Does Energy Efficiency Realize Energy Conservation in the Iron and Steel Industry? A Perspective of Energy Rebound Effect

Abstract

1. Introduction

2. Literature Review

2.1. Definition and Classification of the Energy Rebound Effect

2.2. Research Methods of the Rebound Effect

2.3. Empirical Experience from the Production Side

3. Model Construction and Data

3.1. Measuring Energy Efficiency

3.2. Estimating the Rebound Effect

3.3. Variables and Data Source

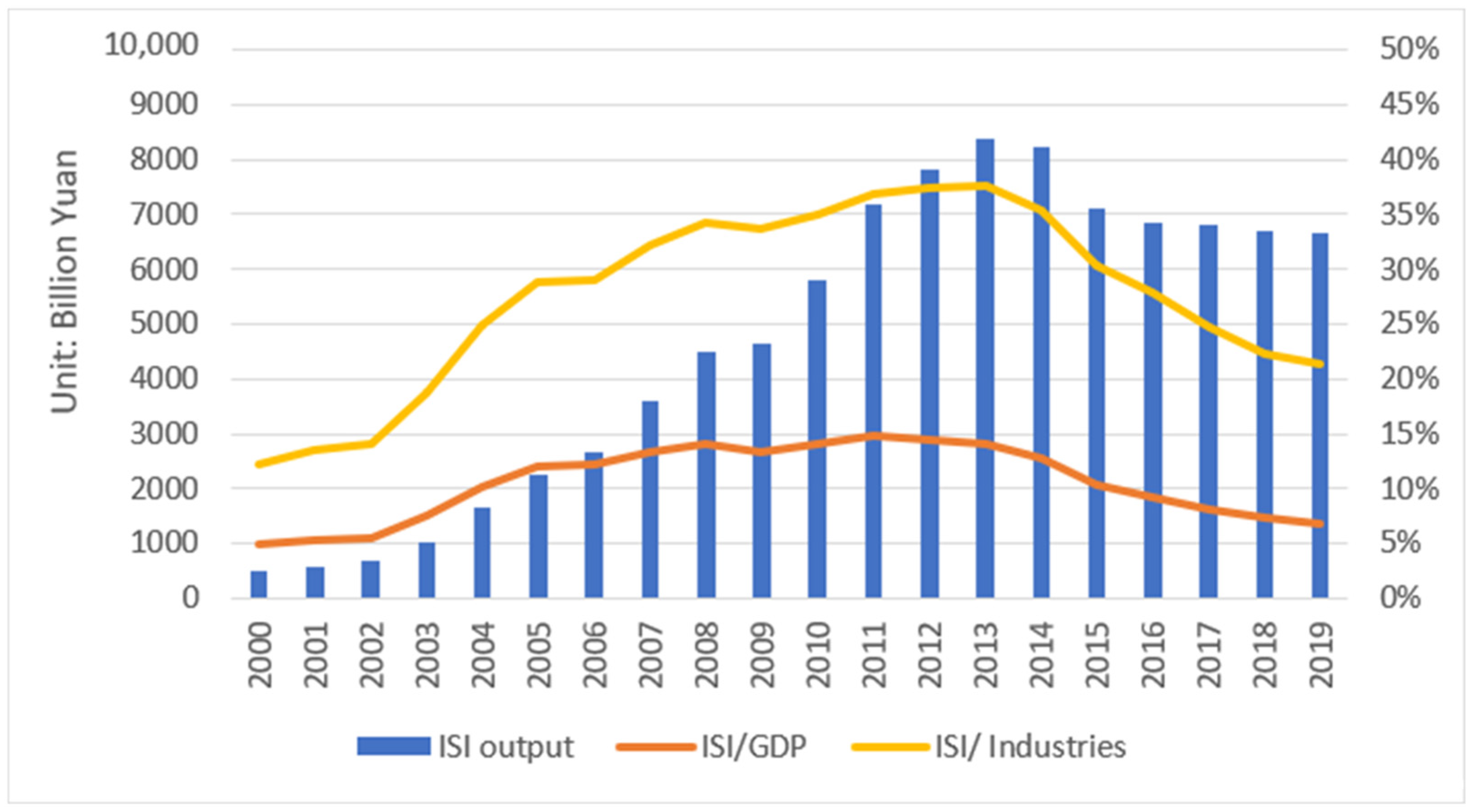

