The Determinants of PayTech’s Success in the Mobile Payment Market—The Case of BLIK

Abstract

:1. Introduction

2. Materials and Methods

3. Results

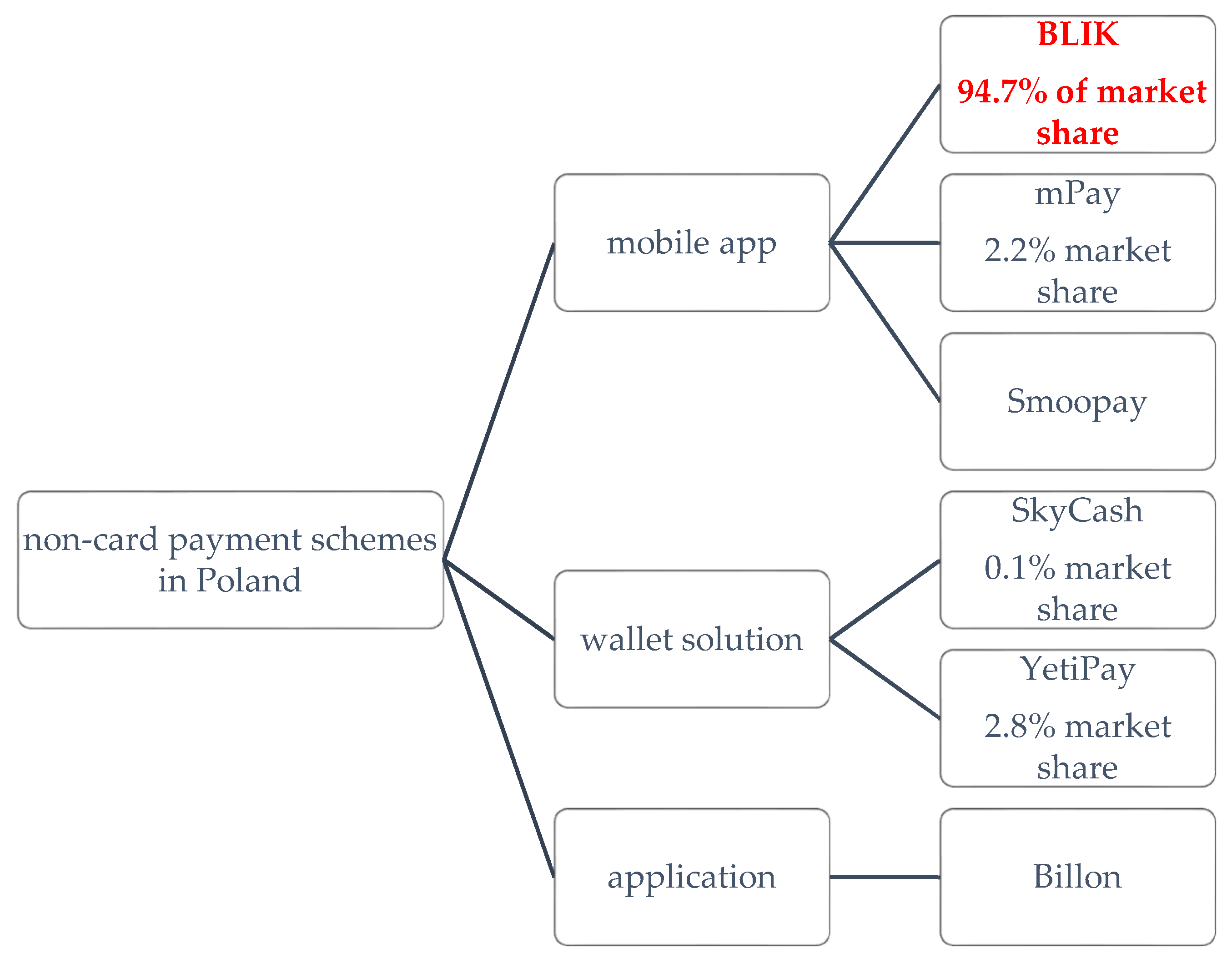

3.1. The Retail Payment Market Landscape in Poland

- systematically important retail payment systems: Elixir operated by the National Clearing House

- prominently important retail payment systems: Euro Elixir operated by the National Clearing House

- other retail payment systems:

- -

- instant payment system: Express Elixir operated by the National Clearing House, Blue Cash operated by Blue Media S.A.

- -

- card payment system: National Clearing System (KSR) operated by First Data Polska S.A., Inkart operated by the National Clearing House

- -

- mobile payment system: BLIK Mobile Payment System operated by Polish Payment Standard (PPS LCC)

