A Primer on Rules of Origin as Non-Tariff Barriers

Abstract

:1. Introduction

- To briefly present the landscape of ROO among a few typical PTAs using heuristics that help to show the complexity and variety across PTAs (Section 2);

- To present the simple analytics of ROO to disentangle the components of compliance costs (Section 3);

- To survey the main findings in the literature (Section 4);

- To make suggestions about next steps to fill the gaps in our knowledge (Section 5).

2. Capturing the Complexity of Rules of Origin

2.1. Regime-Wide Rules (RWRs)

2.2. Product-Specific Rules (PSRs)

- A Change in Tariff Classification (CTC). This change can be a Change of Chapter (CC), a Change of Heading (CTH), or a Change of Sub-heading (CTSH) level);

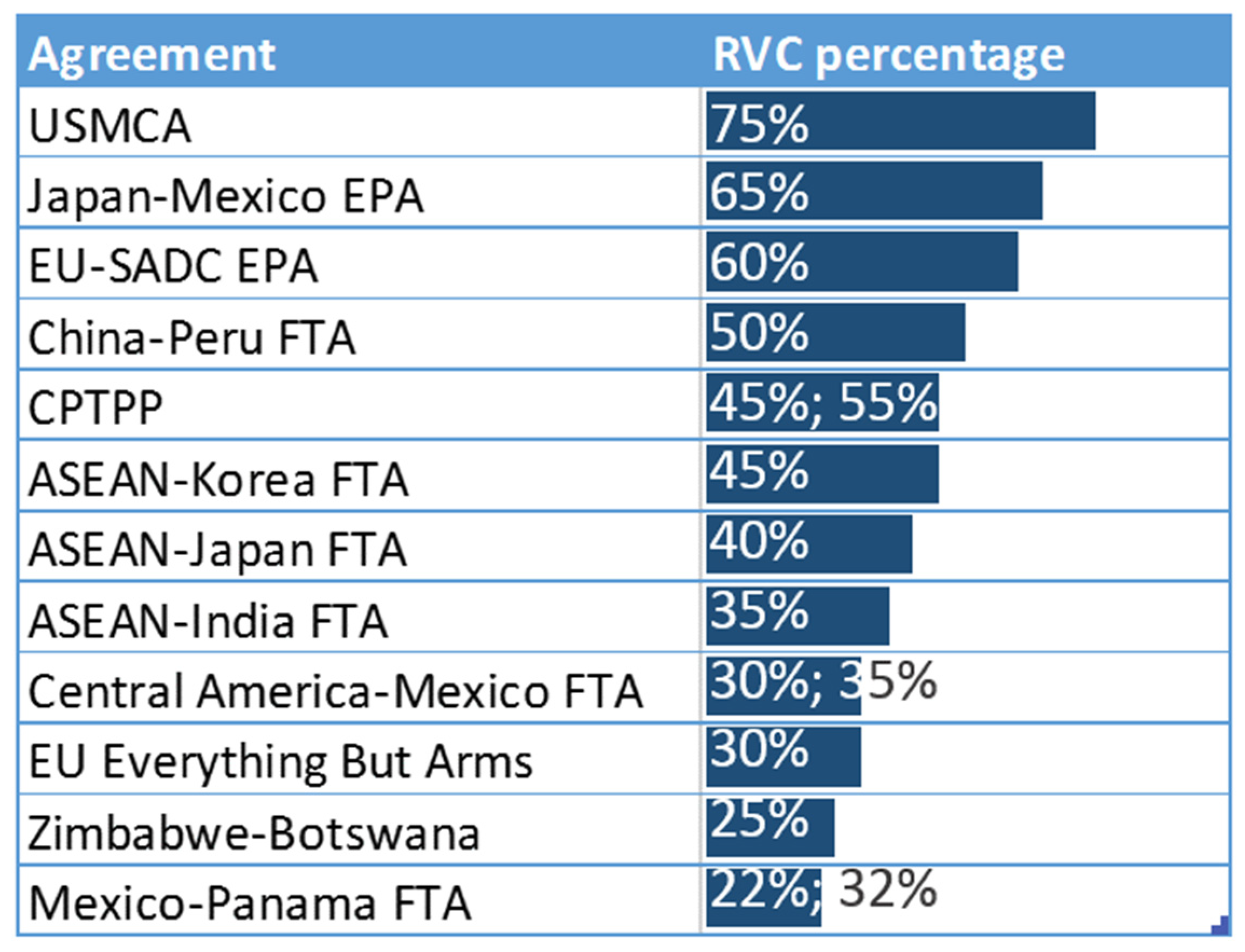

- An ad valorem percentage for Regional Value Content (RVC);

- Specific Processing (SP) operations;

- Exceptions (ECT) and Allowances (ALW).

