Forecasting Commodity Prices Using the Term Structure

Abstract

:1. Introduction

2. Literature Review

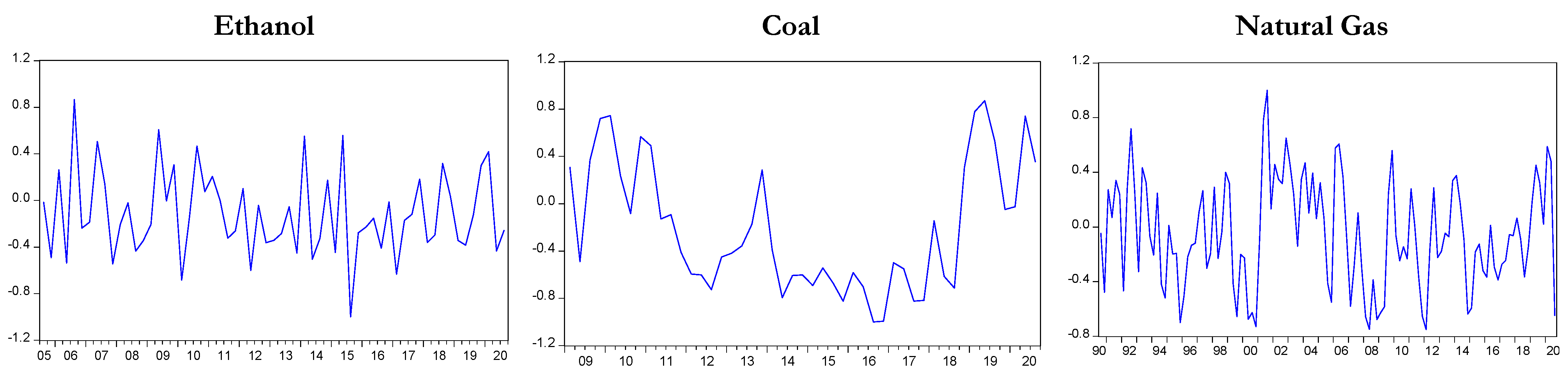

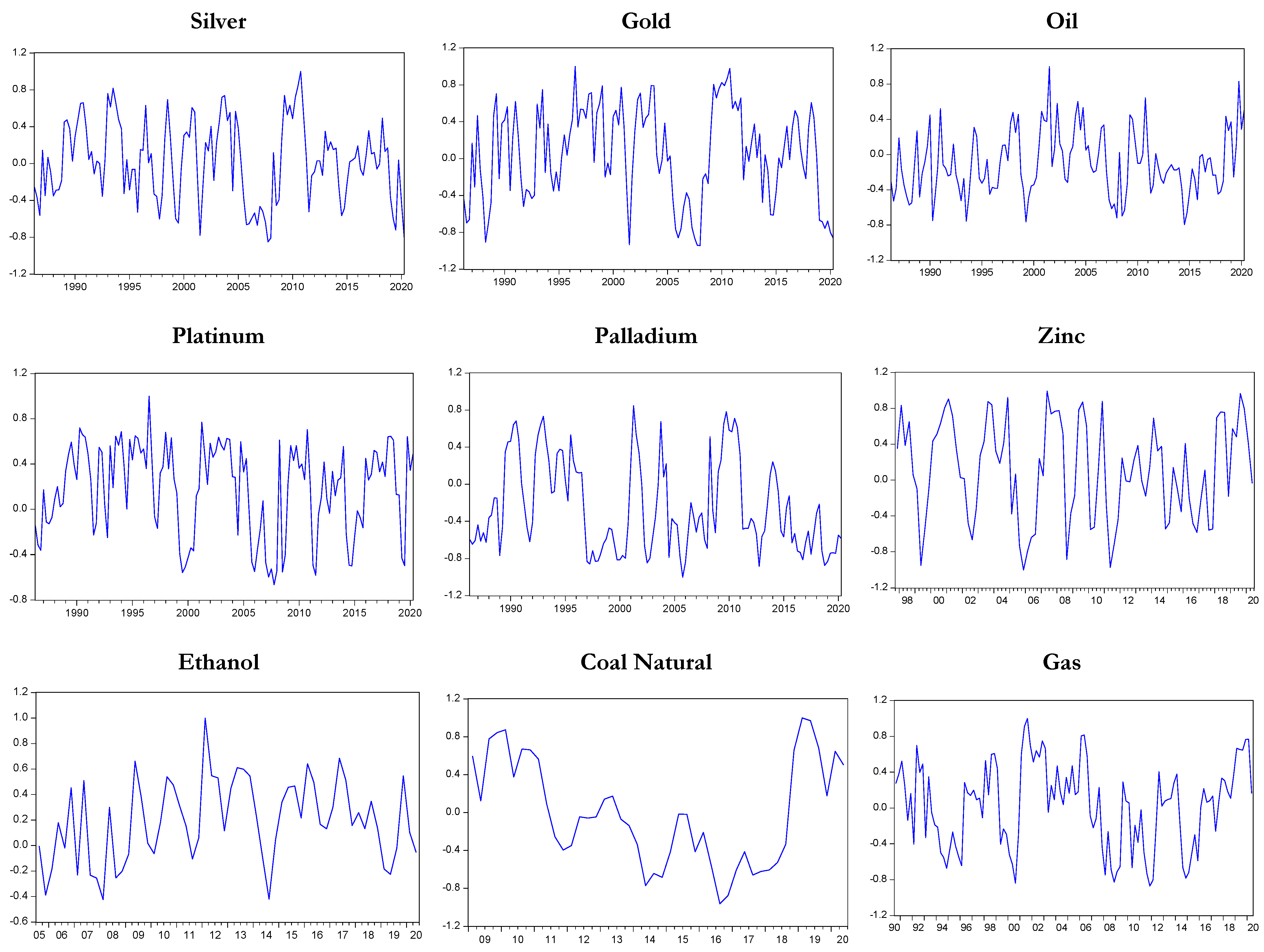

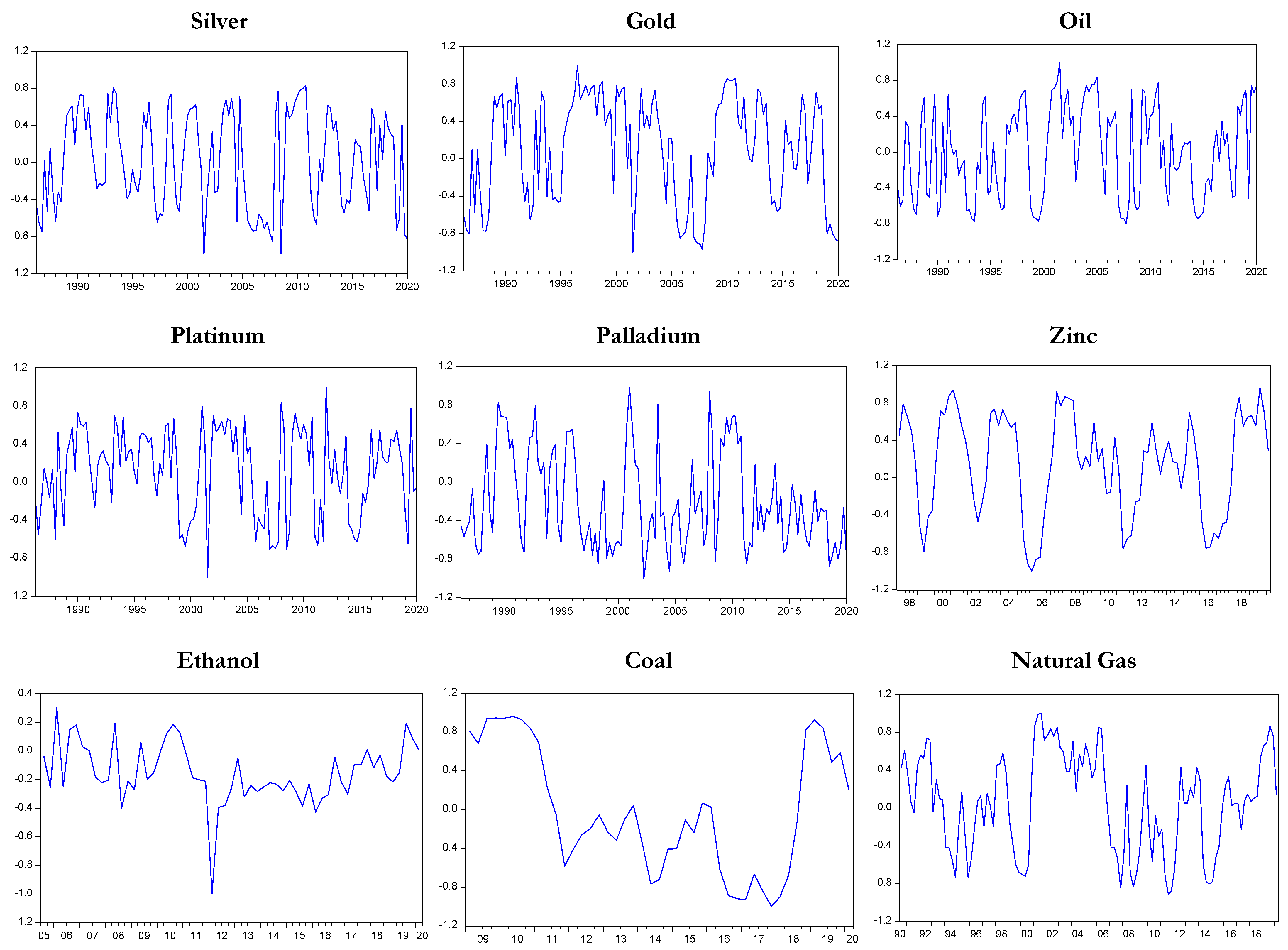

3. Data

4. Method

5. Empirical Findings

6. Robustness Checks

6.1. Additional Proxies for Yield

6.2. Commodity Prices following Periods of Non-Positive Yield Spreads

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A

| Accumulated Returns after: | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 2 Months | 3 Months | 4 Months | 5 Months | 6 Months | 7 Months | 8 Months | 9 Months | 10 Months | |

| Oil | −50.9% | −66.1% | −33.4% | −22.4% | −17.3% | −13.1% | −19.3% | −22.7% | −8.4% | −1.6% |

| Silver | −18.4% | −16.1% | −2.9% | −1.6% | 25.4% | 44.4% | 26.5% | 34.2% | 28.4% | 42.6% |

| Gold | −0.8% | 4.7% | 5.4% | 7.0% | 15.2% | 16.1% | 12.8% | 15.5% | 9.6% | 14.5% |

| PLTNM | −20.0% | −17.0% | −4.9% | −13.9% | 1.7% | 0.2% | −9.7% | −6.4% | 4.0% | 11.9% |

| PLDM | −14.0% | −25.0% | −25.3% | −31.1% | −13.4% | −18.0% | −16.6% | −10.5% | −11.5% | −10.8% |

| Zinc | −9.4% | −7.1% | −1.6% | 1.3% | 9.9% | 22.2% | 16.9% | 25.4% | 35.9% | 41.7% |

| Ethanol | −29.6% | −27.5% | −14.3% | −12.0% | −10.9% | −0.4% | 1.6% | 21.5% | 6.2% | 2.3% |

| Coal | −2.3% | −10.0% | −23.5% | −21.6% | −23.4% | −26.7% | −22.2% | −14.6% | −6.1% | 17.8% |

| Nat.Gas | −10.2% | −5.5% | −6.3% | −19.8% | −2.1% | 34.8% | 15.8% | 63.7% | 56.8% | 46.2% |

| Panel A | ||||||||||||||||

| Forecast Horizon | Oil (1986:01–2020:12) | Silver (1986:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 5.92 | −0.79 | −0.55 | 9.32 | −14.07b | 0.11 | 0.03 | 139 | 1.67 | 1.06 | −0.85 | −10.29 | −4.90 | 0.06 | −0.01 | 139 |

| (0.45) | (−0.12) | (−0.08) | (0.56) | (−2.43) | (1.08) | (0.21) | (0.28) | (−0.21) | (−1.04) | (−1.44) | (0.99) | |||||

| 2 | 7.33 | −1.74 | −5.23 | 2.47 | −3.76 | 0.04 | −0.01 | 138 | 3.12 | 1.40 | −3.50 | −6.35 | −4.05c | −0.05 | 0.02 | 138 |

| (0.84) | (−0.41) | (−1.16) | (0.22) | (−0.99) | (0.66) | (0.58) | (0.54) | (−1.26) | (−0.93) | (−1.73) | (−1.10) | |||||

| 3 | 4.84 | −0.54 | −5.93 | −9.86 | −5.02 | −0.02 | 0.04 | 137 | −0.37 | 2.76 | −2.12 | −8.83 | −5.06a | −0.03 | 0.05 | 137 |

| (0.75) | (−0.17) | (−1.81) | (−1.23) | (−1.75) | (−0.35) | (−0.09) | (1.32) | (−0.96) | (−1.64) | (−2.62) | (−0.77) | |||||

| 4 | 4.49 | −1.48 | −2.40 | −5.33 | 6.23 | −0.01 | −0.01 | 136 | 0.69 | 2.56 | −3.33c | −0.55 | −0.82 | −0.04 | 0.02 | 136 |

| (0.84) | (−0.56) | (−0.85) | (−0.80) | (1.17) | (−0.25) | (0.19) | (1.42) | (−1.71) | (−0.12) | (−0.23) | (−1.38) | |||||

| Forecast Horizon | Gold (1986:01–2020:12) | Platinum (1986:04–2020:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 3.73 | 0.54 | 1.61 | −1.05 | −2.52 | 0.01 | −0.02 | 138 | 3.32 | −0.56 | −3.60 | −8.25 | −1.92 | 0.02 | −0.02 | 139 |

| (0.86) | (0.26) | (0.73) | (−0.20) | (−1.37) | (0.45) | (0.46) | (−0.16) | (−0.96) | (−0.91) | (−0.61) | (0.4) | |||||

| 2 | 5.19c | 0.43 | −2.09 | 2.21 | −1.25 | −0.03 | 0.01 | 137 | 3.83 | −0.31 | −6.05b | −5.14 | 0.50 | −0.03 | 0.02 | 138 |

| (1.76) | (0.30) | (−1.37) | (0.60) | (−0.97) | (−1.14) | (0.79) | (−0.13) | (−2.43) | (−0.84) | (0.24) | (−0.87) | |||||

| 3 | 4.68c | 0.33 | −0.91 | 1.45 | −1.05 | −0.02 | −0.01 | 136 | 0.63 | 1.01 | −2.32 | −7.80c | −1.71 | −0.04 | 0.02 | 137 |

| (1.84) | (0.27) | (−0.71) | (0.46) | (−0.93) | (−0.85) | (0.17) | (0.55) | (−1.21) | (−1.66) | (−1.02) | (−1.44) | |||||

