Abstract

Despite that the relationship between corporate social responsibility activities and real estate operations seems relevant, only some studies have been conducted to explore the reasons that drive these activities in real estate companies. This work presents the relationship between CEO personality traits and corporate social responsibility (CSR) and shows whether corporate governance (CG) practices mitigate or enhance this relationship. This study uses a sample of 420 firm-year-observations using a sample of European real estate firms indexed on Stoxx Europe 600 Index from 2010 to 2019. To test the developed hypotheses, feasible generalized least square (FGLS) regression is applied. The results show that increased confidence in CEOs is an important factor in determining corporate incentives to undertake social responsibility activities. In addition, it has been shown that effective corporate governance practices lead significantly to moderate CEO behavior with regard to corporate social responsibility sharing. Since corporate governance can have a significant impact on CEOs’ behavior in relation to corporate social responsibility, the author recommends firms to improve corporate governance in listed European real estate companies.

1. Introduction

Corporate social responsibility (CSR) can be defined as “a concept whereby companies integrate social and environmental concerns into their activities and their interactions with their stakeholders on a voluntary basis” (Commission of the European Communities 2001). Thus, consumers, investors, and staff with mature awareness have come to expect corporate activities including not only the product, price, and quality, but also environmental and social activities in different fields (Ajaz et al. 2020).

In recent years, many companies have developed concerns with social responsibility and large corporations have invested in philanthropy.

For instance, Amancio Ortega, the CEO of Zara and one of the Spanish billionaires, decided to allocate part of his fortune, which amounts to EUR 15 billion, to provide imaging equipment to the public hospitals in Spain. Napster’s founder Sean Parker has committed 250 million dollars to immunotherapy research to fight cancer. The Walmart Foundation offered 1.5 million dollars to fund eligible non-profit organizations projects to reduce food waste in Canada (Vaccaro et al. 2018).

This intangible asset could be subdivided into classes relating to each of the three main themes of CSR (Park et al. 2020): the social reputation of the employer on well-being at work; societal reputation with regard to stakeholders (customers, consumers, local communities, subcontractors); environmental reputation (Chyz et al. 2019; J. H. Choi et al. 2020).

Some studies have attempted to examine the determinants of CSR dedication and social success, focusing on organizations’ financial constraints and contractual theories. Other studies take into account the behavioral aspects of top executives as determinants of CSR practices (Abatecola et al. 2018; Kim et al. 2018). The behavioral characteristics of top executives are taken into account in other research as determinants of CSR activities (Abatecola et al. 2018; Kim et al. 2018).

According to the US Environmental Protection Agency (US-EPA), the real estate industry plays a major role in improving corporate social responsibility, human health, ethics, sustainability, and the economy as a whole. However, the existing literature on CSR activities in this industry is oriented in general to the financial performance of CSR activities or the lack of them (Andreou et al 2019; Du and Sen 2016; Engelen et al 2016).

The first objective of this study is to introduce the behavioral and psychological dimensions, i.e., narcissism and overconfidence and their link with CSR level. In fact, behavioral theory indicated the importance of psychological profile and/or emotions to better understand the strategic decisions of the firm (Ben Mohamed and Shehata 2017; Buyl et al. 2019). Al-Shammari et al. (2019) showed a positive relationship between CEO and CSR, they found that while CEO narcissism is positively related to externally oriented CSR, the relationship between CEO narcissism and internally oriented CSR is negative but not significant.

Many organizational factors influence CSR engagement and the role of the Chief Executive Officer (CEO) is particularly important. Interestingly, upper echelon theory asserts that CEOs play a vital role in the decision-making process and therefore suggests that their characteristics influence CSR (Ikram et al. 2019; Fung et al. 2020). It is found in recent literature that managerial personality significantly affects RSE performance and makes these CEOs further committed to the social environment (Chen et al. 2019; Cho et al. 2019).

The second objective of this research is to study the impact of corporate governance mechanisms on the personality characteristics of the CEO and the relationship of corporate social responsibility processes. So, to what extent do corporate governance mechanisms modify the relationship between CEO personality traits and corporate social responsibility activities?

In recent years, there has been increased attention to how businesses handle their relationships with their various stakeholders. Researchers claim a close relationship between corporate governance (CG) and CSR dedication from this viewpoint. In fact, CG elements related to strategic decisions can affect a strong commitment to social responsibility (Lee et al. 2019). Therefore, given the mixed results reported in the literature, CG needs to be considered in the CSR-CEO profile.

Accordingly, the objective of the research is to fill an existing research gap by empirically investigate whether the CG practices mitigate or reinforce the impact of CEO narcissism and overconfidence on the orientation of the European real estate companies towards the CSR using a sample of real estate firms listed on the Stoxx Europe 600 Index from 2008 to 2018. Investment in green buildings is frequently the first considerable ethical initiatives adapted by the US companies (Manner 2010).

Therefore, businesses with substantial investments in real estate prefer to pursue CSR programs, and the amount of real estate leased and owned by firms should be taken into account by studying the CSR activities carried out by firms in general. This is the first research, as per the understanding of the authors, that examines the empirical connection between CG practices and CSR with a focus on the real estate industry. The choice of a sample consisting entirely of real estate firms is based on two key factors. First, for the real estate industry, the main dimensions of corporate social responsibility (governance, environmental, social) are important. On the one hand, real estate operations provide accessible business, working, and entertainment environments. Therefore, the association between property management and the environment is direct. On the other hand, new supplies and additions to real estate need neighbourhood approval (e.g., receive permission from city planners).

This implies that real estate operators must be sensitive to community preferences, moral values, and social trends. Second, the real estate industry is largely illiquid and plagued with large information asymmetry since the physical nature of real estate is segmented and heterogeneous. All these make CG mechanisms in the real estate industry challenging.

This means that managers of property management firms must be attentive to the preferences of the population, social movements, and ethical standards. Second, because the physical nature of real estate is segmented and heterogeneous, the real estate market is essentially illiquid and fraught with great data asymmetry. These all make CG processes complicated in the property management business.

The rest of the article is organized as follows. Section 2 presents the theoretical framework. Section 3 develops the literature review and the hypotheses development. Section 4 describes the research methodology. The empirical outcomes and more robustness tests are presented in Section 5. Section 6 concludes.

2. Theoretical Framework

The Global Reporting Initiative (GRI) standardization framework consists of a framework regulating the format and content of CSR reports according to specific principles and indicators allowing stakeholders to judge the CSR performance of companies (Cycyota and Harrison 2006).

Two theoretical backgrounds are based on the CSR idea. After the Rio summit in 1992, the sustainable development stream was operationalized via the triple bottom line (profit, people, and planet) and CSR stream which is associated to moral and ethical aspects about corporate decision-making and actions.

We will use the following theoretical corpus: upper echelon, legitimacy, and stakeholder, and institutional theories.

The upper echelon theory formulated by Hambrick and Mason (1984), represents a theoretical framework regarding the relationship between the behavioral and cognitive biases of the CEOs and the corporate decisions. According to this theory, organizational outcomes and decision-making are reflected by the values and cognitive traits of the authoritative players in an organization. In this sense, a vast body of literature asserts that powerful organizational actors play a significant role in the explanation of CSR activities (Chen et al. 2019; Lee et al. 2019). In this context, a large body of literature notes that strong organizational actors play an important role in describing CSR operations (Lee et al. 2019; Nour et al. 2020).

