A Panel Study of Factor Accumulation and Export Quality

Abstract

:1. Introduction

2. Literature Review

3. Trends in Product-Level Export Unit Values

4. Empirical Analysis

4.1. Estimation

4.2. Data

4.3. Panel of Countries: Empirical Analysis and Data

4.4. Panel of Products: Empirical Analysis and Data

5. Results

5.1. Panel of Countries

5.2. Panel of Products

6. Conclusions

6.1. Discussion

6.2. Overall Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Algeria |

| Argentina |

| Australia |

| Austria |

| Belize |

| Belgium |

| Benin |

| Bangladesh |

| Brazil |

| Burkina Faso |

| Burundi |

| Cameroon |

| Canada |

| Chile |

| China |

| Colombia |

| Congo |

| Costa Rica |

| Central African Republic |

| Denmark |

| Dominican Republic |

| Ecuador |

| Egypt |

| Fiji |

| Finland |

| France |

| Gabon |

| Gambia |

| Ghana |

| Greece |

| Guatemala |

| Guyana |

| Haiti |

| Honduras |

| Hong Kong |

| Hungary |

| Iceland |

| India |

| Indonesia |

| Iran |

| Ireland |

| Israel |

| Italy |

| Cote d’Ivoire |

| Jamaica |

| Japan |

| Jordan |

| Kenya |

| South Korea |

| Kuwait |

| Malawi |

| Malaysia |

| Mali |

| Malta |

| Mauritania |

| Mexico |

| Morocco |

| Mauritius |

| Nepal |

| Netherlands |

| Papua New Guinea |

| New Zealand |

| Nicaragua |

| Niger |

| Nigeria |

| Norway |

| Oman |

| Pakistan |

| Panama |

| Paraguay |

| Peru |

| Philippines |

| Portugal |

| Romania |

| Rwanda |

| El Salvador |

| Saudi Arabia |

| Senegal |

| Sierra Leone |

| Singapore |

| Spain |

| Sri Lanka |

| Sudan |

| Suriname |

| Sweden |

| Switzerland |

| Syria |

| South Africa |

| Thailand |

| Togo |

| Trinidad and Tobago |

| Tunisia |

| Turkey |

| United Kingdom |

| Uruguay |

| Venezuela |

| Democratic Republic of the Congo |

| Zambia |

| Zimbabwe |

| Argentina |

| Australia |

| Austria |

| Belgium |

| Bolivia |

| Canada |

| Chile |

| Colombia |

| Denmark |

| Dominican Republic |

| Ecuador |

| Finland |

| France |

| Germany |

| Greece |

| Guatemala |

| Honduras |

| Hong Kong |

| Iceland |

| India |

| Iran |

| Ireland |

| Israel |

| Italy |

| Cote d’Ivoire |

| Jamaica |

| Japan |

| Kenya |

| South Korea |

| Madagascar |

| Malawi |

| Mexico |

| Morocco |

| Mauritius |

| Nepal |

| Netherlands |

| New Zealand |

| Nigeria |

| Norway |

| Panama |

| Paraguay |

| Peru |

| Philippines |

| Portugal |

| Sierra Leone |

| Spain |

| Sri Lanka |

| Sweden |

| Switzerland |

| Syria |

| Thailand |

| Turkey |

| United Kingdom |

| Venezuela |

| Zambia |

| Zimbabwe |

| Albania |

| Algeria |

| Angola |

| United Arab Emirates |

| Argentina |

| Australia |

| Austria |

| Bahamas |

| Bahrain |

| Belize |

| Belgium |

| Benin |

| Bangladesh |

| Bolivia |

| Brazil |

| Bulgaria |

| Burkina Faso |

| Burundi |

| Cameroon |

| Canada |

| Chad |

| Chile |

| China |

| Colombia |

| Congo |

| Costa Rica |

| Cyprus |

| Central African Republic |

| Denmark |

| Dominican Republic |

| Ecuador |

| Egypt |

| Ethiopia |

| Fiji |

| Finland |

| France |

| Gabon |

| Gambia |

| Germany |

| Ghana |

| Greece |

| Guatemala |

| Guinea |

| Guyana |

| Guinea-Bissau |

| Haiti |

| Honduras |

| Hong Kong |

| Hungary |

| Iceland |

| India |

| Indonesia |

| Iran |

| Ireland |

| Israel |

| Italy |

| Cote d’Ivoire |

| Jamaica |

| Japan |

| Jordan |

| Kenya |

| Kiribati |

| South Korea |

| Kuwait |

| Laos |

| Liberia |

| Libya |

| Macau |

| Madagascar |

| Malawi |

| Malaysia |

| Mali |

| Malta |

| Mauritania |

| Mexico |

| Mongolia |

| Morocco |

| Mozambique |

| Mauritius |

| Nepal |

| Netherlands |

| New Caledonia |

| Papua New Guinea |

| New Zealand |

| Nicaragua |

| Niger |

| Nigeria |

| Norway |

| Oman |

| Pakistan |

| Panama |

| Paraguay |

| Peru |

| Philippines |

| Portugal |

| Romania |

| Rwanda |

| El Salvador |

| Samoa |

| Saudi Arabia |

| Senegal |

| Seychelles |

| Sierra Leone |

| Singapore |

| Spain |

| Sri Lanka |

| Saint Kitts and Nevis |

| Sudan |

| Suriname |

| Sweden |

| Switzerland |

| Syria |

| South Africa |

| Thailand |

| Togo |

| Trinidad and Tobago |

| Tunisia |

| Turkey |

| Uganda |

| United Kingdom |

| Uruguay |

| Venezuela |

| Democratic Republic of the Congo |

| Zambia |

| Zimbabwe |

| Algeria |

| Australia |

| Austria |

| Belize |

| Belgium |

| Benin |

| Brazil |

| Burkina Faso |

| Burundi |

| Cameroon |

| Canada |

| Chad |

| Chile |

| China |

| Colombia |

| Congo |

| Costa Rica |

| Central African Republic |

| Denmark |

| Dominican Republic |

| Ecuador |

| Egypt |

| Fiji |

| Finland |

| France |

| Gabon |

| Gambia |

| Georgia |

| Germany |

| Ghana |

| Greece |

| Guatemala |

| Guyana |

| Honduras |

| Hong Kong |

| Hungary |

| Iceland |

| India |

| Indonesia |

| Iran |

| Ireland |

| Israel |

| Italy |

| Cote d’Ivoire |

| Jamaica |

| Japan |

| Jordan |

| Kenya |

| South Korea |

| Kuwait |

| Latvia |

| Madagascar |

| Malawi |

| Malaysia |

| Mali |

| Malta |

| Mauritania |

| Mexico |

| Morocco |

| Mauritius |

| Nepal |

| Netherlands |

| Papua New Guinea |

| New Zealand |

| Nicaragua |

| Niger |

| Nigeria |

| Norway |

| Oman |

| Pakistan |

| Panama |

| Paraguay |

| Peru |

| Philippines |

| Portugal |

| Romania |

| El Salvador |

| Saudi Arabia |

| Senegal |

| Singapore |

| Spain |

| Sri Lanka |

| Sudan |

| Suriname |

| Sweden |

| Switzerland |

| Syria |

| South Africa |

| Thailand |

| Togo |

| Trinidad and Tobago |

| Tunisia |

| Turkey |

| United Kingdom |

| Uruguay |

| Venezuela |

| Democratic Republic of the Congo |

| Zambia |

| Albania |

| Algeria |

| Angola |

| United Arab Emirates |

| Argentina |

| Armenia |

| Australia |

| Austria |

