1. Introduction

The Sustainable Development Goals include parallel efforts to boost economic growth and make decisions on a range of education, health, social protection, and employment issues. Achieving Sustainable Development Goals also involves addressing the economic and social issues that come with an aging population. The growth in the elderly population has produced one of the most significant transformations of society during the 21st century and represents a serious challenge on a global scale. Globally, the share of the population aged 65 years or over increased from 6% in 1990 to 9% in 2019. That proportion is projected to rise further to 16% in 2050, when it is expected that one in six people worldwide will be aged 65 years or over (

United Nations 2020a).

Since the last quarter of the 20th century, worldwide, including in Russia, population aging has been perceived primarily as a threat to the stability of pension systems and healthcare systems, a brake on labor productivity and economic development, and a source of a systemic crisis in states with a developed social policy. For this reason, researchers are focusing on the economic and fiscal implications of aging. We are witnessing an exaggerated shift of reforms in Russia towards the search for opportunities to keep the elderly in the labor market and sources of savings in the pension system and the healthcare system. Meanwhile, at the international level, there is growing recognition of the change in the stereotypical perception of older people in society from a “burden” to a social resource that opens up new opportunities in the spheres of consumption, lifestyle and quality of life, education, and economic, social, and political activity. These conclusions make it possible to move away from the narrow fiscal and “crisis” interpretation of aging to the perception of it as a source of new opportunities for socio-economic growth in general through the development of the “silver economy”.

The concept of the “silver economy” emerged in connection with the aging population in western Europe. In the developed countries of Europe, the absolute and structural increase in the number of elderly people and their ability to pay led to the formation of demand for new products and services aimed at improving the quality of life in old age. In 2005, the term “silver economy” was used for the first time at the official level by the European Commission at a conference on the aging of the population in Germany.

An unambiguous approach to and a clear definition of the term “silver economy” have yet to be developed, which indicates the complexity of this concept. Initially, it was associated with certain aspects of the “silver economy” that derived from the personal, often subjective, approach of the authors. Norbert Meiners gave an extensive list of definitions (

Meiners 2014). His conclusions are based on a review of scientific articles published between 1964 and 2013. Andrzej Klimczuk’s definition of the economics of aging is worth noting (

Klimczuk 2016). It is consistent with the definition of the economy of aging given in a study conducted by the Technopolis Group in partnership with Oxford Economics and commissioned by the European Commission to support the development of the “silver economy” in Europe (

European Commission 2018). In these studies, the “silver economy” is seen as part of the overall economy that meets the needs and demands of older people. The “silver economy” is defined as the sum of all economic activity that caters to the needs of people aged 50 and over, including the products and services they buy directly and the further economic activity that these costs generate.

In this study, we assessed the conditions under which the “silver economy” in Russia functions, identified the constraints on its growth, and developed recommendations for their elimination to achieve Sustainable Development Goals. We performed a number of tasks to achieve the research goal. We checked for the presence of demographic conditions for the “silver economy” in Russia, studied the income of the elderly population of Russia and the sources of this income, and evaluated Russian pensioners’ experience of participating in voluntary and mandatory funded pension programs. This article is structured as follows. In

Section 2, we identify the conditions for the growth of the “silver economy” in Russia based on theoretical and empirical works. In

Section 3, we present our algorithm, methods of research, and sources of information and data and justify the time horizon of the study. We apply the research algorithm in

Section 4 and discuss the results in

Section 5. In

Section 6, we summarize the results of the study, give recommendations to policymakers for the development of the “silver economy” in Russia, and describe directions of future research on the “silver economy”.

2. Literature Review, Theoretical Basis, and Research Hypotheses

In general, the “silver economy” is a complex phenomenon that encompasses many different but interrelated elements (in the areas of health, education, the labor market, and social services) that together can improve the quality of life and effectively integrate of older people into the economic activities. It is important to emphasize that the movement towards the development of the “silver economy” simultaneously presupposes, on the one hand, a fuller use of the potential of older people and an increase in their socio-economic contribution to society, and, on the other hand, an improvement in the quality of life in old age.

The multidimensional nature of population aging leads to studies of socio-economic aspects: inequality in meeting the growing demand for long-term care depending on socio-economic status (

Lera et al. 2021); the measurement of consumption of older people based on active and assisted living systems using information and communication technologies (

Schneider et al. 2020); the special needs of older people leading active and healthy aging, including in an open public space for their social integration (

Agost-Felip et al. 2021;

Rampioni et al. 2021).

The main subject of the “silver economy” is a “new old person”—an educated, healthy, economically and socially active, productive and wealthy person (

Eatock 2015). The age boundaries of the elderly are blurred. These can be people aged 50 and over, 60 and 65 and over, retired and working pensioners.

