Call Me When You Grow Up: Firms’ Age, Size, and IPO Performance across Sectors

Abstract

:1. Introduction

2. Literature Review

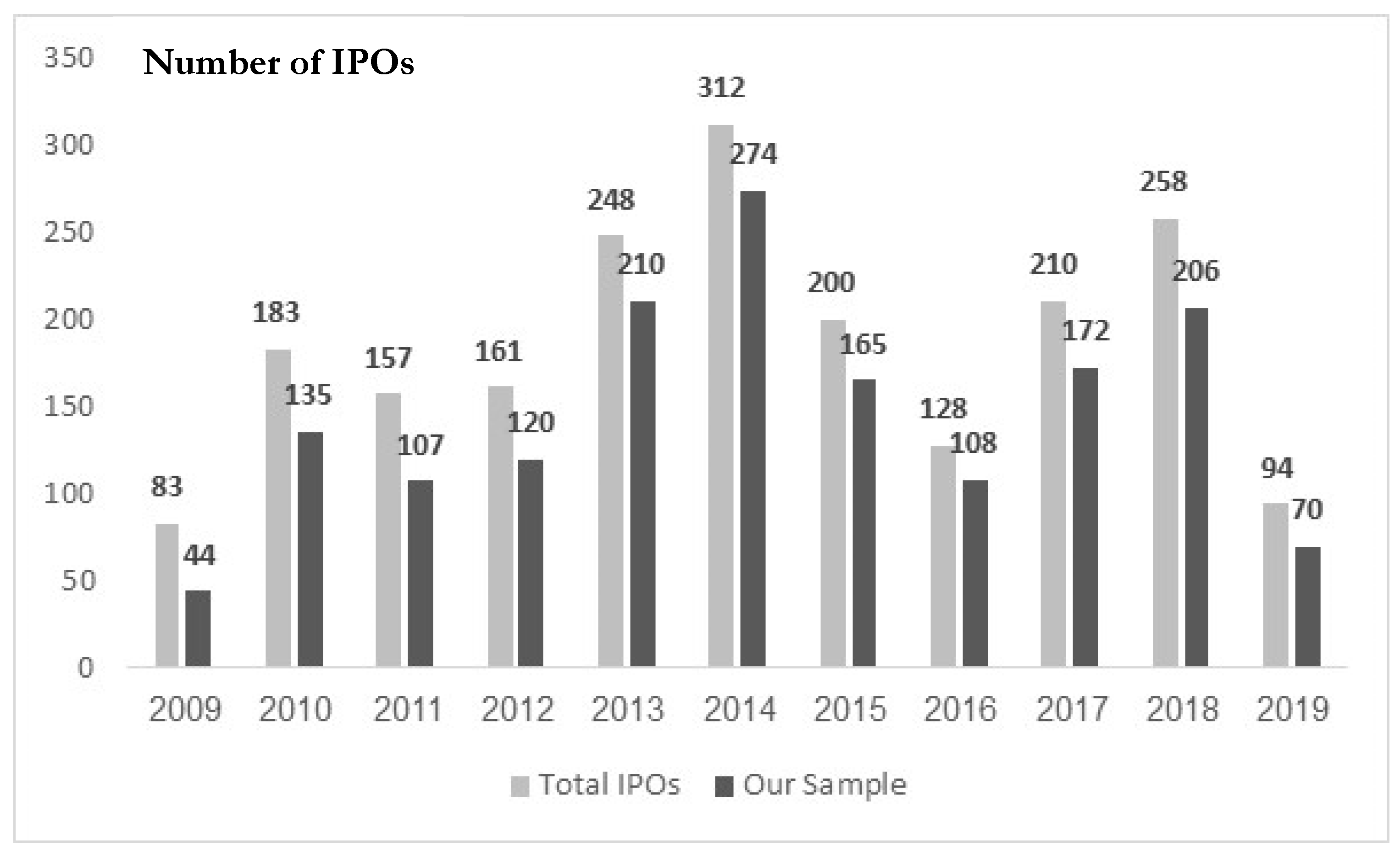

3. Data and Method

4. Empirical Findings

4.1. Portfolio View

4.2. Sector View

5. Robustness Checks

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | For example, Zoom Video Communications IPO was in April 2019 at the young age of 8. It raised USD 750M, which enabled it to improve its online products early before the pandemic outbreak. Zoom has become the leading platform used internationally, leaving its competitors far behind. |

| 2 | https://www.cms.gov/ (accessed on 19 November 2022). |

| 3 | https://www.bls.gov/emp/industry-employment/industry.xlsx (accessed on 19 November 2022). |

| 4 | https://www.zippia.com/advice/us-healthcare-industry-statistics/ (accessed on 19 November 2022). |

| 5 | https://www.statista.com/statistics/1239480/united-states-leading-states-by-tech-contribution-to-gross-product/ (accessed on 19 November 2022). |

| 6 | https://nhtechalliance.org/wp-content/uploads/2019/10/CompTIA_Cyberstates_2019.pdf?x84255 (accessed on 19 November 2022). |

| 7 | According to Stockanalysis.com, there were 232,480 and 1058 IPOs in 2019, 2020 and 2021 respectively. |

| 8 | S&P500 Healthcare for the healthcare sector, S&P500 Real Estate for the real estate sector and so on. |

| 9 | These results are available upon request. |

References

- Abrahamson, Martin, and Adri De Ridder. 2015. Allocation of shares to foreign and domestic investors: Firm and ownership characteristics in Swedish IPOs. Research in International Business and Finance 34: 52–65. [Google Scholar] [CrossRef]

- Agathee, Ushad Subadar, Raja Vinesh Sannassee, and Chris Brooks. 2014. The long-run performance of IPOs: The case of the Stock Exchange of Mauritius. Applied Financial Economics 24: 1123–45. [Google Scholar] [CrossRef]

- Aggarwal, Reena, and Pietra Rivoli. 1990. Fads in the initial public offering market? Financial Management 19: 45–57. [Google Scholar] [CrossRef]

- Alavi, Arash, Peter Kien Pham, and Toan My Pham. 2008. Pre-IPO ownership structure and its impact on the IPO process. Journal of Banking & Finance 32: 2361–75. [Google Scholar]

- Amihud, Yakov, and Haim Mendelson. 1986. Asset pricing and the bid-ask spread. Journal of Financial Economics 17: 223–49. [Google Scholar] [CrossRef]

- Amihud, Yakov, and Shai Levi. 2022. The effect of stock liquidity on the firm’s investment and production. Review of Financial Studies. forthcoming. [Google Scholar] [CrossRef]

- Amor, Salma Ben, and Maher Kooli. 2017. Intended use of proceeds and post-IPO performance. Quarterly Review of Economics and Finance 65: 168–81. [Google Scholar] [CrossRef]

- Bancel, Franck, and Cusha Mittoo. 2001. European managerial perceptions of the net benefits of foreign stock listings. European Financial Management 7: 213–36. [Google Scholar] [CrossRef]

- Bancel, Franck, and Usha Mittoo. 2009. Why do European firms go public? European Financial Management 15: 844–84. [Google Scholar] [CrossRef]

- Banerjee, Shantanu, and Swarnodeep Homroy. 2018. Managerial incentives and strategic choices of firms with different ownership structures. Journal of Corporate Finance 48: 314–30. [Google Scholar] [CrossRef] [Green Version]

- Black, Bernard S., and Ronald J. Gilson. 1998. Venture capital and the structure of capital markets: Banks versus stock markets. Journal of Financial Economics 47: 243–77. [Google Scholar] [CrossRef]

- Brau, James C., Robert B. Couch, and Ninon K. Sutton. 2012. The desire to acquire and IPO long-run underperformance. Journal of Financial and Quantitative Analysis 47: 493–510. [Google Scholar] [CrossRef]

- Brav, Alon, and Paul A. Gompers. 1997. Myth or reality? The long-run underperformance of initial public offerings: Evidence from venture and nonventure capital-backed companies. Journal of Finance 52: 1791–821. [Google Scholar] [CrossRef]

- Butler, Alexander W., Larry Fauver, and Ioannis Spyridopoulos. 2019. Local economic spillover effects of stock market listings. Journal of Financial and Quantitative Analysis 54: 1025–50. [Google Scholar] [CrossRef] [Green Version]

- Carter, Richard B., Frederick H. Dark, and Ajai K. Singh. 1998. Underwriter reputation, initial returns, and the long-run performance of IPO stocks. Journal of Finance 53: 285–311. [Google Scholar] [CrossRef]

- Celikyurt, Ugur, Merih Sevilir, and Anil Shivdasani. 2010. Going public to acquire? The acquisition motive in IPOs. Journal of Financial Economics 96: 345–63. [Google Scholar] [CrossRef]

- Chahine, Chahine. 2008. Underpricing versus gross spread: New evidence on the effect of sold shares at the time of IPOs. Journal of Multinational Financial Management 18: 180–96. [Google Scholar] [CrossRef]

- Chambers, David, and Elroy Dimson. 2009. IPO underpricing over the very long run. Journal of Finance 64: 1407–43. [Google Scholar] [CrossRef]

- Chan, Kalok, Junbo Wang, and K. John Wei. 2004. Underpricing and long-term performance of IPOs in China. Journal of Corporate Finance 10: 409–30. [Google Scholar] [CrossRef] [Green Version]

- Chemmanur, Thomas, and An Yan. 2017. Product market advertising, heterogeneous beliefs, and the long-run performance of initial public offerings. Journal of Corporate Finance 46: 1–24. [Google Scholar] [CrossRef]

