Legitimacy and Reciprocal Altruism in Donation-Based Crowdfunding: Evidence from India

Abstract

:1. Introduction

2. Theoretical Background

2.1. The Economic Theory and the Issue of Legitimacy in Charitable Giving

2.2. Signalling Legitimacy

3. Materials and Methods

3.1. Data

3.2. Sample and Variable Construction

3.3. Methodology

4. Results

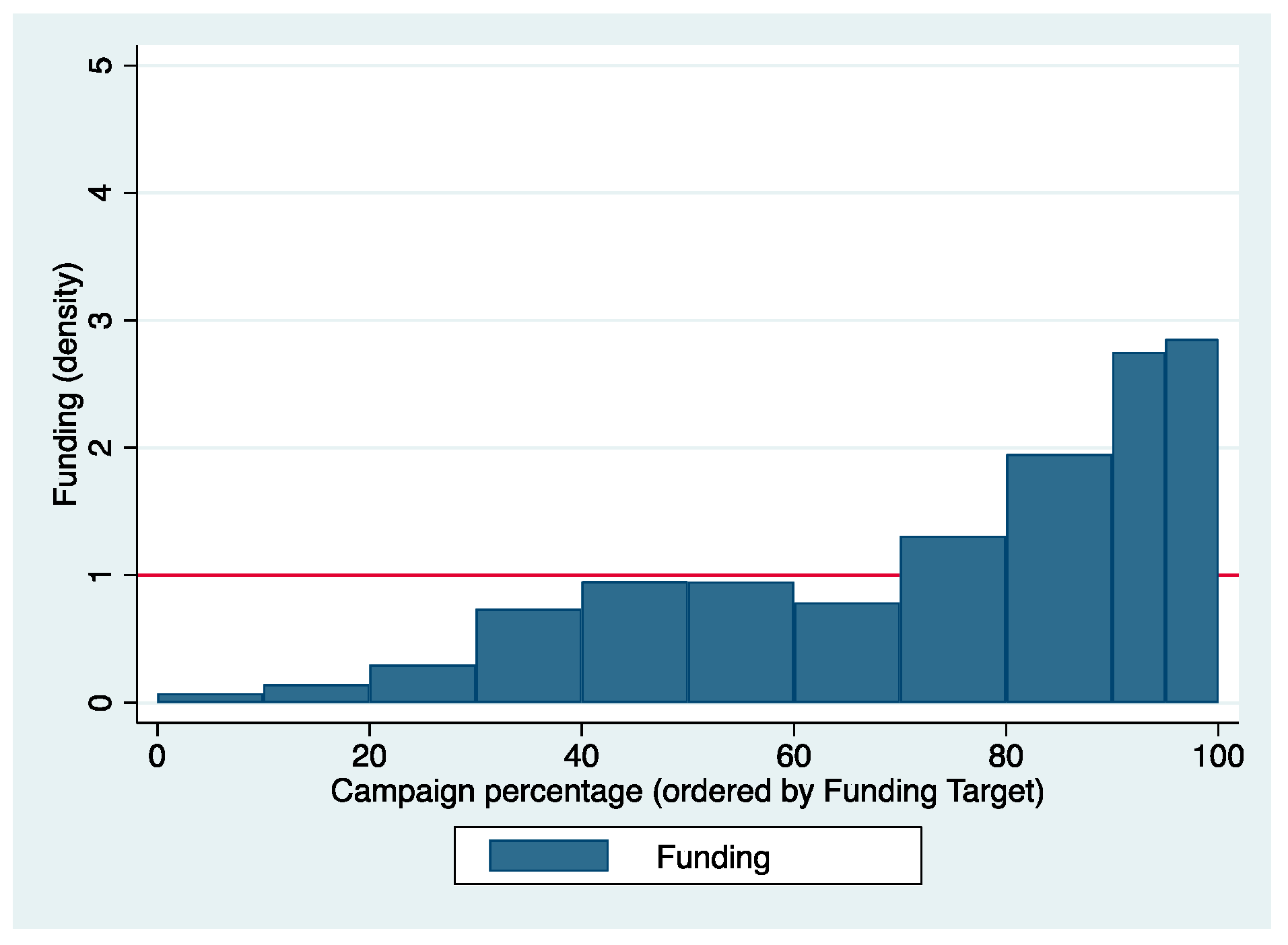

4.1. Descriptive Statistics

4.2. Findings

5. Discussion and Limitations

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

In the context of the United States, NPOs under section 501(C) 3 are tax-exempt and typically provide a tax-deduction benefit to the donors, whereas NPOs under section 501 (C) 4 offer no such tax-deduction benefits. Source—https://www.irs.gov/charities-non-profits/charitable-organizations/exemption-requirements-501c3-organizations (accessed on 8 March 2021). |

