On Survivor Stocks in the S&P 500 Stock Index

Abstract

:1. Introduction

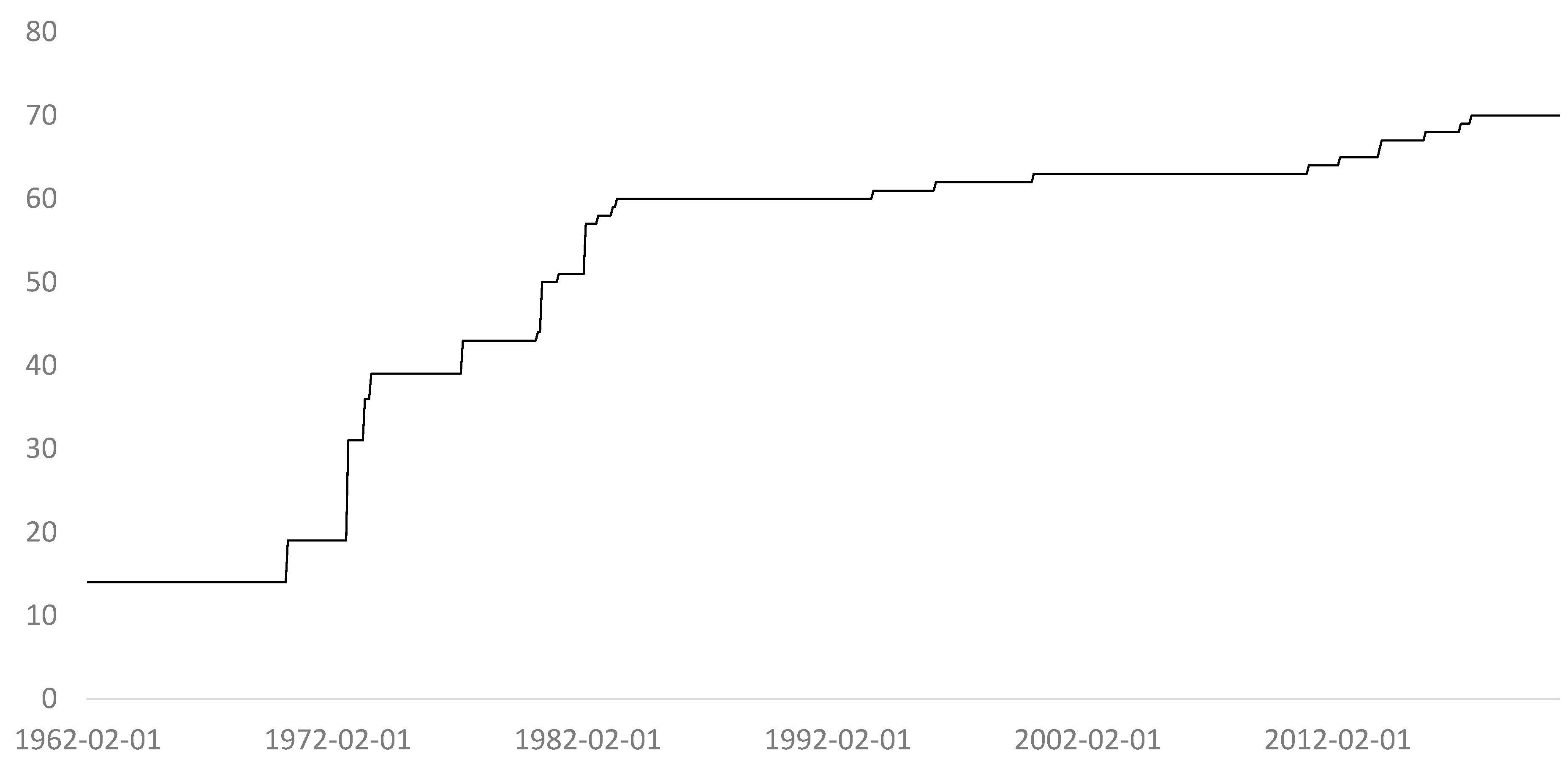

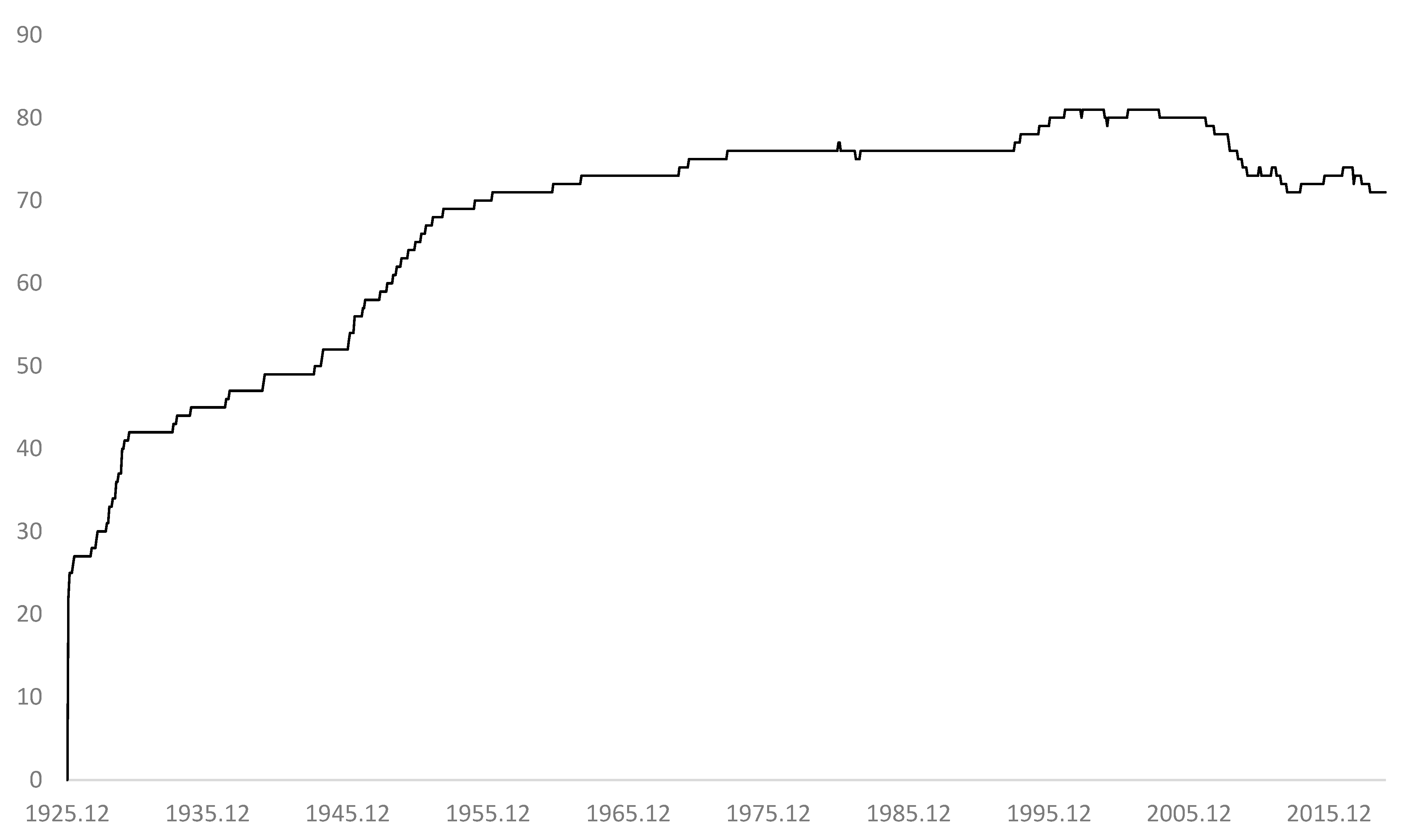

2. Data

3. Statistical Analysis

3.1. Risk Adjustments and Survivor Stock Portfolio Characteristics

3.2. Out-of-Sample Performance

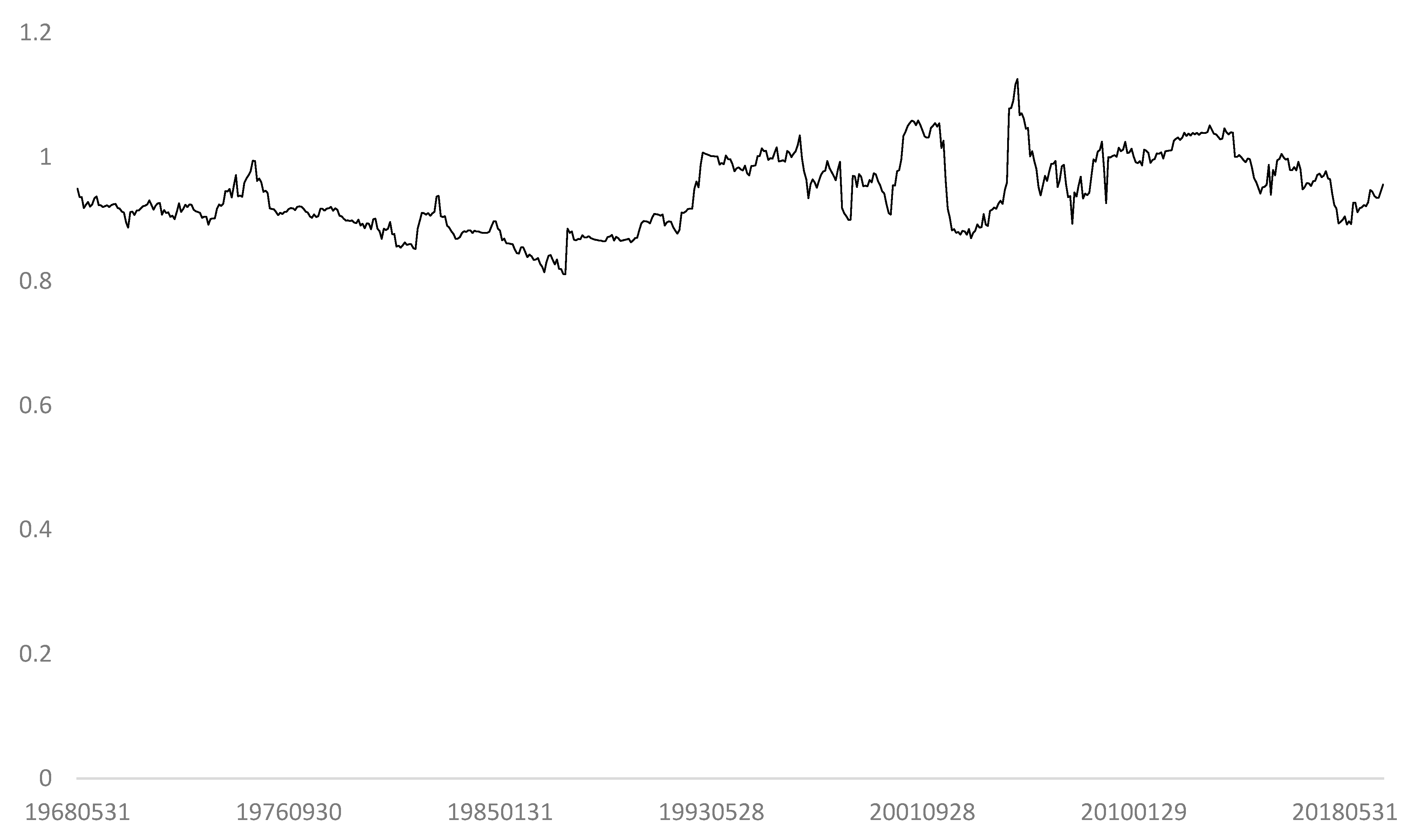

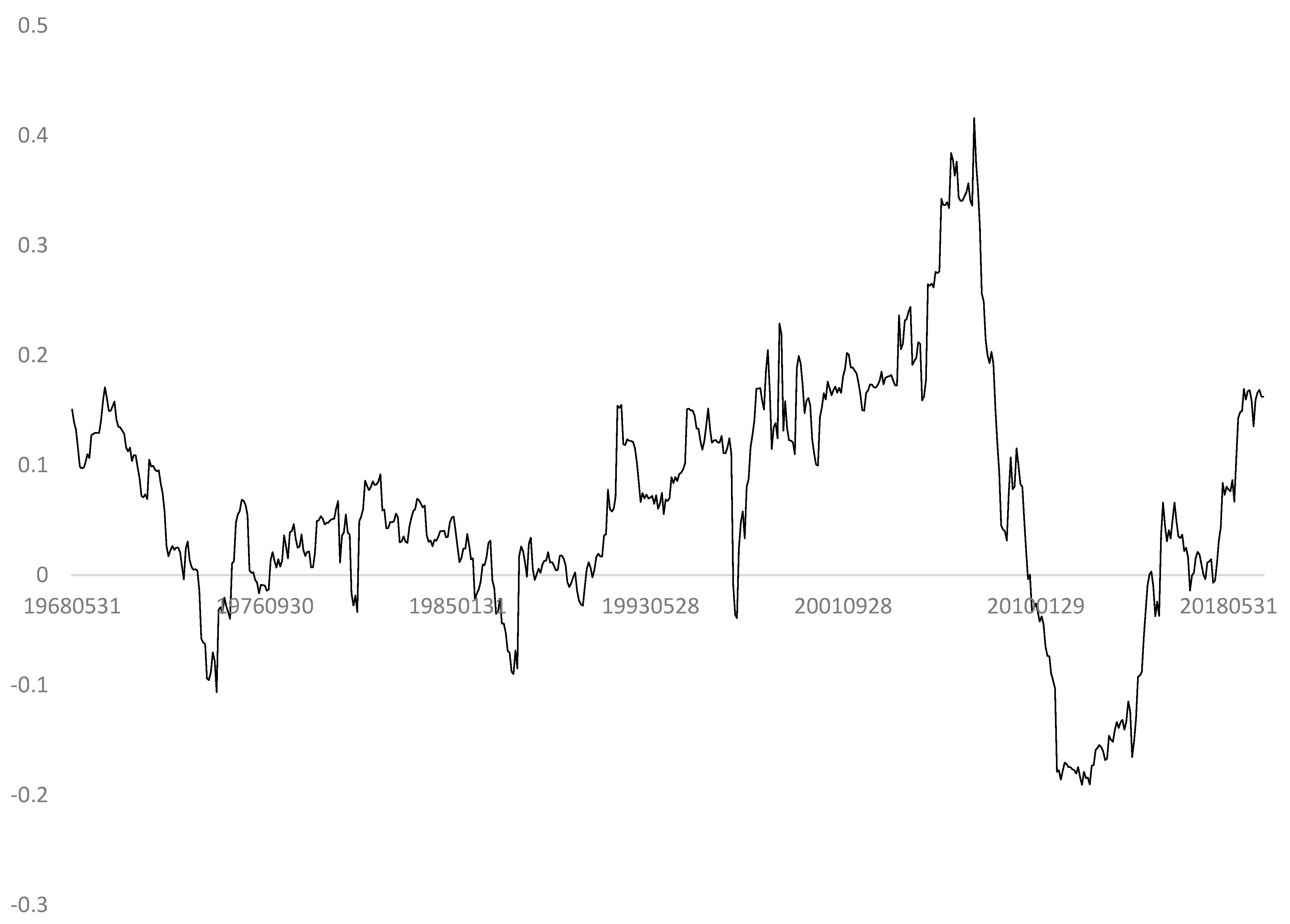

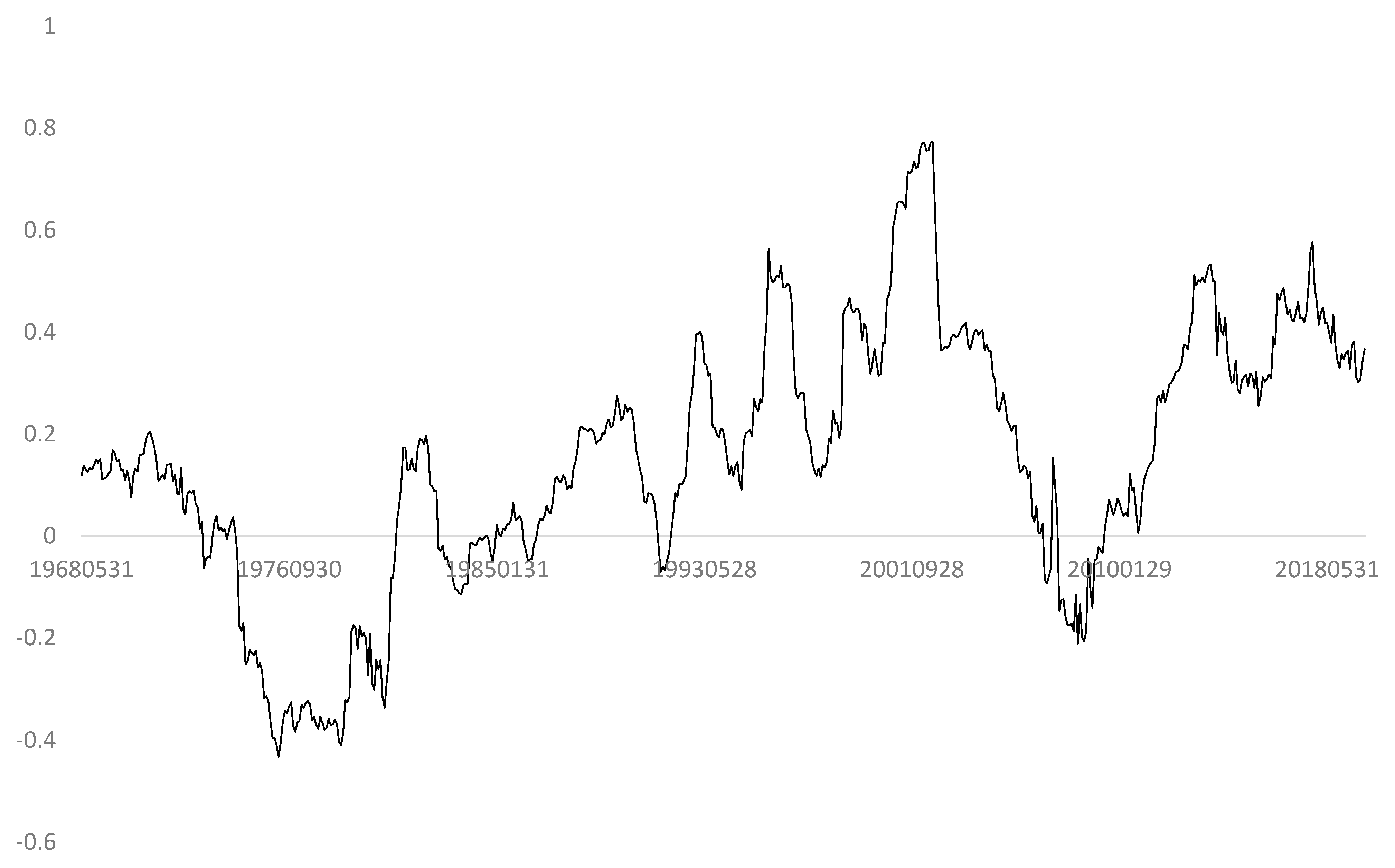

3.3. Time-Varying Factor Exposures

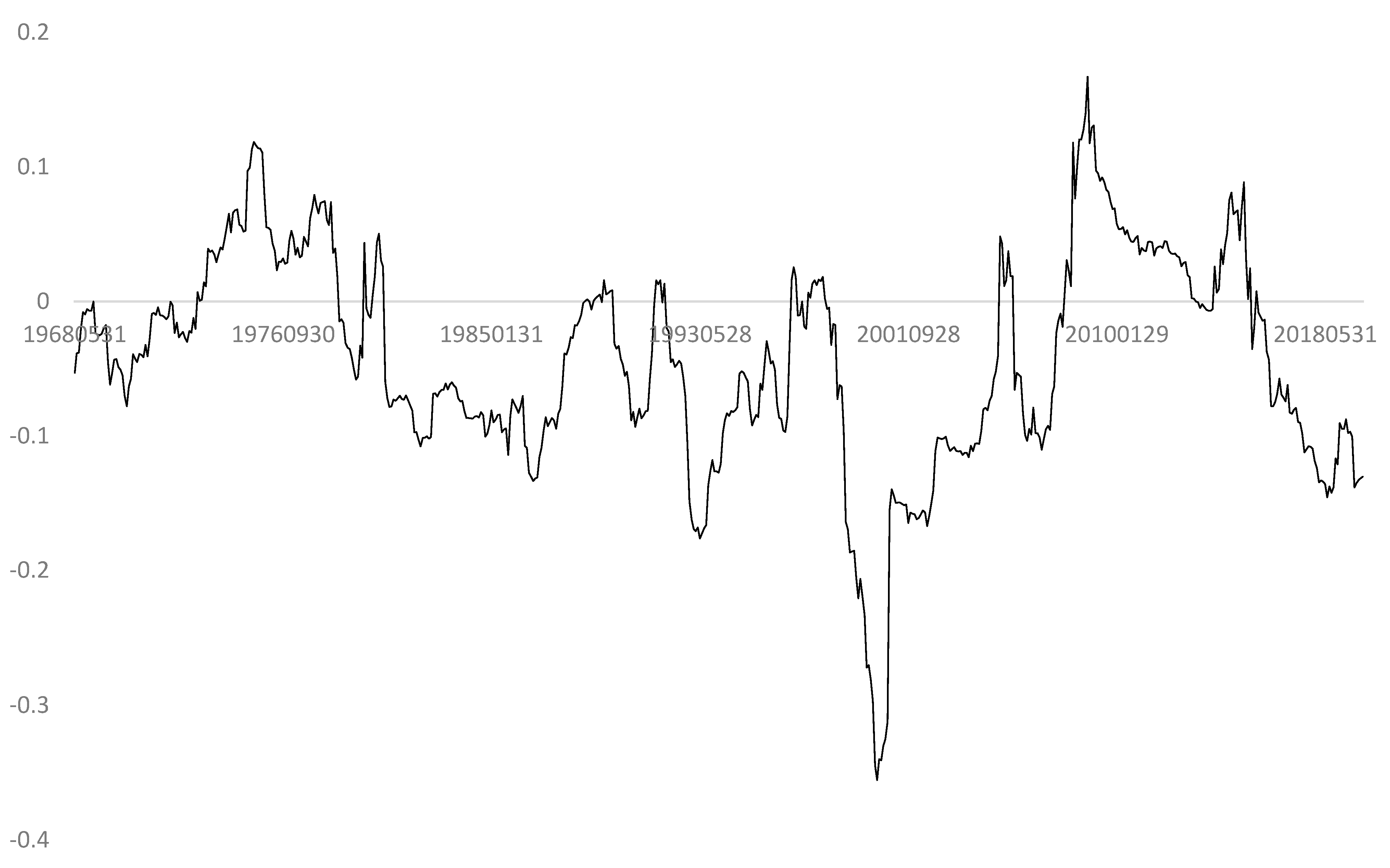

3.4. Conditional Volatility

4. Robustness Checks

4.1. The Multiple Testing Problem

4.2. Replication Using Publicly Available Data

4.3. Survivor Stocks’ Characteristics Relative to S&P 500 Index

4.4. Equal-Weighted Market Factor

4.5. Additional Robustness Checks

5. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 AMERICAN WATER WORKS & ELEC INC 2 WEST PENN ELECTRIC CO 3 ALLEGHENY POWER SYSTEMS INC 4 ALLEGHENY ENERGY INC 5 ALLIED CHEMICAL & DYE CORP 6 ALLIED CHEMICAL CORP 7 ALLIED CORP 8 ALLIED SIGNAL INC 9 HONEYWELL INTERNATIONAL INC 10 ARCHER DANIELS MIDLAND CO 11 BURROUGHS ADDING MACH CO 12 BURROUGHS CORP 13 UNISYS CORP 14 COCA COLA CO 15 CONSOLIDATED GAS CO NY 16 CONSOLIDATED EDISON CO NY INC 17 CONSOLIDATED EDISON INC 18 DETROIT EDISON CO 19 D T E ENERGY CO 20 DU PONT E I DE NEMOURS & CO 21 EATON AXLE & SPRING CO 22 EATON MFG CO 23 EATON YALE & TOWNE INC 24 EATON CORP 25 EATON CORP PLC 26 STANDARD OIL CO N J 27 EXXON CORP 28 EXXON MOBIL CORP 29 ELECTRIC BOAT CO 30 GENERAL DYNAMICS CORP 31 GENERAL ELECTRIC CO 32 GENERAL MOTORS CORP 33 GENERAL MOTORS CO 34 INGERSOLL RAND CO 35 INGERSOLL RAND CO LTD 36 INGERSOLL RAND PLC 37 TRANE TECHNOLOGIES PLC 38 INTERNATIONAL BUSINESS MACHS COR 39 FORTUNE BRANDS HOME & SECUR INC 40 TRANSCONTINENTAL OIL CO 41 OHIO OIL CO 42 MARATHON OIL CO 43 PACIFIC GAS & ELEC CO 44 PG & E CORP 45 LOFT INC 46 PEPSI COLA CO 47 PEPSICO INC 48 PHILIP MORRIS & CO LTD 49 PHILIP MORRIS INC 50 PHILIP MORRIS COS INC 51 ALTRIA GROUP INC 52 PHILLIPS PETROLEUM CO 53 CONOCOPHILLIPS 54 EASTMAN KODAK CO 55 AMERICAN TYPE FOUNDERS CO | 56 AMERICAN TYPE FOUNDERS INC 57 ATF INC 58 DAYSTROM INC 59 SCHLUMBERGER LTD 60 STANDARD OIL CO CALIFORNIA 61 CHEVRON CORP 62 CHEVRONTEXACO CORP 63 CHEVRON CORP NEW 64 UNION TANK CAR CO 65 TRANS UNION CORP 66 UNITED STATES STEEL CORP 67 USX CORP 68 U S X MARATHON GROUP 69 MARATHON OIL CORP 70 KRAFT HEINZ CO 71 WRIGLEY WILLIAM JR CO 72 AMERICAN HOME PRODUCTS CORP 73 WYETH 74 SOUTHERN CALIFORNIA EDISON CO 75 SCE CORP 76 EDISON INTERNATIONAL 77 ALCOA CORP 78 GOODYEAR TIRE & RUBBER CO 79 HERSHEY CHOCOLATE CORP 80 HERSHEY FOODS CORP 81 HERSHEY CO 82 KROGER GROCERY & BAKING CO 83 KROGER COMPANY 84 DOWDUPONT INC 85 DUPONT DE NEMOURS INC 86 MELVILLE SHOE CORP 