- Chen, Honghui, and Minrong Zheng. 2021. IPO underperformance and the idiosyncratic risk puzzle. Journal of Banking & Finance 131: 106190. [Google Scholar]

- da Silva Rosa, Ray, Gerard Velayuthen, and Terry Walter. 2003. The sharemarket performance of Australian venture capital-backed and non-venture capital-backed IPOs. Pacific-Basin Finance Journal 11: 197–218. [Google Scholar] [CrossRef]

- Dambra, Michael, Laura C. Field, and Matthew T. Gustafson. 2015. The JOBS Act and IPO volume: Evidence that disclosure costs affect the IPO decision. Journal of Financial Economics 116: 121–43. [Google Scholar] [CrossRef]

- Dougal, Casey, Christopher A. Parsons, and Sheridan Titman. 2015. Urban vibrancy and corporate growth. The Journal of Finance 70: 163–210. [Google Scholar] [CrossRef]

- Dutta, Anupam. 2016. Reassessing the long-term performance of Indian IPOs. Journal of Statistics and Management Systems 19: 141–50. [Google Scholar] [CrossRef]

- Engelen, Peter-Jan, and Marc Van Essen. 2010. Underpricing of IPOs: Firm-, issue-and country-specific characteristics. Journal of Banking & Finance 34: 1958–69. [Google Scholar]

- Espenlaub, Susanne, Alan Gregory, and Ian Tonks. 2000. Re-assessing the long-term underperformance of UK Initial Public Offerings. European Financial Management 6: 319–42. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1996. Multifactor explanations of asset pricing anomalies. Journal of Finance 51: 55–84. [Google Scholar] [CrossRef]

- Gao, Jing, Ling Mei Cong, and John Evans. 2015. Earnings management, IPO underpricing, and post-issue stock performance of Chinese SMEs. The Chinese Economy 48: 351–71. [Google Scholar] [CrossRef]

- Goergen, Marc, Arif Khurshed, and Ram Mudambi. 2007. The long-run performance of UK IPOs: Can it be predicted? Managerial Finance 33: 401–19. [Google Scholar] [CrossRef]

- Gompers, Paul A., and Josh Lerner. 2003. The really long-run performance of initial public offerings: The pre-Nasdaq evidence. Journal of Finance 58: 1355–92. [Google Scholar] [CrossRef] [Green Version]

- Gregory, Alan, Guermat Cherif, and Al-Fawaz Shawawreh. 2010. UK IPOs: Long run returns, behavioural timing and pseudo timing. Journal of Business Finance & Accounting 37: 612–47. [Google Scholar]

- Hsieh, Jim, Evgeny Lyandres, and Alexei Zhdanov. 2011. A theory of merger-driven IPOs. Journal of Financial and Quantitative Analysis 46: 1367–405. [Google Scholar] [CrossRef] [Green Version]

- Huyghebaert, Nancy, and Cynthia Van Hulle. 2006. Structuring the IPO: Empirical evidence on the portions of primary and secondary shares. Journal of Corporate Finance 12: 296–320. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kim, Jeong-Bon, Itzhak Krinsky, and Jason Lee. 1995. The aftermarket performance of initial public offerings in Korea. Pacific-Basin Finance Journal 3: 429–48. [Google Scholar] [CrossRef]

- Komenkul, Kulabutr, and Santi Kiranand. 2017. Aftermarket performance of health care and biopharmaceutical IPOs: Evidence from ASEAN countries. INQUIRY: The Journal of Health Care Organization, Provision, and Financing 54: 0046958017727105. [Google Scholar] [CrossRef] [Green Version]

- Kooli, Maher, and Jean-Marc Suret. 2004. The aftermarket performance of initial public offerings in Canada. Journal of Multinational Financial Management 14: 47–66. [Google Scholar] [CrossRef] [Green Version]

- Lee, Philip J., Stephen L. Taylor, and Terry S. Walter. 1996. Australian IPO pricing in the short and long run. Journal of Banking & Finance 20: 1189–210. [Google Scholar]

- Ljungqvist, Alexander P. 1997. Pricing initial public offerings: Further evidence from Germany. European Economic Review 41: 1309–20. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay R. Ritter. 1995. The new issues puzzle. Journal of Finance 50: 23–51. [Google Scholar] [CrossRef]

- Loughran, Tim, and Jay Ritter. 2004. Why has IPO underpricing changed over time? Financial Management 33: 35–37. [Google Scholar] [CrossRef] [Green Version]

- Maksimovic, Vojislav, and Pegaret Pichler. 2001. Technological innovation and initial public offerings. Review of Financial Studies 14: 459–94. [Google Scholar] [CrossRef]

- Martiniano, Rui, and Jean Moore. 2018. Health Care Employment Projections, 2016–2026: An Analysis of Bureau of Labor Statistics Projections by Setting and by Occupation. Rensselaer: Center for Health Workforce Studies, School of Public Health, SUNY Albany. [Google Scholar]

- Matray, Adrien. 2021. The local innovation spillovers of listed firms. Journal of Financial Economics 141: 395–412. [Google Scholar] [CrossRef]

- Merton, Robert C. 1987. A Simple Model of Capital Market Equilibrium with Incomplete Information. Journal of Finance 42: 483–510. [Google Scholar] [CrossRef]

- Miller, Edward M. 1977. Risk, uncertainty, and divergence of opinion. The Journal of Finance 32: 1151–68. [Google Scholar] [CrossRef]

- Nguyen, Thanh, Arsenio Staer, and Jing Yang. 2022. Initial Public Offerings and Local Housing Markets. Journal of Real Estate Research 44: 184–218. [Google Scholar] [CrossRef]

- Qadan, Mahmoud, and David Yehiam Aharon. 2019. Can investor sentiment predict the size premium? International Review of Financial Analysis 63: 10–26. [Google Scholar] [CrossRef]

- Rajan, Raghuram G. 1992. Insiders and outsiders: The choice between informed and arm’s-length debt. Journal of Finance 47: 1367–400. [Google Scholar] [CrossRef]

- Ritter, Jay R. 1984. The “hot issue” market of 1980. Journal of Business 57: 215–40. [Google Scholar] [CrossRef]

- Ritter, Jay R. 1991. The long-run performance of initial public offerings. Journal of Finance 46: 3–27. [Google Scholar] [CrossRef]

- Ritter, Jay R., and Ivo Welch. 2002. A review of IPO activity, pricing, and allocations. Journal of Finance 57: 1795–828. [Google Scholar] [CrossRef] [Green Version]

- Rock, Kevin. 1986. Why new issues are underpriced. Journal of Financial Economics 15: 187–212. [Google Scholar] [CrossRef]

- Spiess, D. Katherine, and John Affleck-Graves. 1995. Underperformance in long-run stock returns following seasoned equity offerings. Journal of Financial Economics 38: 243–67. [Google Scholar] [CrossRef]

- Stehle, Richard, Olaf Ehrhardt, and René Przyborowsky. 2000. Long-run stock performance of German initial public offerings and seasoned equity issues. European Financial Management 6: 173–96. [Google Scholar] [CrossRef]

- Su, Dongwei, and Belton M. Fleisher. 1999. An empirical investigation of underpricing in Chinese IPOs. Pacific-Basin Finance Journal 7: 173–202. [Google Scholar] [CrossRef]

- Thomadakis, Stavros, Christos Nounis, and Dimitrios Gounopoulos. 2012. Long-term performance of Greek IPOs. European Financial Management 18: 117–41. [Google Scholar] [CrossRef] [Green Version]

- Wang, Xiaoming, Jerry Cao, Qigui Liu, J. Tang, and Gary Tian. 2015. Disproportionate ownership structure and IPO long-run performance of non-SOEs in China. China Economic Review 32: 27–42. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Yeqing, and Xueyong Zhang. 2020. Patent growth and the long-run performance of VC-backed IPOs. International Review of Economics & Finance 69: 33–47. [Google Scholar]

- Zingales, Luigi. 1995. Insider ownership and the decision to go public. Review of Economic Studies 62: 425–48. [Google Scholar] [CrossRef]

| Panel A: Pre-IPO Market Value of the Q1 to Q5 Portfolios (in USD Millions) | ||||||

| Portfolios: Q1 = lowest quintile; Q5 = highest | ||||||

| EntireSample | Q1 | Q2 | Q3 | Q4 | Q5 | |

| Average | 1561 | 36 | 164 | 371 | 821 | 6400 |

| Median | 357 | 33 | 162 | 357 | 786 | 2539 |

| Min | 0.001 | 0.001 | 90 | 250 | 525 | 1323 |

| Max | 320,213 | 89 | 249 | 524 | 1322 | 320,213 |

| Std. Dev | 9844 | 27 | 46 | 77 | 229 | 21,332 |

| Obs. | 1607 | 322 | 321 | 321 | 321 | 322 |

| Panel B: Pre-IPO Market Value by Sector | ||||||

| Sector | Entire Sample | Healthcare | Technology | Financial Services | Consumer Cyclical | Energy |

| Average | 1561 | 1033 | 1292 | 1920 | 3024 | 1303 |

| Median | 357 | 212 | 483 | 382 | 686 | 722 |

| Min | 0.001 | 0.048 | 0.99 | 0.28 | 0.26 | 4.437 |

| Max | 320,213 | 320,213 | 75,463 | 81,181 | 149,464 | 11,444 |

| Std. Dev | 9841 | 14,274 | 4921 | 6905 | 12,891 | 1816 |

| Obs. | 1611 | 505 | 262 | 169 | 155 | 140 |

| Sector | Industrials | Real Estate | Communication Services | Consumer Defensive | Basic Materials | Utilities |

