The Effects of ERM Adoption on European Insurance Firms Performance and Risks

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

3. Methodology

4. Data

Descriptive Statistics

5. Main Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

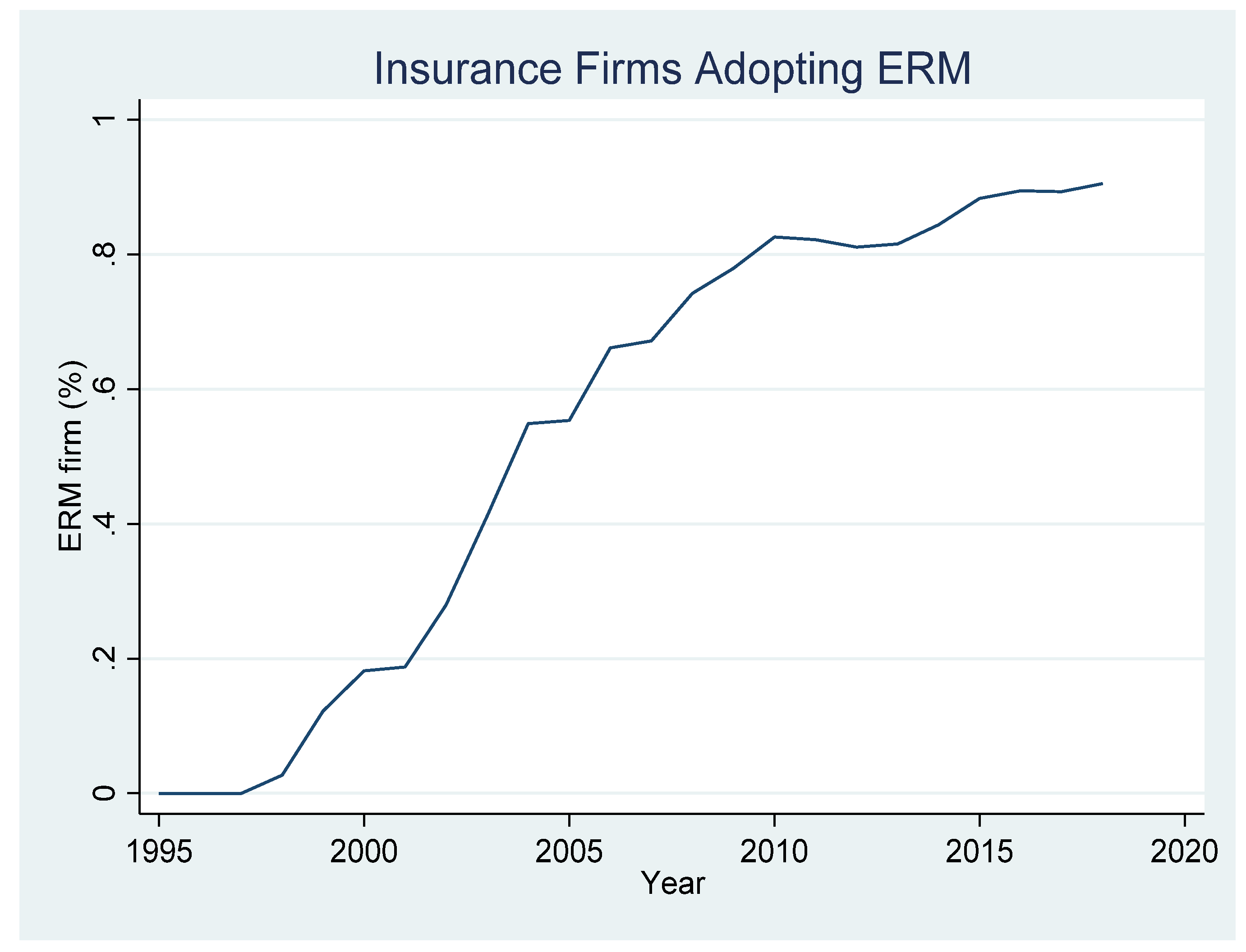

| 1 | The dataset covers a long period (1995–2018) relative to other studies. During this period several directives and regulations have been issued across European countries and have impacted risk management systems in European insurance firms. Pradier and Chneiweiss (2017) document various directives and regulations that have impacted the evolution of the insurance industry in Europe since the 1970s. More recently, the European Parliament and the Council agreed that the Solvency II Directive (including the amendments introduced by Omnibus II) should apply as of 1 January 2016. |

