Predicting Firms’ Financial Distress: An Empirical Analysis Using the F-Score Model

Abstract

1. Introduction

This study contributes by providing evidence that the relationship of the F-Score and probability of firms going into financial distress is significant. This study also demonstrates that firms which are at risk of distress tend to record a negative cash flow from operations (CFO) and show a greater decline in return on assets (ROA) in the year prior to default. Finally, this study contributes to existing literature by examining the usefulness of the Piotroski’s F-Score and its components in predicting financial distress among firms in the United States.

2. Literature Review

2.1. A Review of Literature on Development of Default Prediction Models

2.2. Financial Ratios and Prediction of Financial Distress

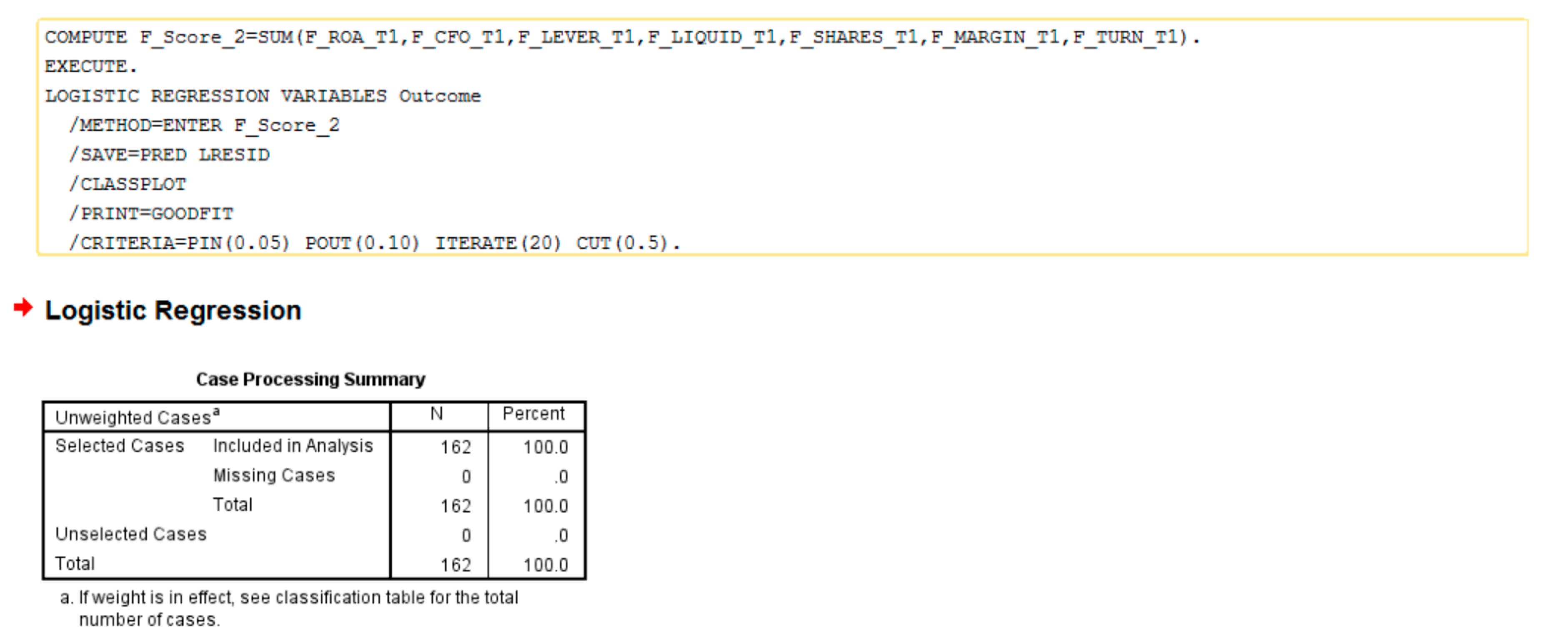

3. Methodology

3.1. A Review of Statistical Techniques in Financial Distress and Bankruptcy Prediction Models

3.2. Sample Description and Statistical Technique

- Companies whereby financial data is unavailable for the period between one to three years prior to bankruptcy.

- Financial data available is insufficient to calculate all the ratios included in the F-Score.

