Does a Recycling Carbon Tax with Technological Progress in Clean Electricity Drive the Green Economy?

Abstract

:1. Introduction

2. Literature Review

2.1. Research on Electricity and Carbon Emissions

2.2. Research on Carbon Tax and Carbon Tax Recycling Policy

2.3. Research on Technological Progress and Carbon Emission Reduction

2.4. Research on CGE Model Involving Electricity

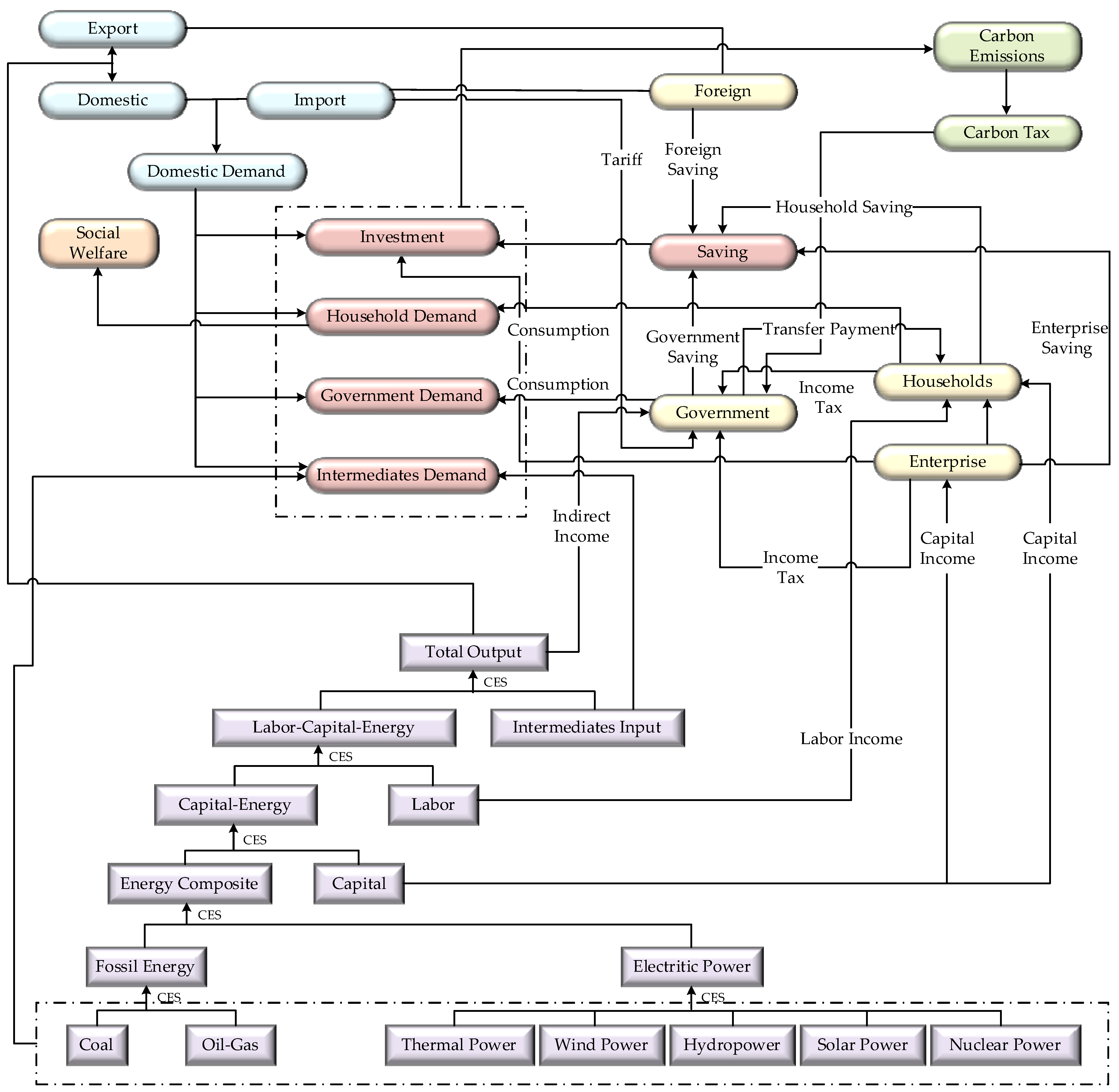

3. Methodology and Data

3.1. CGE Model Structure

3.1.1. Production Module

3.1.2. Trade Module

3.1.3. Institutional Module

3.1.4. Balance Module

3.1.5. Social Welfare Module

3.1.6. The Carbon Emission and Carbon Tax Module

3.2. Data

4. Simulation Analyses

4.1. The Impact of Policy Scenarios on Macroeconomic Variables

4.1.1. Nominal GDP and Real GDP

4.1.2. Resident Income

4.1.3. Corporate Income

