Institutional Investors’ Willingness to Pay for Green Bonds: A Case for Shanghai

Abstract

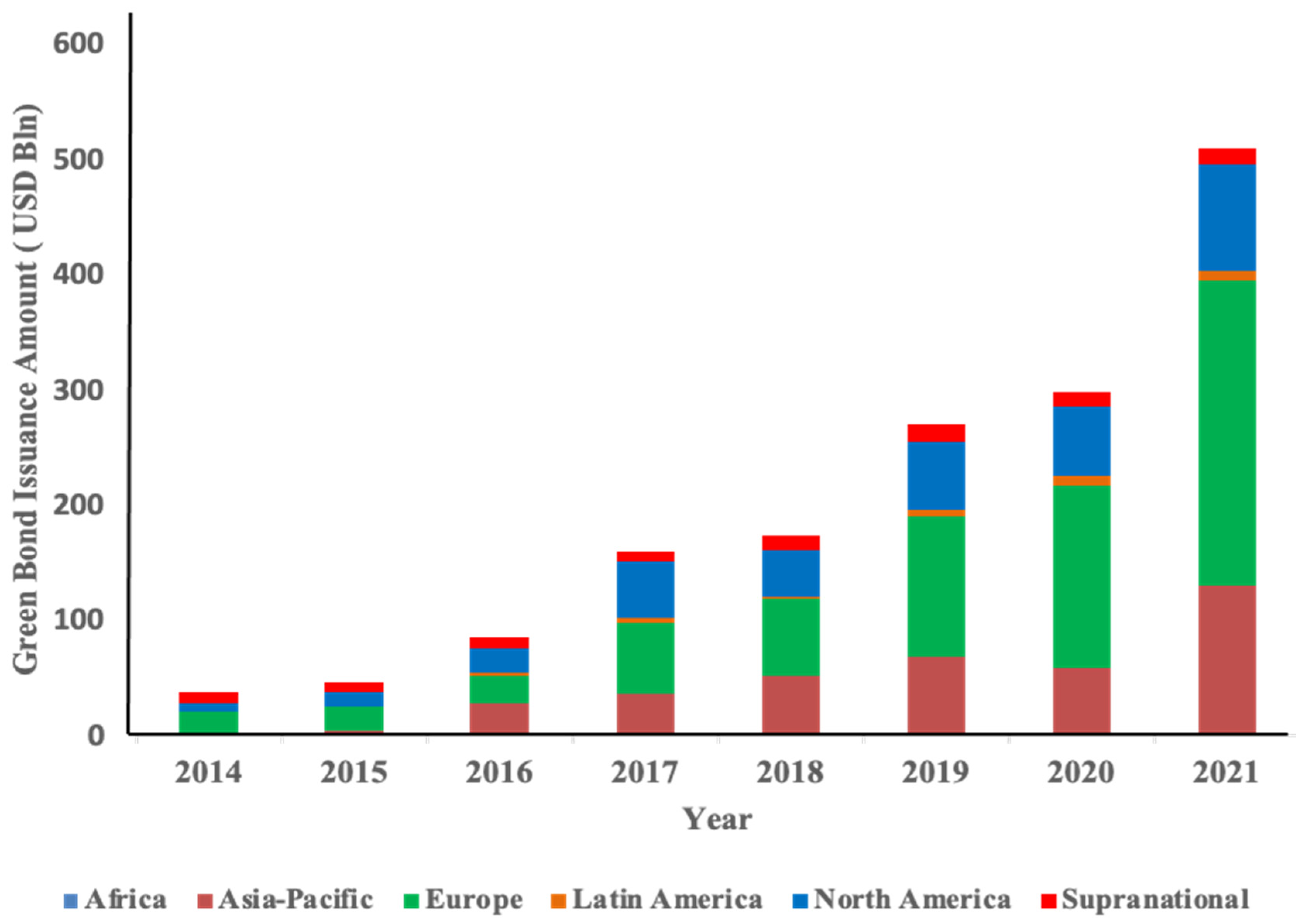

:1. Introduction

2. Previous Studies

3. Materials and Methods

3.1. Study Area

3.2. Survey Methods

3.3. About Wenjuan

3.4. Survey Design

3.5. Contingent Valuation Design

3.6. WTP for the Greenium and Designing of Bids

3.7. Analysis of WTP

3.8. Variables for Analyzing the Effectiveness of the Greenium

3.9. Factors Affecting the Willingness to Buy Green Bonds

4. Results

4.1. Sample Description

4.2. Description of Greenium Explanatory Variables

4.3. Respondents’ Level of Interest in Environmental Issues and Understanding of Green Bonds

4.4. Analysis of Responses Regarding WTP

4.5. Maximum Likelihood Estimation and Mean WTP

4.6. Factors Affecting the Respondents’ WTB

5. Discussion

5.1. Institutional Investors’ WTP for Green Bonds

5.2. Variables Affecting the Institutional Investors’ WTB Green Bonds

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Agliardi, Elettra, and Rossella Agliardi. 2021. Corporate green bonds: Understanding the greenium in a two-factor structural model. Environmental and Resource Economics 80: 257–78. [Google Scholar] [CrossRef] [PubMed]

- Amihud, Yakov, and Haim Mendelson. 1991. Liquidity, maturity, and the yields on US Treasury securities. The Journal of Finance 46: 1411–25. [Google Scholar] [CrossRef]

- Amstad, Marlene, and Zhiguo He. 2019. Chinese Bond Market and Interbank Market (No. w25549). Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Aruga, Kentaka. 2022a. Environmental and Natural Resource Economics. Cham: Springer International Publishing. [Google Scholar] [CrossRef]

- Aruga, Kentaka. 2022b. Are retail investors willing to buy green bonds? A case for Japan. In Mapping the Energy Future-Voyage in Uncharted Territory—43rd IAEE International Conference, Tokyo, Japan, July 31–3 August 2022. Cleveland: International Association for Energy Economics. [Google Scholar]