Van den Berghe and Louche (2005) proposed that social and political theories (institutional, stakeholder, and legitimacy theories) have more potential than economic theories to provide theoretical insights on CSR operations. The theory of legitimacy or the theory of institutional legitimacy implies that businesses do not operate in isolation from the external world and need a continuous interaction with it and that there is a “social contract” between the business and society.

Therefore, the organization attempt to ensure its functions and survival within the guidelines of the society in which it operates. To gain and maintain legitimacy, firms might engage in CSR activities/reporting. To do so, these firms should decrease the bad news disclosed regarding its situation and raise disclosing good CSR practices.

The group, according to this theory, has a “right-to-know” about some aspects of the company’s corporate operations. Therefore, it should be responsibility-driven rather than demand-driven to reveal information (Lindblom 1983) as it plays an important role in the process of transparency. The role of corporate social reporting is to provide the community at large (all stakeholders) with information regarding the extent to which the firm has met the responsibilities imposed upon it.

In order to fulfil its obligations to its stakeholders, corporations may also participate in environmental, social, and economic practices/reporting. “From an institutional point of view, companies operate with standards, values and taken-for-granted assumptions within a social framework about what constitutes appropriate or acceptable economic behavior” (Goel and Thakor 2008).

This approach represents the sociological aspect of CSR. The total commitment of the organization to its environment, including society, laws, values, and culture leads it to consider an institutionalist perspective of CSR. In spite of the richness of its perspectives, the latter remains dominated by the contract theory and the resulting conception, that of the stakeholders.

3. Literature Review and Hypotheses Development

The real estate industry helps in the implementation of the sustainable development agenda worldwide. In the USA, 38 percent of CO2 emissions, 39 percent of total energy usage, and 68 percent of total electricity consumption are accounted for by the property firms.

According to this role, a sustainability programme for real estate firms must integrate all pertinent, environmental, and social dimensions regarding properties. Primarily driven by the economic dimension, literature provides evidence of the positive intrinsic value of sustainable property (Du and Sen 2016). Nevertheless, a broader understanding of sustainability proposes additional key activities within the company that affect the equilibrium between economic decisions, environmental impacts, and social commitment. That is, by integrating CSR aspects into their plan, real estate firms working in a sustainable way should go further and respond to this growth.

Although the link between CSR engagement and real estate operations seems important, little research has been carried out to examine the reasons behind these activities in real estate companies. Jian and Lee (2015) proposed that the more closely related CSR operations are to the real estate industry, the greater the potential to exploit the wealth and ability of the industry to enhance ethical practices and support the society. Corporate decisions are influenced by CEO behaviors, such as narcissism and overconfidence. A narcissistic leader will display a different response to performance and strive to maximize social praise (Chatterjee and Hambrick 2011; Lin et al. 2019). Compared to their unconfident equivalents (Jiraporn and Chintrakarn 2013), overconfident managers on their part will commit to the business more significantly to CSR.

3.1. CEO Narcissism and CSR Activities

As demonstrated by many recent articles in top organizational behavior journals, narcissism is a very common subject in organizational science (Harms et al. 2011; Grijalva and Harms 2014; Chatterjee and Pollock 2017). Such studies demonstrate the significance of narcissism by defining its association with performance in the workplace. Important evidence suggests that narcissists appear to emerge as leaders and hold positions of authority such as CEO and CFO (Grijalva and Harms 2014).

Several researchers argued that the specific characteristics of CEOs can influence preferences for strategic actions and initiatives, including CSR (Wang and Choi 2013; Hiebl 2014; Lewis and Walls 2014; Peni 2014; Tang et al. 2015; Petrenko et al. 2016). Petrenko et al. (2016) found that some CSR choice could arise from the individual requirements of CEOs to attract media attention and boost their image.

These authors postulate that CSR might not be strategic in such instances. Their work is based on the fundamental statement of the theory of the upper echelon, which postulates that the experiences, beliefs, and personalities of CEOs have a major effect on their perception of status and therefore on their choices, as (Hambrick and Mason 1984) also postulated.

The concept of CSR is defined as the “voluntary managerial actions that seem to promote a social good, beyond the performance of the company and what is required by law” (McWilliams and Siegel 2001; Waddock 2004). Managers who overlook shareholders, have a larger action scope. Their decisions are less common and are consequently more difficult to evaluate than the ordinary managers.

The definition of CSR is described as “voluntary management actions that appear to promote a social good, beyond the company’s interests and what is required by law” (McWilliams and Siegel 2001; Waddock 2004). Managers, who neglect customers, have a broader spectrum of action. Their decisions are less widespread and thus more difficult to test than ordinary executives (Margolis and Walsh 2003; Waldman and Siegel 2008).

The interests and priorities of CEOs control these discretionary decisions and affect the commitment of the company to CSR. In this scenario, the traits of the CEO’s personality prevail (Hambrick and Mason 1984; Chatterjee and Hambrick 2007; Gond et al. 2017). CEOs’ psychological profiles and backgrounds are highly predictive of organizational choices and performance. In reality, top managers’ locus of control (Miller et al. 1982), personality (de Vries and Miller 1985), and charisma (Flynn and Staw 2004) have been shown to imply organizational outcomes.

The findings showed that the strategic dynamism and grandiosity as well as the number and size of acquisitions are positively influenced by a CEO who exhibits a high degree of narcissism and generates intense and fluctuating organizational efficiency. The impact of CEO narcissism on earnings management behavior was investigated by Lin et al. (2019). They find that financial decisions are directly affected by CEO narcissism by engaging in earnings manipulations to reach the three earnings targets (earnings of the previous year, zero earnings, and estimates of analysts) and compensate for their results.

For at least three purposes, CSR initiatives represent an especially important framework for the development of a solution for narcissistic CEOs. First, the CSR program is an excellent way to encourage a social good and facilitate trust by benefiting from the high moral load of socially acceptable behaviors (Bogart et al. 2004). Second, CSR includes audiences who are receptive to meaning in admiration, media coverage, and praise (Wallace and Baumeister 2002). To draw attention, then, a narcissistic CEO will engage in CSR. Finally, CSR provides multiple opportunities to foster status by defining the opportunities that narcissistic CEOs are eager to bring to a concentrated, responsive audience with consistency and variety. By attenuating CSR issues and preventing their emergence, narcissistic CEOs are continuously committed to raising affirmative importance. It is likely that they will participate in constructive CSR programs and prevent negative CSR problems in their firms. Hence, the use of CSR to feed their narcissism (Ernawan and Daniel 2019; Ajaz et al. 2020).

Huang and Li (2019) tested the relationship between CEO narcissism and SOP approvals in German companies based on a non-linear research model while also considering the impact of CSR performance. Ninety-three observations of non-financial German companies over the period 2009–2017 were analyzed. The results of the quadratic research model illustrate that there is no significant association between managerial narcissism and companies with good/bad CSR performance. These studies highlighted a significantly affirmative link between CEO narcissism and CSR activities.

Usually, narcissistic managers go to great lengths to distinguish themselves from other leaders in the workplace. If the CEOs of competing companies are already using the same strategy, their commitments to CSR activities would not bring them the social attention they desire. These narcissistic CEOs can then change their strategy and centralize their resources and efforts towards other decisions likely to produce social attention for them. Therefore, they no longer have an interest in following CEOs of competing companies and they will invest heavily in CSR. Based on the above development and conclusion, the first proposition is as follows:

Hypothesis 1 (H1).

Firms with a more narcissistic CEO engage in CSR activities than firms with a less narcissistic CEO.