| 4 | 5.25b | 0.38 | −1.91 | 3.31 | −2.83 | −0.02 | 0.01 | 135 | 1.19 | 0.56 | −1.71 | −0.17 | 4.16 | −0.04c | 0.02 | 136 |

| (2.34) | (0.34) | (−1.61) | (1.19) | (−1.27) | (−1.22) | (0.38) | (0.36) | (−1.03) | (−0.04) | (1.34) | (−1.8) | |||||

| Forecast Horizon | Palladium (1986:04–2020:12) | Zinc (1997:08–2020:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 19.89c | −6.40 | −12.07b | −7.36 | 8.63c | 0.03 | 0.03 | 139 | −1.27 | 0.56 | −6.60 | −15.05 | 0.07 | 0.17b | 0.01 | 93 |

| (1.94) | (−1.29) | (−2.27) | (−0.57) | (1.93) | (0.37) | (−0.13) | (0.11) | (−1.3) | (−1.07) | (0.02) | (2.03) | |||||

| 2 | 16.52b | −4.10 | −7.36c | −10.51 | 4.02 | −0.05 | 0.02 | 138 | −2.35 | 2.75 | −2.46 | −11.65 | −0.71 | 0.03 | −0.03 | 92 |

| (2.16) | (−1.11) | (−1.87) | (−1.1) | (1.21) | (−0.92) | (−0.3) | (0.7) | (−0.61) | (−1.05) | (−0.23) | (0.45) | |||||

| 3 | 11.65c | −1.77 | −0.97 | −5.21 | 2.92 | −0.03 | −0.02 | 137 | −6.15 | 5.27 | −2.60 | −5.86 | −2.95 | 0.02 | −0.01 | 91 |

| (1.78) | (−0.56) | (−0.29) | (−0.64) | (1) | (−0.69) | (−0.91) | (1.59) | (−0.77) | (−0.63) | (−1.07) | (0.43) | |||||

| 4 | 9.71c | −1.60 | 0.49 | −1.63 | 13.19b | −0.03 | 0.01 | 136 | −6.83 | 6.04b | −1.16 | 7.09 | 3.45 | 0.02 | 0.01 | 90 |

| (1.72) | (−0.57) | (0.16) | (−0.23) | (2.35) | (−0.72) | (−1.14) | (2.05) | (−0.37) | (0.86) | (0.57) | (0.38) | |||||

| Forecast Horizon | Ethanol (2005:06–2020:12) | Coal (2009:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −1.39 | −0.65 | 3.71 | 47.44c | −7.37 | 0.20 | 0.07 | 62 | 4.07 | −0.18 | −3.93 | −14.93 | 9.82b | −0.12 | 0.10 | 48 |

| (−0.07) | (−0.07) | (0.35) | (1.95) | (−1.12) | (1.35) | (0.26) | (−0.03) | (−0.54) | (−0.84) | (2.45) | (−1.11) | |||||

| 2 | −5.25 | −0.63 | 1.61 | −2.20 | −7.50c | 0.13 | 0.02 | 61 | −1.02 | 2.98 | −5.38 | −16.73 | 5.05c | −0.20b | 0.15 | 47 |

| (−0.43) | (−0.1) | (0.25) | (−0.15) | (−1.85) | (1.47) | (−0.09) | (0.55) | (−1.02) | (−1.29) | (1.72) | (−2.42) | |||||

| 3 | −5.53 | 0.68 | −0.35 | −8.83 | −5.12c | 0.01 | −0.03 | 60 | −13.96 | 7.81 | −1.61 | −12.06 | −1.60 | −0.13c | 0.07 | 46 |

| (−0.63) | (0.16) | (−0.08) | (−0.83) | (−1.7) | (0.12) | (−1.34) | (1.66) | (−0.36) | (−1.1) | (−0.61) | (−1.84) | |||||

| 4 | −3.89 | 0.66 | −3.32 | 2.19 | 0.06 | −0.02 | −0.07 | 59 | −12.55 | 6.48 | −1.08 | −7.51 | 1.56 | −0.06 | −0.01 | 45 |

| (−0.58) | (0.2) | (−0.87) | (0.27) | (0.01) | (−0.33) | (−1.3) | (1.48) | (−0.24) | (−0.74) | (0.23) | (−0.93) | |||||

| Forecast Horizon | Natural gas (1990:05–2020:12) | |||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 5.82 | −3.09 | 15.11c | 15.35 | 1.91 | 0.00 | 0.00 | 122 | ||||||||

| (0.36) | (−0.4) | (1.87) | (0.74) | (0.29) | (−0.01) | |||||||||||

| 2 | −0.62 | 0.29 | 2.48 | −14.15 | −3.37 | 0.02 | −0.03 | 121 | ||||||||

| (−0.06) | (0.05) | (0.45) | (−1) | (−0.73) | (0.22) | |||||||||||

| 3 | −6.55 | 2.69 | −0.25 | −26.80b | −5.08 | 0.06 | 0.02 | 120 | ||||||||

| (−0.75) | (0.65) | (−0.06) | (−2.46) | (−1.38) | (0.85) | |||||||||||

| 4 | −5.93 | 1.55 | 1.67 | −16.60c | 12.51c | 0.04 | 0.03 | 119 | ||||||||

| (−0.86) | (0.47) | (0.47) | (−1.93) | (1.85) | (0.7) | |||||||||||

| Panel B | ||||||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −0.10 | −0.53 | 0.86 | 16.77 | −15.95b | 0.17 | 0.04 | 68 | 11.98 | −4.06 | −2.96 | −13.37 | −4.65 | 0.11 | −0.03 | 68 |

| (0.00) | (−0.05) | (0.07) | (0.61) | (−2.11) | (1.01) | (0.86) | (−0.6) | (−0.4) | (−0.77) | (−0.98) | (1.09) | |||||

| 2 | 3.69 | −2.15 | 0.72 | 9.54 | −5.95 | 0.08 | −0.03 | 67 | 16.38c | −4.37 | −7.96 | −11.18 | −3.03 | −0.06 | 0.06 | 67 |

| (0.25) | (−0.3) | (0.09) | (0.52) | (−1.2) | (0.73) | (1.77) | (−0.98) | (−1.63) | (−0.98) | (−0.97) | (−0.9) | |||||

| 3 | −0.32 | 0.45 | −6.34 | −16.19 | −6.44c | −0.02 | 0.03 | 66 | 9.86 | −1.47 | −4.98 | −11.62 | −4.22 | −0.03 | 0.05 | 66 |

| (−0.03) | (0.08) | (−1.1) | (−1.21) | (−1.68) | (−0.27) | (1.29) | (−0.4) | (−1.26) | (−1.27) | (−1.6) | (−0.54) | |||||

| 4 | −0.25 | −0.17 | −1.22 | −1.81 | 8.51 | −0.03 | −0.05 | 65 | 10.70c | −0.62 | −6.94c | 3.41 | −0.20 | −0.06 | 0.03 | 65 |

| (−0.03) | (−0.04) | (−0.24) | (−0.17) | (1.04) | (−0.44) | (1.7) | (−0.21) | (−1.98) | (0.45) | (−0.03) | (−1.23) | |||||

| Forecast Horizon | Gold (2004:01–2020:12) | Platinum (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 13.40b | −2.83 | −0.20 | 3.97 | −1.68 | 0.02 | −0.03 | 68 | 7.99 | −5.32 | −5.15 | 0.76 | −1.60 | 0.13 | −0.02 | 68 |

| (2.15) | (−0.94) | (−0.06) | (0.51) | (−0.79) | (0.45) | (0.66) | (−0.9) | (−0.79) | (0.05) | (−0.39) | (1.41) | |||||

| 2 | 15.01a | −2.91 | −3.22 | 0.05 | −0.50 | −0.03 | 0.02 | 67 | 11.86 | −5.76 | −10.43b | −1.19 | 1.81 | −0.01 | 0.05 | 67 |

| (3.24) | (−1.31) | (−1.31) | (0.01) | (−0.32) | (−0.96) | (1.44) | (−1.45) | (−2.4) | (−0.12) | (0.65) | (−0.17) | |||||

| 3 | 14.24a | −2.59 | −1.62 | 1.16 | −0.16 | −0.02 | −0.02 | 66 | 7.39 | −3.57 | −4.49 | −9.43 | −1.74 | −0.05 | 0.05 | 66 |

| (3.44) | (−1.31) | (−0.76) | (0.23) | (−0.11) | (−0.67) | (1.16) | (−1.17) | (−1.36) | (−1.23) | (−0.79) | (−1.04) | |||||

| 4 | 15.03a | −2.38 | −2.94 | 5.51 | −1.90 | −0.03 | 0.06 | 65 | 7.35 | −3.13 | −3.70 | 2.13 | 2.23 | −0.05 | 0.02 | 65 |

| (4.32) | (−1.42) | (−1.52) | (1.31) | (−0.6) | (−1.29) | (1.43) | (−1.26) | (−1.29) | (0.34) | (0.47) | (−1.31) | |||||

| Forecast Horizon | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 25.75 | −8.22 | −8.27 | −5.39 | 6.03 | 0.15 | −0.01 | 68 | 8.68 | −4.06 | −15.79b | −15.38 | 2.54 | 0.22b | 0.06 | 68 |

| (1.66) | (−1.09) | (−0.99) | (−0.28) | (1.14) | (1.26) | (0.66) | (−0.63) | (−2.23) | (−0.93) | (0.56) | (2.19) | |||||

| 2 | 29.00a | −8.33 | −8.79 | −15.25 | 2.57 | −0.06 | 0.03 | 67 | 5.83 | −0.67 | −6.85 | −9.64 | 0.78 | 0.03 | −0.05 | 67 |

| (2.64) | (−1.58) | (−1.51) | (−1.13) | (0.69) | (−0.73) | (0.53) | (−0.13) | (−1.19) | (−0.72) | (0.21) | (0.37) | |||||

| 3 | 23.67b | −5.24 | −2.35 | −12.46 | 0.92 | −0.07 | −0.01 | 66 | −0.61 | 3.31 | −5.75 | −3.17 | −1.63 | 0.01 | −0.04 | 66 |

| (2.54) | (−1.18) | (−0.49) | (−1.11) | (0.29) | (−1.06) | (−0.06) | (0.73) | (−1.17) | (−0.28) | (−0.5) | (0.13) | |||||

| 4 | 21.04a | −3.07 | −3.58 | −4.10 | 1.08 | −0.07 | −0.02 | 65 | −2.05 | 4.53 | −2.82 | 10.35 | 3.08 | 0.00 | −0.03 | 65 |

| (2.65) | (−0.8) | (−0.81) | (−0.43) | (0.15) | (−1.26) | (−0.24) | (1.12) | (−0.6) | (1.02) | (0.4) | (0) | |||||

| Forecast Horizon | Natural gas (2004:01–2020:12) | |||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 4.42 | −5.06 | 17.53c | 29.15 | 0.44 | −0.03 | −0.01 | 68 | ||||||||

| (0.23) | (−0.54) | (1.68) | (1.2) | (0.07) | (−0.2) | |||||||||||

| 2 | 1.56 | −5.31 | 2.90 | −6.76 | −4.44 | 0.06 | −0.05 | 67 | ||||||||

| (0.11) | (−0.77) | (0.38) | (−0.38) | (−0.92) | (0.58) | |||||||||||

| 3 | −1.68 | −4.13 | −1.47 | −18.22 | −5.65 | 0.04 | −0.01 | 66 | ||||||||

| (−0.15) | (−0.75) | (−0.25) | (−1.32) | (−1.43) | (0.51) | |||||||||||

| 4 | −0.06 | −5.29 | −0.68 | −10.39 | 11.01 | 0.03 | −0.01 | 65 | ||||||||

| (−0.01) | (−1.23) | (−0.14) | (−0.96) | (1.35) | (0.42) | |||||||||||

| Panel A | ||||||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | ||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 10.68 | −5.04 | 0.38 | −2.13 | 10.18 | 0.04 | −0.06 | 72 | −12.36 | 10.33 ** (0.03) | 0.09 | −11.41 | −3.41 | 0.06 | 0.02 | 72 |

| 2 | 9.29 | −2.61 | −9.56 * (0.07) | −5.23 | 9.22 | 0.00 | 0.00 | 72 | −10.04 * (0.05) | 8.40 *** (0.01) | 0.54 | −6.30 | −1.82 | −0.01 | 0.05 | 72 |

| 3 | 7.75 | −0.90 | −5.37 | −4.32 | 1.16 | 0.03 | −0.03 | 72 | −10.75 *** (0.01) | 8.55 *** (0.00) | 0.40 | −9.64 * (0.09) | −2.06 | 0.00 | 0.13 | 72 |

| 4 | 6.47 | −0.83 | −3.00 | −7.62 | 1.38 | 0.04 | −0.03 | 72 | −10.23 *** (0.00) | 8.30 *** (0.00) | −0.13 | −7.98 * (0.09) | −1.94 | 0.00 | 0.18 | 72 |

| Forecast Horizon | Gold (1986:01–2003:12) | Platinum (1986:04–2003:12) | ||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −8.47 | 5.17 | 4.41 | −10.64 | 3.55 | 0.01 | 0.03 | 70 | −3.87 | 4.24 | −1.97 | −22.85 | 7.19 | −0.07 | 0.05 | 72 |

| 2 | −4.65 | 5.43 *** (0.01) | −1.55 | 2.89 | −4.56 | −0.01 | 0.07 | 70 | −4.31 | 4.94 * (0.08) | −1.66 | −14.42 ** (0.03) | 3.87 | −0.03 | 0.07 | 72 |

| 3 | −4.99 * (0.05) | 4.71 *** (0.00) | −0.59 | 0.26 | −2.62 | −0.01 | 0.09 | 70 | −5.63 | 5.03 ** (0.02) | 0.32 | −10.42 * (0.05) | 6.87 | −0.01 | 0.11 | 72 |

| 4 | −5.03 ** (0.03) | 4.71 *** (0.00) | −0.98 | −0.86 | −3.38 | −0.01 | 0.12 | 70 | −5.16 | 5.25 *** (0.01) | −0.22 | −5.71 | 5.58 | −0.02 | 0.11 | 72 |

| Forecast Horizon | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | ||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 11.59 | −7.16 | −14.61 * (0.05) | −12.90 | 33.00 ** (0.04) | −0.09 | 0.08 | 72 | −21.33 * (0.06) | 9.16 | 8.23 | −25.35 | 11.31 | 0.03 | 0.10 | 26 |

| 2 | 7.05 | −5.81 | −3.70 | −11.63 | 31.04 *** (0.01) | −0.07 | 0.06 | 72 | −16.97 ** (0.04) | 7.48 | 6.01 | −27.80 | 6.11 | 0.01 | 0.16 | 26 |

| 3 | 3.32 | −4.93 | 3.38 | −4.13 | 36.35 *** (0.00) | −0.02 | 0.14 | 72 | −15.35 ** (0.02) | 7.55 ** (0.04) | 3.84 | −25.00 * (0.09) | −0.50 | 0.08 | 0.23 | 26 |

