Promotion Pressures of Local Leaders and Real Estate Investments: China and Leader Heterogeneity

Abstract

:1. Introduction

2. Literature Review

2.1. Promotion System of Local Officials in China

2.2. Land Finance in Urban China

3. Hypothesis Development

3.1. Fiscal Decentralization, Political Centralization, and Promotion Pressures

3.2. Individual Characteristics of Local Officials and Promotion Pressures

4. Data, Variables, and Model Specification

4.1. Data

4.2. Promotion Pressures

4.3. Model Specification

5. Empirical Findings

5.1. Baseline Results

5.2. Robustness Checks

5.3. Further Analyses

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

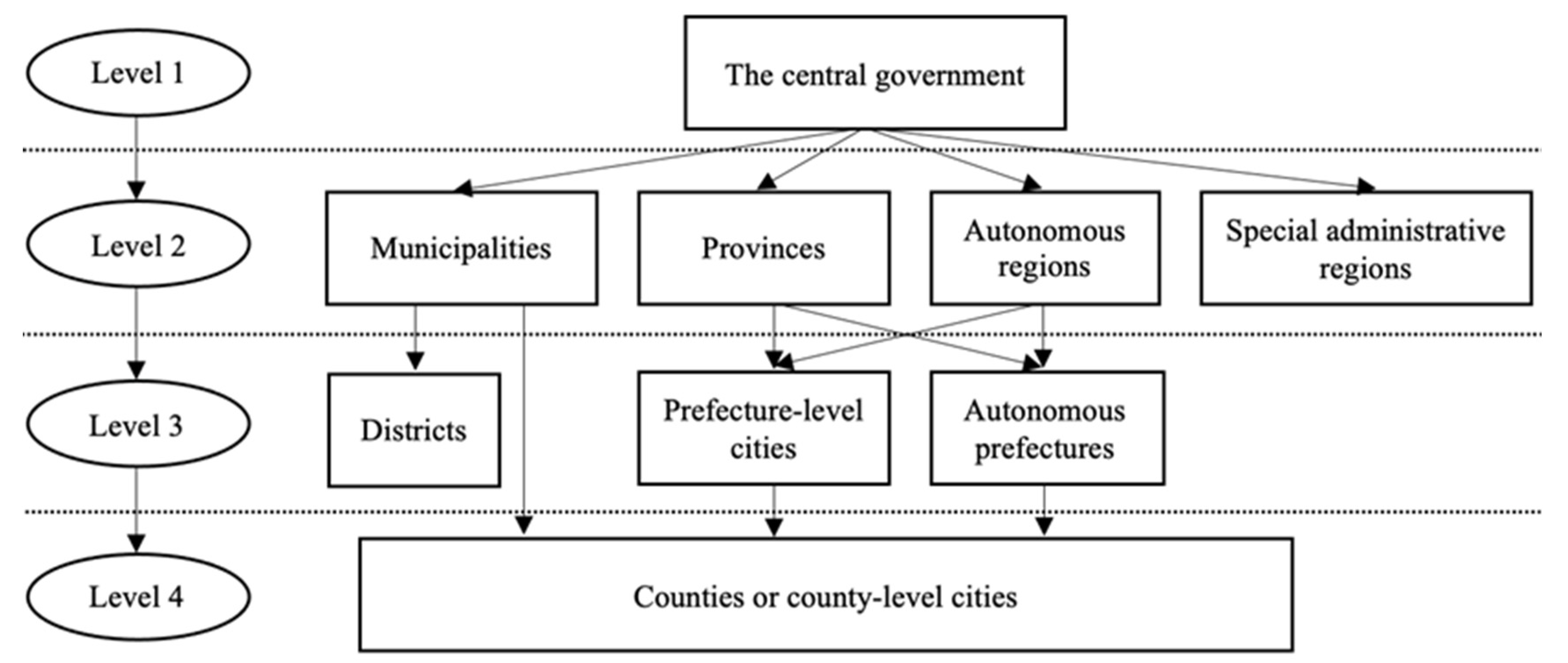

| 1 | The Chinese political hierarchy consists of several levels of local governments, from the central to the township government (Figure 2). Under the central government, there exists provincial level governments (ministries, provinces, centrally administered cities, and ethnic autonomous regions) (He 2006). |

| 2 | See https://www.xinghe.gov.cn/information/xinghe7049/msg2334735249492.html, accessed on 10 June 2022. |

| 3 | We need to point out that arguments were operated before the COVID-19 pandemic. |

| 4 | Sub-provincial city is a special prefecture-level city that is ruled by a province but is administered independently in regard to the economy and law. The mayor of a sub-provincial city is equal in status to a vice-governor of a province. The status is below that of a municipality, which does not belong to any province but is above other, regular prefecture-level cities, which are completely ruled by their provinces. |

