The European Union Green Deal: Clean Energy Wellbeing Opportunities and the Risk of the Jevons Paradox

Abstract

:1. Introduction

2. Present Environmental Dangers and Political Economy Proposals

2.1. General Overview and Framework

2.2. EU Green Deal Framework

3. EU Green Deal Analysis: Development, Goals and Challenges

3.1. Origin and Development

- -

- 2019: The strategic agenda was presented: EU leaders called for a climate-neutral, green, fair and social Europe (European Council, 20–21 June). EU leaders endorsed the 2050 climate neutrality objective (European Council, 12–13 December). An exchange of views on the EU environment and climate policy was proposed for the next term (Environment Council, 19 December).

- -

- 2020: Ministers debated financial and economic aspects of the Green Deal (Economic and Financial Affairs Council, 21 January 2020). They also discussed agricultural aspects of the Green Deal (Agriculture and Fisheries Council, 27 January 2020). Competitiveness Council discussed the transition to climate-neutral EU (Competitiveness Council, 27–28 February 2020). Environment and climate ministers exchanged views on the European Green Deal (Environment Council, 5 March 2020). Agriculture ministers welcomed EU Biodiversity and Farm to Fork strategies (video conference of agriculture ministers, 8 June 2020). EU energy ministers discussed the EU Green Deal and economic recovery (video conference of energy ministers, 15 June 2020). According to the environment ministers, the European Green Deal should guide the recovery towards green growth (video conference of environment ministers, 23 June 2020). The council agrees its position in support of the initiative of the European Year of Rail 2021 (press release, 24 June 2020). The council agrees on its partial negotiating position of the Just Transition Fund (press release, 24 June 2020). EU chooses more ambitious options to calculate offsetting requirements for aviation emissions. The EU confirms its participation in the CORSIA voluntary phase from 2021 and chooses the more ambitious option to calculate its offsetting requirements (press release, 25 June 2020). EU leaders discuss the EU’s climate ambition for 2030 (European Council, 15–16 October 2020). The council prioritizes actions for sustainable food systems and make some conclusions on the Farm to Fork strategy (press release, 19 October 2020). The council agrees its position on the public sector loan facility with a just transition towards climate neutrality (press release, 21 October 2020). Environment ministers reach partial agreement on the EU climate law and adopt conclusions on biodiversity (press release, 23 October 2020). The council adopts conclusions on the EU biodiversity strategy for 2030 (press release, 23 October 2020, Environment Council, 23 October 2020). The EU and member states’ contributions for the climate finance continued to increase in 2019 (press release, 29 October 2020). EU leaders endorsed a new binding climate target (European Council, 10–11 December 2020). The council endorses the political deal with the parliament for the just transition fund. The resources will come from the 2021–2027 multiannual financial framework (EUR 7.5 billion) and the next generation EU instrument of EUR 10 billion spread over three years (press release, 16 December 2020). The council gives a general approach on the European climate law proposal (press release, 17 December 2020).

- -

- 2021: Finally, the council approves the conclusions on the EU chemicals strategy for sustainability (press release, 15 March 2021). Council and parliament reach provisional agreement on the European climate law (press release, 21 April 2021). A public sector loan facility to support just climate transition is accepted in a provisional agreement (press release, 26 April 2021). EU ambassadors approve a compromise text on the EU climate law (press release, 5 May 2021).

3.2. Goals and Challenges

- (1)

- Decarbonisation: In 2019, different countries and big corporations expressed their commitment to a net zero carbon pathway. Renewable technologies have reduced their costs so much that they have become the most economical option [67]. The sector where the decarbonisation process is the easiest is perhaps electricity generation. Globally almost three-quarters of annual net electricity capacity already come from renewable energy. However, a full decarbonisation still requires investments in the sector. Indeed, the main problem of renewable technologies is uncertainty and intermittency, so different strategies must be considered in order to remove, or at least reduce, this problem: a combination of diverse renewable sources, such as solar and wind, the storage of energy and the use of zero-carbon base-load power [68,69]. Though decarbonisation in the electricity generation sector can be addressed with the necessary investment, only around a quarter of global greenhouse gas emissions is caused by this sector. In Figure 2, the composition of energies for electricity generation is shown. However, the decarbonisation of other sectors is much more difficult. For instance, the case of transportation is paradigmatic, as there are less than one percent of electric vehicles. The still high price of these vehicles, together with the reduced number of charging points, explain such a low percentage [70,71]. In the case of the EU, in [72] the necessary energy system transformations and the costs to meet the decarbonisation objectives established in the EU Roadmap 2050 are analysed by seven large-scale energy economy models (also [73]). The emissions reduction target can be achieved with technological options, which entail less than 1% of GDP during the period 2015–2050. The delay in reducing emissions until 2030 increase the energy system costs and makes the objective of decarbonisation difficult [74].

- (2)

- Energy security: The definition of this term is complex [76] as it has implications in very different fields: economic, social, technical, political, etc. In [77], the distinction between “security of supply” and “security of demand” is stressed. This security implies that production and consumption of energy need to be in accordance, and a balance of supply and demand is needed. This balance depends on geopolitics, on the availability and affordability of energy through domestic production or imports and on the diversification of energy sources. At the end of the last century, studies about energy security focused on supply [78], so the main concern for policymakers was getting a non-intermittent flow of energy supply [79]. Currently, the concept of energy security is part of a broad interdisciplinary field including dimensions such as energy efficiency, sustainability, reduction of greenhouse gas, energy poverty, equitable access to energy, energy education, etc. [80,81]. Some scholars, such as [82], add the concept of “cultures”, as different subjects can perceive the energy security in different ways, according to their culture (national, political, economic, professional and epistemic). The IEA defines energy security as the uninterrupted availability of energy sources at an affordable price. To achieve long-term energy security, timely investments are needed to ensure the availability of energy in agreement with the environmental needs and the economic developments. Short-term energy security is referred to the need of the system to react rapidly to sudden shifts in the balance between supply and demand [83]. This issue needs then to be addressed in the scope of different regions [84,85,86,87,88,89].