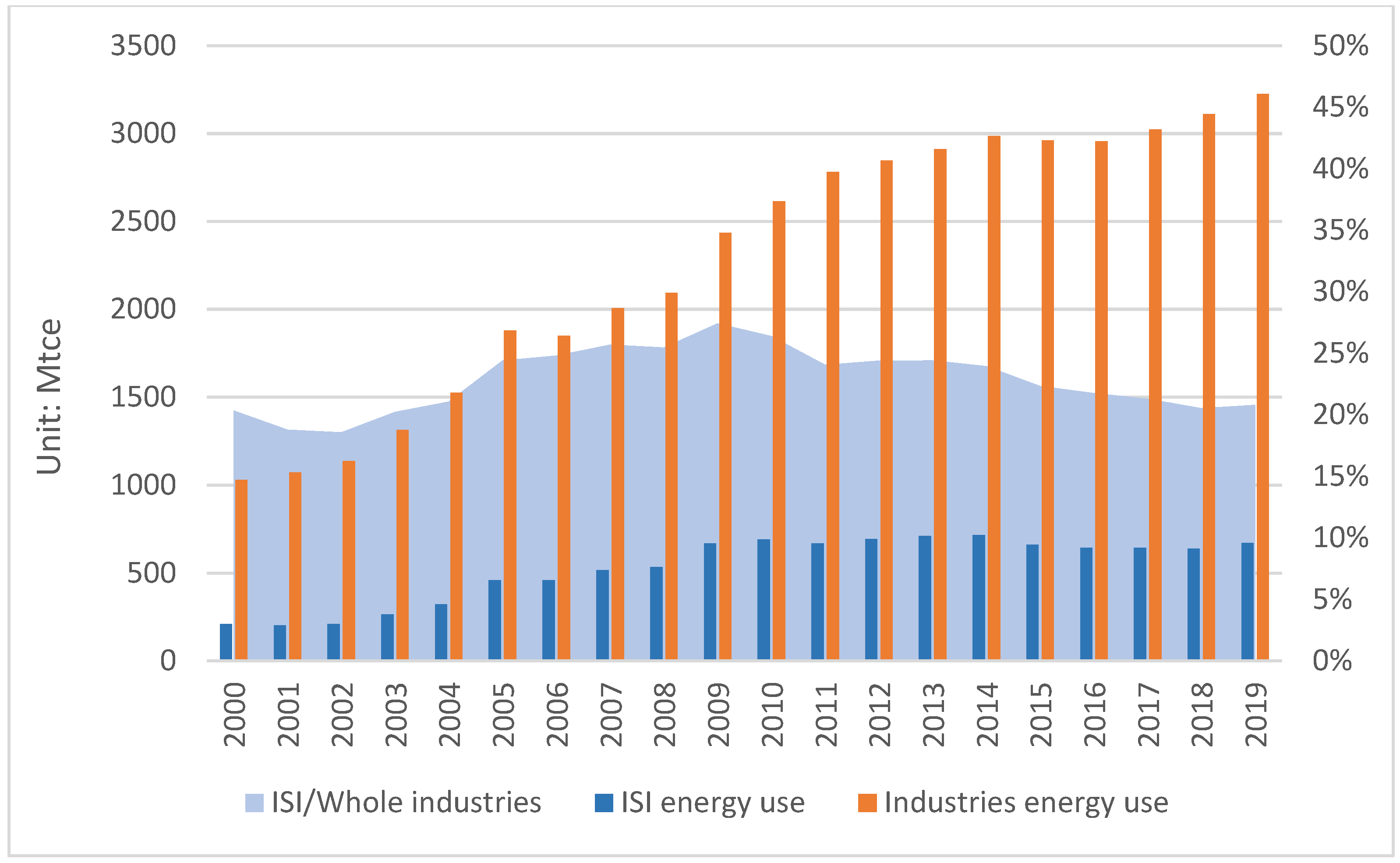

4. Empirical Discussion

4.1. The Result of Dynamic Energy Efficiency

4.2. The Estimation Results of the Rebound Effect

5. Conclusions and Suggestions

5.1. Conclusions

5.2. Policy Suggestions

Supplementary Materials

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- International Energy Agency. World Energy Balances Highlights 2021. Available online: https://www.iea.org/data-and-statistics/data-product/world-energy-balances-highlights (accessed on 21 June 2022).

