The Impact of Institutional Dimensions on Entrepreneurial Intentions of Students—International Evidence

Abstract

:1. Introduction

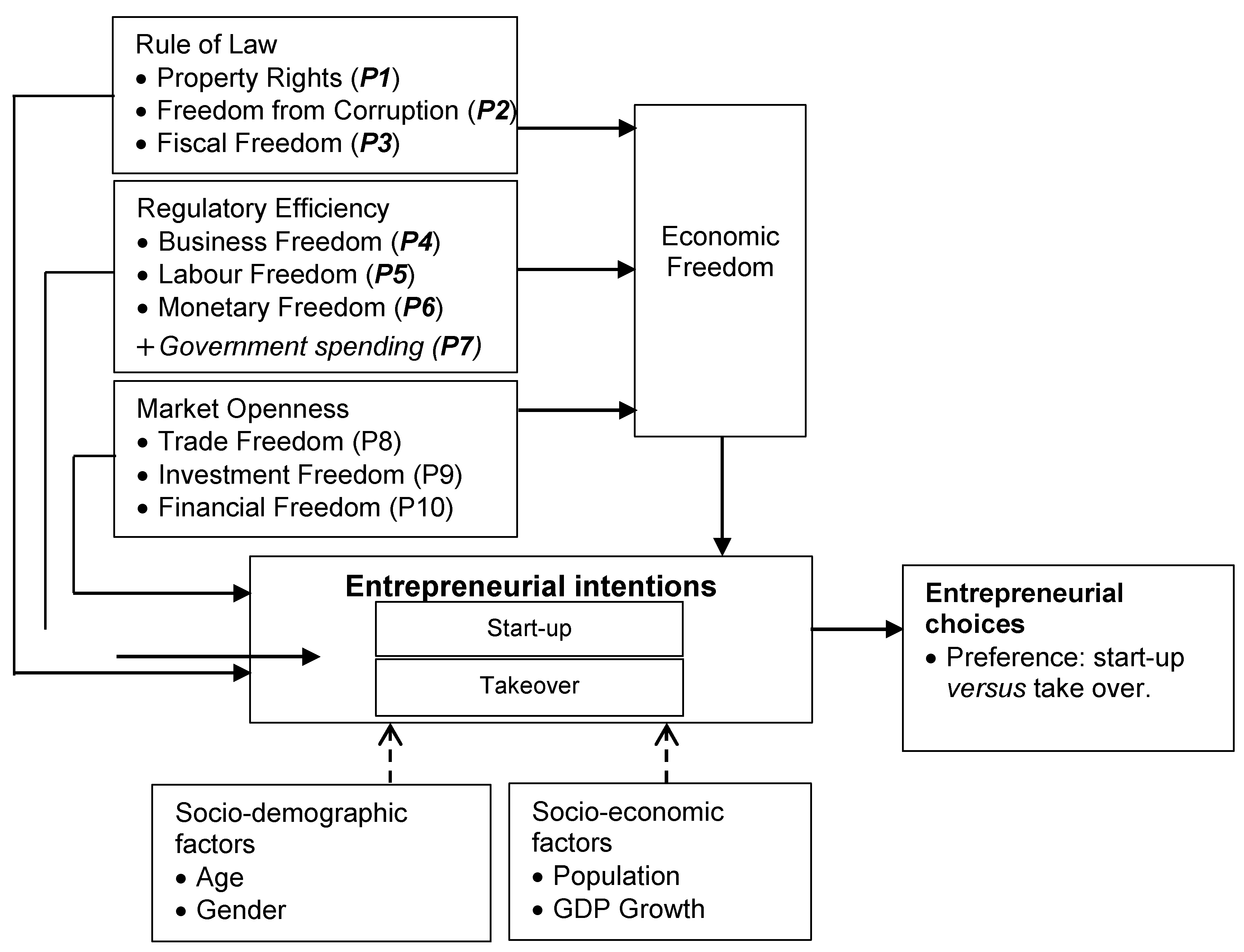

2. Theoretical Background and Development of Propositions

2.1. Different Forms of Entrepreneurship

2.2. Institutional Dimensions Influencing Entrepreneurship

2.2.1. Rule of Law

Property Rights

Freedom from Corruption

Fiscal Freedom

2.2.2. Regulatory Efficiency

Business Freedom

Labour Freedom

Monetary Freedom

Government Spending and Economic Prosperity as Additional Institutional Factor for Regulatory Efficiency

2.2.3. Market Openness

Trade Freedom

Investment Freedom

Financial Freedom

3. Materials and Methods

3.1. Data Sources

3.2. Variables

3.2.1. Entrepreneurship Choices

3.2.2. Institutional Environment and Macro-Variables

3.2.3. Control Variables

4. Methodology

Sample Characteristics and Univariate Analysis

5. Results

Comparison of Results

6. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

| 1. | Albania, Argentina, Australia, Austria, Belarus, Belgium, Brazil, Canada, Chile, China, Colombia, Croatia, Czech Republic, Ecuador, El Salvador, England, Estonia, Finland, France, Germany, Greece, Hungary, India, Ireland, Italy, Japan, Kazakhstan, Korea, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malaysia, Mexico, Morocco, Norway, Pakistan, Panama, Peru, Poland, Portugal, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, Uruguay and USA. |

References

- Aidis, Ruta, Saul Estrin, and Tomasz Marek Mickiewicz. 2012. Size matters: Entrepreneurial entry and government. Small Business Economics 39: 119–39. [Google Scholar] [CrossRef]

- Arenius, Pia, and Maria Minniti. 2005. Perceptual Variables and Nascent Entrepreneurship. Small Business Economics 24: 233–47. [Google Scholar] [CrossRef]

- Austrian Institute for SME Research. 2004. Business Transfers and Successions in Austria. Available online: http://www.kmuforschung.ac.at/de/Forschungsberichte/Vortr%C3%A4ge/Business%20Transfers%20and%20Successions%20in%20Austria.pdf (accessed on 12 August 2008).

