3.1. Problem Description and Hypothesis

In 2019, China revised its green building evaluation standards, which classify green buildings as basic, one-star, two-star and three-star, and increased requirements for the habitable attributes of green buildings. In 2020, China’s latest 14th Five-Year Plan proposal demanded that local governments ‘accelerating the promotion of green and low-carbon development, strengthen the spatial planning and use control of land, and make efforts to develop green building’. On the basis of the central government’s policies, local governments at the provincial level made the policies more refined and specific, including land transfer, land planning, financial subsidies, tax reduction, loan support, floor area ratio incentives, urban infrastructure supporting fees reduction, the priority of administrative approval and awards, the priority of enterprise qualification approval and promotion, and consumer guidance. Most of these policies are applicable to the GH market and can be divided into incentive policies for real estate enterprises and incentive policies for consumers according to the target audience [

37,

39], and into financial and non-financial subsidy policies according to the mode of action [

30,

50,

51]. The classification of green building incentives by these scholars is highly representative and offers a more flexible approach to their classification. Based on relevant studies by previous scholars and considering the policy targets and modes, we classify the incentive policies for GH into the following four categories.

First, subsidy policy for the enterprises

The subsidy policies for real estate enterprises developing GH can be divided into direct and indirect subsidy policies based on whether fiscal funds are involved. Among them, direct subsidy policies with clear implementation standards mainly include monetary subsidies, tax reduction, and urban infrastructure facility fee reduction. In Beijing, Tianjin, Shanghai, Jiangsu, Shandong, Guangdong, Chongqing, Shaanxi and other provinces, the monetary subsidy is mainly to directly issue subsidies to enterprises according to green building grades obtained, construction area or project type. Shanghai, Fujian and other regions have further formulated tax reduction policies for green residential projects. Provinces such as Inner Mongolia, Hainan, and Qinghai have reduced the urban infrastructure facility fee for GH projects in varying ranges. Indirect subsidy policies are mainly based on floor area ratio incentives and preferential loan interest rates. Zhejiang, Fujian, and Guizhou use floor area ratio incentives to reduce the cost to the real estate enterprises developing GH. In addition, Beijing, Henan, Anhui and other provinces require banks to give priority to GH development companies for preferential interest rates. Among them, Anhui has clearly stated that the loan interest rate for enterprises developing GH can be lowered by 1%.

Second, preferential policies for GH

The preferential policies for GH mainly include the priority of administrative approval and awards for GH projects, and the priority of enterprise qualification approval and promotion for enterprises developing GH. Some provinces, such as Fujian, Inner Mongolia, Hubei, Hunan, Qinghai, Ningxia, etc., have established a rapid approval mechanism for green buildings to accelerate the construction and sales of green buildings. In terms of project awards, Shandong, Inner Mongolia, Henan, Shaanxi, Anhui, Jiangxi, Hubei, Hunan, Guangxi, Chongqing, Guizhou, Ningxia and other provinces have made green building projects a priority or necessity for the selection of various national or provincial building awards, which will strengthen the influence of green buildings in the industry by focusing on the advantages of industry evaluation. In terms of enterprise qualification approval, provinces and cities such as Beijing, Hubei, Hunan, Inner Mongolia and Jilin have proposed to reward enterprises that have achieved significant results in implementing green buildings with exemptions, priority and extra points in the annual inspection of enterprise qualifications, upgrading of qualifications and renewal of certificates, and bidding for projects. Compared to the enterprise subsidy policy mention above, the preferential policy cannot bring direct financial benefits to the enterprises, but it can increase the reputation of the real estate enterprises and reduce the administrative costs or land costs associated with GH. The implementation of preferential policy will enhance the competitive advantage of GH projects and will be transformed into a long-term benefit for real estate enterprises [

52,

53], but the competitive advantage only exists when the rival is OH; if the competitor enterprise chooses to develop GH, the benefits due to the policy will be weakened or invalidated.

