The Role of Redenomination Risk in the Price Evolution of Italian Banks’ CDS Spreads

Abstract

1. Introduction

2. Literature Review

3. Model and Data Description

- t = 1, 2, …, T is the time horizon;

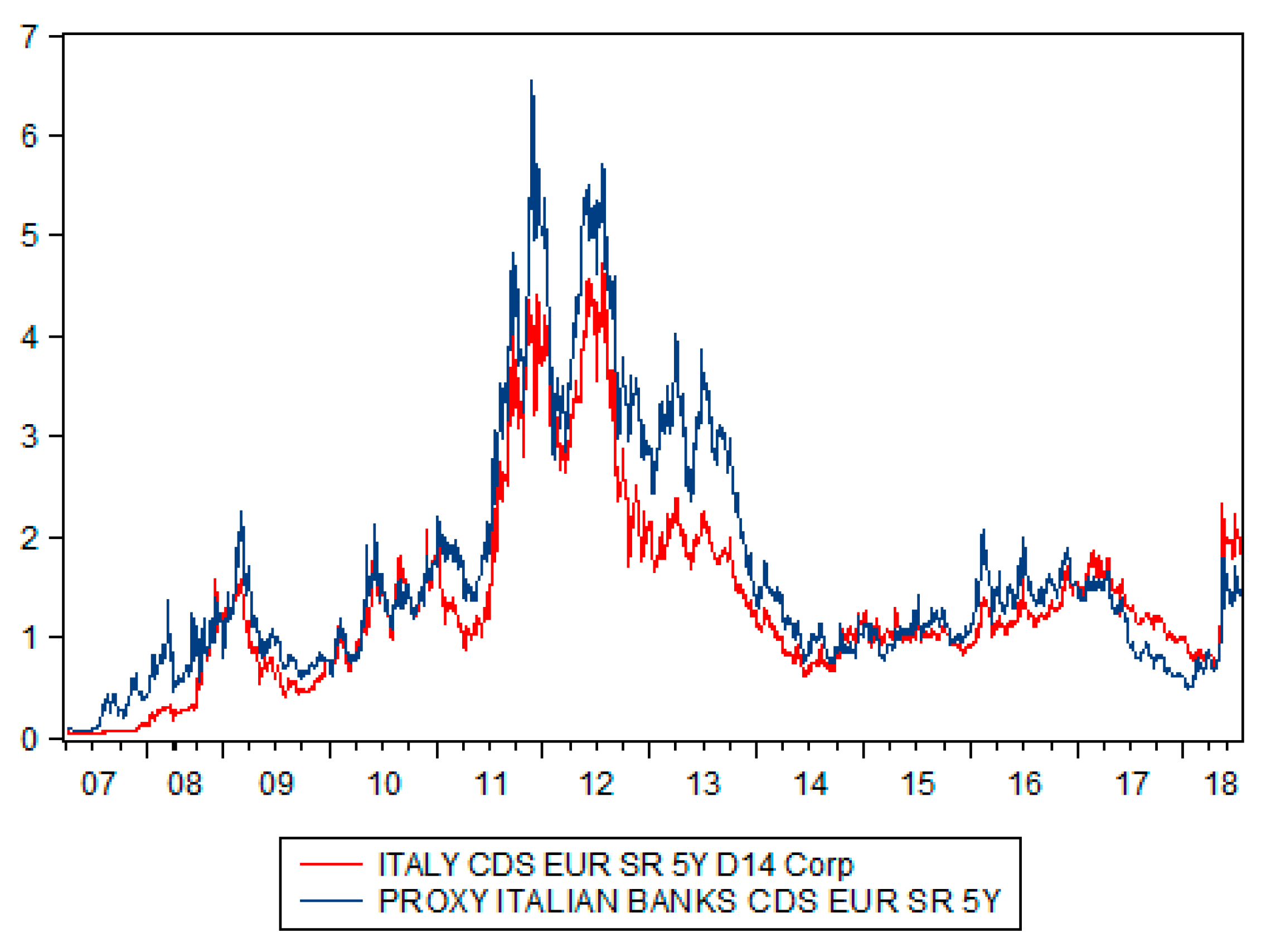

- is the Italian banks’ 5y CDS spread proxy at time t;

- is the risk-free rate at time t;

- is the volatility of the assets at time t;

- is the leverage ratio at time t.