3. Disentangling the Economics of Origin Requirements

- (i).

- heterogeneity in membership. Producers in countries with membership in several PTAs have to choose between several ROO regimes within and across PTAs;

- (ii).

- heterogeneity in firm characteristics: A given preferential margin does give the same market access to firms in a sector but not to the same degree of benefit;

- (iii).

- heterogeneity in ROO requirements: ROO requirements, especially RVC and other PSRs are costly to satisfy; they reduce the benefits from tariff concessions.

3.1. The Decision to Apply for Preferences

3.2. A Summary Formula

- a distorted cost component, , resulting from the beneficiary being forced to source from the partner, e.g., meeting a minimum RVC and/or satisfying the technical requirements listed in Table 3;

- an administrative or fixed cost component, , related to obtaining the certificate of origin (CoOi);

- a rent-sharing component, µi, between the exporter of intermediate goods to the partner exporting the final product to the producer of intermediates. For example, a South African exporter of fabric might charge a higher price for yarn sold to the captive Mozambican producer who has to meet an RVC than to other shirt producers outside SADC.

3.3. Distortionary Costs Caused by Regional Value Content (RVC) Criteria

3.4. Pass-Through, Restrictiveness, and Administrative Costs

- For a given depth of preferences, all other things being equal, more restrictive ROO result in a lower use of preferences, and conversely.

- For a given level of ROO restrictiveness, a higher preference margin leads to a higher use of preferences.

- Decisions concerning the use of preferences by firms are binary (yes or no); the way these decisions accrue in a rate of utilisation of preferences at the sectoral level depends on the (unobserved) distribution of costs of compliance.

- A lower price pass-through of preferences produces, ceteris paribus, a weaker use of preferences.

- An improvement in the use of preferences can be obtained either by a reduction of the restrictiveness of the ROO or by administrative simplification reducing the costs of certification.

4. Summary Evidence

4.1. Utilisation of Preferences

4.2. Third-Country Trade Effects

4.3. Choice of Rules

4.4. Preference Margins and Complexity of ROO

4.5. Trade Deflection

- (1)

- The deflecting traders would not think of triggering duty drawback on tariffs and taxes upon re-exportation, which is allowed in most countries. In efficient trade management, tariffs and taxes are typically paid only at the final destination upon entry into consumption, not at each intermediate destination.

- (2)

- The entrepôt country through which trade deflection occurs somehow compensates the final-destination country for the tariff revenue foregone, or the final-destination country is ignorant of its revenue and does not implement controls. Typically, customs vigorously monitor trade deflection of significant trade flows and intervene to prevent unintended behavior of traders by, e.g., suspending preferences or requiring additional evidence.

- (3)

- Notwithstanding (2), domestic producers will close their eyes on foreign competitors free riding on their preferential rents secured by the negotiators.

4.6. Firm-Level Evidence

5. Conclusions. Looking Ahead: What We Need to Know

- Rather than publishing the data at original level of granularity, compile and publish aggregated indicators (e.g., at HS-2, HS-4 or HS-6 and/or by region) to give an initial sense of uptake of preferences;

- Provide for non-disclosure agreements, e.g., with academia or technical trade organisations, in order to get robust, objective advice based on existing literature and best practices, to help improve future trade policies using ex-post evaluation of existing trade agreements;

- Integrate relevant data-disclosure clauses in FTAs. New generation of FTAs contains clauses where parties are obliged to exchange preference utilisation statistics for monitoring purposes. In practice, this exchange often takes place on a confidential basis. However, nothing should prevent the parties to publish the data upon mutual consent.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | Henceforth, use of ROO in the text implies only preferential rules of origin (PROO). This paper does not undertake the analysis of non-preferential rules of origin (NPROO). |

| 2 | Baldwin and Freeman (2021) note that the 2019 pandemic has exposed the fragility of the world trading system, relying increasingly on outsourcing and just-in-time inventory. They discuss the alternatives of making GVCs shorter and more domestic or more diversified. In either case, ROO will be a key lever to achieve the objective. |

| 3 | Brenton and Imagawa (2004) report results from a survey administered to customs officials in developing economies by the World Customs Organization. Two-thirds of respondents in Sub-Saharan Africa agreed that dealing with ROO under overlapping trade agreements caused major problems. A majority also agreed that administering ROO detracted from the other objectives of tax collection and trade facilitation. |

