Marketing Islamic Financial Services: A Review, Critique, and Agenda for Future Research

Abstract

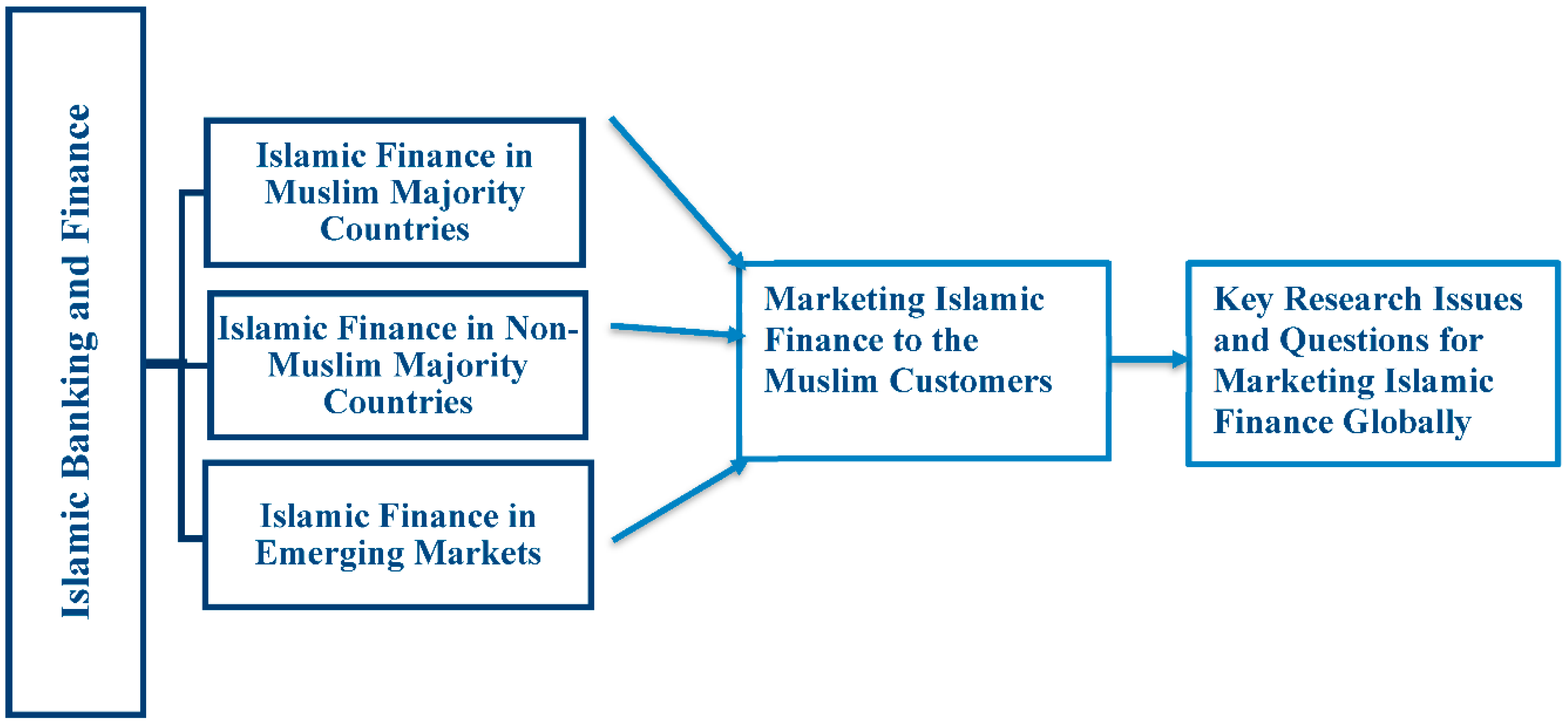

:1. Introduction

2. Review Methodology

3. Islamic Financial Service Sector

3.1. Research Theme 1: Islamic Finance Marketing in Muslim Countries

3.2. Research Theme 2: Islamic Finance Marketing in Non-Muslim Majority Countries

3.3. Research Theme 3: Islamic Finance Marketing in Emerging Countries

4. Conclusions and Implications

5. Future Research Agenda

6. Marketing Related Research Questions

- RQ1: How to brand Islamic financial products and services in various parts of the world?

- RQ2: How the current developments in emerging technology and digital marketing, such as artificial intelligence and virtual reality, impact the marketing of Islamic financial services?

- RQ3: What is the development process of new Islamic financial services?

- RQ4: How to involve Muslim customers in developing new Islamic financial services?

- RQ5: What regulatory factors and legal issues affect the marketing of Islamic financial products and services?

- RQ6: How to use marketing communications to promote Islamic financial products?

- RQ7: What digital and social media marketing strategies are appropriate for marketing and promoting Islamic finance?

- RQ8: What are the optimal delivery process and channel strategies for distributing Islamic financial services?

- RQ9: What sales strategies are needed to help a firm sell more Islamic financial services?

- RQ10: What competitive positioning strategies are appropriate in differentiating Islamic finance from traditional financial services?

- RQ11: How to measure the service quality and customers’ satisfaction and their mutual relationship in the context of Islamic finance?

- RQ12: What marketing strategies are needed to market Islamic financial products and services to non-Muslim customers in various parts of the world?

7. Research Questions Related to Other Issues

- RQ1: How can the Islamic financial system and the mainstream financial system coexist in a country with a sizable Muslim population?

- RQ2: How does Islamic finance contribute to the economic wellbeing of non-Muslim majority countries?

- RQ3: How would the introduction of Islamic finance in non-Muslim majority countries dispel the notion of marginalization of the Muslim population?

- RQ4: What critical steps should the policymakers in non-Muslim majority countries take to develop and promote Islamic finance?

- RQ5: How can a financial services firm take advantage of the growth in the emerging market by offering Islamic finance to Muslim customers?

- RQ6: What cross-country differences exist in the marketing, adoption, and promotion of Islamic finance in various non-Muslim majority countries?

- RQ7: What are some of the key cross-country differences in the marketing, adoption, and promotion of Islamic finance within the emerging markets with a sizable Muslim population?

- RQ8: What decision models do customers use in selecting Islamic financial services over the mainstream traditional financial services in non-Muslim countries?

