Climate Insurance for Agriculture in Europe: On the Merits of Smart Contracts and Distributed Ledger Technologies

Abstract

:1. Introduction

2. State of the Literature

3. Data Description

4. Climate Change—A “Window of Opportunity” for the Insurance Sector?

5. Agricultural Insurance—Status Quo and Prospects for the European Union

6. Yield-Based vs. Index-Based Insurance

7. Index-Based Area Yield Insurance

8. Weather-Based Index Insurance

9. Remote-Sensing-Based and Combined Drought Indicator Index Insurance

10. DLT for a Better Agribusiness and Related Insurance Products

11. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Risk Management Tools of the CAP Post-2020 Reform

- Member States shall grant support for risk management tools under the conditions set out in this Article and as further specified in their CAP Strategic Plans.

- Member States shall grant support under this type of interventions in order to promote risk management tools, which help genuine farmers manage production and income risks related to their agricultural activity which are outside their control and which contribute to achieving the specific objectives set out in Article 6.

- Member States may grant in particular the following support: (a) financial contributions to premiums for insurance schemes; (b) financial contributions to mutual funds, including the administrative cost of setting up;

- Member States shall establish the following eligibility conditions:

- (a)

- the types and coverage of eligible insurance schemes and mutual funds;

- (b)

- the methodology for the calculation of losses and triggering factors for compensation;

- (c)

- the rules for the constitution and management of the mutual funds.

- Member States shall ensure that support is granted only for covering losses of at least 20% of the average annual production or income of the farmer in the preceding three-year period or a three-year average based on the preceding five-year period excluding the highest and lowest entry.

- Member States shall limit the support to the maximum rate of 70% of the eligible costs.

- Member States shall ensure that overcompensation as a result of the combination of the interventions under this Article with other public or private risk management schemes is avoided.

| 1 | Index-based insurance is a relatively new but innovative approach to insurance provision that pays out benefits on the basis of a predetermined index (e.g., rainfall level) for loss of assets and investments—primarily working capital—resulting from weather and catastrophic events (IFC 2020). |

| 2 | Yield-based insurance provides compensation equivalent to the difference between the obtained yield and the yield guaranteed at the pre-defined rate at the beginning of the contract (Atlas Magazine 2017). |

| 3 | Financial technology (fintech) is a technological innovation that aims to compete with traditional financial methods in the delivery of financial services. It is an emerging industry that uses technology (e.g., Distributed Ledger Technologies) to improve activities in finance services. A subset of fintech companies that focus on the insurance industry is collectively known as insurtech. |

| 4 | https://www.climatefinancelab.org/project/climate-risk-crop-insurance/ (accessed on 8 March 2022). |

| 5 | https://www.indexinsuranceforum.org/blog/blockchain-application-agriculture-insurance (accessed on 8 March 2022). |

| 6 | https://socialfintech.org/blockchain-crop-insurance/ (accessed on 8 March 2022). |

| 7 | https://www.the-digital-insurer.com/dia/aon-oxfam-etherisc-agriculture-insurance-blockchain-makes-first-payouts/ (accessed on 8 March 2022). |

| 8 | https://www.surefarmproject.eu/wordpress/wp-content/uploads/2020/08/D4.6_Policy-Brief-on-the-CAP-post-2020.pdf (accessed on 8 March 2022). |

| 9 | Between 2003 and 2015 the “first pillar” accounted for an average of approximately 70 percent (68–72%) of total CAP spending (Matthews 2016). |

| 10 | Sprout Insure (Ashley King-Bischof & Sandro Stark). Blockchain Climate Risk Crop Insurance—The Global Innovation Lab for Climate Finance (climatefinancelab.org (accessed on 20 February 2022)). |

| 11 | https://hackernoon.com/smart-contracts-a-time-saving-primer-b3060e3e5667 (accessed on 8 March 2022). |

| 12 | https://blog.everex.io/problems-with-microlending-and-how-blockchain-solves-them-1582f98e2a7c (accessed on 8 March 2022). |

| 13 | https://p2pconference.com/speaker/tim-kunde/ (accessed on 6 May 2020). |

| 14 | https://www.digitalinsuranceagenda.com/180/shift-technology-ai-that-understands-insurance-claims/ (accessed on 8 March 2022). |

| 15 | http://www.oxbowpartners.com/pdfs (accessed on 8 March; search: Atidot). |

| 16 | https://www.jdsupra.com/legalnews/using-blockchain-for-kyc-aml-compliance-25325/ (accessed on 8 March 2022). |

| 17 | https://www.disruptordaily.com/blockchain-use-cases-insurance/ (accessed on 8 March 2022). |

