The Profitability of Technical Analysis during the COVID-19 Market Meltdown

Abstract

:1. Introduction

2. Methodology

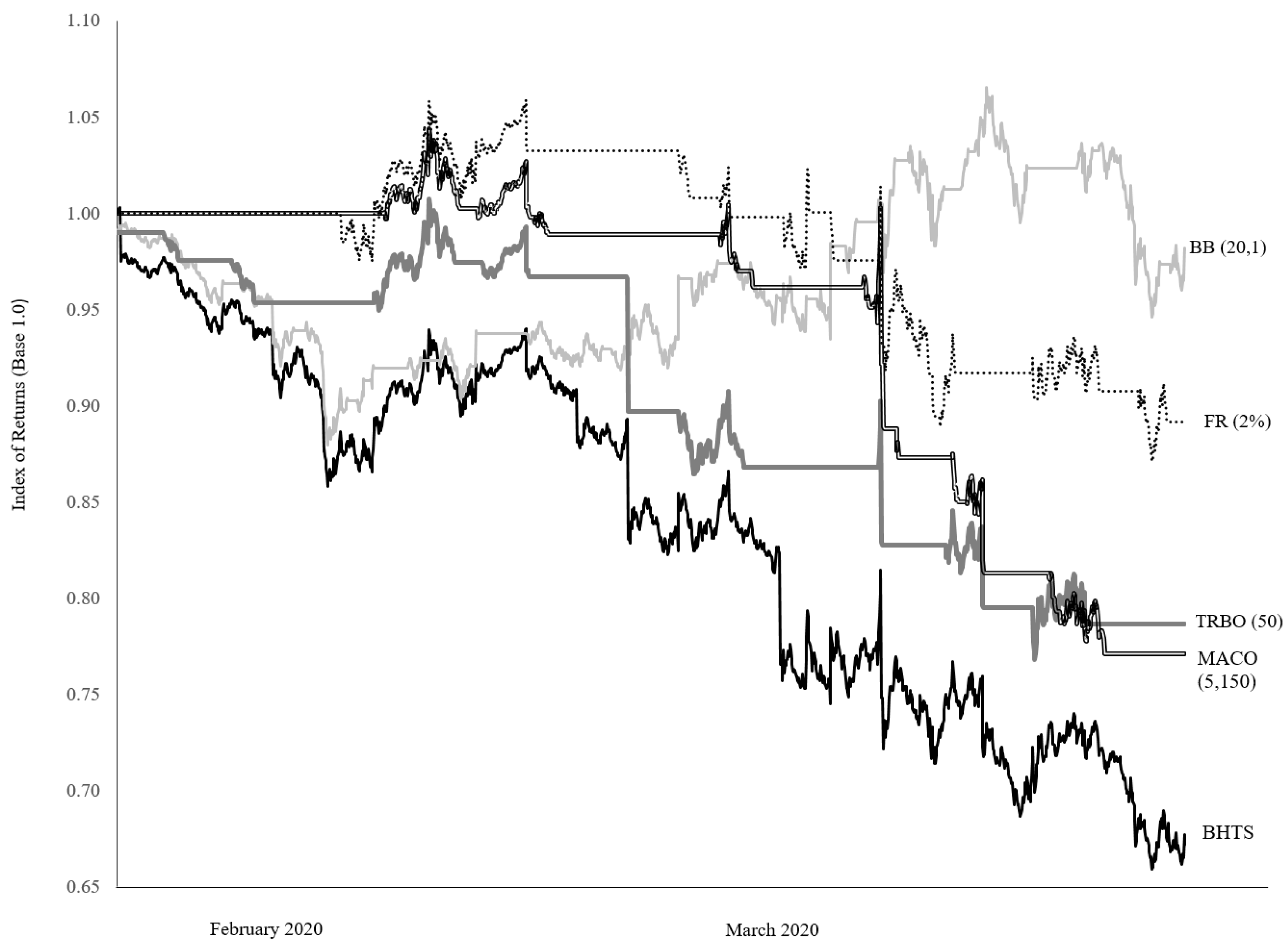

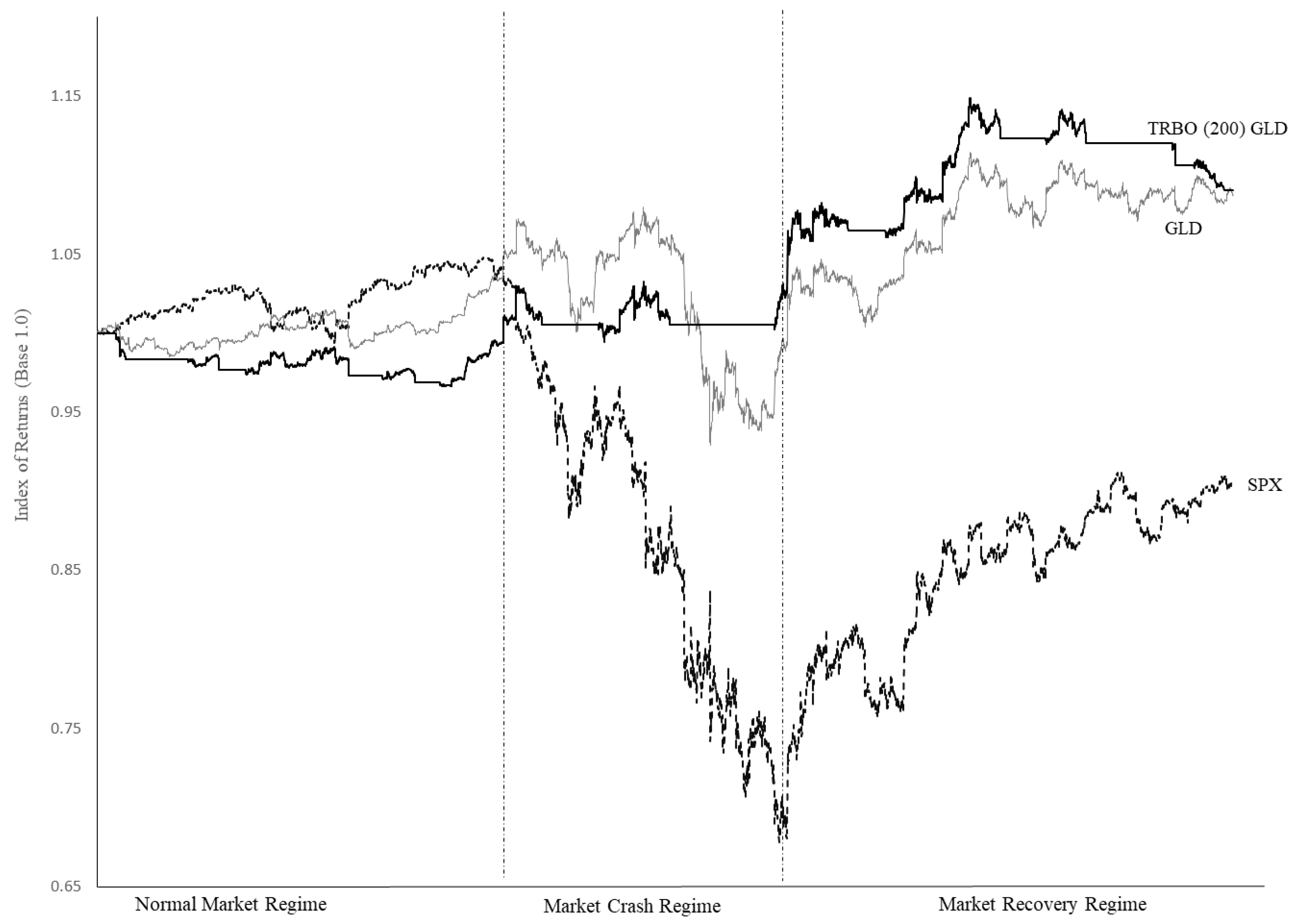

2.1. Trading Rules

2.2. Profitability Measures

