A Survey on Empirical Findings about Spillovers in Cryptocurrency Markets

Abstract

:1. Introduction

2. Methodologies about Studying Spillover Effects in Cryptocurrency and Other Financial Markets

3. Studies about Spillovers among Cryptocurrency Markets

4. Studies about Spillovers between Cryptocurrency Markets and Markets of Other Assets or Economic Conditions

5. Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Ammous, Saifedean. 2018. Can cryptocurrencies fulfil the functions of money? The Quarterly Review of Economics and Finance 70: 38–51. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Bariviera, Aurelio F. 2017. The inefficiency of Bitcoin revisited: A dynamic approach. Economics Letters 161: 1–4. [Google Scholar] [CrossRef]

- Baruník, Jozef, and Tomáš Křehlík. 2018. Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics 16: 271–96. [Google Scholar] [CrossRef]

- Beneki, Christina, Alexandros Koulis, Nikolaos A. Kyriazis, and Stephanos Papadamou. 2019. Investigating volatility transmission and hedging properties between Bitcoin and Ethereum. Research in International Business and Finance 48: 219–27. [Google Scholar] [CrossRef]

- Böhme, Rainer, Nicolas Christin, Benjamin Edelman, and Tyler Moore. 2015. Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives 29: 213–38. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bouri, Elie, Peter Molnár, Georges Azzi, David Roubaud, and Lars Ivar Hagfors. 2017. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters 20: 192–98. [Google Scholar] [CrossRef]

- Bouri, Elie, Mahamitra Das, Rangan Gupta, and David Roubaud. 2018. Spillovers between Bitcoin and other assets during bear and bull markets. Applied Economics 50: 5935–49. [Google Scholar] [CrossRef]

- Chaim, Pedro, and Márcio P. Laurini. 2018. Volatility and return jumps in bitcoin. Economics Letters 173: 158–63. [Google Scholar] [CrossRef]

- Ciaian, Pavel, and Miroslava Rajcaniova. 2018. Virtual relationships: Short-and long-run evidence from BitCoin and altcoin markets. Journal of International Financial Markets, Institutions and Money 52: 173–95. [Google Scholar] [CrossRef]

- Corbet, Shaen, Brian Lucey, Andrew Urquhart, and Larisa Yarovaya. 2019. Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis 62: 182–99. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2009. Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal 119: 158–71. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Dyhrberg, Anne Haubo. 2016. Hedging capabilities of bitcoin. Is it the virtual gold? Finance Research Letters 16: 139–44. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica: Journal of the Econometric Society 50: 987–1007. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Engle, Robert F., and Simone Manganelli. 2004. CAViaR: Conditional autoregressive value at risk by regression quantiles. Journal of Business & Economic Statistics 22: 367–81. [Google Scholar]

- Engle, Robert F., and Tim Bollerslev. 1986. Modelling the persistence of conditional variances. Econometric Reviews 5: 1–50. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Fang, Libing, Elie Bouri, Rangan Gupta, and David Roubaud. 2019. Does global economic uncertainty matter for the volatility and hedging effectiveness of Bitcoin? International Review of Financial Analysis 61: 29–36. [Google Scholar] [CrossRef]

- Garman, Mark B., and Michael J. Klass. 1980. On the estimation of security price volatilities from historical data. Journal of Business 53: 67–78. [Google Scholar] [CrossRef]

- Gillaizeau, Marc, Ranadeva Jayasekera, Ahmad Maaitah, Tapas Mishra, Mamata Parhi, and Evgeniia Volokitina. 2019. Giver and the receiver: Understanding spillover effects and predictive power in cross-market Bitcoin prices. International Review of Financial Analysis 63: 86–104. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Granger, Clive W. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society 37: 424–38. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Shaen Corbet, and Brian Lucey. 2019. Volatility spillover effects in leading cryptocurrencies: A BEKK-MGARCH analysis. Finance Research Letters 29: 68–74. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi. 2017. Volatility estimation for Bitcoin: A comparison of GARCH models. Economics Letters 158: 3–6. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi. 2019a. Volatility co-movement between Bitcoin and Ether. Finance Research Letters 30: 221–27. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi. 2019b. An empirical investigation of volatility dynamics in the cryptocurrency market. Research in International Business and Finance 50: 322–35. [Google Scholar] [CrossRef]

