A Double-Hurdle Model of Healthcare Expenditures across Income Quintiles and Family Size: New Insights from a Household Survey

Abstract

:1. Introduction and Literature Review

2. Health Capital Model of Health Goods/Services Consumption

3. Empirical Strategy

4. Data and Empirical Model

5. Empirical Results and Implications

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | For example, Thai wives strongly prefer HIV vaccines for daughters than for sons. |

| 2 | Using a two-part model and 15,000 individual data from the 1994 Catalan health survey, found that income and cost-sharing are significant determinants of OOP pharmaceutical use (but not expenditure level); gender, health status, and health insurance tend to be significant predictors, and access to drug stores raises both drug use (dichotomous) and expenditure level; and self-medication raises OOP pharmaceutical expenditure. |

| 3 | The goal of this paper remains the empirical estimation of differences in preferences by gender. Since a thorough theoretical treatment would distract from that goal, we do not offer one here; the logic is presented only at a level necessary to better justify the empirical approach we adopt. The institution of any proof is similar to that of stock adjustment models. All proofs are available from the authors if needed. |

| 4 | From here, it is an unnecessary burden on the reader to specify the difference between individuals, households, or agents making decisions on consumption. The basic logical outcome is the same in each case for this model and the idea’s comprehension benefits from its simplicity. For health, rather than healthcare, entering the preference function: it is reasonable to assume that health itself enters the utility function even if health care does not. |

| 5 | Since is a compensated demand in , health expenditures adjust relative to . So, where units of healthcare purchased are not available or are meaningless, observing health expenditure observes compensated demand. |

| 6 | This is a strength of the dataset. Rather than need to control for household fixed effects, survey design implies that all observations are independent and identically distributed (iid) and no such measure are necessary for consistent estimates. |

| 7 | Health expense is estimated separately by gender, income quintile, and household size: twenty permutations in all. |

| 8 | Thailand Socio-Economic Surveys contain: (Record 1) household characteristics, household head, and record control; (Record 2) household member characteristics; (Record 3) income from other sources; (Record 4) change of assets/liabilities and debt; (Record 5) housing characteristics; (Record 6) consumption on goods and services; (Record 7) weekly food consumption by group and items; (Record 8) household income); and (Record 9) summary household expenditures imputed from records (Record 6) and (Record 7). Regretfully, the way the data are provided does not allow the partitioning of HHEXP into public versus private sector spending or outpatient versus inpatient (hospital) care. Finally, it is desirable but impossible to control for household insurance status because the SESs lacked such data. |

| 9 | Male-headed small households in 1st income quintile, female-headed small households in 2nd income quintile, female-headed large households in 3rd income quintile, male-headed large households in 4th income quintile, male-headed large households in 5th income quintile, and female-headed large households in 5th income quintile. |

References

- Alam, Khurshid, and Ajay Mahal. 2014. Economic impacts of health shocks on households in low and middle income countries: A review of the literature. Globalization and health 10: 1–18. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Aregbeshola, Bolaji Samson, and Samina Mohsin Khan. 2018. Determinants of catastrophic health expenditure in Nigeria. The European Journal of Health Economics 19: 521–32. [Google Scholar] [CrossRef]

- Arthur, Eric, and Hassan E. Oaikhenan. 2017. The effects of health expenditure on health outcomes in Sub-Saharan Africa (SSA). African Development Review 29: 524–36. [Google Scholar] [CrossRef]

- Barber, Sarah. L., and Paul J. Gertler. 2009. Empowering women to obtain high quality care: Evidence from an evaluation of Mexico’s conditional cash transfer programme. Health Policy and Planning 24: 18–25. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Çelen, Boğaçhan, Andrew Schotter, and Mariana Blanco. 2017. On blame and reciprocity: Theory and experiments. Journal of Economic Theory 169: 62–92. [Google Scholar] [CrossRef]

- Cheung, Diana, and Ysaline Padieu. 2015. Heterogeneity of the effects of health insurance on household savings: Evidence from rural China. World Development 66: 84–103. [Google Scholar] [CrossRef] [Green Version]

- Chi, Peter. S. K., and Ping-Lung Hsin. 1999. Medical utilization and health expenditure of the elderly in Taiwan. Journal of Family and Economic Issues 20: 251–70. [Google Scholar] [CrossRef]

- Chiappori, Pierre-Andre, Amit Gandhi, Bernard Salanié, and Francois Salanié. 2009. Identifying preferences under risk from discrete choices. American Economic Review 99: 356–62. [Google Scholar] [CrossRef] [Green Version]

- Croson, Rachel, and Uri Gneezy. 2009. Gender differences in preferences. Journal of Economic Literature 47: 448–74. [Google Scholar] [CrossRef] [Green Version]

- Deaton, Angus. S., and Christina. H. Paxson. 1998. Aging and inequality in income and health. The American Economic Review 88: 248–53. [Google Scholar]

- Di Matteo, Livio. 2005. The macro determinants of health expenditure in the United States and Canada: Assessing the impact of income, age distribution and time. Health Policy 71: 23–42. [Google Scholar] [CrossRef] [PubMed]

- Dittrich, Marcus, and Kristina Leipold. 2014. Gender differences in time preferences. Economics Letters 122: 413–5. [Google Scholar] [CrossRef]

- Doepke, Matthias, and Michèle Tertilt. 2009. Women’s Liberation: What’s in it for Men? The Quarterly Journal of Economics 124: 1541–91. [Google Scholar] [CrossRef] [Green Version]

- Dohmen, Thomas, and Armin Falk. 2011. Performance pay and multidimensional sorting: Productivity, preferences, and gender. American Economic Review 101: 556–90. [Google Scholar] [CrossRef] [Green Version]

- Doss, Cheryl. 2013. Intrahousehold bargaining and resource allocation in developing countries. The World Bank Research Observer 28: 52–78. [Google Scholar] [CrossRef] [Green Version]

- Duflo, Esther. 2012. Women empowerment and economic development. Journal of Economic Literature 50: 1051–79. [Google Scholar] [CrossRef]

- Dunn, Abe. 2016. Health insurance and the demand for medical care: Instrumental variable estimates using health insurer claims data. Journal of Health Economics 48: 74–88. [Google Scholar] [CrossRef]

- Ecob, Russell, and George Davey Smith. 1999. Income and health: What is the nature of the relationship? Social Science & Medicine 48: 693–705. [Google Scholar]

- Engström, Per, and Johannes Hagen. 2017. Income underreporting among the self-employed: A permanent income approach. European Economic Review 92: 92–109. [Google Scholar] [CrossRef] [Green Version]