2.3. Bootstrapping Simulations

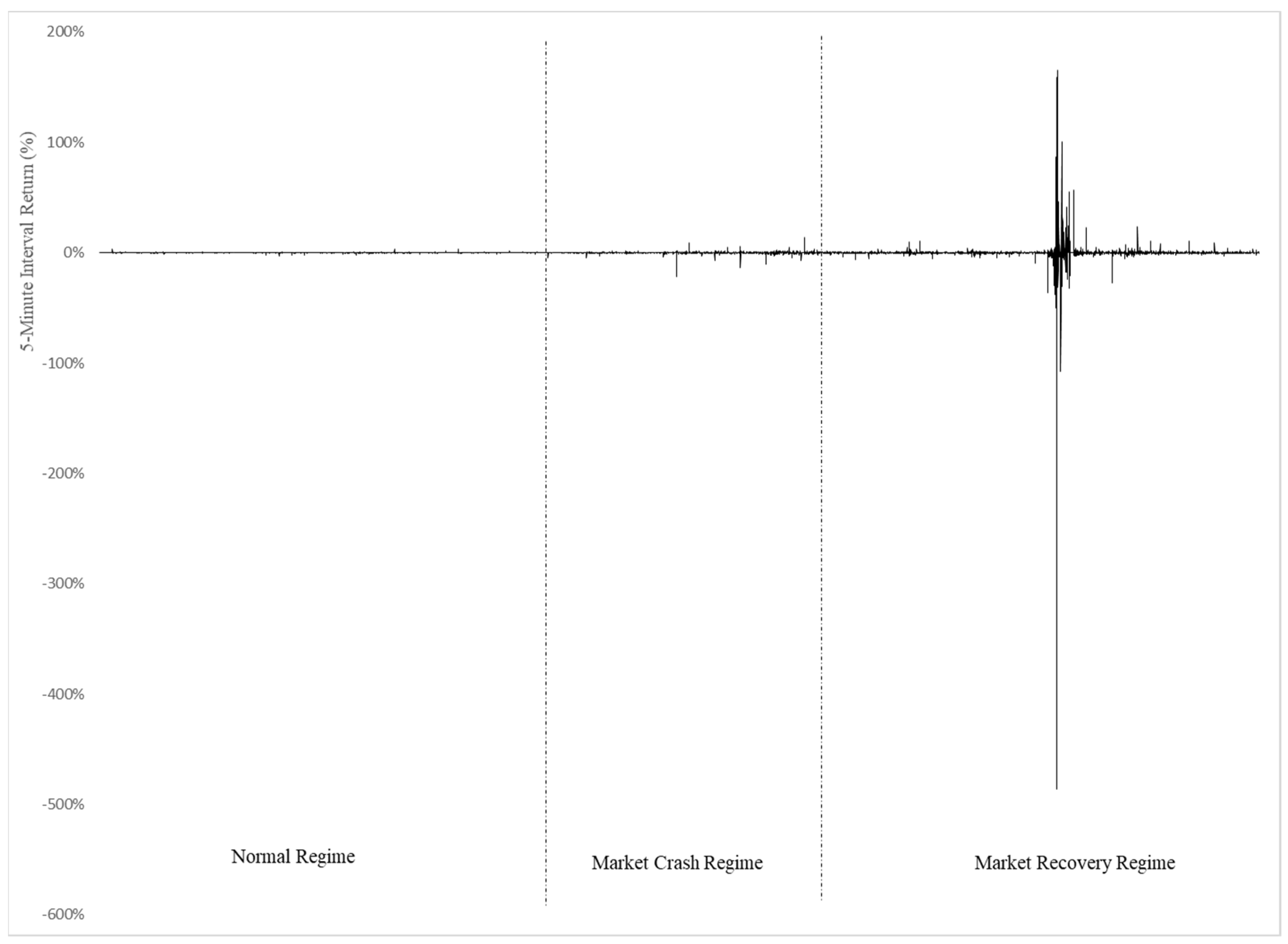

3. Data

4. Results

5. Discussion and Analysis

6. CSA Trading Strategy

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Number of Trade Signal Generated by TR

