Abstract

Technology, along with political and economic factors, is one of the main drivers of the future of banking. Banking managers urgently need to know technological trends to make strategic decisions, know the future accurately, and make the most of existing opportunities. Industry 5.0 is the dream of modern banking, based on strategies for successful entry into the field in a completely different way. Using a complex literature survey, 49 indicators were identified to enter Industry 5.0 and were classified into three categories of insignificant indicators, essential indicators, and very necessary indicators. Then, based on the opinions of 10 experts from ten countries with modern banking in the world, the researchers focused on 14 essential indicators. To analyze the drawn space, structural-interpretive modeling and MICMAC analysis were used and the model was classified into nine levels. The results showed that low-level indices are the most influential (TMBE and HEMS) and higher-level indices are the most influenced (PZM and RNC). Finally, researchers analyzed how to use new technologies in the banking industry with the entry of the Industry 5.0 and revealed what the characteristics of the impact of these indicators on entering Industry 5.0 are.

1. Introduction

In recent decades, the emergence of new technologies has played an important role in increasing the efficiency of organizations [1]. Technological leaps from the beginning of industrialization have caused extensive changes in the process of business development. Hence, these effects can be introduced as industrial revolutions. Organizations are interested in using the benefits of innovation to meet the needs of their customers as well as to obtain useful information from them [2]. In the course of the industrial revolutions, five major changes in industry throughout history are considered. While Industry 5.0 has been the latest major industry development and is considered the next industrial development, its goal is to use the creativity of human experts in collaboration with efficient, intelligent, and accurate machines, to achieve production solutions with efficient and user-friendly resources compared to Industry 4.0 [3].The invention of the steam engine (between 1760 and 1840) defines the first industrial revolution. The second industrial revolution is defined by the use of electricity in industrial processes (between 1870 and 1969). The third revolution began in the 1970s with the use of information and communication technology and industrial automation, and the fourth industrial revolution (Industry 4.0) emerged from several developed countries, in a public-private initiative in Germany to build smart factories by integrating physical objects with digital technologies [4,5] The main element that describes the stages of Industry 4.0 is the profound change in the connection of production systems due to the integration of information and communication technology [3]. The Internet of Things [6], machines in cyber-physical systems [7], big data analysis [8], 3D printing [9], advanced robotics [10], intelligent sensors [11], augmented reality [12], cloud computing [13], artificial intelligence [14], nanotechnology [15], and human-machine interfaces [16,17,18]. Progress towards Industry 4.0 has had a significant impact on the industry, and this is based on the establishment of intelligent factories, intelligent products, and intelligent services based on the Internet of Things and services connected to the industrial Internet [17].Strategic initiatives have been introduced in many countries, for example, Industrial Internet Consortium (USA), Industry 4.0 (Italy), Production 2030 (Sweden), Made in China 2025, and Society 5.0.

In their study, Xu et al. [19] have illustrated that the beginning of the transition from Industry 4.0 to Industry 5.0 is understood to recognize the power of industry to achieve societal goals beyond jobs and growth, to become a resilient provider of prosperity by making production respect the boundaries of our planet and placing the wellbeing of the industry worker at the center of the production process [20,21].Industry 5.0 is now designed to use the unique creativity of human experts to work with powerful, intelligent, and precise machines. Many technical dreamers believe that Industry5.0 will bring the human touch back to the manufacturing industry [22]. Industry 5.0 is expected to integrate high-speed, high-precision machines with critical and human cognitive thinking. Mass personalization is another important affordance of Industry 5.0 as customers can choose personalized and customized products according to their tastes and needs. Industry 5.0 significantly increases production efficiency, creating human-machine adaptability, and enabling responsibility for interaction and continuous monitoring activities. The goal of human-machine cooperation is to increase production at a high rate. Industry 5.0 can increase production quality by assigning repetitive and uniform tasks to robots/machines and tasks that require critical thinking for humans [3].

Although we have not yet fully transitioned from Industry 4.0 to Industry 5.0, and perhaps many fundamental changes are needed for organizations, some researchers have gone a step further and conducted effective research in this area [6]. Well highlighted the role of industrial revolutions in service organizations, especially banks; they showed an outstanding and practical roadmap. Nahavandi et al. [23] in their research article mentioned that Industry 5.0 meets the challenges. The authors have defined robots as intertwined with the human brain and defined them as collaborators. Shahabi et al. [24] in their study have emphasized the impact of Industry 5.0 on the financial sector. He considered the impact of artificial intelligence to be very effective in the emergence of this revolution. Broo et al. [25] in their paper concluded that to meet the challenges of the fifth industrial revolution skills must overcome change, and the four following strategies must be developed: lifelong learning and interdisciplinary training (1), sustainability, flexibility, and design modules, (2), human-centered periods of practical data mastery and management (3), and human-agent interaction/machine/robot/computer experiences (4). Moreover [2] have also conducted a research study on Industry 5.0. In this work, survey-based training was provided on supporting technologies and potential applications of Industry 5.0. This work began by defining some of the concepts of Industry 5.0 from the perspective of the industrial and academic communities, and then some of the potential applications of Industry 5.0 such as smart healthcare, cloud generation, supply chain management, production, etc., were discussed. This was followed by a discussion about activating the keys. Doyle-Kent and Kopacek [26] clearly stated that in the future banking system, Industry 5.0 will be the next industrial revolution and will originate from industrial revolution 4.0. Collaborative robotics will play an important role in providing banking services by enabling humans and robots to work together. Paschek et al. [27] have answered specific questions in their paper. They state that Industry 5.0 is a clear shift from mass automation to the capability enhancement process, and human resources move to the next level to achieve personalization processes by product customization. As a result, future questions need to be answered, such as: what skills are needed and should be developed, what kind of rules between human-machine interactions should be defined, and what effect AI may have, and what causes conflict between humans and artificial intelligence.

However, due to industrial features such as banking, you have to be prepared to enter Industry 5.0. A proverb attributed to Darwin argues: “This is not the strongest species or the most intelligent species that has survived, but the best species for a change.” This statement applies to banking [28]. Accordingly, banks, as one of the largest active industries, to take advantage of the existing conditions must seek to create an integrated system to achieve solutions to facilitate the banking and mobile banking processes. However, not because of new inventions, but because of the maturity and growth of new technologies such as artificial intelligence and virtual reality and voice recognition systems, which together are a powerful team for advancing banking services and solving modern banking problems. They are resetting their strategies [29]. Banking is not necessarily undertaken in banks. Banking should become part of the business activities and tasks of all organizations and individuals. Typical activities should include banking whenever and wherever necessary. Non-financial transactions must record bank transactions clearly for the customer. This does not mean that all businesses or individuals should become banks. That is, banking transactions should be part of their normal activities. The preparation and processing of this transaction should usually be conducted by an external entity that, if necessary, has a bank license to assure the customer of the reliability and trust worthiness of the transaction. In other words, the center of the transaction should be the customer and their needs, not the bank. From an internal perspective, the operation must be performed by an actor who can be a robot, an individual, and in most cases a combination of the two (a Cobot). The robot must have artificial intelligence (AI). This view indicates the importance of cooperation between the individual and the machine. In this new perspective, artificial intelligence is essential. Banking 5.0 was born out of an industrial revolution determined by artificial intelligence, like the previous four industrial revolutions determined by other powerful technologies. The 2020 epidemic is pushing even harder to transform Banking 5.0 and to make it more agile, responsive, and relevant. In a survey of CEOs, 63% said the corona crisis was accelerating their technology investment despite financial pressures. One of the legacies of the epidemic could be the acceleration of the financial institution’s transition to Banking 5.0. This transfer brings challenges [29].

Banking 5.0 brings a cultural transition to customers. This approach must shift from merely passive to preventive, with a wide range of new services and products, new business models, and more attention to default prevention. Customer needs, knowledge, and expectations have expanded exponentially over the years. Financial institutions need to adapt to the needs of their customers. In an age of urgency, constant change, and overwhelming choices in which loyalty is no longer certain, it must expand beyond its core products and services if it is to maintain and increase its customer base. It must innovate and change its approach. Understanding who bank customers are and their needs are articulated or implied are crucial. Table 1 compares the banking model in Industry 5 with the past [30].

