Examining the Asymmetric Effects of Third Country Exchange Rate Volatility on Trade between the US and the EU

Abstract

:1. Introduction

2. Model Specifications

3. Data Sources and Empirical Results

3.1. Data Sources

3.2. Empirical Results

3.2.1. The Estimation Results of the Unit Root Tests

3.2.2. The Estimation Results of the Linear ARDL Model for Exports

3.2.3. The Estimation Results of the Linear ARDL Model for Imports

3.2.4. The Estimation Results of the Nonlinear ARDL Model for Exports

3.2.5. Diagnostic Test Results in the Nonlinear ARDL Model for Exports

3.2.6. The Estimation Results of the Nonlinear ARDL Model for Imports

3.2.7. Diagnostic Test Results in the Nonlinear ARDL Model for Imports

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Code | (Export Share %) | ln REX | D08 | C | ||||

|---|---|---|---|---|---|---|---|---|

| 84 | 12.15 | 1.5489 *** | −0.1763 | 0.0148 | 0.0073 | 0.0011 | −0.0002 | 14.8247 *** |

| 88 | 11.59 | 2.6791 *** | −0.5738 | −0.0487 | 0.0656 | −0.0795 * | −0.0935 * | 9.0323 *** |

| 90 | 10.51 | 1.1464 *** | −0.6044 *** | 0.0003 | 0.0164 | −0.0281 | −0.0414 | 15.7767 *** |

| 30 | 8.80 | 0.1303 | −0.3858 | 0.3761* | 0.0974 | −0.4234 | −0.0707 | 20.5243 *** |

| 85 | 8.35 | 1.6925 *** | −0.2056* | 0.0301 | −0.0202 | 0.0143 | 0.0098 | 12.9735 *** |

| 27 | 7.13 | 5.5512 ** | −5.0997 *** | −0.1345 | 0.1761 | −0.4166 *** | −0.4909 *** | −6.4550 |

| 87 | 6.22 | 2.7232 *** | −0.2586 | 0.3654 *** | −0.1100 *** | 0.0433 | 0.0350 | 7.1458 ** |

| 29 | 5.51 | 1.0004 | −1.3928 *** | −0.2964 ** | 0.0070 | −0.0216 | −0.0272 | 15.6448 *** |

| 71 | 3.15 | 2.5084 *** | −2.1780 *** | −0.2214 | −0.0241 | −0.0195 | −0.0502 | 7.1744 ** |

| 39 | 3.13 | 1.4402 *** | −0.7199 *** | −0.1114 * | −0.0213 | 0.0102 | −0.0036 | 12.8308 *** |

| 98 | 2.79 | 2.4353 *** | −1.2830 *** | −0.0626 | 0.0018 | −0.2132 ** | −0.2270 ** | 8.0108 * |

| 38 | 2.57 | 1.4235 *** | −0.7876 *** | 0.2774 *** | −0.0181 | 0.0044 | −0.0154 | 12.5460 *** |

Appendix B

| Code | Import Share % | ln REX | D08 | C | ||||

|---|---|---|---|---|---|---|---|---|

| 84 | 16.28 | 3.1616 *** | −0.6634 *** | −0.0780 | 0.0238 | −0.0614 ** | −0.0719 ** | 7.4671 *** |

| 30 | 12.53 | 0.5941 ** | 0.1349 | −0.0619 | 0.0172 | 0.0166 | −0.0181 | 18.5248 *** |

| 87 | 11.58 | 3.7940 *** | 0.3580 | 0.1054 | 0.1139 * | −0.1119 ** | −0.1130 ** | 5.3396 |

| 29 | 6.67 | −0.3162 | −0.0515 | 0.1705 * | −0.0679 | 0.0721 ** | 0.0701 ** | 22.2023 *** |

| 90 | 6.60 | 1.6544 *** | −0.4008 *** | −0.0417 | 0.0296 * | −0.0284 ** | −0.0426 *** | 13.5343 *** |

| 85 | 6.03 | 1.7252 *** | −0.0309 | 0.1207 | 0.0180 | −0.0339 | −0.0453 | 13.1437 *** |

| 98 | 4.19 | 0.5564 | −0.2273 | 0.0561 | 0.1221 ** | −0.0009 | −0.0380 | 18.2213 *** |

| 27 | 3.89 | 4.4688 *** | −3.2745 *** | 0.0413 | −0.0029 | −0.0026 | −0.0223 | −0.3420 |

| 88 | 2.90 | 2.4327 *** | −0.6339 * | −0.2139 * | −0.0111 | −0.1132 * | −0.1311 ** | 8.5864 *** |

| 22 | 2.88 | 1.4878 *** | −0.1397 | 0.0345 | −0.0153 | −0.0308 * | −0.0441 ** | 13.1998 *** |

| 71 | 2.08 | 2.2499 *** | −0.9009 *** | 0.0352 | 0.1004 | −0.0352 | −0.0486 | 10.0547 *** |

| 39 | 1.73 | 2.0259 *** | −0.0778 | −0.1807 *** | 0.0135 | −0.0579 *** | −0.0737 *** | 10.3971 *** |

| 1 | The EU consists of 27 members: on/before 2003, there were 15 members, namely Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden, and the United Kingdom. In 2004, Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, and Slovenia joined. In 2007, Bulgaria and Romania joined. In 2013, Croatia joined, but the United Kingdom withdrew in 2020. |

| 2 | This list comprises the 12 largest industries by trade market share, representing the trade flows of an industry as a fraction of the exports or imports of the United States and the EU. |

References

- Arize, Augustine C. 1997. Conditional exchange-rate volatility and the volume of foreign trade: Evidence from seven industrialized countries. Southern Economic Journal 64: 235–54. [Google Scholar]