4.1.4. Social Welfare

4.1.5. CO2 Emission Intensity

4.2. The Impact of Policy Scenarios on Carbon Dioxide Emissions

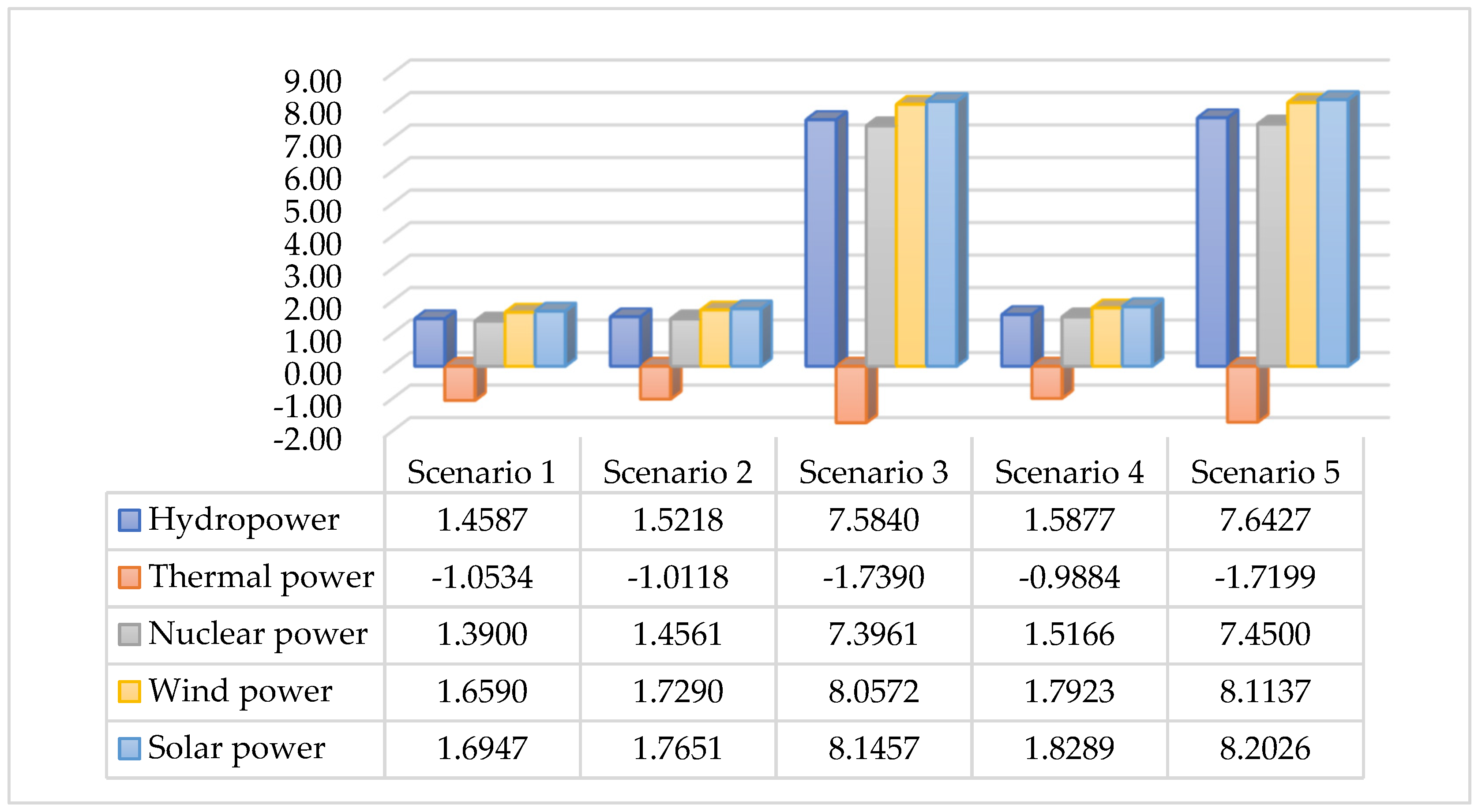

4.3. The Impact of Policy Scenarios on Electricity Energy

4.3.1. Electricity Consumption

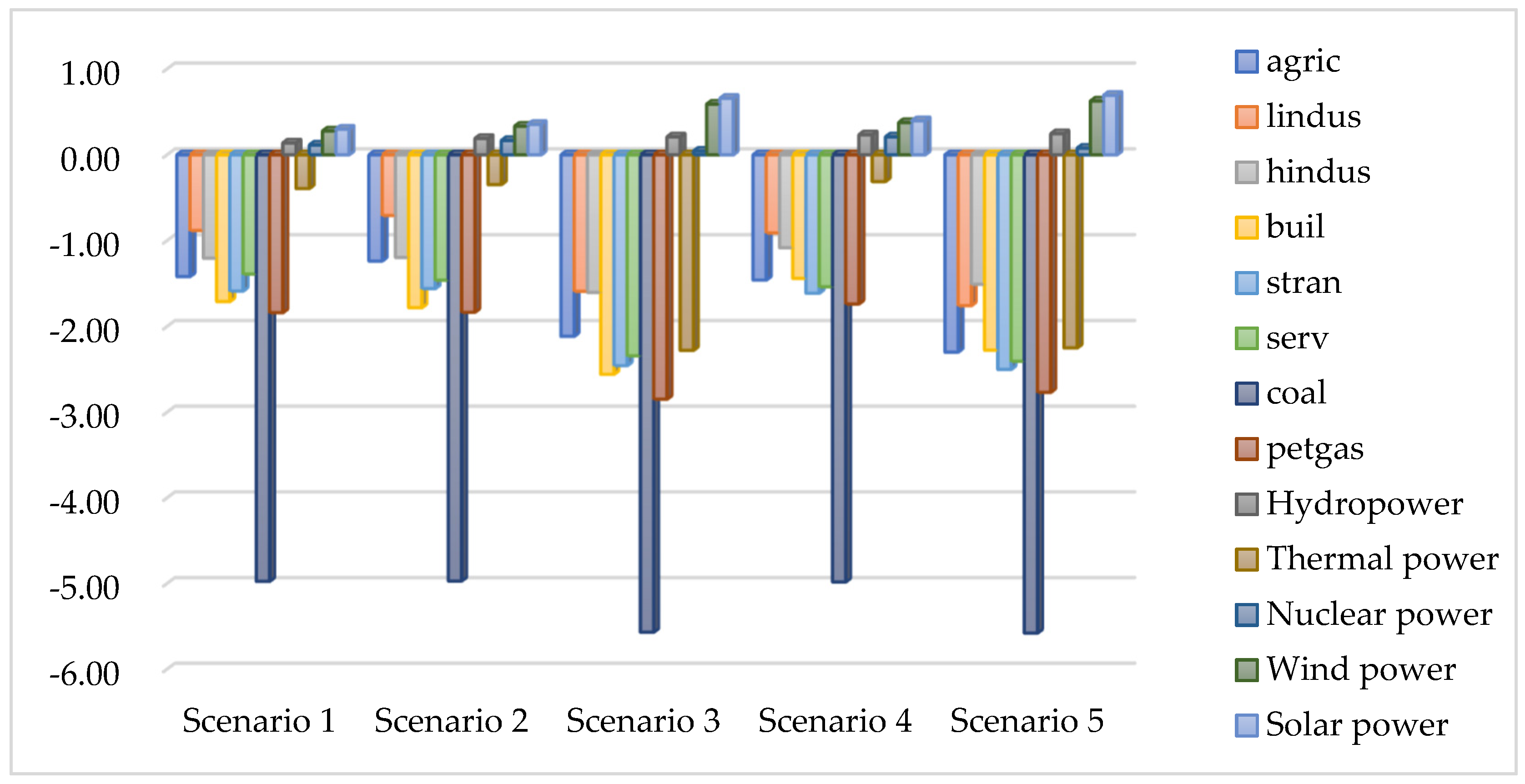

4.3.2. Sectoral Thermal Power Consumption

4.3.3. Electricity Structure

5. Conclusions and Policy Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wu, S.; Li, S.; Lei, Y.; Li, L. Temporal Changes in China’s Production and Consumption-Based CO2 Emissions and the Factors Contributing to Changes. Energy Econ. 2020, 89, 104770. [Google Scholar] [CrossRef]

- Amster, E.; Lew Levy, C. Impact of Coal-Fired Power Plant Emissions on Children’s Health: A Systematic Review of the Epidemiological Literature. Int. J. Environ. Res. Public Health 2019, 16, 2008. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ye, P.; Xia, S.; Xiong, Y.; Liu, C.; Li, F.; Liang, J.; Zhang, H. Did an Ultra-Low Emissions Policy on Coal-Fueled Thermal Power Reduce the Harmful Emissions? Evidence from Three Typical Air Pollutants Abatement in China. Int. J. Environ. Res. Public Health 2020, 17, 8555. [Google Scholar] [CrossRef] [PubMed]

- Pradhan, B.K.; Ghosh, J. COVID-19 and the Paris Agreement Target: A CGE Analysis of Alternative Economic Recovery Scenarios for India. Energy Econ. 2021, 103, 105539. [Google Scholar] [CrossRef]

- Wang, H.; Chen, Z.P.; Wu, X.Y.; Niea, X. Can a Carbon Trading System Promote the Transformation of a Low-Carbon Economy under the Framework of the Porter Hypothesis? -Empirical Analysis Based on the PSM-DID Method. Energy Policy 2019, 129, 930–938. [Google Scholar] [CrossRef]

- Zhou, Y.; Fang, W.; Li, M.; Liu, W. Exploring the Impacts of a Low-Carbon Policy Instrument: A Case of Carbon Tax on Transportation in China. Resour. Conserv. Recycl. 2018, 139, 307–314. [Google Scholar] [CrossRef]

- Jia, Z.J.; Lin, B.Q. Rethinking the Choice of Carbon Tax and Carbon Trading in China. Technol. Forecast. Soc. Change 2020, 159, 120187. [Google Scholar] [CrossRef]

- Zhao, Y.H.; Li, H.; Xiao, Y.L.; Liu, Y.; Cao, Y.; Zhang, Z.H.; Wang, S.; Zhang, Y.F.; Ahmad, A. Scenario Analysis of the Carbon Pricing Policy in China’s Power Sector through 2050: Based on an Improved CGE Model. Ecol. Indic. 2018, 85, 352–366. [Google Scholar] [CrossRef]

- Dissanayake, S.; Mahadevan, R.; Asafu-Adjaye, J. Evaluating the Efficiency of Carbon Emissions Policies in a Large Emitting Developing Country. Energy Policy 2020, 136, 111080. [Google Scholar] [CrossRef]