- Flatø, Martin, Raya Muttarak, and André Pelser. 2017. Women, weather, and woes: The triangular dynamics of female-headed households, economic vulnerability, and climate variability in South Africa. World Development 90: 41–62. [Google Scholar]

- Flores, Gabriela, Por Ir, Chean R. Men, Owen O’Donnell, and Eddy Van Doorslaer. 2013. Financial protection of patients through compensation of providers: The impact of Health Equity Funds in Cambodia. Journal of Health Economics 32: 1180–93. [Google Scholar] [CrossRef] [Green Version]

- Flory, Jeffrey A., Uri Gneezy, Kenneth L. Leonard, and John A. List. 2018. Gender, age, and competition: A disappearing gap? Journal of Economic Behavior & Organization 150: 256–76. [Google Scholar]

- Frijters, Paul, John P. Haisken-DeNew, and Michael A. Shields. 2005. The causal effect of income on health: Evidence from German reunification. Journal of Health Economics 24: 997–1017. [Google Scholar] [CrossRef] [PubMed]

- Galama, Titus J., and Hans Van Kippersluis. 2019. A theory of socio-economic disparities in health over the life cycle. The Economic Journal 129: 338–74. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Garin, Julio, Michael J. Pries, and Eric R. Sims. 2018. The relative importance of aggregate and sectoral shocks and the changing nature of economic fluctuations. American Economic Journal: Macroeconomics 10: 119–48. [Google Scholar] [CrossRef]

- Gong, Liutang, Hongyi Li, and Dihai Wang. 2012. Health investment, physical capital accumulation, and economic growth. China Economic Review 23: 1104–19. [Google Scholar] [CrossRef]

- Grigoli, Francesco, and Javier Kapsoli. 2018. Waste not, want not: The efficiency of health expenditure in emerging and developing economies. Review of Development Economics 22: 384–403. [Google Scholar] [CrossRef] [Green Version]

- Hadad, Sharon, Yossi Hadad, and Tzahit Simon-Tuval. 2013. Determinants of healthcare system’s efficiency in OECD countries. The European Journal of Health Economics 14: 253–65. [Google Scholar] [CrossRef] [PubMed]

- He, Haoran, and Marie Claire Villeval. 2017. Are group members less inequality averse than individual decision makers? Journal of Economic Behavior & Organization 138: 111–24. [Google Scholar]

- Howdon, Daniel, and Nigel Rice. 2018. Health care expenditures, age, proximity to death and morbidity: Implications for an ageing population. Journal of Health Economics 57: 60–74. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Jakovljevic, Mihajlo, Elena Potapchik, Larisa Popovich, Debasis Barik, and Thomas E. Getzen. 2017. Evolving health expenditure landscape of the BRICS nations and projections to 2025. Health Economics 26: 844–52. [Google Scholar] [CrossRef] [PubMed]

- Joshi Rajkarnikar, Pratistha, and Smita Ramnarain. 2020. Female Headship and Women’s Work in Nepal. Feminist Economics 26: 126–59. [Google Scholar] [CrossRef]

- Klasen, Stephan, Tobias Lechtenfeld, and Felix Povel. 2015. A feminization of vulnerability? Female headship, poverty, and vulnerability in Thailand and Vietnam. World Development 71: 36–53. [Google Scholar] [CrossRef]

- Lago-Peñas, Santiago, David Cantarero-Prieto, and Carla Blázquez-Fernández. 2013. On the relationship between GDP and health care expenditure: A new look. Economic Modelling 32: 124–9. [Google Scholar] [CrossRef]

- Liu, Chia, Albert Esteve, and Rocío Treviño. 2017. Female-headed households and living conditions in Latin America. World Development 90: 311–28. [Google Scholar] [CrossRef] [Green Version]

- Marmot, Michael. 2002. The influence of income on health: Views of an epidemiologist. Health affairs 21: 31–46. [Google Scholar] [CrossRef] [PubMed]

- Moore, Joel D., and John A. Donaldson. 2016. Human-scale economics: Economic growth and poverty reduction in Northeastern Thailand. World Development 85: 1–15. [Google Scholar] [CrossRef]

- Murthy, Vasudeva N. R., and Albert A. Okunade. 2016. Determinants of US health expenditure: Evidence from autoregressive distributed lag (ARDL) approach to cointegration. Economic Modelling 59: 67–73. [Google Scholar] [CrossRef]

- Okunade, Albert A., Chutima Suraratdecha, and David A. Benson. 2010. Determinants of Thailand household healthcare expenditure: The relevance of permanent resources and other correlates. Health Economics 19: 365–76. [Google Scholar] [CrossRef]

- Okunade, Albert A., Xiaohui You, and Kayhan Koleyni. 2018. Cross-country medical expenditure modeling using OECD panel data and ARDL approach: Investigating GDP, technology, and aging effects. In Health Econometrics. Bingley: Emerald Publishing Limited. [Google Scholar]

- Onah, Michael Nnachebe, and Susan Horton. 2018. Male-female differences in households’ resource allocation and decision to seek healthcare in south-eastern Nigeria: Results from a mixed methods study. Social Science & Medicine 204: 84–91. [Google Scholar]

- Pistaferri, Luigi. 2001. Superior information, income shocks, and the permanent income hypothesis. Review of Economics and Statistics 83: 465–76. [Google Scholar] [CrossRef]

- Rieger, Matthias, Natascha Wagner, and Arjun S. Bedi. 2017. Universal health coverage at the macro level: Synthetic control evidence from Thailand. Social Science & Medicine 172: 46–55. [Google Scholar]

- Said, Farah, Mahmud Mahmud, Giovanna D’Adda, and Azam Chaudhry. 2020. It is not power, but how you use it: Experimental evidence on altruism from households in Pakistan. Applied Economics Letters 27: 426–31. [Google Scholar] [CrossRef]

- Schünemann, Johannes, Holger Strulik, and Timo Trimborn. 2017. The gender gap in mortality: How much is explained by behavior? Journal of Health Economics 54: 79–90. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Subramanian, S. V., and Ichiro Kawachi. 2006. Being well and doing well: On the importance of income for health. International Journal of Social Welfare 15: S13–S22. [Google Scholar] [CrossRef]

- Swope, Kurtis J., John Cadigan, Pamela M. Schmitt, and Robert Shupp. 2008. Personality preferences in laboratory economics experiments. The Journal of Socio-Economics 37: 998–1009. [Google Scholar] [CrossRef]

