Performance, Risk, and Cost of Capital: Trends and Opportunities for Future CSR Research

Abstract

:1. Introduction

2. Literature Review

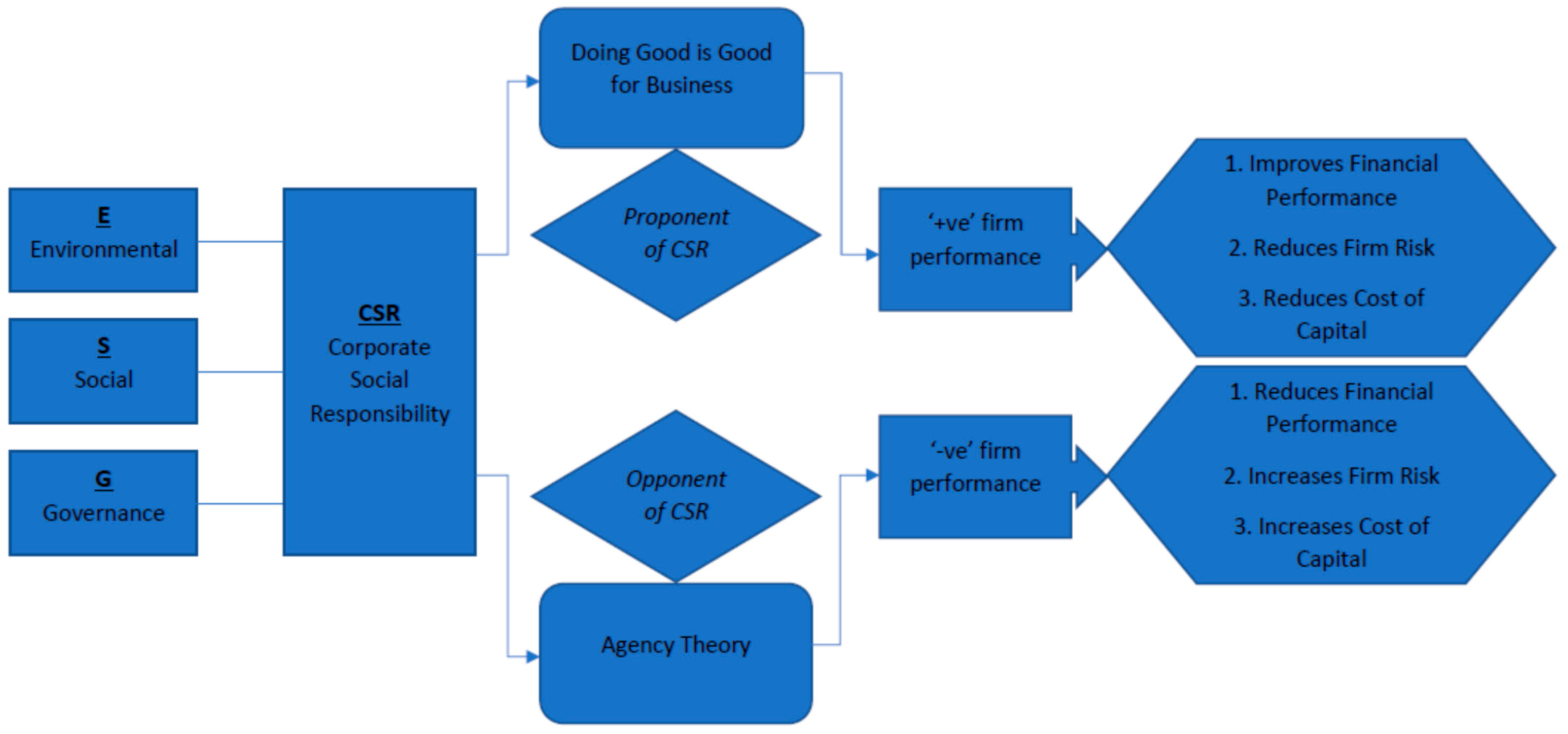

Proponents and Opponents of CSR

3. Methods

4. CSR and Firm’s Financial Characteristics

4.1. CSR and the Firm’s Information Environment

4.2. CSR and Firm Risk

4.3. CSR and Financing Sources

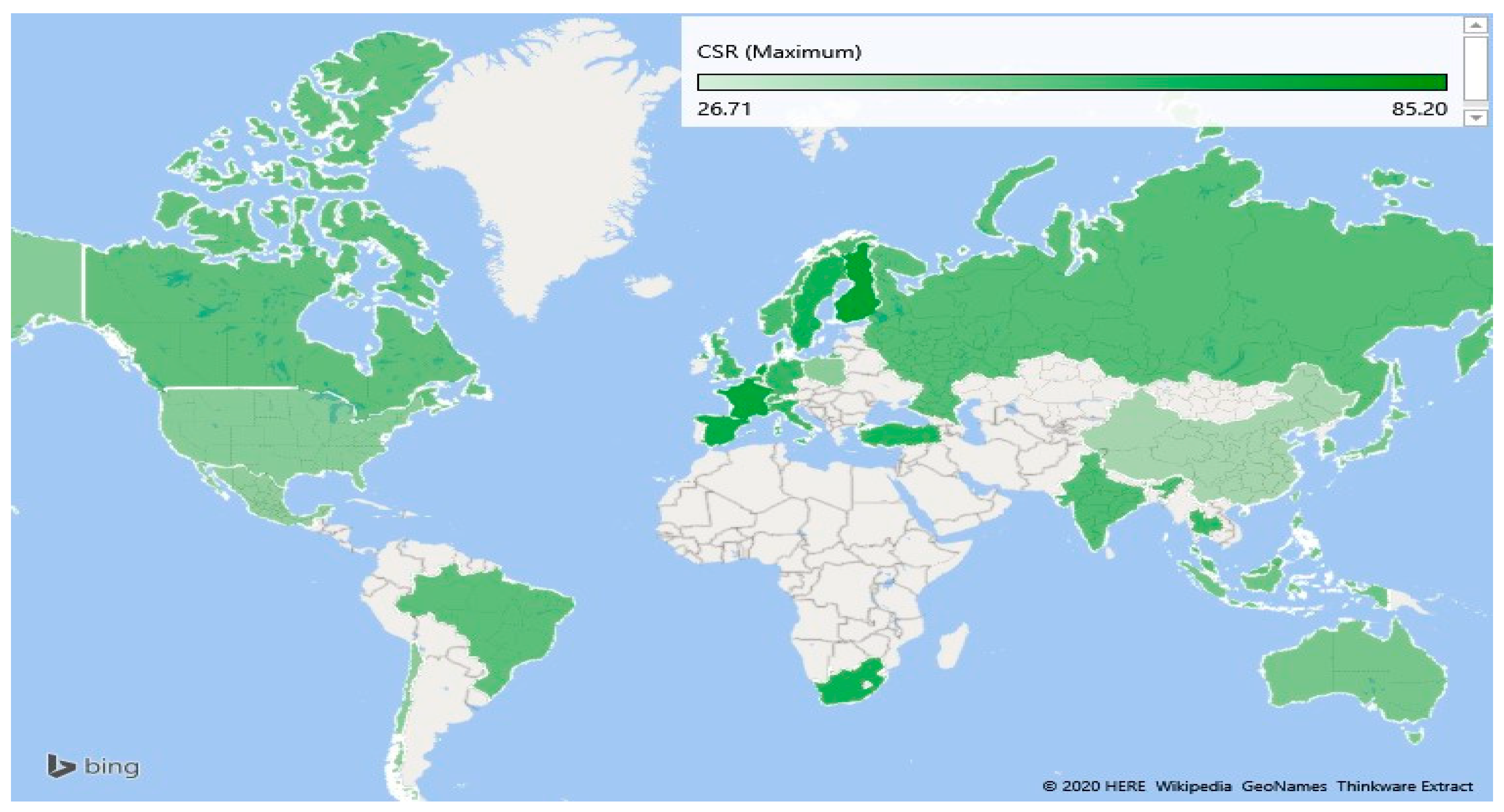

4.4. CSR MNCs and Country Characteristics

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Adhikari, Binay K. 2016. Causal effect of analyst following on corporate social responsibility. Journal of Corporate Finance 41: 201–16. [Google Scholar] [CrossRef] [Green Version]

- Alniacik, Umit, Esra Alniacik, and Nurullah Genc. 2011. How corporate social responsibility information influences stakeholders’ intentions. Corporate Social Responsibility and Environmental Management 18: 234–45. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I., Małgorzata Iwanicz-Drozdowska, Erkki K. Laitinen, and Arto Suvas. 2016. Financial distress prediction in an international context: A review and empirical analysis of altman’s z-score model. Journal of International Financial Management & Accounting 28: 131–71. [Google Scholar]

- Attig, Najah, Sadok El Ghoul, Omrane Guedhami, and Jungwon Suh. 2013. Corporate social responsibility and credit ratings. Journal of Business Ethics 117: 679–94. [Google Scholar] [CrossRef]

- Bénabou, Roland, and Jean Tirole. 2010. Individual and corporate social responsibility. Economica 77: 1–19. [Google Scholar] [CrossRef] [Green Version]