References

- Alesina, Alberto, and Nouriel Roubini. 1992. Political cycles in OECD economies. The Review of Economic Studies 59: 663–88. [Google Scholar] [CrossRef] [Green Version]

- Bo, Zhiyue. 1996. Economic performance and political mobility: Chinese provincial leaders. Journal of Contemporary China 5: 135–54. [Google Scholar] [CrossRef]

- Cai, Hongbin, and Daniel Treisman. 2005. Does competition for capital discipline governments? Decentralization, globalization, and public policy. American Economic Review 95: 817–30. [Google Scholar] [CrossRef] [Green Version]

- Cai, Hongbin, and Daniel Treisman. 2006. Did government decentralization cause China’s economic miracle? World Politics 58: 505–35. [Google Scholar] [CrossRef]

- Cao, Guangzhong, Changchun Feng, and Ren Tao. 2008. Local “land finance” in China’s urban expansion: Challenges and solutions. China & World Economy 2: 19–30. [Google Scholar]

- Chen, Shuo. 2015. From Governance to Institutionalization: Political Selection from the Perspective of Central-local Relations in China--Past and Present (1368–2010). Fudan University Working Paper. Shanghai: Department of Economics, Fudan University. [Google Scholar]

- Chen, Ting, and J.K.-S. Kung. 2016. Do land revenue windfalls create a political resource curse? Evidence from China. Journal of Development Economics 123: 86–106. [Google Scholar] [CrossRef]

- Chen, Jie, Danglun Luo, Guoman She, and Qianwei Ying. 2017. Incentive or selection? A new investigation of local leaders’ political turnover in China. Social Science Quarterly 98: 341–59. [Google Scholar] [CrossRef]

- Chen, Ye, Hongbin Li, and Li-An Zhou. 2005. Relative performance evaluation and the turnover of provincial leaders in China. Economics Letters 88: 421–25. [Google Scholar] [CrossRef]

- Chen, Yunsen, Jianqiao Huang, Hang Liu, and Weimin Wang. 2019. Regional favoritism and tax avoidance: Evidence from China. Accounting & Finance 58: 1413–43. [Google Scholar]

- Choi, Eun Kyong. 2012. Patronage and performance: Factors in the political mobility of provincial leaders in post-Deng China. The China Quarterly 212: 965–81. [Google Scholar] [CrossRef]

- Edin, Maria. 2003. State capacity and local agent control in China: CCP cadre management from a township perspective. The China Quarterly 173: 35–52. [Google Scholar] [CrossRef]

- Fang, Xi, Haiming Liu, and Xianhang Qian. 2018. Political incentives and the effectiveness of monetary policy: Evidence from China’s city commercial banks. Applied Economics Letters 25: 70–73. [Google Scholar] [CrossRef]

- Fu, Qiang. 2015. When fiscal recentralisation meets urban reforms: Prefectural land finance and its association with access to housing in urban China. Urban Studies 52: 1791–809. [Google Scholar] [CrossRef]

- Guo, Ping, Guifeng Shi, Gary Gang Tian, and Siqi Duan. 2021. Politicians’ hometown favoritism and corporate investments: The role of social identity. Journal of Banking & Finance 125: 106092. [Google Scholar]

- Han, Li, and Jams Kai-Sing Kung. 2015. Fiscal incentives and policy choices of local governments: Evidence from China. Journal of Development Economics 116: 89–104. [Google Scholar] [CrossRef]

- He, Canfei. 2006. Regional decentralisation and location of foreign direct investment in China. Post-Communist Economies 18: 33–50. [Google Scholar]

- Hodler, Roland, and Paul A. Raschky. 2014. Regional favoritism. The Quarterly Journal of Economics 129: 995–1033. [Google Scholar] [CrossRef]

- Huang, Yasheng. 2002. Managing Chinese bureaucrats: An institutional economics perspective. Political Studies 50: 61–79. [Google Scholar] [CrossRef]

- Landry, Pierre F. 2008. Decentralized Authoritarianism in China. Cambirdge: Cambridge University Press. [Google Scholar]

- Li, Hongbin, and Li-An Zhou. 2005. Political turnover and economic performance: The incentive role of personnel control in China. Journal of Public Economics 89: 1743–62. [Google Scholar] [CrossRef]