3.3. Variable Descriptions

4. Results

5. Discussion

6. Conclusions

7. Limitation and Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Aziz, M. Adnan, and Humayon A. Dar. 2006. Predicting corporate bankruptcy: Where we stand? Corporate Governance: The International Journal of Business in Society 6: 18–33. [Google Scholar] [CrossRef]

- Aggarwal, Navdeep, and Mohit Gupta. 2009. Do High Book-to-Market Stocks Offer Returns to Fundamental Analysis in India? Decision 36: 304–941. [Google Scholar]

- Agrawal, Khushbu. 2015. Default Prediction Using Piotroski’s F-score. Global Business Review 16S 5: 175. [Google Scholar] [CrossRef]

- Almamy, Jeehan, John Aston, and Leonard N. Ngwa. 2016. An evaluation of Z-score using cash flow ratio to predict corporate failure amid the recent financial crisis: Evidence from the UK. Journal of Corporate Finance 36: 278–85. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporarte bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I., and Anthony Saunders. 1998. Credit risk measurement: Developments over the last 20 years. Journal of Banking & Finance 21: 1721–42. [Google Scholar]

- Altman, Edward I., Robert G. Haldeman, and Paul Narayanan. 1977. Zeta Analysis: A new model to identify bankruptcy risk of corporations. Journal of Banking & Finance 1: 470–92. [Google Scholar]

- Angelini, Eliana, Giacomo di Tollo, and Andrea Roli. 2008. A neural network approach for credit risk evaluation. The Quarterly Review of Economics and Finance 48: 733–55. [Google Scholar] [CrossRef]

- Bandyopadhyay, Arindam. 2006. Predicting probability of default of Indian corporate bonds: Logistic and Z-score model approaches. The Journal of Risk Finance 7: 255–72. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial Ratios As Predictors of Failure. Journal of Accounting Research 4: 71–111. [Google Scholar] [CrossRef]

- Begley, Joy, Jin Ming, and Susan Watts. 1996. Bankruptcy classification errors in the 1980′s: An empirical analysis of Altman’s and Ohlson’s models. Review of Accounting Studies 1: 267–84. [Google Scholar] [CrossRef]

- Berger, Allen N., Christa H. S. Bouwman, Thomas Kick, and Klaus Schaeck. 2016. Bank liquidity creation following regulatory interventions and capital support. Journal of Financial Intermediation 26: 115–41. [Google Scholar] [CrossRef]

- Box, George E. P., and Paul W. Tidwell. 1962. Transformation of the Independent Variables. Technometrics 4: 531–50. [Google Scholar] [CrossRef]

- Brown, Linzee. 2017. BankruptcyData Releases Its Annual Corporate Bankruptcy Report. Available online: http://www.prweb.com/releases/2017/01/prweb13962074.htm (accessed on 13 January 2020).

- Cabrera, Matias, Gerald P. Dwyer, and Margarita Samartín-Saénz. 2016. Government finances and banks bailouts: Evidence from European stock markets. Journal of Empirical Finance 39: 169–79. [Google Scholar] [CrossRef]

- Campbell, John Y., Jens Dietrich Hilscher, and Jan Szilagyi. 2011. Predicting financial distress and the performance of distressed stocks. Journal of Investment Management 9: 14–34. [Google Scholar]

- Castanias, Richard. 1983. Bankruptcy risk and optimal capital structure. The Journal of Finance 38: 1617–35. [Google Scholar] [CrossRef]

- Cleary, Sean, and Greg Hebb. 2016. An efficient and functional model for predicting bank distress: In and out of sample evidence. Journal of Banking & Finance 6: 101–11. [Google Scholar]

- Coats, Pamela K., and L. Franklin Fant. 1993. Recognizing financial distress patterns using a neural network tool’. Financial Management 22: 142–55. [Google Scholar] [CrossRef]

- Dieckmann, Stephan, and Thomas Plank. 2011. Default risk of advanced economies: An empirical analysis of credit default swaps during the financial crisis. Review of Finance 16: 903–34. [Google Scholar] [CrossRef]

- Edmister, Robert O. 1972. An empirical test of financial ratio analysis for small business failure prediction. Journal of Financial and Quantitative Analysis 7: 1477–93. [Google Scholar] [CrossRef]

- Edwards, Jim. 2017. Global Market Cap is About to Hit $100 Trillion and Goldman Sachs Thinks the Only Way Is down. Business Insider Singapore. Available online: http://www.businessinsider.sg/global-market-cap-is-about-to-hit-100-trillion-2017-12 (accessed on 20 February 2020).