- Li, J.; Li, A.; Xie, X. Rebound effect of transportation considering additional capital costs and input-output relationships: The role of subsistence consumption and unmet demand. Energy Econ. 2018, 74, 441–455. [Google Scholar] [CrossRef]

- Zheng, C.; Deng, F.; Li, C.; Yang, Z. The impact of China’s western development strategy on energy conservation and emission reduction. Environ. Impact Assess. Rev. 2022, 94, 106743. [Google Scholar] [CrossRef]

- Zhou, J.; Xu, X.; Jiang, R.; Cai, J. Evaluation of Sustainable Economic and Environmental Development Evidence from OECD Countries. J. Glob. Inf. Manag. 2021, 30, 1–18. [Google Scholar] [CrossRef]

- Du, Z.; Zheng, L.; Lin, B. Does Rent-Seeking Affect Environmental Regulation? J. Glob. Inf. Manag. 2021, 30, 1–22. [Google Scholar] [CrossRef]

- Lin, B.; Li, M. Understanding the investment of renewable energy firms in the face of economic policy uncertainty—Micro-evidence from listed companies in China. China Econ. Rev. 2022, 75, 101845. [Google Scholar] [CrossRef]

- Lin, B.; Wang, S. Mechanism analysis of the influence of oil price uncertainty on strategic investment of renewable energy enterprises. Int. J. Financ. Econ. 2022, 27, 1–8. [Google Scholar] [CrossRef]

- Xu, B.; Xu, R. Assessing the role of environmental regulations in improving energy efficiency and reducing CO2 emissions: Evidence from the logistics industry. Environ. Impact Assess. Rev. 2022, 96, 106831. [Google Scholar] [CrossRef]

- Li, Z.; Lin, B.; Luan, R. Impact assessment of clean air action on total factor energy productivity: A three-dimensional analysis. Environ. Impact Assess. Rev. 2022, 93, 106745. [Google Scholar] [CrossRef]

- Chen, L.; Wang, D.; Shi, R. Can China’s Carbon Emissions Trading System Achieve the Synergistic Effect of Carbon Reduction and Pollution Control? Int. J. Environ. Res. Public Health 2022, 19, 8932. [Google Scholar] [CrossRef]

- Kang, W.; Wang, M.; Chen, Y.; Zhang, Y. Decoupling of the Growing Exports in Foreign Trade from the Declining Gross Exports of Embodied Energy. Int. J. Environ. Res. Public Health 2022, 19, 9625. [Google Scholar] [CrossRef]

- Ye, H.; Li, Q.; Yu, H.; Xiang, L.; Wei, J.; Lin, F. Pyrolysis Behaviors and Residue Properties of Iron-Rich Rolling Sludge from Steel Smelting. Int. J. Environ. Res. Public Health 2022, 19, 2152. [Google Scholar] [CrossRef]

- Li, Z.; Dai, H.; Song, J.; Sun, L.; Geng, Y.; Lu, K.; Hanaoka, T. Assessment of the carbon emissions reduction potential of China’s iron and steel industry based on a simulation analysis. Energy 2019, 183, 279–290. [Google Scholar] [CrossRef]

- Gillingham, K.; Newell, R.G.; Palmer, K. Energy Efficiency Economics and Policy; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Visa, I. Sustainable Energy in the Built Environment-Steps Towards NZEB: Proceedings of the Conference for Sustainable Energy (CSE) 2014; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- International Energy Agency. Energy Efficiency Market Report 2015. Available online: https://www.iea.org/reports/energy-efficiency-market-report-2015 (accessed on 21 June 2022).

- Rehermann, F.; Pablo-Romero, M. Economic growth and transport energy consumption in the Latin American and Caribbean countries. Energy Policy 2018, 122, 518–527. [Google Scholar] [CrossRef]

- Greening, L.A.; Greene, D.L.; Difiglio, C. Energy efficiency and consumption—The rebound effect—A survey. Energy Policy 2000, 28, 389–401. [Google Scholar] [CrossRef]

- Herring, H.; Roy, R. Sustainable services, electronic education and the rebound effect. Environ. Impact Assess. Rev. 2002, 22, 525–542. [Google Scholar] [CrossRef]

- Liu, H.; Du, K.; Li, J. An improved approach to estimate direct rebound effect by incorporating energy efficiency: A revisit of China’s industrial energy demand. Energy Econ. 2019, 80, 720–730. [Google Scholar] [CrossRef]