- Terza, Joseph. V., Anirban Basu, and Paul J. Rathouz. 2008. Two-stage residual inclusion estimation: Addressing endogeneity in health econometric modeling. Journal of Health Economics 27: 531–43. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Van Doorslaer, Eddy, Owen O’Donnell, Ravindra P. Rannan-Eliya, Aparnaa Somanathan, Shiva Raj Adhikari, Charu C. Garg, Deni Harbianto, Alejandro N. Herrin, Mohammed Nazmul Huq, Shamsia Ibragimova, and et al. 2007. Catastrophic payments for health care in Asia. Health Economics 16: 1159–84. [Google Scholar] [CrossRef] [PubMed]

- Wiswall, Matthew, and Basit Zafar. 2018. Preference for the workplace, investment in human capital, and gender. The Quarterly Journal of Economics 133: 457–507. [Google Scholar] [CrossRef] [PubMed]

- Xu, Ke, David B. Evans, Guido Carrin, Ana Mylena Aguilar-Rivera, Philip Musgrove, and Timothy Evans. 2007. Protecting households from catastrophic health spending. Health Affairs 26: 972–83. [Google Scholar] [CrossRef] [Green Version]

| Variable | Total Sample | Male Head | Female Head |

|---|---|---|---|

| Household out-of-pocket (OOP) health expenditure (in Baht) | 351.05 (3242.29) | 348.62 (1926.83) | 357.86 (5434.22) |

| Log (OOP health expenditure) | 3.48 (2.53) | 3.52 (2.52) | 3.39 (5.57) |

| Macroeconomic shock (0 = before 1997, 1 = after 1997) | 0.49 (0.50) | 0.48 (0.50) | 0.51 (0.50) |

| Real monthly household income | 13601.48 (21,980.85) | 14126.16 (23,176.86) | 12134.07 (18,143.85) |

| Real household income squared | 6.68 × 108 (1.20 × 1010) | 7.37 × 108 (1.30 × 1010) | 4.76 × 108 (8.63 × 109) |

| Income quintile household size dummies a - 20th percentile with ≥5 household members - 40th percentile with ≥5 household members - 60th percentile with ≥5 household members - 80th percentile with ≥5 household members - 100th percentile with ≥5 household members | 0.09 (0.285) 0.06 (0.240) 0.05 (0.22) 0.04 (0.20) 0.03 (0.16) | 0.10 (0.30) 0.07 (0.25) 0.06 (0.23) 0.04 (0.21) 0.03 (0.17) | 0.06 (0.24) 0.05 (0.21) 0.04 (0.19) 0.03 (0.18) 0.02 (0.14) |

| Region dummies b - Central - North - Northeast - South | 0.25 (0.43) 0.22 (0.42) 0.28 (0.45) 0.17 (0.37) | 0.24 (0.42) 0.23 (0.42) 0.29 (0.45) 0.17 (0.38) | 0.29 (0.46) 0.22 (0.42) 0.26 (0.44) 0.14 (0.35) |

| Household head education dummies c - Some or complete secondary - Some or complete university | 0.13 (0.34) 0.14 (0.34) | 0.15 (0.35) 0.13 (0.34) | 0.08 (0.28) 0.14 (0.35) |

| Household head gender is male | 0.74 (0.44) | 1.00 (0.00) | 0.00 (0.00) |

| Median age | 33.54 (15.27) | 33.33 (14.92) | 34.13 (16.18) |

| Median age squared | 1357.85 (1245.69) | 1333.22 (1204.79) | 1426.73 (1351.17) |

| Proximity to death | 21.72 (14.62) | 21.88 (14.20) | 21.28 (15.73) |

| Proximity to death squared | 685.77 (689.32) | 680.62 (651.34) | 700.17 (785.70) |

| Wealth index | 0.00 (1.00) | 0.015 (1.00) | −0.043 (0.995) |

| Number of observations | 98,632 | 72,654 | 25,978 |

| Variable | Observations with Non-Zero OOP | Observations with Zero OOP | Statistical Significance of Difference in Means d |

|---|---|---|---|

| Household out-of-pocket (OOP) health expenditure (in Baht) | 490.64 (3824.15) | 0.00 (0) | −21.49 *** |

| Log (monthly OOP health expenditure) | 4.87 (1.5) | 0.00 (0) | −550.00 *** |

| Macroeconomic shock (0 = before 1997, 1 = after 1997) | 0.48 (0.50) | 0.52 (0.50) | 111.42 *** |

| Real monthly household income | 13,392.18 (21,299.55) | 14,127.86 (23,599.7) | 4.74 *** |

| Real household income2 | 6.33 × 108 (1.10 × 1010) | 7.57 × 108 (1.41 × 1010) | |

| Income quintile household size dummies a 20th percentile with ≥5 in the household 40th percentile with ≥5 in the household 60th percentile with ≥5 in the household 80th percentile with ≥5 in the household 100th percentile with ≥5 in the household | 0.10 (0.30) 0.07 (0.25) 0.055 (0.23) 0.04 (0.20) 0.03 (0.16) | 0.07 (0.26) 0.05 (0.21) 0.04 (0.19) 0.04 (0.18) 0.03 (0.16) | 174.74 *** 158.28 *** 108.35 *** 36.62 *** 6.50 ** |

| Region dummies b Central North Northeast South | 0.25 (0.43) 0.23 (0.42) 0.29 (0.45) 0.16 (0.37) | 0.25 (0.43) 0.25 (0.41) 0.26 (0.43) 0.18 (0.38) | 3.04 * 21.96 *** 120.20 *** 92.67 *** |

| Household head education dummies c Some or complete secondary Some or complete university | 0.12 (0.32) 0.12 (0.32) | 0.15 (0.36) 0.19 (0.39) | 216.77 *** 874.25 *** |

| Household head gender is male | 0.74 (0.44) | 0.72 (0.45) | 64.49 *** |

| Median age | 33.68 (15.40) | 33.18 (14.91) | −4.65 *** |

| Median age | 1371.667 (1260.22) | 1323.09 (1207.70) | |

| Proximity to death | 21.01 (14.45) | 23.51 (14.9) | 24.32 *** |

| Proximity to death | 650.33 (664.92) | 774.89 (739.72) | |

| Wealth index | 0.01 (1.00) | −0.01 (0.10) | −2.33 ** |

| Number of observations | 70,571 | 28,061 |

| Male Head | Female Head | Elasticities | |||

|---|---|---|---|---|---|

| Variable | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | Male [Female] |

| Dependent variable: log (out-of-pocket health expenditure) | |||||

| Constant | −0.008 (0.047) | 5.53 *** (0.054) | −0.101 (0.070) | 5.74 *** (0.085) | |