- Avnimelech, Gil, Yaron Zelekha, and Eyal Sharabi. 2014. The effect of corruption on entrepreneurship in developed vs non-developed countries. International Journal of Entrepreneurial Behaviour & Research 20: 237–62. [Google Scholar] [CrossRef]

- Baldine, Nicola, Rosa Grimaldi, and Maurizio Sobrero. 2007. To patent or not to patent? A survey of Italian inventors on motivations, incentives, and obstacles to university patenting. Scientometrics 70: 333–54. [Google Scholar] [CrossRef]

- Ballinger, Gary A., F. David Schoorman, and David W. Lehmanc. 2009. Will you trust your new boss? The role of affective reactions to leadership succession. The Leadership Quarterly 20: 219–32. [Google Scholar] [CrossRef]

- Beach, William. W., and Gerald Patrick O’Driscoll. 2003. Explaining the factors of the index of economic freedom. In 2003 Index of Freedom. Available online: http://www.archive.kubatana.net/docs/resour/economic_freedom_factors_2003.pdf (accessed on 28 May 2020).

- Bennet, Robert J. 2012. Government and small business. In Enterprise and Small Business. Edited by Sara Carter and Dylan Jones-Evans. Harlow: Pearson, pp. 46–77. [Google Scholar]

- Bjørnskov, Christian, and Nicolai. J. Foss. 2016. Institutions, entrepreneurship, and economic growth: What do we know and what do we still need to know? The Academy of Management Perspectives 30: 292–315. [Google Scholar] [CrossRef] [Green Version]

- Bönte, Werner, and Monika Piegeler. 2013. Gender gap in latent and nascent entrepreneurship: Driven by competitiveness. Small Business Economics 41: 961–87. [Google Scholar] [CrossRef]

- Busenitz, Lowell W., G. Page West III, Dean Shepherd, Teresa Nelson, Gaylen N. Chandler, and Andrew Zacharakis. 2000. Entrepreneurship Research in Emergence: Past Trends and Future Directions. Journal of Management 29: 285–308. [Google Scholar] [CrossRef]

- Camerlynck, Jan, Hubert Ooghe, and Tine De Langhe. 2005. Pre-Acquisition Profile of Privately Held Companies Involved in Take-Overs: An Empirical Study. Small Business Economics 24: 169–86. [Google Scholar] [CrossRef] [Green Version]

- Cavusgil, S. Tamer, Gary Knight, and John R. Riesenberger. 2014. International Business. The New Realities, 3rd ed. Harlow: Pearson. [Google Scholar]

- Chowdhury, Farzana, David B. Audretsch, and Maksim Belitski. 2019. Institutions and Entrepreneurship Quality. Entrepreneurship Theory and Practice 43: 51–81. [Google Scholar] [CrossRef] [Green Version]

- Costa, Joana, and M. Pita. 2020. Appraising entrepreneurship in Qatar under a gender perspective. International Journal of Gender and Entrepreneurship 12: 233–51. [Google Scholar] [CrossRef]

- De Clercq, D., W. D. Danis, and Mariana Dakhli. 2010. The moderating effect of institutional context on the relationship between associational activity and new business activity in emerging economies. International Business Review 19: 85–101. [Google Scholar] [CrossRef]

- De Freyman, Julien, and Susanne Durst. 2019. Business Transfer Paradox in Entrepreneurship Education: Rethinking educational policy. Paper presented at the RENT XXXIII Embracing Uncertainty: Entrepreneurship as a Key Capability for the 21st Century, Berlin, Germany, November 28–29. [Google Scholar]

- Dilli, Selin, Niklas Elert, and Andrea M. Herrmann. 2018. Varieties of entrepreneurship: Exploring the institutional foundations of different entrepreneurship types through ‘Varieties-of-Capitalism’ arguments. Small Business Economics 51: 293–320. [Google Scholar] [CrossRef] [Green Version]

- Do Paço, Arminda, João Matos Ferreira, Mário Raposo, Ricardo Gouveia Rodrigues, and Anabela Dinis. 2015. Entrepreneurial intentions: Is education enough? International Entrepreneurship and Management Journal 11: 57–75. [Google Scholar] [CrossRef]

- Dohse, Dirk, and Sascha G. Walter. 2012. Knowledge context and entrepreneurial intentions among students. Small Business Economics 39: 877–95. [Google Scholar] [CrossRef]

- Mojca, Duh. 2014. Family business succession as knowledge creation process. Kybernetes 43: 699–714. [Google Scholar] [CrossRef]

- Durst, Susanne, and Stefan Gueldenberg. 2010. What makes SMEs attractive to external successors? VINE: The Journal of Information and Knowledge Management Systems 40: 108–35. [Google Scholar] [CrossRef]

- Durst, Susanne, and Jan Sedenka. 2016. Entrepreneurial Intentions and Behaviour of Students Attending Swedish Universities Global University Entrepreneurial Spirit Students’ Survey 2016. National Report Sweden. Available online: http://www.guesssurvey.org/resources/nat_2016/GUESSS_Report_2016_Sweden-m.pdf (accessed on 28 May 2020).