- Bahmani-Oskooee, Mohsen, and Abera Gelan. 2018. Exchange-Rate Volatility and International Trade Performance: Evidence from 12 African Countries. Economic Analysis and Policy 58: 14–21. [Google Scholar] [CrossRef] [Green Version]

- Bahmani-Oskooee, Mohsen, and Augustine C. Arize. 2020. On the Asymmetric Effects of Exchange Rate Volatility on Trade Flows: Evidence from Africa. Emerging Markets Finance & Trade 56: 913–39. [Google Scholar]

- Bahmani-Oskooee, Mohsen, and Hanafiah Harvey. 2017. Exchange Rate Volatility and Its Impact on Commodity Trade Flows between Singapore and Malaysia. Journal of Economic Development 42: 17–33. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Huseyin Karamelikli. 2019. Exchange Rate Volatility and Japan—U.S. Commodity Trade: An Asymmetry Analysis. The World Economy 42: 3287–318. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Huseyin Karamelikli. 2021. Exchange Rate Volatility and Commodity Trade between U.K. and China: An Asymmetric Analysis. The Chinese Economy 55: 41–65. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Muhammad Aftab. 2017. On the asymmetric effects of exchange volatility on trade flows: New evidence from US-Malaysia trade at the industry level. Economic Modelling 63: 86–103. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Ridha Nouira. 2020. On the impact of exchange rate volatility on Tunisia’s trade with 16 partners: An asymmetry analysis. Economic Change and Restructuring 53: 357–78. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Scott W. Hegerty. 2007. Exchange Rate Volatility and Trade Flows: A Review Article. Journal of Economic Studies 34: 211–55. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Yongqing Wang. 2007. The Impact of Exchange Rate Volatility on Commodity Trade between the U.S. and China. Economic Issues 12: 31. [Google Scholar]

- Bahmani-Oskooee, Mohsen, Scott W. Hegerty, and Dan Xi. 2015. Third-country exchange rate volatility and Japanese–US trade: Evidence from industry-level data. Applied Economics 48: 1452–62. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, Scott W. Hegerty, and Jia Xu. 2013. Exchange-rate volatility and US–Hong Kong industry trade: Is there evidence of a ‘third country’ effect? Applied Economics 45: 2629–51. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, Scott W. Hegerty, and Ruixin Zhang. 2014. The Effects of Exchange-Rate Volatility on Korea Trade Flows: Industry—Level Estimates. Economic Papers 33: 76–94. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, Toan Luu Duc Huynh, and Muhammad Ali Nasir. 2021. On the asymmetric effects of exchange-rate volatility on trade flows: Evidence from US—UK Commodity Trade. Scottish Journal of Political Economy 68: 51–102. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef] [Green Version]

- Bredin, Don, Stilianos Fountas, and Eithne Murphy. 2003. An empirical analysis of short-run and long run Irish export functions: Does exchange rate volatility matter. International Review of Applied Economics 17: 193–208. [Google Scholar] [CrossRef] [Green Version]

- Broil, Udo, and Bernhard Eckwert. 1999. Exchange rate volatility and international trade. Southern Economic Journal 66: 178–85. [Google Scholar] [CrossRef]

- Chien, Mei-Se, Nur Setyowati, and Chih-Yang Cheng. 2020. Asymmetric effects of exchange rate volatility on bilateral trade between Taiwan and Indonesia. The Singapore Economic Review 65: 857–88. [Google Scholar] [CrossRef]

- Choudhry, Taufiq, Syed Shabi Ul Hassan, and Fotios I. Papadimitriou. 2014. UK imports, third country effect and the global financial crisis: Evidence from the asymmetric ARDL method. International Review of Financial Analysis 32: 199–208. [Google Scholar] [CrossRef] [Green Version]

- Choudhry, Taufiq. 2003. Exchange Rate Volatility and the United States Exports: Evidence from Canada and Japan. Journal of the Japanese and International Economies 19: 51–71. [Google Scholar] [CrossRef]

- Cushman, David O. 1986. Has exchange risk depressed international trade: The impact of third country exchange risk. Journal of International Money and Finance 5: 361–79. [Google Scholar] [CrossRef]

- Dada, James Temitope. 2020. Asymmetric effect of exchange rate volatility on trade in sub-Saharan African countries. Journal of Economic and Administrative Sciences 37: 149–62. Available online: https://www.emerald.com/insight/1026-4116.htm (accessed on 6 June 2020). [CrossRef]

- De Vita, Glauco, and Andrew Abbott. 2004. Real Exchange Rate Volatility and US Exports: An ARDL Bounds Testing Approach. Economic Issues 9: 69–78. [Google Scholar]

- Ekanayake, E. M., Ranjini L. Thaver, and Daniel Plante. 2011. The Effects of Exchange Rate Volatility on South Africa’s Trade with the European Union. Global Conference on Business and Fiance Proceedings 6: 643–50. [Google Scholar]

- Hayakawa, Kazunobu, and Fukunari Kimura. 2009. The Effect of Exchange Rate Volatility on International Trade in East Asia. Journal of the Japanese and International Economies 23: 395–406. [Google Scholar] [CrossRef] [Green Version]

- McKenzie, Michael D. 1998. The impact of exchange rate volatility on Australian trade flows. Journal of International Financial Markets, Institutions and Money 8: 21–38. [Google Scholar] [CrossRef]

- McKenzie, Michael D., and Robert D. Brooks. 1997. The Impact of Exchange Rate Volatility on German—US trade flows. Markets, Institutions and Money 7: 73–87. [Google Scholar] [CrossRef]

