The Capitalist Spirit and Endogenous Growth

Abstract

:1. Introduction

2. Overview: Distribution of Income and Savings Behavior

3. The Model

3.1. Production and Distribution of Income

3.2. The Absolute and Relative Incomes

- An increase in the profits and the relative income of entrepreneurs;

- A decline in the labor and capital income;

- A decrease in relative income of workers;

- An increase in the average income of the working generation.

3.3. Households and Savings Behavior

4. A Generalized Function of Capitalist Spirit

- ;

- , this means is increasing in and decreasing in ;

- ;

- ;

- is homogenous of degree zero in and . Thus, if individual incomes and average income are multiplied by a positive factor, the value of remains constant.

5. A Calibration

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

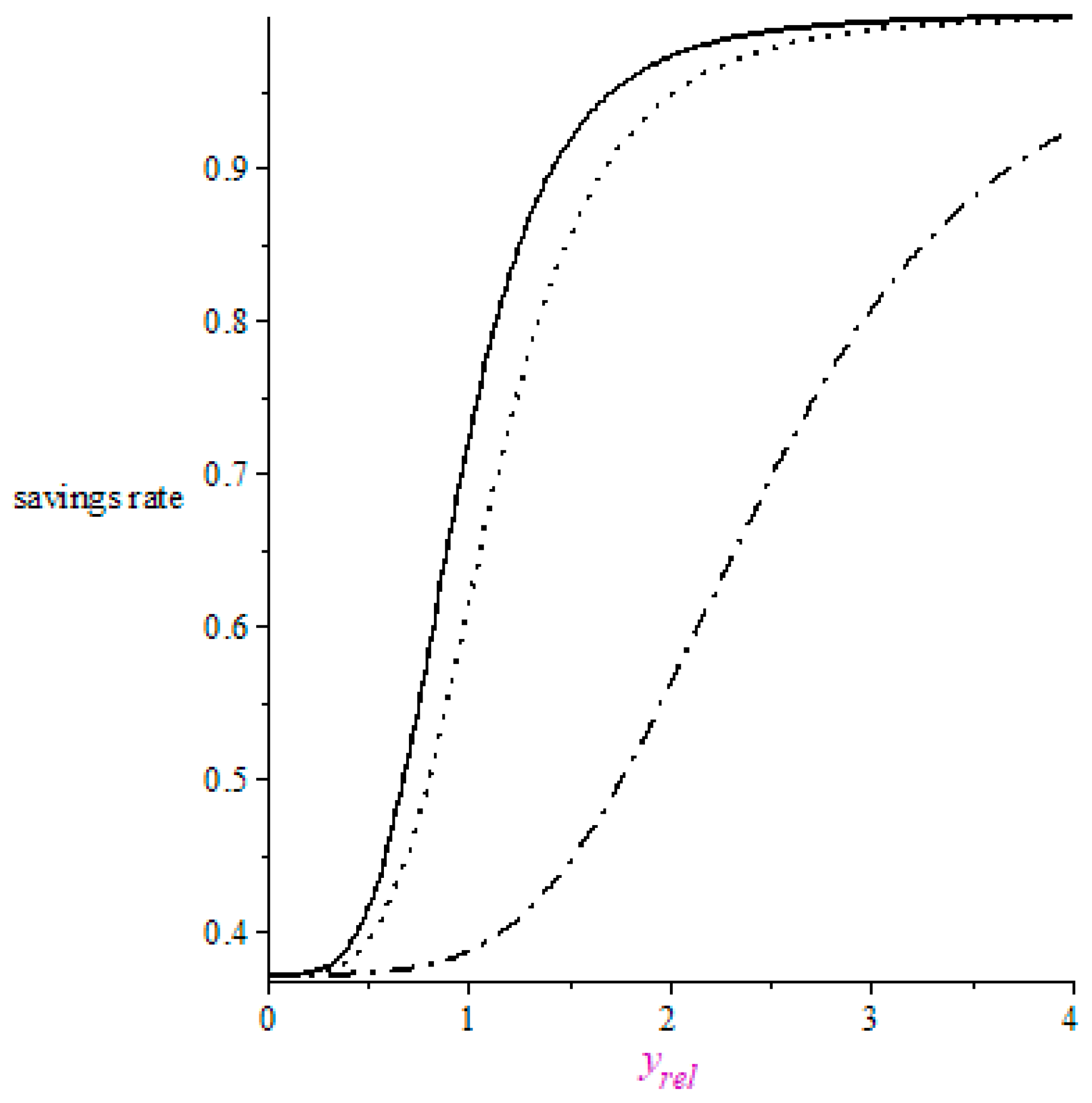

| B | q | ||

|---|---|---|---|

| Solid line | 2 | 0.59 | 4.09 |

| Dotted line | 1 | 0.59 | 4.09 |

| Dash-dot line | 0.04 | 0.59 | 4.09 |

References

- Autor, David, Laurence F. Katz, Chris Patterson, and John van Reenen. 2017. Concentrating on the Fall of the Labor Share. American Economic Review: Papers & Proceedings 107: 180–85. [Google Scholar] [CrossRef] [Green Version]

- Autor, David, David Dorn, Laurence F. Katz, Chris Patterson, and John Van Reenen. 2020. The Fall of the Labor Share and the Rise of Superstar Firms. Quarterly Journal of Economics 135: 645–709. [Google Scholar] [CrossRef] [Green Version]

- Azar, Jose, Ioana Marinescu, and Marshall I. Steinbaum. 2019. Labor Market Concentration; Working Paper 24147. Cambridge: National Bureau of Economic Research. Available online: https://www.nber.org/paper/w24147 (accessed on 24 December 2021).

- Bai, Chong-En, Jiangyong Lu, and Zhigang Tao. 2009. How does privatization work in China? Journal of Comparative Economics 37: 453–70. [Google Scholar] [CrossRef] [Green Version]