| 2 | McShane et al. (2011) discuss the differences between TRM and ERM. The former is silo-based and uncoordinated focusing mainly on financial risk, whereas the latter is broader and includes operational and strategic risks besides financial risks. |

| 3 | The terms we search for include: ‘chief risk officer’, ‘risk management director’, ‘enterprise risk management’, ‘holistic risk management’, ‘strategic risk management’, ‘risk committee’, ‘risk’ and various other synonyms including: ‘enterprise-wide risk management’, ‘integrated risk management’, ‘firm-wide risk management’, ‘group risk management’, ‘comprehensive risk management’, ‘risk coordinator’, ‘risk manager’, ‘COSO’, ‘ORSA’ and ‘integrated framework’ and other. |

| 4 | Insurance firms in this sample are headquartered in Austria, Belgium, Cyprus, Denmark, Finland, France, Germany, the United Kingdom, Greece, Iceland, Ireland, Isle of Man, Italy, Luxembourg, Malta, Netherlands, Norway, Spain, Sweden, and Switzerland. Firms are included in the dataset if they have four years or more of data. |

| 5 | Estimates of the variance inflation factor for independent variables are lower than 10. |

References

- Ai, Jing, Vickie Bajtelsmit, and Tianyang Wang. 2018. The Combined Effect of Enterprise Risk Management and Diversification on Property and Casualty Insurer Performance. The Journal of Risk and Insurance 85: 513–43. [Google Scholar] [CrossRef]

- Allayannis, George, and James P. Weston. 2001. The Use of Foreign Currency Derivatives and Firm Market Value. The Review of Financial Studies 14: 243–76. [Google Scholar] [CrossRef]

- Altuntas, Muhammed, Thomas R. Berry-Stoelzle, and Robert E. Hoyt. 2011. Implementation of Enterprise Risk Management: Evidence from the German Property-Liability Insurance Industry. The Geneva Papers on Risk and Insurance. Issues and Practice 36: 414–39. [Google Scholar] [CrossRef] [Green Version]

- Anton, Sorin Gabriel, and Anca Elena Afloarei Nucu. 2020. Enterprise Risk Management: A Literature Review and Agenda for Future Research. Journal of Risk and Financial Management 13: 281. [Google Scholar] [CrossRef]

- Baxter, Ryan, Jean C. Bedard, Rani Hoitash, and Ari Yezegel. 2013. Enterprise Risk Management Program Quality: Determinants, Value Relevance, and the Financial Crisis. Contemporary Accounting Research 30: 1264–95. [Google Scholar] [CrossRef]

- Beasley, Mark S., Richard Clune, and Dana R. Hermanson. 2005. Enterprise Risk Management: An Empirical Analysis of Factors Associated with the Extent of Implementation. Journal of Accounting and Public Policy 24: 521–31. [Google Scholar] [CrossRef]

- Beasley, Mark, Don Pagach, and Richard Warr. 2008. Information Conveyed in Hiring Announcements of Senior Executives Overseeing Enterprise-Wide Risk Management Processes. Journal of Accounting, Auditing & Finance 23: 311–32. [Google Scholar] [CrossRef]

- Berry-Stölzle, Thomas R., and Jianren Xu. 2018. Enterprise Risk Management and the Cost of Capital. The Journal of Risk and Insurance 85: 159–201. [Google Scholar] [CrossRef]

- Bohnert, Alexander, Nadine Gatzert, Robert E. Hoyt, and Philipp Lechner. 2019. The Drivers and Value of Enterprise Risk Management: Evidence from Erm Ratings. The European Journal of Finance 25: 234–55. [Google Scholar] [CrossRef]

- Chen, Carl R., Thomas L. Steiner, and Ann Marie Whyte. 2006. Does Stock Option-Based Executive Compensation Induce Risk-Taking? An Analysis of the Banking Industry. Journal of Banking & Finance 30: 915–45. [Google Scholar] [CrossRef]

- COSO (Committee of Sponsoring Organizations of the Treadway Commission). 2004. Enterprise Risk Management—Integrated Framework. Available online: www.coso.org (accessed on 1 August 2021).

