Appraising Executive Compensation ESG-Based Indicators Using Analytical Hierarchical Process and Delphi Techniques

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Underpinning of the Study

2.2. ESG as a Mechanism to Deliver on Sustainable Development Goals

2.3. Importance of ESG in Decision Making

2.4. Prioritisation of ESG-Based Performance Indicators

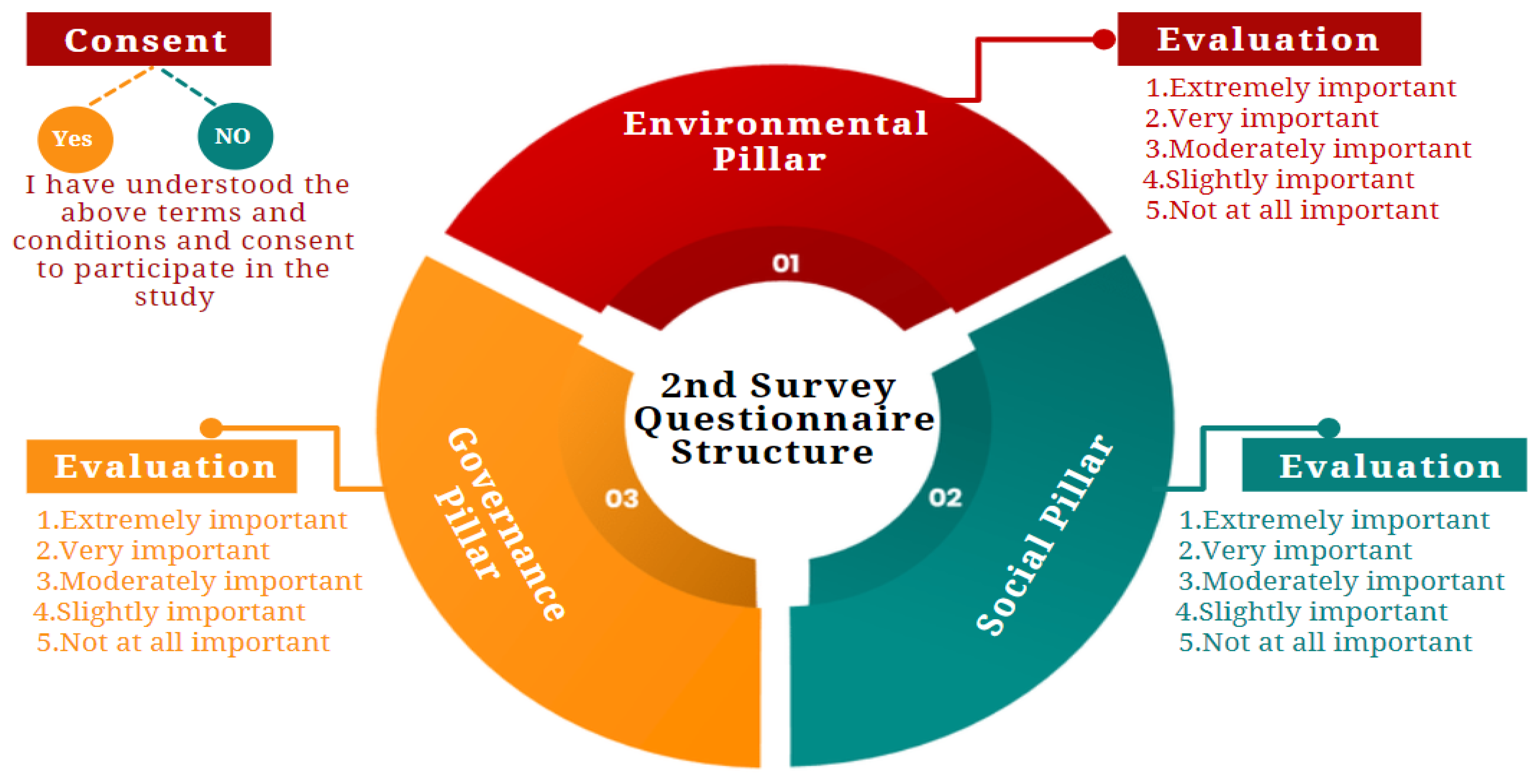

3. Methodology

3.1. Delphi Inquiry Strategy

3.2. Analytical Hierarchical Process

- Pairwise comparison of the pillars in the ESG model;

- Pairwise comparison of the indicators within each pillar of the ESG model;

- Estimation of the weights for the pillars and the indicators in point number 1 and point number 2 above, respectively;

- Computation of consistency ratio, which formed part of validity and reliability assessment.

