her”.

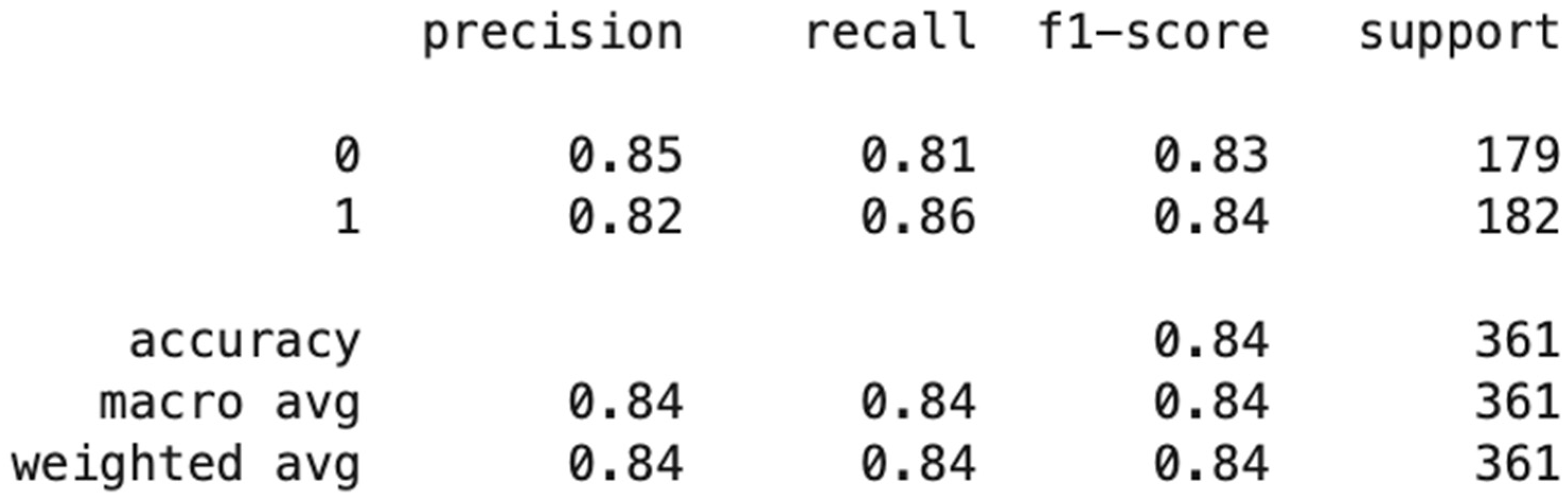

5.2. Accuracy of the Predictive Models

6. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Draper, G.; Quast, G. Fraud Aware 2019: National Study on Reported Fraud Cases in Canada; MNP: Calgary, AB, Canada, 2019. [Google Scholar]

- CSA (Canadian Securities Administrators). Canadian Securities Regulators Propose Changes to Tackle Financial Exploitation; CSA: Toronto, ON, Canada, 2020. [Google Scholar]

- Government of Canada. What We Heard Report: Financial Crimes and Harms against Seniors; Government of Canada: Toronto, ON, Canada, 2019.

- Lokanan, M.E. The Demographic Profile of Victims of Investment Fraud: A Canadian Perspective. J. Financ. Crime 2014, 21, 226–242. [Google Scholar] [CrossRef]

- De Liema, M. Elder Fraud and Financial Exploitation: Application of Routine Activity Theory. Gerontologist 2018, 58, 706–718. [Google Scholar] [CrossRef] [Green Version]

- De Liema, M.; Mottola, G.R.; Deevy, M. Findings from A Pilot Study to Measure Financial Fraud in The United States. SSRN 2017. [Google Scholar] [CrossRef]

- Deliema, M.; Shadel, D.; Pak, K. Profiling Victims of Investment Fraud: Mindsets and Risky Behaviors. J. Consum. Res. 2019, 46, 904–914. [Google Scholar] [CrossRef]

- Blackwell, T. Middle-aged People Actually More Likely to Fall Victim to Con Artists than ‘Risk Averse’ Senior Citizens, Study Says. National Post, 3 July 2014. [Google Scholar]

- The Consumer Fraud Research Group. NASD Investor Education Foundation—Investor Fraud Study Final Report; U.S. Securities and Exchange Commission: Washington, DC, USA, 2006. [Google Scholar]

- Department of Justice. Crime and Abuse Against Seniors: A Review of The Research Literature with Special Reference to the Canadian Situation; Department of Justice: Hong Kong, China, 2015. [Google Scholar]

- HealthLinkBC. Financial Abuse of Older Adults. 2018. Available online: https://www.healthlinkbc.ca/healthlinkbc-files/financial-abuse-older-adults (accessed on 4 October 2020).