- Denis, David J., Diane K. Denis, and Keven Yost. 2002. Global Diversification, Industrial Diversification, and Firm Value. The Journal of Finance (New York) 57: 1951–79. [Google Scholar] [CrossRef] [Green Version]

- Eckles, David L., Robert E. Hoyt, and Steve M. Miller. 2014. The Impact of Enterprise Risk Management on the Marginal Cost of Reducing Risk: Evidence from the Insurance Industry. Journal of Banking & Finance 43: 247–61. [Google Scholar] [CrossRef]

- Farrell, Mark, and Ronan Gallagher. 2015. The Valuation Implications of Enterprise Risk Management Maturity. Journal of Risk and Insurance 82: 625–57. [Google Scholar] [CrossRef]

- Golshan, Nargess, and Siti Zaleha Abdul Rasid. 2012. Determinants of Enterprise Risk Management Adoption: An Empirical Analysis of Malaysian Public Listed Firms. World Academy of Science, Engineering and Technology, International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering 6: 242–49. [Google Scholar]

- González, Luís Otero, Pablo Durán Santomil, and Aracely Tamayo Herrera. 2020. The Effect of Enterprise Risk Management on the Risk and the Performance of Spanish Listed Companies. European Research on Management and Business Economics 26: 111–20. Available online: https://www.sciencedirect.com/science/article/pii/S2444883420303028 (accessed on 1 September 2020).

- Grullon, Gustavo, Roni Michaely, and Bhaskaran Swaminathan. 2002. Are Dividend Changes a Sign of Firm Maturity? The Journal of Business (Chicago, Ill.) 75: 387–424. [Google Scholar] [CrossRef] [Green Version]

- Hann, Rebecca N., Maria Ogneva, and Oguzhan Ozbas. 2013. Corporate Diversification and the Cost of Capital. The Journal of Finance 68: 1961–99. [Google Scholar] [CrossRef]

- Hoyt, Robert E., and Andre P. Liebenberg. 2008. The Value of Enterprise Risk Management: Evidence from U.S. Insurance Industry. Available online: https://www.soa.org/globalassets/assets/files/resources/essays-monographs/2008-erm-symposium/mono-2008-m-as08-1-hoyt-abstract.pdf (accessed on 5 March 2021).

- Hoyt, Robert E., and Andre P. Liebenberg. 2011. The Value of Enterprise Risk Management. Journal of Risk and Insurance 78: 795–822. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. The American Economic Review 76: 323–29. [Google Scholar]

- Lechner, Philipp, and Nadine Gatzert. 2018. Determinants and Value of Enterprise Risk Management: Empirical Evidence from Germany. The European Journal of Finance 24: 867–87. [Google Scholar] [CrossRef]

- Li, Qiuying, Yue Wu, Udechukwu Ojiako, Alasdair Marshall, and Maxwell Chipulu. 2014. Enterprise Risk Management and Firm Value within China’s Insurance Industry. Acta Commercii 14: e1–e10. [Google Scholar] [CrossRef]

- Liebenberg, André P., and Robert E. Hoyt. 2003. The Determinants of Enterprise Risk Management: Evidence from the Appointment of Chief Risk Officers. Risk Management and Insurance Review 6: 37–52. [Google Scholar] [CrossRef]

- Lin, Yijia, Min-Ming Wen, and Jifeng Yu. 2012. Enterprise Risk Management: Strategic Antecedents, Risk Integration, and Performance. North American Actuarial Journal 16: 1–28. [Google Scholar] [CrossRef]

- Lindenberg, Eric B., and Stephen A. Ross. 1981. Tobin’s Q Ratio and Industrial Organization. The Journal of Business (Chicago, Ill.) 54: 1–32. [Google Scholar] [CrossRef]

- Markowitz, Harry. 1952. Portfolio Selection. Journal of Finance 7: 77–91. [Google Scholar] [CrossRef]

- McShane, Michael K., and Larry A. Cox. 2009. Issuance Decisions and Strategic Focus: The Case of Long-Term Care Insurance. The Journal of Risk and Insurance 76: 87–108. [Google Scholar] [CrossRef]