- Nyambariga, Manyara Douglas. 2017. Effects of Exchange Rate Volatility on Imports and Exports in Kenya. International Journal of Economics 2: 71–84. [Google Scholar]

- Ozturk, Ilhan. 2006. Exchange rate volatility and trade: A literature survey. International Journal of Applied Econometrics and Quantitative Studies 3: 85–102. [Google Scholar]

- Perée, Eric, and Alfred Steinherr. 1989. Exchange rate uncertainty and foreign trade. European Economic Review 33: 1241–64. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Senadza, Bernardin, and Desmond Delali Diaba. 2017. Effect of Exchange Rate Volatility on Trade in Sub-Saharan Africa. Journal of African Trade 4: 20–36. [Google Scholar] [CrossRef]

- Serenis, Dimitrios, and Nicholas Tsounis. 2013. Exchange Rate Volatility and Foreign Trade: The case for Cyprus and Croatia. Procedia Economics and Finance 5: 677–85. [Google Scholar] [CrossRef] [Green Version]

- Sharma, Chandan, and Debdatta Pal. 2018. Exchange rate volatility and India’s cross-border trade: A pooled mean group and nonlinear cointegration approach. Economic Modelling 74: 230–46. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2014. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt, Econometric Methods and Applications. Edited by Robin Sickels and William Horrace. New York: Springer, pp. 281–314. [Google Scholar]

- Sugiharti, Lilik, Miguel Angel Esquivias, and Bekti Setyorani. 2020. The impact of exchange rate volatility on Indonesia’s top exports to the five main export markets. Heliyon 6: e03141. [Google Scholar] [CrossRef]

- Sukar, Abdul-Hamid, and Seid Hassan. 2001. US Exports and Time-Varying Volatility of Real Exchange Rate. Global Finance Journal 12: 109–19. [Google Scholar] [CrossRef]

- Tunc, Cengiz, M. Nihat Solakoglu, Senol Babuscu, and Adalet Hazar. 2018. Exchange rate risk and international trade: The role of third country effect. Economics Letters 167: 152–55. [Google Scholar] [CrossRef]

- Usman, Ahmed, Nicholas Apergis, and Sofia Anwar. 2021. Examining the Asymmetric Effects of Third-Country Exchange Rate Volatility on Pakistan–China Commodity Trade. Journal of International Commerce, Economics and Policy 12: 2150008. [Google Scholar] [CrossRef]

- Wang, Xue, Weiming Hu, and Haisheng Yang. 2016. Exchange Rate Volatility and Bilateral Trade Flows of China: Is There a Third Country Exchange Effect. Journal of Financial Research 433: 1–16. [Google Scholar]

- Wong, Hock-Tsen, and Hock-Ann Lee. 2016. Exchange Rate Volatility and Exports of Malaysian Manufactured Goods to China: An Empirical Analysis. International Journal of Business and Society 17: 145–59. [Google Scholar] [CrossRef]

- Yakub, Maaji Umar, Z. Sani, T. O. Obiezue, and Victoria O. Aliyu. 2019. Empirical Investigation on Exchange Rate Volatility and Trade Flows in Nigeria. Economic and Financial Review 57: 23–46. [Google Scholar]