| 4 | PTAs and free trade agreements (FTAs) both require ROO (as do non-reciprocal PTAs such as EU’s Everything But Arms program (EBA), US’ African Growth and Opportunity Act (AGOA), and Generalized System of Preferences (GSP) used by a number of developed nations). Here, the terms will be used inter-changeably. |

| 5 | See Abreu (2016) for a tally of preference utilization rates (purs) on reciprocal PTAs for Australia, Canada, China, the European Union, and the United States. In response to an engagement at the World Trade Organization (WTO) ministerial in 2015, 14 member states granting non-reciprocal preferences to least developed countries (LDCs) have reported purs to the WTO. WTO (2021) reports these purs by country and product over the period 2015–2019. Also see in Crivelli and Inama (2020) how purs can be used to reform PROO towards LDCs. |

| 6 | NAFTA stands for North American Free Trade Agreement of 1994. |

| 7 | ASEAN stands for the agreement in trade in goods adopted among the Association of Southeast Asian Nations. |

| 8 | MERCOSUR stands for the Southern Common Market, a preferential area among Argentina, Brazil, Paraguay, and Uruguay. |

| 9 | SADC stands for preferential area of the Southern African Development Community. |

| 10 | |

| 11 | Gourdon et al. (2021a, sct. 5) discuss at greater length the difficulty in designing criteria to classify PSRs. |

| 12 | Yang (2021) exploits the variation in RVCs in the automative industry over 2000–2014 across 23 PTAs and 26 HS6-digit autoparts. Her results show that ROO facilitate trade diversion, estimating that the impact of RVCs on intermediate trade would be equivalent to the removal of a 19% [53%] ad-valorem tariff when the associated RVC is below [above] 60%. She also detects a hump-shaped relation in the shifting of sourcing with variations in the RVC; when the RVC goes beyond 65%, firms relocate their production elsewhere. This result echoes Head et al. (2021)’s ongoing study of the USMCA who establish a “ROO Laffer curve” where the average automotive regional content in a car within USMCA first expands then contracts with increasing content requirement. |

| 13 | Erosion of preferences coming from competition with other beneficiaries may be a deterrent to export the good altogether for a SME which can only be detected with data on utilisation by firms. See Carrère et al. (2010) for a comparison of unadjusted and adjusted preferential margins. |

| 14 | The average regional MFN tariff on clothing in SADC is 45%. Access to the South African market tor SADC partners requires satisfying the “double transformation” rule for most members, except MMTZ (Malawi, Mozambique, Tanzania, and Zambia) within an origin quota, who only need to satisfy a “single transformation”. |

| 15 | This decomposition is also presented in Gourdon et al. (2020). |

| 16 | The unit value diagram known as the Lerner diagram represents an equilibrium under perfect competition when all prices and technology are taken as given. |

| 17 | Main countries are Australia, Canada, the European Union, Japan, and the United States. No granular data is publicly available for utilisation of preferences by their exporters in partner countries, so it is difficult to estimate the use of preferences of these countries’ exporters in these partners. Nilsson (2016) and Kasteng and Inama (2018) estimate that about two-thirds of EU exporters use tariff-free access in their exports to partners while partners use preferences for over 90% of their exports to the EU. Thanks to data on the EUs purs, Crivelli et al. (2021) identify critical products warranting further scrutiny of their ROO, i.e., purs below 70% and preference margins above 2 percent. |

| 18 | Recent comprehensive surveys include WTO (2011a, 2011b), Abreu (2016). UNCTAD (2019) has case studies covering African PTAs. Contributions in Cadot et al. (2006a) and Estevadeordal and Suominen (2006) cover the economics of ROO. Inama (2009) concentrates on the drafting and administration aspects of ROO. |

| 19 | Building on the Melitz (2003) heterogeneous firm model, Cherkashin et al. (2015) estimate that, for Bangladesh, subsidies applied to fixed costs have a greater impact on exports than subsidies to entry costs. Hayakawa et al. (2019) estimate a fixed-cost ratio of utilisation preferences for Japan’s PTAs. They show that their shortcut method relying only on import data by tariff schemes delivers fixed-cost ratios that are higher for products making use of more inputs. They estimate that Japan’s imports from PTA partners under preferential status requires 8–10% additional fixed costs. |

| 20 | Keck and Lendle (2012) have access to high frequency data by month at the district level. Using combinatorics, they make assumptions about the likelihood of observing more than one observation per month in individual districts from which they derive a subset of the data that is likely to be close to individual transactions. |

| 21 | USITC (2019, Figure ES1) documents the components of automotive ROO. For light vehicles, they include RVC (4 different percentage rates), steel content, aluminium content further detailed into (by weight), and labor value content at a specific minimum-threshold wage. |

| 22 | The word ‘obfuscating’ is borrowed from Magee et al. (1989)’s description of the makings of tariff policy. |

| 23 | The authors did not have exact freight rates between all country pairs for each product. Instead, they used granular import data of the United States which reports both FOB and CIF unit values. The difference between CIF and FOB should, on average, represent transport costs (freight and insurance). |