- Bhandari, Avishek, and David Javakhadze. 2017. Corporate social responsibility and capital allocation efficiency. Journal of Corporate Finance 43: 354–77. [Google Scholar] [CrossRef]

- Bocquet, Rachel, Christian Le Bas, Caroline Mothe, and Nicolas Poussing. 2017. CSR, innovation, and firm performance in sluggish growth contexts: A firm-level empirical analysis. Journal of Business Ethics 146: 241–54. [Google Scholar] [CrossRef]

- Bouslah, Kais, Lawrence Kryzanowski, and Bouchra M’zali. 2013. The impact of the dimensions of social performance on firm risk. Journal of Banking and Finance 37: 1258–73. [Google Scholar] [CrossRef]

- Braune, Eric, Pablo Charosky, and Lubica Hikkerova. 2019. Corporate social responsibility, financial performance and risk in times of economic instability. Journal of Management and Governance 23: 1007–21. [Google Scholar] [CrossRef]

- Brine, Matthew, Rebecca Brown, and Greg Hackett. 2007. Corporate social responsibility and financial performance in the australian context. Economic Round-Up 1: 47–58. [Google Scholar]

- Buchanan, Bonnie, Cathy Xuying Cao, and Chongyang Chen. 2018. Corporate social responsibility, firm value, and influential institutional ownership. Journal of Corporate Finance 52: 73–95. [Google Scholar] [CrossRef]

- Cai, Li, Jinhua Cui, and Hoje Jo. 2015. Corporate environmental responsibility and firm risk. Journal of Business Ethics 139: 1–32. [Google Scholar] [CrossRef]

- Cai, Ye, Carrie H. Pan, and Meir Statman. 2016. Why do countries matter so much in corporate social performance? Journal of Corporate Finance 41: 591–609. [Google Scholar] [CrossRef] [Green Version]