87 MELVILLE CORP 88 CVS CORP 89 CVS CAREMARK CORP 90 CVS HEALTH CORP 91 GENERAL MILLS INC 92 MCGRAW HILL PUBLISHING INC 93 MCGRAW HILL INC 94 MCGRAW HILL COS INC 95 MCGRAW HILL FINANCIAL INC 96 S&P GLOBAL INC 97 KIMBERLY CLARK CORP 98 PHELPS DODGE CORP 99 HERCULES POWDER CO 100 HERCULES INC 101 MINNEAPOLIS HONEYWELL REGULATOR 102 HONEYWELL INC 103 PENNEY J C INC 104 PENNEY J C CO INC 105 COMMONWEALTH & SOUTHERN CORP 106 SOUTHERN CO 107 CATERPILLAR TRACTOR INC 108 CATERPILLAR INC 109 COLGATE PALMOLIVE PEET CO 110 COLGATE PALMOLIVE CO |

| 111 DEERE & CO IL 112 DEERE & CO DEL 113 DEERE & CO 114 BRISTOL MYERS CO 115 BRISTOL MYERS SQUIBB CO 116 BOEING AIRPLANE CO 117 BOEING CO 118 ABBOTT LABS 119 ABBOTT LABORATORIES 120 DOW CHEMICAL CO 121 LOCKHEED AIRCRAFT CORP 122 LOCKHEED CORP 123 LOCKHEED MARTIN CORP 124 WEST VA PULP & PAPER CO 125 WESTVACO CORP 126 MEADWESTVACO CORP 127 WESTROCK CO 128 INTERNATIONAL PAPER & PWR CO 129 INTERNATIONAL PAPER CO 130 PHILADELPHIA ELECTRIC CO 131 P E C O ENERGY CO 132 EXELON CORP 133 PFIZER CHAS & CO INC 134 PFIZER INC 135 COOPER BESSEMER CORP 136 COOPER INDUSTRIES INC 137 COOPER INDUSTRIES LTD 138 COOPER INDUSTRIES PLC 139 PITTSBURGH PLATE GLASS CO 140 P P G INDUSTRIES INC 141 MINNESOTA MINING & MFG CO 142 3M CO 143 MERCK & CO INC 144 MERCK & CO INC NEW 145 GALVIN MANUFACTURING CO 146 MOTOROLA INC 147 MOTOROLA SOLUTIONS