- RQ1: What critical steps should policymakers of the Muslim majority countries take to develop and promote Islamic finance in their respective countries?

- RQ2: How do various institutional and organizational factors in Muslim majority countries affect the overall promotion of Islamic finance?

- RQ3: Taking a cross-country perspective, how do varying rules and regulations in different Muslim and non-Muslim majority countries affect the decisions of a financial services firm to develop and introduce Islamic financial services?

- RQ4: What are the main motivating factors for the customers to adopt Islamic finance in Muslim majority countries?

Author Contributions

Funding

Conflicts of Interest

References

- Abdull-Majid, Mariani, David S. Saal, and Giuliana Battisti. 2010. Efficiency in Islamic and conventional banking: An international comparison. Journal of Productivity Analysis 34: 25–43. [Google Scholar] [CrossRef] [Green Version]

- Abdullrahim, Najat, and Julie Robson. 2017. The importance of service quality in British Muslim’s choice of an Islamic or non-Islamic bank account. Journal of Financial Services Marketing 22: 54–63. [Google Scholar] [CrossRef] [Green Version]

- Abdur Razzaque, Mohammed, and Sadia Nosheen Chaudhry. 2013. Religiosity and Muslim consumers’ decision-making process in a non-Muslim society. Journal of Islamic Marketing 4: 198–217. [Google Scholar] [CrossRef]

- Abedifar, Pejman, Shahid M. Ebrahim, Philip Molyneux, and Amine Tarazi. 2015. Islamic banking and finance: Recent empirical literature and directions for future research. Journal of Economic Surveys 29: 637–70. [Google Scholar] [CrossRef] [Green Version]

- Abou-Youssef, Mariam Mourad Hussein, Wael Kortam, Ehab Abou-Aish, and Noha El-Bassiouny. 2015. Effects of religiosity on consumer attitudes toward Islamic banking in Egypt. The International Journal of Bank Marketing 33: 786–807. [Google Scholar] [CrossRef]

- Ackerman, David, and Gerrad Tellis. 2001. Can culture affect prices? A crosscultural study of shopping and retail prices. Journal of Retailing 77: 57–82. [Google Scholar] [CrossRef]

- Ahmad, Abu Umar Faruq, and M. Kabir Hassan. 2007. Regulation and performance of Islamic banking in Bangladesh. Thunderbird International Business Review 49: 251–77. [Google Scholar] [CrossRef]

- Ahmad, Ashfaque, Kashifur-Ur-Rehman, Iqbal Saif, and Nadeem Safwan. 2010. An empirical investigation of Islamic banking in Pakistan based on perception of service quality. African Journal of Business Management 4: 1185–93. [Google Scholar]

- Ahmed, Syed. 2013. Asia focus: Sun rises in the east. Islamic Finance Asia, October 7. [Google Scholar]

- Ahmed, Abdulkader Mohamed, and Noureddine Khababa. 1999. Performance of the banking sector in Saudi Arabia. Journal of Financial Management & Analysis 12: 30–36. [Google Scholar]

- Akhtar, Muhammad N., Ahmed Imran Hunjra, Syed Waqar Akbar, Kashif-Ur-Rehman, and Ghulam Shabbir Khan Niazi. 2011. Relationship between customer satisfaction and service quality of Islamic banks. World Applied Sciences Journal 13: 453–59. [Google Scholar]

- Al Rahahleh, Naseem, M. Ishaq Bhatti, and Farida Najuna Misman. 2019. Developments in risk management in Islamic finance: A review. Journal of Risk and Financial Management 12: 37. [Google Scholar] [CrossRef] [Green Version]

- Alam, Intekhab. 2013. Customer interaction in service innovation: Evidence from India. International Journal of Emerging Markets 8: 41–64. [Google Scholar] [CrossRef]

- Alam, Intekhab. 2015. Developing Sharia-compliant Financial Services for the Muslim Customers in India. Journal of Islamic Economics, Banking and Finance 11: 47–70. [Google Scholar] [CrossRef]

- Alam, Intekhab. 2019. Interacting with Muslim customers for new service development in a non-Muslim majority country. Journal of Islamic Marketing 10: 1017–36. [Google Scholar] [CrossRef]

- Alemu, Aye Mengistu. 2012. Factors influencing consumers’ financial transactions in Islamic banks compared with conventional banks: Empirical evidence from selected middle-east countries with a dual banking system. African & Asian Studies 11: 444–65. [Google Scholar]

- Al-Jazzazi, Akram M., and Parves Sultan. 2014. Banking service quality in the Middle Eastern countries. International Journal of Bank Marketing 32: 688–700. [Google Scholar] [CrossRef]

- Al-Salem, Fouad, and Mhamed M. Mostafa. 2019. Clustering Kuwaiti consumer attitudes towards sharia-compliant financial products. The International Journal of Bank Marketing 37: 142–55. [Google Scholar] [CrossRef]

- Al-Tamimi, Hussein, and Abdullah Al-Amiri. 2003. Analysing service quality in the UAE Islamic banks. Journal of Financial Services Marketing 8: 119–32. [Google Scholar] [CrossRef]

- Al-Tamimi, Hussein, Adel Shehadah Lafi, and Md Hamid Uddin. 2009. Bank image in the UAE: Comparing Islamic and conventional banks. Journal of Financial Services Marketing 14: 232–44. [Google Scholar] [CrossRef]

- Amin, Hanudin. 2013. Factors influencing Malaysian bank customers to choose Islamic credit cards: Empirical evidence from the TRA model. Journal of Islamic Marketing 4: 245–63. [Google Scholar] [CrossRef] [Green Version]

- Amin, Muslim, Ziadi Isa, and Rordrigue Fontaine. 2013. Islamic banks. The International Journal of Bank Marketing 31: 79–97. [Google Scholar] [CrossRef]

- Amin, Hanudin, Abdul-Rahim Abdul-Rahman, and Dzuljastri Abdul Razak. 2014. Theory of Islamic consumer behaviour. Journal of Islamic Marketing 5: 273–301. [Google Scholar] [CrossRef]

- Amin, Hanudin, Abdul-Rahim Abdul-Rahman, and Dzuljastri Abdul-Razak. 2016. Malaysian consumers’ willingness to choose Islamic mortgage products: An extension of the theory of interpersonal behaviour. The International Journal of Bank Marketing 34: 868–84. [Google Scholar] [CrossRef]