| BTC | GLD | SPX | VIX | WTI | |

|---|---|---|---|---|---|

| MACO (1,50) | 475 (146/109/212) | 458 (159/91/207) | 456 (164/114/175) | 559 (218/133/204) | 427 (156/93/169) |

| MACO (1,200) | 133 (44/25/43) | 165 (32/34/99) | 221 (97/56/66) | 261 (128/53/63) | 174 (62/43/57) |

| MACO (5,150) | 99 (22/24/45) | 108 (30/32/45) | 119 (47/26/44) | 135 (65/33/33) | 90 (36/21/30) |

| BB (20,2) | 585 (189/134/251) | 585 (185/133/264) | 579 (201/142/231) | 574 (219/132/219) | 525 (193/121/204) |

| BB (20,1) | 766 (269/173/305) | 765 (242/185/333) | 703 (254/182/261) | 736 (288/177/267) | 697 (262/169/254) |

| BB (30,2) | 477 (158/115/189) | 478 (156/108/211) | 422 (157/110/150) | 474 (175/122/172) | 428 (167/94/159) |

| FR (1%) | 278 (60/123/82) | 50 (2/37/10) | 223 (3/164/55) | 1,447 (408/574/464) | 765 (36/201/527) |

| FR (2%) | 112 (19/57/28) | 9 (0/7/1) | 21 (0/49/16) | 729 (169/389/170) | 330 (8/85/236) |

| FR (5%) | 21 (2/11/6) | 0 (0/0/0) | 9 (0/8/0) | 170 (26/117/27) | 94 (0/17/77) |

| TRBO (50) | 447 (174/106/107) | 501 (164/58/127) | 557 (208/38/55) | 501 (165/65/69) | 468 (149/39/527) |

| TRBO (150) | 254 (100/52/70) | 306 (104/34/75) | 323 (124/6/140) | 271 (80/45/22) | 283 (89/8/91) |

| TRBO (200) | 226 (84/46/84) | 272 (90/28/106) | 287 (111/2/93) | 229 (65/40/107) | 265 (81/5/52) |

Appendix B. TTR Sharpe Ratios across the Full Sample

| SRs for the MACO TTRs | ||||||

| MACO (1,50) | MACO (1,200) | MACO (5,150) | ||||

| Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | |

| BTC | −1.719 | −4.097 | −1.248 | −2.111 | −2.125 | −2.575 |

| GLD | −4.110 | −5.785 | 0.698 | −8.889 | 0.640 | −6.270 |

| OIL | 3.151 | 4.027 | 9.112 | 6.560 | 2.328 | 2.527 |

| SPX | −1.632 | −4.458 | −0.305 | −3.061 | 0.517 | −1.635 |

| VIX | −11.494 | −14.189 | −2.533 | −4.653 | −1.801 | −2.863 |

| SRs for the BB TTRs | ||||||

| BB (20,2) | BB (20,1) | BB (30,2) | ||||

| Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | |

| BTC | 1.367 | −3.916 | 1.657 | −5.323 | 0.995 | −3.868 |

| GLD | 0.245 | −6.345 | 0.149 | −6.095 | −3.115 | −6.461 |

| OIL | −3.334 | −4.633 | −0.826 | −2.978 | −2.946 | −3.928 |

| SPX | 4.890 | −2.258 | 4.058 | −3.226 | 4.820 | −2.005 |

| VIX | 0.394 | 0.383 | 0.398 | 0.326 | 0.412 | 0.305 |

| SRs for the FR TTRs | ||||||

| FR (1%) | FR (2%) | FR (5%) | ||||

| Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | |

| BTC | −1.598 | −2.387 | −1.083 | −1.471 | 0.226 | 0.081 |

| GLD | −1.729 | −3.238 | −0.274 | −0.382 | 0.000 | 0.000 |

| OIL | 2.322 | 3.120 | 1.192 | 1.419 | 1.260 | 1.333 |

| SPX | 1.308 | −0.719 | 4.608 | 3.829 | 4.514 | 4.550 |

| VIX | −1.391 | −12.266 | −6.640 | −10.814 | −2.388 | −2.820 |

| SRs for the TRBO TTRs | ||||||

| TRBO (50) | TRBO (150) | TRBO (200) | ||||

| Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | Before Tx Costs | After Tx Costs | |

| BTC | −1.009 | −1.488 | 1.688 | 1.544 | 1.107 | 0.862 |

| GLD | 0.863 | −1.965 | −0.067 | −1.272 | 0.576 | 0.044 |

| OIL | 3.310 | 3.507 | 11.604 | 11.083 | 7.292 | 6.757 |

| SPX | 1.563 | −0.779 | 1.688 | 0.866 | 5.103 | 4.415 |

| VIX | −4.850 | −6.415 | −0.618 | −0.721 | 0.264 | 0.237 |

Appendix C. TTR Profitability across COVID-19 Market Meltdown Market Regimes

| TTR Profitability across the Normal Market Regime | ||||||||||||

| MACO | MACO | MACO | BB | BB | BB | FR | FR | FR | TRBO | TRBO | TRBO | |

| (1,50) | (1,200) | (5,150) | (20,2) | (20,1) | (30,2) | (1%) | (2%) | (5%) | (50) | (150) | (200) | |

| BTC | −0.73% −1.36% | −0.44% −0.64% | −0.45% −0.55% | −0.49% −0.81% | −0.34% −0.91% | −0.61% −0.87% | −0.29% −0.42% | −0.44% −0.48% | −0.74% −0.75% | −0.54% −0.67% | −0.36% −0.40% | −0.61% −0.64% |

| GLD | −0.06% −0.75% | −0.01% −0.16% | 0.02% −0.12% | −0.08% −0.47% | −0.14% −0.69% | −0.13% −0.43% | −0.03% −0.04% | −0.16% −0.16% | −0.16% −0.16% | −0.07% −0.19% | −0.08% −0.13% | −0.09% −0.13% |