References

- Ahlers, Gerrit K. C., Douglas Cumming, Christina Günther, and Denis Schweizer. 2015. Signaling in Equity Crowdfunding. Entrepreneurship Theory and Practice 39: 955–80. [Google Scholar] [CrossRef]

- Alegre, Inés, and Melina Moleskis. 2019. Beyond Financial Motivations in Crowdfunding: A Systematic Literature Review of Donations and Rewards. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations, 1–12. [Google Scholar] [CrossRef]

- Allison, Thomas H., Blakley C. Davis, Jeremy C. Short, and Justin W. Webb. 2015. Crowdfunding in a prosocial microlending environment: Examining the role of intrinsic versus extrinsic cues. Entrepreneurship Theory and Practice 39: 53–73. [Google Scholar] [CrossRef]

- André, Kévin, Sylvain Bureau, Arthur Gautier, and Olivier Rubel. 2017. Beyond the opposition between altruism and self-interest: Reciprocal giving in reward-based crowdfunding. Journal of Business Ethics 146: 313–32. [Google Scholar] [CrossRef]

- Andreoni, James. 1989. Giving with impure altruism: Applications to charity and Ricardian equivalence. Journal of political Economy 97: 1447–58. [Google Scholar] [CrossRef]

- Andreoni, James. 1990. Impure altruism and donations to public goods: A theory of warm-glow giving. The Economic Journal 100: 464–77. [Google Scholar] [CrossRef] [Green Version]

- Auten, Gerald E., Holger Sieg, and Charles T. Clotfelter. 2002. Charitable giving, income, and taxes: An analysis of panel data. American Economic Review 92: 371–82. [Google Scholar] [CrossRef] [Green Version]

- Bagheri, Afsaneh, Hasti Chitsazan, and Ashkan Ebrahimi. 2019. Crowdfunding motivations: A focus on donors’ perspectives. Technological Forecasting and Social Change 146: 218–32. [Google Scholar] [CrossRef]

- Becker, Gary S. 1974. A theory of social interactions. Journal of political economy 82: 1063–93. [Google Scholar] [CrossRef]

- Bekkers, René, and Pamala Wiepking. 2011. A literature review of empirical studies of philanthropy: Eight mechanisms that drive charitable giving. Nonprofit and Voluntary Sector Quarterly 40: 924–73. [Google Scholar] [CrossRef]

- Belleflamme, Paul, Thomas Lambert, and Armin Schwienbacher. 2014. Crowdfunding: Tapping the right crowd. Journal of Business Venturing 29: 585–609. [Google Scholar] [CrossRef] [Green Version]

- Bento, Nuno, Gianfranco Gianfrate, and Marco Horst Thoni. 2019. Crowdfunding for sustainability ventures. Journal of Cleaner Production 237: 117751. [Google Scholar] [CrossRef]

- Block, Jörn, Lars Hornuf, and Alexandra Moritz. 2018. Which updates during an equity crowdfunding campaign increase crowd participation? Small Business Economics 50: 3–27. [Google Scholar] [CrossRef]

- Boatright, Robert G., Donald P. Green, and Michael J. Malbin. 2006. Does publicizing a tax credit for political contributions increase its use? Results from a randomized field experiment. American Politics Research 34: 563–82. [Google Scholar] [CrossRef]

- Brown, Eleanor. 1999. Patterns and purposes of philanthropic giving. Philanthropy and the Nonprofit Sector in a Changing America 10: 212–30. [Google Scholar]

- Bruton, Garry, Susanna Khavul, Donald Siegel, and Mike Wright. 2015. New financial alternatives in seeding entrepreneurship: Microfinance, crowdfunding, and peer-to-peer innovations. Entrepreneurship Theory and Practice 39: 9–26. [Google Scholar] [CrossRef]