- Ariff, Mohamed, and Saiful Azhar Rosly. 2011. Islamic banking in Malaysia: Unchartered waters. Asian Economic Policy Review 6: 301–19. [Google Scholar] [CrossRef]

- Arora, Sunit. 2018. Dropping the idea of Islamic banking in India will leave millions shortchanged. The Wire, January 17. [Google Scholar]

- Arshad, Madiha, Samina Aslam, Amir Razi, and Syed Atif Ali. 2011. A comparative analysis of bankers’ perception on Islamic banking in Pakistan. International Journal of Economics and Research 2: 1–12. [Google Scholar]

- Åström, Hafsa Orhan. 2013. Survey on customer related studies in Islamic banking. Journal of Islamic Marketing 4: 294–305. [Google Scholar] [CrossRef]

- Ayub, Muhammad. 2018. Islamic finance crossing the 40-years milestone—The way forward. Intellectual Discourse 26: 463–84. [Google Scholar]

- Azmat, Saad, Haiqa Ali, Kym Brown, and Michael T. Skully. 2019. Persuasion in Islamic Finance (24 January 2019). Available online: https://ssrn.com/abstract=3322056 (accessed on 19 December 2019).

- Bello, Daniel, Radulovich Lori, Rajshekhar Javalgi, Robert Scherer, and Jennifer Taylor. 2016. Performance of professional service firms from emerging markets: Role of innovative services and firm capabilities. Journal of World Business 51: 413–24. [Google Scholar] [CrossRef]

- Belwal, Rakesh, and Ahmad Al Maqbali. 2019. A study of customers’ perception of Islamic banking in Oman. Journal of Islamic Marketing 10: 150–67. [Google Scholar] [CrossRef]

- Bershidsky, Leonid. 2013. Islamic finance can save the world. Bloomberg News, October 29. [Google Scholar]

- Biernacki, Patrick, and Dan Waldorf. 1981. Snowball sampling: Problems and techniques of chain referral sampling. Sociological Methods & Research 10: 141–63. [Google Scholar]

- Bizri, Rima. 2014. A study of Islamic banks in the non-GCC MENA region: Evidence from Lebanon. The International Journal of Bank Marketing 32: 130–49. [Google Scholar] [CrossRef]

- Bo, Ding, Engku Rabiah Adawiah, and Buerhan Saiti. 2016. Sukuk issuance in china: Trends and positive expectations. International Review of Management and Marketing 6: 1020–25. [Google Scholar]

- Bose, Suprio, and Puja Yedukumar. 2013. Finally waking up to Islamic finance opportunities. Islamic Finance Asia, February 15. [Google Scholar]

- Burton, Dawn. 2000. Ethnicity, identity and marketing: A critical review. Journal of Marketing Management 16: 853–77. [Google Scholar] [CrossRef]

- Butt, Irfan, Nisar Ahmad, Amjad Naveed, and Zeeshan Ahmed. 2018. Determinants of low adoption of Islamic banking in Pakistan. Journal of Islamic Marketing 9: 655–72. [Google Scholar] [CrossRef] [Green Version]

- Chakrabarty, Amit Kumar. 2015. Islamic micro finance: Theoretical aspects and Indian status. The Journal of Commerce 7: 169–82. [Google Scholar]

- Chaudhry, Shiv, and Dave Crick. 2004. Attempts to more effectively target ethnic minority customers: The case of HSBC and its South Asian business unit in the UK. Strategic Change 13: 361–68. [Google Scholar] [CrossRef]

- Chaudhury, Masudul Alam, and Ishaq Bhatti. 2017. Heterodox Islamic Economics: The Emergence of an Ethico-Economic Theory. London: Routledge. [Google Scholar]

- Chazi, Abdelaziz, Ashraf Khallaf, and Zaher Zantout. 2018. Corporate Governance and Bank Performance: Islamic Versus Non-Islamic Banks in GCC Countries. Journal of Developing Areas 52: 109–26. [Google Scholar] [CrossRef]

- Dariyoush, Jamshidi, and Nazima Hussin. 2016. Forecasting patronage factors of Islamic credit card as a new e-commerce banking service: An integration of TAM with perceived religiosity and trust. Journal of Islamic Marketing 7: 378–404. [Google Scholar]

- Derbel, Hatem, Taoufik Bouraoui, and Neila Dammak. 2011. Can Islamic finance constitute a solution to crisis? International Journal of Economics and Finance 3: 75–83. [Google Scholar] [CrossRef] [Green Version]

- El-Bassiouny, Noha. 2014. The one-billion-plus marginalization: Toward a scholarly understanding of Islamic consumers. Journal of Business Research 67: 42–49. [Google Scholar] [CrossRef]

- Elbeck, Matt, and Evangellos-Vagelis Dedoussis. 2010. Arabian Gulf innovator attitudes for online Islamic bank marketing strategy. Journal of Islamic Marketing 1: 268–85. [Google Scholar] [CrossRef]

- El-Galfy, Ahmed, and Abdalla Khiyar. 2012. Islamic banking and economic growth: A review. Journal of Applied Business Research 28: 943–55. [Google Scholar] [CrossRef]

- Estiri, Mehrdad, Farshid Hosseini, Hamidreza Yazdani, and Hooman Javidan Nejad. 2011. Determinants of customer satisfaction in Islamic banking: Evidence from Iran. International Journal of Islamic and Middle Eastern Finance and Management 4: 295–307. [Google Scholar] [CrossRef]

- Ezzati, Morteza. 2019. Contributing factors on the allocation of funds in the Islamic society. Journal of Islamic Marketing 10: 1074–90. [Google Scholar] [CrossRef]

- Fang, Eddy. 2014. Islamic finance in global markets: Materialism, ideas and the construction of financial knowledge. Review of International Political Economy 21: 1170–202. [Google Scholar] [CrossRef]

- Fang, Eddy. 2016. Three decades of “repackaging” Islamic finance in international markets. Journal of Islamic Marketing 7: 37–58. [Google Scholar] [CrossRef]

- Ford, Neil. 2012. The rise and rise of Islamic finance. African Banker, September 24. [Google Scholar]

