Investigation of the Financial Stability of S&P 500 Using Realized Volatility and Stock Returns Distribution

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data

2.2. Logarithmic Return

2.3. Realized Volatility

2.4. Beta Coefficient

2.5. Raw Stock Correlations

2.6. Descriptive Statistics

2.7. Results and Discussion

3. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Amaya, Diego, Peter Christoffersen, Kris Jacobs, and Aurelio Vasquez. 2015. Does realized skewness predict the cross-section of equity returns? Journal of Financial Economics 118: 135–67. [Google Scholar] [CrossRef]

- Anderson, Spencer. 2000. A History of the Past 40 Years in Financial Crises. IFR International Financing Review IFR 2000 Issue Supplement. Available online: http://www.ifre.com/a-history-of-the-past-40-years-in-financial-crises/21102949.fullarticle (accessed on 5 March 2018).

- Ang, Andrew, and Geert Bekaert. 2007. Return predictability: Is it there? The Review of Financial Studies 20: 651–707. [Google Scholar] [CrossRef]

- Ang, Andrew, and Jun Liu. 2007. Risk, return and dividends. Journal of Financial Economics 85: 1–38. [Google Scholar]

- Azizian, Abassi. 2006. Investigating the factors determining price coefficient to the profit of listed companies on Tehran Stock Exchange. Master’s thesis, Shahid Beheshti University, Tehran, Iran. [Google Scholar]

- Batten, Jonathan A., Harald Kinateder, Peter G. Szilagyi, and Niklas Wagner. 2018. Addressing COP21 using a Stock and Oil Market Integration Index. Energy Policy 116: 127–36. [Google Scholar] [CrossRef]

- Campbell, John Y., and Samuel B. Thompson. 2008. Predicting the equity premium out of sample: Can anything beat the historical average? The Review of Financial Studies 21: 1509–31. [Google Scholar] [CrossRef]

- Cochrane, John H. 2008. The dog that did not bark: A defense of return predictability. The Review of Financial Studies 21: 1533–75. [Google Scholar] [CrossRef]

- Constantinou, Eleni, Robert Georgiades, Avo Kazandjian, and Georgios P. Kouretas. 2006. Regime switching and artificial neural network for ecasting of the Cyprus Stock Exchange daily returns. International Journal of Finance & Economics 11: 371–83. [Google Scholar]

- Drakos, Anastassios A., Georgios P. Kouretas, and Leonidas P. Zarangas. 2010. Forecasting financial volatility of the Athens stock exchange daily returns: An application of the asymmetric normal mixture GARCH model. International Journal of Finance & Economics 15: 331–50. [Google Scholar]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Green, T. Clifton, and Stephen Figlewski. 1999. Market Risk and Model Risk for a Financial Institution Writing Options. The Journal of Finance 54: 1465. Available online: http://www.investopedia.com/terms/v/volatility.asp (accessed on 5 March 2018).

- Huang, Jui-Chung. 2009. A fuzzy GARCH model applied to stock market scenario using a genetic algorithm. Expert Systems with Applications 36: 11710–17. [Google Scholar] [CrossRef]

- Matías, Jose M., and Juan C. Reboredo. 2012. Forecasting performance of nonlinear models for intraday stock returns. Journal of Forecasting 31: 172–88. [Google Scholar] [CrossRef]

- Nasrollahi, Zahra. 1992. The analysis of Iran stock exchange performance. Master’s thesis, Tarbiat Modares University, Tehran, Iran. [Google Scholar]

- Nobi, Ashadun, and Jae Woo Lee. 2017. Systemic risk and hierarchical transitions of financial networks. Chaos 27: 063107. [Google Scholar] [CrossRef] [PubMed]

- Omed, Amir, and Jiayin Song. 2014. Investors’ pursuit of positive Skewness in Stock Returns-An Empirical Study of the Skewness Effect on Market-to-Boo Ratio. Master’s thesis, University of Gothenburg, Gothenburg, Sweden. Master Degree Project in Finance. [Google Scholar]

- Pástor, Lubos, and Robert F. Stambaugh. 2009. Predictive systems: Living with imperfect predictors. Journal of Finance 64: 1583–628. [Google Scholar] [CrossRef]

- Roll, Richard. 1988. R2. The Journal of Finance 43: 541–66. [Google Scholar] [CrossRef]

- Sonney, Frédéric. 2009. Financial analysts’ performance: Sector versus country specialization. The Review of Financial Studies 22: 2087–131. [Google Scholar] [CrossRef]

- Summers, Lawrence H. 1996. Does the stock market rationally reflect fundamental values? Journal of Finance 41: 591–601. [Google Scholar] [CrossRef]

- Van Binsbergen, Jules H., and Ralph S. J. Koijen. 2010. Predictive regressions: Apresent value approach. Journal of Finance 65: 1439–71. [Google Scholar] [CrossRef]

- Zahedi, Javad, and Mohammad Mahdi Rounaghi. 2015. Application of artificial neural network models and principal component analysis method in predicting stock prices on Tehran Stock Exchange. Physica A: Statistical Mechanics and its Applications 438: 178–87. [Google Scholar] [CrossRef]

