Abstract

Acknowledging the role of different forms of entrepreneurship to continued economic prosper-ity and the role of institutional dimensions on entrepreneurship, this paper investigates if and to what extent a selected number of institutional dimensions influence students’ intentions to ei-ther start a company or take over an existing one. Based on a Global University Entrepreneurial Spirit Students’ Survey (GUESS) dataset and international country-level databases, evidence shows that both entrepreneurship options are hampered by corruption and limited business freedom while promoted through favourable labour regulations and trade freedom. Property rights, fiscal freedom, government spending, monetary freedom, and investment freedom only affect start-ups, while financial freedom adversely affects both options. The study provides new insight into the impact of institutional dimensions on different types of entrepreneurship. Thus, in contrast to extant research in this area, it goes beyond the typical focus on start-ups. Evidence also suggests that male students prefer starting a new company, while female students seem to prefer a takeover. This improved understanding could help in not only designing more targeted entrepreneurship and entrepreneurial financing policies but also in improving entrepreneurship education.

1. Introduction

The study of the role of institutional dimensions in entrepreneurship has increased over the years (Hwang and Powell 2005; Estrin et al. 2013; Herrera-Echeverri et al. 2014; Walter and Block 2016). Research has shown that entrepreneurial activity in general (Tolbert et al. 2011; Urbano et al. 2019; Goel and Karri 2020) and the level of entrepreneurial activity (Stenholm et al. 2013; Chowdhury et al. 2019) in particular differ strongly across countries (Lim et al. 2010; Urbano and Alvarez 2014). Understanding how the institutional environment affects entrepreneurship is crucial, as the latter is viewed as one of the key factors enhancing economic growth (Urbano et al. 2019), and micro and macro elements have been used to explain entrepreneurial activity (Chowdhury et al. 2019).

Extant research in this area shows that the study of entrepreneurial activity is typically focussing on start-ups (Lim et al. 2010; Mergemeier et al. 2018; Urbano et al. 2019). Takeovers that represent another option of embarking on entrepreneurship are neglected. Against the number of companies waiting to be handed over (European Commission 2019), the inclusion of this option in the study of entrepreneurial activity would enable future research to be more focused with regard to the institutional dimensions influencing entrepreneurship. As starting a company from scratch requires different resources and skills compared to taking over a company, the authors of the present paper argue that the institutional dimensions also influence a decision in favour of a new venture creation or a takeover. While the impact on and the role of different institutional dimensions in entrepreneurial activity have been studied (see the systematic literature review by Urbano et al. 2019), we lack an understanding of how these institutional dimensions contribute to entrepreneurial ventures in general (Dilli et al. 2018) and with regard to the selection of different options to entrepreneurship in particular. The latter is addressed in this paper. The authors of this paper argue that the analysis of institutional dimensions regarding the selection of options to entrepreneurship can reveal finer-grained insights beneficial for the link between institutional dimensions and entrepreneurial activity. We aim to find out if there is a particular type of institutional dimension that is more start-up or takeover friendly than others are.

By bringing together a selection of institutional (macro) and personal dimensions, the authors of the paper offer a deeper understanding of their impact on different options to entrepreneurship, going beyond the usual focus on start-ups. Moreover, the present paper contributes to the role of institutional dimensions that are normally found in a country a long time before a student is aware of different options to entrepreneurship. Finally, the paper presents a richer approach to understanding the role of an institutional environment that is attributed by studies that recognize quality-of-institution perspective and economic freedom as main keys to entrepreneurial decision-making (e.g., Stenholm et al. 2013; Walter and Block 2016; Urbano et al. 2019). The findings presented also add to the understanding of the determinants of occupational choice.

The paper is organized as follows. In the next section, the theoretical background is presented and, based on that, propositions are derived. This is followed by a description of the data and the methods used in this paper. Next, the results are presented and discussed. The paper terminates with a conclusion.

2. Theoretical Background and Development of Propositions

2.1. Different Forms of Entrepreneurship

Individuals interested in becoming an entrepreneur have different options to do so. In the main, they can start a company from scratch or take over an already existing company. In this study, a takeover is defined as the transfer of property and/or management of a firm from one individual to another regardless of whether this individual has family connections to the firm, already works for the firm, or is an outsider. Thus, the definition covers both internal and external business transfers.

Despite these options, the study of entrepreneurial activity (including entrepreneurship education) continues to be dominated by a focus on the former (De Freyman and Durst 2019; Dilli et al. 2018; Lim et al. 2010; Urbano and Alvarez 2014). This is surprising as, according to the Austrian Institute for SME research, the survival rate of business formations through company succession is higher compared to that of new venture creations (Austrian Institute for SME Research 2004). Furthermore, the following issues have to be taken into account: (1) more jobs are created by previously established firms than by new ones (Pasanen and Laukkanen 2006); (2) at the European level, there is an increasing number of small and medium-sized enterprises (SMEs) waiting to be transferred to new owners (in absolute terms, this means that, every year, around 450,000 firms and over two million employees are transferred to new owners (European Commission 2019); (3) changing demographic trends and decreasing interest of family members are leading to a lack of successors in family firms (Entrepreneurship Foundation 2010; Durst and Sedenka 2016); and (4) the majority of European business transfers are non-family, meaning they are external transfers (Camerlynck et al. 2005; Van Teeffelen et al. 2011). Consequently, there is a need for more attention as well as research.

The decision to start a new venture or to take over an already existing company requires different skills and competences but also different approaches. In the case of starting a new company, the entrepreneur, for example, needs to develop an attractive product/service, identify customers that are willing to buy this product, inform them about the availability of the product and its benefits (i.e., informative advertising), start hiring personnel, and develop and implement systems and structures to make possible a smooth running of all business functions. Moreover, in the case of a takeover, the entrepreneur needs skills and competencies required for both to (1) keep the company running and then (2) develop it further. A takeover usually causes several changes, such as voluntary resignation of employees, shifts in strategy and structure, promotion, and demotion (Kesner and Dalton 1994; Pitcher et al. 2000; Ballinger et al. 2009), which may also lead to company instability. Thus, compared to a start-up, a business transfer requires more managerial skills from an entrepreneur.

2.2. Institutional Dimensions Influencing Entrepreneurship

North (1991) defined institutions as “humanly devised constraints that structure political, economic and social interaction” (p. 97). In addition to such constraints, other scholars in the field of institutional theory stressed the enabling character of institutions (Meyer and Rowan 1977; Williamson 2000). This additional perspective implies that institutions also can help to create opportunities for individual or organizational actors. According to North (1991), institutions can be formal or informal. Formal institutions refer to constitutions, regulations, contracts, etc., while informal institutions are about attitudes, values, norms of behaviour and conventions, and culture. Following a similar logic, Williamson (2000) differentiated from an economic perspective between three pillars of institutions: informal, formal constitutional, and formal regulatory. Finally, Scott (1995) suggested, also from a sociological perspective, a classification with three pillars, namely, regulative, cognitive, and normative institutions.

Both (potential) individual entrepreneurs and institutions such as schools and universities are embedded into legal, socio-economic, and socio-cultural environments that can influence their behaviour (Oftedal et al. 2017). Institutions can be seen as resources that influence the development of entrepreneurship-specific resources and thus the likelihood of success of different entrepreneurial paths taken. On the other hand, institutions influence the transaction costs entrepreneurs have to pay for using the market (cf., Jackson and Deeg 2008), underlining, in turn, the risk associated with entrepreneurial activities in general and across countries in particular. As Urbano and Alvarez (2014) put it, “the institutional environment defines, creates and limits entrepreneurial opportunities, and thus affects entrepreneurial activity rates” (p. 704).

Institutional theory has proven to help study entrepreneurship (Tolbert et al. 2011; Estrin et al. 2013; Urbano et al. 2019). The basic idea behind this research is that institutional differences across countries impact national entrepreneurship activity profiles. Institutions influence economic behaviours through the generation and the reproduction of certain cognitive assumptions taken for granted by citizens (Lim et al. 2010). In addition, this strand of research stresses that the exploitation of entrepreneurial opportunities is not only influenced by individual-level determinants such as personal traits and person-specific network contacts (Dohse and Walter 2012).