- Calic, Goran, and Elaine Mosakowski. 2016. Kicking off social entrepreneurship: How a sustainability orientation influences crowdfunding success. Journal of Management Studies 53: 738–67. [Google Scholar] [CrossRef]

- Clotfelter, Charles T. 1997. The economics of giving. In Giving Better, Giving Smarter. Working Papers of the National Commission on Philanthropy and Civic Renewal. Edited by Kenneth W. Dam and Bruno V. Manno. Washington, DC: National Commission on Philanthropy and Civic Renewal, pp. 31–55. [Google Scholar]

- Colombo, John D. 2001. The Marketing of Philanthropy and the Charitable Contributions Deduction; Integrating Theories for the Deduction and Tax Exemption. Wake Forest Law Review 36: 657. [Google Scholar]

- Crowdfunding, India. 2019. Crowdfunding India | Compare 10 Crowdfunding Platfrom in India. Available online: https://www.crowdfundingindia.org/ (accessed on 15 January 2020).

- Cumming, Douglas J., Gael Leboeuf, and Armin Schwienbacher. 2017. Crowdfunding cleantech. Energy Economics 65: 292–303. [Google Scholar] [CrossRef]

- Datta, Avimanyu, Arvin Sahaym, and Stoney Brooks. 2019. Unpacking the antecedents of crowdfunding campaign’s success: The effects of social media and innovation orientation. Journal of Small Business Management 57: 462–88. [Google Scholar] [CrossRef]

- Feedspot. 2019. Top 100 Crowdfunding Blogs & Websites in 2019 | Best Crowdfunding Sites. Available online: http://blog.feedspot.com/crowdfunding_blogs/ (accessed on 15 January 2020).

- Frydrych, Denis, Adam J. Bock, Tony Kinder, and Benjamin Koeck. 2014. Exploring entrepreneurial legitimacy in reward-based crowdfunding. Venture Capital 16: 247–69. [Google Scholar] [CrossRef]

- Gandía, Juan L. 2011. Internet disclosure by nonprofit organizations: Empirical evidence of nongovernmental organizations for development in Spain. Nonprofit and Voluntary Sector Quarterly 40: 57–78. [Google Scholar] [CrossRef]

- Gleasure, Rob, and Joseph Feller. 2016. Does heart or head rule donor behaviors in charitable crowdfunding markets? International Journal of Electronic Commerce 20: 499–524. [Google Scholar] [CrossRef]

- Hansmann, Henry B. 1980. The role of nonprofit enterprise. The Yale law journal 89: 835–901. [Google Scholar] [CrossRef]

- Hörisch, Jacob. 2015. Crowdfunding for environmental ventures: An empirical analysis of the influence of environmental orientation on the success of crowdfunding initiatives. Journal of Cleaner Production 107: 636–45. [Google Scholar] [CrossRef]

- Income Tax, Department. 2019. Tax Exempted Institutions. Available online: https://www.incometaxindia.gov.in/Pages/utilities/exempted-institutions.aspx (accessed on 15 January 2020).

- Kemp, Simon. 2017. India Overtakes the USA to Become Facebook’s #1 Country. Available online: https://thenextweb.com/contributors/2017/07/13/india-overtakes-usa-become-facebooks-top-country/ (accessed on 5 May 2020).

- Ketto.org. 2019. How Crowdfunding Works | What is Crowdfunding—Ketto. Available online: https://www.ketto.org/how_it_works/how-fundraising-works.php (accessed on 12 December 2019).

- Lehner, Othmar M., and Alex Nicholls. 2014. Social finance and crowdfunding for social enterprises: A public–private case study providing legitimacy and leverage. Venture Capital 16: 271–86. [Google Scholar] [CrossRef]

- Lehner, Othmar M. 2013. Crowdfunding social ventures: A model and research agenda. Venture Capital 15: 289–311. [Google Scholar] [CrossRef]

- Lehner, Othmar M. 2014. The formation and interplay of social capital in crowdfunded social ventures. Entrepreneurship & Regional Development 26: 478–99. [Google Scholar]

- Li, Ya-Zheng, Tong-Liang He, Yi-Ran Song, Zheng Yang, and Rong-Ting Zhou. 2018. Factors impacting donors’ intention to donate to charitable crowd-funding projects in China: A UTAUT-based model. Information, Communication & Society 21: 404–15. [Google Scholar]