Schulz E., Radvansk M. argue that population aging is an opportunity, including technology and social innovation, and identify comprehensive solutions to improve the overall health and well-being of older people (

Schulz and Radvansky 2014). The authors define the main idea of the “aging economy” through the supply of goods and services to the growing sector of older consumers as a potential to stimulate economic growth and create new jobs. In particular, they expect that three sectors will show strong dynamics driven by demographic changes: the health sector, the long-term care sector, and the goods and services for the elderly.

Krzysztof Malik and Eva Mikolajczak raise the problem of the socio-economic exclusion of older people (

Malik and Mikołajczak 2019). According to their study, the “silver economy” can increase the national economy by 11% of GDP, calculated for the Polish economy in 2019.

A study for the European Commission provided a baseline estimate of the potential size of the European “silver economy” and simulated the impact of spending by elderly people on maintaining extra economic activity in the EU, measured in terms of its contribution to GDP and employment (

European Commission 2018). According to estimates, Europe’s silver economy contributed EUR 3.7 trillion to the EU economy about in 2015. This mainly includes the private spending of older people on a variety of goods and services, from housing to recreation. Over 10% is spent by the government for special programs for seniors, such as free healthcare. Researchers estimate that in 2015, the silver economy contributed over 4.2 trillion euros to GDP and provided more than 78 million jobs for the EU economy. This is equivalent to 29% of EU GDP and 35% of EU employment. Due to the global nature of supply chains, the elderly population demands will also create business opportunities for firms outside the EU. Researchers estimate that the silver economy generated revenues of 780 billion euros for companies in the rest of the world in 2015, or 18.6% of the GDP. According to the baseline forecast, the total consumption for the silver economy will grow by 5% per year until 2025 up to 5–7 trillion euros. In turn, this will lead to a significant increase in the economic activity, supported by the spending of the “silver economy”. Researchers predict that by 2025, this figure will reach 6.4 trillion euros of GDP and 88 million jobs. This will be equivalent to 31.5% of EU GDP and 37.8% of EU employment.

Mikiko Oliver defined how population aging is related to economic growth, measured by the real GDP per capita in Japan (

Oliver 2015). He found that an increase in the population in the 70–74 age group was associated with a decrease in economic growth, while an increase in the population in the 75 and older age group was associated with the growth of the Japanese economy.

Ping-fu (Brian) Lai and Wai Lun (Patrick) Cheung examine the impact of demographic change on economic growth in Hong Kong (

Lai and Cheung 2016). They introduced demographic variables using empirical regression. The estimates indicate that demographic changes in Hong Kong do not affect economic growth.

Boriss Siliverstovs, Konstantin A. Kholodilin and Ulrich Thiessen study the effects of aging on the structure of the economy, which is roughly equal to the share of employment in various sectors (

Siliverstovs et al. 2011). The authors find that aging did have a statistically significant differentiated effect on the proportion of employment, even after accounting for the influence of other relevant factors. In particular, increasing aging has a statistically significant negative impact on the share of employment in agriculture, manufacturing, construction, mining and quarrying. At the same time, an increase in the share of older people in society has a positive effect on the share of employment in public, social and personal services, as well as in the financial sector.

Werner Peña analyzes the impact of an aging population on the social resources demand in El Salvador and discusses the consequences for public finances (

Peña 2020). El Salvador could almost halve the hypothetical debt burden arising from the rejection of fiscal measures aimed at countering demographic change, with a combination of sound fiscal policies aimed at increasing revenues and reducing spending.

Research by Jesus Crespo Cuaresma, Martin Lábaj, and Patrik Pružinský shows that the impact of aging on income dynamics is not uniform across countries, and the negative effects of aging are stronger in countries with relatively poorer economies (

Cuaresma et al. 2014). The authors conclude that monitoring forward-looking aging measures should be a priority in policymaking to combat the negative effects of aging on sustainable economic growth in Europe.

P. Emerson and S. Knabb investigate whether secular stagnation is an inevitable result of population aging (

Emerson and Knabb 2020). They argue that demographic change is not enough to slow economic growth and lower real interest rates in an endogenous growth model with overlapping generations and human capital. The authors also demonstrate how a that society chooses to fund additional transfers to older people will determine the number of “inhibiting” demographic factors for the economy.

In general, the drivers of economic growth associated with aging are diverse. Researchers are unanimous in the strategic goal of the silver economy—improving the quality of life of senior citizens. The term “silver economy” encompasses a wide range of concepts and areas of interest related to both the challenges and opportunities that an aging population present to the economy. The effects of aging will be diverse in different countries as the proportion of older people in the country and cultural values and institutional arrangements differ.