- Calabretta, Giulia, Boris Durisin, and Marco Ogliengo. 2011. Uncovering the intellectual structure of research in business ethics: A journey through the history, the classics, and the pillars of Journal of Business Ethics. Journal of Business Ethics 104: 499–524. [Google Scholar] [CrossRef]

- Carroll, Archie B. 1979. A three-dimensional conceptual model of corporate performance. The Academy of Management Review 4: 497–505. [Google Scholar] [CrossRef]

- Cheng, Beiting, Ioannis Ioannou, and George Serafeim. 2014. Corporate social responsibility and access to finance. Strategic Management Journal 35: 1–23. [Google Scholar] [CrossRef]

- Cheng, Haw, Harrison Hong, and Kelly Shue. 2013. Do Managers do Good with Other People’s Money? Working Paper. Cambridge: National Bureau of Economic Research (NBER). [Google Scholar]

- Chollet, Pierre, and Blaise W. Sandwidi. 2018. CSR engagement and financial risk: A virtuous circle? International evidence. Global Finance Journal 38: 65–81. [Google Scholar] [CrossRef]

- Cooper, Michael J., Huseyin Gulen, and Alexei V. Ovtchinnikov. 2010. Corporate political contributions and stock returns. Journal of Finance 65: 687–724. [Google Scholar] [CrossRef] [Green Version]

- Cui, Jinhua, Hoje Jo, and Haejung Na. 2017. Corporate social responsibility, religion, and firm risk. Asia-Pacific Journal of Financial Studies 46: 305–40. [Google Scholar] [CrossRef]

- Cui, Jinhua, Hoje Jo, and Haejung Na. 2018. Does corporate social responsibility affect information asymmetry? Journal of Business Ethics 148: 549–72. [Google Scholar] [CrossRef]

- Dhaliwal, Dan, Oliver ZhenLi, Albert Tsang, and Yong GeorgeYang. 2014. Corporate social responsibility disclosure and the cost of equity capital: The roles of stakeholder orientation and financial transparency. Journal of Accounting and Public Policy 33: 328–55. [Google Scholar] [CrossRef]

- Dhaliwal, Dan S., Suresh Radhakrishnan, Albert Tsang, and Yong George Yang. 2012. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. The Accounting Review 87: 723–59. [Google Scholar] [CrossRef]

- Di Giuli, Alberta, and Leonard Kostovetsky. 2014. Are red or blue companies more likely to go green? Politics and corporate social responsibility. Journal of Financial Economics 111: 158–80. [Google Scholar] [CrossRef]

- Dionisio, Marcelo, and Eduardo Raupp de Vargas. 2020. Corporate social innovation: A systematic literature review. International Business Review 29: 101641. [Google Scholar] [CrossRef]

- Drago, Danilo, Concetta Carnevale, and Raffaele Gallo. 2019. Do corporate social responsibility ratings affect credit default swap spreads? Corporate Social Responsibility and Environmental Management 26: 644–52. [Google Scholar] [CrossRef]

- Dreesbach-Bundy, Suska, and Barbara Scheck. 2017. Corporate volunteering: A bibliometric analysis from 1990 to 2015. Business Ethics: A European Review 26: 240–56. [Google Scholar] [CrossRef]

- El Ghoul, Sadok, Omrane Guedhami, Chuck C. Y. Kwok, and Dev R. Mishra. 2011. Does corporate social responsibility affect the cost of capital? Journal of Banking and Finance 35: 2388–406. [Google Scholar] [CrossRef]

- El Ghoul, Sadok, Omrane Guedhami, He Wang, and Chuck C. Y. Kwok. 2016. Family control and corporate social responsibility. Journal of Banking and Finance 73: 131–46. [Google Scholar] [CrossRef]

- Elfenbein, Daniel W., Ray Fisman, and Brian McManus. 2012. Charity as a substitute for reputation: Evidence from an online marketplace. The Review of Economic Studies 79: 1441–68. [Google Scholar] [CrossRef]

- Fatemi, Ali, Iraj Fooladi, and Hassan Tehranian. 2015. Valuation effects of corporate social responsibility. Journal of Banking and Finance 59: 182–92. [Google Scholar] [CrossRef]

- Feng, Zhi-Yuan, Ming-Long Wang, and Hua-Wei Huang. 2015. Equity financing and social responsibility: Further international evidence. The International Journal of Accounting 50: 247–80. [Google Scholar] [CrossRef]

- Flammer, Caroline, Bryan Hong, and Dylan Minor. 2019. Corporate governance and the rise of integrating corporate social responsibility criteria in executive compensation: Effectiveness and implications for firm outcomes. Strategic Management Journal 40: 1097–122. [Google Scholar] [CrossRef]

- Friedman, Milton. 2007. The social responsibility of business is to increase its profits. In Corporate Ethics and Corporate Governance. Edited by Zimmerli Walther Ch, Klaus Richter and Markus Holzinger. Berlin/Heidelberg: Springer, pp. 173–78. [Google Scholar]

- Galbreath, Jeremy. 2018. Is board gender diversity linked to financial performance? The mediating mechanism of CSR. Business & Society 57: 863–89. [Google Scholar]

- Galema, Rients, Auke Plantinga, and Bert Scholtens. 2008. The stocks at stake: Return and risk in socially responsible investment. Journal of Banking and Finance 32: 2646–54. [Google Scholar] [CrossRef]

