1. Introduction

Vietnam launched the “Renovation” and “Open-Door” policies in the late 1980s. Since then, a range of consecutive economic reforms have been implemented, rapidly transforming Vietnam’s economy from a centrally planned mechanism to a market-based mechanism. It is discernable that the development of the Vietnamese economy has been so far based on an extensive growth model, which is viewed as a growth strategy associated with the expansion of inputs, including capital accumulation. By the end of the first decade of the 2000s, this growth model exposed many internal limitations, no longer supporting Vietnam’s sustainable growth, especially when the economy was integrating deeply into the regional and world economy. It is imperative that Vietnam renews its growth model so that it can create the “motivation” to promote fast and sustainable growth in the context of globalization and the impact of the industrial revolution 4.0. Renovating the growth model when it becomes obsolete and inhibits growth is considered a strategically crucial task in many countries around the world (

Pham and Pham 2014). The Vietnamese government has shown its determination in directing the implementation of an overall project of economic restructuring in parallel with renovating the growth model on the basis of “quality, efficiency and competitiveness”. The reality of economic mechanism transition and a shift in the growth model raises questions regarding the role of the Vietnamese banking system in growth and its current limitations.

The banking system is the core of any country’s financial system. The investigation of the role of the banking system in economic growth belongs to the research strand on the interaction between financial development and economic growth, which has drawn the interest of many researchers for a long time. Views on the influence of financial development on economic growth can be found in many seminal works.

Levine (

1997) believes that financial development, including the development of the banking system, will help to effectively mobilize and allocate capital, assist enterprises in risk management, promote the purchase and sale of goods and services, and stimulate growth in capital accumulation and technology, hence driving the economy to grow.

Giovannini et al. (

2013) have a similar view, considering financial development as a means to help economic entities improve their ability to manage risks, promote innovation, and reduce information costs, thereby leading to an increase in the efficiency of allocating financial resources and investment activities, which then lead to economic growth. From another perspective,

Aghion et al. (

1999) argue that countries with underdeveloped financial markets, characterized by the absence of a channel connecting savings and investment, tend to grow slowly and often fall into recession and macroeconomic instability. However, the development of the financial system does not always evolve on a stable path. There are periods of uncertainty, with financial crises breaking out, which may cause the financial system to fail to support growth (

Loayza and Ranciere 2006;

Prochniak and Wasiak 2017).

The above views on the impact of financial development on growth have essentially formulated the theoretical framework for many empirical studies. Most empirical studies focus on examining the general interaction between financial development and growth. In these studies, the role and impact of the banking system on growth are often not considered separately but are generally implied in the role and impact of the financial system as a whole. To date, there are only a few studies that focus on the specific impact of the banking system on growth. There are two main findings documented in these studies. First, the development of the banking system is positively correlated with growth, in which the development of the banking system is measured by criteria such as money supply to GDP ratio, credit to GDP ratio and deposit to GDP ratio (

Abubakar and Gani 2013;

Beck and Levine 2004;

Dawson 2008;

Fukuda 2001;

Koivu 2002). Second, bank performance has a positive impact on economic growth (

Al-Khulaifi et al. 1999;

Cole et al. 2008).

Studies on the interaction between the development of the banking system and economic growth are particularly important for providing policy implications for countries with economies in transition, such as Vietnam and a number of countries in Eastern Europe. Before embarking on the path of economic transition, the banking system in these countries operated under a centrally planned economic mechanism. To support the establishment and development of the market mechanism in these transitional economies, the reform and development of the banking system based on market principles are crucial. However, only a few studies have been conducted that attempt to examine the influence of financial development in general and banking development, in particular, on growth in transitional economies (for example, see

Koivu 2002;

Petkovski and Kjosevski 2014). A limitation of studies on this topic, including those conducted for transition economies, is that they provide only general empirical evidence on the impact of certain indicators of financial development on economic growth. Such general empirical evidence is not conducive to provide specific policy recommendations for a country when the channel of impact, the degree of impact and the mechanism of impact of the banking system/financial system can be influenced by the level of economic development and country-specific factors.