As we know, the key factors of economic growth are effective demand and investment (

Keynes 1936). These factors are interrelated. Meeting the demand for goods and services leads to innovations (production, technological) that require investment (

Solow 1956;

Mankiw et al. 1992). This relationship is based on effective demand (supported by the consumers’ capacity to pay) (

Phelps 1966;

Spear and Young 2014). At the same time, the determining conditions for the growth of effective demand as applied to the “silver economy” are the increase in the number and income of the elderly population (

Kuznets 1968).

We consider the life cycle hypothesis as a theoretical basis for the formation of financial resources of the “silver economy”. According to it, by accumulating and spending assets, people can secure their retirement, i.e., adapt their consumption patterns to their own needs at different ages (

Modigliani and Brumberg 1954). A universal feature of all modern societies is the concentrated manifestation of the life cycle theory in financial relations—the economic life cycle. Within the framework of the economic life cycle, the age periods of life differ from the point of income/spending balance. Economic flows from one age group or generation to another are determined on the basis of national transfer accounts (NTAs) (

United Nations 2013;

Nazarova and Chernyavsky 2019;

Lee and Mason 2014;

National Transfer Accounts 2011;

Lee and Mason 2006). NTAs show that the “life cycle deficit” is usually observed in the younger and older age groups, when consumer spending exceeds income from job. The system of national transfer accounts includes an assessment of the flows of economic resources between age groups that support consumption at all stages of the life cycle. According to NTAs, older people’s consumption is funded from four different sources: (1) public transfers, such as pensions, healthcare and other social security programs, (2) private transfers, mainly within families and from other private sources, (3) asset-based reallocation, and (4) labor income of older people.

Anzhela Nazarova and Andrey Chernyavsky compiled NTAs for Russia for 2003–2017. Older people can receive financial support in the form of intra-family transfers. However, there are no statistical data available in Russia to quantify them. Studies show that in 2013–2016, Russia saw a noticeable increase in the state financing of elderly (from 1.7% to 3.7% of GDP), while the private funding decreased (

Nazarova and Chernyavsky 2019).

Asset-based reallocation is important for increasing the effective demand of the elderly population. Maintaining the habitual way of living and effective demand of the “silver population” is a determining condition for economic growth in the current demographic situation. This predetermines an increased scientific and practical interest in investment issues within pension funds’ portfolios. Z. Bodie and coauthors show a close relationship between periods of working life and investment choice (

Bodie et al. 1992). The wider job choice at a young age induces a person to take greater risks in an investment portfolio. If an individual’s human capital is riskier, the share of risky assets in his investment portfolio will be less (

Marekwica et al. 2013;

Kraft et al. 2013;

Guan and Liang 2016).

This idea was further developed in the context of pension provision as a hypothesis of a life cycle investment strategy. The strategy proposes the formation of several pension portfolios, according to a risk profile of a certain age group (depending on the number of years before retirement). The risk profile defines a certain portfolio structure through the diversification of asset classes, which could include stocks, bonds and money market instruments. The regular rebalancing mechanism maintains the specified portfolio structure. Following the hypothesis of the life cycle investment strategy is the main requirement for the investment activities of pension managers. Research by Boldyreva N.B. and Reshetnikova L.G. confirms the effectiveness of this strategy for RF (

Boldyreva and Reshetnikova 2020).

Retirement decisions are complex due to the long-term focus and the variety of factors that influence on the results. Investing is inevitably associated with risks. For example, the decline of the real value of pension capital in the investment process is associated with inflation and investment risks (

Bruno and Chincarini 2011).

Financial conglomerates raise system risks as a result of convergence processes (

Kuznetsova et al. 2016). The mortality risk has opposite variants of realization. The risk of premature death leads to an inadequate reduction in current consumption and too much inheritance. The risk of outliving one’s pension saving leads to a rapid depletion of financial resources and the problem of poverty in old age (

Cocco and Gomes 2012).

There are extra important variables that determine the accumulation of retirement capital: expected payments from a pay-as-you-go pension system, the presence of other assets such as real estate or inheritance, the health status of a person, and family protection (

Pang and Warshawsky 2010).

To make investing decisions of accumulated pension savings, we need to know the characteristics of the available categories of assets in order to make the right investment choice depending on the period of the life cycle. There are several opportunities for investments in debt and equity securities, made attractive by the criterion of “risk-return”, and conditions for diversification, including international, on the Russian financial market (

Boldyreva et al. 2019).

The Russian market is rather volatile. It creates a potential for higher returns in the long run. In this regard, stocks that are riskier in the short term may be a suitable asset for the conservative retirement investor who invests for a long-term period (

Schlechter et al. 2019). The goal of the investment policy of the pension manager is to maximize the accumulated capital by the time the client retires. In general, the amount of pension contributions, the regularity of their receipt and investment income determine the efficiency of the funded pension scheme for a person.

A review of existing research shows that it is important to correctly form a pension portfolio that combines risky and risk-free, liquid and illiquid assets throughout the life cycle. Seniors are independent if they do not rely on transfers from the working-age population. Instead, they can use the investment income from the assets to finance their consumption. This stimulates business activity and employment by expanding the “silver economy”.

