3.1. Results on MIM Regression

In

Table 4, we report the regression results from equation (5), with individual regressors in each column and all the predictors in the right-most column. Note that hereafter we drop the subscript for day

in the variables. We found that the overnight return

and

can have some predictive power on

, but not

. In

Gao et al. (

2018), they combine

with

since they believe it will take some time for the overnight effect to be fully digested by the market. We also conducted this regression with combined

and

, but the result was not significant and so we did not report it here to save space. As a result, we inferred that a separate overnight return

was more relevant in predicting

for our KOSPI data.

Another finding in

Table 4 is that we can use

to predict

with a significantly positive effect. This result was consistent with

Lee et al. (

2017), who found that for the KOSPI200 index, when intraday returns display a J-shape pattern, the MIM will be stronger. Moreover, the individual regressions in

Table 4 have

values that sum up approximately to the

of the regression with all predictors. This result, which was consistent with

Gao et al. (

2018), indicates that the individual regressors are close to independent and complementary events.

To further investigate the degree of MIM in the KOSPI index, we classified our sample by the sum of the overnight and the first 30 min return; if

, we considered there was not much information in the overnight period and vice versa.

Table 5 and

Table 6 report the regression results when

and when

. We find predictive power from

and

for the last 30 min return in

Table 5. On the other hand, when

in

Table 6 we see

can be predicted by

with a higher R-squared value.

To make our results on MIM more robust, we ran the regression (5) for the three different groups (high, medium, low) of volatility, liquidity and volume from the first 30 min in a trading day.

Table 7 reports the estimation results. Under the classification of volatility, we found that

and

can predict

when volatility is high, and

can predict

when volatility is low. In addition, we saw higher

values under high and low volatility than in

Table 4; in particular, estimated

rose from 1.3630% in

Table 4 to 2.8740% when volatility was high.

When liquidity in the first 30 min of a day was high,

,

and

could predict

; when liquidity was low, only

could effectively predict

but with a larger

value. This result was again consistent with

Gao et al. (

2018), who found that MIM was more pronounced when liquidity was low. On the other hand, we found a stronger MIM when the first 30 min of trading volume was high or medium, in terms of estimated

values. This result was consistent with

Gao et al. (

2018) and

Sun et al. (

2016). Specifically,

was the most significant predictor for

when volume was relatively large.

Overall, our results in

Table 7 confirmed the findings in previous papers. For example,

Gao et al. (

2018) found that it was easier to predict

when volatility was high and/or volume was high.

Zhang et al. (

2019) also found a more pronounced MIM in the Chinese market during periods of high volatility and low liquidity.

3.2. MIM-Based Trading Strategies

To assess the effectiveness of MIM, we constructed trading strategies that use

,

and

as signals in trading the last 30 min spot KOSPI index. Specifically, the payoff function

from individual and the joint signals are:

and

In (10), if the individual signals , for , 2 and 11, we will buy at the beginning of the last 30 min of a trading day, and when we will sell. The position will be closed at the end of trading hours on day . When the joint signals are used in (11), we will buy when the signals are all positive and sell when they are all negative.

We report the results of MIM-based trading strategies in

Table 8, including summary statistics of returns and Sharpe ratio. In Panel A, we see that

delivered a 5.46% return, with a winning percentage of 54.3%. For

and

, the returns were 3.76% and 6.68%, respectively. When we considered the joint signal provided by

,

and

, the average return reached a much higher 16.77%. These results were compared to a benchmark strategy, in which we always took a long position at the beginning of the last 30 min of a trading day and sold it at market close. This

always-long strategy gave a return of 12.33%, and was outperformed by our joint-signal strategy

.

We could improve the performance of our MIM-based strategies by separating the long and short positions. In particular, we found that MIM is more suitable for a long position and therefore works better in predicting positive returns. In panel B, where we conducted long-only strategies, returns from individual signals were now similar to those of in panel A, and higher than the benchmark. Moreover, the joint-signal strategy with long positions could achieve a 27.2% return. On the other hand, in panel C, the results indicate that MIM is not suitable for conducting short positions or to predict negative returns. Strategies based on individual signals give negative returns, and the joint-signal could deliver a low return of 1.33%.

The standard deviations of and in panel A were: 0.298%, 0.298%, 0.297% and 0.344%, respectively, which were similar to those in other panels. The Sharpe ratios were 0.057, 0.342, 0.073 and 0.167; for the benchmark it was 0.144. All the strategies in panel B outperformed the benchmark in terms of the Sharpe ratio, with the highest Sharpe ratio 0.291 given by the joint strategy .

Overall, our results in

Table 8 suggest that MIM-based strategies can outperform a simple benchmark, especially in predicting positive returns. The joint strategy

gave superior risk-adjusted profitability, but with a stringer condition—it could only be applied to 772 and 482 days in the sample.

3.3. The Intraday Distribution of Effective Spreads

To further strengthen our results on MIM-based strategies, in this section we evaluated the transaction costs that would incur in such strategies. Specifically, the transaction costs were measured by the CS and BHL spread in (7) and (9);

Table 9 reports the summary statistics from 3087 days in our sample calculated at three different frequencies. In the table,

= 2, 3, 6 corresponds to half-daily, bi-hourly and hourly intervals. Hence, for

= 2, we obtain daily spread estimates, but for

= 3 and 6, the spread values are for the two-interval period

. Following

Corwin and Schultz (

2012), we set negative spread values to zero.