- (3)

- Internal energy market. The EU internal energy market is referred to the integration of gas and electricity markets of EU members into a single market based on the free movement of goods, services, people and capital [90]. The construction of the EU itself had as the principal aim the emergence of an internal energy market. This project began in the Treaty of Paris in 1951 when the European Coal and Steel Community was created to achieve supranationalism in energy supply, and the creation of the Euratom in 1956, which afterwards led to the Treaty of Rome in 1957 when the European Economic Community began with the first six member states. EU’s internal energy market has been harmonised and liberalised by certain measures adopted since 1996. These measures are devoted to achieve a more competitive, flexible and customer-centred electricity market, by addressing aspects such as the transparency, the regulation, the consumer protection, the energy poverty, the supply of electricity, gas and oil or the creation of trans-European networks for energy [91]. Thus, the removal of certain trade barriers, the convergence of pricing and tax policies, and the adoption of environmental and safety regulations are required. The legal basis for these measures is contained in Article 194 and Article 114 of the Treaty on the Functioning of the EU (TFEU). Along the years, different directives about the liberalisation of gas and electricity markets (energy packages) have been adopted. The First Energy Package for electricity was adopted in 1996 and for gas in 1998; the Second Energy Package was adopted in 2003; the Third in 2009; finally, the Fourth Energy Package was adopted in 2019. On the other hand, the Commission put forward several legislative proposals in 2016. The ‘Clean Energy for all Europeans’ package promotes the design of an electricity market, of the security of electricity supply and of governance rules for the Energy Union [92,93]. The proposal COM(2016)0864 for the internal market in electricity proposes that the price at which electricity is supplied to consumers and member states is based on a price competition between suppliers, ensuring the protection of vulnerable households. Now, the goal is to achieve a fair competition in the energy sector. That is, consumers must freely choose the supplier who can provide electricity and gas freely across borders. Fair competition entails harmonized national regulations and the absence of dominant players in the market [94,95].

- (4)

- Research, innovation and competitiveness in energy. According to the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions [57,58], the National Energy and Climate Plans (NECPs) do not pay sufficient attention to research and innovation needs with respect to climate and energy objectives. The national budgets devoted to research and innovation in the clean energy sector have suffered an overall decrease and the national objectives and funding targets are not sufficiently established [96]. Thus, a new approach to research and innovation and competitiveness in clean energy is needed to achieve climate neutrality. Research and innovation policies, both in the European and national level, along with funding and national industrial strategies, must be aligned with the climate and energy objectives. These policies must be carried out through NCEPs. However, circular ecoinnovations do not imply higher growth rates of small- and medium-sized enterprises, SMEs, which need to be engaged for policies to be neutral with the size of the firm [97].

- (5)

- Energy efficiency. In the 2012 directive, amended in 2018, rules are set and obligations are established in order to achieve the EU’s 2020 and 2030 energy efficiency targets. Among the measures promoted to achieve these objectives, they are worth mentioning: making buildings more efficient, promoting cogeneration of heat and power, labelling and ecodesign rules, calling for private financing for investments based on energy efficiency or launching a heating and cooling plan in order to provide the energy consumed by the building and industry [98].

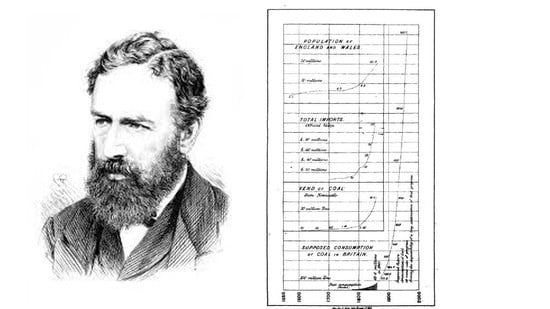

4. The Jevons Paradox and Its Risk

5. Discussion

5.1. The Debate on the Rebound Effect

5.2. Direct and Indirect Rebound Effect

5.3. Economic Growth and Energy Efficiency

5.4. Rebound Effect and Energy Policies

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sánchez-Bayón, A. Renewal of business & economic thought after the globalization. Bajo Palabra 2020, 24, 293–318. [Google Scholar] [CrossRef]

- UN SDG Agenda 2030. Transforming Our World: The 2030 Agenda for Sustainable Development|Department of Economic and Social Affairs. Available online: https://sdgs.un.org/2030agenda (accessed on 15 May 2021).

- OECD. The Economy of Well-Being—OECD. Available online: https://www.oecd.org/about/secretary-general/the-economy-of-well-being-iceland-september-2019.htm (accessed on 15 May 2021).

- WEF. Wellbeing Economy Alliance. About. Available online: https://weall.org/about (accessed on 15 May 2021).

- European Commission. The European Green Deal COM/2019/640 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2019%3A640%3AFIN (accessed on 15 May 2021).

- European Parliament. Multiannual Finance Framework. (Europa.eu). Available online: https://www.consilium.europa.eu/en/press/press-releases/2020/12/17/multiannual-financial-framework-for-2021-2027-adopted (accessed on 15 May 2021).

- De Graaf, J. The Promise of the Green New Deal. Available online: https://weall.org/the-promise-of-the-green-new-deal-by-john-de-graaf (accessed on 8 July 2021).

- Wolf, S.; Teitge, J.; Mielke, J.; Schütze, F.; Jaeger, C. The European Green Deal—More Than Climate Neutrality. Inter Econ 2021, 56, 99–107. [Google Scholar] [CrossRef]

- International Renewable Energy/Agency (IRENA). Renewable Energy and Jobs Annual Review 2020; International Renewable Energy/Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Consoli, D.; Marin, G.; Marzucchi, A.; Vona, F. Do green jobs differ from non-green jobs in terms of skills and human capital? Res. Policy 2016, 45, 1046–1060. [Google Scholar] [CrossRef] [Green Version]

- Bowen, A.; Kuralbayeva, K.; Tipoe, E.L. Characterizing green employment: The impacts of ‘greening’ on workforce composition. Energy Econ. 2018, 72, 263–275. [Google Scholar] [CrossRef]

- Nordstrom, K.A.; Ridderstrale, J. Funky Business: Talent Makes Capital Dance; Pitman Publishing: London, UK, 2000. [Google Scholar]

- Nordstrom, K.A.; Ridderstrale, J. Funky Business Forever: How to Enjoy Capitalism; Financial Times: New York, NY, USA, 2007. [Google Scholar]

- Cubeiro, J.L. Del Capitalismo al Talentismo; Univ. Deusto: Bilbao, Spain, 2012. [Google Scholar]

- Huerta de Soto, J. The Theory of Dynamic Efficiency; Taylor & Francis: London, UK; New York, NY, USA, 2009. [Google Scholar]

- Talido, R. How to Turn Artificial Intelligence into Concrete Value; Capgemini Digital Transformation Institute: Paris, France, 2017; Available online: https://www.capgemini.com/wp-content/uploads/2017/09/artificial-intelligence-e28093-where-and-how-to-invest.pdf (accessed on 15 May 2021).

- Easterlin, R.A. Does Economic Growth Improve the Human Lot? In Nations and Households in Economic Growth; David, P., Reder, M., Eds.; Academic Press Inc.: New York, NY, USA, 1974. [Google Scholar]

- Easterlin, R.A.; McVey, L.A.; Switek, M.; Sawangfa, O.; Zweig, J.S. The happiness-income paradox revisited. Proc. Natl. Acad. Sci. USA 2010, 107, 22463–22468. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Rojas, M. El Estudio Científico de la Felicidad; FCE: Ciudad de México, México, 2014. [Google Scholar]

- UN. Defining a New Economic Paradigm: The Report of the High-Level Meeting on Wellbeing and Happiness. 2012. Available online: https://sustainabledevelopment.un.org/index.php?page=view&type=400&nr=617&menu=35 (accessed on 15 May 2021).