- Bank for International Settlements (BIS). 2020. Summary of Debt Securities Outstanding as of End 2020. Available online: https://stats.bis.org/statx/srs/table/c1 (accessed on 6 May 2022).

- Bhutta, Umair S., Adeel Tariq, Muhammad Farrukh, Ali Raza, and Muhammad K. Iqbal. 2022. Green bonds for sustainable development: Review of literature on development and impact of green bonds. Technological Forecasting and Social Change 175: 121378. [Google Scholar] [CrossRef]

- Budhathoki, Nanda K., Jonatan A. Lassa, Sirish Pun, and Kerstin K. Zander. 2019. Farmers’ interest and willingness-to-pay for index-based crop insurance in the lowlands of Nepal. Land Use Policy 85: 1–10. [Google Scholar] [CrossRef]

- Chen, Ke, and Guo Chen. 2015. The rise of international financial centers in mainland China. Cities 47: 10–22. [Google Scholar] [CrossRef]

- Climate Bond Initiative (CBI). 2021a. Interactive Data Platform as of End 2021. Available online: https://www.climatebonds.net/market/data/ (accessed on 6 May 2022).

- Climate Bond Initiative (CBI). 2021b. The Green Bond Endorsed Project Catalogue 2021 Edition. Available online: https://www.climatebonds.net/market/country/china/green-bond-endorsed-project-catalogue (accessed on 6 May 2022).

- Deschryver, Pauline, and Frederic De Mariz. 2020. What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market? Journal of Risk and Financial Management 13: 61. [Google Scholar] [CrossRef] [Green Version]

- Ehlers, Torsten, and Frank Packer. 2017. Green bond finance and certification. BIS Quarterly Review, September 17. [Google Scholar]

- Escalante, D., J. Choi, N. Chin, Y. Cui, and M. L. Larsen. 2020. The state and effectiveness of the green bond market in China. Climate Policy Initiative 2020: 10–27. [Google Scholar]

- Flammer, Caroline. 2021. Corporate green bonds. Journal of Financial Economics 142: 499–516. [Google Scholar] [CrossRef]

