Formal Finance Usage and Innovative SMEs: Evidence from ASEAN Countries

Abstract

:1. Introduction

2. Literature Review

2.1. Innovation and SMEs

2.2. Innovative SMEs and Finance

2.3. Access to Finance and Firm Characteristics

2.4. Access to Finance and Country-Level Variable

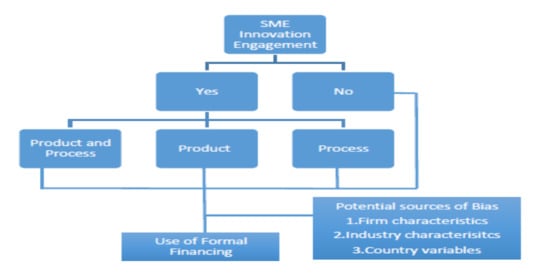

2.5. SME Finance–Innovation Nexus and Propensity Scores

3. Data and Methodology

3.1. Variable Description

- Age: Defined as the number of years since the establishment of the firm. Younger firms have an opaque information environment due to the absence of a record of accomplishments and the newness factor that creates a disadvantage in accessing formal finance (Berger and Udell 1998; Coleman 2004).

- Size: Total value of assets is employed as a proxy for firm size. According to Carey and Prowse (1993) and Berger and Udell (1998), larger SMEs are more likely to access formal finance given their profitability, less information opacity and diversified business operations.

- Foreign ownership: Percentage of foreign ownership in an SME. Studies show a positive association between foreign ownership and access to formal finance (Abor and Biekpe 2007; Wagner and Weche Gelübcke 2015).

- Female ownership (Female top manager): Dummy variables that take the value one if the SME has a female owner (top manager), and zero otherwise. Majority ownership and top-management positions held by a female also exhibit a positive association with access to finance (Abor and Biekpe 2007; Botrić and Božić 2017; Pham and Talavera 2018) and preference for using formal financing sources (Bardasi et al. 2011; Yazdanfar and Turner 2012).

- Manager experience: Number of years a manager has been a top manager. Abdesamed and Abd Wahab (2012) report a positive association between manager experience and formal financing.

- Time spent with government officials: Percentage of total senior management’s time spent on the requirements imposed by government regulations in a typical week over the last year.

- Development of credit markets: Percentage of private credit by deposit money banks and other financial institutions to GDP. According to Palacín-Sánchez et al. (2019), the development of informal and formal credit markets in a country increases the prevalence of formal financing.

- The efficiency of the legal system: the strength of legal rights index that ranges between a weak (0) and strong (12) legal system. Studies show a sound and efficient legal system that protects the rights of SMEs and provides speedy justice increases the likelihood of formal financing (Fatoki 2014; Haselmann and Wachtel 2010).

- GDP per capita: GDP per capita in US dollar. According to Barbu et al. (2019), higher per capita GDP causes SMEs to invest more and acquire funding from formal sources.