North (1991) and other pioneering authors in the field of institutional theory (e.g., Meyer and Rowan 1977; Powell and DiMaggio 1991; Scott 1995; Williamson 2000) considered a wide range of different types of cognitive, informal, regulative, and normative institutions. Recent across country entrepreneurship research, however, has mainly focused on specific normative and regulative “institutional arrangements” (Stenholm et al. 2013; Walter and Block 2016) as external socio-economic factors that influence entrepreneurship. Such socio-economic institutional entrepreneurship dimensions have been measured in prior research (e.g., Bjørnskov and Foss 2016; McMullen et al. 2008; Engle et al. 2011; Herrera-Echeverri et al. 2014; Chowdhury et al. 2019) with basic explaining factors such as economic prosperity (Bjørnskov and Foss 2016) and business easiness or economic freedom (McMullen et al. 2008).

In the present study, which considers start-ups and takeovers, we focus on the institutional context factor “economic freedom”, that is divided into rule of law, government size, regulatory efficiency, and open markets. In line with previous research such as McMullen et al. (2008), Herrera-Echeverri et al. (2014), and Chowdhury et al. (2019), we assume that economic freedom has a significant influence on the students’ intention to either start a new company or take over an already existing one. Following Gwartney and Lawson (2002, p. 5), we define economic freedom in an entrepreneurship context as “the degree to which a market economy is in place, where the central components are voluntary exchange, free competition, and protection of persons and property”.

In the following subsections, the different sub-dimensions, i.e., rule of law, regulatory efficiency, and open markets, are developed in the context of the two entrepreneurship options. We also suggest research propositions.

2.2.1. Rule of Law

Property Rights

Property rights define the legal ownership of resources or economic goods and how these can be used by individuals, organizations, etc. The protection of intellectual property can motivate entrepreneurial action (Lim et al. 2010) and promote entrepreneurship in general, provided that the property rights are not too strong (Aidis et al. 2012). McMullen et al. (2008) showed, for a large-scale dataset of 37 countries, opportunity motivated entrepreneurial activity but not necessity motivated entrepreneurial activity is significantly positively associated with property rights. While Aidis et al. (2012), using survey data of 47 countries from the Global Entrepreneurship Monitor, suggest that property rights for nascent entrepreneurs play less of a role, especially in more developed economies.

However, in general, only a relatively small share of start-ups (e.g., university spin-offs) manage to receive formalized property rights, as, for example, patents (Niefert 2006; Baldine et al. 2007). Thus, for those start-ups, property rights are important to enter into the market. For a successor, on the other hand, extant property rights can mean an additional stream of revenues. Moreover, in case a company that is research and development (R&D) and innovation-driven is taken over, the opportunity of protecting intellectual property from theft is likely to affect the individual’s entrepreneurial decision (Dilli et al. 2018; Duh 2014).

Proposition 1.1.

The existence of property rights reduces the intention to start a company.

Proposition 1.2.

The existence of property rights increases the intention to take over a company.

Freedom from Corruption

Corruption is the abuse of power to achieve illegitimate personal gain, and it is associated with political instability, which in turn discourages inward investments as well as the development of a reliable business environment (Cavusgil et al. 2014). Svensson (2005, p. 20) views corruption as an outcome, one that is a ‘‘reflection of a country’s legal, economic, cultural and political institutions”. Aidis et al. (2012) listed three ways highlighting that corruption is detrimental for entrepreneurial entry. It can (1) discourage potential entrepreneurs who are unwilling to engage in corrupt behaviour from ever starting a business; (2) encourage unproductive and destructive forms of entrepreneurship, and (3) prevent businesses from growing, because the entrepreneurs wish to avoid expropriation by corrupt officials. Avnimelech et al. (2014), based on a data set of entrepreneurial activity within 176 countries, showed that the similar incremental increase in the level of corruption is likely to decrease entrepreneurship in developed countries by twice (or more) as much relative to non-developed countries.

Aidis et al. (2012) in their study also showed that freedom from corruption has a positive and significant impact on entrepreneurial entry. Chowdhury et al.’s (2019) findings for a sample of emerging international start-ups suggest that corruption plays a “greasing” role when indirect taxes are high and a “sanding” role when document requirement for export, cost of export, and corporate tax are high. For transferees, the level of corruption may play less of a role compared to an individual interested in starting from scratch, as in the former case, the company taken over may have learned to function in its existing institutional environment, even where corruption is prevalent. Overall, however, past research indicates that entrepreneurial entry is greater where there is less corruption (e.g., Aidis et al. 2012; Avnimelech et al. 2014).

Proposition 2.

The level of corruption affects entrepreneurial activity regardless of type.

Proposition 2.1.

If corruption exists start-up intentions are more likely to be affected than takeover intentions.

Fiscal Freedom

Fiscal freedom summarizes the absence of high tax rates and government expenditures as a share of the gross domestic product (GDP) in a specific country in relation to comparable countries. A high degree of fiscal freedom in a specific country can improve the possibilities for different types of entrepreneurial activity because the government leaves sufficient space for private business opportunities (Haan and Sturm 2000). McMullen et al. (2008) demonstrated that fiscal freedom is positively and exclusively associated with necessity motivated entrepreneurial activity, but only on the 10% level.

Proposition 3.

The level of fiscal freedom influences entrepreneurial activity regardless of type.

2.2.2. Regulatory Efficiency

The regulative dimension which consists of laws, regulations, and government policies aims at providing support for new businesses, reducing the risks for individuals embarking on entrepreneurial activity and facilitating the entrepreneurs’ efforts to acquire necessary resources (Busenitz et al. 2000). Thus, intervention by the government can both enhance or suppress entrepreneurial activity. According to the Heritage Foundation (2020), the category regulatory efficiency covers business freedom, labour freedom, and monetary freedom. Missing regulatory efficiency can shift individuals’ preferences and negatively impact entrepreneurial activity (Lim et al. 2010).

Business Freedom

Business freedom refers to the ability to start, operate, and close businesses. Thus, it represents the overall burden of regulation as well as the efficiency of government in the regulatory process (Heckelman 2000). This overall burden of regulation for (potential) entrepreneurs and government efficiency can differ considerably across countries. Although some authors assume, based on theoretical considerations, a positive relationship between business freedom and entrepreneurial activity (e.g., Beach and O’Driscoll 2003; McMullen et al. 2008), quantitative empirical evidence to support this assumption is still missing (McMullen et al. 2008).

Proposition 4.

The level of business freedom influences entrepreneurial activity regardless of type.

Labour Freedom

Labour regulations address those areas of law covering the relationship between employers and employees and between employers and trade unions. Aspects such as minimum wages, laws inhibiting layoffs, severance requirements, measurable regulatory burdens on hiring, hours, etc. are concerned. Government policies and social engineering influence work incentives and the labour market (Bennet 2012). Inflexible labour regulations affect the productivity of firms and the ability of people to find work. Thus, the type of labour regulation found in a specific country impacts the costs of working in markets (Jackson and Deeg 2008). Entrepreneurial activity is likely to be affected by the ease of hiring and firing labour (Urbano and Alvarez 2014).

For a start-up, one can assume that it is important to hire labour temporarily to be in a position to quickly adapt to changing business development (Dilli et al. 2018). However, for a successor, it might be more important to quit existing employment contracts at short notice. A takeover may also lead to the adoption of a new entrepreneurial focus; some of the old workforces may no longer be viewed as suitable for taking on the new path because of missing skills, capacity, or motivation (Durst and Gueldenberg 2010).

Proposition 5.

The level of labour freedom influences entrepreneurial activity regardless of type.

Monetary Freedom

Monetary freedom is a measure that combines price stability with an assessment of price controls. It is argued that both inflation and price controls distort market activity. Hence, price stability without microeconomic intervention is, according to the Heritage Foundation (2020), the ideal state of free markets. In the perspective of single entrepreneurs, inflation makes it difficult for them to assess whether revenues exceed costs. McMullen et al. (2008) showed that monetary freedom, as already mentioned for fiscal freedom, is positively and exclusively associated with necessity motivated entrepreneurial activity, but only on the 10% level.

Proposition 6.

The level of monetary freedom influences entrepreneurial activity regardless of type.

Government Spending and Economic Prosperity as Additional Institutional Factor for Regulatory Efficiency

Government programmes focused on providing support for different types of entrepreneurial activity contribute to the promotion of entrepreneurship in general and entrepreneurialism in particular (Urbano and Alvarez 2014). These programmes may provide financial support but also provide access to information, training, fund research, and improve human capital and other non-financial measures individuals need to fulfil their wish of entrepreneurial activity (Temel et al. 2015; Dilli et al. 2018). All these forms of government spending, however, are financed by higher taxation and therefore might entail an opportunity cost to society and run a great risk of crowding out private economic activity. Hence, in this work, we include government spending as a determinant of regulatory efficacy.

