Cryptocurrencies Are Becoming Part of the World Global Financial Market

Abstract

1. Introduction

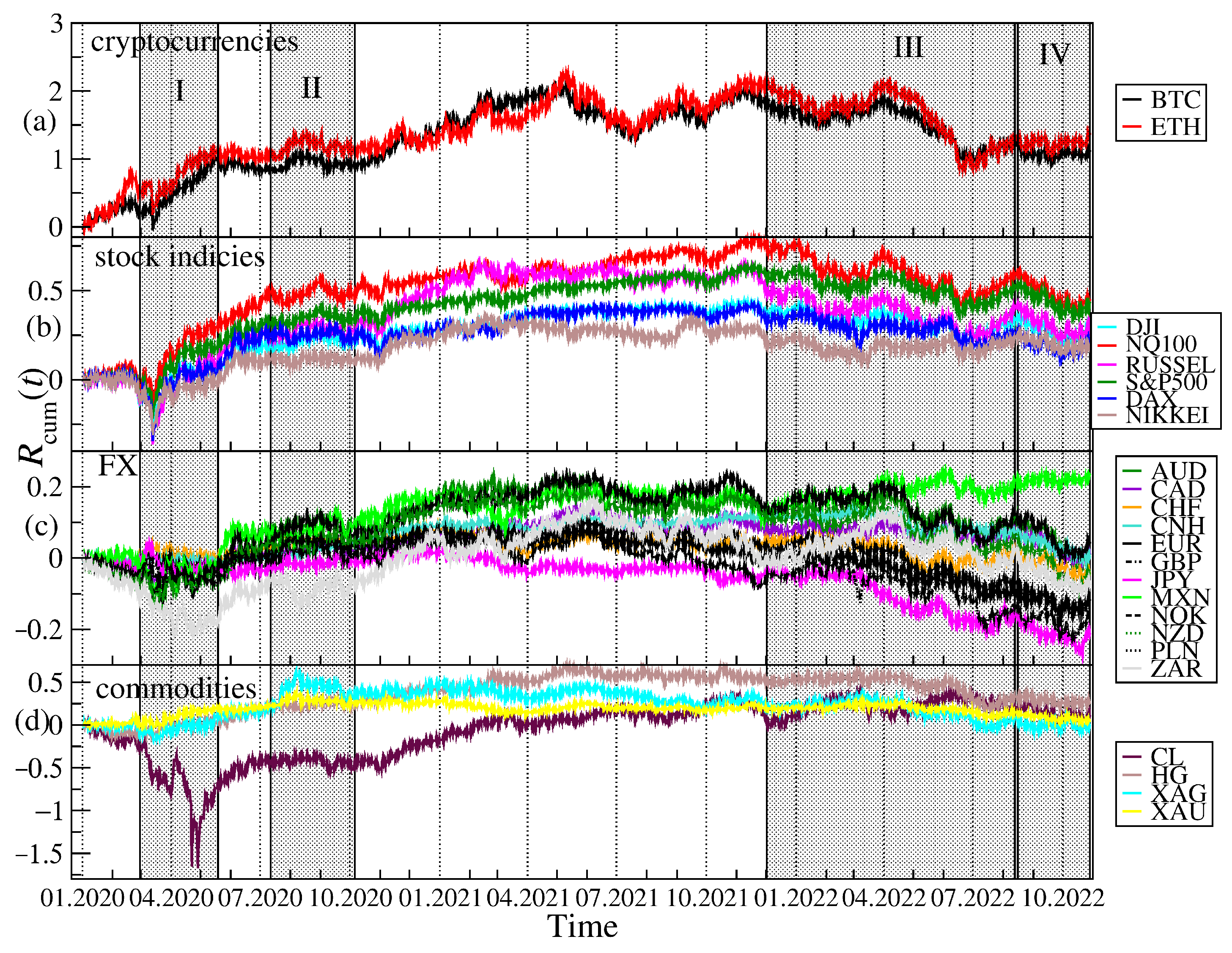

2. Data and Methodology

2.1. Data Sources and Preprocessing

2.2. The q-Dependent Detrended Correlation Coefficient

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kwapień, J.; Drożdż, S. Physical approach to complex systems. Phys. Rep. 2012, 515, 115–226. [Google Scholar]

- Bitcoin Pizzaday. Available online: https://www.investopedia.com/news/bitcoin-pizza-day-celebrating-20-million-pizza-order/ (accessed on 1 November 2022).