- Gentry, James A., Paul Newbold, and David T. Whitford. 1985. Predicting bankruptcy: If cash flow’s not the bottom line, what is? Financial Analysts Journal 41: 47–56. [Google Scholar] [CrossRef]

- Goyal, Shikha, and Ambika Bhatia. 2016. Analysis of Financial Ratios for Measuring Performance of Indian Public Sector Banks. International Journal of Engineering and Management Research (IJEMR) 6: 152–62. [Google Scholar]

- Houghton, KA. 1984. Accounting Data and the Prediction of Business Failure: The Setting of Priors and the Age Data. Journal of Accounting Research 22: 361–68. [Google Scholar] [CrossRef]

- Janes, Troy D. 2005. Accruals, Financial Distress, and Debt Covenants. Doctoral dissertation, University of Michigan, Ann Arbor, MI, USA. [Google Scholar]

- John, Argenti. 1976. Corporate Collapse: The Causes and Symptoms. London: McGraw-Hill Inc. [Google Scholar]

- Jones, Stewart. 2017. Corporate bankruptcy prediction: A high dimensional analysis. Review of Accounting Studies 22: 1366–422. [Google Scholar] [CrossRef]

- Keasey, Kevin, and Paul McGuinness. 1990. The failure of UK industrial firms for the period 1976–1984, logistic analysis and entropy measures. Journal of Business Finance & Accounting 17: 119–35. [Google Scholar]

- Kim, Myoung-Jong, and Dae-Ki Kang. 2010. Ensemble with neural networks for bankruptcy prediction. Expert Systems with Applications 37: 3373–79. [Google Scholar] [CrossRef]

- Kirshner, Jodie A. 2015. The bankruptcy safe harbor in light of government bailouts: Reifying the significance of bankruptcy as a backstop to financial risk. NYUJ Legislation & Public Policy 18: 795. [Google Scholar]

- Kliestik, Tomas, Maria Misankova, Katarina Valaskova, and Lucia Svabova. 2018. Bankruptcy prevention: New effort to reflect on legal and social changes. Science and Engineering Ethics 24: 791–803. [Google Scholar] [CrossRef] [PubMed]

- Kolte, Ashutosh, Arturo Capasso, and Matteo Rossi. 2017. Predicting financial distress of firms. A study on bankruptcy of Kingfisher Airlines. Paper presented at 10th Annual Conference of the EuroMed Academy of Business, Rome, Italy, September 13–15; pp. 735–49. [Google Scholar]

- Kordestani, Gholamreza, Mehrdad Bakhtiari, and Vahid Biglari. 2011. Ability of combinations of cash flow components to predict financial distress. Business: Theory and Practice 12: 277. [Google Scholar] [CrossRef]

- Kovacova, Maria, Tomas Kliestik, Katarina Valaskova, Pavol Durana, and Zuzana Juhaszova. 2019. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oeconomia Copernicana 10: 743–72. [Google Scholar] [CrossRef]

- Kumar, Radha Ganesh, and Kishore Kumar. 2012. A comparison of bankruptcy models. International Journal of Marketing, Financial Services and Management Research 4: 76–86. [Google Scholar]

- Le Maux, Julien, and Danielle Morin. 2011. Black and white and red all over: Lehman Brothers’ inevitable bankruptcy splashed across its financial statements. International Journal of Business and Social Science 2: 39–65. [Google Scholar]

- Lennox, Clive. 1999. Identifying failing companies: A re-evaluation of the logit, probit and DA approaches. Journal of Economics and Business 51: 347–64. [Google Scholar] [CrossRef]

- Mihalovic, Matús. 2016. Performance comparison of multiple discriminant analysis and logit models in bankruptcy prediction. Economics and Sociology 9: 101. [Google Scholar] [CrossRef] [PubMed]

- Odom, Marcus D., and Ramesh Sharda. 1990. A neural network model for bankruptcy prediction. Paper presented at IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, June 17–21; pp. 163–68. [Google Scholar]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 18: 109–31. [Google Scholar] [CrossRef]