- Sustainable Development Solutions Network. World Happiness Report 2020. 2020. Available online: https://s3.amazonaws.com/happiness-report/2020/WHR20.pdf (accessed on 15 May 2021).

- Dell’Anna, F. Green jobs and energy efficiency as strategies for economic growth and the reduction of environmental impacts. Energy Policy 2021, 149. [Google Scholar] [CrossRef]

- Kurzweil, R. The Singularity Is Near: When Humans Transcend Biology; Penguin: New York, NY, USA, 2005. [Google Scholar]

- Kuznets, S. Economic Growth and Income Inequality. Am. Econ. Rev. 1995, 45, 1–28. [Google Scholar]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the Environmental Kuznets Curve. J. Econ. Perspect. 2002, 16, 147–168. [Google Scholar] [CrossRef] [Green Version]

- Sánchez-Bayón, A. Fundamentos de derecho comparado y global: ¿cabe un orden común en la globalización? Bol. Mex. Derecho Comparado 2014, 141, 1021–1051. [Google Scholar] [CrossRef] [Green Version]

- IPCC. IPCC Special Report “Global Warming of 1.5 °C”; IPCC: Geneva, Switzerland, 2018; Available online: https://www.ipcc.ch/sr15/ (accessed on 15 May 2021).

- VijayaVenkataRaman, S.; Iniyan, S.; Goic, R. A Review of Climate Change, Mitigation and Adaptation. Renew. Sustain. Energy Rev. 2012, 16, 878–897. [Google Scholar] [CrossRef]

- Peña, J.A.; García, M.; Sánchez-Bayón, A. The Spanish Energy Transition into the EU Green Deal: Alignments and Paradoxes. Energies 2021, 14, 1994. [Google Scholar] [CrossRef]

- Vanderheiden, S. Political Theory and Global Climate Change; MIT Press: Cambridge, MA, USA, 2008. [Google Scholar]

- Perman, R. The economics of the greenhouse effect. J. Econ. Surv. 1994, 8, 99–132. [Google Scholar] [CrossRef]

- Heilig, G.K. The greenhouse gas methane (ch(4)): Sources and sinks, the impact of population growth, possible interventions. Popul. Environ. 1994, 16, 109. [Google Scholar] [CrossRef] [Green Version]

- Moser, S.C.; Dilling, L. Making Climate Hot: Communicating the urgency and challenge of Climate Change. Environ. Sci. Policy Sustain. Dev. 2004, 46, 32–46. [Google Scholar] [CrossRef]

- Grover, H. Local Response to Global Climate Change: The Role of Local Development Plans in Climate Change Management. Ph.D. Thesis, Texas A&M University, College Station, TX, USA, 2010. Available online: http://repository.tamu.edu/bitstream/handle/1969.1/ETD-TAMU-2010-08-8461/GROVERDISSERTATION.pdf?sequence=3 (accessed on 15 May 2021).

- Moser, S.C. Communicating Climate Change: History, Challenges, Process and Future Directions. Wiley Interdiscip. Rev. Clim. Chang. 2010, 1, 31–53. [Google Scholar] [CrossRef]

- Seacreast, S.; Kuzelka, R.; Leonard, R. Global Climate Change and Public Perception: The Challenge of Translation. J. Am. Water Resour. Assoc. 2000, 36, 253–264. [Google Scholar] [CrossRef]

- Vlassopoulos, C.A. Competing Definition of Climate Change and the Post-Kyoto Negotiations. Int. J. Clim. Chang. Strateg. Manag. 2012, 4, 104–118. [Google Scholar] [CrossRef]

- Rahman, M.I. Climate Change: A Theoretical Review. INDECS 2013, 11, 1–13. [Google Scholar] [CrossRef]

- Consensus reached on climate change causes. Sci. News 1994, 146, 198. [CrossRef]

- Ipcc’s Ritual on Global Warming. Nature 1994, 371, 269. [CrossRef]

- IPCC; United Nations Environment Programme (UNEP) Technology and Economics Assessment Panel; United Nations Environment Programme (UNEP) Technology and Economics Assessment Panel. IPCC/TEAP Special Report on Safeguarding the Ozone Layer and the Global Climate System: Issues Related to Hydrofluorocarbons and Perfluorocarbons; Published for the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

- IPCC. Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation: Special Report of the Intergovernmental Panel on Climate Change; Field, C.B., Ed.; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Bolin, B.; Bolin, B. A History of the Science and Politics of Climate Change: The Role of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Lahn, B. Changing Climate Change: The Carbon Budget and the Modifying-Work of the IPCC. Soc. Stud. Sci. 2021, 51, 3–27. [Google Scholar] [CrossRef] [PubMed]

- National Aeronautics and Space Administration. Climate Change: How Do We Know? NASA: Washington, DC, USA, 2012; Available online: http://climate.nasa.gov/evidence (accessed on 15 May 2021).

- Heredia, J.; Sánchez-Bayón, A. Air Navigation & Tourism on Trial: Current Controversy into the EU Regulation. Mod. Econ. 2015, 6, 595–616. [Google Scholar] [CrossRef] [Green Version]

- Heredia, J.; Sánchez-Bayón, A. The European transition to a green energy production model. Small Bus. J. Int. Rev. 2020, 4, 39–52. [Google Scholar] [CrossRef]

- Peiró-Palomino, J.; Picazo-Tadeo, A.J. Is Social Capital Green? Cultural Features and Environmental Performance in the European Union. Environ. Resour. Econ. 2019, 72, 795–822. [Google Scholar] [CrossRef]

- European Green Deal. EU Adaptation Strategy. Available online: https://ec.europa.eu/clima/policies/adaptation/what_en (accessed on 8 July 2021).

- International Energy Agency. European Union 2020: Energy Policy Review; IEA: Paris, France, 2020. [Google Scholar]

- Ebbesson, J.; Okowa, P.N. Environmental Law and Justice in Context; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Konrad-Adenauer-Stiftung. Climate change: International law and global governance. In Volume II, Policy, Diplomacy and Governance in a Changing Environment; Ruppel, O.C., Roschmann, C., Ruppel-Schlichting, K., Eds.; Open Research Library (ORL): Berlin, Germany, 2013. [Google Scholar]

- Kingston, S. European Perspectives on Environmental Law and Governance; Taylor and Francis: Hoboken, NJ, USA, 2013. [Google Scholar]

- Sebastian, O.; Pallemaerts, M. New Climate Policies of the European Union: Internal Legislation and Climate Diplomacy; Institute for European Studies: Brussels, Belgium; ASP: Bruxelles, Belgium, 2010. [Google Scholar]

- Wurzel, R.; Connelly, J. The European Union as a Leader in International Climate Change Politics; Taylor & Francis: Hoboken, NJ, USA, 2010. [Google Scholar]

- Committing to Climate-Neutrality by 2050: European Commission Proposes European Climate Law, Consults on European Climate Pact. Target. News Serv. Available online: https://ec.europa.eu/clima/news/committing-climate-neutrality-2050-commission-proposes-european-climate-law-and-consults_en (accessed on 4 March 2020).