Proposition 7.

Government spending has a strong effect on entrepreneurial activity regardless of type.

2.2.3. Market Openness

Trade Freedom

Trade freedom is a composite measure of the extent of tariff and non-tariff barriers that affect imports and exports of goods and services according to the Heritage Foundation. It has been shown that nations with more trade freedom have greater political stability and are less likely to experience politically motivated violence, including terrorism (Riley and Tyrrell 2017). For start-ups, trade freedom can be important to find first opportunities for market entry, while for takeovers, trade freedom may influence the overall business development positively (World Bank Group 2010). Engle et al. (2011) found in this context that, from 19 possible formal institutional variables, only three (tax level, access to relevant infrastructure, and freedom of trade (import/export of goods/services)) were statistically significant and positively correlated with the entrepreneurial start-up intentions of the students in the used sample.

Proposition 8.

The level of trade freedom influences entrepreneurial activity regardless of type, but in different ways considering the various tasks that must be addressed.

Investment Freedom

According to the Heritage Foundation, in an economically free country, there would be no constraints on the flow of investment capital. Individuals and companies would be allowed to move their resources into and out of specific activities, both internally and across the country’s borders, without restriction. Most countries, however, have a variety of restrictions on investment, e.g., some have different rules for foreign and domestic investment or restrict access to foreign exchange. Investor freedom can also be affected by labour regulations, corruption, red tape, and low political stability (McMullen et al. 2008; Chowdhury et al. 2019).

Individuals, in general, may be discouraged from starting entrepreneurial activity if they are required to follow too many rules and procedures (Beach and O’Driscoll 2003). Environments that complicate the investment in start-ups or takeovers may also hamper the would-be entrepreneurs from realizing their entrepreneurial intentions (Dilli et al. 2018).

Proposition 9.

The level of investment freedom influences entrepreneurial activity regardless of type, but in different ways considering the various capital needs.

Financial Freedom

Financial freedom displays the independence of the financial sector from government control and interference. Thus, financial institutions can provide various types of financial services to both individuals and companies. It is discussed in the literature that a plurality of various types of financial services favours entrepreneurial activity (e.g., World Bank Group 2010). Thus, we assume that a well-developed network of financial services linking supply with demand is positively related to entrepreneurial activity in general as well as start-up/takeover activities in particular.

Proposition 10.

The level of financial freedom influences entrepreneurial activity regardless of type, but in different ways considering the various capital needs of the two options.

3. Materials and Methods

3.1. Data Sources

To gain insights into how the above presented institutional factors and further macro-economic variables affect the entrepreneurial intentions of university students located all over the world, we combined data from several sources. In this section, we describe the data sources used in this paper. We considered university students as an important and relevant sample as, following Dohse and Walter (2012), the years at the university often give students the time to learn about promising career paths.

We obtained information on students’ entrepreneurial choices from the Global University Entrepreneurial Spirit Students’ Survey (GUESS) database. More precisely, we used data from the seventh wave that was conducted in Spring/Summer 2016, covering 50 countries1. The GUESSS data were linked with various international country-level databases that contain information on institutional factors as well as macro-economic variables. That is, we gathered data on economic freedom indicators and country-specific characteristics from The Heritage Foundation database, the World Development Indicators database, the World Bank, and IMF WEO. The Heritage Foundation dataset has been widely used (e.g., Beach and O’Driscoll 2003; McMullen et al. 2008), as it identifies fundamental institutional development and institutional differences by country.

To build our final dataset, we applied several selection criteria. First, we removed observations where no entrepreneurship choice was available in GUESS. Then, we removed observations of countries with missing information on basic institutional variables. This resulted in a final sample consisting of 111,225 individual observations from 50 countries. More information about the data sources is provided in Table 1.

Table 1.

Description of the variables.

3.2. Variables

3.2.1. Entrepreneurship Choices

We focused on students’ career choice intentions right after completion of their studies (i.e., within the next 5 years). Specifically, we focused on two types of career paths, namely, (1) being a founder of a new business (start-up) or (2) taking over an already existing business (successor). In this study, we defined two dummies that correspond to these two career paths: a dummy variable, “Start-up”, that takes the value of one if the student intends to start a new business and zero otherwise, and a dummy variable, “Successor”, which takes the value of one if the student intends to take over an existent business and zero otherwise.

3.2.2. Institutional Environment and Macro-Variables

We examined sets of institutional variables that assess economic prosperity and economic freedom in a given country. First, we looked at the equally-weighted economic freedom index, provided by the Heritage Foundation, indicating how liberal or stringent a country is. This index ranges from 0 to 100. It captures the global risks and the strengths/weaknesses of economies and conveys critical information on governance, development, access to information, and personal empowerment. The higher a country index is, the higher is its economic freedom and hence the more developed the liberal economy is. However, a low country index denotes a stringent economic regulation. Hence, we expect the freest countries to be the most likely to enhance and support entrepreneurial activity. Economic freedom is evaluated in three pillars/areas: rule of law, regulatory efficiency, and open markets. Within each pillar, we assorted a set of specific indices, scored on a scale of 0–100, where higher index implies freedom and lower index indicates stringency.

Rule of law comprised property rights index, freedom from corruption index, and fiscal freedom index. We also constructed an overall rule of law index that averaged, in an equally weighted way, these three indicators of rule of law.

Regulatory efficiency comprised business freedom index, labour freedom index, and monetary freedom index. We also constructed a composite regulatory efficiency index that averaged, in an equally weighted way, these four indicators of regulatory efficiency.

Market openness comprised trade freedom index, investment freedom index, and financial freedom index. We also constructed a composite market openness index that averaged, in an equally weighted way these three indicators of market openness.

3.2.3. Control Variables

We included in our regression models a set of control variables, which are expected to affect entrepreneurial intentions. Following Thornton et al. (2011), Arenius and Minniti (2005), and Langowitz and Minniti (2007), we accounted for the sociodemographic dimension of individual and socioeconomic dimension of the countries in explaining students’ entrepreneurial behaviour. Hence, we first controlled for sociodemographic characteristics using the individual following factors.

Gender: several studies show that women have less entrepreneurial intentions compared with their male counterparts (e.g., Bönte and Piegeler 2013; Costa and Pita 2020). Thus, we defined a dummy variable, denoted gender, equal to one if the individual is male and zero otherwise, to test the extent of the gender effect.

Age: previous empirical literature indicates multiple roles of age on entrepreneurial behaviour, while others find a non-linear relationship or a “U” shape relationship (e.g., Levesque and Minniti 2006). Thus, we included age to account for its effect on entrepreneurial activity.

Education level: extant research suggests that there is no clear-cut consensus on the effect of the education level on entrepreneurial intentions (Urbano and Alvarez 2014). For that, in our models, we considered a uniform definition of education over all the countries by using the students’ responses. It takes the value of one if the respondent is an undergraduate student (Bachelor), two if he/she is a graduate student (Master), or three if the student is enrolled as a PhD or MBA.

Regarding socioeconomic controls, we accounted for a set of development indications and macroeconomics characteristics of the countries; we used the following factors.

Income level: following the global competitiveness (World Economic Forum), Mendy and Rahman (2019), and Urbano and Alvarez (2014), we considered the income level to be detangled between high-income level countries (North America and Europe), middle-income level countries (Asia-Pacific), and low-income level countries (otherwise).

Population: logarithm of the total population for a country included to control for the ability of the country’s population to start or run businesses (De Clercq et al. 2010).

GDP growth: the annual growth rate of real gross domestic product (GDP) for a country. Previous studies demonstrated a negative relationship between the level of entrepreneurial activity and economic development (Wennekers et al. 2005; Urbano and Alvarez 2014). We included GDP growth to account for its extent on choosing entrepreneurial activity as an appropriate career choice.

Unemployment rate: annual unemployment rate for a country, included to control for the share of labour force that is without work but available for and seeking employment or, otherwise, willing to choose entrepreneurship as an appropriate career choice (start a new business or take over an existent one) (Chowdhury et al. 2019).

