Does Volume of Gold Consumption Influence the World Gold Price?

Abstract

:1. Introduction

2. Review of Literature

3. Objectives, Variables, and Methodology

3.1. Johansen Cointegration Test

3.2. Granger Causality Block Exogeneity Wald Test

3.3. VAR Impulse Response Function

3.4. VAR Variance Decomposition

4. Results and Discussion

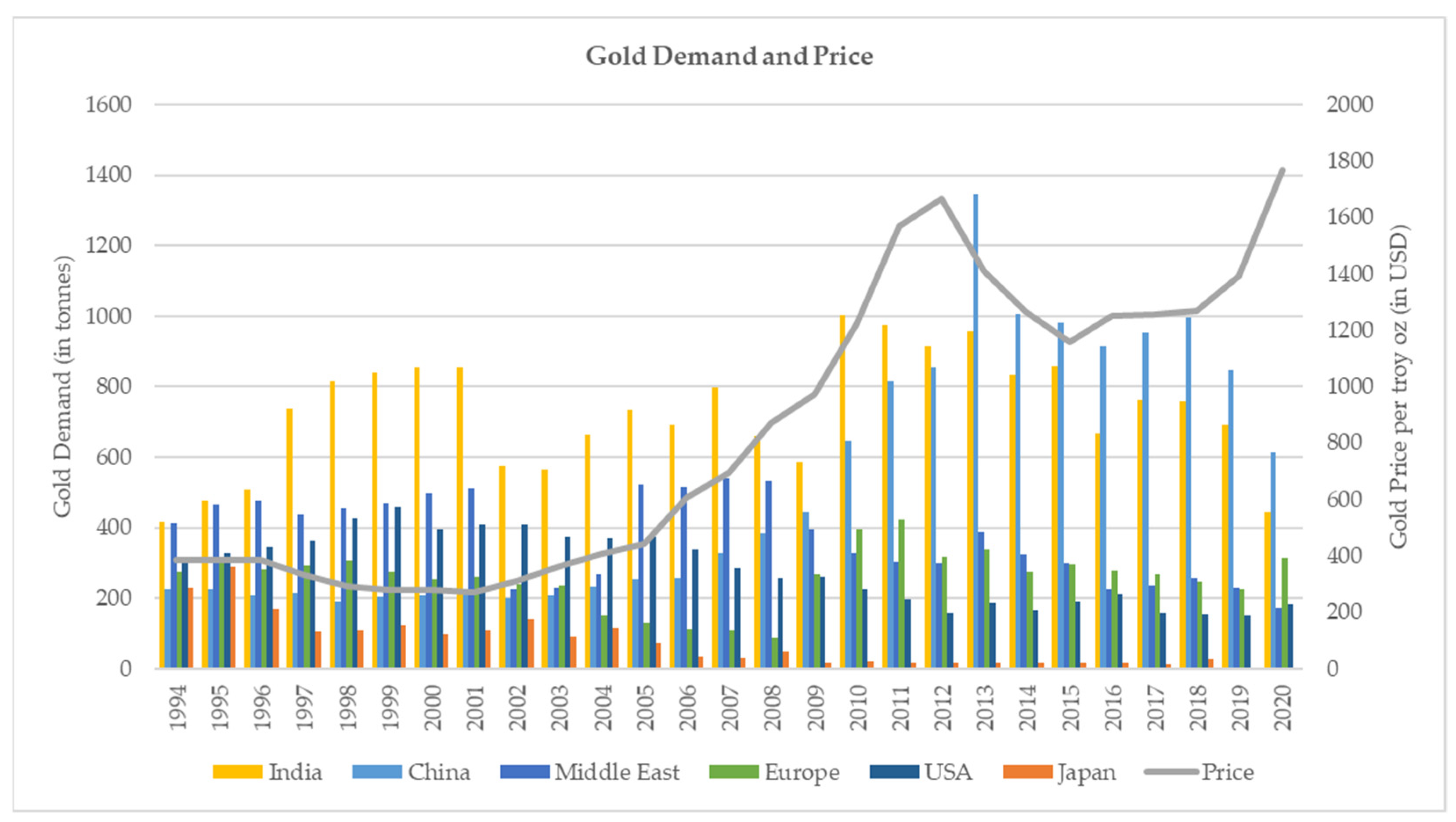

4.1. Trend in Gold Demand and Price

4.2. Descriptive Statistics

4.3. Stationarity of the Variables

4.4. Selection of VAR Lag Length

4.5. Results of the Long-Run Relationship between Gold Demand and Prices

4.6. Individual and Collective Impact of the Variables

4.7. Transmission of Shocks—Impulse Response Function

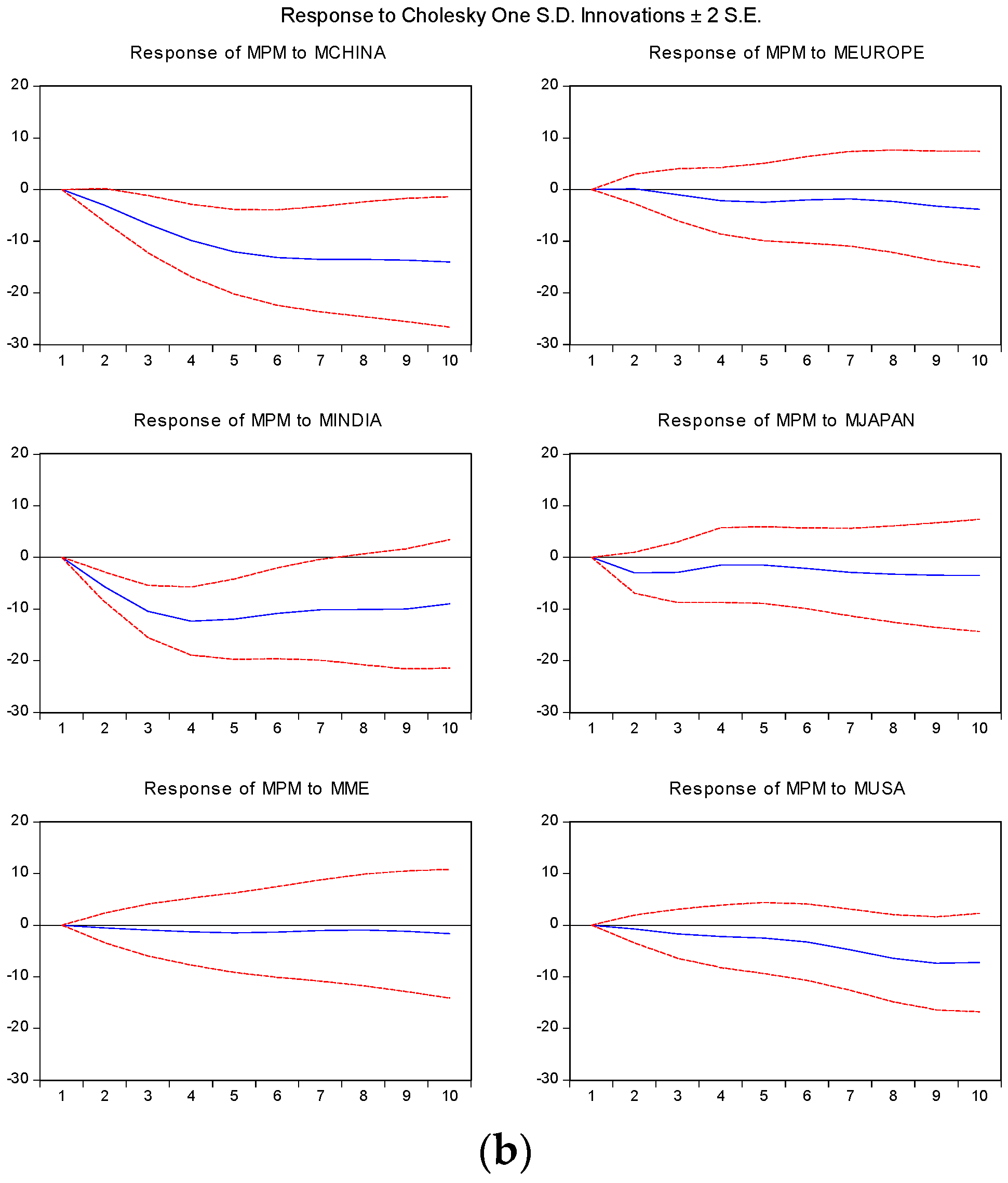

4.8. Proportion of Share of Variances

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aasif, Hirani. 2018. Who Sets Gold Price? This Will Change Your Outlook for the Yellow Metal. Available online: https://economictimes.indiatimes.com/markets/commodities/views/who-sets-gold-price-this-will-change-your-outlook-for-the-yellow-metal/articleshow/62365567.cms?from=mdr (accessed on 20 December 2021).

- Bahmani-Oskooee, Mohsen. 1987. Effects of Rising Price of Gold on the LDSs’ Demand for International Reserves. International Economic Journal 1: 35–44. [Google Scholar] [CrossRef]

