3. The Transformation of the Payments Eco-System in the UAE

The deep transformation of the payments landscape in the UAE, and initiatives to eliminate cash and trial a digital currency, are not surprising. The region counts among the wealthiest and most advanced countries in the world, with Saudi Arabia and the UAE ranked in the Global Competitiveness Index as world leaders in terms of macro-economic stability, while the UAE ranks second in the world for ICT adoption, behind only South Korea, and 15th in terms of the quality of its institutions, ahead of Australia, Germany, Japan, and the United States, reflective of its unmatched infrastructure and the great strides it has made in e-government services. In early 2017, the UAE central bank launched new electronic payment regulations, permitting peer-to-peer and retail players to participate in the country’s payments eco-system alongside banks. The following year, the central bank announced a national payments strategy, which in addition to strengthening the security and efficiency of payments, and bringing down transaction costs, set the objective of gradually transitioning to a cashless economy. The e-dirham—a reloadable prepaid card required to pay for government services—initially launched in 2001 with moderate success, is also subject to a major revamp in collaboration with 22 of the country’s banks. In parallel with the UAE, the Saudi central bank announced the objective of achieving 70 percent cashless payments across the kingdom over the next decade, as part of the financial sector reform plans integrated within Saudi Vision 2030. These policies crystallized cashless economy objectives that have been under discussion since at least 2012.

In the UAE, the new regulations encouraged the entry into the country’s payments eco-system of a new class of payment gateways and processors, with a somewhat baffling mix of international players setting up shop alongside home-grown initiatives, the fruit of local start-up and FinTech hubs. For e-commerce—here taken to mean payments transacted on the internet via mobile, smartphone, or tablet—there are at least 15 players. This includes major international groups like Amazon’s Payfort, Telr, jointly launched in the UAE and Singapore, India’s CCAvenue, as well as local entities like PayBy, Foloosi, and Bahrain’s PayTabs. Some local players had moved beyond online payments and were rolling out point-of-sale devices for in-store payments, competing in an area traditionally controlled by banks. Noon, one of the region’s largest online retailers, launched its own payment gateway in 2020, arming itself with a captive business. With 1.4 million Chinese tourists visiting the region in 2018, China’s QFPay also entered the market through a local joint venture, enabling Chinese visitors to transact QR-code based payments with Alipay and WeChat Pay at shops and restaurants (

Visele 2019). On the eWallet side, Beam, an early mover that first launched in the UAE in 2012, with an attractive points and rewards scheme, soon found itself in competition with “the Pays”—Apple, Samsung, and Google Pay. Not to be outdone, 16 UAE banks joined forces to launch the Emirates Digital Wallet KLIP, which sets out specifically to eliminate cash from the economy, while in Dubai the reloadable NOL transport card used for the metro was expanded to enable payments in taxis and at corner shops. It is in fact hard to keep up with eWallet and prepaid card schemes in the UAE—particularly stand-alone initiatives set up by telcos, retailers, or individual banks—with many failing to gain any traction despite otherwise high-profile launches.

UAE payment industry and FinTech players frequently take South Korea and Sweden as models to replicate in terms of achieving a cashless future. Yet in a world where few countries have succeeded in reducing cash in favor of digital payments, it is interesting to consider what specific attributes these countries share that have made them amenable to a cashless eco-system and whether they can serve as appropriate benchmarks for the GCC states. Notable attributes of these countries are high levels of literacy, moderate levels of income inequality, and almost universal access to smartphones and mobile data. Additionally, close to one hundred percent of the adult population in South Korea and Sweden are banked. This is very different from the situation in the GCC, where a substantial part of the population consists of migrant laborers and blue-collar workers, excluded from the formal banking system.