4. Methodology

Following Urbano and Alvarez (2014), we used a binomial logistic regression model to estimate the likelihood of the entrepreneurial intentions of students and to test our propositions. We determined a set of institutional and macro-economic factors that influence the probability that the decision of becoming an entrepreneur actually happens. This logistic model assumes that the decision of the respondent i in a country j depends on an unobservable utility index Ui. Hence, the higher Ui’s value is, the larger the likelihood is that the respondent will choose to be an entrepreneur. To conduct our analysis, we differentiated between the two options: and . Formally, we express the standard log-linear model as follows:

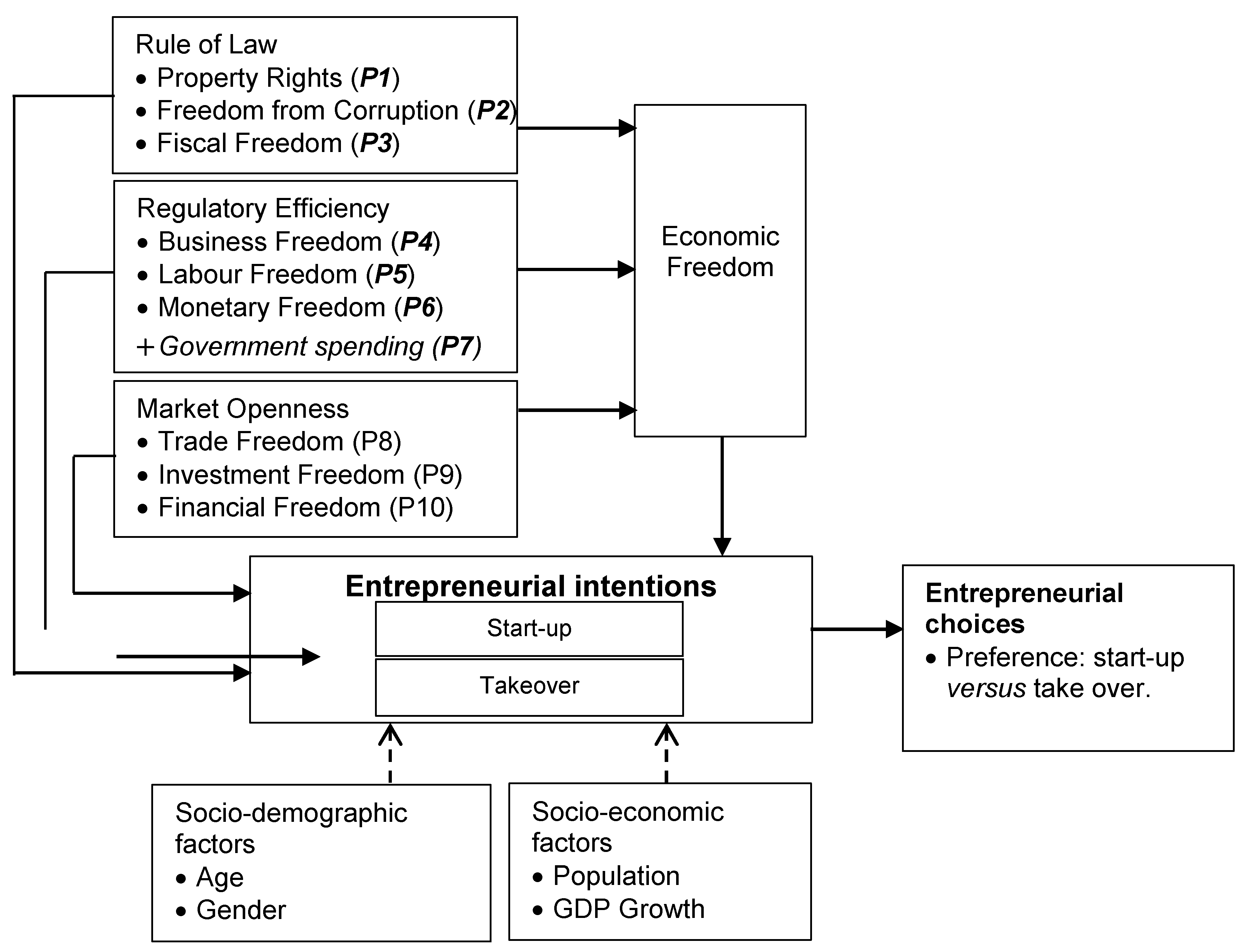

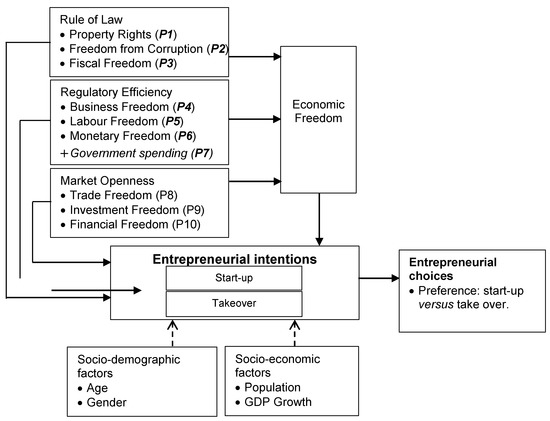

where and represent the main dummies of the entrepreneurial choices of a respondent i in a country. contains the three sets of institutional factors related to the economic freedom of country j. collects indices about rule of law. considers indices of regulatory efficiency. considers indices about market openness. Xij is a k × 1 vector of individual-level controls for individual i that includes age, gender, and education level with the corresponding coefficient vector φ (k × 1). is a k × 1 vector of country-level controls that includes regional development level, the natural logarithm of the number of the country’s population, the unemployment rate, and the growth rate of the real gross domestic product with corresponding coefficient vector γ (k × 1) (for more information about the variables, please see Table 1). The disturbance terms, or , are uncorrelated and, for the ordered logit model, it holds that all follow a logistic distribution with mean zero and variance equal to phi2/3. For the summary of our model, Figure 1 gives a closer look at this relationship with regard to the aforementioned propositions by relating entrepreneurial intentions with institutional constructs.

Figure 1.

A model of the influence of institutional environment on the entrepreneurial intentions.

Table 2 reports a summary of the descriptive statistics of the variables as part of the model examined, covering dependent, independent, and control variables across the 119,446 observations considered.

Table 2.

Summary statistics.

Sample Characteristics and Univariate Analysis

We first ran correlation tests between the variables under analysis. Table 3 presents the Pearson correlation matrix among all the variables. The correlation table shows a low (absence) and negatively significant correlation of about 5% between our two entrepreneurial intention proxies, suggesting that they each capture different aspects of entrepreneurial behaviours. The bivariate correlation results also indicate that there is no significant correlation between entrepreneurial intentions and all institutional—economic freedom and macro-economic—indicators. However, the correlation diagnostics show that many of the institutional indicators and individual-level and country-level variables are highly correlated. Therefore, the main concern regarding formative constructs is that of multicollinearity. Hence, we performed (in unreported results) the variance inflation factor (VIF) test of all variables in the analyses. The average VIF for each regression model is about 5, which is in the recommended boundary of 5–10. Results of the VIF test confirm the absence of major multicollinearity problems.

Table 3.

Pairwise correlation.

To better emphasize the entrepreneurial intentions found in our dataset, we first analysed the entrepreneurial characteristics depending on the presence and the absence of one of the two options. We hence disentangled Start-Up from Successor and conducted univariate analyses to look into individual aspects for two groups of students, those with (Start-Up = 1 or Successor = 1) and those without (Start-Up = 0 or Successor = 0) entrepreneurial intentions. Then, using univariate mean tests, we looked into countries’ economic freedom for these two different entrepreneurial choices.

In Table 4, we display (Panel 1 for the group Start-Up and Panel 2 for the group Successor) information on entrepreneurial intentions of the options. Considering Start-Up, the data show that 32.58% of the students willing to start a new business within 5 years after graduation are from North America and Europe (against 58.52% of the observations if this intention is absent), while 7.28% are from Asia-Pacific and 60.14% from other countries, respectively (against 9.58% and 31.91%, respectively, if absent). Regarding the education level, the data show that 84.83% (against 78.78% of the observations in the absence of this choice) are undergraduates, while only 10.76% and 4.40% are graduates and doctoral/MBA students, respectively (against 16.64% and 4.58%, respectively, if absent). The students willing to start a new business are predominantly male 52.85% (against 40.36% otherwise), while females represent 47.15% (against 59.64%).

Table 4.

Information about entrepreneurial intentions, across the total period.

Considering Successor, the group follows almost a similar distribution. Conversely to Start-Up, 53.59% (46.41%) of the individuals that are willing to take over a business are women (male), against 58.67% (41.33%) of the observations in the absence of Successor choice.