- Batchelor, Roy, and David Gulley. 1995. Jewellery demand and the price of gold. Resources Policy 21: 37–42. [Google Scholar] [CrossRef]

- Bhattacharya, Himadri. 2002. Deregulation of Gold in India: A Case Study in Deregulation of a Gold Market. Research Study No. 27. London: World Gold Council: Research Study, pp. 1–28. [Google Scholar]

- BullionStar. 2017a. What Sets the Gold Price? Is It the Paper Market or Physical Market? Available online: https://www.bullionstar.com/blogs/bullionstar/what-sets-the-gold-price-is-it-the-paper-market-or-physical-market/ (accessed on 20 December 2021).

- BullionStar. 2017b. Indian Gold Market. Available online: https://www.bullionstar.com/gold-university/indian-gold-market (accessed on 15 December 2021).

- Dan Popescu. 2014. India’s Role in the Gold Market. Available online: https://goldbroker.com/news/india-major-player-gold-market-519 (accessed on 1 March 2022).

- Dickey, David, and Wayne A. Fuller. 1979. Distribution of Estimators for Time Series Regressions with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 49: 1057–72. [Google Scholar] [CrossRef]

- Faugere, Christophe, and Julian Van Erlach. 2005. The Price of gold: A global required yield theory. The Journal of Investing 14: 99–111. [Google Scholar] [CrossRef]