- Gerrard, Philip, and Barton Cunningham. 1997. Islamic banking: A study in Singapore. International Journal of Bank Marketing 15: 204–16. [Google Scholar] [CrossRef]

- Goldman, Arieh, and Hyiel Hino. 2005. Supermarkets vs. traditional retail stores: Diagnosing the barriers to supermarkets’ market share growth in an ethnic minority community. Journal of Retailing and Consumer Services 12: 273–84. [Google Scholar] [CrossRef]

- Grier, Sonya, and Rohit Deshpandé. 2001. Social dimensions of consumer distinctiveness: The influence of social status on group identify and advertising persuasion. Journal of Marketing Research 38: 216–24. [Google Scholar] [CrossRef]

- Hamad, Mohammad, and Toeman Duman. 2014. A Comparison of Interest-Free and Interest-Based Microfinance in Bosnia and Herzegovina. European Researcher 79: 1333–50. [Google Scholar] [CrossRef]

- Hamid, Abdul, M. Shabri Abd Majid, and Lilis Khairunnisah. 2017. An empirical re-examination of the Islamic banking performance in Indonesia. International Journal of Academic Research in Economics and Management Sciences 6: 219–32. [Google Scholar] [CrossRef]

- Hammond, Chris. 2012. Could India allow offshore Islamic bonds? Asia Money, November 4. [Google Scholar]

- Haron, Sudin, Norafifah Ahmad, and Sandra L. Planisek. 1994. Bank patronage factors of Muslim and non-Muslim customers. International Journal of Bank Marketing 12: 32–40. [Google Scholar] [CrossRef]

- Hassan, Kabir, Benito Sanchez, and M. Faisal Safa. 2013. Impact of financial liberalization and foreign bank entry on Islamic banking performance. International Journal of Islamic and Middle Eastern Finance and Management 6: 7–42. [Google Scholar] [CrossRef]

- Hoque, Mohammad Enamul, Nik Mohd Hazrul Nik Hashim, and Mohammad Hafizi Bin Azmi. 2018. Moderating effects of marketing communication and financial consideration on customer attitu de and intention to purchase Islamic banking products. Journal of Islamic Marketing 9: 799–822. [Google Scholar] [CrossRef]

- Hossain, Mohammed, and Shirley Leo. 2009. Customer perception on service quality in retail banking in Middle East: The case of Qatar. International Journal of Islamic and Middle Eastern Finance and Management 2: 338–50. [Google Scholar] [CrossRef]

- Hussain, Mareem. 2014. Performance and potential of Islamic finance: A contextual study in the UK. Journal of Shi’a Islamic Studies 7: 441–510. [Google Scholar] [CrossRef]

- Hussein, Kassim. 2010. Bank-level stability factors and consumer confidence—A comparative study of Islamic and conventional banks’ product mix. Journal of Financial Services Marketing 15: 259–70. [Google Scholar] [CrossRef] [Green Version]

- IFSB. 2018. Financial Services Industry Stability Report. The Islamic Financial Services Board. Available online: https://www.ifsb.org/download.php?id=4811&lang=English&pg=/index.php (accessed on 14 December 2019).

- Imran, Muhammad, Shahzad Abdul Samad, and Rass Masood. 2011. Awareness level of Islamic banking in Pakistan’s two largest cities. Journal of Managerial Science 5: 1–20. [Google Scholar]

- Ireland, John. 2018. Just how loyal are Islamic banking customers? The International Journal of Bank Marketing 36: 410–22. [Google Scholar] [CrossRef]

- Islam, Jamidul, and Zillur Rahman. 2017. Awareness and willingness towards Islamic banking among Muslims: An Indian perspective. International Journal of Islamic and Middle Eastern Finance and Management 10: 92–101. [Google Scholar] [CrossRef]

- Jain, Yogesh. 2013. Financial services sector at the center stage of Indian economy: Opportunities and challenges. Asia Pacific Journal of Management & Entrepreneurship Research 2: 209–20. [Google Scholar]

- Jamal, Ahmad. 2003. Marketing in a multicultural world: The interplay of marketing, ethnicity and consumption. European Journal of Marketing 37: 1599–620. [Google Scholar] [CrossRef]

- Jamal, Ahmad, and Syadiyah Abdul Shukor. 2014. Antecedents and outcomes of interpersonal influences and the role of acculturation: The case of young British-Muslims. Journal of Business Research 67: 237–45. [Google Scholar] [CrossRef]

- Jamal, Ahmad, Sue Peattie, and Ken Peattie. 2012. Ethnic minority consumers’ responses to sales promotions in the packaged food market. Journal of Retailing and Consumer Services 19: 98–108. [Google Scholar] [CrossRef]

- Jamaluddin, Nasiruddin. 2013. Marketing of shariah-based financial products and investments in India. Management Research Review 36: 417–30. [Google Scholar] [CrossRef]

- Janahi, Muhamed Abdulnaser, and Muneer Mohamed Saeed Al Mubarak. 2017. The impact of customer service quality on customer satisfaction in Islamic banking. Journal of Islamic Marketing 8: 595–604. [Google Scholar] [CrossRef]

- Kaabachi, Souheila, and Hassan Obeid. 2016. Determinants of Islamic banking adoption in Tunisia: Empirical analysis. The International Journal of Bank Marketing 34: 1069–91. [Google Scholar] [CrossRef]

- Kaakeh, Abdulkader, Kabir Hassan, and Stefan van Hemmen Almazor. 2018. Attitude of Muslim minority in Spain towards Islamic finance. International Journal of Islamic and Middle Eastern Finance and Management 11: 213–30. [Google Scholar] [CrossRef]

- Kaleem, Ahmad, and Saima Ahmad. 2010. Bankers’ perception towards bai salam method for agriculture financing in Pakistan. Journal of Financial Services Marketing 15: 215–27. [Google Scholar] [CrossRef]

- Karbhari, Yusuf, Kamla Naser, and Zerrin Shahin. 2004. Problems and challenges facing the Islamic banking system in the West: The case of the UK. Thunderbird International Business Review 46: 521–43. [Google Scholar] [CrossRef]