References

- Adegoke, Jimmy, Pramod Aggarwal, Mark Rüegg, James Hansen, Daniela Cuellar, Rahel Diro, Rebecca Shaw, Jon Hellin, Helen Greatrex, and Robert Zougmoré. 2017. Improving climate risk transfer and management for Climate-Smart Agriculture. Global Alliance for Climate-Smart Agriculture. Available online: https://www.fao.org/3/bu216e/bu216e.pdf (accessed on 8 March 2022).

- Andriesse, Marcel. 2019. Drought Is Insurable. In Minimising Drought Losses for Agriculture with Innovative Solutions. Zurich: Swiss Re Group, Available online: https://www.swissre.com/risk-knowledge/mitigating-climate-risk/drought-is-insurable.html (accessed on 23 January 2022).

- Aon Benfield. 2019. Weather, Climate & Catastrophe Insights. 2018 Annual Report. Available online: http://thoughtleadership.aonbenfield.com/Documents/20190122-ab-if-annual-weather-climate-report-2018.pdf (accessed on 8 March 2022).

- Atlas Magazine. 2017. Agricultural Insurance: Products and Schemes. Available online: https://www.atlas-mag.net/en/article/agricultural-insurance-products-and-schemes (accessed on 8 March 2022).

- Bielza, Diaz-Caneja Maria, Constanza Conte, Christoph Dittmann, Francisco Javierla Gallego Pinilla, Remo Catenaro, and Josef Stroblmair. 2009. Risk Management and Agricultural Insurance Schemes; EUR 23943 EN. Luxembourg: Reference report by the Joint Research Centre (JRC51982). Available online: http://www.jrc.ec.europa.eu/ (accessed on 8 March 2022).

- Binswanger-Mkhize, Hans P. 2012. Is there too much hype about index-based agricultural insurance? Journal of Development Studies 48: 187–200. Available online: https://doi.org/10.1080/00220388.2011.625411 (accessed on 8 March 2022). [CrossRef]

- Bokusheva, Raushan, and Gunnar Breustedt. 2012. The Effectiveness of Weather-Based Index Insurance and Area-Yield Crop Insurance: How Reliable are ex post Predictions for Yield Risk Reduction? Quarterly Journal of International Agriculture 51: 135–56. [Google Scholar]

- Coleman, Emily, William Dick, Sven Gilliams, Isabelle Piccard, Francesco Rispoli, and Andrea Stoppa. 2018. Remote Sensing for Index Insurance—An Overview of Findings and Lessons Learned for Smallholder Agriculture. Rome: International Fund of Agricultural Development (IFAD). [Google Scholar]