One clear pattern emerged for both the CS and BHL spreads in

Table 9: the mean and median values tend to decrease toward the later intervals in a trading day. For example, the average CS spread values calculated from the hourly range declined from 0.0013 to 0.0009, while the BHL values declined from 0.0040 to 0.0013. The standard deviations displayed a similar pattern. Therefore, we showed that transaction costs measured by spread tended to be small toward the end of trading hours. This empirical finding was consistent with the classic

Glosten and Milgrom (

1985) model, which predicted that market makers will quote smaller spreads after more trades are made in the market, as more information has been revealed through the trading process; see also the review in

Tsai and Tsai (

2021). The same empirical observation was also found by

Bouchaud et al. (

2018), who used tick-y-tick data and documented an “L” shape decline of spread from market open to close.

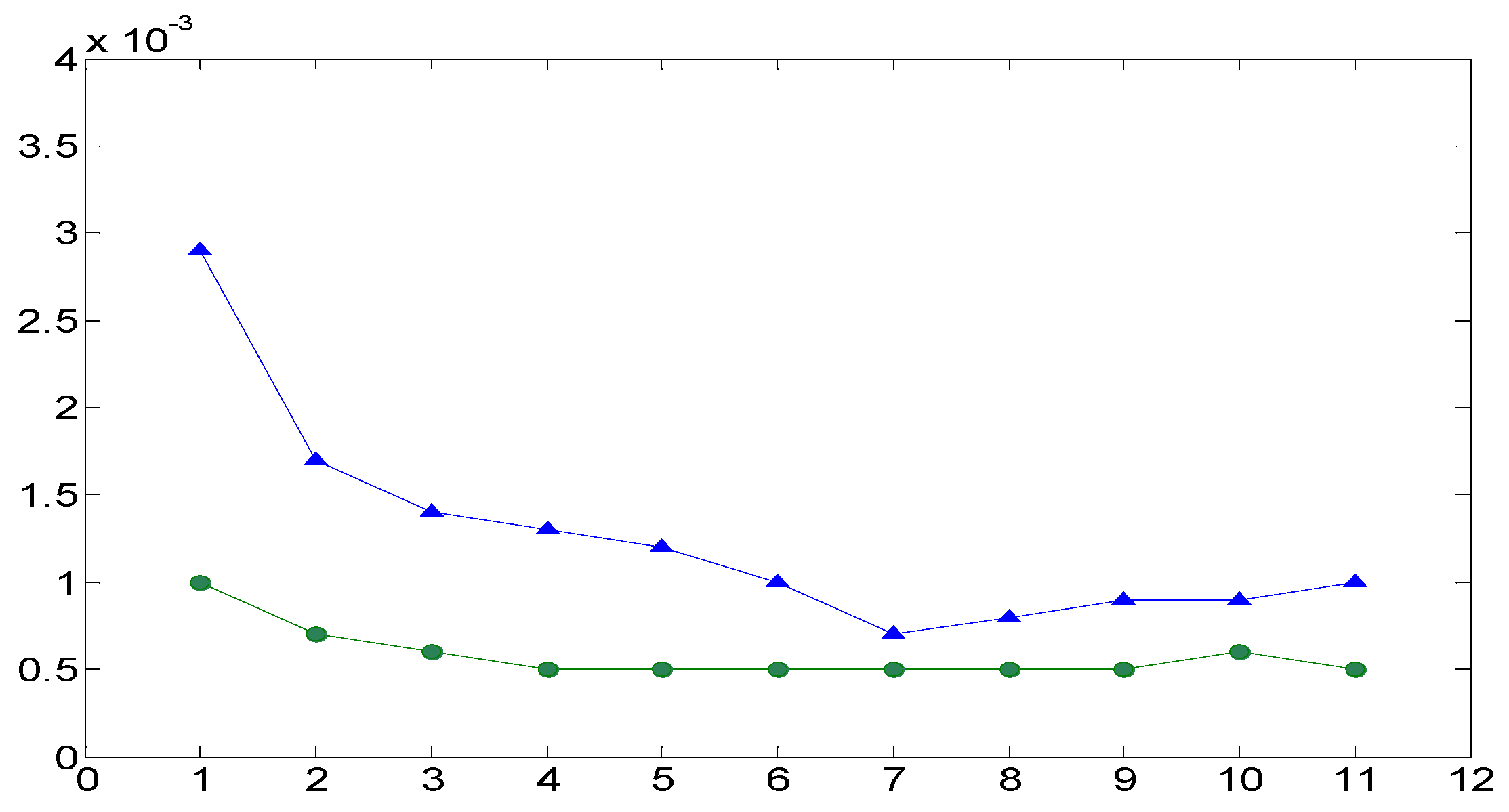

For 30 min intervals, we present the plot of average spread estimates in

Figure 1; the two spread measures declined toward the end of a trading day, with values about 0.0005 (CS) and 0.0010 (BHL). The half of these spread values were then the transaction costs when we bought and sold at the last 30 min using our MIM-based strategy; when compared with the KOSPI index level, which was well above 1000 for most of our sample period, these transaction costs were small and profits from our strategies should remain intact. The overall results in

Table 9 and

Figure 1 thus provide evidence that MIM-based trading strategies can generate profit after accounting for transaction costs.