A Test of Market Efficiency When Short Selling Is Prohibited: A Case of the Dhaka Stock Exchange

Abstract

1. Introduction

2. Data and Methodology

2.1. Data

2.2. Methodology—Calculating Runs and Testing for Statistical Independence

2.3. Methodology—Monte Carlo Simulation and Forming Expectations

2.4. Methodology—The Distribution of n Day Runs and Implications for the Short Selling Ban

3. Empirical Results

3.1. Results for Statistical Independence of Index Returns

3.2. Run Results for Individual Stock Returns

3.3. Further Tests of Robustness—Causality

4. Concluding Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Atkins, Allen B., and Edward A. Dyl. 1990. Price Reversals, Bid-Ask Spreads, and Market Efficiency. Journal of Financial and Quantitative Analysis 25: 535–47. [Google Scholar] [CrossRef]

- ASX Group. 2018. Australian Securities Exchange, LTD, Corporate Overview. Available online: https://www.asx.com.au/about/corporate-overview.htm (accessed on 26 September 2018).

- Beber, Alessandro, and Marco Pagano. 2013. Short-Selling Bans around the World: Evidence from the 2007–2009 Crisis. Journal of Finance 68: 343–81. [Google Scholar] [CrossRef]

- Bris, Arturo, William N. Goetzmann, and Ning Zhu. 2007. Efficiency and the Bear: Short Sales Markets around the World. Journal of Finance 62: 1029–79. [Google Scholar] [CrossRef]

- De Bondt, Werner F.M., and Richard Thaler. 1985. Does the Stock Market Overreact? Journal of Finance 40: 793–805. [Google Scholar] [CrossRef]

- Diamond, Douglas W., and Robert E. Verrecchia. 1987. Constraints on short-selling and asset price adjustment to private information. Journal of Financial Economics 18: 277–311. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1965. The Behavior of Stock Market Prices. Journal of Business 38: 34–105. [Google Scholar] [CrossRef]

- French, Kenneth R., and Richard Roll. 1986. Stock Return Variances: The Arrival of Information and Reaction of Traders. Journal of Financial Economics 17: 5–26. [Google Scholar] [CrossRef]

- Islam, Ainul, and Mohammed Khaled. 2005. Tests of Weak-Form Efficiency of the Dhaka Stock Exchange. Journal of Business Finance and Accounting 32: 1613–24. [Google Scholar] [CrossRef]

- Jain, Archana, Pankaj K. Jain, Thomas H. McInish, and Michael McKenzie. 2013. Worldwide Reach of Short Selling Regulations. Journal of Financial Economics 109: 177–97. [Google Scholar] [CrossRef]

- Miller, Edward M. 1977. Risk, Uncertainty, and Divergence of Opinion. Journal of Finance 32: 1151–68. [Google Scholar] [CrossRef]

- Mobarek, Asma, A. Sabur Mollah, and Rafiqul Bhuyan. 2008. Market Efficiency in Emerging Stock Market: Evidence from Bangladesh. Journal of Emerging Market Finance 7: 17–41. [Google Scholar] [CrossRef]

- Mollik, A., and Md Bepari. 2009. Weak-Form Market Efficiency of Dhaka Stock Exchange (DSE), Bangladesh. Paper presented at 22nd Australasian Finance and Banking Conference (Abstracted in SSRN), Sydney, Australia, December 16–18. [Google Scholar]

- Swidler, Steve. 1988. An Empirical Investigation of Heterogeneous Expectations, Analysts’ Earnings Forecasts and the Capital Asset Pricing Model. Quarterly Journal of Business and Economics 27: 20–41. [Google Scholar]

- Wang, Song. 2014. Does idiosyncratic risk deter short-sellers? Evidence from a First- time Introduction of Short-Selling. Paper presented at European Financial Management Association Meetings, Rome, Italy, June 25–28. [Google Scholar]

- World Federation of Exchanges. 2017. Annual Statistics Guide. London: World Federation of Exchanges. [Google Scholar]

| 1 | For a list of global short selling regulations, see Jain et al. (2013). |

| 2 | Swidler (1988) provides one early empirical study of the effect of short shale restrictions on stock prices and the further effect when there is option trading. He shows that with heterogeneous expectations, estimation risk is more important than short selling restrictions in explaining asset returns. Moreover, for stocks with listed options, investors can synthetically sell short via long puts or short calls. The evidence finds that for stocks with listed options, only estimation risk is important in determining asset returns. |

| 3 | Still another study that looks across regime changes is Wang (2014). He finds that when Chinese regulators lifted the short selling ban on 90 stocks in 2010, they experienced a significant price decline. Moreover, the price declines were positively related to the amount of short selling and is consistent with the notion that short selling can be used as a mechanism to correct for overvaluation. |

