2.3. The Situation of Small and Medium-Sized Enterprises in Ethiopia

Small and Medium Enterprises (SMEs) play a major role in most economies, particularly in developing countries (

OECD 2017).

Olah et al. (

2019) also acknowledge and emphasized the role of small and medium enterprises in the whole economy. SMEs account for the majority of businesses. In emerging markets, most formal jobs are generated by SMEs, which create 7 out of 10 jobs. If we look at the situation of small and medium enterprises in Africa, we can see that this type of business provides the backbone of the continent since represents more than 90% of all enterprises and gives work to about 60% of all employees (

Durst and Gerstlberger 2021). Despite SMEs in Africa significantly spurring economic growth due to the economic integration, there are numerous barriers that have to be faced by them—such as weaknesses in the infrastructure (

Mallinguh and Zeman 2019).

However, access to finance is a key constraint to SME growth; it is the second most cited obstacle facing SMEs growing their businesses in emerging markets and developing countries (

World Bank 2019). Moreover, SMEs can reduce income inequalities if they are enabled to provide good-quality jobs (

Kamal-Chaoui 2017). The study conducted by

Fowowe (

2017) also argues that lack of access to credit has a significant negative effect on firm growth and the study also shows firms that are not credit-constrained experience faster growth than firms that are credit constrained. Another study by

Dinh et al. (

2010) on binding constraint on firms’ growth in developing countries, at the firm level, reveals that having access to finance is correlated with higher job growth rates.

SMEs are closely linked with economic growth. For example,

Beck et al. (

2005a) in their research on SMEs, growth, and poverty found that cross-country evidence reveals that the relative size of the SME sector in a country and economic growth are positively related. Another study by

Ayyagari et al. (

2007) shows that formal SMEs contribute to 50 percent of GDP on average in high-income countries. Besides, there is evidence that SMEs are the major sources of employment in many economies (

Beck et al. 2008a). The survival and protection of SMEs are found as a key for the development of the nation’s economy, mainly in developing countries (

Harith and Samujh 2020).

Moreover, a study by

Ong and Ismail (

2012) and

Ahmad (

2012) supports others’ argument that SMEs play a crucial role in economic development, particularly in developing countries like Africa. For instance,

Ahmad (

2012) stated that SMEs and the informal sector (Iquib and Idir) represent over 90% of businesses, contribute to over 50% of GDP, and account for about 63% of employment (

Ahmad 2012). Similarly, the

ITC (

2019) and

World Bank (

2019) report shows MSMEs (Micro, Small and Medium Enterprises) contribute an average of 60–70% of total employment worldwide and 50% of GDP, and on the other side, they are facing access to credit as the report revealed 40% of formal MSMEs in developing countries have an unmet financing need of

$5.2 trillion every year. Globally, more than 200 million Micro, Small, and Medium Enterprises (MSMEs) exist without access to banking services (

Ernst and Young 2017).

Harith and Samujh (

2020) also argue that access to credit is among the barriers to the development of SMEs.

Accordingly, in most developing countries SMEs are considered a significant tool in job creation, poverty reduction, and economic growth. SMEs have become important urban economic activities particularly in providing urban employment. Similarly, across Ethiopia, SMEs are the predominant income-generating activities and thus they have a significant contribution to local economic development and are used as the basic means of survival (

Egziabher and Demeke 2009). However, despite the acknowledgment of its immense contribution to sustainable economic development, its performance still falls below expectations in many developing countries including Ethiopia (

Arinaitwe 2006). The 2018 World Bank Enterprise Survey report reveals that on average only 22% of Sub-Saharan Africa are more disadvantaged in accessing external credit in comparison, with an average of 43% of other developing economies, excluding Africa. In developing economies including Sub-Saharan Africa, smaller firms are less likely to have access to credit than larger firms (

Beck et al. 2005b,

2008b;

Beck and Demirguc-Kunt 2006;

Ayyagari et al. 2008,

2012).

Ethiopia’s financial sector is shallow, and the penetration of financial services is poor (

Zins and Weill 2016). In the context of Ethiopia, medium and small enterprise development holds a strategic place within Ethiopia’s Industrial Development Strategy (

UNDP 2019), and hence is considered as a key instrument of job creation. Additionally, the SME sector in Ethiopia is taken as an instrument in bringing about economic transition by effectively using the skill and talent of the people particularly women and youth without demanding high-level training, much capital, and sophisticated technology (

Nega and Hussein 2016). However, evidence from different empirical studies shows the reverse result indicating SME sectors in Ethiopia are facing a lot of challenges that hinder them from growing rapidly (

Wolday and Gebrehiwot 2004;

Baza and Rao 2017).