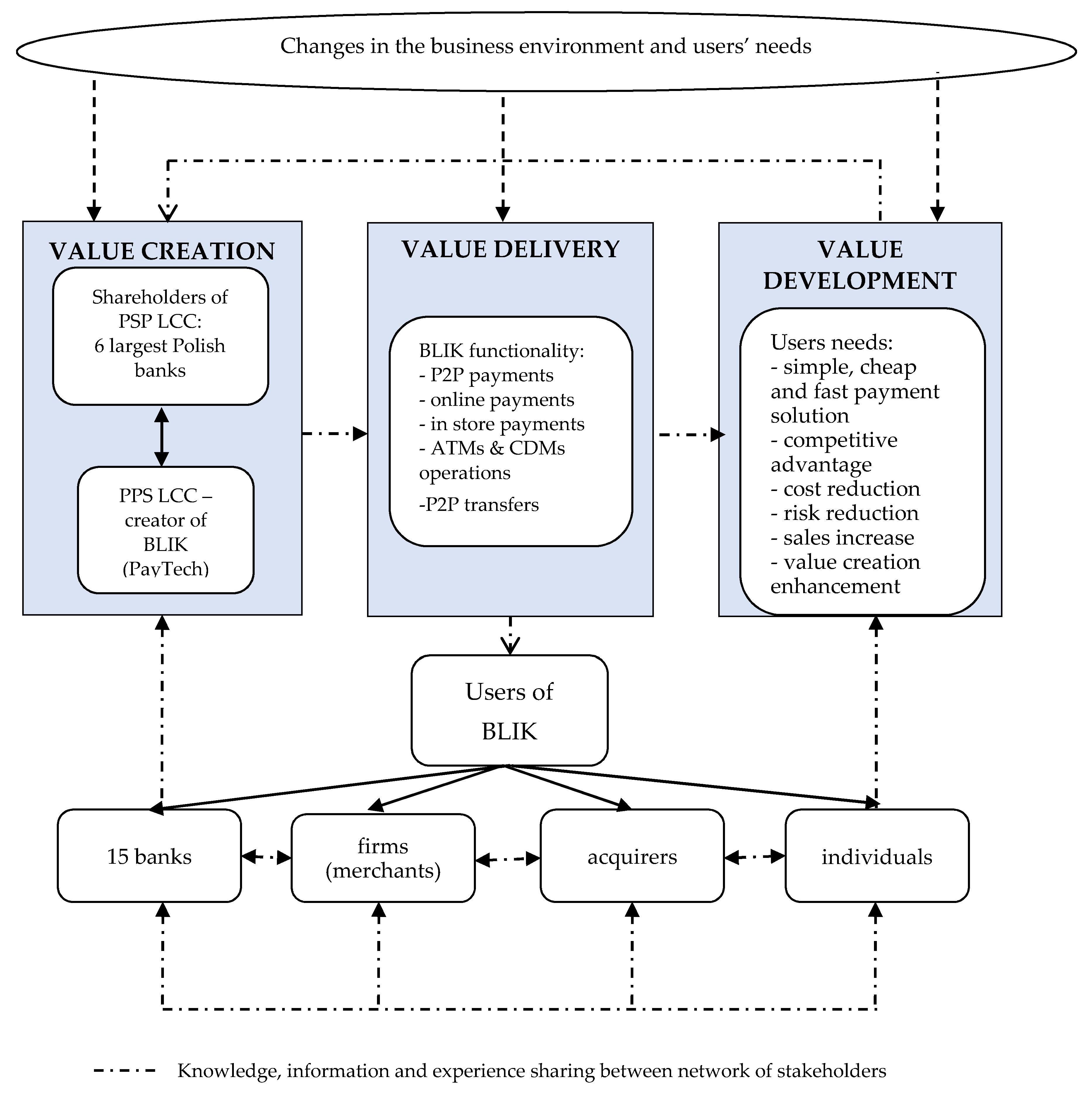

3.2. The Characteristics of BLIK and Its Market Behaviour

3.2.1. Evolution of BLIK as an Open Mobile Payment Standard

- online payments—eCommerce and mCommerce payments

- in-store payments—offering payments at POS terminals, cash register systems, vending and ticket machines

- deposits/withdrawals at ATMs and CDMs by using smartphones

- P2P transfers by using phone number—instant, interbank transfers, without using the 26-digit account number.

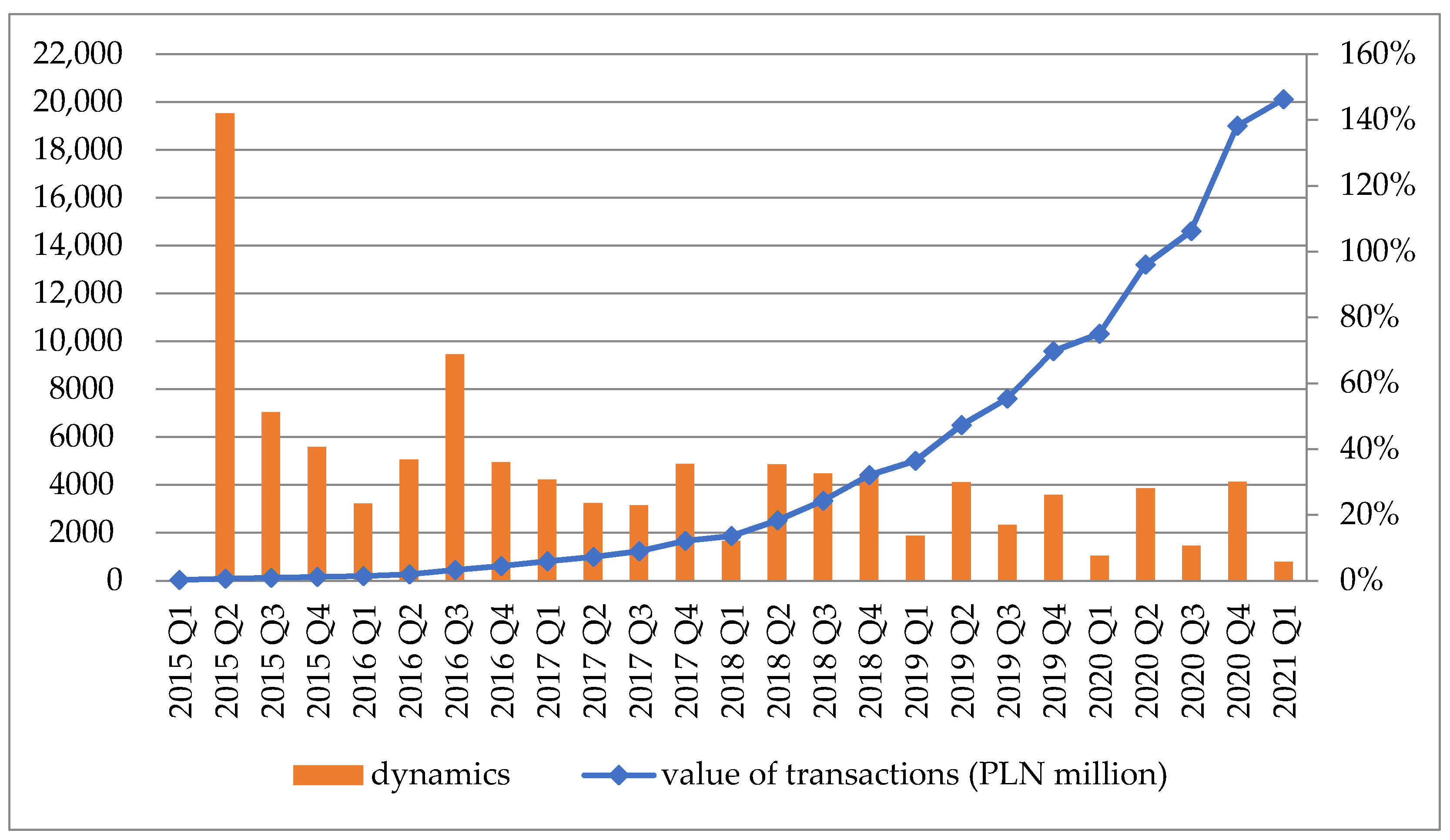

3.2.2. BLIK Diffusion and Adoption

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | |

| 2 | Act of 24 August 2001 on Settlement Finality in Payment and Securities Settlement Systems and the Rules of Oversight of these Systems (Journal of Laws of 2016, item 1224, as amended). |