- Koutmos, Dimitrios. 2018. Return and volatility spillovers among cryptocurrencies. Economics Letters 173: 122–27. [Google Scholar] [CrossRef]

- Kumar, Anoop S., and Suvvari Anandarao. 2019. Volatility spillover in crypto-currency markets: Some evidences from GARCH and wavelet analysis. Physica A: Statistical Mechanics and its Applications 524: 448–58. [Google Scholar] [CrossRef]

- Kundu, Srikanta, and Nityananda Sarkar. 2016. Return and volatility interdependences in up and down markets across developed and emerging countries. Research in International Business and Finance 36: 297–311. [Google Scholar] [CrossRef]

- Kyriazis, Nikolaos A. 2019. A survey on efficiency and profitable trading opportunities in cryptocurrency markets. Journal of Risk and Financial Management 12: 67. [Google Scholar] [CrossRef] [Green Version]

- Kyriazis, Νikolaos A., and Paraskevi Prassa. 2019. Which Cryptocurrencies Are Mostly Traded in Distressed Times? Journal of Risk and Financial Management 12: 135. [Google Scholar] [CrossRef] [Green Version]

- Kyriazis, Νikolaos A., Kalliopi Daskalou, Marios Arampatzis, Paraskevi Prassa, and Evangelia Papaioannou. 2019. Estimating the volatility of cryptocurrencies during bearish markets by employing GARCH models. Heliyon 5: e02239. [Google Scholar] [CrossRef] [PubMed]

- Luu Duc Huynh, Toan. 2019. Spillover Risks on Cryptocurrency Markets: A Look from VAR-SVAR Granger Causality and Student’st Copulas. Journal of Risk and Financial Management 12: 52. [Google Scholar] [CrossRef] [Green Version]

- Mantegna, Rosario N. 1999. Hierarchical structure in financial markets. The European Physical Journal B-Condensed Matter and Complex Systems 11: 193–97. [Google Scholar] [CrossRef] [Green Version]

- Mantegna, Rosario N., and H. Eugene Stanley. 1999. Introduction to Econophysics: Correlations and Complexity in Finance. Cambridge: Cambridge University Press. [Google Scholar]

- McAleer, Michael, Suhejla Hoti, and Felix Chan. 2009. Structure and asymptotic theory for multivariate asymmetric conditional volatility. Econometric Reviews 28: 422–40. [Google Scholar] [CrossRef]

- Nadarajah, Saralees, and Jeffrey Chu. 2017. On the inefficiency of Bitcoin. Economics Letters 150: 6–9. [Google Scholar] [CrossRef] [Green Version]

- Omane-Adjepong, Maurice, and Imhotep Paul Alagidede. 2019. Multiresolution analysis and spillovers of major cryptocurrency markets. Research in International Business and Finance 49: 191–206. [Google Scholar] [CrossRef]

- Parkinson, Michael. 1980. The extreme value method for estimating the variance of the rate of return. Journal of Business 53: 61–65. [Google Scholar] [CrossRef]

- Pesaran, H. Hashem, and Yongcheol Shin. 1998. Generalized impulse response analysis in linear multivariate models. Economics Letters 58: 17–29. [Google Scholar] [CrossRef]

- Selgin, George. 2015. Synthetic commodity money. Journal of Financial Stability 17: 92–99. [Google Scholar] [CrossRef]

- Symitsi, Efthymia, and Konstantinos J. Chalvatzis. 2018. Return, volatility and shock spillovers of Bitcoin with energy and technology companies. Economics Letters 170: 127–30. [Google Scholar] [CrossRef] [Green Version]

- Trabelsi, Nader. 2018. Are There Any Volatility Spill-Over Effects among Cryptocurrencies and Widely Traded Asset Classes? Journal of Risk and Financial Management 11: 66. [Google Scholar] [CrossRef] [Green Version]

- Urquhart, Andrew. 2016. The inefficiency of Bitcoin. Economics Letters 148: 80–82. [Google Scholar] [CrossRef]