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, (COM (2020), 564 Final); European Commission: Bruxelles, Belgium, 2020. [Google Scholar]

- European Commission: European Climate Pact—Empowering Citizens to Shape Greener Europe. Target. News Serv. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_20_2323 (accessed on 10 December 2020).

- European Union: Questions and Answers on the European Climate Law and Climate Pact. Asia News Monit. Available online: https://ec.europa.eu/commission/presscorner/detail/en/QANDA_20_336 (accessed on 6 March 2020).

- Rifkin, J. The Age of Access: The New Culture of Hypercapitalism, Where All of Life Is a Paid-for Experience; Putnam Publishing Group: New York, NY, USA, 2000. [Google Scholar]

- Rifkin, J. The Hydrogen Economy: The Creation of the Worldwide Energy Web and the Redistribution of Power on Earth; Jeremy P. Tarcher: Los Angeles, CA, USA, 2002. [Google Scholar]

- Rifkin, J. The European Dream: How Europe´s Vision of the Future Is Quietly Eclipsing the American Dream; Jeremy P. Tarcher: Los Angeles, CA, USA, 2004. [Google Scholar]

- Rifkin, J. The Empathic Civilization: The Race to Global Consciousness in a World in Crisis; Jeremy P. Tarcher: Los Angeles, CA, USA, 2010. [Google Scholar]

- Rifkin, J. The Third Industrial Revolution: How Lateral Power Is Transforming Energy, the Economy and the World; Palgrave Macmillan: London, UK, 2011. [Google Scholar]

- Rifkin, J. The Zero Marginal Cost Society: The Internet of Things, the Collaborative Commons, and the Eclipse of Capitalism; Palgrave Macmillan: London, UK, 2014. [Google Scholar]

- Rifkin, J. The Green New Deal: Why the Fossil Fuel Civilization Will Collapse by 2028, and the Bold Economic Plan to Save Life on Earth; St. Martin’s Press: New York, NY, USA, 2019. [Google Scholar]

- Organisation for Economic Co-Operation and Development. Costs of Decarbonisation: System Costs with High Shares of Nuclear and Renewables, Revised Version ed.; Place of Publication Not Identified; OECD Publishing: Paris, France, 2021. [Google Scholar] [CrossRef]

- Doukas, H.; Flamos, A.; Lieu, J. (Eds.) Understanding Risks and Uncertainties in Energy and Climate Policy: Multidisciplinary Methods and Tools for a Low Carbon Society; Springer Open: Cham, Switzerland, 2019. [Google Scholar] [CrossRef] [Green Version]

- Vindel, J.M.; Trincado, E.; Sánchez-Bayón, A. European Union Green Deal and the Opportunity Cost of Wastewater Treatment Projects. Energies 2021, 14, 1994. [Google Scholar] [CrossRef]

- International Transport Forum. ITF Transport Outlook 2019; OECD Publishing: Paris, France, 2019. [Google Scholar]

- Muthu, S.S. Carbon Footprints: Case Studies from the Energy and Transport Sectors; Springer: Singapore, 2009. [Google Scholar]

- Capros, P.; Paroussos, L.; Fragkos, P.; Tsani, S.; Boitier, B.; Wagner, F.; Busch, S.; Resch, G.; Blesl, M.; Bollen, J. European decarbonisation pathways under alternative technological and policy choices: A multi-model analysis. Energy Strategy Rev. 2014, 2, 231–245. [Google Scholar] [CrossRef]

- Keppler, J.H.; Oometto, M. The True Costs of Decarbonisation. Nea News 2019, 37, 10–15. [Google Scholar]

- Lopes, M.; Antunes, C.; Janda, K.B. Energy and Behavior: Towards a Low Carbon Future; Elsevier Science & Technology: San Diego, CA, USA, 2019. [Google Scholar]

- Elavarasan, R.M. The Motivation for Renewable Energy and its Comparison with Other Energy Sources. A Review. Eur. J. Sustain. Dev. Res. 2018, 3, 1–19. [Google Scholar] [CrossRef]

- Jakstas, D. Chapter 5—What does energy security mean? In Energy Transformation towards Sustainability; Tvaronačienė, M., Ślusarczyk, B., Eds.; Elsevier: San Diego, CA, USA, 2019; pp. 99–112. [Google Scholar]

- Willrich, M. International Energy Issues and Options. Annu. Rev. Energy 1976, 1, 743–772. [Google Scholar] [CrossRef]

- Yergin, D. Energy Security in the 1990s. Foreign Aff. 1988, 67, 110–132. [Google Scholar] [CrossRef]

- Zajączkowska, M. The Energy Union and European Union Energy Security. Ekonomia I 2018, 17, 319–328. [Google Scholar] [CrossRef]

- Rhodes, J.A. Energy Security. Choice 2018, 55, 655. [Google Scholar]

- Sovacool, B.K.; Cooper, C.; Bazilian, M.; Johnson, K.; Zoppo, D.; Clarke, S.; Eidsness, J.; Crafton, M.; Velumail, T.; Raza, H.A. What Moves and Works: Broadening the Consideration of Energy Poverty. Energy Policy 2012, 42, 715–719. [Google Scholar] [CrossRef]

- Sovacool, B.K. Differing Cultures of Energy Security: An International Comparison of Public Perceptions. Renew. Sustain. Energy Rev. 2016, 55, 811–822. [Google Scholar] [CrossRef]

- International Energy Agency. Power Systems in Transition: Challenges and Opportunities Ahead for Electricity Security; OECD Publishing: Paris, France, 2021. [Google Scholar] [CrossRef]

- International Energy Agency. Energy Security in Asean 6; IEA Publications: Paris, France, 2019. [Google Scholar]

- Wei, Y.-M.; Liang, Q.-M.; Wu, G.; Liao, H. Energy Economics: Understanding Energy Security in China; Emerald Publishing Limited: Bingley, UK, 2019. [Google Scholar]

- Zhao, H. The Economics and Politics of China’s Energy Security Transition; Elsevier Science & Technology: San Diego, CA, USA, 2018; Available online: https://public.ebookcentral.proquest.com/choice/publicfullrecord.aspx?p=5509505 (accessed on 15 May 2021).