| 3 | Act of 19 August 2011 on payment services (Journal of Laws 2016, item 1572, as amended). |

| 4 | Multilateral Interchange Fee, Regulation (EU) No 2015/751 of the European Parliament and of the Council of 29 April 2015 on interchange fees for cardbased payment transactions (EU OJ L 123 of 19.05.2015, page 1). |

| 5 | Strong Customer Authentication, Commission Delegated Regulation (EU) 2018/389 of 27 November 2017 supplementing Directive (EU) 2015/2366 of the European Parliament and of the Council with regard to regulatory technical standards for strong customer authentication and common and secure open standards of communication (EU OJ L 69 of 13.03.2018, p. 23). |

| 6 | Payment Services Directive 2, Directive 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market, amending Directives 2002/65/EC 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC (EU OJ L 337 of 23.12.2015, page 35). |

References

- Alvarez, Sharon A., and Jay B. Barney. 2013. Epistemology, opportunities, and entrepreneurship: Comments on Venkataraman et al. (2012) and Shane (2012). Academy of Management Review 38: 153–66. [Google Scholar] [CrossRef]

- Arner, Douglas W., Janos Natan Barberis, and Ross Buckley. 2015. The Evolution of Fintech: A New Post-Crisis Paradigm? University of Hong Kong Faculty of Law Research Paper, No. 2015/047. p. 4. Available online: https://www.researchgate.net/publication/313365410_The_Evolution_of_Fintech_A_New_Post-Crisis_Paradigm (accessed on 10 July 2021).

- Batterink, Marten H., Emiel F. M. Wubben, Laurens Klerkx, and S. W. F. Lommo Omta. 2010. Orchestrating innovation networks: The case of innovation brokers in the agri-food sector. Entrepreneurship and Regional Development 22: 47–76. [Google Scholar] [CrossRef]

- BBVA. 2018. ‘Fintech’, ‘Proptech’, ‘Femtech’, ‘Edtech’ and Other Related Neologisms. Available online: https://www.bbva.com/en/fintech-proptech-femtech-edtech-and-other-related-neologisms/ (accessed on 8 July 2021).

- BIS. 2020. Available online: https://stats.bis.org/statx/toc/CPMI.html (accessed on 8 July 2021).

- BLIK. 2021. Available online: www.blik.com (accessed on 10 July 2021).

- Borowski-Beszta, Mikołaj, and Marta Jakubowska. 2018. Mobile payments using NFC technology in the light of empirical research. Torun Business Review 17: 5–16. [Google Scholar] [CrossRef]

- Buszko, Michał, Dorota Krupa, and Malwina Chojnacka. 2019. Young people and banking products and services in Poland: The results of empirical studies. Ekonomia i Prawo. Economics and Law 18: 147–64. [Google Scholar] [CrossRef]

- Chesbrough, Henry. 2003. Open Innovation: The New Imperative for Creating and Profiting from Technology. Boston: Harvard Business School Press. [Google Scholar]

- Chmielarz, Witold, and Karol Luczak. 2016. Mobile Payment Systems in Poland-Analysis of Customer Preferences. Transformations in Business & Economics 15: 539–52. [Google Scholar]

- Chmielarz, Witold, and Marek Zborowski. 2017. Analysis of the use of electronic banking and e-payments from the point of view of a client. Paper presented at Federated Conference on Computer Science and Information Systems (FedCSIS) Prague, Czech Republic, September 3–6; pp. 965–69. [Google Scholar] [CrossRef] [Green Version]

- Civelek, Mehmet, Aleksandr Ključnikov, Jitka Kloudová, and Iveta Vozňáková. 2021. Digital Local Currencies as an Alternative Digital Payment Method for Businesses to Overcome Problems of Covid-19 Pandemic. Polish Journal of Management Studies 23. [Google Scholar] [CrossRef]

- Cowan, Robin, Nicolas Jonard, and Jean-Benoit Zimmermann. 2007. Bilateral collaboration and the emergence of innovation networks. Management Science 53: 1051–67. [Google Scholar] [CrossRef]

- Daragmeh, Ahmad, Judit Sági, and Zoltán Zéman. 2021. Continuous Intention to Use E-Wallet in the Context of the COVID-19 Pandemic: Integrating the Health Belief Model (HBM) and Technology Continuous Theory (TCT). Journal of Open Innovation: Technology, Market, and Complexity 7: 132. [Google Scholar] [CrossRef]

- Das, Sanvij R. 2018. The Future of FinTech. p. 3. Available online: https://assets.kpmg.com/content/ (accessed on 8 July 2021).

- Davidsson, Per, Jan Recker, and Frederik von Briel. 2018. External enablement of new venture creation: A framework. Academy of Management Perspective 34: 311–32. [Google Scholar] [CrossRef] [Green Version]

- Davies, Steve, Daniel Jackett, Manoj Kashyap, Dean Nicolacakis, Musarrat Qureshi, and John Shipman. 2016. Customers in the Spotlight—How FinTech Is Reshaping Banking. Global FinTech Survey. Available online: https://www.pwc.com/jg/en/publications/fin-tech-banking-2016.pdf (accessed on 5 July 2021).

- Deloitte. 2020. Digital Banking Maturity 2020. Available online: https://www2.deloitte.com/pl/pl/pages/financial-services/articles/digital-banking-maturity-2020.html (accessed on 10 July 2021).

