Capital Formation, Green Innovation, Renewable Energy Consumption and Environmental Quality: Do Environmental Regulations Matter?

Abstract

1. Introduction

2. Literature Review

3. Theoretical Framework and Model Construction

3.1. Theoretical Framework

3.2. Data

3.3. Estimation Methods

3.3.1. Cross-Sectional Dependence Test

3.3.2. Slope Heterogeneity Test

3.3.3. Unit Root Test

3.3.4. Westerlund Test for Cointegration

3.3.5. Long-Run Estimation Results

3.3.6. Panel Granger Causality Test

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmad, M.; Ahmed, Z.; Majeed, A.; Huang, B. An environmental impact assessment of economic complexity and energy consumption : Does institutional quality make a difference ? Environ. Impact Assess. Rev. 2021, 89, 106603. [Google Scholar] [CrossRef]

- Xue, C.; Shahbaz, M.; Ahmed, Z.; Ahmad, M.; Sinha, A. Clean energy consumption, economic growth, and environmental sustainability: What is the role of economic policy uncertainty? Renew. Energy 2022, 184, 899–907. [Google Scholar]

- Ahmed, N.; Sheikh, A.A.; Hamid, Z.; Senkus, P.; Borda, R.C.; Glabiszewski, W.; Wysoki, A. Exploring the Causal Relationship among Green Taxes, Energy Intensity, and Energy Consumption in Nordic Countries: Dumitrescu and Hurlin Causality Approach. Energies 2022, 15, 5199. [Google Scholar]

- Rout, S.K.; Gupta, M.; Sahoo, M. The role of technological innovation and diffusion, energy consumption and financial development in affecting ecological footprint in BRICS: An empirical analysis. Environ. Sci. Pollut. Res. 2022, 29, 25318–25335. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M.; Sengupta, T. Renewable energy policies and contradictions in causality: A case of Next 11 countries. J. Clean. Prod. 2018, 197, 73–84. [Google Scholar] [CrossRef]

- Sinha, A.; Sengupta, T.; Alvarado, R. Interplay between technological innovation and environmental quality: Formulating the SDG policies for next 11 economies. J. Clean. Prod. 2020, 242, 118549. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Majeed, A.; Umar, M.; Khan, Z.; Muhammad, S. The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Resour. Policy 2020, 69, 101817. [Google Scholar] [CrossRef]

- Can, B.; Can, M. Examining the Relationship Between Knowledge and Well-Being as Values of a Society: An Empirical Analysis for Turkey. In Regulating Human Rights, Social Security, and Socio-Economic Structures in a Global Perspective; IGI Global: Hershey, PA, USA, 2022; pp. 211–226. [Google Scholar]

- Dong, F.; Zhu, J.; Li, Y.; Chen, Y.; Gao, Y.; Hu, M.; Qin, C.; Sun, J. How green technology innovation affects carbon emission efficiency: Evidence from developed countries proposing carbon neutrality targets. Environ. Sci. Pollut. Res. 2022, 29, 35780–35799. [Google Scholar] [CrossRef]

- Södersten, C.J.; Wood, R.; Hertwich, E.G. Environmental Impacts of Capital Formation. J. Ind. Ecol. 2018, 22, 55–67. [Google Scholar] [CrossRef]

- Rahman, Z.U.; Ahmad, M. Modeling the relationship between gross capital formation and CO2 (a)symmetrically in the case of Pakistan: An empirical analysis through NARDL approach. Environ. Sci. Pollut. Res. 2019, 26, 8111–8124. [Google Scholar] [CrossRef]

- Gao, Z.; Geng, Y.; Wu, R.; Zhang, X.; Pan, H.; Jiang, H. China’s CO2 emissions embodied in fixed capital formation and its spatial distribution. Environ. Sci. Pollut. Res. 2020, 27, 19970–19990. [Google Scholar] [CrossRef]