| Variables | Description | Data Sources |

|---|---|---|

| EXP | US Export Volume | US Census Bureau |

| IMP | US Import Volume | US Census Bureau |

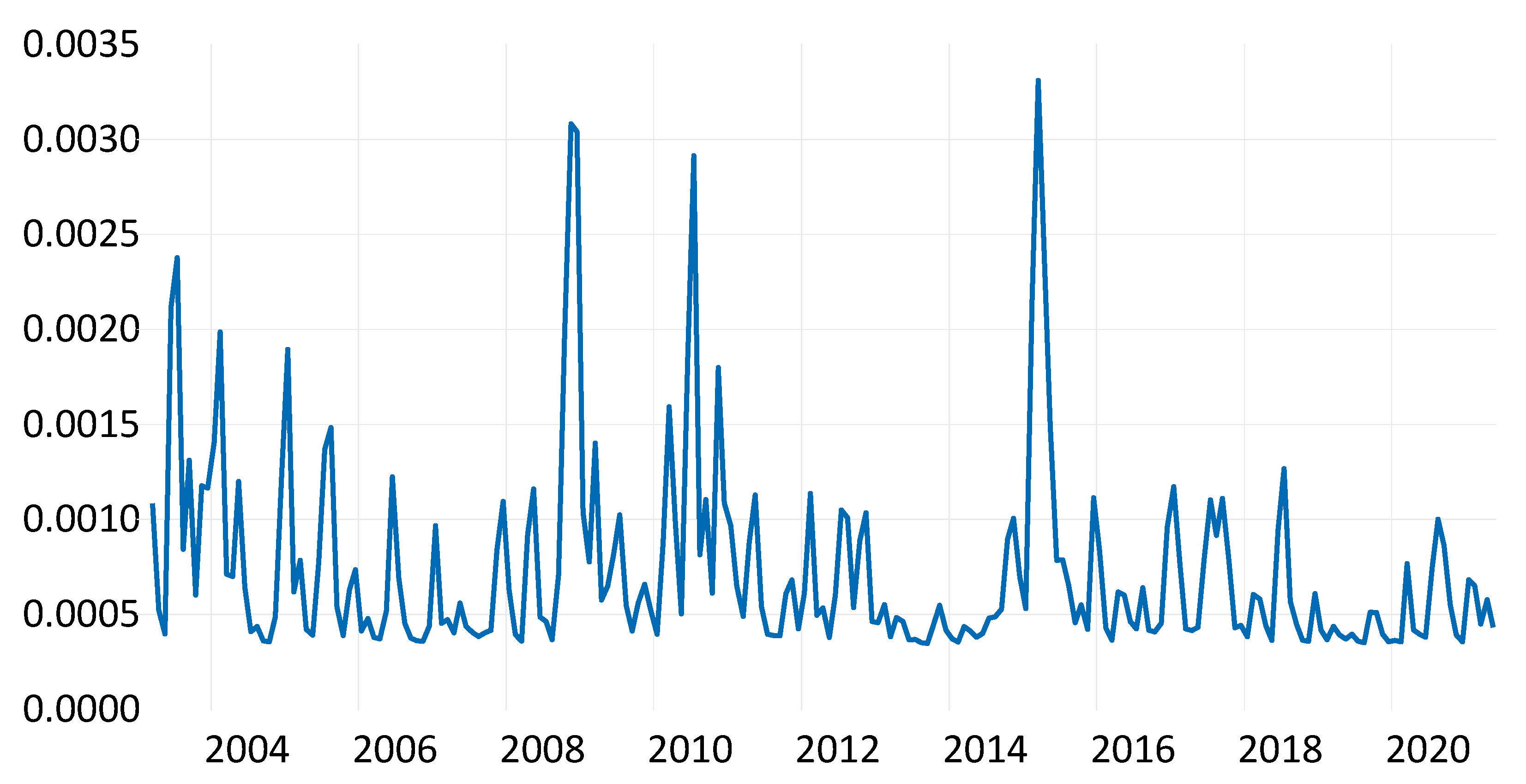

| The volatility of the real USD/EUR exchange rate | Generated by the GARCH model | |

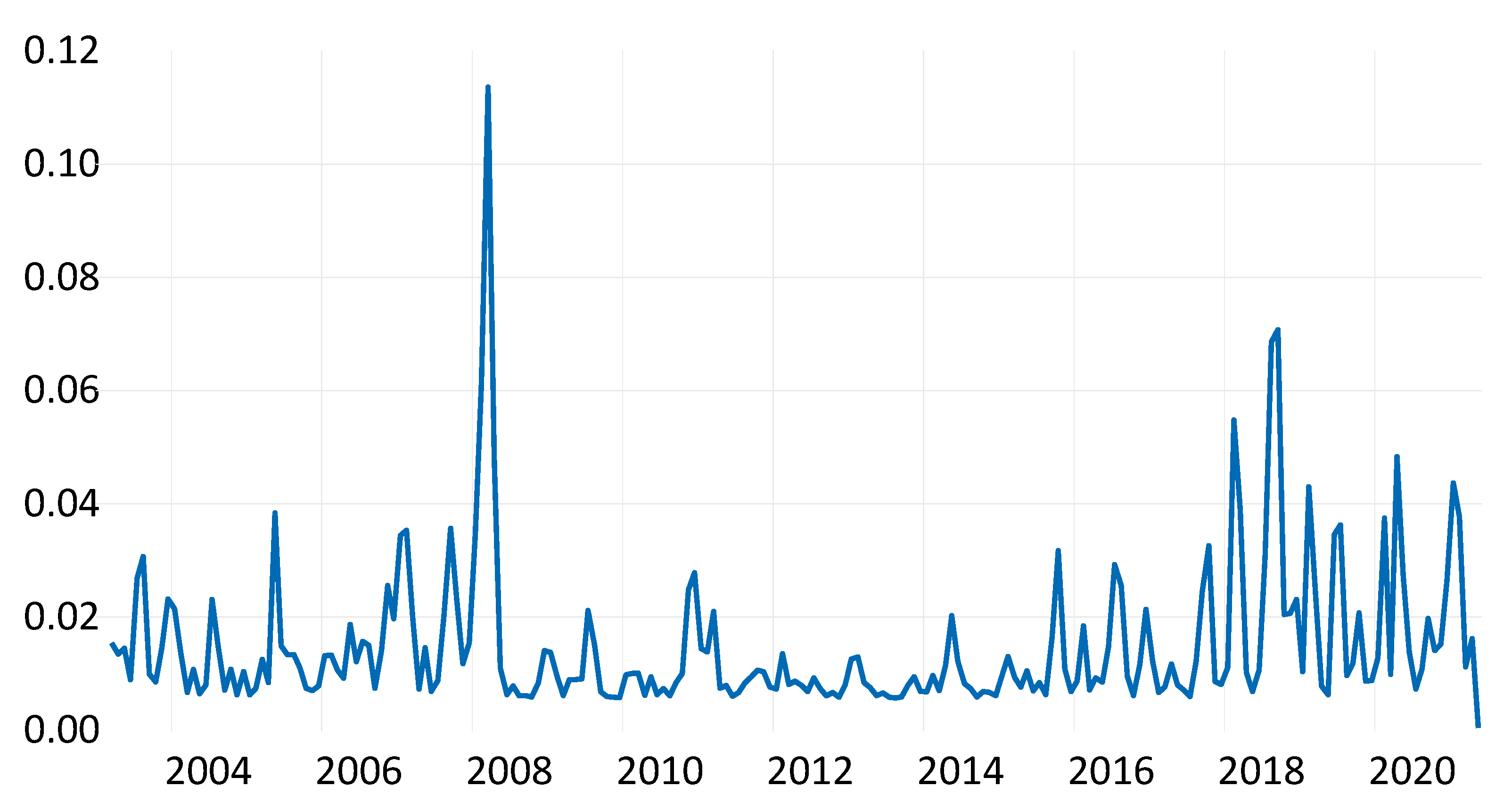

| The volatility of the real CNY/USD exchange rate | Generated by the GARCH model | |

| The partial sum of positive changes in | Calculated from | |

| The partial sum of negative changes in | Calculated from | |

| Industrial Production Index for the EU | Organization for Economic Cooperation and Development (OECD) | |