3.3. Validity and Reliability

- λmax = maximum eigenvalue of the matrix

- n = number of pillars in the ESG model/number of indicators in the ESG pillars.

4. Results

- The survey was conducted online and there was no direct face-to-face interaction with the experts (Apostolou and Hassell 1993).

- Excluding the pillars and indicators with consistency ratios above 0.10 is tantamount to squeezing out the richness provided in the data (Apostolou and Hassell 1993).

- Indeed, in some instances, participants did not rank some of the pillars and indicators. However, upon following up, it was found that the intention was to flag those as equally important and when the data clean-up was conducted, the responses were manually adjusted (Wedley 1993).

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adebayo, Tomiwa Sunday, and Jamiu Adetola Odugbesan. 2021. Modeling CO2 emissions in South Africa: Empirical evidence from ARDL based bounds and wavelet coherence techniques. Environmental Science and Pollution Research 28: 9377–89. [Google Scholar] [CrossRef] [PubMed]

- Adelekan, Adeboye, and Mark Bussin. 2018. Gender pay gap in salary bands among employees in the formal sector of South Africa. SA Journal of Human Resource Management 16: 1–10. [Google Scholar] [CrossRef]

- Ahamed, Faruque. 2022. CEO Compensation and Performance of Banks. European Journal of Business and Management Research 7: 100–3. [Google Scholar] [CrossRef]

- Al-Najjar, Basil. 2017. Corporate governance and CEO pay: Evidence from UK Travel and Leisure listed firms. Tourism Management 60: 9–14. [Google Scholar] [CrossRef]

- Alonso, Jose Antonio, and Teresa Lamata. 2006. Consistency in the analytic hierarchy process: A new approach. International Journal of Uncertainty, Fuzziness and Knowledge-Based Systems 14: 445–59. [Google Scholar] [CrossRef]

- Alosta, Abdulaziz, Omar Elmansuri, and Ibrahim Badi. 2021. Resolving a location selection problem by means of an integrated AHP-RAFSI approach. Reports in Mechanical Engineering 2: 135–42. [Google Scholar] [CrossRef]

- Alsayegh, Maha Faisal, Rashidah Abdul Rahman, and Saeid Homayoun. 2020. Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 12: 3910. [Google Scholar] [CrossRef]

- Altman, Miriam. 2022. Trajectories for South African employment after COVID-19. South African Journal of Science 118: 1–9. [Google Scholar] [CrossRef]

- Altuzarra, Alfredo, José María Moreno-Jiménez, and Manuel Salvador. 2007. A Bayesian priorization procedure for AHP-group decision making. European Journal of Operational Research 182: 367–82. [Google Scholar] [CrossRef]

- Alves, Paulo, Eduardo Barbosa Couto, and Paulo Morais Francisco. 2016. Executive pay and performance in Portuguese listed companies. Research in International Business and Finance 37: 184–95. [Google Scholar] [CrossRef][Green Version]

- Apostolou, Barbara, and John Hassell. 1993. An empirical examination of the sensitivity of the analytic hierarchy process to departures from recommended consistency ratios. Mathematical and Computer Modelling 17: 163–70. [Google Scholar] [CrossRef]

- Bussin, Mark. 2015. CEO pay-performance sensitivity in the South African context. South African Journal of Economic and Management Sciences 18: 232–44. [Google Scholar] [CrossRef]