- Wang, X.; Wen, X.; Xie, C. An evaluation of technical progress and energy rebound effects in China’s iron & steel industry. Energy Policy 2018, 123, 259–265. [Google Scholar] [CrossRef]

- Lin, B.; Li, J. The rebound effect for heavy industry: Empirical evidence from China. Energy Policy 2014, 74, 589–599. [Google Scholar] [CrossRef]

- Turner, K. “Rebound” effects from increased energy efficiency: A time to pause and reflect. Energy J. 2013, 34, 25–42. [Google Scholar] [CrossRef]

- Jevons, W.S. The Coal Question; an Inquiry Concerning the Progress of the Nation and the Probable Exhaustion of Our Coal-Mines; Macmillan and Co.: London, UK, 1865; Available online: https://archive.org/details/coalquestionani00jevogoog/page/n8/mode/2up (accessed on 21 June 2022).

- Khazzoom, J.D. Energy savings from more efficient appliances: A rejoinder. Energy J. 1989, 10, 1–14. [Google Scholar]

- Brookes, L.G.; Grubb, M. Energy efficiency and economic fallacies: A reply. Util. Policy 1992, 20, 390–393. [Google Scholar] [CrossRef]

- Saunders, H.D. The Khazzoom-Brookes postulate and neoclassical growth. Energy J. 1992, 13, 4–7. [Google Scholar] [CrossRef]

- Brookes, L. The greenhouse effect: The fallacies in the energy efficiency solution. Energy Policy 1990, 18, 199–201. [Google Scholar] [CrossRef]

- Lovins, A.B. Energy saving from the adoption of more efficient appliances: Another view. Energy J. 1988, 9, 2–10. [Google Scholar] [CrossRef]

- Berkhout, P.H.; Muskens, J.C.; Velthuijsen, J.W. Defining the rebound effect. Energy Policy 2000, 28, 425–432. [Google Scholar] [CrossRef]

- Gillingham, K.; Rapson, D.; Wagner, G. The Rebound Effect and Energy Efficiency Policy. Rev. Environ. Econ. Policy 2016, 10, 68–88. [Google Scholar] [CrossRef]

- Saunders, H.D. A view from the macro side: Rebound, backfire, and Khazzoom–Brookes. Energy Policy 2000, 28, 439–449. [Google Scholar] [CrossRef]

- Saunders, H.D. Fuel conserving (and using) production functions. Energy Econ. 2008, 30, 2184–2235. [Google Scholar] [CrossRef]

- Sorrell, S.; Dimitropoulos, J.; Sommerville, M. Empirical estimates of the direct rebound effect: A review. Energy Policy 2009, 37, 1356–1371. [Google Scholar] [CrossRef]

- Frondel, M.; Schmidt, C.M. Evaluating environmental programs: The perspective of modern evaluation research. Ecol. Econ. 2005, 55, 515–526. [Google Scholar] [CrossRef]

- Sorrell, S.; Dimitropoulos, J. UKERC review of evidence for the rebound effect: Technical report 5—Energy productivity and economic growth studies. UK Energy Res. Cent. Lond. 2007, 13, 1–178. [Google Scholar]

- Lu, Y.; Liu, Y.; Zhou, M. Rebound effect of improved energy efficiency for different energy types: A general equilibrium analysis for China. Energy Econ. 2017, 62, 248–256. [Google Scholar] [CrossRef]

- Bataille, C.; Melton, N. Energy efficiency and economic growth: A retrospective CGE analysis for Canada from 2002 to 2012. Energy Econ. 2017, 64, 118–130. [Google Scholar] [CrossRef]

- Broberg, T.; Berg, C.; Samakovlis, E. The economy-wide rebound effect from improved energy efficiency in Swedish industries–A general equilibrium analysis. Energy Policy 2015, 83, 26–37. [Google Scholar] [CrossRef]

- Zhou, M.; Liu, Y.; Feng, S.; Liu, Y.; Lu, Y. Decomposition of rebound effect: An energy-specific, general equilibrium analysis in the context of China. Appl. Energy 2018, 221, 280–298. [Google Scholar] [CrossRef]

- Kulmer, V.; Seebauer, S. How robust are estimates of the rebound effect of energy efficiency improvements? A sensitivity analysis of consumer heterogeneity and elasticities. Energy Policy 2019, 132, 1–14. [Google Scholar] [CrossRef]