- McShane, Michael K., Anil Nair, and Elzotbek Rustambekov. 2011. Does Enterprise Risk Management Increase Firm Value? Journal of Accounting, Auditing & Finance 26: 641–58. [Google Scholar] [CrossRef]

- Nguyen, Duc Khuong, and Dinh-Tri Vo. 2020. Enterprise Risk Management and Solvency: The Case of the Listed Eu Insurers. Journal of Business Research 113: 360–69. [Google Scholar] [CrossRef]

- Nocco, Brian W., and René M. Stulz. 2006. Enterprise Risk Management: Theory and Practice. Journal of Applied Corporate Finance 18: 8–20. [Google Scholar] [CrossRef]

- Pagach, Donald, and Richard Warr. 2011. The Characteristics of Firms That Hire Chief Risk Officers. The Journal of Risk and Insurance 78: 185–211. [Google Scholar] [CrossRef]

- Pathan, Shams. 2009. Strong Boards, Ceo Power and Bank Risk-Taking. Journal of Banking & Finance 33: 1340–50. [Google Scholar] [CrossRef]

- Pradier, Pierre-Charles, and Arnaud Chneiweiss. 2017. The Evolution of Insurance Regulation in the Eu since 2005. In Financial Regulation in the Eu: From Resilience to Growth. Edited by Raphaël Douady, Clément Goulet and Pierre-Charles Pradier. Cham: Springer International Publishing, pp. 199–251. [Google Scholar]

- Reeb, David M., Chuck C. Y. Kwok, and Hyungkee Young Baek. 1998. Systematic Risk of the Multinational Corporation. Journal of International Business Studies 29: 263–79. [Google Scholar] [CrossRef]

- Smith, Clifford W., and Ross L. Watts. 1992. The Investment Opportunity Set and Corporate Financing, Dividend, and Compensation Policies. Journal of Financial Economics 32: 263–92. [Google Scholar] [CrossRef]

- Stulz, René M. 2003. Rethinking Risk Management. The Revolution in Corporate Finance, 4th ed. Hoboken: Blackwell Publishing, pp. 367–84. [Google Scholar]

- Stulz, René M. 1996. Rethinking Risk Management. Journal of Applied Corporate Finance 9: 8–25. [Google Scholar] [CrossRef]

- Tahir, Izah Mohd, and Ahmad Rizal Razali. 2011. The Relationship between Enterprise Risk Management and Firm Value: Evidence from Malaysian Public Listed Companies. International Journal of Economics and Management Sciences 1: 32–41. [Google Scholar]

- Tripathy, Niranjan, Da Wu, and Yi Zheng. 2021. Dividends and Financial Health: Evidence from U.S. Bank Holding Companies. Journal of Corporate Finance 66: 101808. [Google Scholar] [CrossRef]

- Von Eije, Henk, Abhinav Goyal, and Cal B. Muckley. 2014. Does the Information Content of Payout Initiations and Omissions Influence Firm Risks? Journal of Econometrics 183: 222–29. [Google Scholar] [CrossRef]

| Variable | Definition | Source |

|---|---|---|

| ERM | ERM = 1, Otherwise = 0. | Annual reports, Bloomberg, and Factiva. |

| Tobin’s Q | (Market Cap + Total Liabilities + Preferred Equity + Minority Interest)/Total Assets. | Bloomberg |

| Total risk | The annualized standard deviation of the relative price change for the 360 most recent trading days closing price. | Bloomberg |

| Systematic risk | Beta is the percent change in the stock price given a 1% change in the market index. | Bloomberg |

| Idiosyncratic risk | The annual standard deviations of residuals are estimated using the daily Fama-French European 3-factor model. | Kenneth French library |

| Dividends | 1 = for years the company has paid dividends, 0 = otherwise. | Bloomberg |

| ERM Leverage | Total Liabilities/Total Assets. | Bloomberg |

| Q Leverage | Total Liabilities/Market Value of Equity. | Bloomberg |

| Opacity | Total Intangible Assets/Total Assets. | Bloomberg |

| Revenue Growth | . | Bloomberg |

| ROA | Trailing 12 Month Net Income/Book Value of Assets. | Bloomberg |

| Size | Natural Logarithm of Total Assets. | Bloomberg |

| Slack | Cash and Marketable Securities/Total Assets. | Bloomberg |

| Big three (Ratings) | 1 = for years the company is rated by one of the big three rating agencies, 0 = otherwise. | Annual Reports |