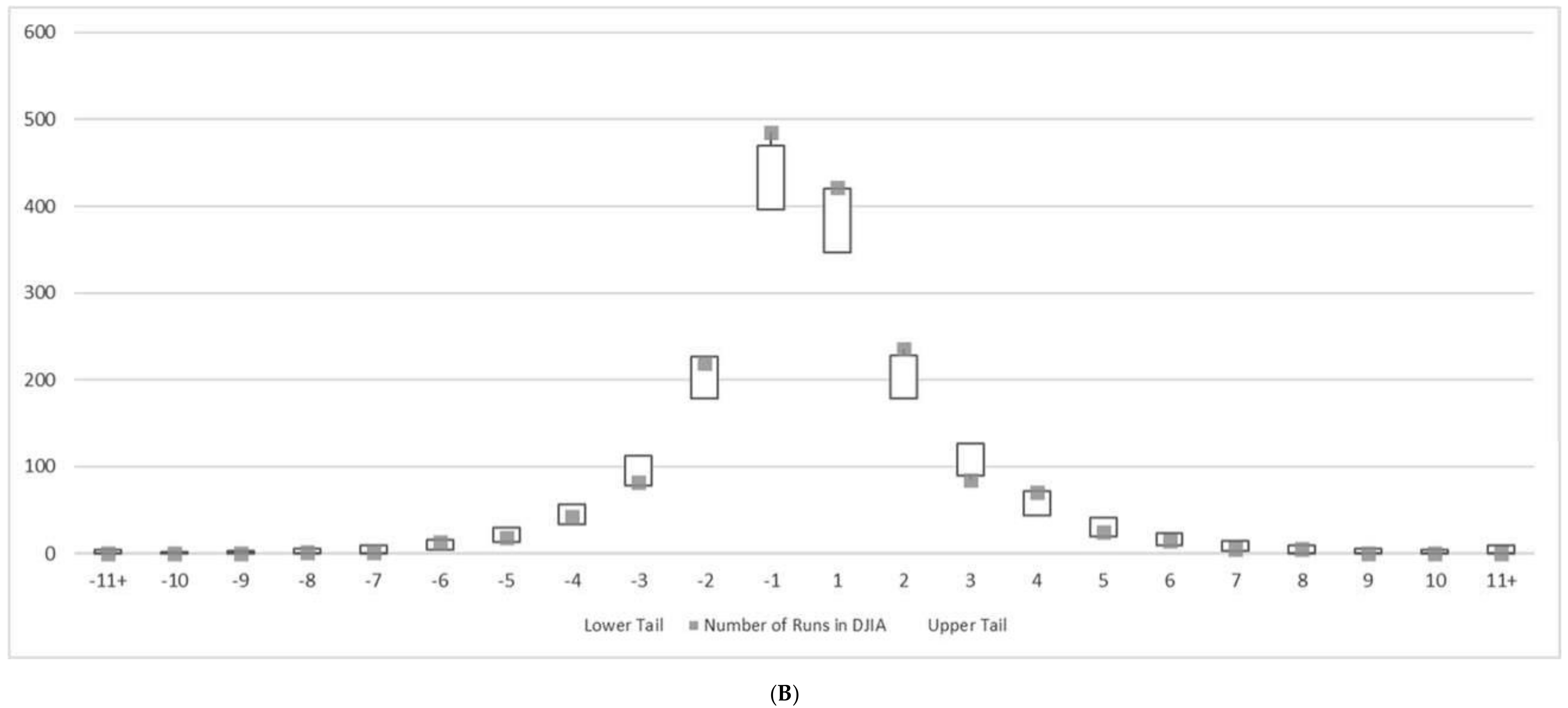

| 4 | While a short selling ban appears to affect both tails of the runs distribution, the tests depend on the success rate, the percentage of positive returns observed. For all DSE stocks, the success rate is less than 50%, while for all Dow Jones stocks the success rate is greater than 50%. Thus, it may be that a short selling ban affects the success rate itself causing these markets to exhibit negative returns more frequently. It should be noted that theory does not give any guidance to what the success rate must be if markets are efficient and follow some type of Markov process. Indeed, it can be shown that if stock prices follow some type of geometric Brownian motion, the success rate increases with the stock returns drift term and decreases with idiosyncratic risk and can theoretically be greater or less than 50%. |