- Khafafa, Ali Joma, and Zurina Shafii. 2013. Measuring the perceived service quality and customer satisfaction in Islamic bank windows in Libya based on structural equation modelling (SEM). Afro Eurasian Studies 2: 56–71. [Google Scholar]

- Khaliq, Ahmad, Ghulam Ali Rustam, and Michael Dent. 2011. Brand preference in Islamic banking. Journal of Islamic Marketing 2: 74–82. [Google Scholar]

- Khan, Omar. 2004. A proposed introduction of Islamic banking in India. International Journal of Islamic Financial Services 5: 1–10. [Google Scholar]

- Khan, Hajera Fatima. 2017. Islamic banking: On its way to globalization. International Journal of Management Research and Reviews 7: 1006–14. [Google Scholar]

- Khan, Mansoor, and Ishaq Bhatti. 2008a. Islamic banking and finance: On its way to globalization. Managerial Finance 34: 708–25. [Google Scholar] [CrossRef] [Green Version]

- Khan, Mansoor, and Ishaq Bhatti. 2008b. Development in Islamic banking: A financial risk-allocation approach. The Journal of Risk Finance 9: 40–51. [Google Scholar] [CrossRef]

- Khan, Mohammad Saif Noman, Kabir Hassan, and Abdullah Ibneyy Shahid. 2007. Banking behavior of Islamic bank customers in Bangladesh. Journal of Islamic Economics, Banking and Finance 3: 159–94. [Google Scholar]

- Khan, Muhammad Asif, Muhammad AfaqHaider, Shujahat Haidar Hashemi, and Muhammad Atif Khan. 2017. Islamic finance service industry and contemporary challenges: A literature outlook (1987–2016). Marketing and Branding Research 4: 310–21. [Google Scholar] [CrossRef]

- Khattak, Naveed Azeem, and Kashifur Rehman. 2010. Customer satisfaction and awareness of Islamic banking system in Pakistan. African Journal of Business Management 4: 662–71. [Google Scholar]

- Kholvadia, Fatima. 2017. Islamic banking in South Africa—Form over substance? Meditari Accountancy Research 25: 65–81. [Google Scholar] [CrossRef] [Green Version]

- Korkut, Cem, and Önder Özgür. 2017. Is there a link between profit share rate of participation banks and interest rate? The case of Turkey. Journal of Economic Cooperation & Development 38: 135–57. [Google Scholar]

- Kumar, Kiran, and Bhawna Sahu. 2017. Dynamic linkages between macroeconomic factors and Islamic stock indices in a non-Islamic country India. Journal of Developing Areas 51: 193–205. [Google Scholar] [CrossRef]

- Kurpad, Meenakshi Ramesh. 2016. Making a case for Islamic finance in India. Law & Financial Markets Review 10: 38–45. [Google Scholar]

- Lai, Karen, and Michael Samers. 2017. Conceptualizing Islamic banking and finance: A comparison of its development and governance in Malaysia and Singapore. Pacific Review 30: 405–24. [Google Scholar] [CrossRef]

- Loo, Mark. 2010. Attitudes and perceptions towards Islamic banking among Muslims and non-Muslims in Malaysia: Implications for marketing to baby boomers and X-generation. International Journal of Arts and Sciences 3: 453–85. [Google Scholar]

- Ltifi, Moez, Lubica Hikkerova, Boualem Aliouat, and Jameleddine Gharbi. 2016. The determinants of the choice of Islamic banks in Tunisia. The International Journal of Bank Marketing 34: 710–30. [Google Scholar] [CrossRef]

- Lyons, Richard K., Jennifer A. Chatman, and Caneel K. Joyce. 2007. Innovation in services: Corporate culture and investment banking. California Management Review 50: 174–91. [Google Scholar] [CrossRef]

- Mahdzan, Nurul Shahnaz, Rozaimah Zainudin, and Sook Fong Au. 2017. The adoption of Islamic banking services in Malaysia. Journal of Islamic Marketing 8: 496–512. [Google Scholar] [CrossRef] [Green Version]

- Majdoub, Jihed, and Salim Ben Sassi. 2017. Volatility spillover and hedging effectiveness among China and emerging Asian Islamic equity indexes. Emerging Markets Review 31: 16–31. [Google Scholar] [CrossRef]

- Malik, Muhammad Shaukat, Ali Malik, and Waqas Mustafa. 2011. Controversies that make Islamic banking controversial: An analysis of issues and challenges. American Journal of Social and Management Sciences 2: 41–46. [Google Scholar] [CrossRef]

- Mehree, Iqbal, Nabila Nisha, and Mamunur Rashid. 2018. Bank selection criteria and satisfaction of retail customers of Islamic banks in Bangladesh. The International Journal of Bank Marketing 36: 931–46. [Google Scholar]

- Mehtab, Humna, Zafar Zaheer, and Shahid Ali. 2015. Knowledge, Attitudes and Practices (KAP) Survey: A Case Study on Islamic Banking at Peshawar, Pakistan. FWU Journal of Social Sciences 9: 1–13. [Google Scholar]

- Mirza, Abdul Malik, and Abdel-Karim Halabi. 2003. Islamic banking in Australia: Challenges and opportunities. Journal of Muslim Minority Affairs 23: 347–59. [Google Scholar] [CrossRef] [Green Version]

- Mohan, Brij. 2014. Islamic Banking: Importance, growth and future with special reference to Indian economy. International Journal in Management & Social Science 2: 286–95. [Google Scholar]

- Mohd Thas Thaker, Mohamed Asmy Bin, Anwar Bin Allah Pitchay, Hassanudin Bin Mohd Thas Thaker, and Md Fouad BinAmin. 2019. Factors influencing consumers’ adoption of Islamic mobile banking services in Malaysia. Journal of Islamic Marketing 10: 1037–56. [Google Scholar] [CrossRef]

- Moktar, Hamim S. Ahmad, Naziruddin Abdullah, and Syed M. Al-Habshi. 2006. Efficiency of Islamic banks in Malaysia: A stochastic frontier approach. Journal of Economic Cooperation among Islamic Countries 27: 37–70. [Google Scholar]

- Muhammad, Mohsin Butt, and Muhammad Aftab. 2013. Incorporating attitude towards halal banking in an integrated service quality, satisfaction, trust and loyalty model in online Islamic banking context. The International Journal of Bank Marketing 31: 6–23. [Google Scholar]