- Khoshkalam, K.M.; Sayadi, M. Tracking the sources of rebound effect resulting from the efficiency improvement in petrol, diesel, natural gas and electricity consumption; A CGE analysis for Iran. Energy 2020, 197, 117134. [Google Scholar] [CrossRef]

- Zheng, Y.; Xu, H.; Jia, R. Endogenous energy efficiency and rebound effect in the transportation sector: Evidence from China. J. Clean. Prod. 2022, 335, 130310. [Google Scholar] [CrossRef]

- Yang, L.; Li, J. Rebound effect in China: Evidence from the power generation sector. Renew. Sustain. Energy Rev. 2017, 71, 53–62. [Google Scholar] [CrossRef]

- Liu, W.; Liu, Y.; Lin, B. Empirical analysis on energy rebound effect from the perspective of technological progress—A case study of China’s transport sector. J. Clean. Prod. 2018, 205, 1082–1093. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Peng, H.-R.; Liu, Z.; Tan, W. Direct energy rebound effect for road passenger transport in China: A dynamic panel quantile regression approach. Energy Policy 2015, 87, 303–313. [Google Scholar] [CrossRef]

- Freire-González, J.; Font Vivanco, D.; Puig-Ventosa, I. Economic structure and energy savings from energy efficiency in households. Ecol. Econ. 2017, 131, 12–20. [Google Scholar] [CrossRef]

- Wen, F.; Ye, Z.; Yang, H.; Li, K. Exploring the rebound effect from the perspective of household: An analysis of China’s provincial level. Energy Econ. 2018, 75, 345–356. [Google Scholar] [CrossRef]

- Li, K.; Zhang, N.; Liu, Y. The energy rebound effects across China’s industrial sectors: An output distance function approach. Appl. Energy 2016, 184, 1165–1175. [Google Scholar] [CrossRef]

- Craglia, M.; Cullen, J. Do vehicle efficiency improvements lead to energy savings? The rebound effect in Great Britain. Energy Econ. 2020, 88, 104775. [Google Scholar] [CrossRef]

- Sorrell, S.; Stapleton, L. Rebound effects in UK road freight transport. Transp. Res. Part D Transp. Environ. 2018, 63, 156–174. [Google Scholar] [CrossRef]

- Dimitropoulos, A.; Oueslati, W.; Sintek, C. The rebound effect in road transport: A meta-analysis of empirical studies. Energy Econ. 2018, 75, 163–179. [Google Scholar] [CrossRef]

- Du, H.; Chen, Z.; Zhang, Z.; Southworth, F. The rebound effect on energy efficiency improvements in China’s transportation sector: A CGE analysis. J. Manag. Sci. Eng. 2020, 5, 249–263. [Google Scholar] [CrossRef]

- Chen, W.; Yin, X.; Ma, D. A bottom-up analysis of China’s iron and steel industrial energy consumption and CO2 emissions. Appl. Energy 2014, 136, 1174–1183. [Google Scholar] [CrossRef]

- Long, W.; Wang, S.; Lu, C.; Xue, R.; Liang, T.; Jiang, N.; Zhang, R. Quantitative assessment of energy conservation potential and environmental benefits of an iron and steel plant in China. J. Clean. Prod. 2020, 273, 123163. [Google Scholar] [CrossRef]

- Lin, B.; Wang, X. Exploring energy efficiency in China’s iron and steel industry: A stochastic frontier approach. Energy Policy 2014, 72, 87–96. [Google Scholar] [CrossRef]

- Adetutu, M.O.; Glass, A.J.; Weyman-Jones, T.G. Economy-wide Estimates of Rebound Effects: Evidence from Panel Data. Energy J. 2016, 37. [Google Scholar] [CrossRef]

- Caves, D.W.; Christensen, L.R.; Diewert, W.E. Multilateral comparisons of output, input, and productivity using superlative index numbers. Econ. J. 1982, 92, 73–86. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Norris, M.; Zhang, Z. Productivity growth, technical progress, and efficiency change in industrialized countries. Am. Econ. Rev. 1994, 84, 66–83. [Google Scholar]

- Li, J.; Liu, H.; Du, K. Does market-oriented reform increase energy rebound effect? Evidence from China’s regional development. China Econ. Rev. 2019, 56, 101304. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Zhou, D.Q. Measuring economy-wide energy efficiency performance: A parametric frontier approach. Appl. Energy 2012, 90, 196–200. [Google Scholar] [CrossRef]