| Azerbaijan |

| Bahamas |

| Bahrain |

| Belarus |

| Belize |

| Belgium |

| Benin |

| Bangladesh |

| Bolivia |

| Bosnia and Herzegovina |

| Brazil |

| Bulgaria |

| Burkina Faso |

| Burundi |

| Cambodia |

| Cameroon |

| Canada |

| Chad |

| Chile |

| China |

| Colombia |

| Congo |

| Costa Rica |

| Croatia |

| Cyprus |

| Czech Republic |

| Central African Republic |

| Denmark |

| Djibouti |

| Dominican Republic |

| Ecuador |

| Egypt |

| Equatorial Guinea |

| Estonia |

| Ethiopia |

| Fiji |

| Finland |

| France |

| Gabon |

| Gambia |

| Georgia |

| Germany |

| Ghana |

| Greece |

| Guatemala |

| Guinea |

| Guyana |

| Guinea-Bissau |

| Haiti |

| Honduras |

| Hong Kong |

| Hungary |

| Iceland |

| India |

| Indonesia |

| Iran |

| Ireland |

| Israel |

| Italy |

| Cote d’Ivoire |

| Jamaica |

| Japan |

| Jordan |

| Kazakhstan |

| Kenya |

| Kiribati |

| South Korea |

| Kuwait |

| Kyrgyz Republic |

| Laos |

| Latvia |

| Lebanon |

| Liberia |

| Lithuania |

| Macau |

| Macedonia |

| Madagascar |

| Malawi |

| Malaysia |

| Mali |

| Malta |

| Mauritania |

| Mexico |

| Moldova |

| Mongolia |

| Morocco |

| Mozambique |

| Mauritius |

| Nepal |

| Netherlands |

| New Caledonia |

| Papua New Guinea |

| New Zealand |

| Nicaragua |

| Niger |

| Nigeria |

| Norway |

| Oman |

| Pakistan |

| Panama |

| Paraguay |

| Peru |

| Philippines |

| Poland |

| Portugal |

| Romania |

| Russia |

| Rwanda |

| El Salvador |

| Samoa |

| Saudi Arabia |

| Senegal |

| Seychelles |

| Sierra Leone |

| Singapore |

| Slovak Republic |

| Slovenia |

| Spain |

| Sri Lanka |

| Saint Kitts and Nevis |

| Sudan |

| Suriname |

| Sweden |

| Switzerland |

| Syria |

| South Africa |

| Tajikistan |

| Tanzania |

| Thailand |

| Togo |

| Trinidad and Tobago |

| Tunisia |

| Turkey |

| Turkmenistan |

| Uganda |

| United Kingdom |

| Ukraine |

| Uruguay |

| Uzbekistan |

| Venezuela |

| Vietnam |

| Yemen |

| Yugoslavia |

| Democratic Republic of the Congo |

| Zambia |

| Zimbabwe |

Appendix B

| Measures Technology Years: 1989–2001 | ||

|---|---|---|

| Low-Income Countries | ||

| Estimate | t-Stat. | |

| TAJIKISTAN | 3.137 | 1.654 * |

| UGANDA | 7.993 | 2.248 ** |

| KYRGYZSTAN | −6.279 | −4.754 |

| IVORY COAST | 3.005 | 3.221 *** |

| GEORGIA | 1.010 | 0.560 |

| EQUATORIAL GUINEA | 0.545 | 0.752 |

| AZERBAIJAN | −0.439 | −0.541 |

| TOGO | −1.690 | −1.780 |

| BANGLADESH | −0.206 | −0.220 |

| INDIA | −0.921 | −3.220 |

| CHAD | 1.184 | 0.198 |

| SENEGAL | −4.440 | −2.465 |

| ARMENIA | 10.651 | 7.301 *** |

| BURUNDI | 0.511 | 0.114 |

| CAMEROON | 0.961 | 0.966 |

| KIRIBATI | −1.546 | −0.912 |

| NEPAL | −2.289 | −3.132 |

| MALI | −6.349 | −2.743 |

| SRI LANKA | −0.856 | −1.171 |

| PAKISTAN | −1.032 | −2.605 |

| UKRAINE | −0.069 | −0.242 |

| SUDAN | −1.141 | −0.769 |

| RWANDA | −0.557 | −0.995 |

| NICARAGUA | −3.566 | −4.395 |

| BENIN | 36.668 | 1.853 * |

| GUYANA | 2.828 | 5.278 *** |

| GHANA | −16.716 | −4.094 |

| TURKMENISTAN | −3.634 | −4.408 |

| TANZANIA | −4.703 | −1.614 |

| INDONESIA | 0.407 | 4.946 *** |

| MAURITIAN | −3.654 | −0.350 |

| YEMEN | −1.023 | −0.341 |

| PHILIPPINES | 0.446 | 1.710 * |

| MOLDOVA | −1.711 | −3.705 |

| MALAWI | 1.850 | 2.730 *** |

| KENYA | −4.017 | −2.818 |

| ZAIRE | 0.722 | 0.575 |

| LIBERIA | −0.654 | −2.102 |

| HONDURA | −1.154 | −3.227 |

| LAOS | −31.988 | −6.637 |

| GUINEA | −0.067 | −0.014 |

| CENTRAL AFRICA | 0.582 | 0.110 |

| ZIMBABWE | −1.276 | −3.516 |

| ALBANIA | −2.819 | −5.175 |

| UZBEKISTAN | −26.741 | −8.080 |

| NIGER | 9.397 | 2.494 *** |

| BOLIVIA | −1.033 | −0.811 |

| CHINA | 0.616 | 4.678 *** |

| SIERRA LEONE | 2.265 | 2.855 *** |

| GUINEA BISSAU | −2.078 | −1.262 |

| MOZAMBIQUE | −2.163 | −0.921 |

| ETHIOPIA | −2.280 | −4.120 |

| CAMBODIA | 1.144 | 1.523 |

| NIGERIA | 3.264 | 2.362 *** |

| BURKINA | −5.359 | −1.542 |

| NEW GUINEA | 2.853 | 2.300 *** |

| MONGOLA | −4.917 | −7.411 |

| SYRIA | −0.363 | −0.620 |

| HAITI | −0.096 | −0.422 |

| ZAMBIA | −1.077 | −0.447 |

| BOSNIA AND HERZEGOVINA | 1.047 | 3.081 *** |

| GAMBIA | −8.251 | −1.947 |

| VIETNAM | 4.081 | 3.953 *** |

| ANGOLA | 6.830 | 5.417 *** |

| MADAGASCAR | −11.858 | −7.857 |

| Middle-Income Countries | ||

| BRAZIL | 0.323 | 1.463 |

| GABON | −9.438 | −6.384 |

| COSTA RICA | −1.763 | −5.445 |

| PANAMA | 1.745 | 2.819 *** |

| VENEZUELA | 0.614 | 2.547 *** |

| POLAND | −3.548 | −10.718 |

| URUGUAY | −0.151 | −0.361 |

| ECUADOR | 1.386 | 4.768 *** |

| PARAGUAY | −3.921 | −2.411 *** |

| CZECHOSLOVAKIA | −0.185 | −0.625 |

| SOUTH AFRICA | 5.386 | 9.218 *** |

| ARGENTINA | 0.585 | 3.053 *** |

| LITHUANIA | 1.398 | 3.709 *** |

| MOROCCO | −0.610 | −2.911 *** |

| GUATEMALA | −0.113 | −0.115 |

| FIJI | 2.160 | 3.416 *** |

| DOMINICAN REPUBLIC | −2.225 | −9.399 *** |

| BELIZE | −3.114 | −6.589 *** |

| SEYCHELLE | −10.074 | −1.507 |

| SLOVAKIA | 5.252 | 3.839 *** |

| PORTUGAL | −0.322 | −0.913 |

| TURKEY | 0.576 | 4.324 *** |

| CHILE | 2.696 | 9.243 *** |

| LEBANON | −1.660 | −8.249 *** |

| TUNISIA | −2.783 | −2.951 *** |

| BULGARIA | −1.025 | −3.455 *** |

| MALAYSIA | 0.476 | 3.438 *** |

| MAURITIUS | 7.729 | 3.191 *** |

| IRAN | −7.755 | −1.318 |

| CONGO | −1.185 | −0.753 |

| LATVIA | 0.588 | 0.417 |

| MACEDONIA | 2.067 | 3.927 *** |

| CROATIA | −2.418 | −8.964 *** |

| MEXICO | −0.028 | −0.270 |

| GREECE | −0.531 | −0.955 |

| TRINIDAD | −1.899 | −2.995 *** |

| SAINT KITTS AND NEVIS | 2.790 | 3.228 *** |

| HUNGARY | −4.466 | −17.811 *** |

| RUSSIA | −0.297 | −1.599 |

| KAZAKHSTAN | −0.681 | −1.507 |

| SOUTH KOREA | 1.014 | 11.500 *** |

| SLOVENIA | −6.060 | −2.707 *** |

| BELARUS | −0.653 | −1.979 *** |

| ALGERIA | −6.463 | −2.331 *** |

| EGYPT | −4.104 | −4.458 *** |