In general, the development of the “silver economy” is based on the following theoretical concepts: the theory of economic growth; the hypothesis of the life cycle; the concept of the investment strategy of the life cycle.

The current period is characterized by an active reform of the national pension system in Russia, which, however, does not take into account the “silver economy” paradigm. Despite the extensive literature on the “silver economy” by foreign authors, the issues of the economy of aging, including the conditions for its development as a driver of economic growth, have not been studied for Russia. This article aims to close that gap.

For the research, we formulated and tested two hypotheses. The first hypothesis: demographic conditions for the growth of the “silver economy” in Russia have already existed. The second hypothesis: the Russian macroeconomic policy has not yet formed the financial basis for the growth of the “silver economy”.

3. Materials and Methods

The research algorithm consists of several stages. First, we checked the existence of the demographic conditions of the “silver economy” in Russia—the total number and share of elderly people compared to developed countries. We compared chosen indicators both for Russia and the European Union in 2015, 2020 and 2025 (forecast) (

Federal State Statistics Service 2021a;

European Commission 2021). We limited research due to the variability of the EU member states and the variability of age groups in Russia and the European Union. According to this indicator, Russia is similar to the developed European countries. This made it possible to proceed with the study of the RF elderly population’s income and its sources, including the comparison with global indicators.

To calculate this, we used the NTA indicators (sources of funding the deficit of the economic life cycle). We assessed the indicators for the period 2011–2019 on the basis of the data from the Federal State Statistics Service. Since 2011, the Federal State Statistics Service has been making disclosure on the level and structure of retirement household income in Russia (

Federal State Statistics Service 2019).

We further developed the analysis and calculated the average pension/average salary ratio (C)—the replacement coefficient:

The ILO Convention No. 102 on Social Security (Minimum Standards) of 1952 recommends the rate of replacement coefficient of at least 40%. Russia ratified this convention in 2018.

It is impossible to assess the income of pensioners without information about the prices of basic goods and services. We compared the RF’s average state pension and the subsistence minimum of a pensioner (set by the government of the Russian Federation). The subsistence minimum of a pensioner is the cost of a consumer basket, which consists of basic food, consumer goods and services. The government of the Russian Federation approves the subsistence minimum of a pensioner on a quarterly basis, taking into account the dynamics of consumer prices. If the pension obtained by a retiree is less than a subsistence minimum of a pensioner, then they receive a social supplement (SS) to the pension:

The source of SS is public transfers. We compared subsistence minimum of a pensioner and state pension from 2013 to 2021.

Then, we investigated the importance of labor income as a financial resource of the “silver economy” in Russia. We calculated the share of working pensioners to the total number of pensioners. The Federal State Statistics Service has been disclosing data on employees by age group since 2011.

We compared the income structure of the Russian population for 2019 with the global indicators for 2005, which we were able to find.

Then, we assessed the results of introducing funded pension provision in Russia. We evaluated the efficiency of the investment activities of pension managers by the indicators of CAGR (

rp), Accumulated Return and Standard Deviation (

σp), and we calculated the Sharpe Ratio (SR) for zero risk-free return (

rf):

As a benchmark, we used investment alternatives: corporate bonds, stocks of oil and gas, chemical and petrochemical of the industries, personal savings in cash USD and bank deposits. We expanded the research horizon from 2008 to 2018 to improve the statistical significance of the results. The limited data is due to the short period of existence of the Russian stock market and the funded pension system. The Russian pension market consists of the obligatory unfunded and funded pension schemes (the provider of the schemes is the State Pension Fund) and voluntary, funded pension schemes б both corporate and private, (the providers are autonomous pension funds). We showed the composition and structure of investment portfolios of different pension managers to confirm our conclusion about the high share of debt financial instruments. The data sources were the official websites of the Moscow Exchange, the Bank of Russia, the Russian Pension Fund, and the National Association of Autonomous Pension Funds, investfunds.ru.

In general, the presented study is based on an integrated approach, including theoretical provisions and empirical research. We applied multivariate statistical analysis methods. The sources of information were legal acts on social policy for the elderly around the world and in Russia, and scientific and expert political publications on the socio-economic aspects of aging in Russia and in the world.

4. Results

Worldwide, the 21st century is marked by changes in the age structure of the population. Russia is no exception in this regard.

However, against the background of the European Union countries, Russia is associated with a moderate rate of aging (

Table 1).