- Durst, Susanne, Urs Baldegger, and Frank Halter. 2010. The Successor or the Neglected Perspective in Company Succession in Family Firms. Paper presented at the 2010 Babson College Entrepreneurship Research Conference, Lausanne, Switzerland, June 9–12. [Google Scholar]

- Edvardsson, Ingi Runar, and Susanne Durst. 2017. Universities and knowledge-based development: A literature review. International Journal of Knowledge-Based Development 8: 105–34. [Google Scholar] [CrossRef]

- Engle, Robert L., Christopher Schlägel, and Nikolay Dimitriadi. 2011. Institutions and entrepreneurial intent: A cross-country study. Journal of Developmental Entrepreneurship 16: 227–50. [Google Scholar] [CrossRef]

- Entrepreneurship Foundation (Fondation de l’Entrepreneurship). 2010. La relève est-elle au rendez-vous au Québec? Available online: http://docplayer.fr/142869-Releve-entrepreneuriale-est-elle-au-rendez-vous-la-releve-au-quebec.html (accessed on 9 April 2021).

- Estrin, Saul, Julia W. Korostelevahich, and Tomasz Mickiewicz. 2013. Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing 28: 564–80. [Google Scholar] [CrossRef] [Green Version]

- European Commission. 2019. Transfer of Businesses. Available online: https://ec.europa.eu/growth/smes/promoting-entrepreneurship/advice-opportunities/transfer-business_en (accessed on 18 September 2019).

- Goel, Sanjay, and Ranjan Karri. 2020. Entrepreneurial aspirations and poverty reduction: The role of institutional context. Entrepreneurship & Regional Development 32: 91–111. [Google Scholar] [CrossRef]

- Gwartney, James, and Robert Lawson. 2002. Economic Freedom of the World: 2002 Annual Report. Vancouver: Fraser Institute. [Google Scholar]

- Haan, Jakob D., and Jan-Egbert Sturm. 2000. On the relationship between economic freedom and economic growth. European Journal of Political Economy 16: 215–41. [Google Scholar] [CrossRef] [Green Version]

- Heckelman, Jac C. 2000. Economic freedom and economic growth: A short-run causal investigation. Journal of Applied Economics 3: 71–91. [Google Scholar] [CrossRef] [Green Version]

- Heritage Foundation. 2020. Available online: https://www.heritage.org/index/ (accessed on 8 April 2020).

- Herrera-Echeverri, Hernán, Jerry Haar, and Juan Benavides Estévez-Bretón. 2014. Foreign direct investment, institutional quality, economic freedom and entrepreneurship in emerging markets. Journal of Business Research 67: 1921–32. [Google Scholar] [CrossRef] [Green Version]

- Hwang, Hokyu, and Walter W. Powell. 2005. Institutions and Entrepreneurship. In Handbook of Entrepreneurship Research. Boston: Springer, pp. 201–32. [Google Scholar]

- Jackson, Gregory, and Richard Deeg. 2008. Comparing capitalisms: Understanding institutional diversity and its implications for international business. Journal of International Business Studies 39: 540–61. [Google Scholar] [CrossRef]

- Kesner, Idalene F., and Dan R. Dalton. 1994. Top management turnover and CEO succession: An investigation of the effects of turnover on performance. Journal of Management Studies 31: 701–13. [Google Scholar] [CrossRef]

- Langowitz, Nan, and Maria Minniti. 2007. The Entrepreneurial Propensity of Women. Entrepreneurship Theory & Practice 31: 341–64. [Google Scholar] [CrossRef]

- Levesque, Moren, and Maria Minniti. 2006. The effect of aging on entrepreneurial behaviour. Journal of Business Venturing 21: 177–194. [Google Scholar] [CrossRef]

- Lim, Dominic. S. K., Eric A. Morse, Ronald K. Mitchell, and Kristie K. Seawright. 2010. Institutional Environment and Entrepreneurial Cognitions: A Comparative Business Systems Perspective. Entrepreneurship Theory and Practice 34: 491–516. [Google Scholar] [CrossRef]

- McMullen, Jeffery S., D. Ray Bagby, and Leslie E. Palich. 2008. Economic Freedom and the Motivation to Engage in Entrepreneurial Action. Entrepreneurship Theory and Practice 32: 875–95. [Google Scholar] [CrossRef]

- Mendy, John, and Mahfuzur Rahman. 2019. Application of human resource management’s universal model: An examination of people versus institutions as barriers of internationalization for SMEs in a small developing country. Thunderbird International Business Review 61: 363–74. [Google Scholar] [CrossRef]

- Mergemeier, Lea, Jessica Moser, and Tessa C. Flatten. 2018. The influence of multiple constraints along the venture creation process and on start-up intention in nascent entrepreneurship. Entrepreneurship & Regional Development 30: 848–76. [Google Scholar] [CrossRef]

- Meyer, John W., and Brian Rowan. 1977. Institutionalized Organizations: Formal Structure as Myth and Ceremony. The American Journal of Sociology 83: 340–63. [Google Scholar] [CrossRef] [Green Version]