| Average | 1141 | 869 | 3657 | 1938 | 1347 | 790 |

| Median | 356 | 271 | 674 | 509 | 740 | 426 |

| Min | 0.001 | 0.37 | 16.288 | 12.186 | 4.096 | 7.3 |

| Max | 12,059 | 6042 | 81,247 | 53,520 | 8981 | 2498 |

| Std. Dev | 1963 | 1269 | 10,017 | 6770 | 1812 | 843 |

| Obs. | 96 | 85 | 85 | 63 | 38 | 13 |

| Panel C: Asset Value of the Firms in the Q1 to Q5 Portfolios Pre-IPO (in USD Millions) | ||||||

| Portfolio | Entire Sample | Q1 | Q2 | Q3 | Q4 | Q5 |

| Average | 1853 | 15 | 61 | 156 | 576 | 8401 |

| Median | 145 | 14 | 60 | 145 | 515 | 2669 |

| Min | 0.001 | 0.001 | 35 | 92 | 261 | 1109 |

| Max | 232,294 | 35 | 91 | 261 | 1109 | 232,294 |

| Std. Dev | 11,721 | 11 | 16 | 48 | 249 | 25,087 |

| Obs. | 1607 | 322 | 321 | 321 | 321 | 322 |

| Panel D: Pre-IPO Asset Value of the Firms by Sector | ||||||

| Sector | Entire Sample | Healthcare | Technology | Financial Services | Consumer Cyclical | Energy |

| Average | 1853 | 156 | 606 | 9574 | 2404 | 1448 |

| Median | 145 | 42 | 122 | 1047 | 416 | 539 |

| Min | 0.001 | 0.001 | 0.19 | 0.001 | 0.232 | 0.001 |

| Max | 232,294 | 8577 | 24,390 | 232,294 | 137,238 | 28,908 |

| Std. Dev | 11,717 | 609 | 1884 | 32,933 | 11,424 | 3304 |

| Obs. | 1608 | 504 | 261 | 169 | 155 | 140 |

| Sector | Industrials | Real Estate | Communication Services | Consumer Defensive | Basic Materials | Utilities |

| Average | 1446 | 1637 | 1510 | 1053 | 1756 | 909 |

| Median | 448 | 327 | 185 | 148 | 702 | 606 |

| Min | 0.348 | 0.001 | 4.987 | 8.235 | 3.035 | 1.198 |

| Max | 17,015 | 18,868 | 36,029 | 9140 | 10,014 | 2654 |

| Std. Dev | 2593 | 3024 | 4679 | 2055 | 2472 | 889 |

| Obs. | 95 | 85 | 85 | 63 | 38 | 13 |

| Panel E: Age of the Firms in the Q1 to Q5 Portfolios (years) | ||||||

| Portfolio | Entire Sample | Q1 | Q2 | Q3 | Q4 | Q5 |

| Average | 16.6 | 10.3 | 12.7 | 14.4 | 17.3 | 28.2 |

| Median | 10.0 | 8.0 | 10.0 | 9.0 | 10.0 | 12.0 |

| Min | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 |

| Max | 186.0 | 122.0 | 160.0 | 172.0 | 158.0 | 186.0 |

| Std. Dev | 23.9 | 11.6 | 16.2 | 20.1 | 22.7 | 36.7 |

| Obs. | 1610 | 321 | 321 | 321 | 321 | 326 |

| Panel F: Age of the Firms by Sector | ||||||

| Sector | Entire Sample | Healthcare | Technology | Financial Services | Consumer Cyclical | Energy |

| Average | 17 | 10 | 13 | 23 | 28 | 13 |

| Median | 10 | 8 | 11 | 12 | 17 | 4 |

| Min | 1 | 1 | 1 | 1 | 1 | 1 |

| Max | 186 | 76 | 73 | 186 | 166 | 150 |

| Std. Dev | 24 | 9 | 10 | 32 | 29 | 28 |

| Obs. | 1610 | 505 | 261 | 169 | 154 | 139 |

| Sector | Industrials | Real Estate | Communication Services | Consumer Defensive | Basic Materials | Utilities |

| Average | 34 | 10 | 14 | 27 | 30 | 9 |

| Median | 21 | 3 | 8 | 14 | 6 | 7 |

| Min | 1 | 1 | 1 | 1 | 1 | 1 |

| Max | 172 | 101 | 160 | 140 | 186 | 29 |

| Std. Dev | 37 | 20 | 22 | 34 | 45 | 8 |

| Obs. | 96 | 86 | 85 | 63 | 39 | 13 |

| Panel G: Funds Raised by the Firms in the Q1 to Q5 Portfolios (USD Million) | ||||||

| Portfolio | Entire Sample | Q1 | Q2 | Q3 | Q4 | Q5 |

| Average | 263.2 | 70.7 | 81.8 | 115.9 | 205 | 834.3 |

| Median | 105.6 | 47.7 | 64.2 | 96.9 | 161 | 446.7 |

| Min | 2.4 | 2.4 | 6.5 | 3.5 | 4.4 | 13.8 |

| Max | 21,767.2 | 2548.5 | 360.3 | 900.0 | 2816.0 | 21,767.20 |

| Std. Dev | 911.9 | 156.3 | 59.4 | 89.6 | 195.7 | 1904.70 |

| Obs. | 1611 | 322 | 321 | 321 | 321 | 326 |

| Panel H: Funds Raised by the Firms by Sector (USD Million) | ||||||

| Sector | Entire Sample | Healthcare | Technology | Financial Services | Consumer Cyclical | Energy |

| Average | 263.2 | 96.6 | 211.5 | 310.6 | 520.5 | 373.7 |

| Median | 105.6 | 70.5 | 102.6 | 101.3 | 164.4 | 230.4 |

| Min | 2.4 | 3.5 | 6.1 | 6.2 | 6.5 | 10.2 |

| Max | 21,767.2 | 2238.6 | 8100 | 7036.7 | 21,767.2 | 2864 |

| Std. Dev | 911.9 | 148 | 555.8 | 746.2 | 2147.7 | 434.3 |

| Obs. | 1608 | 504 | 261 | 169 | 155 | 140 |

| Sector | Industrials | Real Estate | Communication Services | Consumer Defensive | Basic Materials | Utilities |