- Mujtaba, A.; Jena, P.K.; Bekun, F.V.; Sahu, P.K. Symmetric and asymmetric impact of economic growth, capital formation, renewable and non-renewable energy consumption on environment in OECD countries. Renew. Sustain. Energy Rev. 2022, 160, 112300. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Beton Kalmaz, D. Determinants of CO2 emissions: Empirical evidence from Egypt. Environ. Ecol. Stat. 2021, 28, 239–262. [Google Scholar] [CrossRef]

- Asghar Khan, M.; Rehan, R.; Umer Chhapra, I.; Bai, A. Inspecting energy consumption, capital formation and economic growth nexus in Pakistan. Sustain. Energy Technol. Assess. 2022, 50, 101845. [Google Scholar] [CrossRef]

- Zhao, J.; Patwary, A.K.; Qayyum, A.; Alharthi, M.; Bashir, F.; Mohsin, M.; Hanif, I.; Abbas, Q. The determinants of renewable energy sources for the fueling of green and sustainable economy. Energy 2022, 238, 122029. [Google Scholar] [CrossRef]

- khan, I.; Han, L.; BiBi, R.; khan, H. The role of technological innovations and renewable energy consumption in reducing environmental degradation: Evidence from the belt and road initiative countries. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Khan, K.; Su, C.W.; Rehman, A.U.; Ullah, R. Is technological innovation a driver of renewable energy? Technol. Soc. 2022, 70, 102044. [Google Scholar] [CrossRef]

- Cheng, M.; Wen, Z.; Yang, S. The driving effect of technological innovation on green development : Dynamic efficiency spatial variation. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Shi, Y.; Li, Y. An Evolutionary Game Analysis on Green Technological Innovation of New Energy Enterprises under the Heterogeneous Environmental Regulation Perspective. Sustainability 2022, 14, 6340. [Google Scholar] [CrossRef]

- Hashmi, R.; Alam, K. Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J. Clean. Prod. 2019, 231, 1100–1109. [Google Scholar]

- Ahmad, M.; Jiang, P.; Murshed, M.; Shehzad, K.; Akram, R.; Cui, L.; Khan, Z. Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: Does financial globalization matter? Sustain. Cities Soc. 2021, 70, 102881. [Google Scholar] [CrossRef]

- Zafar, M.W.; Saeed, A.; Zaidi, S.A.H.; Waheed, A. The linkages among natural resources, renewable energy consumption, and environmental quality: A path toward sustainable development. Sustain. Dev. 2021, 29, 353–362. [Google Scholar] [CrossRef]

- Zafar, M.W.; Shahbaz, M.; Sinha, A.; Sengupta, T.; Qin, Q. How renewable energy consumption contribute to environmental quality? The role of education in OECD countries. J. Clean. Prod. 2020, 268, 122149. [Google Scholar] [CrossRef]

- Abbas, Q.; Nurunnabi, M.; Alfakhri, Y.; Khan, W.; Hussain, A.; Iqbal, W. The role of fixed capital formation, renewable and non-renewable energy in economic growth and carbon emission: A case study of Belt and Road Initiative project. Environ. Sci. Pollut. Res. 2020, 27, 45476–45486. [Google Scholar] [CrossRef]

- Porter, M.E. Towards a dynamic theory of strategy. Strateg. Manag. J. 1991, 12, 95–117. [Google Scholar] [CrossRef]

- Song, W.; Yu, H. Green Innovation Strategy and Green Innovation: The Roles of Green Creativity and Green Organizational Identity. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 135–150. [Google Scholar] [CrossRef]

- Yunzhao, L. Modelling the role of eco innovation, renewable energy, and environmental taxes in carbon emissions reduction in E−7 economies: Evidence from advance panel estimations. Renew. Energy 2022, 190, 309–318. [Google Scholar] [CrossRef]

- Ullah, A.; Kui, Z.; Pinglu, C.; Sheraz, M. Effect of Financial Development, Foreign Direct Investment, Globalization, and Urbanization on Energy Consumption: Empirical Evidence From Belt and Road Initiative Partner Countries. Front. Environ. Sci. 2022, 10, 937834. [Google Scholar] [CrossRef]