| Big four (Audit) | 1 = for years the company is audited by one of the big four audit firms, 0 = otherwise. | Annual reports and Bloomberg |

| Industry Div. | 1 = if the firm operates in more than 1 segment, 0 otherwise. | Annual reports and Bloomberg |

| International Div. | 1 = if firm has international operations, 0 otherwise. | Annual reports and Bloomberg |

| Variable | N | Mean | Median | Std. Dev. | Min | Max | t-Test | R.S. Test |

|---|---|---|---|---|---|---|---|---|

| ERM | 1369 | 0.641 | 1.000 | 0.480 | 0.000 | 1.000 | - | - |

| Tobin’s Q | 1369 | 1.182 | 1.030 | 0.504 | 0.685 | 7.665 | 0.154 *** | 0.050 *** |

| Total risk | 1369 | 0.325 | 0.270 | 0.173 | 0.060 | 1.625 | 0.046 *** | 0.050 *** |

| Systematic risk | 1366 | 0.008 | 0.010 | 0.128 | −2.769 | 1.832 | −0.002 | 0.000 |

| Idiosyncratic risk | 1369 | 0.938 | 0.780 | 0.590 | 0.096 | 4.024 | 0.305 *** | 0.190 *** |

| Dividends | 1207 | 0.848 | 1.000 | 0.360 | 0.000 | 1.000 | −0.111 *** | 0.000 *** |

| ERM Leverage | 1369 | 0.846 | 0.900 | 0.148 | 0.247 | 0.994 | −0.068 *** | −0.040 *** |

| Q Leverage | 1369 | 13.154 | 7.740 | 20.163 | 0.078 | 147.219 | −3.207 *** | −3.730 *** |

| Opacity | 1369 | 0.035 | 0.010 | 0.070 | 0.000 | 0.584 | -0.006 | −0.010 *** |

| Revenue growth | 1369 | 0.177 | 0.050 | 0.881 | −0.710 | 8.098 | 0.207 *** | 0.050 *** |

| ROA | 1369 | 0.019 | 0.010 | 0.048 | −0.357 | 0.431 | 0.009 *** | 0.000 *** |

| Size | 1369 | 9.530 | 10.310 | 2.815 | −0.984 | 13.875 | −2.700 *** | −2.110 *** |

| Slack | 1369 | 0.061 | 0.030 | 0.105 | 0.000 | 0.769 | 0.043 *** | 0.000 |

| Big three (Ratings) | 1369 | 0.522 | 1.000 | 0.500 | 0.000 | 1.000 | −0.314 *** | −1.000 *** |

| Big four (Audit) | 1369 | 0.888 | 1.000 | 0.316 | 0.000 | 1.000 | −0.221 *** | 0.000 *** |

| Industry Div. | 1369 | 0.970 | 1.000 | 0.171 | 0.000 | 1.000 | −0.017 * | 0.000 * |

| International Div. | 1369 | 0.768 | 1.000 | 0.422 | 0.000 | 1.000 | −0.264 *** | 0.000 *** |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. ERM | 1.000 | ||||||||||||||||

| 2. Tobin’s Q | −0.147 | 1.000 | |||||||||||||||

| 3. Total risk | −0.129 | −0.078 | 1.000 | ||||||||||||||

| 4. Systematic risk | 0.008 | −0.005 | 0.003 | 1.000 | |||||||||||||

| 5. Idiosyncratic risk | −0.248 | 0.159 | 0.157 | 0.005 | 1.000 | ||||||||||||

| 6. Dividends | 0.141 | −0.016 | −0.197 | −0.021 | −0.313 | 1.000 | |||||||||||

| 7. ERM Leverage | 0.221 | −0.472 | 0.002 | −0.002 | −0.322 | 0.059 | 1.000 | ||||||||||

| 8. Q Leverage | 0.076 | −0.176 | 0.152 | −0.083 | −0.005 | −0.090 | 0.376 | 1.000 | |||||||||