3.2. Data Description

3.3. Empirical Method

4. Results and Discussion

4.1. Descriptive Statistics

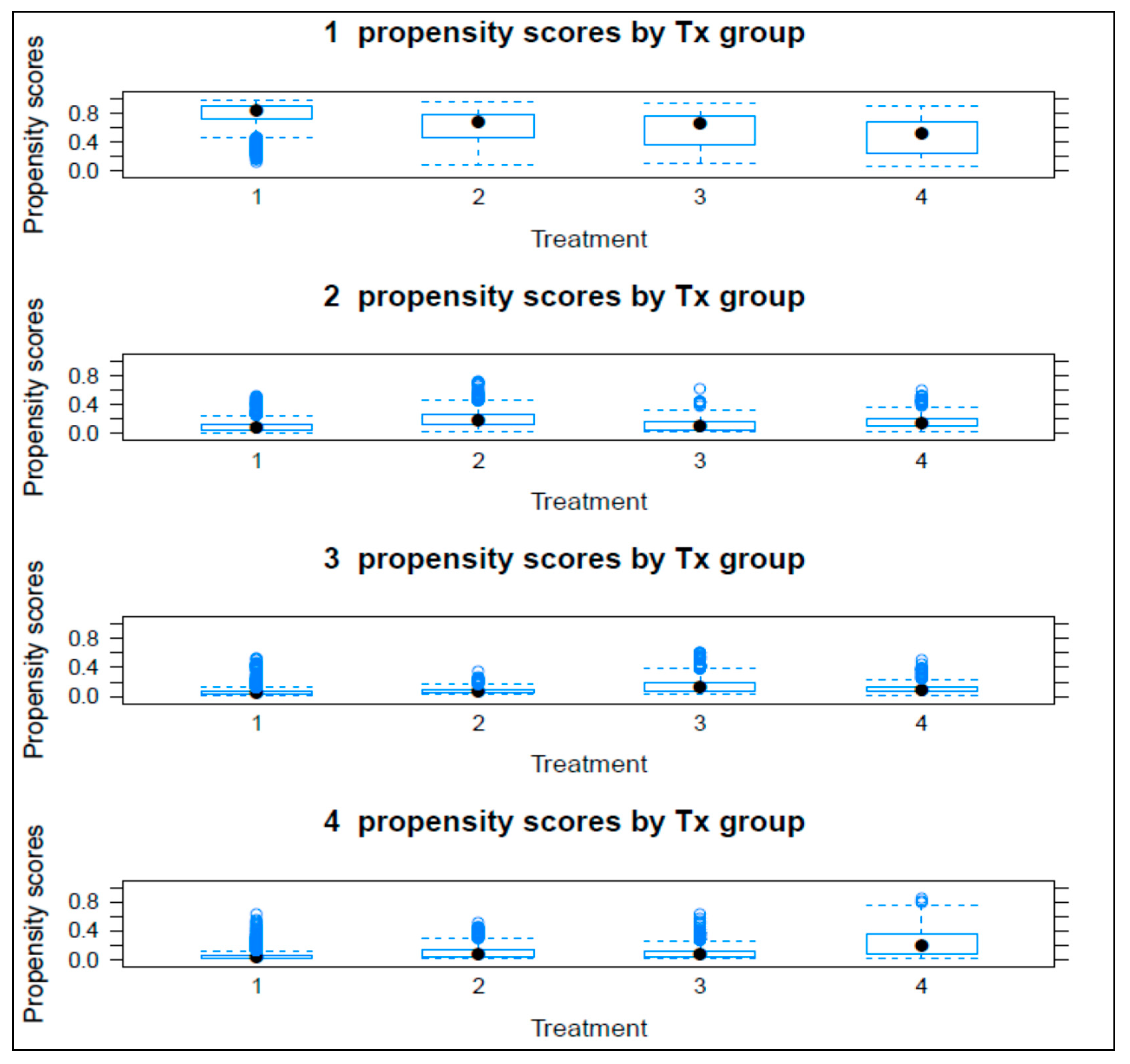

4.2. Balance and Overlap Results

4.3. Causal Effects Analysis

4.4. Additional Analysis

4.5. Robustness Test

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Variable | Definition |

|---|---|

| Non-innovators | A firm that did not introduce a new or significantly improved product or process in the last three years. |

| Product Innovation | A firm that introduced new or significantly improved product/service in the last three years. |

| Process Innovation | A firm that introduced a new or significantly improved process in the last three years. |

| Product and Process Innovation | A firm that introduced new or significantly improved product/service and process in the last three years. |

| Formal Finance | A loan from a bank or non-banking financial institution |

| Informal Finance | A loan from loans from informal sources such as friends, family and trade credits |

| Firm Age | Number of years since the establishment of the firm |

| Firm Size | Log of the total value of assets. |

| Foreign ownership | Percentage of foreign ownership |

| Female ownership | Dummy variables that take the value one if SME has a female owner and zero otherwise |

| Female top manager | Dummy variables that take the value one if SME has a top female manager and zero otherwise |

| Manager experience | Number of years a manager has been a top manager |

| Time spent with government officials | Time spent by senior management in a week dealing with government officials to meet the requirements imposed by respective governments. |

| Development of credit markets: | Private credit by deposit money banks and other financial institutions to GDP (%) |

| The efficiency of the legal system | World bank strength of legal rights index score |

| GDP per capita | GDP per capita in US dollar |

References

- Abdesamed, Khalid, and Kalsom Abd Wahab. 2012. Do experience, Education and Business plan influence SMEs start-up Bank loan? The Case of Libya. Australian Journal of Basic and Applied Sciences 6: 234–39. [Google Scholar]

- Abor, Joshua, and Nicholas Biekpe. 2007. Corporate governance, ownership structure and performance of SMEs in Ghana: Implications for financing opportunities. Corporate Governance: The International Journal of Business in Society 7: 288–300. [Google Scholar] [CrossRef]

- Acemoglu, Daron, Philippe Aghion, and Fabrizio Zilibotti. 2006. Distance to frontier, selection, and economic growth. Journal of the European Economic Association 4: 37–74. [Google Scholar] [CrossRef]

- Adegboye, Abidemi C., and Samuel Iweriebor. 2018. Does access to finance enhance SME innovation and productivity in Nigeria? Evidence from the World Bank Enterprise Survey. African Development Review 30: 449–61. [Google Scholar] [CrossRef]

- Archer, Lan Thanh, Parmendra Sharma, and Jen-Je Su. 2020. Do credit constraints always impede innovation? Empirical evidence from Vietnamese SMEs. Applied Economics 52: 4864–80. [Google Scholar] [CrossRef]

- Armendáriz, Beatriz, and Jonathan Morduch. 2010. The Economics of Microfinance. Cambridge: MIT Press. [Google Scholar]

- Ayyaga, Meghana, Asli Demirguc-Kunt, and Vojislav Maksimovic. 2011. Firm innovation in emerging markets: The role of finance, governance, and competition. Journal of Financial and Quantitative Analysis 46: 1545–80. [Google Scholar] [CrossRef] [Green Version]