2.3.1. Small and Medium Enterprises in Ethiopia

SMEs have a significant effect on the countries’ operation both from economic and socioeconomic aspects. Economically, SMEs can enhance economic growth and accelerate socioeconomic progress by providing traders with the resources to exploit market opportunities and further accelerate the development of rural regions. Socioeconomically, SMEs benefit deprived communities with the financial stability to afford a better quality of life. Therefore, the Ethiopian government continuously creates reformed policies to promote SMEs development. According to the Federal Democratic Republic of Ethiopia (FDRE), the following three strategies were developedfor supporting SMEs:

Strategy 1—Micro and Small Enterprises Development Strategy of Ethiopia (1997—2010): Agricultural Development Led Industrialization (ADLI) is a development strategy that aims to achieve initial industrialization through robust agricultural growth and close linkage between agriculture and industrial sector.

Strategy 2—Micro and Small Enterprises Development Strategy, Provision Framework and Methods of Implementation (2011–2015): The success of ADLI in Strategy 1 will promote the full industrialization of agriculture.

Strategy 3—Industrial Development Strategic Plan (2015–2025): If the first two are successful, the economic level of Ethiopia should reach middle-level income by 2025.

2.3.2. Starting SMEs and the Governing Laws

According to the Commercial Code of Traders and Businesses, a person is considered a trader if he/she is involved in purchasing, building, repairing, maintaining items (not by handicraftsmen), with an intent to resell for profit.

For a trader to start a small or micro business, he/she would first need to register in the commercial register, which is authorized and monitored by the MCI (Ministry of Commerce and Industry). The commercial register consists of two sub-registers; a local register kept at regional states and a central register kept within the DCCR (Department of the Central Commercial Register), a special division established by the MCI in Addis Ababa. The trader will present an application to either local or central registers within the first two months of starting a commercial business. If the trader fails to do so, it will be considered illegal and lead to penalization. The registers contain information such as: name, DOB, nationality, objects of trade, previous trade and registration information, trade name, address of the business, business plan. Once a business license is issued, MCI will carry out supervisions to monitor the success of the establishment. Suppose a business has ceased operation, or the trader is considered incapable of carrying on the registered trade; MCI will submit a notification to the trader and cancel the business registration.

2.3.3. Challenges of the SMEs in Ethiopia’s Economy, Finances, and Policies

Although the FDRE has made promising efforts, the business sector of Ethiopia faces challenges both internally and externally.

Internal challenges:

Management: The lack of professional training and capacity building of SMEs owners in production and management resulted in businesses remaining stagnant. Most SMEs are primary income generators; therefore, owners involve themselves in all aspects of the business. Some traders run multiple establishments but lack full-time commitment for each one, resulting in slow business development.

Education: Most traders enter the business sector with self-taught experience. A study conducted by ADA reported the youth were more successful in running a business as compared to older generations as a result of certifications in higher education. Ethiopians educated by foreign countries in business and management are more responsive to futuristic equipment and methodologies compared to traders who are accustomed to traditional methods of manufacturing. The government makes notable exceptions to involve them in the business sector.

Finances: Since SMEs are the primary income generator of traders, the profits are invested in resolving personal affairs rather than the business. This creates low finances to manage, acquire resources, and cover insurance expenses.

Information: The unavailability of updated information technology disadvantages SMEs by not linking their objects of trade with customer demands and current trends of marketing and distribution.

External challenges

Gender Inequality: Especially in rural regions, women are not given the same opportunities to start SMEs. According to ADA, women in SMEs are more successful in creating and maintaining businesses. They earn more income and become the primary breadwinner in their household.

Finances: MFIs provide outstanding loans to women in an attempt to increase the women force in SMEs by using cash-flow-based loan appraisal methods. However, traders prefer to obtain their finances from family loans, iquub, or personal savings as an alternative to MFI. To borrow money from MFI, traders will need to present the required amount in collateral possessions. Excessive collateral requirements and restrictive MFI policies such as demanding clients save 15% to 20% of the loan amount over six months are significant obstacles to acquiring start-up capital from MFIs. Only 9% of the entrepreneurs studied started with a loan from an MFI plus their savings.