| 9. Opacity | 0.038 | 0.319 | −0.103 | −0.004 | 0.012 | 0.046 | −0.335 | −0.193 | 1.000 | ||||||||

| 10. Revenue growth | −0.113 | 0.033 | 0.167 | 0.004 | 0.135 | −0.082 | −0.145 | −0.020 | 0.030 | 1.000 | |||||||

| 11. ROA | −0.093 | 0.566 | −0.155 | −0.014 | 0.099 | 0.115 | −0.586 | −0.243 | 0.200 | 0.026 | 1.000 | ||||||

| 12. Size | 0.460 | −0.421 | −0.176 | 0.005 | −0.496 | 0.253 | 0.568 | 0.163 | −0.215 | −0.137 | −0.261 | 1.000 | |||||

| 13. Slack | −0.198 | 0.517 | 0.069 | 0.001 | 0.264 | −0.067 | −0.517 | −0.189 | 0.241 | 0.055 | 0.383 | −0.470 | 1.000 | ||||

| 14. Big three (Ratings) | 0.302 | −0.216 | −0.079 | −0.029 | −0.162 | 0.184 | 0.243 | 0.162 | −0.050 | −0.080 | −0.140 | 0.524 | −0.188 | 1.000 | |||

| 15. Big four (Audit) | 0.336 | −0.212 | −0.147 | −0.004 | −0.420 | 0.294 | 0.356 | 0.105 | −0.080 | −0.091 | −0.164 | 0.560 | −0.290 | 0.220 | 1.000 | ||

| 16. Industry Div. | 0.047 | −0.043 | −0.139 | −0.002 | −0.224 | 0.137 | −0.057 | −0.002 | −0.020 | −0.112 | 0.075 | 0.188 | −0.061 | 0.175 | 0.155 | 1.000 | |

| 17. International Div. | 0.300 | −0.256 | −0.093 | 0.030 | −0.441 | 0.303 | 0.325 | 0.065 | −0.023 | −0.115 | −0.175 | 0.476 | −0.341 | 0.276 | 0.336 | 0.066 | 1.000 |