| Average | 275.5 | 294.9 | 631.6 | 211.4 | 339 | 229.5 |

| Median | 152.5 | 176.9 | 150 | 135 | 247.1 | 280 |

| Min | 3.1 | 2.4 | 15.1 | 5.6 | 5.3 | 7.3 |

| Max | 1875.5 | 2292.5 | 16,006.9 | 1022.2 | 2898 | 501.6 |

| Std. Dev | 341.1 | 364.6 | 2008.9 | 234.4 | 473 | 176.7 |

| Obs. | 95 | 85 | 85 | 63 | 38 | 13 |

| Panel A: CAAR Relative to the S&P 500 | ||||||

| Days Relative to Event | Q1 | Q2 | Q3 | Q4 | Q5 | Q5−Q1 |

| 1 to 10 | −2.46% | 0.34% | 2.20% | 0.36% | 1.44% | 3.90% |

| (−2.12) | (0.43) | (2.92) | (0.53) | (1.07) | ||

| 1 to 20 | −2.55% | 1% | 2.90% | 1.66% | 1.44% | 4.00% |

| (−1.71) | (0.98) | (3.28) | (1.9) | (1) | ||

| 1 to 50 | −8.36% | 0.84% | 2.50% | 1.20% | 1.72% | 10.08% |

| (−4.45) | (0.5) | (1.73) | (0.89) | (0.91) | ||

| 1 to 75 | −9.95% | −1.01% | 1.33% | 0.11% | 0.85% | 10.80% |

| (−4.54) | (−0.53) | (0.76) | (0.06) | (0.44) | ||

| 1 to 100 | −16.06% | −5.03% | −1.48% | −1.39% | −1.85% | 14.21% |

| (−6.54) | (−2.1) | (−0.74) | (−0.76) | (−0.87) | ||

| 1 to 150 | −26.18% | −10.89% | −7.18% | −6.83% | −9.15% | 17.03% |

| (−8.92) | (−3.86) | (−2.9) | (−2.84) | (−3.85) | ||

| 1 to 200 | −35.75% | −17.70% | −9.40% | −7.70% | −10.98% | 24.77% |

| (−9.9) | (−5.36) | (−3.22) | (−2.77) | (−4.03) | ||

| 1 to 250 | −42.77% | −18.13% | −13.22% | −9.76% | −14.59% | 28.17% |

| (−10.28) | (−5.15) | (−3.95) | (−3.23) | (−4.72) | ||

| 1 to 300 | −51.54% | −22.41% | −16.23% | −13.51% | −18.97% | 32.58% |

| (−11.19) | (−5.77) | (−4.27) | (−4.07) | (−5.85) | ||

| 1 to 550 | −89.26% | −43.62% | −24.73% | −12.24% | −27.74% | 61.52% |

| (−12.66) | (−7.11) | (−4.47) | (−2.7) | (−5.87) | ||

| 1 to 750 | −113.91% | −45.81% | −32.24% | −11.95% | −25.57% | 88.33% |

| Panel B: CAAR Relative to the Russell 2000 | ||||||

| Days Relative to Event | Q1 | Q2 | Q3 | Q4 | Q5 | Q5−Q1 |

| 1 to 10 | −2.26% | 0.50% | 2.42% | 0.24% | 1.67% | 3.93% |

| (−1.97) | (0.63) | (3.23) | (0.35) | (1.24) | ||

| 1 to 20 | −2.19% | 1.23% | 3.35% | 1.77% | 1.67% | 3.85% |

| (−1.49) | (1.22) | (3.86) | (2.1) | (1.15) | ||

| 1 to 50 | −8.05% | 1.38% | 3.06% | 1.41% | 1.95% | 9.99% |

| (−4.31) | (0.83) | (2.14) | (1.07) | (1.03) | ||

| 1 to 75 | −9.39% | −0.08% | 2.64% | 0.47% | 1.60% | 10.99% |

| (−4.33) | (−0.04) | (1.55) | (0.29) | (0.82) | ||

| 1 to 100 | −15.41% | −4.16% | −0.31% | −0.83% | −1.12% | 14.28% |

| (−6.35) | (−1.79) | (−0.16) | (−0.47) | (−0.53) | ||

| 1 to 150 | −25.17% | −9.60% | −5.46% | −5.89% | −7.75% | 17.42% |

| (−8.65) | (−3.48) | (−2.26) | (−2.54) | (−3.31) | ||

| 1 to 200 | −34.21% | −15.72% | −7.06% | −5.89% | −8.72% | 25.48% |

| (−9.59) | (−4.87) | (−2.48) | (−2.19) | (−3.23) | ||

| 1 to 250 | −40.76% | −15.18% | −9.62% | −7.10% | −10.95% | 29.80% |

| (−9.93) | (−4.41) | (−2.96) | (−2.45) | (−3.55) | ||

| 1 to 300 | −48.84% | −19.35% | −12.39% | −10.77% | −15.36% | 33.47% |

| (−10.81) | (−5.07) | (−3.34) | (−3.33) | (−4.8) | ||

| 1 to 550 | −85.56% | −39.54% | −20.45% | −8.33% | −22.58% | 62.98% |

| (−12.29) | (−6.53) | (−3.75) | (−1.86) | (−4.86) | ||

| 1 to 750 | −110.41% | −42.16% | −28.02% | −8% | −21.51% | 88.90% |

| (−13.05) | (−5.69) | (−4.51) | (−1.5) | (−3.74) | ||

| Panel C: CAAR Relative to the Sector Indices | ||||||

| Days Relative to Event | Q1 | Q2 | Q3 | Q4 | Q5 | Q5−Q1 |

| 1 to 10 | −2.53% | 0.37% | 2.12% | 0.47% | 1.52% | 4.05% |

| (−2.19) | (0.47) | (2.8) | (0.68) | (1.12) | ||

| 1 to 20 | −2.62% | 0.83% | 2.87% | 1.82% | 1.80% | 4.42% |

| (−1.77) | (0.81) | (3.28) | (2.07) | (1.26) | ||

| 1 to 50 | −8.55% | 0.34% | 2.36% | 1.67% | 2.19% | 10.74% |

| (−4.55) | (0.2) | (1.64) | (1.23) | (1.16) | ||

| 1 to 75 | −10.20% | −1.38% | 1.23% | 0.61% | 1.40% | 11.60% |

| (−4.64) | (−0.72) | (0.71) | (0.37) | (0.72) | ||

| 1 to 100 | −16.23% | −5.28% | −1.28% | −0.82% | −1.08% | 15.15% |

| (−6.64) | (−2.2) | (−0.65) | (−0.45) | (−0.52) | ||

| 1 to 150 | −26.46% | −11.39% | −7.01% | −6.24% | −7.63% | 18.83% |

| (−9.06) | (−4.04) | (−2.84) | (−2.63) | (−3.22) | ||

| 1 to 200 | −36.66% | −18.38% | −9.06% | −7.22% | −8.99% | 27.67% |

| (−10.23) | (−5.62) | (−3.12) | (−2.62) | (−3.32) | ||

| 1 to 250 | −43.80% | −19% | −12.97% | −8.88% | −12.48% | 31.31% |

| (−10.5) | (−5.47) | (−3.87) | (−2.96) | (−4.07) | ||

| 1 to 300 | −53.07% | −23.28% | −16.17% | −12.24% | −16.60% | 36.47% |

| (−11.49) | (−6.09) | (−4.25) | (−3.69) | (−5.14) | ||

| 1 to 550 | −90.70% | −43.01% | −23.50% | −9.24% | −23.25% | 67.44% |

| (−12.93) | (−7.19) | (−4.21) | (−2.05) | (−5.08) | ||

| 1 to 750 | −113.44% | −44.37% | −29.91% | −6.94% | −20.85% | 92.59% |

| (−13.5) | (−6.09) | (−4.8) | (−1.31) | (−3.74) | ||

| Entire Sample | Healthcare | Technology | |||||||

| Days Relative to Event | Entire | MV < 500 | MV > 500 | Entire | Small | Big | Entire | Small | Big |

| 1 to 10 | 0.42% | 0.03% | 0.95% | 0.12% | −0.10% | 1.02% | 0.20% | 0.62% | −0.24% |

| (0.96) | (0.05) | (1.28) | (0.15) | (−0.11) | (0.63) | (0.22) | (0.48) | (−0.21) | |

| 1 to 20 | 0.97% | 0.53% | 1.47% | 1.30% | 1.16% | 1.37% | 1.54% | 1.99% | 1.07% |

| (1.84) | (0.78) | (1.79) | (1.22) | (0.96) | (0.66) | (1.31) | (1.09) | (0.73) | |

| 1 to 50 | −0.38% | −1.54% | 1.22% | −1.57% | −2.59% | 2.52% | 2.70% | 3.45% | 1.93% |

| (−0.5) | (−1.54) | (1.07) | (−0.98) | (−1.43) | (0.74) | (1.51) | (1.26) | (0.85) | |

| 1 to 75 | −1.69% | −3.10% | 0.26% | −3.02% | −3.49% | −1.10% | 4.36% | 2.83% | 5.94% |

| (−1.97) | (−2.66) | (0.21) | (−1.66) | (−1.68) | (−0.29) | (2.02) | (0.84) | (2.18) | |

| 1 to 100 | −5.10% | −7.47% | −1.82% | −7.17% | −8.08% | −3.75% | 0.89% | −2.23% | 4.09% |

| (−5.23) | (−5.51) | (−1.32) | (−3.48) | (−3.43) | (−0.88) | (0.35) | (−0.55) | (1.42) | |

| 1 to 150 | −11.95% | −14.67% | −8.23% | −15.56% | −15.80% | −15.62% | −9.92% | −14.76% | −5.04% |

| (−10.13) | (−8.97) | (−4.96) | (−6.39) | (−5.77) | (−2.96) | (−3.19) | (−2.77) | (−1.61) | |

| 1 to 200 | −16.18% | −21.03% | −9.50% | −21.79% | −23.22% | −16.37% | −11.42% | −21.31% | −1.45% |

| (−11.58) | (−10.71) | (−4.98) | (−7.45) | (−6.93) | (−2.8) | (−3.27) | (−3.6) | (−0.42) | |

| 1 to 250 | −19.65% | −24.75% | −12.43% | −25.73% | −26.96% | −20.36% | −14.16% | −25.61% | −2.89% |

| (−12.55) | (−11.2) | (−5.85) | (−7.98) | (−7.23) | (−3.3) | (−3.57) | (−3.88) | (−0.69) | |

| 1 to 300 | −24.59% | −29.96% | −16.87% | −30.76% | −32.57% | −22.12% | −18.80% | −31.66% | −6.24% |

| (−14.19) | (−12.11) | (−7.37) | (−8.6) | (−7.81) | (−3.47) | (−4.23) | (−4.28) | (−1.32) | |

| 1 to 550 | −40.21% | −53.97% | −20.14% | −54.59% | −63.49% | −16.54% | −27.40% | −47.66% | −5.70% |

| (−15.17) | (−14.09) | (−6.18) | (−9.38) | (−9.38) | (−1.75) | (−4.09) | (−4.7) | (−0.71) | |

| 1 to 750 | −46.94% | −65.72% | −18.86% | −76.81% | −89.08% | −22.52% | −20.63% | −41.41% | 1.97% |

| (−14.48) | (−14.2) | (−4.88) | (−10.39) | (−10.61) | (−1.69) | (−2.68) | (−3.76) | (0.2) | |

| Financial Services | Consumer Cyclical | Energy | |||||||

| Days Relative to Event | Entire Sector | Small | Big | Entire Sector | Small | Big | Entire Sector | Small | Big |

| 1 to 10 | 0.80% | −1.06% | 3.04% | 1.47% | 2.30% | 0.96% | 0.79% | 0.79% | 0.79% |

| (0.46) | (−0.81) | (0.85) | (1.12) | (0.96) | (0.63) | (1.28) | (0.68) | (1.13) | |

| 1 to 20 | 0.78% | −0.76% | 2.49% | 1.49% | 3.04% | 0.52% | 2.07% | 0.70% | 2.93% |

| (0.43) | (−0.57) | (0.67) | (1.06) | (1.19) | (0.32) | (2.64) | (0.59) | (2.87) | |

| 1 to 50 | −2.08% | −3.43% | −0.62% | 0.24% | −0.86% | 0.92% | 0.93% | 2.20% | 0.13% |

| (−0.9) | (−1.68) | (−0.14) | (0.12) | (−0.23) | (0.38) | (0.65) | (0.98) | (0.07) | |

| 1 to 75 | −3.60% | −4.90% | −2.23% | −4.10% | −8.52% | −1.35% | 0.22% | 0.72% | −0.10% |

| (−1.38) | (−1.94) | (−0.45) | (−1.83) | (−2.14) | (−0.52) | (0.12) | (0.23) | (−0.04) | |

| 1 to 100 | −3.18% | −3.87% | −2.32% | −8.90% | −16.44% | −4.22% | −3.08% | −3.81% | −2.62% |