- CoinMarketCap. Available online: https://coinmarketcap.com (accessed on 1 November 2022).

- Gerlach, J.C.; Demos, G.; Sornette, D. Dissection of Bitcoin’s multiscale bubble history from January 2012 to February 2018. R. Soc. Open Sci. 2019, 6, 180643. [Google Scholar]

- Bellon, C.; Figuerola-Ferretti, I. Bubbles in Ethereum. Financ. Res. Lett. 2022, 46, 102387. [Google Scholar] [CrossRef]

- Zitis, P.I.; Contoyiannis, Y.; Potirakis, S.M. Critical dynamics related to a recent Bitcoin crash. Int. Rev. Financ. Anal. 2022, 84, 102368. [Google Scholar] [CrossRef]

- Aste, T. Cryptocurrency market structure: Connecting emotions and economics. Digit. Financ. 2019, 1, 5–21. [Google Scholar] [CrossRef]

- Maouchi, Y.; Charfeddine, L.; Montasser, G.E. Understanding digital bubbles amidst the COVID-19 pandemic: Evidence from DeFi and NFTs. Financ. Res. Lett. 2022, 47, 102584. [Google Scholar] [CrossRef]

- Wątorek, M.; Drożdż, S.; Kwapień, J.J.; Minati, L.; Oświęcimka, P.; Stanuszek, M. Multiscale characteristics of the emerging global cryptocurrency market. Phys. Rep. 2021, 901, 1–82. [Google Scholar] [CrossRef]

- Lahmiri, S.; Bekiros, S.; Bezzina, F. Complexity analysis and forecasting of variations in cryptocurrency trading volume with support vector regression tuned by Bayesian optimization under different kernels: An empirical comparison from a large dataset. Expert Syst. Appl. 2022, 209, 118349. [Google Scholar] [CrossRef]

- Drożdż, S.; Gębarowski, R.; Minati, L.; Oświęcimka, P.; Wątorek, M. Bitcoin market route to maturity? Evidence from return fluctuations, temporal correlations and multiscaling effects. Chaos 2018, 28, 071101. [Google Scholar] [CrossRef]

- Drożdż, S.; Minati, L.; Oświęcimka, P.; Stanuszek, M.; Wątorek, M. Competition of noise and collectivity in global cryptocurrency trading: Route to a self-contained market. Chaos 2020, 30, 023122. [Google Scholar] [CrossRef]

- Kaiser, L.; Stöckl, S. Cryptocurrencies: Herding and the transfer currency. Financ. Res. Lett. 2020, 33, 101214. [Google Scholar] [CrossRef]

- Aslanidis, N.; Bariviera, A.F.; Perez-Laborda, A. Are cryptocurrencies becoming more interconnected? Econ. Lett. 2021, 199, 109725. [Google Scholar] [CrossRef]

- Kwapień, J.; Wątorek, M.; Drożdż, S. Cryptocurrency Market Consolidation in 2020-2021. Entropy 2021, 23, 1674. [Google Scholar] [CrossRef]

- Bae, G.; Kim, J.H. Observing Cryptocurrencies through Robust Anomaly Scores. Entropy 2022, 24, 1643. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Collective correlations, dynamics, and behavioural inconsistencies of the cryptocurrency market over time. Nonlinear Dyn. 2022, 107, 4001–4017. [Google Scholar] [CrossRef]

- Kakinaka, S.; Umeno, K. Asymmetric volatility dynamics in cryptocurrency markets on multi-time scales. Res. Int. Bus. Financ. 2022, 62, 101754. [Google Scholar] [CrossRef]

- Arouxet, M.B.; Bariviera, A.F.; Pastor, V.E.; Vampa, V. COVID-19 impact on cryptocurrencies: Evidence from a wavelet-based Hurst exponent. Phys. A 2022, 596, 127170. [Google Scholar] [CrossRef]

- Corbet, S.; Hou, Y.G.; Hu, Y.; Larkin, C.; Lucey, B.; Oxley, L. Cryptocurrency liquidity and volatility interrelationships during the COVID-19 pandemic. Financ. Res. Lett. 2022, 45, 102137. [Google Scholar] [CrossRef]