Using univariate mean tests, Table 5 compares the economic freedom indicators for subsamples of individuals without and with entrepreneurial intentions over the study period. The data mainly show that, irrespective of the institutional indicator, countries with less economic freedom exhibit a significantly higher presence of students willing to start a new business or take over an existent one, suggesting that higher economic freedom does not necessarily enhance entrepreneurial intentions. This finding seems to be in line with previous research that highlighted the role of necessity motivated entrepreneurial intentions in some countries (e.g., McMullen et al. 2008).

Table 5.

Institutional dimensions and macro-economic characteristics by entrepreneurial intentions, on average, across the total period.

5. Results

The causal effect of institutional dimensions on students’ entrepreneurial intentions was analysed in three different set-ups. First of all, we displayed the results of the direct effect of the overall economic freedom score only. Subsequently, we presented direct effects of the three main key aspects of this overall score by including the composite scores for rule of law, regulatory efficiency, and market openness. Afterward, we included, in a meaningful way, the ten equally-weighted and averaged economic environment, governance, and policy aspects of economic freedom. As the next step, we included other macro-environmental factors. All specifications controlled for individual-level and country-level determinants of students’ entrepreneurial choice. The reported p-values were based on robust standard errors to mitigate issues related to heteroskedasticity and autocorrelation among observations in the same country. This procedure related particularly to the institutional variables (see, e.g., White 1980; Pagan 1984).

Table 6 presents the coefficient estimates of Equation (1) for the effect of economic freedom on both entrepreneurial intentions. The table shows two sets of results. Panel 1 displays regression results of the logit estimation of Equation (1): the likelihood of starting a new business for an individual i from country j . Panel 2 presents regression results of the logit estimation of Equation (2): the likelihood of becoming successor for an individual i from country j . In addition to individual-level and country-level controls, we present for both Panels (1) and (2) three columns that correspond with the specifications where (i) we specifically include the direct effect of the overall economic freedom index only on the entrepreneurial intention, (ii) we display jointly the effects of rule of law, regulatory efficiency, and market openness composite scores, and (iii) the effects of their different aspects (Column 3) on the entrepreneurial intention. The reported p-values in parentheses are based on robust standard errors to mitigate issues related to heteroskedasticity and autocorrelation among observations.

Table 6.

Entrepreneurial intention and economic freedom factors.

In Panel 1 of Table 6, Column (1) provides the effect of the overall economic freedom index on the start-up intention. The result shows the existence of a negative and significant relationship at a 1% level between the willingness to start a new business and overall economic freedom, indicating that a unit increase of economic freedom is associated with a decrease in the probability of starting a new firm by a factor of 0.97. This result suggests that higher economic freedom is associated with stable corporate businesses and more job offers, which are likely to curb start-up intentions.

Next, in Column (2) of Table 6, we include the three different equally-weighted composite indexes that combine the three key aspects of economic freedom, i.e., rule of law index, regulatory efficiency index, and market openness index. With this step, we aimed to establish a clear view regarding the specific effect of these three institutional factors that influence students’ entrepreneurial intentions. Interestingly, we found that both rule of law and market openness indexes carry a negative and significant effect at the 1% level. Therefore, (one unit) increase in the rule of low (market openness) composite index will increase the probability of becoming a start-up by 0.96 (0.99). Taken together, this evidence suggests that countries with a high degree of law enforcement and protection of private ownership rights enforce free-market economy, which consequently will create a competitive advantage and enhance the array of investment opportunities as well as foreign direct investments (FDI). This effect, in turn, decreases the probability of becoming a start-up. Coherently, we found that the regulatory efficiency index is positive and significant at the 1% level, suggesting that the availability of good regulatory and infrastructure environments enhances the efficient operation of businesses and hence the probability of start-ups. Economically, (one unit) increase in the regulatory efficiency composite index will increase the probability of a start-up by 0.98.

For deeper insights, in Column (3) of Table 6, we further detail these relationships by detangling the individual effect of the sub-factors forming the three key aspects of economic freedom with regards to students’ start-up intentions. More specifically, we looked more closely at the scores of (i) property rights, freedom from corruption, and fiscal freedom, (ii) business freedom, labour freedom, and monetary freedom, (iii) trade freedom, investment freedom, and financial freedom. The results show that five sub-factors, property rights, government spending, labour freedom, monetary freedom, trade freedom, and financial freedom, interact positively and statistically significant with necessity-motivated start-up intentions, whereas the relationships between the five other sub-scores and the start-up intention are positive and statistically significant. Hence, freedom from corruption, fiscal freedom, business freedom, monetary freedom, and investment freedom exhibit a negative and statistically significant effect. If we were to rank all economic freedom sub-scores according to their effect on the start-up intention, our findings suggest that higher trade freedom and financial freedom are the strongest motivators, whereas higher fiscal freedom and business freedom are the main factors that undermine this intention.

Among the remaining individual-level and country-level controls, all of them carry the signs obtained in previous studies. The probability of starting a business increases with age and with being a man (Arenius and Minniti 2005). This probability is also higher among individuals with undergraduate education, whereas it decreases among those with graduate education (Urbano and Alvarez 2014). Individuals in middle-income countries (developing countries from Asia-Pacific) are significantly more willing to start a new firm than those in high-income countries (most developed countries from North America and Europe) (Urbano and Alvarez 2014). In addition, our results indicate that the lower the natural logarithm of population or the higher the GDP growth of a country is, the higher is the probability of start-ups (Wennekers et al. 2005; Bjørnskov and Foss 2016).

In Panel 2 of Table 6, we display results of Equation (2) for similar regressions, focussing now on the successor. Hence, in the first column, we examine the overall economic freedom index. Similar to previous results, it was found that economic freedom has a negative and significant effect at the 1% level on the intention to take over an existent business (Column 4).

In the subsequent Column, we present regression results using jointly the composite indexes of rule of law, regulatory efficiency, and market openness. Coherently to our start-up findings, also this result indicates that rule of law and market openness indexes are hindering factors for becoming a successor, while the regulatory efficiency index promotes it.

Conversely to what we found in the start-up intention regression model, not all economic freedom regressors are significant for Panel 2 (Column 6). Hence, only the coefficients related to labour freedom and trade freedom are significantly positive, while freedom from corruption and business freedom are significantly negative. Therefore, the findings suggest that favourable labour and trade freedom levels increase the probability of becoming a successor, whereas both freedom from corruption and business freedom deter it. Interestingly, we found that the effect of financial freedom on entrepreneurial intention to become successor is reversed compared to the start-up intention. This opposite finding regarding the effect of financial freedom on the successor intention might be explained by the different services a country’s banking system may offer in terms of extending lending, offering insurance, and securities funding to successors compared to start-ups. Economically, a one unit increase in labour freedom and trade freedom (freedom from corruption and business freedom) is associated with an increase (decrease) in the probability of starting a firm by approximately factors of 1.01 and 1.03 (0.98, 0.99, and 0.98), respectively. However, the effects of property rights, fiscal freedom, government spending, monetary freedom, and investment freedom are not significant.

Regarding the controls, most of them carry the signs obtained in previous specifications. However, we account for two main differences. The succession intention is stronger in countries with unstable employment conditions and decreases with the individual’s age. The latter suggests that succession in the given dataset means primarily family succession, as research has shown (e.g., Durst et al. 2010) that family successors compared to non-family successors are younger.

To check for the robustness and the validity of our results, we conducted two robustness checks. First, we re-estimated the binomial logistic regression models of Equations (1) and (2) by including separately the set of institutional variables components of rule of law, regulatory efficiency, and market openness. Second, we used a modified Gram–Schmidt procedure to orthogonalize the set of institutional variables (see, McMullen et al. 2008). This technique partials out common variance to create transformed variables that are uncorrelated with one another (orthog command, STATA). In the unreported results, the significance and the direction of the transformed variables did not change from our original analysis. Overall, our main results regarding the ten institutional variables on both entrepreneurial intentions remain unchanged. Hence, we conclude that our findings are, by and large, robust to all these alternative regression specifications, and multicollinearity was not an issue.