- Niefert, Michaela. 2006. Patenting Behaviour and Employment Growth in German Start-Up Firms—A Panel Data Analysis. In Entrepreneurship in the Region. Edited by M. Fritsch and J. Schmude. Boston: Springer, pp. 113–42. [Google Scholar]

- North, Douglass Cecil. 1991. Institutions. The Journal of Economic Perspectives 5: 97–112. [Google Scholar] [CrossRef]

- O’Connor, A. 2013. A conceptual framework for entrepreneurship education policy: Meeting government and economic purposes. Journal of Business Venturing 28: 546–63. [Google Scholar] [CrossRef]

- Oftedal, Elin Merethe, Tatiana A. Iakovleva, and Lene Foss. 2017. University context matter: An institutional perspective on entrepreneurial intentions of students. Education + Training 60: 873–90. [Google Scholar] [CrossRef]

- Pagan, A. 1984. Econometric Issues in the Analysis of Regressions with Generated Regressors. International Economic Review 25: 221–47. [Google Scholar] [CrossRef]

- Pasanen, Mika, and Tommi Laukkanen. 2006. Team-managed growing SMEs: A distinct species? Management Research News 29: 684–700. [Google Scholar] [CrossRef] [Green Version]

- Pitcher, Patricia, Samia Chreim, and Veronika Kisfalvi. 2000. CEO succession research: Methodological bridges over troubled waters. Strategic Management Journal 21: 625–48. [Google Scholar] [CrossRef]

- Powell, Walter W., and Paul J. DiMaggio, eds. 1991. The New Institutionalism in Organizational Analysis. Chicago: University of Chicago Press. [Google Scholar]

- Riley, Bryan, and Patrick Tyrrell. 2017. 2018 Index of Economic Freedom: Freedom to Trade Is a Key to Prosperity. BACKGROUNDER. November 21. No. 3266. Available online: https://www.heritage.org/trade/report/2018-index-economic-freedom-freedom-trade-key-prosperity (accessed on 28 May 2020).

- Scott, Richard W. 1995. Institutions and Organizations. Ideas, Interests and Identities. London: Sage. [Google Scholar]

- Stenholm, Pekka, Zoltan J. Acs, and Robert Wuebker. 2013. Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing 28: 176–93. [Google Scholar] [CrossRef]

- Svensson, Jakob. 2005. Eight questions about corruption. Journal of Economic Perspectives 19: 19–42. [Google Scholar] [CrossRef] [Green Version]

- Temel, Serdal, Susanne Durst, Rustem B. Yesilay, Christoph Hinteregger, Fazilet V. Sukan, and Cevahir Uzkurt. 2015. The Drivers of Entrepreneurial Universities in Emerging Economies: A Turkish Case Study. In Handbook of Research on Global Competitive Advantage through Innovation and Entrepreneurship. Edited by Luis M. Farinha, Joao J. M. Ferreira, Helen Lawton Smith and Sharmistha Bagchi-Sen. Hershey: IGI Global, pp. 569–88. [Google Scholar]

- Thornton, Patricia, Domingo Ribeiro-Soriano, and David Urbano. 2011. Socio cultural factors and entrepreneurial activity: An overview. International Small Business Journal 29: 1–14. [Google Scholar] [CrossRef]

- Tolbert, Pamela S., Robert J. David, and Wesley D. Sine. 2011. Studying Choice and Change: The Intersection of Institutional Theory and Entrepreneurship Research. Organization Science 22: 1332–44. [Google Scholar] [CrossRef] [Green Version]

- Urbano, David, and Claudia Alvarez. 2014. Institutional dimensions and entrepreneurial activity: An international study. Small Business Economics 42: 703–16. [Google Scholar] [CrossRef]

- Urbano, David, S. Aparicio, and David Audretsch. 2019. Twenty-five years of research on institutions, entrepreneurship, and economic growth: What has been learned? Small Business Economics 53: 21–49. [Google Scholar] [CrossRef] [Green Version]

- Van Teeffelen, Lex, Lorraine Uhlaner, and Martijn Driessen. 2011. The importance of specific human capital, planning and familiarity in Dutch small firm ownership transfers: A seller’s perspective. International Journal of Entrepreneurship and Small Business 14: 127–48. [Google Scholar] [CrossRef] [Green Version]

- Walter, Sascha G., and Jörn H. Block. 2016. Outcomes of entrepreneurship education: An institutional perspective. Journal of Business Venturing 31: 216–33. [Google Scholar] [CrossRef] [Green Version]

- Wennekers, Sander, André van Stel, Roy Thurik, and Paul Reynolds. 2005. Nascent Entrepreneurship and the Level of Economic Development. Small Business Economics 30: 293–309. [Google Scholar] [CrossRef] [Green Version]

- Wheadon, Mandy, and Nathalie Duval-Couetil. 2019. Token entrepreneurs: A review of gender, capital, and context in technology entrepreneurship. Entrepreneurship & Regional Development 31: 308–36. [Google Scholar]

- White, Halbert. 1980. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 48: 817–38. [Google Scholar] [CrossRef]

- Williamson, Oliver E. 2000. The New Institutional Economics: Taking Stock, Looking Ahead. Journal of Economic Literature 38: 595–613. [Google Scholar] [CrossRef] [Green Version]