INC 148 CAROLINA POWER & LIGHT CO 149 CP & L ENERGY INC 150 PROGRESS ENERGY INC 151 CONSUMERS PWR CO 152 CONSUMERS POWER CO 153 C M S ENERGY CORP 154 PUBLIC SERVICE ELECTRIC & GAS CO 155 PUBLIC SERVICE ENTERPRISE GP INC 156 HALLIBURTON OIL WELL CEMENTING 157 HALLIBURTON COMPANY 158 NORTHERN STATES POWER CO MN 159 XCEL ENERGY INC 160 MIDDLE SOUTH UTILITIES INC 161 ENTERGY CORP 162 ENTERGY CORP NEW 163 AMERICAN GAS & ELECTRIC CO 164 AMERICAN ELECTRIC POWER CO INC 165 CONSOLIDATED GAS ELEC LT & PWR 166 BALTIMORE GAS & ELECTRIC CO 167 CONSTELLATION ENERGY GROUP INC | 168 PITNEY BOWES INC 169 TEXAS UTILITIES CO 170 TXU CORP 171 ALUMINUM COMPANY AMER 172 ALCOA INC 173 ARCONIC INC 174 HOWMET AEROSPACE INC 175 NORTHROP AIRCRAFT INC 176 NORTHROP CORP 177 NORTHROP GRUMMAN CORP 178 RAYTHEON MANUFACTURING CO 179 RAYTHEON CO 180 CAMPBELL SOUP CO 181 FORD MOTOR CO 182 FORD MOTOR CO DEL 183 COOPER TIRE & RUBBER CO 184 OCCIDENTAL PETROLEUM CORP 185 UNION PACIFIC CORP 186 BURLINGTON NORTHERN INC 187 BURLINGTON NORTHERN SANTA FE CP 188 SEALED AIR CORP 189 CSX CORP 190 NORFOLK SOUTHERN CORP 191 ALLSTATE CORP 192 SANTA FE FINANCIAL CORP 193 NGC CORP 194 DYNEGY INC 195 ITT HARTFORD GROUP INC 196 HARTFORD FINANCIAL SVCS GRP INC 197 QUEST DIAGNOSTICS INC 198 SEALED AIR CORP NEW 199 ROCKWELL COLLINS INC 200 DYNEGY INC NEW 201 DYNEGY INC DEL 202 DYNEGY INC NEW DEL |