- Nguyen, A.P.N.; Mai, T.T.; Bezbradica, M.; Crane, M. The Cryptocurrency Market in Transition before and after COVID-19: An Opportunity for Investors? Entropy 2022, 24, 1317. [Google Scholar] [CrossRef]

- Kumar, A.; Iqbal, N.; Mitra, S.K.; Kristoufek, L.; Bouri, E. Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. J. Int. Financ. Mark. Institutions Money 2022, 77, 101523. [Google Scholar] [CrossRef]

- Wątorek, M.; Kwapień, J.; Drożdż, S. Multifractal cross-Correlations of bitcoin and ether trading Characteristics in the Post-COVID-19 Time. Future Internet 2022, 14, 215. [Google Scholar] [CrossRef]

- Corbet, S.; Meegan, A.; Larkin, C.; Lucey, B.; Yarovaya, L. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Econ. Lett. 2018, 165, 28–34. [Google Scholar] [CrossRef]

- Ji, Q.; Bouri, E.; Gupta, R.; Roubaud, D. Network causality structures among Bitcoin and other financial assets: A directed acyclic graph approach. Q. Rev. Econ. Financ. 2018, 70, 203–213. [Google Scholar] [CrossRef]

- Drożdż, S.; Minati, L.; Oświęcimka, P.; Stanuszek, M.; Wątorek, M. Signatures of the Crypto-Currency Market Decoupling from the Forex. Future Internet 2019, 11, 154. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Abakah, E.J.A.; Rojo, M.F.R. Cryptocurrencies and stock market indices. Are they related? Res. Int. Bus. Financ. 2020, 51, 101063. [Google Scholar] [CrossRef]

- Manavi, S.A.; Jafari, G.; Rouhani, S.; Ausloos, M. Demythifying the belief in cryptocurrencies decentralized aspects. A study of cryptocurrencies time cross-correlations with common currencies, commodities and financial indices. Phys. A 2020, 556, 124759. [Google Scholar] [CrossRef]

- Urquhart, A.; Zhang, H. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. Int. Rev. Financ. Anal. 2019, 63, 49–57. [Google Scholar] [CrossRef]

- Wang, P.; Zhang, W.; Li, X.; Shen, D. Is cryptocurrency a hedge or a safe haven for international indices? A comprehensive and dynamic perspective. Financ. Res. Lett. 2019, 31, 1–18. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Bouri, E.; Roubaud, D.; Kristoufek, L.; Lucey, B. Is Bitcoin a better safe-haven investment than gold and commodities? Int. Rev. Financ. Anal. 2019, 63, 322–330. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Bouri, E.; Roubaud, D.; Kristoufek, L. Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Econ. Model. 2020, 87, 212–224. [Google Scholar]

- Bouri, E.; Shahzad, S.J.H.; Roubaud, D.; Kristoufek, L.; Lucey, B. Bitcoin, gold, and commodities as safe havens for stocks:New insight through wavelet analysis. Q. Rev. Econ. Financ. 2020, 77, 156–164. [Google Scholar] [CrossRef]

- Thampanya, N.; Nasir, M.A.; Huynh, T.L.D. Asymmetric correlation and hedging effectiveness of gold & cryptocurrencies: From pre-industrial to the 4th industrial revolution. Technol. Forecast. Soc. Chang. 2020, 159, 120195. [Google Scholar]

- Zhu, X.; Niu, Z.; Zhang, H.; Huang, J.; Zuo, X. Can gold and bitcoin hedge against the COVID-19 related news sentiment risk? New evidence from a NARDL approach. Resour. Policy 2022, 79, 103098. [Google Scholar] [CrossRef]

- Conlon, T.; McGee, R. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Financ. Res. Lett. 2020, 35, 101607. [Google Scholar] [CrossRef]

- Kristoufek, L. Grandpa, Grandpa, Tell Me the One About Bitcoin Being a Safe Haven: New Evidence From the COVID-19 Pandemic. Front. Phys. 2020, 8, 296. [Google Scholar] [CrossRef]