- World Bank Group. 2010. Better Regulation for Growth Governance Frameworks and Tools for Effective Regulatory Reform, Washington. Available online: https://www.worldbank.org/ (accessed on 29 March 2020).

| Variables | Description | Sources |

|---|---|---|

| Entrepreneurship activity | ||

| Start-Up | This is a dummy variable that takes one if the respondent is willing to start a new business and zero otherwise. | Global University Entrepreneurial Spirit Students’ Survey (GUESS) |

| Successor | This is a dummy variable that is one if the interviewee is willing to take over an existent business and zero otherwise. | GUESS |

| Economic Freedom index | Equally-weighted score of country’s economic freedom/stringency. | The Heritage Foundation |

| Rule of Law | ||

| Property Rights | Legal framework allowing individuals to freely accumulate private property (e.g., private property rights, risk of expropriation, quality of land administration, etc.). | The Heritage Foundation |

| Freedom from Corruption | Degree of government integrity and public trust allowing security and certainty into economic relations (e.g., bribery, extortion, transparency, irregular payments, etc.). | The Heritage Foundation |

| Fiscal Freedom | The Heritage Foundation | |

| Regulatory Efficiency | ||

| Government Spending | The burden of government expenditures in a country. | The Heritage Foundation |

| Business Freedom | The regulatory and the infrastructure environments factors affecting the ease of starting, operating, and closing a business. | The Heritage Foundation |

| Labour Freedom | The legal and regulatory framework of a country’s labor market (e.g., minimum wages, hiring and hours worked, etc.). | |

| Monetary Freedom | The strength of economic stability in a country (e.g., price stability, inflation rate, etc.) | The Heritage Foundation |

| Market Openness | ||

| Trade Freedom | The extent of tariff and nontariff barriers in a country. | The Heritage Foundation |

| Investment Freedom | The constraints on the flow of investment capital in a country (e.g., treatment of foreign investment, investment code, etc.) | The Heritage Foundation |

| Financial Freedom | The strength of the financial system and banking efficiency in a country. | The Heritage Foundation |

| Control variables (individual-level) | ||

| Age | Respondents were asked to provide their year of birth. | GUESS |

| Gender | Respondents were asked to provide their gender. It takes the value of one if male and zero if female. | GUESS |

| Education level | Respondents were asked to provide the highest education level. It splits into three categories: 1: Undergraduate (Bachelor), 2: Graduate (Master) and 3: Other (e.g., Ph.D., MBA). | GUESS |

| Control variables (country-level) | ||

| Income level | Countries are classified into three levels of income, according to the Global Competitiveness Report, published by the World Economic Forum and the Global Entrepreneurship Monitor (GEM). 1: High income (North America and Europe), 2: Middle Income (Asia-Pacific), 3: Low Income (the rest) | The World Development Indicators |

| Population | Natural logarithm of the total population in the respondent’s country. | The World Bank/IMF WEO |

| GDP Growth | Realgross domestic product (GDP) growth rate (%) in the respondent’s country. | The World Bank/IMF WEO |

| Unemployment | Real unemployment rate (%) in the respondent’s country. | The World Bank |

| N | Mean | SD | Min | p5 | p25 | p50 | p75 | p95 | Max | |

|---|---|---|---|---|---|---|---|---|---|---|

| Entrepreneurial intention | ||||||||||

| Start-Up | 119,446 | 0.088 | 0.283 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| Successor | 119,446 | 0.026 | 0.160 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 |

| Economic Freedom index | 119,446 | 65.190 | 9.570 | 33.740 | 48.560 | 58.630 | 66.550 | 73.090 | 77.660 | 87.780 |

| Rule of Law | ||||||||||

| Property Rights | 119,446 | 56.516 | 25.873 | 5.000 | 15.000 | 35.000 | 50.000 | 85.000 | 90.000 | 95.000 |

| Freedom from Corruption | 119,446 | 54.233 | 17.913 | 17.000 | 29.000 | 37.000 | 54.000 | 73.000 | 79.000 | 92.000 |

| Fiscal Freedom | 119,446 | 70.730 | 9.865 | 39.500 | 55.800 | 61.500 | 71.500 | 79.100 | 84.400 | 99.900 |

| Regulatory Efficiency | ||||||||||

| Government Spending | 119,446 | 51.024 | 20.326 | 0.000 | 22.100 | 41.300 | 46.500 | 67.600 | 85.300 | 95.200 |

| Business Freedom | 119,446 | 72.599 | 11.598 | 30.000 | 55.500 | 61.400 | 72.100 | 82.200 | 90.000 | 95.400 |

| Labour Freedom | 119,446 | 56.576 | 10.406 | 20.000 | 42.900 | 50.600 | 52.600 | 62.900 | 77.600 | 91.400 |

| Monetary Freedom | 119,446 | 78.325 | 9.421 | 33.800 | 62.900 | 71.500 | 82.900 | 84.500 | 87.800 | 88.300 |

| Market Openness | ||||||||||

| Trade Freedom | 119,446 | 82.372 | 7.407 | 47.800 | 69.400 | 74.600 | 87.000 | 88.000 | 88.000 | 90.000 |

| Investment Freedom | 119,446 | 69.058 | 21.243 | 0.000 | 25.000 | 60.000 | 75.000 | 85.000 | 90.000 | 95.000 |