- Bai, Chong-En, Jie Mao, and Qiong Zhang. 2014. Measuring market concentration in China: The problem with using censored data and its rectification. China Economic Review 30: 432–47. [Google Scholar] [CrossRef]

- Bajgar, Matej, Giuseppe Berlingieri, Sara Calligaris, Chiara Criscuolo, and Jonathan Timmis. 2019. Industry Concentration in Europe and North America. OECD Productivity Working Papers, 2019-18. Paris: OECD Publishing. [Google Scholar]

- Bargain, Olivier, Kristian Orsini, and Andreas Peichl. 2014. Comparing Labor Supply Elasticities in Europe and the United States: New Results. Journal of Human Resources 49: 723–838. [Google Scholar] [CrossRef]

- Barkai, Simcha. 2020. Declining labor and capital shares. The Journal of Finance 75: 2421–63. [Google Scholar] [CrossRef] [Green Version]

- Barkai, Simcha, and Seth G. Benzell. 2018. 70 Years of US Corporate Profits. New Working Paper Series No. 22; Chicago: Stigler Center for the Study of the Economy and the State University of Chicago, Booth School of Business. [Google Scholar]

- Barro, Robert. J. 1990. Government Spending in a Simple Model of Endogenous Growth. Journal of Political Economy 98: S103–25. [Google Scholar] [CrossRef] [Green Version]

- Basu, Susanto. 2019. Are Price-Cost Markups Rising in the United States? A Discussion of the Evidence. Journal of Economic Perspectives 33: 3–22. [Google Scholar] [CrossRef]

- Berry, Steven, Martin Gaynor, and Fiona Scott Morton. 2019. Do Increasing Markups Matter? Lessons from Empirical Industrial Organization. Journal of Economic Perspectives 33: 44–68. [Google Scholar] [CrossRef] [Green Version]

- Bewley, Truman F. 1977. The permanent income hypothesis: A theoretical formulation. Journal of Economic Theory 16: 252–92. [Google Scholar] [CrossRef]

- Beznoska, Martin, and Richard Ochmann. 2013. The Interest Elasticity of Household Savings: A Structural Approach with German Micro Data. Empirical Economics 45: 371–99. [Google Scholar] [CrossRef]

- Blinder, Alan. 1975. Distribution effects and aggregate consumption function. Journal of Political Economy 83: 447–75. [Google Scholar] [CrossRef]