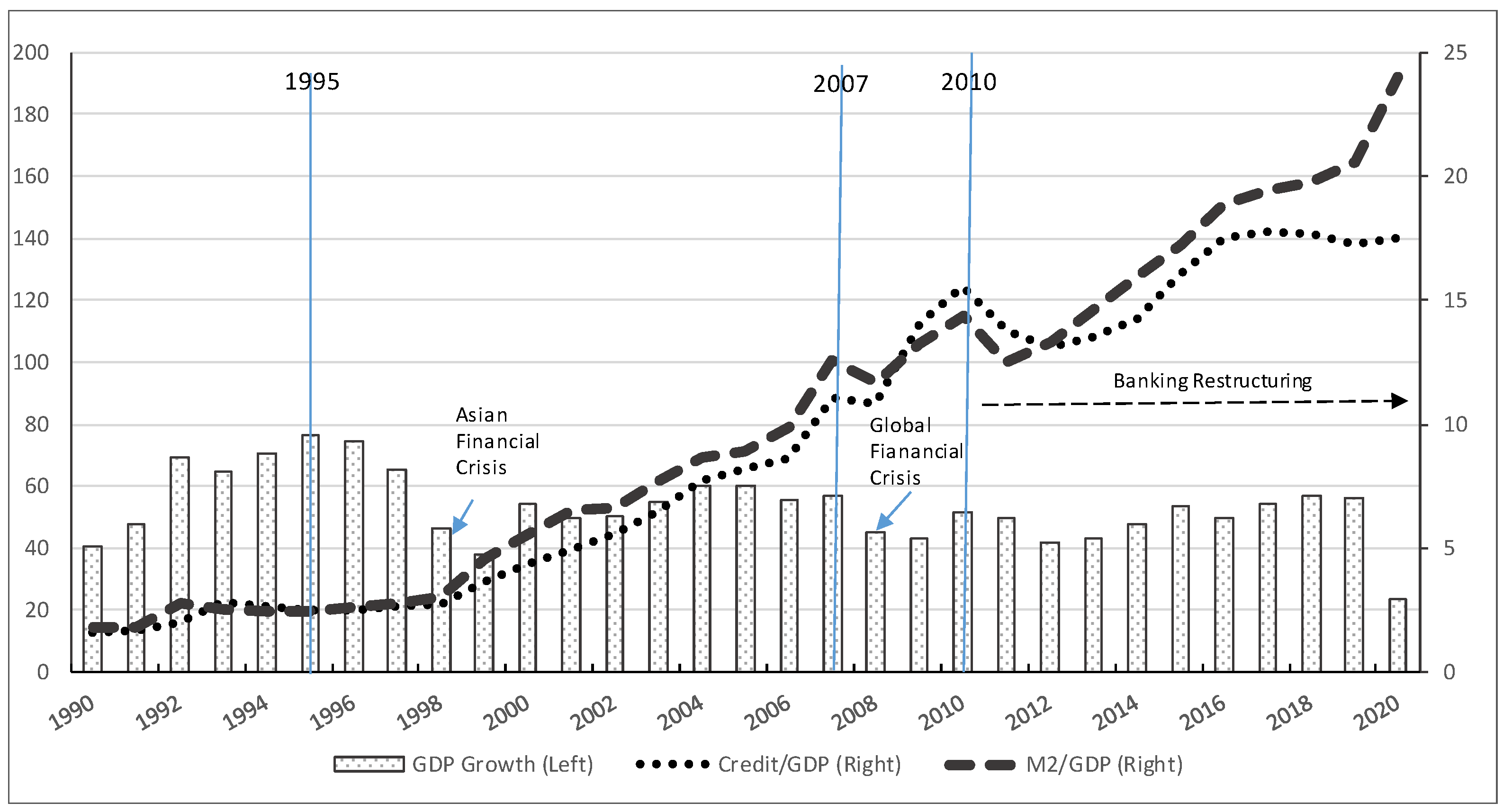

Since the launch of the “Renovation” and “Open-Door” policies, Vietnam’s banking system has quickly shifted from a one-tier system to a two-tier market-based system to facilitate the operation and growth of a transition economy. It is generally perceived in the literature that the development of the Vietnamese banking system has considerably supported the processes of economic transition and international integration, thus contributing to economic growth. The Vietnamese banking system has proved to be a lifeline connecting savings with investment, meeting the rising credit needs of the business sector. At the early stage of transition, credit allocation was generally consistent with the process of monetization of the economy and supported the operation of state-owned enterprises, which play a key economic role (

SBV 2021). Subsequently, credit allocation was flexibly managed in the direction of gradually reducing the proportion of credit extended to state-owned enterprises and actively supporting the equitization process (

IMF 2007). Bank credit has also gradually shifted to facilitate the development of the private enterprise sector, which is increasingly becoming a key economic player (

IMF 2007). Since 2013, bank credit has also been assigned a role in supporting the implementation of the process of economic restructuring with the aim of transforming the growth model toward being based on quality, efficiency and competitiveness (