- Gamerschlag, Ramin, Klaus Möller, and Frank Verbeeten. 2011. Determinants of voluntary csr disclosure: Empirical evidence from germany. Review of Managerial Science 5: 233–62. [Google Scholar] [CrossRef] [Green Version]

- García-Sánchez, García-Sánchez, Nazim Hussain, Jennifer Martínez-Ferrero, and Emiliano Ruiz-Barbadillo. 2019. Impact of disclosure and assurance quality of corporate sustainability reports on access to finance. Corporate Social Responsibility and Environmental Management 26: 832–48. [Google Scholar] [CrossRef] [Green Version]

- Gelb, David S., and Joyce A. Strawser. 2001. Corporate social responsibility and financial disclosures: An alternative explanation for increased disclosure. Journal of Business Ethics 33: 1–13. [Google Scholar] [CrossRef]

- Goss, Allen, and Gordon S. Roberts. 2011. The impact of corporate social responsibility on the cost of bank loans. Journal of Banking and Finance 35: 1794–810. [Google Scholar] [CrossRef]

- Groening, Christopher, and Vamsi K. Kanuri. 2016. Investor reactions to concurrent positive and negative stakeholder news. Journal of Business Ethics 149: 833–56. [Google Scholar] [CrossRef]

- Haggard, K. Stephen, Xiumin Martin, and Raynolde Pereira. 2008. Does voluntary disclosure improve stock price informativeness? Financial Management 37: 747–68. [Google Scholar] [CrossRef]

- Harjoto, Maretno Agus, and Fabrizio Rossi. 2019. Religiosity, female directors, and corporate social responsibility for Italian listed companies. Journal of Business Research 95: 338–46. [Google Scholar] [CrossRef]

- Harris, Jared D., Harry J. Sapienza, and Norman E. Bowie. 2009. Ethics and entrepreneurship. Journal of Business Venturing 24: 407–18. [Google Scholar] [CrossRef]

- Hemingway, Christine A., and Patrick W. Maclagan. 2004. Managers’ personal values as drivers of corporate social responsibility. Journal of Business Ethics 50: 33–44. [Google Scholar] [CrossRef]

- Herremans, Irene M., Parporn Akathaporn, and Morris McInnes. 1993. An investigation of corporate social responsibility reputation and economic performance. Accounting, Organizations and Society 18: 587–604. [Google Scholar] [CrossRef]

- Hong, Harrison, Jeffrey D. Kubik, and Jose A. Scheinkman. 2012. Financial Constraints on Corporate Goodness. Working Paper. Cambridge: National Bureau of Economic Research (NBER). [Google Scholar]

- Humphrey, Jacquelyn E., Darren D. Lee, and Yaokan Shen. 2012. Does it cost to be sustainable? Journal of Corporate Finance 18: 626–39. [Google Scholar] [CrossRef]

- Husted, Bryan W. 2005. Risk management, real options, corporate social responsibility. Journal of Business Ethics 60: 175–83. [Google Scholar] [CrossRef]

- Jamali, Dima, and Archie Carroll. 2017. Capturing advances in CSR: Developed versus developing country perspectives. Business Ethics: A European Review 26: 321–25. [Google Scholar] [CrossRef]

- Jiraporn, Pornsit, Napatsorn Jiraporn, Adisak Boeprasert, and Kiyoung Chang. 2014. Does corporate social responsibility (csr) improve credit ratings? Evidence from geographic identification. Financial Management 43: 505–31. [Google Scholar] [CrossRef]

- Jo, Hoje, and Haejung Na. 2012. Does csr reduce firm risk? Evidence from controversial industry sectors. Journal of Business Ethics 110: 441–56. [Google Scholar] [CrossRef]

- Jones, David A., Alexander Newman, Ruodan Shao, and Fang Lee Cooke. 2019. Advances in employee-focused micro-level research on corporate social responsibility: Situating new contributions within the current state of the literature. Journal of Business Ethics 157: 293–302. [Google Scholar] [CrossRef]

- Kaplan, Steven N., and Luigi Zingales. 1997. Do investment-cash flow sensitivities provide useful measures of financing constraints? The Quarterly Journal of Economics 112: 169–215. [Google Scholar] [CrossRef] [Green Version]

- Kim, Yongtae, Haidan Li, and Siqi Li. 2014. Corporate social responsibility and stock price crash risk. Journal of Banking and Finance 43: 1–13. [Google Scholar] [CrossRef] [Green Version]

- Kim, Yongtae, Myung Seok Park, and Benson Wier. 2012. Is earnings quality associated with corporate social responsibility? The Accounting Review 87: 761–96. [Google Scholar] [CrossRef]

- Kölbel, Julian F., Timo Busch, and Leonhardt M. Jancso. 2017. How media coverage of corporate social irresponsibility increases financial risk. Strategic Management Journal 38: 2266–84. [Google Scholar] [CrossRef]

- KPMG. 2013. The KPMG Survey of Corporate Responsibility Reporting 2013. Available online: http://www.kpmg.com/global/en/issuesandinsights/articlespublications/corporate-responsibility/pages/corporate-responsibility-reporting-survey-2013 (accessed on 25 June 2019).