| JORDAN | 2.059 | 3.356 *** |

| THAILAND | 1.112 | 13.954 *** |

| PERU | 1.244 | 6.336 *** |

| MALTA | 2.911 | 0.780 |

| ROMANIA | −0.494 | −2.304 *** |

| COLOMBIA | 1.455 | 5.813 *** |

| SALVADOR | 4.512 | 10.113 *** |

| JAMAICA | 1.477 | 2.193 ** |

| SURINAME | 6.884 | 4.226 *** |

| ESTONIA | −0.339 | −0.387 |

| SAMOA | −3.933 | −1.996 ** |

| OMAN | 2.223 | 4.727 *** |

| High-Income Countries | ||

| SPAIN | 0.366 | 0.879 |

| MACAU | 2.683 | 15.907 *** |

| ARAB EMPIRE | −1.109 | −3.323 *** |

| ISRAEL | 1.501 | 2.917 *** |

| GERMANY | 1.810 | 7.841 *** |

| ICELAND | −7.411 | −10.729 *** |

| KUWAIT | 6.246 | 4.571 *** |

| BELGIUM-LUXEMBOURG | −0.618 | −1.286 |

| AUSTRIA | 0.198 | 0.342 |

| SINGAPORE | −0.219 | −0.894 |

| ITALY | 2.622 | 7.668 *** |

| NEW ZEALAND | −4.143 | −8.708 *** |

| SAUDI ARABIA | 4.067 | 4.402 *** |

| NETHERLANDS | −4.055 | −6.667 *** |

| CYPRUS | −1.369 | −1.733 * |

| JAPAN | 1.301 | 6.291 *** |

| IRELAND | −0.838 | −2.209 ** |

| HONGKONG | −0.107 | −0.826 |

| UNITED KINGDOM | −1.283 | −4.850 *** |

| DENMARK | −0.334 | −0.530 |

| AUSTRALIA | 0.468 | 4.929 *** |

| NORWAY | 1.533 | 1.645 * |

| SWITZERLAND | −1.372 | −3.805 *** |

| BAHAMAS | −10.749 | −7.526 *** |

| NEW CATALONIA | −5.074 | −2.215 ** |

| CANADA | −1.724 | −13.499 *** |

| BAHRAIN | 2.203 | 3.620 *** |

| FRANCE | 0.902 | 2.800 *** |

| FINLAND | −0.658 | −2.202 ** |

| SWEDEN | −1.875 | −6.017 *** |

| Measures Technology Years: 1972–1988 | ||

|---|---|---|

| Low-Income Countries | ||

| Estimate | t-Stat. | |

| Togo | −0.117 | −0.019 |

| Bangladesh | −3.400 | −2.650 *** |

| Nepal | −1.009 | −1.198 |

| Zambia | −16.619 | −3.549 *** |

| Congo, Dem. Rep. | −2.595 | −1.169 |

| Mozambique | 3.656 | 1.640 |

| Kiribati | −4.474 | −4.093 *** |

| Gambia, The | 6.193 | 1.370 |

| Pakistan | −5.762 | −10.129 *** |

| China | −1.720 | −9.088 *** |

| Morocco | −0.811 | −1.841 * |

| Sri Lanka | 0.084 | 0.226 |

| Central African Republic | 1.045 | 0.117 |

| Cote d’Ivoire | −0.574 | −0.490 |

| Rwanda | 4.417 | 0.519 |

| Mali | 0.617 | 0.404 |

| Sudan | 2.800 | 0.704 |

| Senegal | −1.073 | −0.355 |

| Malawi | −5.105 | −0.766 |

| Egypt, Arab Rep. | −2.920 | −3.812 *** |

| Papua New Guinea | −0.473 | −0.055 |

| Benin | 4.855 | 0.713 |

| Guinea-Bissau | 11.400 | 1.526 |

| Uganda | −6.952 | −0.625 |

| Sierra Leone | 18.089 | 4.329 *** |

| Kenya | −1.677 | −0.926 |

| Guyana | 0.732 | 0.710 |

| Liberia | 4.168 | 0.810 |

| Haiti | 1.677 | 5.362 *** |

| Ethiopia | −1.677 | −1.209 |

| Nicaragua | 1.630 | 3.995 *** |

| Honduras | 3.714 | 4.379 *** |

| Thailand | −0.826 | −2.472 *** |

| Indonesia | −0.039 | −0.070 |

| India | −0.776 | −4.345 *** |

| Congo, Rep. | −3.428 | −1.974 ** |

| Niger | 8.745 | 5.232 *** |

| Zimbabwe | 7.038 | 3.792 *** |

| Mauritania | 8.428 | 1.295 |

| Madagascar | −0.212 | −0.073 |

| Syrian Arab Republic | 1.248 | 1.525 |

| Nigeria | −2.851 | −2.392 *** |

| Cameroon | −2.216 | −1.556 |

| Burkina Faso | 3.242 | 1.415 |

| Philippines | −0.552 | −3.613 *** |

| Bolivia | 2.680 | 2.887 *** |

| Ghana | −4.258 | −3.621 *** |

| Middle-Income Countries | ||

| Mexico | 2.970 | 19.865 *** |

| Brazil | 1.617 | 10.246 *** |

| Malta | 1.448 | 1.275 |

| Malaysia | 2.020 | 6.155 *** |

| Samoa | 0.047 | 0.010 |

| Peru | 0.769 | 4.132 *** |

| Panama | 0.301 | 0.910 |

| Belize | 5.146 | 4.834 *** |

| Venezuela, RB | 3.804 | 6.073 *** |

| Turkey | −2.903 | −6.094 *** |

| Guatemala | −1.067 | −2.034 ** |

| Portugal | −1.408 | −6.285 *** |

| Trinidad and Tobago | −1.084 | −1.045 |

| Greece | −1.903 | −5.286 *** |

| Costa Rica | −0.638 | −1.939 * |

| Dominican Republic | 0.530 | 1.469 |

| Uruguay | −2.441 | −6.626 *** |

| Suriname | −1.126 | −0.571 |

| Paraguay | −5.956 | −5.957 *** |

| Italy | 1.364 | 6.331 *** |

| Chile | −1.927 | −5.288 *** |

| Oman | −5.677 | −2.577 *** |

| Seychelles | −10.661 | −2.791 *** |

| Bulgaria | 8.717 | 4.520 *** |

| Ecuador | −1.300 | −2.413 *** |

| Colombia | 0.819 | 1.316 |

| Cyprus | 1.924 | 1.934 *** |

| Iran, Islamic Rep. | 0.289 | 0.469 |

| Gabon | −1.336 | −0.606 |

| Korea, Rep. | −1.873 | −11.940 *** |

| El Salvador | −0.316 | −0.866 |

| Jordan | −2.751 | −1.022 |

| Algeria | −13.159 | −1.843 ** |

| Spain | −0.611 | −1.955 ** |

| Fiji | −0.425 | −0.406 |

| Tunisia | −7.002 | −5.201 *** |

| Hungary | −0.920 | −1.332 |

| St. Kitts and Nevis | −0.974 | −1.145 |

| Romania | −3.123 | −5.877 *** |

| South Africa | 1.529 | 3.075 *** |

| Libya | 4.066 | 0.682 |

| Argentina | 1.125 | 4.795 *** |

| Jamaica | −2.253 | −4.558 *** |

| Mauritius | 15.443 | 9.374 *** |

| High-Income Countries | ||

| Netherlands | 2.711 | 6.145 *** |

| Sweden | −0.441 | −0.881 |

| Israel | −0.744 | −1.538 |

| Bahamas, The | −0.230 | −0.412 |

| Finland | −4.717 | −7.088 |

| France | 0.967 | 2.662 *** |

| Kuwait | −1.415 | −1.375 |

| Germany | 1.803 | 7.817 *** |

| Japan | −0.368 | −2.265 ** |

| Hong Kong, China | −2.343 | −22.567 *** |

| Saudi Arabia | 1.640 | 1.565 |

| Bahrain | −7.038 | −4.690 *** |

| Austria | 2.810 | 5.923 *** |

| United Arab Emirates | −2.022 | −2.610 *** |

| New Zealand | −4.124 | −5.506 *** |

| Singapore | −0.734 | −2.510 *** |

| Belgium | 2.096 | 6.003 *** |

| Iceland | 0.150 | 0.155 |

| Switzerland | −2.139 | −8.795 *** |

| Denmark | −2.325 | −5.757 *** |

| Ireland | 1.972 | 3.971 *** |

| Macao, China | −0.680 | −2.402 *** |

| New Caledonia | −1.332 | −0.991 |

| Australia | −3.980 | −7.042 *** |

| Canada | 0.314 | 1.581 |

| United Kingdom | −2.804 | −15.034 *** |

| Norway | 2.447 | 4.040 *** |

| Measures Skill Years: 1989–2001 | ||

|---|---|---|

| Low-Income Countries | ||

| Estimate | t-Stat. | |

| FIJI | 2.560 | 1.723 * |

| KUWAIT | −0.409 | −2.361 *** |

| INDIA | −0.584 | −2.198 ** |