SBV 2021). Simultaneously, the intermediary payment function of the banking system has been increasingly improving with a range of diversified services, facilitating the efficient operation of the economy. However, the current banking system has also been exposed to certain limitations in performing its role in growth. One of the limitations is that the banking system acts as a key capital supply channel contributing to growth, but growth has become increasingly dependent on the quantity of invested capital (

ADB 2015). When the quantity of invested capital falls, growth also slows down. In Vietnam’s investment–growth issue, the perceived low investment efficiency is reflected in the high incremental capital output ratio (ICOR) (

GSO 2021), which to a certain extent points to the inefficient allocation of capital resources by the banking system, thus hindering the expected role of the banking system in supporting the process of transforming Vietnam’s growth model to an intensive growth model.

In Vietnam, several empirical studies have been conducted with the aim of quantifying the impact of financial development on economic growth, in which financial development is measured by one or two indicators representing the development of the banking system (for examples, see

Nguyen 2014;

Tran 2005;

Anwar and Nguyen 2011;

Phan 2011). These studies have two main limitations. First, the empirical evidence is based on a short period of time series data, before Vietnam entered the stage of economic restructuring. Second, the possible nonlinear effect of the banking system on growth was not considered in the context that the banking system has expanded strongly according to the measures of banking depth, while growth has slowed down. Thus, the objective of this paper is to quantitatively analyze the influence of the development of the banking system on growth from a more systematic perspective. To facilitate this analysis, the author set up an econometric model on the basis of endogenous economic growth models and applied a relevant cointegration technique to clarify the role of the banking system in Vietnam’s growth for the most extensive period, from 1990 up to 2020, which covers almost the whole process of economic transition in the country as well as the recent process of shifting to a new growth model. The econometric model is also specified in order to shed light on the possibility of a nonlinear effect of the development of the banking system on growth as well as the hypothesis of running out of room for the extensive growth model.

The rest of the paper is structured as follows.

Section 2 presents theoretical views on the impact of banking development on growth, including a brief review of related empirical studies.

Section 3 provides an explanation of the empirical framework and data used. Subsequently,

Section 4 presents the estimated results and a discussion. Finally,

Section 5 draws some significant conclusions and policy implications.

2. Review of the Literature

In theoretical models of growth, investment capital is recognized as the fundamental factor that determines growth from both perspectives: aggregate supply and aggregate demand. An increase in the investment capital (total supply) causes output to increase. An increase in output causes an increase in income and consumption, that is, an increase in aggregate demand. In turn, an increase in aggregate demand stimulates investment and promotes growth. Therefore, a lack of investment capital is often seen as a major obstacle to accelerating economic growth. Investment capital is also a decisive factor in improving infrastructure and promoting the application of technological advances. Domestic investment capital is mainly mobilized from households and entities with idle capital in the economy, which is then allocated to the business sector for developing investment projects or expanding business activities. This financial system helps the processes of capital mobilization and allocation to take place through two main channels: the banking system and the stock market. Thus, the financial system has a special role in the growth process. The ability to raise capital and allocate capital depends on the level of development of the financial system and its components.

The banking system is an integral part of the financial system. Therefore, the nature of the impact of banking system development on economic growth can be clarified on the theoretical ground of the concept of financial development and its role in economic growth.

Levine (

2005) believes that financial development is the process by which financial intermediaries, financial markets and financial instruments perform well in processing information, minimizing transaction costs, and ensuring the execution of financial transaction contracts so that the financial system can best perform its functions.

Levine (

2005) puts forward five important criteria for financial development. First, economic entities can easily find information about potential investment projects and allocate capital efficiently. Second, economic entities can monitor and control investment activities. Third, economic entities can carry out economic transactions and diversify and manage risks. Fourth, there are appropriate channels to mobilize savings. Fifth, the financial system supports and promotes the purchase and sale of goods and services. By performing these functions, the financial system affects saving and investment, thereby promoting economic growth. In addition to the definition of financial development by

Levine (

2005), there are other definitions of financial development in the literature. Indeed, all of these definitions commonly imply financial development in such a sense that the financial system operates more efficiently and performs its functions well (through the operation of financial institutions and financial markets), helping economic entities to access financial resources, invest their savings and satisfy other financial needs as per their functions and roles.