- Ayyagari, Meghana, Asli Demirguc-Kunt, and Vojislav Maksimovic. 2014. Bribe payments and innovation in developing countries: Are innovating firms disproportionately affected? Journal of Financial and Quantitative Analysis 49: 51–75. [Google Scholar] [CrossRef] [Green Version]

- Barbu, Teodora Cristina, Raluca Crina Bucur, Cosmin Octavian Cepoi, and Adina Ionela Străchinaru. 2019. Is the Increase on SMEs’ Access to Finance in the Capital Markets Union Context Real? An Empirical Investigation. Ekonomicky Casopis 67: 245–63. [Google Scholar]

- Bardasi, Elena, Shwetlena Sabarwal, and Katherine Terrell. 2011. How do female entrepreneurs perform? Evidence from three developing regions. Small Business Economics 37: 417. [Google Scholar] [CrossRef]

- Beck, Thorsten, and Asli Demirguc-Kunt. 2006. Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking & Finance 30: 2931–43. [Google Scholar] [CrossRef]

- Beck, Thorsten, Asli Demirgüç-Kunt, and Vojislav Maksimovic. 2008. Financing patterns around the world: Are small firms different? Journal of Financial Economics 89: 467–87. [Google Scholar] [CrossRef] [Green Version]

- Berger, Allen N., and Gregory F. Udell. 1998. The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance 22: 613–73. [Google Scholar]

- Bongini, Paola, Annalisa Ferrando, Emanuele Rossi, and Monica Rossolini. 2019. SME access to market-based finance across Eurozone countries. Small Business Economics, 1–31. [Google Scholar] [CrossRef]

- Botrić, Valerija, and Ljiljana Božić. 2017. Access to Finance: Innovative Firms Perceptions in Post-Transition EU Members. Liberec: Technická univerzita v Liberci. [Google Scholar]

- Brown, James R., Gustav Martinsson, and Bruce C. Petersen. 2013. Law, stock markets, and innovation. The Journal of Finance 68: 1517–49. [Google Scholar] [CrossRef] [Green Version]

- Carey, Mark S., and Stephen D. Prowse. 1993. John Rea and Gregory F. Udell, “The Economics of Private Placements: A New Look”. Financial Markets, Institutions and Instruments 2: 1–67. [Google Scholar]

- Coleman, Susan. 2004. The “Liability of Newness” and Small Firm Access to Debt Capital: Is There a Link? The Journal of Entrepreneurial Finance 9: 37–60. [Google Scholar]

- Cornaggia, Jess, Yifei Mao, Xuan Tian, and Brian Wolfe. 2015. Does banking competition affect innovation? Journal of Financial Economics 115: 189–209. [Google Scholar] [CrossRef] [Green Version]

- Cornelli, Cornelli, Vukile Davidson, and Jon Frost. 2019. SME Finance in Asia: Recent Innovations in Fintech Credit, Trade Finance, and Beyond. Tokyo: Asian Development Bank Institute. [Google Scholar]

- Cuong, Nguyen Viet. 2013. Which covariates should be controlled in propensity score matching? Evidence from a simulation study. Statistica Neerlandica 67: 169–80. [Google Scholar] [CrossRef] [Green Version]

- Degryse, Hans, Olivier De Jonghe, Sanja Jakovljević, Klaas Mulier, and Glenn Schepens. 2017. The impact of bank shocks on firm-level outcomes and bank risk-taking. Paper presented at the Twelfth Young Economists’ Seminar, Dubrovnik, Croatia, June 3–6. [Google Scholar]

- del Brío, Jesús Ángel, and Beatriz Junquera. 2003. A review of the literature on environmental innovation management in SMEs: Implications for public policies. Technovation 23: 939–48. [Google Scholar] [CrossRef]

- Fatoki, Olawale. 2014. External environmental factors impacting on access to debt finance by small and medium enterprises in South Africa. Mediterranean Journal of Social Sciences 5: 1013. [Google Scholar] [CrossRef] [Green Version]

- Fernandez, Viviana. 2017. The finance of innovation in Latin America. International Review of Financial Analysis. International Review of Financial Analysis 53: 37–47. [Google Scholar] [CrossRef]

- Gorodnichenko, Yuriy, and Monika Schnitzer. 2013. Financial constraints and innovation: Why poor countries don’t catch up. Journal of the European Economic Association 11: 1115–52. [Google Scholar] [CrossRef] [Green Version]

- Haselmann, Rainer, and Paul Wachtel. 2010. Institutions and bank behavior: Legal environment, legal perception, and the composition of bank lending. Journal of Money, Credit and Banking 42: 965–84. [Google Scholar] [CrossRef]

- Hau, Harald, Yi Huang, Hongzhe Shan, and Zixia Sheng. 2018. Fintech credit, financial inclusion and entrepreneurial growth. Unpublished Working Paper. [Google Scholar]

- Kijkasiwat, Ploypailin, and Pongsutti Phuensane. 2020. Innovation and Firm Performance: The Moderating and Mediating Roles of Firm Size and Small and Medium Enterprise Finance. Journal of Risk and Financial Management 13: 97. [Google Scholar] [CrossRef]