| Financial Freedom | 119,446 | 60.466 | 15.647 | 10.000 | 30.000 | 50.000 | 70.000 | 70.000 | 80.000 | 90.000 |

| Control variables (individual-level) | ||||||||||

| Age | 119,446 | 23.850 | 4.465 | 18.000 | 19.000 | 21.000 | 23.000 | 26.000 | 36.000 | 54.000 |

| Gender | 119,446 | 0.415 | 0.493 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 |

| Education level | 119,446 | 1.253 | 0.529 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 2.000 | 3.000 |

| Control variables (country-level) | ||||||||||

| Income level | 119,446 | 1.781 | 0.927 | 1.000 | 1.000 | 1.000 | 1.000 | 3.000 | 3.000 | 3.000 |

| Population | 119,446 | 3.451 | 1.373 | −1.277 | 1.368 | 2.341 | 3.638 | 4.396 | 5.312 | 7.221 |

| GDP Growth | 119,446 | 2.184 | 1.883 | −6.830 | −0.400 | 0.903 | 1.836 | 3.316 | 6.200 | 10.347 |

| Unemployment | 119,446 | 8.344 | 5.355 | 0.400 | 4.200 | 5.000 | 6.400 | 9.500 | 24.700 | 60.000 |

| Start-Up | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Entrepreneurial intention | ||||||||||||

| Successor (1) | −0.0510 *** | 1 | ||||||||||

| Economic Freedom index (2) | −0.127 *** | −0.0692 *** | 1 | |||||||||

| Rule of Law | ||||||||||||

| Property Rights (3) | −0.160 *** | −0.0866 *** | 0.896 *** | 1 | ||||||||

| Freedom from Corruption (4) | −0.153 *** | −0.0824 *** | 0.833 *** | 0.947 *** | 1 | |||||||

| Fiscal Freedom (5) | 0.122 *** | 0.0626 *** | −0.248 *** | −0.552 *** | −0.539 *** | 1 | ||||||

| Regulatory Efficiency | ||||||||||||

| Government Spending (6) | 0.0886 *** | 0.0348 *** | 0.0730 *** | −0.205 *** | −0.270 *** | 0.586 *** | 1 | |||||

| Business Freedom (7) | −0.144 *** | −0.0760 *** | 0.745 *** | 0.810 *** | 0.765 *** | −0.451 *** | −0.267 *** | 1 | ||||

| Labour Freedom (8) | −0.0254 *** | −0.00423 | 0.377 *** | 0.232 *** | 0.199 *** | 0.183 *** | 0.176 *** | 0.144 *** | 1 | |||

| Monetary Freedom (9) | −0.117 *** | −0.0525 *** | 0.787 *** | 0.641 *** | 0.589 *** | −0.247 *** | −0.142 *** | 0.540 *** | 0.159 *** | 1 | ||

| Market Openness | ||||||||||||

| Trade Freedom (10) | −0.132 *** | −0.0556 *** | 0.775 *** | 0.703 *** | 0.687 *** | −0.350 *** | −0.299 *** | 0.574 *** | 0.196 *** | 0.848 *** | 1 | |

| Investment Freedom (11) | −0.127 *** | −0.0666 *** | 0.896 *** | 0.829 *** | 0.749 *** | −0.432 *** | −0.134 *** | 0.666 *** | 0.139 *** | 0.809 *** | 0.829 *** | 1 |

| Financial Freedom (12) | −0.101 *** | −0.0630 *** | 0.881 *** | 0.759 *** | 0.681 *** | −0.265 *** | −0.0831 *** | 0.637 *** | 0.200 *** | 0.813 *** | 0.738 *** | 0.874 *** |

| Controls | ||||||||||||

| Gender (13) | 0.0718 *** | 0.0165 *** | 0.0255 *** | 0.0158 *** | 0.00982 *** | −0.00041 | 0.0629 *** | 0.00483 | −0.00193 | 0.0128 *** | −0.0234 *** | 0.0174 *** |

| Income level (14) | 0.166 *** | 0.0702 *** | −0.340 *** | −0.464 *** | −0.458 *** | 0.418 *** | 0.616 *** | −0.536 *** | −0.0524 *** | −0.449 *** | −0.615 *** | −0.380 *** |

| Education level (15) | −0.0333 *** | −0.0332 *** | 0.0446 *** | 0.0869 *** | 0.0809 *** | −0.118 *** | −0.159 *** | 0.0808 *** | −0.0614 *** | 0.101 *** | 0.127 *** | 0.0896 *** |

| Age (16) | 0.0752 *** | −0.0337 *** | 0.00912 ** | 0.0622 *** | 0.0784 *** | −0.129 *** | −0.0755 *** | 0.0259 *** | −0.0449 *** | −0.0323 *** | −0.000146 | 0.0434 *** |

| Population (17) | −0.0445 *** | −0.0217 *** | −0.217 *** | −0.0535 *** | −0.111 *** | −0.251 *** | 0.0869 *** | −0.0353 *** | −0.0226 *** | −0.310 *** | −0.378 *** | −0.268 *** |

| Unemployment (18) | −0.0486 *** | −0.0122 *** | 0.0210 *** | 0.0617 *** | 0.00184 | −0.297 *** | −0.322 *** | 0.0160 *** | −0.192 *** | 0.230 *** | 0.313 *** | 0.229 *** |