- Gelo, Dambala, and Steve F. Koch. 2015. Contingent valuation of community forestry programs in Ethiopia: Controlling for preference anomalies in double-bounded CVM. Ecological Economics 114: 79–89. [Google Scholar] [CrossRef] [Green Version]

- Herbsta, Anthony F., and Wayne F. Pergb. 2001. Efficient investment portfolios in a real-value environment: Implications for portfolio managers and bond yields. International Journal of Business 6: 23–39. [Google Scholar]

- Higano, Yoshiro, and Akihiro Otsuka. 2022. Special Feature on Regional Sustainability: Analysis in a spatial and regional context with broad perspectives on the risk of global warming, natural disasters, and emerging issues due to the globalized economy. Asia-Pacific Journal of Regional Science 6: 239–45. [Google Scholar] [CrossRef]

- Hoyos, David, and Petr Mariel. 2010. Contingent valuation: Past, present and future. Prague Economic Papers 4: 329–43. [Google Scholar] [CrossRef] [Green Version]

- International Energy Agency (IEA). 2020. CO2 Emissions from Fuel Combustion Overview 2020 Edition. Available online: https://enerji.mmo.org.tr/wp-content/uploads/2020/08/IEA-CO2_Emissions_from_Fuel_Combustion_Overview_2020_edition.pdf (accessed on 6 May 2022).

- International Energy Agency (IEA). 2021. World Energy Outlook 2021. Available online: https://www.iea.org/reports/world-energy-outlook-2021 (accessed on 6 May 2022).

- Jiang, Danlu, Dong Bai, Zhaowei Yin, and Gongyuan Fan. 2019. Willingness to pay for enhanced water security in a rapidly developing shale gas region in China. Water 11: 1888. [Google Scholar] [CrossRef] [Green Version]

- Karpf, Andreas, and Antoine Mandel. 2017. Does It Pay to Be Green? Available online: https://ssrn.com/abstract=2923484 (accessed on 6 May 2022).

- Kumar, Sumit. 2022. A quest for sustainium (sustainability Premium): Review of sustainable bonds. Academy of Accounting and Financial Studies Journal 26: 1–18. [Google Scholar]

- Labuszewski, John W., Michael Kamradt, and David Gibbs. 2013. Understanding Treasury Futures. Chicago: CME Group. [Google Scholar]

- Larcker, David F., and Edward M. Watts. 2020. Where’s the greenium? Journal of Accounting and Economics 69: 101312. [Google Scholar] [CrossRef]

- Lebelle, Martin, Souad Lajili Jarjir, and Syrine Sassi. 2020. Corporate green bond issuances: An international evidence. Journal of Risk and Financial Management 13: 25. [Google Scholar] [CrossRef] [Green Version]

- Li, Zhiyong, Ying Tang, Jingya Wu, Junfeng Zhang, and Qi Lv. 2020. The interest costs of green bonds: Credit ratings, corporate social responsibility, and certification. Emerging Markets Finance and Trade 56: 2679–92. [Google Scholar] [CrossRef]

- Lin, Boqiang, and Tong Su. 2022. Green bond vs conventional bond: Outline the rationale behind issuance choices in China. International Review of Financial Analysis 81: 102063. [Google Scholar] [CrossRef]

- Lin, Lin, and Dan W. Puchniak. 2022. Institutional Investors in China: Corporate Governance and Policy Channeling in the Market Within the State. Columbia Journal of Asian Law 35: 74–159. [Google Scholar] [CrossRef]

- Lopez-Feldman, Alejandro. 2012. Introduction to Contingent Valuation Using Stata. Available online: https://mpra.ub.uni-muenchen.de/41018/ (accessed on 6 May 2022).

- Löffler, Kristin U., Aleksandar Petreski, and Andreas Stephan. 2021. Drivers of green bond issuance and new evidence on the “greenium”. Eurasian Economic Review 11: 1–24. [Google Scholar] [CrossRef]

- Mei, Bing, and Gavin T. Brown. 2018. Conducting online surveys in China. Social Science Computer Review 36: 721–34. [Google Scholar] [CrossRef]

- Morano, Pierluigi, Francesco Tajani, and Debora Anelli. 2020. A decision support model for investment through the social impact bonds. The case of the city of Bari (Italy). Valori e Valutazioni 24: 163–78. [Google Scholar]

- People’s Bank of China (PBC). 2021. The Green Bond Endorsed Project Catalogue (2021 Edition). Available online: http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4342400/2021091617180089879.pdf (accessed on 6 May 2022).