- Lim, JoAnne Yong-Kwan, and Lowell W. Busenitz. 2020. Evolving human capital of entrepreneurs in an equity crowdfunding era. Journal of Small Business Management 58: 106–29. [Google Scholar] [CrossRef]

- Ly, Pierre, and Geri Mason. 2012. Individual preferences over development projects: Evidence from microlending on Kiva. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations 23: 1036–55. [Google Scholar] [CrossRef]

- Mauss, Marcel. 1923. Essai sur le don. Forme et raison de L ‘échange dans les sociétés Archaïques. L’Année Sociologique 1: 30–186. [Google Scholar]

- McGregor-Lowndes, Myles, Cameron Newton, and Stephen Marsden. 2006. Did tax incentives play any part in increased giving? Australian Journal of Social Issues 41: 495–509. [Google Scholar] [CrossRef]

- Mohammadi, Ali, and Kourosh Shafi. 2017. Gender differences in the contribution patterns of equity-crowdfunding investors. Small Business Economics 50: 275–87. [Google Scholar] [CrossRef] [Green Version]

- Moleskis, Melina, Inés Alegre, and Miguel Angel Canela. 2019. Crowdfunding Entrepreneurial or Humanitarian Needs? The Influence of Signals and Biases on Decisions. Nonprofit and Voluntary Sector Quarterly 48: 552–71. [Google Scholar] [CrossRef]

- Mollick, Ethan. 2014. The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing 29: 1–16. [Google Scholar] [CrossRef] [Green Version]

- Morgan, James N., Richard F. Dye, and Judith H. Hybels. 1979. Results from Two National Surveys of Philanthropic Activity. Michigan: Survey Research Center, Institute for Social Research, University of Michigan. [Google Scholar]

- Moritz, Alexandra, Joern Block, and Eva Lutz. 2015. Investor communication in equity-based crowdfunding: A qualitative-empirical study. Qualitative Research in Financial Markets 7: 309–42. [Google Scholar] [CrossRef] [Green Version]

- Moysidou, Krystallia, and J. Piet Hausberg. 2020. In crowdfunding we trust: A trust-building model in lending crowdfunding. Journal of Small Business Management 58: 511–43. [Google Scholar] [CrossRef]

- Ottoni-Wilhelm, Mark, Lise Vesterlund, and Huan Xie. 2017. Why do people give? Testing pure and impure altruism. American Economic Review 107: 3617–33. [Google Scholar] [CrossRef] [Green Version]

- Pitschner, Stefan, and Sebastian Pitschner-Finn. 2014. Non-profit differentials in crowd-based financing: Evidence from 50,000 campaigns. Economics Letters 123: 391–94. [Google Scholar] [CrossRef] [Green Version]

- Ralcheva, Aleksandrina, and Peter Roosenboom. 2020. Forecasting success in equity crowdfunding. Small Business Economics 55: 39–56. [Google Scholar] [CrossRef] [Green Version]

- Romney-Alexander, Debbie. 2002. Payroll giving in the UK: Donor incentives and influences on giving behaviour. International Journal of Nonprofit and Voluntary Sector Marketing 7: 84–92. [Google Scholar] [CrossRef]

- Rose-Ackerman, Susan. 1996. Altruism, nonprofits, and economic theory. Journal of Economic Literature 34: 701–28. [Google Scholar]

- Salido-Andres, Noelia, Marta Rey-Garcia, Luis Ignacio Alvarez-Gonzalez, and Rodolfo Vazquez-Casielles. 2021. Mapping the Field of Donation-Based Crowdfunding for Charitable Causes: Systematic Review and Conceptual Framework. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations 32: 288–302. [Google Scholar] [CrossRef]

- Saxton, Gregory D., and Lili Wang. 2014. The social network effect: The determinants of giving through social media. Nonprofit and Voluntary Sector Quarterly 43: 850–68. [Google Scholar] [CrossRef]

- Schroeder, David A., Louis A. Penner, John F. Dovidio, and Jane A. Piliavin. 1995. The Psychology of Helping and Altruism: Problems and Puzzles. New York: McGraw-Hill. [Google Scholar]

- Spence, Michael. 1973. Job Market Signaling. The Quarterly Journal of Economics 87: 355–74. [Google Scholar] [CrossRef]

- Sridhar, Kamal K. 1996. Language in education: Minorities and multilingualism in India. International Review of Education 42: 327–47. [Google Scholar] [CrossRef]