- Khan, H.; Weili, L.; Khan, I. Institutional quality, financial development and the influence of environmental factors on carbon emissions: Evidence from a global perspective. Environ. Sci. Pollut. Res. 2022, 29, 13356–13368. [Google Scholar] [CrossRef]

- Alola, A.A.; Dike, G.C.; Alola, U.V. The Role of Legal System and Socioeconomic Aspects in the Environmental Quality Drive of the Global South. Soc. Indic. Res. 2022, 163, 953–972. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Z.; Kirikkaleli, D.; Adebayo, T.S.; Adeshola, I.; Akinsola, G.D. Modeling CO2 emissions in Malaysia: An application of Maki cointegration and wavelet coherence tests. Environ. Sci. Pollut. Res. 2021, 28, 26030–26044. [Google Scholar] [CrossRef]

- OWD Our World in Data. 2021. Available online: https://ourworldindata.org/grapher/per-capita-renewables%0A (accessed on 2 May 2022).

- WDI World Devleopment Indicators (WDI). 2021. Available online: https://datatopics.worldbank.org/world-development-indicators/ (accessed on 15 May 2022).

- OECD Environmental Tax (Indicator). 2022. Available online: https://doi.org/10.1787/5a287eac-en (accessed on 12 May 2022).

- OECD. Patents on Environment Technologies (Indicator); OECD: Paris, France, 2022. [Google Scholar]

- Pesaran, M.H. Pesaran General Diagnostic Tests for Cross-Sectional Dependence in Panels; Cambridge Working Papers in Economics; University of Cambridge: Cambridge, UK, 2004. [Google Scholar]

- Pesaran, H.; Yamagata, T. Testing slope homogeneity in large panels. Econ. J. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Westerlund, J. Testing for Error Correction in Panel Data. Oxf. Bull. Econ. Stat. 2007, 69, 709–748. [Google Scholar] [CrossRef]

- Machado, J.A.F.; Santos Silva, J.M.C. Quantiles via moments. J. Econom. 2019, 213, 145–173. [Google Scholar] [CrossRef]

- Dumitrescu, E.-I.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Ajide, K.B.; Ibrahim, R.L. Threshold effects of capital investments on carbon emissions in G20 economies. Environ. Sci. Pollut. Res. 2021, 28, 39052–39070. [Google Scholar] [CrossRef]

- Pei, Y.; Zhu, Y.; Liu, S.; Wang, X.; Cao, J. Environmental regulation and carbon emission: The mediation effect of technical efficiency. J. Clean. Prod. 2019, 236, 117599. [Google Scholar] [CrossRef]

- Hassan, T.; Khan, Y.; He, C.; Chen, J.; Alsagr, N.; Song, H.; khan, N. Environmental regulations, political risk and consumption-based carbon emissions: Evidence from OECD economies. J. Environ. Manag. 2022, 320, 115893. [Google Scholar] [CrossRef]

- Hongqiao, H.; Xinjun, W.; Ahmad, M.; Zhonghua, L. Does innovation in Environmental Technologies Curb CO2 Emissions? Evidence From Advanced Time Series Techniques. Front. Environ. Sci. 2022, 10, 930521. [Google Scholar] [CrossRef]

- Aziz, N.; Sharif, A.; Raza, A.; Jermsittiparsert, K. The role of natural resources, globalization, and renewable energy in testing the EKC hypothesis in MINT countries: New evidence from Method of Moments Quantile Regression approach. Environ. Sci. Pollut. Res. 2021, 28, 13454–13468. [Google Scholar] [CrossRef]

- Elahi, E.; Khalid, Z.; Tauni, M.Z.; Zhang, H.; Lirong, X. Extreme Weather Events Risk to Crop-Production and the Adaptation of Innovative Management Strategies to Mitigate the Risk: A Retrospective Survey of Rural Punjab, Pakistan. Technovation 2022, 117, 102255. [Google Scholar] [CrossRef]