- Pedro, Cristina Pereira, Joaquim J. S. Ramalho, and Jacinto Vidigal da Silva. 2018. The main determinants of banking crises in OECD countries. Review of World Economics 154: 203–27. [Google Scholar] [CrossRef]

- Piotroski, Joseph D. 2000. Value investing: The use of historical financial statement information to separate winners from losers. Journal of Accounting Research 38: 1–41. [Google Scholar] [CrossRef]

- Podhorska, Ivana, and Maria Misankova. 2016. Success of prediction models in Slovak companies. Global Journal of Business & Social Science Review 4: 54–59. [Google Scholar]

- Pompe, Paul P. M., and Jan Bilderbeek. 2005. The prediction of bankruptcy of small- and medium-sized industrial firms. Journal of Business Venturing 20: 847–68. [Google Scholar] [CrossRef]

- Pompe, Paul P. M., and A. J. Feelders. 1997. Using machine learning, neural networks, and statistics to predict bankruptcy. Computer-Aided Civil and Infrastructure Engineering 12: 267–76. [Google Scholar] [CrossRef]

- Pongsatat, Surapol, Judy Ramage, and Howard Lawrence. 2004. Bankruptcy prediction for large and small firms in Asia: A comparison of Ohlson and Altman. Journal of Accounting and Croporate Governance 1: 1–13. [Google Scholar]

- Salchenberger, Linda M., E. Mine Cinar, and Nicholas A. Lash. 1992. Neural networks: A new tool for predicting thrift failures. Decision Sciences 23: 899–916. [Google Scholar] [CrossRef]

- Shin, Kyung-Shik, and Yong-Joo Lee. 2002. A genetic algorithm application in bankruptcy prediction modeling. Expert Systems with Applications 23: 321–28. [Google Scholar] [CrossRef]

- Shirata, Cindy Yoshiko. 1998. Financial ratios as predictors of bankruptcy in Japan: An empirical research. Tsukuba College of Technology Japan 1: 1–17. [Google Scholar]

- Sivabalan, Srinivasan. 2017. Indian Stock Market Overtakes Canada in $2 Trillion Standoff. Bloomberg. Available online: https://www.bloomberg.com/news/articles/2017-11-30/indian-stock-market-overtakes-canada-in-2-trillion-standoff (accessed on 10 January 2020).

- Sloan, Richard G. 2005. Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review 71: 289–315. [Google Scholar]

- Tabachnick, Barbara G., Linda S. Fidell, and Jodie B. Ullman. 2007. Using Multivariate Statistics. Boston: Pearson Education Limited. [Google Scholar]

- Tinoco, Mario Hernandez, and Nick Wilson. 2013. Financial distress and bankruptcy prediction among listed companies. International Review of Financial Analysis 30: 394–419. [Google Scholar] [CrossRef]

- United States Courts. 2017a. United States Courts. Available online: http://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-11-bankruptcy-basics (accessed on 5 January 2020).

- United States Courts. 2017b. United States Courts. Available online: http://www.uscourts.gov/services-forms/bankruptcy/b;ankruptcy-basics/chapter-7-bankruptcy-basics (accessed on 5 January 2020).

- Varetto, Franco. 1998. Genetic algorithms applications in the analysis of insolvency risk. Journal of Banking & Finance 22: 1421–39. [Google Scholar]

- Ward, Terry J. 1994. Cash Flow Information And The Prediction Of Financially Distressed Mining, Oil And Gas Firms: A Comparative Study. Journal of Applied Business Research (JABR) 10: 78–86. [Google Scholar] [CrossRef]