| Industrial Production Index for the US | OECD | |

| REX | Bilateral Real Exchange Rate between the US and EU | International Financial Statistics (IFS) |

| 22 | Beverages, Spirits, and Vinegar | US Census Bureau |

| 27 | Mineral Fuel, Oil, etc.; Bitumen Substances; Minerals | US Census Bureau |

| 29 | Organic Chemicals | US Census Bureau |

| 30 | Pharmaceutical Products | US Census Bureau |

| 38 | Miscellaneous Chemical Products | US Census Bureau |

| 39 | Plastics and Articles Thereof | US Census Bureau |

| 71 | Natural Pearls; Precious Stones; Precious Metals; Coins | US Census Bureau |

| 84 | Nuclear Reactors, Boilers, Machinery, etc.; Parts | US Census Bureau |

| 85 | Electric Machinery, etc.; Sound Equipment; TV Equipment | US Census Bureau |

| 87 | Vehicles, Except Railway or Tramway, and Parts, etc. | US Census Bureau |

| 88 | Aircraft, Spacecraft, and Parts Thereof | US Census Bureau |

| 90 | Optics, Photography, etc.; Medical or Surgical Instruments, etc. | US Census Bureau |

| 98 | Special Classification Provisions; Nesoi | US Census Bureau |

| Code | ADF | PP | ||

|---|---|---|---|---|

| Level | First Difference | Level | First Difference | |

| EXP (IMP) | EXP (IMP) | EXP (IMP) | EXP (IMP) | |

| 22 | - (−2.0786) | - (−4.8710 ***) | - (−6.2083 ***) | - (−28.0674 ***) |

| 27 | −2.5873 (−3.8459 ***) | −23.0287 *** (−19.2528 ***) | −3.2917 * (−4.5601 ***) | −27.1056 *** (−21.0906 ***) |

| 29 | −8.4107 *** (−6.5782 ***) | −11.6154 *** (−10.9815 ***) | −8.8106 *** (−12.3140 ***) | −62.4228 *** (−66.0803 ***) |

| 30 | −2.3310 (−0.7706) | −10.1021 *** (−12.6763 ***) | −6.2343 *** (−1.5542) | −45.1170 *** (−97.5126 ***) |

| 38 | −4.2044 *** - | −17.7894 *** - | −4.0994 *** - | −20.9102 *** - |

| 39 | −4.0034 ** (−1.3543) | −4.3161 *** (−4.3175 ***) | −4.9856 *** (−1.3543) | −20.5492 *** (−4.3175 ***) |

| 71 | −3.3483 * (−1.9173) | −14.0898 *** (−4.5924 ***) | −6.9696 *** (−9.4687 ***) | −20.4012 *** (−62.9839 ***) |

| 84 | −4.3227 *** (−2.3409) | −3.9509 ** (−2.8710 *) | −7.5628 *** (−2.7223 *) | −47.0528 *** (−25.4081 ***) |

| 85 | −3.0295 (−1.5848) | −4.3546 *** (−4.2202 ***) | −7.8802 *** (−3.2098 **) | −37.5643 *** (−21.4753 ***) |

| 87 | −2.7866 (−2.1526) | −5.0567 *** (−4.3176 ***) | −6.5573 *** (−6.2841 ***) | −34.2331 *** (−27.4778 ***) |

| 88 | −7.2514 *** (−1.8822) | −12.1127 *** (−12.6688 ***) | −7.0820 *** (−8.0740 ***) | −37.3814 *** (−63.7902 ***) |

| 90 | −2.4094 (−2.1633) | −4.1103 *** (−4.6780 ***) | −6.8750 *** (−3.0940 **) | −47.5503 *** (−32.4129 ***) |

| 98 | −3.7289 ** (−0.6341) | −14.9877 *** (−11.7495 ***) | −5.2079 *** (−2.2660) | −27.0568 *** (−113.9014 ***) |

| −3.0348 | −12.2679 *** | −3.2976 * | −12.7832 *** | |

| −2.0019 | −11.2155 *** | −2.1451 | −10.6790 *** | |

| REX | −3.0614 | −11.5114 *** | −2.9826 | −11.4776 *** |

| −8.3919 *** | −13.4585 *** | −7.7477 *** | −44.0813 *** | |

| −8.3689 *** | −10.7328 *** | −7.7496 *** | −46.6138 *** | |

| −0.4352 | −11.4992 *** | −0.0347 | −15.5532 *** | |

| −0.4053 | −12.2130 *** | −0.0317 | −14.9700 *** | |

| Lags on Δln VEU and VCN | ||||||

|---|---|---|---|---|---|---|

| Code | ||||||

| 84 | 0.0010 | −0.0151 | 0.0207 ** | |||

| 88 | 0.0043 | −0.0499 | 0.0466 | −0.0657 *** | 0.0419 * | |

| 90 | −0.0004 | −0.0156 | 0.0167 * | |||

| 30 | −0.0067 | −0.0509 * | 0.0456 ** | −0.0028 | ||

| 85 | 0.0008 | −0.0197 * | −0.0091 | 0.0131 | ||

| 27 | 0.0120 | −0.0643 ** | ||||

| 87 | −0.0553 ** | −0.0268 | 0.0637 *** | |||

| 29 | −0.0333 | 0.0010 | ||||

| 71 | −0.0314 | 0.0096 | ||||

| 39 | −0.0117 | −0.0074 | 0.0296 ** | −0.0176 | ||

| 98 | −0.0069 | −0.0210 ** | 0.0257 ** | −0.0264 *** | ||

| 38 | −0.0230 ** | 0.0082 | ||||

| Long-Run Coefficient Estimates | |||||||

|---|---|---|---|---|---|---|---|

| Code | ln REX | C | F-Statistic | ||||

| 84 | 1.6443 *** | −0.1058 | 0.0020 | 0.0109 | 13.9132 *** | 10.0130 *** | −0.5175 *** |