| Dummy for economic shock (0 before 1997; 1 thereafter) | −0.091 *** (0.010) | −0.074 *** (0.013) | −0.066 *** (0.017) | −0.045 ** (0.022) | |

| Dummy for consumption income quintile and family size b 20th percentile and family size of 5 members or more | −0.013 (0.023) | −0.060 (0.046) | |||

| 40th percentile and family size of 5 members or more | 0.068 *** (0.026) | 0.061 (0.050) | |||

| 60th percentile and family size of 5 members or more | 0.198 *** (0.028) | 0.179 *** (0.055) | |||

| 80th percentile and family size of 5 members or more | 0.312 *** (0.032) | 0.371 *** (0.060) | |||

| 100th percentile and family size of 5 members or more | 0.671 *** (0.039) | 0.592 *** (0.080) | |||

| Dummy for region c Central | 0.143 *** (0.021) | −0.300 *** (0.028) | 0.132 *** (0.033) | −0.406 *** (0.046) | |

| North | 0.172 *** (0.021) | −0.551 *** (0.028) | 0.154 *** (0.034) | −0.659 *** (0.048) | |

| Northeast | 0.161 *** (0.020) | −0.611 *** (0.028) | 0.198 *** (0.033) | −0.732 *** (0.047) | |

| South | 0.020 (0.021) | −0.400 *** (0.029) | 0.057 (0.036) | −0.487 *** (0.051) | |

| Dummy for education d Secondary | −0.146 *** (0.014) | 0.189 *** (0.020) | −0.213 *** (0.030) | 0.215 *** (0.044) | |

| University | −0.236 *** (0.015) | 0.432 *** (0.022) | −0.349 *** (0.024) | 0.423 *** (0.040) | |

| Median age | 0.0006 (0.002) | −0.005 *** (0.002) | 0.002 (0.002) | −0.009 *** (0.003) | 0.062 [0.111] |

| Median age squared | 0.00004 ** (0.00002) | 0.0001 *** (0.00002) | 0.00002 (0.00003) | 0.0001 *** (0.00003) | |

| Proximity to death | −0.0019 (0.001) | −0.006 *** (0.002) | −0.0007 (0.002) | −0.003 (0.002) | −0.146 [−0.054] |

| Proximity to death squared | 0.00003 (0.00003) | −0.00002 (0.00003) | −0.00004 (0.00004) | −0.00008 (0.00005) | |

| Wealth index | 0.259 *** (0.007) | 0.300 *** (0.011) | −0.011 [0.005] | ||

| Family Size (continuous- selection only) | 0.184 *** (0.010) | 0.151 *** (0.015) | |||

| Family Size squared (continuous- selection only) | −0.010 *** (0.001) | −0.009 *** (0.002) | |||

| No of observations | 72,654 | 25,978 | |||

| No of censored observations | 20169 | 7892 | |||

| Estimated | −0.268 *** | −0.236 *** | |||

| Ln | 0.373 *** | 0.374 *** | |||

| Log-Likelihood function value | −134,904.1 | −47,572.08 | |||

| Waldtest of Indep. Eqns. (p > chi-squared) | 84.40 (0.0000) | 17.52 (0.0000) | |||

| Q1F1_Male | Q1F1_Female | Q1F2_Male | Q1F2_Female | Q2F1_Male | Q2F1_Female | Q2F2_Male | Q2F2_Female | Q3F1_Male | Q3F1_Female | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dep var: log(OOP HH Heal Exp) | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage |

| Constant | 0.465 (0.487) | 4.51 *** (0.451) | 0.250 (0.775) | 5.369 *** (0.130) | −0.049 (0.348) | 4.85 *** (0.399) | −0.32 (0.436) | 4.1 *** (0.721) | −0.202 (0.402) | 4.52 *** (0.344) | 1.96 ** (0.796) | 4.7 *** (0.633) | −0.143 (0.212) | 4.6 *** (0.274) | −0.073 (0.279) | 3.93 *** (0.455) | 0.783 (0.579) | 5.01 *** (0.336) | 0.157 (0.891) | 5.042 *** (0.769) |

| Household income | 0.00007 ** (0.00003) | 0.0001 (0.00007) | 0.0002 ** (0.0001) | 0.0004 *** (0.0001) | 0.00004 (0.0001) | 0.00005 (0.0001) | 0.0001 (0.0001) | 0.0004 *** (0.0001) | 0.00007 ** (0.00003) | 0.00008 * (0.00005) | ||||||||||

| Square of household income | −3.24 × 10−9 (2.75 × 10−9) | −2.28 × 10−9 (5.15 × 10−9) | −2.35 × 10−8 * (1.4 × 10−8) | −6.04 × 10−8 *** (2.27 × 10−8) | 1.18 × 10−9 (1.94 × 10−9) | −1.09 × 10−9 (3.28 × 10−9) | −4.38 × 10−9 (5.48 × 10−9) | −3.32 × 10−8 *** (7.21 × 10−9) | −9.37 × 10−10 (8.94 × 10−9) | −1.4 × 10−9 (1.14 × 10−10) | ||||||||||

| Shock | −0.277 *** (0.033) | −0.055 (0.041) | −0.355 *** (0.073) | −0.028 (0.130) | −0.233 *** (0.03) | 0.058 (0.04) | −0.15 *** (0.052) | 0.213 *** (0.066) | −0.21 *** (0.041) | −0.21 *** (0.056) | −0.014 (0.08) | −0.31 *** (0.105) | −0.1 *** (0.027) | −0.024 (0.034) | −0.113 ** (0.045) | 0.038 (0.058) | −0.078 * (0.045) | −0.17 *** (0.053) | −0.246 *** (0.093) | −0.388 *** (0.145) |

| Central a | 0.166 (0.391) | 0.125 (0.431) | 0.51 (0.538) | −1.16 * (0.685) | 0.322 (0.257) | −0.50 (0.353) | 0.91 *** (0.35) | 0.076 (0.625) | −0.03 (0.164) | −0.044 (0.18) | 0.145 (0.288) | −0.678 * (0.371) | 0.206 (0.131) | −0.15 (0.171) | 0.42 ** (0.192) | 0.094 (0.284) | 0.043 (0.098) | −0.167 (0.11) | −0.0999 (0.188) | −0.362 * (0.199) |