- Gabriel, M. Muller. 2012. Asian Gold Demand: Key Price Determinant. Available online: http://www.resourceinvestor.com/2012/08/09/asian-gold-demand-key-price-determinant (accessed on 20 December 2021).

- Govett, M. H., and G. J. S. Govett. 1982. Gold demand and supply. Resource Policy 8: 84–96. [Google Scholar] [CrossRef]

- Hauptfleisch, Martin, Tālis J. Putniņš, and Brian Lucey. 2016. Who Sets the Price of Gold? London or New York. The Journal of Futures Market 36: 564–86. [Google Scholar] [CrossRef] [Green Version]

- Jena, Sangram Keshari, Aviral Kumar Tiwari, and David Roubaud. 2018. Comovements of gold futures markets and the spot market: A wavelet analysis. Finance Research Letters 24: 19–24. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical Analysis of Cointegrating Vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Johansen, Søren. 1991. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59: 1551–80. [Google Scholar] [CrossRef]

- Johansen, Soren, and Katarina Juselius. 1990. Maximum Likelihood Estimation and Inference on Cointegration with Applications to the Demand for Money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Kannan, R., and Sarat Dhal. 2008. India’s Demand for Gold: Some Issues for Economy Development and Macroeconomic Policy. Indian Journal of Economics & Business 7: 107–28. [Google Scholar]