A banking system that develops, operates and performs its functions well contributes to the healthy and efficient operation of the financial system, thereby promoting economic growth. Intuitively, financial markets and financial institutions can hardly perform their functions if the banking system is primitive and underdeveloped. For example, if the banking system does not perform well as an intermediary for payments and money creation, financial transactions may slow down and financial assets may become illiquid. Similarly, inappropriate credit decisions and asymmetric information may also adversely affect the process of capital flow in financial markets. The banking system itself, if well developed and able to better perform its functions, will directly affect economic activities and promote economic growth. First, the banking system helps to improve the allocation of scarce financial resources by providing credit to the most efficient businesses or investment projects. Second, the banking system assists households in planning and implementing appropriate consumption through savings and bank borrowing (

Allen and Gale 2001). Third, the banking system provides liquidity to the economy by transforming short-term liabilities into long-term assets (

Diamond and Dybvig 1983). Through this activity, the banking system helps savers manage their liquidity risks while providing capital for long-term investment projects. Fourth, the banking system helps to speed up the flow of goods and services, accelerate the payment process, and promote the speed of capital flow, thereby supporting economic growth as well. From the perspective of macroeconomic policy management, the banking system is a channel that the central bank can use to carry out the transmission of monetary policy and achieve its policy targets for each period.

There are two main views on the nexus between financial development and growth. The supply-leading view considers financial development to be the driving force behind economic growth. The demand-following view holds that financial development results from the real needs of the economy. Based on these two views, many empirical studies with different datasets and methods have been carried out in past decades, but they have not yet yielded consensus conclusions about the direction and channel of interaction between financial development and growth. Many studies provide evidence that supports the view that financial development plays a driving role in growth, while others support the view that growth drives the development of the financial system as the latter develops to respond to the needs of the real economy. Meanwhile, a number of studies provide evidence of a two-way cause–effect relationship. Several recent studies have documented the nonlinear impact of financial development on economic growth and the important role of financial stability (

Prochniak and Wasiak 2017;

Bucci and Marsiglio 2019;

Nguyen and Pham 2021). Several reasons can be put forward to explain the differences in empirical findings.

While there are many studies focusing on the relationship between financial development and growth in general, few studies have been conducted to present empirical analyses of the influence of banking development on growth. The studies taking into consideration the influence of banking development are either based on a cross-sectional sample of data collected from a group of countries or a sample of time series data from a given country. Overall, these studies report two main findings. First, banking development has a positive impact on growth, in which banking development is measured by criteria such as money supply to GDP ratio, bank credit to GDP ratio, and deposit to GDP ratio (

Levine 1997;

Fukuda 2001;

Koivu 2002;

Beck and Levine 2004;

Dawson 2008;

Abubakar and Gani 2013). Second, bank performance has a positive effect on growth (

Al-Khulaifi et al. 1999;

Cole et al. 2008).

The study of the impact on growth of financial development in general and banking development in particular is specifically significant for transition economies, such as those in Vietnam and a number of countries in Eastern Europe, as the findings can be useful for drawing policy implications. Before launching the journey of economic transition in the late 1980s or so, the banking systems in these countries purely operated under a centrally planned mechanism. In order to support the formation and operation of the market mechanism in these economies, it is essential for the banking system to reform, innovate and develop market-based principles. However, there are only a few studies on the effects of banking development on growth for transitional economies (see, for example,

Kenourgios and Samitas 2007;

Koivu 2002;

Petkovski and Kjosevski 2014;

Nguyen and Pham 2021).

A conclusion drawn from the review of the literature is that empirical studies provide mixed and inconclusive findings on the interaction between financial development and economic growth. This could be partly due to differences in the adopted methods, data samples and time spans. The multidimensionality of financial development, leading to the use of different measures of financial development, might be another reason. In addition, the degree and direction of interaction between financial development and growth might be dependent on country-specific conditions such as the level of economic development, the degree of financial depth and the macroeconomic environment. Countries differ in their level of financial development due to differences in policies and institutions, thus experiencing different interactions between financial development and economic growth (

World Bank 1993). For example,

Odedokun (

1996) investigated the impact of financial development on economic growth using time series data spanning from 1960 to 1980 collected from 71 less developed countries (LDC), reporting that the impact of financial intermediation on growth in low-income LDCs is more predominant than that in high-income LDCs. A number of empirical studies documented a positive correlation between the size of the financial sector and economic growth for countries with small or medium financial sectors but not for countries with very large financial sectors (

Deidda and Fattouh 2002;

Arcand et al. 2012; and

Cecchetti and Kharroubi 2015). Conducting a short-term causality analysis with a dataset collected from 168 low- and middle-income countries,

Hassan et al. (

2010) provided evidence of bidirectional causality between financial development and growth for countries in most regions, but there was evidence of unidirectional causality from growth to financial development for the two poorest regions.