- Carlsson, Liesel, and Edith Callaghan. 2022. The Social License to Practice Sustainability: Concepts, Barriers and Actions to Support Nutrition and Dietetics Practitioners in Contributing to Sustainable Food Systems. Journal of Hunger & Environmental Nutrition 1: 1–19. [Google Scholar]

- Cavaco, Sandra, Patricia Crifo, and Aymeric Guidoux. 2020. Corporate social responsibility and governance: The role of executive compensation. Industrial Relations: A Journal of Economy and Society 59: 240–74. [Google Scholar] [CrossRef]

- Chen, Jun, Alexandre Garel, and Alireza Tourani-Rad. 2019. The value of academics: Evidence from academic independent director resignations in China. Journal of Corporate Finance 58: 393–414. [Google Scholar] [CrossRef]

- Chen, Yu-Shan. 2008. The driver of green innovation and green image–green core competence. Journal of Business Ethics 81: 531–43. [Google Scholar] [CrossRef]

- Chen, Yu-Shan, Shyh-Bao Lai, and Chao-Tung Wen. 2006. The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics 67: 331–39. [Google Scholar] [CrossRef]

- Chithambo, Lyton, Venancio Tauringana, Ishmael Tingbani, and Laura Achiro. 2022. Stakeholder pressure and greenhouses gas voluntary disclosures. Business Strategy and the Environment 31: 159–72. [Google Scholar] [CrossRef]

- Christensen, Dane M., George Serafeim, and Anywhere Sikochi. 2022. Why is corporate virtue in the eye of the beholder? The case of ESG ratings. The Accounting Review 97: 147–75. [Google Scholar] [CrossRef]

- Cooper, Michael, Huseyin Gulen, and Raghavendra Rau. 2016. Performance for Pay? The Relation between CEO Incentive Compensation and Future Stock Price Performance. Working Paper. Salt Lake City: University of Utah. [Google Scholar]

- Fauzi, Muhammad Ashraf, Christine Tan Nya-Ling, Ramayah Thursamy, and Adedapo Oluwaseyi Ojo. 2019. Knowledge sharing: Role of academics towards research productivity in higher learning institution. VINE Journal of Information and Knowledge Management Systems 49: 136–59. [Google Scholar] [CrossRef]

- Flammer, Caroline, Bryan Hong, and Dylan Minor. 2019. Corporate governance and the rise of integrating corporate social responsibility criteria in executive compensation: Effectiveness and implications for firm outcomes. Strategic Management Journal 40: 1097–122. [Google Scholar] [CrossRef]

- Freeman, Edward. 2010. Strategic Management: A Stakeholder Approach. Cambridge: Cambridge University Press. [Google Scholar]

- Gao, Huasheng, and Kai Li. 2015. A comparison of CEO pay–performance sensitivity in privately-held and public firms. Journal of Corporate Finance 35: 370–88. [Google Scholar] [CrossRef]

- Geza, Wendy, Mjabuliseni Simon Cloapas Ngidi, Rob Slotow, and Tafadzwanashe Mabhaudhi. 2022. The dynamics of youth employment and empowerment in agriculture and rural development in South Africa: A scoping review. Sustainability 14: 5041. [Google Scholar] [CrossRef]

- Golden, Bruce, and Qiwen Wang. 1990. An alternate measure of consistency. In The Analytic Hierarchy Process. Edited by Golden Bruce, Edward Wasil and Patrick Harker. New York: Springer, pp. 68–81. [Google Scholar]

- Gray, Rob, Reza Kouhy, and Simon Lavers. 1995. Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing & Accountability Journal 8: 47–77. [Google Scholar]

- Gyapong, Ernest, and Godfred Adjapong Afrifa. 2019. The simultaneous disclosure of shareholder and stakeholder corporate governance practices and their antecedents. International Journal of Finance & Economics 24: 260–87. [Google Scholar]

- Habiyaremye, Alexis. 2022. Racial capitalism, ruling elite business entanglement and the impasse of black economic empowerment policy in South Africa. African Journal of Business Ethics 16: 25–41. [Google Scholar] [CrossRef]