| 88 | 3.8739 ** | 0.2463 | 0.0035 | −0.0847 | 3.2568 | 6.0488 *** | −0.2812 *** |

| 90 | 1.8363 | −0.2534 | −0.0058 | 0.0147 | 12.8861 * | 1.3108 | −0.0750 *** |

| 30 | 2.3209 | 0.3439 | −0.1801 | −0.0422 | 9.1464 | 1.4321 | −0.0665 *** |

| 85 | 2.2806 *** | −0.0131 | −0.0585 * | 0.0124 | 10.2034 *** | 9.1998 *** | −0.3235 *** |

| 27 | 24.0894 ** | −4.2737 | 0.2167 | −1.1576 * | −94.1988 ** | 3.9315 *** | −0.0556 *** |

| 87 | 3.7619 *** | −0.1732 | −0.1202 ** | 0.0803 | 2.8649 | 12.0498 *** | −0.4600 *** |

| 29 | 0.5379 | −0.7666 ** | −0.0834 | 0.0251 | 17.4808 *** | 5.2884 *** | −0.3987 *** |

| 71 | 1.8282 | −1.3964 | −0.5106 | 0.1556 | 8.4842 | 1.4490 | −0.0614 *** |

| 39 | 2.5245 *** | 0.1223 | −0.0922 | 0.0363 | 7.9893 ** | 3.4661 *** | −0.1270 *** |

| 98 | 6.5076 * | −1.1103 | −0.1348 | −0.4258 * | −13.0612 | 2.2320 * | −0.0510 *** |

| 38 | 3.8603 * | −0.7263 | −0.3674 | 0.1310 | −0.0963 | 2.1723 | −0.0625 *** |

| Lags on Δln VEU and VCN | |||||||

|---|---|---|---|---|---|---|---|

| Code | |||||||

| 84 | 0.0027 | −0.0282 *** | 0.0242** | ||||

| 30 | 0.0031 | −0.0015 | |||||

| 87 | 0.0483 ** | −0.0438 ** | |||||

| 29 | −0.0303 | 0.0495 ** | |||||

| 90 | 0.0186 * | −0.0131 | |||||

| 85 | −0.0009 | −0.0302 *** | 0.0274 ** | ||||

| 98 | 0.0094 | 0.0018 | −0.0437 | 0.0823 *** | −0.0156 | ||

| 27 | 0.0082 | −0.0841 *** | 0.0673 ** | ||||

| 88 | 0.0829 * | −0.1643 *** | 0.0011 | ||||

| 22 | −0.0172 | −0.0046 | −0.0495 * | 0.0386 * | −0.0289 * | ||

| 71 | 0.0140 | −0.0080 | −0.0932 ** | 0.0874 ** | −0.0180 | −0.0155 | 0.0717 ** |

| 39 | −0.0059 | −0.0214 * | 0.0197 * | ||||

| Long-Run Coefficient Estimates | |||||||

|---|---|---|---|---|---|---|---|

| Code | ln REX | C | F-Statistic | ||||

| 84 | 4.8329 *** | −0.4807 | 0.0217 | −0.0325 | 0.0455 | 2.4935* | −0.1254 *** |

| 30 | 4.1277 | 1.4665 | 0.1245 | −0.0607 | 4.6558 | 1.1487 | −0.0246 *** |

| 87 | 4.0503 *** | 0.2681 | 0.1174 ** | −0.1064 ** | 3.7614 | 4.8061 *** | −0.4113 *** |

| 29 | 0.0972 | −0.1743 | −0.0592 | 0.0968 ** | 20.8151 *** | 6.2970 *** | −0.5118 *** |

| 90 | 3.4706 ** | 0.2072 | 0.2565 | −0.1808 | 6.6566 | 1.9074 | −0.0726 *** |

| 85 | 3.5263 *** | 0.1871 | −0.0083 | −0.0256 | 4.9718 | 1.3350 | −0.1088 *** |

| 98 | 15.9842 | −0.9375 | 1.5345 | −0.4784 | −42.9584 | 1.0348 | −0.0325 ** |

| 27 | 4.3212 *** | −3.6576 *** | 0.0248 | −0.0509 | 0.0759 | 6.1983 *** | −0.3308 *** |

| 88 | 2.6490 * | 0.6437 | −0.2488 | 0.0034 | 6.6605 | 3.6094 *** | −0.3268 *** |

| 22 | 2.4198 ** | 0.5791 | −0.1291 | −0.1144 * | 8.0779 ** | 3.8661 *** | −0.2528 *** |

| 71 | 2.6593 ** | −0.2762 | 0.0005 | 0.1144 | 8.4176 | 2.4399 * | −0.3339 *** |

| 39 | 3.5143 ** | 0.4291 | −0.0758 | −0.0220 | 3.3761 | 1.0162 | −0.0772 ** |

| Short-Run Volatility Coefficient Estimates | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | |||||||||||||

| 84 | 0.0045 | 0.0008 | −0.0317 ** | 0.0319 ** | |||||||||

| 88 | 0.0183 | −0.0497 | 0.0578 * | −0.0363 * | −0.1052 *** | 0.0626 * | |||||||

| 90 | 0.0072 | −0.0093 | 0.0002 | −0.0499 ** | 0.0075 | 0.0392 ** | −0.0427 ** | 0.0223 | 0.0339 | 0.0264 | −0.0579 *** | ||