Creel et al. (

2015) applied the generalized method of moments to a dataset formed from European Union countries for the period 1998–2011 and reported that a high degree of financial depth might give rise to a risk of financial instability, which was harmful to macroeconomic performance. By and large, in spite of numerous empirical studies, the reported findings are inclusive and general in nature, and they are not relevant to drawing policy implications for specific conditions.

For a transition-emerging economy such as Vietnam, a clear understanding of the role of the banking system in growth, as well as the interaction channels, is significant in terms of formulating relevant strategic developmental policies. For the Vietnamese case, a few studies have been conducted with the aim of quantifying the impact of financial development on growth in general, in which financial development is measured by one or two indicators normally proxied for the development of the banking system, such as the ratio of bank credit to GDP or the ratio of broad money to GDP (for examples, see

Tran 2005;

Anwar and Nguyen 2011;

Phan 2011;

Nguyen 2014). These studies have two main limitations: (i) they only provide empirical analytic evidence based on too-short time series data with a time span limited to the period before Vietnam started its economic restructuring; and (ii) they do not consider the possible nonlinear effect and diminishing marginal effect of the banking development on growth.

4. Empirical Results and Discussion

Results of the stationarity test. Estimation based on the ARDL model can be applied to time series variables that are not stationary at the same order of integration, but there is no variable stationary at the order of integration of 2.

Table 1 presents the results of the ADF test (

Dickey and Fuller 1979) and PP test (

Phillips and Perron 1988). It appears that variables such as growth (

GROWTH), physical investment capital (

CAP), government spending (

GOV), foreign direct investment (

FDI) and inflation (

INF) are I(0), being stationary at level, while the variables representing banking development (

BM and

CREDIT) are I(1), becoming stationary only after taking the first difference. For the variable

LABOR, the test results are somewhat different between the ADF test and PP test, which are suggested to be I(0) by the ADF test and I(1) by the PP test. However, the KPSS test indicates that this variable is stationary at the 5% significance level. There is no variable of I(2). Thus, the variables are relevant for estimating the ARDL model.

Optimal lags. The optimal lag lengths for variables are determined based on the AIC, which is automatically selected by the ARLD method installed in Eviews 10. Given the use of annual data, the maximum lag initially applied for all variables is 1. Accordingly, four ARDL models are selected, corresponding to two sets of data (1990–2020 and 1995–2020) and two measures of banking development. With the use of the ratio of broad money to GDP as a measure of banking development, the selected model for both sets of data is ARDL (1, 1, 0, 1, 1, 1, 0, 1), in which the numbers in the bracket refer to variables in the following order: growth, broad money, squared value of broad money, physical investment capital, government spending, foreign direct investment, labor and inflation. These ARDL models refer to ARDL 1 and ARDL 2, respectively. These variables are considered as dynamic regressors, which can affect growth in the current period as well as at the selected lag, if any. The dummy variable denoting the years of crisis (CRISIS) and the interaction variable between banking development and the period from the year 2007 onward (D07-20×BANK) are fixed regressors, which are considered to have an influence on the current period only. With the use of the ratio of bank credit to GDP, the selected models for both sets of data are ARDL (1, 0, 1, 1, 1, 1, 0,1), in which the order of variables is similar to that of the determined ARDLs employing the ratio of broad money to GDP as a measure of banking development. These ARDL models are denoted as ARDL 3 and ARDL 4, respectively.

Cointegration test. The results of the bounds tests (F-bounds test and t-bounds test) are reported in

Table 2. Accordingly, the F-statistics of the four ARDL models are 18.59, 18.96, 5.41 and 19.98, respectively. These F-statistics are all higher than the critical value of the upper bound level I(1) at the 1% statistical significance level. The t-statistics of the four ARDL models are −7.50, −6.30, −5.05 and −7.65, respectively. These t-statistics are also lower than the critical value of the upper bound level I(1) at the 1% statistical significance level. The results of the bounds tests suggest that hypothesis H1 can be accepted, and there exists a cointegration relationship among the variables in the selected ARDL models.

Robustness of the model.

Figure 2 shows graphically the results of testing the robustness of all four selected ARDL models through two statistical criteria, CUSUM and CUSUMSQ. The test results show that all of the statistical values of CUSUM and CUSUMSQ lie within the critical bounds at the 5% significance level. Thus, hypothesis H

0 of the tests can be accepted, and the selected ARDL models appear to be stable in nature.