| North | 0.183 (0.391) | −0.154 (0.686) | 0.452 (0.539) | −1.102 (0.427) | 0.382 (0.255) | −0.728 ** (0.351) | 0.82 ** (0.349) | 0.053 (0.62) | 0.02 (0.167) | −0.245 (0.183) | 0.201 (0.298) | −0.86 ** (0.38) | 0.243 * (0.13) | −0.399 ** (0.17) | 0.519 *** (0.191) | −0.207 (0.289) | 0.05 (0.105) | −0.558 *** (0.119) | 0.088 (0.209) | −0.457 ** (0.216) |

| Northeast | 0.225 (0.39) | −0.086 (0.43) | 0.397 (0.535) | −1.101 (0.678) | 0.429 * (0.255) | −0.658 * (0.351) | 0.98 *** (0.348) | −0.038 (0.625) | 0.077 (0.163) | −0.36 *** (0.179) | 0.201 (0.291) | −0.98 *** (0.374) | 0.24 * (0.13) | −0.372 ** (0.171) | 0.518 *** (0.191) | −0.166 (0.289) | 0.102 (0.101) | −0.6 *** (0.114) | 0.112 (0.205) | −0.698 *** (0.208) |

| South | −0.145 (0.39) | −0.025 (0.431) | 0.135 (0.537) | −0.893 (0.672) | 0.195 (0.257) | −0.534 * (0.352) | 0.567 (0.352) | −0.094 (0.617) | −0.152 (0.163) | −0.273 (0.241) | 0.121 (0.299) | −0.627 (0.384) | 0.035 (0.131) | −0.228 (0.172) | 0.233 (0.196) | 0.146 (0.283) | −0.06 (0.1) | −0.384 *** (0.114) | 0.068 (0.208) | −0.662 *** (0.215) |

| Secondary b | −0.088 (0.082) | 0.041 (0.097) | −0.187 (0.305) | 0.154 (0.362) | −0.142 ** (0.062) | 0.02 (0.078) | −0.68 *** (0.165) | 0.157 (0.276) | −0.18 ** (0.073) | −0.003 (0.093) | −0.02 (0.256) | 0.381 (0.322) | −0.13 *** (0.048) | 0.124 ** (0.061) | −0.212 * (0.115) | 0.057 (0.152) | −0.228 *** (0.062) | 0.092 (0.08) | −0.071 (0.188) | 0.12 (0.212) |

| University | 0.541 ** (0.231) | 0.208 (0.202) | −0.535 (0.491) | 0.996 (0.689) | −0.385 *** (0.131) | 0.169 (0.186) | −0.379 * (0.207) | −0.307 (0.302) | 0.072 (0.149) | 0.49 *** (0.164) | −0.462 (0.342) | 0.359 (0.503) | −0.32 *** (0.085) | 0.018 (0.12) | −0.81 *** (0.154) | 0.121 (0.302) | −0.208 ** (0.092) | 0.057 (0.114) | −0.273 (0.24) | 0.24 (0.317) |

| Median age | 0.003 (0.005) | 0.011 ** (0.005) | 0.006 (0.011) | 0.015 (0.011) | −0.006 (0.005) | −0.005 (0.006) | 0.005 (0.006) | −0.011 (0.007) | −0.001 (0.0001) | 0.012 * (0.01) | −0.026 ** (0.013) | 0.012 (0.015) | −0.0001 (0.004) | −0.004 (0.005) | 0.008 (0.005) | −0.005 (0.007) | −0.0003 (0.008) | −0.005 (0.009) | 0.027 * (0.014) | 0.003 (0.02) |

| Median age squared | −0.00002 (0.00007) | −0.0002 *** (0.0001) | −0.00002 (0.0002) | −0.0003 (0.0002) | 0.00006 (0.00006) | 0.0001 (0.0001) | −0.0002 (0.0001) | 0.0002 * (0.0001) | 0.00004 (0.0001) | −0.0001 (0.0001) | 0.0003 (0.0002) | −0.0002 (0.0002) | 0.00003 (0.0001) | 0.0001 * (0.0001) | −0.00007 (0.0001) | 0.0001 (0.0001) | −0.00001 (0.0001) | 0.0001 (0.0001) | −0.0003 (0.0002) | −0.0001 (0.0002) |

| Proximity to death | −0.004 (0.0001) | −0.0003 (0.004) | −0.012 (0.0003) | −0.004 (0.01) | 0.007 * (0.004) | −0.005 (0.006) | −0.002 (0.006) | −0.004 (0.007) | −0.001 (0.005) | −0.003 (0.006) | 0.002 (0.009) | 0.021 * (0.012) | −0.008 ** (0.004) | −0.006 (0.004) | −0.002 (0.005) | −0.012 ** (0.006) | −0.007 (0.006) | −0.006 (0.006) | −0.008 (0.011) | 0.014 (0.012) |

| Proximity to death squared | 0.0001 (0.0001) | −0.0001 (0.0001) | 0.0003 (0.0002) | −0.0002 (0.0002) | −0.0002 ** (0.0001) | 0.0002 (0.0001) | 0.0003 (0.0001) | 0.0001 (0.0002) | 0.00001 (0.0001) | −0.0001 (0.0001) | −0.0002 (0.0002) | −0.0005 * (0.0003) | 0.0001 * (0.00001) | 0.0001 (0.0001) | 0.0001 (0.0001) | 0.0001 (0.0001) | 0.0002 (0.0001) | 0.00007 (0.0002) | 0.0001 (0.0003) | −4.73 × 10−6 (0.0003) |

| Wealth index | 0.189 *** (0.02) | 0.262 *** (0.025) | 0.216 *** (0.019) | 0.275 *** (0.031) | 0.118 *** (0.026) | −0.084 * (0.05) | 0.186 *** (0.018) | 0.166 *** (0.029) | 0.15 *** (0.029) | 0.107 ** (0.054) | ||||||||||

| Household size (continuous) | 0.024 (0.082) | 0.199 (0.144) | 0.299 * (0.156) | −0.178 (0.173) | 0.296 *** (0.102) | −0.227 (0.208) | 0.405 *** (0.114) | 0.013 (0.127) | −0.063 (0.173) | 0.024 (0.251) | ||||||||||

| Household size squared | 0.003 (0.006) | −0.011 (0.009) | −0.038 (0.026) | 0.055 * (0.031) | −0.017 ** (0.007) | 0.015 (0.342) | −0.06 *** (0.019) | 0.013 (0.024) | 0.013 (0.013) | 0.004 (0.018) | ||||||||||

| No of observations | 7225 | 1549 | 8217 | 2738 | 4871 | 1193 | 10,022 | 3646 | 4032 | 980 | ||||||||||