References

- Abreu, Maria Donner. 2016. Preferential rules of origin in regional trade agreements. In Regional Trade Agreements and the Multilateral Trading System. Edited by Rohini Acharya. Cambridge: Cambridge University Press, pp. 58–110. [Google Scholar]

- Albert, Christoph, and Lars Nilsson. 2016. To Use or Not to Use (Trade Preferences) That Is the Question: Estimating the Fixed Cost Threshold. New York: Mimeo. [Google Scholar]

- Anderson, James E., and Eric Van Wincoop. 2004. Trade Costs. Journal of Economic Literature 42: 691–751. [Google Scholar] [CrossRef]

- Augier, Patricia, Michael Gasiorek, and Charles Lai Tong. 2005. The Impact of Rules of Origin on Trade Flows. Economic Policy 20: 586–624. [Google Scholar] [CrossRef]

- Baldwin, Richard. 2006. Multilateralising Regionalism: Spaghetti Bowls as Building Blocs on the Path to Global Free Trade. World Economy 29: 1451–518. [Google Scholar] [CrossRef] [Green Version]

- Baldwin, Richard, and Rebecca Freeman. 2021. Risks and Global Supply Chains: What We Know and What We Need to Know. NBER Working Paper 29444. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Belgian Foreign Trade Agency. 2021. Belgian Exporters and Free Trade Agreements: A Good Match? WTO Webinar on Preference Utilisation. May 19. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjIofbntcX4AhW6w4sBHcxgDf8QFnoECAYQAQ&url=https%3A%2F%2Fwww.wto.org%2Fenglish%2Ftratop_e%2Froi_e%2Fs2_decoster19may21.pdf&usg=AOvVaw2aQPOS6y-MX_zQ3bISnUv5 (accessed on 1 May 2022).

- Bombarda, Pamela, and Elisa Gamberoni. 2019. Diagonal Cumulation and Sourcing Decisions. Policy Research Working Paper No. 8884. Washington, DC: World Bank. [Google Scholar]

- Brenton, Paul, and Hiroshi Imagawa. 2004. Rules of Origin, Trade and Customs. In Customs Modernization Handbook. Edited by Jose B. Sokol and Luc du Wulf. Washington, DC: World Bank. [Google Scholar]

- Brunelin, Stephanie, Jaime de Melo, and Alberto Portugal-Perez. 2019. How Much Market Access? A Case Study of Jordan’s Exports to the EU. World Trade Review 18: 431–49. [Google Scholar] [CrossRef] [Green Version]

- Cadestin, Charles, Julien Gourdon, and Przemyslaw Kowalski. 2016. Participation in Global Value Chains in Latin America: Implications for Trade and Trade-Related Policy. OECD Trade Policy Papers No. 192. Paris: OECD. [Google Scholar]

- Cadot, Olivier, and Jaime de Melo. 2008. Why OECD Countries should reform their Rules of Origin. World Bank Research Observer 23: 77–105. [Google Scholar] [CrossRef]

- Cadot, Olivier, Alejandro Graziano, Jeremy Harris, and Christian Volpe. 2014. Do Rules of Origin Constrain Export Growth: Firm-level Evidence from Colombia. IDB DP #350. Available online: https://publications.iadb.org/publications/english/document/Do-Rules-of-Origin-Constrain-Export-Growth-Firm-Level-Evidence-from-Colombia.pdf (accessed on 1 May 2022).