- Dhanaraj, Charles, and Arvind Parkhe. 2006. Orchestrating innovation networks. Academy of Management Review 31: 659–69. [Google Scholar] [CrossRef] [Green Version]

- Dimler, Nick, Joachin Peter, and Boris Karcher. 2018. Unternehmensfinanzierung im Mittelstand: Lösungsansätze für eine maßgeschneiderte Finanzierung. Wiesbaden: Springer Gabler, p. 9. [Google Scholar]

- Drasch, Benedict J., Andre Schweizer, and Nils Urbach. 2018. Integrating the ‘Troublemakers’: A taxonomy for cooperation between banks and fintechs. Journal of Economics and Business 100: 26–42. [Google Scholar] [CrossRef] [Green Version]

- Ehrentraud, Johannes, Denice Garcia Ocampo, Lorena Garzoni, and Mateo Piccolo. 2020. Policy Responses to Fintech: A Cross-Country Overview. ISI Insights on Policy Implementation, No 23. Available online: https://www.bis.org/fsi/publ/insights23_summary.pdf (accessed on 10 July 2021).

- EMPSA. 2021. Available online: https://empsa.org/#news (accessed on 14 August 2021).

- Esty, Benjamin C. 1999. Petrozuata: A case study of the effective use of project finance. Journal of Applied Corporate Finance 12: 26–42. [Google Scholar] [CrossRef]

- Esty, Benjamin C. 2001. Structuring loan syndicates: A case study of the Hong Kong Disneyland project loan. Journal of Applied Corporate Finance 14: 80–95. [Google Scholar] [CrossRef]

- European Commission. 2020. Digital Economy and Society Index 2020. Available online: https://digital-strategy.ec.europa.eu/en/policies/desi (accessed on 11 July 2021).

- Eurostat. 2021. Available online: https://europa.eu/european-union/about-eu/figures/living_en#population (accessed on 11 August 2021).

- Financial Stability Board. 2017. Financial Stability Implications from FinTech Supervisory and Regulatory Issues that Merit Authorities’ Attention. p. 6. Available online: https://www.fsb.org/wp-content/uploads/R270617.pdf (accessed on 8 July 2021).

- Flyvbjerg, Bent. 2006. Five misunderstandings about case-study research. Qualitative Inquiry 12: 219–45. [Google Scholar] [CrossRef] [Green Version]

- Folwarski, Mateusz. 2018. Sektor bankowy i sektor FinTech–współpraca czy realne zagrożenie dla sektora bankowego. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 529: 84–94. [Google Scholar] [CrossRef]

- Gassmann, Oliver, Ellen Enkel, and Henry Chesbrough. 2010. The future of open innovation. R&D Management 40: 213–21. [Google Scholar] [CrossRef]

- Gebski, Lukasz. 2021. FinTech and FinReg: New challenges for the financial market regulation system in Poland and in the world/FinTech i FinReg--nowe wyzwania dla systemu regulacji rynku finansowego w Polsce i na swiecie. In Public Policy Studies. Gale Academic OneFile. Warszawa: Warsaw School of Economics, Volume 8, p. 141+. Available online: link.gale.com/apps/doc/A661688536/AONE?u=anon~16eb6c72&sid=googleScholar&xid=0b3c09c1 (accessed on 30 August 2021).

- Goffin, Keith, Par Åhlström, Mattia Bianchi, and Anders Richtnér. 2019. Perspective: State-of-the-Art: The Quality of Case Study Research in Innovation Management. Journal of Product Innovation Management 36: 586–615. [Google Scholar] [CrossRef] [Green Version]

- Golubić, Gordana. 2019. Do Digital Technologies Have the Power to Disrupt Commercial Banking? InterEULawEast: Journal for the International and European Law, Economics and Market Integrations 6: 83–110. [Google Scholar] [CrossRef]

- Gomber, Peter, Jascha-Alexander Koch, and Michael Siering. 2017. Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics 87: 537–80. [Google Scholar] [CrossRef]

- Goodell, Geoffrey, Hazem D. Al-Nakib, and Paolo Tasca. 2021. A Digital Currency Architecture for Privacy and Owner-Custodianship. Future Internet 13: 130. [Google Scholar] [CrossRef]

- Górka, Jakub. 2016. Ewolucja funkcjonalna mobilnego portfela. In Obrót bezgotówkowy w Polsce: Stan obecny i perspektywy. Edited by Piotr Bolibok and Marian Żukowski. Lublin: Wydawnictwo KUL, pp. 119–30. [Google Scholar]

- Górka, Jakub. 2018. Banki, GAFAM, FinTech w gospodarce współdzielenia–equilibrium współpracy i konkurencji. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 531: 149–58. [Google Scholar] [CrossRef]

- Grzywacz, Jacek, and Ewa Jagodzińska-Komar. 2018. Rola banków i sektora FinTech w świetle implementacji dyrektywy PSD2. Kwartalnik Kolegium Ekonomiczno-Społecznego. Studia i Prace 2: 159–69. [Google Scholar] [CrossRef]

- GUS. 2015. Available online: https://stat.gov.pl/obszary-tematyczne/nauka-i-technika-spoleczenstwo-informacyjne/spoleczenstwo-informacyjne/spoleczenstwo-informacyjne-w-polsce-wyniki-badan-statystycznych-z-lat-2011-2015,1,9.html (accessed on 16 August 2021).

- GUS. 2020a. Available online: https://bdm.stat.gov.pl/ (accessed on 10 July 2021).

- GUS. 2020b. Available online: https://stat.gov.pl/obszary-tematyczne/nauka-i-technika-spoleczenstwo-informacyjne/spoleczenstwo-informacyjne/wykorzystanie-technologii-informacyjno-komunikacyjnych-w-jednostkach-administracji-publicznej-przedsiebiorstwach-i-gospodarstwach-domowych-w-2020-roku,3,19.html (accessed on 10 July 2021).