- Kramer, Mark R., and Michael E. Porter. 2011. Creating shared value. Harvard Business Review 17: 1–17. [Google Scholar]

- Krüger, Philipp. 2015. Corporate goodness and shareholder wealth. Journal of Financial Economics 115: 304–29. [Google Scholar] [CrossRef]

- La Rosa, Fabio, Giovanni Liberatore, Francesco Mazzi, and Simone Terzani. 2018. The impact of corporate social performance on the cost of debt and access to debt financing for listed European nonfinancial firms. European Management Journal 36: 519–29. [Google Scholar] [CrossRef]

- Lee, Darren D., and Robert W. Faff. 2009. Corporate sustainability performance and idiosyncratic risk: A global perspective. Financial Review 44: 213–37. [Google Scholar] [CrossRef]

- Lee, Changhee, Dan Palmon, and Ari Yezegel. 2018. The corporate social responsibility information environment: Examining the value of financial analysts’ recommendations. Journal of Business Ethics 150: 279–301. [Google Scholar] [CrossRef]

- Lins, Karl V., Henri Servaes, and Ane Tamayo. 2017. Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. Journal of Finance 72: 1785–824. [Google Scholar] [CrossRef] [Green Version]

- Long, Wenbin, Sihai Li, Huiying Wu, and Xianzhong Song. 2019. Corporate social responsibility and financial performance: The roles of government intervention and market competition. Corporate Social Responsibility and Environmental Management 27: 252–541. [Google Scholar] [CrossRef]

- Lys, Thomas, James P. Naughton, and Clare Wang. 2015. Signaling through corporate accountability reporting. Journal of Accounting and Economics 60: 56–72. [Google Scholar] [CrossRef] [Green Version]

- Mackey, Alison, Tyson B. Mackey, and Jay B. Barney. 2007. Corporate social responsibility and firm performance: Investor preferences and corporate strategies. The Academy of Management Review 32: 817–35. [Google Scholar] [CrossRef]

- Malik, Mahfuja. 2015. Value-enhancing capabilities of CSR: A brief review of contemporary literature. Journal of Business Ethics 127: 419–38. [Google Scholar] [CrossRef]

- Margolis, Joshua D., Hillary Anger Elfenbein, and James P. Walsh. 2009. Does It Pay to be Good … And Does it Matter? A Meta-Analysis of the Relationship between Corporate Social and Financial Performance. Working Paper. Available online: https://ssrn.com/abstract=1866371 (accessed on 26 March 2020). [CrossRef]

- Margolis, Joshua D., and James P. Walsh. 2003. Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly 48: 268–305. [Google Scholar] [CrossRef] [Green Version]

- Martinez-Conesa, Isabel, Pedro Soto-Acosta, and Mercedes Palacios-Manzano. 2017. Corporate social responsibility and its effect on innovation and firm performance: An empirical research in SMEs. Journal of Cleaner Production 142: 2374–83. [Google Scholar] [CrossRef]

- Martínez-Ferrero, Jennifer, David Ruiz-Cano, and Isabel-María García-Sánchez. 2016. The causal link between sustainable disclosure and information asymmetry: The moderating role of the stakeholder protection context. Corporate Social Responsibility and Environmental Management 23: 319–32. [Google Scholar] [CrossRef]

- Martínez-Ferrero, Jennifer, Isabel M. Garcia-Sanchez, and Beatriz Cuadrado-Ballesteros. 2015. Effect of financial reporting quality on sustainability information disclosure. Corporate Social Responsibility and Environmental Management 22: 45–64. [Google Scholar] [CrossRef]

- Masulis, Ronald W., and Syed Walid Reza. 2015. Agency problems of corporate philanthropy. The Review of Financial Studies 28: 592–636. [Google Scholar] [CrossRef] [Green Version]

- McCarthy, Scott, Barry Oliver, and Sizhe Song. 2017. Corporate social responsibility and ceo confidence. Journal of Banking and Finance 75: 280–91. [Google Scholar] [CrossRef] [Green Version]

- McWilliams, Abagail, and Donald Siegel. 2001. Corporate social responsibility: A theory of the firm perspective. The Academy of Management Review 26: 117–27. [Google Scholar] [CrossRef]

- Mishra, Saurabh, and Sachin B. Modi. 2013. Positive and negative corporate social responsibility, financial leverage, and idiosyncratic risk. Journal of Business Ethics 117: 431–48. [Google Scholar] [CrossRef]

- Pava, Moses L., and Joshua Krausz. 1996. The association between corporate social-responsibility and financial performance: The paradox of social cost. Journal of Business Ethics 15: 321–57. [Google Scholar] [CrossRef]

- Pope, S., and A. Wæraas. 2016. CSR-washing is rare: A conceptual framework, literature review, and critique. Journal of Business Ethics 137: 173–93. [Google Scholar] [CrossRef]

- Sardana, Deepak, Narain Gupta, Vikas Kumar, and Mile Terziovski. 2020. CSR’ sustainability’practices and firm performance in an emerging economy. Journal of Cleaner Production 258: 120766. [Google Scholar] [CrossRef]

- Servaes, Henri, and Ane Tamayo. 2013. The impact of corporate social responsibility on firm value: The role of customer awareness. Management Science 59: 1045–61. [Google Scholar] [CrossRef] [Green Version]

- Shafai, Nor Atikah Binti, Azlan Bin Amran, and Yuvaraj Ganesan. 2018. Earnings management, tax avoidance and corporate social responsibility: Malaysia evidence. Management 5: 41–56. [Google Scholar] [CrossRef]

- Shapiro, Susan P. 2005. Agency theory. Annual Review of Sociology 31: 263–84. [Google Scholar] [CrossRef]

- Sroufe, Robert. 2018. Integrated Management: How Sustainability Creates Value for Any Business. Bradford: Emerald Group Publishing. [Google Scholar]

- Sun, Wenbin, and Kexiu Cui. 2014. Linking corporate social responsibility to firm default risk. European Management Journal 32: 275–87. [Google Scholar] [CrossRef]

- The Paris Agreement|UNFCC. 2016. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 15 January 2021).