- Cadot, Olivier, Calvin Djiofack, and Jaime de Melo. 2008. Préférences Commerciales et Règles d’Origine: Perspectives des Accords de Partenariat Economique pour l’Afrique de L’Ouest. Revue d’Economie du Développement 24: 1–44. [Google Scholar] [CrossRef] [Green Version]

- Cadot, Olivier, Céline Carrère, Jaime de Melo, and Alberto Portugal-Pérez. 2005. Market Access and Welfare Under Free Trade Agreements: Textiles under NAFTA. The World Bank Economic Review 19: 379–405. [Google Scholar] [CrossRef] [Green Version]

- Cadot, Olivier, Antoni Estevadeordal, Akiko Suwa-Eisenmann, and Thierry Verdier, eds. 2006a. The Origin of Goods: Rules of Origin in Regional Trade Agreements. Oxford: Oxford University Press, 332p. [Google Scholar]

- Cadot, Olivier, Céline Carrère, Jaime de Melo, and Bolormaa Tumurchudur. 2006b. Product-Specific Rules of Origin in EU and US preferential Trade Arrangements: An assessment. World Trade Review 5: 199–224. [Google Scholar] [CrossRef]

- Carrère, Celine, and Jaime de Melo. 2006. Are Rules of Origin Equally Costly? Estimates from NAFTA. In Cadot et al. eds.. Available online: https://ssrn.com/abstract=564942 (accessed on 1 May 2022).

- Carrère, Celine, Jaime de Melo, and Bolormaa Tumurchudur. 2010. Disentangling Market Access Effects of Preferential Trading Arrangements with an Application for ASEAN Members under an ASEAN–EU FTA. The World Economy 33: 42–59. [Google Scholar] [CrossRef] [Green Version]

- Cherkashin, Ivan, Svetlana Demidova, Hiau Looi Kee, and Kala Krishna. 2015. Firm Heterogeneity and Costly Trade: A New Estimation Strategy and Policy Experiments. Journal of International Economics 96: 18–36. [Google Scholar] [CrossRef] [Green Version]

- Conconi, Paola, Manuel García-Santana, Laura Puccio, and Roberto Venturini. 2018. From Final Goods to Inputs: The Protectionist Effects of Rules of Origin. American Economic Review 108: 2335–65. [Google Scholar] [CrossRef] [Green Version]

- Crivelli, Pramila, and Stefano Inama. 2020. Getting to Better Rules of Origin for LDCs Using Utilization Rates: From the WTO Ministerial decision in Hong Kong (2005) To Bali (2013), Nairobi (2015) and beyond. UNCTAD, UNCTAD/ALDC/2019/3. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwi16oOzwMX4AhUID6YKHcisAaYQFnoECAIQAQ&url=https%3A%2F%2Functad.org%2Fsystem%2Ffiles%2Fofficial-document%2Faldc2019d3_en.pdf&usg=AOvVaw11Il8VD7VjQZDvGokYLP8P (accessed on 1 May 2022).

- Crivelli, Pramila, and Stefano Inama. 2021. Improving market for LDCs: The impact of the EU Reform of Rules of Origin on Utilization Rates and Trade Flows under the Everything But Arms Initiative (EBA). UNCTAD Working Paper. August. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjvo4SHxcX4AhXSAogKHdPyBJgQFnoECAsQAQ&url=https%3A%2F%2Fwww.un.org%2Fldc5%2Fsites%2Fwww.un.org.ldc5%2Ffiles%2Ft6_inama_eu_reform_2021_16_helsinki_final_20210816_clean.pdf&usg=AOvVaw3IN3fGdRjRTCXPqEsMTtDD (accessed on 1 May 2022).

- Crivelli, Pramila, Stefano Inama, and Jonas Kasteng. 2021. Using Utilization Rates to Identify Rules of Origin Reforms: The Case of EU Free Trade Area Agreements. EUI WO #21. Available online: https://cadmus.eui.eu/handle/1814/70396 (accessed on 1 May 2022).

- de Melo, Jaime, and Alberto Portugal-Perez. 2014. Preferential Market Access Design: Evidence and Lessons from African Apparel Exports to the United States and the European Union. World Bank Economic Review 28: 74–98. [Google Scholar] [CrossRef] [Green Version]

- Estevadeordal, Antoni. 2000. Negotiating Preferential Market Access. Journal of World Trade 34: 141–66. [Google Scholar] [CrossRef]

- Estevadeordal, Antoni, and Kati Suominen. 2006. Rules of origin: A world map. In Cadot et al. eds. [Google Scholar]

- Felbermayr, Gabriel, Feodora Teti, and Erdal Yalcin. 2019. Rules of origin and the profitability of trade deflection. Journal of International Economics 121: 103248. [Google Scholar] [CrossRef]

- Francois, Joseph, Bernard Hoekman, and Miriam Manchin. 2006. Preference Erosion and Multiateral Trade Erosion. World Bank Economic Review 20: 197–216. [Google Scholar] [CrossRef] [Green Version]

- Gillson, Ian. 2012. Deepening Regional Integration to Eliminate the Fragmented Goods Market in Southern Africa. In De-Fragmenting Africa: Deepening Regional Trade in Goods and Services. Edited by Paul Brenton and Gözde Isik. Washington, DC: World Bank, chp. 8. [Google Scholar]