- Kim, Dong-Young, Vinod Kumar, and Uma Kumar. 2012. Relationship between quality management practices and innovation. Journal of Operations Management 30: 295–315. [Google Scholar] [CrossRef]

- Kim, Won Joong, Tran Viet Hoi, La Ngoc Tuan, and Nguyen Ngoc Trung. 2019. R&D, training and accessibility to finance for innovation: A case of Vietnam, the country in transition. Asian Journal of Technology Innovation 27: 172–93. [Google Scholar] [CrossRef]

- Klewitz, Johanna, and Erik G. Hansen. 2014. Sustainability-oriented innovation of SMEs: A systematic review. Journal of Cleaner Production 65: 57–75. [Google Scholar] [CrossRef]

- Lawless, Martina, Brian O’Connell, and Conor M. O’Toole. 2015. Financial structure and diversification of European firms. Applied Economics 47: 2379–98. [Google Scholar] [CrossRef]

- Le, Danh Vinh, Huong T. T. Le, Thanh Pham, and Lai Van Vo. 2019. Access to Financing and Innovation in Small and Medium Enterprises in Vietnam. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Lee, Ying-Ying. 2018. Efficient propensity score regression estimators of multivalued treatment effects for the treated. Journal of Econometrics 204: 207–22. [Google Scholar] [CrossRef] [Green Version]

- Lee, Neil, Hiba Sameen, and Marc Cowling. 2015. Access to finance for innovative SMEs since the financial crisis. Research Policy 44: 370–80. [Google Scholar] [CrossRef] [Green Version]

- Li, Yan, Md. Main Uddin, and Ye An. 2019. Has financial development benefited the performance of publicly traded cultural and creative firms? Evidence from China. Journal of Cultural Economics 44: 351–95. [Google Scholar] [CrossRef]

- Lööf, Hans, and Pardis Nabavi. 2016. Innovation and credit constraints: Evidence from Swedish exporting firms. Economics of Innovation and New Technology 25: 269–82. [Google Scholar] [CrossRef]

- Mancusi, Maria Luisa, and Andrea Vezzulli. 2010. R&D, Innovation and Liquidity Constraints in Italy. Boston College Working Papers in Economics. Chestnut Hill: Boston College, vol. 442. [Google Scholar]

- McCaffrey, Daniel F., Greg Ridgeway, and Andrew R. Morral. 2004. Propensity score estimation with boosted regression for evaluating causal effects in observational studies. Psychological Methods 9: 403. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- McCaffrey, Daniel F., Beth Ann Griffin, Daniel Almirall, Mary Ellen Slaughter, Rajeev Ramchand, and Lane F. Burgette. 2013. A tutorial on propensity score estimation for multiple treatments using generalized boosted models. Statistics in Medicine 32: 3388–414. [Google Scholar] [CrossRef] [Green Version]

- Moritz, Alexandra, Joern H. Block, and Andreas Heinz. 2016. Financing patterns of European SMEs–an empirical taxonomy. Venture Capital 18: 115–48. [Google Scholar] [CrossRef]

- Nielen, Sebastian. 2016. Product Innovation and Trade Credit Demand and Supply: Evidence from European Countries. In Trade Credit and Temporary Employment. Berlin/Heidelberg: Springer, pp. 23–40. [Google Scholar]

- O’Cass, Aron, and Jay Weerawardena. 2009. Examining the role of international entrepreneurship, innovation and international market performance in SME internationalization. European Journal of Marketing 43: 1325–48. [Google Scholar] [CrossRef]

- Pagano, Marco, and Ailsa Röell. 1998. The choice of stock ownership structure: Agency costs, monitoring, and the decision to go public. The Quarterly Journal of Economics 113: 187–225. [Google Scholar] [CrossRef]

- Palacín-Sánchez, María-José, Francisco-Javier Canto-Cuevas, and Filippo di-Pietro. 2019. Trade credit versus bank credit: A simultaneous analysis in European SMEs. Small Business Economics 53: 1079–96. [Google Scholar] [CrossRef]

- Pellegrini, Carlo Bellavite, and Emiliano Sironi. 2017. Does a one-tier board affect firms’ performances? Evidences from Italian unlisted enterprises. Small Business Economics 48: 213–24. [Google Scholar] [CrossRef]

- Pham, Tho, and Oleksandr Talavera. 2018. Discrimination, social capital, and financial constraints: The case of Viet Nam. World Development 102: 228–42. [Google Scholar] [CrossRef] [Green Version]

- Polo Otero, Jose Luis, Jose Luis Ramos Ruiz, Aquiles Antonio Arrieta Barcasnegras, and Natalia Ramirez Arbelaez. 2018. Impacto de la innovación sobre la conducta exportadora en el sector de alimentos y bebidas de Colombia. Revista de Análisis Económico 33: 89–120. [Google Scholar] [CrossRef]