- Sun, Yabing, and Zhongyue Cao. 2021. Financing Mode Analysis of Chinese Real Estate Enterprises—A Case Study of Evergrande Group. Paper presented at the 2021 2nd Asia-Pacific Conference on Image Processing, Electronics and Computers, Dalian, China, April 14–16; pp. 524–530. [Google Scholar]

- Taherdoost, Hamed. 2016. Sampling methods in research methodology; how to choose a sampling technique for research. How to Choose a Sampling Technique for Research (10 April 2016). International Journal of Academic Research in Management (IJARM), Helvetic Editions 5: hal-02546796. [Google Scholar]

- Wang, Jiazhen, Xin Chen, Xiaoxia Li, Jing Yu, and Rui Zhong. 2020. The market reaction to green bond issuance: Evidence from China. Pacific-Basin Finance Journal 60: 101294. [Google Scholar] [CrossRef]

- Wang, Qinghua, Yaning Zhou, Li Luo, and Junping Ji. 2019. Research on the Factors Affecting the Risk Premium of China’s Green Bond Issuance. Sustainability 11: 6394. [Google Scholar] [CrossRef] [Green Version]

- Wang, Xiaoyang. 2019. The dynamics and governmental policies of Shanghai’s international financial center formation: A financial geography perspective. The Professional Geographer 71: 331–41. [Google Scholar] [CrossRef]

- Watson, Verity, and Mandy Ryan. 2007. Exploring preference anomalies in double bounded contingent valuation. Journal of Health Economics 26: 463–82. [Google Scholar] [CrossRef]

- Yi, Xing, Caiquan Bai, Siyuan Lyu, and Lu Dai. 2021. The impacts of the COVID-19 pandemic on China’s green bond market. Finance Research Letters 42: 101948. [Google Scholar] [CrossRef]

- Zeng, X. 1997. The Development of Financial Industry in Shanghai (1850–1927). Kyoto: Departmental Bulletin Paper, Kyoto University Economic Society, pp. 55–72. [Google Scholar]

- Zerbib, Olivier D. 2016. Is There a Green Bond Premium? The Yield Differential between Green and Conventional Bonds. Journal of Banking and Finance 98: 39–60. [Google Scholar] [CrossRef]

- Zerbib, Olivier D. 2019. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking & Finance 98: 39–60. [Google Scholar]

- Zhao, Xingwang, Jiye Liang, and Chuangyin Dang. 2019. A stratified sampling based clustering algorithm for large-scale data. Knowledge-Based Systems 163: 416–28. [Google Scholar] [CrossRef]

- Zhou, Yaning. 2019. Development of Green Bond Market in China. Paper presented at the 2019 5th International Conference on Humanities and Social Science Research (ICHSSR 2019), Tokyo, Japan, January 6–8. [Google Scholar]

- Z/Yen Group. 2021. The Global Financial Centres Index 30. Long Finance and Financial Centre Futures. Available online: https://www.longfinance.net/media/documents/GFCI_30_Report_2021.09.24_v1.0.pdf (accessed on 6 May 2022).

| Explanatory Variables | Variable Names |

|---|---|

| Green bond issuer’s credit rating/credibility | Credit |

| The type of business of the green bond issuer (e.g., government, municipality, or industry in the case of a company) | Issuer |

| Green bond issuer’s green rating and contribution to the environment | Green rating |

| Amount of green bond issued and liquidity of the bond | Liquidity |

| Redemption term of the green bond | Term |

| Proof of the label | Label |

| Currency of the green bond | Currency |

| The yield offered in the first question | bid1 |

| The yield offered in the second question | bid2 |

| A dummy variable representing the answer to the first question (yes = 1, no = 0) | ans1 |

| A dummy variable representing the answer to the second question (yes = 1, no = 0) | ans2 |