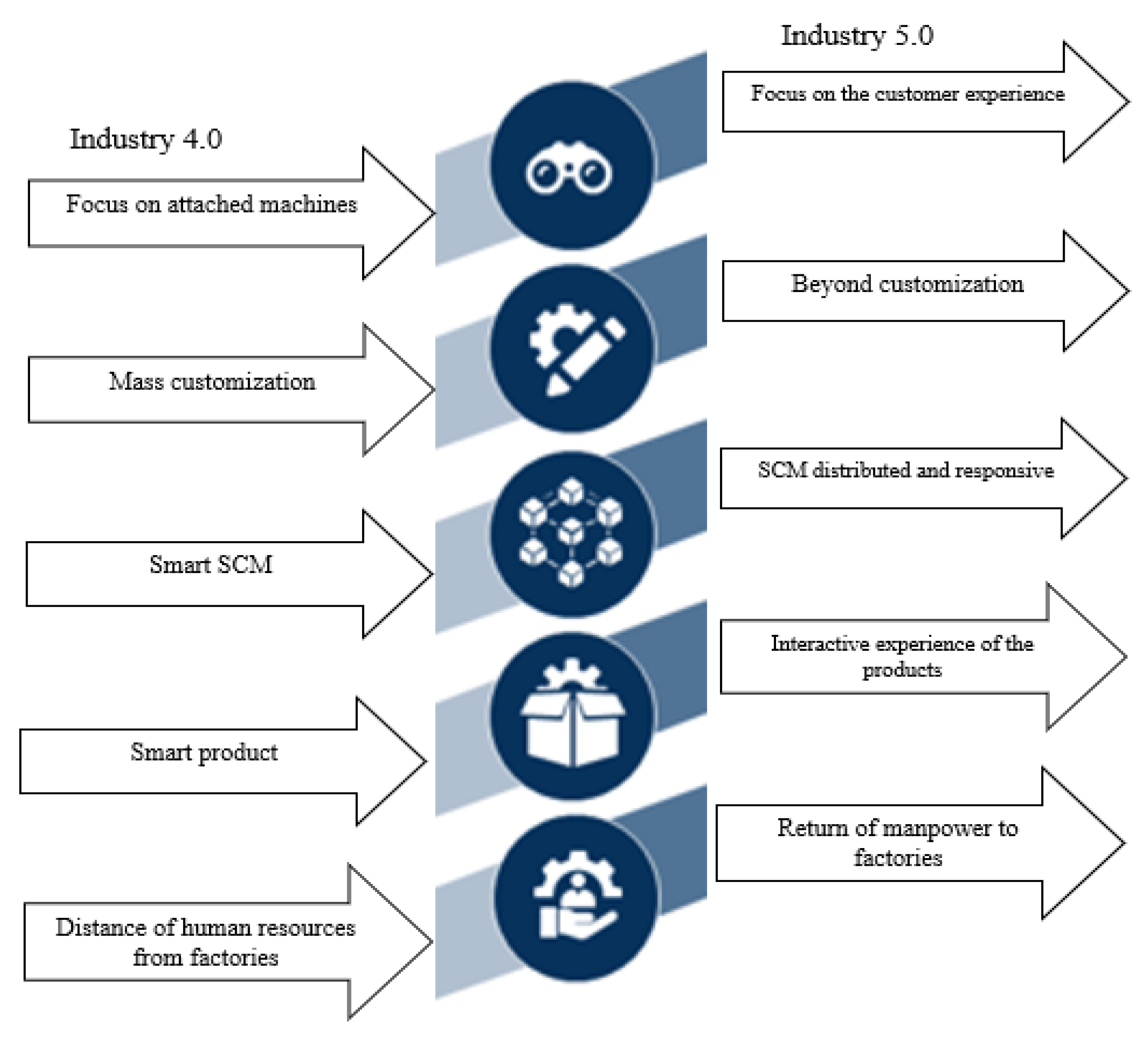

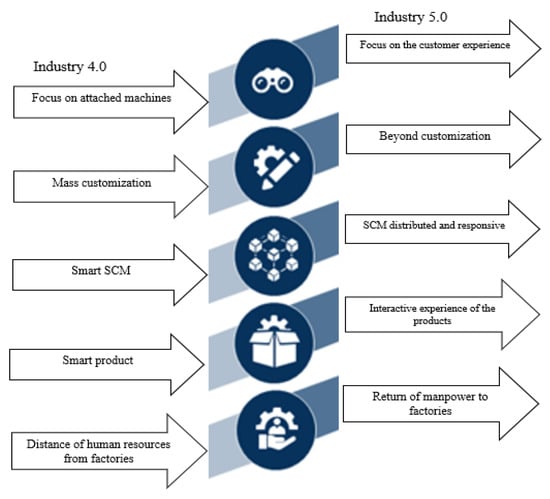

Table 1.

Banking 5.0 compared to the past [31].

In classifying bank developments over the past few decades, the Internet has helped first-generation banking become second-generation banking, and with the rapidly growing popularity of smartphones, third-generation banking has emerged. Now, third-generation banking is moving to fourth-generation banking, but not because of new inventions, but because of the maturity and growth of new technologies such as artificial intelligence and virtual reality, and voice recognition systems, which together is powerful for advancing banking services and solving modern problems of banks that are reshaping their business strategies towards digital banking to achieve rapid growth in financial market development [32]. Meher et al. [33] have defined digital banking such as the “transformation of physical banking wherein customers have to be present in the bank branch for banking transactions such as checking account balance, funds transfer etc.”, considering its importance in the case of financial systems. Globally, however, we are currently in the fourth industrial revolution or Industry 4.0. There are significant academic publications on Industry 4.0, including on the IoT, big data analytics, 3D printing, advanced robotics (automation), smart sensors, augmented reality, cloud computing, energy storage, artificial intelligence or machine learning, nanotechnology, human-machine interfaces, mobile programming. In anticipation of the Fifth industrial revolution, there is very little literature on the subject right now [26]. Industry 5.0 will be very automated, but there is a risk that humans will become unemployed unless they can be upgraded to the high technical level required to interact with this automation. Education is very important and research has been conducted to examine how human beings become proficient in this ever-changing dynamic environment, which of course is only one of the problems. Figure 1 provides a comparison between the concepts of the fourth and fifth industrial revolution Therefore, given the difficulties of the path for banks to enter the fifth industrial revolution, it is very important to carefully examine issues such as the problems, obstacles, and solutions to move banks as quickly as possible to transform the processes.

Figure 1.

Comparison of concepts in Industry 4.0 to 5.0 [34].

Therefore, the following questions have been formed in the minds of researchers and this article has been written to answer them:

- -

- What are the indicators of industrial revolution 5.0 for successful entry into Banking 5?

- -

- What connection can be found between the identified indicators?

- -

- Which indicators should be focused on for successful word Banking 5.0?

The Idea of Industry 5.0

In general, Germany and Japan have focused on the various dimensions of the fifth generation of industry and the characteristics of the next wave of the industrial revolution. The root of the fifth-generation industry goes back to the concept of the fourth-generation industry, which was introduced in Germany for the first time in 2011 as a landmark project and part of the country’s advanced technology strategy, which was jointly established in the field of business, science and decision making. This concept is primarily concerned with how and to what extent the country has progressed during the first decade of the 21st century, and how it can be more effective in the coming decades to stabilize mainly the number of workers in the manufacturing sector. In 2018, when the Industry 5.0 concept was proposed, Özdemir and Hekim [35] wrote a paper reporting the birth of Industry 5.0; they expressed their opinion that Industry 4.0 is a high-tech strategy to automate manufacturing using the Internet of Things to create smart factories, and that this extreme automation still has many drawbacks. Thus, they propose Industry 5.0, which democratizes the knowledge co-production of big data based on the new concept of symmetric innovation. Their proposed Industry 5.0 leverages the Internet of Things, but unlike previous automation systems, the innovation ecosystem design has a three-dimensional (3D) symmetry. In addition, in a research letter provided by Haleem and Javaid [36] the application of Industry 5.0 in orthopedics was briefly discussed and, since then, the concept of Industry 5.0 has become more widespread.

In addition to meeting economic needs, this concept emphasizes the ecological and specific needs of green products that lead to industrial realization with zero and energy-efficient carbon rates. In Japan, too, the concepts of fifth-generation society and fifth-generation industry are interrelated in that both concepts point to a fundamental shift in society and the economy toward a new paradigm. The concept was then popularized by the Japanese government. Japan has essentially expanded the dimensions of digitalization and change, which were primarily used at the level of individual organizations and sections of society into its comprehensive national transformation strategy, policy, and even philosophy of governance. The comprehensive concept refers to how people make sure that their lives are directly related to how they build their community.