| SYRIA | −7.679 | −2.250 ** |

| CHAD | 2.152 | 0.297 |

| NIGER | −14.726 | −3.327 *** |

| SRI LANKA | −3.187 | −3.779 *** |

| MALI | 6.471 | 2.802 *** |

| NEW GUINEA | 6.661 | 3.069 *** |

| MADAGASCAR | 1.412 | 0.928 |

| KENYA | −0.201 | −0.461 |

| BENIN | −25.948 | −4.040 *** |

| GUYANA | −4.814 | −4.401 *** |

| PHILIPPINES | −1.369 | −2.302 *** |

| NEPAL | 0.427 | 0.662 |

| CHINA | 0.229 | 1.307 |

| MALAWI | 2.154 | 2.469 *** |

| HONDURA | −14.604 | −2.364 *** |

| TOGO | −4.458 | −1.950 * |

| CAMEROON | −9.174 | −7.596 *** |

| NICARAGUA | 1.818 | 3.655 *** |

| SENEGAL | −0.080 | −0.037 |

| ZAMBIA | −60.834 | −2.868 *** |

| INDONESIA | 0.865 | 4.948 *** |

| ZIMBABWE | −0.416 | −0.706 |

| NIGERIA | 2.672 | 1.735 *** |

| GAMBIA | 2.105 | 1.564 |

| BURUNDI | −14.180 | −4.579 *** |

| IVORY COAST | 0.422 | 0.267 |

| Middle-Income Countries | ||

| ROMANIA | −4.096 | −8.219 *** |

| TURKEY | −1.588 | −2.970 *** |

| BELIZE | −1.000 | −1.548 |

| PANAMA | −11.199 | −6.423 *** |

| CHILE | 0.368 | 1.261 |

| SURINAM | −4.395 | −4.120 *** |

| THAILAND | 1.146 | 7.241 *** |

| SOUTH AFRICA | 11.569 | 6.419 *** |

| IRAN | 11.814 | 0.913 |

| VENEZUELA | 1.275 | 4.128 *** |

| OMAN | 3.379 | 12.864 *** |

| EGYPT | 1.111 | 1.805 * |

| TUNISIA | −3.133 | −4.723 *** |

| ECUADOR | 1.646 | 7.344 *** |

| CONGO | 0.967 | 0.202 |

| HUNGARY | −1.427 | −3.532 *** |

| DOMINICAN REPUBLIC | −0.574 | −1.231 |

| MOROCCO | 2.636 | 3.374 *** |

| PORTUGAL | 1.121 | 7.033 *** |

| COLOMBIA | 0.750 | 3.384 *** |

| URUGUAY | −1.860 | −2.492 *** |

| GUATEMALA | 0.376 | 0.926 |

| PERU | 0.532 | 1.108 |

| LATVIA | 7.895 | 0.555 |

| GABON | 1.997 | 0.701 |

| MEXICO | −2.488 | −10.965 *** |

| SOUTH KOREA | 0.257 | 1.030 |

| ALGERIA | −20.017 | −3.252 *** |

| MALAYSIA | −1.636 | −5.721 *** |

| PARAGUAY | −2.606 | −2.940 *** |

| JAMAICA | 2.742 | 1.061 |

| BRAZIL | −0.459 | −1.453 |

| JORDAN | 2.556 | 1.368 |

| GREECE | 2.993 | 3.888 *** |

| MAURITIAN | −0.922 | −0.635 |

| MALTA | 4.069 | 2.390 *** |

| SALVADOR | −0.502 | −2.552 *** |

| COSTA RICA | −0.161 | −0.248 |

| TRINIDAD | −0.445 | −0.233 |

| High-Income Countries | ||

| JAPAN | 0.608 | 2.360 *** |

| NORWAY | −0.609 | −2.190 ** |

| AUSTRIA | 2.498 | 2.435 *** |

| SWEDEN | 0.006 | 0.059 |

| ICELAND | −8.240 | −6.706 *** |

| HONGKONG | 0.172 | 0.949 |

| AUSTRALIA | 0.129 | 1.939 * |

| IRELAND | 1.067 | 2.104 ** |

| ITALY | −3.152 | −9.361 *** |

| BELGIUM-LUXEMBOURG | 0.062 | 0.815 |

| GERMANY | 0.586 | 2.446 *** |

| SAUDI ARABIA | −9.472 | −4.218 |

| SPAIN | −0.361 | −0.987 |

| SINGAPORE | 1.501 | 3.801 *** |

| FRANCE | −0.805 | −4.122 *** |

| FINLAND | −2.229 | −3.417 *** |

| SWITZERLAND | 1.366 | 1.416 |

| DENMARK | −3.474 | −3.128 *** |

| CANADA | 3.869 | 6.555 *** |

| NETHERLANDS | −0.123 | −0.796 |

| UNITED KINGDOM | 0.076 | 1.890 *** |

| NEW ZEALAND | −0.936 | −2.071 ** |

| ISRAEL | 0.660 | 1.046 |

| Measures Skill Years: 1972–1988 | ||

|---|---|---|

| Low-Income Countries | ||

| Estimate | t-Stat. | |

| BARBADOS | −5.158 | −2.732 *** |

| THAILAND | 6.209 | 12.316 *** |

| PHILIPPINES | −1.468 | −5.922 *** |

| IVORY COAST | −4.696 | −2.681 *** |

| MALI | 0.192 | 0.097 |

| GHANA | 1.479 | 0.430 |

| ZAMBIA | −7.719 | −1.368 |

| SUDAN | −27.575 | −3.809 *** |

| EGYPT | 14.924 | 10.351 *** |

| BURKINA | −2.204 | −3.160 *** |

| KENYA | 4.153 | 4.389 *** |

| SENEGAL | −2.725 | −0.660 |

| CENTRAL AFRICA | −9.965 | −2.963 *** |

| GUYANA | −3.302 | −3.297 *** |

| NIGER | −8.979 | −2.486 *** |

| NEW GUINEA | −13.545 | −1.156 |

| NIGERIA | 1.165 | 2.170 ** |

| NEPAL | −2.759 | −3.989 *** |

| SRI_LKA | −1.085 | −1.703 * |

| MAURITIUS | −1.774 | −0.097 |

| BANGLADESH | −0.806 | −3.033 *** |

| HAITI | −0.307 | −2.170 ** |

| HONDURA | 5.325 | 7.542 *** |

| SYRIA | −3.621 | −0.818 |

| INDIA | 0.730 | 1.585 |

| TOGO | −10.685 | −3.091 *** |

| CAMEROON | 8.878 | 3.348 *** |

| INDONESIA | −0.651 | −2.115 ** |

| ZAIRE | 1.056 | 0.726 |

| MALAWI | 2.215 | 0.537 |

| MOROCCO | 0.133 | 0.168 |

| SIERRA LEONE | 8.621 | 2.886 *** |

| ZIMBABWE | 1.830 | 4.071 *** |

| CHINA | −1.441 | −20.933 *** |

| Middle-Income Countries | ||

| TURKEY | 0.115 | 0.086 |

| ARGENTINA | −2.033 | −4.920 *** |

| MAURITIAN | 7.030 | 6.779 *** |

| VENEZUELA | 1.340 | 9.814 *** |

| SPAIN | 0.193 | 0.611 |

| JORDAN | 2.775 | 0.458 |

| OMAN | 4.805 | 0.686 |

| JAMAICA | −1.958 | −2.675 *** |

| MEXICO | −0.285 | −0.950 |

| PARAGUAY | 18.900 | 10.715 *** |

| BRAZIL | 0.420 | 1.623 |

| GUATEMALA | −6.798 | −8.810 *** |

| SOUTH KOREA | 1.217 | 4.632 *** |

| URUGUAY | −6.334 | −4.813 *** |

| IRAN | 5.172 | 2.584 *** |

| PANAMA | −12.963 | −5.108 *** |

| COLOMBIA | 0.126 | 0.714 |

| FIJI | −3.160 | −0.912 |

| TRINIDAD | 12.753 | 4.437 *** |

| GABON | 2.759 | 0.560 |

| PORTUGAL | 0.205 | 1.754 * |

| ROMANIA | 1.343 | 4.891 *** |

| SURINAM | −1.160 | −0.499 |

| BELIZE | −8.140 | −3.610 *** |

| SALVADOR | 3.121 | 6.969 *** |

| HUNGARY | −0.673 | −0.925 |

| ALGERIA | −7.270 | −1.357 |

| MALTA | 5.311 | 2.436 *** |

| MALAYSIA | −3.372 | −6.982 *** |

| PERU | −1.955 | −1.578 |

| GREECE | 1.594 | 2.159 ** |

| NICARAGUA | −3.205 | −1.457 |

| CHILE | −3.450 | −4.963 *** |

| CONGO | 6.733 | 2.119 ** |

| COSTA RICA | −5.927 | −8.132 *** |

| DOMINICAN REPUBLIC | 0.896 | 4.832 *** |

| TUNISIA | −7.520 | −5.496 *** |

| ECUADOR | 1.134 | 1.599 |

| High-Income Countries | ||

| SAUDI ARABIA | 2.131 | 0.952 |

| DENMARK | −5.904 | −4.700 *** |

| ITALY | −5.249 | −10.844 *** |

| NETHERLANDS | 0.375 | 2.159 ** |

| UNITED KINGDOM | 6.147 | 7.352 *** |

| SWEDEN | 0.593 | 1.363 |

| ISRAEL | −3.353 | −4.298 *** |

| ICELAND | 2.836 | 0.912 |

| HONGKONG | −18.827 | −21.670 *** |

| NORWAY | 0.955 | 0.682 |

| AUSTRIA | −0.064 | −0.476 |

| KUWAIT | −2.701 | −0.332 |