| 4 | 1.79 | −3.31 | 3.58 | −4.30 | 30.21 *** (0.00) | −0.02 | 0.11 | 72 | −15.03 *** (0.01) | 8.66 *** (0.01) | 2.34 | −12.80 | 3.54 | 0.09 | 0.28 | 26 |

| Forecast Horizon | Natural gas (1990:05–2003:12) | |||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 4.59 | −4.38 | 18.18 | −12.43 | 36.19 | 0.01 | −0.04 | 55 | ||||||||

| 2 | −3.53 | 3.48 | 5.06 | −33.81 | 22.93 | −0.03 | −0.03 | 55 | ||||||||

| 3 | −12.73 | 7.90 | 5.30 | −49.78 *** (0.00) | 23.53 * (0.09) | 0.11 | 0.15 | 55 | ||||||||

| 4 | −9.98 | 8.53 | 4.29 | −31.91 ** (0.02) | 14.60 | 0.09 | 0.10 | 55 | ||||||||

| Panel B | ||||||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 0.01 | −0.71 | 0.87 | 16.72 | −15.96 ** (0.04) | 0.17 | 0.04 | 67 | 13.07 | −6.08 | −2.52 | −14.07 | −4.75 | 0.08 | −0.03 | 67 |

| 2 | 3.06 | −2.22 | 0.81 | 9.33 | −6.02 * (0.09) | 0.07 | −0.03 | 66 | 15.64 * (0.09) | −4.56 | −7.99 | −11.44 | −3.10 | −0.06 | 0.06 | 66 |

| 3 | 2.19 | −1.56 | −6.05 | −16.46 | −6.38 | −0.04 | 0.04 | 65 | 10.99 | −2.58 | −4.89 | −11.82 | −4.20 | −0.04 | 0.06 | 65 |

| 4 | 1.64 | −1.67 | −1.05 | −1.99 | 8.65 | −0.04 | −0.05 | 64 | 11.94 * (0.05) | −1.64 | −6.86 * (0.06) | 3.29 | −0.10 | −0.06 | 0.03 | 64 |

| Forecast Horizon | Gold (2004:01–2020:12) | Platinum (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 12.91 ** (0.03) | −2.92 | −0.23 | 3.82 | −1.73 | 0.02 | −0.03 | 67 | 6.12 | −5.08 | −5.07 | 0.34 | −1.76 | 0.12 | −0.03 | 67 |

| 2 | 14.64 *** (0.00) | −3.10 | −3.25 | −0.10 | −0.54 | −0.03 | 0.02 | 66 | 9.76 | −5.21 | −10.51 ** (0.02) | −1.47 | 1.68 | −0.01 | 0.04 | 66 |

| 3 | 14.14 *** (0.00) | −2.91 | −1.65 | 1.01 | −0.19 | −0.02 | −0.02 | 65 | 7.63 | −4.39 | −4.44 | −9.72 | −1.78 | −0.05 | 0.06 | 65 |

| 4 | 15.12 *** (0.00) | −2.78 | −2.98 | 5.36 | −2.01 | −0.03 | 0.07 | 64 | 7.83 | −4.00 | −3.69 | 1.85 | 2.06 | −0.05 | 0.03 | 64 |

| Forecast Horizon | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 24.57 * (0.09) | −9.53 | −7.76 | −6.41 | 5.78 | 0.10 | −0.02 | 67 | 9.45 | −5.33 | −15.72 ** (0.03) | −15.73 | 2.51 | 0.21 ** (0.04) | 0.06 | 67 |

| 2 | 26.18 ** (0.02) | −7.80 | −8.83 | −15.73 | 2.36 | −0.06 | 0.02 | 66 | 6.95 | −1.46 | −6.89 | −9.66 | 0.83 | 0.03 | −0.05 | 66 |

| 3 | 23.33 *** (0.01) | −5.92 | −2.31 | −12.83 | 0.82 | −0.07 | −0.01 | 65 | 2.55 | 1.68 | −5.68 | −3.06 | −1.41 | 0.01 | −0.05 | 65 |

| 4 | 21.35 *** (0.00) | −3.68 | −3.65 | −4.26 | 1.01 | −0.07 | −0.02 | 64 | 1.63 | 2.63 | −2.57 | 10.56 | 3.89 | −0.01 | −0.05 | 64 |

| Forecast Horizon | Natural Gas (2004:01–2020:12) | |||||||||||||||

| h | C | (Y10-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 1.86 | −3.96 | 17.37 | 28.99 | 0.32 | −0.02 | −0.01 | 67 | ||||||||

| 2 | −0.63 | −4.66 | 2.84 | −7.03 | −4.58 | 0.06 | −0.05 | 66 | ||||||||

| 3 | −2.01 | −4.66 | −1.41 | −18.54 | −5.74 | 0.04 | −0.01 | 65 | ||||||||

| 4 | −1.42 | −5.19 | −0.79 | −10.76 | 10.45 | 0.03 | −0.01 | 64 | ||||||||

| Panel A | ||||||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | ||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 10.51 | −6.94 | 0.47 | −2.11 | 9.52 | 0.04 | −0.06 | 72 | −11.02 | 13.14 ** (0.02) | −0.01 | −11.22 | −1.76 | 0.06 | 0.03 | 72 |

| 2 | 8.54 | −2.87 | −9.57 * (0.07) | −5.37 | 8.69 | 0.00 | 0.00 | 72 | −9.15 * (0.05) | 10.90 *** (0.00) | 0.44 | −6.19 | −0.53 | −0.01 | 0.07 | 72 |

| 3 | 6.92 | −0.37 | −5.42 | −4.51 | 0.81 | 0.03 | −0.03 | 72 | −10.21 *** (0.01) | 11.50 *** (0.00) | 0.26 | −9.61 * (0.08) | −0.86 | 0.00 | 0.17 | 72 |

| 4 | 5.07 | 0.34 | −3.11 | −7.94 | 0.88 | 0.04 | −0.03 | 72 | −9.70*** (0.00) | 11.15 *** (0.00) | −0.26 | −7.95 * (0.08) | −0.77 | 0.00 | 0.23 | 72 |

| Forecast Horizon | Gold (1986:01–2003:12) | Platinum (1986:04–2003:12) | ||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −8.04 | 6.88 * (0.08) | 4.32 | −10.59 | 4.28 | 0.01 | 0.04 | 70 | −3.70 | 5.81 | −2.05 | −22.86 ** (0.03) | 7.76 | −0.07 | 0.05 | 72 |

| 2 | −4.12 | 7.13 *** (0.00) | −1.63 | 2.96 | −3.76 | −0.01 | 0.09 | 70 | −3.63 | 6.24 * (0.07) | −1.71 | −14.32 ** (0.03) | 4.67 | −0.03 | 0.07 | 72 |

| 3 | −4.85 ** (0.03) | 6.54 *** (0.00) | −0.69 | 0.25 | −2.02 | −0.01 | 0.13 | 70 | −5.00 | 6.41 ** (0.02) | 0.27 | −10.32 * (0.05) | 7.67 * (0.07) | −0.01 | 0.12 | 72 |

| 4 | −4.94 *** (0.01) | 6.59 *** (0.00) | −1.08 | −0.89 | −2.80 | −0.01 | 0.18 | 70 | −4.48 | 6.69 *** (0.01) | −0.27 | −5.61 | 6.42 * (0.09) | −0.02 | 0.12 | 72 |

| Forecast Horizon | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | ||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 9.00 | −7.31 | −14.69 | −13.43 | 31.39 | −0.09 | 0.07 | 72 | −19.80 * (0.06) | 10.45 | 8.30 | −24.92 | 12.87 | 0.03 | 0.10 | 26 |

| 2 | 6.24 | −7.35 | −3.65 | −11.75 | 30.10 | −0.07 | 0.06 | 72 | −16.40 ** (0.04) | 9.25 * (0.08) | 5.98 | −27.08 | 7.58 | 0.00 | 0.17 | 26 |

| 3 | 2.72 | −6.32 | 3.43 | −4.21 | 35.57 | −0.02 | 0.14 | 72 | −14.85 ** (0.02) | 9.42 ** (0.03) | 3.79 | −24.23 * (0.09) | 1.01 | 0.08 | 0.26 | 26 |

| 4 | 1.38 | −4.23 | 3.61 | −4.36 | 29.68 | −0.02 | 0.11 | 72 | −14.53 *** (0.01) | 10.91 *** (0.00) | 2.28 | −11.87 | 5.29 | 0.08 | 0.33 | 26 |

| Forecast Horizon | Natural Gas (1990:05–2003:12) | |||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 4.28 | −5.76 | 18.25 | −12.59 | 35.60 | 0.01 | −0.04 | 55 | ||||||||

| 2 | −0.05 | 1.51 | 5.22 | −32.94 | 23.99 | −0.04 | −0.03 | 55 | ||||||||

| 3 | −8.32 | 6.74 | 5.43 | −48.61 *** (0.01) | 25.29 * (0.07) | 0.10 | 0.13 | 55 | ||||||||

| 4 | −6.13 | 8.14 | 4.38 | −30.86 ** (0.03) | 16.34 | 0.08 | 0.08 | 55 | ||||||||

| Panel B | ||||||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 0.64 | −1.32 | 0.90 | 16.67 | −15.94 ** (0.04) | 0.17 | 0.04 | 67 | 12.44 | −6.54 | −2.47 | −14.23 | −4.82 | 0.08 | −0.03 | 67 |

| 2 | 2.39 | −2.04 | 0.81 | 9.29 | −6.07 | 0.07 | −0.03 | 66 | 15.43 * (0.09) | −5.12 | −7.94 | −11.58 | −3.15 | −0.06 | 0.05 | 66 |

| 3 | 2.44 | −2.01 | −6.02 | −16.53 | −6.38 * (0.09) | −0.04 | 0.04 | 65 | 12.12 | −3.87 | −4.83 | −11.96 | −4.17 | −0.04 | 0.06 | 65 |

| 4 | 2.98 | −2.99 | −0.97 | −2.09 | 8.80 | −0.04 | −0.05 | 64 | 13.44 ** (0.03) | −3.08 | −6.78 * (0.06) | 3.18 | 0.08 | −0.06 | 0.04 | 64 |

| Forecast Horizon | Gold (2004:01–2020:12) | Platinum (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 12.82 ** (0.04) | −3.31 | −0.20 | 3.73 | −1.76 | 0.02 | −0.03 | 67 | 4.78 | −4.82 | −5.04 | 0.25 | −1.84 | 0.12 | −0.03 | 67 |

| 2 | 14.76 *** (0.00) | −3.68 | −3.21 | −0.21 | −0.56 | −0.03 | 0.02 | 66 | 8.53 | −5.06 | −10.48 ** (0.02) | −1.57 | 1.59 | −0.01 | 0.04 | 66 |

| 3 | 14.61 *** (0.00) | −3.74 | −1.60 | 0.89 | −0.20 | −0.02 | −0.01 | 65 | 7.96 | −5.35 | −4.37 | −9.88 | −1.82 | −0.05 | 0.06 | 65 |

| 4 | 15.67 *** (0.00) | −3.66 * (0.09) | −2.93 | 5.24 | −2.01 | −0.03 | 0.08 | 64 | 8.58 * (0.09) | −5.23 | −3.62 | 1.69 | 2.05 | −0.05 | 0.04 | 64 |

| Forecast Horizon | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | ||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 23.20 | −9.94 | −7.69 | −6.65 | 5.65 | 0.10 | −0.02 | 67 | 10.90 | −7.32 | −15.61 ** (0.03) | −15.98 | 2.51 | 0.21 ** (0.04) | 0.06 | 67 |

| 2 | 25.65 ** (0.02) | −8.61 | −8.75 | −15.96 | 2.27 | −0.06 | 0.02 | 66 | 9.24 | −3.49 | −6.80 | −9.83 | 0.89 | 0.03 | −0.05 | 66 |

| 3 | 24.84 *** (0.01) | −8.04 | −2.20 | −13.10 | 0.83 | −0.08 | 0.00 | 65 | 5.34 | −0.22 | −5.64 | −3.14 | −1.25 | 0.01 | −0.05 | 65 |

| 4 | 23.42 *** (0.00) | −5.90 | −3.52 | −4.47 | 1.21 | −0.07 | −0.01 | 64 | 4.68 | 0.63 | −2.45 | 10.55 | 4.42 | −0.01 | −0.06 | 64 |

| Forecast Horizon | Natural Gas (2004:01–2020:12) | |||||||||||||||

| h | C | (Y10-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 2.17 | −4.83 | 17.42 | 28.85 | 0.30 | −0.02 | −0.01 | 67 | ||||||||

| 2 | −0.89 | −5.19 | 2.89 | −7.17 | −4.63 | 0.06 | −0.05 | 66 | ||||||||

| 3 | −1.55 | −5.77 | −1.34 | −18.72 | −5.77 | 0.04 | −0.01 | 65 | ||||||||

| 4 | −1.25 | −6.14 | −0.74 | −10.95 | 10.32 | 0.03 | −0.01 | 64 | ||||||||

| Panel A | ||||||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | ||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 12.77 | −4.45 | 0.56 | −1.91 | 11.52 | 0.04 | −0.06 | 72 | −13.32 | 7.41 ** (0.03) | −0.04 | −11.21 | −4.69 | 0.05 | 0.01 | 72 |

| 2 | 9.63 | −1.93 | −9.52 * (0.07) | −5.25 | 9.60 | 0.00 | 0.00 | 72 | −11.32 ** (0.04) | 6.28 *** (0.01) | 0.39 | −6.24 | −3.08 | −0.02 | 0.05 | 72 |

| 3 | 8.10 | −0.78 | −5.34 | −4.29 | 1.39 | 0.03 | −0.03 | 72 | −12.25 *** (0.01) | 6.50 *** (0.00) | 0.24 | −9.61 * (0.09) | −3.43 | −0.01 | 0.14 | 72 |

| 4 | 6.17 | −0.41 | −3.02 | −7.71 | 1.32 | 0.04 | −0.03 | 72 | −11.34 *** (0.00) | 6.13 *** (0.00) | −0.26 | −7.89 * (0.09) | −3.12 | −0.01 | 0.17 | 72 |

| Forecast Horizon | Gold (1986:01–2003:12) | Platinum (1986:04–2003:12) | ||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −7.98 | 3.22 | 4.39 | −10.34 | 3.31 | 0.01 | 0.02 | 70 | −5.10 | 3.47 | −2.09 | −22.94 | 6.29 | −0.07 | 0.05 | 72 |

| 2 | −4.92 | 3.77 *** (0.01) | −1.60 | 3.03 | −5.13 | −0.02 | 0.06 | 70 | −5.62 | 3.98 * (0.06) | −1.79 | −14.49 ** (0.03) | 2.88 | −0.04 | 0.08 | 72 |

| 3 | −5.12 * (0.06) | 3.22 *** (0.01) | −0.63 | 0.41 | −3.06 | −0.02 | 0.07 | 70 | −6.89 * (0.08) | 4.02 *** (0.01) | 0.20 | −10.48 ** (0.04) | 5.88 | −0.01 | 0.12 | 72 |