| OIL | −0.01% −0.69% | 0.33% 0.04% | 0.36% 0.20% | 0.39% −0.01% | 0.52% −0.09% | 0.53% 0.21% | 0.08% 0.01% | 0.36% 0.35% | 0.42% 0.42% | 0.06% −0.08% | 0.48% 0.45% | 0.47% 0.45% |

| SPX | −0.10% −0.82% | −0.08% −0.53% | −0.04% −0.26% | 0.04% −0.40% | 0.06% −0.63% | −0.01% −0.36% | −0.01% −0.01% | −0.13% −0.13% | −0.13% −0.13% | −0.12% −0.29% | −0.08% −0.13% | −0.07% −0.10% |

| VIX | −1.89% −2.82% | −1.30% −1.88% | −0.82% −1.11% | 1.81% * 1.30% * | 1.95% * 1.16% * | 1.22% 0.82% | −1.26% −2.37% | −0.84% −1.23% | −0.70% −0.75% | −1.62% −1.82% | −0.46% −0.51% | −0.34% −0.37% |

| TTR Profitability across the Market Crash Regime | ||||||||||||

| MACO | MACO | MACO | BB | BB | BB | FR | FR | FR | TRBO | TRBO | TRBO | |

| (1,50) | (1,200) | (5,150) | (20,2) | (20,1) | (30,2) | (1%) | (2%) | (5%) | (50) | (150) | (200) | |

| BTC | −0.17% −0.85% | 0.38% 0.19% | 0.38% 0.12% | 2.17% ** 1.78% ** | 2.12% ** 1.60% ** | 2.18% *** 1.84% *** | −0.44% −0.95% | 0.00% −0.23% | 2.10% *** 2.08% ** | −0.57% −0.72% | 1.85% *** 1.82% *** | 1.68% ** 1.66% ** |

| GLD | 0.17% −0.39% | 0.44% ** 0.21% ** | 0.44% ** 0.18% ** | 0.24% * −0.13% | 0.27% * −0.33% | 0.13% −0.17% | 0.00% −0.11% | 0.19% 0.18%* | 0.15% 0.15% | 0.28% ** 0.15% ** | 0.10% 0.04% | 0.50% ** 0.47% ** |

| OIL | 2.67% 2.12% | 2.34% 2.06% | 2.34% 2.62% | 1.42% 1.10% | 3.09% 2.57% | 1.69% 1.45% | 1.94% 1.23% | 3.71% 3.47% | 3.19% 3.15% | 3.14% 3.05% | 3.14% 3.11% | 2.92% 2.89% |

| SPX | −0.02% −0.69% | 0.47% 0.09% | 0.47% 0.57% * | 1.96% *** 1.59% *** | 2.00% *** 1.45% *** | 1.55% ** 1.29% *** | 0.37% −0.19% | 1.36% ** 1.21% ** | 1.46% ** 1.45% ** | 0.79% ** 0.66% ** | 0.89% * 0.85% * | 1.37% *** 1.36% *** |

| VIX | −8.45% −9.23% | −3.80% −4.17% | −3.80% −4.10% | 1.61% * 1.18% | 1.22% 0.62% | −0.92% −1.27% | −2.58% −5.39% | −4.83% −6.36% | −5.72% −6.13% | −3.67% −3.80% | −4.77% −4.83% | −1.40% −1.43% |

| TTR Profitability across the Market Recovery Regime | ||||||||||||

| MACO | MACO | MACO | BB | BB | BB | FR | FR | FR | TRBO | TRBO | TRBO | |

| (1,50) | (1,200) | (5,150) | (20,2) | (20,1) | (30,2) | (1%) | (2%) | (5%) | (50) | (150) | (200) | |

| BTC | −0.58% −1.46% | −0.30% −0.48% | −0.79% −0.98% | −0.59% −1.07% | −0.46% −1.17% | −0.78% −1.16% | −0.20% −0.32% | −0.25% −0.28% | −0.61% −0.62% | −0.25% −0.35% | −0.37% −0.40% | −0.22% −0.24% |

| GLD | −0.24% −1.07% | −0.14% −0.53% | −0.16% −0.35% | 0.06% −0.42% | 0.10% −0.59% | 0.00% −0.33% | −0.13% −0.15% | −0.12% −0.13% | −0.17% −0.17% | −0.01% −0.14% | −0.09% −0.14% | −0.06% −0.10% |

| OIL | 4.19% ** 3.47% ** | 1.54% 1.32% | 6.05% ** 5.92% ** | −3.89% −4.25% | −3.29% −3.81% | −3.84% −4.08% | 5.22% * 3.72% * | 6.81% ** 6.16% ** | 7.10% ** 6.49% ** | 3.61% * 3.49% * | 1.20% 1.17% | 0.17% 0.14% |

| SPX | −0.27% −0.98% | −0.30% −0.59% | −0.28% −0.46% | −0.49% −0.86% | −0.37% −0.90% | −0.53% −0.78% | 0.09% −0.01% | −0.28% −0.31% | −0.62% −0.62% | −0.08% −0.20% | −0.13% −0.17% | −0.29% −0.32% |

| VIX | 0.39% −0.38% | 1.32% 1.05% | 1.69% 1.55% | 1.09% 0.72% | 0.91% 0.36% | 1.05% 0.78% | 1.05% −0.02% | 0.65% 0.27% | 1.53%* 1.49% | 1.18% 1.03% | 1.63% 1.58% | 1.46% 1.44% |