| Indices/Sample Stocks | Period | Average Proportion of Positive Returns | Average Proportion of Negative Returns |

|---|---|---|---|

| DSEX | January 2002–December 2014 | 52.70% | 47.30% |

| DJIA | January 2002–December 2014 | 53.06% | 46.94% |

| 21 DSE Stocks | January 1999–December 2014 | 46.33% | 53.67% |

| 29 Dow Jones Stocks | January 1999–December 2014 | 51.13% | 48.87% |

| −5 | 5 | −6 | 6 | −7 | 7 | −8 | 8 | −9 | 9 | −10+ | 10+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 3.14% | 3.13% | 1.56% | 1.56% | 0.78% | 0.78% | 0.39% | 0.39% | 0.20% | 0.20% | 0.10% | 0.10% |

| 3.13% * | 4.69% | 5.47% | 5.86% | 6.06% | 6.16% | ||||||

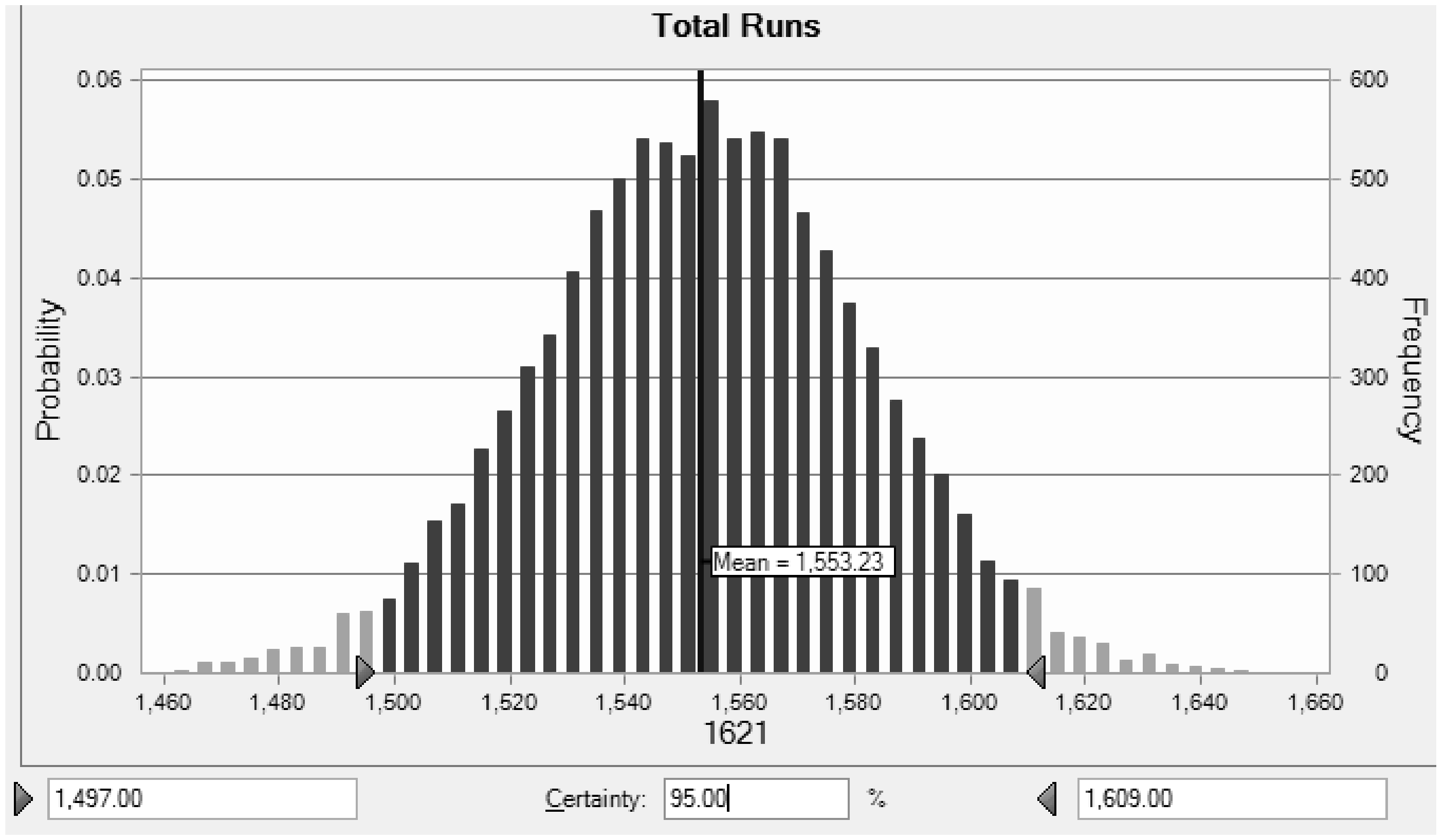

| Indices | Actual Number of Runs | Lower Tail, 95% CI | Upper Tail, 95% CI |

|---|---|---|---|

| DSEX | 1334 | 1497 | 1609 |

| DJIA | 1727 | 1573 | 1685 |

| CI 46.33% | LB 55 UB 87 | 113 155 | 221 278 | 426 501 | 494 577 | 223 279 | 95 135 | 40 68 |

|---|---|---|---|---|---|---|---|---|

| Stocks | −4 | −3 | −2 | −1 | 1 | 2 | 3 | 4 |

| Square Pharma | 78 | 112 | 247 | 367 | 430 | 229 | 95 | 63 |

| Heidelberg | 73 | 141 | 235 | 399 | 467 | 231 | 114 | 60 |

| Shinepukur | 78 | 143 | 235 | 312 | 429 | 247 | 107 | 44 |

| National Bank | 75 | 133 | 222 | 348 | 390 | 235 | 118 | 61 |