- Lin, Min, Gang-Jin Wang, Chi Xie, and H. Eugene Stanley. 2018. Cross-correlations and influence in world gold markets. Physica A: Statistical Mechanics and Its Applications 490: 504–12. [Google Scholar] [CrossRef]

- Lucey, Brian M., Charles Larkin, and Fergal A. O’Connor. 2013. London or New York: In which does the gold price originate and when? Applied Economics Letters 20: 813–17. [Google Scholar] [CrossRef] [Green Version]

- Lucey, Brian M., Charles Larkin, and Fergal O’Connor. 2014. Gold Markets Around the World—Who Spills Over What, to Whom, When? Applied Economics Letters 21: 887–92. [Google Scholar] [CrossRef]

- MacKinnon, James G., Alfred A. Haug, and Leo Michelis. 1999. Numerical Distribution Functions of Likelihood Ratio Tests for Cointegration. Journal of Applied Econometrics 14: 563–77. [Google Scholar] [CrossRef]

- O’Connor, Fergal A., Brian M. Lucey, Jonathan A. Batten, and Dirk G. Baur. 2015. The Financial Economics of Gold—A Survey. International Review of Financial Analysis 41: 186–205. [Google Scholar] [CrossRef]

- Ong, E., M. Grubb, and A. Mitra. 2009. India: Heart of Gold Strategic Outlook. London: World Gold Council. [Google Scholar]

- Ong, E., J. C. Artigas, J. Palmberg, L. Street, N. Tuteja, and M. Grubb. 2010. India: Heart of Gold Revival. London: World Gold Council. [Google Scholar]

- Patel, I. G., and Anand Chandavarkar. 2006. India’s Elasticity of Demand for Gold. Economic and Political Weekly 41: 507–16. [Google Scholar]

- Phillips, Peter C. B., and Sam Ouliaris. 1990. Asymptotic properties of residual based tests for cointegration. Econometrica 58: 165–93. [Google Scholar] [CrossRef] [Green Version]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regressions. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Radetzki, Marian. 1989. The fundamental determinants of their price behaviour. Resources Policy 15: 194–208. [Google Scholar] [CrossRef]

- Rajalakshmi Nirmal and Lokeshwarri SK. 2021. Opinion: India Must Be a Metal Price Setter Globally. Available online: https://www.thehindubusinessline.com/opinion/india-must-be-a-metal-price-setter-globally/article25550372.ece (accessed on 15 January 2022).

- Selvanathan, Saroja, and E. A. Selvanathan. 1999. The effect of the price of gold on its production: A time-series analysis. Resources Policy 25: 265–75. [Google Scholar] [CrossRef]

- Shafiee, Shahriar, and Erkan Topal. 2010. An overview of global gold market and gold price forecasting. International Journal of Minerals Policy and Economics 35: 178–89. [Google Scholar] [CrossRef]

- Starr, Martha, and Ky Tran. 2008. Determinants of the Physical Demand for Gold: Evidence from Panel Data. The World Economy 31: 416–36. [Google Scholar] [CrossRef]

- Warren, G. F., and F. A. Pearson. 1933. Relationship of Gold to Prices. In Proceedings of the American Statistical Association, supplement. Journal of the American Statistical Association 28: 118–26. [Google Scholar]

- Xu, Xiaoqing Eleanor, and Hung-Gay Fung. 2005. Cross-market linkages between U.S. and Japanese precious metals futures trading. Journal of International Financial Markets, Institutions & Money 15: 107–24. [Google Scholar]