Impacts in the long term.

Table 3 presents the results of estimating the impact of banking development and other control variables on growth in the long term. The estimated results are consistent across the selected ARDL models. The long-term impact of banking development possesses the characteristics of nonlinearity. An increase in broad money and bank credit is normally associated with an increase in growth, but if any increase is too large relative to the absorptive capacity of the economy, it may lead to the opposite effect. The thresholds for broad money and bank credit to start having a reverse effect are 107% GDP (= −(1/(2 × 0.0010)) × 0.2134) and 101% GDP (= −(1/(2 × 0.0022)) × 0.4436), respectively. Government spending (

GOV) and foreign direct investment (

FDI) appear to be fundamental determinants of growth in the long term. The impact of foreign direct investment (

FDI) has a statistically significant positive impact on growth in the current period as well as at one-period lag. Government spending (

GOV) in the previous and current period has a positive impact on growth, but the impact of government spending of the current period is not statistically significant, while that of the previous period is much larger, at 1% statistical significance. The long-term impact of physical investment capital

CAP in the current period is positive and statistically significant at the 1% significance level, while this variable with a one-period lag appears to have a negative impact but with similar magnitude. In the long term, labor (

LABOR) and inflation (

INF) have negative impacts on growth. Both fixed regressors, the dummy variable (

CRISIS) and the interaction variable between banking development and the period from 2007 onward

D07-20×BANK, have negative effects on growth.

Impacts in the short term.

Table 4 presents the estimation results of the ECM models, which confirm the long-term impacts of banking development and the considered controlled variables. The coefficients of error terms in the four selected ARDL models have negative values in the range of 0.97 to 1.22 and are statistically significant at the 1% level. These coefficients suggest that growth is likely to adjust to the long-term equilibrium within approximately one year after a short-term “shock” that caused growth to deviate from the long-term equilibrium. The estimation results of ECM models further reveal that there is a difference in the short-term impact on growth of the two measures of banking development. With the ECM models estimated on the basis of ARDL 1 and ARDL 2, broad money has a significant positive impact on growth in the short term. Meanwhile, with the ECM models estimated on the basis of ARDL 3 and ARDL 4, the coefficient of the squared value of bank credit is negative and statistically significant. This result implies that excessive credit expansion may have a more obvious negative impact on growth than broad money. This reflects a difference in the influencing mechanism of these two measures of banking development, although they are closely related. The ratio of broad money to GDP measures the expansion of the payment and deposit-taking activities provided by commercial banks, while the ratio of bank credit to GDP measures the banking depth in terms of the extent to which bank credit is extended to the economy, reflecting the role of commercial banks in connecting savings and investment. The expansion of bank credit certainly has an immediate impact on economic activities, thereby affecting growth. Excessive credit expansion tends to encompass latent poor credit decisions, which negatively affects growth. Thus, the nonlinear effect of excessive credit expansion remains to be seen in the short term. The estimation results of the ECM models also indicate that the short-term impacts of other variables are consistent with the long-term impacts except for the case of government spending. Physical investment capital (

CAP) and foreign direct investment (

FDI) have a positive impact on growth at the 1% statistical significance level. The impact of government spending (

GOV) is not clear in the short term as it is not statistically significant.

Discussion

The finding of nonlinear effects of banking development in this study is consistent with the theoretical view of the possible nonlinear effects of financial development on growth. This is also consistent with the finding of an inverted-u-shape effect of financial development on growth in previous studies. Excessive financial development can become a barrier to growth as it can accumulate risks to the efficient functioning of the financial system, which becomes a latent factor leading to a possible large-scale financial crisis (

Prochniak and Wasiak 2017). High-profit opportunities coupled with human overexcitement may induce a temptation of moral hazard that is not conducive to growth. Several empirical studies could find a positive correlation between the size of the financial sector and growth for countries with small or medium financial sectors but not for countries with large and developed financial sectors (

Deidda and Fattouh 2002;

Arcand et al. 2012; and

Cecchetti and Kharroubi 2015). The positive correlation only remains up to a certain extent of financial development. On the one hand, excessive financial development may also increase the frequency of cyclical booms and busts, resulting in weak economic growth. On the other hand, excessive financial development can lead to a trend in which the talented human resources shift away from the productive sectors to gather in the financial sector.