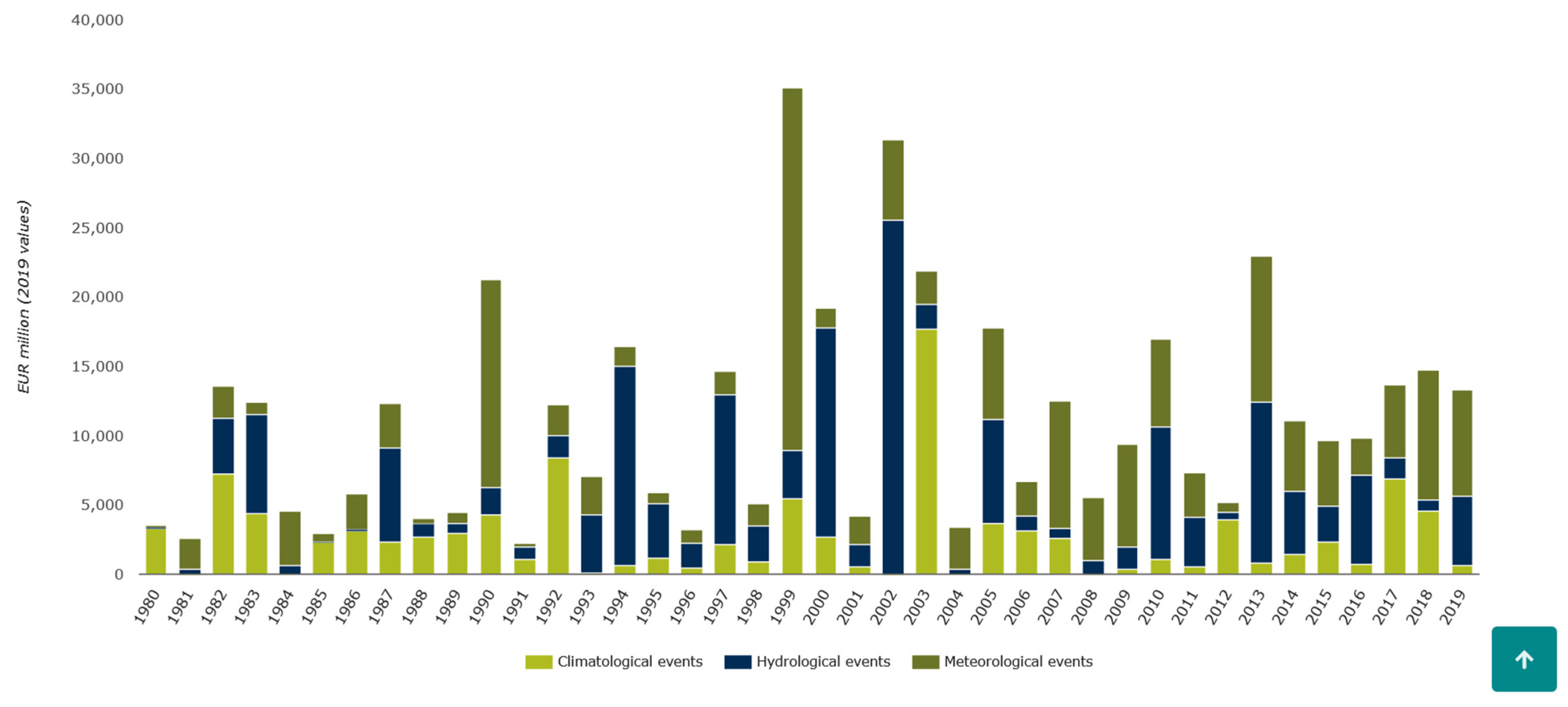

- EEA. 2021. Economic Losses from Climate-Related Extremes in Europe. Available online: https://www.eea.europa.eu/ims/economic-losses-from-climate-related (accessed on 8 March 2022).

- European Commission. 2017. Summary of Main Changes Introduced to the Four Basic Regulations of the CAP through the Omnibus Regulation. Available online: https://ec.europa.eu/agriculture/cap-overview/summary-changes-omnibus_en.pdf (accessed on 8 March 2022).

- European Commission. 2018. Proposal for a Regulation of the European Parliament and of the Council Establishing Rules on Support for Strategic Plans to Be Drawn up by Member States under the Common Agricultural Policy (CAP Strategic Plans) and Financed by the European Agricultural Guarantee Fund (EAGF) and by the European Agricultural Fund for Rural Development (EAFRD) and Repealing Regulation (EU) No 1305/2013 of the European Parliament and of the Council and Regulation (EU) No 1307/2013 of the European Parliament and of the Council. {SEC(2018) 305 Final}-{SWD(2018) 301 Final}. Available online: https://eur-lex.europa.eu/legal-content/EN/HIS/?uri=CELEX%3A52018PC0392 (accessed on 1 May 2022).

- FEMA. 2019. National Advisory Council. DRAFT Report to the FEMA Administrator, FEMA NAC Report, November. Available online: https://www.fema.gov/media-library-data/1572880188002-31454e3c26dff6922fde9d34cbe19e26/November_2019_NAC_Report_Draft_v5.pdf (accessed on 8 March 2022).

- Generali. 2018. Generali Global Corporate & Commercial Italy Promotes the Initiative to Optimize Corporate Risks Quotation, Negotiation and Binding Processes through Blockchain Technology. Available online: https://www.generaliglobalcorporate.com/doc/jcr:d1076099-3628-4d67-a813-3060b7f2ca54/lang:en/PressRelease_Blockchain_Ottimizzazione_vf_ENGLISH.pdf (accessed on 8 March 2022).

- Gommes, Rene, and François Kayitakire. 2013. The Challenges of IBI for Food Security in Developing Countries. Luxembourg: Publications Office of the European Union, Available online: https://op.europa.eu/en/publication-detail/-/publication/d93219f2-252e-48a9-b5de-38d65de16f9a (accessed on 8 March 2022).