- Thies, Ferdinand, Alexander Huber, Carolin Bock, Alexander Benlian, and Sascha Kraus. 2019. Following the Crowd—Does Crowdfunding Affect Venture Capitalists’ Selection of Entrepreneurial Ventures? Journal of Small Business Management 57: 1378–98. [Google Scholar] [CrossRef]

- Trivers, Robert L. 1971. The evolution of reciprocal altruism. The Quarterly Review of Biology 46: 35–57. [Google Scholar] [CrossRef]

- Van Montfort, Kees, Vinitha Siebers, and Frank Jan De Graaf. 2021. Civic Crowdfunding in Local Governments: Variables for Success in the Netherlands? Journal of Risk and Financial Management 14: 8. [Google Scholar] [CrossRef]

- Van Slyke, David M., and Arthur C. Brooks. 2005. Why do people give? New evidence and strategies for nonprofit managers. The American Review of Public Administration 35: 199–222. [Google Scholar] [CrossRef] [Green Version]

- Venable, Beverly T., Gregory M. Rose, Victoria D. Bush, and Faye W. Gilbert. 2005. The role of brand personality in charitable giving: An assessment and validation. Journal of the Academy of Marketing Science 33: 295–312. [Google Scholar] [CrossRef]

- Vesterlund, Lise. 2006. Why do people give. The Nonprofit Sector: A Research Handbook 2: 168–90. [Google Scholar]

- Webb, Deborah J., Corliss L. Green, and Thomas G. Brashear. 2000. Development and validation of scales to measure attitudes influencing monetary donations to charitable organizations. Journal of the Academy of Marketing Science 28: 299–309. [Google Scholar] [CrossRef]

- Weisbrod, Burton A., and Nestor D. Dominguez. 1986. Demand for collective goods in private nonprofit markets: Can fundraising expenditures help overcome free-rider behavior? Journal of Public Economics 30: 83–96. [Google Scholar] [CrossRef] [Green Version]

- Wiepking, Pamala. 2007. The philanthropic poor: In search of explanations for the relative generosity of lower income households. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations 18: 339. [Google Scholar] [CrossRef] [Green Version]

- Wu, Shih-Ying, Tsung Huang Jr., and An-Pang Kao. 2004. An analysis of the peer effects in charitable giving: The case of Taiwan. Journal of Family and Economic Issues 25: 483–505. [Google Scholar] [CrossRef] [Green Version]

- Zhou, Huiquan, and Shihua Ye. 2019. Legitimacy, worthiness, and social network: An empirical study of the key factors influencing crowdfunding outcomes for nonprofit projects. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations 30: 849–64. [Google Scholar] [CrossRef]

| Variable | Description |

|---|---|

| Funding Amount | Total amount of funding received. |

| Funding Target | Ketto does not follow a threshold model that a campaign has to meet and allows the fund seeker to keep the total amount raised through their website. Therefore, we include the log of the target amount as an explanatory variable (Calic and Mosakowski 2016). |

| Number of Donors | Number of people supporting the campaign. |

| Duration of the campaign | Ketto does not have any strict enforcement of days a campaign can stay live on the website; therefore, we rely on the time and date stamps generated by Ketto to capture the duration of the campaign. |

| Campaign Dialogue | We identify two variables for campaign dialogue; first, the total number of updates by the fund seeker during the campaign, and second, the total number of comments by the public during the campaign (Gleasure and Feller 2016). |

| Campaign Quality | Quality measures the effort put into the campaign. We, therefore, include the number of images and total word count explaining the campaign (Calic and Mosakowski 2016). |

| Social Media Connectivity | Various studies document the role of social media in the crowdfunding initiative (Calic and Mosakowski 2016; Datta et al. 2019; Mollick 2014). Therefore, we include a dummy variable, which takes a value of “1” if the campaign is connected with a Facebook account, “0” otherwise. |

| Metropolitan | This is a dummy variable that takes a value of “1” if the campaign is run from a metropolitan area, “0” otherwise. |

| Campaign motive | This is a dummy variable that takes a value of “1” if a campaign is run for self and “0” if a campaign is run on behalf of someone. |

| Final Cause | This variable is divided into children and adult health, education, community development, women empowerment, and others. |