- Sharif, A.; Saqib, N.; Dong, K.; Khan, S.A.R. Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: The moderating role of social globalisation. Sustain. Dev. 2022. [Google Scholar] [CrossRef]

| Variable | Abb. | Proxy | Data Source |

|---|---|---|---|

| Environmental quality | CO2 | CO2 emission (tones per person) | [33] |

| Capital formation | CF | Gross capital formation (constant 2015 USD) | [34] |

| Environmental regulation | ER | Environmental taxes | [35] |

| Green innovation | GI | Patents on environmental technologies (% of total) | [36] |

| Renewable energy | RE | Renewables per capita (kWh—equivalent) | [33] |

| Economic growth | GDP | Per capita (constant 2010 USD) | [34] |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| lnCO2 | 182 | 2.330 | 0.409 | 1.579 | 3.060 |

| lnCF | 182 | 27.201 | 0.777 | 25.881 | 29.096 |

| lnER | 182 | 0.595 | 0.432 | −0.335 | 1.28 |

| lnGI | 182 | 2.251 | 0.287 | 1.627 | 2.754 |

| lnRE | 182 | 1.381 | 1.082 | −1.215 | 3.595 |

| lnGDP | 182 | 10.624 | 0.131 | 10.306 | 10.931 |

| Variables | lnCO2 | lnCF | lnER | lnGI | lnRE | lnGDP |

|---|---|---|---|---|---|---|

| lnCO2 | 1.000 | |||||

| lnCF | 0.414 | 1.000 | ||||

| lnER | −0.817 | −0.678 | 1.000 | |||

| lnGI | −0.137 | 0.077 | −0.163 | 1.000 | ||

| lnRE | 0.404 | −0.133 | −0.462 | 0.349 | 1.000 | |

| lnGDP | 0.434 | 0.592 | −0.787 | 0.537 | 0.462 | 1.000 |

| Variable | CD-Test | p-Value | Mean Abs (ρ) |

|---|---|---|---|

| lnCO2 | 19.072 * | 0.000 | 0.82 |

| lnCF | 7.942 * | 0.000 | 0.51 |

| lnER | 8.231 * | 0.000 | 0.50 |

| lnGI | 21.812 * | 0.000 | 0.93 |

| lnRE | 9.413 * | 0.000 | 0.71 |

| lnGDP | 18.327 * | 0.000 | 0.78 |

| Test | Value | p-Value |

|---|---|---|

| 10.702 * | 0.000 | |

| 12.519 * | 0.000 |

| Variable | CIPS | CADF | ||

|---|---|---|---|---|

| I | I (0) | I | I (0) | |

| lnCO2 | −2.124 | −4.717 * | −2.155 | −3.818 * |

| lnCF | −1.524 | −3.442 * | −1.782 | −3.201 * |

| lnER | −1.496 | −4.382 * | −1.564 | −2.573 ** |

| lnGI | −3.233 * | −4.706 * | −3.359 * | −3.938 * |

| lnRE | −3.299 * | −5.604 * | −1.555 | −4.094 * |

| lnGDP | −1.409 * | −3.768 * | −1.856 | 3.492 * |

| Statistic | Value | Z-Value | Robust p-Value |

|---|---|---|---|

| Gt | −3.430 *** | −1.195 | 0.083 |

| Ga | −11.102 *** | 2.342 | 0.075 |

| Pt | −9.107 ** | −1.743 | 0.040 |

| Pa | −10.890 *** | 1.405 | 0.072 |

| Low | Medium | High | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Q0.10 | Q0.20 | Q0.30 | Q0.40 | Q0.50 | Q0.60 | Q0.70 | Q0.80 | Q0.90 | |