- Lokanan, M.E. Securities Regulation: Opportunities Exist for IIROC to Regulate Responsively. Adm. Soc. 2018, 50, 402–428. [Google Scholar] [CrossRef] [Green Version]

- Government of Canada. What Every Older Canadian Should Know about: Financial Abuse; Government of Canada: Toronto, ON, Canada, 2017.

- Bourque, P. The Case for Self-regulation: Why SROs Work Well for Investors and The Industry. Investment Executive, 8 July 2020. [Google Scholar]

- Gross, N. Why The ‘Self’ in Investment Industry Self-Regulation Needs to Be Re-imagined. The Globe and Mail, 16 July 2020. [Google Scholar]

- Langton, J. Updated: MFDA Proposes SRO Overhaul. Investment Executive, 3 February 2020. [Google Scholar]

- SIPA (Small Investor Protection Agency) Advisory Committee. Investor Protection and IIROC Governance: A SIPA Report; SIPA: Stratford, UK, 2016. [Google Scholar]

- Ontario Securities Commission. Canadian Securities Regulators Announce Review of Framework for Self-Regulatory Organizations; Ontario Securities Commission: Toronto, ON, Canada, 2019. [Google Scholar]

- FAIR Canada. FAIR Canada Proposes Review of The Fundamental Approach to Self-regulation of Canada’s Securities Markets; FAIR Canada: Toronto, ON, Canada, 2020. [Google Scholar]

- Madero-Hernandez, A. Lifestyle Exposure Theory of Victimization. In The Encyclopedia of Women and Crime; Oryx Press: Phoenix, AZ, USA, 2019; pp. 1–3. [Google Scholar]

- Van Wyk, J.; Benson, M.L. Fraud Victimization: Risky Business or Bad Luck? Am. J. Crim. Justice 1997, 21, 163–179. [Google Scholar] [CrossRef]

- Engström, A. Associations between Risky Lifestyles and Involvement in Violent Crime during Adolescence. Vict. Offenders 2018, 13, 898–920. [Google Scholar] [CrossRef] [Green Version]

- Meier, R.F.; Miethe, T.D. Understanding theories of criminal victimization. Crime Justice 1993, 17, 459–499. [Google Scholar] [CrossRef]

- Pratt, T.C.; Turanovic, J.J.; Fox, K.A.; Wright, K.A. Self-control and Victimization: A Meta-Analysis. Criminology 2014, 52, 87–116. [Google Scholar] [CrossRef]

- Pratt, T.C.; Turanovic, J.J. Lifestyle and Routine Activity Theories Revisited: The Importance of ‘Risk’ to The Study of Victimization. Vict. Offenders 2015, 11, 335–354. [Google Scholar] [CrossRef]

- Zaykowski, H.; Campagna, L. Teaching Theories of Victimology. J. Crim. Justice Educ. 2014, 25, 452–467. [Google Scholar] [CrossRef]

- Lokanan, M.E. Self-regulation and Compliance Enforcement Practices by The Investment Dealers Association in Canada: 1984 to 2008. J. Financ. Regul. Compliance 2017, 25, 2–21. [Google Scholar] [CrossRef]

- Policastro, C.; Payne, B.K. Can You Hear Me Now? Telemarketing Fraud Victimization and Lifestyles. Am. J. Crim. Justice 2015, 40, 620–638. [Google Scholar] [CrossRef]

- Sykes, G.M.; Matza, D. Techniques of Neutralization: A Theory of Delinquency. Am. Sociol. Rev. 1957, 22, 664–670. [Google Scholar] [CrossRef]