Comparison of Results

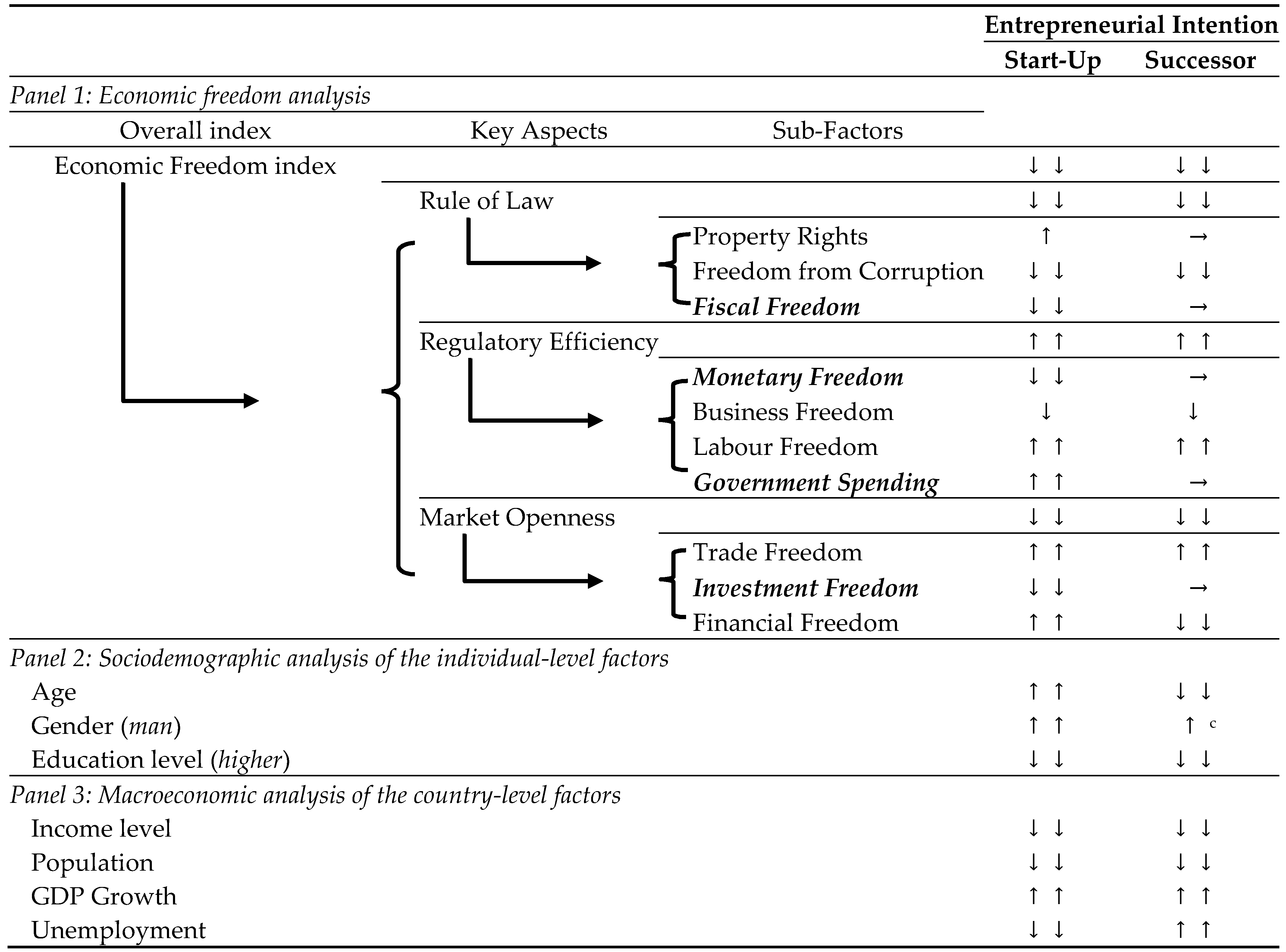

Table 7 provides a summary of the results on the relation between economic freedom factors and other socioeconomic aspects of entrepreneurial activity. It compares their effect on the likelihood of becoming a start-up with regards to the likelihood of becoming a successor and displays the divergent outcomes across the two entrepreneurial intentions. Panel 1 presents the main results of economic freedom factors. Panel 2 gives insights about the importance of sociodemographic factors. Panel 3 summarizes the effects of the macro-economic variables. Symbols ↑ and ↓ indicate, respectively, a significant increase and a significant decrease. Symbols ↑↑ and ↓↓ indicate, respectively, a stronger significant increase and a stronger significant decrease. Symbol → indicates no significant effect. Symbol ↑c indicates a significant increase but to a lesser extent with comparison to the effects on the likelihood of starting a new company.

Table 7.

Summary of the results.

Overall, when we compare our findings, we observe different results for the two options which are in line with our propositions. Several divergent outcomes across the two studied entrepreneurial options are found. For the willingness to start a new start-up, our multivariate results and findings support all the propositions, and, therefore, no proposition can be rejected. However, concerning the entrepreneurial intention to take over an already existing business, our results and conclusions do support only the propositions P2, P2.1, P4, P5, P8, and P10, whereas propositions P1.1, P1.2, P3, P7, P6, and P9 are rejected.

6. Discussion and Conclusions

In this paper, we argue and show empirically that institutional dimensions play an important role in explaining whether an individual—in the given case, a student—starts a new company or takes over an existing one. The findings make clear that the institutional dimensions found in a country have a significant impact on students’ overall entrepreneurial intentions. Thus, the present study joins recent research such as the one by Urbano et al. (2019) or Chowdhury et al. (2019) stressing the importance of studying institutional dimensions to advance the study of entrepreneurship. By having included takeovers in the study and emphasizing their role for economies, we tried to established a better balance between different modes of entrepreneurial activity, of which start-ups is only one, yet the one that is primarily discussed in the current literature (Mergemeier et al. 2018; Urbano et al. 2019).

Summarizing our core findings, the study shows that corruption and limited business freedom have a significant negative influence on both options. On the contrary, favourable labour regulations and trade freedom show a significant positive influence. Furthermore, property rights, fiscal freedom, government spending, monetary freedom, and investment freedom only influence start-ups. Financial freedom, however, affects both options. By having involved property rights as one of the tested institutional dimensions, we addressed Urbano et al.’s (2019) call for more research on this example of formal institutions, which lacked evidence thus far and thus advanced the body of knowledge.

As regards gender differences, our findi6ngs suggest that male students prefer starting a new company, while female students seem to prefer a takeover. This can be viewed as a useful finding for policymakers drafting entrepreneurship policies. This improved understanding may also help to address the gender gap found in entrepreneurship (Wheadon and Duval-Couetil 2019). Yet, it should be relevant for drafting more focused entrepreneurial financing policies too. Moreover, having focused on students, the knowledge gained in this study should be relevant to the further development of entrepreneurship education. We believe that the study provides several findings that could be useful for improving entrepreneurship education, that is, one that focuses on different options of entrepreneurial activity. Such education would come closer to O’Connor’s (2013), who stated that specific forms of entrepreneurship education are needed to deliver upon specific economic purposes. Additionally, it would underline the role of universities (higher education) in making people aware of alternative career options and providing the knowledge that can be used by individuals to develop new business opportunities as well (Do Paço et al. 2015).

This article is one of the first studies to address the impact of a selected number of institutional dimensions on different options to entrepreneurship. As such, it is not without limitations. First, this research was based on university students, which are normally less experienced regarding entrepreneurial activities. Hence, their intentions could follow other drivers than those found among experienced persons.

Furthermore, it is rather likely that some students were undecided when it came to their career preference at the time of data collection. This is another aspect that should be considered. Thus, to verify the robustness of our findings, qualitative research, for example, in forms of interviews, appear advisable. Finally, our dataset did not allow a distinction between family succession and non-family succession. Yet, to develop a more fine-grained understanding of the impact of institutional dimensions on these options, future research should find ways (additional datasets) to address this relevant distinction. Future research may also examine the relationship between the two entrepreneurial options and institutional dimensions using other samples than those of students. By focusing on different options to entrepreneurship, future research could also study how innovation differs in these different types of organizations as well as across countries and regions.

Institutions matter not only at the country level but also at the regional level. Therefore, more differentiated and balanced support of both start-up and succession options is also proposed to be a crucial element of policymakers working at the regional level. While some regions—due to an increasing number of companies waiting to be handed over—may focus more on supporting policies and measures aimed at successors, for other regions which show less developed entrepreneurship, focusing on start-up activities may be a more important policy field. Considering the role of universities in regional innovation and entrepreneurship (Edvardsson and Durst 2017), these regions should also make sure that their entrepreneurship education is reflecting the region’s specific situation. To increase the likelihood of success with regard to these activities, there is a clear need for an entrepreneurial ecosystem that addresses different options of entrepreneurship and that brings together the different actors, e.g., the main actors such as business, university, and government, but also additional actors such as financial institutes and media.

