International Capital Flows and Speculation

Abstract

1. Introduction

2. Literature Review

3. Methods and Data

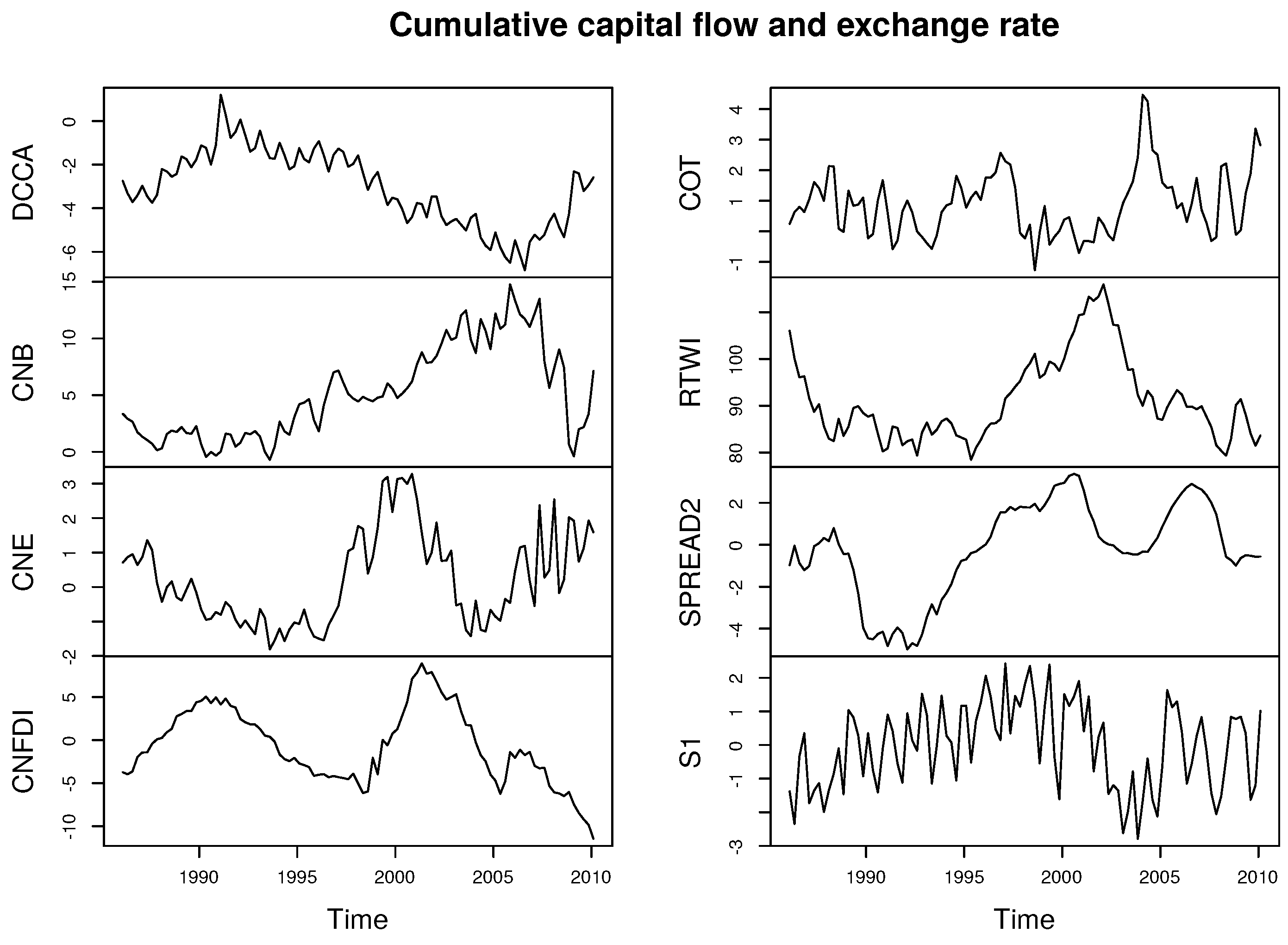

3.1. The Data

3.2. Identification

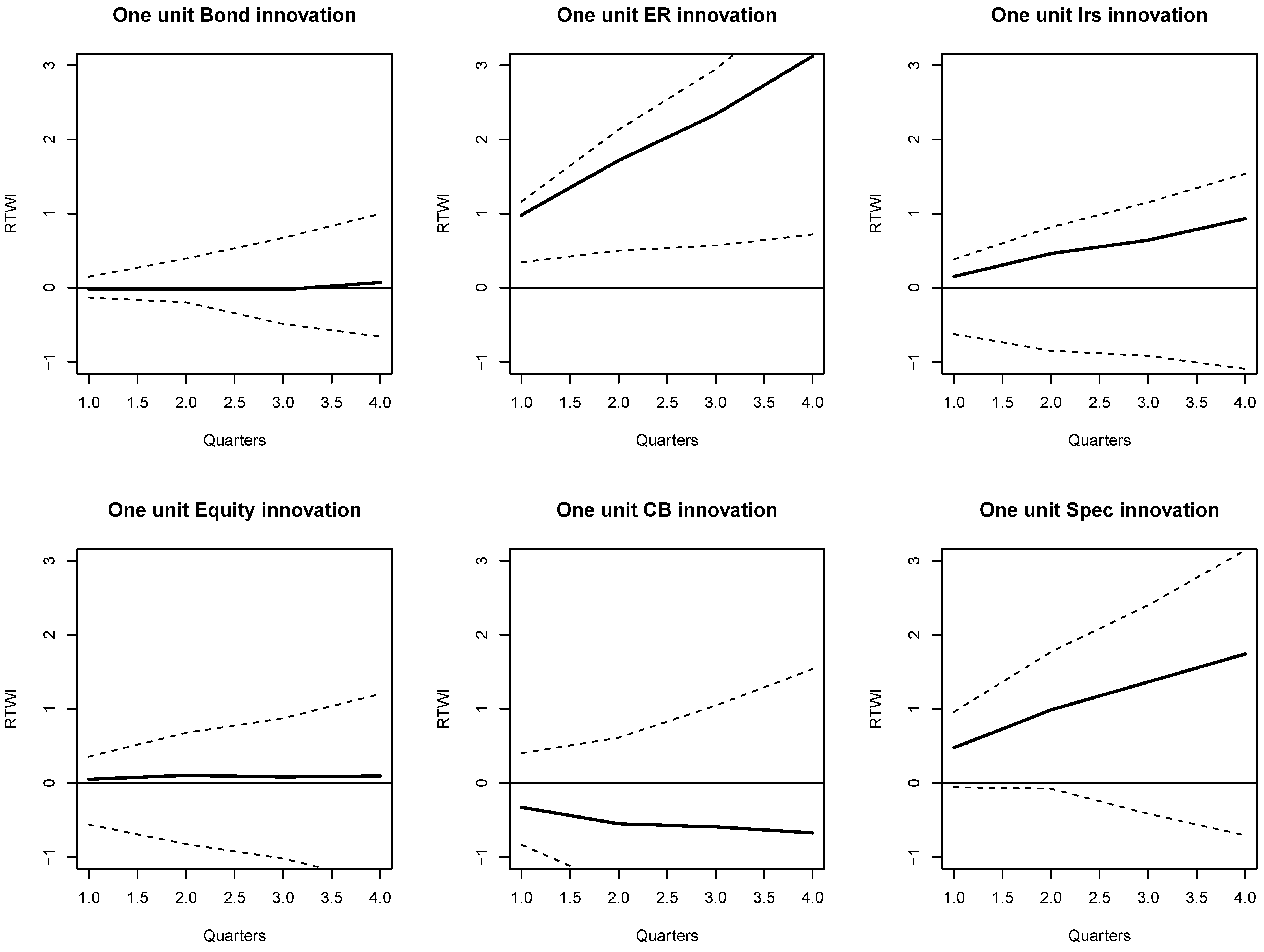

4. Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Adams-Kane, Jonathon, Yueqing Jia, and Jamus Jerome Lim. 2015. Global transmission channels for international bank lending in the 2007–2009 financial crisis. Journal of International Money and Finance 56: 97–113. [Google Scholar] [CrossRef]

- Avdjiev, Stefan, and Zheng Zeng. 2014. Credit growth, monetary policy, and economic activity in a three-regime tvar model. Applied Economics 46: 2936–51. [Google Scholar] [CrossRef]

- Bathia, Deven, Christos Bouras, Riza Demirer, and Rangan Gupta. 2020. Cross-border capital flows and return dynamics in emerging stock markets: Relative roles of equity and debt flows. Journal of International Money and Finance 109: 102258. [Google Scholar] [CrossRef]

- Bernanke, Ben. 1986. Alternative Explanation of the Money-Income Correlation. NBER Working Papers 1842. Available online: https://ssrn.com/abstract=236670 (accessed on 22 April 2021).