| Variables | Samples Frequency | Percentage (%) |

|---|---|---|

| Respondent’s gender | ||

| 1. Female | 245 | 40.83 |

| 2. Male | 355 | 59.17 |

| Respondent’s age (year) | ||

| Age (20–29) | 44 | 7.33 |

| Age (30–39) | 266 | 44.33 |

| Age (40–49) | 249 | 41.50 |

| Age (50–59) | 41 | 6.83 |

| Respondent’s workplace | ||

| Bank | 42 | 7.00 |

| Securities firm | 115 | 19.17 |

| Asset management company | 139 | 23.17 |

| Investing company | 99 | 16.50 |

| Others | 205 | 34.17 |

| Respondent’s total investing amount | ||

| RMB 1–RMB 1 million | 97 | 16.17 |

| RMB 1 million–RMB 3.5 million | 170 | 28.33 |

| RMB 3.5 million–RMB 6.5 million | 213 | 35.50 |

| RMB 6.5 million–RMB 32.5 million | 120 | 20.00 |

| RMB 32.5 million–RMB 65 million | 0 | 0 |

| RMB 65 million or more | 0 | 0 |

| Questions | Variables | Answers | Samples Frequency | Percentage (%) |

|---|---|---|---|---|

| Is the “credit rating” of the issuer of the green bond the criterion for the decision? | credit | YES = 1 NO = 0 | 488 112 | 81.33 18.67 |

| Is the “business category” of the issuer of the green bond the criterion for the decision? | issuer | YES = 1 NO = 0 | 465 135 | 77.5 22.5 |

| Is the “green rating” of the issuer of the green bond the criterion for the decision? | green rating | YES = 1 NO = 0 | 451 149 | 75.17 24.83 |

| Is the “amount” and the “liquidity” of the green bond the criterion for the decision? | liquidity | YES = 1 NO = 0 | 443 157 | 73.87 26.17 |

| Is the “term” of the green bond the criterion for the decision? | term | YES = 1 NO = 0 | 425 175 | 70.83 29.17 |

| Is the “label” the green bond the criterion for the decision? | label | YES = 1 NO = 0 | 454 146 | 75.67 24.33 |

| Is the “currency” of the green bond the criterion for the decision? | currency | YES = 1 NO = 0 | 365 235 | 60.83 39.17 |

| Question and Answers | Samples Frequency | Percentage (%) |

|---|---|---|

| Are you concerned about “anathermal” or “global warming”? | ||

| Very concerned | 192 | 32.00 |

| Concerned a little | 336 | 56.00 |

| Cannot say either | 59 | 9.83 |

| Not concerned very much | 12 | 2.00 |

| Not concerned at all | 1 | 0.17 |

| Questions | Answers | Samples Frequency | Percentage (%) |

|---|---|---|---|

| Do you know that green bonds are used for the construction of power plants and buildings that use clean energy such as solar thermal and wind power in China? | YES = 1 NO = 0 | 284 316 | 47.33 52.67 |

| Do you know that “the Green Bond Endorsed Project Catalogue” prepared by the Committee of Green Finance Specialists of the Chinese Society of Finance was revised in 2021 and coal was removed from the catalog in China? | YES = 1 NO = 0 | 358 242 | 59.67 40.33 |

| Do you know that after President Xi Jinping’s report at the 19th National Congress of the Communist Party of China in 2017, the development of green finance, including green bonds, has been raised to the national strategic level in China? | YES = 1 NO = 0 | 364 236 | 60.67 39.33 |

| Do you know that China has been focusing on market reforms, such as the implementation of the “Green Bond Index” in collaboration with the Luxembourg Stock Exchange? | YES = 1 NO = 0 | 314 286 | 52.33 47.67 |

| Do you know that China promotes product innovations such as “Green Covered Bonds” and “Green ABS”? | YES = 1 NO = 0 | 285 315 | 47.50 52.50 |

| Do you know that the yield of green bonds issued by Chinese financial institutions is often less than the yield of non-green bonds or conventional bonds, issued by the same financial institutions over the same period? | YES = 1 NO = 0 | 135 465 | 22.50 77.50 |