- Zhang, P.; Yin, G.; Duan, M. Distortion Effects of Emissions Trading System on Intra-Sector Competition and Carbon Leakage: A Case Study of China. Energy Policy 2020, 137, 111126. [Google Scholar] [CrossRef]

- Sun, Y.; Mao, X.; Yin, X.; Liu, G.; Zhang, J.; Zhao, Y. Optimizing Carbon Tax Rates and Revenue Recycling Schemes: Model Development, and a Case Study for the Bohai Bay Area, China. J. Clean. Prod. 2021, 296, 126519. [Google Scholar] [CrossRef]

- Li, X.; Yao, X.; Guo, Z.; Li, J. Employing the CGE model to analyze the impact of carbon tax revenue recycling schemes on employment in coal resource-based areas: Evidence from Shanxi. Sci. Total Environ. 2020, 720, 137192. [Google Scholar] [CrossRef] [PubMed]

- Li, P.; Ouyang, Y.F. Quantifying the Role of Technical Progress towards China’s 2030 Carbon Intensity Target. J. Environ. Plan. Manage 2021, 64, 379–398. [Google Scholar] [CrossRef]

- Kutlu, L. Greenhouse Gas Emission Efficiencies of World Countries. Int. J. Environ. Res. Public Health 2020, 17, 8771. [Google Scholar] [CrossRef]

- Belaïd, F.; Zrelli, M.H. Renewable and Non-renewable Electricity Consumption, Environmental Degradation and Economic Development: Evidence from Mediterranean Countries. Energy Policy 2019, 133, 110929. [Google Scholar] [CrossRef]

- Ehigiamusoe, K.U. A Disaggregated Approach to Analyzing the Effect of Electricity on Carbon Emissions: Evidence from African Countries. Energy Rep. 2020, 6, 1286–1296. [Google Scholar] [CrossRef]

- Lin, B.; Li, Z. Is More Use of Electricity Leading to Less Carbon Emission Growth? An Analysis with a Panel Threshold Model. Energy Policy 2020, 137, 111121. [Google Scholar] [CrossRef]

- Wong, J.B.; Zhang, Q. Impact of Carbon Tax on Electricity Prices and Behaviour. Financ. Res. Lett. 2021, 44, 102098. [Google Scholar] [CrossRef]

- Yang, W.; Song, J. Simulating Optimal Development of Clean Coal-Fired Power Generation for Collaborative Reduction of Air Pollutant and CO2 Emissions. Sustain. Prod. Consum. 2021, 28, 811–823. [Google Scholar] [CrossRef]

- Haxhimusa, A.; Liebensteiner, M. Effects of electricity demand reductions under a carbon pricing regime on emissions: Lessons from COVID-19. Energy Policy 2021, 156, 112392. [Google Scholar] [CrossRef]

- Fan, F.; Wang, Y.; Liu, Q. China’s carbon emissions from the electricity sector: Spatial characteristics and interregional transfer. Integr. Environ. Asses. 2022, 18, 258–273. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Bidokhti, A.; Fakhrzad, M.B.; Sadegheih, A.; Mehrjerdi, Y.Z. A new model for the use of renewable electricity to reduce carbon dioxide emissions. Energy 2022, 238, 121602. [Google Scholar] [CrossRef]

- Metcalf, G.E. Carbon Taxes in Theory and Practice. Annu. Rev. Resour. Econ. 2021, 13, 245–265. [Google Scholar] [CrossRef]

- Yamazaki, A. Jobs and Climate Policy: Evidence from British Columbia’s Revenue-Neutral Carbon Tax. J. Environ. Econ. Manag. 2017, 83, 197–216. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. The Energy, Environmental and Economic Impacts of Carbon Tax Rate and Taxation Industry: A CGE Based Study in China. Energy 2018, 159, 558–568. [Google Scholar] [CrossRef]