2. Theoretical Background

Researchers have been seriously discussing Industry 5.0 since 2017 [23,27,37]. There are different views on Industry 5.0. In an article, Motieko et al. [3] assessed the strengths and potentials of Industry 5.0. This fascinating study discusses in detail the potential applications of Industry 5.0, such as smart healthcare, cloud generation, supply chain management, and production generation. Subsequently, some of the technologies supporting Industry 5.0, such as edge computing, digital twins, participatory robots, the Internet of Things, blockchain, and 6G networks and beyond have been discussed. Some futurists argue that Industry 4.0 is essentially about connecting devices to each other, while Industry 5.0 discusses cooperation between humans and machines at different factory levels [38]. Gotfredsen [39] lists the benefits of a joint human-machine workforce related to the creative human touch in production rather than the production of standard robotics. With this, new jobs will be created and human workers will better understand their role on the factory floor. According to Ostergard [40] Industry 5.0 is the return of humans working on the factory floor. Randall [41] argues that although Germany is leading the fourth industrial revolution, North America is unique in the lead of the next industrial revolution, Industry 5.0. Randall [41] and many other researchers share the vision of human-machine collaboration for Industry 5.0. There is a lot of discussion and comment on the Internet about Industry 5.0 However, Johansson [37] argues that the two industrial revolutions are very close to each other and may be considered as a concept. Thus, Industry 5.0 encompasses both human-machine connectivity and cooperation. Industry 5.0 has three main elements: human-centeredness, stability, and resilience. It also states that the historical model, which is profit-oriented, “does not accurately calculate environmental and social costs and benefits.” For the industry to become a provider of real prosperity, the definition of its true purpose must include social, environmental, and social considerations. This new and emerging model must include what they call “responsible innovation”. Johansson [37] defines issue this as having the dual goal of increasing cost-effectiveness (maximizing profits) as well as increasing the well-being of all those involved: investors, workers, consumers. For instance, Soni et al. [42] investigated the impact of financial distress on investor’s behavior in order to accurately forecast corporate bankruptcy. However, for this dynamic and ever-changing environment, skill is required and the design of any social and technical system is complex. One of the most important aspects of Industry 5.0 was finding a protocol to help small to medium-sized enterprises transition to automated and semi-automated systems. The focus will be on redesigning the work by optimizing the human element in line with the company’s strategic values. Therefore, for the success of this new system, it must be ensured that “human needs” have the same priority as the selected technology. If work was to be considered successful, these “human needs” must play a key role in “system design” [26].

In 2020, Ernst and Young surveyed several Swiss financial institutions. Most banks were convinced that a fundamental structural change had begun in the financial industry. In 2007, 73% agreed. This figure was 88% in 2019 and probably much higher in 2020. Most banks (60%) agree that the most important lever for growing a profitable income is to improve customer focus. In total, twenty-five of the surveyed banks believe that the key is product-oriented criteria such as different service packages (19%). The so-called digital evolution is often (but not exclusively) driven by digitization [43]. This is the ability to convert existing products or services into digital ones and offer benefits over tangible products [44]. Implementing innovative solutions is not enough to ensure the success of anorganization. Redesigning the basis of the business model and adapting it to customers and the rules of the digital age is crucial. The idea of a new organization is essential to be able to seize the opportunities that digital transformation offers. This process should cover every aspect of the organization, from the organizational chart to the corporate culture, from the business model to the leadership style, starting with the vision and culture of the financial institution. In the world of VUCA (volatile, unpredictable, complex, and ambiguous), financial institutions need to rethink how they interact with digital solutions to overcome environmental challenges and seize market opportunities. For example, some organizations may use different generations of personnel to create a digital knowledge pool with experienced resources. This approach can change the whole culture of the organization and strengthen the way people work in teams, both with internal staff and partners.

The question of whether robots will take our job in the future is always asked in human societies. Will we not drive anymore? Is privacy lost? These questions arise from the current phenomena of the fourth industrial revolution. In the future, in the fifth period, the riddle of human-machine communication will be solved based on artificial intelligence, and such questions will no longer arise. Smartphones and applications are becoming technologies that live in our bodies. Technology can be like a virtual assistant, a part of our being as a part of the brain that this virtual assistant can orient in our ears, suggest a good restaurant for dinner, and remind us of our appointment, but with more precision and without forgetting. Better than what is going on in our minds right now. Machines will be at our service; sensors collect data, computers and artificial intelligence quickly analyze them, make the best decisions based on algorithms, and transmit those decisions to robots and machines. In this way, human beings are exempted from repetitive tasks and job fields are created based on creativity and the optimization of systems and methods. Unlike the fourth revolution, which focuses on automation, in the future the independent thinking of the machine will be considered. Robots will change from programmable machines to partner machines called “Cobot”, machines that use the Internet of Things and big data. What we now see in the fifth-generation Internet and the Internet of Things is a prelude to a new era. Another prediction for the fifth period is the use of biological resources for industrial purposes to balance ecology, industry, and trade. These include renewable biological resources and the conversion of these resources into value-added products, such as food, bio-based products, and bioenergy. Printing biological organs and copying the map of the human genome is a dream that will come true in the future.

Although different experts have different explanations for the fifth industrial revolution, most of them agree that the fifth period is based on the industry 4.0. Looking at history, we find that every revolution has formed the basis of the next revolution; Thus, we can expect the fifth revolution to be made during the fourth revolution, but with the difference that it will be one step ahead. An article prepared in collaboration with the World Economic Forum states that “contrary to the trend of the previous revolution, the fourth, which was towards dehumanization, the best methods of technology and innovation to serve humanity will be created by the fifth revolution. “In the fifth industrial revolution, humans and machines will dance together.” With this in mind, we can predict the fifth industrial revolution as a revolution (artificial intelligence) with the potential for quantum computing that brings humans and machines closer together in the workplace. Industry 5.0 is about the use of the unique features of artificial intelligence by employers and employees, who will have more equipment for better and more informed decisions. Artificial intelligence is becoming more prominent with 50%of workers currently using some form of artificial intelligence at work. However, 76% of workers (and 81% of HR leaders) find it challenging to keep up with the pace of technological change in the workplace. Now the fundamental question arises as to how the fifth industrial revolution brought humanity back into the spotlight.

Industry 5.0 cares more about human intelligence than ever before. Even today in the battle for talent, artificial intelligence enables employers to better observe and match the characteristics of individuals. The fifth industrial revolution offers you many benefits so that volunteers can look for work with a more personalized experience. According to a Forbes article, “34% of HR leaders invest in manpower learning and workforce change as part of their strategy for future work preparation!” The fifth industrial revolution also removes human resource teams from the bulk of day-to-day management. This gives them time to adapt to the needs of talent identification and also allows them to focus on the growth and productivity of their organization.

“Women have always been at the forefront of leading movements,” says Martha Plimpton. This is true even in Industry 5.0.Industry 5.0 will play a key role in shaping the role of women. By employing jobs impartially, women and girls around the world will become more empowered.

During the first industrial revolution, although the productivity of each worker expanded, their real wages were stagnant for about 50 years. This silence was called Engels’ pause. It is estimated that Industry 5.0 can prevent such a recession. Although Industry 5.0 takes away from repetitive tasks, it opens the door to curiosity, creativity, empathy, and judgment to ensure a balance between people and technology.

We no longer want to work routinely. The way we work is changing dramatically. As our job preferences and schedules change, so do organizations. Certainly, the fifth industrial revolution will change this even more. New employees no longer have to read a lot of documents or attend meetings to get accurate information. This means that you can easily use them without investing a lot of money into training. Industry 5.0 helps organizations draw on existing resources so that management teams can focus on more strategic tasks. Coronavirus (COVID-19) pandemic has also recently paved the way for the culture of telecommuting, which is now very popular. Innovative cloud operating systems, such as InfinCE, support this rapidly evolving work culture with efficient collaboration and smooth communication solutions, they also enable advanced communication channels, video conferencing, and a secure environment for task sharing, monitoring, and collaboration. InfinCE and other integrated cloud platforms are revolutionizing the work culture of the future.

In Industry 5.0, everything is about the adoption of digitalization and intelligent technologies to increase human efficiency and paperless technology does the same. With the simplification of hard paper games in the industry, paperless technology will become much more widespread in the future. By reducing the excessive manual effort to reduce imitation of work and error, paperless technology is now greatly simplifying complex workflows in the banking, financial, and legal sectors. When it comes to paperless technology and the future, let’s not forget how the learning machine will affect this new paperless era. With advanced tools for digital printing, scanning, and signature, ML (Machine Learning) takes the paperless revolution to the next level, providing a wider range for paperless offices and digital environments.

Traditional ICT applications provide some support for exchanging information with clients and intermediaries. The critical change is the transition from “information exchange” to “free flow of information” in the value network between related products, services, and organizations [45]. This exchange needs to be effectively coordinated with a higher degree of data interchangeability, a higher degree of automation in information exchange, and the integrated use of data in the big data analysis approach. In Banking 5.0, both the depth of integration (between financial institutions and customers) and the potential for automation of the entire banking process are much greater than traditional banking services.

Continuous/porous networks are highly integrated and vulnerable to systemic hazards. In other words, the failure of all computer programs in case of failure of one of the components, due to some events such as hacking or cyber viruses, can completely damage the integrated systems. “Smart Banking” shares real-time information among all stakeholders in the ecosystem. They make banking processes visible, complete and transparent, but they must be secure. Security requires a very diverse set of capabilities and competencies to deal with cyber-attacks. To find these talents, it is necessary to find new resources with the help of partners, such as partnership programs with universities and research centers. This helps one to discover new accesses such as social networks, social media, and the like.