| Are you ignorant about the green bonds mentioned above? | YES = 1 NO = 0 | 2 598 | 0.33 99.67 |

| 1st Bid | 2nd Bid (Bl/Bu) | y/y | y/n | n/y | n/n | Total Respondents |

|---|---|---|---|---|---|---|

| 0.50% | +0.25%/+1.00% | 89 | 12 | 14 | 5 | 120 |

| 74.20% | 10.00% | 11.70% | 4.20% | 100.00% | ||

| 0.25% | ±0.00%/+0.50% | 76 | 19 | 17 | 8 | 120 |

| 63.30% | 15.80% | 14.20% | 6.70% | 100.00% | ||

| ±0.00% | −0.25%/+0.25% | 61 | 32 | 18 | 9 | 120 |

| 50.80% | 26.70% | 15.00% | 7.50% | 100.00% | ||

| −0.25% | −0.50%/±0.00% | 43 | 27 | 40 | 10 | 120 |

| 35.80% | 22.50% | 33.30% | 8.30% | 100.00% | ||

| −0.50% | −1.00%/−0.25% | 55 | 23 | 17 | 25 | 120 |

| 45.80% | 19.20% | 14.20% | 20.80% | 100.00% | ||

| Total respondents | 324 | 113 | 106 | 57 | 600 | |

| 54.00% | 18.80% | 17.70% | 9.50% | |||

| Model 1 | Model 2 | |||

|---|---|---|---|---|

| Variable | Coef. | SE | Coef. | SE |

| Constant | 0.680 *** | 0.034 | 0.624 *** | 0.031 |

| Credit | n.a. | 0.429 *** | 0.080 | |

| Issuer | n.a. | 0.076 | 0.076 | |

| Green rating | n.a. | 0.118 | 0.073 | |

| Liquidity | n.a. | 0.070 | 0.073 | |

| Term | n.a. | 0.094 | 0.070 | |

| Label | n.a. | 0.089 | 0.071 | |

| Currency | n.a. | 0.187 *** | 0.644 | |

| Mean WTP | 0.466 *** | 0.036 | 0.472 *** | 0.034 |

| Stage 1 | Stage 2 | |||

|---|---|---|---|---|

| Variable | Coef. | SE | Coef. | SE |

| Constant | −0.754 ** | 0.301 | −0.605 ** | 0.291 |

| bid1 | −1.490 *** | 0.293 | n.a. | |

| bid2 | n.a. | −0.756 *** | 0.211 | |

| Credit | 1.143 *** | 0.249 | 0.556 ** | 0.248 |

| Issuer | 0.075 | 0.241 | 0.202 | 0.231 |

| Green rating | 0.310 | 0.226 | 0.346 | 0.219 |

| Liquidity | 0.055 | 0.230 | 0.347 | 0.219 |

| Term | 0.260 | 0.219 | 0.145 | 0.213 |

| Label | 0.130 | 0.227 | 0.294 | 0.215 |

| Currency | 0.559 *** | 0.203 | 0.429 ** | 0.197 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zenno, Y.; Aruga, K. Institutional Investors’ Willingness to Pay for Green Bonds: A Case for Shanghai. J. Risk Financial Manag. 2022, 15, 508. https://doi.org/10.3390/jrfm15110508

Zenno Y, Aruga K. Institutional Investors’ Willingness to Pay for Green Bonds: A Case for Shanghai. Journal of Risk and Financial Management. 2022; 15(11):508. https://doi.org/10.3390/jrfm15110508

Chicago/Turabian StyleZenno, Yoshihiro, and Kentaka Aruga. 2022. "Institutional Investors’ Willingness to Pay for Green Bonds: A Case for Shanghai" Journal of Risk and Financial Management 15, no. 11: 508. https://doi.org/10.3390/jrfm15110508

APA StyleZenno, Y., & Aruga, K. (2022). Institutional Investors’ Willingness to Pay for Green Bonds: A Case for Shanghai. Journal of Risk and Financial Management, 15(11), 508. https://doi.org/10.3390/jrfm15110508