- Narayan, Paresh Kumar, and Dinh Hoang Bach Phan. 2019. A survey of Islamic banking and finance literature: Issues, challenges and future directions. Pacific-Basin Finance Journal 53: 484–96. [Google Scholar] [CrossRef]

- Naser, Kamal, and Luiz Moutinho. 1997. Strategic marketing management: The case of Islamic banks. International Journal of Bank Marketing 15: 187–203. [Google Scholar] [CrossRef] [Green Version]

- Naser, Kamal, Ahmad Jamal, and Khalid Al-Katib. 1999. Islamic banking: A study of customer satisfaction and preferences in Jordan. International Journal of Bank Marketing 17: 135–50. [Google Scholar] [CrossRef]

- Okumus, Saduman. 2005. Interest free banking in Turkey: A study of customer satisfaction and bank selection criteria. Journal of Economic Cooperation 26: 51–86. [Google Scholar]

- Opromolla, Gabriella. 2012. Islamic finance: What concrete steps is Italy taking? The Journal of Investment Compliance 13: 10–16. [Google Scholar] [CrossRef]

- Osman, Ismah, Husniyati Ali, Anizah Zainuddin, Wan Edura Wan Rashid, and Kamaruzaman Jusoff. 2009. Customers satisfaction in Malaysian Islamic banking. International Journal of Economics and Finance 1: 197–202. [Google Scholar] [CrossRef] [Green Version]

- Oullet, Jean-Fracois. 2007. Consumer racism and its effects on domestic cross-ethnic product purchase: An empirical test in the United States, Canada, and France. Journal of Marketing 71: 113–128. [Google Scholar] [CrossRef]

- Penaloza, Lisa, and Mary Gilly. 1999. Marketer acculturation: The changer and the changed. Journal of Marketing 63: 84–104. [Google Scholar] [CrossRef]

- Petracci, Barbara, and Hussain Rammal. 2014. Developing the Islamic financial services sector in Italy: An institutional theory perspective. Journal of Financial Services Marketing 19: 198–207. [Google Scholar] [CrossRef]

- Potluri, Rajasekhara, Rizwana Ansari, Saqib Rasool Khan, and Srinisava Rao Dasaraju. 2017. A crystallized exposition on Indian Muslims’ attitude and consciousness towards halal. Journal of Islamic Marketing 8: 35–47. [Google Scholar] [CrossRef]

- Rammal, Hussain, and Ralf Zurbruegg. 2007. Awareness of Islamic banking products among Muslims: The case of Australia. Journal of Financial Services Marketing 12: 65–74. [Google Scholar] [CrossRef] [Green Version]

- Richardson, Edana. 2011. Islamic Finance for Consumers in Ireland: A Comparative Study of the Position of Retail-level Islamic Finance in Ireland. Journal of Muslim Minority Affairs 31: 534–53. [Google Scholar] [CrossRef]

- Rosly, Saiful Azhar, and Mohd Afandi Abu Bakar. 2003. Performance of Islamic and mainstream banks in Malaysia. International Journal of Social Economics 30: 1249–65. [Google Scholar] [CrossRef] [Green Version]

- Saiti, Buerhan, and Munsur Masih. 2016. The co-movement of selective conventional and Islamic stock indices: Is there any impact on shariah compliant equity investment in china? International Journal of Economics and Financial Issues 6: 1895–905. [Google Scholar]

- Saleh, Md Abu, Ali Quazi, Byron Keating, and Sanjaya S. Gaur. 2017. Quality and image of banking services: A comparative study of conventional and Islamic banks. The International Journal of Bank Marketing 35: 878–902. [Google Scholar] [CrossRef]

- Samad, Abdus. 1999. Comparative efficiency of the Islamic Bank Malaysia vis-à-vis conventional banks. Journal of Economics and Management 7: 1–25. [Google Scholar]

- Sarker, Md Abdul Awwal. 1999. Islamic banking in Bangladesh: Performance, problems and prospects. International Journal of Islamic Financial Services 1: 1–21. [Google Scholar]

- Schmidt, Alex Paton. 2019. The impact of cognitive style, consumer demographics and cultural values on the acceptance of Islamic insurance products among American consumers. The International Journal of Bank Marketing 37: 492–506. [Google Scholar] [CrossRef]

- Schottmann, Sven Alexander. 2014. From duty to choice: Marketing Islamic banking in Malaysia. South East Asia Research 22: 57–72. [Google Scholar] [CrossRef]

- Seth, Jagdish. 2011. Impact of emerging markets on marketing: Rethinking existing perspectives and practices. Journal of Marketing 75: 166–82. [Google Scholar] [CrossRef]

- Setyobudi, Wahyu, Sudarso Kaderi Wiryono, Reza Ashari Nasution, and Mustika Sufiati Purwanegara. 2016. The efficacy of the model of goal directed behavior in explaining Islamic bank saving. Journal of Islamic Marketing 7: 405–22. [Google Scholar] [CrossRef]

- Shokuhi, Akbar, and Seyed Ali Nabavi Chashmi. 2019. Formulation of Bank Melli Iran marketing strategy based on Porter’s competitive strategy. Journal of Business-to-Business Marketing 26: 209–15. [Google Scholar] [CrossRef]

- Souiden, Nizar, and Marzouki Rani. 2015. Consumer attitudes and purchase intentions toward Islamic banks: The influence of religiosity. International Journal of Bank Marketing 33: 143–61. [Google Scholar] [CrossRef]

- Srairi, Samir Abderrazek. 2010. Cost and profit efficiency of conventional and Islamic banks in GCC countries. Journal of Productivity Analysis 34: 45–62. [Google Scholar] [CrossRef]

- Statistics South Africa. 2016. Community Survey 2016 in Brief; Report Number 03-01-06; Pretoria: Statistics South Africa.