| Beximco Pharama | 76 | 142 | 244 | 299 | 401 | 223 | 119 | 64 |

| Fu-Wang Ceramic | 71 | 144 | 226 | 356 | 430 | 246 | 113 | 54 |

| Olympic Industries | 72 | 125 | 238 | 401 | 464 | 252 | 115 | 55 |

| Apex Foods | 90 | 146 | 239 | 368 | 466 | 264 | 106 | 53 |

| ACI | 78 | 130 | 255 | 378 | 469 | 254 | 106 | 49 |

| Aramit Limited | 81 | 132 | 208 | 356 | 412 | 236 | 95 | 65 |

| BATBC | 62 | 138 | 232 | 400 | 427 | 236 | 115 | 56 |

| Islami Bank | 70 | 100 | 212 | 382 | 390 | 221 | 101 | 62 |

| Padma Oil | 38 | 79 | 180 | 320 | 330 | 188 | 56 | 46 |

| Confidence Cement | 82 | 139 | 209 | 391 | 463 | 231 | 114 | 68 |

| Square Textile | 49 | 108 | 180 | 305 | 346 | 155 | 80 | 45 |

| Keya Cosmetics | 71 | 109 | 186 | 310 | 346 | 185 | 87 | 46 |

| Bangladesh Lamps | 79 | 149 | 260 | 381 | 480 | 250 | 116 | 60 |

| Monno Ceramic | 79 | 130 | 253 | 399 | 495 | 250 | 98 | |

| Quasem Drycells | 83 | 115 | 208 | 325 | 399 | 243 | 95 | 47 |

| Meghna Cement | 87 | 148 | 242 | 362 | 450 | 256 | 104 | 59 |

| Bata Shoes | 67 | 137 | 253 | 430 | 509 | 217 | 119 | 57 |

| CI 46.33% | LB 0 UB 10 | 0 5 | 0 7 | 2 11 | 5 18 | 12 29 | 27 49 | 16 34 | 6 19 | 1 10 | 0 6 | 0 4 | 0 2 | 0 4 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stocks | −11+ | −10 | −9 | −8 | −7 | −6 | −5 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