- Novogrockiene, J.; Siaulyte, E. (Eds.) Addressing Emerging Security Risks for Energy Networks in South Caucasus. In Proceedings of the NATO Advanced Research Workshop on Addressing Emerging Security Risks for Energy Flows over South Caucasus, Tbilisi, Georgia, 5–6 December 2016; Nato Science for Peace and Security Series, E, Human and Societal Dynamics. IOS Press: Amsterdam, The Netherlands, 2017; Volume 137. [Google Scholar]

- Amer, K. (Ed.) The Water, Energy, and Food Security Nexus in the Arab Region; Water Security in a New World; Springer: Cham, Switzerland, 2017. [Google Scholar]

- Boute, A. Energy Security along the New Silk Road: Energy Law and Geopolitics in Central Asia; Cambridge University Press: Cambridge, UK, 2019. [Google Scholar]

- Primova, R. The EU Internal Energy Market and Decarbonization. In Decarbonization in the European Union. Energy, Climate and the Environment; Dupont, C., Oberthür, S., Eds.; Palgrave Macmillan: London, UK, 2015. [Google Scholar]

- Hafner, M.; Tagliapietra, S. The European Gas Markets: Challenges and Opportunities; Palgrave Macmillan: Cham, Switzerland, 2017. [Google Scholar]

- Welsch, M. Europe’s Energy Transition: Insights for Policy Making; Elsevier Science: Saint Louis, MO, USA, 2017. [Google Scholar]

- Iovino, F.; Tsitsianis, N. Changes in European Energy Markets: What the Evidence Tells Us; Emerald Publishing Limited: Bingley, UK, 2020. [Google Scholar]

- European Environment Agency. Energy and Environment in the European Union: Tracking Progress towards Integration; Eea Report, No. 8/2006; Office for Official Publications of the European Communities: Luxembourg, 2006. [Google Scholar]

- Eikeland, P.O. EU Internal Energy Market Policy: Achievements and Hurdles. In Toward a Common European Union Energy Policy: Problems, Progress, and Prospects; Birchfield, V.L., Duffield, J.S., Eds.; Palgrave Macmillan: New York, NY, USA, 2011; pp. 13–40. [Google Scholar]

- Vázquez, A.D.; Peteves, S.; Soria, A. Integrated Research, Innovation and Competitiveness Strategy for the Energy Union. Int. Issues Slovak Foreign Policy Aff. 2016, 25, 17–30. [Google Scholar]

- Demirel, P.; Danisman, G.O. Eco-Innovation and Firm Growth in the Circular Economy: Evidence from European Small- and Medium-Sized Enterprises. Bus. Strategy Environ. 2019, 28, 1608–1618. [Google Scholar] [CrossRef]

- Birchfield, V.L.; Duffield, J.S. Toward a Common European Union Energy Policy: Progress, Problems, and Prospects, 1st ed.; Palgrave Macmillan: New York, NY, USA, 2011. [Google Scholar] [CrossRef]

- Haines, A.; Scheelbeek, P. European Green Deal: A Major Opportunity for Health Improvement. Lancet 2020, 395, 1327–1329. [Google Scholar] [CrossRef]

- Chan, K.; Anderson, E.; Chapman, M.; Jespersen, K.; Olmsted, P. Payments for Ecosystem Services: Rife With Problems and Potential—For Transformation Towards Sustainability. Ecol. Econ. 2017, 140, 110–122. [Google Scholar] [CrossRef] [Green Version]

- Clausen, L.; Rudolph, D. Renewable energy for sustainable rural development: Synergies and mismatches. Energy Policy 2020, 138, 111289. [Google Scholar] [CrossRef]

- Grinde, B.; Patil, G.G. Biophilia: Does Visual Contact with Nature Impact on Health and Well-Being? Int. J. Environ. Res Health Public Health 2009, 6, 2332–2343. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chang, K.G.; Sullivan, W.C.; Lin, Y.-H.; Su, W.; Chang, C.-Y. The Effect of Biodiversity on Green Space Users’ Wellbeing—An Empirical Investigation Using Physiological Evidence. Sustainability 2016, 8, 1049. [Google Scholar] [CrossRef] [Green Version]

- Hepburn, L.; Smith, A.C.; Zelenski, J.; Fahrig, L. Bird Diversity Unconsciously Increases People’s Satisfaction with Where They Live. Land 2021, 10, 153. [Google Scholar] [CrossRef]

- Ojala, M. Coping with Climate Change among Adolescents: Implications for Subjective Well-Being and Environmental Engagement. Sustainability 2013, 5, 2191–2209. [Google Scholar] [CrossRef] [Green Version]

- Sánchez-Bayón, A.; García-Ramos, M.A. A win-win case of CSR 3.0 for wellbeing economics: Digital currencies as a tool to improve the personnel income, the environmental respect & the general wellness. Rev. Estud. Coop. 2021, 138, 1–11. [Google Scholar] [CrossRef]

- OECDiLibrary. 5. Managing Environmental and Energy Transitions in Rural Areas; OECD iLibrary: Paris, France, 2021. [Google Scholar]

- Galliano, D.; Goncalves, A.; Triboulet, P. Eco-innovations in rural territories: Organizational dynamics and resource mobilization in low density areas. J. Innov. Econ. Manag. 2017, 3, 35–62. [Google Scholar] [CrossRef]

- OECD. Linking Renewable Energy to Rural Development; OECD: Paris, France, 2012. [Google Scholar]

- Sánchez-Bayón, A.; Lominchar, J. Labour relations development until the digital transition. J. Leg. Ethical Regul. Issues 2020, 23, 1–13. [Google Scholar]

- Sánchez-Bayón, A.; Trincado, E. Business and labour culture changes in digital paradigm. Cogito 2020, 12, 225–243. [Google Scholar]

- Huerta de Soto, J.; Sánchez-Bayón, A.; Bagus, P. Principles of Monetary & Financial Sustainability and Wellbeing in a Post-COVID-19 World: The Crisis and Its Management. Sustainability 2021, 13, 4655. [Google Scholar] [CrossRef]

- Jevons, W.S. The Theory of Political Economy; Macmillan & Company: London, UK, 1871. [Google Scholar]

- Hollander, S. Classical Economics, 2nd ed.; University of Toronto Press: Toronto, ON, Canada, 1992. [Google Scholar]

- Jonsson, F.A. Enlightenment’s Frontier: The Scottish Highlands and the Origins of Environmentalism. The Lewis Walpole Series in Eighteenth-Century Culture and History; Yale University Press: New Haven, CT, USA, 2013. [Google Scholar]

- Clark, B.; Foster, J.B. William Stanley Jevons and the Coal Question: An Introduction to Jevons’s “of the Economy of Fuel”. Organ. Environ. 2001, 14, 93–98. [Google Scholar] [CrossRef]

- Bauer, D.; Papp, K. Book Review Perspectives: John Polimeni, Kozo Mayumi, Mario Giampietro, & Blake Alcott, the Jevons Paradox and the Myth of Resource Efficiency Improvements. Sustain. Sci. Pract. Policy 2009, 5, 48–54. [Google Scholar]