In the UAE, 32 percent of the working population, 1.7 million individuals, is unbanked, earning less than USD 679 per month, as set out in

Table 1. The additional 19 percent of workers between the USD 680 to USD 1359 band are partially unbanked, as the minimum usually required for opening a bank account is USD 1360. This means that at reasonable estimates, 35 percent of the working population, some 1.9 million individuals, are unbanked, out of a total active labor force of 5.5 million in 2018. These are reliant on money exchanges, and formal and informal networks to receive their wages and remit home savings. Additionally, while some of the unbanked may be able to afford smartphones, it is uncertain whether this segment could easily pay for a monthly mobile data plan to transact mobile payments, once rent, food, transport, and remittances are factored in. With UAE nationals comprising 11 percent of the total population of 9.6 million and concentrated in the upper income tiers with strong social safety nets, the unbanked segment is also overwhelmingly comprised of foreign workers. These socio-economic inequalities are also captured in the Human Development Index, where the percentage of unskilled labor is 41 and 47 percent for Saudi Arabia and the UAE, respectively, placing them closer to developing and emerging economies for this indicator than the high-income group to which they belong.

Despite the large unbanked population, the banking sector and payments industry has maintained a positive outlook with regards to the future of digital payments in the region. In 2018, Mastercard attributed the unprecedented growth of mobile payments in the UAE to the country’s large youth demographic and a mobile penetration rate of 173 percent, described as the “highest in the world” (

Mastercard 2018). In reality, the figure is misleading as while mobile ownership is certainly high, smartphone adoption probably does not exceed 73 percent (

Finastra 2018), an indicator difficult to measure given the UAE’s wealthy frequently own multiple smartphones. Boston Consulting Group, for its part, estimated that achieving a cashless economy in the GCC would provide “at least a 1% boost to non-oil GDP, equating to nearly

$3 billion” and that it was important for monetary authorities to continue addressing barriers to cashless uptake, such as high transaction costs, and cybersecurity and infrastructure readiness (

BCG 2019;

Khan et al. 2019). In parallel, the consensus at the Success 2020 Arabian Business Forum held in Dubai in October 2019 was that the “UAE is moving ever closer to becoming a cashless society”, with Visa’s representative for the UAE explaining that it was important to encourage “smaller retailers and businesses on to the cashless economy” (

Halligan 2019). Equally, the region’s press is awash with reports of the “e-payments revolution”, the “cashless society”, and the “end of cash”.