| Ticker/Metric | AA | ABT | ADM | AEP | ALL | ATI | BA | BMY | BURL | CAT |

| Mean | 0.90 | 1.47 | 1.09 | 0.92 | 1.11 | 1.29 | 1.44 | 1.15 | 2.97 | 1.36 |

| Median | 0.73 | 1.36 | 1.09 | 1.10 | 1.05 | 0.36 | 1.45 | 1.11 | 3.63 | 1.17 |

| Maximum | 54.02 | 22.12 | 32.08 | 28.70 | 30.97 | 62.50 | 48.44 | 43.72 | 25.24 | 40.14 |

| Minimum | −55.59 | −20.74 | −27.36 | −17.77 | −42.78 | −50.26 | −45.47 | −28.87 | −26.73 | −35.91 |

| Std. dev. | 9.98 | 5.97 | 7.89 | 5.73 | 7.59 | 16.38 | 9.59 | 6.97 | 8.51 | 8.40 |

| Skewness | −0.02 | −0.15 | 0.12 | 0.03 | −0.72 | 0.60 | 0.23 | 0.08 | −0.49 | 0.03 |

| Kurtosis | 7.32 | 3.65 | 3.98 | 4.09 | 8.28 | 4.71 | 5.60 | 5.86 | 4.08 | 4.65 |

| Sample start | 1962-02 | 1980-04 | 1980-04 | 1970-02 | 1993-07 | 1999-12 | 1962-02 | 1972-07 | 2013-11 | 1962-02 |

| Ticker/Metric | CL | CMS | COO | COP | CPB | CSX | CVS | CVX | DD | DE |

| Mean | 1.15 | 0.65 | 1.46 | 1.10 | 0.94 | 1.45 | 1.18 | 1.28 | 1.33 | 1.41 |

| Median | 1.21 | 0.90 | 1.05 | 1.36 | 0.94 | 1.55 | 0.75 | 1.34 | 0.66 | 1.26 |

| Maximum | 49.25 | 41.77 | 88.45 | 39.92 | 33.00 | 29.11 | 56.86 | 36.30 | 182.16 | 45.30 |

| Minimum | −21.59 | −44.17 | −52.59 | −35.94 | −18.76 | −31.41 | −36.36 | −21.46 | −67.77 | −29.86 |

| Std. dev. | 6.74 | 8.30 | 13.69 | 8.29 | 6.75 | 7.87 | 8.51 | 6.74 | 12.27 | 8.44 |

| Skewness | 0.76 | −0.12 | 0.56 | 0.20 | 0.26 | −0.14 | 0.41 | 0.35 | 5.96 | 0.08 |

| Kurtosis | 8.89 | 9.87 | 8.26 | 6.00 | 4.35 | 3.89 | 7.96 | 4.99 | 89.80 | 4.53 |

| Sample start | 1973-06 | 1973-03 | 1983-02 | 1982-01 | 1973-03 | 1980-12 | 1973-02 | 1962-02 | 1972-07 | 1972-07 |

| Ticker/Metric | DTE | ED | EIX | ETN | ETR | EXC | F | GD | GDP | GE |

| Mean | 0.95 | 0.98 | 1.10 | 1.96 | 0.98 | 1.04 | 1.17 | 1.44 | 0.94 | 0.90 |

| Median | 0.95 | 0.97 | 1.30 | 1.98 | 0.96 | 1.10 | 0.53 | 1.17 | 0.64 | 0.37 |

| Maximum | 54.18 | 45.00 | 25.92 | 72.89 | 39.24 | 30.69 | 127.38 | 34.00 | 99.77 | 37.20 |

| Minimum | −22.41 | −52.50 | −36.90 | −30.33 | −24.54 | −24.14 | −57.88 | −27.95 | −33.17 | −29.84 |

| Std. dev. | 5.70 | 6.07 | 6.65 | 8.40 | 6.84 | 6.47 | 11.04 | 8.10 | 18.54 | 7.39 |

| Skewness | 1.03 | −0.17 | −0.69 | 0.97 | 0.53 | 0.08 | 2.59 | 0.23 | 2.98 | 0.20 |

| Kurtosis | 13.92 | 16.22 | 6.72 | 12.15 | 6.58 | 4.78 | 33.33 | 4.74 | 18.24 | 5.39 |

| Sample start | 1962-02 | 1962-02 | 1973-06 | 1972-07 | 1972-07 | 1973-06 | 1972-07 | 1977-02 | 2017-01 | 1962-02 |

| Ticker/Metric | GIS | GM | GT | HAL | HIG | HON | HSY | IBM | IP | IR |

| Mean | 1.24 | 0.78 | 0.81 | 1.08 | 1.29 | 1.27 | 1.48 | 0.84 | 0.91 | 2.72 |

| Median | 1.12 | 0.33 | 0.37 | 1.24 | 1.39 | 1.40 | 1.11 | 0.36 | 0.50 | 1.85 |

| Maximum | 19.75 | 28.10 | 75.56 | 54.90 | 103.57 | 51.05 | 27.60 | 35.38 | 79.83 | 26.70 |

| Minimum | −24.08 | −31.87 | −41.74 | −59.61 | −74.82 | −38.19 | −24.91 | −24.86 | −37.61 | −24.37 |

| Std. dev. | 5.65 | 9.06 | 10.77 | 10.83 | 12.94 | 8.12 | 6.45 | 6.94 | 8.60 | 10.65 |

| Skewness | 0.08 | 0.18 | 0.60 | −0.15 | 1.43 | 0.06 | 0.20 | 0.19 | 1.04 | 0.12 |

| Kurtosis | 3.99 | 4.26 | 8.13 | 6.24 | 22.84 | 6.97 | 4.85 | 4.83 | 13.67 | 3.31 |

| Sample start | 1980-04 | 2010-12 | 1962-02 | 1972-07 | 1996-01 | 1970-02 | 1983-04 | 1962-02 | 1962-02 | 2017-06 |