Content means offering a product/service under a portfolio strategy. This includes combining information, brokerage, currency exchange, financial services and products, infrastructure, financial education, financing, investment, payment services, loans/credits, fraud prevention, and user identification. Content is a vital factor for success [46].

The research background is summarized in Table 2 and the main variables are extracted from the research background study.

Table 2.

Research background (Ref. authors).

The Coronavirus (COVID-19) epidemic and the global recession have had a profound effect on all societies. Following these crises, the development and management of innovative banking strategies are critical [30]. Except for Fintech organizations, banking has remained virtually out of the digital landscape. To keep pace with this development, some financial institutions have begun to innovate, create new business models, invest in emerging technologies, partner with FinTech organizations, or finance or purchase them. Accenture found in a survey that only one in ten banks is committed to digital transformation. Four out of ten people were trying to change but had no integrated strategy and five out of ten did not make any progress [30]. Nicoletti [30] analyzed the relationship between Industry 5.0 and Banking 5.0 in a study. This article presents the history of banking development over time with changes in the business and social world. This article analyzes the challenges, opportunities, and benefits of Banking 5.0 and details the critical success factors for Banking 5.0. Finally, the author focuses on the roadmap for successful innovation and the innovation acceptance model. Table 3 summarizes the indicators extracted from the basics.

Table 3.

Variables extracted from research records (Ref: Authors).

3. Research Methodology

Considering that the purpose of conducting research is to design a model for determining and leveling the criteria of Revolution 5.0 in the banking industry, it is in the category of applied research, and in terms of research method, it is in the category of quantitative-qualitative research. The statistical population consisted of managers and experts of the banking system and the statistical sample of this research was 10 experienced heads of banks from 10 countries with at least 15 years of experience in work and education (Table 4). The ISM method has also been used for modeling. In general, it is felt that individuals or groups are faced with problems in dealing with complex topics and systems. The complexity of themes or systems is related to the presence of a large number of elements and the interactions between these elements. The direct or indirect presence of related elements complicates the structure of a system, which may or may not be ambiguous, with a clear style. Resolving such a system becomes difficult if the structure is not clearly defined. Thus, it is necessary to develop a methodology that will help identify the structure within a system. Structural interpretive modeling is such a methodology. Figure 2 shows the executive structure of the research:

Table 4.

Research Experts (Ref: Authors).

Figure 2.

Research structure (Ref: Authors).

Interpretive structural modeling: As a method, system design, especially the system of the economic and social-first time in 1973 by scientist system sciences at Georgetown University Warfield designed economic systems by Mason America and which was then was presented by Sage in 1977. This method is taken from the initials of the term Interpretive Structural Modeling and its purpose is to classify the factors and identify the relationships between the criteria. This is a qualitative-quantitative method that has been widely used in the banking industry and among researchers [57,58,59,60,61].

Many methods have been used for consensus. In this method, the majority opinion is selected as the final opinion. For example, suppose that in comparison of two criteria (a structural self-interaction matrix table cell), out of 10 people, seven experts assign an A value. Because more than half of the comments have been given, this value of V is chosen for that cell. The researcher has used a different approach in selecting research indicators. Thus, experts were asked to classify the indicators into three categories: low importance, necessary, and very necessary. The results are under Table 5, and the researchers focused on the very essential indicators and based their modeling on them. In addition, a researcher-made questionnaire with the description of Appendix A was used to collect data.

Table 5.

Classification of indicators from the perspective of experts (Ref: Authors).

The steps related to ISM are also formulated and used in the analysis as follows:

- 1.

- Structural Self-Interactive Matrix Formation (SSIM)

In this step, the experts consider the criteria in pairs with each other and respond to the pair comparisons based on the following. That is, in each comparison, the two criteria use the letters V, A, X, O based on the following definitions.

- V: The factor of row i causes the factor of column j to be realized.

- A: The factor of column j causes the factor of row i to be realized.

- X: Both row and column factors cause each other to be realized (factors i and j have a two-way relationship)

- O: There is no relationship between the row and column factor.

- 2.

- Obtaining the initial achievement matrix

By converting the symbols of the SSIM matrix to numbers zero and one based on the sub-matrix, the initial achievement is obtained.

- If the symbol of house ij is the letter V, the number one is placed in that house and the number zero is placed in the symmetrical house.

- If the symbol of house ij is the letter A, the number zero is placed in that house and the number one is placed in the symmetrical house.

- If the symbol of house ij is the letter X, the number one is placed in that house and the number one is placed in the symmetrical house.

- If the symbol of house ij is the letter O, the number zero is placed in that house and the number zero is placed in the symmetrical house.

- 3.

- Compatibility of access matrix

The initial access matrix must be checked if i, j = 1, j, k = 1– > i, k = 1. That is, if criterion A is related to criterion B and criterion B is related to criterion C, then criterion A must also be related to C.

- 4.

- Determining the level of variables

In this step, we calculate the set of input (prerequisite) and output (achievement) criteria for each criterion, and then we also specify the common factors. After identifying this variable or variables, we remove their rows and columns from the table and repeat the operation again on the other criteria.

- 5.

- Drawing the network of interactions

In this step, according to the levels of criteria in ISM and the relationships between them, a network of interactions is created. Level one is selected as the most influential level and the last level is selected as the most influential level.

Finally, the MICMAC analysis is performed, which is also described in the continuation of this method.

4. Analysis

First, it is necessary to decide on the choice of research variables. According to the output of Table 4, the researchers focused on the essential indicators in modeling. Thus, 14 indicators of entering Industry 5.0 in the banking industry were based on studies and selected by experts. Questionnaires were prepared and collected after 10 days. Finally, based on group ISM and the frequency of responses, the SSIM matrix is presented according to Table 6.

Table 6.

SSMT matrix (Ref: Authors).

Once the structural self-interaction matrix is obtained, the initial access matrix must be prepared. The initial access matrix is derived from the conversion of a structural self-interactive matrix into a binary (zero-one) matrix (Table 7).

Table 7.

Initial received matrix (Ref: Authors).

After forming the initial access matrix by including transferability in the relationships of the variables, the final access matrix is formed to make the initial access matrix compatible. The transferability of the conceptual relationship between variables is a basic assumption in interpretive structural modeling and states that if variable A affects B and variable B affects C, then A affects C. All secondary relationships between the variables are examined and finally the output is presented according to Table 8.

Table 8.

Final received matrix (Ref: Authors).