- Hahn, Tobias, Frank Figge, Jonatan Pinkse, and Lutz Preuss. 2018. A paradox perspective on corporate sustainability: Descriptive, instrumental, and normative aspects. Journal of Business Ethics 148: 235–48. [Google Scholar] [CrossRef]

- He, Feng, Hanyu Du, and Bo Yu. 2022. Corporate ESG performance and manager misconduct: Evidence from China. International Review of Financial Analysis 82: 1–15. [Google Scholar] [CrossRef]

- Henisz, Witold, and James McGlinch. 2019. ESG, material credit events, and credit risk. Journal of Applied Corporate Finance 31: 105–17. [Google Scholar] [CrossRef]

- Houston, Joel, and Hongyu Shan. 2022. Corporate ESG profiles and banking relationships. The Review of Financial Studies 35: 3373–417. [Google Scholar] [CrossRef]

- Hřebíček, Jiří, Jana Soukopová, Michael Štencl, and Oldřich Trenz. 2011. Corporate key performance indicators for environmental management and reporting. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 59: 99–108. [Google Scholar]

- Hübel, Benjamin, and Hendrik Scholz. 2020. Integrating sustainability risks in asset management: The role of ESG exposures and ESG ratings. Journal of Asset Management 21: 52–69. [Google Scholar] [CrossRef]

- In, Soh Young, Dane Rook, and Ashby Monk. 2019. Integrating alternative data (also known as ESG data) in investment decision making. Global Economic Review 48: 237–60. [Google Scholar] [CrossRef]

- Jegede, Ademola Oluborode, and Azwihangwisi Walter Makulana. 2019. Climate change interventions in South Africa: The significance of Earthlife Africa Johannesburg v Minister of Environmental Affairs (Thabametsi case) [2017] JOL 37526 (GP). Obiter 40: 399–407. [Google Scholar]

- Jensen, Michael, and William Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Khan, Walayet, and João Paulo Vieito. 2013. CEO gender and firm performance. Journal of Economics and Business 67: 55–66. [Google Scholar] [CrossRef]

- Kollamparambil, Umakrishnan. 2020. Educational homogamy, positive assortative mating and income inequality in South Africa: An unconditional quantile regression analysis. The Journal of Development Studies 56: 1706–24. [Google Scholar] [CrossRef]

- Kotsantonis, Sakis, and George Serafeim. 2019. Four things no one will tell you about ESG data. Journal of Applied Corporate Finance 31: 50–58. [Google Scholar] [CrossRef]

- Krejčí, Jana, and Jan Stoklasa. 2018. Aggregation in the analytic hierarchy process: Why weighted geometric mean should be used instead of weighted arithmetic mean. Expert Systems with Applications 114: 97–106. [Google Scholar] [CrossRef]

- Krueger, Philipp, Zacharias Sautner, and Laura Starks. 2020. The importance of climate risks for institutional investors. The Review of Financial Studies 33: 1067–111. [Google Scholar] [CrossRef]

- Lashitew, Addisu. 2021. Corporate uptake of the Sustainable Development Goals: Mere greenwashing or an advent of institutional change? Journal of International Business Policy 4: 184–200. [Google Scholar] [CrossRef]

- Lee, Michael, Robyn Raschke, and Anjala Krishen. 2022. Signaling green! firm ESG signals in an interconnected environment that promote brand valuation. Journal of Business Research 138: 1–11. [Google Scholar] [CrossRef]

- Lozano-Reina, Gabriel, and Gregorio Sánchez-Marín. 2020. Say on pay and executive compensation: A systematic review and suggestions for developing the field. Human Resource Management Review 30: 1–14. [Google Scholar] [CrossRef]

- Maas, Karen. 2018. Do corporate social performance targets in executive compensation contribute to corporate social performance? Journal of Business Ethics 148: 573–85. [Google Scholar] [CrossRef]

- Mans-Kemp, Nadia, Suzette Viviers, and Tyler Shiel. 2022. Drivers of board gender diversity in a self-regulatory context. Management Dynamics: Journal of the Southern African Institute for Management Scientists 31: 1–17. [Google Scholar]

- Matemane, Reon. 2022. Towards Value Adding Performance: A Metric for Executive Compensation. Ph.D. dissertation, University of Johannesburg, Johannesburg, South African. Available online: https://ujcontent.uj.ac.za/esploro/search/outputs?query=any,contains,reon%20matemane&page=1&scope=Research&institution=27UOJ_INST (accessed on 10 October 2022).