- Blundell, Richard W., and Thomas MaCurdy. 1999. Labor Supply: A Review of Alternative Approaches. In Handbook of Labor Economics. Edited by Orley C. Ashenfelter and David Card. Amsterdam: Elsevier North-Holland, chp. 27. vol. 3A. [Google Scholar] [CrossRef]

- Bolt, Jutta, Robert Inklaar, Harmen de Jong, and Jan L. van Zanden. 2018. Rebasing ‘Maddison’: New Income Comparisons and the Shape of Long-Run Economic Development. Maddison Project Working Paper 10. Groningen: Groningen Growth and Development Centre, University of Groningen. [Google Scholar]

- Bosworth, Barry, Gary Burtless, and John Sabelhaus. 1991. The decline in saving: Evidence from household surveys. Brookings Papers on Economic Activity 1: 183–241. [Google Scholar] [CrossRef] [Green Version]

- Brenke, Karl, and Gert G. Wagner. 2013. Ungleiche Verteilung der Einkommen bremst das Wirtschaftswachstum. Wirtschaftsdienst 93: 110–16. [Google Scholar] [CrossRef] [Green Version]

- Buiter, Willem H. 1981. Time preference and international lending and borrowing in an Overlapping-Generations model. Journal of Political Economy 89: 769–97. [Google Scholar] [CrossRef]

- Campbell, John Y., and N. Gregory Mankiw. 1989. Consumption, income, and interest rates: Reinterpreting the time series evidence. NBER Macroeconomics Annual 4: 185–216. [Google Scholar] [CrossRef]

- Campbell, John Y., and N. Gregory Mankiw. 1991. The response of consumption of income: A cross-country investigation. European Economic Review 35: 723–67. [Google Scholar] [CrossRef]

- Carroll, Christopher D. 2000. Why Do the Rich Save So Much? In Does Atlas shrug? The Economic Consequences of Taxing the Rich. Edited by Joel B. Slemrod. Cambridge: Harvard University Press. [Google Scholar]

- Carroll, Christopher D., and Lawrence H. Summers. 1987. Why have private savings rates in the United States and Canada diverged? Journal of Monetary Economics 20: 249–79. [Google Scholar] [CrossRef] [Green Version]

- Cavalleri, Maria C., Alice Eliet, Peter McAdam, Filippos Petroulakis, Ana Soares, and Isabel Vansteenkiste. 2019. Concentration, Market Power and Dynamism in the Euro Area. ECB Working Paper Series No 2253; Frankfurt: European Central Bank, Available online: https://www.ecb.europa.eu//pub/pdf/scpwps/ecb.wp2253~cf7b9d7539.en.pdf (accessed on 24 December 2021).

- Chetty, Raj, Adam Guren, Day Manoli, and Andrea Weber. 2011. Are Micro and Macro Labor Supply Elasticities Consistent? A Review of Evidence on the Intensive and Extensive Margins. American Economic Review 101: 471–75. [Google Scholar] [CrossRef] [Green Version]

- Cole, Harold L., George J. Mailath, and Andrew Postlewaite. 1992. Social norms, saving behavior, and growth. Journal of Political Economy 100: 1092–125. [Google Scholar] [CrossRef]

- De Loecker, Jan, and Jan Eeckhout. 2017. The Rise of Market Power and the Macroeconomic Implications. NBER Working Paper No. 23687. Cambridge: NBER. [Google Scholar] [CrossRef]

- De Loecker, Jan, Jan Eeckhout, and Gabriel Unger. 2020. The Rise of Market Power and the Macroeconomic Implications. Quarterly Journal of Economics 135: 561–644. [Google Scholar] [CrossRef] [Green Version]

- De Nardi, Mariacristina, and Giulio Fella. 2017. Saving and wealth inequality. Review of Economic Dynamics 26: 280–300. [Google Scholar] [CrossRef]

- Diamond, Peter. 1965. National Debt in a Neoclassical Growth Model. American Economic Review 55: 1126–50. [Google Scholar]

- Díez, Federico J., Jiayue Fan, and Carolina Villegas-Sánchez. 2019. Global Declining Competition. IMF Working Paper WP/19/82. Washington, DC: IMF. [Google Scholar] [CrossRef]