Table 1 shows that the share of the Russian elderly population in the total population of the country is slightly behind the same indicator of the European Union (

Federal State Statistics Service 2021a;

European Commission 2021). A special feature of Russia is the statistical accounting of the population older than the working age. This category includes men aged 61 and older and women aged 56 and older. The difference between Russia and most countries facing the process of population aging is that the increase in the share of older people occurred mainly “from the bottom” (due to a decrease in the share of children), while life expectancy does not increase. During the period from 2002 to 2020, the share of the population older than the working age in Russia increased by 4.5% (from 20.5% to 25.0%) (

the Russian Population Census 2002;

Federal State Statistics Service 2021b). High mortality rates go hand in hand with a poor state of public health. In terms of healthy life expectancy (DALE), Russia lags behind the leader in the European Union, Switzerland, being 9.7 years. Nevertheless, there is a tendency in life expectancy increase. Life expectancy over the age of 65 has been steadily increasing since 2003. By 2016, it had increased from 13.3 years to 16.1 years.

This means that the share of the population of older age groups (70 years and older) will gradually increase. In the coming years, the rate of aging “from above” will increase, which is typical for the demographic aging model of developed countries. Features of demographic processes in Russia reflect the wave-like nature of changes in the population of older people, reflecting the consequences of social and economic upheavals in the first half of the twentieth century, as well as the gender imbalance among older generations due to the early super-mortality of men. As a result, while the number of men and women in the 50-54 age group is relatively equal, the number of women has been increasing with age (

Sinyavskaya 2018).

According to UN forecasts, by 2050, the share of the Russian population aged 65 years and older will exceed 20%, as well as in all European countries, the United States, Canada, the Republic of Korea, China, Thailand, Cuba, Chile, Brazil, New Zealand, and Australia. This corresponds to the indicators of countries such as Japan, Germany, and Italy at the present time (

He et al. 2016). By 2050, according to UN estimates, the share of the population over 60 years of age in Russia will reach almost 30%, and the share of the population over 50 years of age—40.5%.

The increasing share of the elderly population requires research on and the assessment of the current state of the “silver economy” of Russia to identify growth factors.

The concept of the “silver economy” pursues the goal of improving the well-being of senior citizens. This means satisfying material needs to be at a decent level, the prerequisite of which is the formation of a stable effective demand of the elderly population, supported by various sources of financing.