- Gourdon, Julien, Dzmitry Kniahin, Jaime de Melo, and Mondher Mimouni. 2020. Rules of Origin across African Regional Trading Agreements: A landscape with measures to address challenges at Harmonization. Journal of African Trade 8: 96–108. [Google Scholar] [CrossRef]

- Gourdon, Julien, Dzmitry Kniahin, Jaime de Melo, and Mondher Mimouni. 2021a. Mapping and Comparing Rules of Origin across Regional Trade Agreements with ITC’s Rules of Origin Facilitator. Available online: https://hal.archives-ouvertes.fr/hal-03420238/ (accessed on 1 May 2022).

- Gourdon, Julien, Dzmitry Kniahin, Jaime de Melo, and Mondher Mimouni. 2021b. Closing in on Harmonizing Rules of Origin for AfCFTA: Anatomy of Reconciliations and Remaining Challenges. Available online: https://hal.archives-ouvertes.fr/hal-03420215/ (accessed on 1 May 2022).

- Hayakawa, Kazunobu, Naoto Jinji, Toshiyuki Matsuura, and Taiyo Yoshimi. 2019. Costs of Utilizing Regional Trade Agreements. Discussion Papers 19-E-054. Research Institute of Economy, Trade and Industry (RIETI). Available online: https://voxeu.org/article/costs-using-regional-trade-agreement (accessed on 1 May 2022).

- Hayakawa, Kazunobu, Nuttawut Laksanapanyakul, and Shujiro Urata. 2016. Measuring the Costs of FTA Utilization: Evidence from Transaction-level Import Data of Thailand. Review of International Economics 152: 559–75. [Google Scholar] [CrossRef] [Green Version]

- Head, Keith, Thierry Mayer, and Marc Melitz. 2021. Moving Parts: When More Restrictive Rules of Origin Backfire. Mimeo. Available online: https://www.bing.com/ck/a?!&&p=2637063df443231208f83e511f4cee9936662b0116760a0def444204715e39aaJmltdHM9MTY1NjA1NTcxNyZpZ3VpZD1kZGY1NzE1ZC0yZjQzLTQwMTQtYjE5MC1iODk4MGFmYzI0YWYmaW5zaWQ9NTEzNw&ptn=3&fclid=42fddad9-f38f-11ec-a0c4-e2425627d37c&u=a1aHR0cHM6Ly93d3cuYWVhd2ViLm9yZy9jb25mZXJlbmNlLzIwMjEvcHJlbGltaW5hcnkvcG93ZXJwb2ludC83MzhhVEhhaA&ntb=1 (accessed on 1 May 2022).

- Hoekman, Bernard, and Stefano Inama. 2018. Harmonization of Rules of Origin: An Agenda for Plurilateral Cooperation? East Asian Economic Review 22: 3–28. [Google Scholar] [CrossRef]

- Inama, Stefano. 2009. Rules of Origin in International Trade. Cambridge: Cambridge University Press, 610p. [Google Scholar]

- ITC (International Trade Centre). 2015. The Invisible Barriers to Trade—How Businesses Experience Non-Tariff Measures. Technical Paper, Doc. No. MAR-15-326.E. Geneva: ITC, vol. xii, 39p. [Google Scholar]

- Johnson, Robert C., and Guillermo Noguera. 2012. Accounting for Intermediates: Production Sharing and Trade in Value Added. Journal of International Economics 86: 224–36. [Google Scholar] [CrossRef] [Green Version]

- Kasteng, Jonas, and Stefano Inama. 2018. The Use of the EU’s Free Trade Agreements: Exporter and Importer Utilization of Preferential Tariffs. UNCTAD. Available online: https://unctad.org/en/PublicationsLibrary/EU_2017d1_en.pdf (accessed on 1 May 2022).

- Keck, Alexander, and Andreas Lendle. 2012. New Evidence on Preference Utilization. WTO Staff Working Papers No. ERSD-2012-12. Available online: https://ideas.repec.org/p/zbw/wtowps/ersd201212.html (accessed on 1 May 2022).

- Krishna, Kala. 2006. Understanding Rules of Origin. In Cadot et al. eds.. Available online: https://ssrn.com/abstract=663516 (accessed on 1 May 2022).