| Ticker/Metric | JCPNQ | KHC | KMB | KO | KODK | KR | LMT | MMM | MO | MRK |

| Mean | −0.15 | −0.49 | 1.22 | 1.56 | 9.41 | 2.04 | 1.70 | 0.98 | 1.81 | 1.14 |

| Median | −0.26 | 0.12 | 0.85 | 1.33 | −1.60 | 1.62 | 1.33 | 1.10 | 1.91 | 1.05 |

| Maximum | 52.91 | 24.70 | 33.21 | 33.22 | 879.82 | 214.90 | 48.26 | 25.80 | 195.19 | 31.34 |

| Minimum | −47.83 | −30.94 | −17.10 | −29.55 | −72.63 | −67.84 | −38.81 | −27.83 | −69.65 | −26.62 |

| Std. dev. | 11.83 | 9.02 | 5.86 | 6.38 | 97.98 | 13.48 | 8.89 | 6.06 | 10.71 | 6.89 |

| Skewness | 0.05 | −0.45 | 0.82 | 0.18 | 8.23 | 7.80 | 0.22 | −0.01 | 7.94 | −0.05 |

| Kurtosis | 5.44 | 4.51 | 6.31 | 5.59 | 73.33 | 124.80 | 6.38 | 4.68 | 154.67 | 4.00 |

| Sample start | 1973-03 | 2015-08 | 1980-04 | 1962-02 | 2013-10 | 1977-02 | 1977-02 | 1970-02 | 1962-02 | 1970-02 |

| Ticker/Metric | MRO | MSI | NOC | NSG | OXY | PBI | PCG | PEP | PFE | PG |

| Mean | 0.92 | 1.25 | 1.53 | 1.36 | 0.98 | 1.06 | 0.85 | 1.20 | 1.15 | 1.04 |

| Median | 0.44 | 1.10 | 1.67 | 1.31 | 0.76 | 0.54 | 1.13 | 0.93 | 1.05 | 0.79 |

| Maximum | 86.02 | 30.73 | 33.88 | 25.53 | 72.62 | 73.04 | 45.71 | 36.89 | 39.67 | 24.69 |

| Minimum | −60.08 | −33.49 | −35.56 | −31.52 | −64.63 | −48.66 | −45.26 | −28.41 | −24.01 | −35.42 |

| Std. dev. | 10.55 | 9.56 | 8.30 | 7.55 | 9.63 | 10.06 | 8.45 | 6.34 | 7.01 | 5.48 |

| Skewness | 0.91 | −0.14 | −0.04 | −0.07 | 0.64 | 0.64 | −0.39 | 0.07 | 0.28 | −0.34 |

| Kurtosis | 12.41 | 3.64 | 5.16 | 4.20 | 14.90 | 11.64 | 11.37 | 6.76 | 4.77 | 6.10 |

| Sample start | 1970-02 | 1977-02 | 1982-02 | 1982-07 | 1982-02 | 1972-07 | 1972-07 | 1972-07 | 1972-07 | 1962-02 |

| Ticker/Metric | PPG | PREX | ROK | SEE | SLB | SO | UIS | UNP | XEL | XOM |

| Mean | 1.39 | 0.89 | 1.84 | 1.69 | 0.77 | 1.24 | 0.81 | 1.35 | 0.91 | 0.98 |

| Median | 1.42 | 0.00 | 1.93 | 2.00 | 0.50 | 1.28 | 0.06 | 1.48 | 1.18 | 0.93 |

| Maximum | 26.71 | 52.50 | 160.92 | 149.35 | 39.16 | 22.57 | 130.19 | 34.44 | 42.13 | 22.69 |

| Minimum | −32.32 | −63.83 | −57.90 | −63.97 | −49.47 | −14.26 | −55.92 | −33.43 | −58.50 | −25.13 |

| Std. dev. | 7.29 | 10.88 | 11.83 | 11.41 | 9.28 | 4.99 | 16.10 | 7.49 | 6.07 | 5.31 |

| Skewness | 0.06 | −0.53 | 4.96 | 3.98 | −0.20 | 0.02 | 1.30 | 0.05 | −0.96 | 0.03 |

| Kurtosis | 4.58 | 18.46 | 73.04 | 61.54 | 5.76 | 3.89 | 12.92 | 4.77 | 22.91 | 4.51 |

| Sample start | 1980-04 | 2012-03 | 1982-01 | 1980-04 | 1982-01 | 1982-01 | 1972-08 | 1980-02 | 1973-03 | 1962-02 |

| S&P 500 | SMB | HML | RMW | CMA | UMD | ||

|---|---|---|---|---|---|---|---|

| Mean | 1.13 | 0.65 | 0.21 | 0.26 | 0.26 | 0.26 | 0.66 |

| Median | 1.23 | 0.91 | 0.09 | 0.25 | 0.22 | 0.11 | 0.71 |

| Maximum | 18.21 | 16.30 | 18.05 | 12.60 | 13.38 | 9.56 | 18.36 |

| Minimum | −20.41 | −21.76 | −14.86 | −14.11 | −18.48 | −6.86 | −34.39 |

| Std. dev. | 4.38 | 4.27 | 3.02 | 2.87 | 2.17 | 1.99 | 4.19 |

| Skewness | −0.31 | −0.44 | 0.33 | 0.01 | −0.33 | 0.32 | −1.28 |

| Kurtosis | 5.80 | 4.87 | 6.02 | 5.39 | 15.38 | 4.61 | 13.19 |

| Alpha | S&P 500 | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|

| 0.49 *** (7.01) | 0.92 *** (56.88) | 0.83 | |||||

| 0.40 *** (6.31) | 0.96 *** (64.32) | 0.05 ** (2.46) | 0.30 *** (13.56) | 0.86 | |||

| 0.27 *** (4.50) | 1.00 *** (67.75) | 0.12 *** (5.87) | 0.18 *** (6.44) | 0.27 *** (9.37) | 0.24 *** (5.65) | 0.88 | |

| 0.34 *** (5.72) | 0.98 *** (68.03) | 0.12 *** (6.17) | 0.13 *** (4.69) | 0.29 *** (10.37) | 0.27 *** (6.58) | −0.10 *** (−6.87) | 0.89 |

| Dependent var. | Alpha | CRSPexcess | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|---|

| 0.09 (1.54) | 0.98 *** (67.50) | −0.04 * (−1.81) | 0.15 *** (5.45) | 0.35 *** (12.32) | 0.31 *** (7.47) | −0.12 *** (−8.14) | 0.89 | |

| −0.25 *** (−15.81) | 1.00 *** (262.94) | −0.16 *** (−30.46) | 0.02 *** (3.08) | 0.06 *** (7.89) | 0.04 *** (3.48) | −0.02 *** (−5.16) | 0.99 |

| Alpha | Dummy | S&P 500 | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|---|

| 0.56 *** (7.05) | −0.31 * (−1.88) | 0.93 *** (57.01) | 0.83 | |||||

| 0.40 *** (5.55) | −0.02 (−0.16) | 0.96 *** (64.27) | 0.05 ** (2.45) | 0.30 *** (13.41) | 0.86 | |||

| 0.28 *** (4.03) | −0.03 (−0.21) | 1.00 *** (67.70) | 0.12 *** (5.85) | 0.18 *** (6.38) | 0.27 *** (9.37) | 0.24 *** (5.65) | 0.88 | |

| 0.37 *** (5.43) | −0.12 (−0.92) | 0.98 *** (68.02) | 0.12 *** (6.12) | 0.13 *** (4.54) | 0.29 *** (10.39) | 0.27 *** (6.59) | −0.10 *** (−6.92) | 0.89 |