- Grobys, K. When Bitcoin has the flu: On Bitcoin’s performance to hedge equity risk in the early wake of the COVID-19 outbreak. Appl. Econ. Lett. 2021, 28, 860–865. [Google Scholar] [CrossRef]

- James, N.; Menzies, M.; Chan, J. Changes to the extreme and erratic behaviour of cryptocurrencies during COVID-19. Phys. A 2021, 565, 125581. [Google Scholar] [CrossRef]

- Barbu, T.C.; Boitan, I.A.; Cepoi, C. Are cryptocurrencies safe havens during the COVID-19 pandemic? A threshold regression perspective with pandemic-related benchmarks. Econ. Bus. Rev. 2022, 8, 22–49. [Google Scholar] [CrossRef]

- Jareno, F.; Gonzàlez, M.D.L.O.; Belmonte, P. Asymmetric interdependencies between cryptocurrency and commodity markets: The COVID-19 pandemic impact. Quant. Financ. Econ. 2022, 6, 83–112. [Google Scholar] [CrossRef]

- Kakinaka, S.; Umeno, K. Cryptocurrency market efficiency in short- and long-term horizons during COVID-19: An asymmetric multifractal analysis approach. Financ. Res. Lett. 2022, 46, 102319. [Google Scholar] [CrossRef]

- Evrim Mandaci, P.; Cagli, E.C. Herding intensity and volatility in cryptocurrency markets during the COVID-19. Financ. Res. Lett. 2022, 46, 102382. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.; Sammon, M.; Viratyosin, T. The Unprecedented Stock Market Reaction to COVID-19. Rev. Asset Pricing Stud. 2020, 10, 742–758. [Google Scholar] [CrossRef]

- Yarovaya, L.; Matkovskyy, R.; Jalan, A. The COVID-19 black swan crisis: Reaction and recovery of various financial markets. Res. Int. Bus. Financ. 2022, 59, 101521. [Google Scholar] [CrossRef]

- Conlon, T.; Corbet, S.; McGee, R.J. Are cryptocurrencies a safe haven for equity markets? An international perspective from the COVID-19 pandemic. Res. Int. Bus. Financ. 2020, 54, 101248. [Google Scholar] [CrossRef]

- Drożdż, S.; Kwapień, J.; Oświęcimka, P.; Stanisz, T.; Wątorek, M. Complexity in economic and social systems: Cryptocurrency market at around COVID-19. Entropy 2020, 22, 1043. [Google Scholar] [CrossRef]

- Caferra, R.; Vidal-Tomas, D. Who raised from the abyss? A comparison between cryptocurrency and stock market dynamics during the COVID-19 pandemic. Financ. Res. Lett. 2021, 43, 101954. [Google Scholar] [CrossRef]

- Jiang, Y.; Lie, J.; Wang, J.; Mu, J. Revisiting the roles of cryptocurrencies in stock markets: A quantile coherency perspective. Econ. Model. 2021, 95, 21–34. [Google Scholar] [CrossRef]

- James, N. Dynamics, behaviours, and anomaly persistence in cryptocurrencies and equities surrounding COVID-19. Phys. A 2021, 570, 125831. [Google Scholar] [CrossRef]

- Elmelki, A.; Chaâbane, N.; Benammar, R. Exploring the relationship between cryptocurrency and S&P500: Evidence from wavelet coherence analysis. Int. J. Blockchains Cryptocurrencies 2022, 3, 256–268. [Google Scholar]

- Wang, P.; Liu, X.; Wu, S. Dynamic Linkage between Bitcoin and Traditional Financial Assets: A Comparative Analysis of Different Time Frequencies. Entropy 2022, 24, 1565. [Google Scholar] [CrossRef]

- Balcilar, M.; Ozdemir, H.; Agan, B. Effects of COVID-19 on cryptocurrency and emerging market connectedness: Empirical evidence from quantile, frequency, and lasso networks. Phys. A 2022, 604, 127885. [Google Scholar] [CrossRef]

- Conlon, T.; Corbet, S.; McGee, R.J. Inflation and cryptocurrencies revisited: A time-scale analysis. Econ. Lett. 2021, 206, 109996. [Google Scholar] [CrossRef]

- Choi, S.; Shin, J. Bitcoin: An inflation hedge but not a safe haven. Financ. Res. Lett. 2022, 46, 102379. [Google Scholar] [CrossRef]