| 4 | −4.96 ** (0.04) | 3.11 *** (0.00) | −1.00 | −0.68 | −3.73 | −0.01 | 0.09 | 70 | −6.42 * (0.07) | 4.17 *** (0.01) | −0.34 | −5.76 | 4.59 | −0.02 | 0.12 | 72 |

| Forecast Horizon | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | ||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 10.62 | −4.30 | −14.65 * (0.05) | −13.36 | 33.17 ** (0.04) | −0.08 | 0.07 | 72 | −21.63 * (0.07) | 6.28 | 7.90 | −25.51 | 9.97 | 0.03 | 0.09 | 26 |

| 2 | 7.04 | −3.89 | −3.67 | −11.85 | 31.52 *** (0.01) | −0.07 | 0.06 | 72 | −18.24 ** (0.04) | 5.68 * (0.09) | 5.59 | −27.52 | 5.02 | 0.01 | 0.17 | 26 |

| 3 | 3.00 | −3.14 | 3.38 | −4.38 | 36.62 *** (0.00) | −0.01 | 0.13 | 72 | −17.30 *** (0.01) | 6.09 ** (0.02) | 3.31 | −24.44 * (0.09) | −1.61 | 0.08 | 0.27 | 26 |

| 4 | 0.66 | −1.64 | 3.51 | −4.65 | 29.98 *** (0.00) | −0.02 | 0.11 | 72 | −17.16 *** (0.01) | 6.94 *** (0.00) | 1.75 | −12.20 | 2.27 | 0.09 | 0.34 | 26 |

| Forecast Horizon | Natural Gas (1990:05–2003:12) | |||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 7.71 | −4.40 | 18.39 | −11.95 | 37.52 | 0.01 | −0.04 | 55 | ||||||||

| 2 | −3.67 | 2.41 | 5.02 | −33.69 | 22.62 | −0.03 | −0.03 | 55 | ||||||||

| 3 | −14.50 | 6.16 | 5.13 | −49.82 *** (0.00) | 22.36 | 0.10 | 0.15 | 55 | ||||||||

| 4 | −13.07 | 7.20 * (0.07) | 4.04 | −32.21 ** (0.02) | 12.97 | 0.09 | 0.11 | 55 | ||||||||

| Panel B | ||||||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −3.50 | 1.08 | 0.76 | 16.84 | −16.06 ** (0.04) | 0.17 | 0.04 | 67 | 15.85 | −5.05 | −2.31 | −14.20 | −4.77 | 0.08 | −0.03 | 67 |

| 2 | 2.08 | −0.98 | 0.81 | 9.35 | −6.09 | 0.07 | −0.03 | 66 | 17.66 * (0.08) | −3.76 | −7.83 | −11.53 | −3.12 | −0.06 | 0.06 | 66 |

| 3 | 0.66 | −0.34 | −6.05 | −16.43 | −6.48 * (0.09) | −0.04 | 0.04 | 65 | 13.20 | −2.58 | −4.77 | −11.91 | −4.17 | −0.04 | 0.06 | 65 |

| 4 | 0.65 | −0.63 | −1.06 | −1.98 | 8.48 | −0.04 | −0.05 | 64 | 13.85 * (0.05) | −1.87 | −6.70 * (0.06) | 3.26 | 0.23 | −0.06 | 0.04 | 64 |

| Forecast Horizon | Gold (2004:01–2020:12) | Platinum (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 15.19 ** (0.03) | −2.83 | −0.11 | 3.73 | −1.71 | 0.02 | −0.03 | 67 | 9.44 | −4.65 | −4.86 | 0.20 | −1.75 | 0.12 | −0.02 | 67 |

| 2 | 16.84 *** (0.00) | −2.91 | −3.12 | −0.19 | −0.52 | −0.03 | 0.04 | 66 | 12.79 | −4.61 | −10.31 ** (0.02) | −1.60 | 1.68 | −0.01 | 0.05 | 66 |

| 3 | 16.44 *** (0.00) | −2.83 * (0.08) | −1.52 | 0.92 | −0.16 | −0.02 | 0.01 | 65 | 9.74 | −3.69 | −4.28 | −9.82 | −1.80 | −0.05 | 0.07 | 65 |

| 4 | 17.09 *** (0.00) | −2.63 * (0.05) | −2.79 | 5.32 | −1.67 | −0.03 | 0.09 | 64 | 9.50 * (0.09) | −3.28 | −3.48 | 1.81 | 2.35 | −0.05 | 0.04 | 64 |

| Forecast Horizon | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 29.84 * (0.07) | −8.31 | −7.40 | −6.65 | 5.77 | 0.10 | −0.01 | 67 | 8.58 | −2.99 | −15.64 ** (0.03) | −15.73 | 2.41 | 0.21 | 0.05 | 67 |

| 2 | 30.47 *** (0.01) | −6.79 | −8.53 | −15.93 | 2.35 | −0.06 | 0.03 | 66 | 5.39 | −0.25 | −6.91 | −9.61 | 0.76 | 0.03 | −0.05 | 66 |

| 3 | 26.31 *** (0.01) | −5.03 | −2.10 | −12.97 | 0.81 | −0.07 | 0.00 | 65 | −0.13 | 2.21 | −5.79 | −2.97 | −1.49 | 0.01 | −0.04 | 65 |

| 4 | 22.79 *** (0.01) | −2.97 | −3.46 | −4.30 | 1.26 | −0.07 | −0.02 | 64 | −1.41 | 3.00 | −2.82 | 10.61 | 3.38 | −0.01 | −0.04 | 64 |

| Forecast Horizon | Natural gas (2004:01–2020:12)) | |||||||||||||||

| h | C | (Y30-M3) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 0.34 | −1.84 | 17.39 | 29.02 | 0.22 | −0.02 | −0.01 | 67 | ||||||||

| 2 | −1.16 | −2.72 | 2.91 | −7.04 | −4.67 | 0.06 | −0.06 | 66 | ||||||||

| 3 | −2.99 | −2.55 | −1.33 | −18.55 | −5.89 | 0.04 | −0.01 | 65 | ||||||||

| 4 | −1.73 | −3.17 | −0.66 | −10.78 | 10.40 | 0.03 | −0.02 | 64 | ||||||||

| Panel A | ||||||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | ||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 11.73 | −4.60 | 0.50 | −1.93 | 10.11 | 0.04 | −0.06 | 72 | −13.51 * (0.08) | 8.82 *** (0.01) | −0.08 | −11.60 | −2.95 | 0.06 | 0.03 | 72 |

| 2 | 9.08 | −1.93 | −9.55 * (0.07) | −5.29 | 8.95 | 0.00 | 0.00 | 72 | −11.34 ** (0.03) | 7.39 *** (0.00) | 0.37 | −6.54 | −1.56 | −0.01 | 0.08 | 72 |

| 3 | 7.17 | −0.36 | −5.41 | −4.46 | 0.90 | 0.03 | −0.03 | 72 | −12.32 *** (0.00) | 7.68 *** (0.00) | 0.21 | −9.93 * (0.07) | −1.88 | 0.00 | 0.19 | 72 |

| 4 | 5.40 | −0.01 | −3.08 | −7.86 | 0.97 | 0.04 | −0.04 | 72 | −11.52 *** (0.00) | 7.31 *** (0.00) | −0.30 | −8.22 * (0.07) | −1.69 | 0.00 | 0.24 | 72 |

| Forecast Horizon | Gold (1986:01–2003:12) | Platinum (1986:04–2003:12) | ||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −8.48 | 4.09 | 4.35 | −10.60 | 3.93 | 0.01 | 0.03 | 70 | −4.59 | 3.77 | −2.06 | −22.99 ** (0.03) | 7.30 | −0.07 | 0.06 | 72 |

| 2 | −4.99 | 4.49 *** (0.00) | −1.62 | 2.85 | −4.25 | −0.01 | 0.09 | 70 | −4.77 | 4.17 * (0.06) | −1.74 | −14.49 ** (0.03) | 4.12 | −0.03 | 0.08 | 72 |

| 3 | −5.71 ** (0.02) | 4.16 *** (0.00) | −0.69 | 0.14 | −2.48 | −0.01 | 0.13 | 70 | −6.35 * (0.08) | 4.39 *** (0.01) | 0.22 | −10.54 ** (0.04) | 7.05 * (0.09) | −0.01 | 0.13 | 72 |

| 4 | −5.69 *** (0.01) | 4.11 *** (0.00) | −1.07 | −0.97 | −3.23 | −0.01 | 0.16 | 70 | −5.93 * (0.07) | 4.60 *** (0.00) | −0.32 | −5.85 | 5.76 | −0.02 | 0.13 | 72 |

| Forecast Horizon | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | ||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 10.57 | −5.02 | −14.64 * (0.05) | −13.17 | 32.11 ** (0.04) | −0.09 | 0.08 | 72 | −21.84 * (0.06) | 6.90 | 8.09 | −25.65 | 11.71 | 0.03 | 0.10 | 26 |

| 2 | 7.38 | −4.78 | −3.63 | −11.59 | 30.69 *** (0.01) | −0.07 | 0.07 | 72 | −18.30 ** (0.03) | 6.16 * (0.08) | 5.78 | −27.69 | 6.57 | 0.00 | 0.18 | 26 |

| 3 | 3.17 | −3.79 | 3.40 | −4.19 | 35.91 *** (0.00) | −0.02 | 0.14 | 72 | −17.09 *** (0.01) | 6.44 ** (0.02) | 3.55 | −24.73 * (0.08) | 0.02 | 0.08 | 0.28 | 26 |

| 4 | 1.10 | −2.19 | 3.55 | −4.48 | 29.72 *** (0.00) | −0.02 | 0.11 | 72 | −17.03 *** (0.00) | 7.41 *** (0.00) | 2.01 | −12.49 | 4.14 | 0.08 | 0.35 | 26 |

| Forecast Horizon | Natural gas (1990:05–2003:12) | |||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 6.68 | −4.48 | 18.32 | −12.18 | 36.38 | 0.01 | −0.04 | 55 | ||||||||

| 2 | −1.62 | 1.67 | 5.15 | −33.25 | 23.58 | −0.04 | −0.03 | 55 | ||||||||

| 3 | −11.31 | 5.34 | 5.33 | −49.12 *** (0.01) | 24.34 * (0.08) | 0.10 | 0.14 | 55 | ||||||||

| 4 | −8.91 | 6.01 | 4.30 | −31.30 ** (0.03) | 15.38 | 0.09 | 0.09 | 55 | ||||||||

| Panel B | ||||||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −3.42 | 1.15 | 0.77 | 16.91 | −16.04 ** (0.04) | 0.17 | 0.04 | 67 | 14.08 | −4.73 | −2.40 | −14.42 | −4.86 | 0.08 | −0.03 | 67 |

| 2 | 0.85 | −0.50 | 0.77 | 9.36 | −6.13 | 0.07 | −0.03 | 66 | 16.73 * (0.09) | −3.71 | −7.89 | −11.72 | −3.19 | −0.06 | 0.06 | 66 |

| 3 | 1.44 | −0.75 | −6.04 | −16.50 | −6.46 * (0.09) | −0.04 | 0.04 | 65 | 13.60 * (0.09) | −3.04 | −4.77 | −12.10 | −4.19 | −0.03 | 0.06 | 65 |

| 4 | 1.53 | −1.12 | −1.02 | −2.06 | 8.57 | −0.04 | −0.05 | 64 | 14.52 ** (0.03) | −2.39 | −6.70 * (0.06) | 3.10 | 0.22 | −0.06 | 0.04 | 64 |

| Forecast Horizon | Gold (2004:01–2020:12) | Platinum (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 14.67 ** (0.03) | −2.87 | −0.14 | 3.57 | −1.76 | 0.02 | −0.03 | 67 | 6.63 | −3.78 | −4.97 | 0.07 | −1.86 | 0.12 | −0.03 | 67 |

| 2 | 16.43 *** (0.00) | −3.02 | −3.15 | −0.36 | −0.57 | −0.03 | 0.04 | 66 | 10.72 | −4.10 | −10.40 ** (0.02) | −1.77 | 1.58 | −0.01 | 0.04 | 66 |

| 3 | 16.26 *** (0.00) | −3.04 * (0.07) | −1.54 | 0.74 | −0.21 | −0.02 | 0.01 | 65 | 9.37 | −3.91 | −4.31 | −10.04 | −1.87 | −0.05 | 0.07 | 65 |

| 4 | 17.07 *** (0.00) | −2.89 ** (0.04) | −2.83 | 5.14 | −1.82 | −0.03 | 0.10 | 64 | 9.44 * (0.08) | −3.58 * (0.09) | −3.53 | 1.58 | 2.15 | −0.05 | 0.05 | 64 |

| Forecast Horizon | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 25.07 | −6.88 | −7.61 | −6.89 | 5.57 | 0.11 | −0.02 | 67 | 8.66 | −3.34 | −15.66 ** (0.03) | −15.93 | 2.38 | 0.21 ** (0.04) | 0.05 | 67 |

| 2 | 27.23 ** (0.02) | −5.95 | −8.68 | −16.16 | 2.20 | −0.06 | 0.02 | 66 | 6.70 | −0.90 | −6.87 | −9.71 | 0.79 | 0.03 | −0.05 | 66 |

| 3 | 25.42 *** (0.01) | −5.14 | −2.15 | −13.24 | 0.70 | −0.07 | 0.00 | 65 | 2.66 | 1.13 | −5.71 | −2.99 | −1.35 | 0.01 | −0.05 | 65 |

| 4 | 23.11 *** (0.00) | −3.43 | −3.49 | −4.53 | 1.13 | −0.07 | −0.02 | 64 | 1.69 | 1.82 | −2.61 | 10.69 | 4.00 | −0.01 | −0.05 | 64 |

| Forecast Horizon | Natural gas (2004:01–2020:12)) | |||||||||||||||

| h | C | (Y30-Y1) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | −1.61 | −1.10 | 17.31 | 29.03 | 0.16 | −0.02 | −0.01 | 67 | ||||||||

| 2 | −3.34 | −1.97 | 2.82 | −7.08 | −4.75 | 0.06 | −0.06 | 66 | ||||||||

| 3 | −3.84 | −2.42 | −1.37 | −18.66 | −5.96 | 0.04 | −0.01 | 65 | ||||||||

| 4 | −3.23 | −2.78 | −0.79 | −10.94 | 10.00 | 0.03 | −0.02 | 64 | ||||||||

| Panel A | ||||||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | ||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 11.32 | −5.65 | 0.56 | −1.99 | 9.36 | 0.04 | −0.06 | 72 | −11.97 * (0.09) | 10.26 *** (0.01) | −0.13 | −11.33 | −1.33 | 0.06 | 0.04 | 72 |