| No of censored observations | 1616 | 347 | 2173 | 780 | 1048 | 249 | 2644 | 1035 | 887 | 215 | ||||||||||

| estimated ρ | −0.223 ** (0.107) | −0.077 (0.517) | −0.148 (0.120) | −0.244 (0.21) | −0.075 (0.225) | 0.839 *** (0.056) | −0.121 (0.123) | −0.129 (0.256) | −0.258 (0.164) | −0.163 (0.717) | ||||||||||

| Ln σ | 0.305 ***(0.014) | 0.272 *** (0.027) | 0.301 *** (0.013) | 0.29 *** (0.031) | 0.321 *** (0.014) | 0.49 *** (0.041) | 0.312 *** (0.011) | 0.287 *** (0.022) | 0.337 *** (0.023) | 0.283 *** (0.056) | ||||||||||

| Log-Likelihood function value | −13341.86 | −2831.137 | −15013.62 | −4901.608 | −9138.254 | −2233.766 | −18446.21 | −6569.145 | −7567.015 | −1800.103 | ||||||||||

| Wald χ2Test of Indep. Eqns. (p > chi-square) | 4.1 (0.0429) | 0.02 (.8826) | 1.47 (0.2258) | 1.24 (0.266) | 0.11 (0.7382) | 41.73 (0.000) | 0.97(0.324) | 0.25 (0.6187) | 2.26 (0.1326) | 0.05 (0.8236) | ||||||||||

| Q3F2_Male | Q3F2_Female | Q4F1_Male | Q4F1_Female | Q4F2_Male | Q4F2_Female | Q5F1_Male | Q5F1_Female | Q5F2_Male | Q5F2_Female | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dep var: log(OOP HH Heal Exp) | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage | 1st Stage | 2nd Stage |

| Constant | −0.144 (0.159) | 4.44 *** (0.224) | 0.343 (0.217) | 4.29 *** (0.297) | −0.368 (0.493) | 5.13 *** (0.458) | 1.17 (1.003) | 5.25 *** (0.806) | −0.51 *** (0.139) | 4.80 *** (0.221) | −0.144 (0.159) | 4.44 *** (0.224) | 0.343 (0.217) | 4.29 *** (0.297) | −0.368 (0.493) | 5.13 *** (0.458) | 1.17 (1.003) | 5.25 *** (0.806) | −0.51 *** (0.139) | 4.80 *** (0.221) |

| Household income | 0.0002 *** (0.00003) | 0.0001 ** (0.00004) | 0.00005 *** (0.00002) | 0.0001 ** (0.00003) | 0.0001 *** (0.00002) | 0.0002 *** (0.00003) | 0.0001 ** (0.00004) | 0.00005 *** (0.00002) | 0.0001 ** (0.00003) | 0.0001 *** (0.00002) | ||||||||||

| Square of household income | −7.05 × 10−9 *** (2.01 × 10−9) | −1.64 × 10−9 (2.88 × 10−9) | −5.25 × 10−10 * (3.08 × 10−10) | −5.85 × 10−10 (4.83 × 10−10) | −2.85 × 10−9 *** (6.08 × 10−10) | −1.73 × 10−9 ** (8.67 × 10−10) | −5.41 × 10−12 *** (1.90 × 10−12) | −6.44 × 10−12 * (3.75 × 10−12) | −1.15 × 10−11 *** (1.59 × 10−12) | −9.88 × 10−12 *** (3.56 × 10−12) | ||||||||||

| Shock | −0.151 *** (0.027) | −0.038 (0.035) | −0.058 (0.041) | −0.163 *** (0.056) | −0.046 (0.05) | −0.155 ** (0.065) | 0.042 (0.098) | −0.39 *** (0.12) | −0.026 (0.026) | −0.17 *** (0.034) | −0.038 (0.038) | −0.063 (0.052) | 0.055 (0.059) | −0.169 ** (0.08) | 0.007 (0.129) | −0.399 ** (0.179) | 0.094 *** (0.024) | −0.241 *** (0.039) | 0.033 (0.035) | −0.088 (0.056) |

| Central a | 0.154 ** (0.064) | −0.128 (0.082) | 0.091 (0.112) | −0.184 (0.158) | 0.121 (0.077) | −0.19 * (0.101) | 0.104 (0.139) | −0.226 (0.181) | 0.194 *** (0.042) | −0.2 *** (0.059) | 0.162 ** (0.067) | −0.041 (0.096) | 0.133 (0.087) | −0.39 *** (0.116) | 0.036 (0.162) | −0.322 (0.225) | 0.091 ** (0.037) | −0.202 *** (0.059) | 0.099 * (0.041) | −0.245 *** (0.086) |

| North | 0.19 *** (0.065) | −0.258 *** (0.083) | 0.139 (114) | −0.373 ** (0.16) | 0.093 (0.09) | −0.227 *(0.117) | 0.141 (0.166) | −0.483 ** (0.216) | 0.182 *** (0.046) | −0.31 *** (0.063) | 0.086 (0.072) | −0.147 (0.101) | 0.171 * (0.099) | −0.72 *** (0.132) | 0.11 (0.207) | −0.718 ** (0.288) | 0.122 *** (0.041) | −0.338 *** (0.064) | 0.092 *** (0.046) | −0.532 *** (0.096) |

| Northeast | 0.181 *** (0.066) | −0.355 *** (0.084) | 0.198 * (0.115) | −0.377 ** (0.161) | 0.075 (0.082) | −0.401 *** (0.106) | 0.153 (0.165) | −0.475 ** (0.213) | 0.174 *** (0.046) | −0.45 *** (0.063) | 0.271 *** (0.073) | −0.31 *** (0.106) | −0.037 (0.084) | −0.97 *** (0.119) | 0.103 (0.202) | −1.1 *** (0.292) | 0.065 * (0.04) | −0.592 *** (0.063) | 0.115 ** (0.058) | −0.632 *** (0.094) |

| South | 0.106 (0.067) | −0.183 ** (0.085) | 0.096 (0.119) | −0.214 (0.166) | 0.162 * (0.085) | −0.246 ** (0.112) | 0.156 (0.182) | −0.203 (0.231) | 0.072 (0.047) | −0.26 *** (0.064) | 067 (0.075) | −0.119 (0.105) | −0.002 (0.098) | −0.53 *** (0.133) | 0.115 (0.237) | −0.55 * (0.327) | 0.04 (0.041) | −0.234 *** (0.065) | 0.148 ** (0.062) | −0.491 *** (0.101) |