| (−1.15) | (−1.41) | (−0.45) | (−3.18) | (−3.01) | (−1.45) | (−1.41) | (−1.09) | (−0.94) | |

| 1 to 150 | −4.65% | −4.09% | −4.89% | −15.61% | −25.15% | −9.68% | −6.36% | −8.42% | −5.06% |

| (−1.5) | (−1.24) | (−0.87) | (−4.12) | (−3.81) | (−2.17) | (−2.17) | (−1.69) | (−1.41) | |

| 1 to 200 | −7.55% | −7.94% | −7.69% | −17.01% | −25.38% | −11.90% | −9.48% | −8.60% | −10.03% |

| (−1.98) | (−1.74) | (−1.19) | (−3.89) | (−3.35) | (−2.27) | (−2.9) | (−1.62) | (−2.42) | |

| 1 to 250 | −8.67% | −9.41% | −7.76% | −21.54% | −27.98% | −17.63% | −13.56% | −12.74% | −14.08% |

| (−2.13) | (−1.74) | (−1.22) | (−4.59) | (−3.9) | (−2.88) | (−3.57) | (−2.02) | (−2.96) | |

| 1 to 300 | −10.70% | −9.67% | −11.48% | −28.05% | −37.62% | −22.11% | −15.74% | −13.01% | −17.48% |

| (−2.35) | (−1.64) | (−1.59) | (−5.43) | (−4.89) | (−3.25) | (−3.68) | (−1.8) | (−3.33) | |

| 1 to 550 | −25% | −27.24% | −16.01% | −40.90% | −68.26% | −23.71% | −39.47% | −48.20% | −33.80% |

| (−3.75) | (−2.94) | (−1.85) | (−6.1) | (−6.14) | (−3.04) | (−5.14) | (−3.67) | (−3.64) | |

| 1 to 750 | −15.89% | −16.03% | −15.74% | −45.03% | −79.82% | −19.73% | −50.94% | −67.78% | −40.23% |

| (−2.37) | (−1.52) | (−1.97) | (−5.53) | (−6.24) | (−2.1) | (−6.23) | (−4.7) | (−4.22) | |

| Industrials | Real Estate | Communication Services | |||||||

| Days Relative to Event | Entire Sector | Small | Big | Entire Sector | Small | Big | Entire Sector | Small | Big |

| 1 to 10 | 0.37% | −0.30% | 1.41% | 0.17% | −1.17% | 2.55% | −4.85% | −5.25% | −4.57% |

| (0.28) | (−0.14) | (1.19) | (0.28) | (−1.52) | (2.81) | (−2.62) | (−2.39) | (−1.67) | |

| 1 to 20 | 0.08% | −1.12% | 1.90% | 0.29% | −1.35% | 3.19% | −5.41% | −7.45% | −3.98% |

| (0.05) | (−0.4) | (1.49) | (0.46) | (−1.96) | (3.12) | (−2.33) | (−2.58) | (−1.18) | |

| 1 to 50 | −1.57% | −2.21% | −0.45% | −1.86% | −5.15% | 3.96% | −5.11% | −12.51% | 0.07% |

| (−0.72) | (−0.72) | (−0.15) | (−1.67) | (−4) | (2.43) | (−1.53) | (−3.19) | (0.01) | |

| 1 to 75 | −4.06% | −4.06% | −3.87% | −4.24% | −8.02% | 2.46% | −6.02% | −14.68% | 0.04% |

| (−1.61) | (−1.06) | (−1.4) | (−3.05) | (−4.91) | (1.2) | (−1.66) | (−2.89) | (0.01) | |

| 1 to 100 | −8.07% | −10.02% | −5.09% | −4.60% | −9.42% | 3.97% | −12.47% | −22.01% | −5.79% |

| (−2.54) | (−2.1) | (−1.42) | (−2.72) | (−5.03) | (1.48) | (−3.09) | (−3.45) | (−1.16) | |

| 1 to 150 | −11.34% | −11.21% | −11.67% | −7.52% | −12.57% | 1.45% | −22.74% | −33.45% | −15.23% |

| (−2.6) | (−1.83) | (−1.93) | (−3.26) | (−5.03) | (0.35) | (−4.85) | (−4.82) | (−2.5) | |

| 1 to 200 | −13.96% | −17.34% | −8.92% | −8.92% | −14.06% | 0.21% | −33.61% | −53.83% | −19.85% |

| (−2.91) | (−2.56) | (−1.38) | (−3.45) | (−4.91) | (0.05) | (−5.09) | (−5.4) | (−2.41) | |

| 1 to 250 | −20.78% | −23.48% | −16.83% | −7.61% | −14.76% | 5.51% | −35.50% | −54.68% | −22.84% |

| (−3.37) | (−2.57) | (−2.3) | (−2.86) | (−4.49) | (1.61) | (−4.83) | (−4.98) | (−2.43) | |

| 1 to 300 | −31.24% | −34.43% | −26.85% | −8.38% | −15.63% | 4.67% | −37.87% | −58.70% | −24.68% |

| (−4.21) | (−3.05) | (−3.67) | (−2.88) | (−4.44) | (1.11) | (−5.05) | (−5.55) | (−2.52) | |

| 1 to 550 | −41.26% | −44.32% | −35.97% | −7.40% | −11.63% | 0.30% | −36.38% | −75.09% | −9.29% |

| (−3.6) | (−2.54) | (−3.11) | (−1.89) | (−2.27) | (0.05) | (−3.32) | (−4.4) | (−0.74) | |

| 1 to 750 | −44.87% | −62.83% | −11.30% | −5.66% | −9.21% | 1.90% | −63.71% | −106.94% | −32.65% |

| (−3.48) | (−3.45) | (−0.98) | (−1.13) | (−1.53) | (0.21) | (−3.86) | (−3.63) | (−1.93) | |

| Consumer Defensive | Materials | Utilities | |||||||

| Days Relative to Event | Entire Sector | Small | Big | Entire Sector | Small | Big | Entire Sector | Small | Big |

| 1 to 10 | 0.96% | 3.64% | −1.63% | 6.29% | −1.20% | 10.49% | 6.18% | 9.05% | 1.60% |

| (0.34) | (0.71) | (−0.7) | (0.96) | (−0.53) | (1.04) | (1.87) | (1.81) | (0.92) | |

| 1 to 20 | −1.11% | 1.32% | −3.46% | 5.35% | −6.21% | 11.83% | 5.59% | 8.19% | 1.43% |

| (−0.39) | (0.26) | (−1.24) | (0.78) | (−1.22) | (1.17) | (0.93) | (0.87) | (0.42) | |

| 1 to 50 | 0.50% | 4.42% | −3.31% | 4.42% | −2.99% | 8.57% | 10.47% | 17.44% | −0.68% |

| (0.13) | (0.77) | (−0.72) | (0.58) | (−0.48) | (0.76) | (1.69) | (2.08) | (−0.11) | |

| 1 to 75 | −1.90% | 5.90% | −9.46% | 2.75% | −2.63% | 5.76% | 6.09% | 9.55% | 0.55% |

| (−0.48) | (1.05) | (−1.83) | (0.33) | (−0.3) | (0.47) | (0.89) | (0.93) | (0.09) | |

| 1 to 100 | −3.58% | 2.63% | −9.61% | −2.29% | −13.76% | 4.13% | −0.65% | 4.83% | −9.42% |

| (−0.78) | (0.41) | (−1.5) | (−0.26) | (−1.24) | (0.34) | (−0.09) | (0.51) | (−0.84) | |

| 1 to 150 | −12.96% | −12.63% | −13.29% | −5.66% | −17.46% | 0.95% | −3.17% | −0.52% | −7.41% |

| (−2.48) | (−1.47) | (−2.18) | (−0.6) | (−1.62) | (0.07) | (−0.45) | (−0.06) | (−0.64) | |

| 1 to 200 | −21.48% | −25.05% | −18.02% | −11.86% | −31.06% | −1.10% | −8.75% | −7.71% | −10.42% |

| (−3.74) | (−2.71) | (−2.62) | (−1.01) | (−1.81) | (−0.07) | (−1.24) | (−0.86) | (−0.92) | |

| 1 to 250 | −27.25% | −30.86% | −23.76% | −20.85% | −57.84% | −0.14% | −7.39% | −4.53% | −11.97% |

| (−4.19) | (−3.05) | (−2.9) | (−1.46) | (−2.4) | (−0.01) | (−1.04) | (−0.47) | (−1.22) | |

| 1 to 300 | −33.28% | −30.73% | −35.66% | −38.77% | −78.23% | −15.75% | −27.64% | −25.48% | −31.10% |

| (−4.27) | (−2.82) | (−3.21) | (−2.83) | (−2.9) | (−1.23) | (−3.04) | (−1.98) | (−2.71) | |

| 1 to 550 | −52.76% | −63.69% | −42.24% | −71.84% | −133.34% | −34.40% | −56.22% | −44.90% | −78.87% |

| (−4.32) | (−3.64) | (−2.51) | (−3.85) | (−3.61) | (−2.25) | (−2.96) | (−2.04) | (−2.36) | |

| 1 to 750 | −35.32% | −57.56% | −10.61% | −68.94% | −109.12% | −43.56% | −45.63% | −51.48% | −30.03% |

| (−2.09) | (−2.07) | (−0.66) | (−3.6) | (−2.77) | (−2.65) | (−2.17) | (−1.82) | (−2.76) | |