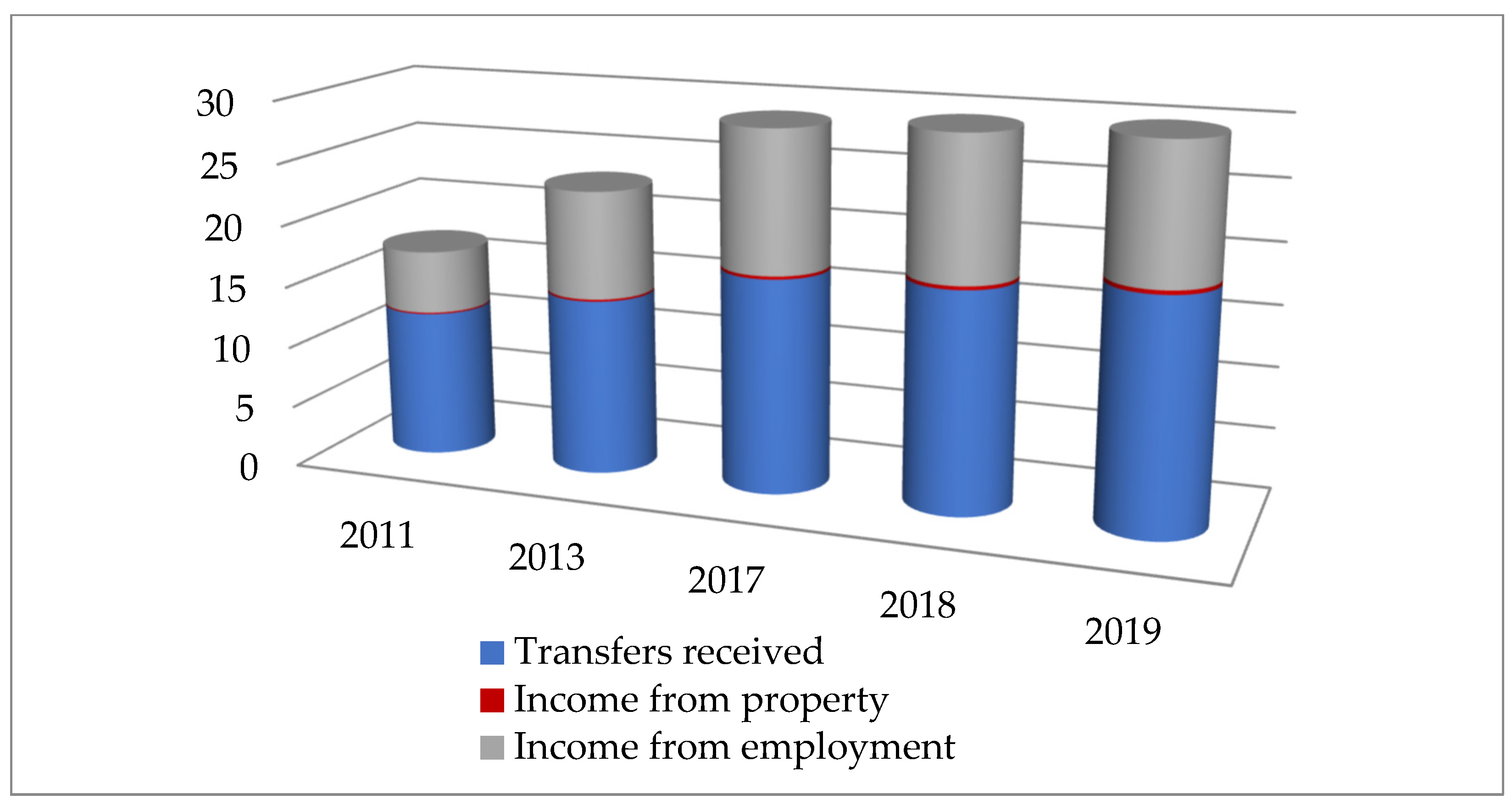

Today in Russia, the basis of the effective demand of the “silver economy” is the system of mandatory pension insurance, which until the beginning of the 21st century was based on the distributive principle (

Figure 1).

Figure 1 shows that in Russia, the main source of income of retired households is invariably social payments (about 59%), in which the overwhelming share is occupied by a pay-as-you-go pensions. At the beginning of 2020, they account for 52.4% of all incomes of retired households. The second place in this structure is occupied by income from employment during the post-retirement period, while income from property is negligible.

Figure 2 shows that for eight years the average replacement coefficient in Russia was at about 33%.

The dynamics of the replacement coefficient shows a clear downward trend; as a result, in 2019 it fell below 30%. An exception to that trend was 2015. Since 2015, the government started to calculate the average monthly salary throughout the country, including data for the Republic of Crimea and the Sevastopol city.

The difficult situation for the “silver economy” of Russia is shown in

Figure 3. The size of the average pension exceeds the subsistence minimum of a pensioner by an average of 63%.

About 17% of pensioners receive a pension below the subsistence minimum, and this indicator does not show the tendency to decrease (

Figure 4). The current solution that supports the demand at the level of the subsistence minimum in the segment of the “silver economy” is public transfers. The shortage of financial resources of pensioners is covered by social supplement (SS) from the state budget.

The second most important financial resource of the “silver economy” of Russia is income from employment during the post-retirement period. The reasons for labor activity in retirement age are diverse. The main one is the desire of elderly Russians to have a decent standard of living. The state pension is intended to provide material support and meet the basic living needs of pensioners. However, in most cases, it does not provide sufficient income that would allow one to maintain their pre-retirement standard of living.

Figure 5 shows that during 2013–2020, on average, about a third of Russian pensioners continued to work.

Until 2016, about 35% of pensioners were employed, and since 2017, this share dropped to an average of 22%, due to changes in pension provision. After the cancellation of the annual indexation of pension payments by the amount of inflation rate for employed pensioners, some of them made a choice in favor of refusing reported employment. This allows us to conclude that the labor income of some pensioners was rather low.

At the end of 2018, the average monthly salary of employed pensioners was about 32 thousand rubles (for women—30 thousand rubles, for men—37 thousand rubles). That was less than the average for the Russian economy; the average monthly accrued salary was 41 thousand rubles. However, taking into account pensions, those figures were higher than that of working Russians of pre-retirement age—46 thousand rubles (

RBC 2018).

At the same time, in 2017, the problem of ousting older workers out of the labor market, the lack of demand for their expertise, and losing competition with younger people was acutely articulated, which was perceived—especially by people of pre-retirement and early retirement ages—as an equally important barrier to continuing employment during retirement than poor health.

Thus, the limitations of the Russian “silver economy” are due to the lack of financial resources of older people, who cannot meet the high level of effective demand, especially its dynamic growth, which can become an incentive for socio-economic development.

To find opportunities to resist the challenges of Russian “silver economy”, let us turn to international experience.

Figure 6 allows us to compare the income structure of the elderly population in Russia with global indicators.

A comparative analysis revealed a disparity: Russian pensioners gain a negligibly small share of income from property, about 1%, which is 28 times less than the global indicators. This disparity is compensated by large shares of social transfers (61% in Russia vs. 49% worldwide) and income from post-retirement employment (38% in Russia vs. 23% worldwide).

A UN study shows that out of 33 countries (developed and emerging), the share of income from asset-based reallocation (income from property) in 24 countries was 20% or higher (in Germany, it was 36%, France—33%, the United States—57% and the United Kingdom—48%) (

United Nations 2020b).