- Harasim, Janina, and Krystyna Mitręga-Niestrój. 2018. FinTech–dylematy definicyjne i determinanty rozwoju. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 531: 169–79. [Google Scholar] [CrossRef]

- Hernández-Murillo, Ruben, Gerard Llobet, and Roberto Fuentes. 2010. Strategic online banking adoption. Journal of Banking & Finance 34: 1650–63. [Google Scholar] [CrossRef] [Green Version]

- Hill, John. 2018. FinTech and the Remaking of Financial Institutions. London: Academic Press. [Google Scholar] [CrossRef]

- Huizingh, Eelko K. R. E. 2011. Open innovation: State of the art and future perspective. Technovation 31: 2–9. [Google Scholar] [CrossRef]

- Hwang, Yoonyoung, Sangwook Park, and Nina Shin. 2021. Sustainable Development of a Mobile Payment Security Environment Using Fintech Solutions. Sustainability 13: 8375. [Google Scholar] [CrossRef]

- Jagtiani, Julapa, and Kose John. 2018. Fintech: The impact on consumers and regulatory responses. Journal of Economics and Business 100: 1–6. [Google Scholar] [CrossRef]

- Johansson, Rolf. 2007. On case study methodology. Open House International 32: 48. [Google Scholar] [CrossRef]

- Karagiannaki, Angeliki, Georgios Vergados, and Konstantinos Fouskas. 2017. The Impact of Digital Transformation in the Financial Services Industry: Insights from an Open Innovation Initiative in Fintech in Greece. MCIS 2017 Proceedings 2. Available online: https://aisel.aisnet.org/mcis2017/2 (accessed on 8 July 2021).

- Kerényi, Ádam, and Julia Molnár. 2017. The Impact of the Fintech Phenomenon-Radical Change Occurs in the Financial Sector? Financial and Economic Review 16: 33. [Google Scholar] [CrossRef]

- Kim, YongHee, Jeongil Choi, Young-Ju Park, and Jiyoung Yeon. 2016. The Adoption of Mobile Payment Services for “Fintech”. International Journal of Applied Engineering Research 11: 1058–61. [Google Scholar]

- Kliber, Agata, Barbara Będowska-Sójka, Aleksandra Rutkowska, and Katarzyna Świerczyńska. 2021. Triggers and Obstacles to the Development of the FinTech Sector in Poland. Risks 9: 30. [Google Scholar] [CrossRef]

- Klimontowicz, Monika, and Janina Harasim. 2019. Mobile technology as a part of banks’ business model. Folia Oeconomica. Acta Universitatis Lodziensis 1: 73–90. [Google Scholar] [CrossRef]

- KPMG. 2018. The Pulse of Fintech 2018. p. 57. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2018/07/h1-2018-pulse-of-fintech.pdf (accessed on 10 July 2021).

- La Torre, Mario, Annarita Trotta, Helen Chiappini, and Alessandro Rizzello. 2019. Business models for sustainable finance: The case study of social impact bonds. Sustainability 11: 1887. [Google Scholar] [CrossRef] [Green Version]

- Lee, In, and Young Jae Shin. 2018. Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons 61: 35–46. [Google Scholar] [CrossRef]

- Leong, Carmen, Barney Tan, Xiao Xiao, Felix Ter Chian Tan, and Yuan Sun. 2017. Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. International Journal of Information Management 37: 92–97. [Google Scholar] [CrossRef]

- Li, Bin, Sherman D. Hanna, and Kyoung Tae Kim. 2020. Who uses mobile payments: Fintech potential in users and non-users. Journal of Financial Counseling and Planning. [Google Scholar] [CrossRef]

- Maitra, Debasish, and Parijat Upadhyay. 2017. Fostering Rural Financial Services through Technology: The Case of FINO PayTech. Asian Case Research Journal 21: 81–117. [Google Scholar] [CrossRef]

- Mastercard. 2019. Available online: https://newsroom.mastercard.com/eu/files/2019/06/Digital_Banking_Results_Mastercard_Overview_Countries_May_2019.pdf (accessed on 14 August 2021).

- Merchant Savvy. 2020. Global Mobile Payment. Available online: https://www.merchantsavvy.co.uk/mobile-payment-stats-trends/ (accessed on 16 August 2021).

- Micu, Ion, and Alexandra Micu. 2016. Financial Technology (Fintech) and Its Implementation on the Romanian Non-Banking Capital Market. SEA-Practical Application of Science 11: 379–84. Available online: https://EconPapers.repec.org/RePEc:cmj:seapas:y:2016:i:11:p:379-384 (accessed on 15 July 2021).

- Milic-Czerniak, Róża. 2019. Rola fintechów w rozwoju innowacji finansowych. Studia BAS 1: 37–60. [Google Scholar] [CrossRef]

- NBP. 2019a. Financial System in Poland. Available online: https://www.nbp.pl/en/systemfinansowy/fsd_2019.pdf (accessed on 10 June 2021).

- NBP. 2019b. Payment System Oversight Policy. Available online: https://www.nbp.pl/en/system_platniczy/payment-system-oversight-policy-Oct-2019.pdf) (accessed on 15 June 2021).

- NBP. 2021a. List of Payment Systems under the Oversight of the President of NBP. Available online: https://www.nbp.pl/en/system_platniczy/list-of-systems-and-schemes.pdf (accessed on 8 July 2021).

- NBP. 2021b. Ocena Funkcjonowania Polskiego Systemu Płatniczego w II Półroczu 2020r. Warszawa: NBP. [Google Scholar]

- NBP Reports. 2015–2021. Informacja kwartalna o rozliczeniach i rozrachunkach międzybankowych for 2015, 2016, 2017, 2018, 2019, 2020 and 2021. Available online: https://www.nbp.pl/home.aspx?f=/systemplatniczy/publikacje/rozrachunki.html (accessed on 10 July 2021).