3.2. CEO Overconfidence and CSR Activities

A recent literature in corporate behavioral finance was attentive about the impact of managerial overconfidence on firms’ strategic decisions, reporting, and accounting choices (Heaton et al. 2011; Hirshleifer et al. 2012; Chyz et al. 2019; Zahid et al. 2020).

Based on a review of recent research that links the CEO incentives (e.g., compensation contracts) and personal characteristics (CEO overconfidence, values, education, and experience) to CSR activities, we find mixed findings. Jiraporn and Chintrakarn (2013) connected the power of CEO to CSR and found that a powerful CEO has a significantly higher CSR commitment. However, the level of CSR investment declines after the CEO’s power reaches a threshold. McCarthy et al. (2017) investigated the relationship between CEO confidence and firm CSR and they found a negative association. Tetrault Sirsly and Lvina (2019) conducted a review of previous literature on the CEO–CSR link. The evaluated quantitative research has shown a bidirectional association. The relation between how companies report CSR and what corporations execute in terms of CSR was examined by Sauerwald and Su (2019).

The authors argued that this CSR decoupling depends on the CEO’s cognitive biases (i.e., CEO overconfidence) using a sample of S&P 500 firms (2006–2014), they found that CEO overconfidence increases the dichotomy between the optimistic tone of CSR reporting and the firm’s actual corporate social performance. Misangyi and Acharya (2014) examined the association between CSR commitment and empire building using US firms as a sample. Consistent with behavioral traits theory, findings provide that CSR engagement decreases empire building for firms with overconfident CEOs. Using unlisted Polish companies, Hribar and Yang (2016) suggested that overconfident executives are inclined to show higher CSR investment. Therefore, the family’s preference for control can be mitigated by overconfident executives who underestimate the risk of family control and focus on enhancing reputation by acting socially responsible.

Therefore, overconfident executives who underestimate the risk of family influence and concentrate on improving legitimacy by acting socially responsible will minimize the preference of the family for control.

The works listed above are consistent with upper echelon theory which asserts that psychological characteristics of the CEO are critical determinants of strategic decisions and the firm’s outcomes. Therefore, the second hypothesis is as follows:

Hypothesis 2 (H2).

Firms with a more overconfident CEO engage in CSR activities than firms with a less overconfident CEO.

3.3. The Moderating Effect of Corporate Governance Mechanisms on the CEO’s Personality Traits—CSR Activities Relationship

The value of CG lies in its search to develop/continually refine set of laws and contracts flexible corporate activities and to ensure that investor rights are secured, the interests of stakeholders and managers are reconciled, and that an open atmosphere is preserved in which each party can assume its obligations and provide to the growth of the business.

A broader concept of CG, based on ideas from the theory of stakeholders (Freeman 1984), may be “the design of institutions that induce or force management to internalize the welfare of stakeholders,” (Tirole 2001, p. 4). In this context, CG tends to be concerned with maintaining a balance between economic and social objectives and between individual and community objectives and tries to match the interests of firms (Chang et al. 2015; Godos-Díez et al. 2018).

Stakeholders suppose that companies depend on a complex network of interdependent actors who support and add value to the business (Freeman 1984; Alam et al. 2018). CG and CSR commit companies to have moral and financial responsibilities towards stakeholders. These responsibilities are vital for a company to win further support from its shareholders and other partners by earning and maintaining their trust (Page 2005). Similarly, efficient CG and CSR initiatives have slowly but surely been updated from a charitable behavior of corporate entrepreneurship to genuine actions within overall strategies to win the trust of customers and society together. Both strategies are being considered by companies to adjust their business and marketing actions (Beltratti 2005; Marsiglia and Falautano 2005; Calvo and Calvo 2018). The theory of legitimacy, according to Windsor and Preston (1988), suggests that CG and CSR are directly related and define the relations between firm and its internal and external socio-political location. Therefore, the two concepts are more and more corresponding fundamental prerequisites for sustainable expansion. Ho (2005) proved that firm competitiveness is boosted by CG best practices and higher financial performance is thus realized. CSR in turn increases the reliability of a company and strengthens relationships with key stakeholders (Aguilera et al. 2007) which can contribute to decreased transaction costs and improved investor attractiveness (Hancock 2005).

Although the cost-effectiveness of CSR has been assessed controversially (Margolis and Walsh 2003), its role in reducing environmental costs is undeniable. It was also proved to foster innovation capacity, recruitment rates, and the optimistic perception of the company (Hancock 2005; Aguilera et al. 2007; Chaudhary 2017). While short-term costs can be distributed in the implementation of high-quality CG and CSR programs, some studies point to positive results for businesses that are serious about both initiatives (Marsiglia and Falautano 2005; Calvo and Calvo 2018; Nour et al. 2020).

In the French context, Calvo and Calvo (2018) analyzed how the board characteristics can be linked with the CSR and its specific areas. Using a sample of French companies listed on the SBF120 between 2003 and 2016, results clearly show that directors’ diversity is positively linked with firm CSR. In addition, the authors locate that all areas of CSR performance are positively related to large boards, while individual and combined CSR scores are negatively linked to CEO type. The aspects of human rights and CG are positively correlated with gender equity on boards. The age of managers is correlated positively with human capital, human rights, and environmental practices. Furthermore, their findings indicate that outside directors care about the success of CSR. More precisely, the connection of international directors is correlated favorably with environmental success and engagement of the group. Other research by Nour et al. (2020) focused on the behavioral element of governance theory, and using the 2014–2016 annual reports of major French corporations, indicated that CSR is in support of the presence of an institutional director on the corporate board.

In conclusion, we note that a number of preceding studies have endorsed the existence of a close association between corporate governance and social responsibility. Thus, if the CEO behavioral biases, specifically narcissism and overconfidence, have an effect on CSR, we can postulate the existence of a significant impact of CG policy on the effect that the CEO psychological profile can have on CSR. Two hypotheses can thus be formulated:

Hypothesis 3 (H3).

CG mechanisms moderate the relationship between CEO narcissism and CSR activities.

Hypothesis 4 (H4).

CG mechanisms moderate the relationship between CEO overconfidence and CSR activities.

4. Research Methodology

4.1. Sample Selection, Data Collection and Empirical Model

A sample of real estate companies listed on the STOXX Europe 600 index with available data for the post-crisis period will be selected to investigate the impact of CEO behavior on CSR activities and whether this relationship is moderated by CG practices in the European context (from 2010 to 2019).

Further, 420 firm-year findings are covered in the final column. The distribution of the sampled real estate companies between countries is presented in Table 1. The United Kingdom, Sweden, and Germany accounted for about 57 percent of the study.

Table 1.

Sample distribution across countries.

Empirically, we use three regression models to validate our hypotheses (H1 through H4). The considered models are as follows:

CSR is corporate social responsibility. NARC is CEO narcissism. OVC is CEO overconfidence. CGS is corporate governance score. NARC × CGS is the interaction term between CEO narcissism and corporate governance score. OVC × CGS is the interaction term between CEO overconfidence and corporate governance score. SIZE is firm size. AGE is firm age. LEV is leverage ratio. ROA is firm performance. RD is Investment intensity in R&D. The models control for year and country fixed effects.

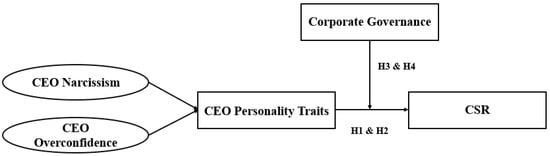

The moderating effect of CGS is detected when the coefficients on and are significant. If the coefficients on and are found to be significant, CGS is a quasi-moderator variable. Figure 1 illustrates the relationship object of this study.