- Duesenberry, James. 1949. Income, Saving and the Theory of Consumer Behavior. Cambridge: Harvard University Press. [Google Scholar]

- Dynan, Karen E., Jonathan Skinner, and Stephen P. Zeldes. 2004. Do the rich save more? Journal of Political Economy 112: 397–444. [Google Scholar] [CrossRef]

- Eggertsson, Gauti B., Jacob A. Robbins, and Ella Getz Wold. 2021. Kaldor and Piketty’s facts: The rise of monopoly power in the United States. Journal of Monetary Economics 124: S18–S38. [Google Scholar] [CrossRef]

- Evers, Michiel, Ruud De Mooij, and Daniel van Vuuren. 2008. The wage elasticity of labor supply: A synthesis of empirical estimates. De Economist 156: 25–43. [Google Scholar] [CrossRef] [Green Version]

- Fershtman, Chaim, and Yoram Weiss. 1993. Social status, culture, and economic performance. Economic Journal 103: 946–59. [Google Scholar] [CrossRef] [Green Version]

- Frank, Robert H. 1985. The demand for the unobservable and other nonpositional goods. American Economic Review 75: 101–16. [Google Scholar]

- Frank, Robert H., Adam S. Levine, and Oege Dijk. 2014. Expenditure cascades. Review of Behavioral Economics 1: 55–73. [Google Scholar] [CrossRef] [Green Version]

- Friedman, Milton. 1957. A Theory of the Consumption Function. Princeton: Princeton University Press. [Google Scholar] [CrossRef]

- Furman, Jason, and Lawrence H. Summers. 2020. A Reconsideration of Fiscal Policy in the Era of Low Interest Rates, Mimeo. Cambridge: Harvard University, Available online: https://www.hks.harvard.edu/centers/mrcbg/programs/growthpolicy/reconsideration-fiscal-policy-era-low-interest-rates-jason (accessed on 24 December 2021).

- Ge, Jinfeng, Jie Luo, and Yangzhou Yuan. 2019. Misallocation in Chinese Manufacturing and Services: A Variable Markup Approach. China and the World Economy 27: 74–103. [Google Scholar] [CrossRef]

- Gentry, William M., and R. Glenn Hubbard. 2004. Entrepreneurship and Household Saving. Advances in Economic Analysis & Policy 4: 8. [Google Scholar] [CrossRef]

- Gong, Liutang, and Hengfu Zou. 2001. Money, Social Status, and Capital Accumulation in a Cash-in-Advance Model. Journal of Money, Credit, and Banking 33: 284–93. [Google Scholar] [CrossRef]

- Gong, Liutang, Xiaojun Zhao, Yunhong Yang, and Hengfu Zou. 2010. Stochastic growth with social-status concern: The existence of a unique stable distribution. Journal of Mathematical Economics 46: 505–18. [Google Scholar] [CrossRef] [Green Version]

- Grossman, Gene M., and Noriyuki Yanagawa. 1993. Asset bubbles and endogenous growth. Journal of Monetary Economics 31: 3–19. [Google Scholar] [CrossRef] [Green Version]

- Guinea, Oscar, and Frederik Erixon. 2019. Standing Up for Competition: Market Concentration, Regulation, and Europe’s Quest for a New Industrial Policy. ECIPE Occasional Paper 01/2019. Brussels: European Centre for International Political Economy (ECIPE). [Google Scholar]

- Hall, Robert E. 1988. lntertemporal substitution in consumption. Journal of Political Economy 96: 339–57. [Google Scholar] [CrossRef] [Green Version]

- Hall, Robert E. 1989. Consumption. In Modern Business Cycle Theory. Edited by Robert J. Barro. Cambridge: Harvard University Press. [Google Scholar]

- Hall, Robert E. 2018. New Evidence on the Markup of Prices over Marginal Costs and the Role of Mega-Firms in the US Economy. Working Paper No. 24574. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef] [Green Version]

- Hart, Oliver. 1982. A Model of Imperfect Competition with Keynesian Features. Quarterly Journal of Economics 97: 109–38. [Google Scholar] [CrossRef]