| Market Value | Assets | |||||

|---|---|---|---|---|---|---|

| Sector | S&P500 | Russle2000 | Sector | S&P500 | Russle2000 | Sector |

| Entire sample | √ | √ | √ | √ | √ | √ |

| Communication Services | √ | √ | √ | √ | √ | √ |

| Consumer Defensive | √ | √ | √ | √ | √ | √ |

| Consumer Cyclical | √ | √ | √ | √ | √ | √ |

| Energy | 0 | √ | √ | × | 0 | 0 |

| Financial Services | 0 | 0 | 0 | √ | √ | √ |

| Healthcare | √ | √ | √ | √ | √ | √ |

| Industrials | √ | √ | √ | √ | √ | √ |

| Technology | √ | √ | √ | 0 | 0 | 0 |

| Basic Materials | √ | √ | √ | √ | √ | √ |

| Real Estate | √ | √ | √ | √ | √ | √ |

| Utilities | × | 0 | √ | × | × | × |

| Sum(V) | 9 | 10 | 11 | 9 | 9 | 9 |

| Panel A: CAAR Relative to the S&P500 | ||||

| Days Relative to Event | A1: 1–6 Years | A2: 7–13 Years | A3: 14+ Years | A3−A1 |

| 1 to 10 | −0.43% | 0.21% | 1.36% | 1.79% |

| (−0.53) | (0.33) | (1.69) | ||

| 1 to 20 | −0.22% | 1.31% | 1.71% | 1.93% |

| (−0.24) | (1.47) | (1.9) | ||

| 1 to 50 | −2.27% | −0.14% | 1.16% | 3.43% |

| (−1.63) | (−0.11) | (0.96) | ||

| 1 to 75 | −3.75% | −0.55% | −0.86% | 2.89% |

| (−2.47) | (−0.36) | (−0.61) | ||

| 1 to 100 | −7.44% | −4.12% | −3.82% | 3.62% |

| (−4.28) | (−2.36) | (−2.42) | ||

| 1 to 150 | −14.58% | −13.91% | −7.41% | 7.17% |

| (−6.95) | (−6.76) | (−3.78) | ||

| 1 to 200 | −20.50% | −17.61% | −10.39% | 10.11% |

| (−8.2) | (−7.22) | (−4.51) | ||

| 1 to 250 | −24.44% | −21.09% | −13.34% | 11.10% |

| (−8.65) | (−7.75) | (−5.2) | ||

| 1 to 300 | −30.81% | −25.09% | −17.58% | 13.23% |

| (−9.96) | (−8.29) | (−6.19) | ||

| 1 to 550 | −45.99% | −45.45% | −28.81% | 17.18% |

| (−10.07) | (−9.71) | (−6.44) | ||

| 1 to 750 | −56.09% | −54.33% | −29.57% | 26.52% |

| (−10.5) | (−8.8) | (−5.75) | ||

| Panel B: CAAR Relative to the Russell 2000 | ||||

| Days Relative to Event | A1: 1–6 Years | A2: 7–13 Years | A3: 14+ Years | A3−A1 |

| 1 to 10 | −0.33% | 0.36% | 1.52% | 1.85% |

| (−0.4) | (0.55) | (1.9) | ||

| 1 to 20 | −0.10% | 1.71% | 2% | 2.10% |

| (−0.11) | (1.96) | (2.25) | ||

| 1 to 50 | −2.08% | 0.34% | 1.61% | 3.69% |

| (−1.51) | (0.27) | (1.32) | ||

| 1 to 75 | −3.07% | 0.40% | −0.14% | 2.93% |

| (−2.06) | (0.27) | (−0.1) | ||

| 1 to 100 | −6.79% | −3.03% | −3.19% | 3.60% |

| (−3.95) | (−1.78) | (−2.05) | ||

| 1 to 150 | −13.46% | −12.25% | −6.37% | 7.10% |

| (−6.48) | (−6.14) | (−3.32) | ||

| 1 to 200 | −18.72% | −15.29% | −8.53% | 10.19% |

| (−7.57) | (−6.43) | (−3.78) | ||

| 1 to 250 | −21.49% | −17.78% | −10.66% | 10.84% |

| (−7.7) | (−6.7) | (−4.24) | ||

| 1 to 300 | −27.38% | −21.72% | −14.80% | 12.58% |

| (−8.99) | (−7.32) | (−5.32) | ||

| 1 to 550 | −42.27% | −40.59% | −24.67% | 17.60% |

| (−9.33) | (−8.76) | (−5.62) | ||

| 1 to 750 | −52.09% | −50.47% | −25.80% | 26.29% |

| (−9.79) | (−8.21) | (−5.03) | ||

| Panel C: CAAR Relative to the Sector Indices | ||||

| Days relative to event | A1: 1–6 Years | A2: 7–13 Years | A3: 14+ Years | A3−A1 |