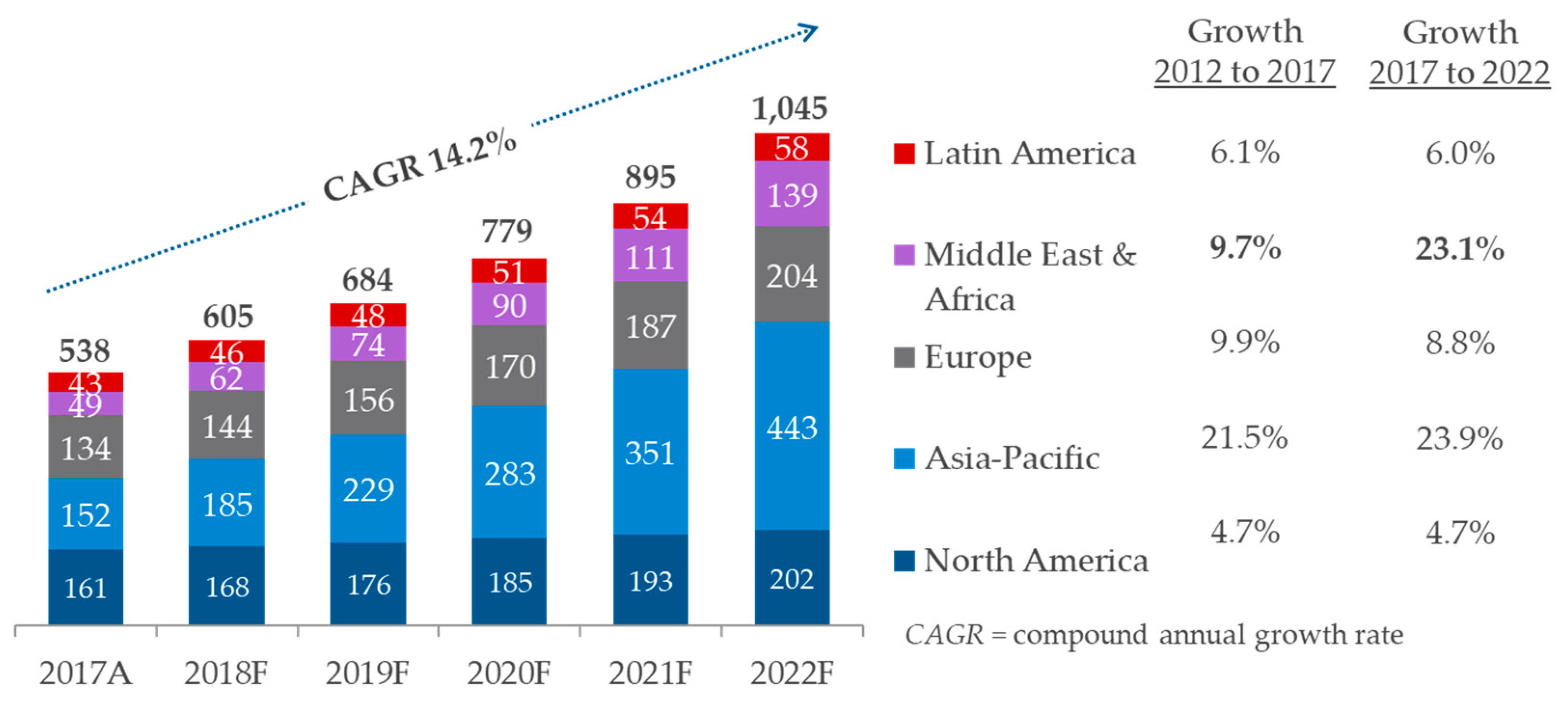

In practice, one cannot blame banks or the payments industry for generating hype around digital payments. The payments business, whether online or in-person at points-of-sale, is lucrative. In the UAE, and mirrored around the world, merchant service fees per transaction, hidden to the buyer, range from around one percent for in-person transactions, to up to 3.0 percent for online payments. These commissions are shared between the acquiring bank, the card association (i.e., Mastercard, Visa), and the payment gateway. It is more of a volume than a value business, which is why the industry has long been more focused on the volume than on the value of transactions, as large payments are less frequent, and are as likely to be made by bank transfer or cheque. From this perspective, the two most promising regions for the growth of digital payments are the emerging markets of East Asia, the Middle East and Africa, as set out in

Figure 1. In the latter, non-cash transactions are forecasted to grow by 23.1 percent between 2017 and 2022, to reach 139 billion transactions, which explains why the payments industry is so keen on the region, particularly when compared to more mature markets in North America and Europe. In the UAE, digital payment uptake has been strong across all sectors, including retail, transport, food delivery, and subscription services (i.e., music and video). Progress in peer-to-peer payments has been slower, partly because of the continued prominence of in-person paper-based know-your-customer (KYC) protocols to sign up for financial services, but regulations in this area are also catching up.

How to explain therefore, considering the phenomenal rise of digital payments in the UAE since the oil price downturn, the continued dominance of cash as a percentage of overall payments? A Mastercard report in 2013 described the UAE as one of the countries “most rapidly moving away from being a predominantly cash-based society” (

Mastercard 2013). At the time, cash transactions constituted 74 percent of customer payments by value at points-of-sale, as set out in

Figure 2. In 2019, this had come down to 67 percent—a modest shift, particularly given the changes in technology, payment channels, and connectivity that have taken place in between, while the figure for Saudi Arabia was 64 percent (

SAMA 2019). This is compared to 10 percent in Canada, 15 percent in Sweden, and 18 percent in South Korea; economies where one can confidently speak of an evolution away from cash payments (

FIS 2020). Of course, the transition in these economies took place gradually, but it is interesting to note that in 2001, both Canada and Sweden were already less cash-reliant than their GCC peers, with cash accounting for around 30 and 55 percent of payments, respectively (

Engert et al. 2019).