| GDP Growth (19) | 0.0678 *** | 0.0342 *** | −0.0146 *** | −0.254 *** | −0.202 *** | 0.453 *** | 0.427 *** | −0.159 *** | 0.148 *** | 0.0938 *** | −0.175 *** | −0.157 *** |

| (12) | (13) | (14) | (15) | (16) | (17) | (18) | ||||||

| Controls | ||||||||||||

| Gender (13) | 0.0145 *** | 1 | ||||||||||

| Income level (14) | −0.343 *** | 0.0587 *** | 1 | |||||||||

| Education (15) | 0.0557 *** | 0.00652 * | −0.193 *** | 1 | ||||||||

| Age (16) | 0.0135 *** | 0.0657 *** | −0.0313 *** | 0.328 *** | 1 | |||||||

| Population (17) | −0.294 *** | 0.0346 *** | −0.00989 *** | −0.00567 | 0.0250 *** | 1 | ||||||

| Unemployment (18) | 0.148 *** | −0.0356 *** | −0.315 *** | 0.0450 *** | 0.000440 | −0.132 *** | 1 | |||||

| GDP Growth (19) | −0.0192 *** | 0.0186 *** | 0.258 *** | −0.0320 *** | −0.0321 *** | −0.0163 *** | −0.231 *** |

| Percentage of Observations | Number of Observations | Percentage of Observations | Number of Observations | |

|---|---|---|---|---|

| Panel 1: Start-Up choice | ||||

| Start-Up = 1 (10,497 observations) | Start-Up = 0 (108,949 observations) | |||

| Income level | ||||

| North America and Europe | 32.58 | 3420 | 58.52 | 63,761 |

| Asia-Pacific | 7.28 | 764 | 9.58 | 10,434 |

| Others | 60.14 | 6313 | 31.90 | 34,754 |

| Education level | ||||

| Undergraduate | 84.83 | 8905 | 78.78 | 85,830 |

| Graduate | 10.76 | 1130 | 16.64 | 18,128 |

| Other | 4.40 | 462 | 4.58 | 4991 |

| Gender | ||||

| Male | 52.85 | 5548 | 40.36 | 43,974 |

| Female | 47.15 | 4949 | 59.64 | 64,975 |

| Panel 2: Successor choice | ||||

| Successor = 1 (3135) | Successor = 0 (116,311) | |||

| Income level | ||||

| North America and Europe | 37.67 | 1181 | 56.74 | 66,000 |

| Asia-Pacific | 6.92 | 217 | 9.44 | 10,981 |

| Others | 55.41 | 1737 | 33.81 | 39,330 |

| Education level | ||||

| Undergraduate | 88.55 | 2776 | 79.06 | 91,959 |

| Graduate | 8.36 | 262 | 16.33 | 18,996 |

| Other | 3.09 | 97 | 4.60 | 5356 |

| Gender | ||||

| Male | 46.41 | 1455 | 41.33 | 48,067 |

| Female | 53.59 | 1680 | 58.67 | 68,244 |

| Entrepreneurial Intention: | Start-Up | Successor | ||||

|---|---|---|---|---|---|---|

| Start-Up = 0 | Start-Up = 1 | t-Statistics | Successor = 0 | Successor = 1 | t-Statistics | |

| Economic Freedom index | 65.568 | 61.267 | 4.300 *** | 65.299 | 61.155 | 4.143 *** |

| Rule of Law | ||||||

| Property Rights | 57.800 | 43.191 | 14,608 *** | 56.884 | 42.872 | 14.011 *** |

| Freedom from Corruption | 55.085 | 45.391 | 9.694 *** | 54.475 | 45.247 | 9.228 *** |

| Fiscal Freedom | 70.358 | 74.597 | −4.239 | 70.629 | 74.491 | −3.863 |

| Regulatory Efficiency | ||||||

| Government Spending | 50.465 | 56.827 | −6.362 | 50.908 | 55.331 | −4.423 |

| Business Freedom | 73.118 | 67.209 | 5.909 *** | 72.743 | 67.232 | 5.511 *** |

| Labour Freedom | 56.658 | 55.725 | 0.933 *** | 56.583 | 56.308 | 0.276 * |

| Monetary Freedom | 78.668 | 74.766 | 3.902 *** | 78.401 | 75.315 | 3.091 *** |

| Market Openness | ||||||

| Trade Freedom | 82.675 | 79.218 | 3.457 *** | 82.439 | 79.861 | 2.578 *** |

| Investment Freedom | 69.895 | 60.364 | 9.530 *** | 59.290 | 60.437 | 8.853 *** |

| Financial Freedom | 60.956 | 55.382 | 5.573 *** | 60.628 | 54.459 | 6.169 *** |

| Entrepreneurial Intention: | Panel 1: Start-Up | Panel 2: Successor | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Economic Freedom index | −0.0329 *** | −0.0360 *** | ||||