| 1 to 10 | −0.36% | 0.28% | 1.26% | 1.62% |

| (−0.45) | (0.42) | (1.58) | ||

| 1 to 20 | −0.11% | 1.39% | 1.66% | 1.77% |

| (−0.12) | (1.57) | (1.86) | ||

| 1 to 50 | −2.02% | −0.23% | 1.07% | 3.09% |

| (−1.46) | (−0.18) | (0.88) | ||

| 1 to 75 | −3.13% | −0.85% | −0.99% | 2.14% |

| (−2.06) | (−0.56) | (−0.7) | ||

| 1 to 100 | −6.52% | −4.46% | −3.76% | 2.76% |

| (−3.75) | (−2.57) | (−2.38) | ||

| 1 to 150 | −13.17% | −14.25% | −7.59% | 5.58% |

| (−6.27) | (−6.93) | (−3.92) | ||

| 1 to 200 | −19.01% | −17.94% | −10.82% | 8.19% |

| (−7.6) | (−7.35) | (−4.78) | ||

| 1 to 250 | −22.73% | −21.76% | −13.60% | 9.13% |

| (−8.04) | (−7.97) | (−5.36) | ||

| 1 to 300 | −28.72% | −25.85% | −18.17% | 10.55% |

| (−9.22) | (−8.5) | (−6.45) | ||

| 1 to 550 | −41.22% | −45.67% | −28.68% | 12.54% |

| (−8.94) | (−9.8) | (−6.52) | ||

| 1 to 750 | −48.07% | −54.24% | −29.46% | 18.61% |

| (−8.91) | (−8.84) | (−5.88) | ||

| Panel A: CAAR Relative to the S&P 500 | ||||||

| Days Relative to Event | Q1 | Q2 | Q3 | Q4 | Q5 | Q5−Q1 |

| 1 to 10 | −1.99% | 0.94% | 0.55% | −0.56% | 2.87% | 4.86% |

| (−1.83) | (0.92) | (0.66) | (−0.8) | (2.42) | ||

| 1 to 20 | −1.07% | 2.12% | 0.60% | −0.58% | 3.51% | 4.58% |

| (−0.72) | (1.77) | (0.62) | (−0.63) | (2.86) | ||

| 1 to 50 | −5.70% | −0.98% | 0.95% | −1.12% | 4.74% | 10.44% |

| (−2.9) | (−0.55) | (0.55) | (−0.84) | (3.27) | ||

| 1 to 75 | −6.16% | −1.54% | −1.52% | −1.56% | 2.66% | 8.82% |

| (−2.76) | (−0.75) | (−0.76) | (−1) | (1.69) | ||

| 1 to 100 | −11.34% | −5.35% | −4.85% | −4.89% | 1.21% | 12.56% |

| (−4.42) | (−2.21) | (−2.22) | (−2.66) | (0.71) | ||

| 1 to 150 | −21.63% | −15.43% | −10.38% | −10.70% | −1.36% | 20.27% |

| (−6.72) | (−5.59) | (−4.09) | (−4.34) | (−0.7) | ||

| 1 to 200 | −31.51% | −21.20% | −12.21% | −12.60% | −3.08% | 28.43% |

| (−8.21) | (−6.33) | (−3.96) | (−4.61) | (−1.42) | ||

| 1 to 250 | −35.19% | −27.82% | −12.81% | −17.42% | −5.35% | 29.84% |

| (−8.23) | (−7.33) | (−3.86) | (−5.44) | (−2.15) | ||

| 1 to 300 | −43.26% | −31.17% | −17.52% | −21.58% | −10% | 33.26% |

| (−9.01) | (−7.38) | (−4.96) | (−6.05) | (−3.65) | ||

| 1 to 550 | −77.59% | −48.20% | −26.04% | −32.57% | −20.18% | 57.42% |

| (−11.14) | (−6.85) | (−4.99) | (−6.05) | (−4.68) | ||

| 1 to 750 | −104.55% | −52.76% | −32.22% | −34.21% | −16.10% | 88.45% |

| (−11.44) | (−6.49) | (−5.02) | (−5.45) | (−3.61) | ||

| Panel B: CAAR Relative to the Russell 2000 | ||||||

| Days Relative to Event | Q1 | Q2 | Q3 | Q4 | Q5 | Q5−Q1 |

| 1 to 10 | −1.87% | 1.20% | 0.64% | −0.45% | 2.98% | 4.85% |

| (−1.74) | (1.18) | (0.77) | (−0.64) | (2.5) | ||

| 1 to 20 | −0.71% | 2.62% | 0.83% | −0.37% | 3.59% | 4.30% |

| (−0.49) | (2.22) | (0.87) | (−0.41) | (2.91) | ||

| 1 to 50 | −4.96% | −0.14% | 1.20% | −1.06% | 4.69% | 9.65% |

| (−2.56) | (−0.08) | (0.7) | (−0.8) | (3.24) | ||

| 1 to 75 | −5.25% | −0.06% | −0.87% | −1.06% | 3.04% | 8.29% |

| (−2.4) | (−0.03) | (−0.44) | (−0.7) | (1.95) | ||

| 1 to 100 | −10.22% | −4% | −4.13% | −4.32% | 1.43% | 11.65% |

| (−4.05) | (−1.68) | (−1.93) | (−2.41) | (0.85) | ||

| 1 to 150 | −19.78% | −13.57% | −9.23% | −9.72% | −0.80% | 18.98% |

| (−6.25) | (−4.99) | (−3.73) | (−4.05) | (−0.42) | ||

| 1 to 200 | −28.93% | −18.71% | −10.40% | −10.88% | −1.71% | 27.21% |

| (−7.68) | (−5.67) | (−3.45) | (−4.07) | (−0.8) | ||

| 1 to 250 | −31.91% | −24.33% | −9.67% | −14.76% | −3% | 28.90% |

| (−7.6) | (−6.5) | (−2.99) | (−4.72) | (−1.21) | ||

| 1 to 300 | −39.05% | −27.98% | −14.04% | −18.70% | −7.76% | 31.29% |

| (−8.3) | (−6.71) | (−4.05) | (−5.36) | (−2.87) | ||

| 1 to 550 | −72.15% | −44.27% | −22.43% | −28.64% | −15.87% | 56.29% |

| (−10.39) | (−6.38) | (−4.29) | (−5.44) | (−3.79) | ||

| 1 to 750 | −99.67% | −48.86% | −29.26% | −30.36% | −12.28% | 87.38% |

| (−10.96) | (−6.01) | (−4.52) | (−4.85) | (−2.83) | ||

| Panel C: CAAR Relative to the Sector Indices | ||||||

| Days Relative to Event | Q1 | Q2 | Q3 | Q4 | Q5 | Q5−Q1 |

| 1 to 10 | −2.13% | 0.73% | 0.59% | −0.32% | 2.98% | 5.11% |

| (−1.96) | (0.73) | (0.72) | (−0.45) | (2.51) | ||

| 1 to 20 | −1.31% | 1.83% | 0.57% | 0.01% | 3.71% | 5.03% |

| (−0.89) | (1.55) | (0.6) | (0.01) | (3.04) | ||

| 1 to 50 | −6.02% | −1.69% | 0.93% | −0.12% | 4.89% | 10.91% |

| (−3.05) | (−0.95) | (0.54) | (−0.09) | (3.37) | ||

| 1 to 75 | −6.52% | −2.39% | −1.27% | −0.60% | 2.98% | 9.50% |

| (−2.9) | (−1.17) | (−0.64) | (−0.39) | (1.9) | ||

| 1 to 100 | −11.73% | −6.30% | −4.60% | −3.64% | 2.15% | 13.88% |

| (−4.57) | (−2.6) | (−2.13) | (−1.98) | (1.29) | ||

| 1 to 150 | −22.16% | −16.48% | −10.06% | −9.30% | 0.01% | 22.16% |

| (−6.93) | (−6) | (−4) | (−3.76) | (0) | ||

| 1 to 200 | −32.60% | −22.40% | −12% | −11.11% | −1.28% | 31.31% |

| (−8.59) | (−6.71) | (−3.91) | (−4.07) | (−0.61) | ||

| 1 to 250 | −36.99% | −29.50% | −12.70% | −15.26% | −2.85% | 34.14% |

| (−8.75) | (−7.72) | (−3.84) | (−4.79) | (−1.18) | ||

| 1 to 300 | −45.70% | −32.69% | −17.45% | −19.18% | −7.29% | 38.41% |

| (−9.57) | (−7.74) | (−4.93) | (−5.35) | (−2.76) | ||

| 1 to 550 | −79.75% | −49.32% | −25.45% | −27.30% | −15.44% | 64.31% |

| (−11.6) | (−7.05) | (−4.82) | (−5.11) | (−3.74) | ||

| 1 to 750 | −103.98% | −53.18% | −31.69% | −27.32% | −10.28% | 93.70% |

| Entire Sample | Healthcare | Technology | |||||||

| Days Relative to Event | Entire | Small | Big | Entire | Small | Big | Entire | Small | Big |

| 1 to 10 | 0.42% | −0.16% | 1.58% | 0.12% | 0.17% | −1.15% | 0.20% | 0.92% | −2.59% |

| (0.96) | (−0.32) | (1.86) | (0.15) | (0.21) | (−0.45) | (0.22) | (0.94) | (−1.43) | |

| 1 to 20 | 0.97% | 0.41% | 2.09% | 1.30% | 1.46% | −2.52% | 1.54% | 2.41% | −1.80% |

| (1.84) | (0.64) | (2.27) | (1.22) | (1.34) | (−0.65) | (1.31) | (1.76) | (−0.83) | |

| 1 to 50 | −0.38% | −1.46% | 1.98% | −1.57% | −1.82% | 4.14% | 2.70% | 4.62% | −4.66% |

| (−0.5) | (−1.52) | (1.76) | (−0.98) | (−1.1) | (1.03) | (1.51) | (2.23) | (−1.44) | |

| 1 to 75 | −1.69% | −2.42% | 0.22% | −3.02% | −3.46% | 7.09% | 4.36% | 6.52% | −3.89% |

| (−1.97) | (−2.2) | (0.17) | (−1.66) | (−1.83) | (1.9) | (2.02) | (2.59) | (−1.01) | |

| 1 to 100 | −5.10% | −6.40% | −1.89% | −7.17% | −7.65% | 3.72% | 0.89% | 2.35% | −4.69% |

| (−5.23) | (−5.08) | (−1.36) | (−3.48) | (−3.58) | (0.68) | (0.35) | (0.81) | (−0.98) | |

| 1 to 150 | −11.95% | −14.55% | −5.74% | −15.56% | −15.82% | −9.71% | −9.92% | −9.25% | −12.48% |

| (−10.13) | (−9.62) | (−3.33) | (−6.39) | (−6.31) | (−1) | (−3.19) | (−2.58) | (−2.04) | |

| 1 to 200 | −16.18% | −19.80% | −7.56% | −21.79% | −22.28% | −10.51% | −11.42% | −11.76% | −10.15% |

| (−11.58) | (−10.93) | (−3.89) | (−7.45) | (−7.4) | (−0.96) | (−3.27) | (−2.83) | (−1.76) | |

| 1 to 250 | −19.65% | −23.59% | −10.70% | −25.73% | −26.55% | −7.12% | −14.16% | −13.63% | −16.10% |

| (−12.55) | (−11.69) | (−4.71) | (−7.98) | (−8.01) | (−0.55) | (−3.57) | (−2.95) | (−2.17) | |

| 1 to 300 | −24.59% | −29.22% | −14.22% | −30.76% | −31.80% | −6.54% | −18.80% | −19.50% | −16.16% |

| (−14.19) | (−13.04) | (−5.8) | (−8.6) | (−8.64) | (−0.51) | (−4.23) | (−3.76) | (−1.99) | |

| 1 to 550 | −40.21% | −48.21% | −22.84% | −54.59% | −56.95% | −5.02% | −27.40% | −28.43% | −23.07% |

| (−15.17) | (−14.13) | (−5.9) | (−9.38) | (−9.48) | (−0.28) | (−4.09) | (−3.75) | (−1.64) | |

| 1 to 750 | −46.94% | −59.13% | −19.68% | −76.81% | −80.59% | −10.98% | −20.63% | −20.43% | −21.50% |

| (−14.48) | (−13.97) | (−4.72) | (−10.39) | (−10.6) | (−0.4) | (−2.68) | (−2.4) | (−1.19) | |

| Financial Services | Consumer Cyclical | Energy | |||||||

| Days Relative to Event | Entire Sector | Small | Big | Entire Sector | Small | Big | Entire Sector | Small | Big |

| 1 to 10 | 0.80% | −3.12% | 2.69% | 1.47% | 0.45% | 2.77% | 0.79% | 1.24% | 0.38% |

| (0.46) | (−1.34) | (1.16) | (1.12) | (0.22) | (2.01) | (1.28) | (1.32) | (0.47) | |

| 1 to 20 | 0.78% | −3.72% | 2.95% | 1.49% | −0.09% | 3.48% | 2.07% | 2.04% | 2.11% |

| (0.43) | (−1.64) | (1.2) | (1.06) | (−0.04) | (2.31) | (2.64) | (1.74) | (1.99) | |

| 1 to 50 | −2.08% | −10.87% | 2.16% | 0.24% | −3.22% | 4.62% | 0.93% | 2.10% | −0.12% |

| (−0.9) | (−2.63) | (0.79) | (0.12) | (−0.95) | (2.54) | (0.65) | (1.1) | (−0.06) | |

| 1 to 75 | −3.60% | −11.53% | 0.22% | −4.10% | −9.54% | 2.79% | 0.22% | 2.66% | −1.96% |

| (−1.38) | (−2.28) | (0.08) | (−1.83) | (−2.75) | (1.24) | (0.12) | (1.03) | (−0.73) | |

| 1 to 100 | −3.18% | −8.98% | −0.43% | −8.90% | −16.71% | 0.97% | −3.08% | 0.72% | −6.46% |

| (−1.15) | (−1.66) | (−0.14) | (−3.18) | (−3.96) | (0.32) | (−1.41) | (0.23) | (−2.18) | |

| 1 to 150 | −4.65% | −10.71% | −1.79% | −15.61% | −25.23% | −3.45% | −6.36% | −0.20% | −11.85% |

| (−1.5) | (−1.64) | (−0.54) | (−4.12) | (−4.5) | (−0.78) | (−2.17) | (−0.05) | (−2.77) | |