Figure 1.

Research model.

4.2. Measurement: Corporate Social Responsibility Measure (CSR)

Following previous research (Ioannou and Serafeim 2012; Luo et al. 2015; El Ghoul et al. 2017), the CSR score reflects the aggregation of social and environmental performance by measuring their average.

4.2.1. CEO Narcissism Measure (NARC)

Heaton (2002), Aktas et al. (2016) and Capalbo et al. (2018) used a linguistic parameter to evaluate narcissism. Their measure is based on the use of first-person pronoun in the boardroom statement. Another measure was suggested by Chatterjee and Hambrick (2007). Two main criteria were applied for their selection to reflect the CEO’s preference. To consider that the indicator properly reflects the CEO’s personality, it should be significantly under the power of the CEO rather than any other forces. The second important condition is that each indicator should translate one or more aspects of the narcissistic personality. We chose the measure of Chatterjee and Hambrick (2007) as adopted in several recent studies (Tang et al. 2015; Oesterle et al. 2016; Al-Shammari et al. 2019). Please refer to Table 2 for more details about the previous measures of CEO narcissism.

Table 2.

A review of the different CEO narcissism measures.

4.2.2. CEO Overconfidence Measure (OVC)

Recent research has assessed the overconfidence level using several distinct measures (Malmendier and Tate 2005, 2008; Malmendier et al. 2011; Hirshleifer et al. 2012; Schrand and Zechman 2012). Please refer to Table 3 for more details about the previous measures of CEO overconfidence.

Table 3.

A review of the different CEO overconfidence measures.

4.2.3. Corporate Governance Measure (CGS)

In this work, CG is taken into account as a moderator variable between the psychological features of CEOs and CSR. Thomson Reuters’ database measures the CG ranking. This ranking includes five main results: board composition, remuneration systems, board roles, shareholder rights, and vision and strategy (Ferrero et al. 2015; Kouaib and Jarboui 2016).

4.2.4. Control Variables Measures

Firm characteristics can be incorporated as control variables. Therefore, we control for firm size (SIZE), firm age (AGE), leverage ratio (LEV), return on assets (ROA), and R&D investment intensity (RD).

Previous studies confirmed a positive association between the CSR and the firm size (Ikram et al. 2019; Li et al. 2019). This study measured SIZE as the log of total assets to measure firm size. Muttakin et al. (2017) and Ernawan and Daniel (2019) found that firm age affects the CSR activities: the older a firm, the more likely it will undertake some form of social activity. AGE is the number of years since the firm creation. (Li et al. 2019) concluded that debt level is positively linked with CSR. However, Giroud and Mueller (2017) confirmed a negative relationship. We measure LEV as the total debt to total assets.

A positive correlation between the CSR and the ROA business was noticed by researchers (El Guindy and Basuony 2018; Cho et al. 2019; Li et al. 2019). ROA gives an idea of the efficacy of team management in producing profits with company assets (El Guindy and Basuony 2018). ROA is calculated as income before tax divided by total assets. Prior et al. (2008) and Saridakis et al. (2020) noted that there is a substantially higher CSR score for companies with a high R&D rating. We calculate RD as the amount of R&D expenditure split by the total revenue of a given business in a given year (Prior et al. 2008). In addition, we check fixed effects for the year and the county.

5. Empirical Analysis and Results Discussion

5.1. Descriptive Statistics

Table 4 reports summary statistics. The average score for overall CSR in the sampled firms is 78.12%. Therefore, real estate firms are socially responsible during the sampling period. The average of the narcissism index is 0.09. This means that the level of CEOs narcissism in the sample is high. The OVC variable shows that the average CEO’s level of overconfidence is 0.75, which is also high. The average score for total CSR in the sampled businesses is 78.12 percent. Table 4 reports summary statistics. During the sampling period, real estate companies are also socially responsible. The index average for narcissism is 0.09. This implies that the degree of narcissism of the CEOs in the sample is high. The OVC variable indicates that the degree of over-confidence of the average CEO is 0.75, which is also high. Regarding the moderator variable, the range of the CGS is 0.70.

Table 4.

Descriptive statistics.

This illustrates that, overall, the businesses sampled have strong governance system. This result is identical to the (Di Giuli and Kostovetsky 2014) results.

In the real estate super-sectors, an average corporate governance index of 72.3 percent is reported. The presence of certain real estate firms that do not have good quality governance may clarify this. A 10 percent average ROA and a debt ratio of 24.53 for the control variables. This means that, for EUR 100 in cash, European real-estate companies have a profit of, on average, EUR 10.

5.2. Tests on Panel Data

Table 5 presents the Pearson’s correlation coefficients among the different explanatory variables. Further, all VIF values presented in the same Table, are less than 2. These results indicate the absence of the multicollinearity problem in our panel data.

Table 5.

Pearson matrix.

Second, we search for heteroscedasticity of the panel stage using the Breusch–Pagan test (1979). For the three versions, the test generates a statistically significant Chi-square for (Table 6). The null hypothesis of constant variation has therefore been dismissed, confirming the existence of the problem of heteroscedasticity.

Table 6.

Empirical results (#Obs. 450).

Third, using the test proposed by Wooldridge, we test for potential serial correlation in the idiosyncratic error term in our panel results (2002). As shown in Table 6, for the three versions, the test shows a statistically relevant F-test at a 5 percent level. Therefore, findings suggest that data include intra-person first-order autocorrelation. As we conclude that heteroscedasticity and first-order autocorrelation issues occur in our panel results, we use the FGLS estimation method to correct linear regression assumptions for such violations. Fourth, we check the reality of individual impacts. As we conclude that heteroscedasticity and first-order autocorrelation issues occur in our panel results, we use the FGLS estimation method to correct linear regression assumptions for such violations. As shown in Table 6, at the 1 percent threshold for the three regressions, the Fisher test is important. This validates the importance of the particular fixed effects (Balestra 1992). This outcome allows H0 to be dismissed and the alternative hypothesis to be accepted: the existence of fixed individual effects. Furthermore, for all models that confirm the importance of random individual effects, the Breusch and Pagan LM test (1980) is important at the 1 percent threshold. H0 (absence of random individual effects) is thus dismissed and the alternative hypothesis is accepted (presence of random individual effects). Finally, the Hausman test is performed to distinguish between set and random models. The standard test for specifying individual effects is this test. For all regressions, the outcome of this test is substantial. We apply the specification to fixed results, therefore.

5.3. Hypotheses Validation

The results from the effect of the CEO behaviors on CSR activities are presented in Panel A from Table 6. Narcissistic CEOs narcissism is found to be positively ( = 0.15) and significantly (at 1% level) associated with the level of CSR activities. Therefore, narcissistic CEOs focus on activities associated with CSR forces, exploit success personally, and orient social praise to improving their public image. Our finding is consistent with the research of Chatterjee and Hambrick (2007, 2011) and Petrenko et al. (2016). Further, it is found that CSR activities significantly increase with the level of CEO overconfidence ( = 0.18). This can be linked with the narcissistic personality of the CEOs. This result contradicts McCarthy et al. (2017). Regarding the control variables, we found a positive and significant relationship (SIZE = 0.16, AGE = 0.03, and ROA = 0.08) with CSR. Certainly, pursuant to the result of Chih et al. (2010), firm size is positively linked with corporate social responsibility performance. In addition, large real estate create a center of attention of a range of partners as they react to stakeholders’ CSR demand. However, a negative relationship between CSR and LEV is found ( = −0.06). This is consistent with earlier empirical findings that CSR has strategic implications (McWilliams and Siegel 2001; Jo and Harjoto 2012). These outcomes confirm H1 and H2.