- Li, Yue, Xiang Shao, Zhigang Tao, and Hongjie Yuan. 2022. How local leaders matter: Inter-provincial leadership transfers and land transactions in China. Journal of Comparative Economics 50: 196–220. [Google Scholar] [CrossRef]

- Lichtenberg, Erik, and Chengri Ding. 2009. Local officials as land developers: Urban spatial expansion in China. Journal of Urban Economics 66: 57–64. [Google Scholar] [CrossRef] [Green Version]

- Lin, George C. S., and Samuel P.S. Ho. 2005. The state, land system, and land development processes in contemporary China. Annals of the Association of American Geographers 95: 411–36. [Google Scholar] [CrossRef]

- Maskin, Eric, Yingyi Qian, and Chenggang Xu. 2000. Incentives, information, and organizational form. The Review of Economic Studies 67: 359–78. [Google Scholar] [CrossRef] [Green Version]

- Muratova, Yulia, Jakob Arnoldi, Xin Chen, and Joachim Scholderer. 2018. Political rotations and cross-province firm acquisitions in China. Asian Business & Management 17: 37–58. [Google Scholar]

- Nordhaus, William D. 1975. The political business cycle. The Review of Economic Studies 42: 169–90. [Google Scholar] [CrossRef]

- Oates, Wallace E. 1999. An essay on fiscal federalism. Journal of Economic Literature 37: 1120–49. [Google Scholar] [CrossRef] [Green Version]

- Opper, Sonjia, Victor Nee, and Stefan Brehm. 2015. Homophily in the career mobility of China’s political elite. Social Science Research 54: 332–52. [Google Scholar] [CrossRef] [PubMed]

- Pan, Jiun-Nan, Jr-Tsung Huang, and Tsun-Feng Chiang. 2015. Empirical study of the local government deficit, land finance and real estate markets in China. China Economic Review 32: 57–67. [Google Scholar] [CrossRef]

- Persson, Petra, and Ekaterina Zhuravskaya. 2016. The limits of career concerns in federalism: Evidence from China. Journal of the European Economic Association 14: 338–74. [Google Scholar] [CrossRef]

- Qian, Yingyi, and Barry R. Weingast. 1997. Federalism as a commitment to reserving market incentives. Journal of Economic Perspectives 11: 83–92. [Google Scholar] [CrossRef]

- Shambaugh, David. 2001. Facing reality in China policy. Foreign Affairs 80: 50–64. [Google Scholar] [CrossRef]

- Shi, Yaobo, Chun-Ping Chang, Chyi-Lu Jang, and Yu Hao. 2018. Does economic performance affect officials’ turnover? Evidence from municipal government leaders in China. Quality & Quantity 52: 1873–91. [Google Scholar]

- Wang, Li, Lukas Menkhoff, Michael Schröder, and Xian Xu. 2019. Politicians’ promotion incentives and bank risk exposure in China. Journal of Banking & Finance 99: 63–94. [Google Scholar]

- Wang, Yuan, and Eddie Chi-man Hui. 2017. Are local governments maximizing land revenue? Evidence from China. China Economic Review 43: 196–215. [Google Scholar] [CrossRef]

- Weingast, Barry R. 1995. The economic role of political institutions: Market-preserving federalism and economic development. Journal of Law, Economics, & Organization 11: 1–31. [Google Scholar]

- Wu, Guiying Laura, Qu Feng, and Pei Li. 2015a. Does local governments’ budget deficit push up housing prices in China? China Economic Review 35: 183–96. [Google Scholar] [CrossRef] [Green Version]

- Wu, Jing, Joseph Gyourko, and Yongheng Deng. 2012. Evaluating conditions in major Chinese housing markets. Regional Science and Urban Economics 42: 531–43. [Google Scholar] [CrossRef] [Green Version]

- Wu, Mingqin, and Bin Chen. 2016. Assignment of provincial officials based on economic performance: Evidence from China. China Economic Review 38: 60–75. [Google Scholar] [CrossRef]

- Wu, Mingqin, and Xun Cao. 2021. Greening the career incentive structure for local officials in China: Does less pollution increase the chances of promotion for Chinese local leaders. Journal of Environmental Economics and Management 107: 102440. [Google Scholar] [CrossRef]

- Wu, Qun, Yongle Li, and Siqi Yan. 2015b. The incentives of China’s urban land finance. Land Use Policy 42: 432–42. [Google Scholar]

- Xu, Chenggang. 2011. The fundamental institutions of China’s reforms and development. Journal of Economic Literature 49: 1076–151. [Google Scholar] [CrossRef]