- Vakhitova, Z.I.; Reynald, D.M.; Townsley, M. Toward the Adaptation of Routine Activity and Lifestyle Exposure Theories to Account for Cyber Abuse Victimization. J. Contemp. Crim. Justice 2016, 32, 169–188. [Google Scholar] [CrossRef]

- Holtfreter, K.; Reisig, M.D.; Pratt, T.C. Low Self-control, Routine Activities, and Fraud Victimization. Criminology 2008, 46, 189–220. [Google Scholar] [CrossRef]

- Holtfreter, K.; Reisig, M.D.; Blomberg, T.G. Consumer Fraud Victimization in Florida: An Empirical Study. St. Thomas Law Rev. 2006, 18, 761–789. [Google Scholar]

- Titus, R.M.; Heinzelmann, F.; Boyle, J.M. Victimization of Persons by Fraud. Crime Delinq. 1995, 41, 54–72. [Google Scholar] [CrossRef]

- Anderson, K.B. Consumer Fraud in The United States: An FTC Survey; Federal Trade Commission: Washington, DC, USA,, 2004. [Google Scholar]

- Schoepfer, A.; Piquero, N.L. Studying the Correlates of Fraud Victimization and Reporting. J. Crim. Justice 2009, 37, 209–215. [Google Scholar] [CrossRef]

- Van Wyk, J.; Mason, K.A. “Investigating Vulnerability and Reporting Behavior for Consumer Fraud Victimization: Opportunity as A Social Aspect of Age. J. Contemp. Crim. Justice 2001, 17, 328–345. [Google Scholar] [CrossRef]

- Reisig, M.D.; Holtfreter, K. Shopping Fraud Victimization among The Elderly. J. Financ. Crime 2013, 20, 324–337. [Google Scholar] [CrossRef]

- AARP (American Association of Retired Persons). Consumer Behavior, Experiences, and Attitudes: A Comparison by Age Groups; American Association of Retired Persons: Washington, DC, USA, 1999. [Google Scholar]

- Holtfreter, K.; Reisig, M.D.; Mears, D.P.; Wolfe, S.E. Financial Exploitation of The Elderly in A Consumer Context; National Institute of Justice: Washington, DC, USA, 2014. [Google Scholar]

- Sudjianto, A.; Nair, S.; Yuan, M.; Zhang, A.; Kern, D.; Cela-Díaz, F. Statistical Methods for Fighting Financial Crimes. Technometrics 2010, 52, 5–19. [Google Scholar] [CrossRef]

- IMF (International Monetary Fund). Financial System Abuse, Financial Crime and Money Laundering—Background Paper; IMF: Washington, DC, USA, 2011. [Google Scholar]

- Jung, J.; Lee, J. Contemporary Financial Crime. J. Public Adm. Gov. 2017, 7, 88–97. [Google Scholar] [CrossRef]

- Ryder, N. Financial Crime in the 21st Century: Law and Policy; Edward Elgar Publishing: Gloucestershire, UK, 2010. [Google Scholar]

- Gottschalk, P. Categories of Financial Crime. J. Financ. Crime 2010, 17, 441–458. [Google Scholar] [CrossRef]

- Jackson, S.L. The Vexing Problem of Defining Financial Exploitation. J. Financ. Crime 2015, 22, 63–78. [Google Scholar] [CrossRef]

- Pickett, K.; Spencer, H.; Pickett, J.M. Financial Crime Investigation and Control; John Wiley & Sons: Hoboken, NJ, USA, 2002. [Google Scholar]

- WHO (World Health Organization). Elder Abuse; WHO: Geneva, Switzerland, 2020. [Google Scholar]

- Wood, S.; Lichtenberg, P.A. Financial Capacity and Financial Exploitation of Older Adults: Research Findings, Policy Recommendations and Clinical Implications. Clin. Gerontol. 2017, 40, 3–13. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lokanan, M.E. An Update on Self-regulation in The Canadian Securities Industry (2009-2016): Funnel in, Funnel out, and Funnel away. J. Financ. Regul. Compliance 2019, 27, 324–344. [Google Scholar] [CrossRef]

- Deane, S. Elder Financial Exploitation: Why It Is A Concern, What Regulators Are Doing About It, and Looking Ahead; U.S. Securities and Exchange Commission: Washington, DC, USA, 2018. [Google Scholar]