- BIS. 2012. BIS Location Banking Statistics. Available online: https://www.bis.org/statistics/bankstats.htm (accessed on 22 April 2021).

- BIS. 2013. Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in 2013. Available online: https://www.bis.org/publ/rpfx13.htm (accessed on 22 April 2021).

- BIS. 2019. Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in 2019. Available online: https://www.bis.org/statistics/rpfx19.htm (accessed on 22 April 2021).

- Blanchard, Oliver, Atish Ghosh, and Marcos Chamon. 2015. Are Capital Inflows Expansionary or Contractionary? Theory, Policy Implications, Some Evidence. IMF Working Paper 15. Available online: https://www.nber.org/papers/w21619 (accessed on 22 April 2021).

- Borio, Claudio, and Piti Disyatat. 2011. Global Imbalances and the Financial Crisis: Link or No Link? BIS Working Papers. Available online: https://www.bis.org/publ/work346.pdf (accessed on 22 April 2021).

- Brooks, Robin, Hali Edison, Manmohan S. Kumar, and Torsten Slok. 2004. Exchange rates and capital flows. European Financial Management 10: 511–33. [Google Scholar] [CrossRef]

- Bruno, Valentina, and Hyun Song Shin. 2014. Cross-border banking and global liquidity. The Review of Economic Studies 82: 535–64. [Google Scholar] [CrossRef]

- Caballero, Ricardo J., and Alp Simsek. 2020. A model of fickle capital flows and retrenchment. Journal of Political Economy 128: 2288–328. [Google Scholar] [CrossRef]

- Calvo, Guillermo A. 1998. Capital flows and capital-market crises: The simple economics of sudden stops. Journal of Applied Economcs 1: 34–54. [Google Scholar] [CrossRef]

- Ceruttie, Eugenio, Stijn Claessens, and Lev Ratnovski. 2014. Global Liquiity and Drivers of Cross-Border Bank Flows. IMF Working Paper. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Global-Liquidity-and-Drivers-of-Cross-Border-Bank-Flows-41511 (accessed on 22 April 2021).

- Cesa-Bianchi, Ambrogio, Michael Kumhof, Andrej Sokol, and Gregory Thwaites. 2019. Towards a New Monetary Theory of Exchange Rate Determination. Bank of England Staff Working Paper. Available online: https://www.bankofengland.co.uk/working-paper/2019/towards-a-new-monetary-theory-of-exchange-rate-determination (accessed on 22 April 2021).

- Chuhan, Punam, Gabriel Perez-Quiros, and Helen Popper. 1996. International Capital Flows: Do Short-Term Investment and Long-Term Investment Differ? World Bank Policy Research Working Paper. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/1813-9450-1669 (accessed on 22 April 2021).

- Claessens, Stijn, Michael P. Dooley, and Andrew Warner. 1995. Portfolio capital flows: Hot or cold? The World Bank Economic Review 9: 153–74. [Google Scholar] [CrossRef]

- Devereux, Michael, Makoto Saito, and Changhua Yu. 2020. International capital flows, portfolio composition, and the stability of external imbalances. Journal of International Economics 127: 103386. [Google Scholar] [CrossRef]

- Dornbusch, Rudiger, and Alejandro Werner. 1995. Currenc crises and collapses. Brookings Papers in Economic Activity 1995: 219–93. [Google Scholar] [CrossRef]

- Gabaix, Xavier, and Matteo Maggiori. 2015. International lliquidity and exchange rate dynamics. Quarterly Journal of Economics 130: 1369–420. [Google Scholar] [CrossRef]

- Gelos, Gaston, Lucyna Gornicka, and Robin Koepke. 2019. Capital Flows at Risk: Taming the Ebbs and Flows. IMF Working Paper. Available online: https://www.imf.org/en/Publications/WP/Issues/2019/12/20/Capital-Flows-at-Risk-Taming-the-Ebbs-and-Flows-48878 (accessed on 22 April 2021).