| 2 | 8.40 | −1.97 | −9.57 * (0.07) | −5.43 | 8.52 | 0.00 | 0.00 | 72 | −10.23 ** (0.03) | 8.73 *** (0.00) | 0.31 | −6.35 | −0.24 | −0.01 | 0.09 | 72 |

| 3 | 6.51 | 0.05 | −5.46 | −4.60 | 0.70 | 0.03 | −0.03 | 72 | −11.45 *** (0.00) | 9.29 *** (0.00) | 0.12 | −9.80 * (0.07) | −0.58 | 0.00 | 0.22 | 72 |

| 4 | 4.35 | 0.81 | −3.17 | −8.10 | 0.73 | 0.04 | −0.03 | 72 | −10.68 *** (0.00) | 8.84 *** (0.00) | −0.38 | −8.09 * (0.07) | −0.44 | 0.00 | 0.28 | 72 |

| Forecast Horizon | Gold (1986:01–2003:12) | Platinum (1986:04–2003:12) | ||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −7.86 | 4.87 * (0.09) | 4.29 | −10.48 | 4.62 | 0.01 | 0.03 | 70 | −4.23 | 4.62 | −2.11 | −22.94 ** (0.03) | 7.92 | −0.07 | 0.06 | 72 |

| 2 | −4.30 | 5.30 *** (0.00) | −1.66 | 2.97 | −3.45 | −0.01 | 0.10 | 70 | −4.00 | 4.81 * (0.05) | −1.76 | −14.35 ** (0.03) | 4.89 | −0.04 | 0.08 | 72 |

| 3 | −5.34 ** (0.02) | 5.13 *** (0.00) | −0.75 | 0.19 | −1.82 | −0.01 | 0.16 | 70 | −5.61 * (0.09) | 5.12 *** (0.01) | 0.19 | −10.41 ** (0.04) | 7.85 * (0.06) | −0.01 | 0.13 | 72 |

| 4 | −5.36 *** (0.00) | 5.10 *** (0.00) | −1.14 | −0.92 | −2.58 | −0.01 | 0.21 | 70 | −5.15 * (0.09) | 5.36 *** (0.00) | −0.35 | −5.71 | 6.60 * (0.08) | −0.02 | 0.14 | 72 |

| Forecast Horizon | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | ||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 8.32 | −4.76 | −14.73 ** (0.04) | −13.64 | 30.87 ** (0.04) | −0.08 | 0.07 | 72 | −20.44 * (0.07) | 7.38 | 8.17 | −25.51 | 12.79 | 0.03 | 0.09 | 26 |

| 2 | 6.49 | −5.51 | −3.60 | −11.75 | 29.80 *** (0.01) | −0.07 | 0.07 | 72 | −17.71 ** (0.03) |

7.05 * (0.07) | 5.76 | −27.27 | 7.72 | 0.00 | 0.19 | 26 |

| 3 | 2.48 | −4.39 | 3.43 | −4.32 | 35.21 *** (0.00) | −0.02 | 0.14 | 72 | −16.55 *** (0.01) | 7.43 ** (0.02) | 3.52 | −24.26 * (0.09) | 1.24 | 0.08 | 0.30 | 26 |

| 4 | 0.64 | −2.48 | 3.56 | −4.56 | 29.30 *** (0.00) | −0.02 | 0.11 | 72 | −16.49 *** (0.00) | 8.59 *** (0.00) | 1.96 | −11.91 | 5.56 | 0.08 | 0.39 | 26 |

| Forecast Horizon | Natural Gas (1990:05–2003:12) | |||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 6.22 | −5.39 | 18.38 | −12.43 | 35.71 | 0.01 | −0.04 | 55 | ||||||||

| 2 | 1.23 | 0.21 | 5.31 | −32.64 | 24.24 | −0.04 | −0.03 | 55 | ||||||||

| 3 | −7.52 | 4.24 | 5.48 | −48.20 *** (0.01) | 25.63 * (0.07) | 0.10 | 0.13 | 55 | ||||||||

| 4 | −5.53 | 5.36 | 4.41 | −30.44 ** (0.03) | 16.70 | 0.08 | 0.07 | 55 | ||||||||

| Panel B | ||||||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −3.48 | 1.30 | 0.75 | 16.95 | −16.03 ** (0.04) | 0.17 | 0.04 | 67 | 13.47 | −4.90 | −2.36 | −14.55 | −4.93 | 0.08 | −0.03 | 67 |

| 2 | −0.15 | −0.03 | 0.74 | 9.42 | −6.15 | 0.07 | −0.03 | 66 | 16.55 * (0.09) | −4.01 | −7.84 | −11.85 | −3.23 | −0.06 | 0.06 | 66 |

| 3 | 1.47 | −0.84 | −6.02 | −16.53 | −6.47 * (0.09) | −0.04 | 0.04 | 65 | 14.86 * (0.07) | −4.02 | −4.68 | −12.32 | −4.20 | −0.03 | 0.07 | 65 |

| 4 | 2.57 | −1.79 | −0.95 | −2.18 | 8.67 | −0.04 | −0.05 | 64 | 16.11 ** (0.02) | −3.48 | −6.58 * (0.06) | 2.90 | 0.34 | −0.06 | 0.05 | 64 |

| Forecast Horizon | Gold (2004:01–2020:12) | Platinum (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 14.78 ** (0.03) | −3.23 | −0.09 | 3.45 | −1.79 | 0.02 | −0.03 | 67 | 5.38 | −3.52 | −4.97 | 0.03 | −1.93 | 0.12 | −0.03 | 67 |

| 2 | 16.70 *** (0.00) | −3.48 | −3.10 | −0.50 | −0.60 | −0.03 | 0.04 | 66 | 9.64 | −3.96 | −10.39 ** (0.02) | −1.84 | 1.51 | −0.01 | 0.04 | 66 |

| 3 | 16.88 *** (0.00) | −3.69 * (0.05) | −1.48 | 0.58 | −0.24 | −0.02 | 0.02 | 65 | 9.76 | −4.53 | −4.24 | −10.22 | −1.92 | −0.05 | 0.07 | 65 |

| 4 | 17.75 *** (0.00) | −3.55 ** (0.03) | −2.76 | 4.97 | −1.83 | −0.03 | 0.11 | 64 | 10.18 * (0.06) | −4.35 * (0.07) | −3.45 | 1.39 | 2.12 | −0.05 | 0.05 | 64 |

| Forecast Horizon | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | ||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 23.62 | −6.84 | −7.57 | −7.03 | 5.47 | 0.11 | −0.03 | 67 | 9.55 | −4.16 | −15.58 ** (0.03) | −16.12 | 2.35 | 0.21 ** (0.04) | 0.05 | 67 |

| 2 | 26.66 ** (0.03) | −6.28 | −8.62 | −16.34 | 2.11 | −0.06 | 0.02 | 66 | 8.53 | −1.96 | −6.79 | −9.89 | 0.81 | 0.04 | −0.05 | 66 |

| 3 | 26.79 *** (0.01) | −6.41 | −2.03 | −13.55 | 0.66 | −0.07 | 0.01 | 65 | 5.05 | 0.00 | −5.65 | −3.13 | −1.27 | 0.01 | −0.05 | 65 |

| 4 | 24.98 *** (0.00) | −4.78 | −3.35 | −4.79 | 1.26 | −0.07 | −0.01 | 64 | 4.33 | 0.61 | −2.48 | 10.59 | 4.39 | −0.01 | −0.06 | 64 |

| Forecast Horizon | Natural Gas (2004:01–2020:12) | |||||||||||||||

| h | C | (Y30-Y2) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | −2.07 | −0.97 | 17.31 | 29.02 | 0.14 | −0.02 | −0.01 | 67 | ||||||||

| 2 | −4.18 | −1.73 | 2.81 | −7.08 | −4.79 | 0.06 | −0.06 | 66 | ||||||||

| 3 | −3.91 | −2.64 | −1.33 | −18.75 | −6.00 | 0.04 | −0.01 | 65 | ||||||||

| 4 | −3.57 | −2.90 | −0.78 | −11.03 | 9.87 | 0.03 | −0.03 | 64 | ||||||||

Note

| 1 | The conditional correlation between two random variables y1 and y2 is . It is acceptable to present returns as the conditional standard deviation times the standardized disturbance. . This is because . For each series i, is a standardized disturbance with a mean of zero and a variance of one. Accordingly, the conditional correlation can be presented as . Hence, the conditional correlation is also the conditional covariance between the standardized disturbances. This is the spirit of the DCC method. |

References

- Abdymomunov, Azamat. 2013. Predicting output using the entire yield curve. Journal of Macroeconomics 37: 333–44. [Google Scholar] [CrossRef]

- Akram, Farooq. 2009. Commodity prices, interest rates and the dollar. Energy Economics 31: 838–51. [Google Scholar] [CrossRef] [Green Version]

- Arango, Luis, Fernando Arias, and Adriana Flórez. 2011. Determinants of commodity prices. Applied Economics 44: 135–45. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 2003. Critical values for multiple structural change tests. Econometrics Journal 6: 72–78. [Google Scholar] [CrossRef]

- Bampinas, Georgios, and Theodore Panagiotidis. 2015. Are gold and silver a hedge against inflation? A two century perspective. International Review of Financial Analysis 41: 267–76. [Google Scholar] [CrossRef] [Green Version]

- Batten, Jonathan, Cetin Ciner, and Brian Lucey. 2010. The macroeconomic determinants of volatility in precious metals markets. Resources Policy 35: 65–71. [Google Scholar] [CrossRef]

- Beckmann, Joscha, and Robert Czudaj. 2013. Gold as an inflation hedge in a time-varying coefficient framework. North American Journal of Economics and Finance 24: 208–22. [Google Scholar] [CrossRef] [Green Version]

- Bodie, Zvi, and Victor Rosansky. 1980. Risk and return in commodity futures. Financial Analysts Journal 36: 27–39. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1990. Modelling the coherence in short-run nominal exchange rates: A multivariate generalized ARCH model. Review of Economics and Statistics 72: 498–505. [Google Scholar] [CrossRef]

- Chevallier, Julien, Mathieu Gatumel, and Florian Ielpo. 2014. Commodity markets through the business cycle. Quantitative Finance 14: 1597–618. [Google Scholar] [CrossRef]

- Chinn, Menzie, and Kavan Kucko. 2015. The predictive power of the yield curve across countries and time. International Finance 18: 129–56. [Google Scholar] [CrossRef]

- Churchill, Sefa, John Inekwe, Kris Ivanovski, and Russell Smyth. 2019. Dynamics of oil price, precious metal prices and the exchange rate in the long-run. Energy Economics 84: 104508. [Google Scholar] [CrossRef]

- Dai, Zhifeng, and Jie Kang. 2021. Bond yield and crude oil prices predictability. Energy Economics 97: 105205. [Google Scholar] [CrossRef]

- Daskalaki, Charoula, George Skiadopoulos, and Nikolas Topaloglou. 2017. Diversification benefits of commodities: A stochastic dominance efficiency approach. Journal of Empirical Finance 44: 250–69. [Google Scholar] [CrossRef]

- Demiralay, Sercan, Selcuk Bayraci, and Gaye Gencer. 2019. Time-varying diversification benefits of commodity futures. Empirical Economics 56: 1823–53. [Google Scholar] [CrossRef]

- Duarte, Angelo, Wagner Gaglianone, Osmani de Carvalho Guillén, and João Issler. 2021. Commodity Prices and Global Economic Activity: A derived-demand approach. Energy Economics 96: 105120. [Google Scholar] [CrossRef]

- Duffee, Gregory. 1998. The relation between treasury yields and corporate bond yield spreads. Journal of Finance 53: 2225–41. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Estrella, Arturo. 2005. Why does the yield curve predict output and inflation? Economic Journal 115: 722–44. [Google Scholar] [CrossRef]

- Estrella, Arturo, and Gikas Hardouvelis. 1991. The term structure as a predictor of real economic activity. Journal of Finance 46: 555–76. [Google Scholar] [CrossRef]

- Evgenidis, Anastasios, Stephanos Papadamou, and Costas Siriopoulos. 2020. The yield spread’s ability to forecast economic activity: What have we learned after 30 years of studies? Journal of Business Research 106: 221–32. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1988. Business cycles and the behavior of metals prices. The Journal of Finance 43: 1075–93. [Google Scholar] [CrossRef]

- Fasanya, Ismail, and Crystal Awodimila. 2020. Are commodity prices good predictors of inflation? The African perspective. Resources Policy 69: 101802. [Google Scholar] [CrossRef]

- Gagnon, Marie, Guillaume Manseau, and Gabriel Power. 2020. They’re back! Post-financialization diversification benefits of commodities. International Review of Financial Analysis 71: 101515. [Google Scholar] [CrossRef]

- Garner, Alan. 1989. Commodity prices: Policy target or information variable?: Note. Journal of Money, Credit and Banking 21: 508–14. [Google Scholar] [CrossRef]

- Giacomini, Raffaella, and Barbara Rossi. 2006. How stable is the forecasting performance of the yield curve for output growth? Oxford Bulletin of Economics and Statistics 68: 783–95. [Google Scholar] [CrossRef]

- Gogas, Periklis, Theophilos Papadimitriou, Maria Matthaiou, and Efthymia Chrysanthidou. 2015. Yield curve and recession forecasting in a machine learning framework. Computational Economics 45: 635–45. [Google Scholar]

- Gorton, Gary, and Geert Rouwenhorst. 2006. Facts and fantasies about commodity futures. Financial Analysts Journal 62: 47–68. [Google Scholar] [CrossRef] [Green Version]

- Granger, Clive. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society 37: 424–38. [Google Scholar] [CrossRef]

- Hamilton, James, and Dong Kim. 2002. A reexamination of the predictability of economic activity using the yield spread. Journal of Money, Credit, and Banking 34: 340–60. [Google Scholar] [CrossRef] [Green Version]

- Hamilton, James, and Jing Wu. 2015. Effects of index-fund investing on commodity futures prices. International Economic Review 56: 187–205. [Google Scholar] [CrossRef] [Green Version]

- Harvey, Campbell. 1989. Forecasts of economic growth from the bond and stock markets. Financial Analysts Journal 45: 38–45. [Google Scholar] [CrossRef]

- Harvey, David, Neil Kellard, Jakob Madsen, and Mark Wohar. 2017. Long-run commodity prices, economic growth, and interest rates: 17th century to the present day. World Development 89: 57–70. [Google Scholar] [CrossRef] [Green Version]

- Henderson, Brian, Neil Pearson, and Li Wang. 2015. New evidence on the financialization of commodity markets. Review of Financial Studies 28: 1285–311. [Google Scholar] [CrossRef] [Green Version]

- Hu, Conghui, Zhibing Li, and Xiaoyu Liu. 2020. Liquidity shocks, commodity financialization, and market comovements. Journal of Futures Markets 40: 1315–36. [Google Scholar] [CrossRef]

- Huang, Jianbai, Yingli Li, Hongwei Zhang, and Jinyu Chen. 2021. The effects of uncertainty measures on commodity prices from a time-varying perspective. International Review of Economics & Finance 71: 100–14. [Google Scholar]