| Square Pharma | 2 | 1 | 3 | 8 | 16 | 20 | 39 | 24 | 27 | 12 | 6 | 0 | 2 | 5 |

| Heidelberg | 0 | 2 | 4 | 3 | 13 | 26 | 38 | 25 | 21 | 8 | 4 | 3 | 1 | 1 |

| Shinepukur | 7 | 1 | 8 | 8 | 16 | 27 | 42 | 24 | 13 | 9 | 1 | 2 | 0 | 0 |

| National Bank | 3 | 2 | 2 | 7 | 19 | 27 | 38 | 38 | 17 | 7 | 6 | 2 | 2 | 0 |

| Beximco Pharama | 7 | 3 | 5 | 11 | 15 | 19 | 43 | 28 | 15 | 11 | 0 | 0 | 1 | 2 |

| Fu-Wang Ceramic | 5 | 2 | 11 | 5 | 14 | 22 | 41 | 31 | 10 | 9 | 5 | 0 | 0 | 0 |

| Olympic Industries | 0 | 1 | 5 | 4 | 14 | 22 | 57 | 25 | 17 | 3 | 6 | 2 | 0 | 0 |

| Apex Foods | 0 | 1 | 8 | 9 | 14 | 18 | 40 | 20 | 12 | 6 | 5 | 1 | 0 | 0 |

| ACI | 4 | 2 | 4 | 9 | 14 | 22 | 36 | 19 | 17 | 10 | 4 | 3 | 0 | 1 |

| Aramit Limited | 1 | 1 | 4 | 3 | 8 | 29 | 33 | 30 | 9 | 6 | 1 | 1 | 0 | 0 |

| BATBC | 0 | 3 | 4 | 6 | 15 | 14 | 31 | 27 | 16 | 10 | 8 | 2 | 3 | 5 |

| Islami Bank | 6 | 2 | 4 | 4 | 14 | 26 | 40 | 37 | 17 | 8 | 8 | 3 | 6 | 6 |

| Padma Oil | 3 | 0 | 4 | 5 | 6 | 15 | 24 | 18 | 12 | 9 | 3 | 3 | 3 | 1 |

| Confidence Cement | 2 | 1 | 3 | 10 | 12 | 26 | 48 | 27 | 12 | 4 | 2 | 2 | 0 | 0 |

| Square Textile | 2 | 0 | 3 | 3 | 8 | 27 | 31 | 24 | 10 | 2 | 2 | 3 | 2 | 0 |

| Keya Cosmetics | 4 | 2 | 6 | 2 | 12 | 24 | 44 | 29 | 10 | 7 | 3 | 3 | 0 | 0 |

| Bangladesh Lamps | 3 | 0 | 3 | 5 | 8 | 19 | 47 | 24 | 10 | 8 | 3 | 1 | 0 | 1 |

| Monno Ceramic | 2 | 6 | 2 | 4 | 8 | 20 | 46 | 31 | 15 | 5 | 3 | 0 | 0 | 1 |

| Quasem Drycells | 5 | 2 | 6 | 5 | 25 | 35 | 42 | 33 | 13 | 9 | 8 | 1 | 0 | 2 |

| Meghna Cement | 0 | 1 | 1 | 5 | 10 | 25 | 43 | 30 | 13 | 8 | 3 | 0 | 0 | 0 |

| Bata Shoes | 3 | 0 | 3 | 10 | 9 | 16 | 29 | 20 | 18 | 9 | 6 | 1 | 1 | 1 |

| CI 51.13% | LB 46 UB 75 | 104 144 | 225 280 | 473 554 | 453 537 | 224 278 | 108 149 | 51 80 |

|---|---|---|---|---|---|---|---|---|

| Stocks | −4 | −3 | −2 | −1 | 1 | 2 | 3 | 4 |

| Apple Inc. | 60 | 138 | 264 | 512 | 506 | 236 | 137 | 60 |

| American Express Company | 57 | 128 | 270 | 550 | 544 | 261 | 143 | 57 |

| The Boeing Company | 58 | 130 | 235 | 550 | 507 | 273 | 109 | 65 |

| Caterpillar Inc. | 65 | 127 | 248 | 485 | 468 | 256 | 121 | 69 |

| Cisco Systems, Inc. | 63 | 147 | 274 | 498 | 522 | 244 | 104 | 75 |

| Chevron Corporation | 57 | 126 | 264 | 529 | 499 | 246 | 127 | 73 |

| E.I. du Pont de Nemours and Company | 57 | 127 | 260 | 512 | 516 | 242 | 127 | 66 |