| BELGIUM−LUXEMBOURG | 1.290 | 2.439 *** |

| FINLAND | −4.118 | −3.744 *** |

| IRELAND | 20.754 | 10.133 *** |

| AUSTRAL | −0.187 | −0.780 |

| NEW ZEALAND | 2.743 | 1.830 * |

| FRANCE | 7.980 | 5.113 *** |

| SINGAPORE | −0.873 | −3.717 *** |

| CANADA | −4.252 | −14.135 *** |

| JAPAN | −0.432 | −0.986 |

| SWITZERLAND | 9.509 | 4.546 *** |

| Measures Capital Years: 1972–1988 | ||

|---|---|---|

| Low-Income Countries | ||

| Estimate | t-Stat. | |

| Name | Yhat_Estimate | Yhat_Tstat |

| POLAND | 1.700 | 0.817 |

| YUGOSLAVIA | 8.723 | 12.401 *** |

| IRAN | 4.732 | 5.710 *** |

| TAIWAN | 3.931 | 19.311 *** |

| SYRIA | −6.035 | −3.295 *** |

| KENYA | 5.905 | 4.222 *** |

| PHILIPPINES | 3.558 | 10.298 *** |

| HONDURA | 3.675 | 6.812 *** |

| NEPAL | 0.463 | 0.192 |

| INDIA | 14.008 | 14.399 *** |

| IVORY COAST | 3.564 | 2.944 *** |

| SRI LANKA | −0.646 | −0.429 |

| BOLIVIA | 2.689 | 3.628 *** |

| MALAWI | −5.803 | −0.886 |

| SIERRA LEONE | −3.428 | −0.354 |

| NIGERIA | 5.517 | 4.487 *** |

| THAILAND | 3.413 | 6.999 *** |

| ZIMBABWE | 9.990 | 4.000 *** |

| MOROCCO | 1.543 | 3.042 *** |

| ZAMBIA | 5.651 | 0.944 |

| Middle-Income Countries | ||

| PARAGUAY | −0.497 | −0.651 |

| MAURITIUS | 3.935 | 7.871 *** |

| CHILE | −1.206 | −2.247 ** |

| GUATEMALA | 3.557 | 7.174 *** |

| PORTUGAL | 3.645 | 10.267 *** |

| ITALY | 11.851 | 31.457 *** |

| SPAIN | 3.546 | 10.095 *** |

| PANAMA | 2.893 | 2.310 *** |

| GREECE | 11.556 | 17.877 *** |

| SOUTH KOREA | 4.781 | 19.208 *** |

| TURKEY | 1.893 | 2.433 *** |

| COLOMBIA | 14.066 | 14.470 *** |

| PERU | 0.310 | 0.628 |

| VENEZUELA | 4.560 | 4.840 *** |

| ECUADOR | 0.846 | 0.965 |

| JAMAICA | 5.064 | 6.171 *** |

| ARGENTINA | 4.451 | 6.965 *** |

| MEXICO | 0.615 | 2.853 *** |

| DOMINICAN REPUBLIC | 7.110 | 15.766 *** |

| High-Income Countries | ||

| BELGIUM−LUXEMBOURG | 13.003 | 25.055 *** |

| GERMANY | 17.464 | 42.090 *** |

| SWEDEN | 2.694 | 6.127 *** |

| NORWAY | 1.395 | 1.432 |

| JAPAN | 7.794 | 36.236 *** |

| SWITZERLAND | 6.746 | 13.022 *** |

| UNITED KINGDOM | 8.121 | 19.872 *** |

| NETHERLANDS | 12.087 | 20.589 *** |

| DENMARK | 4.745 | 6.707 *** |

| HONGKONG | 1.010 | 7.751 *** |

| NEW ZEALAND | 0.095 | 0.066 |

| ISRAEL | 4.844 | 8.242 *** |

| FRANCE | 11.056 | 33.117 *** |

| CANADA | −11.501 | −25.380 *** |

| ICELAND | −1.827 | −0.925 |

| FINLAND | 17.792 | 15.444 *** |

| AUSTRIA | 13.280 | 21.715 *** |

| AUSTRALIA | 21.066 | 7.541 *** |

| IRELAND | 10.529 | 16.306 *** |

Appendix C

Appendix D

Appendix E

Appendix F

| Table 4’s first Stage Regression: | Dependent variable: Log skill level | ||

| Log skill level first lag | 0.22 (82.3) *** | Services exporter dummy | −0.01 (−74.02) *** |

| Log skill level second lag | −0.24 (−89.65) *** | Fuel exporter dummy | 0.02 (9.01) *** |

| Low income dummy | −0.003 (−13.89) *** | Constant | 0.06 (60.09) *** |

| High income dummy | 0.007 (49.27) *** | R-squared | 0.22 |

| Manufacturing exporter dummy | −0.001 (−19.72) *** | Observations | 527,441 |

| Table 5’s first Stage Regression: | Dependent variable: Log Capital Per worker | ||

| Log capital per worker first lag | 0.68 (470.88) | Services exporter dummy | 0.002 (30.59) |

| Log capital per worker second lag | −0.68 (−461.78) | Fuel exporter dummy | −0.01 (−16.08) |

| Low income dummy | −0.002 (−12.52) | Constant | 0.02 (16.27) |

| High income dummy | −0.002 (−16.67) | R-squared | 0.63 |

| Manufacturing exporter dummy | 0.01 (145.6) | ||

| Table 6’s first Stage Regression: | Dependent variable: Log PGDP | ||

| Log PGDP first lag | 0.34 (217.72) *** | Services exporter dummy | 0.0001 (0.73) |

| Log PGDP second lag | −0.35 (−223.44) *** | Fuel exporter dummy | −0.02 (−24.83) *** |

| Low income dummy | −0.02 (−68.14) *** | Constant | 0.07 (21.47) *** |

| High income dummy | 0.01 (54.13) *** | R-squared | 0.34 |

| Manufacturing exporter dummy | 0.01 (189.82) *** | ||

| Table 7’s first Stage Regression: | Dependent variable: Log skill level | ||

| Log skill level first lag | 0.06 (42.23) | Services exporter dummy | 0.03 (55.53) |

| Log skill level second lag | −0.101 (−77.45) | Fuel exporter dummy | −0.02 (−36.89) |

| Low income dummy | 0.001 (2.78) | Constant | 0.19 (152.57) |

| High income dummy | 0.01 (44.73) | R-squared | 0.17 |

| Manufacturing exporter dummy | −0.01 (−79.23) | ||

| Table 8’s first Stage Regression: | Dependent variable: Log PGDP | ||

| Log PGDP first lag | −0.32 (−156.99) *** | Services exporter dummy | 0.01 (95.99) *** |

| Log PGDP second lag | 0.30 (148.77) *** | Fuel exporter dummy | −0.03 (−49.67) *** |

| Low income dummy | 0.01 (25.62) *** | Constant | 0.17 (173.60) *** |

| High income dummy | 0.02 (96.90) *** | R-squared | 0.57 |

| Manufacturing exporter dummy | 0.02 (179.13) *** |

| 1 | I seek to address within-product changes in unit values and not changes in the product mix. Therefore, the focus is the changing unit value of the same product. Schott (2004) found evidence of within-product specialization among countries in cross-sectional analysis. According to Schott (2004), high- and low-income countries export higher and lower unit value versions, respectively, of the same products. My analysis seeks to address this issue over time to investigate if individual countries move up the value ladder in their existing exports. Thus WPI is used as the deflator for this exercise. |

| 2 | The low R-squared was investigated by residual plots for each of the regressions in Table 4, Table 5, Table 6, Table 7 and Table 8. These are presented in Appendix E. The residuals are randomly distributed around 0 when plotted against the fitted value of the equation. The low R-squared appears to come from the noisiness of the data, and the trends we find are still significant and practically meaningful. |