Panel B from Table 6 presents the results of the impact of CG elements as measured by the CGS on the CEO characteristics–CSR activities relationship. The interaction term NARC × CGS is significantly negative (−0.24, 1% level). Such consequence postulates that appropriate performance of CG mechanisms can influence managers’ decisions and thus mitigate the result of CEO quality. Therefore, H3 where CG moderates the association between managerial narcissism and CSR activities is confirmed. High-quality CG practices can moderate the consequences of behavioral and cognitive biases. It thus makes it possible to mitigate the behavioral impact that negatively influences the loyalty of the CEO to CSR activities.

Panel C from Table 6 presents the results of the impact of CG elements (CGS) on the CEO characteristics–CSR activities link. The interaction term OVC × CGS is significantly positive (0.21, 5% level). This finding suggests that good performance of CG mechanisms can affect managers’ decisions and thus mitigate the effect of CEO quality. Therefore, H4 suggesting that CG moderates the association between managerial overconfidence and corporate social performance is confirmed. Therefore, good CG practices will raise the self-possession of CEOs, and make easy planned executive as well as the loyalty to CSR with lucidity rather unethical behavior. Our finding is consistent with the theory of legitimacy based on the premise that the organization functions in society through a social contract in which it participates in carrying out different social acts in return for accepting its ultimate survival.

Therefore, the over-confident CEO must reveal to society adequate social information to show that he is a respectable citizen.

5.4. Robustness Check

The sample appears to be dominated by three nations. Around 57% of the sample came from the United Kingdom, Sweden, and Germany (240 firm-year observation). We re-estimated the three models using the 240 observations in another supplementary examination. The findings shown in Table 7 are identical to those stated previously in the initial estimate.

Table 7.

First robustness test (#Obs. 280).

GRI gathers organizations ‘sustainable development studies. It seeks to resolve the reliability and consistency of CSR disclosure with a high view of appreciation and to harmonize and normalize CSR reporting across organizational and national limitations. Lately, GRI is a recommended reference framework for reporting under the new European directive, especially in France. This makes France a case apart in the context of current CSR policies. Therefore, we check the robustness of our models within French real estate companies (50 firm-year observation). According to Table 8, we achieve the same conclusion and inferences stay unchanged.

Table 8.

Second robustness test (#Obs. 60).

6. Conclusions

Although the relationship between CSR and real estate investment appears to be important, the determinants of corporate social responsibility processes in real estate companies have not been largely addressed.

There is no single study carried out in the post-financial crisis era to clarify the CSR practices of the real estate industry using behavioral finance and CG to the best of the writers’ knowledge. This research is the first to provide an ample overview of corporate social responsibility activities in the European real estate industry. The purpose of this study was to examine, on the one hand, the influence of CEO behavior on the engagement of real estate companies with CSR activities and, on the other hand, the moderating effect of CG on the liaison between CSR and these quality. Results propose that the CEO’s behaviors influence corporate decisions, especially the level of CSR investment. The findings also suggested that effective CG mechanisms can impact the behavior of CEOs and consequently moderate the impact of their cognitive and behavioral biases. This result suggests that in such a context of best CG practices in which the company avoids information asymmetry problem, the CEO is in a secure situation that will amplify their confidence and capacity, and support them to connect in CSR performance. The approval of the moderation investigation is certified to emphasize the significance of the function played by the CG system. This may possibly provide an innovative perspective for understanding the relationship of the CEOs’ characteristics with CSR activities. Implications of theory and method may be drawn. First, by discussing the clarifying aspect of the CSR plan and researching the relation between this contract and the consistency of corporate governance, this research contributes to the improvement of the current literature. Certainly, this revision scrutinizes the connection between CEO behavior and CSR in light of the CG theory. In the Anglo-Saxon and Japanese contexts, research work on this topic is diverse. Meanwhile, studies dealing with the moderating effects of CG on the relation between CEO characteristics and CSR policy are still very little studied in the European context.

Second, our donation lies in incorporating a moderator variable. The exploration of this line of research is relevant insofar as the adoption of the moderating variable methodology allowed us to highlight the role played by the CG elements. This could provide a new perspective for understanding the relationship between top executives’ personality traits and CSR. Second, our contribution lies in the inclusion of a variable moderator. To the degree that the adoption of the moderating variable methodology allowed us to highlight the role played by the CG elements, the exploration of this line of research is important. This could offer a fresh insight for understanding the relationship between personality characteristics of top executives and CSR.

Globally, the results of this study reveal the personal dimensions of CEOs as well as their attitude towards corporate social responsibility activities in the real estate industry.

In fact, the given results demonstrate that CSR is biased due to the influence of executive perception and its personal objective, so this corporate social responsibility policy must be redesigned to incorporate the potential mechanical and substantive conflict consequences. The analysis proves that individual characteristics influence a manager’s behavior in general and his perception of corporate social responsibility in particular. It is also known that the priority of senior executives appears to be oriented towards corporate sustainability, which is a major issue for developing corporate social responsibility.

The current study confirms that CSR corresponds to the representation that everyone has of his own interest and that meets the expectations of all stakeholders. Our research coincides with the study conducted in 2016 by the consulting firm Bain & Company showing that convincing the CEO is the first step to successfully deploy CSR strategy. So how does the company convince the CEO to better integrate CSR into business transformation?

In order to better understand the studied relationship and shed light on this significant research area, further work is needed. Future research will influence demographic factors such as recompense, age, gender, and educational level for the CEO for a better understanding of CSR. In addition, describing how CG processes can play an effective and moderating role in the relationship between the characteristics of the CEO and the activities of CSR separately.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest.

References

- Abatecola, Gianpaolo, Andrea Caputo, and Matteo Cristofaro. 2018. Reviewing Cognitive Distortions in Managerial Decision Making. Toward an Integrative Co-Evolutionary Framework. Journal of Management Development 37: 409–24. [Google Scholar] [CrossRef]

- Aguilera, Ruth V., Deborah E. Rupp, Cynthia A. Williams, and Jyoti Ganapathi. 2007. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Academy of Management Review 32: 836–63. [Google Scholar] [CrossRef]

- Ajaz, Aiman, Zhou Shenbei, and Muddassar Sarfraz. 2020. Delineating the Influence of Boardroom’s Gender Diversity on Corporate Social Responsibility, Firm’s Financial Performance, and Reputation. LogForum 16: 61–74. [Google Scholar]

- Aktas, Nihat, Eric Bodt, Helen Bollaert, and Richard Roll. 2016. CEO Narcissism and the Takeover Process: From Private Initiation to Deal Completion. Journal of Financial and Quantitative Analysis 51: 113–37. [Google Scholar] [CrossRef]

- Alam, Zinat S., Mark A. Chen, Conrad S. Ciccotello, and Harley E. Ryan. 2018. Board structure mandates: Consequences for director location and financial reporting. Management Science 64: 4735–54. [Google Scholar]

- Al-Shammari, Marwan, A. Rasheed, and Hussam A. Al-Shammari. 2019. CEO narcissism and corporate social responsibility: Does CEO narcissism affect CSR focus? Journal of Business Research 104: 106–17. [Google Scholar] [CrossRef]