- Hu, H.; Dong, W.; Zhou, Q. A Comparative Study on the Environmental and Economic Effects of a Resource Tax and Carbon Tax in China: Analysis Based on the Computable General Equilibrium Model. Energy Policy 2021, 156, 112460. [Google Scholar] [CrossRef]

- Khastar, M.; Aslani, A.; Nejati, M. How Does Carbon Tax Affect Social Welfare and Emission Reduction in Finland? Energy Rep. 2020, 6, 736–744. [Google Scholar] [CrossRef]

- Pearce, D. The Role of Carbon Taxes in Adjusting to Global Warming. Econ. J. 1991, 101, 938–948. [Google Scholar] [CrossRef]

- Pohit, S.; Pal, B.; Ojha, V.; Roy, J. GHG Emissions and Economic Growth: A Computable General Equilibrium Model Based Analysis for India; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Metcalf, G.E. On the Economics of a Carbon Tax for the United States. Brook. Pap. Econ. Act. 2019, 2019, 405–484. [Google Scholar] [CrossRef]

- Ojha, V.P.; Pohit, S.; Ghosh, J. Recycling Carbon Tax for Inclusive Green Growth: A CGE Analysis of India. Energy Policy 2020, 144, 111708. [Google Scholar] [CrossRef]

- Kirchner, M.; Sommer, M.; Kratena, K.; Kletzan-Slamanig, D.; Kettner-Marx, C. CO2 Taxes, Equity and the Double Dividend—Macroeconomic Model Simulations for Austria. Energy Policy 2019, 126, 295–314. [Google Scholar] [CrossRef]

- Steenkamp, L.-A. A Classification Framework for Carbon Tax Revenue Use. Clim. Policy 2021, 21, 897–911. [Google Scholar] [CrossRef]

- Wills, W.; La Rovere, E.L.; Grottera, C.; Naspolini, G.F.; Le Treut, G.; Ghersi, F.; Lefèvre, J.; Dubeux, C.B.S. Economic and Social Effectiveness of Carbon Pricing Schemes to Meet Brazilian NDC Targets. Clim. Policy. 2021, 22, 1–16. [Google Scholar] [CrossRef]

- Chen, J.; Gao, M.; Ma, K.; Song, M. Different effects of technological progress on China’s carbon emissions based on sustainable development. Bus. Strategy Environ. 2020, 29, 481–492. [Google Scholar] [CrossRef]

- Wu, L.; Liu, C.; Ma, X.; Liu, G.; Miao, C.; Wang, Z. Global Carbon Reduction and Economic Growth under Autonomous Economies. J. Clean. Prod. 2019, 224, 719–728. [Google Scholar] [CrossRef]

- Guo, Z.Q.; Zhang, X.P.; Ding, Y.H.; Zhao, X.N. A Forecasting Analysis on China’S Energy Use and Carbon Emissions Based on A Dynamic Computable General Equilibrium Model. Emerg. Mark. Financ. Trade 2021, 57, 727–739. [Google Scholar] [CrossRef]

- Settimo, G.; Avino, P. The Dichotomy Between Indoor Air Quality and Energy Efficiency in Light of the Onset of the COVID-19 Pandemic. Atmosphere 2021, 12, 791. [Google Scholar] [CrossRef]

- Chen, J.; Gao, M.; Mangla, S.K.; Song, M.; Wen, J. Effects of Technological Changes on China’s Carbon Emissions. Technol. Forecast. Soc. Change 2020, 153, 119938. [Google Scholar] [CrossRef]

- Wang, S.; Zeng, J.; Liu, X. Examining the Multiple Impacts of Technological Progress on CO2 Emissions in China: A Panel Quantile Regression Approach. Renew. Sust. Energy Rev. 2019, 103, 140–150. [Google Scholar] [CrossRef]