- McIntyre-Mills, Janet Judy. 2022. The importance of relationality: A note on co-determinism, multispecies relationships and implications for COVID-19. Systems Research and Behavioral Science 39: 339–53. [Google Scholar] [CrossRef]

- Nanath, Krishnadas, and Radhakrishna Pillai. 2017. The influence of green is practices on competitive advantage: Mediation role of green innovation performance. Information Systems Management 34: 3–19. [Google Scholar] [CrossRef]

- Naomi, Prima, and Iqbal Akbar. 2021. Beyond sustainability: Empirical evidence from OECD countries on the connection among natural resources, ESG performances, and economic development. Economics & Sociology 14: 89–106. [Google Scholar]

- Nazir, Marina, Minhas Akbar, Ahsan Akbar, Petra Poulovo, Ammar Hussain, and Muhammad Azeem Qureshi. 2022. The nexus between corporate environment, social, and governance performance and cost of capital: Evidence from top global tech leaders. Environmental Science and Pollution Research 29: 22623–36. [Google Scholar] [CrossRef] [PubMed]

- Nekhili, Mehdi, Amal Boukadhaba, Haithem Nagati, and Tawhid Chtioui. 2021. ESG performance and market value: The moderating role of employee board representation. The International Journal of Human Resource Management 32: 3061–87. [Google Scholar] [CrossRef]

- Obermann, Jörn, and Patrick Velte. 2018. Determinants and consequences of executive compensation-related shareholder activism and say-on-pay votes: A literature review and research agenda. Journal of Accounting Literature 40: 116–51. [Google Scholar] [CrossRef]

- Olaniyi, Clement Olalekan, Olufemi Bodunde Obembe, and Emmanuel Oluwole Oni. 2017. Analysis of the Nexus between CEO Pay and Performance of Non-Financial Listed Firms in Nigeria. African Development Review 29: 429–45. [Google Scholar] [CrossRef]

- Park, So Ra, and Jae Young Jang. 2021. The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies 9: 48. [Google Scholar] [CrossRef]

- Phung, Giang, Hai Hong Trinh, Tam Huy Nguyen, and Vu Quang Trinh. 2022. Top-management compensation and environmental innovation strategy. Business Strategy and the Environment 32: 1–16. [Google Scholar] [CrossRef]

- Porcuna Enguix, Luis. 2021. The New EU Remuneration policy as good but not desired corporate governance mechanism and the role of CSR disclosing. Sustainability 13: 5476. [Google Scholar] [CrossRef]

- Preston, Brian. 2021. The influence of the Paris agreement on climate litigation: Legal obligations and norms (Part I). Journal of Environmental Law 33: 1–32. [Google Scholar] [CrossRef]

- Public Investment Corporation (PIC). 2018. Listed Investmensts 31 March 2017. Environmental Social and Governance Quarterly Report. Available online: http://www.pic.gov.za/wp-content/uploads/2012/04/ESG-listed-quarterly-voting-results-Q4-2016-17.pdf (accessed on 22 August 2019).

- Rath, Chetna, Florentina Kurniasari, and Malabika Deo. 2020. CEO Compensation and Firm Performance: The Role of ESG Transparency. Indonesian Journal of Sustainability Accounting and Management 4: 278–93. [Google Scholar] [CrossRef]

- Rathbone, Mark. 2022. Economic inequality and trust from a Smithian perspective. Acta Academica 54: 92–112. [Google Scholar] [CrossRef]

- Roberts, Debra. 2016. A global roadmap for climate change action: From COP17 in Durban to COP21 in Paris. South African Journal of Science 112: 1–3. [Google Scholar] [CrossRef]