- Wang, Gang Jin, Chi Xie, Danyan Wen, and Longfeng Zhao. 2018. When Bitcoin meets economic policy uncertainty (EPU): Measuring risk spillover effect from EPU to Bitcoin. Finance Research Letters. [Google Scholar] [CrossRef]

- Wei, Wang Chun. 2018. Liquidity and market efficiency in cryptocurrencies. Economics Letters 168: 21–24. [Google Scholar] [CrossRef]

- White, Halbert, Tae-Hwan Kim, and Simone Manganelli. 2015. VAR for VaR: Measuring tail dependence using multivariate regression quantiles. Journal of Econometrics 187: 169–88. [Google Scholar] [CrossRef] [Green Version]

- Yi, Shuyue, Zishuang Xu, and Gang-Jin Wang. 2018. Volatility connectedness in the cryptocurrency market: Is Bitcoin a dominant cryptocurrency? International Review of Financial Analysis 60: 98–114. [Google Scholar] [CrossRef]

- Zięba, Damian, Ryszard Kokoszczyński, and Katarzyna Śledziewska. 2019. Shock transmission in the cryptocurrency market. Is Bitcoin the most influential? International Review of Financial Analysis 64: 102–25. [Google Scholar] [CrossRef]

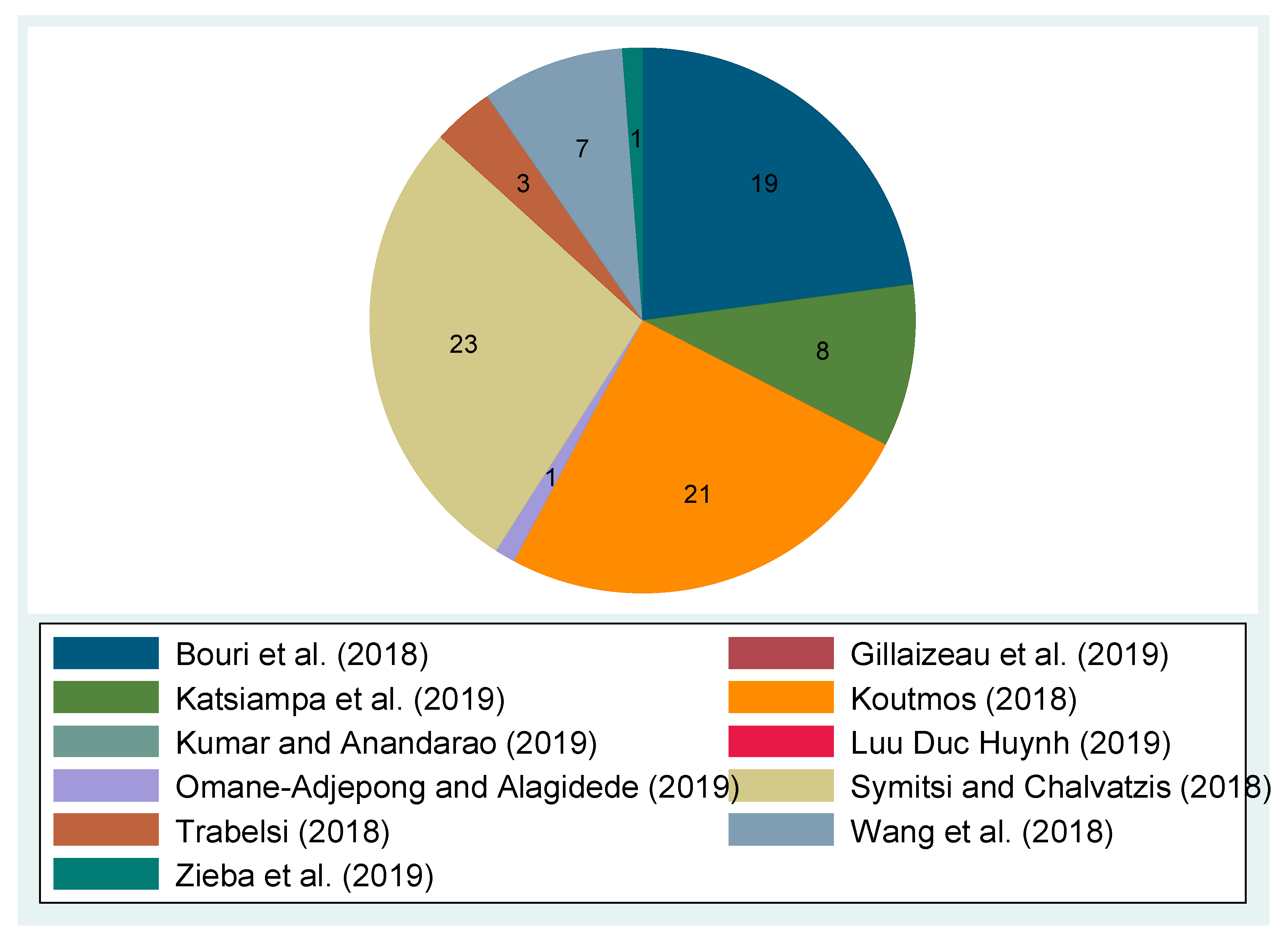

| Authors | Variables Examined | Frequency of Data | Time Period Examined | Data Source | Methodology | Conclusions about Spillovers |

|---|---|---|---|---|---|---|

| Bouri et al. (2018) | Bitcoin MSCI World MSCI Emerging Markets MASCI China SP SGCI Commodity SP SGCI energy Gold US dollar index US 10-year Treasury yields | Daily | 19 July 2010–31 October 2017 | Coindesk Datastream | STVAR-BTGARCH-M as in Kundu and Sarkar (2016) GJR-GARCH by Glosten et al. (1993) DCC-GARCH by Engle (2002) | Asymmetric spillovers. Bitcoin is usually the receiver. Return spillovers higher than volatility spillovers. |