- Hart, Oliver. 1985. Imperfect Competition in General Equilibrium: An Overview of Recent Work. In Frontiers of Economics. Edited by Kenneth Arrow and Seppo Honkapohja. Oxford: Basil Blackwell, pp. 100–50. [Google Scholar]

- Huggett, Mark, and Gustavo Ventura. 2000. Understanding why high income households save more than low income households. Journal of Monetary Economics 45: 361–97. [Google Scholar] [CrossRef] [Green Version]

- Jäntti, Markus, Jukka Pirttilä, and Hakan Selin. 2015. Estimating labour supply elasticities based on cross-country micro data: A bridge between micro and macro estimates? Journal of Public Economics 127: 87–99. [Google Scholar] [CrossRef] [Green Version]

- Jinguo, Wang, Russell Smyth, and Tan Dai Hwee. 2000. The role of Confucianism values in East Asian development before and after the financial crisis. Journal of International and Area Studies 78: 115–35. [Google Scholar]

- Jones, Randall S. 2018. Reforming the Large Business Groups to Promote Productivity and Inclusion in Korea. OECD Economics Department Working Papers No. 1509. Paris: OECD. [Google Scholar] [CrossRef]

- Jones, Randall S., and Jae Wan Lee. 2018. Enhancing Dynamism in SMEs and Entrepreneurship in Korea. OECD Economics Department Working Papers No. 1510. Paris: OECD. [Google Scholar] [CrossRef]

- Kaldor, Nicholas. 1956. Alternative theories of distribution. Review of Economic Studies 23: 83–100. [Google Scholar] [CrossRef]

- Kaldor, Nicholas. 1957. A model of economic growth. Economic Journal 67: 591–624. [Google Scholar] [CrossRef]

- Kalecki, Michal. 1971. Selected Essays on the Dynamics of the Capitalist Economy. Cambridge: Cambridge University Press. [Google Scholar]

- Krugman, Paul. 2016. Robber Baron Recessions. New York Times. April 18. Available online: https://www.nytimes.com/2016/04/18/opinion/robber-baron-recessions.html (accessed on 24 December 2021).

- Kuhn, Moritz, Moritz Schularick, and Ulrike I. Steins. 2020. Income and Wealth Inequality in America, 1949–2016. Journal of Political Economy 128: 3469–519. [Google Scholar] [CrossRef] [Green Version]

- Kumar, Ronald R., and Peter J. Stauvermann. 2020. Economic and Social Sustainability: The Influence of Oligopolies on Inequality and Growth. Sustainability 12: 9378. [Google Scholar] [CrossRef]

- Kumar, Ronald R., and Peter J. Stauvermann. 2021. Revisited: Monopoly and Long-Run Capital Accumulation in Two-sector Overlapping Generation Model. Journal of Risk and Financial Management 14: 304. [Google Scholar] [CrossRef]

- Kuznets, Simon. 1953. Shares of Upper Income Groups in Income and Savings. New York: National Bureau of Economic Research. [Google Scholar]

- Lamoreaux, Naomi R. 2019. The Problem of Bigness: From Standard Oil to Google. Journal of Economic Perspectives 33: 94–117. [Google Scholar] [CrossRef] [Green Version]

- Laubach, Thomas, and John C. Williams. 2003. Measuring the Natural Rate of Interest. Review of Economics and Statistics 85: 1063–70. [Google Scholar] [CrossRef] [Green Version]

- Lieberknecht, Philipp, and Philip Vermeulen. 2018. Inequality and Relative Saving Rates at the Top. Working Paper Series 2204; Frankfurt: European Central Bank. [Google Scholar]

- Liu, Ernest, Atif Mian, and Amir Sufi. 2021. Low Interest Rates, Market Power, and Productivity Growth. forthcoming in Econometrica. Available online: https://www.nber.org/papers/w25505 (accessed on 24 December 2021).