| S&P 500 | 0.39 *** (2.77) | 0.11 (1.28) | 0.20 *** (2.97) | 0.90 *** (28.26) | −0.16 *** (−3.99) | 9.53 |

| All survivors | 0.76 *** (5.44) | 0.14 * (1.79) | 0.14 ** (2.40) | 0.91 *** (34.06) | −0.20 *** (−5.43) | 10.69 |

| Dependent var. | Alpha | CRSPexcess | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|---|

| 0.27 *** (3.02) | 0.87 *** (40.75) | −0.80 *** (−20.27) | 0.10 ** (2.41) | 0.19 *** (4.35) | 0.05 (0.77) | 0.00 (0.08) | 0.75 | |

| −0.28 *** (−5.05) | 0.90 *** (68.29) | −0.85 *** (−36.06) | −0.05 * (−1.75) | 0.05 * (1.92) | −0.11 ** (−2.78) | 0.11 *** (7.77) | 0.90 |

| Alpha | Dummy | S&P 500 | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|---|

| 0.50 *** (5.99) | −0.32 ** (−2.47) | 0.86 *** (33.76) | 0.84 | |||||

| 0.35 *** (4.96) | −0.12 (−0.94) | 0.89 *** (62.46) | 0.08 ** (2.36) | 0.25 *** (4.38) | 0.88 | |||

| 0.23 *** (3.30) | −0.12 (−0.99) | 0.92 *** (63.69) | 0.15 *** (6.89) | 0.16 *** (4.99) | 0.26 *** (3.63) | 0.20 *** (5.30) | 0.90 | |

| 0.30 *** (4.20) | −0.19 * (−1.71) | 0.91 *** (62.52) | 0.15 *** (7.30) | 0.12 *** (3.86) | 0.27 *** (3.70) | 0.22 *** (6.13) | −0.08 *** (−2.75) | 0.90 |

| 1 | See https://fred.stlouisfed.org/series/DDOM01USA644NWDB (accessed on 14 January 2021). |

| 2 | As of February 2019 guidance. |

| 3 | The value of a stock’s market capitalization traded annually should be at least a quarter million dollars of its shares in each of the previous six months. |

| 4 | Additional possible advantages include reduced information asymmetry due to greater scrutiny by investors, increased investor recognition as an industry leader, and a decline in shadow costs. See studies by Denis et al. (2003), Chen et al. (2004), Baran and King (2012), and Chan et al. (2013). |

| 5 | For instance, the annualized sample average return varies between 13.63% per annum and 13.75% per annum for the arithmetic return and equal-weighted portfolios, respectively. |

| 6 | See https://www.globalpapermoney.com/s-p-releases-list-of-86-companies-in-the-s-p-500-since-1957-cms-1023 (accessed on 31 January 2022). |

| 7 | The question arises how does the non-survivorship manifest itself over time? The so-called Lindy law could explain this phenomenon. In this regard, Taleb points out that the Lindy effect (or law) corresponds to situations where the conditional expectation of additional life expectancy increases with time, which requires the survival function of survival time to be that of a power law. A discussion of this issue is provided in Taleb’s study “Lindy as a Distance from an Absorbing Barrier”, which is available at https://www.academia.edu/44944654 (accessed on 31 January 2022). Future research could elaborate on this issue and model the survival, respectively, non-survival functions for companies in the S&P 500. This issue is, however, beyond the scope of this study and therefore left for future research. |

| 8 | As a last resort, the stock name was used to find stock return data in the CRSP database. In this regard, a company could change names or the same company could have different stocks. It is important to note that companies could have similar names and one stock could be changed to another one as successor in the CRSP’s dataset. Additionally, ticker symbols for companies can change. Hence, we used the output produced from the CRSP database for tickers associated with corresponding company names. Finally, one stock does not necessarily mean one firm in the CRSP database. For instance, a firm could change its stock to be a different one. Moreover, a stock could also belong to different firms. As an example, firm A spins off into X, Y, and Z different firms. The original stock (in terms of its permno in CRSP) stays with firm X. However, the core business of firm A is actually in firm Z. Now firm Z is assigned a new stock (permno). When we have firm Z’s name, and we expand its history, we include the original stock for firm A. In the dataset, we used (to be more inclusive) the stock for firm A in the past as well as firm Z’s stock. |

| 9 | There are good reasons to use equal-weighted portfolios in the present study. Most importantly, market capitalization as a financial variable is pareto distributed, which means that if value-weighted portfolios were used, a very small number of stocks would receive extraordinarily high weights. Hence, value weighting would distort the overall portfolio return distribution. This distortion occurs when variables deviate from the normal distribution. Our sample stocks share one commonality—namely, survivorship. We are mainly interested in this common link, rather than potential size effects. |

| 10 | Because the kurtosis of the regression residuals is 9.87, one could argue that standard t-statistics are not valid for making statistical inference. If we assume a t-distribution with υ = 4.5 degrees of freedom, the corresponding kurtosis will be 15, which is much larger than 9.74. Using a 5% significance level, the critical value of this distribution is 2.66. Since the t-statistic of 7.01 well exceeds 2.66, we can safely deduce that our statistical inference is valid. |

| 11 | As an example, the survivor stock portfolio’s loading against the profitability factor exceeds the S&P 500′s loading by a factor of 6.5 implying that, on average, survivor stocks are considerably more profitable than the average S&P 500. |

| 12 | Peak exposure to the value factor was reached in February 2007 at an economic magnitude of 0.37. |

| 13 | Note that excess kurtosis is a stylized fact of financial market data. The use of the Gaussian distribution for modeling the conditional volatilities may lead to misleading results. For this reason, we employ t-distributions to model the innovation processes, which explicitly takes into account the fat-tailed data observed here. |

| 14 | Importantly, our higher cut-off of 3.39 decreases the likelihood that the performance of the survivor stock portfolio diminished in the ex post March 2007 period. Note that the t-statistic of −2.22 for our dummy variable in the CAPM model specification indicated a significant structural break on a common 5% level using standard critical values. |

| 15 | As precedent, Alexander and Dimitriu (2005) used Yahoo Finance. Data providers such as CRSP impose relatively high charges for data, whereas Yahoo Finance is freely available, thereby expanding research replicability to a larger audience of scholars. Many universities around the world do not subscribe to CRSP due to costs; in such cases, Yahoo Finance is available. |

| 16 | We found that 7.38% of RTX returns exceeded 100% in the sample period from February 1970 to December 2019. |

| 17 | These 14 survivor stocks with the longest available data are: Alcoa Corporation (AA), the Boeing Company (BA), Caterpillar Inc. (CAT), Chevron Corporation (CVX), DTE Energy Company (DTE), Consolidated Edison, Inc. (ED), General Electric Company (GE), Goodyear Tire & Rubber Company (GT), International Business Machines Corporation (IBM), International Paper Company (IP), Coca-Cola Company (KO), Altria Group, Inc. (MO), Procter & Gamble Company (PG), and the Exxon Mobil Corporation (XOM). These companies are very old and were originally established between 1823 and 1925. Ten of these 14 companies were originally founded before 1900. |

| 18 | We would like to thank an anonymous reviewer for suggesting this additional robustness check. |

| 19 | We thank an anonymous reviewer for suggesting this additional robustness check. |

References

- Afego, Pyemo N. 2017. Effects of changes in stock index compositions: A literature survey. International Review of Financial Analysis 52: 228–39. [Google Scholar] [CrossRef]

- Alexander, Carol, and Anca Dimitriu. 2005. Indexing and Statistical Arbitrage. Journal of Portfolio Management 31: 50–63. [Google Scholar] [CrossRef]