Appendix D. CSA Strategy Profits across the COVID-19 Market Meltdown Market Regimes

| TTR Profitability across the normal market regime | |||||

| BTC | GLD | SPX | VIX | WTI | |

| CSA (6/12) | −0.37% −0.58% | −0.01% −0.22% | 0.00% −0.41% | −0.51% −1.01% | 0.48% 0.29% |

| CSA (7/12) | −0.24% −0.38% | −0.05% −0.27% | −0.07% −0.61% | −0.19% −0.56% | 0.53% 0.40% |

| CSA (8/12) | −0.24% −0.36% | −0.07% −0.39% | −0.09% −0.49% | 0.21% −0.41% | 0.46% 0.34% |

| CSA (9/12) | −0.86% −1.04% | −0.04% −0.34% | −0.15% −0.28% | −0.58% −1.11% | 0.59% 0.45% |

| CSA (10/12) | −0.91% −1.14% | −0.10% −0.14% | −0.15% −0.16% | −0.10% −0.18% | 0.58% 0.52% |

| CSA (11/12) | −0.92% −1.16% | −0.10% −0.10% | −0.15% −0.15% | −0.11% −0.12% | 0.54% 0.51% |

| TTR Profitability across the market crash regime | |||||

| BTC | GLD | SPX | VIX | WTI | |

| CSA (6/12) | 1.73% 1.44% | 0.35% 0.01% | 1.25% 0.92% | −3.43% −4.18% | 3.27% 2.93% |

| CSA (7/12) | 1.68% 1.53% | 0.50% 0.28% | 1.17% 0.97% | −1.83% −2.64% | 2.66% 2.38% |

| CSA (8/12) | 1.51% 1.31% | 0.45% 0.27% | 1.17% 1.05% | −3.18% −4.53% | 3.82% 3.68% |

| CSA (9/12) | 2.14% 1.89% | 0.28% 0.14% | 1.64% 1.60% | −4.01% −5.36% | 3.74% 3.64% |

| CSA (10/12) | 1.86% 1.79% | 0.33% 0.32% | 1.66% 1.61% | −4.38% −4.75% | 3.88% 3.85% |

| CSA (11/12) | 1.97% 1.97% | 0.35% 0.35% | 1.68% 1.68% | −4.22% −4.44% | 3.89% 3.89% |

| TTR Profitability across the market recovery regime | |||||

| BTC | GLD | SPX | VIX | WTI | |

| CSA (6/12) | −0.28% −0.40% | −0.11% −0.42% | −0.10% −0.39% | 1.42% 1.01% | 5.70% 5.33% |

| CSA (7/12) | −0.19% −0.24% | −0.11% −0.39% | −0.27% −0.54% | 1.92% 1.64% | −0.17% −0.47% |

| CSA (8/12) | −0.21% −0.45% | −0.08% −0.38% | −0.30% −0.62% | 2.43% 2.19% | 0.84% 0.45% |

| CSA (9/12) | −0.31% −0.78% | −0.11% −0.35% | −0.53% −0.79% | 1.75% 1.42% | 0.22% −0.29% |

| CSA (10/12) | −0.86% −1.29% | −0.14% −0.24% | −0.39% −0.52% | 2.12% 2.06% | −1.28% −1.49% |

| CSA (11/12) | −1.24% −1.43% | −0.14% −0.15% | −0.40% −0.40% | 2.24% 2.22% | −1.24% −1.29% |

| 1 | See and Nazário et al. (2017) and Neely and Weller (2012) for extensive surveys on the application of technical analysis in financial markets. |

| 2 | The returns calculated in this study are based on spot indices and therefore may not reflect a true return that would include components, such as a dividend yield (e.g., the S&P 500), convenience yield (e.g., gold), and holding cost (e.g., gold and oil commodities). Investors employing a trading strategy using actual futures contracts (or ETFs) would incorporate such components into their return measures. |

| 3 | We also calculated the percentage of the individual technical indicators that are significantly profitable (at both the 1-day and 10-day lags) to the percentage that would exist by chance assuming a random walk with a drift. The un-tabulated results reveal that the sell signals were more profitable than the buy signals for the VIX and OIL markets driven by the MACO, BB, and TRBO rules. However, buy signals were more profitable for the BTC and GLD mainly driven by the MACO trading rules. These results are not reported for brevity, but they can be available upon request from the authors. We thank the three anonymous referees and the Editor for this and other useful suggestions. |

| 4 | In a related paper, Xu et al. (2020) found predictability in the volatility indices of commodity exchange-traded funds, especially on days with higher volatility and larger jumps. It is important to note that volatility indices cannot be traded directly, but by constructing a portfolio of options that replicates the volatility index. Moreover, recently, Wang et al. (2022) showed that multiscale trading strategies based on the VIX may be possible. |

References

- Akhtaruzzaman, Md, Sabri Boubaker, Brian Lucey, and Ahmet Sensoy. 2021. Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Economic Modelling 102: 105588. [Google Scholar] [CrossRef]

- Allen, Franklin, and Risto Karjalainen. 1999. Using genetic algorithms to find technical trading rules. Journal of Financial Economics 51: 245–71. [Google Scholar] [CrossRef]

- Alonso-Monsalve, Saul, Andres L. Suárez-Cetrulo, Alejandro Cervantes, and David Quintana. 2020. Convolution on neural networks for high-frequency trend prediction of cryptocurrency exchange rates using technical indicators. Expert Systems with Applications 149: 113250. [Google Scholar] [CrossRef]

- Areal, Nelson, Benilde Oliveira, and Raquel Sampaio. 2015. When Times Get Tough, Gold is Golden. The European Journal of Finance 21: 507–26. [Google Scholar] [CrossRef]

- Avramov, Doron, Guy Kaplanski, and Avanidhar Subrahmanyam. 2021. Moving average distance as a predictor of equity returns. Review of Financial Economics 39: 127–45. [Google Scholar] [CrossRef]

- Baur, Dirk G., Hubert Dichtl, Wolfgang Drobetz, and Viktoria-Sophie Wendt. 2020. Investing in gold–Market timing or buy-and-hold? International Review of Financial Analysis 71: 101281. [Google Scholar] [CrossRef]

- Beaupain, Renaud, Lei Meng, and Romain Belair. 2010. The impact of volatility on the implementation of the relative strength index: Evidence from the Shanghai stock exchange. Insurance Markets and Companies 1: 73–78. [Google Scholar]

- Bettman, Jenni L., Stephen J. Sault, and Emma L. Schultz. 2009. Fundamental and technical analysis: Substitutes or complements? Accounting & Finance 49: 21–36. [Google Scholar]

- Bollinger, John. 2001. Bollinger on Bollinger Bands. New York: McGraw-Hill. [Google Scholar]