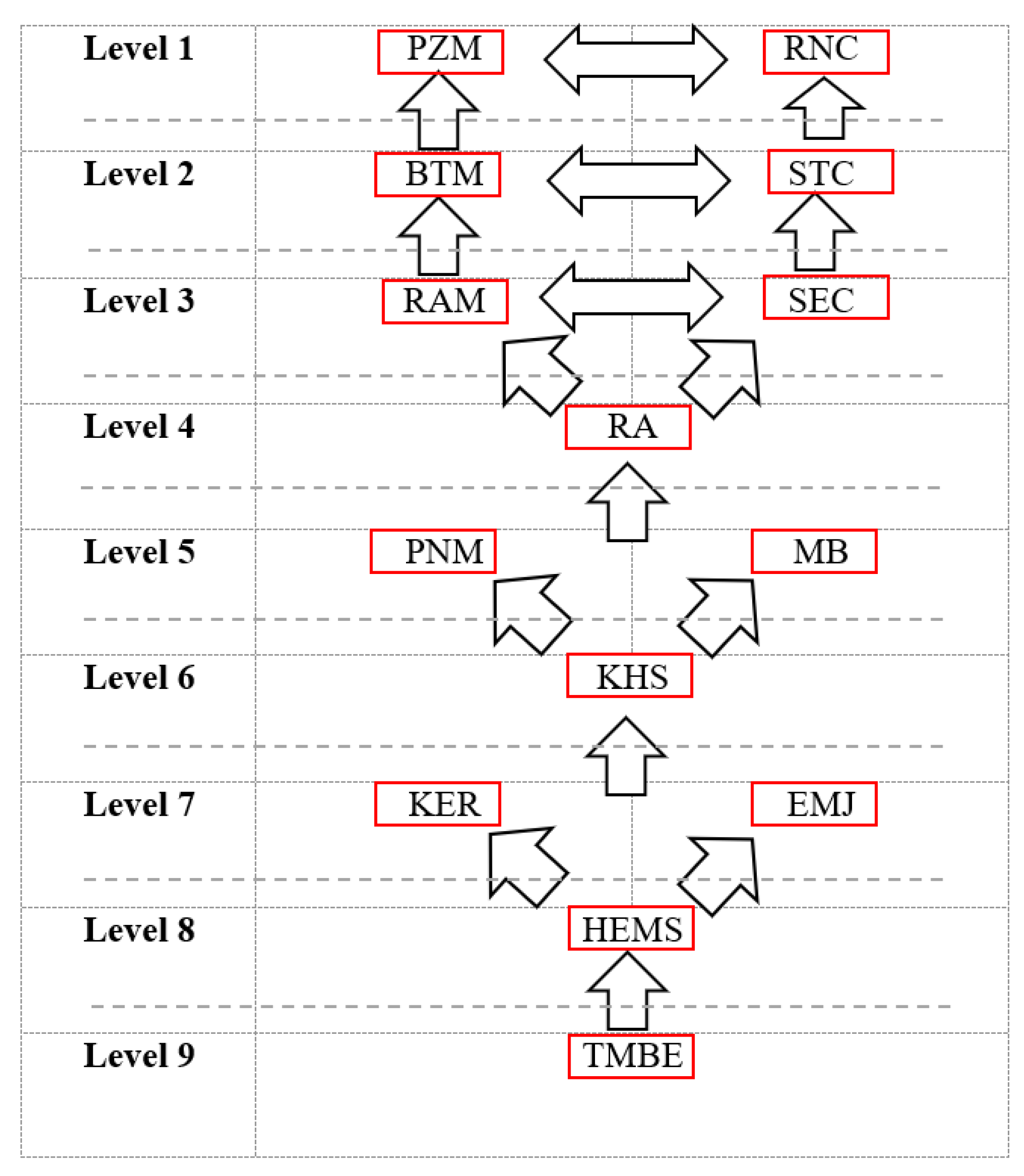

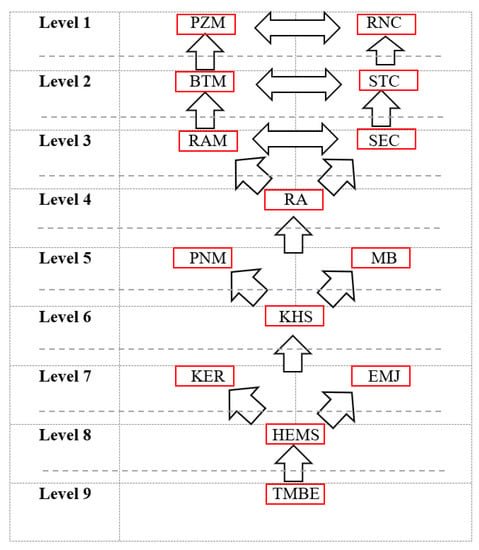

In this matrix, the penetration power and the degree of dependence of each variable are shown. The influence of each variable is the final number of variables (including itself) that can play a role in creating them. Degree of dependence is the final number of variables that cause the mentioned variable (Table 9). Finally, the structural model is presented in 9 levels according to Figure 3.

Table 9.

Influence power and dependence of structural model variables (Ref: Authors).

Figure 3.

Leveling of indicators (Ref: Authors).

Low-level variables are the most influential (TMBE and HEMS) and higher-level variables are the most influenced (PZM and RNC).

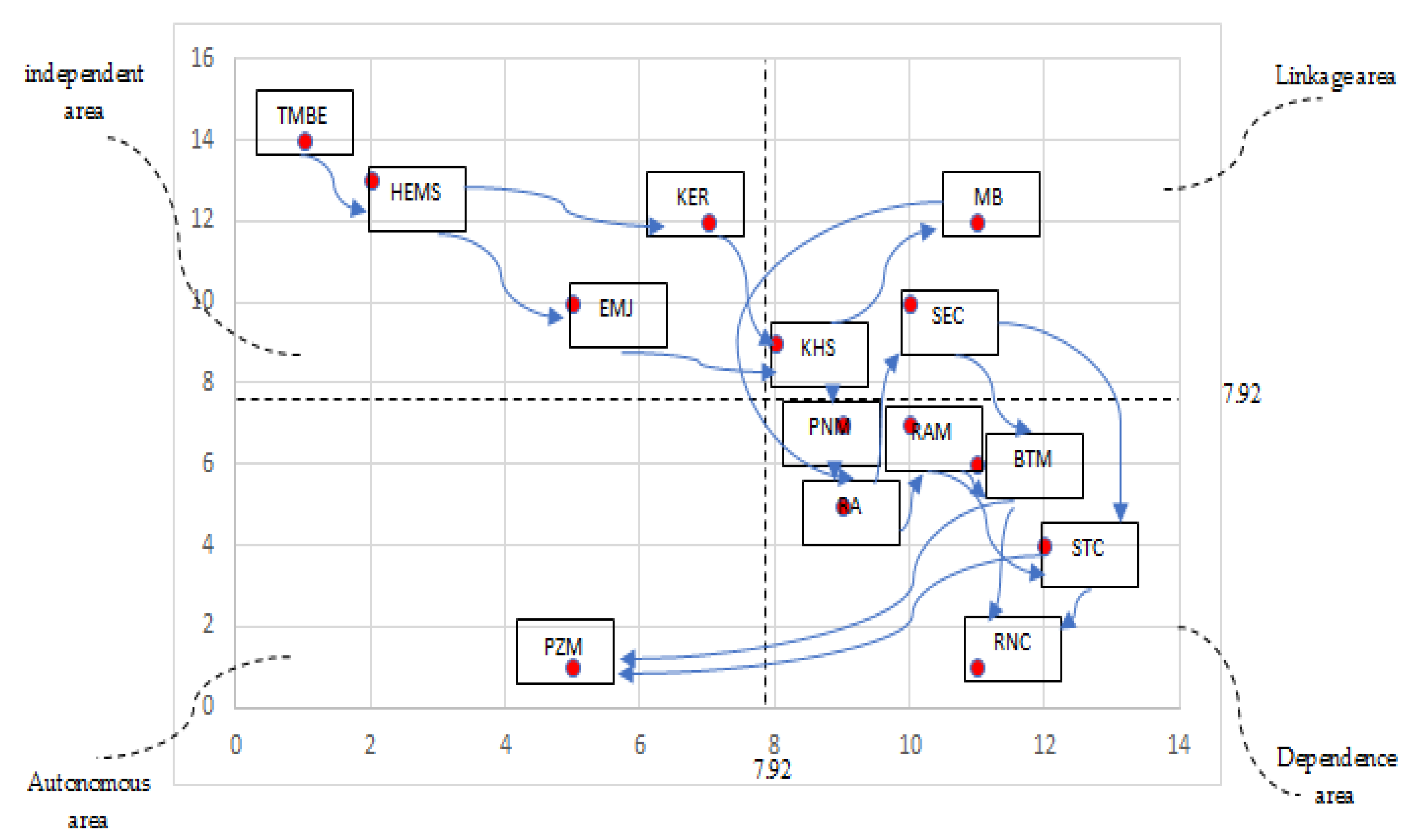

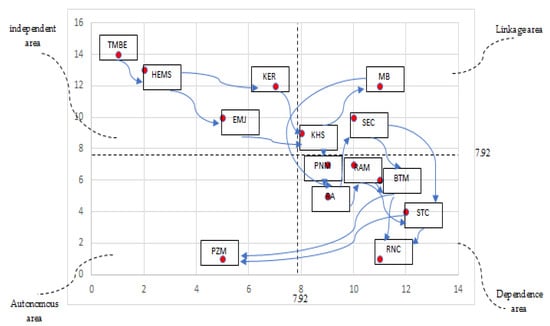

Research model variables can now be identified in terms of penetration and dependency using MICMAC analysis. In MICMAC analysis, the type of variable is determined according to its impact on other variables, and after determining the influence or influence and the dependence of factors, all word factors on Industry 5.0 can be classified in the banking industry (Figure 4).

Figure 4.

MICMAC analysis (Ref: Authors).

MICMAC analysis is a method for graphical representation of variables based on their influence and dependence in structural-interpretive modelling. Based on the power of dependence and the influence of variables, a coordinate system can be defined and divided into four equal parts. MICMAC analysis is based on the power of influence (effective) and the degree of dependence (impressive) of each variable and allows further investigation of the range of each variable. As it is known, it is located in the first region of PZM. This indicates that it operates almost separately from the entire system. This component has little effect on other components and in fact, the relationship of these components with other components is very limited and insignificant. In the second area, there are RNC, RA, STC, RAM, PNM, and BTM indices, which show the low penetration of this index and have a high dependence on other indices in the model. In the third area are the MB, SEC, and KHS indices, which have a strong influence as well as a dependency force. These variables are in fact components that are unstable, meaning that taking any action on these components, in addition, directly affects other components. It can also affect the component itself in the form of feedback from other components. Finally, in the fourth area, there are KER, EMJ, HEMS, and TMBE indices that have a strong influence, but their dependency is weak, and in fact, they are key variables, and by changing them, the other variables can be influenced.