| (−28.78) | (−18.21) | |||||

| Rule of Law | ||||||

| Rule of Law index | −0.0338 *** | −0.0329 *** | ||||

| (−20.94) | (−11.49) | |||||

| Property Rights | 0.00371 * | −0.00296 | ||||

| (1.69) | (−0.75) | |||||

| Freedom from Corruption | −0.0259 *** | −0.0190 *** | ||||

| (−10.32) | (−4.27) | |||||

| Fiscal Freedom | −0.00732 *** | −0.00385 | ||||

| (−2.88) | (−0.84) | |||||

| Regulatory Efficiency | ||||||

| Regulatory Efficiency index | 0.0184 *** | 0.0176 *** | ||||

| (11.03) | (6.33) | |||||

| Government Spending | 0.00433 *** | −0.00102 | ||||

| (4.10) | (−0.54) | |||||

| Business Freedom | −0.00382 ** | −0.00708 ** | ||||

| (−2.17) | (−2.22) | |||||

| Labour Freedom | 0.00602 *** | 0.0109 *** | ||||

| (4.46) | (4.39) | |||||

| Monetary Freedom | −0.0113 *** | −0.00487 | ||||

| (−4.32) | (−1.03) | |||||

| Market Openness | ||||||

| Market Openness index | −0.0111 *** | −0.0134 *** | ||||

| (−7.42) | (−5.31) | |||||

| Trade Freedom | 0.0214 *** | 0.0324 *** | ||||

| (4.93) | (4.17) | |||||

| Investment Freedom | −0.0206 *** | −0.00239 | ||||

| (−11.48) | (−0.81) | |||||

| Financial Freedom | 0.0173 *** | −0.0105 *** | ||||

| (9.40) | (−3.64) | |||||

| Age | 0.0608 *** | 0.0651 *** | 0.0662 *** | −0.0394 *** | −0.0336 *** | −0.0331 *** |

| (28.33) | (30.22) | (30.21) | (−8.42) | (−7.21) | (−7.01) | |

| 1. Gender | 0.484 *** | 0.483 *** | 0.492 *** | 0.243 *** | 0.241 *** | 0.245 *** |

| (22.85) | (22.79) | (23.16) | (6.60) | (6.54) | (6.65) | |

| 1. Education level | 0.266 *** | 0.267 *** | 0.240 *** | 0.234 ** | 0.248 ** | 0.251 ** |

| (5.05) | (5.06) | (4.52) | (2.19) | (2.32) | (2.34) | |

| 2. Education level | −0.105 * | −0.0865 | −0.104 * | −0.162 | −0.127 | −0.133 |

| (−1.78) | (−1.46) | (−1.76) | (−1.34) | (−1.05) | (−1.10) | |

| 1. Income level | −0.779 *** | −0.539 *** | −0.591 *** | −0.500 *** | −0.301 *** | −0.522 *** |

| (−28.28) | (−18.40) | (−12.94) | (−10.44) | (−6.08) | (−6.44) | |

| 2. Income level | −0.753 *** | −0.809 *** | −0.823 *** | −0.633 *** | −0.689 *** | −0.724 *** |

| (−15.21) | (−16.03) | (−15.05) | (−7.04) | (−7.60) | (−7.04) | |

| Population | −0.136 *** | −0.151 *** | −0.150 *** | −0.0936 *** | −0.117 *** | −0.0730 *** |

| (−15.39) | (−16.85) | (−12.18) | (−5.94) | (−7.35) | (−3.20) | |

| GDP Growth | 0.0887 *** | 0.0378 *** | 0.0570 *** | 0.0870 *** | 0.0420 *** | 0.0697 *** |

| (14.02) | (5.66) | (6.89) | (7.86) | (3.65) | (4.91) | |

| Unemployment | −0.00423 | −0.00786 *** | −0.00562 * | 0.0144 *** | 0.0148 *** | 0.0116 ** |

| (−1.63) | (−2.85) | (−1.92) | (3.53) | (3.42) | (2.44) | |

| Constant | −1.450 *** | −2.423 *** | −2.798 *** | −0.416 * | −1.468 *** | −3.046 *** |

| (−12.27) | (−18.33) | (−8.15) | (−1.92) | (−6.09) | (−4.79) | |

| N | 119,446 | 119,446 | 119,446 | 119,446 | 119,446 | 119,446 |

| Pseudo R-squared | 0.080 | 0.086 | 0.090 | 0.041 | 0.046 | 0.050 |

| Akaike criterion (AIC) | 65,429.3 | 65,036.2 | 64,784.6 | 27,832.9 | 27,705.6 | 27,638.5 |

| Schwarz criterion (BIC) | 65,535.9 | 65,162.2 | 64,978.4 | 27,939.5 | 27,831.5 | 27,832.3 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bakkar, Y.; Durst, S.; Gerstlberger, W. The Impact of Institutional Dimensions on Entrepreneurial Intentions of Students—International Evidence. J. Risk Financial Manag. 2021, 14, 174. https://doi.org/10.3390/jrfm14040174

Bakkar Y, Durst S, Gerstlberger W. The Impact of Institutional Dimensions on Entrepreneurial Intentions of Students—International Evidence. Journal of Risk and Financial Management. 2021; 14(4):174. https://doi.org/10.3390/jrfm14040174

Chicago/Turabian StyleBakkar, Yassine, Susanne Durst, and Wolfgang Gerstlberger. 2021. "The Impact of Institutional Dimensions on Entrepreneurial Intentions of Students—International Evidence" Journal of Risk and Financial Management 14, no. 4: 174. https://doi.org/10.3390/jrfm14040174

APA StyleBakkar, Y., Durst, S., & Gerstlberger, W. (2021). The Impact of Institutional Dimensions on Entrepreneurial Intentions of Students—International Evidence. Journal of Risk and Financial Management, 14(4), 174. https://doi.org/10.3390/jrfm14040174