- Ting, Pi-Hui. 2020. Do large firms just talk corporate social responsibility? The evidence from CSR report disclosure. Finance Research Letters 38: 101476. [Google Scholar] [CrossRef]

- Trapp, N. Leila. 2012. Corporation as climate ambassador: Transcending business sector boundaries in a Swedish CSR campaign. Public Relations Review 38: 458–65. [Google Scholar] [CrossRef]

- Verwijmeren, Patrick, and Jeroen Derwall. 2010. Employee well-being, firm leverage, and bankruptcy risk. Journal of Banking and Finance 34: 956–64. [Google Scholar] [CrossRef]

- Vishwanathan, Pushpika, Hans van Oosterhout, Pursey P. M. A. R. Heugens, Patricio Duran, and Marc Van Essen. 2020. Strategic CSR: A concept building meta-analysis. Journal of Management Studies 57: 314–50. [Google Scholar] [CrossRef] [Green Version]

- Waddock, Sandra A., and Samuel B. Graves. 1997. The corporate social performance-financial performance link. Strategic Management Journal 18: 303–19. [Google Scholar] [CrossRef]

- Wanderley, Lilian Soares Outtes, Rafael Lucian, Francisca Farache, and José Milton de Sousa Filho. 2008. CSR information disclosure on the web: A context-based approach analysing the influence of country of origin and industry sector. Journal of Business Ethics 82: 369–78. [Google Scholar] [CrossRef]

- Wright, Peter, and Stephen P. Ferris. 1997. Agency conflict and corporates strategy: The effect of divestment on corporate value. Strategic Management Journal 18: 77–83. [Google Scholar] [CrossRef]

- Wu, Meng-Wen, and Chung-Hua Shen. 2013. Corporate social responsibility in the banking industry: Motives and financial performance. Journal of Banking and Finance 37: 3529–47. [Google Scholar] [CrossRef]

| Authors, Year and Title | Hypothesis | Data and Methodology | Findings |

|---|---|---|---|

| Panel A: CSR and Firm Information Environment | |||

| Alniacik et al. (2011) How Corporate Social Responsibility Information Influences Stakeholders’ Intentions | 1. Positive CSR information will be associated with a greater intention to consume a company’s product compared to negative CSR information. 2. Positive CSR information will be associated with a greater intention to seek employment with a company compared to negative CSR information. 3. Positive CSR information will be associated with a greater intention to invest in a company compared to negative CSR information. | In this study, they use the response of 250 undergraduate students from two Turkish universities. University students are potential customers and active users and future investors and employees of consumer electronics. | Their findings show that firm positive CSR information enhances consumer intentions to purchase products from, potential employees’ intentions to seek employment with, and potential investors’ intentions to invest in the company. |

| Gamerschlag et al. (2011) Determinants of voluntary CSR disclosure: empirical evidence from Germany | 1. CSR is positively associated with company visibility. 2. CSR is positively associated with company profitability. 3. CSR is positively associated with more dispersed ownership. | They used 520 firm-year observations from 2005 and 2008 using the Global Reporting Initiative (GRI). They focus on the German DAX, MDAX, and SDAX. | They find that CSR disclosures are affected by their visibility, shareholder structure, and relationship with U.S. stakeholders. More environmental disclosure leads to a firm’s higher profitability. |

| Gelb and Strawser (2001) Corporate Social Responsibility and Financial Disclosures: An Alternative Explanation for Increased Disclosure | More socially responsible firms are more likely to make discretionary disclosures. | In this study, the sample consists of 233 firm-year using data from the Association for Investment Management and Research (AIMR) ranking for the years 1989 to 1992 of all non-banking firms. | Their results show that socially responsible companies are more willing to provide financial disclosures. This relation is strengthening through better investor relations practices. |

| Haggard et al. (2008) Does Voluntary Disclosure Improve Stock Price Informativeness? | Voluntary disclosure improves the stock price informativeness. | Their final sample consists of 2084 firm-year observations covering the years 1982 to 1995. They only use those companies whose disclosure data are available on AIMR’s database. | They find that overall firm disclosure policy improves the information in stock prices. They make this estimation using analyst evaluation of firm disclosure policy. |

| Kim et al. (2012) Is Earnings Quality Associated with Corporate Social Responsibility? | 1: Socially responsible companies are less likely to engage in earnings management. | The sample consists of 18,160 firm-years observations from 1991 to 2009 using the DSI400 index as a CSR indicator. | Socially responsible companies are less likely to manage their earnings through discretionary accruals, manipulate real operating activities, and be the subject of the SEC investigation. |

| Lee et al. (2018) The corporate social responsibility information environment: Examining the value of financial analysts’ recommendations. | 1. CSR-related information is associated with the variation in the value of analysts’ recommendation revisions. 2. Changes in CSR-related information levels are associated with the value of analysts’ recommendation revisions. | They used MSCI ESG data and IBES from 1995 to 2011 for U.S. companies. The final sample consists of 11,828 firm-year observations. | They find an inverse relationship between the value of both upgrade and downgrade revisions and the supply of CSR-related information compiled by third-party institutions, suggesting that CSR-related data are associated with a richer information environment that makes it more challenging for analysts to issue informative recommendations, thereby mitigating their contribution to the price discovery process. |