- Jevons, W.S. The Coal Question, 2nd ed.; Macmillan and Company: London, UK, 1866. [Google Scholar]

- Alcott, B. Historical Overview of the Jevons paradox in the Literature. In The Jevons Paradox and the Myth of Resource Efficiency Improvements; Alcott, B., Polimeni, J.M., Mayumi, K., Giampietro, M., Eds.; Earthscan: London, UK, 2008; pp. 7–78. [Google Scholar]

- Alcott, B. Jevons’ Paradox. Ecol. Econ. 2005, 54, 9–21. [Google Scholar] [CrossRef]

- York, R. Ecological paradoxes: William Stanley Jevons and the paperless office. Hum. Ecol. Rev. 2006, 13, 143–147. [Google Scholar]

- Jevons, H.S. The British Coal Trade; Kegan Paul, Trench and Trübner: London, UK, 1915. [Google Scholar]

- Gallegati, M.; Mignacca, D. Jevons, sunspot theory and economic fluctuations. Hist. Econ. Ideas 1994, 2, 23–40. [Google Scholar]

- Jevons, W.S. Commercial crises and sun-spots. Nature 1878, 19, 33–37. [Google Scholar] [CrossRef] [Green Version]

- Jevons, W.S. Chapter VI, The Solar Period and the Price of Corn (1875). In Investigations in Currency and Finance; Macmillan: London, UK, 1909; pp. 194–205. [Google Scholar]

- Jevons, W.S. Chapter VII, The Periodicity of Commercial Crises and Its Physical Explanation (1878), with Postscript (1882). In Investigations in Currency and Finance; Macmillan: London, UK, 1909; pp. 206–220. [Google Scholar]

- Jevons, W.S. Chapter VII Commercial Crises and Sunspots Part I (1878). In Investigations in Currency and Finance; Macmillan: London, UK, 1909; pp. 221–234. [Google Scholar]

- Jevons, W.S. Chapter VII “Commercial Crises and Sunspots Part II (1879). In Investigations in Currency and Finance; Macmillan: London, UK, 1909; pp. 235–243. [Google Scholar]

- Cass, D.; Shell, K. Do Sunspots Matter? J. Polit. Econ. 1983, 91, 193–228. [Google Scholar] [CrossRef]

- Peart, S.J. Sunspots and Expectations: W. S. Jevons’s Theory of Economic Fluctuations. J. Hist. Econ. Thought 1991, 13, 243–265. [Google Scholar] [CrossRef]

- Jevons, H.S. The Sun’s Heat and Trade Activity; F. S. King and Son: London, UK, 1910. [Google Scholar]

- Jevons, H.S. The Causes of Fluctuations of Industrial Activity and the Price-Level. J. R. Stat. Soc. 1933, 96, 545–605. [Google Scholar] [CrossRef]

- Greening, L.; Greene, D.L.; Difiglio, C. Energy Efficiency and Consumption—The Rebound Effect—A Survey. Energy Policy 2000, 28, 389–401. [Google Scholar] [CrossRef]

- Herring, H. Does Energy Efficiency Save Energy? The Debate and Its Consequences. Appl. Energy 1999, 63, 209. [Google Scholar] [CrossRef]

- Berkhout, P.H.G.; Muskens, J.C.W.; Velthuijsen, J. Defining the Rebound Effect. Energy Policy 2000, 28, 425–432. [Google Scholar] [CrossRef]

- Henly, J.; Ruderman, H.; Levine, M.D. Energy saving resulting from the adoption of more efficient appliances: A follow-up. Energy J. 1988, 9, 163–170. [Google Scholar]

- Jones, C.T. Another look at U.S. passenger vehicle use and the rebound effect from improved fuel effciency. Energy J. 1993, 14, 99–110. [Google Scholar] [CrossRef]

- Khazzoom, J.D. Economic implications of mandated effciency standards for household appliances. Energy J. 1980, 1, 21–40. [Google Scholar]

- Sorrell, S.; Dimitropoulos, J. The Rebound Effect: Microeconomic Definitions, Limitations and Extensions. Ecol. Econ. 2008, 65, 636. [Google Scholar] [CrossRef]

- Mizobuchi, K. An Empirical Study on the Rebound Effect Considering Capital Costs. Energy Econ. 2008, 30, 2486–2516. [Google Scholar] [CrossRef]

- Velthuijsen, J.W. Determinants of Investments in Energy Conservation. Ph.D. Thesis, University of Groningen, Groningen, The Netherlands, 1995. [Google Scholar]

- Koopmans, C. NEMO: CPB’s New Energy Model. CPB Report 1997, 2, 34–37. [Google Scholar]

- Koopmans, C.C.; te Velde, D.W. Bridging the Energy Efficiency Gap: Using Bottom-Up Information in a Top-Down Energy Demand Model. Energy Econ. 2001, 23, 57–75. [Google Scholar] [CrossRef]

- Boom, J.T. Market Performance and Environmental Policy: A Scenario Study for a Market Oriented Environmental Policy; SEO Report No. 460; Foundation for Economic Research: Amsterdam, The Netherlands; ECOF: Groningen, The Netherlands, 1998. [Google Scholar]

- Jin, T.; Kim, J. A New Approach for Assessing the Macroeconomic Growth Energy Rebound Effect. Appl. Energy 2019, 239, 192–200. [Google Scholar] [CrossRef]

- Greene, D.L. Vehicle Use and Fuel Economy: How Big Is the “rebound” Effect? Energy J. 1992, 13, 117–143. [Google Scholar] [CrossRef]

- Greening, L.A.; Greene, D.L. Where Are We Going Wrong? Modeling the Effects of Energy Technology Gains; Draft Report September 24; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 1997. [Google Scholar]

- Musters, A.P.A. The Energy Economy Environment Interaction and the Rebound Effect; Netherlands Energy Research Foundation: Petten, The Netherlands, 1995. [Google Scholar]

- Barker, T.; Dagoumas, A.; Rubin, J. The Macroeconomic Rebound Effect and the World Economy. Energy Eff. 2009, 2, 411–427. [Google Scholar] [CrossRef]

- Chan, N.W.; Gillingham, K. The Microeconomic Theory of the Rebound Effect and Its Welfare Implications. J. Assoc. Environ. Resour Econ 2015, 2, 133–159. [Google Scholar] [CrossRef] [Green Version]

- Saunders, H. The Khazzoom-Brookes Postulate and Neoclassical Growth. Energy J. 1992, 13, 131–148. [Google Scholar] [CrossRef]

- Binswanger, M. Technological Progress and Sustainable Development: What About the Rebound Effect? Ecol. Econ. 2001, 36, 119–132. [Google Scholar] [CrossRef]

- Zhang, Y. Energy Rebound Effect Analysis Based on Technological Progress. Conf. Ser. Earth Environ. Sci. 2019, 300. [Google Scholar] [CrossRef]