- Lucas, Robert E. 1988. On the Mechanics of Economic Development. Journal of Monetary Economics 21: 3–32. [Google Scholar] [CrossRef]

- Lunsford, Kurt G., and Kenneth D. West. 2019. Some evidence on secular drivers of US safe real rates. American Economic Journal: Macroeconomics 11: 113–39. [Google Scholar] [CrossRef] [Green Version]

- Luo, Yulei, William T. Smith, and Heng-Fu Zou. 2009a. The Spirit of Capitalism and Excess Smoothness. Annals of Economics and Finance 10: 281–301. [Google Scholar]

- Luo, Yulei, William T. Smith, and Heng-Fu Zou. 2009b. The Spirit of Capitalism, Precautionary Savings, and Consumption. Journal of Money, Credit and Banking 41: 544–54. [Google Scholar] [CrossRef]

- Mankiw, N. Gregory. 1988. Imperfect competition and the Keynesian cross. Economics Letters 26: 7–13. [Google Scholar] [CrossRef] [Green Version]

- Mayer, Thomas. 1966. The Propensity to Consume Permanent Income. American Economic Review 56: 1158–77. [Google Scholar]

- Mayer, Thomas. 1972. Permanent Income, Wealth, and Consumption: A Critique of the Permanent Income Theory, the Life-Cycle Hypothesis, and Related Theories. Berkeley: University of California Press. [Google Scholar] [CrossRef]

- Mian, Atif, Ludwig Straub, and Amir Sufi. 2021a. The Saving Glut of the Rich. NBER Working Paper 26941. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef] [Green Version]

- Mian, Atif, Ludwig Straub, and Amir Sufi. 2021b. What Explains the Decline in r∗? Rising Income Inequality versus Demographic Shifts. University of Chicago, Becker Friedman Institute for Economics Working Paper No. 2021-104. Available online: https://ssrn.com/abstract=3916345 (accessed on 24 December 2021).

- Ogilvie, Sheilagh. 2014. The Economics of Guilds. Journal of Economic Perspectives 28: 169–92. [Google Scholar] [CrossRef] [Green Version]

- Ogilvie, Sheilagh, and Andre W. Carus. 2014. Institutions and Economic Growth in Historical Perspective. In Handbook of Economic Growth. Edited by Steven Durlauf and Peter Aghion. Amsterdam: Elsevier, vol. 2, pp. 405–514. [Google Scholar] [CrossRef]

- Pasinetti, Luigi L. 1962. Rate of profit and income distribution in relation to the rate of economic growth. Review of Economic Studies 29: 267–79. [Google Scholar] [CrossRef]

- Philippon, Thomas. 2019. The Great Reversal: How America Gave Up on Free Markets. Cambridge: Harvard University Press. [Google Scholar] [CrossRef]

- Poschke, Markus. 2018. The Firm Size Distribution across Countries and Skill-Biased Change in Entrepreneurial Technology. American Economic Journal: Macroeconomics 10: 1–41. [Google Scholar] [CrossRef] [Green Version]

- Projector, Dorothy. 1968. Survey of Changes in Family Finances; Washington, DC: Board of Governors of the Federal Reserve System.

- Rachel, Lukasz, and Thomas D. Smith. 2015. Secular Drivers of the Global Real Interest Rate. Bank of England Working Paper, Staff Working Paper No. 571. London: Bank of England. [Google Scholar] [CrossRef] [Green Version]

- Rachel, Lukasz, and Lawrence H. Summers. 2019. On Secular Stagnation in the Industrialized World. Working Paper 26198. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Rebelo, Sergio. 1991. Long Run Policy Analysis and Long Run Growth. Journal of Political Economy 99: 500–21. [Google Scholar] [CrossRef]

- Romer, Paul M. 1983. Dynamic Competitive Equilibria with Externalities, Increasing Returns and Unbounded Growth. Ph.D. dissertation, University of Chicago, Chicago, IL, USA. [Google Scholar]

- Romer, Paul M. 1986. Increasing Returns and Long-run Growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef] [Green Version]

- Romer, Paul M. 1990. Endogenous Technological Change. Journal of Political Economy 98: S71–S102. [Google Scholar] [CrossRef] [Green Version]

- Sabelhaus, John. 1993. What is the distributional burden of taxing consumption? National Tax Journal 46: 331–44. [Google Scholar] [CrossRef]