| 30 | 0.0053 | −0.0.491 * | 0.0555 ** | −0.0010 | −0.0454 | 0.0382 | |||||||

| 85 | 0.0051 | −0.0142 | 0.0076 | −0.0232 * | 0.0285 ** | ||||||||

| 27 | 0.0335 | −0.0863 *** | −0.1015 *** | ||||||||||

| 87 | −0.0490* | −0.0126 | 0.0866 * | −0.1181 ** | 0.1322*** | −0.0541 | −0.0833 * | 0.1127 ** | |||||

| 29 | −0.0295 | −0.0070 | 0.0686 | −0.1410 ** | 0.0753 * | −0.0060 | |||||||

| 71 | −0.0169 | −0.0071 | −0.0173 | ||||||||||

| 39 | −0.0130 | −0.0003 | −0.0210 | 0.0476 ** | −0.0333 ** | ||||||||

| 98 | −0.0007 | −0.0047 | 0.0288 | −0.0571 *** | −0.0351 *** | ||||||||

| 38 | −0.0025 | 0.0058 | −0.0011 | ||||||||||

| Code | (Export Share %) | ln REX | C | ||||

|---|---|---|---|---|---|---|---|

| 84 | 12.15 | 1.5775 *** | −0.1957 * | 0.0085 | 0.0015 | 0.0003 | 14.1584 *** |

| 88 | 11.59 | 2.6110 *** | −0.5170 | 0.0591 | −0.0814 * | −0.0954 * | 9.3092 *** |

| 90 | 10.51 | 1.1468 *** | −0.6048 *** | 0.0165 | −0.0281 | −0.0414 | 15.7751 *** |

| 30 | 8.80 | 0.2827 | −0.8675 * | 0.0524 | −0.0045 | −0.0318 | 19.3489 *** |

| 85 | 8.35 | 1.7541 *** | −0.2410 ** | −0.01789 | 0.0150 | 0.0104 | 12.7014 *** |

| 27 | 7.13 | 5.3527 *** | −4.9516 *** | 0.1633 | −0.4200 *** | −0.4943 *** | −5.6105 |

| 87 | 6.22 | 3.2505 *** | −0.7764 *** | −0.0894 ** | 0.0620 | 0.0536 | 4.7458 ** |

| 29 | 5.51 | 0.4323 | −0.9866 *** | −0.0682 | −0.0092 | −0.0138 | 17.8190 *** |

| 71 | 3.15 | 2.0227 *** | −1.9288 *** | −0.0505 | −0.0212 | −0.0519 | 9.2562 *** |

| 39 | 3.13 | 1.3632 *** | −0.5675 *** | −0.0277 | −0.0007 | −0.0144 | 13.1713 *** |

| 98 | 2.79 | 2.3226 *** | −1.2110 *** | −0.0046 | −0.2158 ** | −0.2296 ** | 8.4935 ** |

| 38 | 2.57 | 2.0686 *** | −1.1541 *** | −0.0072 | 0.0165 | −0.0033 | 9.6043 *** |

| Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

| Code | F-Statistic | LM | RESET | CSM(SQ) | Wald-SR | Wald-LR | |

| 84 | 8.8694 *** | −0.5287 *** | 1.9227 | 1.7533 | S(S) | 5.2690 * | 1.9504 |

| 88 | 10.8440 *** | −0.4457 *** | 1.0139 | 3.5968 * | S(S) | 3.4055 * | 24.4481 *** |

| 90 | 7.6505 *** | −0.4362 *** | 1.9334 | 8.1295 *** | US(S) | 11.1704 *** | 145.0658 *** |

| 30 | 2.0472 | −0.2238 *** | 6.0101 *** | 4.0502 ** | S(S) | 2.5870 | 39.8624 *** |

| 85 | 10.8691 *** | −0.5092 *** | 0.8713 | 0.2715 | S(S) | 5.1811 ** | 26.4939 *** |

| 27 | 5.4159 *** | −0.2054 *** | 0.8793 | 0.1313 | S(S) | 15.2927 *** | 78.1205 *** |

| 87 | 12.0988 *** | −0.5477 *** | 0.8061 | 0.0537 | S(S) | 0.7664 | 15.0903 *** |

| 29 | 4.5388 *** | −0.4328 *** | 0.9980 | 0.5442 | S(US) | 0.0000 | 2.0511 |

| 71 | 3.9798 *** | −0.3348 *** | 4.5988 ** | 1.2110 | S(S) | 18.4150 *** | 92.273 *** |

| 39 | 10.5797 *** | −0.4699 *** | 1.8526 | 2.2994 | S(S) | 0.3027 | 176.4649 *** |

| 98 | 3.0985 ** | −0.1531 *** | 1.0693 | 0.0978 | S(S) | 10.8352 *** | 19.1761 *** |

| 38 | 6.3268 *** | −0.3501 *** | 1.4506 | 0.0009 | S(S) | 31.0794 *** | 168.5321 *** |

| Short-Run Volatility Coefficient Estimates | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | |||||||||||||

| 84 | 0.0021 | −0.0158 | 0.0244 | −0.0441 ** | −0.0612 *** | −0.0058 | 0.0410 ** | 0.0162 | −0.0307 ** | ||||

| 30 | 0.0067 | 0.0076 | −0.0120 | ||||||||||

| 87 | 0.0492 ** | −0.0433 ** | −0.0436 ** | ||||||||||

| 29 | −0.0296 | 0.0565 *** | 0.0013 | 0.0539 | |||||||||

| 90 | 0.0165 | −0.0167 * | −0.0254 *** | ||||||||||

| 85 | 0.0098 | −0.0098 | −0.0586 *** | 0.0451 *** | |||||||||

| 98 | 0.0202 | 0.0039 | −0.0385 | 0.0910 *** | 0.0005 | −0.0215 | |||||||

| 27 | 0.0003 | −0.1319 *** | 0.1239 ** | −0.0068 | |||||||||

| 88 | 0.0869 * | −0.1175 ** | 0.0159 | 0.0043 | −0.1483 * | −0.0456 | −0.0760 | 0.1067 | −0.1281 ** | ||||