| Variable | ERM |

|---|---|

| ERM Leverage | −5.636 ** |

| (2.527) | |

| Opacity | 12.452 *** |

| (4.284) | |

| Size | 2.308 *** |

| (0.275) | |

| Slack | −1.478 |

| (3.334) | |

| Big three (Ratings) | 2.646 *** |

| (0.604) | |

| Big four (Audit) | 1.371 ** |

| (0.595) | |

| Industry Div. | −0.302 |

| (1.111) | |

| International Div. | 0.862 |

| (0.920) | |

| Constant | −19.584 *** |

| (2.979) | |

| Number of Obs. | 1369 |

| Number of Clusters (Firms) | 80 |

| Wald test (Chi-squared) | 126.33 *** |

| Variable | Tobin’s Q | ERM |

|---|---|---|

| ERM | 0.534 *** | |

| (0.101) | ||

| Dividends | −0.014 | |

| (0.054) | ||

| ERM Leverage | −0.221 | |

| (1.036) | ||

| Q Leverage | 0.00004 | |

| (0.001) | ||

| Opacity | 3.778 *** | |

| (1.185) | ||

| Revenue growth | −0.014 | |

| (0.014) | ||

| ROA | 5.768 *** | |

| (1.315) | ||

| Size | −0.084 *** | 0.170 *** |

| (0.019) | (0.049) | |

| Slack | 0.706 | |

| (0.855) | ||

| Big three (Ratings) | 0.209 | |

| (0.128) | ||

| Big four (Audit) | 0.850 *** | |

| (0.288) | ||

| Industry Div. | −0.145 | −0.406 |

| (0.205) | (0.631) | |

| International Div. | −0.105 | 0.215 |

| (0.082) | (0.229) | |

| Constant | 1.756 *** | −1.902 * |

| (0.243) | (0.995) | |

| Number of Obs. | 1207 | |

| Number of Clusters (Firms) | 77 | |

| Wald test (Chi-squared) | 58.60 *** | |

| Wald test of indep. equations | 17.23 *** |

| Variable | Total Risk | ERM |

|---|---|---|

| ERM | −0.280 *** | |

| (0.033) | ||

| Dividends | −0.051 ** | |

| (0.020) | ||

| ERM Leverage | −0.782 | |

| (0.554) | ||

| Q Leverage | 0.001 *** | |

| (0.0004) | ||

| Opacity | 2.243 ** | |

| (1.090) | ||

| Revenue growth | 0.013 | |

| (0.010) | ||

| ROA | −0.224 | |

| (0.200) | ||

| Size | 0.009 * | 0.184 *** |

| (0.005) | (0.045) | |

| Slack | −0.794 | |

| (0.736) | ||

| Big three (Ratings) | 0.135 | |

| (0.116) | ||

| Big four (Audit) | 0.609 ** | |

| (0.277) | ||

| Industry Div. | −0.133 ** | −0.461 |

| (0.067) | (0.359) | |

| International Div. | 0.057 * | 0.173 |

| (0.031) | (0.202) | |

| Constant | 0.543 *** | −1.005 * |

| (0.057) | (0.606) | |

| Number of Obs. | 1207 | |

| Number of Clusters (Firms) | 77 | |

| Wald test (Chi-squared) | 179.19 *** | |

| Wald test of indep. equations | 42.44 *** |

| Panel A | Panel B | |||

|---|---|---|---|---|

| Variable | Systematic Risk | ERM | Idiosyncratic Risk | ERM |

| ERM | −0.165 ** | −0.743 *** | ||

| (0.069) | (0.151) | |||

| Dividends | −0.010 | −0.203 *** | ||

| (0.009) | (0.076) | |||

| ERM Leverage | −0.390 | 0.924 | ||

| (0.560) | (1.119) | |||

| Q Leverage | −0.0006 ** | 0.003 | ||

| (0.0003) | (0.002) | |||

| Opacity | 1.724 ** | 4.384 *** | ||

| (0.849) | (1.375) | |||

| Revenue growth | 0.0004 | −0.024 | ||

| (0.001) | (0.022) | |||

| ROA | −0.086 | −0.230 | ||

| (0.073) | (1.416) | |||

| Size | 0.010 ** | 0.149 *** | −0.016 | 0.128 *** |

| (0.005) | (0.038) | (0.022) | (0.045) | |

| Slack | −0.602 | −1.091 | ||

| (0.670) | (0.760) | |||

| Big three (Ratings) | 0.225 | −0.061 | ||

| (0.146) | (0.170) | |||

| Big four (Audit) | 0.362 | 1.006 *** | ||

| (0.243) | (0.260) | |||

| Industry Div. | −0.011 | −0.419 | −0.385 | −0.405 |

| (0.029) | (0.384) | (0.323) | (0.337) | |

| International Div. | 0.030 | 0.191 | −0.241 ** | 0.207 |

| (0.018) | (0.212) | (0.122) | (0.242) | |

| Constant | 0.030 | −0.849 | 2.289 *** | −2.304 ** |

| (0.030) | (0.607) | (0.402) | (1.021) | |

| Number of Obs. | 1207 | 1207 | ||

| Number of Clusters (Firms) | 77 | 77 | ||

| Wald test (Chi-squared) | 12.15 | 60.77 *** | ||

| Wald test of indep. equations | 4.95 ** | 28.72 *** | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jurdi, D.J.; AlGhnaimat, S.M. The Effects of ERM Adoption on European Insurance Firms Performance and Risks. J. Risk Financial Manag. 2021, 14, 554. https://doi.org/10.3390/jrfm14110554

Jurdi DJ, AlGhnaimat SM. The Effects of ERM Adoption on European Insurance Firms Performance and Risks. Journal of Risk and Financial Management. 2021; 14(11):554. https://doi.org/10.3390/jrfm14110554

Chicago/Turabian StyleJurdi, Doureige J., and Sam M. AlGhnaimat. 2021. "The Effects of ERM Adoption on European Insurance Firms Performance and Risks" Journal of Risk and Financial Management 14, no. 11: 554. https://doi.org/10.3390/jrfm14110554

APA StyleJurdi, D. J., & AlGhnaimat, S. M. (2021). The Effects of ERM Adoption on European Insurance Firms Performance and Risks. Journal of Risk and Financial Management, 14(11), 554. https://doi.org/10.3390/jrfm14110554