- Yurdakul, Funda, and Merve Sefa. 2015. An Econometric Analysis of Gold Prices in Turkey. Procedia Economics and Finance 23: 77–85. [Google Scholar] [CrossRef] [Green Version]

| Price | Demand | |||||||

|---|---|---|---|---|---|---|---|---|

| AM Price | PM Price | India | China | Middle East | Europe | USA | Japan | |

| Mean | 834.29 | 834.04 | 181.85 | 129.47 | 92.77 | 64.44 | 71.36 | 18.12 |

| Standard Error | 48.67 | 48.65 | 5.49 | 8.81 | 3.12 | 2.73 | 3.07 | 1.82 |

| Median | 674.08 | 674.18 | 184.25 | 78.70 | 87.89 | 64.13 | 64.85 | 8.10 |

| Mode | 174.10 | 46.00 | 117.40 | 102.20 | 70.70 | 26.50 | ||

| Standard Deviation | 505.76 | 505.62 | 57.05 | 91.55 | 32.46 | 28.40 | 31.90 | 18.91 |

| Sample Variance | 255,792.44 | 255,649.50 | 3254.61 | 8382.26 | 1053.65 | 806.55 | 1017.91 | 357.57 |

| Kurtosis | −1.34 | −1.34 | −0.20 | 0.58 | −0.68 | −0.10 | 0.56 | 1.88 |

| Skewness | 0.37 | 0.37 | 0.12 | 1.01 | 0.37 | 0.23 | 0.95 | 1.45 |

| Range | 1652.62 | 1652.19 | 286.97 | 442.71 | 154.51 | 120.80 | 138.19 | 90.02 |

| Minimum | 259.20 | 259.17 | 34.70 | 39.40 | 23.09 | 13.00 | 29.41 | −3.62 |

| Maximum | 1911.82 | 1911.36 | 321.67 | 482.11 | 177.60 | 133.80 | 167.60 | 86.40 |

| Count | 108.00 | 108.00 | 108.00 | 108.00 | 108.00 | 108.00 | 108.00 | 108.00 |

| Variables | Level | First Difference | ||

|---|---|---|---|---|

| ADF | PP | ADF | PP | |

| AM | 0.052462 | 0.029757 | −7.783063 * | −7.924205 * |

| [0.9605] | [0.9586] | [0.0000] | [0.0000] | |

| PM | 0.056695 | 0.028996 | −7.813382 * | −7.963598 * |

| [0.9609] | [0.9585] | [0.0000] | [0.0000] | |

| INDIA | −0.070992 | −2.923395 | −6.652775 * | −3.622162 ** |

| [0.6583] | [0.1566] | [0.0000] | [0.0296] | |

| EUROPE | −2.629712 | −1.525254 | −4.976002 * | −4.791342 * |

| [0.2674] | [0.5703] | [0.0003] | [0.0000] | |

| CHINA | −1.826870 | 0.072792 | −6.030721 * | −2.897450 * |

| [0.6892] | [0.7052] | [0.0000] | [0.0038] | |

| USA | −2.900411 | −0.979818 | −5.112069 * | −5.152639 * |

| [0.1640] | [0.2926] | [0.0002] | [0.0000] | |

| JAPAN | −2.192246 | −2.056606 | −12.67683 * | −17.87531 * |

| [0.2097] | [0.2627] | [0.0000] | [0.0001] | |

| MEAST | −1.193273 | −0.884538 | −4.999767 * | −3.893559 * |

| [0.2129] | [0.3322] | [0.0000] | [0.0001] | |

| Lag | LogL | LR | FPE | AIC | SC | HQ | |

|---|---|---|---|---|---|---|---|

| AM | 0 | −10,251.20 | NA | 2.62 × 1022 | 71.48569 | 71.57494 | 71.52146 |

| 1 | −7678.774 | 5001.434 | 6.05 × 1014 | 53.90086 | 54.61491 | 54.18704 | |

| 2 | −6676.761 | 1899.286 | 7.90 × 1011 | 47.25966 | 48.59849 | 47.79624 | |

| 3 | −5856.521 | 1514.728 | 3.67 × 109 | 41.88516 | 43.84879 | 42.67216 | |

| 4 | −5322.817 | 959.5518 | 1.25 × 108 | 38.50744 | 41.09585 * | 39.54483 | |

| 5 | −5217.193 | 184.7493 * | 84,901,681 * | 38.11285 * | 41.32605 | 39.40065 * | |