- Grant, Wyn. 2010. Policy Instruments in the Common Agricultural Policy. West European Politics 33: 22–38. [Google Scholar] [CrossRef] [Green Version]

- Greatrex, Helen, James William W. Hansen, Samantha Garvin, Rahel Diro, Sari Blakeley, Kolli Rao, and Daniel E. Osgood. 2015. Scaling up Index Insurance for Smallholder Farmers: Recent Evidence and Insights, CCAFS, No. 14. CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS). Available online: www.ccafs.cgiar.org (accessed on 8 March 2022).

- Hagendorff, Bjoern, Jens Hagendorff, Kevin Keasey, and Angelica Gonzalez. 2014. The risk implications of insurance securitization: The case of catastrophe bonds. Journal of Corporate Finance 25: 387–402. [Google Scholar] [CrossRef] [Green Version]

- Hazell, Peter B., Alexander Jaeger, and Rebecca Hausberg. 2021. Innovations and Emerging Trends in Agricultural Insurance for Smallholder Farmers—An Update. Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ). Competence Centre Financial Systems Development and Insurance. Available online: https://www.giz.de/expertise/downloads/2021%20GIZ_Innovations%20and%20emerging%20Trends%20in%20Agricultural%20Insurance-An%20update.pdf (accessed on 23 January 2022).

- Hazell, Peter B., Rachel Sberro-Kessler, and Panos Varangis. 2017. When and How Should Agricultural Insurance be Subsidized? Issues and Good Practices. In Finance & Markets Global Practice |Global Index Insurance Facility. Impact Insurance Working Paper #48. Washington, DC: World Bank. [Google Scholar]

- Hess, Ulrich, and Joanne Syroka. 2005. Weather-Based Insurance in Southern Africa. The Case of Malawi. Agriculture and Rural Development Discussion Paper 13. Washington, DC: World Bank, Available online: https://documents1.worldbank.org/curated/en/818731468055789892/pdf/370510MW0Weath1d0insurance01PUBLIC1.pdf (accessed on 8 March 2022).

- Hess, Ulrich, and Peter Hazell. 2020. Innovations and Emerging Trends in Agricultural Insurance. How Can We Transfer Natural Risks Out of Rural Livelihooods to Empower and Protect People? Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ). Competence Centre Financial Systems Development and Insurance. Available online: https://www.giz.de/de/downloads/giz-2016-en-innovations_and_emerging_trends-agricultural_insurance.pdf (accessed on 23 January 2022).

- Hochrainer-Stigler, Stefan, and Susanne Hanger-Kopp. 2017. Subsidized Drought Insurance in Austria: Recent Reforms and Future Challenges. Wirtschaftspolitische Blätter 4: 599–614. Available online: http://pure.iiasa.ac.at/id/eprint/15048/1/2017_Subsidized%20Drought%20Insurance%20in%20Austria%20Wipo.pdf (accessed on 8 March 2022).

- IFAD. 2017. Remote Sensing for Index Insurance. An Overview of Findings and Lessons Learned for Smallholder Agriculture. Roma: IFAD. [Google Scholar]

- IFC. 2020. Index Insurance—Frequently Asked Questions. Available online: https://www.ifc.org/wps/wcm/connect/industry_ext_content/ifc_external_corporate_site/financial+institutions/priorities/access_essential+financial+services/giif+frequently-asked-questions (accessed on 8 March 2022).

- IOM. 2009. Disaster Risk Reduction, Climate Change Adaptation and Environmental Migration. A Policy Perspective. Available online: https://publications.iom.int/system/files/pdf/ddr_cca_report.pdf (accessed on 8 March 2022).

- IPCC. 2022. Climate Change 2022: Impacts, Adaptation, and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Edited by Hans-Otto Pörtner, Debra C. Roberts, Melinda Tignor, Elvira Poloczanska, Katja Mintenbeck, Andrés Alegría, Marlies Craig, Stefanie Langsdorf, Sina Löschke, Vincent Möller and et al. Cambridge: Cambridge University Press, Printed March 2022 by the IPCC, Switzerland. ISBN 978-92-9169-159-3. [Google Scholar]

- ISMEA. 2020. Dati Assicurazioni Agricole. Available online: http://www.ismea.it/sicuragro/sa/DettaglioAgg3_Open.php (accessed on 16 April 2022).