- Samuelson, Paul A., and Franco Modigliani. 1966. The Pasinetti Paradox in neoclassical and more general models. The Review of Economic Studies 33: 269–301. [Google Scholar] [CrossRef]

- Shapiro, Carl. 2019. Protecting Competition in the American Economy: Merger Control, Tech Titans, Labor Markets. Journal of Economic Perspectives 33: 69–93. [Google Scholar] [CrossRef] [Green Version]

- Solow, Robert M. 1956. A Contribution to the Theory of Economic Growth. Quarterly Journal of Economics 70: 65–94. [Google Scholar] [CrossRef]

- Solow, Robert M. 1957. Technical Change and the Aggregate Production Function. Review of Economics and Statistics 39: 312–20. [Google Scholar] [CrossRef] [Green Version]

- Stauvermann, Peter J. 1997. Endogenous Growth in OLG Models, Gabler. Wiesbaden: Deutscher Universitätsverlag. [Google Scholar] [CrossRef]

- Stauvermann, Peter J., and Jin Hu. 2018. What can China Expect from an Increase of the Mandatory Retirement Age? Annals of Economics and Finance 19: 229–46. [Google Scholar]

- Stauvermann, Peter J., and Ronald R. Kumar. 2015. The Dilemma of International Capital Tax Competition in the Presence of Public Capital and Endogenous Growth. Annals of Economics and Finance 16: 255–72. [Google Scholar]

- Stauvermann, Peter J., and Ronald R. Kumar. 2021. Does more market competition lead to higher income and utility in the long run? Bulletin of Economic Research, 1–22. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E. 2019. Market concentration is threatening the U.S. Economy. Chazen Global Insights. March 12. Available online: https://www8.gsb.columbia.edu/articles/chazen-global-insights/market-concentration-threatening-us-economy (accessed on 24 December 2021).

- Summers, Lawrence H. 2014. US economic prospects: Secular stagnation, hysteresis, and the zero lower bound. Business Economics 49: 65–73. [Google Scholar] [CrossRef]

- Syverson, Chad. 2019. Macroeconomics and Market Power: Context, Implications, and Open Questions. Journal of Economic Perspectives 33: 23–43. [Google Scholar] [CrossRef] [Green Version]

- Uhlig, Harald, and Noriyuki Yanagawa. 1996. Increasing the capital income tax may lead to faster growth. European Economic Review 40: 1521–40. [Google Scholar] [CrossRef]

- Van Reenen, John. 2018. Increasing Differences Between Firms: Market Power and the Macro-Economy. CEP Discussion Paper No 1576. Brussels: Centre of European Policy. [Google Scholar]

- World Bank. 2021. World Development Indicators. Washington, DC: World Bank. [Google Scholar]

- Zou, Heng-Fu. 1995. The spirit of capitalism and savings behavior. Journal of Economic Behavior and Organization 28: 131–43. [Google Scholar] [CrossRef] [Green Version]

- Zou, Heng-Fu. 2011. The Spirit of Capitalism, Savings, Asset Pricing and Growth. CEMA Working Papers 502. Beijing: China Economics and Management Academy, Central University of Finance and Economics, Available online: https://ideas.repec.org/p/cuf/wpaper/502.html#download (accessed on 24 December 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, R.R.; Stauvermann, P.J.; Wernitz, F. The Capitalist Spirit and Endogenous Growth. J. Risk Financial Manag. 2022, 15, 27. https://doi.org/10.3390/jrfm15010027

Kumar RR, Stauvermann PJ, Wernitz F. The Capitalist Spirit and Endogenous Growth. Journal of Risk and Financial Management. 2022; 15(1):27. https://doi.org/10.3390/jrfm15010027

Chicago/Turabian StyleKumar, Ronald R., Peter J. Stauvermann, and Frank Wernitz. 2022. "The Capitalist Spirit and Endogenous Growth" Journal of Risk and Financial Management 15, no. 1: 27. https://doi.org/10.3390/jrfm15010027

APA StyleKumar, R. R., Stauvermann, P. J., & Wernitz, F. (2022). The Capitalist Spirit and Endogenous Growth. Journal of Risk and Financial Management, 15(1), 27. https://doi.org/10.3390/jrfm15010027