| PM | 0 | −10,250.95 | NA | 2.62 × 1022 | 71.48398 | 71.57324 | 71.51976 |

| 1 | −7677.415 | 5003.602 | 5.99 × 1014 | 53.89139 | 54.60544 | 54.17757 | |

| 2 | −6675.179 | 1899.708 | 7.81 × 1011 | 47.24863 | 48.58747 | 47.78522 | |

| 3 | −5855.270 | 1514.118 | 3.63 × 109 | 41.87645 | 43.84007 | 42.66344 | |

| 4 | −5321.265 | 960.0930 | 1.24 × 108 | 38.49662 | 41.08503 * | 39.53402 | |

| 5 | −5215.803 | 184.4655 * | 84,083,295 * | 38.10316 * | 41.31636 | 39.39096 * |

| Variable | Hypothesis | Eigen Value | Trace Statistics | Critical Value at 5% | Prob ** | Max-Eigen Statistic | Critical Value at 5% | Prob ** |

|---|---|---|---|---|---|---|---|---|

| AM Fix | r = 0 * | 0.288116 | 222.9854 | 125.6154 | 0.0000 | 97.53422 | 46.23142 | 0.0000 |

| r ≤ 1 * | 0.160338 | 125.4512 | 95.75366 | 0.0001 | 50.15485 | 40.07757 | 0.0027 | |

| r ≤ 2 * | 0.128852 | 75.29631 | 69.81889 | 0.0171 | 39.58982 | 33.87687 | 0.0093 | |

| r ≤ 3 | 0.066035 | 35.70649 | 47.85613 | 0.4113 | 19.60667 | 27.58434 | 0.3690 | |

| r ≤ 4 | 0.031220 | 16.09982 | 29.79707 | 0.7052 | 9.102895 | 21.13162 | 0.8240 | |

| r ≤ 5 | 0.019506 | 6.996923 | 15.49471 | 0.5780 | 5.653435 | 14.26460 | 0.6580 | |

| r ≤ 6 | 0.004670 | 1.343488 | 3.841466 | 0.2464 | 1.343488 | 3.841466 | 0.2464 | |

| PM Fix | r = 0 * | 0.287561 | 223.4965 | 125.6154 | 0.0000 | 97.31038 | 46.23142 | 0.0000 |

| r ≤ 1 * | 0.161508 | 126.1862 | 95.75366 | 0.0001 | 50.55522 | 40.07757 | 0.0024 | |

| r ≤ 2 * | 0.129868 | 75.63094 | 69.81889 | 0.0159 | 39.92458 | 33.87687 | 0.0084 | |

| r ≤ 3 | 0.066076 | 35.70636 | 47.85613 | 0.4113 | 19.61936 | 27.58434 | 0.3681 | |

| r ≤ 4 | 0.031166 | 16.08699 | 29.79707 | 0.7061 | 9.087066 | 21.13162 | 0.8253 | |

| r ≤ 5 | 0.019504 | 6.999928 | 15.49471 | 0.5776 | 5.652982 | 14.26460 | 0.6581 | |

| r ≤ 6 | 0.004682 | 1.346946 | 3.841466 | 0.2458 | 1.346946 | 3.841466 | 0.2458 |

| Countries | AM | PM |

|---|---|---|

| China | 11.46316 ** | 11.46697 ** |

| [0.0218] | [0.0218] | |

| Europe | 2.823325 | 2.676316 |

| [0.5878] | [0.6134] | |

| India | 14.26114 * | 14.61548 * |

| [0.0065] | [0.0056] | |

| Middleast | 0.985495 | 1.036224 |

| [0.9120] | [0.9043] | |

| USA | 1.097667 | 1.056319 |

| [0.8946] | [0.9011] | |

| Japan | 5.747930 | 5.559686 |

| [0.2188] | [0.2345] | |

| All | 39.73789 ** | 39.85663 ** |

| [0.0228] | [0.0222] |

| Period | S.E. | AM | CHINA | EUROPE | INDIA | JAPAN | ME | USA |

| 1 | 32.87089 | 100.0000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 48.83444 | 97.81736 | 0.369022 | 0.002640 | 1.362191 | 0.412170 | 0.011811 | 0.024805 |