- Yang, Z. R., Marjorie B. Platt, and Harlan D. Platt. 1999. Probabilistic neural networks in bankruptcy prediction. Journal of Business Research 44: 67–74. [Google Scholar] [CrossRef]

| Year | Number of Financially-Distressed Firms |

|---|---|

| 2009 | 3 |

| 2010 | 2 |

| 2011 | 2 |

| 2012 | 6 |

| 2013 | 4 |

| 2014 | 7 |

| 2015 | 8 |

| 2016 | 43 |

| 2017 | 6 |

| Total | 81 |

| Industry | SIC Code | Number of Firms | Percentage of Total |

|---|---|---|---|

| Air Transportation, Scheduled | 4512 | 1 | 1.2 |

| Bituminous Coal and Lignite Surface Mining | 1221 | 2 | 2.5 |

| Communication Services, Nec | 4899 | 1 | 1.2 |

| Computer Peripheral Equipment, Nec | 3577 | 1 | 1.2 |

| Crude Petroleum and Natural Gas | 1311 | 31 | 38.3 |

| Deep Sea Foreign Transportation Of Freight | 4412 | 2 | 2.5 |

| Drilling Oil and Gas Wells | 1381 | 1 | 1.2 |

| Electric Services | 4911 | 2 | 2.5 |

| Electronic Components, Nec | 3679 | 1 | 1.2 |

| Gold and Silver Ores | 1040 | 1 | 1.2 |

| Household Furniture | 2510 | 1 | 1.2 |

| Industrial Organic Chemicals | 2860 | 1 | 1.2 |

| Mining, Quarrying Of Nonmetallic Minerals (No Fuels) | 1400 | 2 | 2.5 |

| Motor Vehicle Parts and Accessories | 3714 | 2 | 2.5 |

| Natural Gas Transmission | 4922 | 1 | 1.2 |

| Oil and Gas Filed Machinery and Equipment | 3533 | 1 | 1.2 |

| Oil And Gas Field Exploration Services | 1382 | 1 | 1.2 |

| Oil, Gas Field Services, Nbc | 1389 | 4 | 4.9 |

| Operative Builders | 1531 | 1 | 1.2 |

| Pharmaceutical Preparations | 2834 | 1 | 1.2 |

| Radio and TV Broadcasting and Communications Equipment | 3663 | 1 | 1.2 |

| Radio Telephone Communications | 4812 | 1 | 1.2 |

| Retail-Apparel and Accessory Stores | 5600 | 4 | 4.9 |

| Retail-Eating Places | 5812 | 1 | 1.2 |

| Retail-Miscellaneous Retail | 5900 | 1 | 1.2 |

| Retail-Miscellaneous Shopping Goods Stores | 5940 | 1 | 1.2 |

| Retail-Radio Tv and Consumer Electronics Stores | 5731 | 1 | 1.2 |

| Retail-Women’S Clothing Stores | 5621 | 1 | 1.2 |

| Semiconductors and Related Devices | 3674 | 4 | 4.9 |

| Services-Amusement and Recreation Services | 7900 | 1 | 1.2 |

| Services-Business Services, Nec | 7389 | 2 | 2.5 |

| Services-Computer Programming Services | 7371 | 1 | 1.2 |

| Services-Educational Services | 8200 | 1 | 1.2 |

| Services-Pre-packaged Software | 7372 | 2 | 2.5 |

| Water Transportation | 4400 | 1 | 1.2 |

| Total | 81 | 100 |

| Panel A. Descriptive Statistics—Asset Size (US$ Million) | ||

|---|---|---|

| Sample | Mean | Std. Dev. |

| Distressed firms | 2489.30 | 5306.94 |

| Non-distressed firms | 2453.58 | 5562.71 |

| Panel B. Independent Sample t-Test | ||

| Mean Difference | t-value | Sig. (p-value) |

| 35.71 | 0.042 | 0.944 |

| Variable | Distressed Firms | Non-Distressed Firms | Mean Difference | ||

|---|---|---|---|---|---|

| Mean | Std. Dev. | Mean | Std. Dev. | (t-Value) | |

| Piotroski’s F-Score | 3.73 | 1.466 | 4.58 | 1.439 | −0.852 *** |

| (−3.731) | |||||

| Variable | Distressed Firms | Non-Distressed Firms | Mean Difference | ||

|---|---|---|---|---|---|

| Mean | Std. Dev. | Mean | Std. Dev. | (t-Value) | |

| ∆ ROA | −0.130 | 0.266 | −0.060 | 0.200 | −0.078 ** |