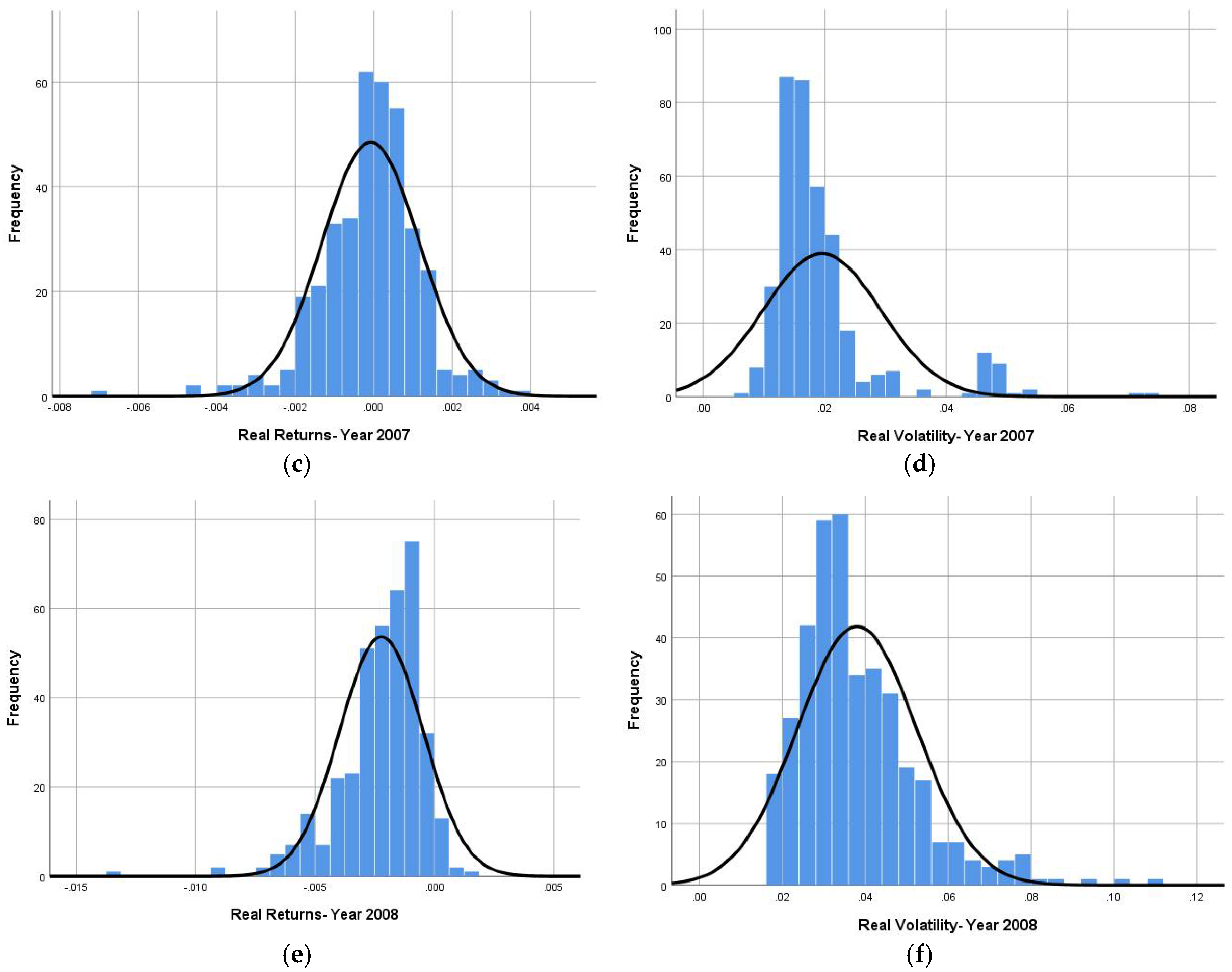

| Year | Features | Realized Returns | Realized Volatility | Realized Skewness | Realized Kurtosis |

|---|---|---|---|---|---|

| 2004 | Mean | 0.0004 | 0.0188 | −1.4819 | 23.9337 |

| Median | 0.0004 | 0.0149 | −0.0721 | 2.3868 | |

| Std. Deviation | 0.00115 | 0.01067 | 3.94839 | 56.12373 | |

| Skewness | 0.004 | 1.760 | −2.366 | 2.643 | |

| Kurtosis | 2.052 | 2.324 | 4.315 | 5.545 | |

| 2007 | Mean | −0.0001 | 0.0195 | −1.1261 | 19.3739 |

| Median | 0 | 0.017 | −0.1546 | 2.7714 | |

| Std. Deviation | 0.00124 | 0.00966 | 3.49547 | 48.95879 | |

| Skewness | −0.766 | 2.518 | −2.568 | 3.039 | |

| Kurtosis | 3.258 | 7.103 | 6.606 | 7.879 | |

| 2008 | Mean | −0.0022 | 0.0380 | −0.1428 | 5.5175 |

| Median | −0.0019 | 0.0344 | −0.0350 | 3.9136 | |

| Std. Deviation | 0.00175 | 0.01437 | 0.93757 | 9.07936 | |

| Skewness | −1.618 | 1.499 | −4.824 | 8.682 | |

| Kurtosis | 5.554 | 3.336 | 36.907 | 91.016 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Akter, N.; Nobi, A. Investigation of the Financial Stability of S&P 500 Using Realized Volatility and Stock Returns Distribution. J. Risk Financial Manag. 2018, 11, 22. https://doi.org/10.3390/jrfm11020022

Akter N, Nobi A. Investigation of the Financial Stability of S&P 500 Using Realized Volatility and Stock Returns Distribution. Journal of Risk and Financial Management. 2018; 11(2):22. https://doi.org/10.3390/jrfm11020022

Chicago/Turabian StyleAkter, Nahida, and Ashadun Nobi. 2018. "Investigation of the Financial Stability of S&P 500 Using Realized Volatility and Stock Returns Distribution" Journal of Risk and Financial Management 11, no. 2: 22. https://doi.org/10.3390/jrfm11020022

APA StyleAkter, N., & Nobi, A. (2018). Investigation of the Financial Stability of S&P 500 Using Realized Volatility and Stock Returns Distribution. Journal of Risk and Financial Management, 11(2), 22. https://doi.org/10.3390/jrfm11020022