- Department of Economic and Social Affairs. World Population Ageing 2019; Department of Economic and Social Affairs: New York, NY, USA, 2019. [Google Scholar]

- Campbell, M.C.; Kirmani, A. Consumers’ Use of Persuasion Knowledge: The Effects of Accessibility and Cognitive Capacity on Perceptions of an Influence Agent. J. Consum. Res. 2000, 27, 69–83. [Google Scholar] [CrossRef]

- Judges, R.A.; Gallant, S.N.; Yang, L.; Lee, K. The Role of Cognition, Personality, and Trust in Fraud Victimization in Older Adults. Front. Psychol. 2017, 8, 588. [Google Scholar] [CrossRef] [Green Version]

- Johnson, K.D. Financial Crimes Against the Elderly; US Department of Justice, Office of Community Oriented Policing Services: Washington, DC, USA, 2004. [Google Scholar]

- Reurink, A. Financial Fraud: A Literature Review. J. Econ. Surv. 2018, 32, 1292–1325. [Google Scholar] [CrossRef] [Green Version]

- Lichtenberg, P.A. Financial Exploitation, Financial Capacity, and Alzheimer’s Disease. Am. Psychol. 2016, 71, 312. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kadoya, Y.; Khan, M.S.R.; Yamane, T. The Rising Phenomenon of Financial Scams: Evidence from Japan. J. Financ. Crime 2020, 27, 387–396. [Google Scholar] [CrossRef]

- Kumari, P.; Mishra, S.P. Analysis of Credit Card Fraud Detection Using Fusion Classifiers. Comput. Intell. Data Min. 2019, 711, 111–122. [Google Scholar]

- Sun, Y.; Wong, A.K.; Kamel, M.S. Classification of Imbalanced Data: A Review. Int. J. Pattern Recognit. Artif. Intell. 2009, 23, 687–719. [Google Scholar] [CrossRef]

- Almhaithawi, D.; Jafar, A.; Aljnidi, M. Example-dependent cost-sensitive credit cards fraud detection using SMOTE and Bayes minimum risk. SN Appl. Sci. 2020, 2, 1–12. [Google Scholar] [CrossRef]

- Heminway, J.M. Female Investors and Securities Fraud: Is the Reasonable Investor A Woman? William Mary J. Women Law 2009, 15, 291–336. [Google Scholar]

- Investment Industry Regulatory Organization of Canada v. George Alexander Pedar Pedersson. Enforcement Notice Decision 17-0104; IIROC: Toronto, ON, Canada, 2017. [Google Scholar]

- Investment Industry Regulatory Organization of Canada v. Michale William Sawisky. Enforcement Notice Decision 17-0026; IIROC: Toronto, ON, Canada, 2017. [Google Scholar]

- de Waal, M.M.; Dekker, J.J.; Kikkert, M.J.; Kleinhesselink, M.D.; Goudriaan, A.E. Gender Differences in Characteristics of Physical and Sexual Victimization in Patients with Dual Diagnosis: A Cross-sectional Study. BMC Psychiatry 2017, 17, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Guhn, M.; Schonert-Reichl, K.A.; Gadermann, A.M.; Hymel, S.; Hertzman, C. A Population Study of Victimization, Relationships, and Well-being in Middle Childhood. J. Happiness Stud. 2013, 14, 1529–1541. [Google Scholar] [CrossRef]

- Banerjee, P. Risky Business: Older, Actively Trading Men More Likely to Be Victims of Investment Fraud. The Globe and Mail. 14 February 2020, pp. 1–37. Available online: https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-risky-business-older-actively-trading-men-more-likely-to-be-victims/ (accessed on 21 January 2021).

- Boyd, N. Eron Mortgage Study; The British Columbia Securities Commission: Vancouver, BC, Canada, 2005. [Google Scholar]

- Ajamie, T.; Kelly, B. Why Smart People Fall for Investment Scams. Forbes. 20 October 2014. Available online: https://www.forbes.com/sites/nextavenue/2014/10/20/why-smart-people-fall-for-investment-scams/#7bd5ba787f48 (accessed on 23 November 2020).