- is the sovereign Italian 5y CDS spread in US dollars;

- is the sovereign Italian 5y CDS spread in euros;

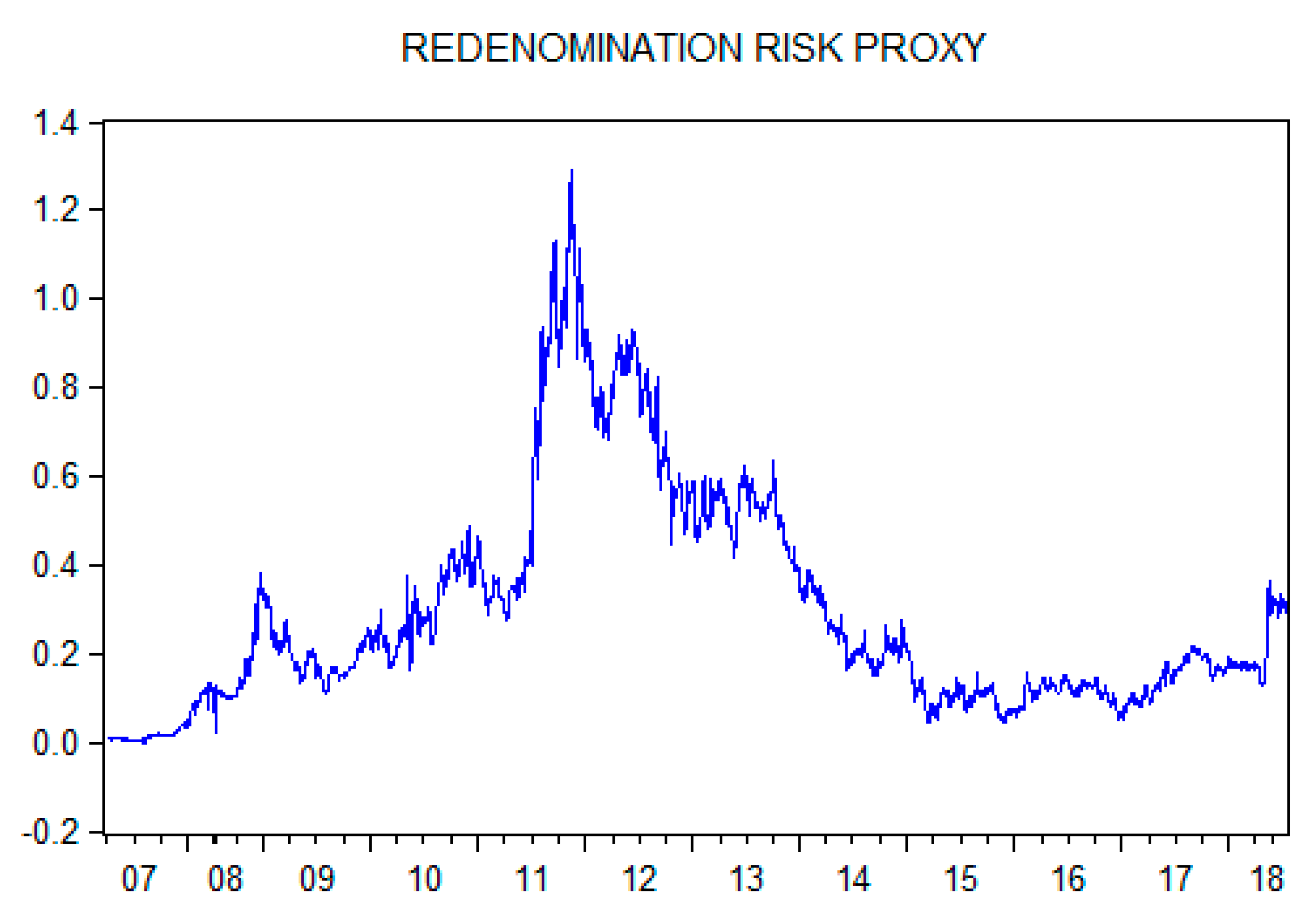

- is the sovereign German 5y CDS spread in US dollars;

- is the sovereign German 5y CDS spread in euros.