| 1 to 200 | −7.55% | −21.11% | −1.13% | −17.01% | −26.27% | −5.43% | −9.48% | −1.97% | −16.18% |

| (−1.98) | (−2.36) | (−0.32) | (−3.89) | (−4.12) | (−1) | (−2.9) | (−0.46) | (−3.41) | |

| 1 to 250 | −8.67% | −20.84% | −3.02% | −21.54% | −32.28% | −8.07% | −13.56% | −3.74% | −22.33% |

| (−2.13) | (−2.2) | (−0.77) | (−4.59) | (−4.84) | (−1.33) | (−3.57) | (−0.79) | (−3.95) | |

| 1 to 300 | −10.70% | −24.12% | −4.47% | −28.05% | −41.45% | −10.72% | −15.74% | −3.52% | −26.79% |

| (−2.35) | (−2.32) | (−1) | (−5.43) | (−5.77) | (−1.59) | (−3.68) | (−0.66) | (−4.27) | |

| 1 to 550 | −25% | −53.08% | −11.27% | −40.90% | −61.24% | −15.92% | −39.47% | −30.53% | −47.73% |

| (−3.75) | (−3.57) | (−1.79) | (−6.1) | (−6.46) | (−1.93) | (−5.14) | (−3.45) | (−3.91) | |

| 1 to 750 | −15.89% | −37.04% | −5.18% | −45.03% | −70.29% | −12.71% | −50.94% | −52.04% | −49.89% |

| (−2.37) | (−2.44) | (−0.84) | (−5.53) | (−6.23) | (−1.28) | (−6.23) | (−4.4) | (−4.41) | |

| Industrials | Real Estate | Communication Services | |||||||

| Days Relative to Event | Entire Sector | Small | Big | Entire Sector | Small | Big | Entire Sector | Small | Big |

| 1 to 10 | 0.37% | 0.08% | 0.69% | 0.17% | −1.06% | 2.16% | −4.85% | −7.22% | −0.51% |

| (0.28) | (0.03) | (0.56) | (0.28) | (−1.26) | (2.84) | (−2.62) | (−2.89) | (−0.22) | |

| 1 to 20 | 0.08% | −2.08% | 2.43% | 0.29% | −1.31% | 2.85% | −5.41% | −7.44% | −1.69% |

| (0.05) | (−0.7) | (1.65) | (0.46) | (−1.75) | (3.1) | (−2.33) | (−2.52) | (−0.47) | |

| 1 to 50 | −1.57% | −4.96% | 2.12% | −1.86% | −4.56% | 2.46% | −5.11% | −9.86% | 3.60% |

| (−0.72) | (−1.54) | (0.76) | (−1.67) | (−3.48) | (1.4) | (−1.53) | (−2.42) | (0.66) | |

| 1 to 75 | −4.06% | −5.25% | −2.76% | −4.24% | −7.93% | 1.68% | −6.02% | −9.83% | 0.97% |

| (−1.61) | (−1.3) | (−0.96) | (−3.05) | (−4.84) | (0.79) | (−1.66) | (−2.16) | (0.17) | |

| 1 to 100 | −8.07% | −10.23% | −5.72% | −4.60% | −9.08% | 2.60% | −12.47% | −15.46% | −6.98% |

| (−2.54) | (−2.14) | (−1.4) | (−2.72) | (−4.57) | (1.01) | (−3.09) | (−2.93) | (−1.17) | |

| 1 to 150 | −11.34% | −15.89% | −6.40% | −7.52% | −14.05% | 2.98% | −22.74% | −26.89% | −15.13% |

| (−2.6) | (−2.31) | (−1.26) | (−3.26) | (−4.91) | (0.97) | (−4.85) | (−4.4) | (−2.18) | |

| 1 to 200 | −13.96% | −21.74% | −5.49% | −8.92% | −15.69% | 1.97% | −33.61% | −37.25% | −27.04% |

| (−2.91) | (−2.92) | (−0.98) | (−3.45) | (−4.61) | (0.63) | (−5.09) | (−4.25) | (−2.85) | |

| 1 to 250 | −20.78% | −27.18% | −13.82% | −7.61% | −13.93% | 2.36% | −35.50% | −38.16% | −30.81% |

| (−3.37) | (−2.88) | (−1.81) | (−2.86) | (−4.16) | (0.63) | (−4.83) | (−3.95) | (−2.79) | |

| 1 to 300 | −31.24% | −36.92% | −25.04% | −8.38% | −15.27% | 2.26% | −37.87% | −42.81% | −29.62% |

| (−4.21) | (−3.39) | (−2.53) | (−2.88) | (−4.21) | (0.54) | (−5.05) | (−4.13) | (−3) | |

| 1 to 550 | −41.26% | −46.06% | −36.35% | −7.40% | −11.24% | −1.14% | −36.38% | −42.08% | −26.58% |

| (−3.6) | (−2.98) | (−2.15) | (−1.89) | (−2.12) | (−0.21) | (−3.32) | (−2.7) | (−2.09) | |

| 1 to 750 | −44.87% | −79.13% | −3.76% | −5.66% | −8.93% | 0.49% | −63.71% | −65.17% | −61.16% |

| (−3.48) | (−3.91) | (−0.36) | (−1.13) | (−1.44) | (0.06) | (−3.86) | (−2.88) | (−2.74) | |

| Consumer Defensive | Materials | Utilities | |||||||

| Days Relative to Event | Entire Sector | Small | Big | Entire Sector | Small | Big | Entire Sector | Small | Big |

| 1 to 10 | 0.96% | 0.06% | 3.39% | 6.29% | 0.15% | 10.13% | 6.18% | 9.88% | 0.47% |

| (0.34) | (0.02) | (2.08) | (0.96) | (0.05) | (0.97) | (1.87) | (1.53) | (1.53) | |

| 1 to 20 | −1.11% | −1.86% | 0.92% | 5.35% | −2.12% | 10.02% | 5.59% | 7.59% | 7.59% |

| (−0.39) | (−0.48) | (0.53) | (0.78) | (−0.4) | (0.95) | (0.93) | (0.61) | (0.61) | |

| 1 to 50 | 0.50% | −1.52% | 5.95% | 4.42% | −0.92% | 7.76% | 10.47% | 22.14% | 22.14% |

| (0.13) | (−0.31) | (2.04) | (0.58) | (−0.11) | (0.69) | (1.69) | (2.23) | (2.23) | |

| 1 to 75 | −1.90% | −3.30% | 1.89% | 2.75% | −1.72% | 5.54% | 6.09% | 17.66% | 17.66% |

| (−0.48) | (−0.63) | (0.55) | (0.33) | (−0.16) | (0.47) | (0.89) | (1.43) | (1.43) | |

| 1 to 100 | −3.58% | −6.11% | 3.25% | −2.29% | −12.54% | 4.12% | −0.65% | 7.82% | 7.82% |

| (−0.78) | (−1) | (0.84) | (−0.26) | (−0.91) | (0.37) | (−0.09) | (0.63) | (0.63) | |

| 1 to 150 | −12.96% | −19.20% | 3.91% | −5.66% | −14.11% | −0.38% | −3.17% | −4.06% | −4.06% |

| (−2.48) | (−2.82) | (1.01 | (−0.6) | (−1.04) | (−0.03) | (−0.45) | (−0.37) | (−0.37) | |

| 1 to 200 | −21.48% | −25.54% | −10.49% | −11.86% | −30.68% | −0.10% | −8.75% | −10.97% | −10.97% |

| (−3.74) | (−3.65) | (−1.13) | (−1.01) | (−1.53) | (−0.01) | (−1.24) | (−0.97) | (−0.97) | |

| 1 to 250 | −27.25% | −35.91% | −3.84% | −20.85% | −51.26% | −1.84% | −7.39% | −5.76% | −5.76% |

| (−4.19) | (−4.43) | (−0.51) | (−1.46) | (−2.01) | (−0.12) | (−1.04) | (−0.47) | (−0.47) | |

| 1 to 300 | −33.28% | −42.91% | −8.92% | −38.77% | −76.44% | −14.20% | −27.64% | −17.86% | −17.86% |

| (−4.27) | (−4.5) | (−0.8) | (−2.83) | (−2.9) | (−1.15) | (−3.04) | (−1.16) | (−1.16) | |

| 1 to 550 | −52.76% | −71.85% | −6.92% | −71.84% | −138.69% | −26.26% | −56.22% | −40.90% | −40.90% |

| (−4.32) | (−5.16) | (−0.34) | (−3.85) | (−4.12) | (−1.75) | (−2.96) | (−1.46) | (−1.46) | |

| 1 to 750 | −35.32% | −54.43% | 1.42% | −68.94% | −128.40% | −26% | −45.63% | −42.30% | −42.30% |

| (−2.09) | (−2.35) | (0.08) | (−3.6) | (−3.77) | (−1.69) | (−2.17) | (−1.18) | (−1.18) | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Siev, S.; Qadan, M. Call Me When You Grow Up: Firms’ Age, Size, and IPO Performance across Sectors. J. Risk Financial Manag. 2022, 15, 586. https://doi.org/10.3390/jrfm15120586

Siev S, Qadan M. Call Me When You Grow Up: Firms’ Age, Size, and IPO Performance across Sectors. Journal of Risk and Financial Management. 2022; 15(12):586. https://doi.org/10.3390/jrfm15120586

Chicago/Turabian StyleSiev, Smadar, and Mahmoud Qadan. 2022. "Call Me When You Grow Up: Firms’ Age, Size, and IPO Performance across Sectors" Journal of Risk and Financial Management 15, no. 12: 586. https://doi.org/10.3390/jrfm15120586