- Sufian, Fadzlan. 2010. Productivity, technology and efficiency of de novo Islamic banks: Empirical evidence from Malaysia. Journal of Financial Services Marketing 15: 241–58. [Google Scholar] [CrossRef]

- Suhartanto, Dwi. 2019. Predicting behavioural intention toward Islamic bank: A multi-group analysis approach. Journal of Islamic Marketing 10: 1091–103. [Google Scholar] [CrossRef]

- Tameme, Mohammed, and Mehmet Asutay. 2012. An empirical inquiry into marketing Islamic mortgages in the UK. The International Journal of Bank Marketing 30: 150–67. [Google Scholar] [CrossRef]

- Taylor, Michael. 2003. Islamic banking—The feasibility of establishing an Islamic bank in the United States. American Business Law Journal 40: 385–416. [Google Scholar] [CrossRef]

- Trakic, Adnan. 2012. Europe’s approach to Islamic banking: A way forward. Journal of Islamic Finance and Business Research 1: 17–33. [Google Scholar]

- Tranfield, David, David Denyer, and Palminder Smart. 2003. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management 14: 207–22. [Google Scholar] [CrossRef]

- Uddin, Md Mahi, Mohammad Aktaruzzaman Khan, and Kazi Deen Mohammad. 2015. Interest-Free Banking in Bangladesh: A Study on Customers’ Perception of Uses and Awareness. Abasyn University Journal of Social Sciences 8: 1–16. [Google Scholar]

- Usman, Haridus, Prijono Tjiptoherijanto, Tengku Ezni Balqiah, and I. Gusti Ngurah. 2017. The role of religious norms, trust, importance of attributes and information sources in the relationship between religiosity and selection of the Islamic bank. Journal of Islamic Marketing 8: 158–86. [Google Scholar] [CrossRef]

- Vahed, Goolam, and Shahid Vawda. 2008. The viability of Islamic banking and finance in a capitalist economy: A South African case study. Journal of Muslim Minority Affairs 28: 453–72. [Google Scholar] [CrossRef]

- Volk, Stefan, and Markus Pudelko. 2010. Challenges and opportunities for Islamic retail banking in the European context: Lessons to be learnt from a British–German comparison. Journal of Financial Services Marketing 15: 191–202. [Google Scholar] [CrossRef]

- Vora, Davina, Lee Martin, Stacey Fitzsimmons, Andre Pekerti, C. Lakshman, and Salma Raheem. 2019. Multiculturalism within Individuals: A review, critique, and agenda for future research. Journal of International Business Studies 50: 499–524. [Google Scholar] [CrossRef] [Green Version]

- Wajdi Dusuki, Asyraf, and Nurdianati Irwani Abdullah. 2007. Why do Malaysian customers patronize Islamic banks? International Journal of Bank Marketing 25: 32–40. [Google Scholar] [CrossRef] [Green Version]

- Wan Ahmad, Wan Marhaini, Mohamed Hisham Hanifa, and Kang Choon Hyo. 2019. Are non-Muslims willing to patronize Islamic financial services? Journal of Islamic Marketing 10: 743–58. [Google Scholar] [CrossRef]

- Warsame, Mohammed Hersi, and Edward Mugambi Ireri. 2018. Moderation effect on Islamic banking preferences in UAE. The International Journal of Bank Marketing 36: 41–67. [Google Scholar] [CrossRef]

- Wilson, Jonathan, and Jonathan Liu. 2011. The challenges of Islamic branding: Navigating emotions and halal. Journal of Islamic Marketing 2: 28–42. [Google Scholar] [CrossRef]

- Zebal, Mostaue Ahmad. 2018. The impact of internal and external market orientation on the performance of non-conventional Islamic financial institutions. Journal of Islamic Marketing 9: 132–51. [Google Scholar] [CrossRef]

| Studies | Country/Region | Dominant Theoretical Lens(es) | Marketing Areas |

|---|---|---|---|

| Al-Tamimi and Al-Amiri (2003) Al-Tamimi et al. (2009) | UAE | Service quality issue in Islamic banks | Service quality analysis |

| Warsame and Ireri (2018) Ireland (2018) | UAE | Customer adoption process of Islamic finance | Product adoption |

| Al-Jazzazi and Sultan (2014) | Various Middle Eastern countries | Service quality and Islamic financing issue | Service quality analysis |

| Al-Salem and Mostafa (2019) | Kuwait | Customer attitude towards Islamic finance | Consumer behavior |

| Chazi et al. (2018) Hussein (2010) | GCC countries | Risk and liquidity of Islamic banking | Product adoption |

| Hassan et al. (2013) | GCC countries | Impact of financial liberalization | Foreign market entry decision |

| Naser and Moutinho (1997) | Various Arab countries | Organizational and managerial issues in marketing Islamic finance | Customer satisfaction |

| Alemu (2012) | Bahrain, Jordan, UAE | Customer choice and satisfaction | Consumer behavior |

| Souiden and Rani (2015) Kaabachi and Obeid (2016) Ltifi et al. (2016) | Tunisia | Customer attitude towards Islamic finance | Consumer behavior |

| Naser et al. (1999) | Jordan | Customer satisfaction for Islamic finance | Consumer behavior |

| Hossain and Leo (2009) | Qatar | Service quality issue for Islamic finance | Customer satisfaction |

| Bizri (2014) | Lebanon | Customer perception and perception of Islamic finance | Consumer behavior |

| Khafafa and Shafii (2013) | Libya | Service quality issue for Islamic finance | Customer satisfaction |

| Abou-Youssef et al. (2015) | Egypt | Customer perception and perception of Islamic finance | Consumer behavior |

| Samad (1999) Moktar et al. (2006) | Malaysia | Improving efficiency in Islamic banking | New service success factors |

| Rosly and Abu Bakar (2003) Sufian (2010) | Malaysia | Performance of Islamic bank and factors for success | New service success factors |

| Wajdi Dusuki and Irwani Abdullah (2007) | Malaysia | Promoting Islamic finance among Malaysian Muslims | Promotion |

| Loo (2010) Hoque et al. (2018) | Malaysia | Customer perception | Consumer behavior |

| Osman et al. (2009) | Malaysia | Customer satisfaction for Islamic finance | Consumer behavior |

| Mahdzan et al. (2017); Mohd Thas Thaker et al. (2019) Amin et al. (2016) | Malaysia | Customer adoption process of Islamic finance | Product adoption |

| Amin et al. (2013) Amin et al. (2014) Haron et al. (1994) Wajdi Dusuki and Irwani Abdullah (2007) | Malaysia | Factors driving patronage for a firm | Product adoption |