- Nejad, Mohammad G. 2016. Research on financial services innovations: A quantitative review and future research directions. International Journal of Bank Marketing 34: 1042–68. [Google Scholar] [CrossRef]

- Pal, Abhipsa, Herath Tejaswini Rahul De, and Rao H. Raghav. 2020. Is the convenience worth the risk? An investigation of mobile payment usage. Information Systems Frontiers, 1–21. [Google Scholar] [CrossRef]

- Polasik, Michał, Agnieszka Huterska, Refan Iftikhar, and Štěpán Mikula. 2020. The impact of Payment Services Directive 2 on the PayTech sector development in Europe. Journal of Economic Behavior and Organization 178: 385–401. [Google Scholar] [CrossRef]

- Powell, Walter W., Kenneth W. Koput, and Laurel Smith-Doerr. 1996. Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Administrative Science Quaterly 41: 116–45. [Google Scholar] [CrossRef] [Green Version]

- PWC. 2017. Banki i Fintech-y—Małżeństwo z Rozsądku. Available online: https://www.pwc.pl/pl/pdf/fintech-2017-raport-pwc.pdf (accessed on 10 August 2021).

- Ramoglou, Stratos, and Eric W. K. Tsang. 2016. A realist perspective of entrepreneurship: Opportunities as propensities. The Academy of Management Review 41: 410–34. [Google Scholar] [CrossRef] [Green Version]

- Rycroft, Robert W., and Don E. Kash. 2014. Self-organizing innovation networks: Implications for globalization. Technovation 24: 187–97. [Google Scholar] [CrossRef]

- Saebi, Tina, and Nicolai J. Foss. 2014. Business model for open innovation: Matching heterogeneous open innovation strategy with business model dimensions. European Management Journal 33: 201–13. [Google Scholar] [CrossRef] [Green Version]

- Saksonova, Svetlana, and Irina Kuzmina-Merlino. 2017. Fintech as Financial Innovation—The Possibilities and Problems of Implementation. European Research Studies Journal 20: 961–73. Available online: https://www.um.edu.mt/library/oar//handle/123456789/30472 (accessed on 15 July 2021).

- Schueffel, Patrick. 2016. Taming the Beast: A Scientific Definition of Fintech. Journal of Innovation Management 4: 36. [Google Scholar]

- Shane, Scott, and Sankaran Venkataraman. 2000. The promise of enterpreneurship as a field of research. The Academy of Management Review 25: 217–26. [Google Scholar] [CrossRef]

- Statista. 2020. Digital Market Outlook. Available online: https://www.statista.com/chart/23470/global-transaction-value-forecast-of-smartphone-mobile-payments/ (accessed on 15 August 2021).

- Statista. 2021. Available online: https://www.statista.com/statistics/1101542/poland-financial-products-used-for-in-store-mobile-payments/ (accessed on 15 August 2021).

- Świecka, Beata, Paweł Terefenko, and Dominik Paprotny. 2021. Transaction factors’ influence on the choice of payment by Polish consumers. Journal of Retailing and Consumer Services 58: 102264. [Google Scholar] [CrossRef]

- Szpringer, Włodzimierz. 2016. Fin-Tech– nowe zjawisko na rynku usług finansowych. E-Mentor 64: 56–69. [Google Scholar] [CrossRef]

- Szpringer, Włodzimierz. 2019. Fintech i blockchain –kierunki rozwoju gospodarki cyfrowej. Studia BAS 1: 9–35. [Google Scholar] [CrossRef]

- Szumski, Oskar. 2020. Technological trust from the perspective of digital payment. Procedia Computer Science 176: 3545–54. [Google Scholar] [CrossRef]

- Tang, Yuk M., Ka Y. Chau, Luchen Hong, Yun K. Ip, and Wan Yan. 2021. Financial Innovation in Digital Payment with WeChat towards Electronic Business Success. Journal of Theoretical and Applied Electronic Commerce Research 16: 1844–61. [Google Scholar] [CrossRef]

- Thakor, Anjan V. 2020. Fintech and banking: What do we know? Journal of Financial Intermediation 41: 100833. [Google Scholar] [CrossRef]

- Tidd, Joe, John Bessant, and Keith Pavitt. 2005. Managing Innovation. Integrated Technological, Market, and Organizational Change. Chichester: JohnWilley & Sons. [Google Scholar]

- Urbinati, Andrea, Davide Chiaroni, Vittorio Chiesa, and Federico Frattini. 2020. The role of Digital Technologies in open innovation processes: An exploratory mulitple case study analysis. Special Issue: Open Innovation in the Digital Age 50: 136–60. [Google Scholar] [CrossRef]

- van Aken, Joan E., and Mathieu P. Weggeman. 2000. Managing learning in informal innovation networks: Overcoming the Daphne-dilemma. R&D Management 30: 139–50. [Google Scholar] [CrossRef]

- Vanhaverbeke, Wim, and Henry Chesbrough. 2014. A classification of open innovation and open business model. In New Frontiers in Open Innovation. Edited by Henry Chesbrough, Wim Vanhaverbeke and Joel West. Oxford: Oxford University Press, Chapter 3. pp. 50–68. [Google Scholar]

- Vives, Xavier. 2019. Competition and stability in modern banking: A post-crisis perspective. International Journal of Industrial Organization 64: 55–69. [Google Scholar] [CrossRef]

- Weichert, Margaret. 2017. The future of payments: How FinTech players are accelerating customer-driven innovation in financial services. Journal of Payments Strategy & Systems 11: 23–33. [Google Scholar]

- World Economic Forum. 2017. Beyond Fintech: A Pragmatic Assessment of Disruptive Potential in Financial Services. Part of the Future of Financial Services. p. 5. Available online: http://www3.weforum.org/docs/Beyond_Fintech_-_A_Pragmatic_Assessment_of_Disruptive_Potential_in_Financial_Services.pdf (accessed on 10 July 2021).