| Secondary b | −0.127 *** (0.038) | 0.074 (0.048) | −0.181 ** (0.081) | −0.295 ** (0.118) | 0.003 (0.064) | −0.101 (0.079) | −0.47 *** (0.159) | 0.034 (0.351) | −0.17 *** (0.032) | 0.099 ** (0.045) | −0.2 *** (0.059) | 0.038 (0.091) | −0.034 (0.083) | −0.021 (0.107) | 0.024 (0.197) | 0.106 (0.26) | −0.167 *** (0.033) | 0.163 *** (0.052) | −0.211 *** (0.053) | 0.176 * (0.09) |

| University | −0.262 *** (0.056) | 0.142 * (0.077) | −0.285 *** (0.095) | −0.212 (0.144) | −0.171 * (0.066) | 0.01 (0.09) | −0.211 (0.142) | −0.242 (0.206) | −0.17 *** (0.037) | 0.12 ** (0.052) | −0.3 *** (0.059) | 0.012 (0.099) | −0.21 *** (0.068) | 0.194 ** (0.097) | −0.43 *** (0.147) | 0.298 (0.272) | −0.242 *** (0.03) | 0.34 *** (0.048) | −0.352 *** (0.039) | 0.271 *** (0.079) |

| Median age | −0.007 * (0.005) | −0.017 *** (0.005) | 0.0004 (0.005) | −0.017 ** (0.007) | 0.019 ** (0.009) | −0.016 (0.012) | 0.015 (0.018) | −0.049 ** (0.024) | −0.004 (0.005) | −0.02 *** (0.006) | 0.003 (0.005) | −0.007 (0.007) | 0.012 (0.01) | −0.002 (0.014) | 0.005 (0.023) | −0.083 ** (0.033) | −0.008 * (0.005) | −0.033 *** (0.0001) | −0.007 (0.006) | −0.034 *** (0.0001) |

| Median age squared | 0.0001 ** (0.00005) | 0.0003 *** (0.00006) | 9.74 × 10−6 (0.00006) | 0.0003 *** (0.0001) | −0.0002 ** (0.0001) | 0.0002 (0.0002) | −0.0003 (0.0002) | −0.001 ** (0.0004) | 0.0001 ** (0.00005) | 0003 *** (0.0001) | 0.0002 (0.0001) | 0.0001 (0.0001) | −0.0002 (0.0001) | 0.0001 (0.0002) | −0.0001 (0.0003) | 0.001 ** (0.0004) | 0.0002 *** (0.0001) | 0.0005 *** (0.0001) | 0.0002 ** (0.0001) | 0.0005 *** (0.0001) |

| Proximity to death | −0.003 (0.004) | −0.004 (0.004) | −0.009 * (0.005) | −0.008 (0.006) | −0.005 (0.006) | −0.017 ** (0.008) | 0.003 (0.011) | 0.006 (0.014) | −0.0009 (0.003) | −0.011 ** (0.004) | 0.002 (0.004) | −0.02 *** (0.006) | −0.02 *** (0.008) | −0.02 * (0.011) | 0.015 (0.015) | −0.006 (0.023) | −0.005 (0.004) | −0.012 ** (0.005) | 0.00003 (0.004) | −0.013 ** (0.006) |

| Proximity to death squared | 0.00004 (0.00007) | 0.00005 (0.00009) | 0.00008 (0.0001) | 0.00003 (0.0001) | 0.00003 (0.0002) | 0.0002 (0.0002) | −0.0001 (0.0003) | −0.0004 (0.0004) | −3.52 × 10−6 (0.00007) | 0.0001 (0.0001) | −0.0001 * (0.0001) | 0.0001 (0.0001) | 0.0005 ** (0.0002) | 0.0004 * (0.0003) | −0.0005 (0.0004) | −0.0002 (0.0006) | 0.0001 (0.0001) | 0.00005 (0.0001) | −0.00003 (0.00007) | 0.00005 (0.0001) |

| Wealth index | 0.198 *** (0.019) | 0.241 *** (0.029) | 0.178 *** (0.032) | 0.231 *** (0.059) | 0.32 *** (0.023) | 0.182 *** (0.031) | 0.227 *** (0.034) | 0.149 * (0.079) | 0.223 *** (0.02) | 0.271 *** (0.031) | ||||||||||

| Household Size (continuous) | 0.556 *** (0.092) | 0.11 (0.104) | 0.171 (0.138) | −0.24 (0.28) | 0.587 *** (0.077) | 0.24 ** (0.098) | 0.072 (0.183) | −0.31 (0.35) | 0.533 *** (0.061) | 0.289 *** (0.09) | ||||||||||

| Household Size squared (continuous) | −0.082 *** (0.004) | 0.004 (0.02) | −0.006 (0.01) | 0.021 (0.02) | −0.08 *** (0.014) | −0.026 (0.02) | 0.0009 (0.013) | 0.019 (0.017) | −0.067 ** (0.012) | −0.032 * (0.019) | ||||||||||

| No of observations | 10,496 | 4220 | 3211 | 850 | 10,825 | 4835 | 2176 | 483 | 11,579 | 5484 | ||||||||||

| No of censored observations | 2795 | 1194 | 777 | 208 | 3340 | 1563 | 574 | 124 | 4315 | 2177 | ||||||||||

| Estimated ρ | −0.157 (0.119) | 0.786 *** (0.042) | −0.257 (0.297) | 0.017 (0.789) | −0.273 *** (0.095) | −0.184 (0.197) | −0.302 (0.192) | −0.273 (0.485) | −0.44 *** (0.048) | −0.371 *** (0.131) | ||||||||||

| Ln σ | 0.323 *** (0.012) | 0.475 *** (0.028) | 0.408 *** (0.039) | 0.356 *** (0.029) | 0.361 *** (0.016) | 0.365 *** (0.023) | 0.453 *** (0.034) | 0.495 *** (0.074) | 0.493 *** (0.016) | 0.478 *** (0.033) | ||||||||||

| Log-Likelihood function value | −19,351.28 | −7650.974 | −6159.519 | −1601.387 | −19,699.99 | −8760.743 | −4191.064 | −947.8253 | −20,863.75 | −9695.167 | ||||||||||

| Wald χ2test of Indep. Eqns. (p > chi-squared) | 1.68 (0.195) | 93.66 (0.0000) | 0.68 (0.4083) | 0.00 (0.9827) | 7.41 (0.0065) | 0.84 (0.3604) | 2.19 (0.1393) | 0.29 (0.5926) | 61.86 (0.0000) | 6.61 (0.0102) | ||||||||||