- Krishna, Kala, Carlos Salamanca, Yuta Suzuki, and Christian Volpe Martincus. 2021. Learning to Use Trade Agreements. NBER WP#29319. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwiGvsvtxsX4AhVBFIgKHeJMBVYQFnoECAQQAQ&url=https%3A%2F%2Fwww.nber.org%2Fsystem%2Ffiles%2Fworking_papers%2Fw29319%2Fw29319.pdf&usg=AOvVaw0DuITH8SRLQltEeeYeJTzd (accessed on 1 May 2022).

- Krueger, Anne O. 1993. Free Trade Agreements as Protectionist Devices: Rules of Origin. NBER Working Paper No. 4352. Available online: https://econpapers.repec.org/paper/nbrnberwo/4352.htm (accessed on 1 May 2022).

- Magee, Stephen, William Brock, and Leslie Young. 1989. Black Hole Tariffs and Endogenous Policy Theory: Political Economy in General Equilibrium. Cambridge: Cambridge University Press, 460p. [Google Scholar]

- Mavroidis, Petros, and Edwin Vermulst. 2018. The Case for dropping Preferential Rules of Origin. Journal of World Trade 52: 1–13. [Google Scholar] [CrossRef]

- Melitz, Marc. 2003. The Impact of trade on intra-industry reallocations and aggregate industry Productivity. Econometrica 71: 1695–725. [Google Scholar] [CrossRef] [Green Version]

- Nilsson, Lars. 2016. EU exports and Uptake of Preferences: A first Analysis. Journal of World Trade 50: 219–52. [Google Scholar] [CrossRef]

- Park, Innwon, and Soonchan Park. 2011. Best practices for regional trade agreements. Review of World Economics 147: 249–68. [Google Scholar] [CrossRef]

- Powers, William, and Ricky Ubee. 2020. Comprehensive Comparison of Rules of Origin in U.S. Trade Agreements. Office of Economics Working Paper 2020-05-D. Available online: https://www.bing.com/ck/a?!&&p=486c6c49dfc5f5ddd8f97dd06ece1595bb34a0ba6196e8fa2fee1ea3b42c003eJmltdHM9MTY1NjA2NDMyOSZpZ3VpZD1kMTJjOWJiNC00M2E5LTQwZDgtYWYxMy03NTdhNDM1Mjg2OWUmaW5zaWQ9NTE0MA&ptn=3&fclid=4fd30220-f3a3-11ec-86c0-2be7f7c9a112&u=a1aHR0cHM6Ly93d3cudXNpdGMuZ292L3B1YmxpY2F0aW9ucy8zMzIvd29ya2luZ19wYXBlcnMvcG93ZXJzX3ViZWVfY29tcHJlaGVuc2l2ZV9hbmFseXNpc19vZl91c19yb29fMjAyMC0wNS0yMF9jb21wbGlhbnQucGRm&ntb=1 (accessed on 1 May 2022).

- Sytsma, Tobias. 2021a. Rules of origin and trade preference utilization among least developed countries. Contemporary Economic Policy 39: 701–18. [Google Scholar] [CrossRef]

- Sytsma, Tobias. 2021b. Improving Preferential Market Access through Rules of Origin: Firm-Level Evidence from Bangladesh. AEJ: Economic Policy 14: 440–72. [Google Scholar] [CrossRef]

- UNCTAD. 2019. Economic Development in Africa Report 2019. Made in Africa—Rules of Origin for Enhanced Intra-African Trade. UNCTAD/ALDC/AFRICA/2019. Geneva: UNCTAD. [Google Scholar]

- USITC. 2019. U.S.-Mexico-Canada Trade Agreement: Likely Impact on the U.S. Economy and on Specific Industry Sectors. Investigation No. TPA-105-003. USITC Publication 4889. April. Available online: https://www.bing.com/ck/a?!&&p=8dea79bcf617e212112f702ab91659ed78edcf21750a0b96c01e18099951d8c0JmltdHM9MTY1NjA1MjYyNSZpZ3VpZD0xMzE1MDkwNS03MzQ2LTQwMWQtOTljZC02MWFlYmJlNDc4MGMmaW5zaWQ9NTEzOA&ptn=3&fclid=0fa53bd0-f388-11ec-bcf8-059e495d5045&u=a1aHR0cHM6Ly93d3cudXNpdGMuZ292L3B1YmxpY2F0aW9ucy8zMzIvcHViNDg4OS5wZGY&ntb=1 (accessed on 1 May 2022).

- WCO. 2017. Update of the Comparative Study on Preferential Rules of Origin (Version 2017). June 20. Available online: http://www.wcoomd.org/en/media/newsroom/2017/june/update-of-the-comparative-study-on-preferential-rules-of-origin.aspx (accessed on 1 May 2022).