- Yang, Marvello, Abdullah A. Mamun, Muhammad Mohiuddin, Noorshella C. Nawi, and Noor R. Zainol. 2021. Cashless Transactions: A Study on Intention and Adoption of e-Wallets. Sustainability 13: 831. [Google Scholar] [CrossRef]

- Yin, Robert K. 2012. Case study methods. In APA Handbooks in Psychology®. APA Handbook of Research Methods in Psychology, Vol. 2. Research Designs: Quantitative, Qualitative, Neuropsychological, and Biological. Edited by Harris Cooper, Paul M. Camic, Debra L. Long, A. T. Panter, David Rindskopf and Kenneth J. Sher. Washington: American Psychological Association, pp. 141–55. [Google Scholar] [CrossRef]

- Zachariadis, Markos, and Pinar Ozcan. 2016. The API Economy and Digital Transformation in Financial Services: The Case of Open Banking. SWIFT Institute Working Paper. [Google Scholar] [CrossRef] [Green Version]

- Zhao, Yuyang, and Fernando Bacao. 2021. How Does the Pandemic Facilitate Mobile Payment? An Investigation on Users’ Perspective under the COVID-19 Pandemic. International Journal of Environmental Research and Public Health 18: 1016. [Google Scholar] [CrossRef]

| Author | FinTech Definition |

|---|---|

| Arner et al. (2015) | the application of technology to finance |

| Micu and Micu (2016) | new sector in the finance industry that incorporates the whole plethora of technology that is used in finance to facilitate trades, corporate business or interaction and services provided to the retail customer |

| Kim et al. (2016) | service sector which uses mobile-centered IT technology to enhance the efficiency of the financial system; as a term it is compound of “finance” and “technology”, and collectively refers to industrial changes forged from the convergence of financial services and IT |

| World Economic Forum (2017) | new entrants (understood as market participants outside the traditional financial system that recently entered a market, use innovative technologies, and change financial services’ business models) that promised to rapidly reshape how financial products were structured, provisioned, and consumed |

| Das (2018) | any technology that eliminates or reduces the of costs financial intermediation |

| Dimler et al. (2018) | the industry in which financial services are changed with technology |

| KPMG (2018) | a portmanteau of finance and technology |

| Financial Stability Board (2017) | technology-enabled innovation in financial services which could lead to new business models, services, products, applications, processes in the area of financial services |

| Sources | Hits in Title | AND/OR Abstract | AND/OR Full Text | Definition Provided |

|---|---|---|---|---|

| EBSCO | 2 | 2 | 2 | 1 |

| Emerald | 0 | 0 | 0 | 0 |

| Cambridge Journals | 0 | 0 | 0 | 0 |

| Oxford Journal— Economics & Finance | 0 | 0 | 0 | 0 |

| ProQuest | 0 | 1 | 6 | 0 |

| SAGE | 0 | 0 | 0 | 0 |

| SCOPUS | 2 | 2 | 2 | 1 |

| Springer Link | 0 | 0 | 1 | 0 |

| Wiley Online Library | 0 | 0 | 2 | 0 |

| Total corrected for duplicated sources | 2 | 3 | 11 | 1 |

| Specification | 2014 | 2018 |

|---|---|---|

| Total population (million) | 38.48 | 38.41 |

| GDP (PLN billion) | 1720 | 2121 |

| Credit institutions | 679 | 647 |

| in this: commercial banks | 64 | 61 |

| Number of current accounts for individual clients (million) | 38.5 | 40.3 |

| Deposits with access via internet (as % in total number of deposits) | 59% | 65% |

| Other institutions offering payment services | 28 | 41 |

| Payment cards (million) | 36.1 | 41.2 |

| ATMs (thousand) | 20.5 | 22.8 |

| POS terminals (thousand) | 398.2 | 786.2 |

| Credit transfer per capita | 51.38 | 73.68 |

| Card payments per capita | 48.66 | 123.18 |

| Cashless payments per capita (PLN) | 972.66 | 1670.7 |

| Cashless payments in total retail payments (%) | 20 | 43 |

| Contactless payments as part of card payments (%) | 32 | 71 |

| Specification | 2014 | 2020 | Change |

|---|---|---|---|

| Households with access to internet at home | 74.8% | 90.4% | ↑21% |

| Households with mobile broadband connection | 28.2% | 66.7% | ↑136% |

| Individuals purchasing via internet | 34.2% | 60.9% | ↑78% |

| Enterprises with access to internet | 93.1% | 98.6% | ↑6% |

| Enterprises receiving orders via internet | 9.5% | 16.5% | ↑74% |

| Year | Mobile Payments System/Originator & Sector | Types of Payments | Application |

|---|---|---|---|

| 2003 | mPay/mPay S.A. (PayTech) | Remote | Public transport, parking payment, prepaid phones, online tickets |

| 2010 | Skycash/SkyCash Poland S.A. (PayTech) | Remote | Public transport, parking payment, prepaid phones, online tickets |

| 2011 | YetiPay/YetiPay sp. z o.o. (PayTech) | Remote | e-commerce, P2P |

| 2013 | IKO/Bank PKO BP (later used in BLIK) (banking sector) | Remote, contactless | POS, ATM, e-commerce, P2P |

| 2013 | Peopay/Bank Pekao S.A. (banking sector) | Remote, contactless | POS, ATM, e-commerce, P2P |

| 2015 | BLIK/PPS: cooperation of 6 banks (PayTech + banking sector) | Remote | POS, ATM, e-commerce, P2P |

| 2016 | Google Pay/Google (IT/PayTech) | Remote, contactless | POS, ATM, e-commerce |

| 2018 | Apple Pay/Apple (IT/PayTech) | Remote, contactless | POS, ATM, e-commerce |

| Year | Milestone |

|---|---|

| 2013 | The six largest Polish banks created Polish Payment Standard LCC (PPS): Alior Bank, Bank Millennium, Bank Zachodni WBK, ING Bank Śląski, mBank, PKO Bank Polski |

| 2014 | PPS received legal consent for the BLIK mobile payments system from the NBP (National Bank of Poland) |

| 2015 | 09/02/2015 BLIK appeared on the Polish market BLIK payments are available to the customers of the six banks, the original founders of PPS LCC In half a year, BLIK achieved the first million of users |

| 2016 | Availability of BLIK in e-commerce sector reached 100% Getin Bank as seventh bank offers BLIK payments |

| 2017 | 4.5 million Poles use regularly BLIK (more than a half of all mobile banking users) BNP Paribas (as the eighth bank) and Raifeisen Polbank (as the ninth bank) offer BLIK payments |

| 2018 | Ninety percent of mobile banking users have access to BLIK Bank Pekao SA (as the 10th bank) and Credit Agricole Bank Polska S.A. (as the 11th bank) offer BLIK payments |