- Qamruzzaman, Md., and Wei Jianguo. 2019. SME financing innovation and SME development in Bangladesh: An application of ARDL. Journal of Small Business & Entrepreneurship 31: 521–45. [Google Scholar] [CrossRef]

- Rajan, Raghuram G. 1992. Insiders and outsiders: The choice between informed and arm’s-length debt. The Journal of Finance 47: 1367–400. [Google Scholar] [CrossRef]

- Rosenbaum, Paul R., and Donald B. Rubin. 1983. The central role of the propensity score in observational studies for causal effects. Biometrika 70: 41–55. [Google Scholar] [CrossRef]

- Sasidharan, Subash, P. J. Jijo Lukose, and Surenderrao Komera. 2015. Financing constraints and investments in R&D: Evidence from Indian manufacturing firms. The Quarterly Review of Economics and Finance 55: 28–39. [Google Scholar] [CrossRef]

- Schäfer, Dorothea, Axel Werwatz, and Zimmermann Volker. 2004. The determinants of debt and (private) equity financing: The case of young, innovative SMEs from Germany. Industry and Innovation 11: 225–48. [Google Scholar] [CrossRef]

- Shashi, Piera Centobelli, Roberto Cerchione, and Rajwinder Singh. 2019. The impact of leanness and innovativeness on environmental and financial performance: Insights from Indian SMEs. International Journal of Production Economics 212: 111–24. [Google Scholar] [CrossRef]

- Shi, Liangxing, Xiangyu Wang, Hongyi Sun, and Zhen He. 2018. The impact of technological innovation on product quality: The moderating role of firm size. Total Quality Management & Business Excellence 29: 746–61. [Google Scholar] [CrossRef]

- Vuong, Quan-Hoang. 2019. The financial economy of Viet Nam in an age of reform, 1986–2016. In Routledge Handbook of Banking and Finance in Asia. London: Routledge, pp. 201–22. [Google Scholar]

- Wagner, Joachim, and John P. Weche Gelübcke. 2015. Access to finance, foreign ownership and foreign takeovers in Germany. Applied Economics 47: 3092–112. [Google Scholar] [CrossRef] [Green Version]

- Wang, Yao. 2016. What are the biggest obstacles to growth of SMEs in developing countries?—An empirical evidence from an enterprise survey. Borsa Istanbul Review 16: 167–76. [Google Scholar] [CrossRef] [Green Version]

- Wellalage, Nirosha Hewa, and Viviana Fernandez. 2019. Innovation and SME finance: Evidence from developing countries. International Review of Financial Analysis. [Google Scholar] [CrossRef]

- Wellalage, Nirosha Hewa, and Krishna Reddy. 2020. Determinants of profit reinvestment undertaken by SMEs in the small island countries. Global Finance Journal 43: 100394. [Google Scholar] [CrossRef]

- Wu, Jie, Steven Si, and Xiaobo Wu. 2016. Entrepreneurial Finance and Innovation: Informal Debt as an Empirical Case. Strategic Entrepreneurship Journal 10: 257–73. [Google Scholar] [CrossRef]

- Yazdanfar, Darush, and Sara Turner. 2012. The structure of external financing at start-up stage: The differences between Swedish female-and male-owned firms. International Journal of Business and Globalization 9: 157–70. [Google Scholar] [CrossRef]

- Lin, Justin Yifu, and Xifang Sun. 2006. Information, Informal Finance, and SME Financing. Frontiers of Economics in China 1: 69–82. [Google Scholar] [CrossRef]

| 1 | The OECD defines marketing and organizational innovations in the Oslo Manual (2005). |

| 2 | Radical innovation has been investigated long before the Klewitz and Hansen (2014) study. |

| Panel A—Country-Wise Data Description | |||||||||

| Country | Freq. | Product | Process | Product and Process | Formal | Informal | Private Credit to GDP | GDP per Capita | Strength of Legal Rights |

| Thailand | 465 | 6.2% | 4.3% | 3.2% | 21.5% | 78.5% | 147.1% | 3769 | 3 |

| Myanmar | 479 | 10.0% | 7.3% | 9.0% | 17.1% | 82.9% | 16.0% | 1192.5 | 2 |

| Cambodia | 255 | 22.7% | 10.2% | 5.5% | 19.2% | 80.8% | 56.5% | 750 | 10 |

| Lao PDR | 307 | 14.0% | 2.6% | 5.9% | 14.7% | 85.3% | 818 | 6 | |

| Vietnam | 682 | 20.1% | 6.0% | 8.9% | 48.4% | 51.6% | 102.8% | 1078 | 7 |

| Indonesia | 888 | 7.8% | 1.8% | 1.8% | 30.7% | 69.3% | 36.0% | 1854 | 6 |

| Philippines | 768 | 18.1% | 11.5% | 17.3% | 32.7% | 67.3% | 39.5% | 1662 | 1 |

| Malaysia | 697 | 2.6% | 15.4% | 4.9% | 35.9% | 64.1% | 119.6% | 7365 | 7 |

| Average | 12.7% | 7.4% | 7.1% | 27.5% | 72.5% | 73.9% | 2311 | 5 | |

| Panel B—Industry-Wise Innovation Engagement | |||||||||

| Industry | Count | Percent | Both | Process | Product | ||||

| Apparel | 93 | 2.05% | 1.08% | 2.15% | 11.96% | ||||

| Chemical Products | 99 | 2.18% | 6.06% | 19.39% | 8.25% | ||||

| Chemicals | 99 | 2.18% | 3.03% | 5.10% | 6.12% | ||||

| Chemicals and Chemical Products | 102 | 2.25% | 17.65% | 27.72% | 37.25% | ||||