5. Discussion, Conclusions and Limitation and Industry Future

5.1. Discussion

The results of this article point to 14 indicators as the most essential indicators of banking entry in the fifth generation of the industrial revolution. Human element optimization and readjustment are vital for companies to maintain and balance workloads. The spread of technology and the development of artificial intelligence in modern life, especially in the field of human communication, has become an opportunity to bring about fundamental changes in this field, both in human-machine relations and in human relations. While companies benefit from optimizing human-AI collaboration, five principles can help them improve that partnership: re-creating business processes, employee acceptance, and interaction, and AI testing and measuring processes. Direct and active guidance of artificial intelligence strategy, data collection, and process redesign to better combine artificial intelligence and manpower. To use machines and intelligent assistants, humans must play three basic roles in the process: they must train machines to perform certain tasks, they must explain the results of this training and the output of the work, and most importantly, when monitoring conflicting or controversial results, consider robots to follow a set of human and ethical rules (for example, to prevent robots from harming humans). In the robots training section, machine learning algorithms must be taught how to do what they are designed to do. In this effort, a huge data set dedicated to robot training is collected and given to machine translation applications so that these machines can be trained and able to translate terms. Consider Cortana, Microsoft’s artificial intelligence assistant. The robot needed extensive training to achieve a suitable character of its own. He should have been confident, compassionate, and helpful but stubborn. It took countless hours for a team of poets, novelists, and playwrights to instill these qualities. Similarly, human trainers were needed to develop Siri characters at Apple and Alexa at Amazon so that the end product would be an accurate reflection of their company brand. For example, the robot has a sense of honesty and politeness in its character; this is what consumers of Apple products might expect from the Apple brand.

5.2. Conclusions

This research offers a new and completely different perspective on the banking industry to prepare for and enter Industry 5.0. What seem important and real in the fifth industrial revolution of banking is not necessarily undertaken in banks. Banking should become part of the business activities and tasks of all organizations and individuals. In other words, the center of the transaction should be the customer and their needs, not the bank. From an internal perspective, the operation must be performed by an actor who can be a robot, an individual, and in most cases a combination of the two (a Cobot). The introduction of Industry 5.0 is based on the observation or assumption that Industry 4.0 focuses less on the original principles of social fairness and sustainability but more on digitalization and AI-driven technologies for increasing the efficiency and flexibility of production [19]. The concept of Industry 5.0, therefore, provides a different focus and point of view and highlights the importance of research and innovation to support the industry in its long-term service to humanity within planetary boundaries [20], Indeed, leading up to this formal introduction of Industry 5.0, there have been some discussions about “Age of Augmentation” where the human and machine reconcile and work in symbiosis [62]. Similarly, Bednar and Welch [63] described “Smart Working” practices. In 2019, Doyle-Kent and Kopacek [26] saw Industry 5.0 as a lifeline to manufacturing. Recalling the benefits that Industry 4.0 has brought to society, they believed that under the background of Industry 5.0, there may be a paradigm shiftin the development mode of industry. In the same year (2019), Nahavandi [23], argued that the compelling need to increase productivity without removing human workers from manufacturing is posing serious challenges to the global economy. To address these challenges, they introduced the concept of Industry 5.0, which treats the human–machine relationship as cooperative rather than competitive. Moreover, in 2019, Demir et al. [37] argued that the previous discussion of Industry 5.0 did not focus on the organizational issues arising from human–computer collaboration; at the same time, they discussed possible issues related to human–computer collaboration from the organizational and employee perspectives. Their research will no doubt be the focus of much upcoming research on organizational robots.

The role of IPAs on Industry 5.0 is crucial. Intelligent Process Automation, or IPA for short, is an evolved version of automation in which machines mimic human actions and have cognitive capabilities, including natural language processing speech recognition, computer vision technology, and machine learning. The digitalization process should strengthen the entire value network of the banking industry. This can affect pricing and competition among banks. The compliance framework should not restrict competition. Instead, customer and data protection should be at the center of consideration. Financial services need innovation. Otherwise, organizations will be damaged or simply disappear.

On the other hand, sustainability means continuity in something such as activity and creating a dynamic balance between many effective factors such as natural, social, and economic factors required by human beings. Sustainability as an attribute of development is a situation in which desirability and possibilities do not diminish over time and are derived from the word Sustenere (Sus, meaning bottom, and Tenere, meaning to hold), meaning to keep alive or to indicate long-term support or durability. Sustainability, in its broadest sense, refers to the ability of a community, ecosystem, or any current system to function indefinitely, without being compulsorily depleted of the resources to which the system depends or due to overload, be weakened. On the other hand, the ability of the system to withstand endurance and reliability inevitably depends on the success of the system in communicating with the external environment; in other words, the stability of the system depends entirely on the ability of the system to adapt, change and evolve and respond to the environment, and since the environment, in turn, is constantly changing, this process of system adaptation must be a dynamic and sensitiveprocess.

A stable system needs proper internal functioning and an environmentally friendly relationship, in other words, the stability inside and stability outside (in interaction with the environment) to act as a stable system as a whole. Sustainability in practice is a balance between environmental necessities and development needs and is achieved in two ways: by reducing pressures and increasing existing capacities. It is expected that the use of Industry 5.0 technologies will reduce transportation costs, make the national and global supply chain more productive, increase revenue levels and improve people’s quality of life. This upgrade will not remain in a country, and we will see new markets and global economic growth due to reduced business costs; but economists believe that this huge change or leap will be the beginning of a human inequality in the manpower sector of companies and industries. This is because the workforce which previously relied on manual labor and experience will be replaced by new technologies and artificial intelligence. Simply put, perhaps the greatest opportunity of this period, which can itself be a threat, is the replacement of talent with manual labor. This factor causes society to be divided into two parts: talented and knowledgeable people with high income and people with skills, knowledge and low income. A social divide that may even lead to tensions in the community. Many economic analysts see this as justifying the concern of some workers and employees about their income and the dissatisfaction of the middle class with their job situation. However, Mendon et al. [64] argued that brand love is different from the concept of consumer satisfaction.

5.3. Limitation

One of the most important limitations of this study is the real concentration of Industry 5.0 in banks. Banks all around the world are still involved in the fascinating events of Industry 4.0, and this research study has been written at a time when the world is still not yet ready for Industry 5.0, and only a handful of countries will be ready to face this unique phenomenon.

5.4. The Future of the Banking Industry

Transformation in the banking industry is inevitable due to industrial revolution 5.0 [65]. Current markets and business models will change in this era. New technological facilities, innovations, and new services will make fundamental changes [66]. Financial scenarios developed by FinTech will be accompanied by new business models [30]. The competition takes place outside the banks. Bigtechs use their financial power and data to calculate risk and marketing in the world’s financial structures [34]. We will have no direct control over the speed of technology or the side effects that result from it. Neither the old managers, who, by denying what is about to happen, emphasize only the traditional way of working, are safe from the challenges of the industrial revolution, nor the young managers, who are relentlessly trying to update everything under their control. What is clear and can illuminate the future for the industrialists a little is to invite these people to study and increase their awareness of technologies related to their industry, increase knowledge and skills in the field of modern management and also equip their collection manpower to skills and technologies which are being replaced. Industrial revolution 5.0 has the potential to replace robots with people who have relied on years of rotation experience in a workshop, or a challenge that invites them and their tech community to update their knowledge and use technology to accelerate processes.

Author Contributions

Conceptualization, A.M., V.S., S.S., M.A., C.S. and R.B.; Formal analysis, V.S.; Investigation, A.M., M.A. and C.S.; Methodology, A.M., C.S. and R.B.; Software, V.S. and M.A.; Validation, S.S.; Visualization, S.S.; Writing—original draft, V.S., S.S., C.S. and R.B.; Writing—review & editing, A.M. and R.B.. All authors read and approved the final manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

- Research questionnaires

- Dear expert

- As a banking system expert, we ask you to answer the questions of this research carefully. The research results will be used only for scientific development:

- General questions:

- Country:

- Gender:

- Education:

- Work experience:

- Expert Questions:

- Tip: How to answer questions and scoring pattern

- Specify the effect of the elements in each row on the elements in the column.

- If the variable i affects j, enter a V.

- If the variable j affects i, enter the symbol A.

- If both variables i and j affect each other, enter an X.

- If none of them affect each other, enter O.

- Note: Please fill only the matrix above the original diameter.