- Xia, B.; Dong, S.; Li, Z.; Zhao, M.; Sun, D.; Zhang, W.; Li, Y. Eco-Efficiency and Its Drivers in Tourism Sectors with Respect to Carbon Emissions from the Supply Chain: An Integrated EEIO and DEA Approach. Int. J. Environ. Res. Public Health 2022, 19, 6951. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Han, J.Y. Total factor carbon emission performance: A Malmquist index analysis. Energy Econ. 2010, 32, 194–201. [Google Scholar] [CrossRef]

- Wu, F.; Fan, L.W.; Zhou, P.; Zhou, D.Q. Industrial energy efficiency with CO2 emissions in China: A nonparametric analysis. Energy Policy 2012, 49, 164–172. [Google Scholar] [CrossRef]

- Sorrell, S.; Dimitropoulos, J. The rebound effect: Microeconomic definitions, limitations and extensions. Ecol. Econ. 2008, 65, 636–649. [Google Scholar] [CrossRef]

- Lin, B.; Du, K. Measuring energy rebound effect in the Chinese economy: An economic accounting approach. Energy Econ. 2015, 50, 96–104. [Google Scholar] [CrossRef]

- Cho, W.G.; Nam, K.; Pagan, J.A. Economic growth and interfactor/interfuel substitution in Korea. Energy Econ. 2004, 26, 31–50. [Google Scholar] [CrossRef]

- Xu, M.; Lin, B.; Wang, S. Towards energy conservation by improving energy efficiency? Evidence from China’s metallurgical industry. Energy 2021, 216, 119255. [Google Scholar] [CrossRef]

- Wu, R.; Lin, B. Environmental regulation and its influence on energy-environmental performance: Evidence on the Porter Hypothesis from China’s iron and steel industry. Resour. Conserv. Recycl. 2022, 176, 105954. [Google Scholar] [CrossRef]

- Chang, T.-P.; Hu, J.-L. Total-factor energy productivity growth, technical progress, and efficiency change: An empirical study of China. Appl. Energy 2010, 87, 3262–3270. [Google Scholar] [CrossRef]

- Wang, X.; Lin, B. Factor and fuel substitution in China’s iron & steel industry: Evidence and policy implications. J. Clean. Prod. 2017, 141, 751–759. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. Assessing CO2 emissions in China’s iron and steel industry: A dynamic vector autoregression model. Appl. Energy 2016, 161, 375–386. [Google Scholar] [CrossRef]

- Goldsmith, R.W. A perpetual inventory of national wealth. In Studies in Income and Wealth; NBER: Cambridge, MA, USA, 1951; Volume 14, pp. 5–73. [Google Scholar]

- Lin, B.; Chen, Y.; Zhang, G. Technological progress and rebound effect in China’s nonferrous metals industry: An empirical study. Energy Policy 2017, 109, 520–529. [Google Scholar] [CrossRef]

- Lin, B.; Zhao, H. Technological progress and energy rebound effect in China’s textile industry: Evidence and policy implications. Renew. Sustain. Energy Rev. 2016, 60, 173–181. [Google Scholar] [CrossRef]

- Wu, R.; Lin, B. Does industrial agglomeration improve effective energy service: An empirical study of China’s iron and steel industry. Appl. Energy 2021, 295, 117066. [Google Scholar] [CrossRef]

- Chen, Y.; Lin, B. Understanding the green total factor energy efficiency gap between regional manufacturing—insight from infrastructure development. Energy 2021, 237, 121553. [Google Scholar] [CrossRef]

- Feng, C.; Huang, J.-B.; Wang, M.; Song, Y. Energy efficiency in China’s iron and steel industry: Evidence and policy implications. J. Clean. Prod. 2018, 177, 837–845. [Google Scholar] [CrossRef]

- Li, J.; Lin, B. Rebound effect by incorporating endogenous energy efficiency: A comparison between heavy industry and light industry. Appl. Energy 2017, 200, 347–357. [Google Scholar] [CrossRef]

- Chitnis, M.; Sorrell, S.; Druckman, A.; Firth, S.K.; Jackson, T. Turning lights into flights: Estimating direct and indirect rebound effects for UK households. Energy Policy 2013, 55, 234–250. [Google Scholar] [CrossRef]