| Gillaizeau et al. (2019) | BTC/USD BTC/AUD BTC/CAD BTC/EUR BTC/GBP EPU | Daily | 12 March 2013–31 January 2018 | www.bitcoincharts.com Mt.Gox Bitstamp LocalBitcoins | Generalized variance decomposition (GVD) approach by Diebold and Yilmaz (2012) in VAR models Parkinson’s high-low historical volatility (HL-HV) model by Parkinson (1980) Garman-Klass measure for volatility by Garman and Klass (1980) | BTC/USD has high predictive power BTC/EUR is net receiver of volatility spillovers |

| Katsiampa et al. (2019) | Bitcoin Ethereum Litecoin | Daily | 7 August 2015 to 10 July 2018 | Coinmarketcap.com | BEKK-MGARCH model by Engle and Kroner (1995) | Bi-directional spillover effects between Bitcoin-Ethereum and between Bitcoin-Litecoin; Uni-directional shock spillover from Ethereum to Litecoin; Bi-directional volatility spillover between all three pairs |

| Koutmos (2018) | Bitcoin Ethereum Ripple Litecoin Dash Stellar NEM Monero Tether Bytecoin BitShares Verge Dogecoin DigiByte MaidSafeCoin MonaCoin ReddCoin Emercoin | Daily | 7 August 2015–17 July 2018 | Coinmarketcap.com | GARCH methodologies by Engle (1982) and Bollerslev (1986) Random rotations by Diebold and Yilmaz (2009) Generalized decomposition in VAR models by Pesaran and Shin (1998) | Bitcoin is the dominant contributor of return and volatility spillovers; Steady increase of spillovers over time; Spikes in spillovers during major events |

| Kumar and Anandarao (2019) | Bitcoin Ethereum Ripple Litecoin | Daily | 15 August 2015–18 January 2018 | Coinmarketcap.com | IGARCH(1,1)—DCC GARCH(1,1) by Engle and Bollerslev (1986) and Engle (2002) Wavelet cross spectra | Significant volatility spillover from Bitcoin to Ethereum and Litecoin |

| Luu Duc Huynh (2019) | Bitcoin Ethereum Ripple Litecoin Stellar | Daily | 8 September 2015–4 January 2019 | - | Pearson correlation VAR-SVAR causality t-Student’s copulas (Gaussian, Student’s-t) | Bitcoin is receiver of spillovers; Ethereum is not affected |