- WTO. 2011a. Section C: Causes and Effects of PTAs: Is it all About Preference. In The WTO and Preferential Trade Agreements: From Co-Existence to Coherence. Geneva: World Trade Report. [Google Scholar]

- WTO. 2011b. Section D: Anatomy of Preferential Trade Agreements. In The WTO and Preferential Trade Agreements: From Co-Existence to Coherence. Geneva: World Trade Report. [Google Scholar]

- WTO. 2021. Utilization Of Trade Preferences by Least Developed Countries: 2015–2019: Patterns and Trends. Note by the Secretariat. G/RO/W/204. May 7. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwiG7eq-ucX4AhXQ3mEKHY8TB1UQFnoECAoQAQ&url=https%3A%2F%2Fdocs.wto.org%2Fdol2fe%2FPages%2FSS%2Fdirectdoc.aspx%3Ffilename%3Dq%3A%2FG%2FRO%2FW204.pdf%26Open%3DTrue&usg=AOvVaw376lWqwhOEgD91Pz1wWYx7 (accessed on 1 May 2022).

- Yang, Chenying. 2021. Rules of Origin in Auto-Parts Trade. Singapore Management University, July. Available online: https://chenying-yang.com/RoO_autoparts.pdf (accessed on 1 May 2022).

| PTA | ASEAN | EFTA | MERCOSUR | NAFTA | SAFTA | SADC |

|---|---|---|---|---|---|---|

| ASEAN | 4 | NA | 14 | 2 | 4 | |

| EFTA | 53 | NA | 4 | 3 | 40 | |

| MERCOSUR | 37 | 30 | NA | NA | NA | |

| NAFTA | 47 | 50 | 37 | 2 | 4 | |

| SAFTA | 63 | 47 | 67 | 40 | 4 | |

| SADC | 47 | 43 | 50 | 53 | 60 |

| Presence in 370 PTAs | Rule | Definition |

|---|---|---|

| 5% | WO | Good is entirely (i.e., wholly) obtained or manufactured in one country without using any non-originating materials. |

| 2% | NC | The non-originating inputs are not required to be classified in a different HS code than the final good to confer originating status. |

| 9% | CC | The originating status is conferred to a good that is classified in a different HS chapter than the non-originating inputs. |

| 45% | CTH | The originating status is conferred to a good that is classified in a different HS heading than the non-originating inputs. |

| 8% | CTSH | The originating status is conferred to a good that is classified in a different HS subheading than the non-originating inputs. |

| 0.02% | CTI | The originating status is conferred to a good that is classified in a different HS tariff item than the non-originating inputs. |

| 5% | ALW | The originating status is allowed to be conferred from non-originating inputs of specific HS codes. |

| 7% | ECT | The originating status cannot be conferred to a good if the non-originating inputs are from HS codes listed under exception. |

| 8% | SP | A good originates in the country where a defined technical requirement, i.e., a specified working or processing, has taken place. |

| 62% | RVC | A good obtains originating status if a defined regional value content percentage has been reached. |

| 0.3% | RQC | A good obtains originating status if a defined regional quantity content percentage has been reached. |

| 1% | RVP | A good obtains originating status if a defined regional value content percentage on a part or parts has been reached. |

| 0.3% | RQP | A good obtains originating status if a defined regional quantity content percentage on a part or parts has been reached. |

| 3% | Other | Origin criteria other than related to wholly obtained, CTC, value (quantity) content, or specified process. |

| Stage of Value Chain | Product/Input | Value Added | Transformation (Jargon) | HS Codes |

|---|---|---|---|---|

| Stage 4 | T-shirt (‘cut and sew’) | +40% | ‘single’ | HS6 codes |

| Stage 3 | Fabric | +20% | ‘double’ | HS6 codes |

| Stage 2 | Yarn | +20% | ‘triple’ | HS6 codes |

| Stage 1 | Raw cotton | +20% | HS6 codes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kniahin, D.; de Melo, J. A Primer on Rules of Origin as Non-Tariff Barriers. J. Risk Financial Manag. 2022, 15, 286. https://doi.org/10.3390/jrfm15070286

Kniahin D, de Melo J. A Primer on Rules of Origin as Non-Tariff Barriers. Journal of Risk and Financial Management. 2022; 15(7):286. https://doi.org/10.3390/jrfm15070286

Chicago/Turabian StyleKniahin, Dzmitry, and Jaime de Melo. 2022. "A Primer on Rules of Origin as Non-Tariff Barriers" Journal of Risk and Financial Management 15, no. 7: 286. https://doi.org/10.3390/jrfm15070286