- Zeng, Y.; Zhang, R.; Wang, D.; Mu, Y.; Jia, H. A Regional Power Grid Operation and Planning Method Considering Renewable Energy Generation and Load Control. Appl. Energy 2019, 237, 304–313. [Google Scholar] [CrossRef]

- Sofia, D.; Gioiella, F.; Lotrecchiano, N.; Giuliano, A. Cost-Benefit Analysis to Support Decarbonization Scenario for 2030: A Case Study in Italy. Energy Policy 2020, 137, 111137. [Google Scholar] [CrossRef]

- He, Y.X.; Zhang, S.L.; Yang, L.Y.; Wang, Y.J.; Wang, J. Economic Analysis of Coal Price-Electricity Price Adjustment in China Based on the CGE Model. Energy Policy 2010, 38, 6629–6637. [Google Scholar] [CrossRef]

- Meng, S. How May a Carbon Tax Transform Australian Electricity Industry? A CGE Analysis. Appl. Econ. 2014, 46, 796–812. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What will China’s Carbon Emission Trading Market Affect with only Electricity Sector Involvement? A CGE Based Study. Energy Econ. 2019, 78, 301–311. [Google Scholar] [CrossRef]

- Mardones, C.; Brevis, C. Constructing a SAMEA to Analyze Energy and Environmental Policies in Chile. Econ. Syst. Res. 2020, 33, 1–27. [Google Scholar] [CrossRef]

- Cui, Q.; Liu, Y.; Ali, T.; Gao, J.; Chen, H. Economic and Climate Impacts of Reducing China’s Renewable Electricity Curtailment: A Comparison Between CGE Models with Alternative Nesting Structures of Electricity. Energy Econ. 2020, 91, 104892. [Google Scholar] [CrossRef]

- Zhang, T.; Ma, Y.; Li, A. Scenario Analysis and Assessment of China’s Nuclear Power Policy Based on the Paris Agreement: A Dynamic CGE Model. Energy 2021, 228, 120541. [Google Scholar] [CrossRef]

- Nong, D. Development of the electricity-environmental policy CGE model (GTAP-E-PowerS): A case of the carbon tax in South Africa. Energy Policy 2020, 140, 111375. [Google Scholar] [CrossRef]

- Mas-Colell, A.; Whinston, M.D.; Green, J.R. Microeconomic Theory; Oxford University Press: New York, NY, USA, 1995; Volume 1. [Google Scholar]

- Lindner, S.; Legault, J.; Guan, D. Disaggregating the Electricity Sector of China’s Input-Output Table for Improved Environmental Life-Cycle Assessment. Econ. Syst. Res. 2013, 25, 300–320. [Google Scholar] [CrossRef]

- Guo, Z.Q.; Zhang, X.P.; Zheng, Y.H.; Rao, R. Exploring the Impacts of a Carbon Tax on the Chinese Economy Using a CGE Model with a Detailed Disaggregation of Energy Sectors. Energy Econ. 2014, 45, 455–462. [Google Scholar] [CrossRef]

- Guo, Z.Q.; Zhang, X.P.; Feng, S.D.; Zhang, H.N. The Impacts of Reducing Renewable Energy Subsidies on China’s Energy Transition by Using a Hybrid Dynamic Computable General Equilibrium Model. Front. Energy Res. 2020, 8, 25. [Google Scholar] [CrossRef]

- Zhai, M.; Huang, G.; Liu, L.; Guo, Z.; Su, S. Segmented Carbon Tax May Significantly Affect the Regional and National Economy and Environment-a CGE-Based Analysis for Guangdong Province. Energy 2021, 231, 120958. [Google Scholar] [CrossRef]

- Fujimori, S.; Masui, T.; Matsuoka, Y. Development of a global computable general equilibrium model coupled with detailed energy end-use technology. Appl. Energy 2014, 128, 296–306. [Google Scholar] [CrossRef]