| Electrical and Communications | 70 | 1.54% | 4.29% | 5.88% | 7.25% | ||||

| Electronic Products | 118 | 2.60% | 7.63% | 25.42% | 9.32% | ||||

| Electronics | 95 | 2.09% | 18.95% | 31.91% | 35.48% | ||||

| Fabricated Metal Products | 202 | 4.45% | 12.38% | 25.25% | 31.68% | ||||

| Food | 263 | 5.79% | 8.75% | 14.07% | 24.81% | ||||

| Food and Beverages | 86 | 1.89% | 5.36% | 15.18% | 9.01% | ||||

| Food Products | 112 | 2.47% | 3.49% | 10.59% | 12.79% | ||||

| Garments | 271 | 5.97% | 7.75% | 13.28% | 26.30% | ||||

| Manufacturing | 465 | 10.24% | 7.96% | 14.90% | 19.91% | ||||

| Non-Metallic Mineral Products | 109 | 2.40% | 1.83% | 2.75% | 6.42% | ||||

| Non-Metallic Mineral Products | 84 | 1.85% | 11.90% | 21.43% | 33.73% | ||||

| Other Manufacturing | 414 | 9.12% | 8.70% | 17.76% | 21.52% | ||||

| Other Services | 715 | 15.75% | 6.71% | 13.28% | 19.10% | ||||

| Retail | 561 | 12.35% | 7.13% | 13.46% | 20.94% | ||||

| Retail Trade | 83 | 1.83% | 2.41% | 19.28% | 3.61% | ||||

| Rubber and Plastics Products | 80 | 1.76% | 15.00% | 28.75% | 37.50% | ||||

| Rubber and Plastics | 203 | 4.47% | 2.46% | 5.47% | 7.92% | ||||

| Textiles | 108 | 2.38% | 1.85% | 2.78% | 14.81% | ||||

| Wearing Apparel | 109 | 2.40% | 3.67% | 22.22% | 8.33% | ||||

| Variable | Mean | Std. Dev. | 2 vs. 1 | 3 vs. 1 | 4 vs. 1 | 3 vs. 2 | 4 vs. 2 | 4 vs. 3 |

|---|---|---|---|---|---|---|---|---|

| Informal | 0.696 | 0.46 | −0.083 | −0.126 | −0.043 | −0.2 | −0.117 | −0.074 |

| (−3.939) | (−4.864) | (−1.359) | (−7.652) | −3.688 | (−2.113) | |||

| Formal | 0.304 | 0.46 | 0.083 | 0.126 | 0.043 | 0.2 | 0.117 | 0.074 |

| (3.939) | (4.864) | (1.359) | (7.652) | (3.688) | (2.113) | |||

| Leverage | 22.85 | 30.0 | −2.257 | −12.25 | −9.993 | −7.249 | −4.992 | 5.001 |

| (−1.630) | (−7.213) | (−4.839) | (−4.228) | (−2.402) | (2.175) | |||

| Research and development | 0.121 | 0.32 | 0.206 | 0.283 | 0.077 | 0.452 | 0.246 | 0.169 |

| (14.303) | (15.945) | (3.559) | (24.734) | (11.179) | (6.959) | |||

| Foreign ownership | 3.970 | 14.9 | −1.015 | 0.912 | 1.928 | 1.162 | 2.177 | 0.249 |

| (−1.461) | (1.07) | (1.859) | (1.349) | (2.086) | (0.216) | |||

| Female ownership | 0.443 | 0.49 | −0.003 | 0.091 | 0.094 | 0.17 | 0.173 | 0.079 |

| (−0.130) | (3.1960) | (2.716) | (5.938) | (4.984) | (2.062) | |||

| Female top manager | 0.332 | 0.47 | −0.016 | −0.017 | −0.001 | −0.013 | 0.003 | 0.004 |

| (−0.747) | (−0.637) | (−0.024) | (−0.492) | (0.093) | (0.105) | |||

| Age | 17.26 | 11.2 | 0.144 | −0.56 | −0.704 | 1.791 | 1.648 | 2.352 |

| (−0.276) | (−0.878) | (−0.906) | (2.772) | (2.103) | (2.717) | |||

| Years of experience | 16.693 | 9.89 | 1.62 | −2.038 | −3.658 | 1.721 | 0.102 | 3.761 |