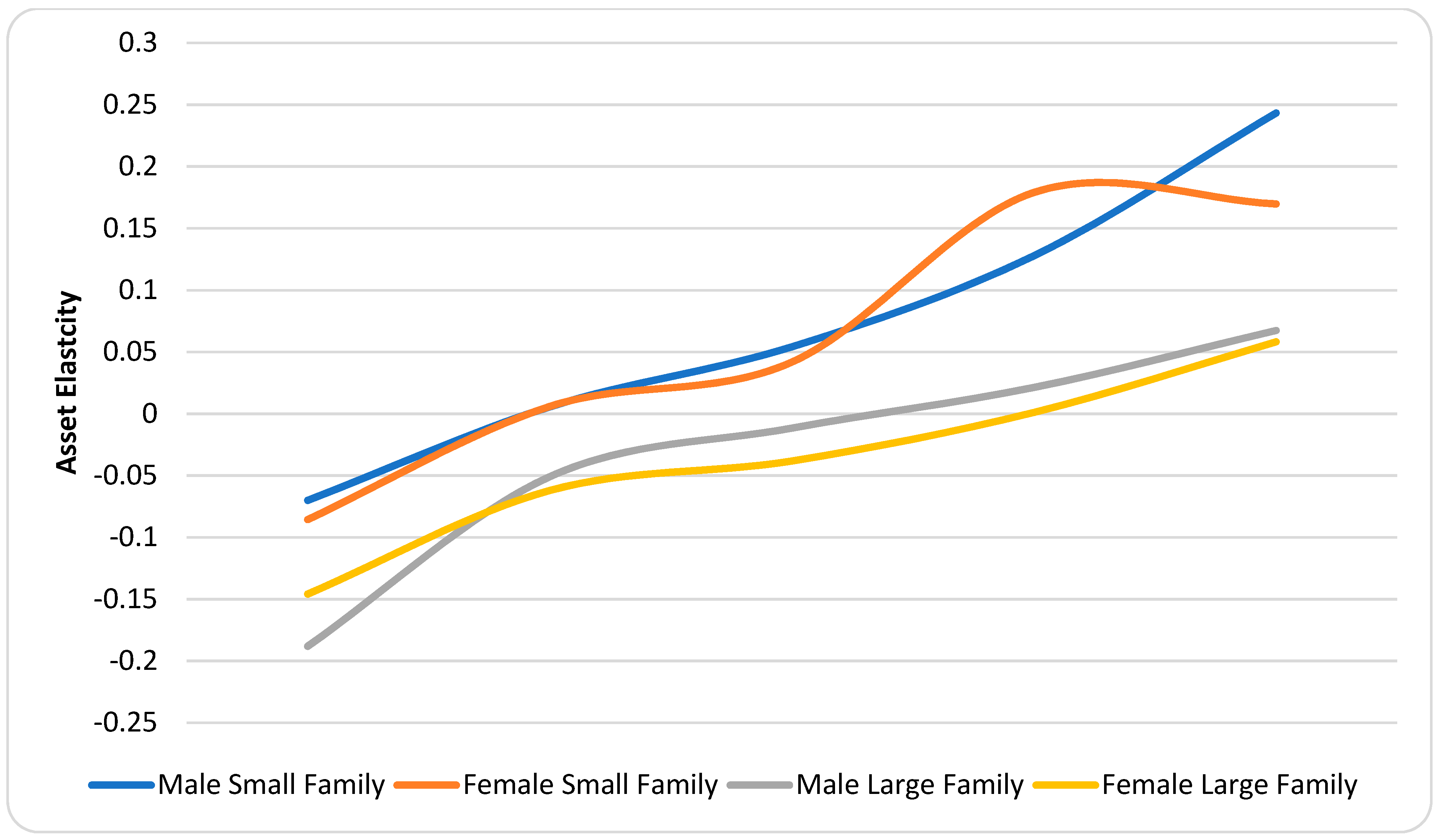

| Variable | Q1F1 | Q1F2 | Q2F1 | Q2F2 | Q3F1 | Q3F2 | Q4F1 | Q4F2 | Q5F1 | Q5F2 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| M | F | M | F | M | F | M | F | M | F | M | F | M | F | M | F | M | F | M | F | |

| Household Income | 0.20 | 0.21 | 0.18 | 0.27 | 0.58 | 0.27 | 0.25 | 0.44 | 0.55 | 0.54 | 0.48 | 0.51 | 0.70 | 0.94 | 0.55 | 0.46 | 0.28 | 0.46 | 0.30 | 0.23 |

| Median Age | 0.03 | 0.02 | 0.04 | −0.03 | 0.18 | 0.08 | 0.13 | −0.02 | 0.05 | −0.08 | 0.05 | 0.07 | −0.14 | −0.02 | 0.07 | 0.02 | 0.08 | −0.60 | 0.00 | −0.03 |

| Proximity to Death | −0.03 | 0.02 | 0.04 | 0.02 | −0.02 | 0.07 | −0.01 | −0.13 | −0.07 | 0.02 | −0.05 | −0.14 | −0.16 | −0.07 | −0.12 | −0.20 | −0.09 | −0.15 | −0.24 | −0.27 |

| Wealth Index | −0.07 | −0.09 | −0.19 | −0.15 | 0.01 | 0.01 | −0.05 | −0.06 | 0.05 | 0.04 | −0.01 | −0.04 | 0.13 | 0.18 | 0.02 | 0.00 | 0.24 | 0.17 | 0.07 | 0.06 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Osmani, A.R.; Okunade, A. A Double-Hurdle Model of Healthcare Expenditures across Income Quintiles and Family Size: New Insights from a Household Survey. J. Risk Financial Manag. 2021, 14, 246. https://doi.org/10.3390/jrfm14060246

Osmani AR, Okunade A. A Double-Hurdle Model of Healthcare Expenditures across Income Quintiles and Family Size: New Insights from a Household Survey. Journal of Risk and Financial Management. 2021; 14(6):246. https://doi.org/10.3390/jrfm14060246

Chicago/Turabian StyleOsmani, Ahmad Reshad, and Albert Okunade. 2021. "A Double-Hurdle Model of Healthcare Expenditures across Income Quintiles and Family Size: New Insights from a Household Survey" Journal of Risk and Financial Management 14, no. 6: 246. https://doi.org/10.3390/jrfm14060246

APA StyleOsmani, A. R., & Okunade, A. (2021). A Double-Hurdle Model of Healthcare Expenditures across Income Quintiles and Family Size: New Insights from a Household Survey. Journal of Risk and Financial Management, 14(6), 246. https://doi.org/10.3390/jrfm14060246