- Jarrod, Katha, Shahbaz Mushtaq, Ross Henry, Adewuyi Adeyinka, and Roger Stone. 2018. Index insurance benefits agricultural producers exposed to excessive rainfall. Weather and Climate Extremes 22: 1–9. Available online: https://www.sciencedirect.com/science/article/pii/S2212094718300513?via%3Dihub (accessed on 8 March 2022).

- Jensen, Nathaniel D., Christopher B. Barrett, and Andrew G. Mude. 2016. Index Insurance Quality and Basis Risk. Evidence from Northern Kenya, American Journal of Agricultural Economics, Agricultural and Applied Economics Association 98: 1450–69. [Google Scholar]

- Jha, Nishant, Deepak Prashar, Osamah I. Khalaf, Youseef Alotaibi, Abdulmajeed Alsufyani, and Saleh Alghamdi. 2021. Blockchain Based Crop Insurance: A Decentralized Insurance System for Modernization of Indian Farmers. Sustainability 13: 8921. [Google Scholar] [CrossRef]

- Kim, Henry, and Marek Laskowski. 2017. Agriculture on the Blockchain: Sustainable Solutions for Food, Farmers, and Financing. York: York University, Blockchain Research Institute, December 15. [Google Scholar]

- KPMG. 2017. Blockchain Accelerates Insurance Transformation. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2017/01/blockchain-accelerates-insurance-transformation-fs.pdf (accessed on 8 March 2022).

- Kumar, Rajesh, and Rewa Sharma. 2021. Leveraging Blockchain for Ensuring Trust in IoT: A Survey, Journal of King Saud University—Computer and Information Sciences. Available online: https://reader.elsevier.com/reader/sd/pii/S131915782100255X?token=EE2D7377E0136A7C8B0945AF26A1FB6443DF082BCD69311DA969E540516DBC5FC38D770FF990F58012772E6E82E5358E&originRegion=eu-west-1&originCreation=20220131200639 (accessed on 8 March 2022).

- Maestro Villarroya, Teresa. 2016. Hydrological Drought Index Insurance for Irrigated Agriculture. Doctorale thesis, Madrid, Spain. Available online: http://oa.upm.es/43595/ (accessed on 14 February 2022).

- Mahul, Olivier, and Charles J. Stutley. 2010. Government Support to Agricultural Insurance: Challenges and Options for Developing Countries. Washington, DC: World Bank, Available online: http://publications/worldbank.org (accessed on 8 March 2022).

- Matthews, Alan. 2016. The future of direct payments. European Parliament, Research For AGRI Committee—Reflections on the Agricultural Challenges Post-2020 In The EU: Preparing The Next CAP Reform, IP/B/AGRI/CEI/2015-70/0/C5/SC1, Brussels, Directorate-General for Internal Policies. Policy Department B: Structural and Cohesion Policies 2016: 3–86. [Google Scholar]

- Micale, Valerio, Bella Tonkonogy, and Federico Mazza. 2018. Understanding and Increasing Finance for Climate Adaptation in Developing Countries. Available online: https://climatepolicyinitiative.org/wp-content/uploads/2018/12/Understanding-and-Increasing-Finance-for-Climate-Adaptation-in-Developing-Countries-1.pdf (accessed on 8 March 2022).

- Michalek, Gabriela, Oleksandr Sushchenko, and Reimund Schwarze. 2020. Why CCA and DRR Are Crucial for Achieving European Green Deal Goals. Available online: https://www.placard-network.eu/why-cca-and-drr-are-crucial-for-achieving-european-green-deal-goals/ (accessed on 8 March 2022).

- Miranda, P. M. Meuwissen, Yann de Mey, and Marcel van Asseldonk. 2018. Prospects for agricultural insurance in Europe. Agricultural Finance Review 78: 174–82. [Google Scholar] [CrossRef]

- Morana, Claudio, and Giacomo Sbrana. 2019. Climate change implications for the catastrophe bonds market: An empirical analysis. Economic Modelling 81: 274–94. [Google Scholar] [CrossRef]

- Palka, Marlene, and Susanne Hanger-Kopp. 2019. Agricultural Crop Insurance in Switzerland, Focusing on Drought. Crop Insurance in Switzerland. IIASA FACTSHEET. Available online: http://pure.iiasa.ac.at/id/eprint/15831/1/Factsheet_Switzerland.pdf (accessed on 8 March 2022).