| (−3.507) | (−3.563) | (−5.282) | (2.983) | (0.146) | (4.857) | |||

| Total Asset | 18.113 | 3.53 | 0.123 | (−1.33) | (−1.453) | (−0.309) | (−0.432) | (−1.021) |

| (−0.568) | (−4.767) | (−4.367) | (−1.168) | (−1.344) | (−2.794) | |||

| Sales Growth | 1.952 | 6.40 | −0.28 | −0.192 | 0.088 | −0.107 | 0.173 | 0.085 |

| (−0.941) | (−0.526) | (0.198) | (−0.290) | (0.388) | (0.173) |

| Covariates | P and P Innov. | Non-Innov. | Process Innov. | Product Innov. | P and P Innov. | Non-Innov. | Process Innov. | Product Innov. | Mean | SD |

|---|---|---|---|---|---|---|---|---|---|---|

| Foreign ownership | 3.94 | 2.92 | 4.85 | 5.10 | 3.87 | 3.15 | 3.52 | 3.97 | 3.97 | 14.99 |

| (0.00) | (0.07) | (0.06) | (0.08) | (0.01) | (0.06) | (0.03) | (0.00) | |||

| Age | 17.16 | 17.30 | 16.60 | 18.95 | 17.22 | 16.91 | 16.31 | 15.73 | 17.27 | 11.22 |

| (0.01) | (0.00) | (0.06) | (0.15) | (0.01) | (0.03) | (0.09) | (0.14) | |||

| Female owner | 0.42 | 0.42 | 0.52 | 0.59 | 0.45 | 0.43 | 0.45 | 0.50 | 0.44 | 0.50 |

| (0.04) | (0.04) | (0.14) | (0.30) ** | (0.01) | (0.03) | (0.02) | (0.11) | |||

| Years of experience | 16.52 | 18.14 | 14.48 | 18.24 | 16.62 | 16.66 | 15.42 | 15.64 | 16.69 | 9.89 |

| (0.02) | (0.15) | (0.22) *** | (0.16) | (0.01) | (0.00) | (0.13) | (0.11) | |||

| Female top manager | 0.34 | 0.32 | 0.32 | 0.32 | 0.33 | 0.33 | 0.30 | 0.31 | 0.33 | 0.47 |

| (0.01) | (0.03) | (0.03) | (0.02) | (0.00) | (0.00) | (0.06) | (0.05) | |||

| Research and development | 0.04 | 0.25 | 0.33 | 0.50 | 0.11 | 0.13 | 0.16 | 0.16 | 0.12 | 0.33 |

| (0.24) ** | (0.39) ** | (0.63) * | (1.15) * | (0.04) | (0.02) | (0.11) | (0.02) | |||

| Time spent with govt. official | 4.01 | 4.51 | 7.97 | 7.68 | 4.58 | 4.71 | 5.40 | 6.46 | 14.83 | 4.63 |

| (0.040) | (0.01) | (0.23) * | (0.21) * | (0.00) | (0.01) | (0.05) | (0.12) | |||

| Firm size | 18.22 | 18.34 | 16.89 | 17.91 | 18.10 | 18.07 | 17.88 | 18.12 | 18.11 | 3.54 |

| (0.03) | (0.06) | (0.35) * | (0.06) | (0.00) | (0.01) | (0.07) | (0.00) | |||

| Firm growth | 2.01 | 1.73 | 1.82 | 1.90 | 1.95 | 1.83 | 1.76 | 2.18 | 1.95 | 6.41 |

| (0.01) | (0.04) | (0.02) | (0.01) | (0.00) | (0.02) | (0.03) | (0.04) | |||

| Leverage | 78.87 | 76.61 | 66.62 | 71.62 | 77.59 | 75.77 | 73.77 | 71.47 | 77.15 | 30.07 |

| (0.06) | (0.02) | (0.35) * | (0.18) | (0.02) | (0.05) | (0.11) | (0.19) |

| Variables | Weighted Logistic | Unweighted Logistic | Younger SMEs | Older SMEs | Medium Size | Small Size |

|---|---|---|---|---|---|---|

| Product and Process Innovation | 1.918 *** | 2.400 *** | 2.100 *** | 1.715 ** | 2.024 *** | 1.666 ** |

| (0.309) | (−0.279) | (0.455) | (0.408) | (0.453) | (0.395) | |

| Process Innovation | 1.176 | 1.773 *** | 1.132 | 1.217 | 0.984 | 1.351 |

| (0.163) | −0.208 | (0.224) | (0.238) | (0.199) | (0.256) | |

| Product Innovation | 1.120 | 1.477 *** | 1.237 | 1.001 | 1.063 | 1.161 |

| (0.133) | −0.144 | (0.201) | (0.173) | (0.182) | (0.193) | |

| Constant | 0.418 *** | −0.996 *** | 0.392 *** | 0.447 *** | 0.548 *** | 0.333 *** |