- Yao, Yang, and Muyang Zhang. 2015. Subnational leaders and economic growth: Evidence from Chinese cities. Journal of Economic Growth 20: 405–36. [Google Scholar] [CrossRef]

- Zeng, Jinghua. 2014. Institutionalization of the authoritarian leadership in China: A power succession system with Chinese characteristics? Contemporary Politics 20: 294–314. [Google Scholar] [CrossRef]

- Zhang, Huiming, Lifang Xiong, Yueming Qiu, and Dequn Zhou. 2017. How have political incentives for local officials reduced environmental pollution in resource-depleted cities? Sustainability 9: 1941. [Google Scholar] [CrossRef] [Green Version]

| Individual Characteristics | Mayors | Municipal Party Secretaries | ||||

|---|---|---|---|---|---|---|

| Observations | Mean | S.D. | Observations | Mean | S.D. | |

| Pressure | 2511 | 1.48 | 0.84 | 2532 | 1.47 | 0.85 |

| Retire | 2477 | 10.24 | 4.01 | 2382 | 8.23 | 3.66 |

| Tenure | 2497 | 2.54 | 1.47 | 2491 | 2.78 | 1.62 |

| Education | 2477 | 1.83 | 0.78 | 2308 | 1.82 | 0.72 |

| Engineering | 2362 | 0.10 | 0.31 | 2186 | 0.07 | 0.25 |

| Economist | 2362 | 0.09 | 0.28 | 2185 | 0.07 | 0.26 |

| Committee | 2432 | 0.38 | 0.49 | 2350 | 0.33 | 0.47 |

| Secretary | 2432 | 0.58 | 0.49 | 2373 | 0.62 | 0.49 |

| Mayors | Municipal Party Secretaries | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Pressure | 0.02 * (1.88) | 0.02 * (1.80) | 0.02 ** (2.05) | 0.02 * (1.87) | 0.02 ** (1.97) | 0.02 * (1.83) |

| Retire | −0.09 * (1.80) | −0.06 (1.09) | −0.06 (1.16) | −0.09 ** (2.14) | −0.09 ** (2.09) | −0.12 ** (2.53) |

| Tenure | 0.04 ** (2.31) | 0.05 ** (2.48) | 0.04 ** (2.38) | 0.04 ** (2.30) | 0.04 ** (2.28) | 0.04 ** (2.30) |

| Education | −0.02 (1.33) | −0.02 (1.39) | −0.02 (1.56) | −0.01 (0.80) | −0.02 (1.39) | −0.02 (1.30) |

| Engineering | −0.06 * (1.77) | −0.06 * (1.69) | −0.15 *** (3.77) | −0.16 *** (3.87) | ||

| Economist | 0.02 (0.61) | −0.06 * (1.69) | 0.04 (1.13) | −0.34 (0.85) | ||

| Committee | 0.05 ** (2.16) | −0.02 (0.81) | ||||

| Secretary | −0.00 (0.19) | 0.03 (1.29) | ||||

| Macroeconomic variables | Y | Y | Y | Y | Y | Y |

| City fixed effect | Y | Y | Y | Y | Y | Y |

| Year fixed effect | Y | Y | Y | Y | Y | Y |

| Adjusted R-squared | 0.78 | 0.78 | 0.78 | 0.80 | 0.80 | 0.80 |

| Observations | 2425 | 2339 | 2326 | 2216 | 2104 | 2082 |

| Value Invested in Real Estate Per Capita | Excluding Observations in 2008 | |||

|---|---|---|---|---|

| Mayors | Municipal Party Secretaries | Mayors | Municipal Party Secretaries | |

| (1) | (2) | (3) | (4) | |

| Pressure | 0.02 ** (2.05) | 0.02 * (1.83) | 0.03 ** (2.20) | 0.02 * (1.73) |

| Retire | −0.06 (1.16) | −0.12 ** (2.53) | −0.06 (0.94) | −0.15 *** (2.88) |

| Tenure | 0.04 ** (2.38) | 0.04 ** (2.30) | 0.04 ** (2.14) | 0.05 *** (2.80) |

| Education | −0.02 (1.56) | −0.02 (1.30) | −0.03 * (1.80) | −0.02 (0.89) |

| Engineering | −0.06 * (1.69) | −0.16 *** (3.87) | −0.07 * (1.80) | −0.15 *** (3.37) |