| 3 | 60.28221 | 93.96896 | 1.437363 | 0.020277 | 3.916234 | 0.525709 | 0.030454 | 0.101004 |

| 4 | 70.57235 | 90.33201 | 2.960562 | 0.099475 | 5.935963 | 0.441409 | 0.052982 | 0.177601 |

| 5 | 80.51930 | 87.86119 | 4.492252 | 0.162236 | 6.792671 | 0.382519 | 0.072330 | 0.236802 |

| 6 | 89.94258 | 86.37892 | 5.747412 | 0.176895 | 6.918623 | 0.374386 | 0.079009 | 0.324757 |

| 7 | 98.76150 | 85.38511 | 6.643931 | 0.175779 | 6.807959 | 0.407142 | 0.076038 | 0.504037 |

| 8 | 107.0527 | 84.54426 | 7.249423 | 0.189330 | 6.695781 | 0.452383 | 0.071566 | 0.797257 |

| 9 | 114.8859 | 83.78750 | 7.694000 | 0.235001 | 6.589393 | 0.496272 | 0.071724 | 1.126109 |

| 10 | 122.2276 | 83.24309 | 8.091308 | 0.299486 | 6.385866 | 0.532952 | 0.080716 | 1.366585 |

| Period | S.E. | PM | CHINA | EUROPE | INDIA | JAPAN | ME | USA |

| 1 | 32.75884 | 100.0000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 48.55616 | 97.78275 | 0.395436 | 0.000573 | 1.401004 | 0.384046 | 0.012659 | 0.023530 |

| 3 | 59.97487 | 93.85970 | 1.515672 | 0.028425 | 3.981353 | 0.488187 | 0.032664 | 0.094002 |

| 4 | 70.23423 | 90.17236 | 3.084398 | 0.118097 | 6.000755 | 0.402811 | 0.056110 | 0.165472 |

| 5 | 80.11301 | 87.68341 | 4.636716 | 0.183294 | 6.851640 | 0.345443 | 0.075958 | 0.223535 |

| 6 | 89.45171 | 86.20311 | 5.892530 | 0.198104 | 6.974789 | 0.335484 | 0.082777 | 0.313202 |

| 7 | 98.20075 | 85.22055 | 6.782923 | 0.197985 | 6.860249 | 0.364696 | 0.079898 | 0.493696 |

| 8 | 106.4393 | 84.39227 | 7.388850 | 0.214875 | 6.740564 | 0.405294 | 0.075625 | 0.782525 |

| 9 | 114.2289 | 83.64683 | 7.845735 | 0.265642 | 6.621410 | 0.444599 | 0.076329 | 1.099456 |

| 10 | 121.5296 | 83.10989 | 8.264412 | 0.333877 | 6.402074 | 0.477294 | 0.086176 | 1.326274 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

S, M.I.; Lazar, D. Does Volume of Gold Consumption Influence the World Gold Price? J. Risk Financial Manag. 2022, 15, 273. https://doi.org/10.3390/jrfm15070273

S MI, Lazar D. Does Volume of Gold Consumption Influence the World Gold Price? Journal of Risk and Financial Management. 2022; 15(7):273. https://doi.org/10.3390/jrfm15070273

Chicago/Turabian StyleS, Maria Immanuvel, and Daniel Lazar. 2022. "Does Volume of Gold Consumption Influence the World Gold Price?" Journal of Risk and Financial Management 15, no. 7: 273. https://doi.org/10.3390/jrfm15070273

APA StyleS, M. I., & Lazar, D. (2022). Does Volume of Gold Consumption Influence the World Gold Price? Journal of Risk and Financial Management, 15(7), 273. https://doi.org/10.3390/jrfm15070273