| Martínez-Ferrero et al. (2015) Effect of Financial Reporting Quality on Sustainability Information Disclosure | Sustainable information standardized disclosures have a negative (substitutive) relationship with financial reporting quality. | Their sample comprises 747 international listed nonfinancial companies from 25 countries from 2002 to 2010 using the Tobit method for panel data. | Results show that conservative companies, with a high level of accruals quality and those that carry out earnings management practices to a lesser extent, report high-quality financial information and, moreover, high-quality CSR information. |

| Martínez-Ferrero et al. (2016) The Causal Link between Sustainable Disclosure and Information Asymmetry: The Moderating Role of the Stakeholder Protection Context | 1. Voluntary CSR disclosures increase information availability by reducing the asymmetric information problem. 2. Voluntary CSR disclosures reduce the information available due to more stakeholder-oriented environments. | They produce their results using the GMM estimator for an international sample of 575 firms for the period 2003 to 2009. | Greater asymmetric information leads to higher voluntary information disclosure practices, reducing the agency problem in environments characterized by strong socially responsible commitment. |

| Wanderley et al. (2008) CSR Information Disclosure on the Web: A Context-Based Approach Analyzing the Influence of Country of Origin and Industry Sector | On corporate website CSR disclosures influenced by country or industry. | They use data from 127 corporations from G20 countries along with Brazil, Chile, China, India, Indonesia, Mexico, South Africa, and Thailand with the chi-square test. | They report that CSR disclosures on websites are influenced by both industry and country. Thus, corporations are increasingly concerned with communicating ethically and responsibly their stakeholder diversity through the web. |

| Panel B: CSR and Firm Risk | |||

| Attig et al. (2013) Corporate Social Responsibility and Credit Ratings | 1. CSR reduces the perceived risk of financial distress, and that has a positive impact on firm credit ratings. | They used an unbalanced panel of 11,662 firm years’ observations representing 1585 unique U.S. firms over the period 1991–2010 using MSCI ESG and CSRSP, and order Probit model. | Using the U.S. sample, they conclude that socially responsible companies enjoy a relatively high credit rating. Furthermore, they explore that both strength and concerns influence the credit rating. |

| Chollet and Sandwidi (2018) CSR engagement and financial risk: A virtuous circle? International evidence | 1. CSR engagement lowers financial risk. 2. Social and governance commitment reduces financial risk. | They used Asset4 data as a CSR measure and systematic, firm-specific, and total risks for the financial risk measure. The final sample consists of 23,194 firm-year observations from 2003 to 2012 from 62 countries. | They show that a firm’s good social and governance performance lowers its financial risk, thereby reinforcing its commitment to good governance and environmental practices. |

| Cui et al. (2017) Corporate Social Responsibility, Religion, and Firm Risk | 1. CSR negative association with firm risk is more pronounced if H.Q. (headquarter) in a religious area. | They used KLD data as a CSR measure and CompStat for the financial risk measure. The final sample consists of 27,800 firm-year observations from 1991 to 2013 from U.S. | They find that CSR religiosity is negatively associated with firm risk. |

| Drago et al. (2019) Do corporate social responsibility ratings affect credit default swap spreads? | 1. Better CSR ratings lead to lower CDS spreads. 2. Better CSR ratings lead to higher CDS spreads. | They used Asset4 ESG data as a CSR measure. The final sample consists of 1349 firm-year observations from 2007 to 2017 from 18 European countries. | Final results support that a better CSR rating brings a significant decrease in CDS spreads. |

| Galema et al. (2008) The stocks at stake: Return and risk in socially responsible investment | CSR has a significant influence on stock returns. | They used KLD and monthly Fama French portfolio data from June 1992 to July 2006. They find results by using the Fama-Macbeth and GMM models. | They find that diversity, environment and product strategies dimensions of CSR has a significant positive impact on stock returns. |

| Husted (2005) Risk Management, Real Options, and Corporate Social Responsibility | Hypothesis: He develops the notion of corporate social responsibility as a real option and its implications for risk management. | Theoretical | Real options theory suggests that corporate social responsibility should be negatively related to the firm’s ex-ante downside business risk. |

| Jo and Na (2012) Does CSR Reduce Firm Risk? Evidence from Controversial Industry Sectors | 1. CSR engagements have a negative association with firm risk in the controversial industry. | They measure CSR with MSCI ESG data and financial variables using Compustat data. Their final sample is comprised of 2719 firm-year (513 controversial firms) observations from 1991 to 2010. | With controversial industries (such as alcohol, tobacco, gambling, and others) sample, they find that improved CSR performance is helpful to reduce the firm risk. Furthermore, they explore that CSR decreases the firm risk statistically more significantly with controversial industry firms than in noncontroversial industry firms. |

| Kim et al. (2014) Corporate social responsibility and stock price crash risk | 1. CSR has a significant influence on firm-level stock price crash risk. | They used 12,978 firm-year observations from 1995 to 2009 using the MSCI ESG database. They use a cluster effect at both firm and year levels. | They find that CSR performance is negatively associated with future crash risk after controlling the crash risk determinants. Because socially responsible companies have a high level of transparency and low level of bad news hoarding. |

| Lee and Faff (2009) Corporate Sustainability Performance and Idiosyncratic Risk: A Global Perspective | 1. Corporate social performance has a significant association with firm idiosyncratic risk. | They used the DJSI and DJGI index from 1998 to 2002 with a combined sample of 11,479 firm-year observations. | Their findings show that leading (lagging) corporate social performance (CSP) firms exhibit significantly lower (higher) idiosyncratic risk and that idiosyncratic risk might be priced by the broader global equity market. |