| (−2.114) | |||||

| CFO | 1.654 | 0.479 | 1.901 | 0.300 | −0.247 *** |

| (−3.934) | |||||

| ∆ Margin | −0.070 | 0.195 | −0.050 | 0.141 | −0.021 |

| (−0.766) | |||||

| ∆ Turnover | −0.050 | 0.345 | −0.040 | 0.345 | −0.012 |

| −0.227 | |||||

| ∆ Leverage | −0.020 | 0.244 | 0.010 | 0.176 | −0.037 |

| −1.115 | |||||

| ∆ Liquidity | −0.250 | 0.762 | −0.100 | 1.538 | −0.158 |

| −0.827 | |||||

| Eq_Offer | −10.450 | 40.818 | −13.440 | 78.051 | 2.986 |

| (0.305) | |||||

| Variables | Model 1 Beta Coefficient (Wald Statistic) | Model 2 Beta Coefficient (Wald Statistic) |

|---|---|---|

| Constant | 1.727 *** | −0.546 * |

| (11.423) | (6.562) | |

| Piotroski’s F−Score | −0.412 *** | |

| (12.571) | ||

| ∆ ROA | −2.301 ** | |

| (5.901) | ||

| CFO | 1.959 *** | |

| (16.618) | ||

| ∆ Margin | 0.831 | |

| (0.482) | ||

| ∆ Turnover | 0.312 | |

| (0.303) | ||

| ∆ Leverage | −1.042 | |

| (1.238) | ||

| ∆ Liquidity | −0.107 | |

| (0.644) | ||

| Eq_Offer | −0.001 | |

| (0.034) | ||

| −2 Log likelihood | 209.252 | 196.041 *** |

| Chi-square | 13.935 *** | 27.146 *** |

| Nagelkerke R2 | 0.111 | 0.207 |

| Estimation Sample | Predicted Group | ||

| Observed Group | Distressed | Non-Distressed | Total |

| Distressed | 43 | 14 | 57 |

| 75.4% a | 24.6% | 100.0% | |

| Non-Distressed | 32 | 25 | 57 |

| 56.1% | 43.9% b | 100.0% | |

| Overall accuracy | 75.4% | 43.9% | 59.6% c |

| Hold-out Sample | Predicted Group | ||

| Observed Group | Distressed | Non-Distressed | Total |

| Distressed | 17 | 7 | 24 |

| 70.8% a | 29.2% | 100.0% | |

| Non-Distressed | 3 | 21 | 24 |

| 12.5% | 87.5%b | 100.0% | |

| Overall accuracy | 70.8% | 87.5% | 79.2% c |

| Estimation Sample | Predicted Group | ||

| Observed Group | Distressed | Non-Distressed | Total |

| Distressed | 27 | 30 | 57 |

| 47.4% a | 52.6% | 100.0% | |

| Non-Distressed | 16 | 41 | 57 |

| 28.1% | 71.9% b | 100.0% | |

| Overall accuracy | 47.4% | 71.9% | 59.6% c |

| Hold-out Sample | Predicted Group | ||

| Observed Group | Distressed | Non-Distressed | Total |

| Distressed | 15 | 9 | 24 |

| 62.5% a | 37.5% | 100.0% | |

| Non-Distressed | 4 | 20 | 24 |

| 16.7% | 83.3% b | 100.0% | |

| Overall accuracy | 62.5% | 83.3% | 72.9% c |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahman, M.; Sa, C.L.; Masud, M.A.K. Predicting Firms’ Financial Distress: An Empirical Analysis Using the F-Score Model. J. Risk Financial Manag. 2021, 14, 199. https://doi.org/10.3390/jrfm14050199

Rahman M, Sa CL, Masud MAK. Predicting Firms’ Financial Distress: An Empirical Analysis Using the F-Score Model. Journal of Risk and Financial Management. 2021; 14(5):199. https://doi.org/10.3390/jrfm14050199

Chicago/Turabian StyleRahman, Mahfuzur, Cheong Li Sa, and Md. Abdul Kaium Masud. 2021. "Predicting Firms’ Financial Distress: An Empirical Analysis Using the F-Score Model" Journal of Risk and Financial Management 14, no. 5: 199. https://doi.org/10.3390/jrfm14050199

APA StyleRahman, M., Sa, C. L., & Masud, M. A. K. (2021). Predicting Firms’ Financial Distress: An Empirical Analysis Using the F-Score Model. Journal of Risk and Financial Management, 14(5), 199. https://doi.org/10.3390/jrfm14050199