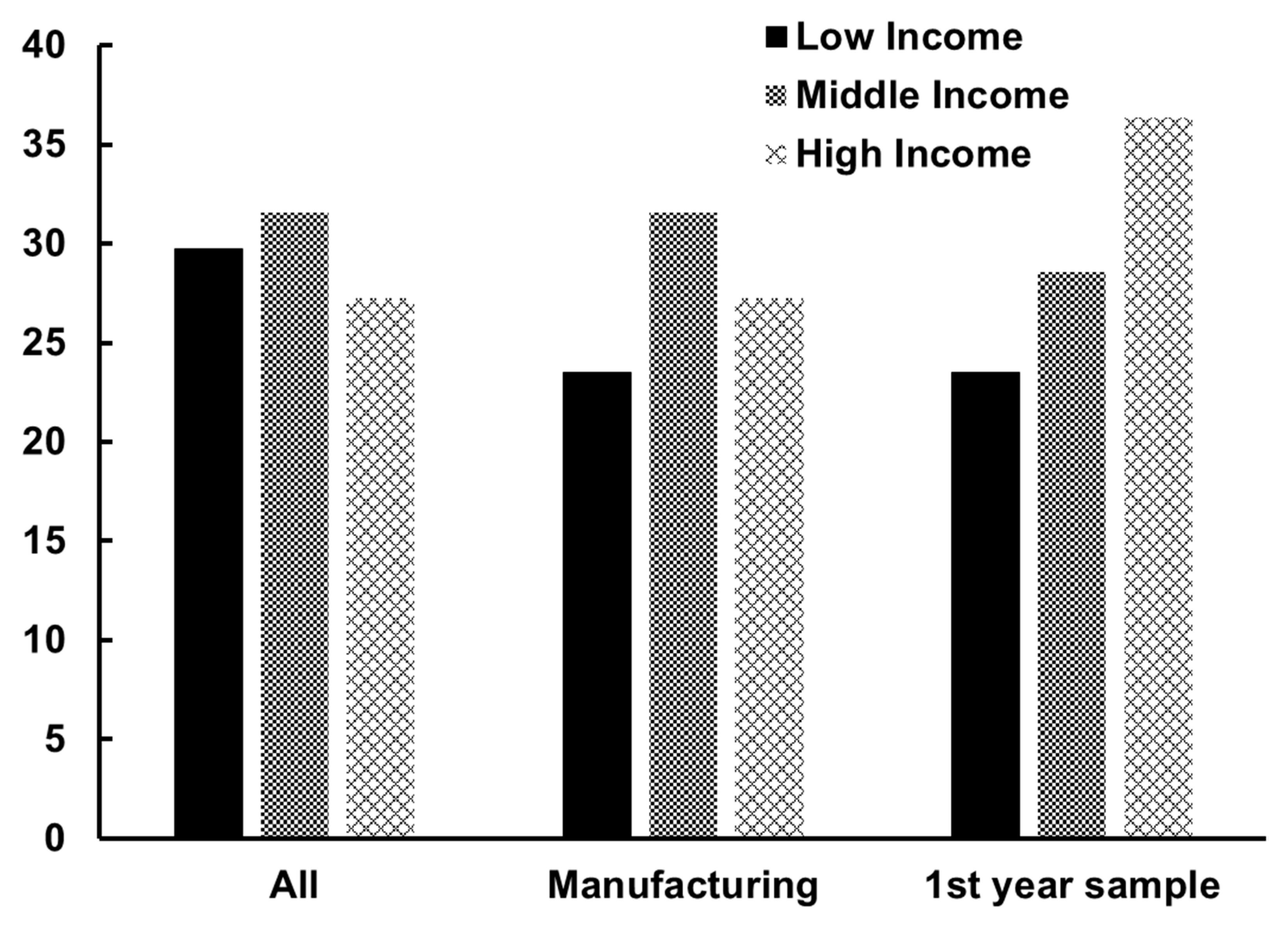

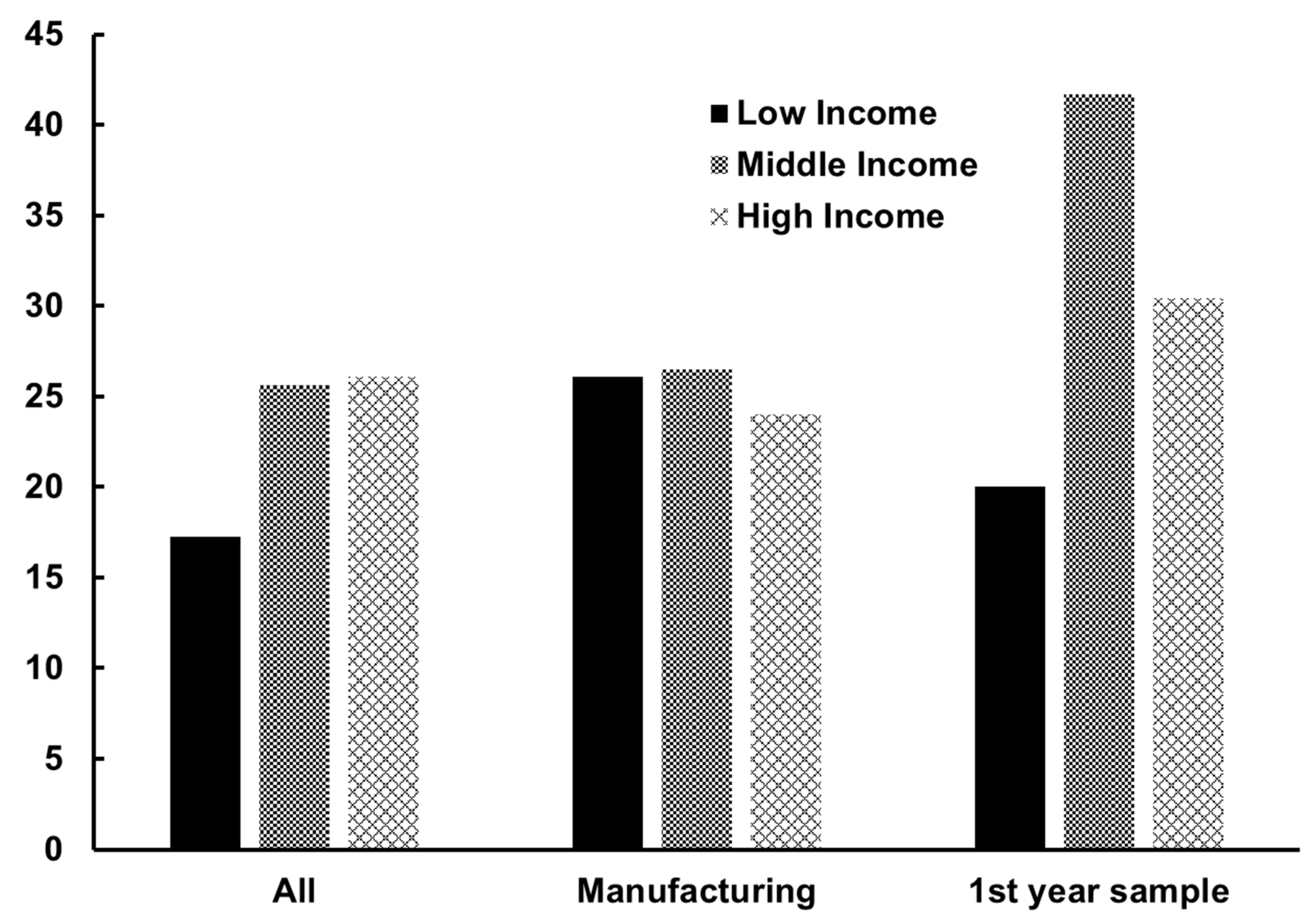

| 3 | Each table’s cell gives the proportion of countries with a significant regression coefficient on the factor accumulation variable. For example, in the first cell, six out of 23—approximately 25%—of high-income countries, in 1989–2001, have a significant positive coefficient on skill accumulation. |

| 4 | Further details are presented in Appendix D. |

References

- Aiginger, Karl. 1998. Unit Values to Signal the Quality Position of CEECS. In The Competitiveness of Transition Economies. Paris: OECD. [Google Scholar]

- Alper, A., S. Webb, and J. Oatis. 2019. U.S.-China Trade War—The Levers Each Country Can Pull. World News. Ann Arbor: Thomson Reuters News Agency. [Google Scholar]

- Balassa, Bela. 1979. The changing pattern of comparative advantage in manufactured goods. The Review of Economics and Statistics 61: 259–66. [Google Scholar] [CrossRef]

- Baldwin, Richard. 2016. The World Trade Organization and the future of multilateralism. Journal of Economic Perspectives 30: 95–116. [Google Scholar] [CrossRef] [Green Version]

- Baldwin, John R., and Wulong Gu. 2003. Export-market participation and productivity performance in Canadian manufacturing. Canadian Journal of Economics/Revue Canadienne D’économique 36: 634–57. [Google Scholar] [CrossRef]

- Barro, Robert J. 1991. Economic Growth in a Cross Section of Countries. The Quarterly Journal of Economics 106: 407–43. [Google Scholar] [CrossRef] [Green Version]

- Barro, Robert J., and Jong-Wha Lee. 2001. International data on educational attainment: Updates and implications. Oxford Economic Papers 53: 541–63. [Google Scholar] [CrossRef]

- Bernard, Andrew B., Bradford J. Jensen, and Peter K. Schott. 2006. Survival of the best fit: Exposure to low-wage countries and the (uneven) growth of US manufacturing plants. Journal of international Economics 68: 219–37. [Google Scholar] [CrossRef] [Green Version]