- Hamilton, James D. 1994. Time Series Analysis. Princeton: Princton University Press. [Google Scholar]

- Hau, Harald, and Helene Rey. 2006. Exchange rates, equity prices and capital flows. Review of Financial Studies 19: 273–317. [Google Scholar] [CrossRef]

- Hayward, Rob. 2018. Foreign exchange speculation: An event study. International Journal of Financial Studies 6: 22. [Google Scholar] [CrossRef]

- Keefe, Helena Glebocki. 2021. The transmission of global monetary and credit shocks on exchange market pressure in emerging and developing economies. Journal of International Financial Markets, Institutions and Money 72: 101320. [Google Scholar] [CrossRef]

- Kouri, Pentti J. K., and M. Porter. 1974. International capital flows and portfolio equilibrium. Journal of Political Economy 82: 443–67. [Google Scholar]

- Krugman, Paul, ed. 2000. Currency Crises. Chicago: University of Chicago Press. [Google Scholar]

- Kumhof, Michael, Phurichai Rungcharoenkitkul, and Andrej Sokol. 2020. How Does International Capital Flow? BIS Working Papers. Available online: https://www.bis.org/publ/work890.htm (accessed on 22 April 2021).

- Lane, P., and G. Milesi-Ferretti. 2008. The drivers of financial globalization. American Economic Review: Papers and Proceedings 98: 327–32. [Google Scholar] [CrossRef]

- Lane, Philip R., and Gian Maria Milesi-Ferretti. 2007. The external wealth of nations part 2: Revised and extended estimates of foreign assets and liabilities 1970–2004. Journal of International Economics 73: 223–50. [Google Scholar] [CrossRef]

- Lutkephole, H. 2006. New Introduction to Multiple Time Series Analysis. New York: Springer. [Google Scholar]

- Obstfeld, Maurice. 2010. Expanding gross asset positions and the international monetary system. In Federal Reserve Bank of Kansas City Symposium on Macroeconomic Challenges: The Decade Ahead. Jackson: Federal Reserve Bank of Kansas City. [Google Scholar]

- Obstfeld, Maurice, and Alan M. Taylor. 2004. Global Capital Markets: Integration, Crisis and Growth. Cambridge: Cambridge University Press. [Google Scholar]

- Prasad, Eswar, Jose de Gregorio, Donald Kohn, Hyun Song Shin, and Charles H. Dallara. 2011. Banks and Cross-Border Capital Flows: Policy Challenges and Regulatory Responses. Technical Report. Washington, DC: The Committe for International Economic Policy and Reform. [Google Scholar]

- Sims, Christopher A. 1980. Macroeconomics and reality. Econometrica 48: 1–48. [Google Scholar] [CrossRef]

- Sims, Christopher A. 1986. Are forecasting models usable for policy analysis? Federal Reserve Bank of Minneapolis Quarterly Review 10: 2–16. [Google Scholar] [CrossRef]

- Siourounis, Gregorios. 2004. Capital Flows and Exchange Rates: An Empirical Analysis. Social Science Research Network Working Paper Series. Available online: https://ssrn.com/abstract=572025 (accessed on 22 April 2021).

- US Department of Commerce. 2014. US International Transactions; Washington, DC: US Department of Commerce.

- US Treasury. 2014. Treasury International Capital (TIC) System; Washington, DC: US Treasury.

| CNB | CNE | CNFDI | COT | RTWI | SPREAD | S1 | |

|---|---|---|---|---|---|---|---|

| CNB | 1 | NA | 0a | 0b | 0c | NA | 0d |

| CNE | NA | 1 | NA | 0e | NA | 0f | NA |

| CNFDI | g | NA | 1 | 0h | NA | 0i | 0j |

| COT | NA | 0k | 0l | 1 | NA | 0m | NA |

| RTWI | 0n | NA | NA | NA | 1 | NA | NA |

| SPREAD | NA | 0p | 0q | 0r | NA | 1 | 0s |

| S1 | 0t | NA | 0u | NA | NA | 0v | 1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hayward, R.; Gregoriou, A. International Capital Flows and Speculation. J. Risk Financial Manag. 2021, 14, 197. https://doi.org/10.3390/jrfm14050197

Hayward R, Gregoriou A. International Capital Flows and Speculation. Journal of Risk and Financial Management. 2021; 14(5):197. https://doi.org/10.3390/jrfm14050197

Chicago/Turabian StyleHayward, Rob, and Andros Gregoriou. 2021. "International Capital Flows and Speculation" Journal of Risk and Financial Management 14, no. 5: 197. https://doi.org/10.3390/jrfm14050197

APA StyleHayward, R., & Gregoriou, A. (2021). International Capital Flows and Speculation. Journal of Risk and Financial Management, 14(5), 197. https://doi.org/10.3390/jrfm14050197