- Determine the type of relationships of the following variables based on the signs in the guide:

| Variables | KHS | TMBE | HEMS | KER | PZM | EMJ | RNC | RAM | PNM | RA | SEC | BTM | STC | MB |

| KHS | ||||||||||||||

| TMBE | ||||||||||||||

| HEMS | ||||||||||||||

| KER | ||||||||||||||

| PZM | ||||||||||||||

| EMJ | ||||||||||||||

| RNC | ||||||||||||||

| RAM | ||||||||||||||

| PNM | ||||||||||||||

| RA | ||||||||||||||

| SEC | ||||||||||||||

| BTM | ||||||||||||||

| STC | ||||||||||||||

| MB |

- Reduce the heavy costs of having a branch = KHS Health and safety of employees = SEC

- Redesign work with human element optimization = TMBE Improve the customer experience = BTM

- Human-machine cooperation at different levels= HEMS

- Stability and continuity of the workforce = STC

- Human creativity in robotic production= KER

- Health Care’s = MB

- Environmental sustainability = PZM

- Create new jobs = EMJ

- Labor welfare = RNC

- Excellent customer relationship = RAM

- Respond to the changing needs of customers = PNM

- Ethical behavior = RA

References

- Maddikunta, P.K.R.; Pham, Q.-V.; B, P.; Deepa, N.; Dev, K.; Gadekallu, T.R.; Ruby, R.; Liyanage, M. Industry 5.0: A survey on enabling technologies and potential applications. J. Ind. Inf. Integr. 2021, 26, 100257. [Google Scholar] [CrossRef]

- Nethravathi, P.S.R.; Bai, G.V.; Spulbar, C.; Suhan, M.; Birau, R.; Calugaru, T.; Hawaldar, I.T.; Ejaz, A. Business intelligence appraisal based on customer behaviour profile by using hobby-based opinion mining in India: A case study. Econ. Res.-Ekon. Istraživanja 2020, 33, 1889–1908. [Google Scholar] [CrossRef]

- Motienko, A. Integration of information and communication system for public health data collection and intelligent transportation system in large city. Transp. Res. Procedia 2020, 50, 466–472. [Google Scholar] [CrossRef]

- Brettel, M.; Friederichsen, N.; Keller, M.; Rosenberg, M. How virtualization, decentralization and network building change the manufacturing Landscape. Int. J. Mech. Ind. Sci. Eng. 2014, 8, 37–44. [Google Scholar]

- Hermann, M.; Pentek, T.; Otto, B. Design Principles for Industrie 4.0 Scenarios. In Proceedings of the 2016 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 3928–3937. [Google Scholar]

- Mehdiabadi, A.; Tabatabeinasab, M.; Spulbar, C.; Karbassi Yazdi, A.; Birau, R. Are We Ready for the Challenge of Banks 4.0? Designing a Roadmap for Banking Systems in Industry 4.0. Int. J. Financ. Stud. 2020, 8, 32. [Google Scholar] [CrossRef]

- Jamal, A.A.; Majid, A.A.M.; Konev, A.; Kosachenko, T.; Shelupanov, A. A review on security analysis of cyber physical systems using Machine learning. Mater. Today Proc. 2021, in press.

- Sung, Y.A.; Kim, K.W.; Kwon, H.J. Big Data analysis of Korean travelers’ behavior in the post-COVID-19 Era. Sustainability 2021, 13, 310. [Google Scholar] [CrossRef]

- Soo, A.; Ali, S.M.; Shon, H.K. 3D printing for membrane desalination: Challenges and future prospects. Desalination 2021, 520, 115366. [Google Scholar] [CrossRef]

- Parmar, H.; Khan, T.; Tucci, F.; Umer, R.; Carlone, P. Advanced robotics and additive manufacturing of composites: Towards a new era in Industry 4.0. Mater. Manuf. Processes 2022, 37, 483–517. [Google Scholar] [CrossRef]

- Yu, Q.; Qin, Z.; Ji, F.; Chen, S.; Luo, S.; Yao, M.; Wu, X.; Liu, W.; Sun, X.; Zhang, H.; et al. Low-temperature tolerant strain sensors based on triple crosslinked organohydrogels with ultrastretchability. Chem. Eng. J. 2021, 404, 126559. [Google Scholar] [CrossRef]

- Bryceson, K.P.; Leigh, S.; Sarwar, S.; Grøndahl, L. Affluent Effluent: Visualizing the invisible during the development of an algal bloom using systems dynamics modelling and augmented reality technology. Environ. Model. Softw. 2022, 147, 105253. [Google Scholar] [CrossRef]

- Vinoth, S.; Vemula, H.L.; Haralayya, B.; Mamgain, P.; Hasan, M.F.; Naved, M. Application of cloud computing in banking and e-commerce and related security threats. Mater. Today Proc. 2022, 51, 2172–2175. [Google Scholar] [CrossRef]

- Srinivasan, S.; Batra, R.; Chan, H.; Kamath, G.; Cherukara, M.J.; Sankaranarayanan, S.K. Artificial Intelligence-Guided De Novo Molecular Design Targeting COVID-19. ACS Omega 2021, 6, 12557–12566. [Google Scholar] [CrossRef] [PubMed]

- Koç, P.; Gülmez, A. Analysis of relationships between nanotechnology applications, mineral saving and ecological footprint: Evidence from panel fourier cointegration and causality tests. Resour. Policy 2021, 74, 102373. [Google Scholar] [CrossRef]

- Gorodetsky, V.; Larukchin, V.; Skobelev, P. Conceptual model of digital platform for enterprises of industry 5.0. In International Symposium on Intelligent and Distributed Computing; Springer: Cham, Switzerland, 2019; pp. 35–40. [Google Scholar]

- Kagermann, H. Change through digitization—value creation in the age of industry 4.0. In Management of Permanent Change; Springer: Wiesbaden, Germany, 2015; pp. 23–45. [Google Scholar] [CrossRef]

- Schwab, K. The Fourth Industrial Revolution, 1st ed.; World Economic Forum: CH-1223 Cologny/Geneva Switzerland, 2017. [Google Scholar]

- Xu, X.; Lu, Y.; Vogel-Heuser, B.; Wang, L. Industry 4.0 and Industry 5.0—Inception, conception and perception. J. Manuf. Syst. 2021, 61, 530–535. [Google Scholar] [CrossRef]

- Breque, M.; De Nul, L.; Petridis, A. Industry 5.0: Towards a Sustainable, Human-Centric and Resilient European Industry; Publications Office of European Commission: Brussels, Belgium, 2021. [Google Scholar] [CrossRef]

- European Economic and Social Committee. Industry 5.0. Available online: https://ec.europa.eu/info/research-and-innovation/research-area/industrial-research-and-innovation/industry-50_en (accessed on 28 September 2021).

- Tange, K.; De Donno, M.; Fafoutis, X.; Dragoni, N. A systematic survey of industrial Internet of Things security: Requirements and fog computing opportunities. IEEE Commun. Surv. Tutor. 2020, 22, 2489–2520. [Google Scholar] [CrossRef]

- Nahavandi, S. Industry 5.0—A human-centric solution. Sustainability 2019, 11, 4371. [Google Scholar] [CrossRef] [Green Version]

- Shahabi, V.; Azar, A.; Faezy Razi, F.; Fallah Shams, M.F. Analysis of factors affecting the development of the banking service supply chain in the Industry 4.0. Manag. Res. Iran. 2022, in press.

- Broo, D.G.; Kaynak, O.; Sait, S.M. Rethinking engineering education at the age of industry 5.0. J. Ind. Inf. Integr. 2022, 25, 100311. [Google Scholar]

- Doyle-Kent, M.; Kopacek, P. Industry 5.0: Is the Manufacturing Industry on the Cusp of a New Revolution? In Proceedings of the International Symposium for Production Research 2019; Springer: Cham, Switzerland, 2019; pp. 432–441. [Google Scholar]

- Paschek, D.; Mocan, A.; Draghici, A. Industry 5.0-The expected impact of next Industrial Revolution. In Proceedings of the Thriving on Future Education, Industry, Business, and Society, Proceedings of the Make Learn and TIIM International Conference, Piran, Slovenia, 15–17 May 2019; pp. 15–17. [Google Scholar]

- Huxley, T.H. The Darwinian Hypothesis; Amazon Digital Press LLC: Bellevue, WA, USA, 2018. [Google Scholar]

- Shahabi, V.; Razi, F.F. Modeling the effect of electronic banking expansion on profitability using neural networks and system dynamics approach. Qual. Res. Financ. Mark. 2019, 11, 197–210. [Google Scholar] [CrossRef]

- Nicoletti, B. Industry 5.0 and Banking 5.0. In Banking 5.0. Palgrave Studies in Financial Services Technology; Palgrave Macmillanl: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- Polop, F.; Levis, S.; Pini, N.; Enría, D.; Polop, J.; Provensal, M.C. Factors associated with hantavirus infection in a wild host rodent from Cholila, Chubut Province, Argentina. Mamm. Biol. 2018, 88, 107–113. [Google Scholar] [CrossRef]

- David, L.; Kaulihowa, T. The Impact of E-Banking on Commercial Banks’ Performance in Namibia. Int. J. Econ. Financ. Res. 2018, 4, 313–321. [Google Scholar]

- Meher, B.K.; Hawaldar, I.T.; Mohapatra, L.; Spulbar, C.; Birau, R.; Rebegea, C. The impact of digital banking on the growth of Micro, Small and Medium Enterprises (MSMEs) in India: A case study. Bus. Theory Pract. 2021, 22, 18–28. [Google Scholar] [CrossRef]

- Frost, J.; Gambacorta, L.; Huang, Y.; Shin, H.S.; Zbinden, P. BigTech and the Changing Structure of Financial Intermediation; BIS Working Papers No 779; Bank for International Settlements: Basel, Switzerland, 2019; Available online: https://www.bis.org/publ/work779.pdf (accessed on 3 January 2022)BIS Working Papers No 779.