- Brambilla, Irene, Amit K. Khandelwal, Peter K. Schott, and Joseph Francois. 2010. China’s Experience under the Multi-Fiber Arrangement (MFA) and the Agreement on Textiles and Clothing (ATC). Chicago: University of Chicago Press, pp. 345–96. [Google Scholar]

- Chor, D. 2010. Unpacking sources of comparative advantage: A quantitative approach. Journal of International Economics 82: 152–67. [Google Scholar] [CrossRef] [Green Version]

- Costinot, A., D. Donaldson, and I. Komunjer. 2011. What goods do countries trade? A quantitative exploration of Ricardo’s ideas. The Review of Economic Studies 79: 581–608. [Google Scholar] [CrossRef]

- Fabrizio, S., D. Igan, and A. Mody. 2007. The Dynamics of Product Quality and International Competitiveness. IMF Working Paper WP/07/97. Washington, DC: International Monetary Fund. [Google Scholar]

- Feenstra, Robert C., Robert E. Lipsey, and Harry P. Bowen. 1997. World Trade Flows, 1970–1992, with Production and Tariff Data. NBER Working Paper Series No. 5910. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Feenstra, Robert C., Robert E. Lipsey, Haiyan Deng, Alyson C. Ma, and Hengyong Mo. 2005. World Trade Flows: 1962–2000. Cambridge: Natioinal Bureau of Economic Research. [Google Scholar]

- Flam, Harry, and Elhanan Helpman. 1987. Vertical Product Differentiation and North-South Trade. The American Economic Review 77: 810–22. [Google Scholar]

- Fouquin, M., and J. Hugot. 2016. Two Centuries of Bilateral Trade and Gravity data: 1827–2014. No. 015129. Bogotá: Universidad Javeriana-Bogotá. [Google Scholar]

- Grossman, Gene M., and Elhanan Helpman. 1989. Product Development and International Trade. The Journal of Political Economy 97: 1261–83. [Google Scholar] [CrossRef] [Green Version]

- Grossman, Gene M., and Elhanan Helpman. 1991a. Quality Ladders in the Theory of Growth. The Review of Economic Studies 58: 43–61. [Google Scholar] [CrossRef] [Green Version]

- Grossman, Gene M., and Elhanan Helpman. 1991b. Trade, knowledge spillovers, and growth. European Economic Review 35: 517–26. [Google Scholar] [CrossRef] [Green Version]

- Hallak, Juan Carlos. 2006. Product quality and the direction of trade. Journal of International Economics 68: 238–65. [Google Scholar] [CrossRef]

- Hallak, Juan Carlos. 2010. A product-quality view of the Linder hypothesis. The Review of Economics and Statistics 92: 453–66. [Google Scholar] [CrossRef] [Green Version]

- Hallak, Juan Carlos, and Peter K. Schott. 2011. Estimating cross-country differences in product quality. The Quarterly Journal of Economics 126: 417–74. [Google Scholar] [CrossRef] [Green Version]

- Helpman, Elhanan, and Paul R. Krugman. 1985. Market Structure and Foreign Trade. Cambridge: MIT Press. [Google Scholar]

- Hummels, David, and Peter J. Klenow. 2005. The Variety and Quality of a Nation’s Trade. American Economic Review 95: 704–23. [Google Scholar] [CrossRef] [Green Version]

- Jin, H., and K. Takenaka. 2019. Japan-South Korea Feud Deepens with Disputed Accounts of Trade Meeting. World News. Ann Arbor: Thomson Reuters News Agency. [Google Scholar]

- Khandelwal, Amit. 2010. The long and short (of) quality ladders. The Review of Economic Studies 77: 1450–76. [Google Scholar] [CrossRef]

- Linder, Staffan Burenstam. 1961. An Essay on Trade and Transformation. New York: Wiley & Sons. [Google Scholar]

- Mason, J. 2019. Risks Aside, Trump’s Team Sees China Trade Stance as Strength in 2020. Business News. Ann Arbor: Thomson Reuters News Agency. [Google Scholar]

- Mukerji, Purba. 2013. State of Technology and Growth of the Extensive Margin. Scottish Journal of Political Economy 60: 390–411. [Google Scholar] [CrossRef]

- Mukerji, Purba, and John Struthers. 2021. Armington elasticity and development. Journal of Industry, Competition and Trade 21: 59–79. [Google Scholar] [CrossRef]

- Payosova, Tetyana, Gary Clyde Hufbauer, and Jeffrey J. Schott. 2018. The Dispute Settlement Crisis in the World Trade Organization: Causes and Cures. Policy Brief No. PB18-5. Washington, DC: Peterson Institute for International Economics. [Google Scholar]

- Radjou, Navi, Jaideep Prabhu, and Simone Ahuja. 2012. Jugaad Innovation: Think Frugal, Be Flexible, Generate Breakthrough Growth. San Francisco: Wiley. [Google Scholar]

- Regan, M. P., and E. Barrett. 2019. Markets That Priced in a Trade Skirmish Now Brace for a Bruising Fight. Bloomberg Businessweek, May 16. [Google Scholar]

- Romalis, John. 2004. Factor Proportions and the Structure of Commodity Trade. The American Economic Review 94: 67–97. [Google Scholar] [CrossRef] [Green Version]

- Schott, Peter K. 2002. Moving Up and Moving Out: US Product-Level Exports and Competition from Low Wage Countries. New Haven: Yale School of Management. [Google Scholar]

- Schott, Peter. 2004. Across-Product Versus Within-Product Specialization in International Trade. Quarterly Journal of Economics 119: 647–78. [Google Scholar] [CrossRef]

- Summers, Robert. 1995. Penn World Table Mark 5.6 Revision of Summers and Heston (1991) on-Line Data. Computing in the Humanities and Social Sciences (CHASS). Toronto: University of Toronto. [Google Scholar]

- Verhoogen, Eric. A. 2008. Trade, Quality Upgrading and Wage Inequality in the Mexican Manufacturing Sector. The Quarterly Journal of Economics 123: 489–530. [Google Scholar] [CrossRef] [Green Version]

- Vernon, Raymond. 1966. International investment and international trade in the product cycle. The Quarterly Journal of Economics 80: 190–207. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2010. Econometric Analysis of Cross Section and Panel Data. Cambridge: MIT Press. [Google Scholar]

| Variable | Definition | Source |

|---|---|---|

| Labor skill | Population share attaining secondary or higher education | World Development Indicators, World Bank andGlobal Development Finance |

| Capital per worker | Capital stock per worker in constant international dollars | Penn World Tables (Mark 5.6) |

| Per capita gross domestic product | In constant dollars | World Development Indicators, World Bank http://data.worldbank.org/data-catalog/world-development-indicators (accessed on 20 December 2020) |

| Unit value of exported products | Nominal dollars | Center of International Data UC Davis http://cid.econ.ucdavis.edu/ (accessed on 20 December 2020) |

| Income level dummy variable (methodology based on Schott (2004)) | The income category is evaluated in the last year of the sample period: 1988 for subsample period 1972–1988 and 2001 for subsample period 1989–2001. Countries at and above the 80th percentile of per capita gross domestic product at constant prices are classified as high income, between the 20th and 80th percentile are classified as middle income and below the 20th percentile as low income. | World Development Indicators, World Bank http://data.worldbank.org/data-catalog/world-development-indicators (accessed on 20 December 2020) |

| Exporter category dummy variable | The dummy variable for exporter equals one if a single category of exports accounts for 50% or more of total exports of the country. The categories considered are: nonfuel primary (SITC 0, 1, 2, 4, plus 68), fuels (SITC 3), manufactures (SITC 5 to 9, less 68), and services (factor and nonfactor service receipts plus workers’ remittances). | Global Development Network Growth Database |