- Saaty, Thomas. 1980. The Analytic Hierarchy Process (AHP) for Decision Making. Kobe: AHP, pp. 1–69. [Google Scholar]

- Samkin, Grant, and Craig Deegan. 2012. New Zealand Financial Accounting. New York: McGraw-Hill Education Australia. [Google Scholar]

- Schuster, Susanne, Katrin Singler, Stephen Lim, Mareen Machner, Klaus Döbler, and Harald Dormann. 2020. Quality indicators for a geriatric emergency care (GeriQ-ED)–an evidence-based delphi consensus approach to improve the care of geriatric patients in the emergency department. Scandinavian Journal of Trauma, Resuscitation and Emergency Medicine 28: 1–7. [Google Scholar] [CrossRef]

- Serafeim, George. 2020. Social-impact efforts that create real value. Harvard Business Review 98: 38–48. [Google Scholar]

- Shapiro, Arnold, and Marie-Claire Koissi. 2017. Fuzzy logic modifications of the analytic hierarchy process. Insurance: Mathematics and Economics 75: 189–202. [Google Scholar] [CrossRef]

- Skordoulis, Michalis, Grigorios Kyriakopoulos, Stamatiοs Ntanos, Spyros Galatsidas, Garyfallos Arabatzis, Miltiadis Chalikias, and Petros Kalantonis. 2022. The Mediating Role of Firm Strategy in the Relationship between Green Entrepreneurship, Green Innovation, and Competitive Advantage: The Case of Medium and Large-Sized Firms in Greece. Sustainability 14: 3286. [Google Scholar] [CrossRef]

- Sobota, Amy, Nishita Shah, and Jennifer Mack. 2017. Development of quality indicators for transition from pediatric to adult care in sickle cell disease: A modified Delphi survey of adult providers. Pediatric Blood & Cancer 64: 1–6. [Google Scholar]

- Sourani, Amr, and Mu Sohail. 2015. The Delphi method: Review and use in construction management research. International Journal of Construction Education and Research 11: 54–76. [Google Scholar] [CrossRef]

- Tshishonga, Ndwakhulu. 2019. The legacy of apartheid on democracy and citizenship in post-apartheid South Africa: An inclusionary and exclusionary binary? African Journal of Development Studies 9: 167–91. [Google Scholar] [CrossRef]

- Tuljak-Suban, Danijela, and Patricija Bajec. 2020. Integration of AHP and GTMA to Make a Reliable Decision in Complex Decision-Making Problems: Application of the Logistics Provider Selection Problem as a Case Study. Symmetry 12: 766. [Google Scholar] [CrossRef]

- Viviers, Suzette, and Nadia Mans-Kemp. 2019. Director overboardedness in South Africa: Evaluating the experience and busyness hypotheses. International Journal of Disclosure and Governance 16: 68–81. [Google Scholar] [CrossRef]

- Wedley, William. 1993. Consistency prediction for incomplete AHP matrices. Mathematical and Computer Modelling 17: 151–61. [Google Scholar] [CrossRef]

- Widyawati, Luluk. 2021. Measurement concerns and agreement of environmental social governance ratings. Accounting & Finance 61: 1589–623. [Google Scholar]

- Yu, Ellen Pei-yi, Bac Van Luu, and Catherine Huirong Chen. 2020. Greenwashing in environmental, social and governance disclosures. Research in International Business and Finance 52: 1–23. [Google Scholar] [CrossRef]

- Zolotoy, Leon, Don O’Sullivan, Geoffrey Martin, and Robert Wiseman. 2021. Stakeholder agency relationships: CEO stock options and corporate tax avoidance. Journal of Management Studies 58: 782–814. [Google Scholar] [CrossRef]