- Jorgenson, D.; Fraumeni, B. Relative prices and technical change. In Modeling and Measuring Natural Resource Substitution; Berndt, E.R., Field, B.C., Eds.; MIT Press: Boston, MA, USA, 1981. [Google Scholar]

- Sue Wing, I. Explaining the Declining Energy Intensity of the U.S. Economy. Resour. Energy Econ. 2008, 30, 21. [Google Scholar] [CrossRef] [Green Version]

- Sue Wing, I.; Eckaus, R.S. The Implications of the Historical Decline in Us Energy Intensity for Long-Run CO2 Emission Projections. Energy Policy 2007, 35, 5267. [Google Scholar] [CrossRef] [Green Version]

- Jorgenson, D.W.; Griliches, Z. The Explanation of Productivity Change. Rev. Econ. Stud. 1967, 34, 249–283. [Google Scholar] [CrossRef]

- Freeman, R.; Yearworth, M.; Preist, C. Revisiting Jevons’ Paradox with System Dynamics: Systemic Causes and Potential Cures. J. Ind. Ecol. 2016, 20, 341–353. [Google Scholar] [CrossRef] [Green Version]

- Sorrell, S. Jevons Paradox Revisited: The Evidence for Backfire from Improved Energy Efficiency. Energy Policy 2009, 37, 1456. [Google Scholar] [CrossRef]

- Thomas, B.A.; Azevedo, I.L. Estimating Direct and Indirect Rebound Effects for U.S. Households with Input-Output Analysis Part 1: Theoretical Framework. Ecol. Econ. 2013, 86, 199–210. [Google Scholar] [CrossRef]

- Ryan, L.; Campbell, N. Spreading the net: The multiple benefits of energy efficiency improvements. IEA Energy Pap. 2012, 27–49. [Google Scholar] [CrossRef]

- Hertwich, E.G. Consumption and the Rebound Effect: An Industrial Ecology Perspective. J. Ind. Ecol. 2005, 9, 85–98. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Liu, H. A Study on the Energy Rebound Effect of China’s Residential Building Energy Efficiency. Energy Build. 2015, 86, 608–618. [Google Scholar] [CrossRef]

- Evans, A.; Schäfer, A. The Rebound Effect in the Aviation Sector. Energy Econ. 2013, 36, 158–165. [Google Scholar] [CrossRef] [Green Version]

- Wang, Z.; Lu, M. An empirical study of direct rebound effect for road freight transport in China. Appl. Energy 2014, 133, 274–281. [Google Scholar] [CrossRef]

- Schleich, J.; Mills, B.; Dütschke, E. A Brighter Future? Quantifying the Rebound Effect in Energy Efficient Lighting. Energy Policy 2014, 72, 35–42. [Google Scholar] [CrossRef] [Green Version]

- Font Vivanco, D.; Freire-González, J.; Kemp, R.; van der Voet, E. The Remarkable Environmental Rebound Effect of Electric Cars: A Microeconomic Approach. Environ. Sci. Technol. 2014, 48, 12063–12072. [Google Scholar] [CrossRef] [Green Version]

- Linn, J. The Rebound Effect for Passenger Vehicles. Energy J. 2016, 37, 257–288. [Google Scholar] [CrossRef] [Green Version]

- Chai, J.; Yang, Y.; Wang, S.; Lai, K.K. Fuel Efficiency and Emission in China’s Road Transport Sector: Induced Effect and Rebound Effect. Technol. Forecast. Soc. Chang. 2016, 112, 188–197. [Google Scholar] [CrossRef]

- De Borger, B.; Mulalic, I.; Rouwendal, J. Measuring the Rebound Effect with Micro Data. J. Environ. Econ. Manag. 2016, 79, 1–17. [Google Scholar] [CrossRef]

- Llorca, M.; Jamasb, T. Energy Efficiency and Rebound Effect in European Road Freight Transport. Transp. Res. Part A 2017, 101, 98–110. [Google Scholar] [CrossRef] [Green Version]

- Freire-González, J. A New Way to Estimate the Direct and Indirect Rebound Effect and Other Rebound Indicators. Energy 2017, 128, 394–402. [Google Scholar] [CrossRef]

- Wei, T.; Liu, Y. Estimation of Global Rebound Effect Caused by Energy Efficiency Improvement. Energy Econ. 2017, 66, 27–34. [Google Scholar] [CrossRef]

- Chakravarty, D.; Dasgupta, S.; Roy, J. Rebound Effect: How Much to Worry? Curr. Opin. Environ. Sustain. 2013, 5, 216–228. [Google Scholar] [CrossRef]

- Gottron, F. Energy Efficiency and the Rebound Effect: Does Increasing Efficiency Decrease Demand? (PDF). National Council for Science and the Environment. 2001. Available online: http://www.policyarchive.org/handle/10207/bitstreams/3492.pdf (accessed on 15 May 2021).

- Hirsch, R.L.; Bezdek, R.; Wendling, R. Peaking of World Oil Production and Its Mitigation. Aiche J. 2006, 52, 2. [Google Scholar] [CrossRef]

- Ayres, R.U.; Warr, B. Two Paradigms of Production and Growth; INSEAD: Fontainbleau, France, 2002. [Google Scholar]

- Barro, R.J.; Sala-I-Martin, X. Economic Growth; McGraw-Hill: New York, NY, USA, 1995. [Google Scholar]

- Denison, E.F. Sources of Economic Growth in United States and the Alternatives before Us; Committee for Economic Development: New York, NY, USA, 1962. [Google Scholar]

- Gullickson, W.; Harper, M.J. Multi factor productivity in US manufacturing 1949–1983. Mon. Labor Rev. 1987, 110, 18–28. [Google Scholar]

- Jones, C.J. Introduction to Economic Growth; W.W. Norton: New York, NY, USA; London, UK, 2001. [Google Scholar]

- Beaudreau, B.C. Energy and Organisation: Group and Distribution Re-Examined; Greenwood Press: Westport, CT, USA, 1998. [Google Scholar]

- Beaudreau, B.C. Engineering and economic growth. Struct. Chang. Econ. Dyn. 2005, 16, 211–220. [Google Scholar] [CrossRef]

- Hall, C.A.S.; Cleveland, C.J.; Kaufmann, R.K. Energy and Resource Quality: The Ecology of the Economic Process; Wiley Interscience: New York, NY, USA, 1986. [Google Scholar]

- Kaufmann, R.K. The Relation between Marginal Product and Price in Us Energy Markets—Implications for Climate Change Policy. Energy Econ. 1994, 16, 145. [Google Scholar] [CrossRef]

- Ruzzenenti, F.; Basosi, R. Energy growth, complexity and efficiency. In Energy Efficiency; Palm, J., Ed.; Sciyo: Rijeka, Croatia, 2007. [Google Scholar]