- Cheng, B.; Dai, H.; Wang, P.; Xie, Y.; Chen, L.; Zhao, D.; Masui, T. Impacts of low-carbon power policy on carbon mitigation in Guangdong Province, China. Energy Policy 2016, 88, 515–527. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Can Carbon Tax Complement Emission Trading Scheme? The Impact of Carbon Tax on Economy, Energy and Environment in China. Clim. Chang. Econ. 2020, 11, 2041002. [Google Scholar] [CrossRef]

- Sofia, D.; Gioiella, F.; Lotrecchiano, N.; Giuliano, A. Mitigation Strategies for Reducing Air Pollution. Environ. Sci. Pollut. Res. 2020, 27, 19226–19235. [Google Scholar] [CrossRef]

| Scenarios | RTP | GDP (%) | RGDP (%) | TCOEI (%) | EV | YTH (%) | YTE (%) |

|---|---|---|---|---|---|---|---|

| Scenario 1 | 0% | −0.0377 | −0.0493 | −4.9641 | −424.3465 | 0.0162 | −0.0753 |

| Scenario 2 | 0% | −0.0500 | −0.0505 | −4.9525 | 851.6128 | −0.0144 | −0.1022 |

| Scenario 3 | 1% | −0.0457 | −0.0334 | −4.9566 | 865.6442 | −0.0126 | −0.0889 |

| 5% | −0.0289 | 0.0335 | −4.9725 | 922.0437 | −0.0052 | −0.0371 | |

| 10% | −0.0093 | 0.1144 | −4.9912 | 993.0338 | 0.0034 | 0.0240 | |

| Scenario 4 | 0% | −0.0303 | −0.0441 | −4.9712 | −530.8357 | −0.0103 | −0.0730 |

| Scenario 5 | 1% | −0.0266 | −0.0273 | −4.9747 | −470.2937 | −0.0086 | −0.0606 |

| 5% | −0.0125 | 0.0389 | −4.9881 | −232.3547 | −0.0018 | −0.0127 | |

| 10% | 0.0041 | 0.1189 | −5.0039 | 55.9304 | 0.0062 | 0.0439 |

| Scenarios | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| Emission reduction contribution (%) | Coal | 97.5820 | 97.6405 | 96.8750 | 98.1246 | 97.2784 |

| Oil–gas | 2.4180 | 2.3595 | 3.1250 | 1.8754 | 2.7216 | |

| Ad valorem tax rate | Coal | 0.0505 | 0.0508 | 0.0435 | 0.0517 | 0.0443 |

| Oil–gas | 0.0129 | 0.0130 | 0.0111 | 0.0133 | 0.0113 | |

| Carbon tax rate (CNY/ton) | 15.3563 | 15.4551 | 13.2062 | 15.7485 | 13.4477 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, W.; Liu, M.; Liu, T.; Li, Y.; Hao, Y. Does a Recycling Carbon Tax with Technological Progress in Clean Electricity Drive the Green Economy? Int. J. Environ. Res. Public Health 2022, 19, 1708. https://doi.org/10.3390/ijerph19031708

Liu W, Liu M, Liu T, Li Y, Hao Y. Does a Recycling Carbon Tax with Technological Progress in Clean Electricity Drive the Green Economy? International Journal of Environmental Research and Public Health. 2022; 19(3):1708. https://doi.org/10.3390/ijerph19031708

Chicago/Turabian StyleLiu, Weijiang, Min Liu, Tingting Liu, Yangyang Li, and Yizhe Hao. 2022. "Does a Recycling Carbon Tax with Technological Progress in Clean Electricity Drive the Green Economy?" International Journal of Environmental Research and Public Health 19, no. 3: 1708. https://doi.org/10.3390/ijerph19031708

APA StyleLiu, W., Liu, M., Liu, T., Li, Y., & Hao, Y. (2022). Does a Recycling Carbon Tax with Technological Progress in Clean Electricity Drive the Green Economy? International Journal of Environmental Research and Public Health, 19(3), 1708. https://doi.org/10.3390/ijerph19031708