- Bouri, Elie, Chi Keung Marco Lau, Tareq Saeed, Shixuan Wang, and Yuqian Zhao. 2021. On the intraday return curves of Bitcoin: Predictability and trading opportunities. International Review of Financial Analysis 76: 101784. [Google Scholar] [CrossRef]

- Bredin, Don, Thomas Conlon, and Valerio Poti. 2015. Does gold glitter in the long-run? Gold as a hedge and safe haven across time and investment horizon. International Review of Financial Analysis 41: 320–28. [Google Scholar] [CrossRef]

- Brock, William, Josef Lakonishok, and Blake LeBaron. 1992. Simple Technical Trading Rules and the Stochastic Properties of Stock Returns. Journal of Finance 47: 1931–1764. [Google Scholar] [CrossRef]

- Buccioli, Alice, and Thomas Kokhol. 2021. Shock waves and golden shores: The asymmetric interaction between gold prices and the stock market. The European Journal of Finance, 1–18. [Google Scholar] [CrossRef]

- Chalmers, John, Aditya Kaul, and Blake Philips. 2013. The wisdom of crowds: Mutual fund investors’ aggregate asset allocation decisions. Journal of Banking & Finance 37: 3318–33. [Google Scholar]

- Chang, Kevin P. H., and Carol L. Osler. 1999. Methodical madness: Technical analysis and the irrationality of exchange-rate forecasts. Economic Journal 109: 636–61. [Google Scholar] [CrossRef]

- Chau, Michael, Chih-Yung Lin, and Tse-Chun Lin. 2020. Wisdom of crowds before the 2007–2009 global financial crisis. Journal of Financial Stability 48: 100741. [Google Scholar] [CrossRef]

- Corbet, Shaen, Veysel Eraslan, Brian Lucey, and Ahmet Sensoy. 2019. The effectiveness of technical trading rules in cryptocurrency markets. Finance Research Letters 31: 32–37. [Google Scholar] [CrossRef]

- Ding, Wenjie, Khelifa Mazouz, and Qinqwei Wang. 2021. Volatility timing, sentiment, and the short-term profitability of VIX-based cross-sectional trading strategies. Journal of Empirical Finance 63: 42–56. [Google Scholar] [CrossRef]

- Fang, Jiali, Ben Jacobsen, and Yafeng Qin. 2017. Popularity versus Profitability: Evidence from Bollinger Bands. The Journal of Portfolio Management 43: 152–59. [Google Scholar] [CrossRef]

- Gençay, Ramazan. 1998. Optimization of technical trading strategies and the profitability in security markets. Economic Letters 59: 249–54. [Google Scholar] [CrossRef]

- Gerritsen, Dirk F., Elie Bouri, Ehsan Ramezanifar, and David Roubaud. 2020. The profitability of technical trading rules in the Bitcoin market. Finance Research Letters 34: 101263. [Google Scholar] [CrossRef]

- Gradojevic, Nikola. 2007. Non-linear, hybrid exchange rate modeling and trading profitability in the foreign exchange market. Journal of Economic Dynamics and Control 31: 557–74. [Google Scholar] [CrossRef]

- Gradojevic, Nikola, and Ramazan Gençay. 2013. Fuzzy logic, trading uncertainty and technical trading. Journal of Banking and Finance 37: 578–86. [Google Scholar] [CrossRef]

- Gradojevic, Nikola, Dragan Kukolj, Robert Adcock, and Vladimir Djakovic. 2021. Forecasting Bitcoin with technical analysis: A not-so-random forest? International Journal of Forecasting, in press. [Google Scholar] [CrossRef]

- Han, Yufeng, Ke Yang, and Guofu Zhou. 2013. A new anomaly: The cross-sectional profitability of technical analysis. Journal of Financial and Quantitative Analysis 48: 1433–61. [Google Scholar] [CrossRef]

- Hertwig, Ralph. 2012. Tapping into the wisdom of the crowd–with confidence. Science 336: 303–4. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hsu, Po-Hsuan, Mark P. Taylor, and Zigan Wang. 2016. Technical trading: Is it still beating the foreign exchange market? Journal of International Economics 102: 188–208. [Google Scholar] [CrossRef] [Green Version]

- Ivanova, Yuliya, Christopher J. Neely, Paul Weller, and Matthew T. Famiglietti. 2021. Can risk explain the profitability of technical trading in currency markets? Journal of International Money and Finance 110: 102285. [Google Scholar] [CrossRef]

- Jiang, Fuwei, Guoshi Tong, and Guokai Song. 2017. Technical Analysis Profitability Without Data Snooping Bias: Evidence from Chinese Stock Market. International Review of Finance 19: 191–206. [Google Scholar] [CrossRef] [Green Version]

- Jin, Xiaoye. 2021. What do we know about the popularity of technical analysis in foreign exchange markets? A skewness preference perspective. Journal of International Financial Markets, Institutions and Money 71: 101281. [Google Scholar] [CrossRef]

- Kho, Bong-Chan. 1996. Time-varying risk premia, volatility, and technical trading rule profits: Evidence from foreign currency futures markets. Journal of Financial Economics 41: 249–90. [Google Scholar] [CrossRef]

- Kirkpatrick, Charles D., and Julie R. Dahlquist. 2016. Technical Analysis: The Complete Resource for Financial Market Technicians. Singapore: Pearson Professional Education. [Google Scholar]

- Kouaissah, Noureddine, and Amin Hocine. 2020. Forecasting systemic risk in portfolio selection: The role of technical trading rules. Journal of Forecasting 40: 708–29. [Google Scholar] [CrossRef]

- Kozyra, James, and Camillo Lento. 2011. Using VIX data to enhance technical trading signals. Applied Economics Letters 18: 1367–70. [Google Scholar] [CrossRef]

- Kwapień, Jaroslaw, Marcin Wątorek, and Stanislaw Drożdż. 2021. Cryptocurrency Market Consolidation in 2020–2021. Entropy 23: 1674. [Google Scholar] [CrossRef] [PubMed]