Third, restriction policy for OH

Currently, China does not have a punitive policy for the development of ordinary residential buildings, but the existing incentive policy for green residential buildings objectively has a limiting effect on the development of ordinary residential buildings. In July 2020, the Ministry of Housing and Construction and the Development and Reform Commission and other departments jointly issued the Action Plan for the Creation of Green Buildings, which requires that by 2022, the proportion of green floor space in new buildings in cities and towns will reach 70% in that year. Previously, many provinces and cities also had clear requirements for the proportion of GH in new urban construction. The implementation of relevant land planning policies and the setting of targets for the scale of green building development, to a certain extent, restricted the supply of land for OH, leading to an increase in the cost of developing OH for enterprises [

16]. At the same time, there are also specific requirements for energy efficiency in ordinary residential buildings in some provinces; for example, the Implementation Plan for Green Building Action in Guizhou Province requires that new buildings in urban areas strictly implement mandatory energy efficiency standards and to meet 100% of the standards at the design stage. In addition, since 1 January 2018, China has officially implemented the Environmental Protection Tax Law, which imposes taxes on four major pollutants, including air, water, solid waste and noise; the introduction and implementation of the environmental protection tax has also increased the cost of developing OH for enterprises to a certain extent. Overall, these policies have increased the cost of developing OH for real estate enterprises, negatively impacting their willingness to develop OH.

Fourth, subsidy policy for the consumers

Currently, only a few provinces in China have implemented incentives for consumers to purchase GH; policies are relatively limited and focus on providing direct or indirect subsidies for buyers, including monetary subsidies, lower interest rates or higher loan amounts, and tax rebates [

37]. Jiangsu and Shaanxi have provided monetary subsidies to encourage consumers to purchase GH. Zhejiang, Shaanxi and Jiangsu have offered larger loan amounts to consumers who use their provident funds to purchase GH, and Anhui has required that banks reduce the interest rates on loans for consumers purchasing GH. Shanghai and Fujian have reduced the cost of buying GH by rebating a certain percentage of the deed tax paid by consumers. As can be seen, the number, strength and scope of subsidies for consumers are weaker than those for enterprises at present.

Based on the above delineation of GH incentive policies, this paper’s research on the impact of GH government policies can be translated into the following specific questions.

- (i)

How do subsidy policies for enterprises affect the diffusion of GH, and is it true that the larger the subsidy, the more effective it is in promoting the diffusion of GH?

- (ii)

How do preferential policies affect the diffusion of GH, and which preferential policies should the government prioritize to promote the proliferation of GH?

- (iii)

How do restrictive policies for OH affect the diffusion of GH, and is it necessary to impose more punitive policies for GH diffusion?

- (iv)

How do subsidy policies for consumer subsidies affect the diffusion of GH? At the same cost, which policy is more effective, consumer subsidy or enterprises subsidy? In order to study the above issues, this paper makes the following assumptions regarding government policy and the price, cost and profits associated with GH and OH.

- (1)

Assumptions related to GH

Assuming that there are only two categories of residential products, GH and OH, in the real estate market environment of provincial areas, the environmental friendliness of GH and OH are respectively and . Based on the definition of GH, it is known that . The unit construction costs of GH and OH are respectively and , and their prices are respectively and . According to previous studies, it can be known that , and .

- (2)

Assumptions related to government policies

A local government may adopt one or several incentive policies to promote the development of the GH industry within its jurisdiction. Firstly, assume that the increased profits for the enterprises developing GH arising from direct or indirect subsidy policies by the local government are , where ω indicates the strength of subsidy policy used by the government. Secondly, assume that the increased benefits due to the preferred policy for the enterprises developing GH are , where is an adjustment factor to identify the extent to which policy affects the enterprises’ profits. Meanwhile, assume that the increased cost for enterprises developing OH due to the restrictive policies by local government are , where is the adjustment factor that indicates the strength of the policy. Lastly, assume that represents the total amount of subsidies that consumers can receive for purchasing GH, where is the adjustment factor that indicates the strength of the policies.

- (3)

Assumptions related to the enterprises and consumers

Assume that in a provincial market, the real estate enterprises have only two strategies, ‘developing GH’ or ‘developing OH’, with which they will earn different profits. The profits are represented as

for GH, and

for OH. Meanwhile, assuming that the total numbers of real estate enterprises and consumers are fixed, and that the consumers are heterogeneous, thus, different consumers have different degrees of green preference, which is an important indicator of consumer purchase intention, represented by

, and that obeys a uniform distribution between 0 and 1. The payment coefficient of consumers’ green preference that indicates the fee that consumers are willing to pay for each increase in the green effort level is

[

39], the net benefits for consumers to purchase GH, OH, and nothing are

,

, and

, respectively.

Table 1 lists the definitions of the variables.

3.2. The Game Models between Real Estate Enterprises

Based on the consumer utility function proposed by Mussa (1978) [

54], the consumers’ willingness to purchase green product is

[

40,

47]; with the introduction of the payment coefficient of consumers’ green preference

[

43], it can be determined that the consumers’ willingness to purchase GH and OH are respectively

and

. According to the calculation methods of previous scholars for consumer utility, considering government subsidies, three kinds of utility can be described as follows:

The above assumptions about consumer utility are based on the fact that consumers have limited rationality, which means that consumption decisions are made with the objective of maximizing utility and that consumers will only make purchases if the utility resulting from the purchase is non-negative. Based on Zhu (2011) [

55] and Liu (2017) [

40], the boundary value of

, which represents that there is no difference between consumers’ perceived utility of GH and OH, can be determined from the association of Equations (1) and (2).