4. Results

4.1. Financial Crisis

4.2. Sovereign Debt Crisis

4.3. Pro Deficit Government

4.4. Granger-Causality Tests

5. Economic Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix A.1. Unit Root Tests14

| Augmented Dickey-Fuller Test | ||

|---|---|---|

| Residuals | ||

| Period | t-Statistic | Prob. * |

| Financial crisis (492 Obs.) | −19.24291 | 0.0000 |

| Sovereign debt crisis (723 Obs.) | −21.51060 | 0.0000 |

| Pro deficit Government (96 Obs.) | −9.863148 | 0.0000 |

Appendix A.2. Basic Model (Inspired by the Classic Merton (1974) Model)

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| β0 | 6.44 × 10−6 | 0.003116 | 0.002066 | 0.9984 |

| Δ(Risk-free Rate) | −0.861810 *** | 0.267762 | −3.218569 | 0.0014 |

| Δ(Volatility) | 0.407496 | 0.960730 | 0.424152 | 0.6716 |

| Δ(Leverage) | 0.043429 | 0.068708 | 0.632086 | 0.5276 |

| R2 | 0.05 | |||

| Adj. R2 | 0.04 | |||

| Prob(F-statistic) | 0.00 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| β0 | 0.002165 | 0.001519 | 1.425300 | 0.1545 |

| Δ(Risk-free Rate) | −0.552276 *** | 0.085677 | −6.446025 | 0.0000 |

| Δ(Volatility) | 0.109614 | 0.733384 | 0.149464 | 0.8812 |

| Δ(Leverage) | −0.006041 | 0.013461 | −0.448774 | 0.6537 |

| R2 | 0.08 | |||

| Adj. R2 | 0.08 | |||

| Prob(F-statistic) | 0.00 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| β0 | 0.007310 | 0.006905 | 1.058616 | 0.2925 |

| Δ(Risk-free Rate) | −0.465662 ** | 0.235470 | −1.977590 | 0.0510 |

| Δ(Volatility) | 0.480214 | 0.818202 | 0.586914 | 0.5587 |

| Δ(Leverage) | −0.375821 | 0.648974 | −0.579100 | 0.5639 |

| R2 | 0.29 | |||

| Adj. R2 | 0.27 | |||

| Prob(F-statistic) | 0.00 | |||

Appendix A.3. Correlation Matrix

| Variable | Δ(Risk-Free Rate) | Δ(Volatility) | Δ(Leverage) | Δ(Reden. Risk) |

|---|---|---|---|---|

| Δ(Risk-free Rate) | 1 | 0.16308 | 0.14920 | −0.00185 |

| Δ(Volatility) | 0.16308 | 1 | 0.18848 | 0.14343 |

| Δ(Leverage) | 0.14920 | 0.18848 | 1 | 0.12399 |

| Δ(Reden. Risk) | −0.00185 | 0.14343 | 0.12399 | 1 |

| Variable | Δ(Risk-Free Rate) | Δ(Volatility) | Δ(Leverage) | Δ(Reden. Risk) |

|---|---|---|---|---|

| Δ(Risk-free Rate) | 1 | 0.03003 | 0.01426 | −0.18996 |

| Δ(Volatility) | 0.03003 | 1 | 0.11177 | −0.06803 |

| Δ(Leverage) | 0.01426 | 0.11177 | 1 | −0.03480 |

| Δ(Reden. Risk) | −0.18996 | −0.06803 | −0.03480 | 1 |

| Variable | Δ(Risk-Free Rate) | Δ(Volatility) | Δ(Leverage) | Δ(Reden. Risk) |

|---|---|---|---|---|

| Δ(Risk-free Rate) | 1 | −0.09275 | −0.00188 | −0.32308 |

| Δ(Volatility) | −0.09275 | 1 | −0.01285 | 0.11611 |

| Δ(Leverage) | −0.00188 | −0.01285 | 1 | −0.01423 |

| Δ(Reden. Risk) | −0.32308 | 0.11611 | −0.01423 | 1 |

Appendix A.4. Basic and Extended Model for the Whole Period (August 2007–September 2018)