2.4. Factors of Financial Inclusion and Its Impact on the Competitiveness of SMEs

The phenomenon of financial inclusion can be traced back to the end of the 20th century when it was also addressed not only academically but also at a political level as a new economic and social phenomenon.

Kabakova and Plaksenkov (

2018) examined the ecosystem components of financial inclusion in their study, besides, summarized its main characteristics—based on definitions by related literature—as the following: uniform availability of financial service, regular usage, good quality of financial services, and potential for increased welfare. Despite the fact that financial inclusion policies and political actions do not have a long history, many empirical and semantic types of research emphasize its importance and highlight its microeconomic and macroeconomic effects on economic development. Besides, several institutions—such as central banks—have a social, economic, legal, and ethical responsibility towards economic growth (also via fair access to financial services) (

Lentner et al. 2017).

Financial inclusion can reduce moral hazard and adverse selection problems, both of which tend to align returns to assets with the initial stock of assets available for individuals in a generation (

Nanziri 2020). According to the

IMF (

2017), SME financial inclusion has a benefit on economic growth, job creation, the effectiveness of the macroeconomic policy, and macro-financial stability. Thus, financial inclusion opens investment opportunities irrespective of parental wealth. Moreover, on one hand, financial inclusion enables households to invest in human capital. On the other hand, firms accessing finance improve productivity by not only investing in physical but also employing highly skilled individuals. Since high skills attract higher wages; highly skilled individuals can only be engaged in firms that are skill-intensive and highly efficient (

Banerjee and Newman 1993) cited (

Nanziri 2020).

A study conducted by (

Hall 1992) suggests two primary causes for the failure of small and medium business enterprises in the world. These failures are classified as a lack of appropriate management skills and inadequate capital (both at start-up and continuingly). Additionally, the study conducted by

Alshardan et al. (

2016) as cited in (

Hall 1992), indicated that the level of employment in any country can influence financial inclusion. The finding of the study reveals that payment of wages and salaries through automated cash transfers is seen to influence financial inclusion in the United Kingdom. Other studies have also shown that payment of social security benefits, pensions, and other cash transfers through the cash system, significantly promotes financial exclusion.

Abera et al. (

2019) conducted a study on contributions of Micro, Small and Medium Enterprises (MSMEs) to income generation, employment, and GDP as a case study in Ethiopia. The finding of the study reveals that lack of credit, weak market linkage, insufficient training, weak human resources development schemes, dependency on government and spoon-feeding mentality, oscillations in government policies, price variations, weak links, and poor market and product development strategies were the main obstacles for the development of SMEs.

Fitane (

2020) conducted a study on factors affecting the sustainability of SMEs: the Case of Addis Ababa, Ethiopia. The general purpose of the study was to identify the major internal & external factors that influence the sustainability of SMEs. The study result reveals that; the most important internal factors that determine SMEs sustainability is work-related factor and marketing, financial, and political-legal factors are major external factors that affecting SMEs sustainability. The major study implication is that improving financial and work-related problems is critical in guaranteeing the survival of SMEs.

Furthermore,

OECD (

2020) examined the potential factors of financial exclusion among youth people and the role of digitization in it. Also, digitization leads to many changes and innovative financial technologies in the financial market (

Bilan et al. 2019).

Mogaka and Languitone (

2016), in their study conducted in Maputo central business district, Mozambique reveals the structure of the financial sector, awareness of funding, collateral requirements, and access to finance by SMEs. The survey conducted by ITC on SME competitiveness in Ghana indicates that insufficient electricity, transport, water, access to finance, access to ICT, and advertising are the determinant factors affecting the competitiveness of SMEs (

ITC 2016). Based on the literature sources the following determinants of financial inclusion were observed as can be seen in

Table 2.