From the association of Equations (2) and (3), it is possible to determine the boundary value

between consumers buying ordinary houses and nothing,

The relationship between and is: ; it reveals the degree of consumer preference for GH and OH. When , consumers will not buy any kind of residential product, when , consumers will buy an ordinary residential product, and when , consumers will buy a green residential product; let the total number of consumers be 1.

The consumer demand for green housing can be determined as follows.

The consumer demand for OH:

The sum of direct benefits for the real estate enterprises in the market for developing green housing is

:

Additionally, the sum of total benefits for the real estate enterprises developing OH is

:

Due to

,

, the profits for the real estate enterprises from developing GH and OH are convex functions with respect to

and

, respectively. Thus, the profit maximization conditions are:

, and

. By associating them, the optimal prices of green housing and OH are found as:

From Equations (10) and (11), it can be seen that the optimal price set by real estate enterprises is influenced by the cost of real estate development, the greenness of the housing, the marginal ability of consumers to pay, and the government’s incentive policies. In the market environment, real estate enterprises will adjust the sales price to the above price in order to maximize profits. Equations (10) and (11) are brought into Equations (6) and (7). It can be determined that under the optimal price strategy, the consumer demands for GH and OH are:

The direct economic benefits for real estate enterprises to develop GH and OH are respectively:

In the above analysis,

and

represent the sum of the profits for the enterprises developing GH and OH, respectively, in a certain market range. For individual enterprises, their profits are also related to the number of enterprises choosing the corresponding strategies. Assuming that the number of enterprises choosing the GH strategy is

and the number of firms choosing the OH strategy is

, the revenue from developing GH for enterprise

i is

and the revenue from developing OH for enterprise

j is

. The payment matrix of the game between enterprise

i and enterprise

j is shown in the

Table 2. The diagram of the networked evolutionary game for GH diffusion is shown in