Taking into account the limited state transfers and the complexity of the situation on the labor market for pensioners, we can see an unrealized potential for funding the needs of future elderly people from property.

The possibilities of this are scientifically justified within the framework of the life cycle theory. At certain stages of the life cycle, a person’s material needs and labor income may not coincide, which leads to a shortage of resources for consumption at the stages of childhood and old age and their surplus in middle age.

The system of national transfer accounts shows that there is a deficit of household budgets in the older age groups; consumer spending exceeds labor income. A comparative analysis of the age profile of labor income per capita in Japan, India and Russia showed their similarity. Labor income increases sharply at the age of 20, reaches a peak around 40, and then decreases (

Nazarova and Chernyavsky 2019).

However, consumption patterns in these countries differ remarkably. In Japan, consumption increases in old age mainly due to high healthcare costs. On the contrary, older-age consumption remains almost unchanged in India and Russia.

The concept of the life cycle allows us to develop promising measures that should become a priority within the framework of policies aimed at combating the negative consequences of aging for sustainable economic growth in Russia. Russia has experience in forming funded elements of the pension system on both voluntary and mandatory principles. The voluntary (funded) mechanism was first implemented in the mid-90s through autonomous pension funds (APFs). Most recipients of the voluntary funded pensions were corporate pension schemes members, and not individual schemes. In 2019, the number of recipients of the voluntary funded pensions in the total number of Russian pensioners were slightly more than 3.5%. Attention is drawn to the stability of this indicator over the past 10 years. The average monthly value of a voluntary funded pension is 4 thousand rubles, which is about 27% of the average state pension. Pension reserves of APFs amount to about 1300 billion rubles (in 2017, 1184 billion rubles, in 2019, 1387 billion rubles). Pension reserves of APFs amount to about 1300 billion rubles (1184 billion rubles in 2017 and 1387 billion rubles in 2019).

In 2002, the mandatory funded pension scheme was presented by the RF government. According to the Annual Report of the Pension Fund of Russia at the end of 2017, mandatory pension savings were formed by 76.7 million people (the entire employed population of Russia). Of those, 42 million people (54.8%) saved in a state-owned asset management company (SAMC), 0.4 million people (0.5%) saved in 32 private asset management companies (PAMCs) and 34.3 million people (44.7%) saved in 38 APFs. The average size of a funded pension was 866 rubles, which was about 7% of the average state pension. The largest state-owned asset management company in terms of the number of insured persons and the volume of pension savings is the VEB. Pension savings in the VEB are more than 1.5 times higher than the pension reserves of all APFs in Russia (as of 2017, 1848 billion rubles and 1184 billion rubles, respectively). Pension savings entrusted to private asset management companies and APFs are estimated at 43.3 billion rubles and 2435 billion rubles, respectively.

In general, the effectiveness of funded pension provision is determined by a complex of factors: the amount and regularity of contributions, the results of investing pension funds, etc. In the framework of mandatory funded pension schemes, the first factor is provided by law. However, the investment activity of pension managers is characterized by low efficiency.

Table 2 shows that for the analyzed period from 2008 to 2018, the real value of both the cumulative annual growth rate (CAGR) and accumulated return of all pension savings managers had a negative value.

At that time, the real growth in pension savings could be attributed to investments in corporate bonds and shares in the main sectors of the Russian economy (the oil and gas industry, the chemical and petrochemical industries) (

Moscow Exchange 2021). Bank deposits and the personal savings in cash USD made it possible to save capital from depreciation.

In general, the low efficiency of pension funds investing made it absolutely unattractive for Russian citizens to participate in funded voluntary pension schemes which were provided by autonomous pension funds. Therefore, APFs were unable to change the financial condition of Russian pensioners.

Nevertheless, the results of scientific research based on RF data confirmed the relevance of the provisions of the investment theory, according to which the effectiveness of investment activity is influenced by costs, the composition and structure of the investment portfolio, and the investment strategy (

Boldyreva and Reshetnikova 2020).

The return on the investment of pension savings depends on the distribution of assets, that is, on the composition and structure of investment portfolios.

Figure 7 shows that bonds account for the largest share in the structure of investment portfolios of pension investors. The second most important asset class for pension investors remains deposits, which also provide a fixed income. A comparison of the data in

Table 2 and

Figure 7 reveals the depth of hidden problems of pension managers, who during the analyzed period received negative results, mainly using financial instruments that brought positive real returns.

In general, the share of debt financial instruments in pension portfolios is on average 85%.

Thus, all pension portfolios are characterized by low diversification by asset classes due to the high share of debt financial instruments. Additionally, pension portfolios are characterized by low country diversification. Russian pension managers are limited by the opportunities of the domestic stock market. In general, the main reason for the low profitability of investing pension savings is the inadequate regulation of the industry.