To make possible future research at this interface of different entrepreneurial options and regional development, novel regional datasets are required. Besides regionalized data regarding entrepreneurial intentions and/or activities, also institutional factors on a regional level should be included in such novel datasets.

Author Contributions

All authors have contributed equally and substantially to the work reported. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1. | Albania, Argentina, Australia, Austria, Belarus, Belgium, Brazil, Canada, Chile, China, Colombia, Croatia, Czech Republic, Ecuador, El Salvador, England, Estonia, Finland, France, Germany, Greece, Hungary, India, Ireland, Italy, Japan, Kazakhstan, Korea, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malaysia, Mexico, Morocco, Norway, Pakistan, Panama, Peru, Poland, Portugal, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, Uruguay and USA. |

References

- Aidis, Ruta, Saul Estrin, and Tomasz Marek Mickiewicz. 2012. Size matters: Entrepreneurial entry and government. Small Business Economics 39: 119–39. [Google Scholar] [CrossRef]

- Arenius, Pia, and Maria Minniti. 2005. Perceptual Variables and Nascent Entrepreneurship. Small Business Economics 24: 233–47. [Google Scholar] [CrossRef]

- Austrian Institute for SME Research. 2004. Business Transfers and Successions in Austria. Available online: http://www.kmuforschung.ac.at/de/Forschungsberichte/Vortr%C3%A4ge/Business%20Transfers%20and%20Successions%20in%20Austria.pdf (accessed on 12 August 2008).

- Avnimelech, Gil, Yaron Zelekha, and Eyal Sharabi. 2014. The effect of corruption on entrepreneurship in developed vs non-developed countries. International Journal of Entrepreneurial Behaviour & Research 20: 237–62. [Google Scholar] [CrossRef]

- Baldine, Nicola, Rosa Grimaldi, and Maurizio Sobrero. 2007. To patent or not to patent? A survey of Italian inventors on motivations, incentives, and obstacles to university patenting. Scientometrics 70: 333–54. [Google Scholar] [CrossRef]

- Ballinger, Gary A., F. David Schoorman, and David W. Lehmanc. 2009. Will you trust your new boss? The role of affective reactions to leadership succession. The Leadership Quarterly 20: 219–32. [Google Scholar] [CrossRef]

- Beach, William. W., and Gerald Patrick O’Driscoll. 2003. Explaining the factors of the index of economic freedom. In 2003 Index of Freedom. Available online: http://www.archive.kubatana.net/docs/resour/economic_freedom_factors_2003.pdf (accessed on 28 May 2020).

- Bennet, Robert J. 2012. Government and small business. In Enterprise and Small Business. Edited by Sara Carter and Dylan Jones-Evans. Harlow: Pearson, pp. 46–77. [Google Scholar]

- Bjørnskov, Christian, and Nicolai. J. Foss. 2016. Institutions, entrepreneurship, and economic growth: What do we know and what do we still need to know? The Academy of Management Perspectives 30: 292–315. [Google Scholar] [CrossRef]

- Bönte, Werner, and Monika Piegeler. 2013. Gender gap in latent and nascent entrepreneurship: Driven by competitiveness. Small Business Economics 41: 961–87. [Google Scholar] [CrossRef]

- Busenitz, Lowell W., G. Page West III, Dean Shepherd, Teresa Nelson, Gaylen N. Chandler, and Andrew Zacharakis. 2000. Entrepreneurship Research in Emergence: Past Trends and Future Directions. Journal of Management 29: 285–308. [Google Scholar] [CrossRef]

- Camerlynck, Jan, Hubert Ooghe, and Tine De Langhe. 2005. Pre-Acquisition Profile of Privately Held Companies Involved in Take-Overs: An Empirical Study. Small Business Economics 24: 169–86. [Google Scholar] [CrossRef]

- Cavusgil, S. Tamer, Gary Knight, and John R. Riesenberger. 2014. International Business. The New Realities, 3rd ed. Harlow: Pearson. [Google Scholar]

- Chowdhury, Farzana, David B. Audretsch, and Maksim Belitski. 2019. Institutions and Entrepreneurship Quality. Entrepreneurship Theory and Practice 43: 51–81. [Google Scholar] [CrossRef]

- Costa, Joana, and M. Pita. 2020. Appraising entrepreneurship in Qatar under a gender perspective. International Journal of Gender and Entrepreneurship 12: 233–51. [Google Scholar] [CrossRef]

- De Clercq, D., W. D. Danis, and Mariana Dakhli. 2010. The moderating effect of institutional context on the relationship between associational activity and new business activity in emerging economies. International Business Review 19: 85–101. [Google Scholar] [CrossRef]

- De Freyman, Julien, and Susanne Durst. 2019. Business Transfer Paradox in Entrepreneurship Education: Rethinking educational policy. Paper presented at the RENT XXXIII Embracing Uncertainty: Entrepreneurship as a Key Capability for the 21st Century, Berlin, Germany, November 28–29. [Google Scholar]

- Dilli, Selin, Niklas Elert, and Andrea M. Herrmann. 2018. Varieties of entrepreneurship: Exploring the institutional foundations of different entrepreneurship types through ‘Varieties-of-Capitalism’ arguments. Small Business Economics 51: 293–320. [Google Scholar] [CrossRef]

- Do Paço, Arminda, João Matos Ferreira, Mário Raposo, Ricardo Gouveia Rodrigues, and Anabela Dinis. 2015. Entrepreneurial intentions: Is education enough? International Entrepreneurship and Management Journal 11: 57–75. [Google Scholar] [CrossRef]

- Dohse, Dirk, and Sascha G. Walter. 2012. Knowledge context and entrepreneurial intentions among students. Small Business Economics 39: 877–95. [Google Scholar] [CrossRef]

- Mojca, Duh. 2014. Family business succession as knowledge creation process. Kybernetes 43: 699–714. [Google Scholar] [CrossRef]

- Durst, Susanne, and Stefan Gueldenberg. 2010. What makes SMEs attractive to external successors? VINE: The Journal of Information and Knowledge Management Systems 40: 108–35. [Google Scholar] [CrossRef]

- Durst, Susanne, and Jan Sedenka. 2016. Entrepreneurial Intentions and Behaviour of Students Attending Swedish Universities Global University Entrepreneurial Spirit Students’ Survey 2016. National Report Sweden. Available online: http://www.guesssurvey.org/resources/nat_2016/GUESSS_Report_2016_Sweden-m.pdf (accessed on 28 May 2020).

- Durst, Susanne, Urs Baldegger, and Frank Halter. 2010. The Successor or the Neglected Perspective in Company Succession in Family Firms. Paper presented at the 2010 Babson College Entrepreneurship Research Conference, Lausanne, Switzerland, June 9–12. [Google Scholar]

- Edvardsson, Ingi Runar, and Susanne Durst. 2017. Universities and knowledge-based development: A literature review. International Journal of Knowledge-Based Development 8: 105–34. [Google Scholar] [CrossRef]

- Engle, Robert L., Christopher Schlägel, and Nikolay Dimitriadi. 2011. Institutions and entrepreneurial intent: A cross-country study. Journal of Developmental Entrepreneurship 16: 227–50. [Google Scholar] [CrossRef]

- Entrepreneurship Foundation (Fondation de l’Entrepreneurship). 2010. La relève est-elle au rendez-vous au Québec? Available online: http://docplayer.fr/142869-Releve-entrepreneuriale-est-elle-au-rendez-vous-la-releve-au-quebec.html (accessed on 9 April 2021).

- Estrin, Saul, Julia W. Korostelevahich, and Tomasz Mickiewicz. 2013. Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing 28: 564–80. [Google Scholar] [CrossRef]

- European Commission. 2019. Transfer of Businesses. Available online: https://ec.europa.eu/growth/smes/promoting-entrepreneurship/advice-opportunities/transfer-business_en (accessed on 18 September 2019).