- Ioannidis, Christos, and Kook Ka. 2018. The impact of oil price shocks on the term structure of interest rates. Energy Economics 72: 601–20. [Google Scholar] [CrossRef] [Green Version]

- Jahan, Sayeeda, and Apostolos Serletis. 2019. Business cycles and hydrocarbon gas liquids prices. The Journal of Economic Asymmetries 19: e00115. [Google Scholar] [CrossRef] [Green Version]

- Kagraoka, Yusho. 2016. Common dynamic factors in driving commodity prices: Implications of a generalized dynamic factor model. Economic Modelling 52: 609–17. [Google Scholar] [CrossRef]

- Kucher, Oleg, and Suzanne McCoskey. 2017. The long-run relationship between precious metal prices and the business cycle. Quarterly Review of Economics and Finance 65: 263–75. [Google Scholar] [CrossRef]

- Kuosmanen, Petri, Jaana Rahko, and Juuso Vataja. 2019. Predictive ability of financial variables in changing economic circumstances. North American Journal of Economics and Finance 47: 37–47. [Google Scholar] [CrossRef]

- Labys, Walter, Aymad Achouch, and Michael Terraza. 1999. Metal prices and the business cycle. Resources Policy 25: 229–38. [Google Scholar] [CrossRef]

- Levine, Ari, Yao Ooi, Matthew Richardson, and Caroline Sasseville. 2018. Commodities for the long run. Financial Analysts Journal 74: 55–68. [Google Scholar] [CrossRef] [Green Version]

- McMillan, David. 2021a. Predicting GDP growth with stock and bond markets: Do they contain different information? International Journal of Finance and Economics 26: 3651–75. [Google Scholar] [CrossRef]

- McMillan, David. 2021b. When and Why Do Stock and Bond Markets Predict Economic Growth? Quarterly Review of Economics and Finance 80: 331–43. [Google Scholar] [CrossRef]

- Newey, Whitney, and Kenneth West. 1987. Hypothesis testing with efficient method of moments estimation. International Economic Review 28: 777–87. [Google Scholar] [CrossRef]

- Orlowski, Lucjan. 2017. Volatility of commodity futures prices and market-implied inflation expectations. Journal of International Financial Markets, Institutions and Money 51: 133–41. [Google Scholar] [CrossRef]

- Plosser, Charles, and Geert Rouwenhorst. 1994. International term structures and real economic growth. Journal of Monetary Economics 33: 133–55. [Google Scholar] [CrossRef]

- Qadan, M., and H. Nama. 2018. Investor sentiment and the price of oil. Energy Economics 69: 42–58. [Google Scholar] [CrossRef]

- Qadan, Mahmoud, David Aharon, and Ron Eichel. 2019. Seasonal patterns and calendar anomalies in the commodity market for natural resources. Resources Policy 63: 101435. [Google Scholar] [CrossRef]

- Saar, Dan, and Yossi Yagil. 2015. Forecasting growth and stock performance using government and corporate yield curves: Evidence from the European and Asian markets. Journal of International Financial Markets, Institutions and Money 37: 27–41. [Google Scholar] [CrossRef]

- Stock, James, and Mark Watson. 1989. New indexes of coincident and leading economic indicators. NBER Macroeconomics Annual 4: 351–94. [Google Scholar] [CrossRef]

- Stock, James, and Mark Watson. 2003. Forecasting output and inflation: The role of asset prices. Journal of Economic Literature 41: 788–829. [Google Scholar] [CrossRef]

- Tang, Ke, and Wei Xiong. 2012. Index investment and the financialization of commodities. Financial Analysts Journal 68: 54–74. [Google Scholar] [CrossRef]

- Umar, Zaghum, Syed Shahzad, and Dimitris Kenourgios. 2019. Hedging US metals & mining Industry’s credit risk with industrial and precious metals. Resources Policy 63: 101472. [Google Scholar]

- Wheelock, David, and Mark Wohar. 2009. Can the term spread predict output growth and recessions? A survey of the literature. Federal Reserve Bank of St. Louis Review 91: 419–40. [Google Scholar] [CrossRef] [Green Version]

| Panel A | |||||||||

| Y3M | Y1 | Y2 | Y10 | Y30 | |||||

| Mean | 3.173 | 3.455 | 3.761 | 4.845 | 5.343 | ||||

| Median | 3.055 | 3.390 | 3.920 | 4.680 | 5.155 | ||||

| Maximum | 9.140 | 9.570 | 9.680 | 9.520 | 9.610 | ||||

| Minimum | 0.010 | 0.100 | 0.130 | 0.620 | 1.270 | ||||

| Std. Dev. | 2.557 | 2.623 | 2.653 | 2.280 | 2.052 | ||||

| Skewness | 0.258 | 0.237 | 0.214 | 0.199 | 0.162 | ||||

| Kurtosis | 1.845 | 1.824 | 1.793 | 1.981 | 2.046 | ||||

| J-Bera | 28.001 | 28.118 | 28.716 | 20.950 | 17.767 | ||||

| #Obs. | 420 | 420 | 420 | 420 | 420 | ||||

| Sample Period | 1986:01 to 2020:12 | 1986:01 to 2020:12 | 1986:01 to 2020:12 | 1986:01 to 2020:12 | 1986:01 to 2020:12 | ||||

| Panel B | |||||||||

| COAL | ETHNL | GOLD | NGAZ | OIL | PLDM | PLTNM | SLVR | ZINC | |

| Mean | 83.85 | 1.89 | 730.10 | 3.75 | 44.15 | 459.31 | 822.34 | 11.20 | 1879.99 |

| Median | 82.65 | 1.77 | 425.55 | 2.92 | 31.90 | 309.75 | 680.50 | 6.72 | 1891.75 |

| Maximum | 130.90 | 3.62 | 1970.80 | 13.92 | 140.97 | 2508.80 | 2180.70 | 48.58 | 4474.00 |

| Minimum | 49.95 | 0.82 | 255.00 | 1.17 | 11.13 | 76.35 | 336.40 | 3.56 | 746.75 |

| Std. Dev. | 21.12 | 0.50 | 480.20 | 2.24 | 28.99 | 440.48 | 440.90 | 8.26 | 807.30 |

| Skewness | 0.280 | 0.672 | 0.792 | 1.721 | 0.879 | 2.111 | 0.813 | 1.418 | 0.528 |

| Kurtosis | 2.142 | 3.121 | 2.151 | 6.416 | 2.671 | 8.299 | 2.611 | 4.823 | 2.765 |

| J-Bera | 6.30 | 14.20 | 56.52 | 360.54 | 55.93 | 797.60 | 48.57 | 198.86 | 13.68 |

| #Obs. | 144 | 187 | 420 | 368 | 420 | 417 | 417 | 420 | 281 |

| Sample Period | 2009:01 to 2020:12 | 2005:06 to 2020:12 | 1986:01 to 2020:12 | 1990:05 to 2020:12 | 1986:01 to 2020:12 | 1986:04 to 2020:12 | 1986:04 to 2020:12 | 1986:01 to 2020:12 | 1997:08 to 2020:12 |

| Panel A | ||||||||||||

| Forecast Horizon | Oil (1986:01–2020:12) | Silver (1986:01–2020:12) | Gold (1986:01–2020:12) | |||||||||

| h | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N |

| 1 | 10.61 (0.42) | −3.78 (0.56) | 0.003 | 139 | 5.33 (0.48) | −0.37 (0.92) | 0.000 | 139 | 4.89 (0.24) | 0.08 (0.97) | 0.000 | 138 |

| 2 | 9.03 (0.29) | −3.08 (0.46) | 0.004 | 138 | 3.97 (0.45) | 0.39 (0.88) | 0.000 | 138 | 4.74 (0.10) | 0.15 (0.92) | 0.000 | 138 |

| 3 | 7.41 (0.24) | −2.30 (0.46) | 0.004 | 137 | 1.85 (0.67) | 1.40 (0.50) | 0.003 | 137 | 4.56 * (0.06) | 0.11 (0.93) | 0.000 | 137 |

| 4 | 4.29 (0.41) | −0.91 (0.72) | 0.001 | 136 | −0.23 (0.95) | 2.40 (0.17) | 0.014 | 136 | 4.47 ** (0.04) | 0.06 (0.95) | 0.000 | 136 |

| Forecast Horizon | Platinum (1986:04–2020:12) | Palladium (1986:04–2020:12) | Zinc (1997:08–2020:12) | |||||||||

| h | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N |

| 1 | 5.23 (0.45) | −1.48 (0.66) | 0.001 | 139 | 19.38 * (0.06) | −6.14 (0.22) | 0.011 | 139 | 3.18 (0.75) | −0.02 (0.99) | 0.000 | 93 |

| 2 | 3.68 (0.44) | −0.72 (0.76) | 0.000 | 138 | 15.63 ** (0.04) | −3.95 (0.28) | 0.009 | 138 | −1.03 (0.89) | 2.62 (0.49) | 0.005 | 92 |

| 3 | 1.27 (0.73) | 0.45 (0.80) | 0.0005 | 136 | 10.53 * (0.09) | −1.16 (0.70) | 0.001 | 137 | −4.31 (0.51) | 4.53 (0.17) | 0.021 | 91 |

| 4 | −0.18 (0.95) | 1.17 (0.43) | 0.004 | 136 | 8.18 (0.14) | 0.24 (0.93) | 0.000 | 136 | −6.91 (0.23) | 6.04 ** (0.04) | 0.05 | 90 |

| Forecast Horizon | Ethanol (2005:06–2020:12) | Coal (2009:01–2020:12) | Natural Gas (1990:05–2020:12) | |||||||||

| h | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N |

| 1 | 3.52 (0.86) | −2.70 (0.79) | 0.012 | 62 | −7.04 (0.66) | 4.08 (0.59) | 0.006 | 48 | 4.24 (0.79) | −1.36 (0.86) | 0.0003 | 122 |

| 2 | 1.49 (0.90) | −2.32 (0.70) | 0.002 | 61 | −10.92 (0.37) | 5.85 (0.31) | 0.0.23 | 47 | 2.11 (0.84) | −0.40 (0.94) | 0.000 | 121 |

| 3 | −1.69 (0.84) | −0.64 (0.88) | 0.004 | 60 | −15.40 (0.12) | 7.67 (0.10) | 0.06 | 46 | −1.00 (0.91) | 1.02 (0.80) | 0.001 | 120 |

| 4 | −5.01 (0.43) | 0.61 (0.85) | 0.001 | 59 | −14.55 (0.11) | 7.14 * (0.09) | 0.06 | 45 | −3.51 (0.61) | 2.39 (0.47) | 0.005 | 119 |

| Panel B | ||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | Gold (1986:01–2003:12) | |||||||||

| h | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N |

| 1 | 11.73 (0.42) | −3.38 (0.63) | 0.003 | 71 | −6.16 (0.40) | 4.15 (0.25) | 0.019 | 71 | −4.99 (0.37) | 3.60 (0.18) | 0.025 | 70 |

| 2 | 10.25 (0.29) | −2.58 (0.58) | 0.004 | 71 | −8.19 (0.13) | 5.85 ** (0.03) | 0.07 | 71 | −4.51 (0.18) | 3.36 ** (0.04) | 0.06 | 71 |

| 3 | 10.62 (0.13) | −2.91 (0.39) | 0.01 | 71 | −7.71 * (0.07) | 5.28 *** (0.01) | 0.09 | 71 | −3.99 (0.13) | 2.74 ** (0.03) | 0.06 | 71 |

| 4 | 9.55 (0.12) | −2.26 (0.44) | 0.009 | 71 | −7.57 ** (0.04) | 5.20 *** (0.004) | 0.114 | 71 | −3.54 (0.13) | 2.40 ** (0.04) | 0.06 | 71 |

| Forecast Horizon | Platinum (1986:04–2003:12) | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | |||||||||

| h | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N |

| 1 | −1.01 (0.89) | 2.90 (0.44) | 0.009 | 71 | 11.53 (0.40) | −4.63 (0.49) | 0.007 | 71 | −17.87 (0.11) | 9.02 (0.12) | 0.10 | 25 |

| 2 | −3.28 (0.51) | 4.35 * (0.07) | 0.046 | 71 | 4.58 (0.66) | −0.001 (0.99) | 0.000 | 71 | −15.85 * (0.06) | 9.50 ** (0.03) | 0.18 | 25 |

| 3 | −4.65 (0.23) | 4.74 ** (0.014) | 0.085 | 70 | 0.13 (0.99) | 2.20 (0.60) | 0.004 | 71 | −14.08 ** (0.04) | 8.39 ** (0.02) | 0.20 | 25 |

| 4 | −4.98 (0.15) | 4.91 *** (0.004) | 0.112 | 71 | −1.30 (0.87) | 2.99 (0.43) | 0.009 | 71 | −13.17 ** (0.03) | 8.38 *** (0.01) | 0.26 | 25 |

| Forecast Horizon | Natural Gas (1990:05–2003:12) | |||||||||||

| h | C | (Y10-Y3M) | R2 | N | ||||||||

| 1 | 8.41 (0.76) | 1.11 (0.93) | 0.0002 | 54 | ||||||||

| 2 | −0.57 (0.97) | 5.51 (0.50) | 0.009 | 54 | ||||||||

| 3 | −5.24 (0.69) | 7.99 (0.19) | 0.03 | 54 | ||||||||

| 4 | −7.17 (0.48) | 9.42 * (0.05) | 0.07 | 54 | ||||||||

| Panel C | ||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | Gold (2004:01–2020:12) | |||||||||

| h | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N |

| 1 | 9.51 (0.67) | −4.22 (0.70) | 0.002 | 68 | 17.23 (0.20) | −5.16 (0.44) | 0.009 | 68 | 14.40 ** (0.02) | −3.29 (0.27) | 0.019 | 68 |

| 2 | 7.77 (0.59) | −3.65 (0.60) | 0.004 | 67 | 16.94 * (0.07) | −5.45 (0.23) | 0.022 | 67 | 14.54 *** (0.002) | −3.29 (0.14) | 0.033 | 67 |

| 3 | 3.90 (0.72) | −1.62 (0.76) | 0.001 | 66 | 12.35 (0.11) | −2.87 (0.44) | 0.009 | 66 | 13.92 *** (0.00) | −2.81 (0.14) | 0.03 | 66 |

| 4 | −1.66 (0.85) | 0.66 (0.88) | 0.0004 | 65 | 8.09 (0.20) | −0.78 (0.80) | 0.001 | 65 | 13.53 *** (0.00) | −2.64 (0.12) | 0.04 | 65 |

| Forecast Horizon | Platinum (2004:01–2020:12) | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | |||||||||

| h | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N | C | (Y10-Y3M) | R2 | N |

| 1 | 11.84 (0.31) | −6.18 (0.29) | 0.017 | 68 | 27.41 * (0.07) | −7.64 (0.31) | 0.016 | 68 | 13.99 (0.29) | −4.68 (0.48) | 0.008 | 68 |