- Wang, Z.; Lu, M. An empirical study of direct rebound effect for road freight transport in China. Appl. Energy 2014, 133, 274–281. [Google Scholar] [CrossRef]

- Lin, B.; Liu, X. Dilemma between economic development and energy conservation: Energy rebound effect in China. Energy 2012, 45, 867–873. [Google Scholar] [CrossRef]

- Liu, Y.; Tang, L.; Liu, G. Carbon Dioxide Emissions Reduction through Technological Innovation: Empirical Evidence from Chinese Provinces. Int. J. Environ. Res. Public Health 2022, 19, 9543. [Google Scholar] [CrossRef]

- Zhang, R.; Ma, Y.; Ren, J. Green Development Performance Evaluation Based on Dual Perspectives of Level and Efficiency: A Case Study of the Yangtze River Economic Belt, China. Int. J. Environ. Res. Public Health 2022, 19, 9306. [Google Scholar] [CrossRef]

- Zhang, J.; Lin Lawell, C.Y.C. The macroeconomic rebound effect in China. Energy Econ. 2017, 67, 202–212. [Google Scholar] [CrossRef]

- Brännlund, R.; Ghalwash, T.; Nordström, J. Increased energy efficiency and the rebound effect: Effects on consumption and emissions. Energy Econ. 2007, 29, 1–17. [Google Scholar] [CrossRef]

- Xie, C.; Hong, Y.; Ding, Y.; Li, Y.; Radcliffe, J. An economic feasibility assessment of decoupled energy storage in the UK: With liquid air energy storage as a case study. Appl. Energy 2018, 225, 244–257. [Google Scholar] [CrossRef]

| Variable (Abbreviation) | Unit | Size | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Industrial output (Y) | Hundred million Yuan | 29 | 1245.151 | 1867.287 | 10.750 | 13,960.170 |

| Labor (L) | Ten thousand persons | 29 | 12.256 | 12.558 | 0.860 | 77.780 |

| Capital (K) | Hundred million Yuan | 29 | 542.098 | 714.011 | 5.359 | 5085.804 |

| Energy (E) | Million Tce | 29 | 17.638 | 25.311 | 0.380 | 202.391 |

| Industrial price (PY) | Price index | 29 | 127.747 | 29.677 | 84.323 | 254.786 |