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Β0 | 0.000577 | 0.000875 | 0.659485 | 0.5096 |

| Δ(Risk-free Rate) | −0.007744 | 0.006293 | 1.230467 | 0.2186 |

| Δ(Volatility) | 0.415109 | 0.323954 | 1.281382 | 0.2002 |

| Δ(Leverage) | 0.004257 | 0.019649 | 0.216628 | 0.8285 |

| R2 | 0.004 | |||

| Adj. R2 | 0.003 | |||

| Prob(F-statistic) | 3.87 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| β0 | 0.000304 | 0.000828 | 0.367692 | 0.7131 |

| Δ(Risk-free Rate) | −0.007493 | 0.006182 | −1.212124 | 0.2256 |

| Δ(Volatility) | 0.266848 | 0.288883 | 0.923725 | 0.3557 |

| Δ(Leverage) | −0.011348 | 0.013020 | −0.871559 | 0.3835 |

| Δ(Reden. Risk) | 0.150402 *** | 0.035404 | 4.248143 | 0.0000 |

| R2 | 0.11 | |||

| Adj. R2 | 0.11 | |||

| Prob(F-statistic) | 84.47 | |||

References

- Acharya, Viral V., Itamar Drechsler, and Philipp Schnabl. 2011. A Pyrrhic Victory? Bank Bailouts and Sovereign Credit Risk. NBER Working Paper. Cambridge: National Bureau of Economic Research. Available online: https://www.nber.org/papers/w17136.pdf (accessed on 9 July 2020).

- Ainger, John. 2018. Another Euro Crisis? Here’s What Markets Are Saying about Italy. Available online: https://www.bloomberg.com/news/articles/2018-09-28/another-euro-crisis-here-s-what-markets-are-saying-about-italy (accessed on 28 September 2018).

- Avino, Davide, and John Cotter. 2014. Sovereign and Bank CDS Spreads: Two Sides of the Same Coin? Journal of International Financial Markets, Institutions and Money 32: 72–85. Available online: https://www.sciencedirect.com/science/article/abs/pii/S104244311400064X (accessed on 9 July 2020). [CrossRef]

- Banca d’Italia. 2018a. Banche e Moneta: Serie Nazionali–Ottobre 2018. Available online: https://www.bancaditalia.it/pubblicazioni/moneta-banche/2018-moneta/statistiche_BAM_20181211.pdf (accessed on 11 December 2018).

- Banca d’Italia. 2018b. Rapporto Sulla Stabilità Finanziaria. Available online: http://www.bancaditalia.it/pubblicazioni/rapporto-stabilita/2018-2/RSF_2_2018.pdf (accessed on 23 November 2018).

- Berlinger, Edina, Illés Ferenc, Badics Milan, Banai Adam, Daróczi Gergely, Dömötör Barbara, Gabler Gergely, Havran Daniel, Juhász Peter, Margitai Istvan, and et al. 2015. Mastering R for Quantitative Finance. Birmingham: Packt Publishing. [Google Scholar]

- Brooks, Chris. 2002. Introductory Econometrics for Finance. Cambridge: Cambridge University Press. [Google Scholar]

- Byström;, Hans. 2006. Merton Unraveled. The Journal of Alternative Investments 8: 39–47. Available online: https://jai.pm-research.com/content/8/4/39.short (accessed on 9 July 2020).