The estimated results suggest that the threshold for broad money and bank credit to reverse from having a positive effect to a negative effect on growth is 107% and 101%, respectively. That is, before reaching the level of 107%, an increase in the ratio of broad money to GDP would have a positive effect on growth. However, beyond this threshold, any further increase in the ratio of broad money to GDP would negatively affect growth. Similarly, any further increase in the ratio of bank credit to GDP beyond the threshold of 101% would also have a negative effect on growth. This finding is consistent with the threshold of financial development (measured by similar criteria) found in previous studies. For example, for the ratio of credit to GDP, the threshold is reported in the range from 80% to 100% of the GDP (

Prochniak and Wasiak 2017;

Nguyen and Pham 2021). Using the financial development index calculated by the IMF,

Sahay et al. (

2015) find that if the value of this index is between 0.4 and 0.7, financial development will have an optimal impact on growth. The threshold for bank credit found in this study (101%) is at the upper end of the range found in previous studies, closely reflecting the reality of credit channels in Vietnam during the examined period. For Vietnamese businesses, bank credit obviously represents the main source of external funding. Vietnam’s rapid economic growth over the past three decades or so has been mainly driven by rapid growth in bank credit. In the period 2011–2020, the average growth rate of bank credit was approximately 24% per year. On average, the ratio of bank credit to GDP increased from 41.8% in the period 1996–2006 to 103.1% in the period 2007–2010 and then to 123.6% in the period 2011–2020. Vietnam’s ratio of bank credit to GDP is higher than that of countries with a similar level of economic development (

IMF 2017) and higher than that of other transitional economies (

Nguyen and Pham 2021).

The estimated coefficient of the interaction variable between banking development and the dummy variable, taking a value of 1 for the years 2007–2020, is negative and statistically significant for all of the selected ARDL models. This means the positive impact of banking development on growth appears to be marginally reduced in the period from 2007 onwards as compared to the preceding period. This result might indicate that there is no longer “room” for growth under the extensive growth. It is noted that the ratio of broad money to GDP and the ratio of bank credit to GDP exceeded the found threshold in many years in the period 2007–2020, especially in the later years of the period. Bank credit grew rapidly, at about three times the rate of growth, leading to a decline in credit productivity and investment returns (

IMF 2017). Perceiving the potential negative effect of rapid credit expansion, the State Bank of Vietnam has determinedly adopted a quota for annual credit growth, which has been imposed on commercial banks in implementing the project of restructuring the banking system since 2013. In reality, this quota tool has actually helped to control the annual rate of credit growth for the whole banking system in recent years. However, this tool is administrative in nature, and it is not in line with market principles. Determining credit growth targets for each bank and each industry can lead to an inefficient allocation of credit resources among businesses and across industries (

IMF 2017).

In the period 2011–2020, the proportion of credit granted to the state-owned enterprise sector sharply decreased compared to the preceding period (

SBV 2021). This is in line with the policy of reducing state investment capital in non-essential sectors. However, in a number of state-owned enterprises, bank credit capital still accounts for a major source of external funds. Bad debt has been a rather difficult problem since 2011, contributing to the reduction in the capital adequacy ratios of commercial banks. At the beginning of this period, the proportion of credit granted to sectors such as real estate, stock trading and consumer spending increased rapidly (

SBV 2021). In the 2011–2020 period, the ratio of credit to GDP virtually exceeded the level of the period 2007–2010 when the economy experienced tough macro instability. Extensive credit expansion occurred in the years 2007–2010, in which most of the credit was channeled to state-owned enterprises and the real estate sector, leading to a deterioration in the quality of the balance sheets of commercial banks. The proportion of bad debt was pushed up, contributing to an upsurge in inflation (

IMF 2017;

SBV 2021). The evidence of a nonlinear effect and diminishing marginal effect of banking development on growth points out that the development of the banking system (through broad money and credit growth) needs to be carefully monitored to ensure its growth and stability.

The impacts of other factors on growth found in this study are consistent with the theoretical expectation of the determinants of growth and the reality of the Vietnamese economy. The estimated coefficient of the government expenditure ratio is positive and statistically significant in the long term in all the selected ARDL models. However, the effect of this variable is not found to be statistically significant in the short term. To a certain extent, this finding reflects the fact that government spending is largely extended to developmental infrastructure projects, which are viewed as an important determinant of growth in the long term (

GSO 2021;

Tung-Linh 2022). There is a time lag for these projects to be connected in order to form a synchronous infrastructure system and influence economic activities.