- Andreou, Panayiotis C., John A. Doukas, Demetris Koursaros, and Christodoulos Louca. 2019. Valuation effects of overconfident CEOs on corporate diversification and refocusing decisions. Journal of Banking & Finance 100: 182–204. [Google Scholar]

- Balestra, Pietro. 1992. Fixed Effect Models and Fixed Coefficient Models. In The Econometrics of Panel Data. Advanced Studies in Theoretical and Applied Econometrics. Edited by L. Mátyás and P. Sevestre. Dordrecht: Springer, vol. 28. [Google Scholar] [CrossRef]

- Beltratti, Andrea. 2005. The complementarily between corporate governance and corporate social responsibility. Geneva Papers on Risk and Insurance 30: 373–86. [Google Scholar] [CrossRef]

- Ben Mohamed, Ezzeddine, and Mohammed A. Shehata. 2017. R&D investment–cash flow sensitivity under managerial optimism. Journal of Behavioral and Experimental Finance 14: 1–4. [Google Scholar]

- Ben Mohamed, Ezzeddine, Amel Baccar, and Abdelfatteh Bouri. 2013. Investment Cash Flow Sensitivity and Managerial Optimism: A Literature Review Via the Classification Scheme Technique. Review of Finance and Banking 5. [Google Scholar] [CrossRef]

- Bogart, Laura M., Eric G. Benotsch, and Jelena D. Pavlovic. 2004. Feeling superior but threatened: The relation of narcissism to social comparison. Basic and Applied Social Psychology 26: 35–44. [Google Scholar] [CrossRef]

- Buyl, Tine, Christophe Boone, and James B. Wade. 2019. CEO narcissism, risk-taking, and resilience: An empirical analysis in US commercial banks. Journal of Management 45: 1372–400. [Google Scholar] [CrossRef]

- Calvo, Nuria, and Flora Calvo. 2018. Corporate Social Responsibility and Multiple Agency Theory: A case study of internal stakeholder engagement. Corporate Social Responsibility and Environmental Management 25: 1223–30. [Google Scholar] [CrossRef]

- Capalbo, Francesco, Alex Frino, Ming Ying Lim, Vito Mollica, and Riccardo Palumbo. 2018. The impact of CEO narcissism on earnings management. Abacus 54: 210–26. [Google Scholar] [CrossRef]

- Chang, Chen Shan, Shang Wu Yu, and Cheng Huang Hung. 2015. Firm risk and performance: The role of corporate governance. Review of Managerial Science 9: 141–73. [Google Scholar] [CrossRef]

- Chatterjee, Arijit, and Donald C. Hambrick. 2007. It’s all about me: Narcissistic CEOs and their effects on company strategy and performance. Administrative Science Quarterly 52: 351–86. [Google Scholar] [CrossRef]

- Chatterjee, Arijit, and Donald C. Hambrick. 2011. Executive personality, capability cues, and risk taking: How Narcissistic CEOs react to their successes and stumbles. Administrative Science Quarterly 56: 202–37. [Google Scholar] [CrossRef]

- Chatterjee, Arijit, and Timothy G. Pollock. 2017. Master of puppets: How narcissistic CEOs construct their professional worlds. Academy of Management Review 42: 703–25. [Google Scholar] [CrossRef]

- Chaudhary, Richa. 2017. Corporate social responsibility and employee engagement: Can CSR help in redressing the engagement gap? Social Responsibility Journal 13: 323–38. [Google Scholar] [CrossRef]

- Chen, Jie, Woon Sau Leung, Wei Song, and Marc Goergen. 2019. Why female board representation matters: The role of female directors in reducing male CEO overconfidence. Journal of Empirical Finance 53: 70–90. [Google Scholar] [CrossRef]

- Chih, Hsiang Lin, Hsiang Hsuan Chih, and Tzu Yin Chen. 2010. On the Determinants of Corporate Social Responsibility: International Evidence on the Financial Industry. Journal of Business Ethics 93: 115–35. [Google Scholar] [CrossRef]

- Cho, Sang Jun, Chune Young Chung, and Jason Young. 2019. Study on the Relationship between CSR and Financial Performance. Sustainability 11: 343. [Google Scholar] [CrossRef]

- Choi, Jun Hyeok, Saerona Kim, and Ayoung Lee. 2020. CEO Tenure, Corporate Social Performance, and Corporate Governance: A Korean Study. Sustainability 12: 99. [Google Scholar] [CrossRef]

- Choi, Paul Moon Sub, Chune Young Chung, and Chang Liu. 2018. Self-attribution of overconfident CEOs and asymmetric investment-cash flow sensitivity. The North American Journal of Economics and Finance 46: 1–14. [Google Scholar] [CrossRef]

- Chyz, James A., Fabio B. Gaertner, Asad Kausar, and Luke Watson. 2019. Overconfidence and corporate tax policy. Review of Accounting Studies 24: 1114–45. [Google Scholar] [CrossRef]

- Commission of the European Communities. 2001. A Sustainable Europe for a Better World: A European Union Strategy for Sustainable Development. Luxembourg: Commission of the European Communities. [Google Scholar]

- Cycyota, Cynthia S., and David A. Harrison. 2006. What (not) to expect when surveying executives: A meta-analys is of top manager response rates and techniques over time. Organizational Research Methods 9: 133–60. [Google Scholar] [CrossRef]

- de Vries, Manfred FR Kets, and Danny Miller. 1985. Narcissism and leadership: An object relations perspective. Human Relations 38: 583–601. [Google Scholar] [CrossRef]

- Di Giuli, Alberta, and Leonard Kostovetsky. 2014. Are red or blue companies more likely to go green? Politics and corporate social responsibility. Journal of Financial Economics 111: 158–80. [Google Scholar] [CrossRef]

- Du, Shuili, and Sankar Sen. 2016. Challenging Competition with CSR: Going Beyond the Marketing Mix to Make a Difference. GfK Marketing Intelligence Review 8: 18–23. [Google Scholar] [CrossRef]

- El Ghoul, Sadok, Omrane Guedhami, and Yongtae Kim. 2017. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies 48: 360–85. [Google Scholar] [CrossRef]

- El Guindy, Medhat N., and Mohamed A. Basuony. 2018. Audit Firm Tenure and Earnings Management: The Impact Of Changing Accounting Standards In UK Firms. The Journal of Developing Areas 52: 167–81. [Google Scholar] [CrossRef]

- Engelen, Andreas, Christoph Neumann, and Susanne Schmidt. 2016. Should entrepreneurially oriented firms have narcissistic CEOs? Journal of Management 42: 698–721. [Google Scholar] [CrossRef]

- Ernawan, Kadek, and Debby Ratna Daniel. 2019. The Influence of CEO Narcissism on Corporate Social Responsibility Disclosure. Journal Akuntansi 23: 253–68. [Google Scholar]

- Fama, Eugene F., and Kenneth R. French. 1997. Industry costs of equity. Journal of Financial Economics 43: 153–93. [Google Scholar] [CrossRef]

- Ferrero, Ferrero Idoya, F. Angeles Izquierdo, and María Jesús Torres. 2015. Integrating sustainability into corporate governance: An empirical study on board diversity. Corporate Social Responsibility and Environmental Management 22: 193–207. [Google Scholar] [CrossRef]

- Flynn, Francis J., and Barry M. Staw. 2004. Lend me your wallets: The effect of charismatic leadership on external support for an organization. Strategic Management Journal 25: 309–30. [Google Scholar] [CrossRef]