| The Walt Disney Company | 58 | 143 | 269 | 484 | 482 | 250 | 122 | 80 |

| General Electric Company | 54 | 129 | 281 | 491 | 506 | 263 | 131 | 64 |

| The Goldman Sachs Group, Inc. | 63 | 116 | 262 | 521 | 511 | 253 | 116 | 73 |

| The Home Depot, Inc. | 76 | 115 | 268 | 514 | 506 | 253 | 119 | 64 |

| International Business Machines Corporation | 56 | 128 | 245 | 534 | 511 | 260 | 131 | 60 |

| Intel Corporation | 63 | 134 | 241 | 519 | 502 | 263 | 127 | 54 |

| Johnson & Johnson | 56 | 128 | 274 | 514 | 505 | 254 | 141 | 56 |

| JPMorgan Chase & Co. | 53 | 139 | 266 | 535 | 527 | 270 | 142 | 57 |

| The Coca-Cola Company | 56 | 121 | 240 | 533 | 508 | 246 | 116 | 66 |

| McDonald’s Corp. | 56 | 133 | 244 | 530 | 467 | 256 | 143 | 66 |

| 3M Company | 59 | 127 | 266 | 517 | 499 | 247 | 135 | 55 |

| Merck & Co. Inc. | 68 | 112 | 271 | 480 | 470 | 230 | 156 | 64 |

| Microsoft Corporation | 58 | 140 | 248 | 530 | 535 | 256 | 124 | 60 |

| Nike, Inc. | 75 | 123 | 281 | 484 | 470 | 250 | 146 | 75 |

| Pfizer Inc. | 70 | 108 | 260 | 504 | 503 | 260 | 122 | 61 |

| The Procter & Gamble Company | 56 | 123 | 273 | 527 | 500 | 263 | 130 | 73 |

| The Travelers Companies, Inc. | 51 | 107 | 265 | 560 | 525 | 264 | 126 | 65 |

| UnitedHealth Group Incorporated | 53 | 128 | 246 | 541 | 486 | 267 | 125 | 65 |

| United Technologies Corporation | 60 | 118 | 287 | 546 | 523 | 266 | 133 | 69 |

| Verizon Communications Inc. | 53 | 113 | 279 | 519 | 527 | 237 | 131 | 68 |

| Wal-Mart Stores Inc. | 62 | 125 | 259 | 543 | 519 | 260 | 136 | 62 |

| Exxon Mobil Corporation | 39 | 127 | 278 | 565 | 530 | 270 | 138 | 57 |

| CI 51.13% | 0 5 | 0 3 | 0 4 | 0 8 | 2 13 | 7 22 | 19 41 | 23 46 | 10 25 | 3 15 | 1 9 | 0 5 | 0 4 | 0 9 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stocks | −11+ | −10 | −9 | −8 | −7 | −6 | −5 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

| Apple Inc. | 0 | 0 | 0 | 0 | 6 | 9 | 26 | 31 | 23 | 6 | 7 | 4 | 3 | 1 |

| American Express Company | 0 | 0 | 0 | 4 | 4 | 14 | 29 | 27 | 7 | 9 | 4 | 3 | 1 | 0 |

| The Boeing Company | 0 | 0 | 3 | 1 | 5 | 10 | 36 | 37 | 25 | 4 | 5 | 1 | 2 | 0 |

| Caterpillar Inc. | 0 | 1 | 1 | 1 | 7 | 20 | 31 | 31 | 25 | 8 | 4 | 2 | 2 | 0 |

| Cisco Systems, Inc. | 0 | 0 | 1 | 2 | 2 | 9 | 24 | 40 | 15 | 9 | 5 | 4 | 1 | 1 |

| Chevron Corporation | 1 | 0 | 1 | 2 | 1 | 12 | 27 | 44 | 14 | 5 | 5 | 5 | 1 | 1 |

| E.I. du Pont de Nemours and Company | 1 | 1 | 3 | 4 | 7 | 14 | 29 | 33 | 15 | 11 | 1 | 3 | 0 | 1 |

| The Walt Disney Company | 0 | 2 | 1 | 5 | 6 | 13 | 19 | 33 | 18 | 10 | 2 | 2 | 0 | 1 |

| General Electric Company | 0 | 1 | 0 | 5 | 9 | 16 | 31 | 30 | 8 | 5 | 5 | 2 | 2 | 1 |