| Parent-Cause | This variable is measured by creating three dummy variables—(i) Campaigns by individuals: takes a value of “1” if a campaign is run by an individual and “0” otherwise, (ii) Campaigns by NPO with tax benefit: takes a value of “1” if an NPO provides tax-benefit and “0” otherwise, (iii) Campaigns by NPO without tax benefit: takes a value of “1” if an NPO does not provide tax-benefit and “0” otherwise. |

| Variables | Mean | Std. dev | Minimum | Maximum |

|---|---|---|---|---|

| Funding Amount (in INR) | 64,347.33 | 144,502.47 | 1.00 | 1,491,991.90 |

| Funding Target (in INR) | 461,465.53 | 814,301.41 | 2000.00 | 6,000,000.00 |

| Number of Donors | 21.79 | 36.98 | 1.00 | 288.00 |

| Duration of the Campaign (days) | 69.45 | 52.81 | 2.00 | 289.00 |

| Number of comments by public | 3.69 | 7.02 | 0.00 | 47.00 |

| Updates during the campaign | 1.80 | 1.78 | 1.00 | 12.00 |

| Number of images | 7.95 | 6.54 | 1.00 | 20.00 |

| Word count | 431.98 | 285.20 | 0.00 | 2150.00 |

| Linked with Facebook | 0.60 | 0.49 | 0.00 | 1.00 |

| Metropolitan | 0.69 | 0.46 | 0.00 | 1.00 |

| Campaign for self | 0.27 | 0.44 | 0.00 | 1.00 |

| Children | 0.23 | 0.42 | 0.00 | 1.00 |

| Health | 0.19 | 0.39 | 0.00 | 1.00 |

| Education | 0.17 | 0.37 | 0.00 | 1.00 |

| Women | 0.05 | 0.22 | 0.00 | 1.00 |

| Community development | 0.04 | 0.18 | 0.00 | 1.00 |

| Other | 0.33 | 0.47 | 0.00 | 1.00 |

| Campaigns by individuals | 0.41 | 0.49 | 0.00 | 1.00 |

| Campaigns by NPO with tax benefit | 0.33 | 0.47 | 0.00 | 1.00 |

| Campaigns by NPO without tax benefit | 0.26 | 0.44 | 0.00 | 1.00 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) Funding Amount | 1.000 | |||||||||||||

| (2) Funding Target | 0.272 | 1.000 | ||||||||||||

| (3) Number of Donors | 0.819 | 0.255 | 1.000 | |||||||||||

| (4) Duration of Campaign | 0.193 | 0.172 | 0.212 | 1.000 | ||||||||||

| (5) Number of comments by public | 0.818 | 0.237 | 0.888 | 0.230 | 1.000 | |||||||||

| (6) Updates during the campaign | 0.271 | 0.080 | 0.267 | 0.211 | 0.327 | 1.000 | ||||||||

| (7) Number of images | 0.085 | 0.040 | 0.116 | 0.004 | 0.093 | 0.100 | 1.000 | |||||||

| (8) Word Count | 0.153 | −0.048 | 0.103 | 0.234 | 0.167 | 0.070 | 0.188 | 1.000 | ||||||

| (9) Linked with Facebook | 0.083 | 0.105 | 0.137 | 0.048 | 0.163 | 0.211 | 0.085 | −0.053 | 1.000 | |||||

| (10) Metropolitan | −0.058 | −0.222 | −0.075 | −0.032 | −0.093 | −0.115 | 0.026 | 0.066 | −0.157 | 1.000 | ||||

| (11) Campaign for self | 0.044 | 0.120 | 0.049 | 0.007 | 0.122 | 0.089 | −0.011 | 0.039 | 0.201 | −0.151 | 1.000 | |||

| (12) Campaigns by individuals | 0.129 | 0.345 | 0.152 | −0.038 | 0.152 | 0.178 | 0.091 | −0.152 | 0.243 | −0.328 | 0.350 | 1.000 | ||

| (13) Campaigns with tax benefit | −0.002 | −0.183 | −0.067 | 0.083 | −0.062 | −0.145 | 0.001 | 0.241 | −0.187 | 0.218 | −0.326 | −0.581 | 1.000 | |

| (14) Campaigns without tax benefit | −0.143 | −0.191 | −0.098 | −0.046 | −0.104 | −0.044 | −0.102 | −0.088 | −0.073 | 0.134 | −0.044 | −0.498 | −0.417 | 1.000 |