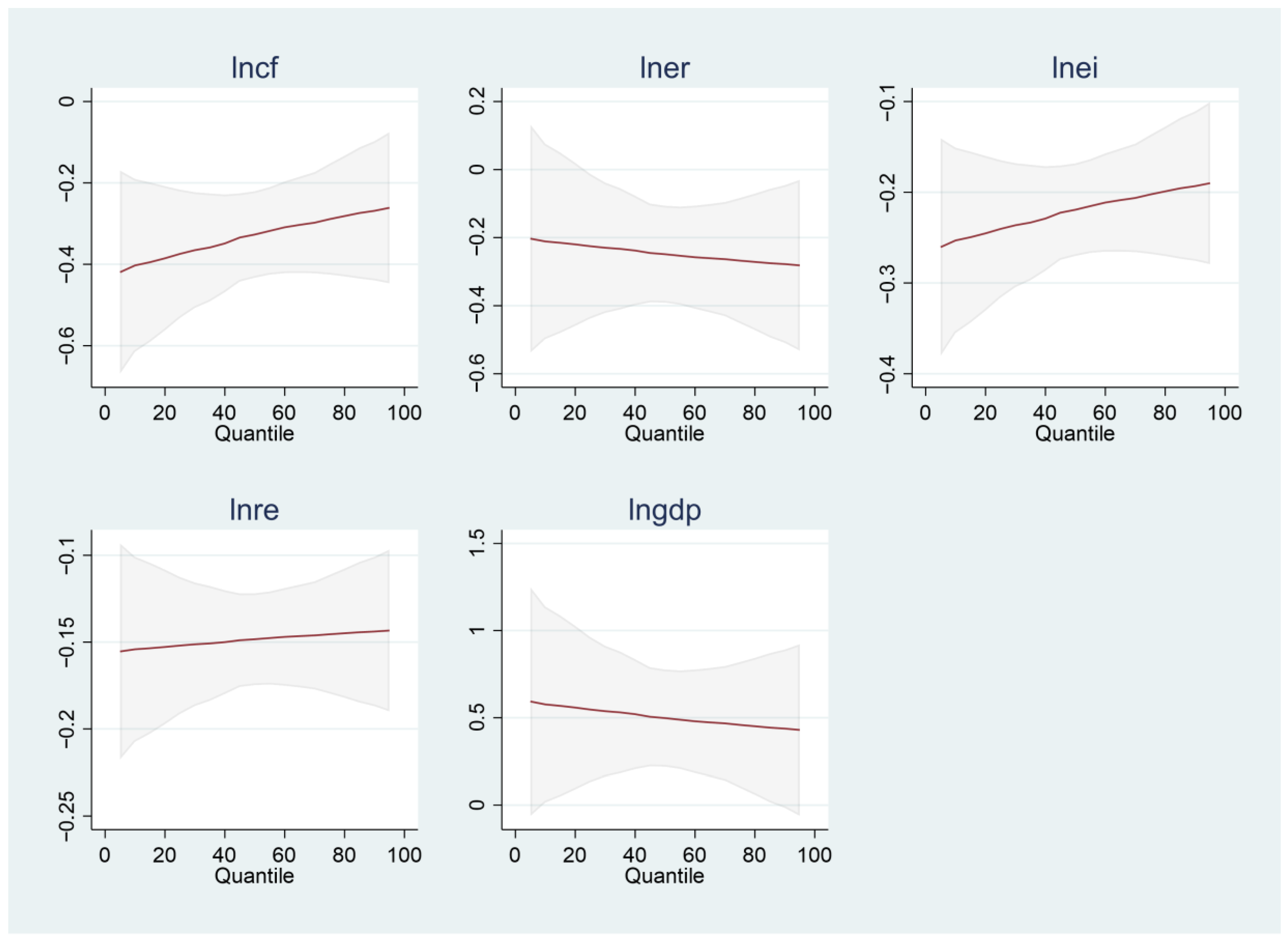

| lnCF | −0.403 * [0.108] | −0.385 * [0.090] | −0.365 * [0.072] | −0.349 * [0.061] | −0.327 * [0.054] | −0.309 * [0.057] | −0.298 * [0.063] | −0.281 * [0.075] | −0.269 * [0.087] |

| lnER | −0.211 [0.146] | −0.220 *** [0.122] | −0.230 ** [0.097] | −0.238 * [0.082] | −0.249 * [0.072] | −0.258 * [0.077] | −0.263 * [0.085] | −0.271 * [0.102] | −0.278 ** [0.118] |