- Peled, E., Emanuel Dutra, Pedro Viterbo, and Alon Angert. 2010. Technical Note: Comparing and ranking soil drought indices performance over Europe, through remote-sensing of vegetation. Hydrology and Earth System Sciences 14: 271–77. [Google Scholar] [CrossRef] [Green Version]

- Pistorius, Magdalena. 2021. Macron Announces New French Crop Insurance Scheme|EURACTIV France|13 September 2021 (Updated: 16 September 2021). Available online: https://www.euractiv.com/section/agriculture-food/news/macron-announces-new-french-crop-insurance-scheme/ (accessed on 8 March 2022).

- PwC. 2016. Opportunities Await: How InsurTech Is Reshaping Insurance. Available online: https://www.pwc.lu/en/fintech/docs/pwc-insurtech.pdf (accessed on 8 March 2022).

- Ramsey, Austin Ford, and Fabio Gaetano Santaremo. 2017. Crop Insurance in the European Union: Lessons and Caution from the United States. Available online: https://mpra.ub.uni-muenchen.de/79164/1/MPRA_paper_79164.pdf (accessed on 8 March 2022).

- Rao, Kolli N. 2010. Index based Crop Insurance. Agriculture and Agricultural Science Procedia 1: 193–203. [Google Scholar] [CrossRef] [Green Version]

- Ronaghi, Mohammad Hossein. 2021. A blockchain maturity model in agricultural supply chain. Information Processing in Agriculture 8: 398–408. [Google Scholar] [CrossRef]

- Russell, Alex. 2020. How NDVI Transformed Insurance as a Tool to Build Resilience. Available online: https://www.agrilinks.org/post/how-ndvi-transformed-insurance-tool-build-resilience (accessed on 8 March 2022).

- Schwarze, Reimund, and Oleksandr Sushchenko. 2021. A Green and Resilient Recovery for Europe. UNDRR Working Paper Oktober 2021. United Nations Office for Disaster Risk Reduction—Regional Office for Europe & Central Asia. Preventionweb. Available online: https://www.undrr.org/publication/green-and-resilient-recovery-europe (accessed on 1 May 2022).

- Sepulcre-Canto, Guadalupe, Stephanie Horion, Andrew Singleton, Hugo Carro, and Jürgen Vogt. 2012. Developing a Combined Drought Indicator to detect agricultural drought in Europe. Natural Hazards and Earth System Sciences 12: 3519–31. [Google Scholar] [CrossRef] [Green Version]

- Sibiko, Kenneth W., Prakashan Chellattan Veettil, and Matin Qaim. 2018. Small farmers’ preferences for weather index insurance: Insights from Kenya. Agriculture and Food Security 7: 1–14. [Google Scholar] [CrossRef] [Green Version]

- Stranieri, Stefanella, Federica Riccardi, Miranda Meuwissen, and Claudio Soregaroli. 2021. Exploring the impact of blockchain on the performance of agri-food supply chains. Food Control 119: 107495. [Google Scholar] [CrossRef]

- SURE Farm. 2021. Policy Brief with a Critical Analysis of How Current Policies Constrain/Enable Resilient European Agriculture and Suggestions for Improvements, Including Recommendations for the CAP Post-2020 Reform. A Project Funded by the European Union’s Horizon 2020 Research and Innovation Programme under Grant Agreement No. 727520. Available online: https://www.surefarmproject.eu/deliverables/policybusiness-briefs-and-short-communications/ (accessed on 8 March 2022).

- World Bank. 2011. Weather Index Insurance for Agriculture: Guidance for Development Practitioners. Agriculture and rural Development Discussion Paper, Nr. 50. Washington, DC: World Bank. [Google Scholar]

- UNEP. 2021. Emissions Gap Report 2021. Available online: http://wedocs.unep.org/bitstream/handle/20.500.11822/26895/EGR2018_FullReport_EN.pdf (accessed on 8 March 2022).

- UNEP-FI. 2021. Taskforce on Nature-Related Financial Disclosures (tnfd) Launched. Available online: https://www.unepfi.org/news/themes/ecosystems/tnfd-launch/ (accessed on 1 May 2022.).

- UNFCCC. 2015. The Paris Agreement—Main Page. Available online: http://unfccc.int/paris_agreement/items/9485.php (accessed on 8 March 2022).

- UNISDR. 2015. Sendai Framework for Disaster Risk Reduction 2015–2030. Available online: http://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_69_283.pdf (accessed on 8 March 2022).