| 2 | 11.20 (0.17) | −6.21 (0.12) | 0.04 | 67 | 27.36 ** (0.013) | −8.18 (0.13) | 0.036 | 67 | 6.80 (0.52) | −0.91 (0.86) | 0.0005 | 67 |

| 3 | 7.84 (0.21) | −4.25 (0.17) | 0.029 | 66 | 21.92 ** (0.02) | −4.88 (0.26) | 0.02 | 66 | 0.98 (2.38) | 2.38 (0.59) | 0.005 | 66 |

| 4 | 5.27 (0.30) | −2.97 (0.23) | 0.023 | 65 | 18.91 ** (0.02) | −2.94 (0.43) | 0.01 | 65 | −3.42 (0.67) | 4.67 (0.24) | 0.022 | 65 |

| Forecast Horizon | Natural Gas (2004:01–2020:12) | |||||||||||

| h | C | (Y10-Y3M) | R2 | N | ||||||||

| 1 | 1.95 (0.92) | −4.07 (0.67) | 0.003 | 68 | ||||||||

| 2 | 5.14 (0.71) | −5.95 (0.38) | 0.012 | 67 | ||||||||

| 3 | 3.37 (0.76) | −5.48 (0.31) | 0.016 | 66 | ||||||||

| 4 | 0.49 (0.96) | −4.21 (0.32) | 0.016 | 65 | ||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 11.80 | −4.97 | 0.48 | −2.20 | 11.89 | 0.03 | −0.06 | 71 | −8.22 | 4.93 | 0.58 | −10.74 | −1.92 | 0.00 | −0.04 | 71 |

| (0.76) | (−0.62) | (0.06) | (−0.11) | (0.67) | (0.26) | (−1.06) | (1.23) | (0.15) | (−1.06) | (−0.22) | (−0.07) | |||||

| 2 | 10.61 | −3.25 | −9.41c | −5.24 | 10.78 | −0.02 | 0.00 | 71 | −9.31 | 6.50b | 0.58 | −5.78 | −3.10 | −0.01 | 0.01 | 71 |

| (1.06) | (−0.63) | (−1.82) | (−0.4) | (0.95) | (−0.19) | (−1.64) | (2.22) | (0.2) | (−0.78) | (−0.48) | (−0.27) | |||||

| 3 | 10.22 | −2.73 | −5.10 | −4.14 | 3.21 | 0.00 | −0.03 | 71 | −9.37b | 6.04a | 0.53 | −9.09 | −2.79 | −0.02 | 0.06 | 71 |

| (1.39) | (−0.72) | (−1.35) | (−0.43) | (0.38) | (−0.03) | (−2.11) | (2.64) | (0.23) | (−1.57) | (−0.55) | (−0.4) | |||||

| 4 | 8.01 | −1.83 | −2.85 | −7.46 | 2.58 | 0.02 | −0.03 | 71 | −8.92b | 5.92a | −0.02 | −7.43 | −2.73 | −0.01 | 0.09 | 71 |

| (1.25) | (−0.56) | (−0.86) | (−0.9) | (0.35) | (0.44) | (−2.36) | (3.05) | (−0.01) | (−1.51) | (−0.63) | (−0.46) | |||||

| Forecast Horizon | Gold (1986:01–2003:12) | Platinum (1986:04–2003:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | −7.28 | 3.49 | 4.47 | −10.20 | 3.19 | 0.00 | 0.01 | 70 | −2.64 | 2.25 | −1.79 | −22.72b | 7.66 | −0.10 | 0.06 | 71 |

| (−1.23) | (1.17) | (1.52) | (−1.39) | (0.5) | (0.1) | (−0.34) | (0.57) | (−0.45) | (−2.26) | (0.87) | (−1.57) | |||||

| 2 | −4.01 | 4.01b | −1.50 | 3.21 | −5.20 | −0.02 | 0.04 | 70 | −5.10 | 4.63c | −1.73 | −14.33b | 2.42 | −0.03 | 0.07 | 71 |

| (−1.14) | (2.23) | (−0.83) | (0.7) | (−1.3) | (−0.72) | (−1.01) | (1.78) | (−0.66) | (−2.17) | (0.42) | (−0.75) | |||||

| 3 | −3.74 | 3.04b | −0.49 | 0.67 | −2.80 | −0.02 | 0.02 | 70 | −5.71 | 4.17b | 0.32 | −10.25c | 5.89 | −0.02 | 0.09 | 71 |

| (−1.35) | (2.14) | (−0.35) | (0.19) | (−0.89) | (−0.93) | (−1.42) | (2.02) | (0.16) | (−1.97) | (1.29) | (−0.49) | |||||

| 4 | −3.62 | 2.94b | −0.87 | −0.42 | −3.48 | −0.02 | 0.03 | 70 | −5.19 | 4.32b | −0.21 | −5.51 | 4.59 | −0.02 | 0.09 | 71 |

| (−1.46) | (2.31) | (−0.68) | (−0.13) | (−1.24) | (−0.84) | (−1.44) | (2.33) | (−0.11) | (−1.17) | (1.12) | (−0.7) | |||||

| Forecast Horizon | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | ||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N |

| 1 | 15.89 | −10.17 | −14.00b | −13.30 | 38.73 | −0.18 | 0.13 | 71 | −19.18c | 5.87 | 8.85 | −27.86 | 9.80 | −0.02 | 0.07 | 25 |

| (1.2) | (−1.49) | (−2.05) | (−0.77) | (2.57) | (−1.6) | (−1.76) | (1.00) | (1.59) | (−1.15) | (0.66) | (−0.18) | |||||

| 2 | 6.75 | −4.82 | −3.68 | −12.06 | 32.29a | −0.08 | 0.06 | 71 | −17.44b | 7.48 | 5.42 | −26.55 | 4.01 | 0.04 | 0.15 | 25 |

| (0.65) | (−0.9) | (−0.68) | (−0.89) | (2.72) | (−0.9) | (−2.13) | (1.7) | (1.3) | (−1.47) | (0.36) | (0.38) | |||||

| 3 | 3.16 | −4.11 | 3.39 | −4.46 | 37.41a | −0.02 | 0.13 | 71 | −15.76b | 7.29c | 3.40 | −24.21 | −2.48 | 0.10 | 0.21 | 25 |

| (0.38) | (−0.95) | (0.78) | (−0.41) | (3.9) | (−0.35) | (−2.4) | (2.07) | (1.02) | (−1.67) | (−0.28) | (1.26) | |||||

| 4 | 0.88 | −2.11 | 3.50 | −4.59 | 30.30a | −0.01 | 0.10 | 71 | −15.02b | 7.85b | 2.03 | −12.48 | 1.41 | 0.09 | 0.22 | 25 |

| (0.11) | (−0.53) | (0.88) | (−0.46) | (3.46) | (−0.23) | (−2.59) | (2.52) | (0.69) | (−0.97) | (0.18) | (1.37) | |||||

| Forecast Horizon | Natural gas (1990:05–2003:12) | |||||||||||||||

| h | C | (Y10-Y3M) | ∆SP | ∆EX | ∆IP | ∆EPU | R2 | N | ||||||||

| 1 | 4.31 | −3.20 | 18.12 | −12.32 | 36.33 | 0.04 | −0.04 | 54 | ||||||||

| (0.15) | (−0.23) | (1.33) | (−0.33) | (1.14) | (0.16) | |||||||||||

| 2 | −6.06 | 4.49 | 4.89 | −34.36 | 21.29 | −0.03 | −0.03 | 54 | ||||||||

| (−0.34) | (0.52) | (0.57) | (−1.43) | (1.06) | (−0.18) | |||||||||||

| 3 | −16.59 | 9.11 | 5.02 | −50.56a | 20.50 | 0.12 | 0.16 | 54 | ||||||||

| (−1.32) | (1.51) | (0.83) | (−3.02) | (1.46) | (1.15) | |||||||||||

| 4 | −15.38 | 10.68b | 3.90 | −32.98b | 10.68 | 0.11 | 0.13 | 54 | ||||||||

| (−1.51) | (2.19) | (0.8) | (−2.44) | (0.94) | (1.33) | |||||||||||

| h = 2 (Two Quarters Ahead) | |||||||||

| Silver | Oil | Gold | PLTNM | PLDM | Zinc | ETHNL | Coal | NatGas | |

| Break Point #1 | 2003Q2 | = | 2001Q2 | = | = | = | = | = | = |

| Break Point #2 | 2011Q2 | = | 2012Q3 | = | = | = | = | = | = |

| Break Point #3 | = | = | = | = | = | = | = | = | = |

| h = 3 (Three Quarters Ahead) | |||||||||

| Silver | Oil | Gold | PLTNM | PLDM | Zinc | ETHNL | Coal | NatGas | |

| Break Point #1 | 2003Q2 | = | 2001Q1 | = | 1996Q3 | = | = | 2011Q1 | = |

| Break Point #2 | 2011Q1 | = | 2012Q2 | = | = | = | = | 2015Q4 | = |

| Break Point #3 | = | = | = | = | = | = | = | = | = |

| h = 4 (Four Quarters Ahead) | |||||||||

| Silver | Oil | Gold | PLTNM | PLDM | Zinc | ETHNL | Coal | NatGas | |

| Break Point #1 | 2003Q1 | 1995Q4 | 2001Q2 | 1998Q4 | 1996Q2 | = | = | 2011Q1 | 2000Q3 |

| Break Point #2 | 2011Q1 | = | 2012Q2 | 2010Q4 | 2001Q2 | = | = | 2015Q4 | 2006Q2 |

| Break Point #3 | = | = | = | = | 2008Q4 | = | = | = | = |

| Coal | Ethanol | Gold | Nat.Gas | Oil | PLDM | PLTNM | Silver | Zinc | |

|---|---|---|---|---|---|---|---|---|---|

| Coal | 1.00 | ||||||||

| Ethanol | 0.647 *** | 1.00 | |||||||

| Gold | 0.090 | −0.230 * | 1.00 | ||||||

| Nat.Gas | 0.124 | 0.321 ** | −0.153 * | 1.00 | |||||

| Oil | 0.692 *** | 0.519 *** | 0.167 * | 0.627 *** | 1.00 | ||||

| PLDM | 0.407 *** | 0.205 | 0.166 * | −0.222 ** | −0.141 * | 1.00 | |||

| PLTNM | 0.120 | −0.037 | 0.534 *** | 0.354 *** | 0.406 *** | 0.327 *** | 1.00 | ||

| Silver | 0.249 | −0.071 | 0.730 *** | −0.065 | 0.091 | 0.487 *** | 0.630 *** | 1.00 | |

| Zinc | 0.493 *** | 0.277 ** | −0.154 | 0.086 | 0.196 * | 0.278 *** | 0.081 | 0.159 | 1.00 |

| Panel A | ||||||||||||

| Forecast Horizon | Oil (1986:01–2020:12) | Silver (1986:01–2020:12) | Gold (1986:01–2020:12) | |||||||||

| h | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N |

| 1 | 10.51 (0.25) | −4.45 (0.38) | 0.003 | 139 | 3.28 (0.61) | 1.01 (0.79) | 0.000 | 139 | 3.82 (0.40) | 0.84 (0.72) | 0.001 | 138 |

| 2 | 8.59 (0.30) | −3.40 (0.47) | 0.004 | 138 | 2.60 (0.67) | 1.43 (0.70) | 0.002 | 138 | 3.65 (0.41) | 0.94 (0.68) | 0.003 | 138 |

| 3 | 7.34 (0.35) | −2.71 (0.55) | 0.005 | 137 | 1.03 (0.86) | 2.26 (0.52) | 0.007 | 137 | 3.41 (0.42) | 0.94 (0.67) | 0.004 | 137 |

| 4 | 4.95 (0.51) | −1.56 (0.72) | 0.002 | 136 | −0.65 (0.90) | 3.19 (0.35) | 0.021 | 136 | 3.30 (0.42) | 0.89 (0.67) | 0.004 | 136 |

| Forecast Horizon | Platinum (1986:04–2020:12) | Palladium (1986:04–2020:12) | Zinc (1997:08–2020:12) | |||||||||

| h | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N |

| 1 | 3.98 (0.45) | −0.88 (0.78) | 0.000 | 139 | 18.34 ** (0.04) | −6.63 (0.25) | 0.01 | 139 | 3.24 (0.80) | −0.06 (0.99) | 0.000 | 93 |

| 2 | 3.15 (0.54) | −0.49 (0.87) | 0.0003 | 138 | 15.69 * (0.08) | −4.79 (0.39) | 0.01 | 138 | 0.19 (0.99) | 2.13 (0.71) | 0.003 | 92 |

| 3 | 1.71 (0.73) | 0.23 (0.94) | 0.0001 | 136 | 12.24 (0.18) | −2.59 (0.63) | 0.004 | 137 | −2.26 (0.84) | 3.74 (0.46) | 0.01 | 91 |

| 4 | 0.49 (0.92) | 0.94 (0.72) | 0.002 | 136 | 10.16 (0.27) | −1.10 (0.83) | 0.001 | 136 | −4.33 (0.69) | 5.12 (0.27) | 0.03 | 90 |

| Forecast Horizon | Ethanol (2005:06–2020:12) | Coal (2009:01–2020:12) | Natural gas (1990:05–2020:12) | |||||||||

| h | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N |

| 1 | 2.00 (0.88) | −1.97 (0.80) | 0.001 | 62 | −4.91 (0.79) | 3.21 (0.71) | 0.004 | 48 | 5.07 (0.71) | −2.16 (0.76) | 0.001 | 122 |

| 2 | 0.20 (0.98) | −1.70 (0.78) | 0.001 | 61 | −8.31 (0.61) | 4.90 (0.52) | 0.02 | 47 | 2.75 (0.82) | −0.90 (0.89) | 0.0002 | 121 |

| 3 | −1.68 (0.84) | −0.72 (0.90) | 0.000 | 60 | −12.06 (0.40) | 6.51 (0.34) | 0.04 | 46 | 0.96 (0.93) | −0.12 (0.98) | 0.000 | 120 |

| 4 | −4.84 (0.46) | 0.56 (0.91) | 0.000 | 59 | −11.26 (0.42) | 5.98 (0.37) | 0.04 | 45 | −1.10 (0.91) | 1.19 (0.82) | 0.001 | 119 |

| Panel B | ||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | Gold (1986:01–2003:12) | |||||||||

| h | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N |

| 1 | 12.42 (0.31) | −4.79 (0.43) | 0.005 | 71 | −7.50 (0.15) | 6.26 * (0.07) | 0.03 | 71 | −5.59 (0.14) | 5.00 ** (0.03) | 0.04 | 70 |

| 2 | 10.64 (0.33) | −3.56 (0.50) | 0.006 | 71 | −9.37 * (0.05) | 8.28 ** (0.03) | 0.11 | 71 | −5.59 * (0.07) | 5.06 *** (0.01) | 0.10 | 71 |