While infrastructure readiness and transaction costs, particularly for smaller businesses, certainly have something to do with the continued preference for cash, one angle that has been less explored is the relationship between cash transactions and the unbanked population. One only needs to visit UAE exchange houses on payday in any given month to witness the queues of workers waiting to remit money home, often in the form of cash, sometimes via payroll cards on which wages are disbursed, to understand why cash remains important in GCC economies. UAE-based foreign workers remitted USD 45 billion to their home countries, mainly in East and South Asia in 2019—the equivalent of 11 percent of the UAE’s GDP (

UAE Central Bank 2019). This was just through formal channels. The World Bank estimates that an additional 35 to 75 percent of the total value of global remittances are delivered through informal channels (

Freund and Spatafora 2005). In the Middle East, individuals send funds via the age-old

hawala system, a trust-based network where cash is handed to a local agent, either a corner shop or a designated community member, whose counterpart in the home country disburses the funds to the intended recipient, against a small commission. While hawala operates outside of formal channels, it is essential for sustaining remittance corridors to locations where recipients have no easy access to exchange houses or banks. In the absence of digital money transfer technologies accessible to both senders and recipients along these corridors, it is difficult to imagine how this segment of the population can forgo cash.

This leads to the interesting question of whether a link can be established more generally between socio-economic inequality and reliance on cash. In

Figure 3, the Gini coefficient for income inequality within countries is compared to the total value of payments transacted in cash for 37 emerging and advanced economies. What is apparent is that countries like Sweden and South Korea that have implemented solid digital payment eco-systems and substantially reduced cash are also among the least unequal societies in the world. In Saudi Arabia and South Africa, the latter one of the world’s most unequal societies, cash continues to dominate payments, despite otherwise advanced infrastructure, booming industrial sectors, and high levels of integration into the global economy. While no Gini coefficient was available for the UAE, Saudi Arabia’s position on the chart is a good approximation of the position of GCC states. What the chart suggests is that in countries with high levels of inequality, eliminating cash may be more challenging, especially where bank accounts and digital payments solutions are out-of-reach to poorer segments of society, or represent a high switching cost, as discussed by

Bajaj and Damodaran (

2020).

There is no doubt that in the UAE and the GCC more needs to be done to promote financial inclusion. A recent IMF report on the region found significant gaps in access to finance, particularly for women, youth, and small-and-medium enterprises (SMEs). The latter only received 4.5 percent of total bank loans, lower than the regional average for the Middle East and North Africa. The report also highlighted the continued importance of informal finance, echoing the findings related to remittances and the use of cash above, but this time in relation to loans, stating that “26 percent of adults in GCC reported having borrowed informally”, compared to 13 percent in advanced economies, and that “GCC households rely on informal financing channels, where peer financing … remains the dominant source of financing, with bank loans being the residual” (

Ben Ltaifa et al. 2018). The situation for SMEs, which in the UAE account for an estimated 60 percent of non-oil GDP, has been particularly challenging since the oil-price downtown of 2015. This set off a wave of SME loan defaults equivalent to USD 1.4 billion, hitting the banking sector and drying up new loans, particularly trade finance, the main lubricant in oil economies where the retail sector is entirely reliant on imports (

Everington 2015). This as the region registered its largest ever current account deficit of USD 127 billion, equivalent to 9.1 percent of combined GDP, putting immense pressure on the maintenance of the US dollar anchor (

Iradian and Preston 2016). In fact, much of the drive by monetary authorities to expand digital payments can be traced to the oil-price downturn of 2015 and the subsequent implementation of a value-added tax regime in all six GCC states, as governments cut spending and scrambled to make up for lost revenue. This from the perspective that digital payments leave a clearer accounting trail and result in better tax collection.