- Baran, Lindsay, and Tao-Hsien King. 2012. Cost of equity and S&P 500 index revisions. Financial Management 41: 457–81. [Google Scholar]

- Chan, Kalok, Hung Wan Kot, and Gordon Y. N. Tang. 2013. A comprehensive long-term analysis of S&P 500 index additions and deletions. Journal of Banking and Finance 37: 4920–30. [Google Scholar]

- Chen, Honghui, Gregory Noronha, and Vijay Singal. 2004. The price response to S&P 500 index additions and deletions: Evidence of asymmetry and a new explanation. Journal of Finance 59: 1901–29. [Google Scholar]

- Chen, Sheng-Syan, and Yueh-Hsiang Lin. 2018. The competitive effects of S&P 500 index revisions. Journal of Business Financial Accounting 45: 997–1027. [Google Scholar]

- Denis, Diane K., John J. McConnell, Alexei V. Ovtchinnikov, and Yun Yu. 2003. S&P 500 index additions and earnings expectations. Journal of Finance 58: 1821–40. [Google Scholar]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2015. A Five-Factor Asset Pricing Model. Journal of Financial Economics 116: 1–22. [Google Scholar] [CrossRef] [Green Version]

- Fama, Eugene F., and Kenneth R. French. 2018. Choosing Factors. Journal of Financial Economics 128: 234–52. [Google Scholar] [CrossRef]

- Foster, Richard, and Sarah Kaplan. 2001. Creative Destruction: Why Companies That Are Built to Last Underperform the Market and How to Successfully Transform Them. New York: Random House. [Google Scholar]

- Gnabo, Jean-Yves, Lyudmyla Hvozdyk, and Jérôme Lahaye. 2014. System-wide tail comovements: A bootstrap test for cojump identification on the S&P 500, US bonds and currencies. Journal of International Money and Finance 48: 147–74. [Google Scholar]

- Harvey, Campbell R., Yan Liu, and Heqing Zhu. 2016. … and the cross-section of expected returns. Review of Financial Studies 29: 5–68. [Google Scholar] [CrossRef] [Green Version]

- Hou, Kewei, Chen Xue, and Lu Zhang. 2020. Replicating Anomalies. Review of Financial Studies 33: 2019–133. [Google Scholar] [CrossRef]

- Newey, Whitney K., and Kenneth D. West. 1987. A Simple, Positive Semi-definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix. Econometrica 55: 703–8. [Google Scholar] [CrossRef]

- Platikanova, Petya. 2016. S&P 500 index addition, liquidity management and Tobin’s Q. Accounting and Finance 56: 479–508. [Google Scholar]

- Shankar, Gowri S., and James M. Miller. 2006. Market Reaction to Changes in the S&P SmallCap 600 Index. Financial Review 41: 339–60. [Google Scholar]

- Siegel, Jeremy J., and Jeremy D. Schwartz. 2006. Long-term returns on the original S&P 500 companies. Financial Analysts Journal 62: 18–31. [Google Scholar]

- Taleb, Nassim N. 2012. Antifragile. New York: Penguin Books. [Google Scholar]

| S&P 500 | SMB | HML | RMW | CMA | UMD | ||

|---|---|---|---|---|---|---|---|

| Mean | 1.05 | 0.65 | 0.21 | 0.26 | 0.26 | 0.26 | 0.66 |

| Median | 1.28 | 0.91 | 0.09 | 0.25 | 0.22 | 0.11 | 0.71 |

| Maximum | 15.25 | 16.30 | 18.05 | 12.60 | 13.38 | 9.56 | 18.36 |

| Minimum | −18.67 | −21.76 | −14.86 | −14.11 | −18.48 | −6.86 | −34.39 |

| Std. dev. | 3.94 | 4.27 | 3.02 | 2.87 | 2.17 | 1.99 | 4.19 |

| Skewness | −0.36 | −0.44 | 0.33 | 0.01 | −0.33 | 0.32 | −1.28 |

| Kurtosis | 5.22 | 4.87 | 6.02 | 5.39 | 15.38 | 4.61 | 13.19 |

| Alpha | S&P 500 | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|

| 0.43 *** (7.11) | 0.86 *** (60.11) | 0.84 | |||||

| 0.32 *** (5.97) | 0.89 *** (68.02) | 0.08 *** (4.63) | 0.26 *** (13.39) | 0.88 | |||

| 0.21 *** (4.10) | 0.92 *** (72.51) | 0.15 *** (8.39) | 0.16 *** (6.61) | 0.26 *** (10.41) | 0.20 *** (5.36) | 0.90 | |

| 0.26 *** (5.16) | 0.91 *** (72.56) | 0.15 *** (8.75) | 0.13 *** (5.09) | 0.27 *** (11.31) | 0.22 *** (6.14) | −0.07 *** (−6.11) | 0.90 |

| Dependent var. | Alpha | CRSPexcess | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|---|

| 0.03 (0.60) | 0.91 *** (74.79) | −0.00 (−0.00) | 0.15 *** (6.04) | 0.33 *** (13.98) | 0.26 *** (7.49) | −0.09 *** (−7.70) | 0.91 | |

| −0.25 *** (−15.81) | 1.00 *** (262.94) | −0.16 *** (−30.46) | 0.02 *** (3.08) | 0.06 *** (7.89) | 0.04 *** (3.48) | −0.02 *** (−5.16) | 0.99 |

| Alpha | Dummy | S&P 500 | SMB | HML | RMW | CMA | UMD | R2 |

|---|---|---|---|---|---|---|---|---|

| 0.50 *** (7.33) | −0.32 ** (−2.22) | 0.86 *** (60.33) | 0.84 | |||||

| 0.35 *** (5.67) | −0.12 (−0.91) | 0.89 *** (68.01) | 0.08 *** (4.58) | 0.25 *** (13.22) | 0.88 | |||

| 0.23 *** (4.08) | −0.12 (−1.00) | 0.92 *** (72.52) | 0.15 *** (8.34) | 0.16 *** (6.51) | 0.26 *** (10.41) | 0.20 *** (5.37) | 0.90 | |

| 0.30 *** (5.33) | −0.19 * (−1.65) | 0.91 *** (72.66) | 0.15 *** (8.68) | 0.12 *** (4.90) | 0.27 *** (11.33) | 0.22 *** (6.17) | −0.08 *** (−6.25) | 0.90 |

| S&P 500 | 0.39 *** (2.77) | 0.11 (1.28) | 0.20 *** (2.97) | 0.90 *** (28.26) | −0.16 *** (−3.99) | 9.53 |

| All survivors | 0.69 *** (5.23) | 0.13 * (1.92) | 0.11 ** (2.09) | 0.92 *** (36.31) | −0.19 *** (−5.39) | 10.95 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grobys, K. On Survivor Stocks in the S&P 500 Stock Index. J. Risk Financial Manag. 2022, 15, 95. https://doi.org/10.3390/jrfm15020095

Grobys K. On Survivor Stocks in the S&P 500 Stock Index. Journal of Risk and Financial Management. 2022; 15(2):95. https://doi.org/10.3390/jrfm15020095

Chicago/Turabian StyleGrobys, Klaus. 2022. "On Survivor Stocks in the S&P 500 Stock Index" Journal of Risk and Financial Management 15, no. 2: 95. https://doi.org/10.3390/jrfm15020095

APA StyleGrobys, K. (2022). On Survivor Stocks in the S&P 500 Stock Index. Journal of Risk and Financial Management, 15(2), 95. https://doi.org/10.3390/jrfm15020095