- Ali, H.; Salleh, M.N.M.; Hussain, K.; Ahmad, A.; Ullah, A.; Muhammad, A.; Naseem, R.; Khan, M. A Review on Data Preprocessing Methods for Class Imbalance Problem. Int. J. Eng. Technol. 2019, 8, 390–397. [Google Scholar]

- Hosmer, D.W., Jr.; Lemeshow, S.; Sturdivant, R.X. Applied Logistic Regression; John Wiley & Sons: Toronto, ON, Canada, 2013; Volume 398. [Google Scholar]

- Kleinbaum, D.G.; Klein, M. Logistic Regression; Springer: New York, NY, USA, 2002. [Google Scholar]

- Lokanan, M.E. Data Mining for Statistical Analysis of Money Laundering Transactions. J. Money Laund. Control 2019, 22, 753–763. [Google Scholar] [CrossRef]

- Press, S.J.; Wilson, S. Choosing Between Logistic Regression and Discriminant Analysis. J. Am. Stat. Assoc. 1978, 73, 699–705. [Google Scholar] [CrossRef]

- Patel, S. Why Women Investors Are True Allies for Financial Advisors. The Global and Mail, 3 March 2020. [Google Scholar]

- StatCan. Number of Persons in Low Income Families in Canada from 2000 to 2018, by Gender (in 1000s) [Graph]; Statista: Toronto, ON, Canada, 2020. [Google Scholar]

- Statistics Canada. Table 11-10-0239-01-Income of Individuals by Age Group, Sex and Income Source, Canada, Provinces and Selected Census Metropolitan Areas; Statistics Canada: Toronto, ON, Canada, 2020. [Google Scholar]

- Drolet, M. Insights on Canadian Society—Gender Differences in the Financial Knowledge of Canadians; Statistics Canada: Toronto, ON, Canada, 2016. [Google Scholar]

- Dickson, J. Women and Wealth: How Investment Managers Can Better Serve Women Clients. Forbes, 23 June 2020. [Google Scholar]

- Investment Industry Regulatory Organization of Canada v. David Hayes. Enforcement Notice Decision 14-0165; IIROC: Toronto, ON, Canada, 2014. [Google Scholar]

- Chen, S. This Simple Step Can Address Your #1 Retirement Fear. Forbes, 20 October 2019. [Google Scholar]

- 81. The Canadian Press. More than Half of Canadians Fear Not Having Enough for Retirement: Poll. CTVNews, 11 February 2020.

- Government of Canada Report on the Social Isolation of Seniors; Government of Canada: Toronto, ONT, Canada, 2016.

- Yang, S.; Berdine, G. The Receiver Operating Characteristic (ROC) Curve. Southwest Respir. Crit. Care Chron. 2017, 5, 34–36. [Google Scholar] [CrossRef]

- FAIR Canada, A Report on A Decade of Financial Scandals; FAIR Canada: Toronto, ON, Canada, 2011.

- Carson, J. Letter: What’s the Rush to Merge IIROC and MFDA? Investment Executive, 5 August 2020. [Google Scholar]

- FAIR Canada A Canadian Strategy to Combat Fraud; FAIR Canada: Toronto, ON, Canada, 2014; pp. 1–39.

- Williams, J.W. Policing the Markets: Inside the Black Box of Securities Enforcement; Taylor & Francis: London, UK, 2012. [Google Scholar]

- Bhattacharya, U. Enforcement and Its Impact on Cost of Equity and Liquidity of the Market. SSRN 2006. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lokanan, M.; Liu, S. Predicting Fraud Victimization Using Classical Machine Learning. Entropy 2021, 23, 300. https://doi.org/10.3390/e23030300

Lokanan M, Liu S. Predicting Fraud Victimization Using Classical Machine Learning. Entropy. 2021; 23(3):300. https://doi.org/10.3390/e23030300

Chicago/Turabian StyleLokanan, Mark, and Susan Liu. 2021. "Predicting Fraud Victimization Using Classical Machine Learning" Entropy 23, no. 3: 300. https://doi.org/10.3390/e23030300

APA StyleLokanan, M., & Liu, S. (2021). Predicting Fraud Victimization Using Classical Machine Learning. Entropy, 23(3), 300. https://doi.org/10.3390/e23030300