| Countries | Percentage with Increasing Unit Value | |

|---|---|---|

| 1972–1988 | 1989–2001 | |

| High | 29 | 30 |

| Middle | 21 | 29 |

| Low | 18 | 26 |

| Products | Percentage with Increasing Unit Value | |

|---|---|---|

| 1972–1988 | 1989–2001 | |

| All | 29 | 30 |

| SITC 0 | 32 | 20 |

| SITC 1 | 9 | 22 |

| SITC 2 | 47 | 31 |

| SITC 3 | 31 | 36 |

| SITC 4 | 34 | 38 |

| SITC 5 | 45 | 37 |

| SITC 6 | 26 | 30 |

| SITC 7 | 25 | 34 |

| SITC 8 | 18 | 27 |

| SITC 9 | 33 | 9 |

| Dependent Variable: Log Real Unit Value of Exports | |

|---|---|

| Log skill level | −0.51 (−1.85) * |

| [Log skill level × low income dummy] | 0.74 (2.22) ** |

| [Log skill level × high income dummy] | 0.30 (0.81) |

| [Log skill level × manufacturing exporter] | −0.15 (−0.51) |

| [Log skill level × services exporter] | 1.09 (2.74) *** |

| [Log skill level × fuel exporter] | −0.82 (−1.11) |

| Low income dummy | −0.01 (−0.97) |

| High income dummy | 0.02 (3.04) *** |

| Manufacturing exporter dummy | 0.004 (0.68) |

| Services exporter dummy | −0.03 (−2.84) *** |

| Fuel exporter dummy | 0.002 (0.06) |

| Observations | 527,441 |

| R-squared2 | 0.02 |

| F-stat of joint significance of instruments | 9906.92 |

| Prob. > F | 0.00 |

| Dependent Variable: Log Real Unit Value of Exports | |

|---|---|

| [Log capital per worker] | 0.42 (2.75) *** |

| [Log capital per worker × low income dummy] | −0.53 (−1.99) ** |

| [Log capital per worker × high income dummy] | −0.20 (−1.16) |

| [Log capital per worker × manufacturing exporter] | −0.21 (−1.13) |

| [Log capital per worker × services exporter] | −0.04 (−0.13) |

| [Log capital per worker × fuel exporter] | 0.91 (1.45) |

| Low income dummy | 0.02 (2.49) ** |

| High income dummy | 0.03 (3.72) *** |

| Manufacturing exporter dummy | 0.01 (1.41) |

| Services exporter dummy | 0.01 (0.56) |

| Fuel exporter dummy | −0.03 (−1.33) |

| Observations | 786,584 |

| R-squared | 0.02 |

| F-stat of joint significance of instruments | 310,000 |

| Prob. > F | 0.00 |

| Dependent Variable: Log Real Unit Value of Exports | |

|---|---|

| [Log PGDP] | 0.90 (5.39) *** |

| [Log PCGDP × low income dummy] | −0.83 (−4.34) *** |

| [Log PCGDP × high income dummy] | 0.70 (3.78) *** |

| [Log PCGDP × manufacturing exporter] | −0.27 (−1.59) |

| [Log PCGDP × services exporter | −1.22 (−4.65) *** |

| [Log PCGDP × fuel exporter] | −0.84 (−1.11) |

| Low income dummy | 0.02 (2.59) *** |

| High income dummy | 0.01 (1.26) |

| Manufacturing exporter dummy | 0.01 (0.91) |

| Services exporter dummy | 0.03 (3.41) *** |

| Fuel exporter dummy | −0.02 (−0.82) |

| Observations | 899,688 |

| R-squared | 0.02 |

| F-stat of joint significance of instruments | 46,654.39 |

| Prob. > F | 0.00 |

| Dependent Variable: Log Real Unit Value of Exports | |

|---|---|

| [Log skill level] | −0.17 (−0.70) |

| [Log skill level × low income dummy] | −0.42 (−1.37) |

| [Log skill level × high income dummy] | −0.20 (−0.74) |

| [Log skill level × manufacturing exporter] | −0.23 (1.00) |

| [Log skill level × services exporter] | −0.44 (−1.49) |

| [Log skill level × fuel exporter] | 0.50 (0.56) |

| Low income dummy | 0.01 (0.44) |

| High income dummy | 0.01 (0.52) |

| Manufacturing exporter dummy | 0.01 (0.95) |

| Services exporter dummy | 0.004 (0.32) |

| Fuel exporter dummy | −0.02 (−0.50) |

| Observations | 647,161 |

| R-squared | 0.01 |

| F-stat of joint significance of instruments | 24,975.01 |

| Prob. > F | 0.00 |

| Dependent Variable: Log Real Unit Value of Exports | |

|---|---|

| Log PCGDP | −0.25 (−3.07) *** |

| [Log PCGDP × low income dummy] | 0.05 (0.82) |

| [Log PCGDP × high income dummy] | −0.08 (−1.29) |

| [Log PCGDP × manufacturing exporter] | 0.11 (2.10) ** |

| [Log PCGDP × services exporter] | 0.11 (1.25) |

| [Log PCGDP × fuel exporter] | 0.54 (2.37) ** |

| Low income dummy | −0.02 (−4.65) *** |

| High income dummy | −0.02 (−4.68) *** |

| Manufacturing exporter dummy | 0.004 (1.16) |

| Services exporter dummy | 0.01 (0.89) |

| Fuel exporter dummy | −0.02 (−1.23) |

| Observations | 1,589,264 |

| R-squared | 0.01 |

| F-stat of joint significance of instruments | 22,057.92 |

| Prob. > F | 0.00 |

| Dependent Variable: Real Unit Value of Exports ($ Deflated by CPI) | |||||||

|---|---|---|---|---|---|---|---|

| Year | Independent Variable | Positive Significant/Total | Negative Significant/Total | ||||

| High Inc. | Low Inc. | Middle Inc. | High Inc. | Low Inc. | Middle Inc. | ||

| 1989–2001 | Skill | 6/23 | 5/29 | 10/39 | 8/23 | 12/29 | 12/39 |

| PCGDP | 10/30 | 14/65 | 23/57 | 12/30 | 20/65 | 19/57 | |

| 1972–1988 | Skill | 6/22 | 11/37 | 12/38 | 8/22 | 15/37 | 10/38 |

| Capital | 15/18 | 13/19 | 18/21 | 2/18 | 1/19 | 1/21 | |

| PCGDP | 8/25 | 13/48 | 18/49 | 9/25 | 19/48 | 17/49 | |

| Dependent Variable: Real Unit Value of Exports (Home Currency Deflated by WPI) | |||||||

|---|---|---|---|---|---|---|---|

| Year | Independent Variable | Positive Significant/Total | Negative Significant/Total | ||||

| High Inc. | Low Inc. | Middle Inc. | High Inc. | Low Inc. | Middle Inc. | ||

| 1989–2001 | Skill | 7/21 | 2/8 | 5/22 | 4/21 | 4/8 | 6/22 |

| Technology | 12/25 | 6/11 | 20/37 | 5/25 | 2/11 | 9/37 | |

| 1972–1988 | Skill | 7/18 | 3/10 | 7/19 | 5/18 | 4/10 | 6/19 |

| Technology | 14/17 | 3/11 | 13/22 | 0/17 | 3/11 | 7/22 | |

| Dependent Variable: Real Unit Value of Exports ($ Deflated by CPI) | |||||||

|---|---|---|---|---|---|---|---|

| Year | Independent Variable | Positive Significant/Total | Negative Significant/Total | ||||

| High Inc. | Low Inc. | Middle Inc. | High Inc. | Low Inc. | Middle Inc. | ||

| 1989–2001 | Skill | 7/23 | 5/25 | 15/36 | 9/23 | 8/25 | 12/36 |

| Technology | 7/29 | 8/51 | 15/57 | 8/29 | 12/51 | 16/57 | |

| 1972–1988 | Skill | 8/22 | 8/34 | 10/35 | 7/22 | 8/34 | 10/35 |

| Capital | 8/17 | 2/19 | 1/22 | 7/17 | 10/19 | 13/22 | |

| Technology | 7/22 | 6/41 | 15/52 | 6/22 | 13/41 | 16/52 | |

| Dependent Variable: Real Unit Value of Exports ($ Deflated by CPI) | |||||||

|---|---|---|---|---|---|---|---|

| Year | Independent Variable | Positive Significant/Total | Negative Significant/Total | ||||

| High Inc. | Low Inc. | Middle Inc. | High Inc. | Low Inc. | Middle Inc. | ||

| 1989–2001 | Skill | 6/25 | 6/23 | 9/34 | 7/25 | 6/23 | 12/34 |

| Technology | 8/30 | 13/61 | 20/55 | 9/30 | 16/61 | 13/55 | |

| 1972–1988 | Skill | 6/22 | 8/34 | 12/38 | 7/22 | 14/34 | 10/38 |

| Capital | 15/19 | 13/20 | 15/19 | 1/19 | 1/20 | 1/19 | |

| Technology | 7/27 | 7/47 | 34/44 | 12/27 | 12/47 | 14/44 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mukerji, P. A Panel Study of Factor Accumulation and Export Quality. J. Risk Financial Manag. 2021, 14, 447. https://doi.org/10.3390/jrfm14090447

Mukerji P. A Panel Study of Factor Accumulation and Export Quality. Journal of Risk and Financial Management. 2021; 14(9):447. https://doi.org/10.3390/jrfm14090447

Chicago/Turabian StyleMukerji, Purba. 2021. "A Panel Study of Factor Accumulation and Export Quality" Journal of Risk and Financial Management 14, no. 9: 447. https://doi.org/10.3390/jrfm14090447

APA StyleMukerji, P. (2021). A Panel Study of Factor Accumulation and Export Quality. Journal of Risk and Financial Management, 14(9), 447. https://doi.org/10.3390/jrfm14090447