- Cesaratto, Sergio. 2016. Sei Lezioni di Economia. Reggio Emilia: Imprimatur. [Google Scholar]

- Chiaramonte, Laura, and Barbara Casu. 2010. Are CDS Spread a Good Proxy of Bank Risk? Evidence from the Financial Crisis. SSRN Electronic Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1666793 (accessed on 9 July 2020). [CrossRef]

- Collin-Dufresne, Pierre, Robert Goldstein, and J. Spencer Martin. 2002. The Determinants of Credit Spread Changes. The Journal of Finance 56: 2177–207. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/0022-1082.00402 (accessed on 9 July 2020). [CrossRef]

- De Santis, Roberto. 2019. Redenomination Risk. Journal of Money, Credit and Banking 51: 2173–206. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/jmcb.12582 (accessed on 9 July 2020). [CrossRef]

- Di Cesare, Antonio, and Giovanni Guazzarotti. 2005. An Analysis of the Determinants of Credit Default Swap Spread Using Merton’s Model. Banca d’Italia. Available online: https://www.researchgate.net/publication/228638411_An_analysis_of_the_determinants_of_credit_default_swap_spreads_using_Merton%27s_model (accessed on 9 July 2020).

- Di Cesare, Antonio, and Giovanni Guazzarotti. 2010. An Analysis of the Determinants of Credit Default Swap Spread Changes before and during the Subprime Financial Turmoil. SSRN Electronic Journal. Available online: http://www.bancaditalia.it/pubblicazioni/temi-discussione/2010/2010-0749/en_tema_749.pdf (accessed on 9 July 2020). [CrossRef]

- Ericsson, Jan, Kris Jacobs, and Rodolfo Oviedo. 2009. The Determinants of Credit Default Swap Premia. The Journal of Financial and Quantitative Analysis 44: 109–32. Available online: https://www.cambridge.org/core/journals/journal-of-financial-and-quantitative-analysis/article/determinants-of-credit-default-swap-premia/C90E99F64F47A41170EACD7F7A4929EE (accessed on 9 July 2020). [CrossRef]

- Galil, Koresh, Offer Shapir, Dan Amiram, and Uri Ben-zion. 2013. The Determinants of CDS Spreads. SSRN Electronic Journal. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0378426613004676?via%3Dihub (accessed on 9 July 2020). [CrossRef]

- Galliani, Clara, and Stefano Zedda. 2015. Will the Bail-in break the vicious circle of banks and their sovereign? Computational Economics 45: 597–614. Available online: https://link.springer.com/article/10.1007/s10614-014-9436-9 (accessed on 9 July 2020). [CrossRef]

- Guazzarotti, Giovanni. 2004. The Determinants of Changes in Credit Spread of European Corporate Bonds, Mimeo, Banca d’Italia, Economic Research Department. Available online: http://www.greta.it/credit/credit2005/Friday/Poster/05_DiCesare_Guazzarotti.pdf (accessed on 9 July 2020).

- Hull, John, Mirela Predescu, and Alan White. 2004. The relationship between credit default swap spreads, bond yields, and credit rating announcements. Journal of Banking & Finance 28: 2789–811. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0378426604001098?via%3Dihub (accessed on 9 July 2020).

- Kingsley, Patrick. 2012. Financial Crisis: Timeline. The Guardian. Available online: https://www.theguardian.com/business/2012/aug/07/credit-crunch-boom-bust-timeline (accessed on 18 December 2018).

- Lahmann, Wolfgang. 2012. Contagion Effects between Sovereign and Bank Credit Spreads—A Global Analysis of Interdependencies between Sovereign and Bank CDS Spreads. SSRN Electronic Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1994866 (accessed on 9 July 2020). [CrossRef]

- MacKinnon, J. G. 1996. Numerical distribution functions for unit root and cointegration tests. Journal of Applied Econometrics 11: 601–18. [Google Scholar] [CrossRef]

- Matteucci, Piera. 2018. Elezioni Politiche: Vincono M5s E Lega. Crollo Del Partito Democratico. Centrodestra Prima Coalizione. Il Carroccio Sorpassa Forza Italia. Available online: https://www.repubblica.it/speciali/politica/elezioni2018/2018/03/04/news/risultati_elezioni_politiche_pd_centrodestra_m5s_fi_lega-190424815/ (accessed on 18 December 2018).

- Maverick, Jack. 2018. What Debt-to-Equity Ratio Is Common for a Bank? Available online: https://www.investopedia.com/ask/answers/052515/what-debt-equity-ratio-common-bank.asp (accessed on 20 December 2018).