| 22 | −0.0097 | −0.0228 | −0.0333 ** | ||||||||||

| 71 | 0.0284 | 0.0001 | −0.0642 | 0.0583 | 0.0580 | −0.0262 | −0.0364 | ||||||

| 39 | −0.0014 | −0.0166 * | −0.0233 ** | ||||||||||

| Code | Import Share % | ln REX | C | ||||

|---|---|---|---|---|---|---|---|

| 84 | 16.28 | 3.0570 *** | −0.5447 *** | 0.0046 | −0.0777 *** | −0.0885 *** | 7.8334 *** |

| 30 | 12.53 | 0.5397 * | 0.2039 | 0.0119 | 0.01342 | −0.0212 | 18.7473 *** |

| 87 | 11.58 | 3.9741 *** | 0.2239 | 0.1217 * | −0.1069 ** | −0.1078 ** | 4.5540 |

| 29 | 6.67 | −0.2081 | −0.2788 | −0.0493 | 0.0942 ** | 0.0919 ** | 21.7854 *** |

| 90 | 6.60 | 1.4762 *** | −0.3290 *** | 0.0274 | −0.0277 * | −0.0420 *** | 14.3434 *** |

| 85 | 6.03 | 1.9003 *** | −0.1943 | 0.0303 | −0.0304 | −0.0419 | 12.3994 *** |

| 98 | 4.19 | 0.6495 | −0.3005 | 0.1291 ** | 0.0009 | −0.0363 | 17.8343 *** |

| 27 | 3.89 | 4.5172 *** | −3.3241 *** | 0.0008 | −0.0233 | −0.0199 | −0.5435 |

| 88 | 2.90 | 2.2953 *** | −0.2789 | −0.0373 | −0.1565 ** | −0.1745 *** | 9.1278 *** |

| 22 | 2.88 | 1.5188 *** | −0.1789 | −0.0123 | −0.0290 | −0.0423 ** | 13.0726 *** |

| 71 | 2.08 | 2.3121 *** | −0.9479 *** | 0.1056 | −0.0343 | −0.0477 | 9.7998 *** |

| 39 | 1.73 | 2.0333 *** | 0.0287 | −0.0033 | −0.0382 * | −0.0537 ** | 10.2658 *** |

| Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

| Code | F-Statistic | LM | RESET | CSM(SQ) | Wald-SR | Wald-LR | |

| 84 | 8.9789 *** | −0.4568 *** | 1.7695 | 1.3872 | S(S) | 2.4036 | 99.6392 *** |

| 30 | 5.3399 *** | −0.5656 *** | 1.0763 | 0.3644 | S(S) | 30.8561 *** | 685.3393 *** |

| 87 | 4.1153 *** | −0.4047 *** | 4.6378 ** | 7.8975 *** | S(S) | 0.1001 | 0.0965 |

| 29 | 2.6912 ** | −0.1113 *** | 1.5402 | 6.3643 ** | S(S) | 1.0523 | 1.0705 |

| 90 | 6.9633 *** | −0.6042 *** | 0.1190 | 2.7887 * | S(S) | 37.3727 *** | 277.7342 *** |

| 85 | 4.5122 *** | −0.3233 *** | 0.6873 | 1.3849 | S(US) | 9.0488 *** | 42.7281 *** |

| 98 | 5.8005 *** | −0.5935 *** | 0.8053 | 0.0187 | S(US) | 34.2494 *** | 376.5459 *** |

| 27 | 5.8955 *** | −0.3420 *** | 1.4678 | 1.3799 | S(S) | 4.4972 ** | 0.4772 |

| 88 | 22.2503 *** | −0.8192 *** | 1.1902 | 0.7947 | S(S) | 0.0458 | 56.1025 *** |

| 22 | 13.7898 *** | −0.7855 *** | 1.2310 | 12.0802 *** | US(S) | 52.5791 *** | 150.6753 *** |

| 71 | 6.0020 *** | −0.7641 *** | 2.6424 ** | 0.2891 | S(S) | 30.3843 *** | 43.5830 *** |

| 39 | 8.5275 *** | −0.4348 *** | 0.8443 | 1.8100 | S(S) | 42.4359 *** | 129.4087 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, C.-H.; Li, S.-H.; Lee, J.-Y. Examining the Asymmetric Effects of Third Country Exchange Rate Volatility on Trade between the US and the EU. J. Risk Financial Manag. 2022, 15, 321. https://doi.org/10.3390/jrfm15080321

Lee C-H, Li S-H, Lee J-Y. Examining the Asymmetric Effects of Third Country Exchange Rate Volatility on Trade between the US and the EU. Journal of Risk and Financial Management. 2022; 15(8):321. https://doi.org/10.3390/jrfm15080321

Chicago/Turabian StyleLee, Chien-Hui, Shu-Hui Li, and Jen-Yu Lee. 2022. "Examining the Asymmetric Effects of Third Country Exchange Rate Volatility on Trade between the US and the EU" Journal of Risk and Financial Management 15, no. 8: 321. https://doi.org/10.3390/jrfm15080321

APA StyleLee, C.-H., Li, S.-H., & Lee, J.-Y. (2022). Examining the Asymmetric Effects of Third Country Exchange Rate Volatility on Trade between the US and the EU. Journal of Risk and Financial Management, 15(8), 321. https://doi.org/10.3390/jrfm15080321