- Cleveland, C.J.; Ruth, M. Indicators of Dematerialization and the Materials Intensity of Use. J. Ind. Ecol. 1998, 2, 15–50. [Google Scholar] [CrossRef]

- Cleveland, C.J.; Kaufmann, R.K.; Stern, D.I. Aggregation and the role of energy in the economy. Ecol. Econ. 2000, 32, 301–317. [Google Scholar] [CrossRef]

- Richmond, A.K.; Kaufmann, R.K. Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecol. Econ. 2006, 56, 176–189. [Google Scholar] [CrossRef]

- Stern, D.I. The Rise and Fall of the Environmental Kuznets Curve. World Dev. 2004, 32, 1419. [Google Scholar] [CrossRef]

- Stern, D.I.; Cleveland, C.J. Energy and Economic Growth; Rensselaer Polytechnic Institute Troy: New York, NY, USA, 2004. [Google Scholar]

- Díaz, A.; Puch, L.A. Investment, Technological Progress and Energy Efficiency. J. Macroecon. 2019, 19. [Google Scholar] [CrossRef] [Green Version]

- Marrero, G.A. Greenhouse Gases Emissions, Growth and the Energy Mix in Europe. Energy Econ. 2010, 32, 1356–1363. [Google Scholar] [CrossRef]

- Barrera-Santana, J.; Marrero, G.A.; Puch, L.A.; Díaz, A. CO2 Emissions and Energy Technologies in Western Europe. Series 2021. [Google Scholar] [CrossRef]

- Wei, T.; Zhou, J.; Zhang, H. Rebound Effect of Energy Intensity Reduction on Energy Consumption. Resour. Conserv. Recycl. 2019, 144, 233–239. [Google Scholar] [CrossRef]

- Torrie, R.D.; Stone, C.; Layzell, D.B. Reconciling Energy Efficiency and Energy Intensity Metrics: An Integrated Decomposition Analysis. Energy Eff. 2018, 11, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Bolt, J.; Inklaar, R.; de Jong, H.; van Zanden, J.L. Rebasing ‘Maddison’: New Income Comparisons and the Shape of Long-Run Economic Development; Maddison Project Working Paper 10; University of Groningen: Groningen, The Netherlands, 2018. [Google Scholar]

- Ehrhardt-Martinez, K.; Laitner, J.A. The Size of the U.S. Energy Efficiency Market: Generating a More Complete Picture; American Council for a More Energy-Efficient Economy: Washington, DC, USA, 2008. [Google Scholar]

- Ehrhardt-Martinez, K.; Laitner, J.A. Rebound, Technology and People: Mitigating the Rebound Effect with Energy-Resource Management and People-Centered Initiatives. In Proceedings of the 2010 ACEEE Summer Study on Energy Efficiency in Buildings, Pacific Grove, CA, USA, 15–20 August 2010. [Google Scholar]

- Dorner, Z. A Behavioral Rebound Effect. J. Environ. Econ. Manag. 2019, 98. [Google Scholar] [CrossRef]

- Wright, A.J.; Formby, J.R.; Holmes, S.J. A Review of the Energy Efficiency and Other Benefits of Advanced Utility Metering; EA Technology: Chester, UK, 2000. [Google Scholar]

- Freire-González, J.; Puig-Ventosa, I. Energy Efficiency Policies and the Jevons Paradox. Int. J. Energy Econ. Policy 2015, 1, 69–79. [Google Scholar]

- Santarius, T.; Walnum, H.J.; Aall, C. (Eds.) Rethinking Climate and Energy Policies: New Perspectives on the Rebound Phenomenon; Springer: Cham, Switzerland, 2016. [Google Scholar]

- Westergård, R. One Planet Is Enough: Tackling Climate Change and Environmental Threats through Technology; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Wackernagel, M.; Rees, W.E. Perceptual and Structural Barriers to Investing in Natural Capital: Economics from an Ecological Footprint Perspective. Ecol. Econ. 1997, 20, 3. [Google Scholar] [CrossRef]

- Owen, D. Annals of Environmentalism the Efficiency Dilemma What’s the Best Way to Use Less Energy? New Yorker 2010, 78, 78. [Google Scholar]

- Hilty, L.M.; Arnfalk, P.; Erdmann, L.; Goodman, J.; Lehmann, M.; Wäger Patrick, A. The Relevance of Information and Communication Technologies for Environmental Sustainability—A Prospective Simulation Study. Environ. Model. Softw. 2006, 21, 1618–1629. [Google Scholar] [CrossRef]

- Fischer-Kowalski, M.; Gaube, V.; Rainer, G. Mefaspace: A Model Predicting Freight Transport from Materials Flows, and Transport Activity in Europe. J. Ind. Ecol. 2008, 10, 15–35. [Google Scholar] [CrossRef]

- Amado, N.B.; Sauer, I.L. An Ecological Economic Interpretation of the Jevons Effect. Ecol. Complex. 2012, 9, 2–9. [Google Scholar] [CrossRef]

- Laitner, J.A.; De Canio, S.J.; Peters, I. Incorporating Behavioural, Social, and Organizational Phenomena in the Assessment of Climate Change Mitigation Options. Society, Behaviour, and Climate Change Mitigation. Adv. Glob. Chang. Res. 2003, 8, 1–64. [Google Scholar]

- Brookes, L. Energy efficiency and the greenhouse effect. Energy Environ. 1990, 14, 318–333. [Google Scholar] [CrossRef]

- Brookes, L.G. The greenhouse effect: The fallacies in the energy efficiency solution. Energy Policy 1990, 18, 199–201. [Google Scholar] [CrossRef]

- Brookes, L.G. Energy efficiency fallacies revisited. Energy Policy 2000, 28, 355–366. [Google Scholar] [CrossRef]

- Brookes, L.G. Energy efficiency fallacies—A postscript. Energy Policy 2004, 32, 945–947. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trincado, E.; Sánchez-Bayón, A.; Vindel, J.M. The European Union Green Deal: Clean Energy Wellbeing Opportunities and the Risk of the Jevons Paradox. Energies 2021, 14, 4148. https://doi.org/10.3390/en14144148

Trincado E, Sánchez-Bayón A, Vindel JM. The European Union Green Deal: Clean Energy Wellbeing Opportunities and the Risk of the Jevons Paradox. Energies. 2021; 14(14):4148. https://doi.org/10.3390/en14144148

Chicago/Turabian StyleTrincado, Estrella, Antonio Sánchez-Bayón, and José María Vindel. 2021. "The European Union Green Deal: Clean Energy Wellbeing Opportunities and the Risk of the Jevons Paradox" Energies 14, no. 14: 4148. https://doi.org/10.3390/en14144148

APA StyleTrincado, E., Sánchez-Bayón, A., & Vindel, J. M. (2021). The European Union Green Deal: Clean Energy Wellbeing Opportunities and the Risk of the Jevons Paradox. Energies, 14(14), 4148. https://doi.org/10.3390/en14144148