- James, N.; Menzies, M.; Chin, K. Economic state classification and portfolio optimisation with application to stagflationary environments. Chaos, Solitons Fractals 2022, 164, 112664. [Google Scholar] [CrossRef]

- Phochanachan, P.; Pirabun, N.; Leurcharusmee, S.; Yamaka, W. Do Bitcoin and Traditional Financial Assets Act as an Inflation Hedge during Stable and Turbulent Markets? Evidence from High Cryptocurrency Adoption Countries. Axioms 2022, 11, 339. [Google Scholar] [CrossRef]

- Dukascopy. Available online: https://www.dukascopy.com/swiss/pl/cfd/range-of-markets/ (accessed on 1 November 2022).

- Pearson, K. Note on regression and inheritance in the case of two parents. Proc. R. Soc. Lond. 1895, 58, 240–242. [Google Scholar]

- Gopikrishnan, P.; Plerou, V.; Nunes Amaral, L.A.; Meyer, M.; Stanley, H.E. Scaling of the distribution of fluctuations of financial market indices. Phys. Rev. E 1999, 60, 5305–5316. [Google Scholar] [CrossRef]

- Cont, R. Empirical properties of asset returns: Stylized facts and statistical issues. Quant. Financ. 2001, 1, 223–236. [Google Scholar] [CrossRef]

- Gabaix, X.; Gopikrishnan, P.; Plerou, V.; Stanley, H.E. A theory of power-law distributions in financial market fluctuations. Nature 2003, 423, 267–270. [Google Scholar] [CrossRef]

- Kwapień, J.; Oświęcimka, P.; Drożdż, S. Detrended fluctuation analysis made flexible to detect range of cross-correlated fluctuations. Phys. Rev. E 2015, 92, 052815. [Google Scholar] [CrossRef]

- Peng, C.K.; Buldyrev, S.V.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685–1689. [Google Scholar] [CrossRef]

- Jiang, Z.Q.; Xie, W.J.; Zhou, W.X.; Sornette, D. Multifractal analysis of financial markets: A review. Rep. Prog. Phys. 2019, 82, 125901. [Google Scholar] [CrossRef]

- Oświęcimka, P.; Drożdż, S.; Kwapień, J.; Górski, A. Effect of detrending on multifractal characteristics. Acta Phys. Pol. A 2013, 123, 597–603. [Google Scholar] [CrossRef]

- Zebende, G. DCCA cross-correlation coefficient: Quantifying level of cross-correlation. Phys. A 2011, 390, 614–618. [Google Scholar] [CrossRef]

- Gębarowski, R.; Oświęcimka, P.; Wątorek, M.; Drożdż, S. Detecting correlations and triangular arbitrage opportunities in the Forex by means of multifractal detrended cross-correlations analysis. Nonlinear Dyn. 2019, 98, 2349–2364. [Google Scholar] [CrossRef]

- Wątorek, M.; Drożdż, S.; Oświęcimka, P.; Stanuszek, M. Multifractal cross-correlations between the world oil and other financial markets in 2012–2017. Energy Econ. 2019, 81, 874–885. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Bouri, E.; Gupta, R.; Ma, S.J. Risk spillover between Bitcoin and conventional financial markets: An expectile-based approach. North Am. J. Econ. Financ. 2021, 55, 101296. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wątorek, M.; Kwapień, J.; Drożdż, S. Cryptocurrencies Are Becoming Part of the World Global Financial Market. Entropy 2023, 25, 377. https://doi.org/10.3390/e25020377

Wątorek M, Kwapień J, Drożdż S. Cryptocurrencies Are Becoming Part of the World Global Financial Market. Entropy. 2023; 25(2):377. https://doi.org/10.3390/e25020377

Chicago/Turabian StyleWątorek, Marcin, Jarosław Kwapień, and Stanisław Drożdż. 2023. "Cryptocurrencies Are Becoming Part of the World Global Financial Market" Entropy 25, no. 2: 377. https://doi.org/10.3390/e25020377

APA StyleWątorek, M., Kwapień, J., & Drożdż, S. (2023). Cryptocurrencies Are Becoming Part of the World Global Financial Market. Entropy, 25(2), 377. https://doi.org/10.3390/e25020377