In 2014, the mandatory funded pension scheme in the RF was “frozen” and pension contributions were directed to cover the deficit of unfunded pension scheme.

The length, and quality of life of the older generation have come into the focus of state policy recently. In 2016, the Action Plan in the Interests of Older Citizens in Russian Federation until 2025 was adopted. From that time, the elderly population is now considered as a resource for economic growth not only at the international level, but also at the Russian level. Since 2019, the mainstream of state policy has been the formation of funded pension provision in Russia, which involves the introduction of incentives for the formation of individual pension capital on a voluntary basis.

As the financial literacy of the population has been increasing and interest rate on bank deposits decreases, the financial behavior of the Russian population is changing towards an increased interest in investment. As a result, the number of brokerage accounts of private investors on the Moscow Exchange have been growing. From mid-2007 to mid-2021, the number of individual investors on the exchange increased 40 times (from 0.5 to 20 million people) (

Moscow Exchange 2021).

The effective management of pension portfolios based on the Assets Allocation strategy, taking into account the long-term horizon and the concept of the life cycle (

Boldyreva and Reshetnikova 2020), can form the financial support of the “silver economy” for the sustainable development of Russia.

5. Discussion

The “silver economy” can become a driver for economic development and growth under certain conditions and a reasonable economic policy.

We consider the “silver economy” as part of the overall economy, which allows us to use the provisions of economic theory to determine the conditions for the growth of the “silver economy”. Theories of economic growth consider effective demand as a key factor of economic growth. The determining conditions for the development of the “silver economy” for achieving the Sustainable Development Goals are an increase in the number of the elderly population and their financial support.

To achieve the research purpose, we assessed the conditions in which the “silver economy” of Russia functions, identified obstacles to its growth and developed recommendations for their elimination.

First of all, we checked the availability of demographic conditions for the development of the “silver economy” in Russia.

The absolute and structural increase in the number of elderly people is taking place in Russia. The share of people of retirement age in the total population of the country is steadily increasing and is approaching the EU countries. However, this process has peculiarities. In comparison with the EU countries, the aging of the population in Russia is characterized by a moderate pace. The aging of the population in Russia occurs mainly from below due to a decrease in the birth rate. Since 2003, we have seen the strengthening of another reason for the aging of the Russian population—an increase in life expectancy. In general, the study confirms the validity of the first hypothesis—demographic conditions for the growth of the “silver economy” in Russia have already existed.

Financial support for the needs of the elderly population is another important condition for the growth of the “silver economy”. We studied the income of the elderly population of Russia and their sources.

As we know, the consumption of older persons is financed from four different sources: (1) public transfers, (2) private transfers, (3) asset-based reallocations income and (4) labor income of older persons. In Russia, public transfers in the form of a state pension play a major role in financing of the pensioner’s needs.

Labor income is the second most important. The reasons for the labor activity of Russian pensioners are varied. The main one is the desire of elderly Russians to ensure a decent standard of living. A state pension in most cases does not provide sufficient income to maintain their previous consumption. At the same time, over the past quarter century, elderly Russians have become much more educated and subjectively healthier. A higher level of education and health contributes to a longer retention of labor activity. In addition, the level of education of the elderly in Russia can be considered as a valuable resource not only for maintaining employment at an older age, but also for expanding other types of activities after retirement.

For current Russian pensioners, the income from property is insignificant. The reason for this is related to the peculiarities of the Soviet pension system based on the pay-as-you-go principle.

Maintaining the same structure of the income of pensioners increases the burden on the state budget and reduces the income of taxpayers, which leads to a decrease in the coefficient of replacement of wages by pensions. The average pension exceeds the subsistence minimum of a Russian pensioner by an average of 63%. A fifth of pensioners constantly receive a pension below the subsistence minimum, and this indicator does not tend to decrease. The current solution that supports the demand at the level of the subsistence minimum in the segment of the “silver economy” is public transfers.

Thus, an obstacle to the Russian “silver economy” is the lack of financial resources of older people. The effective demand of elderly Russians is low. It cannot become an incentive for socio-economic development.

Our second hypothesis we tested—the Russian macroeconomic policy has not yet formed the financial basis for the growth of the “silver economy”—was confirmed. Asset-based reallocation income is a source of financial support for future pensioners. It must be formed. The task of the government of the Russian Federation is to create conditions for the formation of this income for future pensioners. It will allow them to maintain their usual standard of living and increase the effective demand of the elderly population.

The Russian government has been working on this problem since 2002. We evaluated the experience of voluntary and mandatory funded pension provision in Russia. Russia has a negative experience of using the funded element in pension provision. The main reason is the low efficiency of investment activities of pension managers. Industry regulation does not take into account the theoretical and empirical results of effective investment performance based on the life cycle hypothesis.

The problems of the aging economy are related to its capabilities. The task is to transform the challenges of the aging economy into opportunities for economic growth.