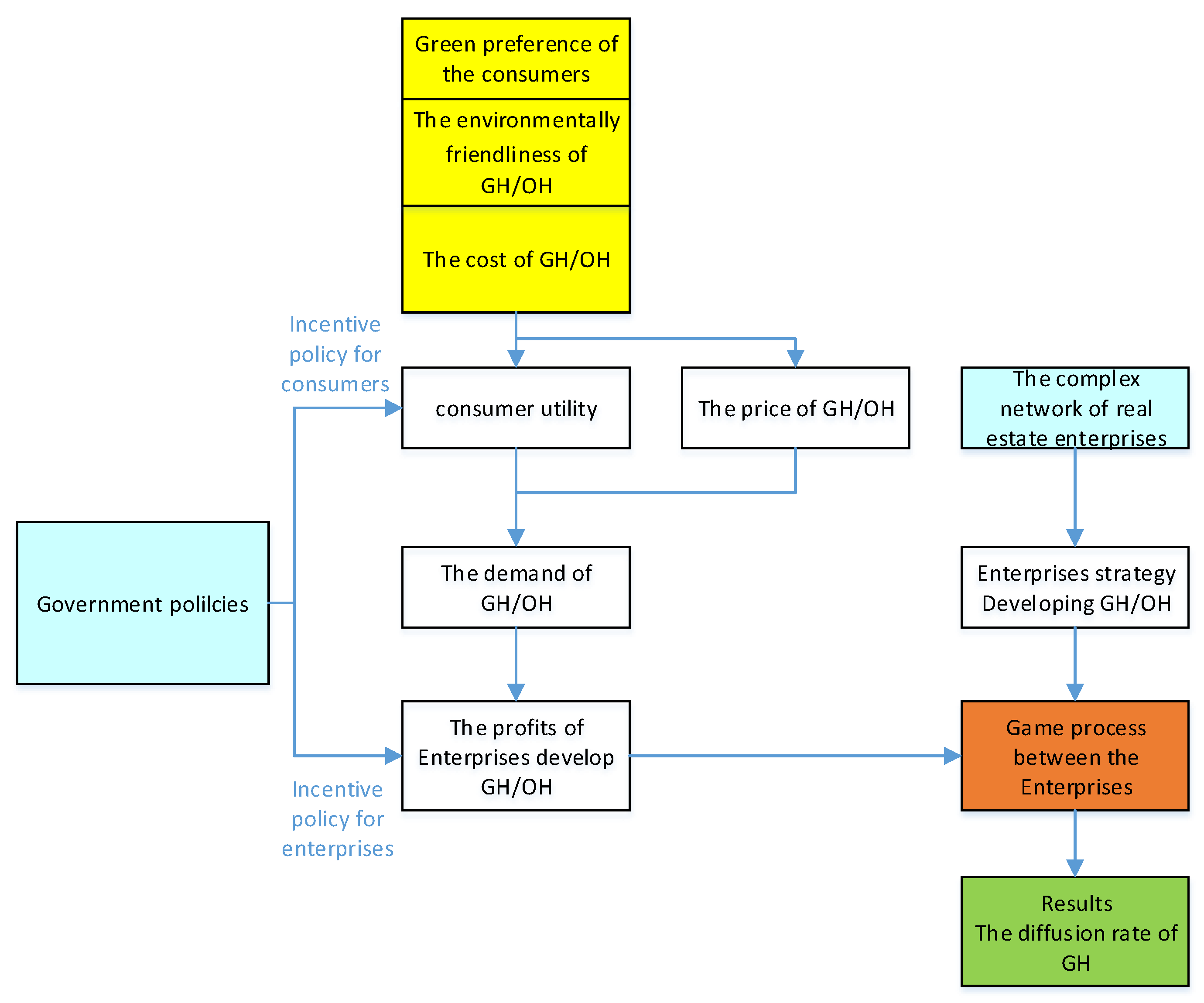

Figure 2.

3.3. Networked Evolutionary Dynamics Model

The game relationship among players in the evolutionary game model mentioned above reflects the information interaction or market competition existing among the real estate enterprises, which in reality can be more specifically expressed as a network structure. Considering that some large real estate enterprises have a large number of partners or competitors, and some small enterprises have few in the real estate market, we constructed a scale-free (SF) network to study the diffusion of GH. The SF network constructed by the real estate enterprises is based on the BA SF network [

56]; the degree of distribution of scale-free networks follows a power law, meaning that a few hub nodes have an extremely large number of connections, while most nodes have only a small number of connections. Let the network of real estate enterprises be

G(V,E), where

V is the set of network nodes, each node is a specific real estate enterprise,

E is the set of network-connected edges, each edge represents the game relationship between two node enterprises, and the number of nodes is expressed as

N. Considering that the communication between enterprises is mutual behavior, there is no direction, so the network

G(V,E) is an undirected network.

In the scale-free network model, the game object of a node enterprise is the neighboring nodes with which it has connected edges, and in each game, all nodes play this game with their neighbors and accumulate the gains. In the strategy evolution, the stochastic strategy evolution rule is considered based on the Fermi rule, i.e., individual

i will randomly choose a neighbor

j for strategy comparison, and if the neighbor’s current round gain is higher than its own gain, in the next round it will imitate the neighbor’s current round strategy with a certain probability. This imitation probability is calculated according to the Fermi function in statistical physics.

where:

denotes the strategy taken by the individual enterprise

i and,

is the gain by enterprise

i in this round.

is the strategy of individual enterprise

j, and

is the gain by enterprise

j in this round. The function indicates that when the gain of enterprise

i in this round is lower than the gain of enterprise

j, enterprise

i will easily accept the strategy of enterprise

j. However, when the gain of

i is higher than the gain of

j, it will also learn the strategy of enterprise

j with a weak probability. This irrational choice of the individual is portrayed by

k; values of

k closer to 0 mean that the individual’s irrational choice tends to zero, and the strategy update is determined. If the gain of the comparison object is higher than its own, it will definitely choose to learn, or vice versa, it will stick to its original strategy; a

k value tending toward infinity means that the individual is in a noisy environment, unable to make rational decisions, and can only update its own strategy randomly. The potential adopter node

i, after choosing a learning strategy with probability

W, will reconnect with other nodes in the network with probability

. In this paper, the reconnection mechanism with preference is used to determine the outgoing connection

j of a node, and the random probability

can be expressed as:

where,

is the gain of node

i,

is the gain of node

j,

=0 means this link does not have any preference tendency and is a random link; the larger

is, the more obvious the preference tendency is. According to the above rules, the node enterprise determines its own revenue in this round by forming patterns with other neighboring nodes, and then learns the game strategies of other nodes by comparing the revenue, and the game and learning among nodes realize the diffusion of ‘developing GH’ strategy on the whole network model, so as to simulate the diffusion of GH in the market. This is to simulate the diffusion of GH in the market.