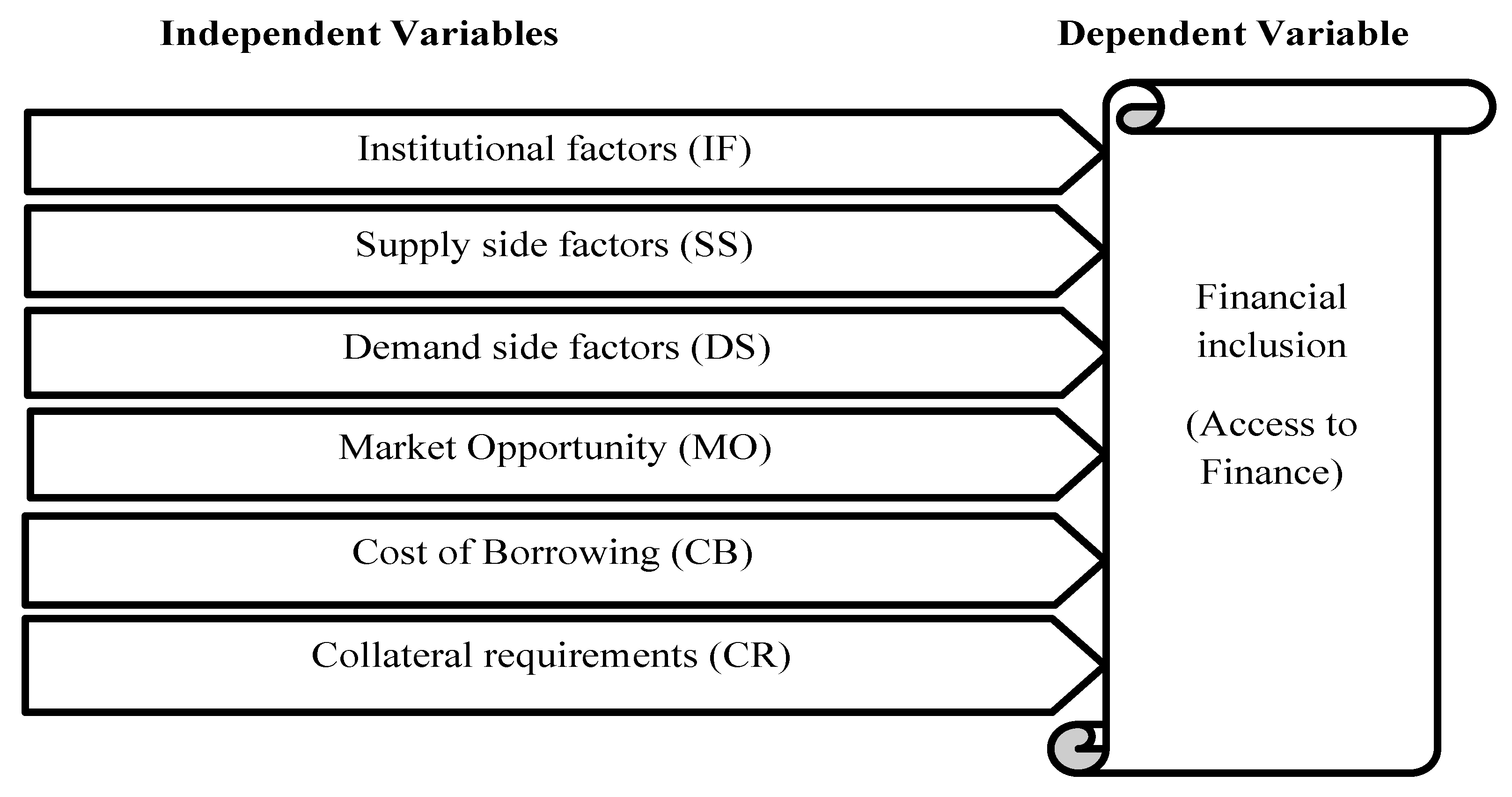

2.5. Research Framework and Hypotheses

As a result of the empirical review and theoretical assumptions, the researchers have developed the following schematic representation of the conceptual framework as can be seen in

Figure 1.

Through the systematic literature review, the formulated factors of financial inclusion are examined by seminal works presented in

Table 2.

Based on these literature discussions as above, this study formulates the following hypotheses for testing:

Hypothesis 1 (H1). Institutional framework factors have a negative and significant effect on financial inclusion.

Hypothesis 2 (H2). Supply-side factors have a positive and significant effect on financial inclusion.

Hypothesis 3 (H3). Demand-side factors have a positive and significant effect on financial inclusion.

Hypothesis 4 (H4). Market opportunity has a positive and significant effect on financial inclusion.

Hypothesis 5 (H5). Cost of borrowing has a negative and significant effect on financial inclusion.

Hypothesis 6 (H6). Collateral requirement has a negative and significant effect on financial inclusion.