- Lento, Camillo. 2009. Combined signal approach: Evidence from the Asian–Pacific equity markets. Applied Economics Letters 16: 749–53. [Google Scholar] [CrossRef]

- Lento, Camillo, and Nikola Gradojevic. 2007. The Profitability of Technical Trading Rules: A Combined Signal Approach. Journal of Applied Business Research 23: 13–28. [Google Scholar] [CrossRef] [Green Version]

- Lento, Camillo, and Nikola Gradojevic. 2021. S&P 500 Index Price Spillovers around the COVID-19 Market Meltdown. Journal of Risk and Financial Management 14: 330. [Google Scholar]

- Lento, Camillo, Nikola Gradojevic, and Chris S. Wright. 2007. Investment information content in Bollinger Bands? Applied Financial Economics Letters 3: 263–67. [Google Scholar] [CrossRef]

- Levich, Richard M., and Lee R. Thomas. 1993. The Significance of Technical Trading Rules Profits in the Foreign Exchange Market: A Bootstrap Approach. Journal of International Money and Finance 12: 451–74. [Google Scholar] [CrossRef] [Green Version]

- Lo, Andrew W. 2004. The adaptive markets hypothesis: Market efficiency from an evolutionary perspective. Journal of Portfolio Management 30: 15–29. [Google Scholar] [CrossRef]

- Lo, Andrew W., Harry Mamaysky, and Jiang Wang. 2000. Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. Journal of Finance 55: 1705–65. [Google Scholar] [CrossRef] [Green Version]

- M’ng, Jacinta Chan Phooi. 2018. Dynamically Adjustable Moving Average (AMA’) technical analysis indicator to forecast Asian Tigers’ futures markets. Physica A: Statistical Mechanics and Its Applications 509: 336–45. [Google Scholar] [CrossRef]

- Makarov, Igor, and Antoinette Schoar. 2020. Trading and arbitrage in cryptocurrency markets. Journal of Financial Economics 135: 293–319. [Google Scholar] [CrossRef] [Green Version]

- Marshall, Ben. R., Nhut H. Nguyen, and Nuttawat Visaltanachoti. 2017. Time series momentum and moving average trading rules. Quantitative Finance 17: 405–21. [Google Scholar] [CrossRef]

- Menkhoff, Lukas, and Mark P. Taylor. 2007. The obstinate passion of foreign exchange professionals: Technical analysis. Journal of Economic Literature 45: 936–72. [Google Scholar] [CrossRef] [Green Version]

- Menkhoff, Lukas, Lucio Sarno, Maik Schmeling, and Andreas Scrimpf. 2012. Carry trades and global foreign exchange volatility. Journal of Finance 67: 681–718. [Google Scholar] [CrossRef] [Green Version]

- Narayan, Paresh Kumar, Seema Narayan, and Susan Sunila Sharma. 2013. An analysis of commodity markets: What gain for investors? Journal of Banking and Finance 37: 3878–89. [Google Scholar] [CrossRef]

- Nazário, Rodolfo Toribio Farias, Jessica Lima Silva, Vinicius Amorim Sobreiro, and Herbert Kimura. 2017. A literature review of technical analysis on stock markets. The Quarterly Review of Economics and Finance 66: 115–26. [Google Scholar] [CrossRef]

- Neely, Christopher, and Paul Weller. 2012. Technical analysis in the foreign exchange market. In Handbook of Exchange Rates. Edited by Jessica James, Lucio Sarno and Ian Marsh. London: Wiley, pp. 343–74. [Google Scholar]

- Neely, Christopher, Paul Weller, and Rob Dittmar. 1997. Is technical analysis in the foreign exchange market profitable? A genetic programming approach. Journal of Financial and Quantitative Analysis 32: 405–26. [Google Scholar] [CrossRef]

- Neely, Christopher J., David E. Rapach, Jun Tu, and Guofu Zhou. 2014. Forecasting the equity risk premium: The role of technical indicators. Management Science 60: 1772–91. [Google Scholar] [CrossRef] [Green Version]

- Ni, Yen-Sen, Jen-Tsai Lee, and Yi-Ching Liao. 2013. Do variable length moving average trading rules matter during a financial crisis period? Applied Economics Letters 20: 135–41. [Google Scholar] [CrossRef]

- Ni, Yensen, Yi.-Ching Liao, and Paoyu Huang. 2015. MA trading rules, herding behaviors, and stock market overreaction. International Review of Economics & Finance 39: 253–65. [Google Scholar]

- Ni, Yensen, Min-Yuh Day, Paoyu Huang, and Shang-Ru Yu. 2020. The profitability of Bollinger Bands: Evidence from the constituent stocks of Taiwan 50. Physica A: Statistical Mechanics and its Applications 551: 124144. [Google Scholar] [CrossRef]

- Ratner, Mitchell, and Ricardo P. C. Leal. 1999. Tests of technical trading strategies in the emerging equity markets of Latin America and Asia. Journal of Banking and Finance 23: 1887–905. [Google Scholar] [CrossRef] [Green Version]

- Ray, Russ. 2006. Prediction Markets and the Financial “Wisdom of Crowds”. Journal of Behavioral Finance 7: 2–4. [Google Scholar] [CrossRef]

- Savin, Gene, Paul Weller, and Janis Zwingelis. 2007. The predictive power of head-and-shoulders price patterns in the U.S. stock market. Journal of Financial Econometrics 5: 243–65. [Google Scholar] [CrossRef]

- Surowiecki, James. 2005. The Wisdom of Crowds. New York: Anchor Books. [Google Scholar]

- Wang, Fei, Philip L. H. Yu, and David W. Cheung. 2014. Combining technical trading rules using particle swarm optimization. Expert Systems with Applications 41: 3016–26. [Google Scholar] [CrossRef]

- Wang, Zhenkin, Elie Bouri, Paulo Ferreira, Syed Jawad Hussain Shahzad, and Roman Ferrer. 2022. A grey-based correlation with multi-scale analysis: S&P 500 VIX and individual VIXs of large US company stocks. Finance Research Letters 48: 102872. [Google Scholar] [CrossRef]