| 3 | 9.74 (0.32) | −3.03 (0.53) | 0.009 | 71 | −8.99 ** (0.03) | 7.64 ** (0.01) | 0.14 | 71 | −5.41 ** (0.04) | 4.52 *** (0.004) | 0.13 | 71 |

| 4 | 8.86 (0.34) | −2.35 (0.62) | 0.007 | 71 | −8.93 ** (0.01) | 7.60 *** (0.003) | 0.19 | 71 | −5.18 ** (0.04) | 4.26 *** (0.003) | 0.15 | 71 |

| Forecast Horizon | Platinum (1986:04–2003:12) | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | |||||||||

| h | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N |

| 1 | −0.64 (0.93) | 3.39 (0.35) | 0.01 | 71 | 14.98 (0.29) | −8.42 (0.31) | 0.02 | 71 | −16.75 (0.14) | 9.49 (0.12) | 0.09 | 25 |

| 2 | −2.72 (0.68) | 5.09 (0.12) | 0.05 | 71 | 8.46 (0.54) | −2.89 (0.72) | 0.004 | 71 | −14.68 (0.15) | 10.01 * (0.09) | 0.17 | 25 |

| 3 | −3.93 (0.52) | 5.45 * (0.07) | 0.09 | 70 | 4.74 (0.73) | −0.63 (0.93) | 0.000 | 71 | −13.22 (0.18) | 8.97 * (0.09) | 0.20 | 25 |

| 4 | −4.48 (0.43) | 5.85 * (0.04) | 0.12 | 71 | 2.72 (0.84) | 0.80 (0.91) | 0.001 | 71 | −12.50 (0.17) | 9.12 * (0.06) | 0.26 | 25 |

| Forecast Horizon | Natural Gas (1990:05–2003:12) | |||||||||||

| h | C | (Y10-Y1) | R2 | N | ||||||||

| 1 | 10.73 (0.67) | −0.22 (0.99) | 0.000 | 54 | ||||||||

| 2 | 2.97 (0.89) | 4.30 (0.66) | 0.004 | 54 | ||||||||

| 3 | −0.41 (0.98) | 6.44 (0.47) | 0.02 | 54 | ||||||||

| 4 | −1.84 (0.92) | 7.84 (0.30) | 0.04 | 54 | ||||||||

| Panel C | ||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | Gold (2004:01–2020:12) | |||||||||

| h | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N |

| 1 | 8.26 (0.60) | −3.95 (0.64) | 0.002 | 68 | 15.22 (0.10) | −4.46 (0.46) | 0.006 | 68 | 13.82 ** (0.01) | −3.34 (0.29) | 0.02 | 68 |

| 2 | 6.04 (0.65) | −2.99 (0.69) | 0.002 | 67 | 15.87 * (0.06) | −5.53 (0.34) | 0.019 | 67 | 14.21 *** (0.01) | −3.52 (0.26) | 0.03 | 67 |

| 3 | 4.29 (0.73) | −2.10 (0.76) | 0.002 | 66 | 12.56 (0.12) | −3.41 (0.55) | 0.012 | 66 | 13.88 *** (0.01) | −3.18 (0.29) | 0.04 | 66 |

| 4 | −0.09 (0.99) | −0.28 (0.97) | 0.000 | 65 | 9.14 (0.25) | −1.59 (0.78) | 0.004 | 65 | 13.71 *** (0.004) | −3.12 (0.26) | 0.05 | 65 |

| Forecast Horizon | Platinum (2004:01–2020:12) | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | |||||||||

| h | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N | C | (Y10-Y1) | R2 | N |

| 1 | 8.60 (0.24) | −4.83 (0.30) | 0.01 | 68 | 22.90 ** (0.01) | −5.63 (0.44) | 0.01 | 68 | 13.37 (0.46) | −4.91 (0.58) | 0.01 | 68 |

| 2 | 9.07 (0.19) | −5.64 (0.23) | 0.03 | 67 | 24.29 *** (0.004) | −7.25 (0.32) | 0.02 | 67 | 7.93 (0.65) | −1.80 (0.82) | 0.002 | 67 |

| 3 | 7.55 (0.25) | −4.66 (0.27) | 0.03 | 66 | 21.46 ** (0.01) | −5.25 (0.43) | 0.02 | 66 | 3.58 (0.83) | 0.97 (0.89) | 0.000 | 66 |

| 4 | 5.67 (0.37) | −3.65 (0.33) | 0.03 | 65 | 19.62 ** (0.03) | −3.82 (0.54) | 0.01 | 65 | 0.15 (0.99) | 2.97 (0.66) | 0.01 | 65 |

| Forecast Horizon | Natural Gas (2004:01–2020:12) | |||||||||||

| h | C | (Y10-Y1) | R2 | N | ||||||||

| 1 | 0.56 (0.97) | −3.69 (0.63) | 0.002 | 68 | ||||||||

| 2 | 2.48 (0.86) | −4.99 (0.49) | 0.01 | 67 | ||||||||

| 3 | 1.93 (0.88) | −5.27 (0.41) | 0.01 | 66 | ||||||||

| 4 | −0.77 (0.94) | −3.97 (0.47) | 0.01 | 65 | ||||||||

| Panel A | ||||||||||||

| Forecast Horizon | Oil (1986:01–2020:12) | Silver (1986:01–2020:12) | Gold (1986:01–2020:12) | |||||||||

| h | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N |

| 1 | 11.27 (0.20) | −6.39 (0.30) | 0.004 | 139 | 2.30 (0.70) | 2.18 (0.65) | 0.001 | 139 | 2.96 (0.48) | 1.86 (0.50) | 0.004 | 138 |

| 2 | 8.47 (0.27) | −4.25 (0.44) | 0.004 | 138 | 1.81 (0.75) | 2.56 (0.58) | 0.004 | 138 | 2.87 (0.48) | 1.91 (0.47) | 0.01 | 138 |

| 3 | 7.27 (0.32) | −3.41 (0.52) | 0.005 | 137 | 0.69 (0.90) | 3.20 (0.47) | 0.01 | 137 | 2.61 (0.51) | 1.92 (0.45) | 0.01 | 137 |

| 4 | 5.27 (0.45) | −2.29 (0.66) | 0.003 | 136 | −0.55 (0.91) | 3.99 (0.35) | 0.02 | 136 | 2.50 (0.51) | 1.86 (0.45) | 0.01 | 136 |

| Forecast Horizon | Platinum (1986:04–2020:12) | Palladium (1986:04–2020:12) | Zinc (1997:08–2020:12) | |||||||||

| h | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N |

| 1 | 3.51 (0.50) | −0.71 (0.85) | 0.0002 | 139 | 16.64 * (0.06) | −6.94 (0.33) | 0.01 | 139 | 3.79 (0.76) | −0.54 (0.94) | 0.000 | 93 |

| 2 | 2.90 (0.55) | −0.40 (0.91) | 0.0001 | 138 | 15.04 * (0.09) | −5.55 (0.42) | 0.01 | 138 | 1.10 (0.93) | 1.78 (0.78) | 0.002 | 92 |

| 3 | 2.18 (0.65) | −0.13 (0.97) | 0.000 | 136 | 12.77 (0.15) | −3.80 (0.57) | 0.01 | 137 | −0.98 (0.93) | 3.41 (0.56) | 0.01 | 91 |

| 4 | 1.29 (0.77) | 0.49 (0.88) | 0.0005 | 136 | 10.88 (0.21) | −2.05 (0.74) | 0.003 | 136 | −2.64 (0.80) | 4.73 (0.38) | 0.02 | 90 |

| Forecast Horizon | Ethanol (2005:06–2020:12) | Coal (2009:01–2020:12) | Natural gas (1990:05–2020:12) | |||||||||

| h | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N |

| 1 | 1.64 (0.91) | −1.94 (0.84) | 0.0004 | 62 | −4.20 (0.82) | 3.23 (0.74) | 0.003 | 48 | 6.92 (0.59) | −4.28 (0.62) | 0.002 | 122 |

| 2 | −0.35 (0.97) | −1.50 (0.84) | 0.001 | 61 | −6.71 (0.69) | 4.59 (0.62) | 0.01 | 47 | 5.23 (0.65) | −3.24 (0.67) | 0.002 | 121 |

| 3 | −1.33 (0.88) | −1.11 (0.87) | 0.001 | 60 | −9.94 (0.51) | 6.12 (0.47) | 0.03 | 46 | 3.88 (0.72) | −2.62 (0.71) | 0.002 | 120 |

| 4 | −4.08 (0.55) | 0.05 (0.99) | 0.000 | 59 | −8.80 (0.56) | 5.31 (0.53) | 0.03 | 45 | 1.61 (0.87) | −0.77 (0.90) | 0.0003 | 119 |

| Panel B | ||||||||||||

| Forecast Horizon | Oil (1986:01–2003:12) | Silver (1986:01–2003:12) | Gold (1986:01–2003:12) | |||||||||

| h | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N |

| 1 | 12.81 (0.24) | −7.33 (0.31) | 0.01 | 71 | −6.76 (0.17) | 8.23 * (0.07) | 0.04 | 71 | −5.11 (0.15) | 6.71 ** (0.02) | 0.05 | 70 |

| 2 | 10.36 (0.30) | −4.83 (0.46) | 0.01 | 71 | −8.65 * (0.06) | 11.18 ** (0.02) | 0.13 | 71 | −5.24 * (0.07) | 6.93 *** (0.004) | 0.13 | 71 |

| 3 | 8.78 (0.34) | −3.34 (0.57) | 0.01 | 71 | −8.73 ** (0.03) | 10.73 *** (0.01) | 0.18 | 71 | −5.34 ** (0.03) | 6.45 *** (0.001) | 0.18 | 71 |

| 4 | 7.32 (0.39) | −1.74 (0.77) | 0.003 | 71 | −8.63 *** (0.01) | 10.65 *** (0.001) | 0.24 | 71 | −5.25 ** (0.03) | 6.22 *** (0.00) | 0.21 | 71 |

| Forecast Horizon | Platinum (1986:04–2003:12) | Palladium (1986:04–2003:12) | Zinc (1997:08–2003:12) | |||||||||

| h | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N |

| 1 | −0.19 (0.98) | 4.41 (0.37) | 0.01 | 71 | 14.57 (0.25) | −11.71 (0.27) | 0.02 | 71 | −14.39 (0.22) | 10.23 (0.17) | 0.08 | 25 |

| 2 | −1.92 (0.77) | 6.49 (0.15) | 0.05 | 71 | 9.81 (0.44) | −5.60 (0.58) | 0.01 | 71 | −13.13 (0.19) | 11.82 * (0.09) | 0.18 | 25 |

| 3 | −2.94 (0.62) | 6.78 * (0.09) | 0.09 | 70 | 6.75 (0.59) | −3.07 (0.75) | 0.004 | 71 | −12.20 (0.18) | 10.99 * (0.06) | 0.22 | 25 |

| 4 | −3.43 (0.54) | 7.32 ** (0.05) | 0.13 | 71 | 4.49 (0.71) | −0.74 (0.93) | 0.0003 | 71 | −11.53 (0.16) | 11.25 ** (0.02) | 0.29 | 25 |

| Forecast Horizon | Natural Gas (1990:05–2003:12) | |||||||||||

| h | C | (Y10-Y2) | R2 | N | ||||||||

| 1 | 12.09 (0.59) | −1.61 (0.91) | 0.0002 | 54 | ||||||||

| 2 | 7.03 (0.72) | 2.16 (0.85) | 0.001 | 54 | ||||||||

| 3 | 3.90 (0.83) | 4.94 (0.64) | 0.01 | 54 | ||||||||

| 4 | 1.86 (0.91) | 7.49 (0.40) | 0.02 | 54 | ||||||||

| Panel C | ||||||||||||

| Forecast Horizon | Oil (2004:01–2020:12) | Silver (2004:01–2020:12) | Gold (2004:01–2020:12) | |||||||||

| h | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N |

| 1 | 9.12 (0.58) | −5.25 (0.61) | 0.002 | 68 | 14.73 (0.13) | −4.77 (0.53) | 0.005 | 68 | 13.80 *** (0.01) | −3.85 (0.31) | 0.02 | 68 |

| 2 | 5.56 (0.67) | −3.09 (0.71) | 0.002 | 67 | 15.76 * (0.08) | −6.31 (0.38) | 0.02 | 67 | 14.40 *** (0.01) | −4.22 (0.26) | 0.03 | 67 |

| 3 | 4.61 (0.71) | −2.68 (0.73) | 0.002 | 66 | 13.68 (0.10) | −4.82 (0.49) | 0.02 | 66 | 14.39 *** (0.01) | −4.07 (0.25) | 0.04 | 66 |

| 4 | 1.36 (0.91) | −1.44 (0.85) | 0.001 | 65 | 10.82 (0.17) | −3.11 (0.64) | 0.01 | 65 | 14.36 *** (0.00) | −4.11 (0.22) | 0.06 | 65 |

| Forecast Horizon | Platinum (2004:01–2020:12) | Palladium (2004:01–2020:12) | Zinc (2004:01–2020:12) | |||||||||

| h | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N | C | (Y10-Y2) | R2 | N |

| 1 | 7.53 (0.31) | −4.74 (0.36) | 0.01 | 68 | 21.92 ** (0.02) | −5.74 (0.50) | 0.01 | 68 | 15.05 (0.41) | −6.99 (0.51) | 0.01 | 68 |

| 2 | 8.12 (0.25) | −5.78 (0.26) | 0.02 | 67 | 23.87 *** (0.01) | −8.05 (0.33) | 0.02 | 67 | 10.20 (0.57) | −3.84 (0.69) | 0.01 | 67 |

| 3 | 7.92 (0.23) | −5.67 (0.24) | 0.03 | 66 | 22.88 *** (0.01) | −7.17 (0.36) | 0.03 | 66 | 6.35 (0.71) | −1.01 (0.91) | 0.001 | 66 |

| 4 | 6.56 (0.29) | −4.90 (0.25) | 0.04 | 65 | 21.70 *** (0.01) | −6.01 (0.40) | 0.03 | 65 | 3.36 (0.84) | 0.99 (0.90) | 0.001 | 65 |

| Forecast Horizon | Natural Gas (2004:01–2020:12) | |||||||||||

| h | C | (Y10-Y2) | R2 | N | ||||||||

| 1 | 0.76 (0.96) | −4.42 (0.63) | 0.002 | 68 | ||||||||

| 2 | 2.15 (0.88) | −5.52 (0.52) | 0.01 | 67 | ||||||||

| 3 | 2.29 (0.86) | −6.38 (0.40) | 0.01 | 66 | ||||||||

| 4 | −0.56 (0.96) | −4.76 (0.47) | 0.01 | 65 | ||||||||

| Panel A | ||||||||||||

| Forecast Horizon | Oil (1986:01–2020:12) | Silver (1986:01–2020:12) | Gold (1986:01–2020:12) | |||||||||

| h | C | (Y30-Y3M) | R2 | N | C | (Y30-Y3M) | R2 | N | C | (Y30-Y3M) | R2 | N |