| Model 1 | Model 2 | |

|---|---|---|

| Funding Target (log) | 0.27 *** | 0.26 *** |

| (4.12) | (3.98) | |

| Number of Donors | 0.02 *** | 0.02 *** |

| (4.47) | (4.59) | |

| Duration of the Campaign (log) | 0.02 | 0.03 |

| (0.17) | (0.23) | |

| Number of comments by public | 0.05 * | 0.05 * |

| (2.34) | (2.18) | |

| Updates during the campaign | 0.09 * | 0.10 * |

| (2.34) | (2.43) | |

| Number of images | 0.03 * | 0.03 ** |

| (2.58) | (2.63) | |

| Word count (log) | −0.19 | −0.24 |

| (−1.44) | (−1.76) | |

| Linked with Facebook | 0.21 | 0.21 |

| (1.19) | (1.22) | |

| Metropolitan | 0.28 | 0.28 |

| (1.44) | (1.42) | |

| Campaign for self | −0.77 ** | −0.73 ** |

| (−3.09) | (−2.92) | |

| Health | −0.78 * | −0.73 * |

| (−2.25) | (−2.10) | |

| Education | −0.98 *** | −0.79 ** |

| (−3.87) | (−3.06) | |

| Women | 0.24 | 0.23 |

| (0.86) | (0.79) | |

| Community development | 0.10 | 0.26 |

| (0.19) | (0.48) | |

| Other | −0.21 | −0.09 |

| (−0.77) | (−0.33) | |

| Campaigns by individuals | −0.53 * | −0.77 ** |

| (−2.19) | (−2.94) | |

| Campaigns by NPO without tax benefit | −0.48 * | |

| (−2.40) | ||

| Constant | 6.60 *** | 7.04 *** |

| (6.02) | (6.05) | |

| N | 451 | 451 |

| Model 3 | Model 4 | |

|---|---|---|

| Funding Target (log) | 0.31 *** | 0.30 *** |

| (4.70) | (4.50) | |

| Number of Donors | 0.02 *** | 0.02 *** |

| (4.51) | (4.62) | |

| Duration of the Campaign (log) | 0.09 | 0.10 |

| (0.66) | (0.73) | |

| Number of comments by public | 0.04 | 0.04 |

| (1.94) | (1.79) | |

| Updates during the campaign | 0.07 | 0.08 |

| (1.74) | (1.78) | |

| Number of images | 0.03 * | 0.03 * |

| (2.23) | (2.30) | |

| Word count (log) | −0.19 | −0.23 |

| (−1.31) | (−1.55) | |

| Linked with Facebook | 0.18 | 0.18 |

| (1.04) | (1.03) | |

| Metropolitan | 0.29 | 0.29 |

| (1.45) | (1.44) | |

| Campaign for self | −0.79 ** | −0.76 ** |

| (−3.13) | (−2.97) | |

| Health | −0.62 | −0.59 |

| (−1.74) | (−1.63) | |

| Education | −1.06 *** | −0.89 ** |

| (−4.07) | (−3.28) | |

| Women | 0.39 | 0.38 |

| (1.41) | (1.31) | |

| Community development | 0.08 | 0.22 |

| (0.14) | (0.38) | |

| Other | −0.14 | −0.04 |

| (−0.49) | (−0.13) | |

| Campaigns by individuals | −0.61 * | −0.81 ** |

| (−2.45) | (−3.04) | |

| Campaigns by NPO without tax benefit | −0.42 * | |

| (−2.02) | ||

| Constant | 5.76 *** | 6.15 *** |

| (5.03) | (5.06) | |

| N | 425 | 425 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khurana, I. Legitimacy and Reciprocal Altruism in Donation-Based Crowdfunding: Evidence from India. J. Risk Financial Manag. 2021, 14, 194. https://doi.org/10.3390/jrfm14050194

Khurana I. Legitimacy and Reciprocal Altruism in Donation-Based Crowdfunding: Evidence from India. Journal of Risk and Financial Management. 2021; 14(5):194. https://doi.org/10.3390/jrfm14050194

Chicago/Turabian StyleKhurana, Indu. 2021. "Legitimacy and Reciprocal Altruism in Donation-Based Crowdfunding: Evidence from India" Journal of Risk and Financial Management 14, no. 5: 194. https://doi.org/10.3390/jrfm14050194