- Özdemir, V.; Hekim, N. Birth of industry 5.0: Making sense of big data with artificial intelligence, “the internet of things” and next-generation technology policy. Omics A J. Integr. Biol. 2018, 22, 65–76. [Google Scholar] [CrossRef] [PubMed]

- Haleem, A.; Javaid, M. Industry 5.0 and its applications in orthopaedics. J. Clin. Orthop. Trauma 2019, 10, 807–808. [Google Scholar] [CrossRef] [PubMed]

- Demir, K.A.; Döven, G.; Sezen, B. Industry 5.0 and Human-Robot Co-working. Procedia Comput. Sci. 2019, 158, 688–695. [Google Scholar] [CrossRef]

- Johansson, H. Profinet Industrial Internet of Things Gateway for the Smart Factory. Master’s Thesis, Chalmers University of Technology, Gothenburg, Sweden, 2017. [Google Scholar]

- Gotfredsen, S. Bringing back the human touch: Industry 5.0 concept creating factories of the future. Manuf. Mon. Dostęp 2016, 11, 2018. [Google Scholar]

- Østergaard, E.H. Industry 5.0—Return of the Human Touch. 2016. Available online: https://blog.universal-robots.com/industry-50-return-of-the-human-touch (accessed on 3 January 2022).

- Rendall, M. The New Terminology: CRO and Industry 5.0. 2017. Available online: https://www.automation.com/automation-news/article/the-new-terminology-cro-and-industry-50 (accessed on 3 January 2022).

- Soni, R.R.; Hawaldar, I.T.; Vaswani, A.S.; Spulbar, C.; Birau, R.; Minea, E.L.; Mendon, S.; Criveanu, M.M. Predicting financial distress in the Indian textile sector. Ind. Text. 2021, 72, 503–508. [Google Scholar] [CrossRef]

- Cappiello, A. The digital (r)evolution of insurance business models. Am. J. Econ. Bus. Adm. 2020, 12, 1–3. [Google Scholar] [CrossRef]

- Gassmann, O.; Frankenberger, K.; Csik, M. The St. Gallen Business Model Navigator. 2014. Available online: www.im.ethz.ch/education/HS13/MIS13/Business_Model_Navigator.pdf (accessed on 3 January 2022).

- Schlick, J.; Stephan, P.; Loskyll, M.; Lappe, D. Industries 4.0 in der praktischenAnwendung. In Industrie 4.0 to Produktion, Automatisierung und Logistik: Anwendung. Technologien. Migration; Bauernhansl, T., Hompel, M.T., Vogel-Heuser, B., Eds.; Springer: Wiesbaden, Germany, 2014; pp. 57–84. [Google Scholar]

- Roeder, J.; Cardona, D.R.; Palmer, M.; Werth, O.; Muntermann, J.; Breitner, M.H. Make or break: Business model determinants of FinTech venture success. In Proceedings of the Multikonferenz Wirtschaftsinformatik, Lüneburg, Germany, 6–9 March 2018. [Google Scholar]

- Alkhowaiter, W.A. Digital payment and banking adoption research in Gulf countries: A systematic literature review. Int. J. Inf. Manag. 2020, 53, 102102. [Google Scholar] [CrossRef]

- Farsi, M.; Erkoyuncu, J.A. Industry 5.0 Transition for an Advanced Service Provision. In Proceedings of the The 10th International Conference on Through-Life Engineering Services 2021 (TESConf 2021), Twente, The Netherlands, 16–17 November 2021. [Google Scholar] [CrossRef]

- Aslam, F.; Aimin, W.; Li, M.; Ur Rehman, K. Innovation in the era of IoT and industry 5.0: Absolute innovation management (AIM) framework. Information 2020, 11, 124. [Google Scholar] [CrossRef] [Green Version]

- Jünger, M.; Mietzner, M. Banking goes digital: The adoption of FinTech services by German households. Financ. Res. Lett. 2020, 34, 101260. [Google Scholar] [CrossRef]

- Al Faruqi, U. Future Service in Industry 5.0. J. Sist. Cerdas 2019, 2, 67–79. [Google Scholar] [CrossRef]

- Khanboubi, F.; Boulmakoul, A.; Tabaa, M. Impact of digital trends using IoT on banking processes. Procedia Comput. Sci. 2019, 151, 77–84. [Google Scholar] [CrossRef]

- Mbama, C. Digital Banking Services, Customer Experience and Financial Performance in UK Banks. Doctoral Dissertation, Sheffield Hallam University, Sheffield, UK, 2018. [Google Scholar]

- Ozkeser, B. Lean innovation approach in Industry 5.0. Eurasia Proc. Sci. Technol. Eng. Math. 2018, 2, 422–428. [Google Scholar]

- Skobelev, P.O.; Borovik, S.Y. On the way from Industry 4.0 to Industry 5.0: From digital manufacturing to digital society. Industry 4.0 2017, 2, 307–311. [Google Scholar]

- Sonono, B.; Ortstad, R. The Effects of the Digital Transformation Process on Banks’ Relationship with Customers: Case Study of a Large Swedish Bank. Master’s Thesis, Department of Business Studies Uppsala University, Uppsala, Sweden, 2017. Available online: https://www.diva-portal.org/smash/get/diva2:1115984/FULLTEXT01.pdf (accessed on 3 January 2022).

- Kumar, S.; Shukla, G.P.; Dubey, R.K.D. Barriers to Financial Inclusion: An ISM Micmac Analysis. Int. J. Account. Financ. Rev. 2020, 5, 74–89. [Google Scholar] [CrossRef]

- Khalilzadeh, M.; Katoueizadeh, L.; Zavadskas, E.K. Risk identification and prioritization in banking projects of payment service provider companies: An empirical study. Front. Bus. Res. China 2020, 14, 15. [Google Scholar] [CrossRef]

- Owlia, M.; Roshani, K.; Abooei, M. Interpretive Structural Modeling (ISM) of Intellectual Capital Components. J. Ind. Eng. Int. 2020, 16, 41–56. [Google Scholar] [CrossRef]

- Hakimi, H.; Divandari, A.; Keimasi, M.; Haghighikaffash, M. Development of Retail Banking Customer Experience Creation Model from Manageable Factors by Organization Using Interpretive Structural Modeling (ISM). J. Bus. Manag. 2019, 11, 565–584. [Google Scholar]

- Rizvi, N.U.; Kashiramka, S.; Singh, S.; Sushil. A hierarchical model of the determinants of non-performing assets in banks: An ISM and MICMAC approach. Appl. Econ. 2019, 51, 3834–3854. [Google Scholar] [CrossRef]

- Longo, F.; Padovano, A.; Umbrello, S. Value-oriented and ethical technology engineering in Industry 5.0: A human-centric perspective for the design of the factory of the future. Appl. Sci. 2020, 10, 4182. [Google Scholar] [CrossRef]

- Bednar, P.M.; Welch, C. Socio-technical perspectives on smart working: Creating meaningful and sustainable systems. Inf. Syst. Front. 2020, 22, 281–298. [Google Scholar] [CrossRef] [Green Version]

- Mendon, S.; Nayak, S.; Nayak, R.; Spulbar, C.; Bai Gokarna, V.; Birau, R.; Anghel, L.C.; Stanciu, C.V. Exploring the sustainable effect of mediational role of brand commitment and brand trust on brand loyalty: An empirical study. Econ. Res.-Ekon. Istraživanja 2022, 1–23. [Google Scholar] [CrossRef]

- Camussone, P.F. Digital for job: The future of work—Solution. Digit. World 2017, 2, 1–15. [Google Scholar]

- Prognos, A.G. Digitalisierung in der Versicherungswirtschaft; Studie. Hg. v. vbw Vereinigung der BayerischenWirtschaft e. V.: München, Germany, 2017. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).