- Freeman, Robert Edward. 1984. Strategic Management: A Stakeholder Approach. Boston: Pi Iman. [Google Scholar]

- Fung, Hung Gay, Penghua Qiao, Jot Yau, and Yuping Zeng. 2020. Leader narcissism and outward foreign direct investment: Evidence from Chinese firms. International Business Review 29: 101–632. [Google Scholar] [CrossRef]

- Giroud, Xavier, and Holger M. Mueller. 2017. Firm leverage, consumer demand, and employment losses during the Great Recession. The Quarterly Journal of Economics 132: 271–316. [Google Scholar] [CrossRef]

- Godos-Díez, José-Luis, L. Cabeza-García, Daniel Alonso-Martínez, and Roberto Fernández-Gago. 2018. Factors influencing board of directors’ decision-making process as determinants of CSR engagement. Review of Managerial Science 12: 229–53. [Google Scholar] [CrossRef]

- Goel, Anand M., and Anjan V. Thakor. 2008. Overconfidence, CEO selection, and corporate governance. The Journal of Finance 63: 2737–84. [Google Scholar] [CrossRef]

- Gond, Jean-Pascal, A. El Akremi, Valrie Swaen, and Nishat Babu. 2017. The psychological micro foundations of corporate social responsibility: A person-centric systematic review. Journal of Organizational Behavior 38: 225–46. [Google Scholar] [CrossRef]

- Grijalva, Emily, and Peter D. Harms. 2014. Narcissism: An integrative synthesis and dominance complementarity model. The Academy of Management Perspectives 28: 108–27. [Google Scholar] [CrossRef]

- Hambrick, Donald C., and Phyllis A. Mason. 1984. Upper echelons: The organization as a reflection of its top managers. Academy of Management Review 9: 193–206. [Google Scholar] [CrossRef]

- Hancock, Kerri. 2005. Employee engagement partnerships: Can they contribute to the development of an integrated CSR culture. Partnership Matters: Current Issues in Cross-Sector Collaboration 3: 17–20. [Google Scholar]

- Harms, Peter D., Seth M. Spain, and Sean T. Hannah. 2011. Leader development and the dark side of personality. Leadership Quarterly 22: 495–509. [Google Scholar] [CrossRef]

- Heaton, James B. 2002. Managerial optimism and corporate finance. Financial Management 31: 33–45. [Google Scholar] [CrossRef]

- Heaton, James B., Simon Gervais, and Terrance Odean. 2011. Overconfidence, Compensation Contracts, and Capital Budgeting. The Journal of Finance 66: 1735–77. [Google Scholar]

- Hiebl, Martin. R. 2014. Upper echelons theory in management accounting and control research. Journal of Management Control 24: 223–40. [Google Scholar] [CrossRef]

- Hirshleifer, David, Angie Low, and Siew Hong Teoh. 2012. Are Overconfident CEOs Better Innovators? The Journal of Finance 67: 1457–98. [Google Scholar] [CrossRef]

- Ho, Chi-Kun. 2005. Corporate governance and corporate competitiveness: An international analysis. Corporate Governance: An International Review 13: 211–53. [Google Scholar] [CrossRef]

- Hribar, Paul, and Holly Yang. 2016. CEO overconfidence and management forecasting. Contemporary Accounting Research 33: 204–27. [Google Scholar] [CrossRef]

- Huang, Ying Sophie, and Mengyu Li. 2019. Are overconfident executives alike? overconfident executives and compensation structure: Evidence from China. The North American Journal of Economics and Finance 48: 434–49. [Google Scholar] [CrossRef]

- Ikram, Atif, Zhichuan Frank Li, and Dylan Minor. 2019. CSR-contingent executive compensation contracts. Journal of Banking & Finance, 105–655. [Google Scholar] [CrossRef]

- Ioannou, Ioannis, and Geogre Serafeim. 2012. What drives corporate social performance? The role of nation-level institutions. Journal of International Business Studies 43: 834–64. [Google Scholar] [CrossRef]

- Jamali, Dima, Mona Zanhour, and Tamar Keshishian. 2008. Peculiar strengths and relational attributes of SMEs in the context of CSR. Journal of Business Ethics 87: 355–77. [Google Scholar] [CrossRef]

- Jian, Ming, and Kin-Wai Lee. 2015. CEO compensation and corporate social responsibility. Journal of Multinational Financial Management 29: 46–65. [Google Scholar] [CrossRef]

- Jiraporn, Pornsit, and Pandej Chintrakarn. 2013. How do powerful CEOs view corporate social responsibility (CSR)? An empirical note. Economics Letters 119: 344–47. [Google Scholar] [CrossRef]

- Jo, Hoje, and Maretno A. Harjoto. 2012. The causal effect of corporate governance on corporate social responsibility. Journal of Business Ethics 106: 53–72. [Google Scholar] [CrossRef]

- Kendall, Nigel. 1999. Good Corporate Governance. London: Accountants Digest. [Google Scholar]

- Kim, Bora, Seoki Lee, and Kyung Ho Kang. 2018. The moderating role of CEO narcissism on the relationship between uncertainty avoidance and CSR. Tourism Management 67: 203–13. [Google Scholar] [CrossRef]

- Koellinger, Philipp, Maria Minniti, and Christian Schade. 2007. I think I can, I think I can”: Overconfidence and entrepreneurial behavior. Journal of Economic Psychology 28: 502–27. [Google Scholar] [CrossRef]

- Konrath, Sara, Brain P. Meier, and Brad J. Bushman. 2014. Development and validation of the single item narcissism scale (SINS). PLoS ONE 9: e103469. [Google Scholar] [CrossRef]

- Kouaib, Amel, and Anis Jarboui. 2016. The moderating effect of CEO profile on the link between cutting R&D expenditures and targeting to meet/beat earnings benchmarks. The Journal of High Technology Management Research 27: 140–60. [Google Scholar]

- Lee, Jin-Ping, Edward M. Lin, James Juichia Lin, and Yang Zhao. 2019. Bank systemic risk and CEO overconfidence. The North American Journal of Economics and Finance. forthcoming. [Google Scholar] [CrossRef]

- Lewis, Ben W., and Judith L. Walls. 2014. Difference in degrees: CEO characteristics and firm environmental disclosure. Strategic Management Journal 35: 712–22. [Google Scholar] [CrossRef]

- Li, Jialong, Zulfiquer Ali Haider, Xianzhe Jin, and Wenlong Yuan. 2019. Corporate controversy, social responsibility and market performance: International evidence. Journal of International Financial Markets, Institutions and Money 60: 1–18. [Google Scholar] [CrossRef]

- Lin, Fengyi, Sheng-Wei Lin, and Wen Chang Fang. 2019. How CEO narcissism affects earnings management behaviors. The North American Journal of Economics and Finance. forthcoming. [Google Scholar] [CrossRef]

- Lindblom, C. K. 1983. The Concept of Organizational Legitimacy and its Implications for Corporate Social Responsibility Disclosure. American Accounting Association Public Interest Section, 220–21. [Google Scholar]

- Luo, Xueming, Heli Wang, Sascha Raithel, and Qinglin Zheng. 2015. Corporate social performance, analyst stock recommendations, and firm future returns. Strategic Management Journal 36: 123–36. [Google Scholar] [CrossRef]

- Malmendier, Ulrike, and Geoffrey Tate. 2005. CEO overconfidence and corporate investment. The Journal of Finance 60: 2661–700. [Google Scholar] [CrossRef]