| Characteristics | Frequency | Percentage | |

|---|---|---|---|

| Country | SA | 94 | 83.2 |

| UK | 14 | 12.4 | |

| US | 1 | 0.9 | |

| Others | 2 | 3.5 | |

| Total | 113 | 100 | |

| Qualification | PhD | 25 | 22.1 |

| Masters, CA(SA) | 17 | 15 | |

| Masters, CPA | 1 | 0.9 | |

| Masters | 36 | 31.9 | |

| CA(SA) | 14 | 12.4 | |

| CFA | 7 | 6.2 | |

| Honours | 7 | 6.2 | |

| Degree | 6 | 5.3 | |

| Total | 113 | 100 | |

| Field | Academic | 47 | 41.6 |

| Executive/Board member | 34 | 30.1 | |

| Audit firm | 15 | 13.3 | |

| Institutional investors | 10 | 8.8 | |

| Others (NGOs, labour unions and shareholder activists) | 7 | 6.2 | |

| Total | 113 | 100 |

| Likert Scale Rating | Meaning |

|---|---|

| 1 | Extremely less important |

| 3 | Very strongly less important |

| 5 | Strongly less important |

| 7 | Moderately less important |

| 9 | Equally important |

| 11 | Moderately more important |

| 13 | Strongly more important |

| 15 | Very strongly more important |

| 17 | Extremely more important |

| 2, 4, 6, 8, 10, 12, 14 and 16 | Midway between two close scales |

| Qualtrics questionnaire code | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| Recoded values | 0.111 | 0.125 | 0.143 | 0.167 | 0.2 | 0.25 | 0.333 | 0.5 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| N | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| RI | 0 | 0 | 0.58 | 0.89 | 1.12 | 1.24 | 0.1.33 | 1.40 | 1.45 | 1.49 |

| Environmental | Social | Governance | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pillar level | ||||||||||||

| Arithmetic mean | 0.397 | 0.281 | 0.214 | |||||||||

| Geometric mean | 0.430 | 0.304 | 0.265 | |||||||||

| Ranking | 1 | 2 | 3 | |||||||||

| Consistency ratio | 0.19 | |||||||||||

| Indicator level | ||||||||||||

| Arithmetic mean | Geometric mean | Ranking | Consistency ratio | Arithmetic mean | Geometric mean | Ranking | Consistency ratio | Arithmetic mean | Geometric mean | Ranking | Consistency ratio | |

| Indicator 1 | 0.319 | 0.271 | 2 | 0.147 | 0.317 | 0.276 | 1 | 0.189 | 0.302 | 0.252 | 1 | 0.205 |

| Indicator 2 | 0.194 | 0.176 | 3 | 0.194 | 0.169 | 3 | 0.201 | 0.188 | 2 | |||

| Indicator 3 | 0.169 | 0.147 | 4 | 0.123 | 0.108 | 5 | 0.204 | 0.179 | 3 | |||

| Indicator 4 | 0.837 | 0.729 | 1 | 0.158 | 0.119 | 4 | 0.155 | 0.139 | 4 | |||

| Indicator 5 | 0.151 | 0.116 | 5 | 0.208 | 0.182 | 2 | 0.137 | 0.104 | 5 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Matemane, R.; Moloi, T.; Adelowotan, M. Appraising Executive Compensation ESG-Based Indicators Using Analytical Hierarchical Process and Delphi Techniques. J. Risk Financial Manag. 2022, 15, 469. https://doi.org/10.3390/jrfm15100469

Matemane R, Moloi T, Adelowotan M. Appraising Executive Compensation ESG-Based Indicators Using Analytical Hierarchical Process and Delphi Techniques. Journal of Risk and Financial Management. 2022; 15(10):469. https://doi.org/10.3390/jrfm15100469

Chicago/Turabian StyleMatemane, Reon, Tankiso Moloi, and Michael Adelowotan. 2022. "Appraising Executive Compensation ESG-Based Indicators Using Analytical Hierarchical Process and Delphi Techniques" Journal of Risk and Financial Management 15, no. 10: 469. https://doi.org/10.3390/jrfm15100469

APA StyleMatemane, R., Moloi, T., & Adelowotan, M. (2022). Appraising Executive Compensation ESG-Based Indicators Using Analytical Hierarchical Process and Delphi Techniques. Journal of Risk and Financial Management, 15(10), 469. https://doi.org/10.3390/jrfm15100469