- Vasilaky, Kathryn, Rahel Diro, Michael Norton, Geoff McCarney, and Daniel Osgood. 2020. Can Education Unlock Scale? The Demand Impact of Educational Games on a Large-Scale Unsubsidised Index Insurance Programme in Ethiopia. Journal of Development Studies 56: 361–83. [Google Scholar] [CrossRef]

- Vroege, Willemijn, Tobias Dalhaus, and Robert Finger. 2019. Index insurance for grasslands—A review for Europe and North-America. Agricultural Systems 168: 101–11. [Google Scholar] [CrossRef]

- WEF. 2022. The Global Risks Report 2022, 17th ed. Colony: WEF, Available online: https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf (accessed on 8 March 2022).

- Weingärtner, Lena, Catherine Simonet, and Alice Caravani. 2017. Disaster Risk Insurance and the Triple Dividend of Resilience. London: Overseas Development Institute. [Google Scholar]

- Xu, Jie, Shuang Guo, David Xie, and Yaxuan Yan. 2020. Blockchain: A new safeguard for agri-foods. Artificial Intelligence in Agriculture 4: 153–61. [Google Scholar] [CrossRef]

| Hail | Storm | Heavy Rainfall | Frost | Drought | |

|---|---|---|---|---|---|

| Belgium (1)(3) | X | X | X | ||

| Denmark | X | X | X | ||

| Germany (2) | X | X | X | X | X |

| Italy (1)(3) | X | X | X | X | X |

| Croatia (1)(3) | X | X | X | X | |

| Luxembourg (1)(3) | X | X | X | X | X |

| Latvia (1)(3) | X | X | X | X | |

| Lithuania (1)(3) | X | X | X | X | X |

| Netherlands (1) | X | X | X | X | X |

| Austria (1)(2)(3) | X | X | X | X | |

| Poland (1)(3) | X | X | X | X | |

| Spain (1)(2)(3) | X | X | X | X | X |

| Switzerland (1)(2)(3) | X | X | X | X (4) | X |

| Insurance Type | Strengths | Weaknesses |

|---|---|---|

| Yield-based |

|

|

| Index-based |

|

|

| Area of Application | Practical Cases | Time/Money Savings | |

|---|---|---|---|

| Signing the contract and execution | Smart contracts | R3, CatBonds, CatSwaps, Sprout Insure10, Etherisc (Kim and Laskowski 2017, p. 13) | up to 2–3 days, no escrow cost11, reducing the costs of issuing contracts by 41% |

| Microfinancing | Peer-to-peer insurance | Lydia, Everex12 | average cashback of 30% of the premiums13 |

| Claim management | Fraud detection | Shift Technology (Claims automation) | “hit-rate” more than 2.5 times better than standards14, reduction of annual losses of up to 10% decrease in claim cycles from three months to one week (Sprout Insure) |

| Underwriting | Behaviour-based underwriting | Atidot | identification of up to 25% under-insured policies15 |

| Parametric insurance | Mechanism selection | Kenyan Livestock Insurance Program (KLIP) | up to 2–3 months |

| KYC (“Know your client”) and AML (Anti-Money-Laundering Laws) | Due diligence | InterchainZ | up to 90% of time up to 8 billion USD16 |

| Risk transfer | Reinsurance | B3i (Aegon, Allianz, Munich Re, Swiss Re and Zurich Re) | 15–20% expenses17 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schwarze, R.; Sushchenko, O. Climate Insurance for Agriculture in Europe: On the Merits of Smart Contracts and Distributed Ledger Technologies. J. Risk Financial Manag. 2022, 15, 211. https://doi.org/10.3390/jrfm15050211

Schwarze R, Sushchenko O. Climate Insurance for Agriculture in Europe: On the Merits of Smart Contracts and Distributed Ledger Technologies. Journal of Risk and Financial Management. 2022; 15(5):211. https://doi.org/10.3390/jrfm15050211

Chicago/Turabian StyleSchwarze, Reimund, and Oleksandr Sushchenko. 2022. "Climate Insurance for Agriculture in Europe: On the Merits of Smart Contracts and Distributed Ledger Technologies" Journal of Risk and Financial Management 15, no. 5: 211. https://doi.org/10.3390/jrfm15050211

APA StyleSchwarze, R., & Sushchenko, O. (2022). Climate Insurance for Agriculture in Europe: On the Merits of Smart Contracts and Distributed Ledger Technologies. Journal of Risk and Financial Management, 15(5), 211. https://doi.org/10.3390/jrfm15050211