| Schottmann (2014) | Malaysia | Advertising of Islamic banks | Advertising and promotion |

| Khan and Bhatti (2008a) | Various Arab and non-Arab countries | Adoption and popularization of Islamic finance in various parts of the world | Product adoption |

| Ahmad and Hassan (2007) Sarker (1999) | Bangladesh | Regulation of Islamic finance | Product adoption |

| Mehree et al. (2018) M.S.N. Khan et al. (2007) Saleh et al. (2017) | Bangladesh | Behavior of Islamic banking customers | Consumer behavior |

| Uddin et al. (2015) | Bangladesh | Marketing promotion and awareness of Islamic banking is needed | Promotion |

| Zebal (2018) | Bangladesh | Market orientation of Islamic finance firm | Market orientation |

| Usman et al. (2017) Suhartanto (2019) | Indonesia | Consumer behavior for the selection of Islamic banking services | Consumer behavior |

| Hamid et al. (2017) | Indonesia | Need for more promotion of Islamic finance among customers | Promotion |

| Butt et al. (2018) Muhammad and Aftab (2013) | Pakistan | Factors contributing to the low adoption rate of Islamic finance | Product adoption |

| Imran et al. (2011) Mehtab et al. (2015) Khattak and Rehman (2010) | Pakistan | Customer awareness and satisfaction | Promotion and consumer behavior |

| Ahmad et al. (2010) Akhtar et al. (2011) | Pakistan | Service quality and customer satisfaction | Service quality analysis |

| Arshad et al. (2011) | Pakistan | Employee perception of Islamic finance | Consumer behavior |

| Kaleem and Ahmad (2010) | Pakistan | Regulatory and risks issues in Islamic finance in the agriculture sector | Product adoption |

| Korkut and Özgür (2017) | Turkey | Importance of customer satisfaction | Consumer behavior |

| Okumus (2005) | Turkey | Customer satisfaction for Islamic finance | Consumer behavior |

| Estiri et al. (2011) | Iran | Factors of customer satisfaction for Islamic finance | Consumer behavior |

| Shokuhi and Nabavi Chashmi (2019) | Iran | Differentiation strategy for the Islamic financial service firm | Market positioning |

| Ezzati (2019) | Iran | Meeting customer need and demand or Islamic finance | New service development |

| Empirical Studies | Country/Region | Dominant Theoretical Lens(es) | Marketing Topics Covered |

|---|---|---|---|

| Opromolla (2012) Petracci and Rammal (2014) | Italy | The need for Islamic finance and its implication for the Italian economy | Basic marketing issues |

| Trakic (2012) | Various European countries | Regulatory issues in the introduction of Islamic finance | Product adoption |

| Karbhari et al. (2004) | UK | Problems and challenges in Islamic finance adoption | Product adoption |

| Chaudhry and Crick (2004) | UK | Customer targeting | Segmentation and targeting |

| Abdullrahim and Robson (2017) | UK | Importance of service quality among Muslim customers | Consumer behavior |

| Hussain (2014) Tameme and Asutay (2012) | UK | Creating customer awareness of Islamic finance | Market Promotion |

| Volk and Pudelko (2010) | UK Germany | Challenges and opportunities for Islamic retail banking in the European context. | Product adoption |

| Richardson (2011) | Ireland | Feasibility of Islamic finance and customer adoption | Product adoption |

| Kaakeh et al. (2018) | Spain | Attitude and awareness of the customers for the Islamic finance | Consumer behaviorPromotion |

| Hamad and Duman (2014) | Bosnia and Herzegovina | Customer behavior for the acceptance of Islamic finance | Consumer behavior |

| Abdur Razzaque and Chaudhry (2013) | Australia | Packaging and marketing impact customers’ purchase decision | Consumer behavior |

| Mirza and Halabi (2003) | Australia | Growth of Islamic finance and related risks and challenges | Product adoption |

| Rammal and Zurbruegg (2007) | Australia | Creating awareness about Islamic finance among Muslim customers | Advertising |

| Gerrard and Cunningham (1997) | Singapore | Creating awareness about Islamic finance among Muslim customers | Promotion |

| Lai and Samers (2017) | Singapore | Development and governance of Islamic financial system | Product adoption |

| Schmidt (2019) Taylor (2003) | USA | Customer behavior for the acceptance of Islamic finance | Product adoption |

| Empirical Studies | Country/Region | Dominant Theoretical Lens(es) | Marketing Topics Covered |

|---|---|---|---|

| Jamaluddin (2013) Chakrabarty (2015) | India | Importance of marketing Islamic finance | Product adoption |

| Islam and Rahman (2017) | India | Willingness of the customers to adopt Islamic finance | Product adoption |

| Alam (2015) Alam (2019) | India | New service development | Service innovation |

| Kurpad (2016) Kumar and Sahu (2017) O. Khan (2004) | India | Need for Islamic finance | Product adoption |

| Majdoub and Sassi (2017) Bo et al. (2016) Saiti and Masih (2016) | China | Need for Islamic finance | Product adoption |

| Kholvadia (2017) Vahed and Vawda (2008) | South Africa | Need for Islamic finance | Product adoption |

| Wan Ahmad et al. (2019) | South Korea | Creating awareness about Islamic finance among non-Muslim customers | Product adoption |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alam, I.; Seifzadeh, P. Marketing Islamic Financial Services: A Review, Critique, and Agenda for Future Research. J. Risk Financial Manag. 2020, 13, 12. https://doi.org/10.3390/jrfm13010012

Alam I, Seifzadeh P. Marketing Islamic Financial Services: A Review, Critique, and Agenda for Future Research. Journal of Risk and Financial Management. 2020; 13(1):12. https://doi.org/10.3390/jrfm13010012

Chicago/Turabian StyleAlam, Intekhab, and Pouya Seifzadeh. 2020. "Marketing Islamic Financial Services: A Review, Critique, and Agenda for Future Research" Journal of Risk and Financial Management 13, no. 1: 12. https://doi.org/10.3390/jrfm13010012

APA StyleAlam, I., & Seifzadeh, P. (2020). Marketing Islamic Financial Services: A Review, Critique, and Agenda for Future Research. Journal of Risk and Financial Management, 13(1), 12. https://doi.org/10.3390/jrfm13010012