| Sun and Cui (2014) Linking corporate social responsibility to the firm default risk | 1. CSR has a negative relationship with firm default risk. 2. When a capability is higher, CSR has a strong impact on reducing default risk. 3. When environmental dynamism is higher, CSR has a strong impact on reducing default risk. | The final sample consists of 829 observations from 303 firms for 2008 to 2010 period. They use standard and poor credit rating data as a financial default risk measure. | They conclude that CSR has a strong effect on firm financial default risk reduction. Moreover, they observe that this relationship is stronger for high dynamism environments than low dynamism environments. |

| Panel C: CSR and Financing Sources | |||

| Cheng et al. (2014) Corporate Social Responsibility and Access to Finance | 1. CSR performance reduces agency cost due to effective stakeholder engagement. 2. CSR performance reduces the information asymmetry due to extensive CSR disclosures. | They used Asset4 data as a CSR measure and Kaplan-Zingales Index for the capital constraint measure. The final sample consists of 10,078 firm-year observations from 2002 to 2009 from 49 countries. | They find that better CSR performance faces significantly lower capital constraints. Stakeholder engagement and transparency both play an essential role in creating this impact. These results are also consistent with both the social and environmental dimensions of CSR. |

| Dhaliwal et al. (2012) Nonfinancial Disclosure and Analyst Forecast Accuracy: International Evidence on Corporate Social Responsibility Disclosure | 1: CSR performance is positively associated with the accuracy of analyst earnings management. 2: CSR positive relationship with analyst forecast accuracy is more pronounced in countries with a high level of stakeholder orientation. 3: This relationship is stronger for firms with a high level of financial disclosures. | They used 7779 stands-alone CSR reports issued by public firms from 49 countries during 1994–2007. Their final sample consists of 7108 standalone CSR reports published by 1297 unique commercial companies. | They find a positive relationship between CSR stands-alone CSR reports issuance and a higher level of analyst forecast opacity. Furthermore, they explore that this association is more pronounced with more stakeholder-oriented countries and firms with a high level of financial disclosures. |

| El Ghoul et al. (2011) Does corporate social responsibility affect the cost of capital? | 1. High CSR firms have a lower cost of equity. | They used KLD STATS data for CSR measure. Their final sample consists of 12,915 observations representing 2809 unique firms between 1992 and 2007. To test their hypothesis, they use a pooled cross-sectional time series regression. | They find that firms with better CSR performance exhibit cheaper equity financing. They also suggest that employee relations, environmental policies, and product strategies dimensions of CSR are playing an essential role in reducing the cost of equity. |

| Feng et al. (2015) Equity Financing and Social Responsibility: Further International Evidence | 1. Improved CSR has a significant influence on the firm’s cost of equity capital. 2. CSR’s negative relationship with the cost of equity capital is well-established in North America and Europe compared to other regions. | In this study, they used 10,803 firm-year observations from 2002 to 2010. They use Thomson Reuters Asset4 data from 25 countries. | They find that better CSR performance reduces the cost of equity capital in North America and Europe. But these results do not hold for Asian countries. |

| Goss and Roberts (2011) The impact of corporate social responsibility on the cost of bank loans | 1. CSR concerns have a negative association with loan maturity. 2. CSR strength has a positive association with loan maturity (mitigating risk view). | They used the KLD dataset of 3996 loans extended to 1265 firms from 1991 to 2006. | They provide evidence in support of CSR concerns pay between 7 and 18 basis points more than firms that are more responsible. Lenders give importance to CSR strengths in the absence of security. |

| Jiraporn et al. (2014) Does Corporate Social Responsibility (CSR) Improve Credit Ratings? Evidence from Geographic Identification | Hypothesis: Increase in social responsibility increases the firm credit rating | Used the KLD database for CSR measurement. Their final sample consists of 2516 firm-year observations from 1995 to 2007. | They find that more socially responsible companies enjoy a more favorable credit rating. One standard deviation increase in CSR measure increase the 4.5% of firm credit rating. Furthermore, they also test these results using geographic proximity with 2SLS. |

| Verwijmeren and Derwall (2010) Employee well-being, firm leverage, and bankruptcy risk | Hypothesis: Firms with high employee well-being have lower target leverage. | They analyze 7494 observations from 2001–2005 using KLD data. | The results confirm that a firm with a leading record of employee well-being significantly reduces the probability of bankruptcy through a lower debt ratio. After controlling the differences in leverage, they observe that with better employee well track records firm improves their credit rating. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saeed, A.; Sroufe, R. Performance, Risk, and Cost of Capital: Trends and Opportunities for Future CSR Research. J. Risk Financial Manag. 2021, 14, 586. https://doi.org/10.3390/jrfm14120586

Saeed A, Sroufe R. Performance, Risk, and Cost of Capital: Trends and Opportunities for Future CSR Research. Journal of Risk and Financial Management. 2021; 14(12):586. https://doi.org/10.3390/jrfm14120586

Chicago/Turabian StyleSaeed, Asif, and Robert Sroufe. 2021. "Performance, Risk, and Cost of Capital: Trends and Opportunities for Future CSR Research" Journal of Risk and Financial Management 14, no. 12: 586. https://doi.org/10.3390/jrfm14120586

APA StyleSaeed, A., & Sroufe, R. (2021). Performance, Risk, and Cost of Capital: Trends and Opportunities for Future CSR Research. Journal of Risk and Financial Management, 14(12), 586. https://doi.org/10.3390/jrfm14120586