| Omane-Adjepong and Alagidede (2019) | Bitcoin BitShares Litecoin Stellar Ripple Monero Dash | Daily | 8 May 2014–12 February 2018 | Coinmarketcap.com | Maximum Overlap Discrete Wavelet Transform (MODWT) Granger causality (Granger 1969) in a VAR system GARCH GJR-GARCH by Glosten et al. (1993) | (Non)linear feedback linkages or unidirectional transmission of shocks Bitcoin and Ethereum most influential |

| Symitsi and Chalvatzis (2018) | Bitcoin SP Global Clean Energy Index (SPGCE) MSCI World Energy Index (MSCIWE) MSCI World Information Technology Index (MSCIWIT) | Daily | 22 August 2011–15 February 2018 | Datastream | VAR(1)-BEKK-AGARCH model by McAleer et al. (2009) | Significant return spillovers from energy and technology stocks to Bitcoin Short-run volatility spillovers from technology companies and long-run towards energy companies. Bi-directional asymmetric character |

| Trabelsi (2018) | Bitcoin Ethereum Ripple Litecoin Bitcoin Price Index SP500 NASDAQ FTSE100 HangSeng Nikkei225 EUR/USD GBP/USD USD/JPY USD/CHF USD/CAD Gold Brent futures contracts | Daily | 7 October 2010–8 February 2018 | Coindesk - | Spillover index approach by Diebold and Yilmaz (2009) FEVD by Diebold and Yilmaz (2012) and Baruník and Křehlík (2018) | No significant spillover effects |

| Wang et al. (2018) | Bitcoin US EPU index Equity market uncertainty index VIX index | Daily | 18 July 2010–31 May 2018 | www.policyuncertainty.com by Baker et al. (2016) Coindesk | MVQM-CAViaR model based on White et al. (2015) and Engle and Manganelli (2004) | Negligible risk spillover impact from EPU to Bitcoin |

| Zięba et al. (2019) | Pura Emercoin Verge LEOcoin Nexus NewYorkCoin MonetaryUnion Dimecoin I.O.Coin Groestlcoin Energycoin NeosCoin Cloakcoin Ubiq BitBay ECC Mooncoin Monacoin FedoraCoin BitSend Crown CasinoCoin Tether BitCNY Mintcoin Siacoin Boolberry Monero Aeon PotCoin Viacoin FlorinCoin Burst MaidSafeCoin Ethereum Clams DigitalNote NavCoin ByteCoin Omni ReddCoin Stealthcoin Blocknet Bean.Cash Dash FoldingCoin GridCoin Myriad Einstenium OKCash FairCoin WhiteCoin SolarCoin RubyCoin Gulden Feathercoin Diamond Unobtanium DNotes NEM GameCredits DigiByte Counterparty Syscoin VeriCoin BitcoinDark Primecoin Dogecoin BlackCoin Vertcoin Nxt Stellar Ripple BitShares Namecoin Peercoin Litecoin Bitcoin | Daily | 01 September 2015–19 December 2016 20 December 2016–02 May 2018 | Coinmarketcap.com | Minimum-spanning tree (MST) by Mantegna (1999) and Mantegna and Stanley (1999) VAR models and causality by Granger (1969) | No significant spillover effects towards or from Bitcoin. Linkages among Bitcoin, Monero, and Dash. Also interconnectedness among Dogecoin, Ripple, Stellar, and BitShares |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kyriazis, N.A. A Survey on Empirical Findings about Spillovers in Cryptocurrency Markets. J. Risk Financial Manag. 2019, 12, 170. https://doi.org/10.3390/jrfm12040170

Kyriazis NA. A Survey on Empirical Findings about Spillovers in Cryptocurrency Markets. Journal of Risk and Financial Management. 2019; 12(4):170. https://doi.org/10.3390/jrfm12040170

Chicago/Turabian StyleKyriazis, Nikolaos A. 2019. "A Survey on Empirical Findings about Spillovers in Cryptocurrency Markets" Journal of Risk and Financial Management 12, no. 4: 170. https://doi.org/10.3390/jrfm12040170

APA StyleKyriazis, N. A. (2019). A Survey on Empirical Findings about Spillovers in Cryptocurrency Markets. Journal of Risk and Financial Management, 12(4), 170. https://doi.org/10.3390/jrfm12040170