Foreign Direct Investment (FDI) is found to have a positive impact on growth in both the short and long term, affirming the significant role of this external capital source in the economic growth of Vietnam since the launching of the “Open-Door” policy. The contribution of the FDI sector to Vietnam’s exports and GDP growth can be seen very clearly in the statistics periodically reported by the General Statistics Office. This finding reflects the appropriateness of the country’s growth strategy, which has been based on exports and foreign direct investment.

The estimated results indicate a negative impact of labor (

LABOR) on growth in the long term, implying that the labor growth rate has been causing pressure on the economy. The positive impact of labor on growth is not confirmed in similar studies (

Prochniak and Wasiak 2017). The measure of labor as the ratio of the population aged 15–65 to the total population is intuitively not a perfect measure, as this only represents the quantity, but not the quality, of labor. Labor quality is a matter of concern in the case of Vietnam. The number of students in universities and colleges has increased sharply along with the establishment and operation of many new universities and colleges, while high-school graduates have not paid much attention to vocational training. The number of university graduates has increased significantly, but to a certain extent, they do not meet the requirements of employers in terms of qualifications and professional skills. Meanwhile, there is a lack of skillful technical workers (

Vu 2019).

The positive effect of physical investment capital is not seen clearly in the long term, although a positive effect is found to be statistically significant in the short term in the selected ARDL models. This result partly reflects the low efficiency of the investment projects implemented to form production facilities. In fact, there are investment projects that are not well controlled, leading to overinvestment, prolonged investment time, poor quality, a lack of synchronization and low efficiency. The allocation of capital in general and bank credit in particular to such investment projects can help growth in the short term, but whether these investment projects support growth in the long term depends on whether they help to form competitive and breakthrough manufacturing industries. The observed characteristics of investment projects in Vietnam (to form the fixed assets of the manufacturing sector) can be viewed as reasons why the incremental capital output ratio (ICOR) of Vietnam remains relatively high as compared to other countries at the same level of development (

Phạm and Vuong 2009).

Finally, inflation is found to have a negative impact on growth in both the long term and short term. Throughout the examined period, Vietnam experienced considerably high inflation rates, especially in the first years of economic transition and in years of crisis. Thus, the high-inflation environment was not conducive to economic growth.

5. Conclusions

This study was conducted to clarify two main questions: (i) Is the impact of banking development on Vietnam’s economic growth nonlinear in the process of transition? (ii) Is there a difference in the impact on growth of banking development in different stages of economic transition? An ARDL-based multivariate regression technique is adopted to empirically assess the long-term and short-term impact of banking development on growth throughout the period 1990–2020. First, the empirical findings confirm the cointegration relationship between growth and the explanatory variables in the model, including the focused variables standing for banking development. Both measures of banking development have statistically significant impacts on growth in the long term. This result reflects the fundamental fact that Vietnam’s financial system is a bank-based system. Since switching to a two-tier banking system in the late 1980s, the Vietnamese banking system has developed and expanded swiftly, playing a main role in mobilizing and supplying capital to the economy, thus contributing to economic growth. In Vietnam, the stock market was established in 2000, but it came into actual operation only in 2006 with a relatively small scale compared to other stock markets in the region (

Nguyen and Pham 2021).

Second, the findings indicate a nonlinear effect of banking development on growth. The threshold for bank credit is estimated to be around 101% of the GDP, suggesting that any further increase in the ratio of bank credit to GDP beyond this threshold would negatively affect growth. This finding is consistent with those documented in previous studies on the nonlinear effect of the financial system, reflecting the reality of the interaction between bank credit expansion and growth in Vietnam. The empirical evidence of this study confirms the crucial role of the banking system in Vietnam’s economic growth during the economic transition since the late 1980s. However, this nonlinear effect of the in-depth measures of banking development implies that bank credit expansion needs to be closely controlled in order to be adaptive to the capital-absorptive capacity of the economy. Concurrently, attention should be paid to promoting the development of other aspects of the banking system, such as the diversification of services, financial strength and risk management.

Third, the positive impact of banking development appears to decrease in the period 2007–2020 as compared to the period 1990–2006. This can be considered to represent the diminishing marginal effect of banking development on growth. This finding is consistent with the fact that credit growth was significantly high in the period 2007–2020. The ratio of credit to GDP exceeded the threshold of 101% for many years. The annual credit growth rate during this period was approximately three times higher than the economic growth rate, leading to a decline in credit productivity and investment return. To some extent, this finding is an indicator of the ongoing extensive growth model adopted in Vietnam, which relies heavily on the quantity of invested capital. Thus, further credit expansion should be closely monitored to ensure its effective contribution to growth.