| Economist | 0.03 (0.82) | 0.03 (0.85) | 0.03 (0.71) | 0.04 (0.97) |

| Committee | 0.05 ** (2.16) | −0.02 (0.81) | 0.05 * (1.93) | −0.01 (0.56) |

| Secretary | −0.00 (0.19) | 0.03 (1.29) | −0.01 (0.37) | 0.02 (0.82) |

| Macroeconomic variables | Y | Y | Y | Y |

| City fixed effect | Y | Y | Y | Y |

| Year fixed effect | Y | Y | Y | Y |

| Adjusted R-squared | 0.77 | 0.79 | 0.78 | 0.80 |

| Observations | 2326 | 2082 | 2054 | 1826 |

| Mayors | Municipal Party Secretaries | |||

|---|---|---|---|---|

| Young | Old | Young | Old | |

| (1) | (2) | (3) | (4) | |

| Pressure | 0.04 ** (2.36) | 0.02 (1.07) | 0.03 ** (2.20) | 0.03 (1.28) |

| Tenure | 0.07 ** (2.22) | 0.05 ** (2.04) | 0.07 *** (2.64) | 0.02 (0.73) |

| Education | 0.01 (0.46) | −0.08 *** (3.27) | −0.00 (0.01) | 0.00 (0.12) |

| Engineering | −0.06 (1.37) | −0.11 (1.45) | −0.19 *** (3.40) | −0.10 (1.30) |

| Economist | −0.03 (0.54) | 0.04 (0.66) | 0.02 (0.30) | 0.04 (1.21) |

| Committee | 0.07 ** (2.24) | 0.03 (0.82) | −0.05 * (1.68) | 0.00 (0.03) |

| Secretary | −0.00 (0.13) | −0.03 (0.85) | −0.05 (1.43) | 0.03 (0.72) |

| Macroeconomic variables | Y | Y | Y | Y |

| City fixed effect | Y | Y | Y | Y |

| Year fixed effect | Y | Y | Y | Y |

| Adjusted R-squared | 0.77 | 0.79 | 0.79 | 0.73 |

| Observations | 1326 | 1003 | 1238 | 910 |

| Mayors | Municipal Party Secretaries | |||

|---|---|---|---|---|

| Native | Non-Native | Native | Non-Native | |

| (1) | (2) | (3) | (4) | |

| Pressure | 0.03 *** (2.60) | 0.03 (1.15) | 0.03 ** (2.22) | 0.00 (0.25) |

| Retire | 0.05 (0.86) | 0.21 (1.41) | −0.02 (0.39) | 0.23 *** (3.06) |

| Tenure | 0.05 *** (2.57) | −0.00 (0.01) | −0.02 (0.85) | 0.11 *** (4.23) |

| Education | −0.03 * (1.88) | −0.04 (0.75) | −0.03 (1.30) | 0.02 (0.58) |

| Engineering | −0.05 (1.13) | −0.21 ** (2.26) | −0.14 *** (2.62) | −0.05 (0.56) |

| Economist | −0.03 (0.54) | −0.24 ** (2.46) | 0.11 ** (2.00) | 0.02 (0.24) |

| Committee | −0.03 (1.31) | 0.15 ** (2.40) | 0.00 (0.13) | −0.21 *** (3.95) |

| Secretary | 0.00 (0.17) | −0.13 * (1.87) | 0.06 ** (1.99) | −0.05 (1.01) |

| Macroeconomic variables | Y | Y | Y | Y |

| City fixed effect | Y | Y | Y | Y |

| Year fixed effect | Y | Y | Y | Y |

| Adjusted R-squared | 0.81 | 0.68 | 0.79 | 0.79 |

| Observations | 1643 | 657 | 1432 | 630 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Z.; Hu, M.; Qiu, Z. Promotion Pressures of Local Leaders and Real Estate Investments: China and Leader Heterogeneity. J. Risk Financial Manag. 2022, 15, 341. https://doi.org/10.3390/jrfm15080341

Chen Z, Hu M, Qiu Z. Promotion Pressures of Local Leaders and Real Estate Investments: China and Leader Heterogeneity. Journal of Risk and Financial Management. 2022; 15(8):341. https://doi.org/10.3390/jrfm15080341

Chicago/Turabian StyleChen, Zhuo, Mingzhi Hu, and Zhiyi Qiu. 2022. "Promotion Pressures of Local Leaders and Real Estate Investments: China and Leader Heterogeneity" Journal of Risk and Financial Management 15, no. 8: 341. https://doi.org/10.3390/jrfm15080341

APA StyleChen, Z., Hu, M., & Qiu, Z. (2022). Promotion Pressures of Local Leaders and Real Estate Investments: China and Leader Heterogeneity. Journal of Risk and Financial Management, 15(8), 341. https://doi.org/10.3390/jrfm15080341