Another reason for the prevalence of cash payments is that in countries with high socio-economic inequality, financial literacy tends to be low. In both Saudi Arabia and the UAE, efforts are nonetheless being made to increase participation in the formal banking system. Saudi Arabia’s Financial Sector Development Program has sought to enhance financial planning skills for youth and women and increase access to digital financial services for the unbanked. These efforts seem to have yielded positive results, with 69 percent of adults having bank accounts in 2017, compared to 51 percent in 2011. In the UAE, financial literacy initiatives seem to be more focused on middle- and upper-income earners to improve individual financial planning, while one FinTech, NOW Money, has launched a mobile banking and remittance solution for low-income workers (

Buller 2020). On the SME front, the Emirates Development Bank in 2019 launched a USD 27 million credit guarantee to improve access to finance for small businesses.

4. The Relationship between Cash and Digital Payments in Emerging Economies

The broader point related to the cashless economy, both in the economics literature as well as in payment industry circles, is that the choice between cash and digital payments is often presented as a binary one. This supposes a linear evolution from cash to digital payments, where a rise in digital payments should result in a decline in the use of cash. It is a view that intuitively makes sense and is often repeated in GCC banking and payment industry circles. Reality, however, appears to be more nuanced, with empirical data showing that for most emerging and advanced economies, both digital payments and cash-in-circulation are on the rise.

Figure 4 looks at currency-in-circulation as a percentage of GDP for nine major developed and emerging economies, showing declines only in Russia and Sweden since 2007. In the seven other markets, including Saudi Arabia and the UAE, currency-in-circulation—that is, cash outside of banks and deposit-taking institutions—has increased. Some interesting work has been done to explain this counter-intuitive phenomenon, even if it is not yet fully understood.

Ashworth and Goodhart (

2020), analyzing the Eurozone, Japan, the United Kingdom, and the United States, demonstrate remarkably that cash-in-circulation has been consistently on the increase in these markets since the 1990s. Recent increases could be correlated to the low interest rates that have prevailed since the global financial crisis, as well as the rise of the shadow economy and informal work. A BIS study focused on 20 emerging and advanced economies for the period 2000 to 2016 found that cash-in-circulation had increased from 7 to 9 percent of GDP during the period (

Bech et al. 2018). The report reached similar conclusions with regard to low interest rates, as individuals had less incentive to hold money in savings accounts. The authors also found that currency holdings related particularly to higher denomination notes, leading them to speculate that money was likely being held more with a store-of-value purpose in mind than as a means of payment.

Less is known about the reasons underlying the increase in cash-in-circulation in emerging economies or those with large unbanked populations. Anecdotal evidence suggests that the adoption of mobile money and e-wallets as alternatives to bank accounts has resulted in an expansion of the cash-based economy. More than 60 percent of mobile money transactions globally are based on the cash-in-cash-out model, where individuals utilize licensed agents to either top-up or receive cash held in mobile wallets, enabling them to disburse salaries or transact peer-to-peer payments across large distances (

Naghavi 2019). Additionally, this is not just for within-country transfers. A significant proportion of remittances between France and major west African economies like Côte d’Ivoire, Mali, and Senegal are transacted via Orange Money, one of the most widely used mobile money applications in French-speaking Africa.

Similarly, in South Africa, the country’s leading economics advisory firm, Genesis Analytics, found in 2018 that a rise in non-performing micro-loans had resulted in a return to mobile money, prepaid cards and cash, and an avoidance of bank accounts, where positive balances can automatically be debited to settle outstanding debts. To match the services offered by mobile money, South African banks also enabled their customers to make instant cash transfers to anyone in the country with access to an ATM terminal, with no need for the recipient to hold an account at the bank (

Ketley 2018); another example of digital technologies expanding cash-in-circulation. What these trends reveal is that for many emerging markets, the relationship between cash and digital payments may not be a zero-sum game. Rather, the cash-based and the digital economy appear to reinforce each other, with digital technologies boosting cash-in-circulation, and cash-in-circulation in turn sustaining the digital payments eco-system. While further study is required to better understand these trends in emerging markets, what they suggest is that policies seeking to eliminate cash prematurely may result in more harm than good.