- Merton, Robert C. 1974. On the pricing of corporate debt: the risk structure of interest rates. Journal of Finance 29: 449–70. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6261.1974.tb03058.x (accessed on 9 July 2020).

- Ministero dell’Economia e delle Finanze. 2018. Nota Di Aggiornamento Del Documento Di Economia E Finanza 2018. Available online: http://www.mef.gov.it/inevidenza/documenti/NADEF_2018.pdf (accessed on 18 December 2018).

- Nelson, Eshe. 2017. Five Years ago Today, Mario Draghi Saved the Euro. Available online: https://qz.com/1038954/whatever-it-takes-five-years-ago-today-mario-draghi-saved-the-euro-with-a-momentous-speech/ (accessed on 26 July 2017).

- Panetta, Fabio, Faeh Thomas, Giuseppe Grande, Corrinne Ho, Michael King, Aviram Levy, Federico Signoretti, Marco Taboga, and Andrea Zaghini. 2009. An Assessment of Financial Sector Rescue Programmes. BIS Papers No. 48. New Delhi: BIS. Available online: https://www.bis.org/publ/bppdf/bispap48.pdf (accessed on 9 July 2020).

- Politi, James, and Davide Ghiglione. 2018. Italy Anti-Establishment Parties Make Big Gains in Election | Financial Times. Available online: https://www.ft.com/content/e6a89252-1ffa-11e8-a895-1ba1f72c2c11 (accessed on 5 March 2018).

- Reed, Jonathan R. 2018. Major Global Markets Are Already in a Bear Market or Getting Close, Stoking Fears of Slowing Growth. Available online: https://www.cnbc.com/2018/12/17/major-global-markets-already-in-bear-market-stoking-growth-fears.html (accessed on 18 December 2018).

- Romano, Beda. 2017. La Ue Approva Il Salvataggio Di Mps. Lo Stato Avrà Il 70%. Rimborsi Sui Bond Fino A 1,5 Miliardi. Available online: https://www.ilsole24ore.com/art/la-ue-approva-salvataggio-mps-stato-avra-70percento-rimborsi-bond-fino-15-miliardi-AETrvUrB (accessed on 4 July 2020).

- Samaniego-Medina, Reyes, Antonio Trujillo-Ponce, Purificación Parrado-Martínez, and Filippo di Pietro. 2016. Determinants of bank CDS spreads in Europe. Journal of Economics and Business 86: 1–15. Available online: https://www.sciencedirect.com/science/article/abs/pii/S014861951630011X?via%3Dihub (accessed on 9 July 2020). [CrossRef]

- Sirletti, Sonia, and Giovanni Salzano. 2018. Italy Banks Get Some Relief as EU Budget Deal Lifts Shares. Available online: https://www.bloomberg.com/news/articles/2018-12-19/italy-banks-gain-breathing-room-as-budget-accord-with-eu-nears (accessed on 9 July 2020).

- Zhang, Benjamin, Hao Zhou, and Haibin Zhu. 2005. Explaining Credit Default Swap Spreads with the Equity Volatility and Jump Risks of Individual Firms. Working Paper No. 181. New Delhi: BIS. Available online: https://www.bis.org/publ/work181.pdf (accessed on 9 July 2020).

| 1 | On 9 August 2007, BNP Paribas announced that it was ceasing activity in three hedge funds specialized in US mortgage debt. On 15 September 2008, Lehman Brothers declared bankruptcy (Kingsley 2012). |

| 2 | On 18 October 2009, the Greek prime minister, George Papandreou admitted that the budget deficit would have been doubled with respect to the previous Government’s estimate and would have hit 12% of the GDP. On 26 July 2012, the ECB president Mario Draghi tried to convince international investors that the eurozone’s economy was not as bad as it seemed, and he announced a program to buy the bonds of its distressed countries, known as Outright Monetary Transactions (Cesaratto 2016). |

| 3 | On 4 March 2018, the so-called populist parties were elected (Matteucci 2018). Before 27 September 2018, the Italian Government presented the NaDef (Ministero dell’Economia e delle Finanze 2018). |

| 4 | The Italian banking system includes more than 700 banks. Intesa San Paolo and Unicredit are the largest Italian banks in terms of market capitalization and total assets (Sirletti and Salzano 2018). |