| 2019 | Number of payments in payment terminals increased by 340% year-on-year Transfers to telephone number increased by 200% PPS and Mastercard signed a strategic cooperation agreement—BLIK users may use proximity payments throughout the world PPS received the consent of the NBP to introduce the “request for payment” solution as part of the BLIK Payment Scheme Spółdzielcza Grupa Bankowa (SGB Bank) offers BLIK payments |

| 2020 | 02/03/2020: BLIK can be used on international e-commerce websites that use the solutions offered by the global payment operators: Adyen and PPRO 09/03/2020: BLIK joined the European Mobile Payment Systems Association (EMPSA)—currently consisting of nine members with approximately 40 million users 15/04/2020: Mastercard became the seventh shareholder of PPS LCC Nest Bank (as the 12th bank), BPS Bank (as the 13th bank) and Bank Pocztowy S.A. (as the 14th bank) offer BLIK payments |

| 2021 | Cooperative Bank in Brodnica (as the 15th bank) and BOŚ Bank (as the 16th bank) offer BLIK payments July 2021: BLIK offers contactless payments |

| Features | BLIK | Google Pay | Apple Pay |

|---|---|---|---|

| Start (in Poland) | 2015 | 2016 | 2018 |

| Devices | Smartphone or smartwatch with Android or iOS, tablets, laptops, computers | Smartphone or smartwatch with Android | Smartphone or smartwatch with iOS |

| Technology | 6-digit codes and bank’s mobile application | Contactless payments using NFC (Near Field communication) technology | Contactless payments using NFC (Near Field communication) technology |

| Underlying financial instrument | Bank account and bank transfer | Payment card | Payment card |

| Bank’s acceptance | Required | Required | Required |

| Options | In-store payments On-line payments ATM cash withdrawals P2P transfers | In-store payments On-line payments | In-store payments On-line payments |

| Authorization | Code, fingerprint, PIN, password | Fingerprint, PIN, pattern, or password | FaceID or Fingerprint |

| Scope | Originally: domestic payments Evolving towards international payments | International payments | International payments |

| Specification | Q2/15 | Q4/15 | Q4/16 | Q4/17 | Q4/18 | Q4/19 | Q4/20 | Q1/21 |

|---|---|---|---|---|---|---|---|---|

| Banks | 6 | 6 | 7 | 9 | 11 | 11 | 14 | 15 |

| users (in million) | 0.67 | 1.4 | 3.1 | 6.1 | 8.8 | 13.1 | 16.9 | 18.3 |

| stores (in thousand) | 84.87 | 136.8 | 185.3 | 255.4 | 384 | 476.2 | 611.4 | 632.2 |

| POS (in thousand) | 100.3 | 132.8 | 177.0 | 232.2 | 413.8 | 538.4 | 701.7 | 712.1 |

| online stores (in thousand) | 24.5 | 28 | 42.9 | 79.9 | 91.8 | 110.3 | 142.2 | 151.4 |

| ATMs (in thousand) | 6.1 | 14.3 | 15.9 | 17.2 | 19.8 | 20 | 20.2 | 19.8 |

| number of transactions (in million) | 0.267 | 0.615 | 3.8 | 12.0 | 33.7 | 71.9 | 140.1 | 153.1 |

| value of transactions (in PLN million) | 74.8 | 159 | 616.7 | 1660 | 4400 | 9600 | 18,800 | 20,100 |

| daily number of transactions (in thousand) | 2.94 | 6.68 | 41.64 | 130.6 | 366.4 | 782 | 1500 | 1700 |

| daily value of transactions (in PLN million) | 0.8 | 1.73 | 6.7 | 18.1 | 48.0 | 104.1 | 204.3 | 222.9 |

| average value of transaction (in PLN) | 279 | 259 | 161 | 138 | 131 | 133 | 134 | 131 |

| Success Drivers | Barriers to Success | |

|---|---|---|

| External factors | Digitalization of financial services Popularization of smartphones, smartwatches, and tablets Development of e-commerce and m-commerce Increasing demand for m-payments Decreasing costs of data transfer Increasing number of internet and mobile banking users Increasing number of merchants accepting m-payments | Lack of financial knowledge and the limited acceptance of new payment solutions by the end-users Households and merchants’ habits—preferences for cash payments or card payments and limited trust to payment innovations Security and privacy concerns Poor quality of mobile internet connection (instable internet connection reduces the convenience of usage) Strong competition from other m-payments providers: e.g., Google Pay, Apple Pay Potential development of entirely new payment solutions based, e.g., on distributed ledger technology (DLT) Excessive regulatory burdens |

| Internal factors | Simplicity and convenience—BLIK was implemented in already working m-banking apps Speed and security (verification of user, access to app with PIN, fingerprint scan or password, one-time code) Special features: P2P transfers, request for payment, one-click (continuous development) Evolving towards cross-border payments No extra costs for consumers Adding value to existing m-banking solutions Substitute for card and cash transactions Open business model | Costs related to cybersecurity and fraud risk management Potential conflict of interest among participants of the open business model and the shareholders of BLIK |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Błach, J.; Klimontowicz, M. The Determinants of PayTech’s Success in the Mobile Payment Market—The Case of BLIK. J. Risk Financial Manag. 2021, 14, 422. https://doi.org/10.3390/jrfm14090422

Błach J, Klimontowicz M. The Determinants of PayTech’s Success in the Mobile Payment Market—The Case of BLIK. Journal of Risk and Financial Management. 2021; 14(9):422. https://doi.org/10.3390/jrfm14090422

Chicago/Turabian StyleBłach, Joanna, and Monika Klimontowicz. 2021. "The Determinants of PayTech’s Success in the Mobile Payment Market—The Case of BLIK" Journal of Risk and Financial Management 14, no. 9: 422. https://doi.org/10.3390/jrfm14090422

APA StyleBłach, J., & Klimontowicz, M. (2021). The Determinants of PayTech’s Success in the Mobile Payment Market—The Case of BLIK. Journal of Risk and Financial Management, 14(9), 422. https://doi.org/10.3390/jrfm14090422