| (0.0173) | (0.039) | (0.0225) | (0.0267) | (0.0341) | (0.0186) | |

| Observations | 4541 | 4541 | 2374 | 2167 | 1994 | 2547 |

| Pairwise Comparisons | Contrast | Std. Err. | t-Statistic | p-Value |

|---|---|---|---|---|

| none vs. product and process | −0.150 | 0.039 | −3.810 | 0.000 |

| process vs. product and process | −0.115 | 0.048 | −2.390 | 0.017 |

| product vs. product and process | −0.126 | 0.045 | −2.780 | 0.005 |

| process vs. none | 0.035 | 0.030 | 1.140 | 0.254 |

| product vs. none | 0.024 | 0.026 | 0.940 | 0.345 |

| product vs. process | −0.011 | 0.038 | −0.280 | 0.780 |

| Variables | Full Sample | Medium Size | Small Size | Younger SMEs | Older SMEs |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Product and process innovation | 1.803 *** | 1.875 ** | 1.701 * | 1.815 ** | 1.729 * |

| (0.356) | (0.462) | (0.520) | (0.484) | (0.493) | |

| Process innovation | 1.077 | 0.873 | 1.264 | 1.069 | 1.129 |

| (0.201) | (0.238) | (0.321) | (0.306) | (0.273) | |

| Product innovation | 1.189 | 1.218 | 1.188 | 1.124 | 1.135 |

| (0.180) | (0.252) | (0.265) | (0.224) | (0.287) | |

| Foreign ownership | 0.999 | 1.002 | 0.985 * | 0.989 | 1.004 |

| (0.00462) | (0.00522) | (0.00906) | (0.00786) | (0.00557) | |

| Female ownership | 1.013 | 1.361 | 0.709 | 0.820 | 1.533 * |

| (0.165) | (0.315) | (0.171) | (0.186) | (0.338) | |

| Age | 1.009 | 0.995 | 1.028 ** | 1.028 | 0.990 |

| (0.00683) | (0.00858) | (0.0111) | (0.0280) | (0.00906) | |

| Years of experience | 1.004 | 1.006 | 0.995 | 0.983 | 1.019 * |

| (0.00821) | (0.0111) | (0.0120) | (0.0134) | (0.0107) | |

| Female top manager | 1.117 | 0.861 | 1.367 | 1.187 | 0.860 |

| (0.195) | (0.205) | (0.361) | (0.297) | (0.206) | |

| Research and development | 1.264 | 1.228 | 1.286 | 1.340 | 1.365 |

| (0.207) | (0.288) | (0.320) | (0.299) | (0.345) | |

| Time spent with govt. author | 1.007 * | 1.009 * | 1.004 | 1.009 | 1.004 |

| (0.00402) | (0.00532) | (0.00571) | (0.00584) | (0.00554) | |

| Firm size | 1.001 *** | 1.001 *** | 1.001 *** | 1.001 *** | 1.001 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Firm growth | 1.009 | 1.023 | 1.010 | 1.019 | 1.003 |

| (0.0112) | (0.0158) | (0.0159) | (0.0155) | (0.0158) | |

| Leverage | 0.974 *** | 0.967 *** | 0.975 *** | 0.978 *** | 0.964 *** |

| (0.00255) | (0.00339) | (0.00315) | (0.00317) | (0.00352) | |

| Private credit to GDP | 0.990 * | 0.993 | 0.987 | 0.993 | 0.989 |

| (0.00590) | (0.00836) | (0.00832) | (0.00993) | (0.00768) | |

| GDP per capita | 1.000 * | 1.000 | 1.000 * | 1.000 | 1.000 ** |

| (0.000140) | (0.000203) | (0.000186) | (0.000196) | (0.000195) | |

| Strength of legal rights | 0.900 * | 0.832 ** | 0.931 | 0.971 | 0.826 ** |

| (0.0516) | (0.0700) | (0.0765) | (0.0821) | (0.0627) | |

| Observations | 3341 | 1548 | 1793 | 1766 | 1575 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arif, M.; Hasan, M.; Shafique Joyo, A.; Gan, C.; Abidin, S. Formal Finance Usage and Innovative SMEs: Evidence from ASEAN Countries. J. Risk Financial Manag. 2020, 13, 222. https://doi.org/10.3390/jrfm13100222

Arif M, Hasan M, Shafique Joyo A, Gan C, Abidin S. Formal Finance Usage and Innovative SMEs: Evidence from ASEAN Countries. Journal of Risk and Financial Management. 2020; 13(10):222. https://doi.org/10.3390/jrfm13100222

Chicago/Turabian StyleArif, Muhammad, Mudassar Hasan, Ahmed Shafique Joyo, Christopher Gan, and Sazali Abidin. 2020. "Formal Finance Usage and Innovative SMEs: Evidence from ASEAN Countries" Journal of Risk and Financial Management 13, no. 10: 222. https://doi.org/10.3390/jrfm13100222

APA StyleArif, M., Hasan, M., Shafique Joyo, A., Gan, C., & Abidin, S. (2020). Formal Finance Usage and Innovative SMEs: Evidence from ASEAN Countries. Journal of Risk and Financial Management, 13(10), 222. https://doi.org/10.3390/jrfm13100222