- Goel, Sanjay, and Ranjan Karri. 2020. Entrepreneurial aspirations and poverty reduction: The role of institutional context. Entrepreneurship & Regional Development 32: 91–111. [Google Scholar] [CrossRef]

- Gwartney, James, and Robert Lawson. 2002. Economic Freedom of the World: 2002 Annual Report. Vancouver: Fraser Institute. [Google Scholar]

- Haan, Jakob D., and Jan-Egbert Sturm. 2000. On the relationship between economic freedom and economic growth. European Journal of Political Economy 16: 215–41. [Google Scholar] [CrossRef]

- Heckelman, Jac C. 2000. Economic freedom and economic growth: A short-run causal investigation. Journal of Applied Economics 3: 71–91. [Google Scholar] [CrossRef]

- Heritage Foundation. 2020. Available online: https://www.heritage.org/index/ (accessed on 8 April 2020).

- Herrera-Echeverri, Hernán, Jerry Haar, and Juan Benavides Estévez-Bretón. 2014. Foreign direct investment, institutional quality, economic freedom and entrepreneurship in emerging markets. Journal of Business Research 67: 1921–32. [Google Scholar] [CrossRef]

- Hwang, Hokyu, and Walter W. Powell. 2005. Institutions and Entrepreneurship. In Handbook of Entrepreneurship Research. Boston: Springer, pp. 201–32. [Google Scholar]

- Jackson, Gregory, and Richard Deeg. 2008. Comparing capitalisms: Understanding institutional diversity and its implications for international business. Journal of International Business Studies 39: 540–61. [Google Scholar] [CrossRef]

- Kesner, Idalene F., and Dan R. Dalton. 1994. Top management turnover and CEO succession: An investigation of the effects of turnover on performance. Journal of Management Studies 31: 701–13. [Google Scholar] [CrossRef]

- Langowitz, Nan, and Maria Minniti. 2007. The Entrepreneurial Propensity of Women. Entrepreneurship Theory & Practice 31: 341–64. [Google Scholar] [CrossRef]

- Levesque, Moren, and Maria Minniti. 2006. The effect of aging on entrepreneurial behaviour. Journal of Business Venturing 21: 177–194. [Google Scholar] [CrossRef]

- Lim, Dominic. S. K., Eric A. Morse, Ronald K. Mitchell, and Kristie K. Seawright. 2010. Institutional Environment and Entrepreneurial Cognitions: A Comparative Business Systems Perspective. Entrepreneurship Theory and Practice 34: 491–516. [Google Scholar] [CrossRef]

- McMullen, Jeffery S., D. Ray Bagby, and Leslie E. Palich. 2008. Economic Freedom and the Motivation to Engage in Entrepreneurial Action. Entrepreneurship Theory and Practice 32: 875–95. [Google Scholar] [CrossRef]

- Mendy, John, and Mahfuzur Rahman. 2019. Application of human resource management’s universal model: An examination of people versus institutions as barriers of internationalization for SMEs in a small developing country. Thunderbird International Business Review 61: 363–74. [Google Scholar] [CrossRef]

- Mergemeier, Lea, Jessica Moser, and Tessa C. Flatten. 2018. The influence of multiple constraints along the venture creation process and on start-up intention in nascent entrepreneurship. Entrepreneurship & Regional Development 30: 848–76. [Google Scholar] [CrossRef]

- Meyer, John W., and Brian Rowan. 1977. Institutionalized Organizations: Formal Structure as Myth and Ceremony. The American Journal of Sociology 83: 340–63. [Google Scholar] [CrossRef]

- Niefert, Michaela. 2006. Patenting Behaviour and Employment Growth in German Start-Up Firms—A Panel Data Analysis. In Entrepreneurship in the Region. Edited by M. Fritsch and J. Schmude. Boston: Springer, pp. 113–42. [Google Scholar]

- North, Douglass Cecil. 1991. Institutions. The Journal of Economic Perspectives 5: 97–112. [Google Scholar] [CrossRef]

- O’Connor, A. 2013. A conceptual framework for entrepreneurship education policy: Meeting government and economic purposes. Journal of Business Venturing 28: 546–63. [Google Scholar] [CrossRef]

- Oftedal, Elin Merethe, Tatiana A. Iakovleva, and Lene Foss. 2017. University context matter: An institutional perspective on entrepreneurial intentions of students. Education + Training 60: 873–90. [Google Scholar] [CrossRef]

- Pagan, A. 1984. Econometric Issues in the Analysis of Regressions with Generated Regressors. International Economic Review 25: 221–47. [Google Scholar] [CrossRef]

- Pasanen, Mika, and Tommi Laukkanen. 2006. Team-managed growing SMEs: A distinct species? Management Research News 29: 684–700. [Google Scholar] [CrossRef]

- Pitcher, Patricia, Samia Chreim, and Veronika Kisfalvi. 2000. CEO succession research: Methodological bridges over troubled waters. Strategic Management Journal 21: 625–48. [Google Scholar] [CrossRef]

- Powell, Walter W., and Paul J. DiMaggio, eds. 1991. The New Institutionalism in Organizational Analysis. Chicago: University of Chicago Press. [Google Scholar]

- Riley, Bryan, and Patrick Tyrrell. 2017. 2018 Index of Economic Freedom: Freedom to Trade Is a Key to Prosperity. BACKGROUNDER. November 21. No. 3266. Available online: https://www.heritage.org/trade/report/2018-index-economic-freedom-freedom-trade-key-prosperity (accessed on 28 May 2020).

- Scott, Richard W. 1995. Institutions and Organizations. Ideas, Interests and Identities. London: Sage. [Google Scholar]

- Stenholm, Pekka, Zoltan J. Acs, and Robert Wuebker. 2013. Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing 28: 176–93. [Google Scholar] [CrossRef]

- Svensson, Jakob. 2005. Eight questions about corruption. Journal of Economic Perspectives 19: 19–42. [Google Scholar] [CrossRef]

- Temel, Serdal, Susanne Durst, Rustem B. Yesilay, Christoph Hinteregger, Fazilet V. Sukan, and Cevahir Uzkurt. 2015. The Drivers of Entrepreneurial Universities in Emerging Economies: A Turkish Case Study. In Handbook of Research on Global Competitive Advantage through Innovation and Entrepreneurship. Edited by Luis M. Farinha, Joao J. M. Ferreira, Helen Lawton Smith and Sharmistha Bagchi-Sen. Hershey: IGI Global, pp. 569–88. [Google Scholar]

- Thornton, Patricia, Domingo Ribeiro-Soriano, and David Urbano. 2011. Socio cultural factors and entrepreneurial activity: An overview. International Small Business Journal 29: 1–14. [Google Scholar] [CrossRef]

- Tolbert, Pamela S., Robert J. David, and Wesley D. Sine. 2011. Studying Choice and Change: The Intersection of Institutional Theory and Entrepreneurship Research. Organization Science 22: 1332–44. [Google Scholar] [CrossRef]

- Urbano, David, and Claudia Alvarez. 2014. Institutional dimensions and entrepreneurial activity: An international study. Small Business Economics 42: 703–16. [Google Scholar] [CrossRef]

- Urbano, David, S. Aparicio, and David Audretsch. 2019. Twenty-five years of research on institutions, entrepreneurship, and economic growth: What has been learned? Small Business Economics 53: 21–49. [Google Scholar] [CrossRef]

- Van Teeffelen, Lex, Lorraine Uhlaner, and Martijn Driessen. 2011. The importance of specific human capital, planning and familiarity in Dutch small firm ownership transfers: A seller’s perspective. International Journal of Entrepreneurship and Small Business 14: 127–48. [Google Scholar] [CrossRef]

- Walter, Sascha G., and Jörn H. Block. 2016. Outcomes of entrepreneurship education: An institutional perspective. Journal of Business Venturing 31: 216–33. [Google Scholar] [CrossRef]

- Wennekers, Sander, André van Stel, Roy Thurik, and Paul Reynolds. 2005. Nascent Entrepreneurship and the Level of Economic Development. Small Business Economics 30: 293–309. [Google Scholar] [CrossRef]

- Wheadon, Mandy, and Nathalie Duval-Couetil. 2019. Token entrepreneurs: A review of gender, capital, and context in technology entrepreneurship. Entrepreneurship & Regional Development 31: 308–36. [Google Scholar]

- White, Halbert. 1980. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 48: 817–38. [Google Scholar] [CrossRef]

- Williamson, Oliver E. 2000. The New Institutional Economics: Taking Stock, Looking Ahead. Journal of Economic Literature 38: 595–613. [Google Scholar] [CrossRef]

- World Bank Group. 2010. Better Regulation for Growth Governance Frameworks and Tools for Effective Regulatory Reform, Washington. Available online: https://www.worldbank.org/ (accessed on 29 March 2020).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).