- Malmendier, Ulrike, and Geoffrey Tate. 2008. Who makes acquisitions? CEO overconfidence and the market’s reaction. Journal of Financial Economics 89: 20–43. [Google Scholar] [CrossRef]

- Malmendier, Ulrike, Geoffrey Tate, and Jon Yan. 2011. Overconfidence and early-life experiences: The effect of managerial traits on corporate financial policies. The Journal of Finance 66: 1687–733. [Google Scholar] [CrossRef]

- Manner, Mikko H. 2010. The impact of CEO characteristics on corporate social performance. Journal of Business Ethics 93: 53–72. [Google Scholar] [CrossRef]

- Margolis, Joshua D., and James P. Walsh. 2003. Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly 48: 268–305. [Google Scholar] [CrossRef]

- Marsiglia, Emanuele, and Isabella Falautano. 2005. Corporate social responsibility and sustainability challenges for a Bancassurance Company. The Geneva Papers 30: 485–97. [Google Scholar] [CrossRef]

- McCarthy, Scott, Barry Oliver, and Sizhe Song. 2017. Corporate social responsibility and CEO confidence. Journal of Banking and Finance 75: 280–91. [Google Scholar] [CrossRef]

- McWilliams, Abagail, and Donald Siegel. 2001. Corporate social responsibility: A theory of the firm perspective. Academy of Management Review 26: 117–27. [Google Scholar] [CrossRef]

- Miller, Danny, Manfred F. R. Kets De Vries, and Jean-Marie Toulouse. 1982. Top Executive Locus of Control and Its Relationship to Strategy-Making, Structure, and Environment. The Academy of Management Journal 25: 237–53. [Google Scholar]

- Misangyi, Vilmos F., and Abhijith G. Acharya. 2014. Substitutes or complements? A configurational examination of corporate governance mechanisms. Academy of Management Journal 57: 1681–705. [Google Scholar] [CrossRef]

- Muttakin, Mohammad Badrul, Arifur Khan, and Dessalegn Getie Mihret. 2017. Business group affiliation, earnings management and audit quality: Evidence from Bangladesh. Managerial Auditing Journal 32: 427–44. [Google Scholar] [CrossRef]

- Nour, Abdulnaser Ibrahim, Abdel-Aziz Ahmad Sharabati, and Khitam Mahmoud Hammad. 2020. Corporate Governance and Corporate Social Responsibility Disclosure. International Journal of Sustainable Entrepreneurship and Corporate Social Responsibility (IJSECSR) 5: 20–41. [Google Scholar] [CrossRef]

- O’Reilly, Charles A., III, and Bernadette Doerr. 2020. Conceit and deceit: Lying, cheating, and stealing among grandiose narcissists. Personality and Individual Differences 154: 109–627. [Google Scholar] [CrossRef]

- Oesterle, Michael-Jörg, Corinna Elosge, and Lukas Elosge. 2016. Me, myself and I: The role of CEO narcissism in internationalization decisions. International Business Review 25: 1114–23. [Google Scholar] [CrossRef]

- Park, Kyung-Hee, Jinho Byun, and Paul Moon Sub Choi. 2020. Managerial Overconfidence, Corporate Social Responsibility Activities, and Financial Constraints. Sustainability 12: 61. [Google Scholar] [CrossRef]

- Peni, Emilia. 2014. CEO and chairperson characteristics and firm performance. Journal of Management and Governance 18: 185–205. [Google Scholar] [CrossRef]

- Petrenko, Oleg V., Federico Aime, Jason Ridge, and Aaron Hill. 2016. Corporate social responsibility or CEO narcissism? CSR motivations and organizational performance. Strategic Management Journal 37: 262–79. [Google Scholar] [CrossRef]

- Prior, Helmut, Ariane Schwarz, and Onur Güntürkün. 2008. Mirror-induced behavior in the magpie (Pica pica): Evidence of self-recognition. PLoS Biology 6: e202. [Google Scholar] [CrossRef]

- Raskin, Robert, and Howard Terry. 1988. A principal-components analysis of the narcissistic personality inventory and further evidence of its construct validity. Journal of Personality and Social Psychology 54: 890–902. [Google Scholar] [CrossRef]

- Saridakis, Charalampos, Sofia Angelidou, and Arch G. Woodside. 2020. What type of CSR engagement suits my firm best? Evidence from an abductively-derived typology. Journal of Business Research 108: 174–87. [Google Scholar] [CrossRef]

- Sauerwald, Steve, and Weichieh Su. 2019. CEO Overconfidence and CSR Decoupling (July 2019). Corporate Governance: An International Review 27: 283–300. [Google Scholar] [CrossRef]

- Schrand, Catherine, and Sarah Zechman. 2012. Executive overconfidence and the slippery slope to financial misreporting. Journal of Accounting and Economics 53: 311–29. [Google Scholar] [CrossRef]

- Tang, Yi, Cuili Qian, Guoli Chen, and Rui Shen. 2015. How CEO hubris affects corporate social (ir)responsibility: CEO hubris and CSR. Strategic Management Journal 36: 1338–57. [Google Scholar] [CrossRef]

- Tetrault Sirsly, Carol-Ann, and Elena Lvina. 2019. From doing good to looking even better: The dynamics of CSR and reputation. Business & Society 58: 1234–66. [Google Scholar]

- Tirole, Jean. 2001. Corporate governance. Econometrica 69: 1–35. [Google Scholar] [CrossRef]

- Vaccaro, Annemarie, Ezekiel W. Kimball, Adam M. Moore, Barbara M. Newman, and Peter F. Troiano. 2018. College students with disabilities narrating an emerging sense of purpose: A grounded theory model. Journal of College Student Development 59: 37–54. [Google Scholar] [CrossRef]

- Van den Berghe, Lutgrat, and Celine Louche. 2005. The link between corporate governance and corporate social responsibility in insurance. The Geneva Papers 30: 425–42. [Google Scholar] [CrossRef]

- Van der Linden, Sander, and Seth A. Rosenthal. 2016. Measuring narcissism with a single question? A replication and extension of the Single-Item Narcissism Scale (SINS). Personality and Individual Differences 90: 238–41. [Google Scholar] [CrossRef]

- Waddock, Sandra. 2004. Parallel universes: Companies, academics and the progress of corporate citizenship. Business and Society Review 109: 5–42. [Google Scholar] [CrossRef]

- Waldman, David, and Donald Siegel. 2008. Defining the socially responsible leader. Leadership Quarterly 19: 117–31. [Google Scholar] [CrossRef]

- Wallace, Harry M., and Roy F. Baumeister. 2002. The performance of narcissists rises and falls with perceived opportunity for glory. Journal of Personality and Social Psychology 82: 819–34. [Google Scholar] [CrossRef] [PubMed]

- Wang, Heli, and Jaepil Choi. 2013. A new-look at the corporate social-financial performance relationship: The moderating roles of temporal and interdomain consistency in corporate social performance. Journal of Management 39: 416–41. [Google Scholar] [CrossRef]

- Windsor, Duane, and Lee Preston. 1988. Corporate Governance, Social Policy and Social Performance in the Multinational Corporation. Research in Corporate Social Performance and Policy 10: 45–58. [Google Scholar]

- Zahid, Muhammad, Haseeb Ur Rahman, Wajahat Ali, Musa Khan, Majed Alharthi, Muhammad Imran Qureshi, and Amin Jan. 2020. Boardroom Gender Diversity: Implications for Corporate Sustainability Disclosures in Malaysia. Journal of Cleaner Production 224: 118683. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).