| 5 | In Bloomberg, the CDS spreads series are available only for three Italian banking groups, namely Unicredit, Intesa San Paolo and Monte dei Paschi di Siena. In our view, Monte dei Paschi di Siena should not be included due to specific idiosyncratic issues that have also caused the acquisition of a stake close to 70% by the Italian State, approved by the EU Antitrust Commission in 2017 (Romano 2017). Unicredit and Intesa San Paolo represented in 2018 around 45% of the Italian banking system in terms of total assets (own calculation based on data provided by Banca d’Italia (2018a). |

| 6 | The Merton model sets the firm’s default probability as determined by the firm’s leverage, equity volatility and risk-free interest rate (Merton 1974). |

| 7 | See e.g., Berlinger et al. (2015). |

| 8 | Traders approximate risk-free interest rates with Libor/Swap rates when they evaluate derivatives. Some researchers have shown that the same seems to apply to the credit market (Hull et al. 2004). |

| 9 | As shown by Byström (2006), equity and asset volatility are related by a positive linear expression. For simplicity, based on the efficient market hypothesis (EMH), we quantified the equity volatility, assuming that share prices reflect all information available in the market. As in Galil et al. (2013), we expect that higher stock volatility determines a higher probability of default and higher CDS spreads. |

| 10 | Daily market cap adjusted. |

| 11 | As crises are characterized by higher variance, when considering the whole period, we do have heteroskedasticity. This is another reason why we just considered crises times and estimated it separately, as in this latter case, the estimations do not suffer from heteroskedasticity. |

| 12 | The E/D ratio is the inverse of the classical leverage ratio (Debt/Equity). This measure gives us a better idea of the evolution of the equity portion on total debts during the whole decade under investigation. The variation in the leverage ratio elasticities, indeed, is relatively small and could be confusing for the reader’s sensitivity. |

| 13 | According to Banca d’Italia, Italian banks held in their portfolios around EUR 380 billion of sovereign Italian bonds in October 2018. See Banca d’Italia (2018b). |