- Xu, Yahua, Elie Bouri, Tareq Saeed, and Zhuzhu Wen. 2020. Intraday return predictability: Evidence from commodity ETFs and their related volatility indices. Resources Policy 69: 101830. [Google Scholar] [CrossRef]

- Zakamulin, Valeriy, and Javier Giner. 2020. Trend following with momentum versus moving averages: A tale of differences. Quantitative Finance 20: 985–1007. [Google Scholar] [CrossRef]

- Zhu, Hong, Zhi-Qiang Jiang, Sai-Pring Li, and Wei-Xing Zhou. 2015. Profitability of simple technical trading rules of Chinese stock exchange indexes. Physica A: Statistical Mechanics and Its Applications 439: 75–84. [Google Scholar] [CrossRef] [Green Version]

- Zhu, Sha, Qiuhong Liu, Yan Wang, Yu Wei, and Guiwu Wei. 2019. Which fear index matters for predicting US stock market volatilities: Text-counts or option based measurement? Physica A: Statistical Mechanics and Its Applications 536: 122567. [Google Scholar] [CrossRef]

| Mean | Median | Standard Deviation | Skewness | Coefficient of Variation | Excesskurtosis | |

|---|---|---|---|---|---|---|

| BTC | 0.005% | 0.007% | 0.624% | −13.29 | 118.57 | 520.33 |

| GLD | 0.002% | 0.002% | 0.163% | −0.05 | 98.62 | 133.50 |

| SPX | −0.001% | 0.002% | 0.342% | −3.34 | 388.83 | 139.00 |

| VIX | 0.021% | 0.000% | 1.510% | 6.29 | 71.69 | 150.25 |

| WTI | −0.008% | 0.000% | 7.415% | −36.01 | 972.99 | 2719.80 |

| MACO | MACO | MACO | BB | BB | BB | |

|---|---|---|---|---|---|---|

| (1,50) | (1,200) | (5,150) | (20,2) | (20,1) | (30,2) | |

| BTC | −0.32% −1.07% | −0.22% −0.43% | −0.47% −0.63% | 0.21% −0.19% | 0.32% * −0.30% | 0.13% −0.19% |

| GLD | −0.07% −0.78% | 0.04% * −0.22% | 0.04% * −0.13% | 0.01% −0.41% | 0.01% * −0.62% | −0.01% −0.38% |

| OIL | 2.16% 1.49% | 1.22% 0.94% | 2.90% 2.76% | −1.06% −1.43% | −0.27% −0.85% | −0.95% −1.22% |

| SPX | −0.22% −0.93% | −0.02% −0.37% | 0.03% −0.15% | 0.27% * −0.13% | 0.35% ** −0.27% | 0.16% −0.14% |

| VIX | −2.71% −3.57% | −0.88% −1.30% | −0.63% −0.85% | 1.50% *** 1.04% *** | 1.35% *** 0.68% *** | 0.79% * 0.44% * |

| FR | FR | FR | TRBO | TRBO | TRBO | |

| (1%) | (2%) | (5%) | (50) | (150) | (200) | |

| BTC | −0.30% −0.54% | −0.18% −0.26% | 0.02% 0.01% | −0.22% −0.35% | 0.24% 0.20% | 0.11% 0.08% |

| GLD | −0.05% −0.09% | −0.01% −0.02% | −0.12% −0.12% | 0.06% −0.07% | 0.00% −0.05% | 0.04% ** 0.00% |

| OIL | 2.39% 1.60% | 3.57% 3.26% | 3.36% * 3.26% * | 2.07% 1.95% | 1.15% 1.12% | 0.84% 0.81% |

| SPX | 0.10% −0.09% | 0.20% ** 0.15% | 0.28% 0.28% ** | 0.09% −0.06% | 0.10% 0.05% | 0.17% 0.14% |

| VIX | −0.51% −2.06% | −1.09% −1.77% | −0.94% −1.08% | −1.05% −1.21% | −0.32% −0.37% | 0.21% 0.19% |

| BTC | GLD | SPX | VIX | WTI | |

|---|---|---|---|---|---|

| CSA (6/12) | 0.22% 0.01% | 0.05% −0.21% | 0.26% −0.05% | −0.41% −0.94% | 2.96% 2.66% |

| CSA (7/12) | 0.20% 0.05% | 0.07% −0.19% | 0.23% −0.11% | 0.24% −0.20% | 0.69% 0.43% |

| CSA (8/12) | 0.33% 0.09% | 0.00% −0.29% | 0.15% −0.13% | 0.24% −0.42% | 1.34% 1.09% |

| CSA (9/12) | 0.24% −0.07% | −0.04% −0.33% | 0.23% 0.02% | −0.87% −1.54% | 1.10% 0.80% |

| CSA (10/12) | −0.04% −0.31% | −0.09% −0.17% | 0.09% −0.04% | −0.80% −0.95% | 0.62% 0.50% |

| CSA (11/12) | −0.16% −0.31% | −0.09% −0.10% | 0.11% 0.05% | −0.74% −0.81% | 0.63% 0.60% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lento, C.; Gradojevic, N. The Profitability of Technical Analysis during the COVID-19 Market Meltdown. J. Risk Financial Manag. 2022, 15, 192. https://doi.org/10.3390/jrfm15050192

Lento C, Gradojevic N. The Profitability of Technical Analysis during the COVID-19 Market Meltdown. Journal of Risk and Financial Management. 2022; 15(5):192. https://doi.org/10.3390/jrfm15050192

Chicago/Turabian StyleLento, Camillo, and Nikola Gradojevic. 2022. "The Profitability of Technical Analysis during the COVID-19 Market Meltdown" Journal of Risk and Financial Management 15, no. 5: 192. https://doi.org/10.3390/jrfm15050192

APA StyleLento, C., & Gradojevic, N. (2022). The Profitability of Technical Analysis during the COVID-19 Market Meltdown. Journal of Risk and Financial Management, 15(5), 192. https://doi.org/10.3390/jrfm15050192