| The Goldman Sachs Group, Inc. | 1 | 0 | 1 | 4 | 3 | 12 | 30 | 33 | 17 | 4 | 3 | 0 | 0 | 2 |

| The Home Depot, Inc. | 1 | 0 | 1 | 4 | 6 | 12 | 21 | 47 | 12 | 10 | 5 | 1 | 0 | 0 |

| International Business Machines Corporation | 1 | 1 | 1 | 2 | 8 | 12 | 36 | 34 | 11 | 11 | 3 | 1 | 0 | 2 |

| Intel Corporation | 0 | 0 | 1 | 2 | 5 | 8 | 42 | 30 | 21 | 7 | 5 | 3 | 1 | 2 |

| Johnson & Johnson | 0 | 1 | 1 | 3 | 6 | 12 | 27 | 37 | 13 | 7 | 4 | 4 | 1 | 1 |

| JPMorgan Chase & Co. | 0 | 1 | 0 | 2 | 8 | 14 | 29 | 31 | 14 | 3 | 2 | 1 | 1 | 0 |

| The Coca-Cola Company | 1 | 0 | 2 | 2 | 8 | 15 | 34 | 35 | 24 | 7 | 8 | 1 | 1 | 0 |

| McDonald’s Corp. | 1 | 0 | 2 | 1 | 5 | 12 | 25 | 46 | 15 | 12 | 1 | 2 | 0 | 1 |

| 3M Company | 0 | 2 | 0 | 1 | 8 | 10 | 26 | 44 | 20 | 11 | 1 | 1 | 1 | 2 |

| Merck & Co. Inc. | 1 | 2 | 0 | 5 | 5 | 18 | 26 | 34 | 24 | 5 | 2 | 1 | 1 | 1 |

| Microsoft Corporation | 0 | 1 | 0 | 3 | 8 | 17 | 29 | 29 | 15 | 9 | 4 | 1 | 0 | 1 |

| Nike, Inc. | 0 | 0 | 0 | 0 | 7 | 12 | 22 | 35 | 14 | 8 | 3 | 2 | 0 | 1 |

| Pfizer Inc. | 0 | 1 | 3 | 3 | 9 | 24 | 26 | 32 | 17 | 6 | 3 | 3 | 1 | 0 |

| The Procter & Gamble Company | 0 | 1 | 0 | 2 | 2 | 16 | 29 | 33 | 19 | 4 | 5 | 1 | 0 | 1 |

| The Travelers Companies, Inc. | 1 | 0 | 0 | 4 | 5 | 21 | 28 | 31 | 17 | 6 | 3 | 3 | 1 | 1 |

| UnitedHealth Group Incorporated | 0 | 1 | 0 | 4 | 11 | 13 | 17 | 32 | 15 | 11 | 4 | 4 | 4 | 2 |

| United Technologies Corporation | 0 | 0 | 2 | 2 | 9 | 10 | 16 | 31 | 16 | 8 | 1 | 2 | 1 | 0 |

| CBA | WBC | ANZ | NAB | MQG | SUN | QBE | AMP | ASX | Total |

|---|---|---|---|---|---|---|---|---|---|

| B 88 | 86 | 88 | 88 | 94 | 90 | 80 | 96 | 82 | 792 |

| A 87 | 81 | 76 | 76 | 72 | 74 | 86 | 92 | 84 | 728 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sochi, M.; Swidler, S. A Test of Market Efficiency When Short Selling Is Prohibited: A Case of the Dhaka Stock Exchange. J. Risk Financial Manag. 2018, 11, 59. https://doi.org/10.3390/jrfm11040059

Sochi M, Swidler S. A Test of Market Efficiency When Short Selling Is Prohibited: A Case of the Dhaka Stock Exchange. Journal of Risk and Financial Management. 2018; 11(4):59. https://doi.org/10.3390/jrfm11040059

Chicago/Turabian StyleSochi, Maria, and Steve Swidler. 2018. "A Test of Market Efficiency When Short Selling Is Prohibited: A Case of the Dhaka Stock Exchange" Journal of Risk and Financial Management 11, no. 4: 59. https://doi.org/10.3390/jrfm11040059

APA StyleSochi, M., & Swidler, S. (2018). A Test of Market Efficiency When Short Selling Is Prohibited: A Case of the Dhaka Stock Exchange. Journal of Risk and Financial Management, 11(4), 59. https://doi.org/10.3390/jrfm11040059