| Labor price (PL) | Thousand Yuan | 29 | 27.135 | 13.095 | 5.715 | 81.156 |

| Capital price (PK) | Price index | 29 | 9.967 | 2.170 | 0.150 | 15.657 |

| Energy price (PE) | Price index | 29 | 180.635 | 60.276 | 96.018 | 441.993 |

| Province | MEPI | EEC | TC |

|---|---|---|---|

| Beijing (E) | 1.125 | 1.028 | 1.089 |

| Fujian (E) | 1.093 | 0.989 | 1.107 |

| Guangdong (E) | 1.110 | 0.990 | 1.123 |

| Hebei (E) | 1.077 | 0.997 | 1.089 |

| Jiangsu (E) | 1.135 | 1.014 | 1.122 |

| Liaoning (E) | 1.077 | 1.003 | 1.079 |

| Shandong (E) | 1.119 | 1.016 | 1.114 |

| Shanghai (E) | 1.095 | 0.993 | 1.113 |

| Tianjin (E) | 1.130 | 1.006 | 1.120 |

| Zhejiang (E) | 1.099 | 1.002 | 1.097 |

| Anhui (C) | 1.128 | 1.049 | 1.082 |

| Heilongjiang (C) | 1.070 | 1.010 | 1.061 |

| Henan (C) | 1.124 | 1.040 | 1.089 |

| Hubei (C) | 1.058 | 0.986 | 1.083 |

| Hunan (C) | 1.061 | 0.991 | 1.074 |

| Inner Mongolia (C) | 1.057 | 0.993 | 1.072 |

| Jiangxi (C) | 1.051 | 0.978 | 1.082 |

| Jilin (C) | 1.028 | 0.958 | 1.077 |

| Shanxi (C) | 1.059 | 0.994 | 1.071 |

| Chongqing (W) | 1.091 | 1.025 | 1.066 |

| Gansu (W) | 1.042 | 0.963 | 1.083 |

| Guangxi (W) | 1.120 | 1.038 | 1.084 |

| Guizhou (W) | 1.066 | 1.002 | 1.072 |

| Ningxia (W) | 1.036 | 0.972 | 1.069 |

| Qinghai (W) | 0.948 | 0.895 | 1.070 |

| Shaanxi (W) | 1.188 | 1.077 | 1.140 |

| Sichuan (W) | 1.049 | 0.986 | 1.072 |

| Xinjiang (W) | 1.058 | 0.981 | 1.078 |

| Yunnan (W) | 1.030 | 0.971 | 1.068 |

| East China mean | 1.106 | 1.004 | 1.105 |

| Central China mean | 1.071 | 1.000 | 1.077 |

| West China mean | 1.063 | 0.991 | 1.080 |

| China mean | 1.080 | 0.998 | 1.088 |

| Period | Year | MEPI | EEC | TC |

|---|---|---|---|---|

| 10th Five-Year Plan | 2001–2005 | 1.469 | 0.844 | 1.734 |

| 11th Five-Year Plan | 2006–2010 | 2.371 | 0.825 | 2.820 |

| 12th Five-Year Plan | 2011–2015 | 3.660 | 1.031 | 3.470 |

| 13th Five-Year Plan | 2016–2019 | 4.029 | 0.876 | 4.455 |

| Variables | SL | SES |

|---|---|---|

| lagSL | 0.807 *** (0.000) | |

| lnPK | −0.007 *** (0.000) | −0.094 *** (0.000) |

| lnPL | 0.012 *** (0.000) | −0.005 *** (0.000) |

| lnPES | −0.005 *** (0.000) | 0.099 *** (0.000) |

| lnY | −0.002 *** (0.000) | −0.014 *** (0.000) |

| lagSES | 0.742 *** (0.000) | |

| Constant | 0.025 *** (0.000) | −0.082 *** (0.000) |

| Observations | 521 | 521 |

| R2 | 0.628 | 0.800 |

| ηij | K | L | ES |

|---|---|---|---|

| K | −0.1970 | 0.5400 | 0.3249 |

| L | 0.0520 | −0.7491 | 0.0451 |

| ES | 0.1451 | 0.2091 | −0.3700 |

| Eastern Province | Eastern RE | Central Province | Central RE | Western Province | Western RE |

|---|---|---|---|---|---|

| Beijing | 0.3057 | Anhui | 0.4731 | Chongqing | 0.4330 |

| Fujian | 0.4550 | Heilongjiang | 0.4319 | Gansu | 0.4585 |

| Guangdong | 0.4072 | Henan | 0.4304 | Guangxi | 0.4220 |

| Hebei | 0.4119 | Hubei | 0.4602 | Guizhou | 0.3409 |

| Jiangsu | 0.4741 | Hunan | 0.4605 | Ningxia | 0.3075 |

| Liaoning | 0.4739 | Inner Mongolia | 0.4730 | Qinghai | 0.4408 |

| Shandong | 0.4739 | Jiangxi | 0.4279 | Shaanxi | 0.4520 |

| Shanghai | 0.3468 | Jilin | 0.4639 | Sichuan | 0.4738 |

| Tianjin | 0.4684 | Shanxi | 0.4231 | Xinjiang | 0.4111 |

| Zhejiang | 0.4704 | Yunnan | 0.3895 | ||

| East mean | 0.4287 | Central mean | 0.4493 | West mean | 0.4129 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, R.; Lin, B. Does Energy Efficiency Realize Energy Conservation in the Iron and Steel Industry? A Perspective of Energy Rebound Effect. Int. J. Environ. Res. Public Health 2022, 19, 11767. https://doi.org/10.3390/ijerph191811767

Wu R, Lin B. Does Energy Efficiency Realize Energy Conservation in the Iron and Steel Industry? A Perspective of Energy Rebound Effect. International Journal of Environmental Research and Public Health. 2022; 19(18):11767. https://doi.org/10.3390/ijerph191811767

Chicago/Turabian StyleWu, Rongxin, and Boqiang Lin. 2022. "Does Energy Efficiency Realize Energy Conservation in the Iron and Steel Industry? A Perspective of Energy Rebound Effect" International Journal of Environmental Research and Public Health 19, no. 18: 11767. https://doi.org/10.3390/ijerph191811767

APA StyleWu, R., & Lin, B. (2022). Does Energy Efficiency Realize Energy Conservation in the Iron and Steel Industry? A Perspective of Energy Rebound Effect. International Journal of Environmental Research and Public Health, 19(18), 11767. https://doi.org/10.3390/ijerph191811767