| lnGI | −0.253 * [0.052] | −0.245 * [0.043] | −0.236 * [0.035] | −0.229 * [0.029] | −0.219 * [0.026] | −0.211 * [0.027] | −0.206 * [0.030] | −0.199 * [0.036] | −0.193 * [0.042] |

| lnRE | −0.154 * [0.027] | −0.153 * [0.023] | −0.151 * [0.018] | −0.150 * [0.015] | −0.148 * [0.013] | −0.147 * [0.014] | −0.146 * [0.015] | −0.145 * [0.019] | −0.144 * [0.022] |

| lnGDP | 0.576 ** [0.287] | 0.558 ** [0.239] | 0.537 ** [0.191] | 0.520 * [0.160] | 0.498 * [0.142] | 0.479 * [0.151] | 0.468 * [0.167] | 0.451 ** [0.200] | 0.438 *** [0.231] |

| FMOLS | DOLS | |||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | Coefficient | Std. Error |

| lnCF | −0.336 * | 0.033 | −0.525 * | 0.135 |

| lnER | −0.278 * | 0.042 | −0.430 * | 0.075 |

| lnGI | −0.222 * | 0.014 | −0.334 * | 0.035 |

| lnRE | −0.151 * | 0.007 | −0.191 * | 0.016 |

| lnGDP | 0.445 * | 0.086 | 0.726 ** | 0.326 |

| Null Hypothesis | W-Stat. | Zbar-Stat. | Prob. | Conclusion |

|---|---|---|---|---|

| lnCF ↮ lnCO2 | 5.553 * | 8.517 | 0.000 | lnCF →lnCO2 |

| lnCO2 ↮ lnCF | 3.483 | 1.312 | 0.189 | |

| lnER ↮ lnCO2 | 6.570 * | 8.614 | 0.000 | lnER → lnCO2 |

| lnCO2 ↮ lnER | 2.979 | 0.782 | 0.434 | |

| lnGI ↮ lnCO2 | 5.636 * | 7.143 | 0.000 | lnGI → lnCO2 |

| lnCO2 ↮ lnGI | 2.793 | 0.587 | 0.557 | |

| lnRE ↮ lnCO2 | 3.338 * | 3.524 | 0.000 | lnRE → lnCO2 |

| lnCO2 ↮ lnRE | 3.639 | 1.477 | 0.139 | |

| lnGDP ↮ lnCO2 | 7.386 * | 9.898 | 0.000 | lnGDP ↔ lnCO2 |

| lnCO2 ↮ lnGDP | 4.615 ** | 2.503 | 0.012 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Meng, X.; Li, T.; Ahmad, M.; Qiao, G.; Bai, Y. Capital Formation, Green Innovation, Renewable Energy Consumption and Environmental Quality: Do Environmental Regulations Matter? Int. J. Environ. Res. Public Health 2022, 19, 13562. https://doi.org/10.3390/ijerph192013562

Meng X, Li T, Ahmad M, Qiao G, Bai Y. Capital Formation, Green Innovation, Renewable Energy Consumption and Environmental Quality: Do Environmental Regulations Matter? International Journal of Environmental Research and Public Health. 2022; 19(20):13562. https://doi.org/10.3390/ijerph192013562

Chicago/Turabian StyleMeng, Xueying, Tianqing Li, Mahmood Ahmad, Guitao Qiao, and Yang Bai. 2022. "Capital Formation, Green Innovation, Renewable Energy Consumption and Environmental Quality: Do Environmental Regulations Matter?" International Journal of Environmental Research and Public Health 19, no. 20: 13562. https://doi.org/10.3390/ijerph192013562

APA StyleMeng, X., Li, T., Ahmad, M., Qiao, G., & Bai, Y. (2022). Capital Formation, Green Innovation, Renewable Energy Consumption and Environmental Quality: Do Environmental Regulations Matter? International Journal of Environmental Research and Public Health, 19(20), 13562. https://doi.org/10.3390/ijerph192013562