| 14 |

| Variable (Basis Points—0.01%) | Mean | SD | Min | Max | Median |

|---|---|---|---|---|---|

| Sovereign Italian 5y CDS | 134.58 | 91.48 | 4.04 | 472.86 | 114.90 |

| Italian banks proxy 5y CDS | 163.86 | 120.26 | 6.70 | 653.68 | 128.27 |

| Variable | Mean | SD | Min | Max | Median |

|---|---|---|---|---|---|

| Financial crisis (Aug 2007–Oct 2009)—492 Obs. | |||||

| Δ5y Euro Swap Rate (%) | 3.68 | 0.79 | 2.63 | 5.19 | 3.92 |

| ΔDaily Volatility Stock (%) | 2.82 | 1.26 | 1.30 | 4.40 | 3.05 |

| E/D (%)12 | 36.50 | 7.53 | 18.14 | 45.03 | 39.41 |

| ΔQuanto CDS Spread (0.01%) | 13.64 | 8.50 | −0.22 | 38.05 | 13.47 |

| Sovereign debt crisis (Oct 2009–Jul 2012)—723 Obs. | |||||

| Δ5y Euro Swap Rate (%) | 2.20 | 0.52 | 1.01 | 3.23 | 2.15 |

| ΔDaily Volatility Stock (%) | 3.42 | 0.66 | 2.54 | 4.40 | 3.49 |

| E/D (%) | 31.98 | 9.21 | 17.47 | 42.55 | 38.63 |

| ΔQuanto CDS Spread (0.01%) | 52.41 | 29.70 | 16.15 | 129.25 | 38.80 |

| Anti-establishment Government (Mar 2018–Sep 2018)—96 Obs. | |||||

| Δ5y Euro Swap Rate (%) | 0.36 | 0.06 | 0.22 | 0.47 | 0.37 |

| ΔDaily Volatility Stock (%) | 1.75 | 0.95 | 1.59 | 1.95 | 1.69 |

| E/D (%) | 33.57 | 0.95 | 32.39 | 34.54 | 33.51 |

| ΔQuanto CDS Spread (0.01%) | 23.74 | 7.83 | 12.83 | 36.62 | 20.19 |

| Q2 2007–Q3 2018—2859 Obs. | |||||

| Δ5y Euro Swap Rate (%) | 1.61 | 1.43 | −0.18 | 5.19 | 1.12 |

| ΔDaily Volatility Stock (%) | 2.89 | 0.91 | 1.29 | 4.40 | 2.77 |

| E/D (%) | 33.74 | 6.59 | 17.47 | 45.03 | 35.13 |

| ΔQuanto CDS Spread (0.01%) | 29.28 | 25.10 | −0.22 | 129.25 | 19.55 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| β0 | −0.000309 | 0.003002 | −0.102779 | 0.9182 |

| Δ(Risk-free Rate) | −0.814622 *** | 0.221771 | −3.673263 | 0.0003 |

| Δ(Volatility) | 0.131785 | 0.820409 | 0.160633 | 0.8724 |

| Δ(Leverage) | 0.017579 | 0.050774 | 0.346210 | 0.7293 |

| Δ(Reden. Risk) | 0.080068 *** | 0.024640 | 3.249537 | 0.0012 |

| R2 | 0.10 | |||

| Adj. R2 | 0.09 | |||

| Prob(F-statistic) | 0.00 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| β0 | 0.001337 | 0.001216 | 1.099076 | 0.2721 |

| Δ(Risk-free Rate) | −0.340677 *** | 0.066582 | −5.116620 | 0.0000 |

| Δ(Volatility) | 0.401680 | 0.278591 | 1.441824 | 0.1498 |

| Δ(Leverage) | 0.002897 | 0.009493 | 0.305228 | 0.7603 |

| Δ(Reden. Risk) | 0.491289 *** | 0.029953 | 16.40215 | 0.0000 |

| R2 | 0.40 | |||

| Adj. R2 | 0.40 | |||

| Prob(F-statistic) | 0.00 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| β0 | 0.002929 | 0.004784 | 0.612316 | 0.5419 |

| Δ(Risk-free Rate) | −0.288470 *** | 0.084666 | −3.407152 | 0.0010 |

| Δ(Volatility) | 0.115309 | 0.322290 | 0.357779 | 0.7213 |

| Δ(Leverage) | −0.286173 ** | 0.118990 | −2.405022 | 0.0182 |

| Δ(Reden. Risk) | 0.635197 *** | 0.107532 | 5.907030 | 0.0000 |

| R2 | 0.65 | |||

| Adj. R2 | 0.64 | |||

| Prob(F-statistic) | 0.00 | |||

| Null Hypothesis | Obs | F-Statistic | Prob. |

|---|---|---|---|

| %Δ daily banks’ stock price does not Granger-cause redenomination risk growth rate | 96 | 2.51428 | 0.1162 |

| redenomination risk growth rate does not Granger-cause %Δ daily banks’ stock price | 0.43497 | 0.5112 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Anelli, M.; Patanè, M.; Toscano, M.; Zedda, S. The Role of Redenomination Risk in the Price Evolution of Italian Banks’ CDS Spreads. J. Risk Financial Manag. 2020, 13, 150. https://doi.org/10.3390/jrfm13070150

Anelli M, Patanè M, Toscano M, Zedda S. The Role of Redenomination Risk in the Price Evolution of Italian Banks’ CDS Spreads. Journal of Risk and Financial Management. 2020; 13(7):150. https://doi.org/10.3390/jrfm13070150

Chicago/Turabian StyleAnelli, Michele, Michele Patanè, Mario Toscano, and Stefano Zedda. 2020. "The Role of Redenomination Risk in the Price Evolution of Italian Banks’ CDS Spreads" Journal of Risk and Financial Management 13, no. 7: 150. https://doi.org/10.3390/jrfm13070150

APA StyleAnelli, M., Patanè, M., Toscano, M., & Zedda, S. (2020). The Role of Redenomination Risk in the Price Evolution of Italian Banks’ CDS Spreads. Journal of Risk and Financial Management, 13(7), 150. https://doi.org/10.3390/jrfm13070150